Abstract

This study evaluates how the environment, the strategic posture, and the organizational structure contribute to the decline and performance of small- and medium-sized enterprises (SME). Based on a sample of SME and through recourse to Altman’s Z-score model, we evaluate the situation of companies that declare they are facing difficulties in conjunction with their financial performance. The results demonstrate that a strategic entrepreneurial posture and an organic organizational structure, characterized by dynamism, decentralization, and control over the objectives, positively contribute to the performance of companies and prevent their bankruptcy. Our study findings contribute to a better understanding of the factors that lead to SME decline and failure while highlighting the factors that improve their performance levels. The study also reflects on the turnaround process and the redefinition of strategies, new ways of planning, internal organization, and management control.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

There is no specific method available for preventing companies from entering into decline. Companies, adopting a biological analogy, go through their own life cycles. Various researchers (Hanks et al., 1994; Levie & Lichtenstein, 2010; Phelps et al., 2007) establish a consensus around the existence of a series of phases that companies go through during their life cycles, from birth to growth, maturity, diversification, and decline, a phase when a turnaround may take place. However, as decline may occur during any other phases, this dimension frequently gets overlooked by research (Ferreira et al., 2011; Hanks et al., 1994).

Any turnaround process involves the adoption of a plan and deploying corrective measures to reverse the factors driving the decline. Thus, definitions of turnarounds focus on the restoration of the economic performance of a company after a period of decline that called into question its very existence (Rico et al., 2021). Some researchers posit that bankruptcies represent avoidable events as managers may always act to correct the many situations undergoing deterioration (Chowdhury & Lang, 1993; O’Kane & Cunningham, 2014; Pretorius, 2008; Soininen et al., 2012). Furthermore, the literature also maintains that the earlier the application of these corrective actions, the greater the chance of surviving the downturn (Scherrer, 2003).

In this context, the financial ratios provide valuable indicators for detecting the problems that may surge at a later date. Among the most deployed ratios is return on investment (ROI), calculated for 3-year periods (Abebe et al., 2012) and Altman’s Z-score model for predicting bankruptcies (Radivojac et al., 2021; Goh et al., 2022). Nevertheless, due to indulgence or lack of appropriate means of control (Pretorius, 2008), the management sometimes only begins taking measures at an already late stage, making the difficulties more difficult to overcome. Hence, coherently defining the factors that may trigger this position (Kahveci, 2021), taking long-term preventive measures, enabling the construction of flexible emergency plans are necessary steps to coping with any potential future crises (Koyuncugil & Ozgulbas, 2012) and achieving successful turnarounds.

Earlier research findings conclude that, due to their scale and limited scope of action, small- and medium-sized enterprises (SME) register a greater propensity to decline than their larger peers (Kraus et al., 2013; Owalla et al., 2022; Rico et al., 2021). In transition phases, SME become vulnerable due to their scale, their original contexts (Ivanova & Castellano, 2011), and the prevailing external economic conditions (Owalla et al., 2022). However, in recessionary situations, due to their considerable weighting in every economy, SME take on an additional importance and strategic relevance on the path back to sustainable growth and the corresponding economic recovery (Papaoikonomou et al., 2012).

This same vulnerability of SME reflects the need for redoubled attention in tailoring responses to crisis situations, requiring planning and appropriate structures to be able to overcome these challenges (Johari et al., 2021). Hence, this requires referencing within the scope of clarifying and redefining the strategies, encountering new ways of planning and organizing, changing behaviors, improving management control (Burns & Stalker, 1961; Obiajunwa, 2013), adapting company resources to the changes in the environment, and internalizing the knowledge necessary to obtaining more promising competitive positions. Obtaining a high-performance level fundamentally depends on the capacity for innovation and the exploration of intangible resources, such as knowledge (Ferreira et al., 2017).

The literature identifies both exogenous and endogenous factors as determinants of decline. The exogenous factors correspond to hostile environments characterized by intense competition, instability, and global economic crises (Frank et al., 2017; Makkonen et al., 2014). Regarding endogenous factors, the literature references internal organizational weaknesses (Ghazzawi, 2018; Panicker & Manimala, 2015) and management shortcomings (Milošević et al., 2019). Covin and Slevin (1989) highlight how a conservative strategic posture, highly resistant to innovation, lacking in the vocation for assuming competitive positions, and shy in the acceptance of risks reflect entirely the wrong posture necessary to deal with hostile environments. On the contrary, entrepreneurial strategic postures nurture socioeconomic development and boost the economy through innovation in products and services (Behling & Lenzi, 2019).

Mechanistic organizational structures are also inappropriate to coping with hostile exogenous conditions (Brown, 2014), potentially creating greater difficulties in reversing the trend towards decline (Barker & Mone, 1998). In turn, while organic organizational structures favor creativity and innovation, mechanistic structures generate restrictions on organizations designing and implementing innovative solutions (Crisan-Mitra, 2019). Despite recent years having witnessed growing interest in the research field on the decline, in keeping with its practical and theoretical relevance, there remains a certain level of fragmentation in the literature (Czakon et al., 2022). This review did not identify any studies that simultaneously approach the style of organizational structure and the strategic posture in hostile environments that undermine the performance of SME and contribute to their decline.

Given this context, it seems particularly relevant to analyze those factors that contribute to companies entering into decline as well as highlight them as this may foster responses capable of improving the strategic and structural processes within the scope of cutting the incidence of failure and bankruptcy among SME. Furthermore, this simultaneously contributes towards identifying those conditions that best enable improvements to performance through reflecting on the redefinition of strategies, new forms of planning, internal organization, and management control. Hence, this present study aims to verify in what ways hostile environment, strategic posture, and organizational structure contribute towards the performance levels of SME.

After introducing the topic, this study first presents the theoretical foundation, the literature review, the hypotheses formulated, and the research model. Secondly, the methodology and description of the analysis methods used are presented, followed by the results of the empirical study and respective discussion. Finally, the main conclusions, limitations found, and future lines of investigation are presented.

Theory and Hypotheses

Life Cycle Theory

The conceptual models developed according to life cycle theory and applied to company development, in keeping with the biological life analogy, adopt a cycle that begins with birth and continues through growth, maturity, and diversification and culminates in decline. This represents a sequence that obtains consensus and underlies the bulk of research under company life cycle theory (Ahsan et al., 2016; Costa et al., 2017). Based on this approach and now ongoing throughout decades, efforts have focused on establishing a business life cycle model capable of reflecting each of the growth phases and the changes inherent to each respective phase (Lichtenstein & Lyons, 2008).

What the stages are in company life cycle and what defines and characterizes each one constitute the objects of study for different researchers (Ferreira et al., 2011; Lester & Tran, 2008; Miller & Friesen, 1983). Indeed, despite certain researchers alluding to the need to better define the life cycle stage concept, this nevertheless still remains a vague notion incorporating a certain ambiguity (Hanks et al., 1994; Levie & Lichtenstein, 2010). While some authors make explicit references to the life cycle stages (Miller & Friesen, 1984), others refer to growth phases and phases of development (Ferreira et al., 2011), often while simply ignoring the decline phase (Hanks et al., 1994).

The justification put forward by Hanks et al. (1994) for the overlooking of the decline stage in the majority of models points to the attribution of two characteristics to decline: (i) the impact of decline on the structure and systems of an organization is far less predictable than the changes associated with growth and (ii) decline may occur in any phase of the life cycle of organizations.

Organizations progress through an ordered series of stages to the extent that they grow, gain maturity, and change their strategies (Miller & Friesen, 1983). Greiner (1972) presents a model that contemplates distinctive different growth phases, and with the passage from one stage to another culminating in a crisis, Greiner (1972) designates a revolution that, following its passage, leads onto the following stage. Within this framework, Miller and Friesen (1983) set out how there are significant differences between phases of success and failure, as success in each phase of the life cycle depends on high level of performance with companies capable of turning in good or bad performance standards in each of the five life cycle phases. A company may regress to an earlier phase or slide into decline at any stage (Lichtenstein & Lyons, 2008; Milošević et al., 2019).

Figure 1 depicts the life cycle of a company the moment when they should experience diversification or transformation and, should this not happen, when they enter decline and open the potential scope for a turnaround.

