Abstract

Purpose

This article analyses the factors influencing the uptake of computed tomography (CT) and magnetic resonance imaging (MRI) technologies by a sample of private hospitals located in Galicia-North of Portugal European Region.

Methods

Regarding adoption, associations with the different variables were analysed by means of binary logistic regression for CT and MRI of data from 24 private hospitals for the period 2006–2019. The sample data used to perform the regression analyses were panel data (Wooldridge in Econometric Analysis of Cross Section and Panel Data, Cambridge, Massachusetts, 1) and statistical significance was established at p ≤ 0.05.

Results

We find that hospital size, proxied by the number of beds, best explains the decision to adopt CT technology, while the only sociodemographic variable that affects the adoption decision is age above 64 years. Hospital size is also the main explanatory variable for MRI technology adoption, and in this case, all sociodemographic variables, except for population density, affect the adoption decision.

Conclusions

The availability of a CT scanner reduces the probability of a private hospital adopting MRI technology. Contracts with Public Sector have a counterfactual effect on CT uptake and a negative influence on MRI uptake.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The role of the private sector in developing better health systems and improving healthcare worldwide is increasingly recognized [2]. Galicia – a region in northwest Spain forming part of the Galicia-North Portugal cross-border Euroregion – is no exception, since 24 of the 36 hospitals that make up the Galician healthcare system (SERGAS) are private hospitals, accounting for 2,285 of a total of 9,809 beds and 73 of a total of 282 operating theatres [3, 4]. Moreover, 12 of the 187.6 specialist care doctors and 30 of the 340.5 nursing assistants per 100,000 inhabitants in Galicia are employed in private hospitals, while an annual average of 12.6% of diagnostic tests and 25.5% of surgical interventions are undertaken in private hospitals. Private hospitals thus play a significant role in SERGAS, despite the prevalence of a subsector with no profit motive and financed by agents who are not the main users of its services.

A crucial role in guaranteeing quality healthcare is played by advanced medical technologies, which are complex, costly, and usually limited to a few locations where they are managed by specialists [5]. Diagnostic technologies, in particular, are very important in guaranteeing healthcare quality, as they are essential to improving diagnostic precision and therapeutic decision-making [6]. Key diagnostic technologies are computed tomography (CT) and magnetic resonance imaging (MRI) scanners [7,8,9,10,11, 12]. Since their commercialization from the mid-1970s (CT) and the mid-1980s (MRI) [13], both have revolutionized medical diagnostics.Footnote 1 MRI scanners are used to evaluate blood vessels, breasts, and major organs, while CT scanners are used for clinical evaluation of the pelvis, thorax, abdomen, and colon, for the detection of tumours, pulmonary embolisms (CT angiography), abdominal aortic aneurysms, and spinal lesions, and for cardiology examinations, while CT enhancements (such as dose-modulated acquisition and iterative reconstruction algorithms) reduce X-ray dosage, improve hospital efficiency and clinical effectiveness, and reduce costs.

Key technology assessment agenciesFootnote 2 list CT and MRI as priority technologies, while a survey asking 387 internists to rank 30 medical innovations in terms of importance resulted in MRI and CT scanners being placed first and second, in that order [14]. Use of both technologies has increased rapidly – by an annual average of 5.6% and 6.8% for MRI and CT technologies, respectively, in the period 2014–2019 [15]. World Health Organization (WHO) objectives regarding systematic assessment of medical technologies refer to appropriate use, safety and acceptability, and practical and economic effectiveness [16], and highlight the usefulness of CT and MRI technologies for diagnosing severe injuries and substituting for more invasive and higher-risk approaches.

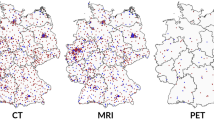

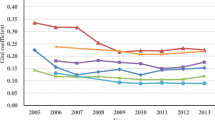

Nonetheless, in the interest of monitoring and controlling health spending [17, 18], identifying how and why these new technologies are adopted is timely and relevant. First, new healthcare needs require new diagnostic and therapeutic procedures that need to be analysed in terms of their use by hospitals. Second, new healthcare technologies are a key contributor to increased health spending in recent decades [19],indeed, several studies refer to a medical arms race, with advanced medical technologies deployed as a competitive strategy to attract patients and specialist physicians [20, 21]. Third, expected profits cannot be the only criterion that determines medical technology uptake by private hospitals [22].Footnote 3 Finally, a clear adoption pattern by private hospitals seems not to exist, as confirmed by annual variations in the number of CT and MRI scans (see Fig. 1 below).

