Abstract

High-frequency traders account for a significant part of overall price formation and liquidity provision in modern securities markets. In order to react within microseconds, high-frequency traders depend on specialized low latency infrastructure and fast connections to exchanges, which require significant IT investments. The paper investigates a technical failure of this infrastructure at a major exchange that prevents high-frequency traders from trading at low latency. This event provides a unique opportunity to analyze the impact of high-frequency trading on securities markets. The analysis clearly shows that although the impact on trading volume and the number of trades is marginal, the effects on liquidity and to a lesser extent on price volatility are substantial when high-frequency trading is interrupted. Thus, investments in high-frequency trading technology provide positive economic spillovers to the overall market since they reduce transaction costs not only for those who invest in this technology but for all market participants by enhancing the quality of securities markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The financial services industry currently faces and has already experienced considerable changes due to digitization and the automation of business processes. This is especially true for the securities trading industry, where the use of computers and algorithms for the automation of trading processes has reshaped financial markets into modern highly technologized places (Gomber and Zimmermann 2018). Along with advancements in process automation related to information retrieval, interpretation, and processing into investment signals, the speed of trading in financial markets has dramatically increased and traders known as high-frequency traders (HFTs) emerged. These traders pursue specialized business models dedicated to trading within microseconds and account for a large share of the market. In Europe, the market share of high-frequency trading (HFT) represents around 35% of the total equity trading volume after peaking in 2010 with 40%. In the U.S., the share of HFT is even higher and has settled at around 50% of total equity trading after a peak in 2009 with about 60% (Zaharudin et al. 2022).

Various studies highlight the importance of HFT for the efficiency of modern securities markets. Menkveld (2013) finds that an often pursued strategy of HFTs is market making, i.e., to provide liquidity to the market on a continuous basis, allowing others to trade on the basis of efficient prices throughout the day. Moreover, due to their speed advantage, HFTs quickly incorporate new information into prices (Brogaard et al. 2014) and coordinate prices across different venues (Haferkorn 2017). However, exorbitant investments in fast computer systems and communication infrastructure not only by traders but also by exchanges are necessary to facilitate the innovation of trading at minimum latency, which raises the question whether these investment in information technology (IT) are economically valuable. In particular, Budish et al. (2015) claim that recurring investments in ever faster infrastructure and technology due to the race of being able to trade at the highest speed currently possible are not efficient. Yet, research has shown that HFTs fulfill important intermediary functions which are beneficial for all market participants, and that HFT contributes to the efficiency of securities markets (Brogaard et al. 2014; Hasbrouck and Saar 2013; Menkveld 2013).

Consequently, HFT not only benefits trading firms investing in this technology (Baron et al. 2012) but can lead to IT spillover effects (Han et al. 2011) to all market participants, which makes HFT a relevant research area from an information systems (IS) perspective. Because data is continuously available and transparent in securities markets, spillover effects of IT investments can be analyzed in this environment and their magnitude can be determined as suggested by Han et al. (2011). Thus, our paper aims to add to this research stream by analyzing potential spillover effects of investments in HFT technology on liquidity and volatility of securities markets, which affect transaction costs of the entire securities trading industry.

HFTs use special infrastructures and dedicated access points to the infrastructure of exchanges besides standard gateways for slower traders that do not require such latency sensitive connections. On October 2nd, 2017, Deutsche Börse’s electronic trading venue Xetra experienced a technical failure on their HFT gateway that interrupted the high-frequency connections, thus making it impossible for HFTs to communicate with the exchange at low latency, which effectively stopped HFT. Taking away their speed advantage, this event severely interfered with the trading strategies of HFTs and prevented the use of their ultra-fast trading technology. We exploit this event to empirically investigate how today’s automated securities markets react if HFT technology is unavailable in order to measure the spillover effects of investments in this technology on overall market quality. Specifically, we investigate how the sudden interruption of HFT technology influences liquidity and volatility, two central measures of market quality, which determine implicit transaction costs for all market participants.

Our results show that an interruption of HFT significantly decreases liquidity of the affected stocks along different dimensions. Thus, securities markets become less efficient and trading becomes more costly for all market participants. Also, price volatility significantly increases leading to higher risks for traders and intermediaries. Consequently, our results show that HFT and corresponding investments in the necessary infrastructure have significant positive spillover effects for the whole securities trading industry and affect the efficiency of the entire securities market. Adding to the discussion on resilient financial markets, we find that securities markets do not collapse if HFT technology is suddenly unavailable due to a technical failure.

The remainder of the paper is structured as follows: Sect. 2 presents related research on HFT, investments in HFT technology, and IT spillover effects in securities markets. In Sect. 3, we derive our research hypotheses and introduce the data set. Methodology and results of our empirical study are described in Sect. 4. Finally, we discuss the implications of our findings as well as limitations of our approach in Sect. 5 and conclude the paper in Sect. 6.

2 Background and Related Research

2.1 HFT and Investments in Fast Trading Technology

The securities trading industry has experienced significant technological changes due to different waves of automation, which first affected exchanges and then went further down the value chain from the sell side (i.e., intermediaries such as brokers and dealers) to the buy side (i.e., institutional investors) (Francioni and Gomber 2017). In particular, the automation of the buy side led to an innovation of trading technology and associated trading strategies with the emergence of algorithmic trading and HFT.

According to the revised European directive on markets in financial instruments (MiFID II), algorithmic trading means “trading in financial instruments where a computer algorithm automatically determines individual parameters of orders such as whether to initiate the order, the timing, price or quantity of the order or how to manage the order after its submission, with limited or no human intervention” (European Parliament and Council 2014). Further, HFT is defined as a particular kind of algorithmic trading that is characterized by (1) infrastructure intended to minimize latency such as co-location, (2) no human intervention in order initiation, generation, and routing, and (3) high intraday message volumes (i.e., order, quote, and cancellation messages) (European Parliament and Council 2014). HFTs regularly employ trading strategies such as market making or news trading, which have already been profitable before the emergence of low latency trading technology (Gomber et al. 2011). However, based on their superior and faster trading technology, HFTs have developed these different trading strategies further, which provides them with a competitive advantage compared to traditional traders (Lattemann et al. 2012; Seddon and Currie 2017).

Yet, market observers and also researchers criticize the high investments in ever-faster trading technology for HFT, which can lead to market concentration and an inefficient and costly technological arms race (Biais et al. 2015; Budish et al. 2015). From an IS research perspective, the value of HFT-related IT investments is therefore to be evaluated. For HFT firms, the profitability of investments in the underlying trading technology has already been confirmed (Baron et al. 2012). As pointed out by Kohli and Grover (2008), research on the economic value of IT should in particular also consider potential indirect effects of these investments. Such indirect effects can materialize in the form of positive spillover effects to either (1) connected downstream industries (Han et al. 2011) or (2) the industry or sector as a whole. We follow the call by Kohli and Grover (2008) and investigate whether HFT and associated investments in low-latency trading technology lead to positive spillover effects on securities markets, thus indirectly providing economic value also for traders who do not invest in HFT technology. Such spillover effects might materialize because HFTs are able to provide more and cheaper liquidity to the market and also improve price discovery due to their technology-based information processing and speed advantages (see next subsection for further details). Moreover, we contribute to the HFT research agenda for IS scholars proposed by Currie and Seddon (2017).

In order to assess potential spillover effects of HFT investments for the entire securities market and the securities trading industry, securities markets are evaluated according to different dimensions of market quality. Market quality is the general concept used to describe the (operational) efficiency of securities markets and is regularly assessed along the dimensions liquidity, volatility, and price discovery. Most empirical studies find a positive effect of HFT on these dimensions of market quality (O’Hara 2015).

2.2 The Effects of HFT on Securities Markets

HFT and algorithmic trading are not an entirely new phenomenon in academia. In particular, a growing research stream around this topic emerged in the finance literature. In their seminal paper on the impact of algorithmic trading on the quality of securities markets, Hendershott et al. (2011) find that the introduction of algorithmic trading on the New York Stock Exchange enhanced market quality since algorithmic trading leads to lower bid-ask spreads, i.e., the difference between the cheapest sell offer and the highest buy offer. Lower bid-ask spreads allow market participants to trade at more favorable prices, which decreases transaction costs and increases the liquidity of a market. This finding is further supported by Hendershott and Riordan (2013), who show that algorithmic traders consume liquidity when bid-ask spreads are narrow and provide liquidity when they are wide.

