Abstract

This study empirically examines the relationship between persistence in innovation and firm growth in Spanish manufacturing firms during the period 2005–2016. We include a number of input and output indicators for innovation persistence (R&D, product and process innovation, and patent filings) and use the changes in firms’ annual sales as a measure of firm growth. Differences in how innovation persistence affects firm growth are also explored for the subsets of small and large firms. We employ conditioned quantile regression (CQR) models to see how innovation persistence affects firms located at different quantiles of the firm growth distribution and unconditional quantile regression (UQR) which allow us to compare similar firms in terms of their propensity to innovate on a persistent basis. Our findings are sensitive to the choice of econometric approach. Overall, results indicate that the type of innovation persistence does influence growth. Persistence in R&D activities does not play any relevant role whereas persistence in innovation outputs (product, process, and patents) is a driver for growth only in firms with medium-to-low sales growth rates.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the last two decades, there has been an increasing interest in understanding the relationship between innovation and firm growth (Audretsch et al., 2014) using different proxies for firm growth: productivity (Crépon et al., 1998), employment growth (Coad & Rao, 2010a, 2010b, 2011) and to a lesser extent market success (Santi & Santoreli, 2017). In parallel, studies addressing the underlying patterns and mechanisms driving persistence in innovation have received increasing attention in the academic and political arena. However, research on the connection between innovation persistence and firm growth has received less attention in the literature. Despite the importance of this issue, only a limited number of empirical studies have examined the relationship between innovation persistence and firms’ growth patterns, and the results to date are not conclusive. Differences in the definition of innovation persistence, the proxy for firm growth, the time span, the country, and the estimation procedure could partially explain the lack of consensus. Demirel and Mazzucato (2012) for the US pharmaceutical firms between 1950 and 2008, Deschryver (2014) for the Finnish firms between 1998 and 2008, and Guarascio and Tamagni (2019) for a panel of Spanish manufacturing firms during the period 1990–2012 have addressed the link between innovation persistence and the growth of firm sales using different econometric specifications, countries, and time span. The lack of consensus on the results suggests that new evidence using alternative methodology and data would be necessary in order to advance our knowledge of this relationship.

This study attempts to contribute to the existing knowledge by providing new empirical evidence on the link between persistence in innovation and firm growth in Spanish manufacturing companies during the period 2005–2016 using more recent econometric techniques based on the unconditional quantile regression (UQR) (Firpo et al., 2009). We use a number of indicators of input and output innovation to study innovation persistence including R&D activities, product and process innovation, and patenting. The rationale behind examining such a relationship using different measures of innovation is that the different stages behind each type of innovation and their persistence may differ in terms of financial needs, sunk costs, scientific and technological knowledge, learning processes, and external relations with other actors. Several theories have explained persistence in innovation and suggested different degrees of persistence depending on the type of innovation (see Tavassoli & Karlsson, 2015). For example, the investments needed to set up R&D infrastructures and laboratories are often very costly, so firms tend to maintain these activities in the long term to recover the fixed costs through innovations (Sutton, 1991). On the other hand, process and product innovations are not always the result of R&D but may be the result of cooperation with other agents or learning processes, which would explain a different degree of persistence between R&D and process and product innovation (Triguero & Corcoles, 2013). Product innovation, on the other hand, has a stronger connection with R&D activities, and when successfully introduced to the market provides market gains that can induce innovations. We proxy firm growth through the growth of sales which at the same time serves as a measure of firms’ market success.

Our study differs in several ways from Guarascio and Tamagni (2019) including data source, study period, persistence definition, and methodology. These authors use the Spanish Business Strategy Survey over the years 1990–2012 while we employ the Spanish part of the Community Innovation Survey considering a more updated period (2005–2016). This database has the advantage of making the results more comparable with other possible international studies. Second, our definition of persistence in innovation is stricter than the one used by them. We define persistence using the years 2005–2012, i.e., considering firms that have innovated continuously during years of both economic expansion and economic recession, whereas they define persistence taking into account the years 1990–1999, a more economically stable period. However, we analyze company growth over the period 2013–2016, i.e., a homogeneous period in terms of economic stability. This restricted definition of innovation persistence allows for a more rigorous identification of firms with a clear innovative vocation, i.e., firms that carry out this activity regardless of the economic cycle in which they find themselves. Using a stable economic period to evaluate firm growth helps to reduce the noise that cyclical events may cause. Third, Guarascio and Tamagni (2019) run several quantile regressions while we estimate unconditional quantile regressions (UQR), which yields results independent of the other covariates of the model. This estimator is more robust since it allows the effect of persistence in innovation on firm growth to be estimated by comparing firms that are similar in terms of their propensity to innovate on an ongoing basis. Fourth, we extend our study, using this more robust estimator to examine whether innovation persistence affects firm growth differently in small or large firms. In order to do so, we split the sample into small-medium (< 200 employees) and large firms (> 200 employees).

Enhancing our understanding of the link between innovation persistence and firm growth holds the utmost significance from both business and political perspectives. In the business realm, innovation is widely recognized as the primary driver of company growth, while the persistence of innovation is acknowledged as a fundamental contributor to a firm's competitive advantage (Tavassoli & Karlsson, 2015). Nonetheless, engaging in continuous innovation involves substantial costs, risks, and uncertainties, which can only be justified if there is a tangible linkage between persistence and achieving market success. For policy-makers, the understanding of the innovation persistence-growth link might have far-reaching implications for the design and implementation of innovation policies aimed at supporting business growth. If persistence in innovation does not have an effect on firms’ market success, public policies that protect incumbent innovative firms will not have any effect on firms’ growth dynamics. Conversely, if growth depends on the firm’s innovation persistence behavior, innovation-stimulating policy measures for incumbent firms will be effective for their growth.

