Abstract

I analyze new data on subjective probabilistic expectations on house prices collected in the Spanish Survey of Household Finances. Households are asked to distribute ten points among five different scenarios for the change in the price of their homes over the next 12 months. This paper is the first empirical study to document the beliefs of a representative sample of households about the future value of their homes. It also reviews the methodology of expectation measurement and recent work on household subjective probabilities. I model individual subjective probability densities using splines, construct quantiles from those densities, and analyze how the heterogeneity in the individual distributions relates to differences in housing and household characteristics. An important result of the paper is that women are more optimistic about the evolution of house prices than men. Location at the postal code level accounts for a large fraction of the variation in the subjective distributions across households. Finally, I provide some results on how subjective expectations matter for predicting spending behavior. Housing investment and car purchases are negatively associated with pessimistic expectations about future house price changes and with uncertainty about those expectations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This lecture is concerned with household subjective expectations. Its central theme is the analysis of new data on subjective probabilistic expectations on house prices collected in the Spanish Survey of Household Finances (EFF). As a front-end, I first provide a review of the methodology of expectation measurement and of some recent work that use household subjective probabilities. Finally, as a back-end I provide some results on how subjective expectations matter for predicting consumption behavior.

Despite widespread agreement on the fundamental role of expectations in explaining behavior, direct measurement of individual expectations is a relatively recent activity. The standard practice in the economics of the last century was to infer the individuals’ decision process from their observed choices. Following this revealed preference analysis, both preferences and the uncertainty about the future are identified from data on choices and market outcomes alone. Such strategy requires strong assumptions. For example, assuming individuals have rational expectations as well as knowledge of the model may be needed despite that this has often not been credible. In his seminal paper Manski (2004) strongly advocated for collecting self reported expectation data and using those jointly with observed choice data. The hope is this would improve economists’ credibility and ability to predict behavior. But are household expectations collected through surveys trustworthy? Do subjective household survey expectations really improve the ability to predict behavior? To help put these questions in context, I begin by reviewing basic concepts of the methodology of expectation measurement as well as recent work on the elicitation and use of household subjective expectations.

The EFF is a representative survey of the Spanish population that contains detailed information on household assets, debts, income and consumption. Data have been collected every three years since 2002. Starting in 2011, the EFF introduced a new question to elicit household house price probabilistic expectations. Households were asked to distribute ten points among five different scenarios concerning the price change of their homes over the next 12 months. In this way respondents provide information not only about point expectations but also about the probabilities they assign to different future outcomes.

One motivation for introducing this question in the EFF is the importance of real estate assets in the wealth of Spanish households (80 % of the value of household assets) all along the wealth distribution (88 % for the bottom quartile and 67.5 % for the top decile). Aside from a high proportion of owner occupier households (83 %), 36 % of Spanish households hold some other real estate property.

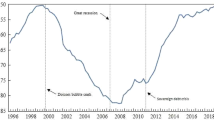

It is also a timely question due to the housing market collapse that shattered house price expectations after 2007 in Spain. The number of households buying housing dropped dramatically from an overall annual average rate of 2.3 % between 2002 and 2005 to 1.1 % in 2011. According to the data I analyze in this paper, in 2011 over 23 % of households expected a large drop (of over 6 %) in the future price of their homes. Moreover, among households expecting such large drops, the fraction who bought a car was half the fraction in the total population (4.5 instead of 9.4 %).

This paper is one of the first empirical studies to document the beliefs of households about the future value of their homes, and the first one that uses a representative sample of households. Questions on probabilistic house price expectations have only recently been introduced in household surveys, as detailed in Sect. 3. Niu and van Soest (2014) have independently obtained results that are complementary to ours using newly collected house price expectations data from the Rand American Life Panel.

I start by analyzing patterns of the answers provided by the EFF2011 respondents to the house price probabilistic expectation question to assess the coherency of responses. These include bunching, number of intervals used, and their association with the extent of non-response. Next I model individual probability densities and analyze how the heterogeneity in the individual distributions relates to differences in housing properties and in the characteristics of households.

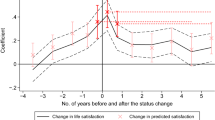

An important result of the paper is that women are more optimistic about the evolution of house prices than men. Being a woman is associated with a positive shift in the median and the quartiles of the subjective distributions. I further examined potential differences in asset valuations by gender by considering self-assessed values of other assets reported in the EFF. I find that women tend to provide higher estimates for the value of their home compared to men but lower ones when it comes to value their financial assets.

Location at the postal code level accounts for a large fraction of the variation in the subjective distributions across households. Importantly, in the absence of postal code fixed effects the estimated effects of demographics on house price expectations would be biased. For example, the result on gender would not be found. Moreover, the location effects that emerge from the subjective probability data are meaningful and respond to economic fundamentals. In particular, estimated location fixed effects respond to past local house prices and unemployment rates.

Finally, I study whether reported household expectations predict household expenditure decisions. This is of substantive interest to understand household behavior and also a further step in the validation of the house price expectation responses. I exploit the availability in the EFF of information about purchases of secondary housing, cars, other big ticket items, and food. These data allow me to uncover some novel findings about correlations of house price expectations and their uncertainty with those purchases and expenditures. I find that housing investment and car purchases are negatively associated with pessimistic expectations about future house price changes and with uncertainty about those expectations. Moreover, these effects depend on household wealth. Specifically, the negative effects of holding very pessimistic house price expectations on secondary housing purchases are more pronounced at the top of the wealth distribution than at the median, while the opposite is true for car purchases.

The paper is structured as follows. In Sect. 2 the work on elicitation and use of household expectations is reviewed. I discuss the specificities in implementing expectation questions in household surveys and the validation of such questions. I also discuss some specific uses of subjective expectations, work on expectation formation, and some enlightening experiments conducted within expectation surveys. Section 3 contains the analysis of the house price expectations data in the EFF. First I describe the formulation of the question and I examine the quality of the responses. Next I estimate a probability density for each respondent, which I use to document the extent of heterogeneity in beliefs. Based on these individual densities I compute various quantiles and measures of dispersion, and study their association with respondent and house characteristics. Finally, Sect. 4 reports the results on the relation between house price expectations and expenditure decisions. I present predictive results for the probabilities of purchasing secondary housing, an automobile, and other big ticket items.

2 The quantification of human uncertainty from social surveys

2.1 Preliminaries

After years of distrust, the measurement of individual expectations is becoming a very active topic in economics, both for research and for immediate policy use. Since the 1990s an increasing number of household surveys have been collecting data on subjective probabilistic expectations.Footnote 1 Expectation questions may be about future outcomes concerning the individual (e.g. own income, health, death, job security, home value, pension benefits, bequests) or about future aggregate conditions (e.g. inflation, house prices, stock market).

There are two important distinctions when considering asking expectations questions. First, whether the question is about eliciting point expectations as, for example, asking for the expected number of children, or about eliciting probabilistic expectations. A probabilistic counterpart to the previous example would be to ask about the probability of having no children, of having one child, of having two children, etc.

The second important distinction when considering eliciting expectations is whether the answer we seek is qualitative or quantitative. Qualitative questions to measure expectations have been used for some time. An example of qualitative question is as follows:

“Thinking about the next 12 months how likely do you think it is that you will lose your job? Possible answers: very likely, fairly likely, not too likely, not at all likely”.

