Abstract

This study has reviewed the literature related to corporate governance (CG) and blockchain technology (BCT). Theoretical and conceptual arguments are used to develop the link between CG mechanisms and BCT. The author identifies that BCT helps firms in reducing the unethical and harmful effects of entrenched managers and the information asymmetry between management and shareholders in firms. BCT, which is a distributed and decentralised ledger for recording transactions, does this by providing an advanced level of security, accuracy, transparency, and accountability in record-keeping. Thus, BCT has the potential to lower agency costs and the roles and functions of traditional CG practices in firms. However, empirical studies on this particular area are scant. Therefore, this study proposed a model for future researchers to test empirically that develops a mechanism between CG practices and BCT. This study will raise awareness among shareholders, practitioners, and policymakers about the need and importance of inducting BCT and modifying CG mechanisms in order for them to survive and be competitive.

Similar content being viewed by others

Data Availability

Data sharing not applicable to this article as no datasets were generated or analysed during the current study.

Notes

The costs of monitoring corporate insiders when they ignore the assumption of optimising corporate wealth and invest assets in wasteful projects that lower the firm’s value (Jensen, 1986).

For example, the term IT governance is used in the literature and is described as a set of procedures used to manage information technology through an organisation, that is, information technology alignment with business objectives, provision of resources for IT projects, and control IT performance (Bowen et al., 2007; Kaplan, 2005).

This study analyzed 129 English-language studies published from 1972 to 2021. No strict guidelines or selection criteria are established for reviewing the literature other than time constraints and language requirements. This study has employed the online database library for its literature search. This includes peer-reviewed, well-catalogued publication databases like Elsevier or Science Direct, Sage Publications, Emerald, Springer, Taylor & Francis, EBSCO Host, JSTOR, Oxford Journals, and Web of Science. The following keywords were used for literature searches, either separately or in combination, across all sources: Blockchain Technology (BCT), corporate governance, firm performance, firm value, determinants, the board size, BOD, board independence, CEO, CEO duality, managers, ownership, agency theory, agency cost, managerial entrenchment, investor protection, shareholder rights, creditor rights, information asymmetry, ownership, private firms, public firms, the major hypothesis regarding corporate governance, firm value, Tobin-Q and many other.

For more details on how BCT works, please see Yermack (2017, p. 10–17).

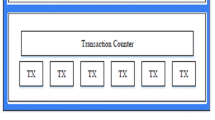

According to Franks (2019, 2020), BCT stores data in three phases, BC 1.0, BC 2.0 and BC 2.0. BC 1.0 enabled cryptocurrency-based financial transactions and payments, starting with Bitcoin. The nodes on the distributed network include financial transactions that took place in the first phase. Financial transactions from the first phase are included among the nodes on the dispersed network. These nodes can be full nodes and light nodes. Full nodes keep track of the entire transaction list, whereas light nodes keep track of the partial transaction list. Miners make blocks by arranging transactions and submitting these blocks for authorization to the network. Miners are paid for their work, and the network is extended using authenticated blocks. When Ethereum offered smart contracts distributed apps that run on top of a BC, BC 2.0 was born. Ethereum also launched solidity, a contract-based programming language for smart contracts (Kasireddy, 2017). Smart contracts enable the creation of agreements for multi-signature wallets, blind auctions, voting, crowdsourcing, and other uses. Whenever a set of regulations is followed, as when opposing sides execute a contract, smart contracts perform transactions (agreements). Interoperability with other systems and services via the BCT network is a requirement in BC 3.0. This phase of BCT introduces BC as a service (BaaS), a model in which existing businesses pool customer services with respective assets. Clients can design, store, and use their own BC apps, smart contracts, and services using cloud-based alternatives. All of the tasks and operations required to keep the infrastructure nimble and operational are managed by the cloud-based service provider. Clients can make nodes of hyperledger fabric (things like desktops or laptops etc.) and link them to a BC network using cloud-based vendors' BC solutions.

A technology, which is home to global payments, digital money, and applications. The community has created a thriving digital economy, innovative ways for creators to make money online, and more.

