Abstract

Innovative development to some extent overcomes the path-dependent characteristics of knowledge proximity, and the diversity and complexity of regional knowledge and technology foster regional economic growth. This study constructs a dynamic mechanism for maximizing the enterprise profit to explore the conditions enabling regions that can achieve knowledge accumulation and technological leapfrogging. Utilizing the fitness landscape methodology based on customs data from 30 provinces in China and employing genetic algorithms, we analyze two modes of enterprises with similar and different initial conditions under varying leapfrogging scenarios. By applying profit maximization rules within the fitness landscape of the product space, we examine how to promote regional industrial transformation and upgrade. The results indicate that a larger leap range in the production of products by enterprises, reflecting stronger innovative capabilities, significantly enhances the region’s ability for industrial transformation and upgrade. There is a strong positive relationship between the initial industrial foundation and regional economic development. When regions share a similar industrial base, the complexity of regional knowledge becomes more critical. Therefore, an increase in the foundational development of industries and technology-intensive products can enhance the potential for regional path innovation. Past research has primarily been based on the path dependence theory, emphasizing that the most crucial aspect for underdeveloped economies is the accumulation and development of foundational capabilities. However, our study contends that, for emerging economies, it is crucial to enhance the diversity and complexity of knowledge and technology. Particularly, it is essential to, based on a comprehensive understanding of their own strengths, open up new areas and new arenas in development, continually shaping new growth drivers and new strengths. This emerges as a significant factor in regional growth and leapfrog development.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Advanced technologies and financial resources tend to concentrate in metropolis, widening economic development gap between economically lagging regions and knowledge innovation centers. This has led to a new round of regional differentiation (Feldman et al., 2021). Fundamentally, underdeveloped regions, relying on resources and investment for growth, struggle to sustain their economic development and catch up. Even with policy support, these regions consistently lag behind developed areas, ultimately causing severe imbalance in regional development. Relying on traditional resources and investment-driven development methods cannot effectively promote high-quality regional development and economic convergence among regions. As the economy transitions towards high quality, regional growth patterns have shifted from factors and investment-driven to innovation-driven.

Evolutionary development economics proposes that regional development has entered the innovation-driven stage, where knowledge and technology are fundamental factors determining the regional development gap and serving as the primary drivers of regional economic development (Andrews and Alexander, 2022). In technologically advanced regions, ongoing industrial and technological competitions continually deepen, fostering the emergence of new technologies and industries. This process stimulates the derivation of significant innovation and industrial clusters, gradually accompanied by higher-level infrastructure, research institutions, and universities, creating a matching environment for the region’s innovation. Consequently, the regional innovation ecosystem and innovation capacity reach higher levels, transforming these regions into innovation centers. Conversely, regions with weaker technological capabilities, stemming from an overreliance on traditional resource inputs, lack inherent innovation mechanisms and effective reform strategies, resulting in insufficient growth momentum. Consequently, these regions gradually assume the status of innovative peripheral areas.

Industrial transformation is a development process that evolves from labor-intensive to capital-intensive industries and then to technology-intensive industries, thereby fostering regional productivity (Kee and Heiwai, 2016; Bing et al., 2020; Jones, 2022). Neo-Schumpeterian growth theory challenging the equilibrium notion of neoclassical economics and asserting endogenous knowledge and innovation are the core driving forces of economic growth (Boschma and Lambooy, 1999). Therefore, the current focus should shift from discussions solely on the traditional static comparative advantages of regions to a multidimensional analysis of the generation, overflow, accumulation, recombination, and distribution of knowledge and technology within the context of dynamic evolution. Additionally, the current research lacks a detailed study of the structural transformation process. Throughout the process of the economic system evolution, innovation continuously emerges, presenting new opportunities (Xiao, Makhija and Karim, 2022). Economically disadvantaged regions possess the potential of catching up or even surpass economically better-off areas through path innovation.

Therefore, previous research has predominantly focused on the differences in static comparative advantages shaping regional development. In the stage of innovative development, this study explores how the evolution of knowledge and technology from a dynamic perspective influences the development capabilities of different regions and the leapfrog development of economically disadvantaged areas.

The article is structured as follows. The “Literature Review” section critically reviews the literature on regional development path, knowledge, and product space. In the “Analytical Framework for Industrial Development Path: Maximizing Enterprise Profits” section, we present an analytical framework for the theory of industrial development paths based on maximizing enterprise profits. The “Characteristics of China’s Product Space” section describes the characteristics of China’s product space, while the “Fitness Landscape of China’s Product Space” section constructs the fitness landscape of China’s product space. The “Results” section is the results of the study. Our discussion in the “Discussion” section summarizes the findings of the study. In the “Conclusion” section, we carry future research directions for deepening our understanding of regional development paths.

Literature Review

Path of Regional Industry Derivation

Industrial evolution exhibits path-dependent characteristics (Martin and Sunley, 2006; Boschma and Frenken, 2011). New industries emerge in close connection to historical economic activities, as enterprises, the primary agent within the economic system, tend to generate products that build upon existing knowledge and technology. This process is guided by cognitive proximity (Boschma, 2005; Uyarra and Flanagan, 2022). Consequently, industries that share strong technical connections with local industries are more likely to emerge. Hidalgo et al. (2007) introduced the product space theory, which utilizes global trade data to show the technology embedded in regional development through exported products. Based on the product space derived from the complex network theory, they creatively analyzed industrial transformation and upgrading using the dynamic evolution of comparative advantage. The study confirmed that regional industrial evolution is a path-dependent process. Guo and He (2017) used China’s customs data to map China’s product space and found that new industries have a strong tendency toward proximity to local industries, highlighting path-dependence characteristics of industrial evolution of. Furthermore, for countries and regions with a strong economic foundation, possessing a product space with relatively technology-intensive or complex technologies is more conducive to industrial transformation. However, emerging countries with a weak economic base face challenges in achieving industrial transition through endogenous impetus (Junyang and Shengjun, 2020). In this context, product space theory only explains how regions fall into the development trap.

