Abstract

In this paper we empirically address the issue of whether reductions in card payment interchange fees have a significant impact on prices paid by consumers. The answer to this question is at the core of most competition policy cases and regulations that have been applied to card payment markets. Relying on Rochet and Tirole’s (RandJEcon 33:549–570, 2002) model of this sector as a two-sided market, we identify the two channels through which interchange fee reductions may influence retail prices: the impact on cards’ demand and on the merchant service charge, which may be passed through to retail prices. We use Spanish sectoral data to estimate the resulting system of equations. Our results imply that a 1% reduction in the level of the interchange fee leads to a long run 0.17% reduction in the retail price index. Such outcome is almost exclusively the result of the interchange fees being passed through as lower prices by merchants, as we find that they have a negligible impact on payment cards’ usage.

Similar content being viewed by others

1 Introduction

The use of cards as payment methods continues to rise across the World. In the European Union (EU), payment cards accounted for 47% of all non-cash transactions in 2021, up from 34% in 2010 and 21% in 2000. In the USA, cards were used by consumers in 51% of their transactions in 2018 (Kumar and O’Brien 2019).

Although using a card to pay any transaction may appear to be costless for the consumer, in order for that payment to take place a relatively complex structure of agreements between banks and card networks needs to exist, where different fees are paid and collected every time such an operation takes place. The level of those fees has been subject to a lot of attention by regulators and competition policy agencies.Footnote 1 At the core of the policy problem lies the issue of whether the fees may be excessive, as they are likely to be passed on to consumers in the form of higher retail prices.

Despite the importance of this question, the empirical literature dealing with the analysis of payment card markets seems to have overlooked the measurement of the impact of card payment fees on consumer prices. Understanding that impact is increasingly relevant not only because card payments are on the way to becoming standard in most countries, but also due to the recent surge in inflation, which has put its control back at the top of the economic policy agenda.

In order to deal with this issue, we employ a two-sided market model that identifies the different channels through which payment card fees may have an impact on retail prices.Footnote 2 In particular, we look at the role of the interchange fee (IF), which is charged by the cardholder’s bank to that of the merchant selling the goods or services. A higher IF results in a higher cost of accepting card payments for the merchant, which he may pass through to consumers in the form of higher retail prices. On the other hand, a higher IF benefits consumers using cards as their bank may provide them with more benefits in order to incentivise their use instead of alternative payment methods. However, as that would add on merchants’ costs, it may prompt further price increases. Thus, there are two channels through which IF changes may influence retail prices. In this paper, we empirically measure the relative importance of each one of them using Spanish data from a period in which the reduction in the IF, by different magnitudes in each sector of activity, may have affected price setting behaviour.

Our results provide evidence that in the long run decreasing IF leads to lower retail prices. However, this effect does not take place through both channels, as it is almost exclusively due to it being passed through by merchants into lower prices. We identify a negative, but almost negligible, impact of interchange fees on the use of payment cards, and thus on prices.

The remainder of the paper is organised as follows. In Sect. 2 we describe the operation of an open payment card network and characterise it as an example of a two-sided market, following Rochet and Tirole (2002). The main outcome of this section are the equations explaining the price impacts of IF charges, as they form the basis of our empirical model. Section 3 describes both the EU’s antitrust activity and the regulatory changes in Spain’s payment card markets, which have had the explicit aim of reducing the IFs. Section 4 reviews the main empirical studies related to the effects of capping the IF and in Sect. 5 we describe the data that we employ to estimate the model, whose econometric specification is discussed in Sect. 6. Section 7 presents our estimation results and analyses their policy implications. A final section concludes.

2 Card payment networks as two-sided markets

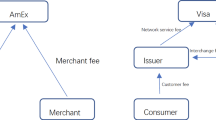

Following Economides (2009), we characterise a card payment system as the combination of four different but related markets:

Market 1 puts in contact the cardholder (the consumer who wants to use a card to pay for his purchase) with his bank (called issuer), which supplies him with the card (on behalf of the card network). The cardholder pays a membership fee (\(f\)) to the issuer to cover its costs for providing the payment service (\({c}_{I}),\) and may obtain extra services (\({b}_{B}\)) such as cash-back, travel insurance or loyalty rewards to encourage the substitution of card payment for cash.

Market 2 takes place between the merchant (the seller providing the goods or services to the consumer) and his bank (called acquirer). The acquirer supplies the merchant with payment services such as clearing electronic payments and settlement guarantees for POS.Footnote 3 The merchant obtains some conveniences and transaction benefits from accepting a card payment such as security, protection against fraud and theft, and guarantees that the payment will be received quickly (henceforth \({b}_{S}\)). The acquirer’s costs (\({c}_{A}\)) for providing those services are covered by a merchant service charge (MSC) paid by the merchant, which may be either a fixed quantity per transaction or a percentage of the purchase’s value. Given that the level of the MSC is negotiated between the acquirer and the merchant, it can depend on the volume and value of the merchant’s POS transactions.

Market 3 puts the cardholder in contact with the merchant, with the latter providing the purchased goods or services as the former accepts the card payment transaction at the POS. One important assumption is that the costs to the merchant of dealing with card payments (which include the charge to his acquirer bank) are higher than those of accepting a cash payment.Footnote 4

Market 4 closes the circle, as it connects the issuer and acquirer banks. The first transfers the amount of the purchase to the second, after deducting the IF amount. As in the case of the MSC, the IF can be either a fixed amount or a percentage of the transaction value. In practice, the value of both fees varies depending on a combination of several factors such as the card’s type and the merchant’s sector of activity. In an open payment card network,Footnote 5 the payment to the merchant is guaranteed by the issuer against fraud and cardholder’s default. Therefore, the IF exists to compensate for the risk and cost associated with the card payment that the issuer entails.

To these four markets an additional one can be added representing the relationship between the card network and the banks. Here, the card network licenses the use of its payment card in exchange for a licence fee (\({L}_{f}\)) charged on both the issuer and the acquirer, allowing transactions to take place through its system. The \({L}_{f}\) is generally set based on the number of cards issued and the number of transactions made.

2.1 Modelling card payments as a two-sided market

The system of payment card markets is an example of a two-sided market, whose two distinct parties are the cardholder and the merchant. Customers become cardholders when they decide to use a payment card to pay their purchases. This will be more likely when a large number of merchants accept card payments. In a similar way, a merchant will be more willing to accept cards if a large number of consumers opt to pay with them. Thus, consumers’ participation in this market depends on that of the merchants, and vice versa, implying that the net utility of any user on one side increases with the number of members on the other one. The existence of such cross-group externalities, usually referred to as ‘membership externalities’, is what characterises the payment card market as a two-sided market (Rochet and Tirole 2002, 2006; Armstrong 2006; Jullien et al. 2021).