The main contributions of this paper to the current empirical literature about this topic are the following. First, it provides additional empirical evidence on the innovation persistence-firm growth relationship, considering different innovation inputs and outputs (R&D activities, product innovation, process innovation, and patent filings) and using data from the Spanish Technological Innovation Panel (PITEC) for Spanish manufacturing firms. This dataset is of the same type as the Community Innovation Survey (CIS), which is designed with a particular focus on innovation and, since it is conducted across multiple countries, enables cross-country comparisons regarding the patterns of persistence in innovation and its relationship with firms’ growth. Second, we employ more recent econometric techniques based on unconditional quantile regression (UQR), allowing for a more precise and robust analysis of the relationship between innovation persistence and the growth of Spanish manufacturing firms. We apply conditioned quantile regression (CQR) models to see how innovation persistence affects firms located at different quantiles of the firm growth distribution. Furthermore, we use unconditional quantile regression (UQR) (Firpo et al., 2009), which allows us to estimate the effect of innovation persistence on sales growth by comparing firms which are similar in terms of their propensity to innovate on a persistent basis. To the best of our knowledge, this is the first time that this methodology is used to address the relationship between persistence and firm growth. Third, with this more recent and robust methodology, we extend our work by examining whether the growth premium derived from innovation persistence might be mediated by firm size. To test this hypothesis, we split the sample in order to consider small firms (fewer than 200 employees) and large firms (200 and more employees) and in doing so, we shed more light on the complexity of the relationship between innovation persistence and growth. In short, this paper adds new empirical evidence using more robust estimators to the current research by tackling several questions: Do different forms of innovation persistence drive different patterns of firm growth? Are there any differences in the innovation persistence-growth pattern relationship based on the size of the companies? What policy recommendations can be drawn from the empirical results?

The remainder of the paper is as follows. The “Theoretical and Empirical Literature Review” section reviews the existing literature on the relationship between innovation persistence and market success and proposes the testable hypotheses. The “Data and Descriptive Statistics” section describes the data, offers some descriptive statistics, and explains the econometric strategy. The “Results” section presents the empirical results. Finally, the “Discussion and Conclusions” section concludes the paper and outlines some policy implications.

Theoretical and Empirical Literature Review

Firm Innovation Persistence: A Brief Overview

It is largely recognized that persistence in innovation can be explained by various complementary, rather than competing, theoretical approaches: first, Schumpeter’s work (1934, 1942) related to market power and the role of innovation. The latter provides innovative firms, particularly large firms, with a temporary monopoly that they will try their best to maintain via continuous innovation. It follows that a firm that makes the decision to innovate and gains access to the benefits of having a monopoly will have greater incentives to innovate on a sustained basis in order to defend its market share from new potential entrants. Since new entrants will reduce monopoly profits, the incumbent firm has more incentive to remain a monopolist than the entrant’s incentive to become a duopolist (Le Bas & Scellato, 2014). Second, the hypothesis that success breeds success (Mansfield, 1968; Stoneman, 1983) suggests that successful previous innovations provide firms with more technological opportunities and market power (Scherer, 1986) and enable future innovations to be more successful. The rationale is that successful firms will tend to accumulate those resources that they need to innovate in the future (Cefis, 2003; Cefis & Orsenigo, 2001). Third, the sunk cost hypothesis (Sutton, 1991) is further used to explain persistence in innovation. The role of sunk costs applies especially to research activities because these activities require significant upfront costs and continuous funding to move a product through the different stages of the R&D process until it reaches the market. Therefore, once firms have invested in R&D, further R&D becomes less costly each year, which encourages firms to engage in yet further R&D. Fourth, the dynamic increasing returns to innovation hypothesis (Nelson & Winter, 1982) suggest that technological capabilities and learning processes are crucial factors in explaining innovation. This approach emphasizes the cumulative nature of the learning process and the specific characteristics of knowledge. Knowledge is path-dependent since current knowledge depends on previous knowledge and is the basis on which future knowledge is built (Cohen & Levinthal, 1990).

A growing body of literature, mainly based on empirical studies, has recently focused on the study of persistence through different forms of innovation, namely R&D activities, process and product innovation (Antonelli et al., 2012), marketing and organizational innovation (Tavassoli & Karlsson, 2015), sales share derived from innovative products (Raymond et al., 2010), and patents (Cefis & Orsenigo, 2001; Geroski et al., 1997; Malerba et al., 1997). However, the empirical literature provides evidence of mixed results depending on the type of innovation indicator considered, the econometric model employed, and the period studied.

In general, the empirical results suggest that R&D activities show the highest degree of persistence (see Peters (2009) for German firms over the period 1994–2002; Huang and Yang (2010) for a panel of Taiwanese manufacturing firms over the period 1990–2003; Mañez et al. (2014) for Spanish small-medium enterprises (SME) for the period 1990–2011; Triguero and Corcoles (2013) using the same data for Spain for the period 1990–2008). Technological innovation also shows a high degree of persistence, although typically lower than R&D activities (Clausen et al., 2012; Raymond et al., 2010). Product innovators, meanwhile, show a higher degree of persistence than process innovators (see Roper and Hewitt-Dundas (2008) for a set of manufacturing firms in Northern Ireland, Le Bas and Poussing (2014) for Luxembourg over the period 2002–2008, Tavassoli and Karlsson (2015) for Sweden using five waves (2002–2012) of the Community Innovation Survey). By contrast, Martínez-Ros and Labeaga (2009) used a Spanish database for the years 1990–1999 and found that the highest persistence was associated with process innovation rather than product innovation. Studies using patents as a measure of innovation suggest weak persistence, except for firms with a large number of patents (Cefis, 2003; Cefis & Orsenigo, 2001; Geroski et al., 1997).

Innovation and Firm Growth

The basic construct describing the evolution of firm growth is Gilbrat’s law of proportional effects (Gibrat, 1931) which is based on the hypothesis that firm growth is independent of initial size. This implies that a firm’s growth is decided randomly. There is extensive empirical literature to test whether Gibrat’s law holds empirically (see Sutton, 1997, for a discussion). In general, Gibrat’s law is believed to have some validity for larger firms (Simon & Bonini, 1958; Wagner, 1992), while it is (weakly) rejected for smaller firms (Evans, 1987). Furthermore, Gibrat’s law requires that no third variables exist that can explain the growth rates of firms, as the shocks firms face are predicted to be randomly distributed (Spescha, 2018). Empirical research, however, has revealed that there are a large number of variables associated with firm growth (Del Monte & Papagni, 2003; Demirel & Mazzucato, 2012) such as the type of industry in which the firm operates and market structure–related variables (Cohen et al., 1987; Scherer, 1965, 1983), among others. Following this line of research, we assume that other variables are related to firm growth, especially input and output innovation–related variables, namely R&D activities, product and process innovation, and patents.