Considerable research attention has been devoted to innovation within regional development paths. Exogenous forces, unrelated technologies, and various factors may prompt regional industries to embark on a breakthrough in their development path. In the theory of windows of opportunities, the evolution of new regional industries is no longer overtly tied to historical legacies due to economic globalization. These industries possess the capacity to attract global working capital and advanced technology, thereby diminishing their dependence on a locally entrenched industrial base (Neffke et al., 2011; Gong et al., 2022). Furthermore, targeted regional industrial strategies play an important role in achieving breakthroughs in development paths. Regions can strengthen economic ties with other area, foster new industries and technologies of unrelated diversity to current production capacities, and introduce foreign technologies. This, in turn, paves the way for the creation of new growth paths (Bathelt et al., 2004; Martin and Sunley, 2006; Zhu et al., 2017; Allen and Donaldson, 2021; Baumgartinger-Seiringer et al., 2022). Neffke et al. (2018) conducted an analysis of the relationship between related variety, unrelated variety, and regional industry. They found that new enterprises with unrelated variety, especially non-local enterprises with foreign characteristics, are more likely to achieve a breakthrough in their development path.

For emerging countries, lacking the technological and industrial foundation of developed nations, it is challenging to rely on endogenous derivation to generate high-productivity emerging industries. Consequently, this challenge has prompted extensive research into the evolutionary process of emerging industries in these economies (Zhong and He, 2021). In the course of China’s economic transformation, technological proximity has endowed regional industrial development with path dependence. However, to a large extent, exogenous forces are driving the path innovation of China’s regional industry (Guo and He, 2017; Li et al., 2019). Since the initiation economic reform and opening up, China’s economy has undergone advanced transformation, transitioning from a planned economy to a market economy and from a closed economy to an open one. This transformative journey is intricately connected with the endogenous factors of long-term capacity accumulation. Nevertheless, external drivers from the reform and opening up have provided more opportunities for industrial transformation. Wei and He (2021) conducted an analysis of the industrial evolution paths in China’s regions using Chinese customs data. Their findings revealed that industrial development in the eastern coastal areas and capitals of the central and western regions demonstrates high path innovation. The increasingly tightened affiliations between China and other countries, driven by export-led policies, are fostering industry evolution in China (Felipe et al., 2010; Hu and Hassink, 2017; Zhu et al., 2017; Wang and Wei, 2021).

Product Space, Knowledge, and Regional Development Path

Currently, numerous studies have explored the product space of countries in European, America, East Asia, the Latin America, and Africa. Research indicates that developed countries encompass a diverse and complex of knowledge types in their products, leading to a dense product space with a highly concentrated central location. In contrast, economically less developed countries exhibit lower diversity and complexity in the knowledge embedded in their products, resulting in a relatively sparse product space. In these countries, the majority of exported products cluster at the periphery of the product space, primarily comprising unprocessed raw materials, resource products, textiles, and agricultural goods (Boschma et al., 2013; Hausmann et al., 2014; Boschma, 2022).

According to the product space theory, the revealed comparative advantage of new products is heavily influenced by the current products within the product space. Therefore, the prevailing industrial structure will significantly impact the future economic development path, indicating a process of path dependence. If a country’s product space is relatively sparse, with most products clustering at the periphery, it implies lower diversity and complexity in knowledge. Consequently, transitioning to new products with comparative advantages may be more challenging, posing the risk of falling into a path of weak development and a growth trap (Hidalgo et al., 2007).

Look at China’s development history, in the 1960s, the main products consisted of raw materials and semi-processed products, predominantly clustering at the periphery of the product space. Subsequently, in the 1970s, China’s exported products primarily comprised labor-intensive products, such as clothing. Overall, during this period, the product space had a lower density and was situated at the periphery. Moving into the 1990s, China’s export products gradually shifted toward technology-intensive products, including machinery manufacturing and electronics. In the early twenty-first century, the comparative advantage in electronics became evident. Felipe et al. (2010) conducted an analysis of China’s product space over the past 50 years and found that the knowledge diversity and complexity embedded in China’s exported product have consistently increased, with the majority of products exhibiting revealed comparative advantages. As early as 1962, China had 105 out of 779 globally recognized products with a comparative advantage, indicating the potential for China’s future economic development. Li et al. (2019) observed that the knowledge diversity embedded in China’s exported products continues to strengthen, and product space structure has evolved from a polarized structure to a relative balance one.

Fitness Landscape

The complex adaptive system, based on evolutionary theory, is a tool that was previously utilized to analyze the mechanisms of genetic selection, differentiation, and mutation. The system adopts the concept of species inheritance found in nature and simulates gene sequence using a genetic algorithm. It combines these sequences to form a population and promotes natural genetic selection in populations. Fitness denotes an individual’s adaptation to the current environment, serving as an indicator to measure whether an individual can sustainably survive in its the current surroundings. The fitness landscape is depicted as a 3D map formed by combining genes and their corresponding fitness levels. It is employed to analyze the reproductive ability of individuals and optimize genes according to the specific target. The application of this method in the complex adaptive system is more commonly observed (Kauffman & Levin, 1987).

The complex adaptive system has found applications in various fields over time. In economics, the system, which is based on a network composed of agents, captures the dynamic activities of the economy through individual behaviors and interactions. March (1991) utilized the NK model within the complex adaptive system of the fitness landscape and found that when the cognitive environment of employee changes, those engaged in rapid social interaction and experiencing high turnover positively impact enterprise development. Kaufmann et al. (2000) calculated the optimal distance for a firm to improve the technology by assessing the cost of moving the company within the fitness landscape. Their results indicated that rational firms would initially seek opportunities for improvement in a broader range (breakthrough innovation) before selectively adopting incremental innovation for enterprise development. Chang and Harrington (2000) constructed an adaptive landscape for enterprise performance and analyzed the optimal performance of subsidiary and parent companies. They incorporated an economic base into the complex adaptive model, specifically considering the interrelationship between consumer preferences and firm performance.

