Abstract

Adopting design approaches that allow products to last multiple use-cycles supports European Commission objectives to reduce greenhouse gas emissions and reduce primary material impacts. Remanufacturing is an example of an appropriate circular strategy and it can be applied in a variety of industries that are intensive materials users. However, most companies have not yet adopted design strategies facilitating remanufacturing at scale. In this paper, we explored how design management can facilitate the implementation of Design for Remanufacturing, based on a literature review and in-depth interviews. Seven companies active in business-to-business markets were interviewed about the design-related opportunities and barriers they see for remanufacturing. We found that access to technical knowledge is not a barrier, whereas integrating this knowledge into the existing design process is. We conclude that design management can contribute to the uptake of Design for Remanufacturing for the following reasons: by making the value of Design for Remanufacturing to the company at large explicit, by building bridges between internal and external stakeholders, and by embedding Design for Remanufacturing into existing processes by means of Key Performance Indicators (KPIs) and roadmaps.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

For decades, the practice of remanufacturing has been used as a tool to create economic benefits from previously used products. From an environmental sustainability perspective, extending the life of a product via remanufacturing is a promising approach to reduce pollution, in particular CO2 emissions, and our dependence on primary (geologically sourced) material use.

The closed loop, product life extension, lower impact, approach fits within the frame of the circular economy. In the EU, Circular Economy (CE) is a relatively new policy concept that came into the spotlight following the European Commission’s 2015 CE Action Plan [22].

Remanufacturing is an example of a strategy which supports CE. It is applied in a range of intensive material using industries. Technical solutions for remanufacturing are extensively discussed in the literature and are centred around product design to facilitate the remanufacturing process, which includes disassembly, cleaning, testing, and reassembly [26, 28, 31, 46]. The emphasis is on optimising part re-use by minimising the possibility of parts being damaged during the process. This helps in maintaining high product quality at a low cost, and reducing production time. To tap into the full potential of these technical solutions, integration within the new product development process is crucial, yet uncommon in practice [46].

Strategic design solutions may advance this integration, however their development is much less reported in the literature [29, 37]. Strategic design takes place during the early phase of product development and is concerned with concept development based on, for example, market analysis, consumer behaviour, product portfolio management, and the available innovation capacity. The body of literature on topics like market analysis and consumer behaviour is growing [25, 49], however discussions are rarely linked back to early stage design activities.

In this study, therefore, we investigated the opportunities and barriers to implementing Design for Remanufacturing in early stage product development. We aimed to build a better understanding of these early stage dynamics by taking a design management view. Design management provides a structural approach to exploring the value created through design by taking different perspectives like a customer perspective and learning perspective [7]. This allowed us to explore the full potential Design for Remanufacturing can have for the entire company.

In the background section, we introduce the concept of design management in more depth and present the corresponding roles found in the literature with regard to remanufacturing. In the methods section, we explain how we collected data through in-depth interviews. Lastly, we analyse the results and finalise with a discussion and the overall conclusion.

Background

Framework

The objective of giving products multiple use-cycles through remanufacturing is to create benefits for the target market, the environment, and for profitability [3, 21, 27, 36, 55]. The better a product’s design is adjusted to serve multiple use-cycles, the greater these benefits will be [26, 28, 50, 52, 54]. In this paper, we use the following definition of remanufacturing, as described by the International Resource Panel [32]:

“[Remanufacturing] refers to a standardized industrial process that takes place within industrial or factory settings, in which cores are restored to original as-new condition and performance, or better. The remanufacturing process is in line with specific technical specifications, including engineering, quality, and testing standards, and typically yields fully warranted products. Firms that provide remanufacturing services to restore used goods to original working condition are considered producers of remanufactured goods.”

Design for Remanufacturing literature is primarily concerned with finding the optimal alignment between product properties and the remanufacturing production process [26, 28, 46, 55]. In their paper, Prendeville and Bocken [51] highlight the importance of strategic design as a wider frame to add to the technical design solutions. Strategic design takes place in the early stage of product development and is expected to lay the foundation for a more integrated remanufacturing design strategy. Formulating an innovation direction requires expertise and input from different disciplines, including business development, marketing, manufacturing, and product development. In line with this, Lindkvist Haziri and Sundin [39] also explored the opportunities to include insights from the remanufacturing department in these early stages of product development. In their study, they assessed both the current, and ideal, level of information exchange at a manufacturer of electro-mechanical machines. To achieve this, they used design tools like visualisation techniques. In the following step of the study, they identified concrete actions to implement the ideal scenario. One of the important factors they mention in building up a relationship between departments is to sensitise employees to each other’s work. One of their proposed solutions was to give designers first-hand experience by having them visit the remanufacturing production line.

