Abstract

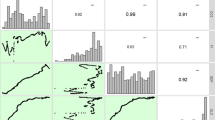

This study aims to investigate the relationships between economic growth, foreign direct investment (FDI) inflows, environment quality, and financial development for Middle East countries using simultaneous equation models over the period 1980–2014. Our empirical results pointed out that there is a unidirectional causality running from financial development to CO2 emissions. However, the results support the occurrence of bidirectional causality from CO2 emissions and economic growth, a bidirectional causal relationship between FDI inflows and CO2 emissions, and a bidirectional causal relationship between FDI inflows, economic growth, and financial development for the global panel. The study suggests that financial systems should take into account environmental aspects in their current operations in these countries. In addition, it is obligatory for Middle East countries to adopt sound financial, foreign, and economic policies to promote economic growth, protect the environment, with strong FDI inflows and a higher level of financial development.

Similar content being viewed by others

Notes

The unidirectional hypothesis is supported when three variables affect the remaining variable. The latter validate the conservation hypothesis.

Bidirectional hypothesis supports the interrelationship between economic growth, FDI inflows, environment, and financial development since four variables affect each other. This encourages the implementation of a sound economic, foreign, and financial policy to improve environmental quality.

In the same context, Desbordes and Wei (2014) used panel data analysis to test the relation between financial development and inward FDI for 67 developed and developing countries. The empirical results show that there is a conditional relation between financial development and FDI inflows. This implies that the FDI inflow increase in the level of financial development in the financial sector is very vulnerable.

Neutrality hypothesis suggests no causality between economic growth, FDI inflows, environment, and financial development. This implies that three variables may not affect the remaining variable.

This result is consistent with the classical trade perspective of comparative advantage theory and considered the environment as another factor of production. However, this perspective shows that developing countries applied low environmental regulation to attract more FDI inflows. This implies that FDI inflows have a comparative advantage to invest in pollution production (Hassaballa 2014; Shahbaz et al. 2013a, b, c).

This is in line with the neo-technology theories of trade which show that there is a positive relationship between FDI inflows and environment. This implies that FDI inflows used the technology with respect to the environment because of the strict environmental laws, which validate the pollution halo hypothesis (Doytch 2012; Hassaballa 2014).

A wealthy nation can afford to spend more on R&D technological progress which occurs with economic growth, and the dirty and obsolete technologies are replaced by upgraded new and cleaner technology, which improves environmental quality.

References

Abbasi, F., & Riaz, K. (2016). CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy, 90, 102–114.

Abdouli, M., & Hammami, S. (2015). The impact of FDI inflows and environmental quality on economic growth: an empirical study for the MENA countries. Journal of the Knowledge Economy, 1–25. https://doi.org/10.1007/s13132-015-0323-y.

Abdouli, M., & Hammami, S. (2016a). The dynamic links between environmental quality, foreign direct investment, and economic growth in the Middle Eastern and North African countries (MENA region). Journal of the Knowledge Economy, 1–21. https://doi.org/10.1007/s13132-016-0369-5.

Abdouli, M., & Hammami, S. (2016b). Economic growth, FDI inflows and their impact on the environment: an empirical study for the MENA countries. Quality and Quantity, 1–26. https://doi.org/10.1007/s11135-015-0298-6.

Abdouli, M., & Hammami, S. (2017). Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. International Business Review, 26, 264–278.

Abdouli, M., Kamoun, O., & Hamdi, B. (2017). The impact of economic growth, population density, and FDI inflows on CO2 emissions in BRICTS countries: does the Kuznets curve exist? Empirical Economics, 54, 1717–1742. https://doi.org/10.1007/s00181-017-1263-0.

Acharyya, J. (2009). FDI, growth and the environment: evidence from India on CO2 emission during the last two decades. Journal of Economic Development, 1, 43–34.

Adams, S. (2009). Can foreign direct investment (FDI) help to promote growth in Africa? African Journal of Business Management, 3, 178–183.

Aga, A. A. K. (2014). The impact of foreign direct investment on economic growth: A case study of Turkey 1980–2012. International Journal of Economics and Finance, 6(7), 71.

Ahlin, C., & Pang, J. (2008). Are financial development and corruption control substitutes in promoting growth? Journal of Development Economics, 86(2), 414–433.

Ahmadi, R., & Ghanbarzadeh, M. (2011a). FDI, exports and economic growth: evidence from MENA region. Middle-East Journal of Scientific Research, 10(2), 174–182.