Overall, we contend that the product space lacks an interpretation of regional development path innovation. Product space theory places greater emphasis on the importance of the initial state of a region. If a region currently possesses a product space with high density and a concentrated central location, indicating a greater diversity and complexity of knowledge, the probability of new products with revealed comparative advantage is higher. For regions with a sparse product space, predominantly at the periphery, industrial transformation and upgrading tend to be relatively challenging. Furthermore, the construction of the product space is based on the scope of all globally exported products, showing the industrial development paths of various countries within this framework. This indicates that the regional industrial structural transformation and upgrading occur within the current global product framework, continually enriching the existing global product space and gradually converging from the periphery towards the center. Therefore, the product space theory does not explain situations where regions break through the current product space scope.

Moreover, a premise is that the product space is continuous, implying that as long as an economy can constantly improve its production capacity based on comparative advantage, it will eventually become prosperous, albeit at varying rates. Given this assumption, there is a lack of a micro-dynamic mechanism driving structural transformation and upgrading. In a product space, the acquisition of production capacity required for each product is random, indicating that regional capacity acquisition is not further refined. However, as the main agents in the economic system, enterprises engage in various production activities, ultimately producing a range of products in the market with diverse knowledge and technological complexity. Therefore, the acquisition of different products is closely related to the enterprise and is not random.

This study establishes a dynamic mechanism for micro-enterprise profit maximization. It employs the fitness landscape approach and uses 2001–2016 China customs data and CEPII-BACI data, analyzing patterns of change in the fitness landscape of the product space to explain the emergence of regional development traps and leaps in economic development.

Analytical Framework for Industrial Development Path: Maximizing Enterprise Profits

This study establishes a dynamic enterprise mechanism to explore industrial development path, drawing on the model developed by Hausmann and Klinger (2006b). We posit a scenario with two enterprises in a market: the first enterprise produces the existing good A, while the second enterprise produces good A in the early stage and a new good B in the later stage. The standard price for good A is \({P}_{A}=1\), and the price for the new good B is \({P}_{B}>1\). The enterprise faces the decision of whether to produce good B based on its the current productivity. The first enterprise possesses a mature production capacity for A, ensuring stable produce and profits. Another option is to produce higher-priced good B for additional benefits \({P}_{B-A}\). However, the first enterprise lacks production capacity for B, necessitating an investment cost C to enhance its production capacity. According to product space theory, cost C is determined by product proximity \(C\left({\delta }_{AB}\right)\). The additional revenues of transformation to the new product are

Once the enterprise successfully undergoes transformation and acquires the production capacity for the new product B, this capacity becomes a public good. Other companies will no longer pay the fixed costs if they wash to produce B, resulting in first-period benefit. If \({P}_{B-A}< C\left({\delta }_{AB}\right)+1\), the new product is unprofitable, and the first enterprise will continue producing A. The second enterprise has the option to produce product A in both periods, yielding a revenue of 2. Alternatively, it can incur cost for producing good B while also producing A, resulting in a revenue of \({P}_{B}\). Therefore, the condition for enterprises to choose the transformation to produce B is

If the specified conditions are met, the enterprise will produce the new good B in both periods and maintain that state. The other enterprise will continue producing A, which does not achieve Pareto optimality for social development. In the third period, satisfying the inequality becomes easier, as

This suggests that the enterprise is not internalizing profits. When the model is extended to n products, the interindustry spillover effect persists. The enterprise will continue to shorten the distance to the new product by enhancing its production capacity. The jump distance will be determined by the enterprise to maximize profits. Product revenue remains proportional to the proximity (\({\delta }_{AB}\)).

Cost C is proportional to the square of the proximity. As the proximity increases, so does the cost. If the connection between the products is very low, there is no technical proximity. Then, it is extremely difficult to shift to another product.

The profit (\({R}_{B-A}\)) that the first enterprise wants to obtain through industrial transformation is

The first derivative of profit can be used to find the optimal proximity that maximizes the profit of the enterprise:

If the first enterprise wants to keep it, it needs to satisfy \({\delta }_{AB}>2f/c\). If the region’s initial capacity endowment does not reach this proximity, it will be difficult to transform. Good A cannot be transformed into good B, nor will it be transformed into a higher profit good C or D.

The model is extended to the maximum profit of many enterprises as

where \(f/c\) is the jump distance of the new enterprise in the first phase, and \(2f/c\) is the jump distance of the new enterprise in the second period. We then expand the proximity matrix (\({\mathrm{\varphi }}_{n*n}\)) to n-dimensions, including all products.

It can be found that industrial transformation depends on the proximity and whether the price of new products is higher than that of current products. The assumption is that the evolution of new products is a linear process (Fig. 1).

However, this path-dependent process cannot capture the leapfrog development paths in the region. Consequently, there is a need to elucidate path innovation in industrial transformation. The hypothesis posits that the profit of new good B is n times than that of good A.

The enterprise’s maximum revenue is

The optimal distance for the enterprise’s maximum revenue is \(\delta =ndf/c\), and the maximum jump distance is \({\delta }^{*}=2ndf/c\). If the initial capability of the enterprise can support this jump distance, it will achieve path innovation and obtain high value-added profit. Figure 2 shows that a linear development path can only jump \(f/c\) distances, and the revenue is \({f}^{2}/2c\), but it is more likely that the region will be locked into a barren product space. The optimal distance increases to \(ndf/c\), and the revenue is \({d{n}^{2}f}^{2}/2c\). Through the accumulation of production capacity and innovation, enterprises can enhance the optimal jump and longest jump distances supported under the current conditions. This increases the probability of new products with high value added in the product space and reduce the likelihood of regions falling into lock-in and development traps. Consequently, regions facing difficulties in industrial transformation due to their spare product space can also achieve leapfrog development. Additionally, with significantly expanded enterprise profits, the region can be propelled to the technology forefront, enabling emerging countries to achieve technological catch-up to some extent.