Company life cycle. Source: adapted from Slatter and Lovett (1999)

Not all companies go through this life cycle, given that organizations may undergo a relaunch or transformation at any moment in time. However, the model provides a useful illustration of what is understood as a turnaround situation clearly portraying how this occurs during the decline phase.

Company Decline and Strategic Posture

Occasionally, there is confusion between “decline” and “crisis.” The application of these two concepts requires some clarification. Although rooted in different causes, both reflect a deterioration in the performance indicators. The decline corresponds to a relatively smooth trend that involves a downturn in performance (Chowdhury & Lang, 1993; Gopinath, 2005; McKinley et al., 2014) and a measurable threat to organizational viability, including sustained declines in market share, financial losses, and sliding levels of turnover (Mone et al., 1998).

Situations of decline lead to lower levels of liquidity, causing a lack of financial flexibility that drives rising levels of debt alongside a progressively increasing recourse to financing. In turn, a crisis assumes a sudden fall, involving a sharp change, with a high index of poor performance driving greater urgency in obtaining external financial resources (Gopinath, 2005; Kahveci, 2021; Milošević et al., 2019; Rosslyn-Smith et al., 2020). This distinction may bear implications both in terms of the capacity of company management structures to oversee a turnaround and the ability to seek out the necessary external financial support. These two phenomena do not occur autonomously. Conventional knowledge maintains that companies display a lesser propensity to get out of crisis situations than steer their way out of gradual declines (Chowdhury & Lang, 1993) as individuals, when confronted by sudden threats, tend to remain inactive and passive.

In addition to this and in situations of risk or strategy failure, the decline may swiftly transform into crisis when companies do not take the appropriate measures (Angelova et al., 2017; Pretorius, 2008). Analyzing these phenomena from another perspective, Scherrer (2003) recognizes three distinct phases to company declines: early, medium term, and late, with treasury difficulties emerging as symptomatic of the first two stages while the latter involves experiencing a fall in business turnover. Equally, and making recourse to a contingency model, Mone et al. (1998) put forward two contradictory perspectives on the effects of organizational decline. The first stems from research lines identifying how organizational decline negatively interferes with organizational innovation capacities. A second perspective conveys exactly the opposite, and thus, organizational decline stimulates innovation (Czakon et al., 2022) with the conclusion that the particular factors of each organization constitute the grounds for encouragement.

Trahms et al. (2013) argue that much remains for research as regards the causes and consequences of decline given the inconsistencies prevailing in the many studies on this theme. In situations of decline, the greater the knowledge about the causes, the greater the likelihood companies can undertake successful turnaround processes (Kraus et al., 2013). Whatever the perspective, the literature maintains that the determinants of situations of decline and crisis derive from both exogenous and endogenous sources (Santana et al., 2018). The environment has long since displayed high levels of instability, whether due to the fallout from the financial crisis that erupted in 2008 and the consequent deep economic recession (Makkonen et al., 2014), the COVID-19 pandemic (Johari et al., 2021; Pedauga et al., 2022) or, more recently, due to the global repercussions triggered by the Russian invasion of Ukraine (Qureshi et al., 2022).

All of these factors may contribute to the decline of companies whenever the management bodies do not perceive the risks in due time (Scherrer, 2003). This reflects how the primary causes of organizational decline stem from its own internal weaknesses as external changes bring about adverse impacts, especially when the organization displays such structural shortcomings (Ghazzawi, 2018; Panicker & Manimala, 2015).

Hypotheses and Research Model

Companies require internal equilibrium to adapt to external environmental circumstances. Within this perspective, managers hold the function of adjusting to the situations arising to maintain competitiveness in keeping with the complexity characterizing the environment. Hostile environments are dynamic and intensify companies’ complex challenges (Miller & Friesen, 1983). Given their dependence on resources, hostile business environments generate greater risks and are aggressive, demanding, competitive, and dominant (Covin & Slevin, 1989; Lee et al., 2008; Sila, 2010) with a special focus on SME. This environmental hostility may represent an even greater threat to SME, given their inherent resource limitations and lack of capacity to respond and ensure their survival as well as the fragility of the decision-making processes undertaken by their management bodies (Covin & Slevin, 1989; Dele-Ijagbulu et al., 2020).

Financial crises bear consequences for economies, generating enormous problems for the banking sector with repercussions for companies due to a lack of financing throughout such periods of crisis (Petráková et al., 2021; Vermoesen et al., 2013; Vithessonthi, 2011). The instability prevailing in economies throughout such crisis periods produces a diversified range of effects. Makkonen et al. (2014), after studying the relationship between dynamic capabilities and environmental instability in the wake of the 2008 financial crisis, conclude that dynamic capabilities shape the performance of companies in unstable environments. The credit restrictions faced in the wake of the global crisis that erupted in 2008 (Vermoesen et al., 2013; Banerjee & Ćirjaković, 2021) led to substantial falls in employment and investment at companies across Europe, the USA, and Asia, resulting in sharp falls in their productivity, turnover, and profitability (Tikicia et al., 2011; Banerjee & Ćirjaković, 2021). This crisis, in addition to its devaluation of asset prices, due to the emergence of a trend among companies to liquidate assets to secure financing for their activities, negatively impacted on the market for real assets (Campello et al., 2010).

Economic crises certainly rank as one of the fundamental causes of decline (Mrockova, 2022; Tikicia et al., 2011). When companies fail to grasp the prevailing market conditions and thus do not adapt their behaviors to deal with the turbulence in the business environment caused by the fallout from such crises, they are heading into critical situations (Hager et al., 1996). More recently, the generalized crisis provoked by the COVID-19 pandemic, which cast a climate of uncertainty over the business environment right around the world, has generated substantial impacts on SME as stated in the 2020 report by the Organisation for Economic Cooperation and Development (OECD) (Kahveci, 2021).

Financial restrictions become more relevant when companies struggle with their performance levels as the lack of financial room for maneuver inherently restricts the scope of strategic options available (Vithessonthi, 2011). Furthermore, companies experience these crises in different ways: while some cannot overcome their difficulties, others clearly manage to avoid the worst effects (Makkonen et al., 2014). External resources enable companies, through timely interpretations of the competition prevailing in the environment (SE hereafter), to manage their capacities for establishing networks with suppliers, channels of distribution, other firms, and clients (Wai et al., 2022), hence not only responding more swiftly to the difficulties but also with greater innovation in comparison with their peers (Giaglis & Fouskas, 2011).

Companies able to advance their competitive advantages through appropriate international strategies thereby strengthen the competitive advantages generated internally (Chen et al., 2014; Johari et al., 2021). Nevertheless, when companies do not take advantage of the opportunities in real time, do not apply the best product diversification strategies, and fail to tailor their technological resources, then they will run serious risks (Chen et al., 2014) due to changes in the level of competition. The current context of increasingly intense competition demands high management capacities and continuous innovation, in keeping with the needs of clients, sharing information with suppliers and planning partnerships capable of facilitating entrance into new markets (Chen et al., 2014; Prasad & Rajan, 2006).

Companies that strongly prioritize creativity and emphasize innovation are correspondingly better prepared to take risks in addition to attributing a significant proportion of their resources to R&D (Colvin & Maravelias, 2011; Seybert, 2010; Yao & Yang, 2022). The acquisition of new technologies for product innovation, investing in innovative marketing strategies, raising production capacity, and taking into account the extremely variable needs of clients all combine to drive higher levels of performance (Weber, 2002). Nevertheless, innovation-focused investments may lead to situations that threaten the viability of companies. Hence, despite companies ensuring high levels of operation to underpin their strategic flexibility regarding the competition, this may jeopardize much of their profits due to the high level of operating costs incurred (Yang & Li, 2011).

Changes and the overall unpredictability of the environment, for example, the enactment of new competition regulations (Vithessonthi, 2011), as well as external resources, directly interconnect and shape the response capacity of companies (Cho et al., 2022; Giaglis & Fouskas, 2011; Hassani & Mosconi, 2021). Nevertheless, the external challenges, coupled with a lack of innovation, may hit company profitability (Miller & Friesen, 1984). With the maturing of industries, growth tends to slow with competitors emerging with identical products due to the dissemination of technology. The preferences of consumers converge and a trend arises towards an intensification of competition, whether in terms of prices or other forms of competition (McKinley et al., 2014). The literature demonstrates that, to the extent that competition and innovation intensify in global markets, many SME experience difficulties, with a particular emphasis on the situations prevailing in developing companies (Amoah et al., 2021).