In order to understand the role of the IF in card payment markets, and its impact on the retail prices faced by consumers, we follow the model of Rochet and Tirole (2002).Footnote 6 Assuming that there is a single payment card network that sets a common IF to all acquirers, the issuer will choose a membership fee (\(f\)) payable by its cardholders such that:

where \({c}_{I}\) is the issuer’s cost. The membership fee level is decreasing on the IF, as both fees are sources of revenue to the issuer. The consumer, in turn, will decide to become a cardholder and pay with the card instead of with another form of payment by comparing \(f\) with the benefits obtained from using the card (\({b}_{B}\)). The demand for cards can thus be expressed as

where \(H(f)\) is the cumulative distribution function that captures the fraction of customers with \({b}_{B}<f\). Card demand is a decreasing function of the membership fee, and thus increases with IF.

On the other side of the market, the acquirer sets the Merchant Service Charge (MSC) in a way that covers the costs of dealing with card payments (\({c}_{A}\)), plus the IF as it adds to the acquirer’s cost of providing payment card services to merchants

When analysing the impact of the IF on retail prices via the MSC, Rochet and Tirole (2002) assume that acquirers operate in a perfectly competitive market, and therefore fully pass the IF to merchants.Footnote 7 The merchants’ market is assumed to consist of two payment card-accepting merchants selling the same product to consumers distributed along a Hotelling segment, with the merchants located at the extremes. Normalising the number of card transactions to 1, the profit maximising decision of each merchant when setting their retail price can be expressed as:

where the term \((\tau +D\left(f\left({c}_{I}-\mathrm{IF}\right)\right)\cdot \mathrm{MSC}\left(\mathrm{IF}\right))\) is the merchant’s marginal cost in which τ captures the transaction cost associated with other forms of payment, \(D\) is the demand for cards in Eq. (2) and the MSC is the merchant service charge given by Eq. (3). The term \({x}_{i}\) is the market share of merchant \(i\) with \(i\in \{1, 2\}\). Given retail prices of both merchants (\({p}_{i},{p}_{j}\)), merchant \(i\)’s market share is given by \({x}_{i}=\frac{1}{2}+\frac{{p}_{j}-{p}_{i}}{2\sigma }\) where \(\sigma \) reflects the consumers’ transportation costs between the two merchants. Then, the solution of problem Eq. (4) yields:

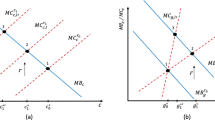

Equation (5) reveals the two mechanisms through which the IF level can affect retail prices. From the cardholders’ side, the IF affects the fee f, which in turn determines card payment demand, and from the merchants’ side, it directly impacts on the MSC. As any of those two channels can be expected to impact on retail prices, we rely on Eq. (5) to empirically test the impact that IF changes may have on prices paid by consumers, as well as the relative contribution of each channel.

This model is based on the assumption that merchants do not price discriminate against customers who pay by a card instead of cash. This assumption is in line with the ‘no-surcharge’ rule that is usually imposed by open payment card networks, but leads to ‘merchant internalisation’ in the form of higher prices for all customers, independently of their payment method. Therefore, under ‘no-surcharge’, customers who pay with cash grant a subsidy to cardholders since both are charged the same price, but it is cardholders who force merchants to pay the MSC (Carlton and Frankel 1995). Besides, cardholders may receive benefits from their issuer, inducing them to use cards more frequently (see Carbó-Valverde and Liñares-Zegarra (2011) on the impact of issuers benefits on payment card usage in Spain).

3 Antitrust and regulation of payment card markets

The association of banks created by a card payment network provides specific services that its members cannot produce on their own (Carlton and Frankel 1995; Evans and Schmalensee 1995). Payment card networks set some rules, such as the IF, to control the relationship between their members. Some authors (Rochet and Tirole 2002; Sykes 2014 among others) argue that the setting of the IF as the outcome of an agreement among banks is beneficial as it reduces the per-card transaction cost of bilateral negotiations between the issuer and the acquirer. On the contrary, Prager et al. (2009) argue that the setting of a common IF for all banks could be interpreted as collective price determination by the banks belonging to the network, which could be considered as illegal collusion under antitrust principles.

There is also competition between banks in the two sides of the downstream segment. Between acquirers as they try to gain merchants as their customers by means of more attractive MSCs, and between issuers as they try to persuade consumers to use their cards by offering low membership fees or better rewards. Under imperfect competition, issuers may pass less than 100% of the IF to cardholders, resulting in supra-competitive profits (Prager et al 2009). Although the IF level directly affects the merchants’ cost of accepting the card, they can compensate these costs by increasing retail prices. Under the previously explained ‘no-surcharge’ rule, this process of ‘merchant internalisation’ harms all consumers, independently of whether they pay cash or by card. Therefore, cardholders may end up paying twice for their card usage: once through the membership fee charged by the issuer and the second time through higher retail prices, even if, as previously mentioned, cash-paying customers also cross-subsidise them.

Given the potentially damaging impacts of IF levels on consumers’ welfare, it is no surprise that the IF-setting behaviour by card payment networks has been under frequent scrutiny by antitrust authorities. Although different aspects of card networks’ behaviour have been analysed in different occasions, a relatively common theme has been the perception that an arbitrarily high IF is set when compared to the costs incurred by issuers or acquirers. A high IF limits the acquirer’s power to set the lower MSC when negotiating with merchants. In fact, the IF determines a floor under the MSC and restricts competition between acquirers, as it is unlikely that an acquirer would be willing to reduce the level of its MSC below the IF. The restriction on competition between acquirers results in inflating the cost of accepting cards. Despite the high MSC, merchants are compelled to accept card payment since refusing the card may result in losing part of their customers. Besides, merchants may pass-through the MSC in the form of higher retail prices to all consumers.

Veljan et al. (2021) and Górka (2018) summarise the different cases that the European Commission’s DG COMP and some European national competition authorities have brought against payment card networks due to the level of their interchange fees. For the EC, one of the lessons drawn from such investigations on the practices of Visa and MasterCard was the evidence that the IF level varied significantly across the countries in the European Economic Area (EEA), as shown by Borestam and Schmiedel (2011) and summarised in Table 1. From the EC’s point of view, this diversity was problematic since it prevented further integration and hindered the creation of an internal market. The Commission, thus, sought to reduce the level of IFs, both for domestic and international transactions (including those where the acquirer is located outside the EEA) leading to different negotiations with Visa and MasterCard, but also to the imposition of fines. As a result of such processes, both Visa and MasterCard agreed to reduce their IFs to 0.2% and 0.3% for debit and credit cards, respectively, which are the results obtained from applying the so-called ‘tourist test’ measuring the level at which a merchant would be indifferent between accepting cash or card payments by a non-returning customer (Rochet and Tirole 2011). These levels were subsequently adopted as benchmarks by the EU’s Interchange Fee Regulation (2015/751), which entered into force in December 2015.