The importance of strategic design for remanufacturing was already recognized in studies from the 70s, where, for example, Lund and Denney [42] reported the success of effects of customer perception, product planning, and innovation management. The authors highlight that customers should be well-informed about benefits like cost savings, and that product parts should, where possible, be standardized across different models alongside product innovation. Calabretta and Gemser [10] define strategic design as the following: to “co-determine strategy formulation and implementation toward innovative outcomes that benefit people and organisations alike”. This definition shows that besides using design to implement a strategy, it can also be of use to formulate a strategy.

To get an understanding of the full potential strategic design can have within an organisation, we have turned to the field of design management. This field revolves around more generic values of design: value creation, problem solving, skill improvement, and design as leadership (to reach company goals) [13]. Design management makes use of design competencies to connect market needs with company goals in creating products and/ or services. This can, for instance, be directed at improving product performance or durability, or be applied to the integration of new design requirements, or to creative thinking to find new business opportunities. Other roles associated with design management are creating competitive advantage, improving customer perception, and increasing market share [6]. Its value becomes particularly evident in multidisciplinary environments involving complex problems [14].

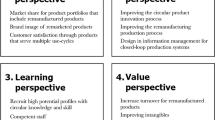

Borja de Mozota [7] created a balanced score card for design managers. She formulated four capacities for design: design as differentiator, design as integrator, design as transformer, and design as good business. Design as differentiator takes a customer perspective and focuses on design’s abilities to be distinctive from competitors and to be easy to recognize for customers. Design as integrator takes a process perspective, and focuses on design’s abilities to function as an innovator of the product development process, by, for example, implementing new tools or methods. Design as a transformer takes a learning perspective. It is about the ability to assist a company in adapting to change, in, for example, finding new business opportunities. Lastly, design as good business takes a financial perspective and focuses on design’s ability to increase financial gains and actualise sustainable growth for the business by, for example, increasing the market share.

Using Borja de Mozota’s design capacities and perspectives, we developed a framework for design management roles for remanufacturing (Table 1). For each of the four design capacities and perspectives (i.e. Design as Differentiator/ Customer perspective, etc.), the remanufacturing literature was reviewed to identify opportunities and barriers for design management. After grouping the opportunities and barriers, sub-categories for each perspective emerged. For example, based on the literature, the Customer Perspective was further subdivided into market assessment, customer acceptance, and customer relationships. For each of these sub-categories, we then assigned a number of design management roles. We would for instance find in the literature that a clear definition of suitable markets for remanufactured products is important, but that companies often do not prioritise the activities of defining markets and collecting market insights for remanufactured products [24, 58]. Based on this finding, we concluded that a role for design management would be to ‘identify customer needs that can be met by offering remanufactured products’. We have applied this approach for all the roles included in Table 1. In the following section we describe our approach in more detail. The findings of the literature review can be found in Table 4 in Appendix 1.

Opportunities and barriers to implementing Design for Remanufacturing

Design management roles were identified based on opportunities and barriers to implementing Design for Remanufacturing; these are discussed below for each of the four perspectives. The design management roles derived from these opportunities and barriers are listed in Table 1.

Design as differentiator - the customer perspective

This perspective discusses the connection of the company to its market. Understanding market dynamics and customer needs allows a company to develop products and/ or services that fit its market. When remanufacturing is concerned, efforts to define markets and collect market insights are usually not prioritised within companies [25, 59]. A growing market demand for remanufactured products is expected to positively influence the marketing teams’ commitment to perform such studies [17, 29]. However, the risk of cannibalizing new sales is often highlighted as a drawback in promoting remanufactured goods [40]. For market assessment, possible roles for design management therefore are identifying target markets and identifying customer needs that can be met through remanufacturing.

From the customer’s point of view, the interest in remanufactured products is affected by the lack of information about product history, the remanufacturing process, and/ or product quality [1, 17, 26, 30, 58]. Financial risks most prominently influence the purchasing intention [42, 48, 53, 58]. Improved information transparency and certification or quality labels are expected to improve the quality perception [1, 30, 35, 47, 48].

Lastly, customer cooperation can influence the success of remanufacturing (e.g. proper use of products or timely product returns) [42]. The customer relationship can be improved by instructing customers about the desired use [16]. This can for example translate into the design management role of engaging customers and stakeholders in returning products timely.

Design as integrator - the process perspective

The process perspective focuses on all actions required to get from a business idea to market introduction. It involves the actual product development and the design competencies needed to fulfil the tasks. To develop remanufacturable products, the development department needs to receive input from the remanufacturing department. An important factor is that the required information should be carefully specified [40]. In turn, the remanufacturing department requires detailed product information from the product development, manufacturing and servicing, to produce high quality output [29, 55]. Currently, channels for information exchange are often non-existant or rely on informal exchanges [39, 53].