The Frankfurt Deutsche Borse and the US NASDAQ are among the beginners to investigate the use of BCT in stock markets (see, for example, Hope and Casey (2015) and Anna (2015)). In 2016, the Estonian Stock Exchange did an experiment to cast shareholder votes using BCT. Irrera and Kelly (2017) stated in their study that the stock exchanges worldwide, including the Australian securities exchange, London stock market, NASDAQ, Korean stock market, and Tallinn stock market, have executed BCT. NASDAQ’s Linq and LSE offer the transfer of shares among investors, employees, and founders to companies. These facilities allow their clients to register the firm’s ownership online, thus decreasing the settlement involved in the supply of shares and reducing the need of using paper shares (Petrasic & Bomfreund, 2016). BCT has been the most widely used in Australia in the area of corporate finance. The Sydney Stock Exchange announced in January 2016 that it is planning to modify its settlement and clearing system using BCT.

Some of the scandals due to these issues are documented by Yermack (2017) include the LIBOR manipulation (2011), foreign exchange front-running (2013), gold and silver fixing (2014), NASDAQ odd-eighths (1994), after-hours mutual fund trading (2003), and the technology stock IPO (2002).

Grover et al. (2019) found BCT diffusion in various industries. They have reported that innovative decision-making processes (knowledge, persuasion, decision, implementation, and assurance) vary across industries. Tijan et al. (2019) stated that the logistics sector uses BCT extensively. They argued that logistic challenges such as cargo damage, omissions, order delays, incorrect carts, and data entry errors are greatly reduced with the use of BCT.

Akgiray (2019) and Franks (2020) have further divided these two types of BCT into four sub-categories. Public permission-less: open to anyone, and anyone can write and commit. Public permissioned: open to anyone, and only authorised persons can write and commit. The consortium: restricted to an authorised set of participants, and only authorised persons can write and commit. Private permissioned: a fully private or limited set of authorised nodes and only the network operator can write and commit.

Due to mandatory disclosure requirements, record-keeping, and specific requirements of the stock exchange for public firms, it is hard to fully implement the BCT in private firms (Sing et al., 2019). Recording financial data on the public BC makes the transactions more transparent and reduces manipulation in accrual earning management and other financial reporting–related activities (Yermack, 2017). Through public BCT, the information related to the transfer of share ownership, acquisitions of shares, and liquidating assets becomes much more transparent and is easily available at a lower cost.

BCT uses a “chain of blocks” to record data, which is usually updated by several participants in an open-source network (Nakamoto, 2008). Since “rewrite history” or changing entries by the participant is impossible, and the BCT is updating information on a continuous (daily) basis thus, manipulations become difficult and getting real-time data by the participant is much easier (Bystrom, 2019).

Singh et al. (2019) investigated BC acceptance through the technology acceptance model by stakeholders in the context of CG. To check the model fit between the actual behaviour and behavioural intention, they have used structural equation modelling and confirmatory factors analysis. Based on the trading corporate stocks experience, they have selected 223 respondents. They have found a strong association between behavioural intention and actual behaviour, perceived usefulness, and behavioural intention to adopt advanced technology. Jain et al. (2020) conducted a similar study and examined the customer acceptance of BCT in the logistics industry. On the other hand, Franks (2020) has discussed the challenges that organisations face in the adaptation of BCT.

Yermack (2017) provides this information and can be found at; http://www.coindesk.com/kenyan-court-upholds-bid-keep-bitpesa-off-mobilemoney-platform/.

References

Adams, R. B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94(2), 291–309.

Adams, R., Hermalin, B., & Weisbach, M. (2010). The role of boards of directors in corporate governance: A conceptual framework and survey. Journal of Economic Literature, 48(1), 58–107.

Akgiray, V. (2018). Blockchain technology and corporate governance: Technology, markets, regulation and corporate governance. Organisation for Economic Cooperation and Development, DAF/CA/CG/RD (2018), 1.

Akgiray, V. (2019). The potential for blockchain technology in corporate governance. In OECD Corporate Governance Working Papers No. 21.

Akhtar, T., Tareq, M. A., & Rashid, K. (2021). Chief executive officers’ monitoring, board effectiveness, managerial ownership, and cash holdings: Evidence from ASEAN. Review of Managerial Science, 15(8), 2193–2238.

Al-Dhamari, R. A., & Ismail, N. I. K. (2014). An investigation into the effect of surplus free cash flow, corporate governance and firm size on earnings predictability. International Journal of Accounting and Information Management, 22(2), 118–133.