In Spain, until 2018 there were three national financial associations of banks acting as card payment networks (namely, Servired, Euro 6000 and Sistema 4B) such that all banks, including savings’ banks, belonged to each one of them. They were licensed as principal members of Visa and MasterCard, which allowed them to issue their cards, set the operating rules and decide on the level of the IF. As in many other European countries, their behaviour frequently drew the attention of antitrust authorities and regulators. This is shown by two events that significantly affected the setting of IF levels in Spain. The first one took place in December 2005, when the government (through its Ministry of Industry, Tourism and Trade) reached an agreement with merchants’ associations and the three card networks on a schedule for reducing IF levels applied to debit and credit card transactions. Although the main political objective of reaching an agreement on the IF level was to reduce them, as small retailers argued that they just transferred rents from them to the banks and card payment companies, lowering the IF was also considered to be a means of contributing to reducing price inflation in Spain, which in December 2005 ran at 3.7%, clearly above the 2.3% Eurozone average. The Parliamentary declaration that urged the government to reach an agreement on IF levels explicitly mentioned “the reduction of final prices paid by consumers” as one of its objectives (BOCG 2005). The agreement established that the IF level had to be based on the cost of providing card payment services, distinguishing between debit and credit cards, so that the IF was to be progressively reduced during a transitional period of three years (2006 to 2008) as shown in Table 2. The IF for credit card payments was set as a percentage of the purchase, while for debit cards it amounted to a fixed fee per transaction. The actual rates also depended on the volume of annual POS card payments by merchant. Besides, the agreement provided a guarantee clause for the years 2009 and 2010 whose aim was to protect merchants from higher IFs. In this way, from 2010 onwards Spanish card networks were free to set the IF based on the issuer’s cost, but had to report to the competition authority (CNMCFootnote 8) any agreement that they could reach on this issue so that its compatibility with antitrust legislation could be checked.

The second event took place in July 2014, when the government capped IFs via RDL 8/2014 with the aim of increasing the use of payment cards by reducing its acceptance costs for merchants, with the expectation that retail prices would also be reduced. The IF for the debit card had to be set as a percentage of the transaction value. The maximum IF for debit card payments was 0.2% of the transaction amount, with a maximum of 7 euro cents. For credit cards the maximum IF was 0.3%.Footnote 9 As can be seen, such terms anticipated what EU’s regulations were about to impose one year later.

4 Literature review on impacts of IF policies

Different authors have analysed the impacts of regulations imposed on card payment systems from different perspectives and in different contexts. Carbó-Valverde et al. (2016) exploit proprietary data on 45 Spanish banks to empirically assess the effects of the different caps on interchange fees that were implemented during the period 1997–2007. Their results show that, as could be expected, interchange fee reductions result in increased merchants’ acceptance of payment cards and increased payment volumes, as they are transmitted into lower merchant service charges. The reduction of interchange fees is also beneficial for issuers, as the fall in received earnings per transaction from the acquirers is more than offset by an increase in the number of card transactions. The increase in the card payments takes place despite the expected increase in issuers’ fees (which is not observed in their data), as it is driven by the benefits that result from increased acceptance of payment cards by merchants. The results from this paper are important, as they quantify the different mechanisms at play within this two-sided market in Spain. However, it does not address our main research question, which is the impact that interchange fees may have on retail prices.

Ardizzi and Zangrandi (2018) study the effects of the EU’s 2015 regulation on MSC levels and merchant acceptance in Italy. Using institution-level data from more than 400 acquirers between 2009 and 2017, they observe that the MSC fell and merchant’s card acceptance increased as a consequence of the regulation. These results are in line with the ones by Carbó-Valverde et al. (2016).

Some papers have analysed similar policies applied in other contexts. In 2011, the US Federal Reserve Board implemented the Durbin Amendment (also known as Regulation II), as part of the Dodd-Frank financial reform legislation. It enforced a reduction on the debit card IF from 44 to 21 cents per transaction plus 0.05% of the transaction amount for debit card issuers with assets above USD 10 bn. Wang (2012) studies the effect of this cap on the revenues of issuers by means of a descriptive comparative analysis, finding that for those with assets above the USD 10 bn threshold, revenues decreased, while the opposite happened for those above the threshold. On the other hand, merchants as a whole benefited from this regulatory change, as they faced lower MSC. Evans et al. (2015) find that the cap harmed lower-income households and small businesses since banks immediately offset the lower IF by raising the membership fees. These authors consider that the higher membership fees are unlikely to be compensated through lower prices in the short run, as merchants do not quickly change prices in response to lower MSCs. Manuszak and Wozniak (2017) assess the impact of setting IF caps on debit cards on commissions and conditions imposed by banks on checking accounts, as both products are usually bundled.

In 2003, the Reserve Bank of Australia (RBA) enforced a cap on the credit card IF, reducing it from 0.95 to 0.55% of the transaction amount. The RBA argued that the credit card’s IF was too high, resulting in too low charges of credit card usage, leading to them being overused when compared to debit cards. This reform also forbade the imposition on merchants of the ‘no-surcharge’ rule. Although prior to the reform the RBA expected that lower MSC would be passed through to retail prices, lowering them by between 0.1 and 0.2%, it found no evidence to assess if this had been the case (RBA, 2008). However, Chang et al. (2005) used data provided by Visa in Australia between 1992:3 and 2005:1 to study the effects of capping the credit card IF on cardholders and merchants. On the cardholder’s side, they look at the effect of this cap on the issuer’s revenue and the cardholder’s fee. On the merchant’s side, they ask how much of the IF reduction passes to the merchant through the lower MSC and how much of the MSC reduction passes to buyers through lower retail prices. They find that issuers lost around 42% of their IF’s revenues but they were able to offset them by charging higher fees to cardholders. Merchants benefited from this regulation with a 0.21% reduction in the MSC. Assuming a 50% pass-through rate, retail prices would have fallen by 0.105%, which coincides with the lower bound of the RBA’s initial forecasts. However, Farrell (2005) considers that the data used in by Chang et al. (2005) is too noisy to support their conclusions.

