Abstract

We develop a model to forecast the equilibrium price in the oil market by balancing demand and supply at the level of interaction of the largest oil-consuming and -producing countries. Our model is based on the global vector autoregression methodology and allows us to make a medium-term forecast of the equilibrium oil price in dynamics analyzing the co-movement of oil demand and supply in various countries, in view of possible shocks from countries and companies. The proposed model allows us to reveal responses in economic indicators in various countries to changes in the equilibrium oil price. Our model covers 47 countries, including the member countries of the Organization of Petroleum Exporting Countries (OPEC), the Commonwealth of Independent States (CIS), and the largest oil-consuming countries. The majority of models analyze the only largest market players, but we consider the member countries of the CIS (Russia, Kazakhstan, and Azerbaijan) and OPEC member countries such as Iraq, the United Arab Emirates (UAE), Qatar, Venezuela, Algeria, Nigeria, and Angola. The test results on economic consequences of a shock to oil supplies from the largest producer (Saudi Arabia) and a shock to oil demand from the largest consumer (China) are of empirical interest.

Similar content being viewed by others

Notes

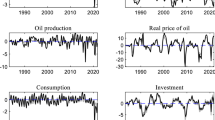

Consumers and producers.

We present assumptions that constrain the possibility of substantive interpretation of the modeling results. General assumptions (normal distribution of residuals, stationarity of time series, etc.) are not considered.

Calculator for converting tons into barrels from CME Group, URL: http://www.cmegroup.com/tools-information/calc_crude.html.

References

Alquist, R., Kilian, L.: What do we learn from the price of crude oil futures? J Appl Econ 25(4), 539–573 (2010)

Baumeister, C., Hamilton, J.: Sign restrictions, structural vector autoregressions, and useful prior information. Econometrica 83(5), 1963–1999 (2015)

Baumeister, C., Hamilton, J.: Structural interpretation of vector autoregressions with incomplete identification: revisiting the role of oil supply and demand shocks. NBER working paper, 24167 (2017). URL: http://nber.org/papers/w24167

Baumeister, C., Peersman, G., Van Robays, I.: The economic consequences of oil shocks: Differences across countries and time. In: Fry, R., Jones, C., Kent, C. (eds.) Inflation in an Era of Relative Price Shocks. Reserve Bank of Australia, Sydney (2010)

BP: statistical review of world energy. BP, London, UK (2016)

Chudik, A., Pesaran, M.H.: Theory and practice of GVAR modelling. J Econ Surv 30(1), 165–197 (2016)

Coppola, A.: Forecasting oil price movements: exploiting the information in the futures market. J Futures Mark 28(1), 34–56 (2008)

Dees, S., Mauro, F.D., Pesaran, M.H., Smith, L.V.: Exploring the international linkages of the euro area: a global VAR analysis. J Appl Econ 22, 1–38 (2007)

Dees, S., Pesaran. M.H., Smith, L.V., Smith, R.: Supply, demand and monetary policy shocks in a multi-country new Keynesian model. ECB working paper, 1239. European Cental Bank, Frankfurt am Main, Germany (2010)

Dybczak, K., Voňka, D., van der Windt, N.: The effect of oil price shocks on the Czech Economy. Czech Natl Bank Work Pap Ser 5. Praha, Czech Republic (2008)

Fattouh, B., Kilian, L., Mahadeva, L.: The role of speculation in oil markets: what have we learned so far? Energy J 34(3), 7–33 (2013)

Ghadimi, H.: A dynamic CGE analysis of exhaustible resources: the case of an oil exporting developing country. Research paper 2006-7 (2006)

Gregory, A.W., Head, A.C., Raynauld, J.: Measuring world business cycles. Int Econ Rev 38(3), 677–702 (1997)

Hagen, R.: How is the international price of a particular crude determined? OPEC Rev 18(1), 127–135 (1994)

Haugom, E., Mydland, O., Pichler, A.: Long term oil prices. Energy Econ 58, 84–94 (2016)