With respect to HFTs, which are algorithmic traders that additionally rely on low latency infrastructure, most empirical studies show that these traders also provide additional liquidity to securities markets leading to lower bid-ask spreads and decreased transaction costs for investors and intermediaries (Carrion 2013; Zhang and Riordan 2011). The results of Hasbrouck and Saar (2013) further suggest that increased HFT activity enhances traditional market quality measures, i.e., HFT leads to decreased spreads, increased order book depth in terms of tradable volumes, and lower short-term price volatility. The positive effect of HFT on liquidity in securities markets results, among other reasons, from the observation that most HFTs employ market-making strategies (Hagströmer and Nordén 2013) and that they predominantly submit passive orders, which provide liquidity to the market (Menkveld 2013). Moreover, the positive effect of HFT and associated spillover effects on spreads are in line with the model predictions of Aït-Sahalia and Sağlam (2017), who state that speed advantages allow market makers to revise quotes more efficiently and thereby to reduce inventory costs allowing them to quote tighter spreads. Furthermore, research has shown that HFT facilitates price discovery by incorporating new information into prices more efficiently and by trading against transitory pricing errors (Brogaard et al. 2014). Moreover, HFT technology improves price coordination across different markets by reducing costs and time to monitor and react to information from the different markets on which an asset is traded (Haferkorn 2017). Contrary to the majority of findings for equity markets, Lee (2015) finds no positive effects of HFT on liquidity and volatility in futures markets. Specifically, his results indicate that HFTs do not provide additional liquidity but increase intraday volatility. Also, Shkilko and Sokolov (2020) observe a positive effect on liquidity when the speed advantages of the fastest HFTs are removed due to weather-related interruptions of their microwave networks. The authors show that these periods are associated with lower adverse selection and trading costs.

Despite these findings, research on HFT is challenging since public data feeds do not contain a flag whether an order book activity or a trade is caused by an algorithm or a human and whether a trader is using low latency infrastructure. Therefore, researchers either have to rely on proprietary data sets that include HFT flags (e.g., Brogaard et al. 2014; Menkveld 2013), which impede replication and comparability of results, or have to use proxies that draw on specific trading characteristics to quantify HFT activity (Haferkorn 2017). Another possibility to infer the impact of HFT on securities markets is to analyze events that affect the share or speed of HFT. E.g., previous research analyzed speed upgrades of trading systems (Wagener et al. 2010; Riordan and Storkenmaier 2012) or regulatory acts aimed at limiting HFT activity (Friederich and Payne 2015). However, all these methods only allow to analyze incremental changes in HFT activity over time or events that indirectly affect HFT activity.

Our study adds to the finance and information systems literature on HFT by analyzing the impact of HFT on securities market quality based on a public data feed for an event with a sharp and unexpected cut in HFT activity without the need of any approximation method to quantify HFT activity. Previous studies either analyze minor changes in HFT activity over time (e.g., Hasbrouck and Saar 2013) or use regulatory acts aimed at HFT as events (e.g., Friederich and Payne 2015), which, however, are known in advance and thus might be biased by announcement effects. To the best knowledge of the authors, this is the first study analyzing the impact of HFT based on a technical failure that entirely prevents HFTs from trading at low latency at a major stock exchange. Due to the disruption of HFT, we are able to derive whether potential economic spillovers of investments in ultra-fast trading technology to other market participants and the quality of securities markets exist.

3 Research Approach

3.1 Research Hypotheses

The large literature body on HFT on the one hand and the high proportion of HFT relative to overall trading volume on the other hand emphasize the high academic and practical interest in this trading technology and its effects on securities markets (Currie and Seddon 2017). Moreover, regulatory interventions aimed at HFT in Italy, Germany, and the European financial market regulation MiFID II renewed the necessity to clearly evaluate the effect of HFT on financial markets and potential spillover effects of HFT investments on the securities trading industry.

Since empirical studies partially come to contradicting results whether HFT enhances market quality (e.g., Carrion 2013; Hasbrouck and Saar 2013) or not (e.g., Shkilko and Sokolov 2020; Lee 2015) and because existing studies regularly analyze incremental changes of HFT activity over time, we evaluate the impact of HFT on modern securities markets based on a recent public data set with a sharp and clear cut-off of HFT activity due to a technical failure interrupting HFT activity. Consequently, our approach is a suitable setup to answer our research question whether and how the sudden interruption of HFT technology influences liquidity and volatility in securities markets. This allows us to infer how HFT technology impacts efficiency and transaction costs in the securities trading industry and to determine the magnitude of potential spillover effects of HFT investments.

Although coming to contradicting results, existing studies that investigate the impact of HFT on market quality observe that HFT influences liquidity in financial markets (e.g., Carrion 2013; Shkilko and Sokolov 2020). Since HFT provides additional order flow to securities markets, which is generally beneficial because more orders increase the liquidity of a market (O’Hara 2015), and because HFTs acting as market makers can quote more efficiently due to their speed advantage (Aït-Sahalia and Sağlam 2017), we hypothesize that liquidity on the respective exchange deteriorates when HFT activity is interrupted. In order to avoid the detection of mechanical patterns due to HFTs being unable to trade (using fast connections to the exchange), we hypothesize that liquidity decreases more than trading activityFootnote 1 decreases. Specifically, we hypothesize that liquidity deteriorates along different dimensions, i.e., the bid-ask spread as the most important measure of implicit transaction costs, the volume available in the order book (order book depth), and the imbalance between buy and sell orders (order imbalance).

H1a

If HFT activity is interrupted, bid-ask spreads increase more than trading activity decreases.

H1b

If HFT activity is interrupted, order book depth decreases more than trading activity decreases.

H1c

If HFT activity is interrupted, order imbalance increases more than trading activity decreases.

Moreover, research shows that HFT reduces short-term volatility in equity markets (Hasbrouck and Saar 2013). This can be explained by the observation that HFTs, which employ market making strategies, mitigate the price impact of multiple orders in the same direction and even provide liquidity in times of market stress, which weakens price fluctuations (Brogaard et al. 2018). On the other hand, HFTs also contribute to an acceleration of volatility in case of market-wide extreme price movements known as (mini) flash crashes (Brogaard et al. 2018; Kirilenko et al. 2017). Therefore, it is relevant to analyze how a sudden interruption of HFT affects stock market volatility. Because HFTs might influence price volatility and midpoint volatility differently due to their frequent order updates that lead to faster and more frequent changes of the order book and the midpoint between best bid and best ask (Haferkorn 2017), we distinguish between trade price and midpoint volatility and hypothesize:

H2a

If HFT activity is interrupted, price volatility increases more than trading activity decreases.

H2b

If HFT activity is interrupted, midpoint volatility increases more than trading activity decreases.

3.2 Data Set and Institutional Background

To assess the impact of HFT on market quality, we analyze a technical failure at Deutsche Börse’s electronic trading platform Xetra that interrupted HFT connections, and thus made it impossible for HFTs to trade at low latency. Specifically, there was an outage of high-frequency sessions offering low latency connections to Xetra on October 2nd, 2017.Footnote 2 At 09:00:22, Deutsche Börse published the following message on their news board: “Please be aware that due to technical problems we are currently experiencing a failure (connectivity over HF [high frequency] sessions) in the Xetra market” (Deutsche Börse 2017a). At 10:01:03, the technical failure was officially resolved (Deutsche Börse 2017b). We analyze the time frame from the beginning of continuous tradingFootnote 3 to 10:00:00 and exclude the opening auction as it started before the official announcement of the technical difficulties. The exclusion of the opening auction is also reasonable because HFTs are less active in auctions (European Securities and Markets Authority 2014). Moreover, we stop our analysis at 10:00:00 since the connections may have already been reestablished a few seconds before the news was officially published.