From this overview of the empirical literature dealing with the impacts of payment card regulations, we conclude that the effect on retail prices of changes in the IF has not received much attention. The lack of conclusive empirical evidence has led some authors (Arruñada 2005; De Matteis and Giordano 2015) to cast doubts on whether reductions in interchange fees may have significant impacts in reducing retail prices.

We shed light on this issue by carrying out an empirical estimation of the three equations identified in Rochet and Tirole (2002) using data from the period during which the IF in Spain experienced some of the regulatory changes described above. When doing so, we will distinguish between the short- and long-run price impacts of IF reductions. The difference between both types of effects may provide evidence on the stickiness of prices in the short run, as argued by Evans et al. (2011), Carlton (1986), Alvarez et al. (2010), Dhyne et al. (2006) or Anderson et al. (2015).

5 Data

We use aggregate quarterly data from different sources in order to obtain the empirical variables required by the model. Different measures characterising the evolution of the card payment system in Spain with quarterly frequency have been obtained from the Bank of Spain’s Department of Payment Systems for the period 2008:1 to 2019:4. Besides data on the number of devices accepting card payments by Spanish banks (POS and ATMs), volume and value of card transactions at POS and ATM, and volume of cards in circulation, the Bank of Spain also provided information on the MSC and IF levels charged by card networks in Spain in each quarter. For the MSC, the data distinguishes the charges for domestic payment transactions by 21 merchant sectors. Regarding the IF, two different time periods can be identified. During the first period (2008:1 to 2014:2), data on the IF level is available as a percentage of the value of the purchase (following the details of the 2005 agreement), with different levels depending on whether the transaction takes place between cards and POS of the same network or not. Fees are detailed at sector level, for the same merchant sectors as the MSC. In the second period (2014:3 to 2019:4) the data distinguishes between IFs for credit and debit card payments in 9 different merchant sectors.

The description in the previous paragraph implies that available IF series are not uniformly defined across the sample period. We proceed as follows to build a homogeneous measure of such variable: for the period 2008:1 to 2014:2 we compute the average of inter- and intra-network IF for each sector, thus obtaining a single value for each one of the sectors for which we have MSC data. For the period 2014:3 to 2019:4 we compute the average of the IFs for debit and credit card payments for each merchant sector.

The resulting evolution of IFs and MSCs in selected merchant sectors is shown in Fig. 1 in the appendix. It can be observed that initially there were substantial differences among the IFs charged in each sector, with transportation and large supermarkets paying much lower fees than transactions in restaurants or drugstores. The sharp drop in 2014:3 is a direct consequence of RDL 8/2014, after which IF fluctuates smoothly below the 0.2% level and becomes almost identical across sectors. The MSC charts show there is a downward trend in all sectors.Footnote 10 The higher MSCs are those of postal services and restaurants and the lower ones are those of petrol stations and large supermarkets. The impact of the IF imposed on 2014:3 is also evident, although much less so than the drop in the IF. However, while the IF stabilises after the third quarter of 2014, the MSCs of some merchant sectors increase at the end of the sample period.

The data also shows that following the 2014 regulatory change, the number of cards in circulation (comprising debit and credit cards) and POS terminals rose significantly. The volume of card transaction at ATM has a downward trend over the sample period, while the volume and value of card transactions at POS increased (see Figs. 2, 3, 4, 5 and 6 in the appendix). Consumer Price Index (CPI) data are obtained from the Spanish Statistical Institute (INE), which provides monthly measures, obtained from reported prices of approximately 220,000 items. We compute quarterly measures of CPI levels (on a 2016 = 100 base) as 3-month average from the reported monthly data. In order to obtain sectoral price data we need to adapt INE’s ECOICOP classification for products to the descriptive sectoral classification used by the Bank of Spain when reporting card payment fees. The merchant sectors defined by the Bank of Spain are taken as the baseline, to which the most similar ECOICOP sectors are associated.Footnote 11 In this way we are able to select 10 merchant sectors for which there is a suitable coincidence between the two sources: large supermarket − food, petrol stations, travel agencies, hotels, drugstores, restaurants, transportation services, jewellery stores, postal services, and retailers. Our sample is therefore limited to those sectors.Footnote 12

Finally, we use quarterly GDP growth rates to account for the overall evolution of economic activity. This data is originally generated by the Spanish Statistical Institute (INE), but historical quarterly series are also made available by the Federal Reserve Bank of St. Louis in its FRED database. We also rely on INE’s Household Budget Survey (Encuesta de Presupuestos Familiares) to measure total household expenditure in different sectors, which will be the variable taking into account the impact of the evolution of demand on each sector’s price index.

6 Empirical model

In order to examine the impact of the IF on retail prices taking into account the two sides of the card payment market, we rely on the set of equations characterising the behaviour of the three relevant markets involved in a card transaction with an open payment card network: market 1 between issuers and cardholders, market 2 between acquirers and merchants and market 3 between merchants and cardholders. For each one of them, we discuss the empirical specification of the expression derived from Rochet and Tirole’s (2002) model.

The equation of market 2 shows how IF changes affect the MSC paid by the merchant to the acquirer. Our empirical version of Eq. (3) is specified as follows:

where the dependent variable is the merchant service charge, while our main explanatory variable of interest is the IF. In order to capture the effect of payment card usage on the MSC we include the transaction volumes at POS (\(\mathrm{Volpos}\)). As in Carbó-Valverde and Rodríguez-Fernández (2014), we use the number of cards held by consumers (NC) to capture the externality that they may have on MSC through merchant’s acceptance decisions. We measure the overall evolution of economic activity by GDP growth. Subscripts \(i\) identify each of the merchant sectors and \(t\) (for \( t = 2008:1, \ldots , 2019:4)\) are the quarterly time periods.

The impact of IF changes on the cardholder’s side takes place in market 1, where issuers can affect card usage by modifying the membership fee or rewards. The empirical version of Eq. (2), which characterises that process, is specified as follows:

The dependent variable is the transaction values at POS (\(\mathrm{Valpos}\)). Explanatory variables include the fee paid by cardholders to their issuers (\(f\)), the number of POS (\(\mathrm{NPOS}\)) that measures the attractiveness of holding cards by cardholders (Carbó-Valverde and Rodriguez-Fernández 2014), and GDP growth as in Eq. (6).

Although in our data we do not observe cardholder’s membership fees, from Eq. (1) we can identify them as a function of the difference between the issuer’s per-transaction costs and the IF. Assuming that issuer’s costs remain constant, we can replace the cardholder’s fee in (7) by the IF, obtaining:

where now the constant term \(\omega_{i}^{\prime }\) includes the per-transaction cost \({c}_{I}\).

