Abstract

This study investigates the presence of a non-linear relationship between market concentration and bank risk-taking using a balanced dataset of 78 European commercial banks during the period 2006 to 2016. In order to test the hypothesis of non-linearity, this study applies the threshold estimation technique developed by Hansen (1999). We choose the non-performing loans ratio, the loan loss provision ratio to measure credit risk, and the cat-nonfat to proxy liquidity risk.

Our main findings are twofold. The outcome of our analysis indicates that the threshold effect indeed exists. Moreover, our results suggest that there is a significant positive relationship between market concentration and bank credit risk. This positive impact is diminished when the level of market concentration is above a certain threshold. Overall, this study finds evidence that banks’ risk-taking behavior varies under different levels of market concentration. The results are robust under additional tests. These findings have strong implications for regulators.

Similar content being viewed by others

References

Allen, F., & Gale, D. (2004). Competition and financial stability. Journal of Money, Credit and Banking, 36(3), 454–480.

Asongu, S. A. (2015). Financial sector competition and knowledge economy: Evidence from SSA and MENA countries. Journal of the Knowledge Economy, 6, 717–748.

Bahri, F., & Hamza, T. (2020). The impact of market power on bank risk-taking: An empirical investigation. Journal of the Knowledge Economy, 11, 1198–1233.

Balboa, M., López-Espinosa, G., & Rubia, A. (2013). Nonlinear dynamics in discretionary accruals: An analysis of bank loan-loss provisions. Journal of Banking and Finance, 37(12), 5186–5207.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2006). Bank concentration, competition, and crises: First results. Journal of Banking and Finance, 30(5), 1581–1603.

Behr, P., Schmidt, R., & Xie, R. (2009). Market structure, capital regulation and bank risk taking. Journal of Financial Services Research, 37(2–3), 131–158.

Berger, A., & Bouwman, C. (2009). Bank liquidity creation. Review of Financial Studies, 22(9), 3779–3837.

Berger, A., & Bouwman, C. (2013). How does capital affect bank performance during financial crises? Journal of Financial Economics, 109(1), 146–176.

Berger, A., & Bouwman, C. (2017). Bank liquidity creation, monetary policy, and financial crises. Journal of Financial Stability, 30, 139–155.

Berger, A., Klapper, L. F., & Turk-Ariss, R. (2009). Bank competition and financial stability. Journal of Financial Services Research, 35, 99–118.

Bick, A. (2010). Threshold effects of inflation on economic growth in developing countries. Economics Letters, 108(2), 126–129.

Boyd, J., & De Nicoló, G. (2005). The theory of bank risk taking and competition revisited. Journal of Finance, 60(3), 1329–1343.

Boyd, J., De Nicoló, G., & Jalal, A. (2009). Bank competition, risk and asset allocations. IMF Working paper.

Campanella, F., Della Peruta, M. R., & Del Giudice, M. (2017). The effects of technological innovation on the banking sector. Journal of the Knowledge Economy, 8, 356–368.

Chen, M., Wu, J., Jeon, B., & Wang, R. (2017). Monetary policy and bank risk taking: Evidence from emerging economies. Emerging Markets Review, 31, 116–140.

Dam, L., & Koetter, M. (2012). Bank bailouts and moral hazard: Evidence from Germany. Review of Financial Studies, 25(8), 2343–2380.

Demirgüç-Kunt, A., & Huizinga, H. (2010). Bank activity and funding strategies: The impact on risk and returns. Journal of Financial Economics, 98(3), 626–650.

De Nicoló, G., Jalal, A., & Boyd, J. (2006). Bank risk-taking and competition revisited: New theory and new evidence. IMF Working Paper.

De Nicoló, G., & Loukoianova, E. (2007). Bank ownership, market structure, and risk. IMF Working paper.

De Nicoló, G., & Lucchetta, M. (2009). Financial Intermediation, competition, and risk: A general equilibrium exposition. IMF Working paper.

Diamond, D., & Rajan, R. (2001). Liquidity risk, liquidity creation and financial fragility: A theory of banking. Journal of Political Economy, 109(2), 287–327.

Distinguin, I., Roulet, C., & Tarazi, A. (2013). Bank regulatory capital buffer and liquidity: Evidence from US and European publicly traded banks. Journal of Banking and Finance, 37(9), 3295–3317.

Ghardallou, W. (2022). Financial system development and democracy: A panel smooth transition regression approach for developing countries. Journal of the Knowledge Economy. https://doi.org/10.1007/s13132-022-00988-x

González, L., Razia, A., Búa, M., & Sestayo, R. (2017). Competition, concentration and risk taking in Banking sector of MENA countries. Research in International Business and Finance, 42, 591–604.

Gujarati, D., & Porter, D. (2012). Essentials of econometrics. Fourth Edition, Irwin/McGraw-Hill.