What could help improve these exchanges is setting up interdepartmental collaborations. Organising workshops, for example, is a way of bringing different stakeholders together. These workshops can also take place with external stakeholders, for example, with part suppliers. These collaborations can help in taking a lifecycle perspective during product development [29, 53]. It is important to carefully coordinate these collaborations [29]. Coordinating these workshops has been identified as a role for design management.

In support of collaborations, it helps to have a clear strategy formulated by top management and that this is communicated throughout the company [29]. This can also help spread awareness and knowledge of remanufacturing, which tends to be concentrated at the remanufacturing department [39].

In addition to acquiring information, people’s task-commitment is expected to be at least as important [29]. Companies with a clear overall vision, and task division, motivate their employees to take action [29]. This motivation can be enhanced by giving employees first-hand experience of a subject [29, 39]. This can be achieved by, for example, inviting them to the production line and scheduling regular follow ups [29, 39]. From the employee’s point of view, a lack of trust in product quality and the absence of leadership have negative effects on motivation [29]. A role for design management in getting employees committed is identifying and assigning relevant tasks.

To ensure improved integration of remanufacturing guidelines into the existing process, the literature notes the importance of early stage design [24, 29, 35, 53, 61]. Early stage involvement can also assist in signalling and solving the unwanted effects of adding new requirements (e.g. increased environmental impact) [28, 51, 53]. The use of design tools can also be of value; familiarity with, and the complexity and accuracy of these tools is essential for a seamless integration [28]. Roles for design management therefore are the early identification of potentially conflicting product requirements and improving the compatibility of new design tools.

Design as transformer - the learning perspective

The learning perspective focuses on finding new ways to design, manufacture, or market products. In this context, it is important to design products that are suitable for the remanufacturing process. Remanufacturing can also be used as a tool to innovate. For example, from a marketing point of view, since remanufacturing allows for shortened time-to-market lead times compared to that of new products, it can be used as a tool to react to a sudden market demand [45, 49].

Another important aspect is the return flow of products, as input for the remanufacturing process. One way to support this is through product development: by identifying and standardising (target) parts and components to create more homogeneous volume [42]. Another way is to adopt different business models. A shift from sales models to access or performance business models, for example, can increase the return flow of products [4, 35, 55, 56]. To support such a shift, setting up new supply chain collaborations may be valuable [35, 53]. A role for design management is, therefore, to explore the opportunities for adopting access or performance models.

Design as good business - the financial perspective

The financial perspective is the fourth perspective; it’s value is related to the way a company optimises its profit from remanufacturing. Improving product design can help to increase profit margins and ecological benefits [9, 29, 41, 53]. The most promising scenarios to initiate remanufacturing are those where costs for initial production are high and costs for remanufacturing are low [17]. The required labour, and more frequent servicing, however, can add significantly to the costs of remanufacturing [51].

Competing remanufacturers are the main drivers for Original Equipment Manufacturers (OEMs) to start up remanufacturing [29, 48]. OEM remanufacturing can prevent third party remanufacturers from entering the market [53]. Yet, companies producing low-budget or counterfeit products can also be a threat [35, 53]. At the same time, OEMs perceive cannibalisation of their own new product sales to be a risk [35]. A role for design management is to explore the possibility to use remanufacturing as a tool for quality and brand management.

Methodology

To set the starting point for this study, we reviewed the literature for barriers and opportunities for design management for remanufacturing. A combination of the search terms ‘remanufacturing’, ‘product design’ and ‘management’ was used to find articles in the Scopus search engine; this yielded 102 documents. We narrowed this number down by selecting articles focussed on non-engineering barriers and opportunities affecting the design process, from a consumer, process, learning, and financial perspective. We based this on the titles and abstracts, and by looking for keywords such as: integration, implementation, acceptance, knowledge, demand, needs, value, awareness, risks, costs and coordination. The resulting papers were read in more detail and additional papers were found through snowballing. In the end, 26 papers were selected for the literature overview (Appendix 1), of which 22 formed the basis for the design management roles for remanufacturing presented in Table 1, column 2. This table was structured according to the four capacities of design described by Borja de Mozota [7]. The sub-categories that emerged by grouping the input from literature were defined using additional references, see Table 1, column 1.

After developing the framework, we conducted in-depth interviews to further explore the possible roles for design management in the implementation of Design for Remanufacturing. Figure 1 shows the research process.

Seven companies operating in business-to-business markets were selected for inclusion based on their product properties, their level of influence on the product design, and their interest in (setting up) remanufacturing activities. The first criterion was that the company’s product properties had to have the potential for remanufacturing. Examples are durability, the possibility for long term part standardisation, and the use of a stable technology [43]. The second criterion was that the companies could influence decisions made in the product development process; there had to be a link with the product development department. The last criterion was the level of interest in recovery activities; a basic interest in setting up remanufacturing was required. The final selection included four OEMs, two OEMs with recovery activities in place, and one third party remanufacturer. A summary of the case details can be found in Table 2 and the company descriptions can be found in Appendix 2.

