Abstract

We investigate the dynamics of a hybrid manufacturing/remanufacturing system (HMRS) by exploring the impact of the average return yield and uncertainty in returns volume. Through modelling and simulation techniques, we measure the long-term variability of end-product inventories and orders issued, given its negative impact on the operational performance of supply chains, as well as the average net stock and the average backlog, in order to consider the key trade-off between service level and holding requirements. In this regard, prior studies have observed that returns may positively impact the dynamic behaviour of the HMRS. We demonstrate that this occurs as long as the intrinsic uncertainty in the volume of returns is low —increasing the return yield results in decreased fluctuations in production, which enhances the operation of the closed-loop system. Interestingly, we observe a U-shaped relationship between the inventory performance and the return yield. However, the dynamics of the supply chain may significantly suffer from returns volume uncertainty through the damaging Bullwhip phenomenon. Under this scenario, the relationship between the average return yield and the intrinsic returns volume variability determines the operational performance of closed-loop supply chains in comparison with traditional (open-loop) systems. In this sense, this research adds to the still very limited literature on the dynamic behaviour of closed-loop supply chains, whose importance is enormously growing in the current production model evolving from a linear to a circular architecture.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The traditional linear economic model, which covers from resource extraction to disposal, is evolving into a new one, which collects and brings used products into a circular system. As a consequence, supply chains are currently developing from open-loop to closed-loop architectures in an attempt to capture the environmental, financial, and societal opportunities derived from these circular economic models [2, 15, 20]. However, these opportunities emerge with relevant challenges to deal with, as the complexity of managing efficiently closed-loop systems significantly increases. One of the reasons behind that is the fact that closed-loop archetypes should accommodate at the same time uncertainty in the volume of demand and in the returns, which implies that traditional models for controlling open-loop systems must be reconsidered in this new closed-loop setting [9].

In this sense, the new circular model creates the need for understanding the dynamic behaviour of closed-loop production and distribution systems and developing knowledge equivalent to the one we have for traditional (open-loop) systems. As such, a new line of enquiry has emerged in the literature: that of understanding how the main variables of these closed-loop supply chains, mainly orders and inventories, behave over time. However, the literature in this field is still relatively limited.

Interestingly, Tang and Naim [18] observed that returns may positively impact on the operational performance of these systems through a significant decrease of order variability, even though their complexity is higher (as previously discussed). Later works confirmed these results [1, 3, 19, 22, 23], while we note that Adenso-Díaz et al. [1] observed that for high values of the return yield, this parameter tended to increase the variability of the orders issued – hence suggesting a nonlinear relationship between order variability and return yield. In addition, several works showed that a higher return yield reduces inventory variability [3, 23]. However, Turrisi et al. [19] reported an increase of end-product inventory variability when the return yield increases.

Overall, these works provide us with interesting insights on the dynamic response of closed-loop supply chains. Nonetheless, they generally consider that a fixed percentage of the used products, namely the return yield, is collected after a consumption lead time [1, 3, 18, 19, 22, 23]. This assumption, which can be attributed to the complexity of the relevant analytical modelling, implies that returns variations are exclusively a consequence of variations in the product demand. Hence, it is reasonable to interpret these previous conclusions as the positive impact of the returns on the supply chain when these are highly correlated with the demand. Under these circumstances, we wonder how uncertainty in the volume of returns collected from the market would alter these conclusions. In this sense, we tackle what we name a ‘dual source uncertainty problem’ (demand uncertainty plus returns uncertainty), which is widely recognised by both managers and academics, but has been barely analysed in the literature.

Thus, this research work adds to the literature by exploring the impact of the uncertainty in the volume of returns on the dynamic behaviour of closed-loop supply chains. To do so, we will consider a hybrid manufacturing/remanufacturing system (HMRS). Our study is concerned with the proportional order-up-to (POUT) replenishment rule [8]. We selected this discrete-time inventory policy since it is optimal to maximize the dynamic performance of supply chains when both order and inventory variabilities are considered [7]. Potter and Disney [17] illustrate how this rule can be easily employed in real-world supply chains to effectively cope with the well-known Bullwhip Effect [13], which refers to the amplification of the variability of orders as one moves up a supply chain. Our methodological approach is based on modelling and simulation techniques, while we employ designed experiments and statistical analyses to derive real-world implications.