Characteristics of China’s Product Space

Study Area and Data

This study’s focuses on 30 provinces on the Chinese mainland (excluding Tibet). The data were obtained from China customs data and CEPII-BACI data. The China customs database was updated until 2016, and this study’s starting year was set as 2001, coinciding with China’s entry into the WTO. Therefore, the data cover the period from 2001 to 2016.

Revealed Comparative Advantage

Hausmann et al. (2014) assessed the product proximity of 128 countries, representing for 99% of global trade, 97% of global GDP, and 95% of the world’s population. The assessment was based on the United Nations commodity trade database for HS and SITC 4-digit level, and it involved mapping the product spaces of these countries. In China’s product space, the number of products with revealed comparative advantage (RCA) experienced a significant increase, rising from 316 in 2001 to 389 in 2018. While there was a slight decline in minerals and agriculture, there was a consistent upward trend in textiles, stone, metals, chemicals, vehicles, machinery, and electronics. The continued increase in product diversity indicates an enhancement in the knowledge diversity and complexity embedded in the regionFootnote 1.

Next, we analyze changes in the RCAFootnote 2 of different types of products at the HS 1-digit level. We use 2001 as the starting year and 2018 as the comparison period to determine the presence of RCA for each product. The products are categorized as follows: (1) products that maintain their RCA (with RCA in both 2001 and 2018), (2) products that are abandoned (with RCA in 2001 but without RCA in 2018), (3) a shift to new products (without RCA in 2001 but with RCA in 2018), and (4) products with no RCA (without RCA in both 2001 and 2018).

Table 1 indicates that the first product category comprises 264 RCAs, the second product has 52, the third product has 125, and the fourth product has a total of 425. Among products that maintain their RCA, textiles account for 78 kinds (the largest number), while minerals only have three kinds. For successfully transitioned products, chemicals and machinery lead with 31 and 29, respectively, while minerals have the lowest count at only 1. China’s economic transformation is facing huge environmental and resource pressures, with gradual decline in resource exports or a shift to imports to sustain development. In the fourth category of products, agriculture holds the highest proportion, with 136 agriculture products accounting for 32%, 86 chemicals making up about 20%, and 62 machinery products constituting approximately 15% (a total of 425 products). The results suggest that China’s previous two decades of high GDP growth rate relied heavily on traditional labor-intensive industries, occupying a significant number of production factors and resources. This situation has impacted the development of capital- and technology-intensive industries.

We illustrate the dynamic evolution of RCA in 30 provinces of China from 2001 to 2016, utilizing data from the China customs and CEPII-BACI databases. As depicted in Fig. 3, the number of products with RCA has witnessed a substantial increased. The eastern region consistently outperforms other regions, maintaining a prolonged absolute advantage, especially in provinces like Shanghai, Jiangsu, Zhejiang, and Shandong. In the northeast, there has been a significant decline in the number of products from 2012 to 2016, as observed in Liaoning, Jilin, and Heilongjiang, where the decrease amounted to 21%, 16%, and 25%, respectively. Conversely, the western region has demonstrated significant improvement. Gansu and Qinghai, in particular, experienced a more than threefold increase in the number of products, reaching 411 and 349, respectively, in 2016 compared to 2001. The implementation of “The Belt and Road Initiative” in 2013 provided a substantial economic stimulus to western China and regions along the route. In 2016, Gansu’s foreign trade with other countries exceeded $1.4 billion, reflecting a year-on-year growth of 10% according to China’s customs data. Qinghai leveraged “The Belt and Road Initiative,” with its total foreign trade increasing from $0.14 billion in 2010 to $1.4 billion in 2016, boasting an average annual growth rate of 17.6%.

Proximity

Based on data availability and applicability, we utilized export data spanning from 2001 to 2016 from China Customs Import and CPEII-BACI (covering 224 countries). The China Customs Import and Export Database provides information such as the HS 6-digit code, enterprise codes, and the export trade value of export products. Meanwhile, the CPEII-BACI database includes the HS 6-digit code, country code, and export trade value of export products. Upon initial data processing, we extracted the HS 4-digit code, comprising 1251 kinds of Chinese export products and 1257 kinds of global export products from 2001 to 2016. Subsequently, we calculated a product proximity matrix of dimensions 1251 * 1251 based on the data, yielding 781,875 pairs of proximity relationships between products. Flowing the product space construction method outlined by Hidalgo et al. (2007), we employed the product proximity matrix as the node connection and the export volume as the node size to construct the product space of the region. Proximity is between goods i and j in time t.

where \({{\mathrm{RCA}}x}_{i,t}\) shows the comparative advantage of goods i in time t. We measure the proximity of products and show the results by the cumulative probability distribution in Fig. 4.

In Fig. 4, around 80% of the product proximity was less than 0.2 in 2001, decreasing to approximately 70% by 2016. This indicates an improvement in the proximity among products, with knowledge spillover continuously enhancing regional production capacity. The increased probability of new product emergence suggests that the region will encompass more diverse and complex knowledge. However, it is also noticeable that from 2001 to 2016, over 80% of the products proximity were below 0.3, with less than 10% having proximities exceeding 0.4. This implies that the knowledge proximity of the majority of Chinese products is not particularly high. Relying solely on path dependence is challenging for driving industrial transformation and upgrading. This also exhibits distinct features of path breakthroughs

Fitness Landscape of China’s Product Space

We construct the fitness landscape of product space using the methods of Desmarchelier et al. (2018). This fitness landscape delineates the easy with which a region can undergo industrial transformation via jump methods by enterprises. Each optimal point in the fitness landscape serves as a stimulus for enterprises to engage in jump behavior, subsequently fostering regional growth. Giving the symmetric of the proximity matrix, we solely utilize upper triangular data to construct \({{\mathrm{Fitness}}}_{i,j}\) based on the export value at HS 4-digit level.

where i and j represent product i and product j, respectively; r is the province; and \({{\mathrm{export}}}_{r,i,t}\) is the export value of good i for province r in time t. On the diagonal of the proximity matrix, the fitness of i is equal to the sum of the export values of product i with RCA (\({{\mathrm{RCA}}}_{r,i,t}>1\)) across all provinces. If not on the diagonal of the proximity matrix, the fitness measurement necessitates that both products i and j exhibit an RCA (\({{\mathrm{RCA}}}_{r,i,t}>1\) and \({{\mathrm{RCA}}}_{r,j,t}>1\)).