Different theoretical approaches have highlighted the relevance of innovation for firm growth (Nelson & Winter, 1982; Dosi et al., 1995; Aghion et al., 2005). Broadly speaking, these models suggest that the market will reward innovators since it is expected that they will outperform non-innovators in terms of growth (Demirel & Mazzucato, 2013). The existing empirical literature, however, does not robustly support a positive association between innovation and firm growth (Coad, 2009). Geroski et al. (1997), Geroski and Mazzucato (2002), and Bottazzi et al. (2001) fail to find a direct relationship between these two variables. Freel and Robson (2004), on their part, found a negative relationship between innovation and firm growth. The rationale behind these counterintuitive results might be the very nature of the distribution of a firm’s growth rates, which are characterized by fat tails (Bottazzi & Secchi, 2006) and by the fact that the average firm does not grow particularly fast (Bianchi & Pellegrino, 2019). This evidence has led some authors to study the behavior of fast-growing firms. For example, Hölzl and Friesenbichler (2010) compared the innovation performance of fast-growing firms in 16 European Union countries and found that in countries located close to the technological frontier, firms are more innovative and are more R&D-intensive than average-growth firms. However, in countries further away from the technological frontier, innovation and R&D play a relatively minor role in fast-growing firms. Coad and Roa (2008) using a quantile regression approach in high-tech industries in the USA find that innovation is critical for fast-growing firms.

When considering the type of innovations, empirical evidence usually shows a positive impact of R&D expenditures on firms’ sales growth For instance, Del Monte and Papagni (2003) provide an overview of research studies demonstrating a positive impact of firms’ R&D intensity on both sales and productivity growth. Nevertheless, there are also studies that suggest a lack of significant or even negative correlation between R&D efforts and firm performance (Rosenbusch et al., 2011). When R&D predominantly yields mediocre outcomes, a negative relationship between these two variables can emerge. This scenario occurs when the newly introduced innovations fail to substitute for a diminishing demand for existing products (Spescha, 2018). Some authors have highlighted the strong link between R&D expenditure and patents (Crépon et al., 1998; Spescha, 2018). As for technological innovation, product innovations are associated with the creation of new markets and new employment while process innovations are related to lower costs. Both types of innovation, through different channels, may contribute to firm growth.

Innovation Persistence and Firm Growth

The relationship between innovation persistence and firm growth has been explored far less in the literature than the innovation-growth connection. Consequently, studies investigating that relationship remain scarce in the existing body of research. These few studies have used different proxies for firm growth, namely profitability growth, productivity growth, employment growth, and sales growth. One of the early research papers that examined the relationship between innovation and firm growth used profitability growth as a measure of firm growth. Cefis and Ciccarelli (2005) investigate the effects of innovative activities, measured as the number of patents, on corporate profitability, using a panel of 267 UK manufacturing firms, over the period 1988–1992. Using the Bayesian approach, they find a positive effect of innovation on profits that smoothly decreases as time passes. They reveal a difference in profitability between firms that engage in innovation and those that do not, with a more significant gap observed when comparing persistent innovators with non-innovators. Huergo and Moreno (2011), in turn, examine the relationship between R&D expenditure, innovation, and productivity growth, considering the persistence in a firm’s behavior for a sample of Spanish manufacturing firms between 1990 and 2005. They conclude that neglecting persistence results in an upward estimation of the effect of innovation on productivity growth. However, accounting for persistence in technological inputs and outputs reveals that current R&D has long-term effects on a firm’s productivity. Triguero et al. (2014) examine the impact of innovation persistence on employment growth in Spanish manufacturing firms from 1990 to 2008, employing the GMM-system estimator. They reveal that only process innovation positively affects employment growth. Similarly, Bianchini and Pellegrino (2019) examine the effect of persistence in product and process innovations on the employment dynamics of a representative sample of Spanish manufacturing firms over two decades. They use a synthetic indicator of innovation persistence and find that persistence in product innovation affects both employment and sales growth while persistence in process innovation does not have any significant effect.

To the best of our knowledge, there are just a few papers that study the link between innovation persistence and growth using changes in sales as a proxy for firm growth, and there are none that use the proposed econometric approach. Demirel and Mazzucato (2012) explore how innovation affects firm growth proxied by the annual percentage increases in sales in small and large publicly quoted US pharmaceutical firms between 1950 and 2008. They conclude that the positive effect of R&D on firm growth depends on a combination of firm-specific factors, such as firm size, patenting activities, and persistence in patenting. In small firms, R&D contributes to growth only in firms that have engaged in patenting for at least 5 years. For large firms, R&D can potentially harm growth. Deschryver (2014) analyzes how the relationship between R&D and firm growth varies between continuous and occasional innovators for a sample of Finnish firms between 1998 and 2008. He finds that only continuous product and process innovators show positive associations between R&D growth and sales growth. Guarascio and Tamagni (2019) examine the long-run contribution of innovation persistence to sales growth and market share dynamics using a different data panel of Spanish manufacturing firms and a different period from the one we use. They find that firms that innovate continuously do not grow more in subsequent years. The same is true regardless of the innovation measure used.

Hypotheses

According to the previous literature, we can establish a set of hypotheses regarding the expected behavior in the innovation persistence–growth link. According to evolutionary approaches, continuous innovation is a strategy that leads firms to competitive trajectories superior to firms that follow a pattern of occasional innovation. This suggests that companies with persistent innovation will be more dynamic in terms of market success than the rest of the companies. Hölzl and Friesenbichler (2010), in turn, state that countries far from the technological frontier may have a more tenuous relationship between innovation and growth. However, an alternative theoretical approach inspired by Gibrat (1931) considers that the dynamics of firm growth is a quasi-random process; therefore, firm growth would not be directly related to persistence in innovation. Taking these two approaches into account, the first hypothesis we put forward is:

-

H1: The relationship between persistence and firm growth in innovation in Spanish manufacturing firms, if any, will be modest.

Considering the different impacts that the four types of innovation may have on the growth pattern, it is important to differentiate between innovation inputs (R&D) and outputs. The former are more distant from the market due to the inherent uncertainty of the outcome of this type of activity. Therefore, it is reasonable to assume that persistence in R&D performance will have a lesser effect on firm growth than the other types of innovation. Following the third edition of the Oslo Manual (2005), we define process innovation as the introduction of a new or significantly improved production or distribution process and product innovation as the introduction of a new or significantly improved good or service in terms of its characteristics or intended use. The hypothesis that follows is:

-

H2: The link between the persistence in R&D activities on market success is expected to be smaller than that of other forms of innovation persistence.

In relation to innovation outputs, product innovation pursues differentiation, opens up new market spaces, and creates new demand (Cohen, 2010). Similarly, patents have also been linked to market success (Hall et al., 2005; Patel & Ward, 2011). On the contrary, process innovation is oriented towards cost reduction and only indirectly affects sales (Dosi et al., 1995). Therefore, it is expected that persistence in product innovation and patents would lead to a higher firm growth than persistence in process innovation. The hypothesis we propose is:

-

H3: The relationship between persistence in product innovation and in patents and market success is expected to be larger than that of persistence in process innovation.