For the empirical investigations, we use Refinitiv Tick History data including highly granular trade and order book information. The trade data contains executed trades together with information on price and volume time-stamped to the microsecond. The order book information contains price limit and order volume at the respective limit for both sides of the book, i.e., bid and ask, for the limits one to ten. Once the order book is updated (caused by an order updateFootnote 4 or a trade execution), a new observation is saved on a microsecond level, which allows us to analyze HFT activity. Due to the fact that HFTs predominantly operate in highly liquid stocks (European Securities and Markets Authority 2014), the constituents of the blue chip index DAX30 traded on Xetra are analyzed in this study.

Deutsche Börse’s electronic trading platform Xetra is an order-driven market with an open limit order book and the main venue for trading DAX30 stocks. Since we apply a difference-in-differences (DiD) approach to analyze the effects of an absence of HFT activity, we use the DAX30 constituents as the treatment group (which consists of 30 stocks) and the constituents of the highly correlated French CAC40 index as the control group (which consists of 40 stocks). A list of all stocks analyzed in this study is provided in Table 5 in the Supplementary file1. The stocks of the control group are predominantly traded on the main market Euronext Paris and serve as reference to exclude any confounding effects. Euronext Paris is also highly comparable to Xetra in terms of market design and trading hours, which strengthens the fit of the control group. Moreover, both indices have a comparable industry coverage and the stocks share a similar European macroeconomic dependency due to the close geographic proximity. Therefore, the constituents of the CAC40 are suitable to control for macroeconomic news and other confounding effects. Finally, and important within the context of our study, also the amount of HFT actvity on Xetra and Euronext Paris is comparable (European Securities and Markets Authority 2014). Because stocks from different European or even non-European markets do not fulfill these requirements or are not as comparable to DAX30 stocks as the stocks of the French CAC40 index, they do not qualify for the control group. The use of DAX30 and CAC40 stocks as treatment and control group in a DiD-setup has also been applied in other empirical studies and has been proven to work well (e.g., Gomber et al. 2016b; Clapham et al. 2021).

Our observation window covers the first hour of trading on the event day October 2nd, 2017 as well as the first hour of trading on the two previous (September 18th and 25th) and consecutive (October 9th and 16th) Mondays. We use Mondays instead of just the previous and following trading day to account for the day-of-the-week effect that has been found in financial markets (Dubois and Louvet 1996). Specifically, we use every order book update and trade as reported by Refinitiv Tick History (so-called tick-by-tick analysis) for DAX30 and CAC40 stocks traded on Xetra and Euronext for the first hour of continuous trading on the five mentioned trading days. This results in 307,525 trades and more than 7.3 million order book updates being included in our analysis.

4 Empirical Study

4.1 Market Quality Measurement and Variable Operationalization

Market quality is the key concept to evaluate the operational efficiency of financial markets and usually involves the dimensions liquidity and volatility (Harris 2003). Consequently, we focus on different measures of these two dimensions of market quality in order to assess the impact of the sudden and unanticipated interruption of HFT on market quality. With this analysis, we provide insights whether the investments in HFT technology lead to a positive spillover for the entire securities market by increasing market quality.

Liquidity is one of the core concepts of market quality since it determines implicit transaction costs for investors. It can be measured along different dimensions and empirical studies regularly analyze the bid-ask spread, representing transaction costs for small orders, and order book depth, which indicates how much liquidity denoted in euro volume is offered by passive orders on both sides of the book (Chordia et al. 2001). Specifically, we use the relative quoted spreadFootnote 5, which is the quoted bid-ask spread (i.e., the difference between the best bid and best ask) divided by the midpoint (i.e., the price in between best bid and best ask) as shown in Eq. (1). The subscripts i and t represent stock and point in time respectively. Using the relative instead of the absolute spread is meaningful in order to account for the different price levels of the stocks. Throughout the paper, we report the relative quoted spread in basis points (bps)Footnote 6.

Regarding order book depth, we use two different measures. First, L1-Volume (see Eq. (2)) represents the euro volume available at the best bid and ask. Therefore, this measure indicates how much volume can be traded immediately without further market impact in terms of worse prices than the current best bid and ask. Second, we rely on the Depth(10) measure proposed by Degryse et al. (2015) in order to measure liquidity that is provided on deeper levels of the order book, i.e., at worse prices than the current best bid and ask, but still within an appropriate range of ten basis points (bps) around the current midpoint. The calculation of the Depth(10) measure is provided in Eq. (3). The subscript l indicates the order book level. Order book levels and the euro volume provided on these levels are taken into account as long as the respective level’s bid (ask) limit is larger (smaller) than ten bps below (above) the current midpoint, which represents the fair value of a stock.

Moreover, we analyze order imbalance similar to Chordia et al. (2002) in order to evaluate whether asymmetries in the order book change when HFT is interrupted. Order imbalances in either direction, i.e., excess interest to buy or to sell a stock, imply lower levels of liquidity. We calculate order imbalance based on the difference in trading interest revealed in the order book. Specifically, we measure imbalances in the amount of buy and sell order volume based on the difference between the euro volume on both sides of the order book that is close to the midpoint (i.e., within ten bps in line with the Depth(10) measure). Possible values of the order imbalance measure specified in Eq. (4) range between zero and one.

Volatility is the second dimension of market quality analyzed in our empirical study. We differentiate between trade price volatility (S.D. Price) and midpoint volatility (S.D. Midpoint). As shown in Eq. (5), trade price volatility is measured by the standard deviation of trade prices \(p_{i,t}\) in a given time interval T divided by the average trade price \(\overline{p_{i,t}}\) in the same time interval to obtain the measure in relative terms to account for different price levels of the analyzed stocks. The variable n represents the number of trades (midpoints) in time interval T. Midpoint volatility is computed identically except that \(p_{i,t}\) represents the midpoint of best bid and best ask and not trade prices. Due to the fast quoting behavior in today’s automated securities markets and particularly the fast quoting behavior of HFTs, it is of interest to differentiate between these two volatility measures (Haferkorn 2017). As the relative spread, both measures for volatility are provided in bps throughout the paper.

In order to rule out that our observations regarding changes in liquidity and volatility are only driven by mechanical changes in trading activity due to the potential absence of HFTs despite their possibility to revert to slower connections, we also incorporate measures for trading activity in our analysis. Trading activity is regularly measured via the number of trades and the euro volume traded in a given period (Chordia et al. 2001). In particular with the emergence of HFTs, who often update their orders leading to a large number of orders relative to the number of executed trades, the number of quotes, i.e., changes of best bid and/or best ask, and the number of order submissions in a given time interval are also analyzed (Hasbrouck and Saar 2013).

In order to be able to run regression analyses with contemporaneous observations, we aggregate all measures of liquidity, volatility, and trading activity into one-minute intervals. This means, we average all liquidity measures in a given one-minute interval and sum up the observed number of trades, quotes, order submissions, as well as the trading volume, which indicate trading activity. Both volatility measures are calculated based on all observations of prices respectively midpoints in a certain one-minute interval. This results in 20,990 observations in total for the 70 stocks and 60 min on five trading days.Footnote 7 Due to order book data issues for three CAC40 stocks (ACCP.PA, BNPP.PA, and UNBP.AS), market quality measures that depend on full order book information (i.e., number of submissions, Depth(10), and order imbalance) could not be calculated for 180 observations. Thus, the final data set to investigate these measures consists of 20,810 observations.

4.2 Methodology

For the analysis of our research hypotheses, we rely on two different methodologies to (i) study the effects of an interruption of HFT over time and (ii) to identify the overall effect of an interruption of HFT on liquidity and volatility. In the first part of the analysis, we investigate the minute-wise differences between treatment (i.e., DAX30 stocks traded on Xetra) and control group (i.e., CAC40 stocks traded on Euronext) during the trading hour where the technical failure existed following the approach of Battalio and Schultz (2011). This analysis allows us to observe whether the impact of the interruption of HFT is particularly strong during a specific period, whether the market gradually adapts to the new situation, or whether the impact is constant during the observation period. Specifically, we run cross-sectional regressions for each minute of the first hour of trading on the event day and the non-event days (see Eq. (6)).