When the companies charge base prices in excess of the competition (Hassani & Mosconi, 2021) and their strategies fail to adapt to the competition (Hassani & Mosconi, 2021), then they lose competitive advantage. According to Sorensen and Stuart (2000), the key pressures detected in the competitive environment interrelate with the rapid obsoletion of existing products and services and the pressing need to develop others swiftly. The emergence of substitute products in competition, resulting from technological advances, may also drive losses in competitiveness as these comply with the same function at a lower cost to their consumers (Bumgardner et al., 2011; Giaglis & Fouskas, 2011). Thus, with lower production costs, such products may provide a better qualitative performance. Hence, this highlights how the rise in competition represents one of the causes of the decline (Hassani & Mosconi, 2021). However, change in lifestyles or consumer preferences may drive downturns in demand, which may also constitute another highly relevant cause (Bumgardner et al., 2011).

The endogenous factors potentially facilitate the level of allocation of exogenous factors. In generalized financial crisis situations, monitoring the environment has to constitute a dynamic process (Pandelica et al., 2010), taking into account the internal repercussions for the organization and driving adjustments to the strategy in accordance with the external context (Asgary et al., 2020). Any misalignment between companies and their environments requires managers to act and undertake the appropriate strategic actions (Katsamba & Pellissier, 2021; Liang et al., 2018). In light of these considerations, we may present the first analytical model for evaluating whether the hostility of the environment (SE) generates a moderating effect on the relationship between strategic posture and decline as set out in our first research hypothesis (H1).

-

H1: In hostile environments, a conservative posture positively relates to business decline.

Different researchers (Campello et al., 2010; Prasad & Rajan, 2006; Tikicia et al., 2011; Vithessonthi, 2011) have built up a portfolio of endogenous causes that drive companies into decline and crisis. The internal factors depend essentially on the workings of the organic structure, the perceptions of the prevailing market conditions, and the actions of management (Rasheed, 2005).

Mismanagement stands out as one of the major causes of sustained decline (Collett et al., 2014; Owalla et al., 2022). Generally, warning signs appear well before any business declines despite managers commonly ignoring or not understanding such signs. When they recognize the problem, they perceive it as only temporary and do not take any measures to reverse the decline, which may cause irreversible damage to the company (Scherrer, 2003).

Sudden crises may bring about cognitive rigidity that severely harms decision-making processes and only deepens the existing problems (Chowdhury & Lang, 1993; Mintzberg, 1979). Thus, organizational reasons for delays in action may lead to distorted thought processes and the incapacity to make rational decisions (Gopinath, 2005).

Grasping the trends in the business environment and how these situations can cause negative impacts may assist in locating and correcting problems prior to them worsening and deepening (Scherrer, 2003) as the sooner these receive effective attention, the lesser will be the future damage (Frank et al., 2017).

A lack of vision, the inability to develop effective business strategies, an absence of planning, the failure to deal seriously with human resource issues, and inadequate financial control are some factors that best characterize mismanagement (Scherrer, 2003). Burns and Stalker (1961) introduce the concepts of “mechanistic” and “organic” management systems and demonstrate how they serve as dependent variables for changes in the environment.

In a mechanistic structure, decision-making is based on superiorly defined policies and limited in action within established parameters. Leadership corresponds to a top-down hierarchy, and authority is based on function and exercised by those who have little direct interaction with the environment. There is tight control, performance measures are result-oriented and short term, and goals are controlled within functional areas. There is little propensity for innovation, low capacity for change, and little employee involvement (Brown, 2014; Klarner et al., 2013; Ylinena & Gullkvist, 2014).

In an organic structure, decision-making is based on values and information and appropriate to the particular circumstances. Leadership is interactive and establishes the vision and values to guide the organization. Authority is based on knowledge. Performance measures are supported by processes and systems, aimed at the long term, and the goals are specific and common to the entire organization. There is a good receptivity to change and a high capacity for innovation and employees have high involvement (Brown, 2014; Klarner et al., 2013; Ylinena & Gullkvist, 2014).

The mechanistic paradigm interlinks closely with a bureaucracy, even while this enables organizational survival during periods of stability, which turns out inappropriate in periods of turbulence (Brown, 2014), potentially driving greater difficulties in changing strategic direction during periods of decline (Barker & Mone, 1998).

In companies displaying mechanistic organizational structures, authority resides in persons with little direct interaction with the environment. Senior managers design and develop fewer alternatives due to only vertical communication and procedures that run counter to innovative solutions (Mintzberg, 1979). The failure to delegate autonomy on members of staff hinders the likelihood of innovation (Barker & Mone, 1998; Brown, 2014; Owalla et al., 2022; Ylinena & Gullkvist, 2014). Organic structures, in contrast, stand out for nurturing learning, enabling the acquisition and management of new knowledge and deploying this to the benefit of organizations, paying less attention to hierarchy and fostering greater flexibility between the different functions (Brown, 2014). This perspective frames our second hypothesis (H2).

-

H2: In a hostile environment, a mechanistic organizational structure positively interrelates with business decline.

The conjunctural changes brought about by the current economic and financial crisis may drive higher rates of bankruptcy when the indicators register an à priori weak financial performance (Balan, 2012; Rico et al., 2021). Correspondingly, a lack of capitalization accounts for one of the main reasons causing the closure of companies (Koyuncugil & Ozgulbas, 2012; Rico et al., 2021).

Furthermore, when negative cashflows begin eating up the resources available, to the point of delaying payments to third parties, this results in the company only acquiring the goods and services necessary to its functioning on less advantageous terms and requiring payment on delivery (Hager et al., 1996). In association with this situation, taxation and social security debts begin accumulating. Companies entering into situations of decline encounter more difficulties in obtaining the financial support necessary to their operations (Chowdhury & Lang, 1993; Dele-Ijagbulu et al., 2020; Johari et al., 2021). The non-existence of bank credit implies providing better conditions to clients in the expectation of generating more liquidity but with clear consequences for business profit margins (Chowdhury & Lang, 1996; Vithessonthi, 2011; Vermoesen et al., 2013; Petráková et al., 2021). During the phase when such difficulties arise, which financial reporting does not always reveal either in due time or appropriately, the risks of crisis situations appear. Using Altman’s Z-score model, one of the indicators used by financial entities, it is possible to detect the risk situation of companies (Robbins & Pearce, 1992).

Financial management failures may derive from a range of different factors: inadequate financial controls (Barker, 2005; Slatter & Lovett, 1999; Sulaiman et al., 2005), high levels of debt in relation to assets, excessively conservative financial policies, inadequate sources of financing (Decker, 2018; Johari et al., 2021; Slatter & Lovett, 1999), incapacity to plan for growth, inefficient budgetary procedures, generating imprecise data on financial performance, inability to evaluate the value of an acquisition, and excessive leverage appropriately (Sulaiman et al., 2005; Waqas & Md-Rus, 2018).

Worsening levels of financial performance may receive due and timely identification through the management instruments that enable such predictions. Return on investment (ROI) represents one of the financial indicators most commonly applied for this purpose (Abebe et al., 2012; Rico et al., 2021). Following utilization over the course of at least 3 consecutive years, this indicator ensures the detection of any serious decline. However, other tools are existing and many researchers unanimously back the reliability of Altman’s Z-score model first put forward in 1968 (Abebe et al., 2012; Karahan & Yüzbaşıoğlu, 2021; Lizarzaburu et al., 2021).

Another aspect requiring attention encapsulates how the Chief Executive Officers (CEO), responsible for the negative consequences, may attempt to disguise the downturn, potentially leading to still more serious outcomes (Chowdhury & Lang, 1993). Hence, and coupled with the dependence on financial institutions for their short-term survival, negative results tend to get buried. Indeed, the results published are very often unreal (Beke, 2010), for example, boosting the value of intangible assets to create value for organizations despite not reflecting their current independent market value. Similarly, the value of inventories may get overstated, revaluing assets without their actual economic value, justifying and registering imparities that fall short of the real exposure to risks. These factors alter the components submitted to economic-financial analysis (Griffiths, 1992), distorting the liquidity, solvability, and financial autonomy ratios alongside the analysis of both risks and treasury funding requirements.