Splitting the sample into two groups of firms according to their size is relevant since several authors argued that there is a positive link between firm size and persistence in innovation. The cumulative nature of knowledge fosters dependence on innovative behavior, and internal funding increases the likelihood of engaging in innovation on an ongoing basis (Antonelli et al., 2013). For instance, Ganter and Hecker (2013) using the German part of the CIS for the period 2000–2008 found that larger firms are more persistent in all forms of innovation. Antonelli et al. (2012) arrived at the same result with a sample of 7000 Italian firms for the period 1996–2005. Mañez et al. (2014) using a sample of Spanish manufacturing firms for the period 1990–2011 found that large firms are more persistent in carrying out R&D activities while SMEs are more persistent in all other forms of innovation.

-

H4: The relationship between persistence in innovation and sales growth is expected to be larger in small firms.

Data and Descriptive Statistics

Data

We use data from the Spanish Technological Innovation Panel (PITEC) drawn up by the Spanish Statistical Office (INE) with the collaboration of the Spanish Foundation for Science and Technology (FECYT) and the Foundation for Technological Innovation (COTEC) for the period 2005–2016. This survey collects the responses from Spanish companies participating in the community innovation survey (CIS). This dataset is formed by an unbalanced panel of Spanish manufacturing and service firms that provides sampling information for firms with fewer than 200 employees and exhaustive data for firms with 200 and more employees. The PITEC database was launched in 2004; however, in 2005, there were some changes in the composition of the sample. Therefore, we have removed the 2004 wave from our analysis as well as those firms engaged in mergers and acquisitions processes. More specifically, we have selected a subsample made up of manufacturing firms with more than ten employees for the period 2005–2016.

We have 52,284 firm-year observations in our unbalanced panel corresponding to 5,942 manufacturing firms. We have constructed a balanced panel in order to carry out part of our empirical study since some of our empirical analysis requires this structure. The balanced panel contains 31,692 firm-year observations corresponding to 2641 companies. Although it may introduce some bias towards surviving firms, the balanced sample allows us to address our research question as it contains a substantial number of firms that can be tracked over a long period of time with regard to a wide range of variables relating to innovation and growth.Footnote 1

Variables and Descriptive Statistics

Innovation Persistence Variables

Table 1 presents the probability of transitioning from one state (no innovate) to another (innovate) taking into account a different number of years of persistence. More specifically, we look at the pattern of persistent behavior over 1, 3, 5, 8, and 12 years. Results show that both innovators and non-innovators have a strong tendency to remain within their states. The degree of persistence varies according to the measure of innovation. Firms that undertake R&D show the highest persistence, which, a priori, seems reasonable since carrying out R&D requires large sunk-cost investments that firms need to capitalize. Persistence is higher in the case of firms that innovate in products rather than in processes. The lowest persistence is found in patents. In addition, results show that persistence decreases over the years in all types of innovation. Furthermore, small firms seem to be less persistent than large firms regardless of the type of innovation.

Since there is no specific definition in the literature of how many consecutive years, a company should innovate in order to be considered a persistent innovator; in this paper, we will follow the strategy proposed by Guarascio and Tamagni (2019). We consider persistent innovators those firms that innovate over the first eight consecutive years (2005–2012) and study the impact on growth performance of persistent and non-persistent innovators over the subsequent years (2013–2016). This approach enables us to address endogeneity concerns by reducing the potential possibility that firm growth is simultaneously determined by its persistence in innovation. Furthermore, it mitigates the risk that the firm’s growth is the drive of its innovation persistence, a crucial factor for the robustness of the relationship we aim to analyze.

Firm Growth Measurement

In this section, we discuss the variables used in the empirical analysis. Consistent with most of the literature, we define the annual average firm growth rate as:

where Sit is the annual sales S of firm i in year t, normalized by the sector average (NACE rev 2 two digits) of sales (in logs) in the same industry to which firm i belongs to.

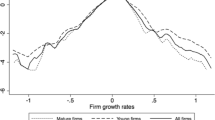

Figures 1, 2, 3, and 4 show the kernel distribution of the growth rates of firm sales. In line with other empirical contributions (Bottazzi & Secchi, 2006; Coad, 2009; Santi & Santoleri, 2017), we can observe that sales growth rates are not normally distributed. The data follows a distribution with values quite close to the mean and fat tails.

Table 2 presents some basic descriptive statistics of sales growth and a set of firms’ characteristics for the most recent period 2013–2016, distinguishing between persistent innovators and non-persistent innovators. Data show that persistent innovators display higher mean and median growth rates than other firms. Moreover, persistent innovators, compared to other firms, are larger, older, invest more in R&D, export more, participate more in groups of firms, and operate in higher technology sectors (except for persistent process innovators). This holds regardless of the innovation persistence indicator under consideration.

Empirical strategy

Before discussing the empirical strategy, it is worth testing whether the sales growth rates of persistent innovators and non-persistent innovators come from the same population. In order to do so, we perform the Fligner-Policello (FP) robust rank order test (Fligner & Policello, 1981). This test assumes that the distributions of the groups of persistent innovators and non-innovators are symmetric. The null hypothesis tests the equality of medians of the two groups. Results suggest that persistence in innovation could account for differences in sales growth across all types of innovations, with the exception of patents (Table 3).Footnote 2

We used conditional quantile regression (CQR) (Koenker & Basett, 1978) and unconditional quantile regression (UQR) (Firpo et al., 2009) as our primary statistical method to test the proposed hypotheses.Footnote 3 We also run ordinary least squares (OLS) regressions just for the purpose of comparison. The equations we use are as follows:

where the subscript refers to firm-year pairs over the regression time period 2013–2016; GRit is the relative sales growth of firm i at time t, as previously defined. \({PERS\_R\&D}_{i}\), \({PERS\_PROD}_{i}\), \({PERS\_PROC}_{i}\), and \({PERS\_PAT}_{i}\) are dummy variables that take the value 1 if the firm is a persistent innovator according to our criterion and types of innovation. We distinguish four different types of persistent innovation: R&D, product innovation, process innovation, and patent persistent innovator, respectively. These variables are time-invariant since a firm’s innovation status remains unchanged during the regression period 2013–2016. \({X}_{it-1}\) is a vector of control variables including firm size, age, R&D intensity, propensity to export, belonging to a group of firms, and technology level of the industry. These variables are those that have been traditionally related to firm performance in the literature. All controls are lagged one period to account for potential simultaneity. \({\mu }_{it}\) represents the error term. All regressions include time dummies Tables 4, 5, 6, 7 and 8.