Interviews with these companies were conducted following the structure for shorter interviews described by Yin [60]. They were semi-structured and lasted approximately one hour each. The interview protocol led discussions around opportunities and barriers to remanufacture products from a product design perspective, and can be found in Appendix 3. The interview recordings were then transcribed.

The data for the company producing window shades (A4) was collected in a four-hour workshop, followed up by conversations with the company. This workshop was set up using a protocol in the form of worksheets and structure documents from an EU project [5]. Elements discussed were the opportunities for remanufacturing the product in relation to market potential, product and production, and the remanufacturing process.

Data analysis was performed using the framework of design management roles for remanufacturing presented in Table 1. The researcher carefully went through the transcriptions in order to develop themes that reflected the respondents’ meanings. These were related to opportunities and barriers for design management and addressed market issues, customer perspectives, product design issues, and finances; the findings are summarized in Table 3. Themes found for design as a differentiator, for example, were: market assessment, customer acceptance and customer relationship. In the following step, we compared these opportunities and barriers to the design roles in Table 1. This led to the identification of a number of new roles for design management; these are described in the discussion.

Results

In this section, we describe the findings from the interviews for each of the four design capacities. The list of opportunities and barriers is presented in Table 3, column 1. The details for the case references can be found in the methods section in Table 2. In the discussion section, we reflect on how the opportunities and barriers link to the earlier-identified design management roles (Table 3, column 2).

When analysing the interviews, we added the new sub-category called external drivers to the capacity of design as good business (the financial perspective). External drivers are defined as incentives out of the company’s control that influence the company’s way of doing business [19, 20].

For each of the four capacities we were able to identify opportunities or barriers that were not mentioned in the literature reviewed for this paper. We will discuss these opportunities and barriers in more detail, starting with the sub-category customer relationship. The barriers found here are the result of operating in highly complex supply chains. Due to this complexity, companies may not have existing channels to communicate with their (end) customer and therefore experience difficulties when initiating circular models. To illustrate this, an interviewee from company A1 describes their customer relationship as follows:

“We do not deliver our products to the end user or the building investor, but to the installer. Once the system is installed, the end user is out of our sight. This is where we try to make a connection, to stay in the picture. Only then can we start offering circularity.”

In the next sub-category, innovation, the interviewees from companies A3 and A4 mentioned the risk of designing products for the long term because of the difficulty of assessing future market needs and uncertainties regarding technological developments. The interviewee from company A3 shared the following:

“Our assets last for many decades, but at one point they become outdated, written off, or too expensive to maintain. How can we deal with this? One thing to consider is the difficulty of looking into the future. Most people say: ‘I don’t believe in [circular design]. You don’t know anything about what’s going to happen after five years.’ And the challenge is that a lot of our products are custom built, so how do you approach remanufacturing when every part is slightly different to the other? This is a big challenge.”

In the business development sub-category, many barriers have to do with the complexity of setting up circular business models. Companies A3 and B2 point out the misalignment of exploring circular business opportunities with the existing way companies develop new business cases. The existing process is strongly driven by direct costs and profits, and leaves very little room for exploration. In addition, companies A2, B2 and C1 sense that it is important to collaborate with supply chain partners, yet they experience dependence as a risk for the longer term. The interviewee from company C1 noted the following:

“Many potential customers were initially very interested in remanufacturing. But once they headed back to their company, they experienced a lot of resistance; it was not a priority and it was expected to be too complex. Which it is. Any business expert knows that a linear process is simpler than a circular process. But, in the end, you will earn more money with it.”

A quote from the interviewee from company C1 illustrates the need for collaboration with supply chain partners to make remanufacturing feasible:

“We were in the process of remanufacturing a very expensive pump, when we realised that replacing the worn-out component would be incredibly expensive. This was due to the price the supplier charges for spare parts. Buying a new pump would almost cost the same.”

Another example, with regard to the dependency of suppliers, was given by the company B2 interviewee:

“The design of our machines changes every five years. If we extend the product lifetime even further, there is a big chance we will run out of spare parts. The supplier simply no longer produces those parts. By refurbishing a second or third time, we would risk not being able to service the machines in field properly. That is why we only refurbish our machines once.”

The sub-categories financial drivers and external drivers also yielded several new barriers. While the external barriers mentioned are difficult to influence through design management, the financial barriers can be influenced. One of the barriers relates to the company reward system for product sales. The company A3 interviewee explained the following:

“[In selling remanufacturing products] the main obstacle, internally, would be the reward-system. [The way it is organised now,] sales people get paid as a percentage of the new-build products. When you stop selling new-build, how should the reward structure for sales be organised so that that they will accept and work with it? The reward-system has to change.”

Discussion

In this section, we compare the opportunities and barriers found in the interviews with the earlier-identified design management roles for remanufacturing. Most of these barriers and opportunities have been addressed in similar forms in previous studies in literature and can therefore be linked to design management roles identified in the background section (Table 3, column 2).