This research article has been structured as follows. After developing the problem statement in this section, we describe the supply chain model that has been considered for the purposes of this research. Then, we present and justify the experimental design, followed by the numerical results and their statistical analysis as well as discussion according to our research aim of investigating the effect of returns volume uncertainty. Finally, we conclude and suggest a future research agenda in this field.

Supply chain model

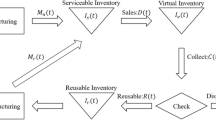

The HMRS that we have considered in this study can be seen in Fig. 1. It highlights two types of material flows. First, the forward, or traditional, material flow, which refers to the process of manufacturing products from raw materials; the products are subsequently consumed. Second, the reverse material flow, which is associated with the collection of a portion of the consumed products and its remanufacturing. We have thus three relevant lead times in the system; i.e. manufacturing, consumption, and remanufacturing lead times.

We assume the following operation for the closed-loop supply chain, which can be divided into three sequential states per time period, which we consider as one week:

- (1)

RSF (reception, settling, and feeding) state. At the beginning of each time period, the end-product inventory receives both new and remanufactured products, assuming the latter are as-good-as-new. If past backorders exist, they are also satisfied from the end-product inventory. In addition, the raw-material inventory provides manufacturing with what is required to meet the orders issued, while all the returns that have been collected during the previous period are pushed into the remanufacturing process. This assumption is common in works in this field [1, 3, 18, 19, 22, 23], which will be the benchmark for our study.

- (2)

MSC (manufacturing, serving, and collection) state. During the course of the time period, consumer demand is received, and it is satisfied as long as inventory is available. If stock-out occurs, unsatisfied demand is also recorded. Similarly, returns are collected and stored in the returns inventory. During this main part of the time period, both the manufacturing and remanufacturing processes are ongoing.

- (3)

UFS (updating, forecasting, and sourcing) state. At the end of each time period, the inventory on-hand (or net stock) and work-in-progress are updated. If necessary, a new backorder is generated. Then, product needs are forecasted by means of using a simple exponential smoothing (SES) method, and finally an order is issued to manufacture the new products required according to a POUT replenishment model.

This sequence of events in the closed-loop supply chain is summarized in Fig. 2.

Mathematical model

We have modelled both the consumer demand (Dt) and the product returns (Rt) by using white-noise processes. This is a common assumption in the literature on reverse logistics [10, 12, 14]. The demand is expressed as the sum of its mean (μ) and an error term (εt), which is an independent and identically distributed (i.i.d.) random variable following a normal distribution with a mean of 0 and a standard deviation of σ; see Eq. (1). On the other hand, the returns are expressed as the sum of their mean (which is the average return yield β times the mean of the demand μ), a fraction β of the error term in the demand Tc periods ago (Tc is the average consumption lead time), and an intrinsic error term (γt), which is an i.i.d. random variable following a normal distribution with a mean of 0 and a standard deviation of λ. Note that the returns process can be simplified to the sum of a fraction of the past demand and the error term, as per Eq. (2).

Conceptually, the first term models the variability in returns due to variations in the demand, while the second term models the intrinsic variability of returns. We will use the noise ratio m = λ/σ to express the relationship between the standard deviation of both errors.

To implement the previously described operation of the closed-loop supply chain, we have built on the model by Tang and Naim [18] for HMRSs with fixed return yield, which in turn was developed as an extension of the widely studied APIOBPCS model [11] for traditional supply chains. Specifically, our study is based on Tang and Naim‘s [18] type 3 system where the closed-loop supply chain makes the best use of the information shared.

The end-product inventory, or net stock (NSt), balance considers negatively the consumer demand and positively both the manufacturing completion rate (MCt) and the remanufacturing completion rate (RCt); see Eq. (3). A positive value of this variable refers to storage, while a negative value refers to backorders. On the other hand, the HMRS work-in-progress (Wt) is decreased by both completion rates and is increased by the collected products, or returns (Rt-1), and the orders issued at the end of the previous period (Ot-1), according to Eq. (4).