Our paper contributes to the literature on health technology evaluation with several findings. First, CT and MRI technology uptake by private hospitals as a substitute for more invasive and higher-risk medical interventions is mainly explained by hospital size, measured as the number of beds. Size can be understood as a proxy for hospital prestige and quality, since it is widely perceived that healthcare quality is better in larger hospitals, as confirmed by research into three overlapping areas that are near-synonymous with care in large institutions, namely specialization, centralization, and volume. Since each of these care areas produces significant profits, recognition and perceptions of prestige are on the side of larger hospitals with more beds [23,24,25]Footnote 4 Second, payment policies influence CT and MRI technology uptake by private hospitals, as already suggested by [26]. Because public sector Contracts influence the profitability of private hospitals, variable Contracts can be understood as a proxy for the profitability associated with new technologies.Footnote 5 Third, population density does not appear to significantly impact on CT and MRI technology uptake by private hospitals, suggesting that demand for CT and MRI scans is induced in private hospitals. Finally, the adoption rate of a new technology is slowed down when the innovation replaces older equipment in which professionals and institutions have invested substantial resources (time and money). Resistance to abandoning an obsolete or near-obsolete technology may be explained as a natural defence of past efforts to incorporate and master the technology, and often those who advocate innovation are also reluctant to abandon older technologies. This is especially relevant to MRI technology uptake, which seems to be affected by the fact that it is supposed to replace nuclear medicine technologies, e.g., gamma cameras and single-photon emission computerized tomography (SPECT) scanners.

Our findings can help decision-makers better plan investments in new medical technologies and to forestall possible premature diffusion without adequate knowledge of true efficacy, given that evaluation of costly technologies is crucial to monitoring and controlling health spending [17, 18].

Thus, starting from how private hospitals decide whether or not to acquire advanced medical technologies (probably based on expected profits, enhanced reputation, and/or competitive advantage), we explore other factors influencing the adoption decision. The uptake of advanced medical technology can potentially transform a fundamental healthcare resource into a symbol of power and prestige, or even an end in itself [27, 28]. Another issue is the technological imperative itself [29], which may stimulate technological innovation beyond genuine healthcare needs of diagnosing a disease and providing a cure [30, 31].

The remainder of the article is laid out as follows. Section 2 describes our data and analysis methods, Sect. 3 describes our results, Sect. 4 discusses the results and their implications, and Sect. 5 concludes.

2 Data and methods

Our research scope was Galician private hospitals equipped with CT and MRI technologies and the study period was 2006–2019. Data on CT and MRI scanners were provided by the Spanish Ministry of Health, while data on hospital inputs were obtained from specialist healthcare and in-patient healthcare establishment statistics as reported by SERGAS and hospitals and published by the Spanish Ministry of Health [32]. Measured as annual hospital inputs were number of beds, number of CT and MRI scanners, and number of other diagnostic and therapeutic medical technologies (gamma cameras, lithotripsy units, linear accelerator units, SPECT scanners, and haemodynamic facilities, henceforth referred to as other high-tech equipment). Sociodemographic data was obtained from the Galician Institute of Statistics (IGE)Footnote 6 for each hospital’s catchment area, as follows: number of inhabitants, population density (inhabitants per km2), and age as a factor explaining healthcare demand (population aged > 64 years).

Regarding adoption, associations with the different variables were analysed by means of binary logistic regression for CT and MRI, as follows:

In both equations, the explanation variables refer to the number of hospital beds, the existence or otherwise of a Contract for CT or MRI services, the number of inhabitants, population density, the number of inhabitants aged above 64 years, and the existence or otherwise of other high-tech equipment, respectively. Note that CT technology predates MRI technology and that our sample has no case of adoption of MRI before CT technology. Thus, in Eq. (1), we do not include the prior existence of MRI technology as a possible explanatory variable for CT acquisition, and in Eq. (2), CT reflects whether or not a hospital has CT technology; this is because CT technology adoption/non-adoption is an additional explanatory variable for MRI uptake, given that CT technology predates and therefore may influence adoption of MRI technology [33]. Note that the Contract and other high-tech equipment variables in both equations are categorical variables.

The sample data used to perform the regression analyses were panel data [1] and statistical significance was established at p \(\le\) 0.05. Goodness-of-fit of the logistic regression models was evaluated using Pearson’s chi-square statistic, which compares observed and expected frequencies in a binomial scenario. Also calculated were odds ratio (OR) values. Given that the OR is around 1 for continuous independent variables, OR > 1 indicated that, as the continuous variable increases, a technology is more likely to be adopted, while the reverse is true for OR < 1, and OR = 1 indicates no change.