Hence, what on occasion gets termed as creative accounting explores the scope of opportunities available in accountancy norms and evaluation processes to register better results, release financial statements that reflect a distorted vision of company situations to access further financing (Kosmidis & Terzidis, 2011; Mayr & Lixl, 2019).

Such situations include the lack of accountancy information (Sulaiman et al., 2005), false accountancy details or systems lacking in such financial information (Scherrer, 2003), and acts of fraud and deception (Oliver, 2017). These do not account for the immediate causes of companies collapsing but rather reflect the means of hiding, throughout some time, the generalized failures (Marwa & Zairi, 2008). The lack of information or its poor quality only worsens organizations’ problems over time. The majority of accountancy systems produce operational data on earnings and expenditure. Still, these outputs are only general details and not necessarily susceptible to revealing the real problems hanging over the organizations and failing to detect, for example, when the cost structure is too high (Slatter & Lovett, 1999). Thus, the specific causes of decline still require fully identifying and explaining (Barker, 2005).

The rising level of competitiveness and the shrinkage in the life cycle of products generates the need for more precise and detailed information, especially as regards the scope of financial control capable of detecting such weaknesses. Jiang and Li (2010) state that managers’ resistance towards establishing control systems often arises from the high level of costs their operation incurs. The weakness may derive from managers ignoring the relationship between non-financial causes and their specific financial effects, such as liquidity, profitability, and solvency. The endogenous factors listed above contribute towards the failure of companies. The entrepreneurial stance of managers needs to support organizational learning (Stokes & Blackburn, 2002) capable of fostering a holistic vision of the organization. The research approach to the failure of small companies fundamentally interrelates managers and entrepreneurship in efforts to established interlinkage between entrepreneurial activities and performance (Owalla et al., 2022).

However, hostile environments demand the capacity to think creatively and act innovatively, based upon the existing resources and processes, to deal with the inherent challenges (Sulistyo, 2016). These dynamic management capabilities directly interrelate with the entrepreneurial posture (Helfat & Martin, 2015) and, as such, are deemed a factor for SME success (Tehseen & Ramayah, 2015; Faulks et al., 2021). A strategic entrepreneurial posture may be especially beneficial to small companies facing such hostile environments as they contain fewer opportunities and are more competitive than their more stable counterparts. In turn, a conservative posture, with a great deal of resistance to innovation, lacking in the vocation for seeking out competitive positions, and reticent about accepting risks represents a posture contrary to that most desirable in hostile environments (Covin & Slevin, 1989; Owalla et al., 2022). This context establishes our third research hypothesis (H3).

-

H3: In hostile environments, conservative strategic postures lead to poor financial performance.

The type of organizational structure also holds consequences for the financial performance of companies. While hostile SE require organic organizational structures, mechanistic organizational structures are more appropriate in stable SE (Covin & Slevin, 1989; Mintzberg, 1979). As hostile environments display unpredictability, demand swift responses, and a certain level of organizational flexibility (Frank et al., 2017; Mintzberg, 1979; Owalla et al., 2022), organic organizational structures achieve better results with mechanistic organizational structures more appropriate to stable environments. In the mechanistic organizational structure, starting from the assumption that all other factors remain constant, companies and organizations can predict future situations, establish fixed rules, formalize the contents of work, and plan with relative security (Mintzberg, 1979; Owalla et al., 2022). Hence, we arrive at our fourth research hypothesis (H4).

-

H4: In hostile environments, mechanistic organizational structures lead to poor levels of financial performance.

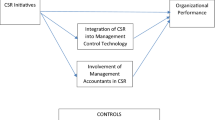

Based on this literature review and the hypotheses set out, Fig. 2 details the resulting conceptual model.

This model thus aims to interrelate the endogenous factors, strategic posture, and organizational structure, with financial performance and decline in hostile environments defined according to their competition, turbulence, and opportunities.

Method

Data and Sample

We carried out a questionnaire survey to establish a sample of Portuguese SME. Respondents answered this questionnaire through an Internet page with the respective link submitted via email. We carried out a questionnaire survey to establish a sample of Portuguese SMEs. Respondents responded to this questionnaire via a website with the respective link sent by email. The questionnaire was open during the last 3 months of 2021. We obtained a total of 103 responses, although 33 were excluded from the sample because they did not indicate the financial elements requested and necessary for performance evaluation. Thus, only 70 were considered validations and constituted the final sample. This research made recourse to Altman’s Z-score model (1968) to, on the one hand, confirm the situation of decline that companies declare they are encountering in this particular phase and comparing the results of this indicator with those for companies in other stages of their life cycle. On the other hand, this indicator also verified the financial performance (FP) turned in by respondent companies.

Altman (1968), in order to obtain the final profile of the variables, applied a set of procedures: (i) observation of the statistical significance of the various alternative functions, including the decrease in the relative contributions of each independent variable, (ii) evaluation of the intercorrelations among the relevant variables, (iii) observation of the accuracy of the predictions of the various profiles, and (iv) judgment of the analyst. This essentially constitutes an iterative process that drives the optimization of the resulting discriminant function. The Z-score formula is the following:

This transforms the values of the individual variables into a single discriminant score with “V” corresponding to the discriminant coefficients and “X” to the independent variables. The optimal combination of the coefficients with the five ratios is the following:

The ratios selected are the following: (i) X1—treasury/assets, (ii) X2—retained profits/assets, (iii) X3—EBIT/assets, (iv) X4—company value/third party capital, and (v) X5—sales/assets.

-

(i)

X1—treasury funds/assets: Altman (1968) defines treasury funding as the difference between current assets and current liabilities. This reflects how any company making constant operating losses experiences a decrease in their current assets relative to their total assets.

-

(ii)

X2—retained profits/assets: Altman (1968) attributed the total value of reinvested profits and/or losses of a company throughout its years in business. This highlights the situations of more recent businesses that may only have returned a low level of accumulated profits, which might jeopardize the analytical findings. However, this also reflects the reality that the incidence of failure is far greater in the early years of company operations as demonstrated by the respective statistics.

-

(iii)

X3—EBIT (earnings before interest and taxes)/assets: the proportion between the earnings before financial gains and losses and taxes/total assets constitutes one of the most effective measurements of the true productivity of company assets, irrespective of any taxation or other factors for leveraging, according to Altman (1968).

-

(iv)

X4—company value/third party capital: Altman (1968) maintains that the value of any company corresponds to its net assets as measured by their market value while the liabilities include both short and long-term debt. When dealing with companies that are not stock market listed, their value is determined by their equity capital.

-

(v)

X5—sales/assets: the capital rotation index is a standardized financial indicator that illustrates the capacity to generate sales based on company assets. This is a measurement of the capacity of management teams to deal with competitive conditions (Altman, 1968).

According to Altman (1968), lower levels of Z results indicate a greater risk of failure and that any Z ranking below 3, throughout at least 1 year prior to the period of decline, conveys a very high probability of failure. In this context, the Altman Z-scores guarantee that the performance decline is of sufficient gravity to threaten the company’s survival.

The levels of classification for the results returned by this model (Altman, 1968) are the following: (i) financially healthy, whenever Z > 2.99; (ii) uncertain, considered to be a gray zone for results between 1.81 and 2.99, divided into two levels of risk of bankruptcy: lower, when 2.675 < Z < 2.99; greater, when 1.81 < Z < 2.675 taking into consideration 2.675 as the median value for the interval; and (iii) the highest risk of bankruptcy, when Z < 1.81.

In order to estimate the consistency of the scale deployed in this analysis, we made recourse to Cronbach’s alpha indicator (Cronbach, 1951). To analyze whether there is a relationship between the quantitative variables (hostility of the environment, strategic posture, and organizational structure), how they mutually vary, and the respective intensity of the linear relationship, we applied Pearson’s correlation coefficient. In turn, we deployed the points biserial correlation to determine the relationships between the quantitative variables and the (dichotomic nominal type) variable of decline. Finally, we also conducted a regression analysis to evaluate the effects of the independent variables on the dependent variables.