Almatarneh, A. (2020). Blockchain technology and corporate governance: The issue of smart contracts—current perspectives and evolving concerns. Éthique et économique= Ethics and economics, 17(1). https://papyrus.bib.umontreal.ca/xmlui/handle/1866/23114

Amaral-Baptista, M., Klotzle, M., & De Melo, M. (2011). CEO duality and firm performance in Brazil: Evidence from 2008. RPCA Rio De Janeiro, 5(1), 24–37.

Anna, I. (2015). CME and Deustche Bo¨rse Join Blockchain Gang, Financial News, July 20, 2015.

Arnold, V. (2018). The changing technological environment and the future of behavioural research in accounting. Accounting & Finance, 58(2), 315–339.

Arrunada, B., & Garicano, L. (2018). Blockchain: The birth of decentralised governance. Pompeu Fabra University, Economics and Business Working Paper Series 1608. Available at https://econ-papers.upf.edu/papers/1608.pdf Accessed 31.08.19.

Association of Chartered Certified Accountants (ACCA). (2012). 100 Drivers of change for the global accountancy profession. London, UK: ACCA.

AXA. (2017). AXA goes blockchain with fizzy, news release, 13 September 2017. Available at https://www.axa.com/en/newsroom/news/axa-goes-blockchain-with-fizzy

Bhagat, S., & Jefferis, R. (2002). The econometrics of corporate governance studies. MIT Press.

Bhasa, M. P. (2004). Global corporage governance: Debates and challenges. Corporate Governance: The International Journal of Business in Society, 4(2), 5–17.

Boubaker, S., Derouiche, I., & Lasfer, M. (2015). Geographic location, excess control rights, and cash holdings. International Review of Financial Analysis, 42, 24–37.

Bowen, P. L., Cheung, M. Y. D., & Rohde, F. H. (2007). Enhancing IT governance practices: A model and case study of an organisation’s efforts. International Journal of Accounting Information Systems, 8(3), 191–221.

Brennan, N. M., Subramaniam, N., & Van Staden, C. J. (2019). Corporate governance implications of disruptive technology: An overview. The British Accounting Review, 51(6), 100860.

Brickley, J., Coles, J., & Jarrell, G. (1997). Leadership structure: Separating the CEO and chairman of the board. Journal of Corporate Finance, 3(3), 189–220.

Brockmann, E. N., Hoffman, J. J., Dawley, D. D., & Fornaciari, C. J. (2004). The impact of CEO duality and prestige on a bankrupt organisation. Journal of Managerial Issues, 16(2), 178–196.

Byrnes, N., & Der Hovanesian, M. (2002). Earnings: A cleaner look. Business Week, 27, 32–35.

Bystrom, H. (2019). Blockchains, real-time accounting, and the future of credit risk modeling. Ledger, 4, 40–47.

Cadbury. (2000). The corporate governance agenda. Journal of Corporate Governance, Practice Based Papers, 8(2), 7–15.

Cadbury, A. (1992). The Cadbury Committee Reports: Financial aspects of corporate governance. Gee & Co. Ltd, London.

Calderon, M., Lawrence, S., & Churchil, S. (2016). Distributed ledgers: A future in financial services? Journal of International Banking Law and Regulation., 31(5), 246–247.

Capgemini. (2013). Managing city assets: A new perspective; a new model; and transformed value. Available at: www.capgemini.com (Accessed 25 December 2021).

Carter, D. A., D’Souza, F., Simkins, B. J., & Simpson, W. G. (2010). The gender and ethnic diversity of US boards and board committees and firm financial performance. Corporate Governance: An International Review, 18(5), 396–414.

Carter, D. A., Simkins, B. J., & Simpson, W. G. (2003). Corporate governance, board diversity, and firm value. The Financial Review, 38, 33–53.

Chahine, S., & Filatotchev, I. (2008). The effects of information disclosure and board independence on IPO discount. Journal of Small Business Management, 46(2), 219–241.

Chen, G., Crossland, C., & Huang, S. (2016). Female board representation and corporate acquisition intensity. Strategic Management Journal, 37(2), 303–313.