An alternative probabilistic question on the same subject is:

“Using a scale from 0 to 100 what is the percent chance that you lose your job in the next 12 months?”.

This type of probabilistic questions are usually preceded by some explanations and examples about the meaning of probabilities (e.g. using examples about the probability of rain) and/or accompanied by some visual aid (e.g. a ruler).

Two limitations of verbal expressions of expectations (of the type “very likely”, “fairly likely”, “not too likely”) are that different respondents may interpret them differently and that they convey limited information about respondents’ expectations. In fact, Dominitz and Manski (1997, 2004) blame the early use of verbal expectations for the economists’ distrust of expectations data. In particular, they cite a controversy in the 1950s and 1960s about the usefulness of elicited verbal assessments of expected consumer finances in the Federal Reserve Board Survey of Consumer Finances conducted by the University of Michigan Survey Research Center. The debate had George KatonaFootnote 2 as the leading proponent of qualitative attitudinal questions vs. Thomas Juster who did not find them useful in predicting behavior.Footnote 3 This debate would have left economists suspicious of any expectation data for a while.

The advantages of asking probabilistic expectations are that numeric answers are comparable across persons and over time, algebra may be used to examine consistency, and they allow respondents to express uncertainty or risk.

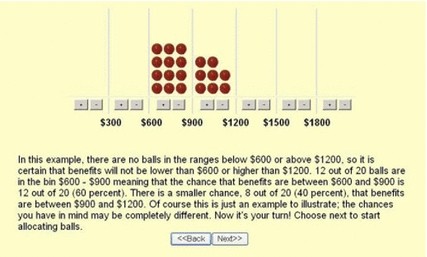

Measuring probabilistic expectations about future continuous outcomes entails obtaining each respondent’s subjective probability distribution. An early example is the following question about earnings uncertainty included in the 1989 Survey of Household Income and Wealth (Banca d’Italia):

“We are interested in knowing your opinion about labor earnings or pensions 12 months from now. Suppose now that you have 100 points to be distributed between these intervals (a table is shown to the person interviewed). Are there intervals which you definitely exclude? Assign zero points to these intervals. How many points do you assign to each of the remaining intervals?”.

A different formulation with the same objective could be

“How likely do you think it is that your income in the coming year will be higher than ___ (A/B/C) Rupees?”

as adopted in Attanasio and Augsburg (2012), where A, B, and C are different income thresholds. The information is elicited in the form of a probability density in the first case and of a cumulative distribution in the second.

Despite some potential added difficulty for the respondent in answering questions in a probabilistic form, most of the evidence shows that respondents are willing to answer probabilistic questions and that their responses are generally sensible and internally consistent. This is so when the questions concern well defined events that relate to respondents’ lives (see for example evidence cited in Manski 2004; van der Klaauw et al. 2008).

Recently probabilistic expectations data have also been collected in developing countries (see Attanasio 2009; Attanasio and Augsburg 2012) where getting sensible answers to such questions has also proved feasible. Some controversy however remains related to Tversky and Kahneman (1974) randomized experiments, which reveal that individuals often use heuristic methods rather than Bayes theorem.

Studies on decision making under ambiguity take probability expectations one step further. Ambiguity arises when individuals do not hold a single subjective distribution but may hold a set of them. In the case of binary events this would translate into allowing answers in intervals of probabilities instead of only point probabilities (for an extended explanation see Manski 2004). Manski (2004) provides the following example in the case of binary events: “What do you think is the percent chance that event A will occur? Please respond with a particular value or a range of values, as you see fit”. He comments that this formulation enables respondents to express uncertainty or ambiguity. For example, complete ignorance may be expressed by reporting “0–100 %”, bounded ambiguity by reporting “30–70 %”, uncertainty by reporting “60 %,” or certainty by reporting “100 %”.

2.2 Elicitation methodology

Asking for uncertainty requires a process of elicitation. It is not like asking for age. Hence elicitation methods matter to what gets elicited. Understanding this is important but does not necessarily render the request for elicitation meaningless.

Wording A substantial amount of work has been produced to try to minimize bias and systematic error by refining the way information is elicited. This is relevant since even apparently minimal differences in wording may produce different interpretations of the question.

A salient example is the experiment conducted by the Federal Reserve Bank of New York, as part of their Household Inflation Expectations Project, on the effects of alternative wordings for eliciting inflation expectations. One conclusion is that reported expectations were higher when the question asked was about expectations of “prices in general” (as in the long standing Michigan Survey question) than when the formulation was in terms of “inflation” expectations (see for example Bruine de Bruin et al. 2011b, 2012). These authors report that question about “prices in general” and “prices you pay” focus respondents more on personal price experience and since these may be driven by prices of different goods over time the answers may be less comparable than the ones prompted by an “inflation” formulation.

More generally, the wording used in eliciting subjective probabilities has to convey the concept of probability in a manner the respondent understands, so that he is able to express his probabilistic beliefs. In developed countries the usual wording is “percent chance” or “how likely”, while in developing countries respondents are often given a number of beans or balls they are asked to distribute.Footnote 4 Delavande et al. (2011) compare distributing balls across bins to the percent chance approach. In their Indian setting beans generate usable answers for almost all respondents while a percent chance formulation produced a significant fraction of inconsistent answers.Footnote 5 A practical consideration is the number of beans respondents are given to distribute. Greater accuracy may be expected the larger this number is but with too many beans eventually proving difficult to handle by the respondent.

Visual aids are often employed to help respondents. In particular, a ruler may be used to explain the percent chance scale from 0 to 100 %. Visual aids have also proven useful in internet administered surveys in the US (see Delavande and Rohwedder 2011).Footnote 6 Often, time is also spent in providing examples about probability statements (for example, the probability of rain tomorrow) to try and make sure respondents understand probabilistic statements.Footnote 7

Eliciting subjective distributions: range of variation Various elements need to be specified when formulating questions to obtain subjective distributions. The first consideration is to establish the range of variation of the outcome of interest. This may be obtained by asking the respondent to report the maximum and minimum possible outcome in a couple of preliminary questions. Alternatively the support may be chosen by the developer of the questionnaire and to be the same for all respondents.Footnote 8 The first option is now routinely used when the outcome is household or individual specific (e.g. own income) because it decreases the natural focus of the respondent on central tendencies and avoids that pre-established reference values influence his answers (also known as anchoring problem).Footnote 9 Predetermined ranges are predominant when eliciting expectations about aggregate outcomes (e.g. inflation). Once the range of variation is established it is divided in intervals (not necessarily equally wide) and corresponding cut-off points are determined. Presenting a large number of intervals may subsequently allow for more precise statistics but be more cognitively demanding on the respondent. More intervals may be needed for individual outcomes with predetermined supports than with self-anchored ones to allow for individual heterogeneity in outcomes.Footnote 10

Eliciting subjective distributions: cdf vs. pdf A third consideration when devising subjective distribution questions is whether to elicit the information in the form of a probability density (pdf) or a cumulative distribution (cdf). With a pdf format the respondent is faced with assessing the probabilities that the outcome lies in each interval (e.g. the 1989 SHIW question cited earlier) while with a cdf format he has to assess the probabilities that the outcome does not exceed the sequence of thresholds (e.g. as in Attanasio and Augsburg 2012; also the question cited in the introduction).