Variables

Financial Performance (FP)

In scenarios of economic recession, greater attention needs paying to FP. In companies, the analysis of financial performance makes it possible to assess whether companies are heading towards decline or to determine the phase of decline that companies are in, as well as the probability of bankruptcy (Altman et al., 2013). Consequently, predictive models for company bankruptcies have developed within the framework of verifying the need for strategic actions to maximize the likelihood of survival. The academic literature contains a diverse range of studies with multiple discriminant analysis techniques also applied in the model proposed by Altman (1968). The proposition of this model, entitled the Z-score, for predicting company failure dates back to 1968. The indices in the model took into account those most popular in the literature and their potential relevance for study. This highlighted four variables from balance sheets and financial reporting alongside an additional variable for the market. The variables correspondingly selected span liquidity, profitability, leveraging, solvability, and activity, thereby returning better results regarding the prediction of failure.

The Z-score indicator obtains a relatively high level of reliability and provides a valuable tool for detecting serious financial difficulties (Abebe et al., 2012; Alareeni & Branson, 2013; Celli, 2015). Over three decades, Altman refined the model, with a particular incidence on the initial parameters and adapting it to different populations (Altman et al., 2013).

The results produced by Altman (1968) achieve a 95% level of accuracy in cases 1 year prior to the companies going bankrupt and a 72% level in cases 2 years before the failure of the business. The empirical evidence demonstrates that the Z-score model is most reliable when applied 2 years prior to bankruptcy (Slatter & Lovett, 1999) with various studies proving the Z-score model achieves an over 80% level of precision and correspondingly concluding that this is a robust and relevant tool for evaluating performance and predicting potential dangers for companies (Zaabi, 2011). Some studies on business failure also reference Altman’s Z-score model as an appropriate indicator for verifying the gravity of the decline, thus when this reaches a point of threatening the survival of companies (Bernini et al., 2013; Celli, 2015; Steinker et al., 2016) and therefore justifying recourse to strategic action (Abebe et al., 2012).

Decline

This dichotomic variable accounts for the responses concerning the situation of decline and reporting the value of “1” for companies declaring that they were facing decline and “0” for companies reporting they were in other stages of their life cycle (Ferreira et al., 2011; Hanks et al., 1994).

Strategic Posture (SP)

In order to measure SP, we applied a list of items spanning innovation, proactivity, and the acceptance of risks. Conservative SP contain a minimum of technological and product innovation, a cautious competitive orientation, and a low propensity for risk. In turn, entrepreneurial SP display frequent technological innovation, an aggressive competitive stance, and the senior management displaying a strong propensity to take risks (Covin & Slevin, 1989). The higher the classification, the more entrepreneurial the SP.

Organizational Structure (OS)

Analysis of the OS measures its organic nature, thus the structures of organizations in terms of organic structures vs. mechanistic structures. Respondents indicated the level to which each item characterizes the OS of their companies. The higher the classification, the greater the correspondence to an organic OS.

Moderating Variable: Environment Hostility (EH)

This calculates the evaluations made by respondents of the prevailing competition, market turbulence, and opportunities to produce an EH index. This makes recourse to a scale of opposite declarations, ranging from 1 to 7. The higher the classification, the greater the hostility of the SE.

Table 8 (in Annex) summarizes the measurement items and scales used for each variable.

Results and Discussion

In order to ascertain situations of company decline, we applied Altman’s Z-score model (1968). We correspondingly carried out statistical analysis of each of the ratios integrated into the Z-score model to determine the averages for the two sample groups (companies undergoing decline and companies in other life cycle stages) and the standard deviation as set out in Table 1. The results returned demonstrate that, across every ratio, companies in decline register lower values than their peers.

Table 2 sets out the average Z-score results broken down by two company groups, those in different life cycle stages and those facing decline. The Z-score result provides an average of 1.09 for companies declaring they are in a decline stage. According to Altman’s classification, this result reflects a risk of bankruptcy given it is clearly below the 1.81 benchmark reference. This represents the zone of greatest risk and situations serious enough to threaten the company’s future survival and justifying immediate corrective strategic actions.

The dispersion (Fig. 3) depicts the correlation among the variables (life cycle stage and Z-score indicator).

The empirical evidence generated by the Z-score model confirms that the largest number of companies reporting situations of decline cluster in the high-risk zone with a ranking of below 1.81 for the FP item. A smaller group emerges in that termed the gray zone, with a ranking of between 1.81 and 2.99, indicating a probability of risk and thereby confirming the validity of Altman’s model (1968) for predicting the risk of company failure.

To analyze the causes of decline, we made recourse to Pearson’s correlation coefficient (Table 3) with data consistency verified through application of Cronbach’s alpha. The average alpha coefficients return results in excess of the 0.70 reference value (Peterson, 1994), thereby confirming the data’s consistency.

This identifies a significant and positive correlation of moderate intensity between decline and EH (R = 0.683, p < 0.001). The experience of business decline therefore interlinks with high levels of HE. This result corroborates the literature review analyzing the external causes of organizational decline. A risky, aggressive, demanding, and highly competitive EH (Covin & Slevin, 1989; Lee et al., 2008; Sila, 2010) and impossible to control external events may render strategies ineffective and drive organizational decline (Trahms et al., 2013).

There is a significant and negative correlation of moderate intensity between decline stage and OS (R = − 0.561, p < 0.001). Thus, the results report an association between decline and more mechanistic OS. There is similar moderate intensity, significant and negative correlations between EH and SP (Pearson = − 0.456) and FP (Pearson = − 0.461) and, with low intensity, between EH and OS (Pearson = − 0.299). The greater the hostility of the EH, the deeper the trend towards mechanistic OS and conservative SP. These findings thereby concur with the results of the study by Covin and Slevin (1989) that maintains that the performance of SME in EH positively relates to OS and entrepreneurial SP while non-hostile SE see performance more positively associated to mechanistic OS and conservative SP.

We tested hypotheses H1 and H2 through recourse to logistic regression in keeping with the dependent variable (decline) being of a nominal dichotomic type. The determinant model for the dependent variable of decline (Table 4) attains significance across the variables studied, with 49.78% and 56.6% of the variations explained by the variables calculated. Furthermore, the model explains 73.18% and 83.2% of the variations registered in the dependent variable.

Table 5 presents the logistic regression results for the dependent variable decline. From the calculations made, we may infer that SP generates a significant negative effect on the decline as the more entrepreneurial the SP, the lower the probability of decline (B = − 2.4312, t = − 2.3739, p = 0.0176, 95% IC = − 4.4385; − 0.4239). The results also convey how SE hostility does not moderate the relationship between SP and decline (B = − 0.9737, t = − 0.7598, p = 0.4474).

Hence, regarding H1, despite the results obtained not portraying any moderating effect for EH, they verify that conservative SP positively interrelate with company decline (B = − 2.4312, t = − 2.3739, p = 0.0176, 95% IC = − 4.4385; 1.5379). Thus, the deeper the conservatism of the SP, the greater the likelihood of decline. Therefore, it appears that this hypothesis is partially supported.

The literature indicates that the causes of decline depend on factors in the external environment (Covin & Slevin, 1989; Tikicia et al., 2011; Vithessonthi, 2011; Li, 2015) as well as facets related to the management style and internal organization (Klarner et al., 2013; Brown, 2014; Ylinena & Gullkvist, 2014). However, these internal factors wield a major influence over decline (Hager et al., 1996; Panicker & Manimala, 2015; Scherrer, 2003), with a greater incidence among SME (Mayr et al., 2021). An entrepreneurial SP may be particularly beneficial to small businesses facing EH characterized by high levels of competition and fewer opportunities through focusing their efforts on maintaining their competitive advantages (Covin & Slevin, 1989).

This also observes that the OS generates a significant and negative effect on business decline given that the more organic the OS, the lower the likelihood of company decline (B = − 5.1881, t = − 2.6498, p = 0.0081, 95% IC = − 9.0255; − 0.2189). The results also portray how hostile SEs significantly moderate the relationship between OS and decline (B = − 3.5149, t = − 2.0902, p = 0.0366). These results therefore confirm hypothesis H2. Hence, in hostile SE, mechanistic OS positively interrelate with the decline of companies and businesses. The results convey how decline interlinks with structures tend to display mechanistic characteristics and non-decline with more organic organizational structures. According to the literature, the more organic the type of OS, the lower the likelihood of decline in hostile EH (Barker & Mone, 1998; Brown, 2014; Burns & Stalker, 1961), with these results thus in alignment with the literature.