A number of opportunities and barriers were linked to the same design management roles because they share an underlying cause, for example, for the opportunities and barriers related to customer awareness under the sub-category market assessment. The role linked to these opportunities and barriers is to ‘increase awareness and trust by developing a marketing and branding strategy for remanufactured products’ and covers all of the barriers in this sub-category.

Several barriers from the interviews did not show clear links with the reviewed literature. For these, we formulated additional roles for design management based on insights from the cases and by reflecting on the literature review in the background section. We discuss these additional roles in more detail in this section.

Firstly, for design as a differentiator, the new role is to ‘Identify what new channels are suitable to start up communication with customers in complex supply chains’. This role addresses the difficulty for companies in complex supply chains to communicate with their (end-) customers. The importance of communication with customers, as well as the type of information to be communicated, have been thoroughly discussed in the literature [1, 30, 35, 47, 48]. In industries with complex supply chains, however, there are often no existing communication paths with these customers; therefore these need to be developed (A1, A2, A4).

One new role was identified for the process perspective: ‘Identify the added value of remanufacturing to the manufacturing department’. The importance of the exchange of product/ production information between the manufacturing department and remanufacturing department is addressed in the literature [29, 40, 55]. In our study, we found that remanufacturing can also add value in other ways, for example by resolving production errors (B1).

For the learning perspective, we found one additional role: ‘Compile technological roadmaps to make estimations of the duration certain technologies will be used’. To include remanufacturing in early stages of the product development process has proven to be important, for example, when identifying which component can be standardized [24, 28, 35, 53, 61]. In line with this, and to support portfolio management, drafting an early stage technology roadmap is essential for identifying design opportunities (B1, B2).

For the financial perspective, we added two new roles for design management. The first of these is to ‘Identify the non-financial benefits of remanufacturing’. While the literature discusses the costs and profits, the non-financial benefits are also likely to have a valuable impact [9, 17, 29, 41, 53]. A shift towards a value-based view in, for example, feasibility studies, by including aspects like brand management, parts harvesting, and the possibility to reduce time-to-market, will demonstrate the full potential of remanufacturing (A1, B1, B2).

The second role is to ‘Identify existing KPIs which are directly or indirectly unsupportive of remanufacturing, and formulate new KPIs where possible’. The topic of KPIs is not extensively discussed in the literature due to the fact that remanufacturing is often not yet embedded in the company. One of the case study companies addressed this topic by noting that company reward systems in sales departments are attuned to new product sales, while no reward system is in place for the sales of remanufactured products (A3).

For this study we interviewed seven companies in addition to the literature review. Even though this number is limited, it resulted in the formulation of several new roles. This implies that either 1) the topic requires a more extensive literature review to cover the remaining roles, or 2) there is much more to be expected from design (management); it is an overlooked capacity that might be instrumental in making remanufacturing more successful.

Conclusion

The use of a design management approach leads to a good understanding of the importance of strategic design for remanufacturing and it leads to formulating concrete actions. As a starting point, we were able to formulate a number of design management roles based on the literature review. This was reviewed using a design management framework based on four capacities of design: design as differentiator, design as integrator, design as transformer, and design as good business. The framework was further developed by adding sub-categories to these capacities, based on grouping the opportunities and barriers found in remanufacturing literature. After conducting in-depth interviews with seven different companies, we defined several additional roles for design management.

Design for Remanufacturing has been thoroughly discussed in literature in recent decades. Its implementation in practice, however, has not followed at the same pace. The (early) integration of the knowledge into existing company processes is considered important. Current literature has revealed numerous points for improving the uptake of this knowledge in the early design stage. Our study contributes by initiating an exploration for concrete design management roles, as a next step in finding a structured approach for implementing Design for Remanufacturing.

As a result, we found that the roles for design management can contribute in three ways. Firstly, they make explicit the added value of Design for Remanufacturing for an organisation. Additionally, the roles aid in building bridges amongst both internal and external stakeholders. And finally, they contribute to embedding Design for Remanufacturing into existing processes by means of KPIs and roadmaps.

The exploratory work in this paper yielded a detailed list of concrete design management roles for remanufacturing. To get insights in the added value of these roles in practice, further research is needed. In-depth studies with companies have the potential to provide a more detailed description of the added value of these roles. They can also help in further detailing and finetuning, as well as increasing our understanding of their effect on information exchange and collaboration amongst stakeholders. Lastly, in-depth case studies may reveal opportunities or knowledge gaps for further development of (early stage) design tools to aid OEMs in the development of remanufacturable products.