Finally, retail prices are set in market 3 as explained by Eq. (5), which shows the effect of both a change in the MSC and card usage on retail prices. The econometric specification of such equation is:

where the dependent variable is the retail price index in the merchant sector \(i\) at time \(t\) and the main explanatory variables of interest are the card usage and the MSC. In order to control the effect of the alternative payment method (cash), we include the number of ATM cash withdrawals (\(\mathrm{Volatm}\)). Moreover, we distinguish between a change in prices due to the changing demand of products and what is associated with a decline in the MSC. We do this by including the household total expenditure in each sector as a control variable. This variable can also take into account the effect of the economic cycle on consumption.

The estimation of the system of Eqs. (6), (8) and (9) makes it possible to quantify the role of each one of the two channels through which a change in the IF may affect retail prices. On one side of the market, the relationship between retail prices and the MSC reveals how much of a reduction in that cost is passed onto retail prices \(\left( {\frac{{\partial P_{m} }}{{\partial {\text{MSC}}}}} \right)\). But, given that the MSC reacts to IF changes, we can make use of the following expression to measure the impact of IF on prices through this channel.

On the other side, card payment usage can also affect retail prices \(\left( {\frac{{\partial P_{c} }}{{\partial {\text{Valpos}}}}} \right)\). Again, as card usage depends on IF, the impact on prices through the cardholder’s side of the market can be expressed as follows:

Combining expressions (10) and (11), we can assess the total effect of a change in IF on retail prices, which takes into account the relative magnitude of effects one of the two channels in the card payment market.

6.1 Econometric methods

Given that the identification strategy of the model’s parameters depends on the dynamics of the time series across the different sectors, we need to analyse the integration and cointegration of the time series. Therefore, we take first differences on all series to assure their stationarity (see Levin-Lin-Chu and Hadri LM tests results in Table 6 in the appendix). With variables characterised as I(1) or I(0) and a relatively large time length in our panel (48 periods × 10 sectors), the appropriate econometric specification would be an Autoregressive Distributed Lag (ARDL) (Pesaran and Smith 1995; Pesaran et al. 1999), which deals with potential endogeneity problems as it includes lags of both dependent and independent variables. Another advantage of this model is that it makes it possible to examine short- and long-run relationships between the variables. However, in order to ensure that the long-run relationships exists, a check of panel data cointegration needs to be carried out. The results of the Westerlund’s ECM test (Table 7 in the appendix) reveal that the series are co-integrated.

In order to apply ARDL model, we first determine the lag length applying the Schwarz Bayesian Criterion (SBC) to each variable in each sector to determine the model’s order in each sector (see Table 8 in the appendix). The test results show that in more than half of the merchant sectors the maximum lag length is 1. Therefore, in what follows we implement the ARDL model and error correction model for Eqs. (6), (8), and (9).

The ARDL model of Eq. (6) can be specified as follows:

This expression can be re-parametrised and rewritten as an error correction model as follows:

where \({\theta }_{0i}=\frac{{\mu }_{i}}{1-{\lambda }_{i}}\), \({\theta }_{1i}=\frac{{\delta }_{10i}+{\delta }_{11i}}{1-{\lambda }_{i}}\), \({\theta }_{2i}=\frac{{\delta }_{20i}+{\delta }_{21i}}{1-{\lambda }_{i}}\), \({\theta }_{3i}=\frac{{\delta }_{30i}+{\delta }_{31i}}{1-{\lambda }_{i}}\), \({\theta }_{4i}=\frac{{\delta }_{40i}+{\delta }_{41i}}{1-{\lambda }_{i}}\), and \({\varphi }_{i}=-(1-{\lambda }_{i})\). The parameter \({\varphi }_{i}\) is the error correction parameter, and the term in brackets is the error correction component. The error correction parameter has to lie between 0 and − 1; otherwise, the short-run relationships would not converge towards their long-run equilibrium. The parameter \({\varphi }_{i}\) shows the speed of adjustment to the long-run equilibrium. The parameters \({\theta }_{ji}\) \((j=0,\dots ,4)\) are the long-run relationships between dependent and independent variables and \({\delta }_{ji}\) indicates the short-run relationships between them.

In the case of Eq. (8), the ARDL model can be defined as follows:

The error correction of Eq. (15) is given by:

where \(\theta_{0i}^{\prime } = \frac{{\omega_{i}^{\prime } }}{{1 - \lambda_{i}^{\prime } }}\), \(\theta_{1i}^{\prime } = \frac{{\delta_{10i}^{\prime } + \delta_{11i}^{\prime } }}{{1 - \lambda_{i}^{\prime } }}\), \(\theta_{2i}^{\prime } = \frac{{\delta_{20i}^{\prime } + \delta_{21i}^{\prime } }}{{1 - \lambda_{i}^{\prime } }}\), \(\theta_{3i}^{\prime } = \frac{{\delta_{30i}^{\prime } + \delta_{31i}^{\prime } }}{{1 - \lambda_{i}^{\prime } }}\), and \( \varphi_{i}^{\prime } = - \left( {1 - \lambda_{i}^{\prime } } \right)\).

Finally, the ARDL model of Eq. (9) follows structure laid out below:

And the error correction of Eq. (17) is given by:

where \(\theta_{0i}^{\prime \prime } = \frac{{\mu_{i}^{\prime \prime } }}{{1 - \lambda_{i}^{\prime \prime } }}\), \(\theta_{1i}^{\prime \prime } = \frac{{\delta_{10i}^{\prime \prime } + \delta_{11i}^{\prime \prime } }}{{1 - \lambda_{i}^{\prime \prime } }}\), \(\theta_{2i}^{\prime \prime } = \frac{{\delta_{20i}^{\prime \prime } + \delta_{21i}^{\prime \prime } }}{{1 - \lambda_{i}^{\prime \prime } }}\), \(\theta_{3i}^{\prime \prime } = \frac{{\delta_{30i}^{\prime \prime } + \delta_{31i}^{\prime \prime } }}{{1 - \lambda_{i}^{\prime \prime } }}\), \(\theta_{4i}^{\prime \prime } = \frac{{\delta_{40i}^{\prime \prime } + \delta_{41i}^{\prime \prime } }}{{1 - \lambda_{i}^{\prime \prime } }}\), and \(\varphi_{i}^{\prime \prime } = - \left( {1 - \lambda_{i}^{\prime \prime } } \right)\).