As set out in Fig. 4, the OS effect on company decline slides in keeping with rising levels of hostility in the respective EH; thus, the greater the SE hostility, the lower the effect of OS on company decline. In particular, when there are low levels of hostility in the environment, the more organic OS of companies, the lower their probability of entering into decline. When the EH is high, the lower the impact of OS on reducing the likelihood of company decline whenever such businesses broadly adopt organic OS.

In order to test both hypotheses H3 and H4, model the relationships between the independent variables (SP and OS), and analyze the moderating effect of EH, we applied the linear regression technique (Table 6).

The model accounts for 35.05% (R2 = 0.3505) of the variation in FP arising from the independent variable SP and 26.31% (R2 = 0.2631) of the FP variation as explained by OS, with both results obtaining statistical significance: F = 11.8730, p < 0.001; F = 7.8530, p < 0.001. The moderating effect of EH significantly improved the explanation of the relationship between SP and FP, up 9.71% (R2 = 0.0971, F = 9.8642, p = 0.0025). This confirms how SP generates a significant and positive effect on FP (Table 6); thus, the more entrepreneurial the SP, the higher the level of FP (B = 0.4253, t = 2.6130, p = 0.0111, 95% IC = 0.1003; 0.7504).

In the case of hypothesis H3, the results confirm how conservative SP negatively influence FP. Regarding the EH, the more EH, the greater the influence on FP. The OS endows a significant and positive effect on FP as more strongly organic OS correlates with higher levels of FP (B = 0.3970, t = 2.1005, p = 0.0395, 95% IC = 0.0196; 0.7744). The results demonstrate that EH significantly moderates the relationship between SP and FP (B = 0.5750, t = 3.1407, p = 0,0025). Regarding H4, it is not verified that EH, in a mechanistic OS, leads to poor FP (B = 0.0962, t = 0.4190, p = 0.6766) (Table 7). In an EH, dynamic management capabilities, which necessarily incorporate an entrepreneurial posture, emerge as factors for success in SME performance (Helfat & Martin, 2015; Tehseen & Ramayah, 2015; Sulistyo, 2016).

From this analysis, we may conclude that OS wields a significant effect over FP with more organic OS generating higher levels of FP. According to Covin and Slevin (1989), running organic OS positively interrelates with the performance of small firms in EH, which concurs with the findings of this research study.

As Fig. 5 shows, the effect of SP on FP rises in keeping with rising levels of EH. In particular terms, we may report that SP does not significantly influence FP when EH is low. This influence only emerges and becomes relevant when the level of EH reaches medium or high levels (medium and high levels of effect of the moderating variable, respectively), with the highest level of influence prevailing during periods of high-level EH.

Contributions and Conclusions

Theoretical Contributions

This study set out to contribute towards greater knowledge about the factors leading to the decline of SME, such as the type of environment, the organizational structure, and strategic posture. Despite studies on this theme in the literature, the empirical results remain inconsistent and fragmented (Kücher et al., 2020; Trahms et al., 2013).

The study analyzes financial performance as a relevant factor in assessing the declining situation of companies. The decline may not immediately threaten the financial viability of companies, but it has an impact on their competitiveness and can lead to poor financial performance. The empirical evidence demonstrates that an entrepreneurial strategic posture and an organic organizational structure positively enhance financial performance in addition to countering the threat of decline. The findings also verify the existence of a positively significant relationship between hostility in the environment and decline; thus, the more hostile the environment, the greater the propensity for decline.

Therefore, this study emphasizes the organizational structure’s role in shaping decline, providing evidence that the more mechanistic the organizational structure, the greater the propensity for the companies to enter into decline. The literature suggests that the main causes of business decline stem from internal organizational weaknesses as external changes may adversely impact companies whenever there are weaknesses in the organization (Panicker & Manimala, 2015; Scherrer, 2003).

Hence, this sought to identify the strategic means and the appropriate structures to offset these situations of failure. The conclusion points to how an entrepreneurial strategic posture and an organic organizational structure are factors enabling companies to combat the onset of decline.

Practical Contributions

This study holds practical implications for companies in the sense of warning about the potential for decline and highlighting the factors that best enable improvements to performance.

Thus, the findings suggest the need to redefine entrepreneurial strategies, implement organic organizational structures, and ensure consistent strategic planning in alignment with the environment. The twenty-first century business environment, characterized by profound changes, ambiguity, complexity, and turbulence, presents only threats to the profitability and survival of companies. However, opportunities arise that could help companies succeed.

Limitations and Future Lines of Research

Through this study, we sought to respond to the research questions on the factors explaining the decline of SME. This simultaneously set out to verify how the strategic posture and/or the organizational structure contribute to levels of SME performance in hostile environments. In brief, this signposts those factors that enable the identification of means to improve strategic and structural procedures within the scope of raising performance standards and overcoming situations of SME failure.

Two factors emerge as capable of preventing the decline of SME: an entrepreneurial strategic posture and an organic style of management characterized by dynamism, decentralization, and control over the objectives. However, this study displays certain limitations. Firstly, the limited scale of the sample may affect the generalization of these results. Secondly, the sample, despite only containing SME, is heterogeneous and correspondingly contains responses from very micro firms and SME. We did not consider this aspect within the scope of this study despite the particularities associated with company size. Thirdly, we could not determine the intensity of the severity of the decline of survey respondents. Finally, we obtained responses only for the period of the global financial crisis, which broke out in 2008 and led to a fairly environment hostility.

Despite the contributions of this study in both theoretical and practical terms, a great deal of research is still required to deepen the knowledge of the causes triggering the decline of SME. In this context, lines of future research should extend to wider-reaching studies, preferably sector-based, to corroborate or contradict the results obtained here. Analysis should also focus on companies in decline in accordance with their scales: micro, small, and medium-sized companies to ensure the literature covers the aspects intrinsic to each particular group. The research should contain wide-reaching empirical studies of companies entering decline but experiencing different levels of severity and accompanied by companies in different phases of their turnaround processes, companies that go on to achieve success and those that succumb to the adversities prevailing and enter into bankruptcy.

References

Abebe, M., Angriawan, A., & Ruth, D. (2012). Founder-CEOs, external board appointments, and the likelihood of corporate turnaround in declining firms. Journal of Leadership & Organizational Studies, n., 19, 273–283.

Ahsan, T., Wang, M., & Qureshi, M. (2016). How do they adjust their capital structure along their life cycle? An empirical study about capital structure over life cycle of Pakistani firms. Journal of Asia Business Studies, 10(3), 276–302.

Alareeni, B., & Branson, J. (2013). Predicting listed companies’ failure in Jordan using Altman models: A case study. International Journal of Business and Management, 1, 113–126.

Altman, E. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, XXIII(4), 589–609.

Altman, E., Danovi, A., & Falini, A. (2013). Z-score models’ application to Italian companies subject to extraordinary administration. Journal of Applied Finance, 23(1), 128–137.

Amoah, J., Jibril, A., Luki, B., Odei, M., & Yawson, C. (2021). Barriers of SMEs’ sustainability in sub-Saharan Africa: A PLS-SEM approach. International Journal of Entrepreneurial Knowledge, 9(1), 10–24. https://doi.org/10.37335/ijek.v9i1.129

Angelova, B., Petroska-Angelovska, N., & Ackovska, M. (2017). Possibilities for managing financial Crises of Macedonian Companies. Journal of Accounting and Finance, 2017(Special Issue), 106–115. https://doi.org/10.25095/mufad.402533.

Asgary, A., Ozdemir, A., & Özyürek, H. (2020). Small and medium enterprises and global risks: Evidence from manufacturing SMEs in Turkey. International Journal Disaster Risk Science, 11, 59–73.

Balan, M. (2012). Stochastic methods for prediction of the bankruptcy risk of SMEs. Procedia Economics and Finance, 3, 125–131.

Banerjee, B., & Ćirjaković, J. (2021). Firm Indebtedness, Deleveraging, and Exit: The Experience of Slovenia during the Financial Crisis, 2008–2014. Eastern European Economics, 59(6), 537–570. https://doi.org/10.1080/00128775.2021.1966310

Barker, V. (2005). Traps in diagnosing organization failure. The Journal of Business Strategy, 26(2), 44–50.

Barker, V., & Mone, M. (1998). The mechanistic structure shift and strategic reorientation in declining firms attempting turnaround. Human Relations, 51(10), 1227–1258.

Behling, G., & Lenzi, F. (2019). Entrepreneurial competencies and strategic behavior: A study of micro entrepreneurs in an emerging country. Brazilian Business Review, 16(3), 255–272.

