Abstract

The calibration problem of implied volatility surface under complex financial models can be formulated as a nonlinear high-dimensional optimization problem. To resolve this problem for genuine volatility models, we develop a sequential methodology termed two-stage Monte Carlo calibration method. It consists of the first stage-dimension separation for splitting parametric set into two subsets, and the second stage-standard error reduction for efficient evaluation of option prices. The first stage dimension separation aims to reduce dimensionality of the optimization problem by estimating some volatility model parameters a priori under the historical probability measure such that the total number of model parameters under an option pricing measure is significantly reduced. The second stage standard error reduction aims simultaneously to reduce variance of option payoffs by the martingale control variate algorithm, and to increase the total number of Monte Carlo simulation by the hardware graphics processing unit (GPU) for parallel computing. This two-stage Monte Carlo calibration method is capable of solving a variety of complex volatility models, including hybrid models and multifactor stochastic volatility models. Essentially, it provides a general framework to analyze backward information from the historical spot prices and the forward information from option prices.

Similar content being viewed by others

Notes

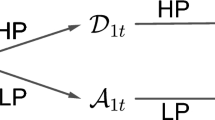

For example, \(\hbox {Y}_{\mathrm{1{t}}} \) stands for the stochastic volatility process from intraday data, comparing with \(\hbox {Y}_{\mathrm{2{t}}} \) that stands for the stochastic volatility process from daily data.

References

Barucci, E., Mancino, M.E.: Computation of volatility in stochastic volatility models with high frequency data. Int. J. Theor. Appl. Finance 13(5), 767–787 (2010)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Political Econ. 81, 637–659 (1973)

Boyle, P.: Options: a Monte Carlo approach. J. Finance Econ. 43, 323–338 (1977)

Carr, P., Wu, L.: Stock options and credit default swaps: a joint framework for valuation and estimation. J. Finance Econ. 8(4), 409–449 (2010)

Clark, I.J.: Foreign exchange option pricing: a practitioner’s guide. Wiley, Hoboken (2011)

Choi, S.-Y., Fouque, J.-P., Kim, J.-H.: Option pricing under hybrid stochastic and local volatility. Quant. Finance 13(8), 1157–1165 (2013)

Christoffersen, P., Heston, S., Jacobs, K.: The shape and term structure of the index option smirk: why multifactor stochastic volatility models work so well. Manag. Sci. 55, 1914–1932 (2009)

Derman, E., Kani, I., Chriss, N.: Implied trinomial tress of the volatility smile. J. Deriv. 3(4), 7–22 (1996)

Dupire, B.: Pricing with a smile. Risk 7(1), 18–20 (1994)

Fouque, J.-P., Han, C.H.: A Martingale control variate method for option pricing with stochastic volatility. ESAIM Probab. Stat. 11, 40–54 (2007)

Fouque, J.-P., Papanicolaou, G., Sircar, R., Solnar, K.: Multiscale stochastic volatility asymptotics. SIAM J. Multiscale Model. Simul. (2003)

Fouque, J.-P., Papanicolaou, G., Sircar, R., Solnar, K.: Multiscale stochastic volatility for equity, interest rate, and credit derivatives. Cambridge University Press, Cambridge (2011)

Han, C.-H.: Instantaneous volatility estimation by Fourier transform methods. In: Lee, C.F. (ed.) Handbook of financial econometrics and statistics. Springer, New York (2015)

Han, C.-H., Lin, Y.-T.: Accelerated Variance Reduction Methods on GPU. Proceedings of the 20th IEEE International Conference on Parallel and Distributed Systems (2014)

Han, C.-H., Molina, G., Fouque, J.-P.: MCMC estimation of multiscale stochastic volatility models with applications. Math. Comput. Simul. 103, 1–11 (2014)

Han, C.-H., Liu, W.-H., Chen, T.-Y.: VaR/CVaR estimation under stochastic volatility models. Int. J. Theor. Appl. Finance. 17(02) (2014)

Han, C.-H., Tai, H.-H.: Joint calibration of market risk, credit risk, and interest rate risk. Preprint. National Tsing-Hua University (2017)

Han, C.-H., Yu, S.-T.: GPU acceleration for computational finance. Submitted (2017)

Heston, S.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327–343 (1993)

Hull, J., White, A.: The pricing of options on assets with stochastic volatilities. J. Finance 42(June 1987), 281–300 (1987)

Jex, M., Henderson, R., Wang, D.: Pricing exotics under the smile. Derivatives Research, JP Morgan (1999)

Lee, G., Tian, Y., Zhu, Z.: Monte Carlo pricing scheme for a stochastic-local volatility model. Proceedings of the World Congress on Engineering. 2 (2014)

Lipton, A.: The vol smile problem, Risk, February, 81–85 (2002)

Malliavin, P., Mancino, M.E.: Fourier series method for measurement of multivariate volatilities. Finance Stoch. 6, 49–61 (2002)

Malliavin, P., Mancino, M.E.: A Fourier transform method for nonparametric estimation of multivariate volatility. Ann. Stat. 37, 1983–2010 (2009)

Maruhn, J.H.: Combining numerical & technological advances for fast & robust monte carlo model calibration, global derivatives trading & risk management, Barcelona, April 16–20 (2012)

Ren, Y., Madan, D., Qian, M.: Calibrating and pricing with embedded local volatility models. Risk Magazine. 20(9) (2007)

Tataru, G., Fisher, T.: Stochastic local volatility. Quantitative development group, Bloomberg Version 1 (2010)

Author information

Authors and Affiliations

Corresponding author

Additional information

C. Han: Work supported by NSC 102-2115-M-0070006-MY1. We are grateful for Ching Chen on empirical implementations and for CUDA Center of Excellence at National Tsing-Hua University for providing GPU computing facility.

C. Kuo: Opinions expressed herein are entirely those of the authors, rather than those of KGI Bank.

About this article

Cite this article

Han, CH., Kuo, CL. Monte Carlo calibration to implied volatility surface under volatility models. Japan J. Indust. Appl. Math. 34, 763–778 (2017). https://doi.org/10.1007/s13160-017-0270-z

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13160-017-0270-z

Keywords

- Implied volatility surface

- Multi-factor stochastic volatility model

- Hybrid model

- Fourier transform method

- Monte Carlo simulation

- Standard error reduction

- Martingale control variate

- GPU parallel computing