Most studies have been eliciting cdfs although lately an increasing number of questions are being framed as pdfs (for examples of pdf questioning see Arrondel et al. 2011, the New York Federal Reserve inflation question in Bruine de Bruin et al. 2011b; Delavande et al. 2011). Morgan and Henrion (1990) cite experimental evidence reporting that individuals find it easier to deal with pdfs that allow an easier visualization of certain properties of the distribution like location and symmetry. Traditionally, the larger probabilities involved in cdfs was thought to help respondents.

An alternative to eliciting probabilities in the form of cdfs or pdfs is to ask for quantiles of the distribution, for example, the respondent is prompted to provide a value X such that there is a 25 % chance of her income being less than X. Early on both Morgan and Henrion (1990) and Dominitz and Manski (1997) rejected eliciting quantiles citing evidence that probabilities assessed in this way match less well empirical frequencies.

Last but not least, knowledge about the subject matter There are two basic considerations for successfully eliciting probabilistic expectations. The respondent should have knowledge about the event or outcome to be assessed as well as some skills in expressing beliefs in probabilistic form.Footnote 11 Although the later condition may often seem difficult to satisfy, there have been advances in learning forms of elicitation that may be easier for the respondent as we have discussed above. However, lack of knowledge about the subject matter may prove more difficult to overcome. This may be the case, for example, when trying to elicit stock market return expectations from low income and low education households. For many people mutual fund returns are not part of their lives and hence they lack knowledge of the subject matter which is a necessary condition for individuals to be able to express meaningful beliefs about it. Subjects in general know a lot about themselves but much less about aggregate circumstances.

2.3 Validation diagnostics

Response rates Individuals are willing to answer probabilistic expectation questions. Response rates in many cases are high (e.g. 97 % in Attanasio and Augsburg 2012, 99 % in Bruine de Bruin et al. 2011a, 79–87 % in Hurd et al. 2011) and higher than for actual or historical outcomes in the same surveys. But non-response varies substantially with the matter being elicited. For example, in the 2006 HRS non-response was 4 % for the expected survival probability question but 24 % for the expected gain in the stock market.Footnote 12

Coherence However, a major concern has been whether the answers obtained could really be interpreted as the respondent’s subjective beliefs about uncertain outcomes. Therefore, in all studies some time is spent analyzing coherence of the responses in various ways. In the first place, checks to verify compliance with basic probability laws are usually reported. Authors working with cdf formulation type questions report a varying degree of monotonicity violations. In some cases high compliance is achieved with the help of a programmed automatic prompting in case of violation. Dominitz and Manski (1997) report around 10 % of monotonicity violations before the prompt and 5 % afterwards while Attanasio and Augsburg (2012) report 1 % without the help of such prompting. Automatic warnings for additivity violation (i.e. if probabilities or beans do not sum up to the required amount) in pdf questions are also useful.Footnote 13 Bruine de Bruin et al. (2011a) report other checks to support the validity of responses like the fraction of respondents who put positive probability mass in more than one bin (96.4 %) or the low fraction who put positive probability mass in non-contiguous bins (1.3 %) although some people may have bimodal beliefs.

Correlations and predictive power Correlations with other survey variables may sometimes provide information about the soundness of expectation answers. Attanasio and Augsburg (2012) make use of the standard preliminary question about the likelihood of rain. This question is often carried out to convey the idea of probability to respondents to further check the expected income distribution data they obtain from households in rural India. They find a significant correlation between the answers to the likelihood of rain and expected income for households whose main income is derived from agriculture and no significant correlation for those that do not. More routinely, assessing how answers to subjective probabilities vary with socio-demographic characteristics of the respondent (i.e. compliance with prior beliefs about correlates of expectations), is often seen as part of the validation of the data.

Predictive power is a desirable feature for the credibility of elicited expectations. However, beliefs may be inaccurate but nevertheless be the relevant measure behind observed behaviour. In many different surveys individual expectations about stock market gains have been found to be substantially lower than what observed past (and future) averages would justify. Additionally, young educated males are found to systematically hold more optimistic expectations about the stock market than other groups (see Hurd 2009, for this and other examples). Moreover, beliefs about stock market gains correlate with ownership of stocks.

Rounding Rounding of responses to the nearest 5 % is often reported although at the tails respondents may round to the nearest 1 % (see for example Dominitz and Manski 1997; Hudomiet et al. 2011; Attanasio and Augsburg 2012). Rounding may be influenced to some extent by the design of the visual aid attached to the question, for example, marks on a ruler.

Epistemic uncertainty (ignorance about probabilities) More importance has been given to the bunching of responses at 50 % for the expected probability of a binary event (e.g. the percent chance of a positive stock market return or the probability for a 70 years old person to live to at least the age of 80). Psychologists have reported that a 50 % reply may disguise a “don’t know” answer and reflect epistemic uncertainty, that is, the tendency to choose towards the middle of a scale when the respondent is not able to provide an answer or does not understand the question. Alternatively, such answers could reflect a genuine belief that the event is equally likely to occur or not to occur (see Fischhoff and Bruine de Bruin 1999, for an early paper on the subject).

In order to disentangle responses that reflect a genuine probability belief from those reflecting epistemic uncertainty some studies have included a follow up question in the case of a 50 % answer. In 2006 the HRS added such an epistemic follow up question to some of the probability questions, which revealed that, for example, the fraction of 50 % answers to the survival probability question being simply ignorance (i.e. being unsure about the chances) was as high as 60 %. The HRS formulation of the follow up question for the percent chance of an increase in the value of mutual fund shares was: “Do you think that it is about equally likely that these mutual fund shares will increase in worth as it is that they will decrease in worth by this time next year or are you just unsure about the chance?”.

In contrast, Dominitz and Manski (2007) provide some evidence that such answers could reflect a genuine belief that the event is equally likely to occur or not to occur. In particular, they show that persons answering 50 % to the 2004 HRS question about their perceived percent chance of a positive stock return hold more stocks than persons with lower expected probabilities but less than persons with higher expected probabilities. They infer therefore that such answers reflect a higher perceived chance of a positive stock return than less than 50 % answers but lower perceived chance of a positive stock return than more than 50 % answers.

Heaping Heaping at 0 and 100 reported but this is usually less problematic than at 50 %. A high number of 0 and 100 responses probably reflects absence of precise beliefs and therefore some uncertainty. However, they convey the information that the chances of the event occurring are thought to be extremely low or extremely high. In any case focal answers at 0, 50, 100 reflect less precisely known probabilities than non-focal ones. Lillard and Willis (2001) find that the tendency to give focal answers is associated with lower cognitive ability. Hurd et al. (2011) find in their data a fraction of “50 %-respondents” lower than in many other surveys and attribute this to the fact that Dutch CentER Panel members are experienced survey respondents.

In the context of eliciting expected distributions of continuous variables (either cdf or pdf formulation) too many answers of 0 % (100 %) chance of the outcome to be higher than the lowest (highest) threshold may sometimes indicate that the chosen range is not adequate.

Addressing Kahneman’s critique One critique to collecting subjective probabilistic expectations is that respondents would not apply much effort and hence would not provide thoughtful answers. In Kahneman’s dual system terminology, respondents will tend to use intuition (system 1) and not reasoning (system 2). Gouret and Hollard (2011) take this criticism seriously and try to separate the fraction of respondents that do provide valuable information about expected mutual fund return distribution. To achieve this they construct a coherency measure and show that only for the most coherent individuals there is a significant monotonic relationship between expected returns and perceived risk. They find that their measure of coherency correlates with education and income.