Beke, J. (2010). Accounting management by international standards. International Journal of Business and Management, 5(5), 36–43.

Bernini, F., Mariani, G., & Panaro, D. (2013). The corporate governance drivers: What relations with performance and risk? Empirical evidence from Italian context. Corporate Ownership Et Control, 10(4–5), 510–523.

Brown, A. (2014). Organizational paradigms and sustainability in excellence: From mechanistic approaches to learning and innovation. International Journal of Quality and Service Sciences, 6(2/3), 190–181.

Bumgardner, M., Buehlmann, U., Schuler, A., & Crissey, J. (2011). Competitive actions of small firms in a declining market. Journal of Small Business Management, 49(4), 578–598.

Burns, T., & Stalker, G. (1961). The management of innovation. Tavistock.

Campello, M., Graham, J., & Harvey, C. (2010). The real effects of financial constraints: Evidence from a financial crisis. Journal of Financial Economics, 97(3), 470–487.

Celli, M. (2015). Can Z-score model predict listed companies’ failures in Italy? An empirical test. International Journal of Business and Management, 10(3), 57–66.

Chen, Y., Jiang, Y., Wang, C., & Chung Hsu, W. (2014). How do resources and diversification strategy explain the performance consequences of internationalization? Management Decision, 52(5), 915–897.

Cho, H., Jeong, I., Kim, E., & Cho, J. (2022). Achieving superior performance in international markets: The roles of organizational agility and absorptive capacity. Journal of Business & Industrial Marketing. https://doi.org/10.1108/JBIM-09-2021-0425

Chowdhury, D., & Lang, J. (1993). Crisis, decline, and turnaround: A test of competing hypotheses for short-term performance improvement in small firms. Journal of Small Business Management, 31(4), 8–17.

Chowdhury, S., & Lang, J. (1996). The decline of small firms: A preliminary investigation into the concept of complacency. Canadian Journal of Administrative Sciences, 13(4), 321–331.

Collett, N., Pandit, N., & Saarikko, J. (2014). Success and failure in turnaround attempts. An analysis of SMEs within the Finnish Restructuring of Enterprises Act. Entrepreneurship & Regional Development, 26(1–2), 123–141.

Colvin, M., & Maravelias, C. (2011). R&D pipeline management: Task interdependencies and risk management. European Journal of Operational Research, 215(3), 616–628.

Costa, W., Macedo, M., Yokoyama, K., & Almeida, J. (2017). The determinants of the life cycle stages of Brazilian public companies: A study based on financial-accounting variables. Brazilian Business Review, 14(3), 304–320.

Covin, J., & Slevin, D. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10(1), 75–87.

Crisan-Mitra, C. (2019). Organizational structure as a factor of development of corporate social responsibility in Romanian companies. Economy, 14(1), 145–159.

Cronbach, L. (1951). Coefficient alpha and the internal structure of tests. Psychometrika, 16(3), 297–334.

Czakon, W., Klimas, P., Tiberius, V., Ferreira, J., Veiga, P., & Kraus, S. (2022). Entrepreneurial failure: Structuring a widely overlooked field of research. Entrepeneurship Research Journal. https://doi.org/10.1515/erj-2021-0328

Decker, C. (2018). Stakeholders’ impact on turnaround performance: The case of German savings banks. Journal of Small Business Management, 56(4), 534–554.

Dele-Ijagbulu, O., Moos, M., & Eresia-Eke, C. (2020). The relationship between environmental hostility and entrepreneurial orientation of small businesses. Journal of Entrepreneurship and Innovation in Emerging Economies, 6(2), 1–16.

Faulks, B., Song, Y., Waiganjo, M., Obrenovic, B., & Godinic, D. (2021). Impact of empowering leadership, innovative work, and organizational learning readiness on sustainable economic performance: An empirical study of companies in Russia during the COVID-19 pandemic. Sustainability, 13(22), 1–27.

Ferreira, J., Azevedo, S., & Cruz, R. (2011). SME growth in the service sector: A taxonomy combining life-cycle and resource-based theories. The Service Industries Journal, 31(2), 251–271.

Ferreira, J., Fernandes, C., & Ratten, V. (2017). Entrepreneurship, innovation and competitiveness: What is the connection? International Journal of Business and Globalisation, 18(1), 73–95.

Frank, H., Gu, W., Kepler, J., & Kessler, A. (2017). Environmental dynamism, hostility, and dynamic capabilities in medium-sized enterprises. The International Journal of Entrepreneurship and Innovation, 18(3), 185–194.

Ghazzawi, I. (2018). Organizational decline: A conceptual framework and research agenda. International Leadership Journal, 10(1), 37–80.

Giaglis, G., & Fouskas, K. (2011). The impact of managerial perceptions on competitive response variety. Management Decision, 49(8), 1257–1275.

Goh, E., Mat Roni, S., & Bannividadmath, D. (2022). Thomas Cook(ed): Using Altman’s z-score analysis to examine predictors of financial bankruptcy in tourism and hospitality businesses. Asia Pacific Journal of Marketing and Logistics, 34(3), 475–487.

Gopinath, C. (2005). Recognizing decline: The role of triggers. American Journal of Business, 20(1), 21–27.

Greiner, L. (1972). Evolution and revolution as organizations grow. Harvard Business Review (July–August), 37–46.

Griffiths, I. (1992). Creative accounting. Routledge.

Hager, M., Galaskiewicz, Bielefeld, & W., & Pins, J. (1996). Tales from the grave organizations’ accounts of their own demise. American Behavioral Scientist, 39(8), 975–994.

Hanks, S., Watson, C., Jansen, E., & Chandler, G. (1994). Tightening the life-cycle construct: A taxonomic study of growth stage configurations in high-technology organizations. Entrepreneurship: Theory and Practice, 18(2), 5–30.

Hassani, A., & Mosconi, E. (2021). Competitive intelligence and absorptive capacity for enhancing innovation performance of SMEs. Journal of Intelligence Studies in Business, 11(1), 19–32.

Helfat, C., & Martin, J. (2015). Dynamic managerial capabilities: Review and assessment of managerial impact on strategic change. Journal of Management, 41(5), 1281–1312.

Ivanova, O., & Castellano, S. (2011). The impact of globalization on legitimacy signals. Baltic Journal of Management, 6(1), 105–123.

Jiang, L., & Li, X. (2010). Discussions on the improvement of the internal control in SMEs. International Journal of Business and Management, 5(9), 214–216.

Johari, N., Mohamad, E., Rahman, N., & Chin, O. (2021). Factoring tangible and intangible resources into small medium enterprise resilient index (SMERi): A novel contribution for SME sustainability. Global Business and Management Research: An International Journal, 13(4), 801–814.

Kahveci, E. (2021). Surviving Covid-19 and beyond: A conceptual framework for SMEs in crisis. Business: Theory and Practice, 22(1), 167–179.

Karahan, M., & Yüzbaşıoğlu, M. (2021). Estimating re-evaluation of the risk report obtained using the Altman Z-score model in mergers with neutrosophic numbers. Neutrosophic Sets and Systems, 43, 54–60.

Katsamba, D., & Pellissier, R. (2021). Organisational innovation success factors that supported survival and growth of businesses. The International Journal of Organizational Innovation, 14(1), 175–191.

Klarner, P., Treffers, T., & Picot, A. (2013). How companies motivate entrepreneurial employees: The case of organizational spin- alongs. Journal of Business Economics, 83(4), 319–355.

Kosmidis, K., & Terzidis, K. (2011). Manipulating an IRB model: Considerations about the Basel II framework. EuroMed Journal of Business, 6(2), 174–191.

Koyuncugil, A., & Ozgulbas, N. (2012). Financial early warning system model and data mining application for risk detection. Expert Systems with Applications, 39(6), 6238–6253.

Kraus, S., Moog, P., Schlepphorst, S., & Raich, M. (2013). Crisis and turnaround management in SMEs: A qualitative-empirical investigation of 30 companies. International Journal of Entrepreneurial Venturing, 5(4), 406–430.

Kücher, A., Mayr, S., Mitter, C., Duller, C., & Feldbauer-Durstmüller, B. (2020). Firm age dynamics and causes of corporate bankruptcy: Age dependent explanations for business failure. Review of Managerial Science, 14, 633–661.