The dependent variable \(Y_{i}\) accounts for each liquidity, volatility, and trading activity parameter introduced in the previous section, where i represents the respective stock. The dummy variable \(DAX_i\) has a value of one if the specific stock is in the treatment group (i.e., is a constituent of the DAX30 and traded on Xetra, thus being affected by the interruption of HFT) and takes a value of zero otherwise. \(C_{i}\) is a vector of control variables commonly applied in market microstructure research comprising log market cap, the reciprocal of the closing price, log trading volume in euro, and range volatility (i.e., the daily high price divided by the low price) (Hendershott et al. 2011; Gresse 2017).Footnote 8 All control variables are computed on a daily basis for each of the five days under investigation (one event day, four control days). The variable \(\varepsilon _{i}\) equals the idiosyncratic error term. Standard errors are clustered by stock. The variable of interest is \(\beta _1\), which explains the difference in market quality between treatment and control group for each minute of the period under investigation. We plot \(\beta _1\) and the corresponding upper and lower bounds of its 95%-confidence interval for each minute and market quality variable to illustrate the differences between treatment and control group during the interruption of HFT during the first trading hour on the event day.

In the second part of the analysis, we rely on a DiD-appoach to identify the overall effect of an interruption of HFT technology during the entire observation period. Because the technical failure leading to an interruption of HFT on Xetra on October 2nd, 2017 represents a natural experiment arising from an exogenous event, the DiD-approach is a suitable research method to analyze the effects of this event on market quality (Wooldridge 2013). In the case at hand, the DiD-analysis consists of a treatment and a control group, which are observed on event and non-event days. However, only the treatment group is affected by the exogenous event on the event day. The DiD-methodology allows a clear analysis of the effect of a treatment (here the exogenous and unanticipated interruption of HFT on Xetra) since it cancels out potential confounding effects such as trends in the treatment group over the observation period and permanent differences between both groups (Imbens and Wooldridge 2009). Moreover, this methodology is commonly used to assess the impact of new regulations, market design variations, or changes in trading technology on the quality of securities markets (e.g., Gomber et al. 2016b; Clapham et al. 2021; Hendershott et al. 2011). Yet, the referenced studies apply the DiD-approach to analyses based on daily data whereas this study is based on intraday data. In additional tests reported together with other robustness checks in Sect. 4.4, we confirm that the common trends assumption of the DiD-approach (Angrist and Pischke 2008) holds for our sample despite the use of intraday data. Thereby, this study shows that the DiD-approach can also be used in case of observations at intraday frequency. Our regression setup for the DiD-approach is implemented as shown in Eq. (7):

Again, \(Y_{i,t}\) accounts for each liquidity, volatility, and trading activity parameter, where i represents the respective stock and t the respective one-minute observation interval. The dummy variable \(DAX_i\) has a value of one if the specific stock is in the treatment group and takes a value of zero otherwise. \(Event_t\) is also a dummy variable and indicates whether a one-minute interval belongs to one of the trading days without technical problems (zero) or whether it is on the treatment day where HFT was not possible on Xetra (one). In order to control for potential time trends and trend-driven differences between treatment and control group in the data, we also include a linear time trend \((Day \cdot DAX_{i})\) in the regression. Moreover, we add common market microstructure controls (\(C_{i}\), same as before) and control for each minute of the analyzed first hour of trading on the observed days by adding dummy variables for each minute (\(Minute_{t}\)). Minute controls are included since market quality parameters change over the trading day and also vary within the first hour of trading (McInish and Wood 1992). The variable \(\varepsilon _{i,t}\) represents the idiosyncratic error term. We derive the results of the panel regression relying on stock fixed effects (FE) estimators to cancel out stock specific time-constant and unobserved effects as suggested by Wooldridge (2002). Therefore, a single \(DAX_{i}\) dummy is not considered in the regression setup because it does not vary over time and would be dropped due to FE.

4.3 Results

4.3.1 Descriptive Statistics

Before discussing the results of our regression analyses, we will first focus on the descriptive statistics of our data. As described in the data set section, we aggregate all variables into one-minute intervals for the following analysis. Table 1 reports descriptive statistics for the four liquidity and two volatility measures analyzed in this study. In this table, liquidity and volatility measures are averaged separately across DAX30 stocks traded on Xetra and CAC40 stocks traded on Euronext as well as separately across days with HFT on Xetra (non-event) and the day where HFT on Xetra was interrupted (event). Also, the table shows percentage-wise changes in liquidity and volatility for each group of stocks between the first hour of trading on non-event days and the event day. Moreover, it includes a descriptive DiD-calculation, which shows the difference between the average changes within the two groups of stocks that serves as a first indicator for the effects of an interruption of HFT on securities market quality. Detailed descriptive statistics of the whole data set are provided in Tables 6 and 7 in the Supplementary file1, which provide further support for the comparability of treatment and control group.

With an average spread of 4.90 bps on days where HFT is possible, the constituents of the DAX30 are equally liquid as the stocks of the CAC40, which have an average relative spread of 4.95 bps. During the interruption of HFT connections on Xetra on October 2nd, 2017, however, the average spread of DAX30 stocks rises by 17.4% to 5.75 bps while the average spread of CAC40 stocks marginally decreases by 3.7%. Taking the difference between the respective changes in these two groups, which leads to a descriptive DiD-result based on means, we see that the average spread of stocks where HFT is not possible is 21.1% higher than the average spread of stocks where HFT takes place. Consequently, this is a first indication that HFT and the underlying low-latency trading infrastructure might increase liquidity in terms of relative spreads and, thus, lead to a positive economic spillover of this technology to other market participants and market quality as a whole.

Regarding the two measures L1-Volume and Depth(10) quantifying different dimensions of order book depth, we also see that liquidity deteriorates since less quoted volume is available in the order book when HFTs are absent. Order volume at the top of the order book (L1-Volume) on average decreases by 9.1% whereas the euro volume ten bps around the midpoint (Depth10) even decreases by 24.0% compared to CAC40 stocks. Most severely, order imbalance of DAX30 stocks increases by 32.5% when HFT is interrupted compared to the control group traded on Euronext where HFT is still possible. Again, these descriptive results suggest that investments in the underlying infrastructure and technology of HFT lead to spillover effects to securities markets and market participants since the market is more liquid and thus operationally more efficient if HFT technology is available.

Looking at the two volatility measures, we observe an increase for DAX30 stocks traded on Xetra from the non-event days to the event day while volatility for CAC40 stocks even declines. This results in 16.8% higher trade price volatility and 7.3% higher midpoint volatility on average when HFTs are suddenly absent. Consequently, this first descriptive analysis provides several indications that HFT positively affects market quality by increasing liquidity and decreasing volatility. Moreover, the descriptive analysis reveals that the non-event means for all analyzed variables are highly comparable between DAX30 stocks traded on Xetra and CAC40 stocks traded on Euronext, which reinforces the suitability of our selected control group.