In contrast, the results in Zafar (2011), analyzing a panel dataset of Northwestern University undergraduates that contains subjective expectations about major specific outcomes, support the hypothesis that students exert sufficient mental effort when reporting their beliefs.

However, in some cases, the problem may not lay in not exerting enough mental effort but in the wording of survey questions making it easy for some respondents to express their probability beliefs.

2.4 Some uses of subjective probability questions

An important motivation for introducing expectation questions in household surveys is to help explain household choices. Another still undeveloped use of individual responses is the construction of statistics like, for example, statistics about inequality in expected survival probabilities.Footnote 14

Although there are already important studies that make use of subjective probabilities to explain economic behavior, a large proportion of the literature to date has focused on assessing the properties of the elicited information and establishing its validity. Further to the basic validation checks described previously, this literature has analyzed variation in subjective probabilities across individuals and their predictive power on outcomes.

To illustrate research work that uses subjective expectations survey data, I will briefly review findings regarding three questions: survival probability, probability of positive stock return, and expected inflation distribution.Footnote 15

Survival probability The expected probability of survival to age 75 was introduced early on in the 1992 HRS.Footnote 16 Data from the first wave did show that the average survival probability was very similar to the 1990 survival rate from life tables. Once a second wave was available in 1994 subjective survival probabilities elicited in 1992 were proved to be a good predictor of mortality for the period between the two waves. This has been also true in the European SHARE (see Winter 2008). Moreover, after few years, it was established that elicited survival probabilities and actual mortality data correlate with variables like education, wealth, income etc. in a similar way. In general, as Hurd (2009) points out, subjective probabilities have “predictive power” when individuals have considerable private information about the subject matter. Indeed, predictive power in itself may not be as interesting as indirectly getting insight about private information.

Some work has also been done on using expected survival probability to explain economic behaviour. For example, Hurd et al. (1998), using the survey of the Asset and Health Dynamics among the Oldest Old (AHEAD), find that the probability of saving correlates in a significant and substantial way with individual subjective beliefs about their own mortality risk but not, when jointly included, with life-table probabilities. Using the HRS, Hurd et al. (2004) study whether individuals who expect to be long-lived claim Social Security benefits later than those expecting to be more short-lived. Although they find effects in the expected direction, their size is modest in general but increases with education. Finally, Gan et al. (2004) compare the ability of expected survival probability in predicting out of sample wealth with life-tables using a life-cycle model of consumption.

Expectations about stock market return Subjective expectations about stock market returns have proven to be useful in helping resolve the stock holding puzzle. Under the traditional assumption of rational and homogeneous expectations, observed low rates of stockholding would be attributed to high risk aversion. However, elicited data show that subjective stock return expectations are very heterogeneous and that this heterogeneity helps explain participation in the stock market (while there is no evidence of a risk aversion effect).Footnote 17 Individuals having more optimistic beliefs about returns are more likely to hold stocks. This effect was first found in Dominitz and Manski (2007) and has been confirmed by other authors in various contexts (Hurd et al. 2011; Hudomiet et al. 2011; Arrondel et al. 2011). Importantly, those heterogeneous beliefs seem to present systematic biases. Individuals are found to be more pessimistic about rates of return than the historical performance of the stock market (see evidence in Hurd et al. 2011 for the Netherlands and Kézdi and Willis 2008, for the US) and men are consistently found to be more optimistic than women. Observed heterogeneity in stock market expectations raises an important question about how beliefs are formed and what are the reasons behind such systematic differences given that information about stock prices is public and there is no private information.

Inflation expectations Household expected inflation is assumed to feed into realized prices if households take inflation into account when deciding about their purchase of large durables, saving instruments, wage negotiations, etc. Given this role of inflation expectations in the monetary transmission mechanism it is widely agreed that in order to control inflation it is important to learn about people’s beliefs concerning future inflation.

For a long time many household surveys have asked point forecasts of expected inflation (e.g. the Michigan Panel, the Bank of England/NOP Inflation Attitudes Survey) but without eliciting related uncertainty.Footnote 18 \(^,\) Footnote 19 For example, the Bank of England/NOP survey question is the following:

“How much would you expect prices in the shops generally to change over the next 12 months?”.

In 2007 the Federal Reserve Bank of New York (FRBNY) began to develop a survey to measure and analyse consumers’ inflation expectations.Footnote 20 In this survey, carried out every six weeks approximately, the full expected distribution is elicited asking respondents about the percent chance of inflation in the next 12 months being in eight separate intervals. After instructions, the wording of the question is as follows:

“What do you think is the percent chance that, during the next 12 months, the following things will happen? Prices in general will:

Armentier et al. (2013) present various validation diagnostics for this question. For their experimental panel survey, non-response rate is less than half a percentage point, the proportion with positive probability in more than one bin is 89.4 % and the proportion with positive probability in non-contiguous bins is 1.6 %.

There is considerable heterogeneity across respondents in median forecasts which are higher for respondents who are women, less educated, poorer, single, or older. When conditioning for all demographics only education remains significant but when further controlling for financial literacy the effect of education is reduced.

Moreover, as we will see in detail below in Sect. 2.6, the authors find coherency between individual inflation expectations and financial choices. Related with the findings on the effect of education and literacy, these data reveal the inability of some groups of the population to form sensible expectations. The results are also indicative of the economic effects expectations of poor quality may have.

Uncertainty about future inflation is positively related to mean and median expected inflation. Moreover, using the panel dimension of the survey, respondents who are more uncertain are found to make larger revisions to their expectations in the next survey (see Bruine de Bruin et al. 2011a; van der Klaauw et al. 2008).

2.5 Expectation formation

The availability of data on individual subjective expectations has prompted renewed interest in analyzing their determinants and the amount of information households use when forming those expectations.

Testing for rational expectations There has been work with individual expectations data testing models of the way expectations are formed and in particular testing for rational expectations. When considering expectations over variables for which the individual has substantial private information (e.g. educational attainment, mortality risk) and in some cases are under his control up to some extent (e.g. retirement age) the rational expectations hypothesis cannot be rejected.Footnote 21 Benítez-Silva et al. (2008) test for rational expectations in the formation of retirement and longevity expectations using the Health and Retirement Study (1992–2002) and of educational attainment expectations using the National Longitudinal Survey of Youth (1979–2000). In their framework this amounts to testing that differences in expectations in successive periods cannot be forecast.Footnote 22 Using instrumental variables for measurement error and accounting for sample selection the authors cannot reject the rational expectations hypothesis.

Following a similar methodology Das and Donkers (1999) analyze the answers about expected income growth in the Netherland’s Socio-Economic Panel but they reject the hypothesis that these expectations are rational and find instead that households are excessively pessimistic about their future income growth. However, the force of the evidence is limited by the fact that expectations in that survey are elicited in a more qualitative way than in the HRS or the NLSY. In particular the set of possible answers are: “strong decrease”, “decrease”, “no change”, “increase”, “strong decrease”.