The manufacturing completion rate responds to the order placed Tm + 1 periods ago, where Tm is the manufacturing lead time; see Eq. (5). Note that orders are issued at the end of each period. Hence, e.g. if the lead time is 1 and the order is issued at the end of t = 3, the product will be available at the beginning of t = 5. Similarly, the remanufacturing completion rate corresponds to the product collected Tr + 1 periods ago; see Eq. (6).

As previously discussed, manufacturing orders are issued according to a POUT model as the sum of three terms: (i) the forecast of the product needs; (ii) a fraction, 1/Ti, of the gap between the target and the actual net stock; and (iii) a fraction, 1/Tw, of the gap between the desired and the actual work-in-progress. First, the forecast of the product needs is expressed as the product of the demand forecast (Ft) and the estimation of the percentage of products that will not return to the supply chain; that is, the difference between 1 and the average return yield (β). Second, the target net stock, or safety stock (SS), constitutes a decision variable of the system, which must be defined according to the desired customer service level. Third, the target work-in-progress is a forecast of consumption over the estimated pipeline lead time Tp. The ordering rule is represented by Eq. (7). To estimate the pipeline lead time, we employ the solution by Tang and Naim [18], aimed at avoiding long-term inventory offset. This obtains the pipeline as a weighted average, defined by the average return yield, of the manufacturing and remanufacturing lead times; see Eq. (8).

Last, we note that we forecast consumer demand through a simple exponential smoothing by Eq. (9), where the parameter Ta defines the ratio between the weights of both terms.

Performance metrics

Like in previous studies in the area of closed-loop supply chain dynamics, the performance of the HMRS will be measured by the variability generated. To do so, we will consider the Bullwhip (BW) and the Net Stock Amplification (NSAmp) ratios. The former quantifies the relation between the variance of the manufacturing orders issued and the variance of the customer demand, while the latter compares the variance in the net stock to the demand variance. We consider that these relevant ratios, which can be seen in Eq. (10) and Eq. (11) respectively, define the internal performance of the closed-loop supply chain.

It should be highlighted that production-related costs are related to the BW ratio, while inventory-related costs tend to increase as the NSAmp ratio grows increase [7]. This underscores the need for finding an appropriate balance between both sources of internal variability, where it is commonly possible to reduce one of them at the expense of increasing the other [16].

On the other hand, we also look at the external performance of the supply chain. To do so, we measure the average backlog (AB) and the average net stock (ANS) in the system, between which inventory managers look for an appropriate equilibrium that determines inventory-related costs. Note that the average backlog directly measures the out-of-stock level in the supply chain, which represents a critical concern in modern service-oriented business environments [4]. The indicators are expressed by Eq. (12) and Eq. (13), respectively, where [x]+ = max{0, x}.

To sum up, Fig. 3 illustrates the ‘scorecard’ that we have considered to measure the operational performance of the supply chain, including the relationship of the four relevant metrics with production- and inventory-related costs.

Experimental design

To investigate the impact of the average and uncertainty in returns volume on the operational performance of the HMRS, we adopt an approach based on designed experiments. In line with our aim, we consider the impact of two main factors:

Average return yield (β), which allows us to compare the traditional system, when β = 0, versus the closed-loop system. With the aim of capturing nonlinear effects if they exist, we consider five scenarios defined by different levels for this variable: 0, 0.25, 0.50, 0.75, and 1.

Noise ratio (m), which allows us to analyse the impact of the returns volume uncertainty in the closed-loop supply chain. For the same previous reason, we consider five scenarios defined by levels for this variable: 0 (case of no uncertainty in returns volume, as they only vary according to the demand), 0.5, 1, 2, and 4 (case of very high uncertainty in volume of returns).