Chen, N., & Yang, T. (2017). Democracy, rule of law, and corporate governance-a liquidity perspective. Economics of Governance, 18(1), 35–70.

Chen, Y.-R. (2008). Corporate governance and cash holdings: Listed new economy versus old economy firms. Corporate Governance: An International Review, 16(5), 430–442.

Christensen, C. M., Raynor, M. E., & McDonald, R. (2015). Disruptive innovation. Harvard Business Review, 93(12), 44–53.

Christidis, K., & Devetsikiotis, M. (2016). Blockchains and smart contracts for the internet of things. IEEE Access, 4, 2292–2303.

Clarke, T. (2009). A critique of the Anglo-American model of corporate governance. CLPE Research Paper, (15/09). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1440853

Cunningham, L. (2006). Too big to fail: Moral hazard in auditing and the need to restructure the industry before it unravels. Columbia Law Review, 106, 1698–1748.

Cygnetise. (2018). Blockchain as a tool for corporate governance. Available at https://www.cygnetise.com/blog/blockchain-as-a-tool-for-corporate-governance

Dahya, J., Dimitrov, O., & McConnell, J. (2008). Dominant shareholders, corporate boards, and corporate value: A cross-country analysis. Journal of Financial Economics, 87(1), 73–100.

Dai, J., & Vasarhelyi, M. A. (2017). Toward blockchain-based accounting and assurance. Journal of Information Systems., 31(3), 5–21.

Daily, C. M., & Dalton, D. R. (1997). CEO and board chair roles held jointly or separately: Much ado about nothing? Academy of Management Executive, 11(3), 11–20.

Daily, C. M., & Dalton, D. R. (2003). Women in the boardroom: A business imperative. Journal of Business Strategy, 24, 8–10.

Danneels, E. (2004). Disruptive technology reconsidered: A critique and research agenda. The Journal of Product Innovation Management., 21(4), 246–258.

Davidson, S., De Filippi, P., & Potts, J. (2016). Disrupting governance: The new institutional economics of distributed ledger technology. Available at SSRN 2811995.

de Oliveira Luna, A. J. H., Kruchten, P., Pedrosa, M. L. G. E., de Almeida Neto, H. R., & de Moura, H. P. (2014). State of the art of agile governance: A systematic review. International Journal of Computer Science & Information Technology, 6(5), 121–141.

Deloitte. (2016). Blockchain technology a game-changer in accounting?. Available at https://www2.deloitte.com/content/dam/Deloitte/mt/Documents/audit/dt_mt_article_blockchain_gamechanger-for-audit-sandro-psaila.pdf

Drees, F., Mietzner, M., & Schiereck, D. (2013). Effects of corporate equity ownership on firm value. Review of Managerial Science, 7(3), 277–308.

Durston, L., Pesce, M., & Wenborn, G. (2018). Governance in a disruptive world. Issue #13. Issues Paper. Sydney: Australian Institute of Company Directors (AICD).

Emerson, K., Nabatchi, T., & Balogh, S. (2011). An integrative framework for collaborative governance. Journal of Public Administration Research and Theory, 22(1), 1–29.

Erhardt, N. L., Werbel, J. D., & Shrader, C. B. (2003). Board of director diversity and firm financial performance. Corporate Governance: An International Review, 11(2), 102–111.

Fama, E. F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288–307.

Fama, E., & Jensen, M. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301–325.

Fearnley, B., & Soohoo, S. (2018). Blockchain: Market spend & trend outlook for 2018 and beyond. IDC.

Fink Bradley. (2017). Blockchain comes to corporate governance with AST proxy voting. Available at https://www.nasdaq.com/articles/blockchain-comes-corporate-governanceast-proxy-voting-2017-05-18

Forbes, D. P., & Milliken, F. J. (1999). Cognition and corporate governance: Understanding boards of directors as strategic decision-making groups. Academy of Management Review, 24(3), 489–505.

Franks, P. (2019). S19 Blockchain technologies applied to government archives and records”, 2019 NAGARA Conference, available at https://www.nagara.org/Public/Events/Meeting_Presentations/2019_NAGARA_Annual_Conference. Accessed 5 Feb 2020.