This study measures China’s average fitness using province data for the period 2001–2016 and illustrates the fitness landscape (Fig. 5) with a symmetric fitness matrix (1251 * 1251). Figure 5 reveals a substantial zero area (yellow) and local optima represented by darker colors (ranging from red to black). Most capital- and technology-intensive products, along with some textiles, exhibit high fitness levels (600–1251). Conversely, most agricultural products, minerals, and chemicals display low fitness, with only a few achieving local optimal fitness (1–600). Textiles and stone, being China’s traditional comparative advantage industries, consistently maintain their competitiveness (600–800). In comparison to electronics and vehicles (1100–1251), metals and machinery (800–1100) demonstrate higher fitness, although the optimal value for these products remain somewhat indistinct.

Setting of Initial Conditions

As a structured simulation method, low-value-added products lacking competitiveness can attain the optimal position through enterprises’ search of the optimal fitness of products. However, when a majority of enterprises in a region exhibit low production capacities, reaching an optimal position becomes challenging, and the risk of being confined to an underperforming area increases. Consequently, the initial location selection of enterprises becomes crucial. It is conceivable that if a region’s products have a RCA, then at least one firm in the region produces the product in time t. We make two assumptions about the initial conditions.

The first assumption posits that provinces possess vary numbers of enterprises engaged in the production of different product types. The number of enterprises producing a product with an RCA ranges from 1 to 5. If both products i and j have an RCA, the enterprises can produce both products simultaneously; otherwise, only the product with an RCA is produced. Consequently, all the regions in the initial setup mirror the real product space. In the actual product space, the number of products with RCAs in Shanghai was 337 in 2001, while in Guizhou, it was 125 during the same period. The former is 2.696 times that of the latter. Under the current assumption, the number of enterprises in Shanghai will be more than twice that of Guizhou. Therefore, this assumption underscores substantial differences in the initial conditions of regions. The second assumption stipulates that the number of enterprises producing different products in provinces remains constant, implying there are 2000 enterprises in each province, thereby ensuring uniform initial conditions across regions.

Dynamic Behavior of Enterprises

Enterprises strive to navigate within the fitness landscape of product space continually, motivated by the goal of maximizing revenue and searching for the optimal product location. The movement of the enterprise is influenced by the fitness landscape and competition of surrounding enterprises. Hence, a product location selection algorithm is established:

Based on the Von Neumann neighborhood, enterprises are constrained to a maximum jump distance of 5 or 10. The new position after a random jump in the fitness landscape is \({(i}^{\prime},{j}^{\prime})\). A larger set jump distance signifies greater innovation capability for enterprises, where \({N}_{{i}^{\prime},{j}^{\prime}}\) is the number of enterprises producing \({(i}^{\prime},{j}^{\prime})\). A successful jump occurs if the proximity matrix at the new location is consistently larger than the random uniformly distributed \(U(\mathrm{0,1})\). Consequently, each mode is executed randomly 100 times, with a minimum of 30 completions to ensure the stability of each region. Within the fixed product space, enterprises continuously attempt to transform into new products to maximize revenue. The spatial location of products is updated with each enterprise jump, and the scope of fixed product space may even be expanded through innovation, thereby facilitating industrial transformation.

Results

This study utilizes the fitness landscape of product space to explore regional industrial transformation and growth paths. We have chosen eight provinces, namely, Hebei, Shanxi, Henan, Guizhou, Inner Mongolia, Liaoning, Shanghai, and Guangdong, to illustrate the obtained results. These eight provinces, each possessing distinctive characteristics, are deemed representative for this study. Specifically, the selected provinces are Shanghai and Guangdong, situated on the east coast and serving as economic hubs of China. Hebei is a significant eastern province. Shanxi and Inner Mongolia are resource-based provinces in the central region. Henan stands out as a major province in central China. Liaoning represents an established industrial area in the northeast. Guizhou, situated in western China, has undergone rapid growth in recent years.

Regional Growth Paths with Different Initial Conditions

The product space theory posits that countries have distinct initial product space, and the varying probabilities of new products emerging in the evolution of comparative advantage determine the divergence in development paths. Some regions demonstrate robust economic vitality, while others face sluggish growth or even the potential to fall into a development trap. The first hypothesis proposes that the differences in the initial development of regions persist. It posits that a region exports a certain product with an RCA, signifying that at least one firm produces the product and possesses the associated knowledge and technology. Under unchanged conditions, it is assumed that from 2001 to 2016, 1–5 firms randomly produce products with RCA. Consequently, in regions with a greater variety of products, more enterprises emerge, leading to a more diverse and complex of regional knowledge and technology, as well as regional higher development capacity. Considering the fitness and competition of surrounding enterprises, enterprises are constantly seeking new optimal positions in the fitness landscape to achieve higher fitness for producing new products with higher complexity and added value. This pursuit promotes industrial transformation.

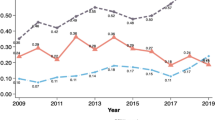

The selection of a new location involves averaging 100 simulation runs 30 times, each computed with different seeds for random draws. Figure 6 presents the estimation results of products with an RCA over 30 times in settings with distances D = 5 (left) and D = 10 (right). Figure 7 illustrates fitness in these settings for both distances. Under varying initial conditions, enterprise optimal position within the D = 5 range results in a significant increase in the number of products with an RCA in provinces, stabilizing at t = 10. In the evolution of fitness for, D = 5 and D = 10, regions exhibit similar development trends. The expanded range with D = 10 more local optimal choices leads to increased regional average fitness.