House price change is a relevant variable for the macroeconomy that has been elicited in a few household surveys. The question may refer to house prices at the national level or at a more disaggregate level (area, own house) for which households may have more information. Case et al. (2012) test rationality of area house price expectations by regressing future house price change on the expected change. One-year price expectations are found to under-react to information while 10-year expectations seem likely to have been over-reacting although this longer term rationality is still difficult to assess with the authors survey data for the 2003–2012 period.

Expectations about macro variables A recent literature on this topic has been focusing on the study of individual expectations (or “sentiment”) about macroeconomic variables where there is public information but no individual information (e.g. inflation, house prices, stock returns). In those cases expectations are found to be systematically biased and the literature has unveiled heterogeneity in various dimensions.Footnote 23 Men, individuals who are young, highly educated, with high income are more optimistic and believe inflation will rise at a slower pace (Bruine de Bruin et al. 2010). However, these systematic biases in people’s expectations are not constant over time (Souleles 2004). Similar findings are obtained by looking at expected stock returns (Dominitz and Manski 2007): there is variation in the empirical distributions over time and men report higher expected returns than women (and the young higher than the old).

A relevant question is therefore what could explain these demographic differences in expectations. Regarding inflation we have learned (see for example Bruine de Bruin et al. 2010) that inflation expectations are higher among respondents who thought relatively more about how to cover expenses and about specific prices, and among those with low financial literacy. Perceptions of past inflation are a major determinant of inflation expectations (see Blanchflower and MacCoille 2009, using UK data) but this is less so for individuals with high education. Cavallo et al. (2014) find that an individual’s expectations are influenced both by inflation statistics and supermarket prices albeit more by the latter that are less costly to understand. Another finding regarding heterogeneity and biases in household inflation expectation is that individuals report biased beliefs on inflation in part because they use their price memories or other private information rather than inflation statistics. Moreover, this would mean that observed heterogeneity in household expectations reflects heterogeneity in individual beliefs rather than measurement error.

Differences between consumers and professional forecasters There have also been some results about patterns in individual expectations over time abstracting from the cross-sectional dimension of the data. Carroll (2003) finds that differences between professional forecasters and consumers narrow when inflation is more significant, probably due to increased coverage of the matter in the media and increased household interest who would improve their expectations when inflation matters. An alternative sticky-information model explanation (in Mankiw et al. 2003), by which economic agents do not update their information continuously because of the cost of collecting and processing the information, does not explain the positive association found between the level of inflation and the extent of the disagreement between consumers and professional forecasters.

2.6 Expectation experiments

Do individuals act on their inflation beliefs? To validate elicitation of inflation expectations data one would like to have evidence that reported beliefs on future inflation help explain financial decisions. This is especially relevant in a low inflation environment. Indeed, it may be argued that consumers may not act on their inflation beliefs because the impact of future inflation is not sufficiently salient or because they may suffer from money illusion.

In an innovative paper Armantier et al. (2013) compare the behavior of consumers in a financially incentivized investment experiment with the beliefs they self-report in an inflation expectation survey. More precisely, respondents are first asked about their inflation beliefs as usually elicited in the FRBNY Survey. Several questions later they are asked to chose among different investment options in which the payoffs depend on future inflation. In particular, for each of the ten available choices, they are presented with two options: one where the payoff depends on inflation over the next 12 months and another where the payoff is fixed. The idea is to look at how reported expectations in the survey correlate with their decisions in the investment experiment.

The experiment was incentivized. Two participants randomly chosen would be paid one year later according to the investment choices they made in the experiment (which in turn were influenced by their inflation expectations).

An important characteristic of the design of this experiment is that when respondents reported their inflation expectations they were not aware of the experiment in which payoffs depend on future inflation.

Data on numeracy and financial literacy as well as a self-reported measure of risk tolerance are also collected as part of the survey.

The conclusion is that on average there is a high correspondence between reported beliefs and behavior in the experiment, and the substantial amount of heterogeneity across respondents can largely be explained by the respondent’s self-reported risk tolerance. Moreover, when considering changes in beliefs over time for the same respondent, the adjustment in experimental behavior is mostly consistent with expected utility theory. Finally but importantly, individuals whose behavior is difficult to rationalize tend to obtain low scores on numeracy and financial literacy questions and are less educated.

Revising expectations Research that analyzes revisions to expectations in association with interim events or information may provide clues about how people form their expectations (as first advocated by Manski 2004). Armantier et al. (2013) carry out an information experiment embedded in one of the regular New York Federal Reserve Bank Surveys along those lines. They first elicit expectations for future inflation, then randomly provide a subset of respondents with information relevant to inflation (either past-year average food price inflation or professional economists’ median forecast of the year ahead inflation), and finally expectations are re-elicited from all respondents. The findings are that respondents do revise their inflation expectations in response to information and that they do so in a meaningful way. In particular revisions are in the direction of the information provided and proportional to the prior perception gap and to the uncertainty of initial expectations. Moreover, updating behavior is heterogeneous with women updating more substantially than men and individuals with low education, low income, low financial literacy being more responsive to information treatment than their counterparts. These are the demographic groups who initially had the higher perception gaps and the more uncertain expectations. This leads the authors to advocate for a potential role for policies that incorporate public information campaigns.

3 Subjective house price expectations in the Spanish Survey of Household Finances

3.1 The EFF and its house price expectation question formulation

The Spanish Survey of Household Finances contains detailed information on household assets, debts, income and consumption and has now been conducted on five occasions (2002, 2005, 2008, 2011, and 2014).Footnote 24 The EFF was specially designed for the study of household wealth. While providing a representative picture of the structure of household assets and debt it incorporates an oversampling of wealthy households based on individual wealth tax files. In addition, there is an important panel component while the sample is being refreshed at each wave to maintain current population representativity. The sample size is around 6000 households, the exact number depending on the wave. Questions on assets, debts, consumption refer to the household as a whole while demographics and labour income information is available for each of its members. The person answering the survey is the one who is most knowledgeable about the household finances although very often help is provided from other members to answer individual specific information. The survey is administered by a computer assisted face to face interview.

Starting in the EFF2011 a new question to elicit household house price expectations was introduced. The motivation behind is the importance of real estate assets in household wealth (80 % of the value of household assets) all along the wealth distribution (88 % for the bottom quartile and 67.5 % for the top decile). Aside from a high proportion of owner occupier households (83 %), 36 % of Spanish households hold some other real estate property. Aggregate expectations about rates of return on housing have been found to be an important determinant of house purchase (see Bover 2010). Moreover, uncertainty about that return has also been found to play a role. Learning about household house price expectations at the individual level may be therefore useful in understanding portfolio composition as well as consumption behavior.