Ahmadi, R., & Ghanbarzadeh, M. (2011b). Openness, economic growth and FDI: evidence from Iran. Middle-East. Journal of Scientific Research, 10, 168–173.

Ajmi, A. N., Hammoudeh, S., Nguyen, D. K., & Sato, J. R. (2015). On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Economics, 49, 629–638.

Al Nasser, M. O., & Gomez, X. G. (2009). Do well-functioning financial systems affect the FDI flows to Latin America? International Research Journal of Finance and Economics, 29, 61–75.

Alam, M. J., Begum, I. A., Buysse, J., Rahman, S., & Van Huylenbroeck, G. (2011). Dynamic modeling of causal relationship between energy consumption, CO2 emissions and economic growth in India. Renewable and Sustainable Energy Reviews, 15, 3243–3251.

Aliyu, M. A. (2005). Foreign direct investment and the environment: Pollution haven hypothesis revisited. In Eight Annual Conference on Global Economic Analysis, Lübeck, Germany (pp. 9–11).

Alfaro, L., Chanda, A., Ozcan, S. K., & Sayek, S. (2004). FDI and economic growth: the role of local financial markets. Journal of International Economics, 64, 89–112.

Alfaro, L., Kalemli-Ozcan, S., & Volosovych, V. (2008). Why doesn’t capital flow from rich to poor countries? An empirical investigation. The Review of Economics and Statistics, 90, 347–368.

Ali Bekhet, A., Matar, A., & Yasmin, T. (2017). CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renewable and Sustainable Energy Reviews, 70, 117–132.

Al-Iriani, M. A. (2006). Energy-GDP relationship revisited: an example from GCC countries using panel causality. Energy Policy, 34, 3342–3350.

Anwar, S., & Nguyen, L. P. (2010). Foreign direct investment and economic growth in Vietnam. Asia Pacific Business Review, 16, 83–202.

Anyanwu, J. C. (2012). Why Does Foreign Direct Investment Go Where It Goes?: New Evidence From African Countries. Annals of Economics & Finance, 13(2).

Arouri, M. E. H., Youssef, A. B., M’henni, H., & Rault, C. (2012). Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy, 45, 342–349.

Asghari, M. (2013). Does FDI promote MENA region’s environment quality? Pollution halo or pollution haven hypothesis. Int J Sci Res Environ Sci, 1(6), 92–100.

Asongu, S. A., & Nwachukwu, J. C. (2017). ICT, financial sector development and financial access. Journal of the Knowledge Economy, 1–26.

Ayeche, M. B., Barhoumi, M., & Hammas, M. A. (2016). Causal linkage between economic growth, financial development, trade openness and CO2 emissions in European countries. American Journal of Environmental Engineering, 6, 110–122.

Azlina, A. A., & Mustapha, N. H. N. (2012). Energy, economic growth and pollutant emissions Nexus: the case of Malaysia. Procedia-Social and Behavioral Sciences, 65, 1–7.

Ben Jebli, M., Ben Youssef, S., Apergis, N., 2014. The dynamic linkage between CO2 emissions, economic growth, renewable energy consumption, number of tourist arrivals and trade. MPRA Paper 57261. University Library of Munich, Germany.

Boutabba, M. A. (2014). The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Economic Modelling, 40, 33–41.

Boyd, J. H., & Smith, B. D. (1992). Intermediation and the equilibrium allocation of investment capital: Implications for economic development. Journal of Monetary Economics, 30, 409–432.

Calderón, C., & Liu, L. (2003). The direction of causality between financial development and economic growth. Journal of Development Economics, 72, 321–334.

Charfeddine, L., & Ben Khediri, K. (2016). Financial development and environmental quality in UAE: cointegration with structural breaks. Renewable and Sustainable Energy Reviews, 55, 1322–1335.

Cole, M. A., & Fredriksson, P. G. (2009). Institutionalized pollution havens. Ecological Economics, 68(4), 1239–1256.

Day, K. M., & Graften, R. Q. (2003). Growth and the environment in Canada: an empirical analysis. Canadian Journal of Agricultural Economics, 51, 197–216.

De Gregorio, J., & Guidotti, P. E. (1995). Financial development and economic growth. World Development, 23, 433–448.

Dean, J. M., Lovely, M. E., & Wang, H. (2009). Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. Journal of Development Economics, 90, 1–13.

Deichmann, J., Karidis, S., & Sayek, S. (2003). Foreign direct investment in Turkey: regional determinants. Journal Applied Economics, 35, 1767–1778.