Franks, P. C. (2020). Implications of blockchain distributed ledger technology for records management and information governance programs. Records Management Journal, 30(3), 287–299. https://doi.org/10.1108/RMJ-08-2019-0047

Gans, J. (2016). The disruption dilemma. The MIT Press.

Goyal, V., & Park, C. (2002). Board leadership structure and CEO turnover. Journal of Corporate Finance., 8(1), 49–66.

Grover, P., Kar, A., & Janssen, M. (2019). Diffusion of blockchain technology. Journal of Enterprise Information Management, 32(5), 735–757.

Gul, F. A., Srinidhi, B., & Ng, A. C. (2011). Does board gender diversity improve the informativeness of stock prices? Journal of Accounting and Economics, 51(3), 314–338.

Haber, S., & Stornetta, W. S. (1990, August). How to time-stamp a digital document. In Conference on the Theory and Application of Cryptography (pp. 437–455). Springer, Berlin, Heidelberg.

Haque, F. (2018). Ownership, regulation and bank risk-taking: Evidence from the Middle East and North Africa (MENA) region. Corporate Governance: The International Journal of Business in Society, 19(1), 23–43.

Heenetigala, K., & Armstrong, A. (2011). The impact of corporate governance on firm performance in an unstable economic and political environment: Evidence from Sri Lanka. Conference on Financial Markets and Corporate Governance, 13, 1–17.

Hope, B., & Casey, M. J. (2015). A bitcoin technology gets Nasdaq test, The Wall Street Journal, May 10, 2015. Available at; https://www.wsj.com/articles/a-bitcoin-technology-gets-nasdaq-test-1431296886

Hopp, C., Antons, D., Kaminski, J., & Salge, T. O. (2018). The topic landscape of disruption research—a call for consolidation, reconciliation, and generalisation. Journal of Product Innovation Management, 35(3), 458–487.

Irrera, A., & Kelly, J. (2017). London stock exchange group tests blockchain for private company share. Available at https://www.reuters.com/article/us-lse-blockchainidUSKBN1A40ME

Jain, G., Singh, H., Chaturvedi, K. R., & Rakesh, S. (2020). Blockchain in logistics industry: In fizz customer trust or not. Journal of Enterprise Information Management, 33(3), 541–558.

Jamali, D., Safieddine, A. M., & Rabbath, M. (2008). Corporate governance and corporate social responsibility synergies and interrelationships. Corporate Governance: An International Review Journal, 16(50), 443–459.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review., 76(2), 323–329.

Johnson, B. T., & Eagly, A. H. (1990). Involvement and persuasion: Types, traditions, and the evidence. Psychological Bulletin., 107(3), 375–384.

Kahan, M., & Rock, E. (2008). The hanging chads of corporate voting. The Georgetown Law Journal., 96, 227–1281.

Kalpana, U. (2018). Top ten issues in corporate governance practices in India. https://www.acc.com/resource-library/top-ten-issues-corporategovernance-practices-india

Kaplan, J. (2005). Strategic IT portfolio management: Governing enterprise transformation. Pittiglio Rabin Todd and McGrath Inc.

Kashyap, R., & Saurav, V. (2021). Blockchain technology: Road to transform the Indian banking sector. Materials Today: Proceedings, https://doi.org/10.1016/j.matpr.2021.02.774

Kasireddy, P. (2017). How does Ethereum work, anyway?. Medium, available at https://medium.com/@preethikasireddy/how-does-ethereum-work-anyway-22d1df506369

Kim, D., & Starks, L. T. (2016). Gender diversity on corporate boards: Do women contribute unique skills? The American Economic Review., 106(5), 267–271.

Kim, K., Kitsabunnarat-Chatjuthamard, P., & Nofsinger, J. (2007). Large shareholders, board independence, and minority shareholder rights: Evidence from Europe. Journal of Corporate Finance, 13(5), 859–880.

Kostyuk, A. (2005). Business innovations and structure of corporate ownership in Ukraine. Corporate Governance: The International Journal of Business in Society, 5(5), 19–29.

Kouaib, A., & Almulhim, A. (2019). Earnings manipulations and board’s diversity: The moderating role of audit. The Journal of High Technology Management Research, 30(2), 100356.

Lafarre, A., & Van der Elst, C. (2018). Blockchain technology for corporate governance and shareholder activism. European Corporate Governance Institute (ECGI)-Law Working Paper, (390).