Other surveys eliciting subjective expectations about house prices are the HRS and ELSA targeted to the over 50 years of age households, the NYFRB internet survey, and the Asset Price and Expectations module in the ALP. The introduction of this question is in all cases very recent: 2011 in the ALP module and 2010 in the case of the HRS and the NYFRB survey. This paper is one of the first attempts to analyze answers to this type of questions.Footnote 25

The person answering the 2011 EFF questionnaire was asked the following:Footnote 26

We are interested in knowing how you think the price of your home will evolve in the next 12 months: distribute ten points among the following five possibilities, assigning more points to the scenarios you think are more likely (assign 0 if a scenario looks impossible)

-

Large drop (more than 6 %)

-

Moderate drop (around 3 %)

-

Approximately stable

-

Moderate increase (around 3 %)

-

Large increase (more than 6 %)

-

Don’t know

-

No answer

Several comments are in order. The question refers to the price of the household main residence because of the belief that households have more information about their own house than about prices of houses in the area or nationwide. Moreover, answers provide information about unobservables and heterogeneity in the housing market even if people were to have plenty of information about aggregates. A sentiment about house prices nationwide could be inferred by aggregating from a representative sample like the EFF although these are of course different questions. The question was posed to all households and not only to home owners. When eliciting the subjective distribution numerical answer options are provided together with verbal descriptions. The number of intervals among which the probability mass is distributed is five and it was preferred to offer the respondent ten points to distribute as opposed to 100 because it is cognitively less demanding. For the same reason it was chosen to elicit the distribution using a density formulation rather than a cumulative distribution. Respondents are also handed out a sheet of paper containing the question and the response options on which they could draft their answers. Explanations are provided by the interviewer when needed. Finally, an automatic prompt would appear on the screen whenever the answers entered in the computer by the interviewer do not add up to ten. In such cases the household and the interviewer are asked to revise the answers.

The elicitation specificities in other surveys containing house price expectation questions are diverse. The HRS asks about own house price expectations (to owners only) using a cdf formulation with four cut-off points. The ALP module refers to house price in the area for renters and own home values for owners and has a pdf type of question with three intervals (two of them open ended). Finally the NYFRB survey asks about prices of a typical home in their zip code and follows their usual ten interval pdf formulation.

With the exception of the ALP, the previous surveys formulate their house price expectation question in terms of rates of change (as opposed to levels). In the EFF given that households provide a self-assessed current value for their home one could also derive the expected level of house price in 12 months time using the expected rate of change.

3.2 Item non-response

Only 4.1 % of households who participated in the EFF2011 did not answer the house price expectation question.Footnote 27 Table 1 (columns 2 and 3) provides some breakdown by demographic characteristics of the respondent. Sample shares are discussed in the text but the corresponding estimated shares for the population are also contained in Table 1 columns 3 and 5.

This percentage is higher for non-owner occupiers (10.7 %) than for owners of their main residence (3.2 %). In any case it compares favorably with the 2006 HRS response rates to an expected stock returns question, to which 24 % of households did not respond, suggesting how unfamiliar the stock market is for many households. Even among stockholders non response was 11 % (and 29 % for non-stock holders).

Men are more prone to answering the question than women (2.8 vs. 6.2 % non-response) and non-response rates decrease with education (7 % for individuals with up to primary education, 2.3 % for those with secondary education, and 1.4 % in case of holding a university degree). By age, the non-response of the over 64 stands out. Table 2 (column 1) presents results from a multiple regression including income and wealth variables as well.

In the EFF I construct various measures to assess the amount of questions the household has provided an answer for. Among others, I calculate the percentage of monetary questions that have been answered with a point value (as opposed to an interval) as the ratio of exact answers to total questions posed to the households. The correlation of this precise information ratio with not having answered the house price expectations question is \(-\)0.10 (\(-\)0.17 with a t-ratio of 8.2 in a simple regression). Not answering the house price expectation question also correlates significantly with not having been able to provide an estimate of the current value of their home (0.10; 0.05 with a t-ratio of 7.4 in a simple regression).Footnote 28

3.3 Coherency analysis

Bunching in the middle of the scale The percentage of respondents placing all ten points in the middle-of-the-scale option is 18.8 %. For reference, in the 2006 HRS 23 % of respondents chose the middle of the scale to the question on survival probability to age 75 and 30 % chose it as a response to a question about the probability of stock market gains.Footnote 29

There is certain heterogeneity by demographic groups (see Table 1, columns 4 and 5). Among home-owners 18.4 % chose this answer while the share among non home owners is 21.1 %. There is also some variation by education (varying from 19.5 % for respondents with no secondary education to 17.8 % in the ca.se of University educated respondents). By gender there are some differences as well (18.2 % in the case of men, 19.6 % for women). Differences by age are less noticeable (ranging from 16.8 % among the under 34–20 % among the over 64). In a multiple regression (see Table 2, column 2) only being aged over 64 has a significant (positive) effect on bunching. All in all these are small differences across groups, which is suggestive of bunching driven by beliefs more than by ignorance, except may be for the older respondents.

The correlation between the constructed information ratio variable and choosing to put all ten points in the middle of the scale is not significant (0.004 and 0.01 with a t-ratio of 0.31 in a simple regression). Along the same lines, the correlation with not being able to provide a value of their home is not significant either (\(-\)0.002 and \(-\)0.002 with a t-ratio of 0.13 in a simple regression).

The effects of demographic variables do not work in the same direction as in the case of non-response and are much less significant in this case despite the sizeable number of such respondents (Table 2, column 2). This may indicate that there are different factors at work. Namely, while a fraction of individuals giving all ten points to the approximately no house price change option may do so because they are unable to express beliefs about the future path of house prices there are others who strongly believe (i.e. put all ten points) that the price of their house will experience no change over the next 12 months (see more details on epistemic uncertainty in Sect. 2.3). The absence of correlation with the information ratio and with not answering the current value of their house points in this direction as well. Unfortunately, I cannot separate the two types of answers because in the EFF the house price expectation question is not followed by one trying to disentangle ignorance from genuine belief of no change in house prices.

Number of intervals used 61 % of the respondents express uncertainty and put some probability mass in more than one interval while 28 % of all respondents use more than two intervals (see Table 3). Only 6.32 % use all five intervals.

Using non-adjacent intervals There is a very small fraction of respondents (1.6 %) that assign non-zero probabilities to non-adjacent intervals.

3.4 Preliminary analysis

Average histogram and most frequent answers Figure 1 shows an average histogram showing the percentage probability mass in each of the five predefined intervals of the density function. The figure shows that respondents overwhelmingly put most of the probability mass in the expected drop-in-price region. Therefore, Spanish households at the end of 2011 were in general not expecting increases in the price of their homes over the next 12 months.Footnote 30 But importantly, around this average of distributions there is a large heterogeneity in individual subjective probability distributions. To provide more detail about the pattern of answers, Table 4 shows the most frequent answers up to 90 % of the cumulative sample distribution. The ten most frequent answers collectively account for 60 % of the sample.

Probability of a positive return I calculate the respondent probability of a positive change in house prices as the sum of the number of points attributed to intervals 4 and 5 (i.e. to a moderate increase of around 3 % and a large increase of over 6 %). A fraction of 15.7 % of respondents put some probability mass to an increase in house price and 3 % (2.5 % of men, 4.1 % of women) believe this probability exceeds 50 %.

The demographic characteristics behind the likelihood attributed to an increase are analyzed by reporting linear regression results for the probability of a positive return (Table 2, column 3).Footnote 31 The positive effect of having bought the main residence recently stands out. Other noticeable effects are the negative effects of age and having a University degree although these are not precisely estimated.

Probability of a negative return The respondent’s probability of a negative change in house prices is calculated as the sum of the number of points attributed to intervals 1 and 2 (i.e. to a moderate drop of around 3 % and a large drop of over 6 %). The results (Table 2, column 4) show no significant association of such beliefs with household characteristics, except for a not very precise positive effect of household income. Negative house price expectations were therefore widespread across groups of the population at the end of 2011.