Desbordes, R., & Wei, S. J. (2014). The effects of financial development on foreign direct investment. The World Bank.

Dinda, S. (2005). A theoretical basis for the environmental Kuznets curve. Ecological Economics, 53(3), 403–413.

Doherty, O. J., Critchley, H., Deichmann, R., & Dolan, R. J. (2003). Dissociating valence of outcome from behavioral control in human orbital and ventral prefrontal cortices. The Journal of Neuroscience, 23, 7931–7939.

Doytch, N., & Eren, M. (2012). Institutional determinants of sectoral FDI in Eastern European and Central Asian countries: The role of investment climate and democracy. Emerging Markets Finance and Trade, 48(sup4), 14–32.

Eskeland, G. S., & Harrison, A. E. (2003). Moving to greener pastures? Multinationals and the pollution haven hypothesis. Journal of Development Economics, 70, 1–23.

Farhani, S., & Ozturk, I. (2015). Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environmental Science and Pollution Research, 22, 15663–15676.

Feridun, M., & Sissoko, Y. (2011). Impact of FDI on economic development: a causality analysis for Singapore, 1976–2002. International Journal of Economic Sciences and Applied Research, 1, 7–17.

Fodha, M., & Zaghdoud, O. (2010). Economic growth and pollutant emissions in Tunisia: an empirical analysis of the environmental Kuznets curve. Energy Policy, 38(2), 1150–1156.

Friedl, B., & Getzner, M. (2003). Determinants of CO2 emissions in a small open economy. Ecological Economics, 45(1), 133–148.

Ghosh, S. (2010). Examining carbon emissions economic growth nexus for India: a multivariate co integration approach. Energy Policy, 38, 2613–3130.

Govindaraju, C. V. G. R., & Tang, C. F. (2013). The dynamic links between CO2 emissions, economic growth and coal consumption in China and India. Applied Energy, 104, 310–318.

Grossman, G. M., & Krueger, A. B. (1991). Environmental impacts of a North American free trade agreement (No. w3914). National Bureau of Economic Research.

Hakimi, A., & Hamdi, H. (2016). Trade liberalization, FDI inflows, environmental quality and economic growth: a comparative analysis between Tunisia and Morocco. Renewable and Sustainable Energy Reviews, 58, 1445–1456.

Halicioglu, F. (2009). An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy, 37, 1156–1164.

Hassaballa, H. (2014). The effect of lax environmental laws on foreign direct investment inflows in developing countries. Journal of Emerging Trends in Economics and Management Sciences, 5, 305–315.

Hermes, N., & Lensink, R. (2003). Foreign direct investment, financial development and economic growth. The Journal of Development Studies, 40, 142–163.

Hoffmann, R., Lee, C. G., Ramasamy, B., & Yeung, M. (2005). FDI and pollution: a granger causality test using panel data. Journal of International Development: The Journal of the Development Studies Association, 17(3), 311–317.

Hossain, M. S. (2011). Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy, 39, 6991–6999.

Im, K.S., Pesaran, M.H. (2003) On the panel unit root tests using nonlinear instrumental variables, manuscript, University of Southern California.

Jalil, A., & Mahmud, S. F. (2009). Environment Kuznets curve for CO2 emissions: a cointegration analysis for China. Energy Policy, 37, 5167–5172.

Kahouli, B., & Kadhraoui, N. (2012). Consolidation of Regional Groupings and Economic Growth: Empirical Investigation by Panel Data. International Journal of Euro-Mediterranean Studies, 5, 71–92.

Kalai, M., & Zghidi, N. (2017). Foreign direct investment, trade, and economic growth in MENA countries: empirical analysis using ARDL bounds testing approach. Journal of the Knowledge Economy, 1–25.

Kasman, A., & Duman, Y. S. (2015). CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Economic Modelling, 44, 97–103.

Kinda, T. (2010). Investment climate and FDI in developing countries: firm-level evidence. World Development, 38, 498–513.

King, R. G., Levine, R. (1993). "Finance and growth : Schumpeter might be right," Policy Research Working Paper Series 1083, The World Bank

Klasra, M. A. (2009). Cointegration, causality and the transmission of shocks across wheat market in Pakistan. Quality & Quantity, 4, 305–315.

Kumar, G., & Dhingra, N. (2011). Impact of liberalization on FDI structure in India. The International Journal of Economics Research, 2(2), 80–94.

Lau, L. S., Chong, C. K., & Eng, Y. K. (2014). Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: do foreign direct investment and trade matter? Energy Policy, 68, 490–497.