Hea, Y., Hongb, Y.: Unbiasedness and market Query efficiency of crude oil futures markets: a revisit. Unpublished manuscript (2011)

Hubbert, M.K.: Nuclear energy and the fossil fuels. Drill Prod Prac 95, 1–57 (1956)

International energy agency: world energy model documentation. http://worldenergyoutlook.org/media/weowebsite/2015/WEM_Documentation_WEO2015.pdf (2015). Accessed 1 Feb 2018

International monetary fund: direction of trade statistics. http://data.imf.org/?sk=9D6028D4-F14A-464C-A2F2-59B2CD424B85. Accessed 1 Feb 2018

Kilian, L.: A comparison of the effects of exogenous oil supply shocks on output and inflation in the G7 countries. J Eur Econ Assoc 6(1), 78–121 (2008)

Kilian, L.: Exogenous oil supply shocks: how big are they and how much do they matter for the US economy? Rev Econ Stat 90(2), 216–240 (2008)

Koop, G., Korobilis, D.: Forecasting inflation using dynamic model averaging. Int Econ Rev 53(3), 867–886 (2012)

McDonald, S.: A computable general equilibrium (CGE) analysis of the impact of an oil price increase in South Africa. Working paper, 15633 (2005)

Mohaddes, K., Pesaran, M.H.: Country-specific oil supply shocks and the global economy: a counterfactual analysis. Energy Econ 59, 382–399 (2016)

Mohaddes, K., Pesaran, M.H.: Oil prices and the global economy: is it different this time around? IMF working paper no. 16/210 (2016)

Naser, H.: Estimating and forecasting the real prices of crude oil: a data rich model using a dynamic model averaging (DMA) approach. Energy Econ 56, 75–87 (2016)

Peersman, G., Robays, I.V.: Oil and the Euro area economy. Econ Policy 24(60), 603–651 (2012)

Peersman, G., Van Robays, I.: Oil and the Euro area economy. Econ Policy 24, 603–651 (2009)

Pesaran, M.H., Schuermann, T., Weiner, S.M.: Modeling regional interdependencies using a global error-correcting macroeconomic model. J Bus Econ Stat 22, 129–162 (2004)

Pesaran, M.H., Schuermann, T., Treutler, B., Weiner, S.M.: Macroeconomic dynamics and credit risk: a global perspective. J Money Credit Bank 38(5), 1211–1261 (2006)

Pesaran, M.H., Smith, V., Smith, R.P.: What if the UK or Sweden had joined the euro in 1999? An empirical evaluation using a global VAR. Int J Financ Econ 12, 55–87 (2007)

Pesaran, M.H., Schuermann, T., Smith, V.: Rejoinder to comments on forecasting economic and financial variables with global VARs. Int J Forecast 25(4), 703–715 (2009)

Smith, L.V., Galesi, A.: GVAR toolbox 2.0, https://sites.google.com/site/gvarmodelling/gvar-toolbox (2014). Accessed 1 Feb 2018

Stevens, P.: The determination of oil prices 1945–1995: a diagrammatic interpretation. Energy Policy 23(10), 861–870 (1995)

International energy outlook. US energy information administration. Washington, US (2016)

Zagaglia, P.: Macroeconomic factors and oil futures prices: a data-rich model. Energy Econ 32(2), 409–417 (2010)

Author information

Authors and Affiliations

Corresponding author

Appendix 1. Conditional forecast of GDP of Russia, the USA and Saudi Arabia in the scenario of oil supply reduction from Saudi Arabia

Appendix 1. Conditional forecast of GDP of Russia, the USA and Saudi Arabia in the scenario of oil supply reduction from Saudi Arabia

Rights and permissions

About this article

Cite this article

Teplova, T.V., Lysenko, V.V. & Sokolova, T.V. Shocks to supply and demand in the oil market, the equilibrium oil price, and country responses in economic indicators. Energy Syst 10, 843–869 (2019). https://doi.org/10.1007/s12667-018-0303-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-018-0303-y