References

Abbey JD, Kleber R, Souza GC, Voigt G (2017) The role of perceived quality risk in pricing remanufactured products. Prod Oper Manag 26(1):100–115. https://doi.org/10.1111/poms.12628

Acceptance (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/acceptance

Amezquita, T., Hammond, R., Salazar, M., & Bras, B. (1995, September). Characterizing the remanufacturability of engineering systems. In ASME Advances in Design Automation Conference (Vol. 82, pp. 271-278)

Bakker, C., den Hollander, M., Van Hinte, E., & Zijlstra, Y. (2014). Products that last: product design for circular business models. TU Delft Library

Boorsma, N., Tsui, T., & Peck, D. (2019) Circular building products, a case study of soft barriers in design for remanufacturing. In Proceedings of the International conference of Remanufacturing 2019

Borja de Mozota B (2002) Design and competitive edge: a model for design management excellence in European SMEs. Des Manag J 2:88–103

Borja de Mozota B (2006) The four powers of design: a value model in design management. Design Management Review 17(2):44–53

Business (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/business

Bras, B., & Hammond, R. (1996, November). Towards Design for Remanufacturing–metrics for assessing remanufacturability. In Proceedings of the 1st International Workshop on Reuse, 5-22

Calabretta G, Gemser G (2017) Building blocks for effective strategic design. Journal of Design, Business & Society 3(2):109–124. https://doi.org/10.1386/dbs.3.2.109_1

Collaboration (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/collaboration

Commitment (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/commitment

Cooper, R.; Junginger, S.; Lockwood, T. (Eds.) (2011). The Handbook of Design Management

Cooper R, Press M (1995) The design agenda: a guide to successful design management. John Wiley and Sons

Customer relationship (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/customer-relationship

Daugherty PJ, Richey RG, Hudgens BJ, Autry CW (2003) Reverse logistics in the automobile aftermarket industry. Int J Logist Manag 14(1):49–62

Debo LG, Toktay LB, Van Wassenhove LN (2005) Market segmentation and product technology selection for remanufacturable products. Manag Sci 51(8):1193–1205. https://doi.org/10.1287/mnsc.1050.0369

Development (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/development

Driver (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/driver

External (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/external

Esmaeilian B, Behdad S, Wang B (2016) The evolution and future of manufacturing: a review. J Manuf Syst 39:79–100. https://doi.org/10.1016/j.jmsy.2016.03.001

European Commission (EC) (2015). COM 614 final - Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. Retrieved from: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52015DC0614

Financial (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/financial

Gehin A, Zwolinski P, Brissaud D (2008) A tool to implement sustainable end-of-life strategies in the product development phase. J Clean Prod 16(5):566–576. https://doi.org/10.1016/j.jclepro.2007.02.012

Govindan K, Jiménez-Parra B, Rubio S, Vicente-Molina MA (2019) Marketing issues for remanufactured products. J Clean Prod 227:890–899. https://doi.org/10.1016/j.jclepro.2019.03.305

Gray C, Charter M (2008) Remanufacturing and product design. Int J Prod Dev 6(3–4):375–392

Guide VDR Jr (2000) Production planning and control for remanufacturing: industry practice and research needs. J Oper Manag 18(4):467–483. https://doi.org/10.1016/S0272-6963(00)00034-6

Hatcher GD, Ijomah WL, Windmill JFC (2011) Design for remanufacture: a literature review and future research needs. J Clean Prod 19(17–18):2004–2014. https://doi.org/10.1016/j.jclepro.2011.06.019

Hatcher GD, Ijomah WL, Windmill JFC (2013) Integrating design for remanufacture into the design process: the operational factors. J Clean Prod 39:200–208. https://doi.org/10.1016/j.jclepro.2012.08.015

Hazen BT, Boone CA, Wang Y, Khor KS (2017) Perceived quality of remanufactured products: construct and measure development. J Clean Prod 142:716–726. https://doi.org/10.1016/j.jclepro.2016.05.099

Ijomah WL, McMahon CA, Hammond GP, Newman ST (2007) Development of robust design-for-remanufacturing guidelines to further the aims of sustainable development. Int J Prod Res 45(18–19):4513–4536

IRP (2018) Re-defining Value – The Manufacturing Revolution. Remanufacturing, Refurbishment, Repair and Direct Reuse in the Circular Economy. Nabil Nasr, Jennifer Russell, Stefan Bringezu, Stefanie Hellweg, Brian Hilton, Cory Kreiss, and Nadia von Gries. A Report of the International Resource Panel. United Nations Environment Programme, Nairobi, Kenya. Retrieved from: https://www.resourcepanel.org/reports/re-defining-value-manufacturing-revolution

Information management (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/information-management

Integration (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/integration

Karvonen I, Jansson K, Behm K, Vatanen S, Parker D (2017) Identifying recommendations to promote remanufacturing in Europe. Journal of Remanufacturing 7(2–3):159–179. https://doi.org/10.1007/s13243-017-0038-2