To test the first hypothesis, we look at the coefficients of the four estimations. The second hypothesis requires the coefficients of the variable of interest in Eq. (3) to be compared with those obtained from Eqs. (4) and (5). The third hypothesis compares the coefficients obtained in Eqs. (3) and (5). To test hypothesis 4, we followed the previous procedure, but previously, we had segmented the database into two groups according to firm size. We distinguish two firm sizes: fewer than 200 employees and 200 or more employees. Table 8 in Annex 1 presents the definition of the variables.

Conditional quantile regression enables us to identify different relationships at different parts of the distribution of the dependent variable. The CQR (Koenker & Bassett, 1978) aims to find coefficients that best fit the different quantiles of the conditional distribution of the dependent variable. The estimated coefficients represent the marginal effect of a covariate on a given quantile of the dependent variable’s distribution, considering the average values of all other variates in the model. A drawback of this method is that the coefficient interpretation will change when including different control variables in the model. The UQR model (Firpo et al., 2009), in turn, overcomes this shortcoming and yields coefficients associated with the effects of a given quantile of the distribution of the dependent variable, regardless of the control variables included in the model.

Results

Results from CQR

Table 4 presents the results of the CQR regressions for the four different indicators of innovation persistence. The first column presents the results of the OLS regression, which is the estimate of the marginal effect of the explanatory variables on the mean of the growth distribution. We present this estimate only for comparison and for the completeness of our results. Columns 2–10 present the CQR results.

Results from OLS regressions show that there are differences in the pattern of sales growth between persistent and non-persistent innovators depending on the type of innovation. We find a negative association between market success and carrying out R&D on a persistent basis while this relationship is positive with patenting, though only statistically significant at the 10% level. There is no statistically significant link between sales growth and persistently introducing product and process innovations.

The CQR models also reveal a different pattern of sales growth and persistence in innovation according to the type of innovation. In general, the coefficients of persistence are positive and statistically significant with higher absolute values at the lower quantiles. This evidence suggests that in low-growth firms (10th–20th), innovation persistence makes an important contribution to their superior growth performance. However, at larger quantiles (higher than 40th for process innovation and 60th for the remaining modalities of innovation), the coefficients are not statistically significant or even negative as is the case of R&D persistence. Therefore, it seems that many companies persistently engage in innovation activities but their efforts do not have a positive impact in terms of market success and even have a negative effect on the company’s growth. These results have some similarities with those obtained by Guarascio and Tagmani (2019). Persistence in R&D seems to hinder faster-growing (90th) firms. Moreover, for all other forms of innovation, it seems that persistence has hardly any effect on the fastest-growing firms (higher than 60th). However, our results differ in the sense that we find a positive effect of persistent innovative behavior in firms with medium-to-low growth rates (30th–60th, except for process innovation). These differences can be explained by the fact that our dataset, study period, definition of persistence, and the control variables included in the estimation are different.

All in all, persistent innovation does not seem to have a positive relationship with market success in fast-growing firms (higher than 60th) though it might have a positive effect on slower-growing firms. This seems to be true in all types of innovation under study.

We extend the study to explore whether innovation persistence affects firm growth differently in small or large firms. In order to do so, we split the sample into small-medium (< 200 employees) and large firms (> 200 employees).

Table 5 documents the regression results of the sample split by size. OLS regressions reveal that persistence in innovation is not statistically significant for sales growth in large firms, this being true for all innovation indicators. CQR regressions, however, display different results. At the median and lower quantiles, the relationship between persistence in R&D and in product innovation is positive and statistically significant. Therefore, in firms with high sales growth, innovating on a persistent basis (in R&D and product innovation) does not contribute to increasing market success.

In small firms, using OLS regression models, there is a negative association between permanent R&D and sales growth while this link is positive between permanent patenting and market success. There is no statistically significant link between product and process innovation and market success. When using CQR models, however, there is a positive link between permanent R&D and firm growth within the middle quantiles (40th–60th). Persistence in patenting has a positive association in firms within the intermediate quantiles (30th–70th) and particularly at the highest tail of the distribution (90th). In contrast to the results of the OLS models, we find a positive relationship between process and product innovation persistence and growth in firms with growth rates between the 10th and 60th quantiles.

In short, examining the link between innovation persistence and market success by firm size is worthwhile since we have observed substantial differences across the range of firm size.

Results from UQR

Table 6 presents the estimates of the relationship between persistence in innovation and firm growth regressions for the four innovation persistence variables using the UQR. We consider these estimates more robust than the previous ones since, as noted, they allows us to estimate the effect of innovation persistence on sales growth by comparing firms, which are similar in terms of their propensity to innovate on a persistent basis.

The results indicate that there is a considerable difference when employing UQR compared with CQR in some modalities of innovation persistence. For example, UQR results reveal that most coefficients are either not statistically significant or significant at less than 5% level, which is in line with our first hypothesis that states that the link between innovation persistence and sales growth, if it exists, would be small. In addition, results indicate that performing R&D on a persistent basis does not have a statistically significant effect on sales growth. The lack of statistically significant effects of persistence in innovation on sales growth can be attributed to the stages of the product life cycle. According to Demirel and Mazzucato (2009), innovation persistence tends to be greater during the later stages of the product life cycle, while it is relatively low in the early stages. It is plausible that persistence in innovation has a higher impact on growth during the initial phases of the product life cycle, when disruptive innovations can generate rapid sales growth. However, as the product matures and establishes itself in the market, incremental innovations may have a comparatively limited effect on sales growth. Given Spain’s medium–low technology level, the prevalence of disruptive innovations is not widespread. On the other hand, Demirel and Mazzucato (2012) state that firm growth is affected by different firms´ specific characteristics. Hence, the absence of statistically significant effects could be due to other factors affecting sales growth. Persistence in innovation may not be enough to drive sales growth, and additional firm strategies may be required.

The results partially support our second hypothesis that the impact of the persistence in R&D on market success is expected to be smaller than that of other forms of innovation. The hypothesis is accomplished for product innovation and patents in intermediate quantiles and for process innovation in the lowest quantiles (10th–30th). Persistent product innovators have a positive association with the market in the intermediate quantiles (30th–50th) as well as in the case of persistent patentees (30th–60th). There are some possible reasons for this pattern of behavior. On the one hand, the long-term nature of R&D investments may make it challenging to directly measure their impact on sales. On the other, persistence in product or process innovation can generate more immediate and tangible outcomes, such as improvements in product quality or process efficiency, which directly affect sales.