Regions with high fitness at t = 1, like Shanghai and Guangzhou, maintain t maximum fitness at t = 30, regardless of the distance jumped, showing an absolute advantage. Similarly, regions with low fitness at t = 1, such as Shanxi, continue to have lower fitness than other regions at t = 30. In 2016, Shanxi has 148 products with an RCA, while Shanghai and Guangzhou had 402 and 306, respectively. With the 1–5 random assignment, the number of enterprises in Shanghai and Guangdong was at least twice that of ShanxiFootnote 3. Despite the increase in products with an RCA in all the provinces through the path innovation, development disparities persist.

Whether the distance is 5 or 10, Shanghai and Guangdong consistently exhibit the highest level of fitness, indicating a growth trend (Fig. 7). These regions produce a diverse of highly competitive products internationally, particularly in technology-intensive sectors like chemicals, vehicles, machinery, and electronics, each with various development paths. A higher fitness value facilitates significant leaps for enterprises, increasing the likelihood of entering areas with optimal fitness. In contrast, other provinces experience gradual decline in growth rate, which stabilizes after t = 24 (as shown by the blue dotted line). This result may be attributed to a limited number of products with an RCA, most of which have low technological complexity. Consequently, the initial product space is relatively sparse, with the majority of the products distributed along the edges. This challenge makes it difficult for enterprises to make local optimal location selections (as depicted by the extensive yellow area in Fig. 5), leading to early signs of sluggish growth.

In the context of endogenous growth theory, the expected “late-mover advantage,” where emerging countries benefit from learning and imitate through “learning by doing,” does not seem evident in the fitness of the product space. On the contrary, regions with less advanced technology trend to lock into their current development paths earlier, despite having greater catch-up potential. For instance, in Guizhou, fitness exhibits a significant upward trend, gradually narrowing the gap with other regions.

Regional Growth Paths with the Same Initial Conditions

The second hypothesis eliminates differences in the initial conditions among provinces and seeks to analyze the development paths assuming each province has 2000 firmsFootnote 4 producing products with an RCA. Figure 8 presents the fitness of provinces with the same initial conditions under the jump distances of D = 5 and D = 10. In comparison with previous results, there is no clear correlation between the fitness at t = 1 and t = 30. Shanghai and Guangdong continue to maintain an absolute advantage in fitness. With a jump distance of 5, their fitness is significantly higher than that of other provinces. As the jump distance increases to 10, the gap between regions gradually narrows, a trend also reflected in the map of products with RCAs (Fig. 6). Despite an equal initial number of firms, the relative position distribution of regions remains similar to that in Fig. 7, owing to differences in regional product types.

Regions producing higher complexity products exhibit higher fitness than those producing low-complexity products. Enterprises seek optimal positions in the fitness landscape from various directions, leading to gradual regional differentiation. For instance, Shanxi maintains lower fitness; however, Guizhou’s fitness has steadily improved, with a more significant trend when the jump range is larger (D = 10).

Figure 8 reveals emergence of “clubs” among regions. The first echelon comprises Shanghai and Guangdong, which are notably higher than other regions. The second echelon includes Liaoning, Hebei, and Guizhou; the third echelon comprises Inner Mongolia and Henan, while Shanxi constitutes the fourth echelon. Liaoning’s products with an RCA primarily include agriculture, metals, chemicals, and machinery. In recent years, the province has exhibited a sluggish economic growth rate, significant path dependence on specific industries, and insufficient market vitality.

Shanxi’s products mainly consist of stone, minerals, and metals, with fewer technology-intensive products such as machinery, vehicles, and electronics. The sparse product space limits opportunities for optimal location selection in the fitness landscape. Even with an increased jump distance to 10, the enhancement in economic growth is not significant, making it challenging to transition to new products with diverse knowledge and complex technology. In contrast, Guizhou, building on a less favorable product space, places greater emphasis on accumulating production capacity and introduces high-tech industries. This has led to a significant enhancement in knowledge diversity and technological complexity, creating a fertile product space. As the distance expanded to 10, Guizhou’s industrial transformation and upgrade become even more pronounced.

Discussion

Broadly speaking, if a region has a weak industrial foundation primarily centered around labor- and capital-intensive industries, the product space tends to be sparse and concentrated at the edges. In such cases, the development of future new products tends to follow the gradual evolution of existing edge products, leading to a reduction in potential development paths. This, in turn, makes it challenging to enhance knowledge diversity and complexity, posing significant difficulties for industrial transformation. Product space theory, which primarily focuses on the evolution within a fixed product space, assumes that the path dependence process is self-evolving. While it discusses how regions may fall into development traps, it does not provide an explanation for the leapfrog development observed in emerging countries.

Thus, we establish a dynamic mechanism for maximization enterprise profit, exploring the conditions under which a region can achieve knowledge accumulation and technological leapfrogging. Utilizing the fitness landscape approach in the product space, we analyze potential ways for enterprises in a region to leap, considering two modes with both similar and different initial conditions. Within the fitness landscape, we set jump distances at 5 or 10, examining how enterprises, guided by profit maximization, promote regional structural transformation and upgrade.

Our findings indicate that the outcomes of studies on enterprises with different initial conditions explain why a region might enter a suboptimal product space, potentially leading to regional growth sluggishness. When the initial product space is poor, the region is more likely to experience a less favorable growth path. Subsequently, if the region creates an environment conducive to enterprise development by increasing the number of new enterprises, especially those producing products with an RCA, and enhancing property rights, this can prevent the region from falling into a development trap. Furthermore, an increase in foreign direct investment bringing capital and advanced technology, coupled with the enhancement of indigenous innovation capabilities, can improve fitness which makes it easier for the regions to position itself at the center of the product space, increasing the development paths for new products and thereby enhancing opportunities for industrial transformation and upgrade. Results from enterprises with identical initial conditions highlight particular importance of the knowledge complexity of products. This to some extent may negate the significance of product diversity, suggesting that products with high knowledge and technology complex are crucial for the future.