4.3.2 Minute-Wise Regression Analysis

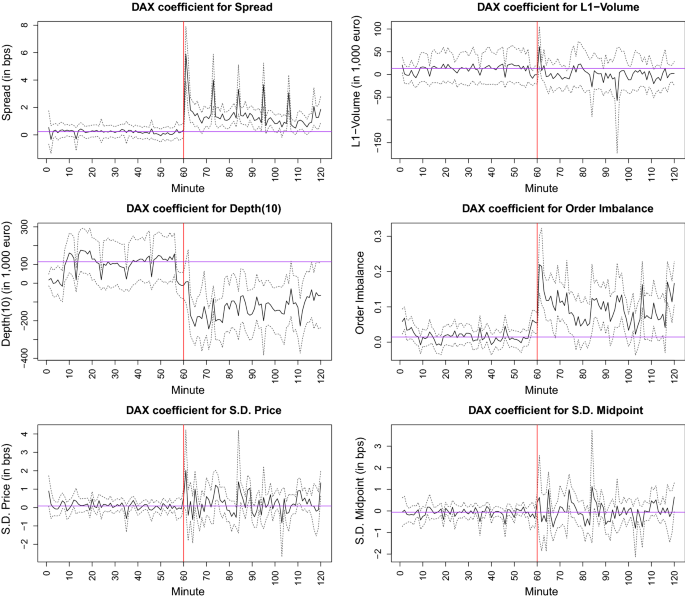

The results of the minute-wise regressions (see Fig. 1) show that the interruption of HFT significantly affects liquidity in terms of increased spreads and decreased order book depth measured by Depth(10). Bid-ask spreads are particularly high in the first minutes of the interruption of HFT and then gradually decrease. Yet, spreads remain significantly higher than the median bid-ask spread in the first hour of trading on non-event days throughout the entire period during which HFT was not possible. Also, Depth(10) is significantly lower on the event day indicating that less volume is available in the order book. Similarly to the spread, order imbalance is significantly higher in the first 15 min of the interruption of trading and then gradually decreases, thereby not always being significantly different from the non-event median as the lower bound of the 95%-confidence interval touches the non-event median several times. The effect on the volume available at the top of the order book (L1-Volume) is less pronounced. Although it is also slightly lower in almost every minute of the interruption of HFT, the non-event median is still within the 95%-confidence interval. Consequently, the analysis based on minute-wise regressions reveals a significant negative effect on most liquidity dimensions if HFT technology is unavailable.

Changes in liquidity and volatility due to the interruption of HFT (minute-wise regressions). This figure illustrates the \(\beta _1\)-coefficient from Eq. (6), i.e., the minute-wise cross-sectional differences between treatment (DAX30) and control group (CAC40), for each minute of the first hour of trading on non-event days (minutes 1 to 60) and the event day (minutes 61 to 120) separated by the red line. Dependent variables are Spread, L1-Volume, Depth(10), Order Imbalance, S.D. Price, and S.D. Midpoint. The purple line represents the median coefficient for non-event days and the dotted lines represent the upper and lower bounds of the 95%-confidence interval

Looking at the two volatility measures, we observe that the variance of the minute-wise cross-sectional differences between treatment (DAX30) and control group (CAC40) substantially rises. Because the majority of coefficients is above the non-event median, a slight increase in volatility, particularly in trade price volatility, is visible. However, this effect is less pronounced than for the liquidity measures and the coefficients are not significantly different from the non-event median but rather fluctuate around it. Consequently, the effect of an interruption of HFT on volatility is not so strong that it consistently affects volatility in each one-minute interval of the observation period.

To answer our hypotheses and to avoid the detection of mechanical effects due to the potential absence of one group of tradersFootnote 9, also changes in trading activity need to be evaluated. The results of the minute-wise regression analyses of trading activity are provided in Fig. 2 in the Supplementary file1. As the results show, no significant effect on trading activity is observable due to the interruption of HFT technology. Thus, this analysis provides first supporting evidence for all three liquidity-related hypotheses H1a to H1c, although there is weaker evidence for changes in order book depth measured by L1-Volume. A significant effect on trade price and midpoint volatility (H2a and H2b) cannot be found based on this analysis.

4.3.3 DiD-Regression Analysis

In order to evaluate the overall effect of the interruption of HFT technology on liquidity and volatility, we perform a DiD-regression as described in Eq. (7). The DiD-regression allows us to attribute changes in market quality to the sudden interruption of HFT since the control group filters out potential confounding effects that affect both DAX30 and CAC40 stocks and which would otherwise bias our results. Therefore, we are able to assess whether there are positive spillover effects of HFT investments on the quality of securities markets.

Table 2 provides the results of the DiD-regression for the analyzed liquidity and volatility measures that quantify different dimensions of market quality. Our main variable of interest is the interaction term \(Event \cdot DAX\) (abbreviated as DiD), which is the DiD-coefficient and thus represents the impact of a sudden interruption of HFT on the respective market quality measure. For all four liquidity measures, we observe a statistically significant negative effect when HFT is suddenly interrupted. Relative spreads for DAX30 stocks increase by 1.08 bps compared to regular trading days when HFT technology is available. Relative to a spread of 4.90 bps for DAX30 stocks when HFT is possible (see non-event value for Xetra in Table 1), the increase of 1.08 bps due the interruption of HFT is also economically relevant since it equals an increase in implicit transaction costs by 22% for (smaller) trades that are executed at the best bid or best ask.

Besides increased spreads, also order book depth measured by Depth(10) and L1-Volume worsens significantly when HFT is interrupted. Sufficient order book depth is particularly relevant to mitigate the price impact and the resulting implicit transaction costs of larger orders. Again, the reduction of order book depth is economically relevant as Depth(10) decreases by 203,947 euro (25%) compared to 813,850 euro (see Table 1) when HFT is possible. L1-Volume representing the passive volume quoted at the top of the order book decreases by 11,291 euro when HFTs are unable to trade at low latency. Yet, the coefficient is only significant at the 10%-level and the corresponding \(R^2\) is relatively low. Consequently, the evidence regarding the effect on L1-Volume is less pronounced, which is in line with the results of the minute-wise regression analysis (see Fig. 1) and the non-significant effect of a robustness test based on matched pairs (see Sect. 4.4 and Table 8 in the Supplementary file1). Moreover, we observe a significant increase in order book imbalance when HFTs are unable to trade at low latency amounting to more than 31% relative to the non-event value. This shows that markets are more vulnerable to price shocks due to sudden excess demand or excess supply when HFT is unavailable, which is in line with Brogaard et al. (2018).

The results for changes in volatility, which are depicted in the last two columns of Table 2, show that trade price volatility significantly increases when HFT is interrupted. Although the minute-wise changes are not significantly different from the non-event median (see Fig. 1), the overall effect of the unavailability of HFT technology leads to significantly increased trade price volatility when taking the whole interruption period into account. Consequently, HFT technology and the liquidity providing trading strategies of many HFTs seem to absorb short-term price changes and thus reduce trade price volatility, which again is valuable for all market participants since lower volatility reduces risk and transaction costs in securities markets. Yet, the effect on midpoint volatility is not significant. Since HFTs are highly active in the order book with frequent order submissions and cancellations, this result is surprising at first glance. However, this typical behavior of HFTs directly serves as explanation for this results since there is a trade-off between the positive influence of HFTs reducing short-term volatility and the increased flickering of the order book due to HFTs’ frequent order updates. When HFT is suddenly interrupted, these two effects might cancel out, which can explain the non-significant result for midpoint volatility while we do see an effect on trade price volatility.

The other reported coefficients predominantly serve to control for general differences between the event day and non-event days (Event), differences over time that apply to both DAX30 and CAC40 stocks (Day), and a potential time trend (\(Day \cdot Dax\)) in the differences between DAX30 and CAC40 stocks. They are important to rule out that these effects influence our DiD-variable of interest, but are not relevant to answer our research question. Therefore, these variables are not discussed in detail. The same applies to the control variables.

In order to rule out that the observed effects on liquidity and volatility result from mechanical effects due to changes in trading activity caused by the interruption of HFT, we also conduct the DiD-analysis for the trading activity measures. The results are reported in Table 3 and clearly show that the interruption of HFT connections did not significantly change any of the four measures of trading activity. The DiD-coefficient for trading volume is even positive although not significant. These findings can be explained by the fact that traders who usually act as HFTs do not completely lose the connection to Xetra. They are only unable to trade at low latency using the usual high-frequency connections to the exchange and can thus continue trading via connections to the market that offer the regular speed. Consequently, the results of the DiD-regression strongly support that HFT technology increases stock market liquidity along different dimensions (H1a to H1c) and thus leads to lower transaction costs for all market participants. Moreover, we find support for increased trade price volatility when HFT is interrupted (H2a). Hypothesis H2b regarding midpoint volatility needs to be rejected, most likely due to the ambivalent nature of HFT with respect to order book and midpoint changes.