The findings also partly support our third hypothesis that the link between persistence in product innovation and patents and market success is expected to be larger than that of persistence in process innovation. This hypothesis is fully fulfilled in intermediate quantiles (30th–60th). The result could be explained by the fact that product innovation often involves the development of new or improved products that offer benefits to customers leading to a competitive edge for some firms and enabling them to gain larger market shares. Moreover, product innovations are more likely to generate patentable inventions, granting legal protection and exclusivity, which empowers firms to maintain control over their innovative products, reap financial gains, and potentially amplify their sales. However, according to our results, this is only true for firms in the intermediate quantiles.

When we split the sample by firm size, we also find some differences between the estimates for CQR and UQR, particularly in certain modalities of innovation (Table 7). In general terms, these UQR results are more restrictive than those from CQR estimations. The relationship between persistence in R&D activities and sales growth is not statistically significant, neither for small nor for large companies. Persistent product innovation only has a positive effect on sales growth for small firms that are located at the median of the distribution. For large companies, on the other hand, the relationship between the variables of interest occurs in the left tail of the distribution (20th–30th). For small firms that carry out process innovation on a regular basis, market success occurs in firms with sales growth at the lower quantiles (20th–50th). For large firms, we find a negative association with growth at the 70th quantile. Finally, patent persistence has no statistically significant association with sales growth in large firms while there is a positive and statistically significant effect in firms at some quantiles over the 40th.

Therefore, our fourth hypothesis that the relationship between persistence in innovation and market success is expected to be larger in small firms is fulfilled only for persistence in patents in intermediate-growth firms (40th–70th) and in process innovation in low-growth firms (20th–50th). However, in persistent product innovation, low-growth large companies (20th–30th) exhibit a greater market success.

Discussion and Conclusions

This study provides empirical evidence on the relationship between persistence in innovation and the growth of firm sales in Spanish manufacturing firms during the period 2005–2016. We use different input and output indicators of innovation and run CQR and UQR models in order to account for the fat tails that characterized the distribution of firm growth rates. In addition, we extended our research by running our estimators in two different subsets of firms obtained by splitting the sample according to firm size.

A large number of studies have shown that innovation activity is path-dependent, implying that a firm that innovates successfully in one period is likely to be successful in the subsequent period. This behavior has been explained from different theoretical approaches including the market power, the hypothesis of success breeds success, the increasing returns hypothesis, and the sunk costs view. Moreover, empirical evidence has shown that innovation can have different degrees of persistence depending on the type of innovation indicator used. We further explored the idea that firms can have different sales growth rates depending on the persistence of innovation and on the type of innovation persistence.

Overall, results suggest that the innovation–growth relationship is not as straightforward as it might appear at first sight. We find that our results are sensitive to the choice of econometric approach (CQR vs UQR) in some modalities of innovation persistence. When using UQR, results show that carrying out R&D activity persistently does not have an impact on the sales growth of firms. However, persistent product innovators have a positive association with the market only in the intermediate quantiles (30th–50th) along with persistent patentees (30th–60th). Coefficients of persistence in process innovation are greater at the lower quantiles (10th–60th) suggesting that innovation persistence makes a higher contribution to firm growth in low-growth firms.

Our results, therefore, point to the fact that the type of innovation persistence matters for growth. Persistence in R&D activities does not play any relevant role whereas persistence in innovation outputs (product, process, and patents) is a driver for growth in firms with medium-to-low sales growth rates. In terms of innovation studies, our findings highlight that the innovation-growth nexus is not as strong as is often assumed (Coad, 2009). Innovation persistence, therefore, does not work as a robust predictor of subsequent sales expansion (Guarascio & Tagmani, 2019).

We found results to vary by firm size. According to the UQR estimations, the relationship between persistence in R&D and firm growth is not statistically significant, neither for small nor for large companies. The positive impact of persistent product innovation only applies to small firms that are located at the median of the distribution while for large companies, this occurs in the left tail of the distribution (20th–30th). For small firms that carry out process innovation on a regular basis, market success occurs in firms with sales growth in the lower quantiles (20th–50th). For large firms, however, there is a negative impact at the 70th quantile. Finally, patent persistence does not have a statistically significant association with sales growth in large firms while there is a positive and statistically significant effect in small firms at some quantiles over the 40th.

Our results have some implications for innovation policy. It is commonly assumed that technological advances require systematic involvement in R&D activities (Mañez et al., 2009). However, our findings do not suggest that policy makers should fund persistent R&D innovators to boost firm growth, as these innovators do not appear to grow faster than firms that do not engage in R&D on a regular basis. The innovation policy recommendations, however, differ when it comes to persistence in innovation outputs (product, process, and patents). Firms with slow and moderate growth rates that innovate persistently tend to grow more than those that do not continuously innovate.

Some future lines of research can be derived from this study. It would be desirable to have new studies that provide new empirical evidence on the functioning of the relationship between persistence in innovation and market success in countries with different levels of development. Similarly, it would also be pertinent to have studies that analyze this relationship in different industries and in companies belonging to different levels of technological content (high technology, medium–high technology, medium–low technology, and low technology) since the dynamics involved could be different. Further, we suggest analyzing the relationship between persistence in innovation and firm growth by considering ways of pursuing innovation other than technological innovation. Finally, since there is not a clear-cut definition of persistence, it would be interesting to advance in the clarification regarding what should be considered a persistent behavior and to test different measures of innovation persistent activity.

Notes

We acknowledge the trade-off associated with opting for a balanced panel, which involves a loss of information compared to an unbalanced panel. Despite the potential advantages of conducting a more detailed analysis, our choice is in line with the specific focus of our research. Our criteria dictate that firms must remain in the sample from 2005 to 2012, enabling an exploration of whether persistent innovation affects firm growth in the subsequent 2013–2016 period. This approach enhances the comparability of firms throughout the study.

We have run the test for the periods 2013–2016 and 2005–2016, and the conclusions remain essentially unchanged.

Even though other estimators were considered, we believe that the UQR estimator has several advantages over others such as, for example the weighted least square (WLS) estimator when working with long tail variables. One of these advantages is that the UQR model directly focuses on estimating quantiles of the conditional distribution of the dependent variable. This approach enables a better understanding of the distinct features of the distribution’s long tail, without requiring assumptions about the distribution’s shape. Conversely, the WLS model assumes a normal distribution and primarily concentrates on estimating the conditional mean, which may be less appropriate for handling long-tailed variables. In addition, the UQR model is especially robust to outliers or extreme values in the long tail of the distribution.