In this research work, we have chosen Tm = Tr = 4, hence illustrating a practical setting where the manufacturing and remanufacturing lead times are equal. Setting the equality Tm = Tr is aligned with prior works, who showed that this yields ‘optimum’ dynamics. For example, Hosoda and Disney [10] underlined the benefits of making equal the manufacturing and remanufacturing lead times. Interestingly, they observed that shortening remanufacturing lead times may not have desirable consequences if manufacturing lead times are fixed (a ‘lead-time paradox’). Tang and Naim [18] also showed that the equality yields trade-offs in overall dynamic performance. From Eq. (8), given that Tm = Tr = 4, the estimated pipeline lead time that minimizes the long-term inventory drift in the inventory is easily given by Tp = 4. Since the consumption time tends to be significantly higher than the manufacturing and remanufacturing lead times, we have selected Tc = 16. For the consumer demand, we have assumed μ = 100 and σ = 20, whose coefficient of variation (20%) is within the common range of variation of retail series: 15% - 50% [5].

Regarding the value of the control parameters, Disney [6] recommends, for Tm = 4, the setting Ta = 4, Ti = 7, Tw = 28 with the aim of balancing the Bullwhip phenomenon and inventory holding requirements. We have employed this combination, as it represents a ‘good design’ of a traditional supply chain. Finally, we have fixed SS = 50, which represents a practical setting where the safety stock equals to 50% of the mean demand.

We selected Th = 10,000 time periods as the horizon of the simulation runs, where the first 100 time periods, a warm-up area, are not considered to minimize the impact of the initial conditions of the HMRS. We have verified the stability of the response and the consistency of the results under these conditions according to common practices [21]. We note that this discrete-time simulation model has been implemented via MatLab R2014b. Given the low experimental effort of each simulation run, of less than 1 second per run, we have used a full factorial design of experiments composed of 52 = 25 scenarios, which has been replicated five times for a total of 125 simulation runs.

Results and discussion

Table 1 summarizes the numerical results of the experimental analysis, where β varies from 0 to 1 and m varies from 0 to 4. In each row (one scenario), the table shows the average of the four performance metrics from the five simulation runs conducted in this scenario.

To analyse these results, we have first resorted to inferential statistics. Specifically, we have carried out an ANOVA (analysis of variance) study, whose results are reported in Table 2. Using a level of significance of 5%, these results confirm that both the average return yield β and the noise ratio m significantly impact on the four considered performance indicators (P values in all cases much lower than 5%). In contrast, the two-way interaction of both factors has not proven to be significant, so this will not be considered in the following discussion. In all cases, the Rsq (adj) is higher than 98%, which indicates that the models explain most of the variance and hence fit well the data.

The main effects plots displayed in Figs. 3 and 4 illustrate how the average return yield (β) and the noise ratio (m), respectively, impact on the operational performance of closed-loop supply chains.

It can be seen from Fig. 4 that as the percentage of recollected products increases, the BW ratio decreases. This is not a new insight, since previous works in this field have also observed this effect, as previously discussed [1, 3, 18, 19, 22, 23]. This result may suggest that the dynamics of the supply chain benefit from adding the reverse loop. However, Fig. 5 shows that the dynamic response of the closed-loop system also, and even largely, depends on the noise ratio. This shows that, in the considered supply chain context, the operational response of the HMRS is severely impacted by the uncertainty of returns volume. In this regard, Fig. 5 displays that the closed-loop supply chain attenuates the variability of orders issued (i.e. BW < 1) for low and mid values of the noise ratio, hence showing the effectiveness of the proposed control setting. However, this system suffers from the Bullwhip phenomenon (BW > 1) for high values of the noise ratio, that is, when returns volume uncertainty is very relevant. Hence, when we considered the ‘dual source uncertainty problem’, both demand and returns volume uncertainty were found to contribute to the Bullwhip Effect.

Under these circumstances, and according to the framework defined in Fig. 2, we observe that increasing the return yield has a significant potential for reducing production-related costs in the HMRS. However, if closing the loop also translates into a relevant increase in the returns volume uncertainty, the reverse material flow could enormously complicate the efficient control of inventories up to the extent of provoking an undesired surge in production costs.

Figure 4 shows an interesting U-shaped relationship between the NSAmp and the average return yield. That is, for low values of the yield, the variability of inventories is decreasing in β, which has been observed in previous works [3, 23]; however, for high values of this parameter, the variability of inventories is increasing in β, an effect that has also been observed in the literature [19]. This striking relationship requires further investigation. Given that the slope of the BW ratio is decreasing in β, we conclude that the improvement of the dynamics in the closed-loop system is more significant in the first stages of the implementation of the circular model (i.e. when β is increasing but it is still low).