6.2 Estimators

Three different methods can be used to estimate the error correction models defined by Eqs. (14), (16) and (18): the mean group (MG) estimator proposed by Pesaran and Smith (1995), the pooled mean group (PMG) estimator proposed by Pesaran et al. (1999), and the dynamic fixed effect estimator (DFE). MG estimates separate regressions for each sector and then calculates a simple arithmetic average of their coefficients. This consistent estimator allows all coefficients to differ across merchant sectors. The DFE only allows intercepts to differ across merchant sectors, imposing the restriction that the speed of adjustment, the slope coefficients and the error variances are equal across all merchant sectors in the short and the long run. The PMG estimator is an intermediate estimator between MG and DFE whose key feature is that it lets the intercepts, short-run coefficients, the speed of adjustment to the long-run equilibrium and the error variances to be heterogeneous across merchant sectors, but the long-run coefficients \({\theta }_{ji}\) are constrained to be identical across them. Thus, the PMG estimator allows for long-run homogeneity without imposing homogeneity in the short run. All three estimators use Maximum Likelihood (ML) methods to estimate the short- and long-run relationships.

The Hausman test can be used to select among the MG, PMG and DFE estimators, where the null hypothesis can be expressed as there being no systematic differences between PMG and MG or PMG and DFE. If the null hypothesis is not rejected, then the PMG estimator is preferred, as it is both consistent and efficient. As under the PMG the coefficients are homogeneous in the long run, the Hausman test can be understood as a way to check the existence of the long-run homogeneity of coefficients. If the null hypothesis is rejected, then the coefficients are not the same across the merchant sectors in the long-run and the PMG estimator is inconsistent (Blackburne and Frank 2007).

7 Results

As an initial step of the empirical analysis of the impact of IF changes on retail prices, we carry out a reduced form estimation. Thus we postulate the following empirical equation to estimate the impact on retail prices at sector level:

We then implement the error correction of Eq. (19) as follows:

Table 9 (in the appendix) reports the estimation results of Eq. (20) using PMG, MG, and DFE methods. As can be observed, under this specification the impact of IF on prices does not appear to be significantly different from zero in any case. However, this empirical model ignores the two transmission channels through which the IF may affect retail prices, and whose measurement is our main objective. More precisely, it does not allow to estimate the different pass through rates that may exist on each side of the market, and which jointly determine the impact that IF changes may have on prices. Therefore, in what follows we report the results of estimating the error correction models (14), (16) and (18) separately, as well as the results of the corresponding Hausman test.

The results of the estimation of Eq. (14) are reported in Table 3, along with the Hausman test which shows that the PMG results are not rejected with respect to the MG and DFE ones. The error correction coefficient is significantly negative, proving the reliability, consistency and efficiency of the long-run relationship between the variables. The results indicate that all variables’ coefficients are significant in the long run, while they are not significant in the short run. The IF has a positive effect on the MSC, implying that a 1% reduction in the IF is passed through as a 0.39% lower MSC in the long run. The estimated 39% pass-through rate from IF to MSC is substantially higher than the already cited value of 17% estimated by Ardizzi and Zangrandi (2018) for Italy in the 2015–2017 period or the 21% found by Chang et al. (2005) in Australia. Our result would imply, other things equal, a higher intensity of competition in this market in Spain.Footnote 13 Transaction volumes at POS have a significant negative impact on the MSC, implying that merchants with large transaction volumes have more power to negotiate a lower MSC.

Table 4 reports the estimation results of Eq. (16), which measures the effect of IF changes on card payment usage. As before, the Hausman test confirms that the PMG is the preferred estimator and the negative and significant error correction coefficient proves the efficiency of the long-run relationship between the variables. As shown in the table, the IF has a significant effect on card usage in the long run. As an IF reduction results in lower revenues for the issuer, it may compensate this loss by increasing the membership fee, which leads to a reduction in card usage. However, issuers may increase consumers’ benefits from card usage or reduce processing and credit intermediation costs to encourage them to use their cards (Carbó-Valverde et al. 2016). Besides, the reduction in MSC following lower IF increases card acceptance by merchants, strengthening membership externalities and resulting in higher card usage. This result is consistent with the findings of Carbó-Valverde et al. (2016), and Carbó-Valverde and Liñares-Zegarra (2011), all of whom identify a positive impact of reduced IF on card usage in Spain. The variable showing the number of available POS has a positive impact on card usage, providing evidence on the importance of the membership externality effect, as a larger diffusion of POS terminals increases the attractiveness of using a card.

Finally, we turn to the analysis of the overall effect on retail prices taking into account the impacts that arise from the two sides of the market. The results of the estimation of Eq. (18) are reported in Table 5 where, again, the Hausman test favours the PMG over MG and DFE and the error-correction term proves the existence of the long-run relationship across merchant sectors. The results show that a reduction of 1% in the MSC results in a 0.44% price reduction.Footnote 14 The transaction volumes at ATM have a negative impact on retail prices, as more cash payments decrease demand for cards (Carbo-Valverde and Rodriguez-Fernandez 2014) and contributes to decreasing MSC, thus putting less pressure on retail prices. Total expenditure has the expected a positive impact on retail prices.

Having obtained reliable estimates of the three equations of interest, we can now compute the overall impact of IF changes on retail prices.

7.1 Impact of IF changes from the cardholders’ side.

Table 5 shows that card payment usage has a positive impact on retail prices in the long run. Recalling the results obtained in the estimation of Eq. (16) (Table 4), where it was found that a lower IF leads to an increase in card usage in the long run and, taking into account the effect of a change in card payment usage on retail prices, we observe that reducing the IF leads to an increase in retail prices from the cardholder side. A 1% reduction in IF will increase retail prices by 0.0048% in the long run since \(\frac{\partial P}{\partial IF}=\frac{\partial P}{\partial \mathrm{Valpos}}\frac{\partial \mathrm{Valpos}}{\partial \mathrm{IF}}=0.12\cdot \left(-0.04\right)=-0.0048\).

7.2 Impact of IF changes from the merchants’ side

In the long run, there is a direct relationship between the MSC and retail prices. The results show that a 1% decrease in the MSC results in a 0.44% reduction in retail prices. Then, taking into account the results of estimating Eq. (14) it can be computed that a 1% reduction in IF will induce a 0.1716% fall in retail prices since \(\frac{\partial P}{\partial \mathrm{IF}}=\frac{\partial P}{\partial \mathrm{MSC}}\frac{\partial \mathrm{MSC}}{\partial \mathrm{IF}}=0.44\cdot 0.39=0.17\) 16. It should be noted that merchants benefit from the IF reduction with a 0.39% contraction in the MSC.