Lee, J., Johnson, K., Gahring, S., & Lee, S. (2008). Business strategies of independent retailers: Effects of environmental hostility. Journal of Small Business and Entrepreneurship, 21(3), 277–291.

Lester, D. L., & Tran, T. T. (2008). Information Technology Capabilities: Suggestions for SME growth. Journal of Behavioral and Applied Management, 10(1), 72–88. https://doi.org/10.21818/001c.17169

Levie, J., & Lichtenstein, B. (2010). A terminal assessment of stages theory: Introducing a dynamic states approach to entrepreneurship. Entrepreneurship Theory and Practice, 34(2), 317–350.

Li, Y. (2015). SMEs and Entrepreneurial Finance in OECD Countries: Good Practice and Lessons Learned. Journal of Law and Governance, 10(2), 31–36. https://doi.org/10.1080/00128775.2021.1966310

Liang, X., Barker, V., & Schepker, D. (2018). Chief executive cognition, turnaround strategy and turnaround attempts of declining firms. Journal of Change Management, 18(4), 304–326.

Lichtenstein, G., & Lyons, T. (2008). Revisiting the business life-cycle: Proposing an actionable model for assessing and fostering entrepreneurship. Entrepreneurship and Innovation, 9(4), 241–250.

Lizarzaburu, E., Burneo, K., & Berggrun, L. (2021). Risk of insolvency and return of shares: Empirical analysis of Altman’s Z-score in the Peruvian mining sector between 2008 and 2018. Universidad & Empresa, 23(40), 1–33.

Makkonen, H., Pohjola, M., Olkkonen, R., & Koponen, A. (2014). Dynamic capabilities and firm performance in a financial crisis. Journal of Business Research, 67, 2707–2719.

Marwa, S., & Zairi, M. (2008). An exploratory study of the reasons for the collapse of contemporary companies and their link with the concept of quality. Management Decision, 46(9), 1342–1370.

Mayr, S., & Lixl, D. (2019). Restructuring in SMEs-A multiple case study analysis. Journal of Small Business Strategy, 29(1), 85–98.

Mayr, S., Mittera, C., Kucher, A., & Dullerc, C. (2021). Entrepreneur characteristics and differences in reasons for business failure: Evidence from bankrupt Austrian SMEs. Journal of Small Business & Entrepreneurship, 33(5), 539–558.

McKinley, W., Latham, S., & Braun, M. (2014). Organizational decline and innovation: Turnarounds and downward spirals. The Academy of Management Review, 39(1), 88–110.

Miller, D., & Friesen, P. (1983). Successful and unsuccessful phases of the corporate life cycle. Organization Studies, 4, 339–356.

Miller, D., & Friesen, P. (1984). A longitudinal study of the corporate life cycle. Management Science, 30(2), 1161–1183.

Milošević, I., Mihajlović, I., & Stojanović, A. (2019). Dominant factors of SMEs failure – multigroup confirmatory factor analysis. Serbian Journal of Management, 14(2), 345–360.

Mintzberg, H. (1979). The structuring of organizations. Prentice-Hall.

Mone, M., McKinley, W., & Barker, V. (1998). Organizational decline and innovation: A contingency framework. The Academy of Management Review, 23(1), 115–132.

Mrockova, N. (2022). Resolving SME insolvencies: an analysis of new Chinese rules. Journal of Corporate Law Studies, 22(1), 469–503. https://doi.org/10.1080/14735970.2022.2043543

O’Kane, C., & Cunningham, J. (2014). Turnaround leadership core tensions during the company turnaround process. European Management Journal, 32, 963–980.

Obiajunwa, C. (2013). Skills for the management of turnaround maintenance projects. Journal of Quality in Maintenance Engineering, 19(1), 61–73.

Oliver, J. (2017). Is «transgenerational response» a hidden cause of failed corporate turnarounds and chronic underperformance? Strategy and Leadership, 45(3), 23–29.

Owalla, B., Gherhes, C., Vorley, T., & Brooks, C. (2022). Mapping SME productivity research: A systematic review of empirical evidence and future research agenda. Small Business Economics, n., 58, 1285–1307.

Pandelica, I., Pandelica, A., & Dabu, B. (2010). The response of organizations in crisis conditions. Journal of American Academy of Business, 15(2), 151–160.

Panicker, S., & Manimala, M. (2015). Successful turnarounds: The role of appropriate and entrepreneurial strategies. Journal of Strategy and Management, 8(1), 21–40.

Papaoikonomou, E., Segarra, P., & Li, X. (2012). Entrepreneurship in the context of crisis: Identifying barriers and proposing strategies. International Advances in Economic Research, n., 18, 111–119.

Pedauga, L., Sáez, F., & Delgado-Márquez, B. (2022). Macroeconomic lockdown and SMEs: The impact of the COVID-19 pandemic in Spain. Small Business Economics, n., 58, 665–688.

Peterson, R. (1994). A meta-analysis of Cronbach’s coefficient alpha. Journal of Consumer Research, 21(2), 381–391.

Petráková, Z., Okręglicka, K., Maňák, R., & Fialová, V. (2021). Generation disparities on the perception of SMEs business risks. International Journal of Entrepreneurial Knowledge, 9(2), 32–48.

Phelps, R., Adams, R., & Bessant, J. (2007). Life cycles of growing organizations: A review with implications for knowledge and learning. International Journal of Management Reviews, 9(1), 1–30.

Prasad, E., & Rajan, R. (2006). Modernizing China’s growth paradigm. American Economic Review, 96(2), 331–336.

Pretorius, M. (2008). When Porter’s generic strategies are not enough: Complementary strategies for turnaround situations. Journal of Business Strategy, 29(6), 19–28.

Qureshi, A., Rizwan, M., Ahmad, G., & Ashraf, D. (2022). Russia–Ukraine war and systemic risk: Who is taking the heat? Finance Research Letters, 48, 103036. https://doi.org/10.1016/j.frl.2022.103036

Radivojac, G., Krčmar, A., Mekinjić, B., Zbornik, R., Ekonomskog, F., & Istočnom, S. (2021). Comparison of Altman’s Z-score model and Altman’s Z’-score model on the sample of companies whose shares are included in the Republic of Srpska stock exchange index. Business Source Complete, n., 22, 11–21.

Rasheed, H. (2005). Turnaround strategies for declining small business: The effects of performance. Journal of Developmental Entrepreneurship, 10(3), 239–252.

Rico, M., Pandit, N., & Puig, F. (2021). SME insolvency, bankruptcy, and survival: An examination of retrenchment strategies. Small Business Economics, n., 57, 111–126.

Robbins, D., & Pearce, J. (1992). Turnaround: Retrenchment and recovery. Strategic Management Journal, 13(4), 287–309.

Rosslyn-Smith, W., De Abreu, N., & Pretorius, M. (2020). Exploring the indirect costs of a firm in business rescue. South African Journal of Accounting Research, 34(1), 24–44.

Santana, M., Cabrera, R., & González, J. (2018). Sources of decline, turnaround strategy and HR strategies and practices: The case of Iberia Airlines. Economic and Industrial Democracy, 40(3), 1–28.

Scherrer, P. (2003). Management turnarounds: Diagnosing business ailments. Corporate Governance, 3(4), 52–62.

Seybert, N. (2010). R&D capitalization and reputation driven real earnings management. The Accounting Review, 85(2), 671–693.

Sila, I. (2010). Do organisational and environmental factors moderate the effects of Internet-based interorganisational systems on firm performance? European Journal of Information Systems, 19(5), 581–600.

Slatter, S., & Lovett, D. (1999). Corporate turnaround. Penguin Books.

Soininen, J., Puumalainen, K., Sjögrén, H., & Syrjä, P. (2012). The impact of global economic crisis on SMEs. Management Research Review, 35(10), 927–944.

Sorensen, J., & Stuart, T. (2000). Aging, obsolescence, and organizational innovation. Administrative Science Quarterly, 45(1), 81–112.

Steinker, S., Pesch, M., & Hoberg, K. (2016). Inventory management under financial distress: An empirical analysis. International Journal of Production Research, 54(17), 5182–5207.

Stokes, D., & Blackburn, R. (2002). Learning the hard way: The lessons of owner managers who have closed their businesses. Journal of Small Business and Enterprise Development, 9(1), 17–27.