No uncertainty 32.7 % of respondents believe the price of their homes will drop for sure during 2012 (i.e. they distribute all points between intervals 1 and 2—large drop over 6 %, moderate drop around 3 %). Over half of them (57.2 %) attribute all ten points to one of the two price drop alternatives and hence answer without uncertainty. The results in the fifth column of Table 2 are an attempt to uncover demographic differences associated with these “no uncertainty” answers. The only significant difference between these no-uncertainty respondents and the rest of respondents expecting a drop is gender and owning other housing.Footnote 32 According to these results, women are less likely than men to give a 100 % probability to one of the two drop-in-price scenarios (and hence more likely than men to distribute the chances among the two alternatives). Additionally, households owning other housing aside from their main residence are more likely to believe in a drop with no uncertainty about its magnitude.

Analyzing answers without uncertainty in the expected positive domain is not undertaken because it is hampered by the small number of observations.

3.5 Fitting subjective house price distributions

Calculating individual distributions As seen above, subjects are asked to distribute ten points among five possible changes to the price of their homes over the next year. I use the subject responses to fit a saturated probability distribution for each respondent. This is useful because it facilitates the calculation of comparable measures of position, uncertainty, and quantiles for all individuals. Using a saturated distribution avoids placing restrictions on the form of the distribution relative to the information in the data.

I assume that the probability distributions have a pre-specified support and a pre-specified neighborhood around zero for the no-change category. Having specified end-points and an interval around zero, to get a full cdf I connect the observed points using straight lines so that the cdf is piece-wise linear and the density is flat within segments. This allows calculating all quantiles by linear extrapolation.

Figure 2 illustrates the estimation of the probability distribution for a respondent having distributed his ten points as follows: one point to a drop of more than 6 %, six points to a drop of around 3 %, one point to more or less the same, one point to an increase of around 3 % and one point to an increase larger than 6 %. The limits of the support are defined to be \(-\)15 and +15 % and the interval around zero for the non-change category to be between \(-\)1 and +1 %. To obtain the \({\varvec{\tau }}\)-quantile \(q_{\tau i}\) for some \({\varvec{\tau }}\in (z_{li}, z_{(l+1)i})\) we use:

where the \(z_{l i}\) are cumulative probabilities and \(q_{zli}\) the corresponding quantiles for \(l = 0, 1, {\ldots }, 5\), which are given by (\(-\)15, \(-\)6, \(-\)1, 1, 6, 15).

Quantile regressions from subjective quantile variables Measured quantiles \(q_{\tau i}\) are to be interpreted as conditional quantiles given characteristics of the individual and the house, both observable and unobservable. To look at the variablility in these distributions, I estimate least squares regressions of individual quantiles on measured characteristics and postal code dummies (that is within postal code quantile estimates). These quantile regressions are very different from ordinary quantile regressions where one fits a quantile model to data that are sample draws from the distribution. Here the left hand side variable consists of direct measures of the conditional quantiles.

A factor model for unobserved heterogeneity in subjective quantiles The quantile regression errors capture unobservable heterogeneity in the subjective probability distributions (except for functional form approximation errors). I estimate a random effects model for the errors of different quantiles to see to what extent a single factor captures the unobserved heterogeneity in the distributions.

Consider for example regressions for \(q_{.25i,} q_{.50i,} q_{.75i}\)

The factor model is:

I estimate the variance of the common factor \({\varvec{\eta }}_{i,}\) the variances of the random errors \({\varvec{\varepsilon }}_{\tau i }\) and the factor loadings \({\varvec{\delta }}_{\tau }\) subject to \({\varvec{\delta }}_{0.5 }= 1\) and the assumption that \({\varvec{\eta }}_{i}\) and the \({\varvec{\varepsilon }}_{\tau \mathrm{i}}\) are mutually independent.

3.6 Relating heterogeneity in expectations to housing and household characteristics

Individual density position measures and demographics I examine the association between quantiles at various points of the estimated individual densities and demographics, within postal codes.Footnote 33 In particular I consider the individual median and the 10th, 25th, 75th, and 90th percentiles as distributional measures for each respondent. Multiple regression results for those variables on demographics may be found in Table 5.

The regression equations are of the form:

where \(X_{i}\) is a vector of household characteristics such as age, education, gender, income and wealth. Moreover, \(Z_{i}\) is a vector of house characteristics, which includes postal code dummies, log (price/square meter) and in some cases also an indicator of age of the house.

The results include the household estimated price (per square meter) of their home. Interestingly, the self-assessed house price of a household is not a significant predictor of the expected evolution of the price of its home conditional on postal code dummies (and the rest of included controls).

We observe lower expected declines in the lower part of the distribution as age increases. This relates to the finding by Malmendier and Nagel (2013) that experience of older individuals draw on longer history of data when forming their expectations while expectations of younger ones are dominated by more recent data. In Spain in 2011 the house price drops experienced since 2007 came after decades of rising house prices.

Blue collar workers are associated with more optimistic expectations all over the distribution while for the self-employed there is a negative shift in the upper part of the distribution. Households in the middle-upper part of the wealth distribution have their expectation distribution shifted upwards (more pronounced in the lower part).

Interestingly, there is a positive effect for those households who bought their main residence recently (in the last 6 years). Moreover, this effect is quite uniform across the whole range of the distribution although more precise in the upper part of the distribution. Recent buyers may be more reluctant to accept a prospect of no house price increases as compared to non-recent buyers who have experienced sizeable house price returns. This effect may also reflect reverse causality, that is, buyers who expected higher house price changes than the rest were the ones who bought recently. Table 12 presents results omitting this variable and the results are unchanged (columns 1 and 2). The same result is obtained if instead a variable reflecting that the house was built in the last 6 years is included. These could be taken as suggesting that the previous result does not seem to be driven by reverse causality.

The results on gender stand up. Being a woman produces a positive shift that is particularly noticeable at the median and at the top quartile. This is difficult to explain in terms of differences in information as one may do with occupation or age. It does not seem to be related to risk aversion either. Indeed, I have also included a measure of risk aversion available in the EFF but the results are unchanged (see Table 12 columns 3 and 4).Footnote 34

What these results say is that there is a difference by gender among the respondents to the survey (controlling for postal code and other covariates), who are meant to be the most knowledgeable about the household finances, as explained earlier. Whether these differences would still hold for randomly selected individuals cannot be answered on the current data.

To check the robustness of the gender result I estimated an Abadie and Imbens (2006) matching estimator of the gender average treatment effect which uses the control variables in a non-parametric way. This produces similar results both in magnitude and significance. The same result is also found estimating the gender average treatment effect by weighting on the propensity score. This is at odds with the generally accepted finding that women tend to be less optimistic than men (see for example Balasuriya et al. 2010).

To further assess potential differences in asset valuations by gender we regressed self-assessed values of different assets reported in the EFF on the same demographic and socio-economic characteristics. The results in Table 13 show that women tend to provide higher estimates for the value of their home compared to men but lower ones when it comes to value their financial assets.

An open research question in economic psychology is to what extent people’s price perceptions and expectations are mediated by psychological variables like emotions and attitudes (see for example Ranyard et al. 2008). One hypothesis for further research that could explain our results would be that women positive affective feelings for their home (and its value) are stronger than for men and that these preferences affect the judgment of men and women. For a detailed description and evidence see Slovic et al. (2001).