Kerr W, Ryan C (2001) Eco-efficiency gains from remanufacturing: a case study of photocopier remanufacturing at Fuji Xerox Australia. J Clean Prod 9(1):75–81. https://doi.org/10.1016/S0959-6526(00)00032-9

Lange, U. (2017) Resource efficiency through remanufacturing. VDI Zentrum Ressourceneffizienz GmbH. Retrieved from: https://www.resource-germany.com/fileadmin/user_upload/downloads/kurzanalysen/VDI_ZRE_KA18_Remanufacturing_en_bf.pdf

Law J (2009) A dictionary of business and management, 5th edn. Oxford University Press, URL https://www.oxfordreference.com/view/10.1093/acref/9780199234899.001.0001/acref-9780199234899

Lindkvist Haziri L, Sundin E (2019) Supporting Design for Remanufacturing-a framework for implementing information feedback from remanufacturing to product design. Journal of Remanufacturing 10:1–20. https://doi.org/10.1007/s13243-019-00077-4

Lindkvist Haziri L, Sundin E, Sakao T (2019) Feedback from remanufacturing: its unexploited potential to improve future product design. Sustainability 11(15):4037. https://doi.org/10.3390/su11154037

Linton JD (2008) Assessing the economic rationality of remanufacturing products. J Prod Innov Manag 25(3):287–302. https://doi.org/10.1111/j.1540-5885.2008.00301.x

Lund RT, Denney WM (1977) Opportunities and implications of extending product life. Center for Policy Alternatives, Massachusetts Institute of Technology

Lund RT, Mundial B (1984) Remanufacturing: the experience of the United States and implications for developing countries, vol 31. World Bank, Washington, DC

Market share (n.d.) In Merriam-Webster.com. Retrieved from https://www.merriam-webster.com/dictionary/market%20share

Matsumoto M, Chinen K, Endo H (2018) Remanufactured auto parts market in Japan: historical review and factors affecting green purchasing behavior. J Clean Prod 172:4494–4505. https://doi.org/10.1016/j.jclepro.2017.10.266

Matsumoto M, Yang S, Martinsen K, Kainuma Y (2016) Trends and research challenges in remanufacturing. International Journal of Precision Engineering and Manufacturing-Green Technology 3(1):129–142. https://doi.org/10.1007/s40684-016-0016-4

Milios L, Matsumoto M (2019) Consumer perception of remanufactured automotive parts and policy implications for transitioning to a circular economy in Sweden. Sustainability 11(22):6264. https://doi.org/10.3390/su11226264

Michaud C, Llerena D (2011) Green consumer behaviour: an experimental analysis of willingness to pay for remanufactured products. Bus Strateg Environ 20(6):408–420. https://doi.org/10.1002/bse.703

Parker, D., Riley, K., Robinson, S., Symington, H., Tewson, J., Jansson, K., Ramkumar, S. & Peck, D. (2015). Remanufacturing market study

Pigosso DC, Zanette ET, Guelere Filho A, Ometto AR, Rozenfeld H (2010) Ecodesign methods focused on remanufacturing. J Clean Prod 18(1):21–31. https://doi.org/10.1016/j.jclepro.2009.09.005

Prendeville S, Bocken N (2017) Design for remanufacturing and circular business models, In Sustainability through innovation in product life cycle design (pp. 269–283). Springer, Singapore. https://doi.org/10.1007/978-981-10-0471-1_18

Rashid A, Asif FM, Krajnik P, Nicolescu CM (2013) Resource conservative manufacturing: an essential change in business and technology paradigm for sustainable manufacturing. J Clean Prod 57:166–177. https://doi.org/10.1016/j.jclepro.2013.06.012

Subramoniam R, Huisingh D, Chinnam RB (2010) Aftermarket remanufacturing strategic planning decision-making framework: theory & practice. J Clean Prod 18(16–17):1575–1586. https://doi.org/10.1016/j.jclepro.2010.07.022

Sundin E. (2002) Design for Remanufacturing from a remanufacturing process perspective, Linköping studies in science and technology, licentiate thesis no. 944, LiU-TEK-LIC-2002-17, Department of Mechanical Engineering, Linköping University, SE-581 83 Linköping, Sweden

Sundin E, Bras B (2005) Making functional sales environmentally and economically beneficial through product remanufacturing. J Clean Prod 13(9):913–925. https://doi.org/10.1016/j.jclepro.2004.04.006

Sundin E, Lindahl M, Ijomah W (2009) Product design for product/service systems: design experiences from Swedish industry. J Manuf Technol Manag 20(5):723–753. https://doi.org/10.1108/17410380910961073

Support (n.d.) In Cambridge Dictionary. Retrieved from https://dictionary.cambridge.org/dictionary/english/support

Wang, Y., Wiegerinck, V., Krikke, H., & Zhang, H. (2013). Understanding the purchase intention towards remanufactured product in closed-loop supply chains. International Journal of Physical Distribution & Logistics Management