References

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and Innovation: An Inverted-U Relationship. The Quarterly Journal of Economics, 120, 701–728. https://doi.org/10.1162/0033553053970214

Antonelli, C., Crespi, F., & Scellato, G. (2012). Inside innovation persistence: New evidence from Italian micro-data. Structural Change and Economic Dynamics, 23(4), 341–353. https://doi.org/10.1016/j.strueco.2012.03.002

Antonelli, C., Crespi, C., & Scellato, G. (2013). Internal and external factors in innovation persistence. Economics of Innovation and New Technology, 22(3), 1–35. https://doi.org/10.1080/10438599.2012.708135

Audretsch, D., Coad, A., & Segarra, A. (2014). Firm growth and innovation. Small Business Economics, 43(4), 743–749. https://doi.org/10.1007/s11187-014-9560-x

Bianchini, S., & Pellegrino, G. (2019). Innovation persistence and employment dynamics. Research Policy, 48(5), 1171–1186. https://doi.org/10.1016/j.respol.2018.12.008

Bottazzi, G., & Secchi, A. (2006). Explaining the distribution of firms growth rates. RAND Journal of Economics, 37(1), 235–256. https://doi.org/10.1111/j.1756-2171.2006.tb00014.x

Bottazzi, G., Dosi, G., Lippi, M., Pammolli, F., & Riccaboni, M. (2001). Innovation and corporate growth in the evolution of the drug industry. International Journal of Industrial Organization, 19(7), 1161–1187. https://doi.org/10.1016/S0167-7187(01)00068-6

Cefis, E. (2003). Is there persistence in innovative activities? International Journal of Industrial Organization, 21(4), 489–515. https://doi.org/10.1016/S0167-7187(02)00090-5

Cefis, E., & Ciccarelli, M. (2005). Profit differentials and innovation. Economics of Innovation and New Technology., 14(1–2), 43–61. https://doi.org/10.1080/1043859042000232160

Cefis, E., & Orsenigo, L. (2001). The persistence of innovative activities: A cross-countries and cross-sectors comparative analysis. Research Policy, 30(7), 1139–1158. https://doi.org/10.1016/S0048-7333(00)00139-6

Clausen, T., Pohjola, M., Sapprasert, K., & Verspagen, B. (2012). Innovation strategies as a source of persistent innovation. Industrial and Corporate Change, 21(3), 553–585. https://doi.org/10.1093/icc/dtr051

Coad, A. (2009). The growth of firms: A survey of theories and empirical evidence. Edward Elgar Publishing.

Coad, A., & Rao, R. (2008). Innovation and firm growth in high-tech sectors: A quantile regression approach. Research Policy, 37, 633–648. https://doi.org/10.1016/j.respol.2008.01.003

Coad, A., & Rao, R. (2010a). R&D and firm growth variance. Economics Bulletin, 30(1), 702–708.

Coad, A., & Rao, R. (2010b). Firm growth and R&D expenditure (2010b). Economics of Innovation and New Technology, 19(2), 127–145. https://doi.org/10.1080/10438590802472531

Coad, A., & Rao, R. (2011). The firm-level employment effects of innovations in high-tech US manufacturing industries. Journal of Evolutionary Economics, 21(2), 255–283. https://doi.org/10.1007/s00191-010-0209-x

Cohen, W. M., & Levinthal, D. A. (1990). Absortive Capacity: A new perspective on learning and innovation. Administrative Science Quaterly, 35(1), 128–1250. https://doi.org/10.2307/2393553

Cohen, W. M., Levin, R. C., & Mowery, D. C. (1987). Firm size and R&D intensity: A re-examination. Journal of Industrial Economics, 35(4), 543–563. https://doi.org/10.2307/2098587

Cohen, W. M. (2010). Fifty Years of Empirical Studies of Innovative Activity and Performance. In B. H. Hall & N. Rosenberg (Eds.), Handbook of the Economics of Innovation (pp. 129–213). Amsterdam: Elsevier. https://doi.org/10.1016/S0169-7218(10)01004-X

Crépon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation and productivity: An econometric analysis at the firm level. Economics of Innovation and New Technology, 7(2), 115–158. https://doi.org/10.1080/10438599800000031

Del Monte, A., & Papagni, E. (2003). R&D and the growth of firms: Empirical analysis of a panel of Italian firms. Research Policy, 32(6), 1003–1014. https://doi.org/10.1016/S0048-7333(02)00107-5

Demirel, P. & Mazzucato, M. (2009). Survey of the literature on innovation and economic performance. FINNOV Discussion Paper. Work Package 2. Deliverable Number: 2.1

Demirel, P., & Mazzucato, M. (2012). Innovation and firm growth: Is R&D worth it? Industry and Innovation, 19(1), 45–62. https://doi.org/10.1080/13662716.2012.649057

Demirel, P., & Mazzucato, M. (2013). Innovation and economic performance (industrial and finance): Recent results and questions for future research. In A. P. Andreas Pyka & Burghof, (Eds.), Innovation and Finance. London: Routledge. https://doi.org/10.4324/9780203797747

Deschryver, M. (2014). R&D, firm growth and the role of innovation persistence: An analysis of Finnish SMES and large firms. Small Business Economics, 43(4), 767–785. https://doi.org/10.1007/s11187-014-9559-3

Dosi, G., Marsili, O., Orsenigo, L., & Salvatore, R. (1995). Learning, market selection and evolution of industrial structures. Small Business Economics, 7, 411–436. https://doi.org/10.1007/BF01112463

Evans, D. S. (1987). Tests of alternative theories of firm growth. Journal of Political Economy, 95(4), 657–674. https://doi.org/10.1086/261480

Firpo, S., Fortin, N., & Lemieux, T. (2009). Unconditional quantile regression. Econometrica, 77(3), 953–973. https://doi.org/10.3982/ECTA6822

Fligner, M. A., & Policello, G. E., II. (1981). Robust rank procedures for the Behrens-Fisher problem. Journal of the American Statistical Association, 76(373), 162–168. https://doi.org/10.1080/01621459.1981.10477623

Freel, M. S., & Robson, P. J. A. (2004). Small firm innovation, growth and performance evidence from Scotland and Northern England. International Small Business Journal, 22(6), 561–575. https://doi.org/10.1177/0266242604047410

Ganter, A., & Hecker, A. (2013). Persistence of innovation: Discriminating between types of innovation and sources of state dependence. Research Policy, 42(8), 1431–1445. https://doi.org/10.1016/j.respol.2013.04.001

Geroski, P. A., & Mazzucato, M. (2002). Learning and the sources of corporate growth. Industrial and Corporate Change, 11(4), 623–644. https://doi.org/10.1093/ICC/11.4.623

Geroski, P. A., Van Reenen, J., & Walters, Ch. (1997). How persistently do firms innovate? Research Policy, 26(1), 33–48. https://doi.org/10.1016/S0048-7333(96)00903-1

Gibrat, R. (1931). Les Inégalités Économiques. Recueil Sirey.