Compared to previous research, we have primarily established a micro-level dynamic mechanism for maximizing enterprise profits. Current studies on industrial transformation predominantly focus on analyzing the static comparative advantages of regions. While related studies in the product space explore structural transformation from a dynamic perspective, their assumption is that the product transformation within the network is random. Our research findings reveal that the probability of transformation varies for different types of products. Thus, we construct a micro-level dynamic mechanism for profit maximization using enterprises as the micro-level entities, showing the characteristics of industrial structural transformation.

Secondly, we have addressed the gap in explaining path innovation of regional development using economic development data from China. Existing studies on industrial transformation often analyze the path dependence of regional development. We employ the adaptive landscape approach of genetic algorithms. From a dynamic perspective, our approach not only identifies the path-dependent characteristics of regional industrial development but, more importantly, reveals that emerging economies must also enhance the complexity of knowledge and technology. Based on a thorough understanding of their own strengths, it may be even more critical for these economies to open up new areas and new arenas in development.

Conclusion

Innovative development has significantly increased the diversity and complexity of knowledge and technology and optimizes resource allocation, overcoming proximity limitation and promoting the accumulation of regional production capacity and the speed and extent of industrial transformation. In regions with initial higher production capacity, innovative development expands the existing product space. Simultaneously, emerging countries can achieve leapfrog development by successfully shifting towards technology-intensive products.

Our research conclusions also hold certain guiding implications for industrial development. Firstly, the development of technological capabilities follows path-dependent characteristics, necessitating the enhancement of regional basic technological levels and the improvement of initial capacity endowments. Therefore, elevating the foundational development capacity of a region is crucial. Secondly, unrelated new technologies indicate the direction of technological innovation for high-quality economic development in the region. By focusing on intertechnological connections, guiding regional enterprises towards diverse non-related innovations, and assisting and directing enterprises in conducting research and development activities in areas of weak foundations, this can help them move beyond the innovation “comfort zone.”

This study has a few limitations. Firstly, it assesses product proximity based on China’s customs data. Future research should consider situating proximity within the context of the evolving global economy to examine how the positioning of products in the global environment influences the substitutability of production factors. Secondly, our analysis relies on CEPII-BACI and China customs data, excluding information on the service trade, potentially impacting the results. Given growing role of services in global trade, incorporating service trade data would enable a more nuanced analysis of industrial transformation and economic growth in the future.

Data Availability

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Data resource: http://atlas.cid.harvard.edu

\({{\mathrm{RCA}}}_{r,i,t}=\frac{{~}^{{X}_{r,i,t}}\!\left/ \!{~}_{{\sum }_{i}{X}_{r,i,t}}\right.}{{~}^{{\sum }_{r}{X}_{r,i,t}}\!\left/ \!{~}_{{\sum }_{r}{\sum }_{i}{X}_{r,i,t}}\right.}\), \({\mathrm{RCA}x}_{i,t}=\left\{\begin{array}{cc}1 & if\;{\mathrm{RCA}}_{r,i,t}>1\\ 0&otherwise\end{array}\right.\left\{\right.\), where \({X}_{r,i,t}\) is the export value of good i in region r in time t. \({{\mathrm{RCA}}x}_{i,t}\) indicates whether the product has revealed comparative advantage.

The results of a random assignment simulation show that there are 445 enterprises in Shanxi, 1225 in Shanghai, and 926 in Guangdong.

The setting of the number of enterprises is random. To test the robustness of the results, we set the number of enterprises at 5000, which is the same as the currently estimated result.

Abbreviations

- CEPII-BACI:

-

Research and expertise on the world economy-Base pour l’Analyse du Commerce International

References

Allen, T., & Donaldson, D. (2021). Persistence and path dependence: A primer[J]. Regional Science and Urban Economics., 06, 103724.

Andrews, M. J., & Alexander, W. (2022). 150 years of the geography of innovation. Regional Science and Urban Economics, 94, 103627.

Bathelt, H., Malmberg, A., & Maskell, P. (2004). Clusters and knowledge: Local buzz, global pipelines and the process of knowledge creation. Progress in Human Geography., 28(1), 31–56.

Baumgartinger-Seiringer, S., Fuenfschilling, L., Miörner, J., & Trippl, M. (2022). Reconsidering regional structural conditions for industrial renewal. Regional Studies., 56(4), 579–591.

Bing, S. H., Danni, S., & Zhaodui, S. H. (2020). Global value chain, national value chain and economic growth: Substitution or complementarity. The Journal of World Economy., 43(04), 3–27.

Boschma, R., & Frenken, K. (2011). Technological relatedness, related variety and economic geography. Handbook of regional innovation and growth. 187.

Boschma, R. (2005). Proximity and innovation: A critical assessment. Regional Studies., 39(1), 61–74.

Boschma, R. (2022). Global value chains from an evolutionary economic geography perspective: A research agenda. Area Development and Policy., 7(2), 123–146.

Boschma, R., Minondo, A., & Navarro, M. (2013). The emergence of new industries at the regional level in Spain: A proximity approach based on product relatedness. Economic Geography., 89(1), 29–51.

Boschma, R. A., & Lambooy, J. G. (1999). Evolutionary economics and economic geography. Journal of Evolutionary Economics., 9(4), 411–429.

Chang, M. H., & Harrington, J. E. (2000). Centralization vs. decentralization in a multi-unit organization: A computational model of a retail chain as a multi-agent adaptive system. Management Science., 46(11), 1427–1440.

Deng, X., Liang, L., Wu, F., Wang, Z. B., & He, S. J. (2022). A review of the balance of regional development in China from the perspective of development geography. Journal of Geographical Sciences., 32(1), 3–22.

Desmarchelier, B., Regis, P. J., & Salike, N. (2018). Product space and the development of nations: A model of product diversification. Journal of Economic Behavior & Organization., 145, 34–51.

Feldman, M., Guy, F., & Iammarino, S. (2021). Regional income disparities, monopoly and finance. Cambridge Journal of Regions, Economy and Society, 14(1), 25–49.

Felipe, J., Kumar, U., Usui, N., & Abdon, A. (2010). Why has China succeeded? And why it will continue to do so? Cambridge Journal of Economics., 37(4), 791–818.