Having identified the overall impact of an interruption of HFT on liquidity and volatility, we need to evaluate the effect size by comparing it to potentially mechanical effects of an interruption of HFT on trading activity. This allows us to determine the excess effect on liquidity and trading volume in addition to potential changes in trading activity and to derive final conclusions regarding our hypotheses. Although the DiD-analysis revealed no significant effects of an interruption of HFT on trading activity, we still use the corresponding coefficients as a conservative approach to determine the net effect of HFTs’ low-latency technology on liquidity and volatility. Specifically, we compare the percentage change of trading activity and liquidity/volatility measures using the respective DiD-coefficient and the corresponding non-event mean value. The results of this analysis are reported in Table 4.

As already discussed, all DiD-coefficients for the different liquidity measures and trade price volatility are significant. The analysis provided in Table 4 further shows a substantial effect of an interruption of HFT net of changes in trading activity, particularly for the liquidity measures spread (net increase by 11% to 15%), Depth(10) (net decrease by 14% to 18%), and order imbalance (net increase by 21% to 25%). The net effect is calculated by subtracting the percentage change of market quality variables based on the DID-coefficient from Eq. (7) from the percentage change in the number of trades and quotes.Footnote 10 The effect on L1-Volume is less strong (net decrease up to 5%), which is in line with the previous analyses. One likely explanation for the smaller impact of an interruption of HFT on L1-Volume is that without HFT technology, two-sided liquidity-providing orders are submitted with wider spreads, but not necessarily with substantially lower volume. Consequently, the whole order book moves further away from the midpoint and liquidity-providing orders now rest on relatively lower levels of the order book compared to days on which HFT is possible. While L1-Volume captures the (slightly lower) volume at the new best bid and ask, and thus does not decrease that substantially, it is of completely other quality because of the larger distance to the midpoint representing the fair value of a stock.

Taken together, the net-effect analysis shows a positive spillover of HFT technology on securities markets by leading to higher levels of liquidity. This holds for relative spreads, thus confirming Hypothesis H1a, order book imbalance (H1c), and at least partially for order book depth (H1b). Consequently our results clearly show that HFT increases liquidity along different dimensions.

We also observe a positive net effect on trade price volatility indicating that an interruption of HFT increases stock market volatility. The net effect on midpoint volatility is not substantially different from zero and also the direction of the effect is not robust (see Sect. 4.4), which can be explained by the opposing effects of HFT on midpoint volatility as already discussed. With respect to our second hypothesis, we thus provide evidence that the interruption of HFT increases trade price volatility up to 7% net of changes in trading activity (H2a) but does not lead to significant changes in midpoint volatility (H2b).

In summary, our analysis shows that HFT significantly improves the quality of securities markets. While we do not find any changes in trading activity that can be traced back to an interruption of HFT technology, we do find a positive effect of HFT on liquidity and also on trade price volatility. If HFT is suddenly interrupted, three of the four analyzed liquidity measures significantly deteriorate and trade price volatility increases. Most importantly, all these effects are substantially larger than any of the insignificant changes in trading activity so that they do not mechanically result from the potential absence of some traders. However, the impact of HFT on liquidity is more pronounced than its effect on trade price volatility. For the latter, we only find significant evidence based on the entire interruption period but not when looking at the individual one-minute observations. In summary, our findings show that investments in HFT infrastructure and technology provide positive economic spillover effects for the entire securities market since HFT enhances market quality and reduces transaction costs for all market participants.

4.4 Robustness Checks

We also perform different robustness checks to validate the results of our analyses. First, we test whether the basic assumption of the DiD-approach, i.e., the existence of a common trend in treatment and control group before the treatment (Angrist and Pischke 2008), holds in our case. This is particularly relevant because different from previous studies (e.g., Gomber et al. 2016b; Clapham et al. 2021; Hendershott et al. 2011), this study applies the DiD-analysis to intraday data. Fig. 3 in the Supplementary file1 plots the market quality and trading activity measures for DAX30 and CAC40 stocks averaged for each minute of the first hour of trading on non-event days and the event day. The plots provide strong support for a common trend of DAX30 and CAC40 stocks in the non-event period, especially for the liquidity measures spread and order imbalance as well as for the two volatility measures. The common trend assumption also holds for the two order book depth measures Depth(10) and L1-Volume except for a jump in DAX30 stocks (which is not observable for CAC40 stocks) in the minutes 15 to 20. Common trends are also visible for the trading activity measures number of trades, quotes, submissions, and trading volume.

To provide further evidence for the assumption of common trends to hold for our sample, we also conduct a formal test as suggested by Autor (2003) and Pischke (2005). Therefore, we interact the treatment variable with time dummies (in our case for every minute of the pre-event period) and leave out the interaction term for the last pre-event period to test whether the differences between treatment and control group in earlier non-event periods deviate from the last pre-event period. If treatment and control group follow common trends, the majority of interaction terms should be insignificant. The analysis shows that this is the case for our sample. For the analyzed liquidity and volatility measures, the average share of insignificant non-event interaction terms is 85.0% (min 66.1%, max 94.9%) while it is 76.3% (min 62.7%, max 83.1%) for the trading activity measures. Thus, the DiD-assumption of common trends is fulfilled for our sample despite the short observation period and the use of intraday data.

Second, since the control group of CAC40 stocks is larger than the treatment group of DAX30 stocks, we repeat the DiD-analysis using one-to-one nearest-neighbor matching without replacement as suggested by Davies and Kim (2009). With this methodology, the most similar CAC40 stock is assigned to each DAX30 stock, which results in equally sized treatment and control group, each consisting of 30 stocks.Footnote 11 Following Davies and Kim (2009), we match stocks according to market capitalization and stock price as of the event day.Footnote 12 The findings of this analysis based on matched stocks from the control to the treatment group strongly support our results. The results are highly comparable to the results of the DiD-regressions based on the full sample both in terms of effect size and significance (see Tables 8 and 9 in the Supplementary file1). Only the negative effect on L1-Volume is not significant based on the matched pairs sample. Yet, this is in line with the results of the minute-wise regressions and the relatively low significance of the effect for the full sample. Moreover, also the effect size net of changes in trading activity is highly comparable between our initial results and the matched sample (see Table 10 in the Supplementary file1). We only observe a sign change for the insignificant effect of HFT on midpoint volatility. For all other measures, the impact of HFT on market quality net of changes in trading activity is even slightly more pronounced when comparing the results for the matched sample with those for the full sample.

Third, we investigate whether the impact of an interruption of HFT on market quality differs for large and small stocks. Therefore, we divide the matched sample into thirds according to market capitalization and run the DiD-regression separately for each subset of stocks. As shown in Table 11 in the Supplementary file1, the results for the different subsets according to market capitalization are qualitatively similar while the effect of an interruption of HFT on volatility is mainly driven by the medium third group. Yet, although the stocks in our sample significantly vary in size (market capitalization of the largest DAX30 stock is 18 times larger than that of smallest DAX30 stock in our sample), they still represent the largest and most liquid German stocks.

5 Discussion

5.1 Contribution to Research

5.1.1 IS Literature

With our research, we add to the IS-literature in manifold ways. We contribute to the long standing question raised by Han et al. (2011) whether IT-systems can be beneficial not only for the companies that invest in them but also for firms in the same industry that do not directly invest in such systems. In this paper, we show that the IT-systems used by HFTs indeed have a positive effect on the overall market (measured by market quality) and consequently all market participants. This comes despite the fact that only a subset of market participants, i.e., HFTs, invest in such IT-systems. Therefore, these investments and trading systems provide a positive spillover to the rest of the market. With this finding, we follow the call of Kohli and Grover (2008) and contribute to the proposed research thrust on the indirect and intangible paths of economic value of IT. In this regard, our paper increases the understanding of the effects of HFT and the underlying technology on the securities trading industry and adds to the call for IS-related research on HFT by Currie and Seddon (2017).