The trade-off between the average backlog and the average net stock is highly related with the NSAmp ratio, as we discussed in Section 2.2. Consistently with this notion, we can also observe here the previously highlighted U-shaped relationship. Thus, for low values of the return yield, the HMRS is capable of achieving a higher customer service level (that is, it operates with a lower backlog) with less stock. However, for high values of the average return yield, the decrease in production costs occurs at the expense of an increased stock-out size and holding costs.

Nonetheless, Fig. 5 suggests that the NSAmp ratio, the average backlog, and the average net stock are much more sensitive to the noise ratio m. That is, we again observe that although the dynamic behaviour of the HMRS may benefit from collecting products, returns volume uncertainty strongly and negatively impacts on the operational performance of closed-loop supply chains. In this sense, we see by observing Fig. 5 that when the intrinsic variability of returns increases, the actual service level significantly decreases even though the supply chain is operating with a higher level of average inventory. For this reason, returns volume uncertainty also tends to increase significantly the inventory-related costs of the HMRS under consideration.

Conclusions

It is widely accepted that reverse logistics represent, together with a clear environmental opportunity for societies that are embracing them, a relevant financial opportunity for businesses derived from retaining the value of products. Several prior works have observed that, in addition, closed-loop supply chains can benefit from decreased production- and inventory- related costs through a smoothed dynamic behaviour. We show that, at the same time, uncertainty in the returns volume significantly threatens the operational performance of such supply chains, which may make that real-world supply chains struggle to materialise the said benefits of closed-loop contexts. In this sense, closed-loop supply chain managers face new challenges that must be overcome in order to strengthen the current transformation from a linear to a circular economic model.

The main results of this research can be interpreted as follows: (1) closed-loop supply chains experience a considerable reduction of variability, and hence of production- and inventory-related costs, when returns volume can be accurately estimated; while (2) closed-loop supply chains may suffer from a dramatic increase in instability, and hence of costs, when the uncertainty in the volume of returns is very high. This puts special emphasis on managers to invest in forecasting the volume of returns. Previous research on both open-loop and closed-loop supply chains have highlighted the benefit of information transparency of work-in-process or good-in-transit pipelines in the supply chain. Utopianly, this would be achieved in a closed-loop setting by tracking products that are consumed and ascertaining volume of goods that are returned. In a practical setting, establishing forecasting techniques that can estimate such returns is a realistic substitute. In addition, such forecasting approaches will need to be appropriately integrated into the inventory policies of HMRSs to ensure ‘optimum’ stock control and ordering.

Alternatively, closed-loop supply chains can be proactive in establishing a returns policy to encourage and regulate the volume of returns. This may be done via incentive schemes and establishing a collection network as a way of capturing the positive impact of a high yield and alleviating the negative impact of returns volume uncertainty.

An interesting contribution of our research to the literature on closed-loop supply chain dynamics is the fact that we observed a U-shaped relationship between the return yield and the inventory performance of the HMRS. That is, when the return yield is high, the increase in the production stability in the closed-loop system may occur at the expense of increasing at the same time the average backlog and the average inventory. In this sense, production-related costs are minimized when the average return yield is maximum and returns volume uncertainty is null, while inventory-related costs are minimized for an intermediate value of the return yield and also when the intrinsic variations of returns are null. Managers would therefore be required to determine the U-shape of their specific operation in order to better control their systems.

As with other previous studies, our model as described in Section 2, assumes a push policy, that is, returns are remanufactured as soon as possible in make-to-stock manner. While such a policy works well in the reverse flow of materials in some practical settings, other strategies for regulating the returns inventory may help to decrease the impact of returns volume uncertainty on closed-loop supply chains. This research avenue is highlighted as an essential step in the exploration of the dynamic behaviour of closed-loop supply chains.