Are women more optimistic, or simply more realistic? A bold answer to this question can be based on the aggregate of counterfactual point predictions of house price changes across all households as if all were male respondents. Using the median as a point forecast measure, the estimation results inform us that the counterfactual female aggregate is 0.4 percentage points higher than the corresponding male aggregate. We can now look at the actual aggregate house price change between 2011 and 2012 to find out which one of the two genders was closer to the truth. The national house price change December 2011–December 2012 for second hand housing was around \(-\)10 %.Footnote 35 The counterfactual aggregate male and female point forecasts are \(-\)3 and \(-\)2.6 %, respectively. Even if the position of the subjective probability distribution may be affected by framing, the distance between actual and predicted changes is sufficiently large to conclude that women were more optimistic rather than more realistic by comparison with men.

Uncertainty and demographics As a first measure of individual forecast uncertainty I consider the inter-quartile range. I also analyze the range given by the difference between the 90th and 10th percentiles. Heterogeneity in self-reported uncertainty is examined in Table 6. A distinct effect on uncertainty in a multiple correlation context is age. Older people express less uncertain expectations. Households in the middle-upper part of the wealth distribution are also less uncertain about their expectations. In line with other authors (see for example Bruine de Bruin et al. 2011a) I also find that differences in uncertainty across demographic groups are smaller than those in central tendency forecasts.

Are people with more certain expectations more accurate? Since older people have more certain expectations, we can answer the question with relation to age. This is relevant because age is the main observable associated with differences in the degree of certainty in expectations. It turns out that age does not have a significant effect on point-forecasts as measured by the subjective median. Therefore, there is no evidence of differences in predictive accuracy according to the degree of certainty as captured by age.

As another indicator of the potential association between accuracy and certainty I calculated the correlation between the median and the inter-quartile range of the individual subjective distributions. It turns out to be \(-\)0.4. Therefore, more certain individuals tend to predict lower falls in house prices. Given the actual declines described above, such negative correlation would suggest that more certain expectations are less accurate. This result is consistent with recent evidence in psychology that superforecasters are more uncertain about their forecasts (Tetlock and Gardner 2015).

Robustness to alternative cutting points and to bunching As explained above, the individual densities required specifying values for various cutting points in the probability density. We analyzed the determinants of robustness of the analysis of beliefs and their uncertainty to alternative values of the cutting points. Table 12 (columns 5 and 6) presents results obtained increasing the minimum and maximum values of the support (from \(\mp 15\) to \(\mp 20\)). As we can see the results are qualitatively robust to these alternative ways of fitting the distribution. The size of the effects varies depending on the cutting point but relative effects as well as significance are maintained. The conclusions hold for other changes in these values and in the interval chosen around zero.

As a further robustness check I estimate the models in Tables 5 and 6 dropping those respondents who put all ten points in the “more or less the same” alternative. The results (not shown) are similar except for the various effects of age that mostly disappear. This is not surprising given the estimates presented in Table 2 column 2 about the factors influencing the probability of assigning all ten points to the middle interval.

Importance of detailed location of the house Table 7 highlights the central importance of the detailed location of the house and in particular of introducing postal code information. Location at the postal code level accounts for 97 % of the observed variation in the estimated median expectation and for 95 % of the variation in uncertainty across households (as measured by the inter-quartile range). More aggregate location information like municipality or province do not do such a good job, as one would expect. Municipality dummies account for 66 % of explained variation in the median (and 80 % in the inter-quartile range).

Table 14 (columns 1–3) presents some of the regressions reported in Tables 5 and 6 but without location information. This shows how misleading the estimated effects of other variables could be in the absence of location information. In particular, the gender effect would not be found. Municipality dummies produce results more similar to estimates that control for postal code dummies but still quite different (Table 14 columns 4–6). As expected, it is location at a very disaggregate level that matters for house prices.

Relating expectations to local housing and labour markets Inspection of the estimated postal code effects estimated in Tables 5 and 6 indicate that respondents expect the price of their home to grow more in areas where housing prices are already high. Figure 3 plots the estimated postal code effects for Barcelona and Madrid sorted in ascending order. The highest postal code effects in both cities correspond to sought-after areas. The opposite is true at the other end of the scale.

In Tables 8 and 9 estimated postal code fixed effects are regressed on housing and labour market variables, in particular rates of return on housing and unemployment rates at the province level. The results show that when forming expectations about the future price of their home respondents extrapolate the recent evolution of the province labour and housing markets. This is true both for the location of the distribution and for the measure of uncertainty. For example, an increase in the unemployment rate in the previous year of 1 percentage point leads to a decrease of 0.18 percentage point in expected median house price and to an increase of 0.1 point in uncertainty as measured by the inter-quartile range.

Quantile error structure The first principal component of the (.1, .5, .9) quantile residuals explains 99 % of total variation in a model with postal code dummies, and 98 % with province dummies. When five residuals are used (.1, .25, .5, .75, .9) the variation captured by the first principal component is 91 % with postal code dummies and 89 % with province dummies. Estimation of the random effects model produces an estimated residual variance at the zero boundary (a Heywood case), which is not surprising given the high correlation among residuals. The estimated factor loadings for 0.25 and 0.75 in the three error specification are close to unity (0.94 and 0.95) with corresponding residual variances in the 0.10 range. Relative to those residuals the single common factor explains 97 % of total variation.

4 House price expectations and consumption decisions

Expectations and decisions One of the main purposes of collecting subjective expectation data is to help understand behavior. In this section I study whether house price expectations reported in the EFF predict household expenditure decisions. This is of substantial interest in its own right and also a further step in the validation of the information collected.

There were large unexpected shocks to house price expectations in Spain after 2007. The percentage of households buying second housing decreased dramatically since the bursting of the housing bubble. In the three year period between the 2002 and the 2005 EFFs, 5.2 % of households bought a second house (an average of over 1.7 % a year) while this percentage was only 0.6 % for 2011. Also according to EFF data, 9.4 % of the Spanish households bought a car in 2011. However, among the households who are very pessimistic about the future price of their house (i.e. those assigning all ten points to the over 6 % drop scenario) only 4.5 % did so.Footnote 36 In this section I use information on expenditure outcomes on various items available in the EFF to see if house price expectations are predictive of purchase and expenditure decisions once a rich set of controls are taken into account.

Expenditure and purchases in the EFF In the EFF households provide information on whether they bought a car in the last 12 months and the price paid for those who did. The same information is collected about other big ticket items (furniture, washing machines etc) as a whole. Amounts spent on food at home and outside as well as on other non-durables are also collected.

The EFF provides detailed information on purchases of secondary housing (for households owning their main residence). Housing purchases are both consumption and investment decisions. Bover (2010) provides evidence that aggregate predicted returns on housing have a large positive effect on the hazard of purchasing a house. However, aggregate returns are probably masking different individual expectations concerning future house prices, both in terms of differences in household characteristics and in terms of differences in house specific attributes like location. I therefore explore if individual household expectations about house prices help predict the probability of purchasing a house and, in case of purchase, the amount spent on it.

A word about the timing of subjective expectations and expenditure outcomes. Ideally, the interest is in how expectations held at t about the future influence decisions at t. The expectation data correspond to beliefs held at the time of the interview, while the expenditure data refer to purchases during the last 12 months, which is a good timing approximation, specially for durables.