Lakhal, F., Aguir, A., Lakhal, N., & Malek, A. (2015). Do women on boards and top management reduce EM? Evidence in France. The Journal of Applied Business Research, 31(3), 1107–1118.

Lee, K., & Lee, C. (2009). Cash holdings, corporate governance structure and firm valuation. Review of Pacific Basin Financial Markets and Policies, 12(3), 475–508.

Lee, L. (2016). New kids on the blockchain: How bitcoin’s technology could reinvent the stock market. Hastings Business Law Journal, 12, 81–132.

Lemieux, V. L., Rowell, C., Seidel, M.-D.L., & Woo, C. C. (2020). Caught in the middle? Strategic information governance disruptions in the era of blockchain and distributed trust. Records Management Journal, 30(3), 301–324.

Lepore, L., Paolone, F., Pisano, S., & Alvino, F. (2017). A cross-country comparison of the relationship between ownership concentration and firm performance: Does judicial system efficiency matter? Corporate Governance: The International Journal of Business in Society, 17(2), 321–340.

Letza, S., Kirkbride, J., & Sun, X. (2004). Shareholding versus stakeholding: A critical review of corporate governance. Corporate Governance, 12(3), 242.

Lipton, M., & Lorsch, J. W. (1992). A modest proposal for improved corporate governance. The Business Lawyer, 48(1), 59–77.

Lombardi, R., de Villiers, C., Moscariello, N., & Pizzo, M. (2021). The disruption of blockchain in auditing – a systematic literature review and an agenda for future research. Accounting, Auditing & Accountability Journal. https://doi.org/10.1108/AAAJ-10-2020-4992

MacMillan, K., Money, K., Downing, S., & Hillenbrad, C. (2004). Giving your organisation SPIRIT: An overview and call to action for directors on issues of corporate governance, corporate reputation and corporate responsibility. Journal of General Management, 30(2), 15–42.

McConnell, J., & Servaes, H. (1990). Additional evidence on equity ownership and firm value. Journal of Financial Economics, 27(2), 595–612.

McWaters, R. J., Galaski, R., & Chatterjee, S. (2016). The future of financial infrastructure: An ambitious look at how blockchain can reshape financial services. In World Economic Forum (vol. 49, pp. 368–376).

Morck, R., Shleifer, A., & Vishny, R. W. (1988). Management ownership and market value: An empirical analysis. Journal of Financial Economics, 20(1–2), 293–315.

Morin, R. A., & Jarrell, S. L. (2001). Driving shareholder value, value-building techniques for creating shareholder wealth. McGraw-Hill.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Unpublished manuscript.

Opler, T., Pinkowitz, L., Stulz, R., & Williamson, R. (1999). The determinants and implications of corporate cash holdings. Journal of Financial Economics, 52(1), 3–46.

Petrasic, K., & Bomfreund, M. (2016). Beyond bitcoin: The blockchain revolution in financial services. White & Case.

Piazza, F. S. (2017). Bitcoin and the blockchain as possible corporate governance tools: Strengths and weaknesses. Bocconi Legal Papers, 9, 125.

PolySwarm. (2018). 5 companies already brilliantly using smart contracts. Available at https://medium.com/polyswarm/5-companies-already-brilliantly-using-smart-contracts-ac49f3d5c431

Propy. (2020). Company website, available at https://propy.com/browse/

Rose, C. (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), 404–413.

Rosenstein, S., & Wyatt, J. (1990). Outside directors, board independence, and shareholder wealth. Journal of Financial Economics, 26(2), 175–191.

Ruckeshauser, N. (2017). Do we really want blockchain-based accounting? Decentralised consensus as enabler of management override of internal controls. In J. M. Leimeister & W. Brenner (Eds.), Proceedings of the 13th International Conference on Wirtschaftsinformatik, 12–15 February 2017, (pp. 16–30), St. Gallen, Switzerland.

Schaefer, C., & Edman, C. (2019). Transparent logging with hyperledger fabric. In 2019 IEEE International Conference on Blockchain and Cryptocurrency (ICBC) (pp. 65–69). IEEE.

Schmitz, J., & Leoni, G. (2019). Accounting and auditing at the time of blockchain technology: a research agenda. Australian Accounting Review, 29(2), 331–342.