Gong, H., Binz, C., Hassink, R., & Trippl, M. (2022). Emerging industries: Institutions, legitimacy and system-level agency. Regional Studies., 56(4), 523–535.

Guo, Q., & He, C. (2017). Production space and regional industrial evolution in China. GeoJournal., 82(2), 379–396.

Hausmann, R., & Klinger, B. (2006). The evolution of comparative advantage: The impact of the structure of the product space. Harvard University, Cambridge, MA.

Hausmann, R., & Klinger, B. (2006b). Structural transformation and patterns of comparative advantage in the product space. KSG Working Paper No. RWP06-041.

Hausmann, R., Hidalgo, C. A., Bustos, S., Coscia, M., & Simoes, A. (2014). The atlas of economic complexity: Mapping paths to prosperity. MIT Press.

Hidalgo, C. A., & Hausmann, R. (2009). The building blocks of economic complexity. Proceedings of the National Academy of Sciences., 106(26), 10570–10575.

Hidalgo, C. A., Klinger, B., Barabasi, A. L., & Hausmann, R. (2007). The product space conditions the development of nations. Science., 317(5837), 482–487.

Holland, J. H., & Miller, J. H. (1991). Artificial adaptive agents in economic theory. The American Economic Review., 81(2), 365–370.

Hu, X., & Hassink, R. (2017). Exploring adaptation and adaptability in uneven economic resilience: A tale of two Chinese mining regions. Cambridge Journal of Regions, Economy and Society., 10(3), 527–541.

Jing, Z., & Tangwei, T. (2022). The impact of industrial agglomeration on regional economic resilience—Based on the data of 108 cities in the Yangtze River Economic Belt. Economic research on the Yangtze River Basin., 01, 115–147.

Johnson, S., & Robinson, J. A. (2005). Institutions as the fundamental cause of long-run growth. In P. Aghion & S. Durlauf (Eds.), Handbook of economic growth (pp. 385–472). Elsevier.

Jones, C. I. (2022). The past and future of economic growth: A semi-endogenous perspective. Annual Review of Economics. 14,: 125-152.

Junyang, L., & Shengjun, Z. H. (2020). Research on knowledge spillover at different scales: Taking the interaction effect between import and export as an instance. Geographical Research., 39(11), 2493–2507.

Kauffman, S., & Levin, S. (1987). Towards a general theory of adaptive walks on rugged landscapes. Journal of theoretical Biology, 128(1), 11–45.

Kaufmann, S., Lobo, J., & Macready, W. G. (2000). Optimal search on a technology landscape. Journal of Economic Behavior & Organization., 43(2), 141–166.

Kee, H., & Heiwai, T. (2016). Domestic value added in exports: Theory and firm evidence from China? American Economic Review., 106(6), 1402–36.

Li, S., Li, X., Chen, H., & Lang, W. (2019). China’s export evolution in the dynamic global product space from 2000 to 2011. Current Science., 117(3), 470–479.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science., 2(1), 71–87.

Martin, R., & Sunley, P. (2006). Path dependence and regional economic evolution. Journal of Economic Geography., 6(4), 395–437.

Neffke, F., Hartog, M., Boschma, R., & Henning, M. (2018). Agents of structural change: the role of firms and entrepreneurs in regional diversification. Economic Geography., 94(1), 23–48.

Neffke, F., Henning, M., Boschma, R., Lundquist, K. J., & Olander, L. O. (2011). The dynamics of agglomeration externalities along the life cycle of industries. Regional Studies., 45(1), 49–65.

Shouying, L., & Jidong, Y. (2019). The evolution and the policy selection in China’s industrial upgrading: Based on product space perspective. Management World., 35(06), 81–94.

Talebzadehhosseini, S., & Garibay, I. (2022). The interaction effects of technological innovation and path-dependent economic growth on countries overall green growth performance. Journal of Cleaner Production., 333, 130134.

Uyarra, E., & Flanagan, K. (2022). Going beyond the line of sight: Institutional entrepreneurship and system agency in regional path creation. Regional Studies., 56(4), 536–547.

Wang, Z., & Wei, W. (2021). Regional economic resilience in China: Measurement and determinants. Regional Studies., 55(07), 1228–1239.

Wei, L., & Canfei, H. (2021). Regional industrial diversification of China: Based on technological relatedness and complexity. Progress in Geography., 40(04), 620–634.

Xiao, T., Makhija, M., & Karim, S. (2022). A knowledge recombination perspective of innovation: Review and new research directions. Journal of Management., 48(6), 1724–1777.

Zamani, Z., & Tayebi, S. K. (2022). Spillover effects of trade and foreign direct investment on economic growth: An implication for sustainable development. Environment, Development and Sustainability. 1-15.

Zhong, Z., & He, L. (2021). Macro-regional economic structural change driven by micro-founded technological innovation diffusion: An agent-based computational economic modeling approach. Computational Economics. 1-55.

Zhu, S., He, C., & Zhou, Y. (2017). How to jump further and catch up? Path-breaking in an uneven industry space. Journal of Economic Geography., 17(3), 521–545.

Funding

The authors acknowledge the National Natural Science Foundation of China (Grant No. 42130510).

Author information

Authors and Affiliations

Contributions

Research framework: Jing Zhang, Tangwei Teng, and Gang Zeng; funding acquisition: Gang Zeng; methodology: Jing Zhang and Tingting Wang; resources: Jing Zhang and Tangwei Teng; supervision: Tangwei Teng and Gang Zeng; visualization: Jing Zhang and Tangwei Teng; writing original draft: Jing Zhang and Tangwei Teng; writing, review, and editing: Jing Zhang, Tangwei Teng, Tingting Wang, and Gang Zeng. All authors have read and agreed to the published version of the manuscript.

Corresponding authors

Ethics declarations

Conflict of Interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhang, J., Teng, T., Wang, T. et al. The Path Innovation of Regional Economic Growth: Data Analysis Based on China. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-01847-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-01847-7