Lee, C. G. (2009). Foreign direct investment, pollution and economic growth: evidence from Malaysia. Applied Economics, 41(13), 1709–1716.

Lee, W. J. (2013). The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy, 55, 483–489.

Lee, K. J., Fariza, B., & Sharipova, Z. (2015). The Relationship between FDI, Diversification and Economic Growth in Natural Resource Oriented Countries: Case of Kazakhstan. Journal of International Business and Economics, 3, 51–62.

Lenuta, C. C. (2012). Analysis of relation entre FDI and economic—research literature review. The USV Annals of Economics and Public Administration, 12, 154–160.

Levin, A., Lin, C. F., & Chu, C. S. J. (2002). Unit root test in panel data: asymptotic and finite sample properties. Journal of Econometrics, 108, 1–24.

Levine, R. (1997). Financial development and economic growth: views and agenda. Journal of Economic Literature, 35, 688–726.

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3–42.

Managi, S., & Jena, P. R. (2008). Environmental productivity and Kuznets curve in India. Ecological Economics, 65(2), 432–440.

Ming-Qing, J., & Jia, Y. (2011). Empirical research on the environmental effect of foreign direct investment: the case of Jiangsu Province. Advanced Materials Research, 204, 1–4.

Mizan, H., & Borhan, B. H. B. (2012). FDI, Growth and the Environment: Impact on Quality of Life in Malaysia. Procedia - Social and Behavioral Sciences, 50, 333–342.

Moudatsou, A., & Kyrkilis, D. (2011). FDI and economic growth: causality for the EU and ASEAN. Journal of Economic Integration, 26, 554–577.

McKinnon, R., & Shaw, E. (1973). Financial deepening in economic development. Washington: Brookings Institution.

Nguyen, A. N., & Nguyen, T. (2007). Foreign direct investment in Vietnam: an overview and analysis of the determination of spatial distribution. Hanoi: Working Paper Development and Polices Research Center.

Olusanya, S. O. (2013). Impact of foreign direct investment inflow on economic growth in a pre and postderegulated Nigeria. A Granger causality test (1970–2010). European Scientific Journal, 9, 335–356.

Omisakin, O. A. (2009). Economic growth and environmental quality in Nigeria: does environmental Kuznets curve hypothesis hold? Environmental Research Journal, 3, 14–18.

Omran, M., & Bolbol, A. (2003). Foreign direct investment, financial development, and economic growth: evidence from the Arab countries. Review of Middle East Economics and Finance, 1, 231–249.

Omri, A. (2013). CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Economics, 40, 657–664.

Omri, A., & Kahouli, B. (2014). Causal relationships between energy consumption, foreign direct investment and economic growth: fresh evidence from dynamic simultaneous-equations models. Energy Policy, 67, 913–922.

Omri, A., Khuong, N. D., & Rault, C. (2014). Causal interactions between CO2 emissions, FDI, and economic growth: evidence from dynamic simultaneous-equation models. Original Research Article Economic Modeling, 42, 382–389.

Omri, A., Daly, S., Rault, C., & Chaib, A. (2015). Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Economics, 48, 242–252.

Ozturk, I., & Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Economics, 36, 262–267.

Pao, H. T., & Tsai, C. M. (2010). CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy, 38, 7850–7860.

Pazienza, P. (2015). The environmental impact of the FDI inflow in the transport sector of OECD countries and policy implications. International Advances in Economic Research, 21, 105–116.

Pradhan, R. P. (2009a). The nexus between financial development and economic growth in India: evidence from multivariate VAR model. International Journal of Research and Reviews in Applied Sciences, 1(2).

Pradhan, R. P. (2009b). The FDI led-growth hypothesis in ASEAN-5 countries: evidence from co-integration panel analysis. International Journal of Business and Management, 4, 153–164.

Rawshan, A. B., Kazi, S., Sharifah, M., Syed, A., & Mokhtar, J. (2014). CO2 emissions, energy consumption, economic and population growth in Malaysia. Renewable and Sustainable Energy Reviews, 41, 594–601.

Raza, S. A., & Jawaid, S. T. (2014). Foreign capital inflows, economic growth and stock market capitalization in Asian countries: an ARDL bound testing approach. Quality & Quantity, 48(1), 375–385.

Ren, S., Yuan, B., Ma, X., & Chen, X. (2014). International trade, FDI (foreign direct investment) and embodied CO2 emissions: A case study of Chinas industrial sectors. China Economic Review, 28, 123–134.