Guarascio, D., & Tamagni, F. (2019). Persistence of innovation and patterns of firm growth. Research Policy, 48(6), 1493–1512. https://doi.org/10.1016/j.respol.2019.03.004

Hall, B. H., Jaffe, A., & Trajtenberg, M. (2005). Market value and patent citations. The RAND Journal of Economics, 36(1), 16–38.

Hölzl, W., & Friesenbichler, K. (2010). High-growth firms, innovation and the distance to the frontier. Economics Bulletin, 30(2), 1016–1024.

Huang, C., & Yang, C. (2010). Persistence of innovation in Taiwan’s manufacturing firms. Taiwan Economic Review, 38, 199–231.

Huergo, E., & Moreno, L. (2011). Does history matter for the relationship between R&D, innovation, and productivity? Industrial Corporate Change, 20(5), 1335–1368. https://doi.org/10.1093/icc/DTR019

Koenker, R., & Basett, G. (1978). Regression quantiles. Econometrica, 46(1), 33–50. https://doi.org/10.2307/1913643

Le Bas, Ch., & Poussing, N. (2014). Are complex innovation more persistent than single? An empirical analysis of innovation persistence drivers international. Journal of Innovation Management, 18(1), 1–21. https://doi.org/10.1142/S136391961450008X

Le Bas, Ch., & Scellato, G. (2014). Firm innovation persistence: A fresh look at the frameworks of analysis. Economics of Innovation and New Technology, 23(5–6), 423–446. https://doi.org/10.1080/10438599.2014.895511

Malerba, F., Orsenigo, L., & Pereto, P. (1997). Persistence of innovation activities, sectoral patterns of innovation and international technological specialization. International Journal of Industrial Organization, 15(6), 801–826. https://doi.org/10.1016/S0167-7187(97)00012-X

Mañez, J. A., Rochina-Barrachina, M. E., Sanchis-Llopis, A., & Sanchis-Llopis, J. A. (2009). The role of sunk costs in the decision to invest in R&D. The Journal of Industrial Economics, 57(4), 712–735. https://doi.org/10.1111/j.1467-6451.2009.00398.x

Mañez, J. A., Rochina-Barrachina, M. E., Sanchis-Llopis, A., & Sanchis-Llopis, J. A. (2014). The determinants of R&D persistence in SMEs. Small Business Economics, 44, 505–528. https://doi.org/10.1007/s11187-014-9611-3

Mansfield, E. (1968). Industrial research and technological innovation: An econometric analysis. Norton.

Martínez-Ros, E., & Labeaga, J. M. (2009). Product and process innovation: Persistence and complementarities. European Management Review, 6(1), 64–75. https://doi.org/10.1057/emr.2009.4

Nelson, R. R., & Winter, S. (1982). An evolutionary theory of economic change. The Belknap Press of Harvard University Press.

Organisation for Economic Co-operation and Development, Statistical Office of the European Communities, Luxembourg, & OECD iLibrary. (2005). Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data (3rd ed.). OECD Publishing. https://doi.org/10.1787/9789264013100-en

Patel, D., & Ward, M. R. (2011). Using patent citation patterns to infer innovation market competition. Research Policy, 40(6), 886–894. https://doi.org/10.1016/j.respol.2011.03.006

Peters, B. (2009). Persistence of innovation: Stylized facts and panel data evidence. The Journal of Technology Transfer, 34(4), 226–243. https://doi.org/10.1007/s10961-007-9072-9

Raymond, W., Mohnen, P., Palm, F., & van der Loeff, F. S. (2010). Persistence of innovation in Dutch manufacturing: Is it spurious? Review of Economics and Statistics, 92(3), 495–504. https://doi.org/10.1162/REST_a_00004

Roper, S., & Hewitt-Dundas, N. (2008). Innovation persistence: Survey and case-study evidence. Research Policy, 37(1), 149–162. https://doi.org/10.1016/j.respol.2007.10.005

Rosenbusch, N., Brinckmann, J., & Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing, 26(4), 441–457. https://doi.org/10.1016/j.jbusvent.2009.12.002

Santi, C., & Santoleri, P. (2017). Exploring the link between innovation and growth in Chilean firms. Small Business Economics, 49(2), 445–467. https://doi.org/10.1007/s11187-016-9836-4

Scherer, F. M. (1986). Innovation and growth: Schumpeterian perspectives. MIT Press.

Scherer, F. M. (1965). Size of firm, oligopoly, and research: a comment. Canadian Journal of Economics and Political Science, 31(2), 256–266. https://doi.org/10.2307/140068

Scherer, F. M. (1983). Concentration, R&D and productivity change. Southern Economic Journal, 50(1), 221–225. http://www.jstor.org/stable/1058053

Schumpeter, J. A. (1934). The theory of economic development. Harvard University Press.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy. New York, NY: Harper.

Simon, H. A., & Bonini, C. P. (1958). The size distribution of business firms. The American Economic Review, 48(4), 607–617.

Spescha, A. (2018). R&D expenditures and firm growth – Is small beautiful. Economics of Innovation and New Technology, 28(2), 156–179. https://doi.org/10.1080/10438599.2018.1443154

Stoneman, P. (1983). The economic analysis of the technical change. Oxford University Press.

Sutton, J. (1991). Sunk costs and market structure. The MIT Press.

Sutton, J. (1997). Gibrat’s legacy. Journal of Economic Literature, 35(1), 40–59.

Tavassoli, S., & Karlsson, Ch. (2015). Persistence of various types of innovation analyzed and explained. Research Policy, 44(10), 1887–1901. https://doi.org/10.1016/j.respol.2015.06.001

Triguero, A., & Corcoles, D. (2013). Understanding innovation: An analysis of persistence for Spanish manufacturing firms. Research Policy, 42(2), 340–352. https://doi.org/10.1016/j.respol.2012.08.003

Triguero, A., Córcoles, D., & Cuerva, M. (2014). Persistence of innovation and firms growth: Evidence from a panel of SME and large Spanish manufacturing firms. Small Business Economics, 43, 787–804. https://doi.org/10.1007/s11187-014-9562-8

Wagner, J. (1992). Firm size, firm growth, and persistence of chance: Testing GIBRAT’s law with establishment data from Lower Saxony. Small Business Economics, 4(2), 125–131. https://doi.org/10.1007/bf00389853

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Annex 1 Structure of the unbalanced and balanced panel

Annex 1 Structure of the unbalanced and balanced panel

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Altuzarra, A. Innovation Persistence and Firm Growth: Do They Go Hand in Hand?. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-01809-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-01809-z