5.1.2 Finance Literature

Based on an event with a technical disruption of the ultra-fast connections to the exchange that suddenly interrupted HFT in a securities market, we contribute to the research stream of HFT and market quality in the finance literature. Our results confirm the results of previous studies (e.g., Hasbrouck and Saar 2013) and indicate positive effects of HFT on liquidity and volatility measured along a variety of dimensions. The positive impact on volatility, however, is less distinct than the positive impact on liquidity. Our methodology has two major advantages compared to existing empirical studies. First, the connectivity failure for HFTs allows us to investigate a sharp and unanticipated cut in HFT activity, which enables us to analyze market quality with and without HFT activity. Previous studies either analyze incremental changes in HFT activity over time (e.g., Hasbrouck and Saar 2013) or conduct event studies based on regulatory acts aimed to limit HFT (e.g., Friederich and Payne 2015), which, however, are known in advance and thus might be biased by announcement effects. Second, we are able to use a public data feed but still do not need to rely on any proxy for HFT activity. Moreover, our results show that markets do not collapse when HFTs as a significant group of market participants lose their primary market access. Nevertheless, trading becomes more costly for all market participants and volatility increases when HFTs are unable to trade at low latency.

5.2 Practical Implications

The results of our analysis are highly relevant for investors, market operators, and regulators alike. The trading strategies of HFTs are not only profitable for those traders that have the ability to use low latency infrastructure, but our results show that HFT activity also enhances market quality for all participants in financial markets and the securities trading industry as a whole. Thus, other institutional investors and also retail investors benefit from the liquidity provided by HFTs since lower spreads and higher order book depth decrease transaction costs. In particular, our results show that spreads increase by 22% (15% net of changes in trading activity) and depth decreases by 25% (18% net of changes in trading activity) when HFT technology is unavailable, which is highly relevant from an economic point of view since these are the major determinants of implicit transaction costs that traders and investors have to bear. Despite these huge cost savings and improvements in liquidity, sufficient and resilient protection mechanisms need to be in place to curb the risk of potential negative effects of HFT such as flash crashes, e.g., by using circuit breakers, which most regulators demand exchanges to implement (Gomber et al. 2016a).

From the perspective of market operators, our results emphasize the importance of HFTs for the liquidity of a market. Since a liquid market is necessary to compete with other trading venues, market operators should continue to invest in low latency infrastructure and fast trading systems in order to attract HFTs’ order flow. Nevertheless, exchange operators need to be aware that the market quality of their trading platform (and thus its attractiveness) depends on a potentially small group of HFT firms, which could create a disadvantageous dependency for the exchange. Our results also suggest that market regulation which potentially limits HFT activity should be designed with caution since our results show that HFT activity enhances market quality. Yet, also potential harmful effects of HFTs need to be taken into consideration. Further, the analyzed event impressively illustrates the role that operational risk plays in today’s financial markets. With new technologies emerging, regulators should also consider these developments in their regulatory approach to ensure safe and resilient markets.

5.3 Limitations and Future Research

We are aware that our empirical study has some limitations. First, we rely on a DiD-approach to exclude any confounding effects using the stocks of the CAC40 index as control group. Although DAX30 and CAC40 show common trends in the non-event period and the stocks as well as both markets Xetra and Euronext are highly comparable in several dimensions, there could still be other effects besides the sudden interruption of HFT that only affect German stocks and not the control group of French stocks or vice versa. Second, we rely on the first hour of trading on four different Mondays where HFT was possible as control period. Nevertheless, there might be other specific differences on these days although we have checked that there were no other major announcements or events and included several controls in our analyses. However, since the first hour of trading exhibits significantly other market quality parameters than other hours throughout the trading day (McInish and Wood 1992), a comparison with the first trading hour on other days is necessary and Mondays appear to be the best choice given the existence of the day-of-the-week effect in financial markets (Dubois and Louvet 1996). Finally, our observations are based on highly liquid blue chip stocks and a short observation window of one hour for the interruption of HFT at a particular stock exchange. Thus, our findings might not be completely generalizable regarding other stock segments and markets although our results are comparable to the findings of other academic studies on HFT.

Most importantly, our results need to be put in relation to potential adverse effects of HFT and its underlying technology that are not part of our study. For instance, although HFTs initially trade in the opposite direction of sudden and extreme price movements, they support an acceleration of such events in case extreme price movements persist for a longer time or affect multiple securities, which can lead to so-called mini flash crashes (Brogaard et al. 2018). This behavior of HFTs was also visible during the Flash Crash in May 2010 where major U.S. stock market indices plunged and recovered within minutes (Kirilenko et al. 2017). Moreover, HFT and the speed of trading can have negative implications for information production since informed traders have less time to trade on their information, which they, e.g., obtained via research (Baldauf and Mollner 2020). Therefore, and as HFTs try to detect and join such informed trading, prices become more efficient in the short run since private information is incorporated into market prices more quickly. But informational rents have to be shared so that institutional traders might have less incentives to engage in costly research and information production, which could lead to less efficient prices in the long run (Van Kervel and Menkveld 2019).

Despite the large literature stream on HFT, there are still many interesting directions and opportunities for future research. For example, future work could focus on the interconnectedness of primary markets and alternative trading venues due to HFT in order to investigate whether and how a technical problem regarding HFT on one exchange might affect trading and market quality on alternative trading venues. In addition, taking into account the limitation that we only analyze European securities markets, future research could investigate technical problems with HFT in U.S. markets, which show even higher levels of HFT activity than European markets. Finally, future research could investigate how the interruption of HFT due to a technical failure affects price discovery and information transmission in securities markets.

6 Conclusion

Besides regulatory changes, technological advancements and the automation of trading processes have led to major transformations of the securities trading industry and securities markets in Europe as well as in other jurisdictions. In particular, the emergence and rise of HFT, which accounts for around 35% of the equity trading volume in Europe and around 50% in the U.S. (Zaharudin et al. 2022), has gained academic and regulatory attention. We want to contribute to the discussion on whether HFT is beneficial for financial markets and whether the huge investments in necessary low latency infrastructure have positive spillover effects for the entire market and all market participants due to improvements in market quality.

Unlike existing studies on HFT, we analyze a technical failure at a major stock exchange that prevents HFTs from trading at low latency in order to draw conclusions about the impact of HFT on securities market quality and the securities trading industry. This event allows us to analyze a sharp and unexpected cut-off of HFT activity rather than to investigate incremental changes in HFT activity over time. Moreover, we can rely on a public data feed without the need to approximate HFT activity. Showing how securities markets react when HFT technology is suddenly interrupted due to a technical failure, our results confirm the positive impact of HFT on liquidity and trade price volatility. Consequently, HFT and associated investments in the necessary infrastructure lead to more efficient markets and lower transaction costs for all market participants, which confirms the value of this technology for securities markets and the existence of a positive spillover effect of investments in low-latency infrastructure for the entire securities trading industry.

Notes

We measure trading activity along different dimensions and account for the number and volume of transactions as well as for the number of order book interactions (number of submissions and number of quote updates).

The event date October 2nd, 2017 was a regular trading day with otherwise “normal” trading conditions, relatively low market volatility on the event day and the days before and after as measured by the volatility index VDAX, and no increased number of (ad-hoc) news according to Thomson Reuters and Bloomberg.

Continuous trading for each stock starts at 09:00:00 plus a random end of the opening auction of up to 30 s. Deutsche Börse confirmed that the outage of high-frequency connections already started slightly before 09:00:00.

Order updates result from new orders entering the market or from modifications or deletions of existing orders.

Besides quoted spreads, other studies on market quality often also analyze effective spreads (e.g., Chordia et al. 2001; O’Hara 2015). The quoted spread averages the bid-ask spread over a given period, and thus, provides an indication of the implicit transaction costs during a given period independent from trade executions. The effective spread, in contrast, is only calculated once a trade occurs by multiplying the difference between trade price and midpoint by two. Since traders might trade strategically when bid-ask spreads are narrow, the quoted spread can overestimate implicit transaction costs. However, the dependence of the effective spread on actual trades and a potential strategic behavior of traders is the reason why we do not use the effective spread in this study but focus on the quoted spread. Compared to other traders, HFTs are particularly strong at trading strategically when bid-ask spreads are narrow (e.g., Hendershott and Riordan 2013). Consequently, effective spreads would mechanically rise when HFT technology is unavailable although not necessarily leading to worse spreads for other market participants. This does not hold for quoted spreads, which are only determined by liquidity supply. Therefore, relying on quoted spreads allows us to analyze spillover effects of HFT without potential biases or mechanical adjustments in effective spreads.