7.3 The total effect of IF changes on retail prices

The total effect of the IF on retail prices depends on the magnitude of these two effects. In the long run, we find that a 1% reduction in IF leads to a 0.1716% reduction on retail prices from the merchant’s side, while it increases price by 0.0048% from the cardholder’s side, which gives the total effect of 0.1668% reduction in retail prices in the long run.

8 Conclusions

This paper evaluates the effects of the IF reduction on retail prices in Spain in a context of policy changes regulating its level for credit and debit card payments. The objective of these regulations was to achieve a decrease in the MSC and, ultimately, a decrease in retail prices. This work studies the extent to which the IF reduction benefited consumers through lower retail prices. Taking into account the two sides of the card payment market, the paper analyses the effect of the IF reduction on the MSC and card usage, and finally the joint impact of changes in the MSC and card usage on retail prices.

According to our knowledge, this is the first attempt to assess the effect of the IF reduction on retail prices in an economy by focusing on the two-sided market theory in the short run and long run. The results obtained provide robust evidence of decreasing the MSC as a result of the IF reduction in the long run. Merchants pass some part of their cost reduction to cardholders by deflating retail prices. Furthermore, the results show that the IF reduction leads to an increase in card usage, which results in an increase in retail prices. The total effect of a 1% reduction in the IF is a 0.17% deflation of retail prices.

Notes

A Point-Of-Sale (POS) is a device with a combination of hardware and software that is used by a merchant and a cardholder to complete a transaction.

This may not necessarily be the case in all European countries, as shown in the surveys summarised by Junius et al. (2022)

Open payment card networks are those to which any bank can join as an issuer and/or acquirer, in contrast to closed ones where the network itself assumes the role of issuer and acquirer.

See Weyl and Fabinger (2013) on whether the conditions for full pass through are met in market 2, as previously defined.

The National Competition and Markets Commission (CNMC) is the sectoral regulator and competition agency Spain. Until 2013 its functions were carried out by the National Competition Commission (CNC) and different sectoral regulators. Although the CNMC has not specifically analysed the operation of card payments in one of its sector reports, its views on this market may be deduced from its analysis of the Servired, Sistema 4B and Euro 6000 merger in 2018 which it accepted subject to conditions that mostly aimed at guarantee access to the card payment system by new entities at fees that needed to be communicated to it (CNMC,2018).

In addition, the RDL 8/2014 restricted the maximum permissible IF for transactions of less than 20 euros so that the maximum fee for debit cards was 0.1% of the transaction amount and for the credit card was 0.2% of the transaction amount.

We interpolate missing values of MSC in the third and fourth quarters of 2018, as they were unavailable in the data supplied by the Bank of Spain.

For further details on this, see Shabgard (2020).

This leaves aside the following sectors included in the Bank of Spain’s data: supermarkets categorised as ‘other’, chemists, toll-highways, car rental, entertainment, casinos, massage-saunas, night clubs, low-value category items, payments to charity and solidarity organisations, and others.

As a comparative benchmark from other sectors in the Spanish economy, Fabra and Reguant (2014) estimate an 80% pass-through rate of emissions’ costs to electricity prices (in an auction-based market) while Apergis and Vouzavalis (2018) measure the pass-through of oil prices to gasoline ones at 52.6%

References

Adachi T, Tremblay MJ (2022) Do no—surcharge rules increase effective retail prices? Avail SSRN. https://doi.org/10.2139/ssrn.3450855

Alvarez LJ, Dhyne E, Hoeberichts MM, Kwapil C, Bihan HL, Lünnemann P, Martins F, Sabbatini R, Stahl H, Vermeulen P, Vilmunen J (2010) Sticky prices in the Euro area, a summary of new micro evidence. J Eur Econ Assoc 4(2–3):575–584. https://doi.org/10.1162/jeea.2006.4.2−3.575

Anderson E, Jaimovich N, Simester DI (2015) Price stickiness: empirical evidence of the menu cost channel. Rev Econ Stat 97(4):813–826. https://doi.org/10.1162/REST_a_00507

Ardizzi G, Zangrandi MS (2018) The impact of the interchange fee regulation on merchants: evidence from Italy. Bank of Italy Occas Paper. https://doi.org/10.2139/ssrn.3211843

Armstrong M (2006) Competition in two-sided markets. Rand J Econ 37(3):668–691

Arruñada B (2005) Price regulation of plastic money: a critical assessment of Spanish rules. Eur Bus Org Law Rev 6:625–660

Blackburne EF III, Frank MW (2007) Estimation of nonstationary heterogeneous panels. Stand Genomic Sci 7(2):197–208. https://doi.org/10.1177/1536867X0700700204

BOCG (2005) Proposición no de Ley relativa al cumplimiento de las resoluciones del Tribunal de Defensa de la Competencia en materia de fijación de tasas de intercambio aplicadas sobre los pagos efectuados mediante tarjetas de crédito o débito, Boletín Oficial de las Cortes Generales – Congreso de los Diputados, May 9th 2005, 162/000332, pages− 9− 11

Boik A (2016) Intermediaries in two-sided markets: an empirical analysis of the US cable television industry. Am Economic J Microecon 8(1):256–282

Borestam A, Schmiedel H (2011) Interchange fees in card payments. ECB Occas Paper. https://doi.org/10.2139/ssrn.1927925

Carbó-Valverde S, Liñares-Zegarra JM (2011) How effective are rewards programs in promoting payment card usage? Empirical evidence. J Bank Financ 35(12):3275–3291

Carbó-Valverde S, Rodríguez-Fernández F (2014) ATM withdrawals, debit card transactions at the point of sale and the demand for currency. Series 5(4):399–417

Carlton DW (1986) The rigidity of prices. Am Econ Rev 76(4):637–658

Carlton DW, Frankel AS (1995) The antitrust economics of credit card networks. Antitrust Law J 63(2):643–668

Chang HH, Evans DS, Garcia Swartz DD (2005) The effect of regulatory intervention in two-sided markets: an assessment of interchange fee capping in Australia. Rev Netw Econ 4(4):328–358. https://doi.org/10.2202/1446−9022.1080

CNMC, Informe y propuesta de resolución expediente c/0911/17 Servired/Sistema 4B/Euro 6000. Expediente C/0911/17. Comisión Nacional de los Mercados y la Competencia

De Matteis A, Giordano S (2015) Payment cards and permitted multilateral interchange fees (MIFs): Will the European Commission harm consumers and the European payment industry? J Eur Compet Law Pract 6(2):85–95. https://doi.org/10.1093/jeclap/lpu106