Richmond, A. K., & Kaufmann, R. K. (2006). Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecological Economics, 56, 176–189.

Romer, P. (1993). Idea gaps and object gaps in economic development. Journal of Monetary Economics, 32, 543–573.

Saboori, B., Sulaiman, J., & Mohd, S. (2012). Economic growth and CO2 emissions in Malaysia: a cointegration analysis of the environmental Kuznets curve. Energy Policy, 51, 184–191.

Sadorsky, P. (2011). Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy, 39, 999–1006.

Sahin, S., & Ege, I. (2015). Financial development and FDI in Greece and neighbouring countries: a panel data analysis. Procedia Economics and Finance, 24, 583–588.

Saini, W. N., Baharumshah, A. Z., & Law, S. H. (2010). Foreign direct investment, economic freedom and economic growth: international evidence. Economic Modeling, 27, 1079–1089.

Saqib, D., Masnoon, M., & Rafique, N. (2013). Impact of foreign direct investment on economic growth of Pakistan.

Sbia, R., Shahbaz, M., & Hamdi, H. (2014). A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Economic Modelling, 36, 191–197.

Sebri, M., & Ben Salha, O. (2014). On the causal dynamics between economic growth, renewable energy consumption, CO2 emissions and trade openness: fresh evidence from BRICS countries. Renewable and Sustainable Energy Reviews, 39, 14–23.

Selden, T. M., & Song, D. (1994). Environmental quality and development: is there a Kuznets curve for air pollution emissions? Journal of Environmental Economics and management, 27(2), 147–162.

Sghaier, I. M., & Abida, Z. (2013). Foreign direct investment, financial development and economic growth: Empirical evidence from North African countries. Journal of International and Global Economic Studies, 6(1), 1–13.

Shahbaz, M., & Lean, H. H. (2012). Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy policy, 40, 473–479.

Shahbaz, M., Khan, S., & Tahir, M. I. (2013a). The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Economics, 40, 8–21.

Shahbaz, M., Lean, H. H., & Farooq, A. (2013b). Natural gas consumption and economic growth in Pakistan. Renewable and Sustainable Energy Reviews, 18, 87–94.

Shahbaz, M., Solarin, S. A., Mahmooda, H., & Arouri, M. (2013c). Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Economic Modelling, 35, 145–152.

Shahbaz, M., Solarin, S. A., Sbia, R., & Bibi, S. (2015). Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecological indicators, 50, 215–224.

Shan, J. (2005). Does financial development ‘lead’ economic growth? A vector auto-regression appraisal. Applied Economics, 37(12), 1353–1367.

Shur, Y. L., & Jorgenson, M. T. (2007). Patterns of permafrost formation and degradation in relation to climate and ecosystems. Permafrost and Periglacial Processes, 18(1), 7–19.

Tamazian, A., Chousa, J. P., & Vadlamannati, K. C. (2009). Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy, 37, 246–253.

Tang, S., Selvanathan, E. A., & Selvanathan, S. (2008). Foreign direct investment, domestic investment and economic growth in China: a time series analysis. The World Economy, 31, 1292–1309.

Temiz, D., & Gökmen, A. (2014). FDI inflow as an international business operation by MNCs and economic growth: An empirical study on Turkey. International Business Review, 23(1), 145–154.

Tsai, P. (1994). Determinants of foreign direct investment and its impact on economic growth. Journal of Economic Development, 19, 137–163.

Turnbull, C., Sun, S., & Anwar, S. (2016). Trade liberalisation, inward FDI and productivity within Australia’s manufacturing sector. Economic Analysis and Policy, 50, 41–51.

Wang, S. S., Zhou, D. Q., Zhou, P., & Wang, Q. W. (2011). CO2 emissions, energy consumption and economic growth in China: a panel data analysis. Energy Policy, 39, 4870–4875.

Yu, J., & Walsh, M. J. P. (2010). Determinants of foreign direct investment: A sectoral and institutional approach (No. 10-187). International Monetary Fund.

Zanin, L., & Marra, G. (2012). Assessing the functional relationship between CO2 emissions and economic development using an additive mixed model approach. Economic Modelling, 29, 1328–1337.

Zhang, Y. J. (2011). The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy, 39, 2197–2203.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Abdouli, M., Hammami, S. Economic Growth, Environment, FDI Inflows, and Financial Development in Middle East Countries: Fresh Evidence from Simultaneous Equation Models. J Knowl Econ 11, 479–511 (2020). https://doi.org/10.1007/s13132-018-0546-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-018-0546-9