To get spreads in bps, the relative quoted spread shown in Eq. (1) is multiplied by 10,000.

There are are five extended opening auctions of 2 min in the sample that reduce the theoretical maximum number of observations of 21,000 by 10.

Due to the high correlation of trading volume and the number of trades, log trading volume is not included in the regressions where Trades and Volume are the dependent variables.

Although HFTs cannot trade using their regular high-frequency gateways and infrastructure, they can still trade via slower connections to the exchange.

Changes in the number of trades and quotes are chosen as reference because they represent the strongest effect on trading activity in terms of executed trades and order book activity, respectively, thus being the most conservative references.

The 30 CAC40 stocks included in the matched pairs sample are denoted by * in Table 5 in the Supplementary file1.

The results do not change if we use the first or the last control day as reference.

References

Aït-Sahalia Y, Sağlam M (2017) High frequency market making: optimal quoting. Working Paper

Angrist JD, Pischke JS (2008) Mostly harmless econometrics. Princeton University Press, Princeton

Autor DH (2003) Outsourcing at will: the contribution of unjust dismissal doctrine to the growth of employment outsourcing. J Labor Econ 21(1):1–42

Baldauf M, Mollner J (2020) High-frequency trading and market performance. J Finance 75(3):1495–1526. https://doi.org/10.1111/jofi.12882

Baron M, Brogaard J, Kirilenko A (2012) The trading profits of high frequency traders. Working Paper

Battalio R, Schultz P (2011) Regulatory uncertainty and market liquidity: the 2008 short sale ban’s impact on equity option markets. J Finance 66(6):2013–2053. https://doi.org/10.1111/j.1540-6261.2011.01700.x

Biais B, Foucault T, Moinas S (2015) Equilibrium fast trading. J Finance Econ 116(2):292–313. https://doi.org/10.1016/j.jfineco.2015.03.004

Brogaard J, Hendershott T, Riordan R (2014) High-frequency trading and price discovery. Rev Finance Stud 27(8):2267–2306. https://doi.org/10.1093/rfs/hhu032

Brogaard J, Carrion A, Moyaert T, Riordan R, Shkilko A, Sokolov K (2018) High frequency trading and extreme price movements. J Finance Econ 128(2):253–265. https://doi.org/10.1016/j.jfineco.2018.02.002

Budish E, Cramton P, Shim J (2015) The high-frequency trading arms race: frequent batch auctions as a market design response. Q J Econ 130(4):1547–1621. https://doi.org/10.1093/qje/qjv027

Carrion A (2013) Very fast money: high-frequency trading on the NASDAQ. J Finance Market 16(4):680–711. https://doi.org/10.1016/j.finmar.2013.06.005

Chordia T, Roll R, Subrahmanyam A (2001) Market liquidity and trading activity. J Finance 56(2):501–530. https://doi.org/10.1111/0022-1082.00335

Chordia T, Roll R, Subrahmanyam A (2002) Order imbalance, liquidity, and market returns. J Finance Econ 65(1):111–130. https://doi.org/10.1016/S0304-405X(02)00136-8

Clapham B, Gomber P, Lausen J, Panz S (2021) Liquidity provider incentives in fragmented securities markets. J Empire Finance 60:16–38. https://doi.org/10.1016/j.jempfin.2020.11.002

Currie WL, Seddon JJ (2017) The regulatory, technology and market ‘dark arts trilogy’ of high frequency trading: a research agenda. J Inf Technol 32(2):111–126. https://doi.org/10.1057/s41265-016-0025-3

Davies RJ, Kim SS (2009) Using matched samples to test for differences in trade execution costs. J Finance Market 12(2):173–202. https://doi.org/10.1016/j.finmar.2008.06.001

Degryse H, de Jong F, van Kervel V (2015) The impact of dark trading and visible fragmentation on market quality. Rev Finance 19(4):1587–1622. https://doi.org/10.1093/rof/rfu027

Deutsche Börse (2017a) XETR : Emergency information MIC: XETR. https://www.xetra.com/xetra-en/newsroom/xetra-newsboard/XETR-Emergency-Information-MIC-XETR-422166. Accessed 09 April 2021

Deutsche Börse (2017b) XETR : Emergency information MIC: XETR - resolved. https://www.xetra.com/xetra-en/newsroom/xetra-newsboard/XETR-Emergency-Information-MIC-XETR-resolved-422912. Accessed 09 April 2021

Dubois M, Louvet P (1996) The day-of-the-week effect: the international evidence. J Bank Finance 20(9):1463–1484. https://doi.org/10.1016/0378-4266(95)00054-2

European Parliament and Council (2014) Markets in financial instruments directive 2014/65/EU: MiFID II

European Securities and Markets Authority (2014) High-frequency trading activity in EU equity markets. ESMA Economic Report No 1, 2014

Francioni R, Gomber P (2017) High frequency trading: market structure matters. In: Francioni R, Schwartz RA (eds) Equity markets in transition: the value chain, price discovery, regulation, and beyond, Springer, Cham, pp 363–390, https://doi.org/10.1007/978-3-319-45848-9_13

Friederich S, Payne R (2015) Order-to-trade ratios and market liquidity. J Bank Finance 50:214–223. https://doi.org/10.1016/j.jbankfin.2014.10.005

Gomber P, Zimmermann K (2018) Algorithmic trading in practice. In: Chen SH, Kaboudan M, Du YR (eds) The Oxford handbook of computational economics and finance, Oxford University Press, New York, pp 311–332. https://doi.org/10.1093/oxfordhb/9780199844371.013.12

Gomber P, Arndt B, Lutat M, Uhle T (2011) High-frequency trading. SAFE White Paper No 3

Gomber P, Clapham B, Haferkorn M, Panz S, Jentsch P (2016) Ensuring market integrity and stability: circuit breakers on international trading venues. J Trad 12(1):42–54

Gomber P, Haferkorn M, Zimmermann K (2016) Securities transaction tax and market quality – the case of France. Europ Financ Manag 22(2):313–337. https://doi.org/10.1111/eufm.12062

Gresse C (2017) Effects of lit and dark market fragmentation on liquidity. J Finance Market 35:1–20. https://doi.org/10.1016/j.finmar.2017.05.003

Haferkorn M (2017) High-frequency trading and its role in fragmented markets. J Inf Technol 32(3):283–296. https://doi.org/10.1057/s41265-016-0030-6

Hagströmer B, Nordén L (2013) The diversity of high-frequency traders. J Finance Market 16(4):741–770. https://doi.org/10.1016/j.finmar.2013.05.009

Han K, Chang YB, Hahn J (2011) Information technology spillover and productivity: the role of information technology intensity and competition. J Manag Inf Syst 28(1):115–146. https://doi.org/10.2753/MIS0742-1222280105

Harris L (2003) Trading and exchanges: market microstructure for practitioners. Oxford University Press, New York

Hasbrouck J, Saar G (2013) Low-latency trading. J Finance Market 16(4):646–679. https://doi.org/10.1016/j.finmar.2013.05.003

Hendershott T, Riordan R (2013) Algorithmic trading and the market for liquidity. J Finance Quant Anal 48(4):1001–1024. https://doi.org/10.1017/S0022109013000471

Hendershott T, Jones CM, Menkveld AJ (2011) Does algorithmic trading improve liquidity? J Finance 66(1):1–33. https://doi.org/10.1111/j.1540-6261.2010.01624.x

Imbens GW, Wooldridge JM (2009) Recent developments in the econometrics of program evaluation. J Econ Lit 47(1):5–86. https://doi.org/10.1257/jel.47.1.5

Kirilenko A, Kyle AS, Samadi M, Tuzun T (2017) The Flash Crash: high-frequency trading in an electronic market. J Finance 72(3):967–998. https://doi.org/10.1111/jofi.12498

Kohli R, Grover V (2008) Business value of IT: an essay on expanding research directions to keep up with the times. J Assoct Inf Syst 9(1):23–39. https://doi.org/10.17705/1jais.00147