Dhyne E, Alvarez LJ, Bihan HL, Veronese G, Dias D, Hoffmann J, Jonker N, Lunnemann P, Rumler F, Vilmunen J (2006) Price changes in the Euro area and the United States: some facts from individual consumer price data. J Econ Perspect 20(2):171–192

Economides N (2009) Competition policy issues in the consumer payments industry. In: Litan RE, Baily MN (eds) Moving money: The future of consumer payument. Brookings Institution Press, Washington

Evans DS, Schmalensee R (1995) Economic aspects of payment card systems and antitrust policy toward Joint Ventures. Antitrust Law J 63(3):861–901

Evans DS, Litan RE, Schmalensee R (2011) Economic analysis of the effects of the Federal Reserve Board’s proposed debit card interchange fee regulations on consumers and small businesses. SSRN. https://doi.org/10.2139/ssrn.1769887

Evans DS, Chang H, Joyce S (2015) The impact of the U.S. debit card interchange fee regulation on consumer welfare. J Compet Law Econ 11(1):23–67. https://doi.org/10.1093/joclec/nhu032

Farrell J (2005) Assessing Australian interchange regulation: comments on Chang, Evans and Garcia Swartz. Rev Netw Econ 4(4):359–363. https://doi.org/10.2202/1446−9022.1081

Genakos C, Valletti T (2012) Regulating prices in two-sided markets: the waterbed experience in mobile telephony. Telecommun Policy 36(5):360–368

Górka J (2018) Interchange Fee Economics to regulate or not to regulate? Palgrave macmillan, Cham

Jullien B, Pavan A, Rysman M (2021) Two-sided markets, pricing, and network effects. In: Ho K, Hortacsu A, Lizzeri A (eds) Handbook of Industrial Organization, vol 4. Elsevier, pp 485–592

Junius K, Devigne L, Honkkila J, Jonker N, Kajdi L, Kimmerl J, Korella L, Matos R, Menzl N, Przenajkowska K, Reijerink J, Rocco G, Rusu C (2022) Costs of retail payments–an overview of recent national studies in Europe. ECB Occas Paper, (2022/294). https://doi.org/10.2139/ssrn.4115174

Kumar R, O’Brien S (2019) 2019 Findings from the Diary of Consumer Payment Choice. Federal Reserve Bank of San Francisco. Available at https://www.frbsf.org/cash/publications/fed-notes/2019/june/2019-findings-from-the-diary-of-consumer-payment-choice/. Accessed 18 Apr 2023

Manuszak MD, Wozniak K (2017) The Impact of Price Controls in Two− sided Markets: Evidence from US Debit Card Interchange Fee Regulation, Finance and Economics Discussion Series 2017− 074. Washington: Board of Governors of the Federal Reserve System, https://doi.org/10.17016/FEDS.2017.074

Pavel F, Kornowski A, Knuth L, et al. (2020) Study on the application of the Interchange Fee Regulation: final report, Publications Office, European Commission, Directorate− General for Competition. Available at https://op.europa.eu/en/publicationdetail/-/publication/79f1072d-d6c2-11eaadf7-01aa75ed71a1/language-en/format-PDF/source-241107820. Accessed 18 Apr 2023

Pesaran MH, Smith RP (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econ 68(1):79–113. https://doi.org/10.1016/0304−4076(94)01644−F

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94(446):621–634. https://doi.org/10.2307/2670182

Pindyck RS (2007) Governance, issuance restrictions, and competition in payment card networks. NBER Working Paper. 13218. Available at http://www.nber.org/papers/w13218. Accessed 18 Apr 2023

Prager RA, Manuszak MD, Kiser EK, Borzekowski R (2009) Interchange fees and payment card networks: economics, industry developments, and policy issues. Financ Econ Discuss Series 23. https://doi.org/10.17016/feds.2009.23

Reserve Bank of Australia (2008). Reform of Australia’s Payment System. Conclusions of the 2007/2008 Review, September

Rochet JC, Tirole J (2002) Cooperation among competitors: some economics of payment card associations. Rand J Econ 33(4):549–570. https://doi.org/10.2307/3087474

Rochet JC, Tirole J (2006) Two-sided markets: a progress report. Rand J Econ 37(3):645–667

Rochet JC, Tirole J (2011) Must-take cards: merchant discounts and avoided costs. J Eur Econ Assoc 9(3):462–495

Rysman M (2009) The economics of two-sided markets. J Econ Perspect 23(3):125–143. https://doi.org/10.1257/jep.23.3.125

Shabgard B (2020) Card payment market and retail prices: an empirical analysis of the effects of the interchange fees on the price levels in Spain. Universitat Autònoma de Barcelona, Barcelona

Sykes AO (2014) Antitrust issues in two-sided network markets: lessons from in re payment card interchange fee and merchant discount antitrust litigation. Compet Policy Int 10(2):119–136. https://doi.org/10.2139/ssrn.2530657

Carbó-Valverde S, Chakravorti S, Fernández FR (2016) The role of interchange fees in two-sided markets: an empirical investigation on payment cards. Rev Econ Statis 98(2):367–381. https://doi.org/10.1162/REST_a_00502

Veljan A, McInnes S, Petit N (2021) Ex post assessment of European competition policy in the payment sector: the Visa Europe 2010 commitments decision. In: Komninos AP, Petit N (eds) Ex-post evaluation of competition cases. Kluwer Law International, Zuidpoolsingel

Wang Z (2012) Debit card interchange fee regulation: some assessments and considerations. Econ Q 98(3):159–183

Weyl EG, Fabinger M (2013) Pass-through as an economic tool: principles of incidence under imperfect competition. J Polit Econ 121(3):528–583. https://doi.org/10.1086/670401

Acknowledgements

We thank Angel Luis López, Alfredo Martín− Oliver, Jozsef Sakovics, Abel Lucena, and Pau Balart for comments, as well as participants at SAEe 2021 (Barcelona) and JEI 2022 (Las Palmas de Gran Canaria), seminar participants at Universitat de les Illes Balears, as well as the referees and editor in charge of this paper. All errors are the authors’ unique responsibility. This work has been supported by the Beatriz Galindo grants and project RTI2018− 097434− B− I00 of Spain's Ministry of Science and Innovation.

Funding

Funding was provided by Ministerio de Asuntos Económicos y Transformación Digital, Gobierno de España, (Grant No. RTI2018-097434-B-I00) and by Beatriz Galindo research project (BG20/00079).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors report there are no competing interests to declare. Data and replication files are available at https://zenodo.org/record/7753815.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Shabgard, B., Asensio, J. The price effects of reducing payment card interchange fees. SERIEs 14, 189–221 (2023). https://doi.org/10.1007/s13209-023-00278-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13209-023-00278-y