Schwab, K. (2016). The fourth industrial revolution: What it means, how to respond. Geneva, Switzerland: World Economic Forum. Available at https://www.weforum.org/agenda/2016/01/the-fourth-industrial-revolution-what-it-means-and-how-to-respond/

Shleifer, A., & Vishny, R. (1997). A survey of corporate governance. Journal of Finance, 52(2), 737–783.

Singh, H., Jain, G., Munjal, A., & Rakesh, S. (2019). Blockchain technology in corporate governance: Disrupting chain reaction or not? Corporate Governance, 20(1), 67–86.

Sisli-Ciamarra, E. (2012). Monitoring by affiliated banker son board of directors: Evidence from corporate financing outcomes. Financial Management, 41(3), 665–702.

Steiner, I. D. (1972). Group Process and Productivity. Academic Press.

Tapscott, A., & Tapscott, D. (2017). How blockchain is changing finance. Harvard Business Review, 1(9), 2–5.

Tapscott, D., & Tapscott, A. (2016). Blockchain Revolution (1st ed.). Penguin Random House.

Tassabehji, R., Hackney, R., & Popovič, A. (2016). Emergent digital era governance: Enacting the role of the ‘institutional entrepreneur’ in transformational change. Government Information Quarterly, 33(2), 223–236.

Termeer, C. J. A. M. (2009). Barriers to new modes of horizontal governance: A sensemaking perspective. Public Management Review, 11(3), 299–316.

Tijan, E., Aksentijevi, S., Ivani, K., & Jardas, M. (2019). Blockchain Technology Implementation in Logistics. Sustainability, 11(4), 1185.

Turnbull, S. (1997). Corporate governance: Its scope, concerns and theories. Corporate Governance: An International Review, 5(4), 180–205.

Van der Elst, C., & Lafarre, A. (2017). Bringing the AGM to the 21st century: Blockchain and smart contracting tech for shareholder involvement. European Corporate Governance Institute (ECGI)-Law Working Paper, (358).

Vetasi (2018). IBM maximo for enterprise asset management, available at: https://www.ibm.com/topics/enterprise-assetmanagement?utm_content=SRCWW&p1=Search&p4=43700068838234465&p5=e&gclid=EAIaIQobChMIt4XqkMDN9QIVUed3Ch3pDgSwEAAYASAAEgIGY_D_BwE&gclsrc=aw.dswww.vetasi.com/products/ibm-maximo-eam (Accessed 25 January 2022).

Voegtlin, C., & Scherer, A. G. (2017). Responsible innovation and the innovation of responsibility: Governing sustainable development in a globalised world. Journal of Business Ethics, 143(2), 227–243.

Wang, Y., & Kogan, A. (2017). Designing privacy-preserving blockchain based accounting information systems. Available at SSRN 2978281.

Wang, M. (2016). Idiosyncratic volatility, executive compensation and corporate governance: Examination of the direct and moderate effects. Review of Managerial Science, 10(2), 213–244.

Wunsche, A. (2016). Technological disruption of capital markets and reporting. An introduction to blockchain. Chartered Professional Accountants of Canada (CPA Canada).

Xu, M., Chen, X., & Kou, G. (2019). A systematic review of blockchain. Financial Innovation, 5(1), 27.

Yermack, D. (2015). Corporate governance and blockchains, Working Paper No. w21802, National Bureau of Economic Research, available at : https://www.nber.org/papers/w21802 (Accessed 5 January 2022).

Yermack, D. (2017). Corporate governance and blockchains. Review of Finance, 21(1), 7–31.

Yu, H., Sopranzetti, B., & Lee, C. (2015). The impact of banking relationships, managerial incentives, and board monitoring on corporate cash holdings: An emerging market perspective. Review of Quantitative Finance and Accounting, 44(2), 353–378.

Zachariadis, M., Hileman, G., & Scott, S. V. (2019). Governance and control in distributed ledgers: Understanding the challenges facing blockchain technology in financial services. Information and Organization, 29(2), 105–117.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Akhtar, T. Blockchain Technology: the Beginning of a New Era in Reforming Corporate Governance Mechanisms. J Knowl Econ (2023). https://doi.org/10.1007/s13132-023-01289-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-023-01289-7