Watson, M. (2008). A review of literature and research on public attitudes, perceptions and behaviour relating to remanufactured, repaired and reused products. Report for the Centre for Remanufacturing and Reuse, 1-26

Yin RK (2018) Case study research and applications: design and methods. Sage publications

Zwolinski P, Lopez-Ontiveros MA, Brissaud D (2006) Integrated design of remanufacturable products based on product profiles. J Clean Prod 14(15–16):1333–1345. https://doi.org/10.1016/j.jclepro.2005.11.028

Acknowledgements

This paper was funded through EU-funded H2020 project ‘Resource-Efficient Circular Product Service Systems’ (ReCiPSS), under grant agreement number 776577-2. The results were collected in EU-funded EIT KIC Raw Materials projects, called: ‘Remanufacturing Pathways’ (RemanPath), under grant agreement number 17087, and Catalyse Remanufacturing through Design Bootcamp (CARED), under grant agreement number 18024.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Appendix 2

Company descriptions:

Air treatment units for buildings – This company offers customised solutions for air treatment systems for buildings. The products have high potential to be remanufactured as they are built up out of standardised parts, with varying dimensions. The design is highly modular, upgradable and made of long-lasting materials. The product technology is relatively stable, and functionality and costs are the main selling points

Outdoor furniture – This company develops products for the public domain. Examples of such products are street furniture, bike parks, infrastructural devices, and equipment for sports and play grounds. The products are made from highly durable, wear-resistant materials, from both a functional and aesthetical point of view. The products are designed according to the specifications in a tender

Vessel and maritime equipment – This company offers a range of products used in the maritime industry. These large systems typically have extremely long lifetimes, lasting for many decades. Activities for the application of these systems range from dredging, oil and gas, offshore wet mining, etc. Large amounts of high-grade materials are used requiring enormous investments

Window shades – This company develops and manufactures high-end, bespoke shading products for facades of buildings. The products are made from durable and well-recyclable materials, and the design allows for ease of disassembly and replacement of parts. Main selling points of the products are the aesthetics, the functionality, and costs

Electro motors – This company offers customised electro motors for a broad range of applications, from all sorts of conveyers to industrial mixers, grinders and cranes. The lay-out of the production process for new products is set up in a way that it allows for integration of remanufacturing in the same process. Existing customers can make use of this to remanufacture their products, which offers benefits like maintaining exactly the same product specification, as well as cost-saving

Professional coffee machines – This company retains ownership of their products and offers access or performance models to customers. The machines are installed at the preferred location and offers are based on either a monthly fee (access model) or a price per served beverage (performance model). The machines are designed for service and maintenance and therefore enable ease of replacement of parts and ease of recovery to return the product to its original state

Electro motors – Using their knowledge of producing new electro motors, this company remanufactures used electro motors as a contractor. The company has a dedicated production line for high-grade recovery of each of the parts of this product, allowing their customers to make efficient use of their resources. Since the company has gained experience in, and developed a method for, remanufacturing, they are also expanding to other product groups

Appendix 3

Interview protocol:

-

Can you describe your current offer?

-

What product functionality do you offer?

-

To what target market?

-

To meet what market needs?

-

Do you offer performance related services (e.g. maintenance, quality control)?

-

Do you offer any additional services?

-

In what way is the value proposition for remanufactured products different from newly produced products? Or in what way would it be different?

-

-

What are barriers to remanufacture your product?

-

What are drivers to remanufacture your product?

-

What are enablers to remanufacture your product?

-

What type of investments are required for remanufacturing? If applicable

-

How are your products developed?

-

What process steps do you follow?

-

Which departments/ functions outside of the product development department contribute to product development? And why?

-

Do you Design for Remanufacturing? In what way?

-

How do you deal with (future) technological developments during product design (in relation to remanufacturing)?

-

Do you make use of critical materials?

-

-

What does your remanufacturing process look like? If applicable

-

What are the most time-consuming steps? And why?

-

What are the costliest steps? And why?

-

Do you improve the product during the process?

-

-

Are you planning to implement new business models, like service-based business models?

-

Would this be desirable?

-

Can you give an example?

-

Who would be involved in this process?

-

What prevents this from happening now?

-

-

What additional services could you offer your clients through remanufacturing?

-

Would this be desirable?

-

Can you give an example?

-

Who would be involved in this process?

-

What prevents this from happening now?

-

-

How do you market your remanufactured products? (/ How do you ensure customer acceptance?) If applicable

-

Do you target the same customer segment for remanufactured products as for new products?

-

Through which channels?

-

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Boorsma, N., Balkenende, R., Bakker, C. et al. Incorporating design for remanufacturing in the early design stage: a design management perspective. Jnl Remanufactur 11, 25–48 (2021). https://doi.org/10.1007/s13243-020-00090-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13243-020-00090-y