References

Adenso-Díaz B, Moreno P, Gutiérrez E, Lozano S (2012) An analysis of the main factors affecting bullwhip in reverse supply chains. Int J Prod Econ 135(2):917–928

Asgari N, Nikbakhsh E, Hill A, Farahani RZ (2016) Supply chain management 1982–2015: a review. IMA J Manag Math 27(3):353–379

Cannella S, Bruccoleri M, Framinan JM (2016) Closed-loop supply chains: what reverse logistics factors influence performance? Int J Prod Econ 175:35–49

Corsten D, Gruen T (2003) Desperately seeking shelf availability: an examination of the extent, the causes, and the efforts to address retail out-of-stocks. Int J Retail Distrib Manag 31(12):605–617

Dejonckheere J, Disney SM, Lambrecht MR, Towill DR (2003) Measuring and avoiding the bullwhip effect: a control theoretic approach. Eur J Oper Res 147(3):567–590

Disney SM (2001) The production and inventory control problem in vendor managed inventory supply chains. PhD thesis. In: Cardiff business school. Cardiff University, UK

Disney SM, Lambrecht MR (2008) On replenishment rules, forecasting, and the bullwhip effect in supply chains. Found Trends Tech Inf Oper Manag 2(1):1–80

Disney SM, Towill DR, Van de Velde W (2004) Variance amplification and the golden ratio in production and inventory control. Int J Prod Econ 90(3):295–309

Goltsos TE, Ponte B, Wang S, Liu Y, Naim MM, Syntetos AA (2018) The boomerang returns? Accounting for the impact of uncertainties on the dynamics of remanufacturing systems. Int J Prod Res in press:1–34

Hosoda T, Disney SM (2018) A unified theory of the dynamics of closed-loop supply chains. Eur J Oper Res 269:313–326

John S, Naim MM, Towill DR (1994) Dynamic analysis of a WIP compensated decision support system. Int J Manuf Syst Des 1(4):283–297

Ketzenberg M (2009) The value of information in a capacitated closed loop supply chain. Eur J Oper Res 198(2):491–503

Lee HL, Padmanabhan V, Whang S (1997) Information distortion in a supply chain: the bullwhip effect. Manag Sci 43(4):546–558

Mitra S (2012) Inventory management in a two-echelon closed-loop supply chain with correlated demands and returns. Comput Ind Eng 62(4):870–879

Parker D, Riley K, Robinson S, Symington H, Tewson J, Jansson K, Rankumar S, Peck D (2015) Remanufacturing market study. Internal report by the European Remanufacturing Network

Ponte B, Sierra E, de la Fuente D, Lozano J (2017) Exploring the interaction of inventory policies across the supply chain: an agent-based approach. Comput Oper Res 78:335–348

Potter A, Disney SM (2010) Removing bullwhip from the Tesco supply chain. Proceedings of the POMS Annual Conference 23:109–118

Tang O, Naim MM (2004) The impact of information transparency on the dynamic behaviour of a hybrid manufacturing/remanufacturing system. Int J Prod Res 42(19):4135–4152

Turrisi M, Bruccoleri M, Cannella S (2013) Impact of reverse logistics on supply chain performance. Int J Phys Distrib Logist Manag 43(7):564–585

Worrell E, Allwood J, Gutowski T (2016) The role of material efficiency in environmental stewardship. Annu Rev Environ Resour 41:575–598

Zhang C, Zhang C (2007) Design and simulation of demand information sharing in a supply chain. 15(1):32–46

Zhou L, Disney SM (2006) Bullwhip and inventory variance in a closed loop supply chain. OR Spectr 28(1):127–149

Zhou L, Naim MM, Disney SM (2017) The impact of product returns and remanufacturing uncertainties on the dynamic performance of a multi-echelon closed-loop supply chain. Int J Prod Econ 183:487–502

Acknowledgements

This research was supported by UK’s Engineering and Physical Sciences Research Council (EPSRC) under the project Resilient Remanufacturing Networks (ReRuN): Forecasting, Informatics, and Holons (grant no. EP/P008925/1).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Ponte, B., Naim, M.M. & Syntetos, A.A. The effect of returns volume uncertainty on the dynamic performance of closed-loop supply chains. Jnl Remanufactur 10, 1–14 (2020). https://doi.org/10.1007/s13243-019-00070-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13243-019-00070-x