Abstract

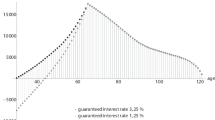

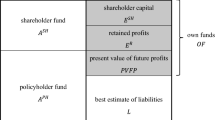

With the commencement of the Solvency II directive, insurers in the European Union need to provide a projection of their solvency figures into the future (as part of the Own Risk and Solvency Assessment, ORSA). This is a highly complex task since future solvency figures depend on the development of numerous (stochastic) risk factors. The required evaluations are numerically challenging, which in practice forces companies to limit their analyses to only a few selected deterministic scenarios. These deterministic scenarios clearly cannot describe the full probability distribution of a company’s future solvency situation. The focus of this paper is on financial guarantees in participating life insurance products. In particular, we study two major types of interest rate guarantees in life insurance, a maturity guarantee and a (path-dependent) cliquet-style guarantee. In order to derive entire probability distributions of future solvency ratios, we limit the model framework to two sources of risk (a Hull–White model for interest rates and a geometric Brownian motion for stocks). This partly leads to closed-form solutions of the market-consistent valuation of the liabilities, ensures higher accuracy in computations and less numerical effort. Furthermore, the model allows for a detailed analysis of the impact of the different types of interest rate guarantees on the future solvency situation. Our results suggest that the type of guarantee has a significant impact on the long-term solvency of the company.

Similar content being viewed by others

Notes

Cf. Section 5 for the specification of \(n\) within our numerical analyses.

Since the variance-covariance matrix has a determinant of zero, we apply the algorithm of Cheng and Higham [11] to make it positive definite.

References

Barbarin J, Devolder P (2005) Risk measure and fair valuation of an investment guarantee in life insurance. Insur Math Econ 37(2):297–323

Bauer D, Reuss A, Singer D (2012) On the calculation of the solvency capital requirement based on nested simulations. ASTIN Bull J IAA 42(2):453–499

Berdin E (2016) Interest rate risk, longevity risk and the solvency of life insurers. ICIR Working Paper Series, 23/2016

Berdin E, Gründl H (2015) The effects of a low interest rate environment on life insurers. Geneva Papers Risk Insur Issues Pract 40(3):385–415

Berdin E, Pancaro C, Kok C (2016) A stochastic forward-looking model to assess the profitability and solvency of European insurers. SAFE Working Paper, p 137

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Political Econ 81(3):637–654

Bonnin F, Planchet F, Juillard M (2014) Best estimate calculations of savings contracts by closed formulas: application to the ORSA. Eur Actuar J 4(1):181–196

Brigo D, Mercurio F (2006) Interest rate models—theory and practice: with smile, inflation and credit, 2nd edn. Springer Finance, Heidelberg

Briys E, De Varenne F (1997) On the risk of insurance liabilities: debunking some common pitfalls. J Risk Insur 64(4):673–694

Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) (2017) ORSA-Berichte. BaFin Journal, 2017, https://www.bafin.de/SharedDocs/Downloads/DE/BaFinJournal/2017/bj_1709.html. Accessed 29 Sep 2017

Cheng SH, Higham NJ (1998) A modified Cholesky algorithm based on a symmetric indefinite factorization. SIAM J Matrix Anal Appl 19(4):1097–1110

Christiansen MC, Niemeyer A (2014) Fundamental definition of the solvency capital requirement in solvency II. ASTIN Bull J IAA 44(3):501–533

Deutsche Aktuarvereinigung (DAV) (2015) Ergebnisbericht des Ausschusses Investment: Zwischenbericht zur Kalibrierung und Validierung spezieller ESG unter Solvency II

Deutsche Aktuarvereinigung (DAV) (2018) Ergebnisbericht des Ausschusses Investment: Beispielhafte Kalibrierung und Validierung des ESG im BSM zum 31.12.2018

European Parliament and the Council (2009) Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II). Official Journal of the European Union, L335

Graf S, Kling A, Ruß J (2011) Risk analysis and valuation of life insurance contracts: combining actuarial and financial approaches. Insur Math Econ 49(1):115–125

Grosen A, Jørgensen PL (2002) Life insurance liabilities at market value: an analysis of insolvency risk, bonus policy, and regulatory intervention rules in a barrier option framework. J Risk Insur 69(1):63–91

Hull J, White A (1990) Pricing interest-rate-derivative securities. Rev Financ Stud 3(4):573–592

Kijima M, Wong T (2007) Pricing of Ratchet equity-indexed annuities under stochastic interest rates. Insur Math Econ 41(3):317–338

Miltersen KR, Persson SA (2003) Guaranteed investment contracts: distributed and undistributed excess return. Scand Actuar J 2003(4):257–279

Planchet F, Guibert Q, Juillard M (2012) Measuring uncertainty of solvency coverage ratio in ORSA for non-life insurance. Eur Actuar J 2(2):205–226

Vedani J, Devineau L (2012) Solvency assessment within the ORSA framework: issues and quantitative methodologies. arXiv1210.6000[q-fin.RM]

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

We recall formula (5) from Sect. 5.4.

It remains to show that the first part of the argument in the quantile can be written as a product of \({A}_{t}/{L}_{t}\) and some stochastic factor, namely,

under the real-world measure \(\mathcal{P}\). In the case of the maturity company, the second part corresponds to

where \({e}^{-\int_{t}^{t+1}r\left(s\right)ds} {A}_{t+1}/{L}_{t}\) was already discussed above and

\({I}_{P}\) is deterministic and \(I{I}_{P}\) is stochastic. \({d}_{1}(t+1)\) and \({d}_{2}(t+1)\) entail \({A}_{t+1}/P(t+1,T)\), which can be rewritten as

and was therefore already covered above. It now remains to show that \(P(t,T)/{A}_{t}\) is fully determined by \({A}_{t}/{L}_{t}\). The relation between the two is given by

We are thus interested in the existence of an inverse function of

\({L}_{t}/{A}_{t}(x)\) is defined for all positive \(x\). Clearly, the function is continuous on its domain as all of its components are continuous. Next, we check for monotonicity by taking the derivative.

since

\(N{^{\prime}}(x)\) is the probability density function of a standard normal random variable, that is

The evaluation of this function at \({d}_{1}(t,x)\) and \({d}_{2}(t,x)\) yields

Since \(K\) is the strike price \({L}_{T}^{G}/\alpha\), the two parts of (6) containing \(N{^{\prime}}\) cancel out. We finally obtain

as long as \(\delta\) does not exceed one. In total, the function \({L}_{t}/{A}_{t}(x)\) is continuous and strictly monotonically increasing on its domain of all positive \(x\). Checking the limits, it takes values in \(\left(\delta \alpha ,+\infty \right)\). Therefore, an inverse function exists on the domain \(\left(\delta \alpha ,+\infty \right)\), which is equivalent to \(P(t,T)/{A}_{t}\) being uniquely determined by \({A}_{t}/{L}_{t}\).

Rights and permissions

About this article

Cite this article

Rödel, K.T., Graf, S. & Kling, A. Multi-year analysis of solvency capital in life insurance. Eur. Actuar. J. 11, 463–501 (2021). https://doi.org/10.1007/s13385-021-00259-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-021-00259-0

Keywords

- Life insurance

- Participating contracts

- Interest rate guarantees

- Solvency II

- Own risk and solvency assessment (ORSA)