Haffoudhi, H., & Bellakhal, R. (2020). Threshold effect of globalization on democracy: The role of demography. Journal of the Knowledge Economy, 11, 1690–1707.

Hamdi, B., Abdouli, M., Ferhi, A., Aloui, M., & Hammami, S. (2019). The stability of Islamic and conventional banks in the MENA region countries during the 2007–2012 financial crisis. Journal of the Knowledge Economy, 10, 365–379.

Hansen, B. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. Journal of Econometrics, 93(2), 345–368.

Hassen, T., Fakhri, I., Bilel, A., Wassim, T., & Faouzi, H. (2018). Dynamic effects of mergers and acquisitions on the performance of Commercial European Banks. Journal of the Knowledge Economy, 9, 1032–1048.

Hellmann, T., Murdock, K., & Stiglitz, J. (2000). Liberalization, moral hazard in banking, and prudential regulation: Are capital requirements enough? American Economic Review, 90(1), 147–165.

Horváth, R., Seidler, J., & Weill, L. (2013). Bank capital and liquidity creation: Granger-Causality evidence. Journal of Financial Services Research, 45(3), 341–361.

Imbierowicz, B., & Rauch, C. (2014). The relationship between liquidity risk and credit risk in banks. Journal of Banking and Finance, 40, 242–256.

Jiménez, G., Lopez, J., & Saurina, J. (2013). How does bank competition affect bank risk-taking? Journal of Financial Stability, 9(2), 185–195.

Jiménez, G., Saurina, J., Ongena, S., & Peydro, J. (2014). Hazardous times for monetary policy: What do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking?’. Econometrica, 82(2), 463–505.

Kasman, S., & Kasman, A. (2015). Bank competition, concentration and financial stability in the Turkish banking industry. Economic Systems, 39(3), 502–517.

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2006). Governance matters V: Aggregate and individual governance indicators for 1996–2005. World Bank Policy Research Working Paper, No.4012.

Keely, M. C. (1990). Deposit insurance, risk, and market power in banking. American Economic Review, 80, 1183–1200.

Khan, M., Scheule, H., & Wu, E. (2017). Funding liquidity and bank risk taking. Journal of Banking and Finance, 82, 203–216.

Laeven, L., & Majnoni, G. (2003). Loan loss provisioning and economic slowdowns: Too much, too late? Journal of Financial Intermediation, 12(2), 178–197.

Law, S., Azman-Saini, W., & Ibrahim, M. (2013). Institutional quality thresholds and the finance – Growth nexus. Journal of Banking and Finance, 37(12), 5373–5381.

Liu, H., Molyneux, P., & Nguyen, L. (2011). Competition and risk in the south East Asian commercial banking. Applied Economics, 44(28), 3627–3644.

Marquez, R. (2002). Competition, adverse selection, and information dispersion in the banking industry. Review of Financial Studies, 15(3), 901–926.

Martinez-Miera, D., & Repullo, R. (2010). Does competition reduce the risk of bank failure? Review of Financial Studies, 23(10), 3638–3664.

Mishkin, S., & F. (1999). Financial consolidation: Dangers and opportunities. Journal of Banking and Finance, 23(2–4), 675–691.

Paligorova, T., & Santos, J. (2017). Monetary policy and bank risk-taking: Evidence from the corporate loan market. Journal of Financial Intermediation, 35, 35–49.

Pana, E., Park, J., & Query, T. (2010). The impact of mergers on liquidity creation. Journal of Risk Management in Financial Institutions, 4, 74–96.

Repullo, R. (2004). Capital requirements, market power and risk-taking in banking. Journal of Financial Intermediation, 13(2), 156–182.

Tabak, B., Gomes, G., & da Silva Medeiros, M. (2015). The impact of market power at bank level in risk-taking: The Brazilian case. International Review of Financial Analysis, 40, 154–165.

Uhde, A., & Heimeshoff, U. (2009). Consolidation in banking and financial stability in Europe: Empirical evidence. Journal of Banking and Finance, 33(7), 1299–1311.

Younsi, M., & Nafla, A. (2019). Financial stability, monetary policy, and economic growth: Panel data evidence from developed and developing countries. Journal of the Knowledge Economy, 10, 238–260.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

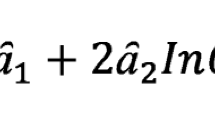

Appendices

Appendix 1

Appendix 2

Rights and permissions

About this article

Cite this article

Abdesslem, R.B., Dabbou, H. & Gallali, M.I. The Impact of Market Concentration on Bank Risk-Taking: Evidence from a Panel Threshold Model. J Knowl Econ 14, 4170–4194 (2023). https://doi.org/10.1007/s13132-022-01028-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-022-01028-4