In order to overcome the risk of overfitting due to the small sample obtained (although it represents 100% of the universe of private hospitals in the region under study), the logistic regression was performed with a bootstrapping procedure. Bootstrapping is an internal validation method and is ideal for small samples [34]. The aim of bootstrapping is to replicate this procedure by sampling within the study population, with replacement to create more learning subgroups [35]. In each bootstrap sample, data are analysed as in the original study sample, repeating each step of model development, including predictor selection strategies. The bootstrap sample repetition process has been performed 1000 times.

3 Descriptive data and results

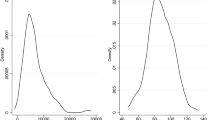

The population of the health areas in which the private hospitals are located has an average of 229,835 inhabitants (range 5,817–413,996), and the population is relatively aged, with inhabitants aged above 64 years numbering 35,546 on average (range 1,288–67,957). The population is also quite dispersed, with an average density of 412 inhabitants per km2 (range 57–1,005).

The sample included the 24 private hospitals providing healthcare services to SERGAS, accounting, in 2019, for 17 CT and 12 MRI scanners, representing 30% of all CT and 46.3% of all MRI units in SERGAS. Among the private hospitals, 49% have CT technology, 32% have MRI technology, and 31% have at least one other high-tech equipment item. The private hospitals account for 2,040 beds in total, for an average of 85 beds per hospital (maximum 656 beds in a single hospital).

Figure 1, which depicts the evolution in the number of CT and MRI units installed in private hospitals during the study period, suggests that uptake does not seem to follow any particular pattern.

Tables 1 and 2 summarize results for CT and MRI technology uptake by private hospitals according to the logistic models proposed in Eqs. (1) and (2), respectively. Cox and Snell (C&S) R2 is a generalized coefficient of determination that estimates how much variance in the dependent variable is explained by the independent variables. The Hosmer and Lemeshow (H&L) test is a data goodness-of-fit test of logistic regression model, with p > 0.05 confirming the null hypothesis that the proposed model fits the observed data.

Regarding CT adoption (Table 1), C&S R2 indicates that the independent variables explain 41.4% of the variance and the H&L test result of p > 0.05 confirms that the proposed model fits the observed data. The overall model classification rate for CT adoption is 80.97%. From the OR values, it can be inferred that the variable that most influences CT adoption by private hospitals, although by a small margin, is hospital size, proxied by the number of beds. Contrariwise, and rather surprisingly, none of the sociodemographic variables other than age above 64 years were significant in influencing CT technology uptake. The availability of other high-tech equipment and the existence of a Contract both reflect an inverse probability of acquiring a CT scanner, estimated as 2.66 and 8 times less likely, respectively.

Regarding MRI adoption (Table 2), Cox and Snell R2 indicates that the independent variables explain 44.2% of the variance and the Hosmer and Lemeshow test result of p > 0.05 confirms that the model fits the data well. The overall model classification rate for MRI adoption is 84.73%. The OR values indicate that, as happens with CT technology adoption, hospital size is the variable that most influences MRI adoption. All sociodemographic variables, with the exception of population density, influence the decision to adopt MRI technology – positively in the case of the number of inhabitants, and negatively in the case of the population aged > 64 years. The availability of high-tech equipment is not statistically significant, which would suggest that MRI is a complementary rather than a substitute technology. Availability of CT technology reflects an inverse probability of MRI scanner acquisition (estimated as 14.5 times less likely), suggesting that CT and MRI are substitute rather than complementary technologies. Finally, Contract funding of MRI scans reflects an inverse probability of acquiring an MRI scanner (estimated as 15.62 times less likely).

4 Discussion

Our results suggest that size, i.e., the number of beds, is the most influential variable in CT and MRI technology uptake by private hospitals. The expected profits of these hospitals is therefore not the only criterion determining their choice of medical technologies [22].

This finding is in accordance with previous literature on medical technology uptake. Folland et al. [36] reported greater technology uptake by larger hospitals, while Russell [37] found that larger hospitals were more likely to adopt new technologies, with both bed numbers and specialists and family physicians per bed positively influencing uptake. Likewise, Abedini et al. [38] concluded that the main factors influencing CT and MRI technology uptake were the number of beds and hospital location, Jae-Seok Hong [39] showed that the number of CT units reflected bed numbers and especially location in larger cities, and Hall [40] found that greater use of diagnostic technologies was associated with greater population density, more doctors per capita, a higher ratio of specialists to family physicians, and a higher percentage of doctors involved in teaching. Similar conclusions have also been reached by [41] regarding the influence of hospital size on CT and MRI technology uptake, by [42] on CT and MRI technology uptake in German hospitals, and by Zhu et al. [43] on medical technology uptake in US private hospitals. The fact that size is the most influential factor in technology uptake also corroborates the result obtained by [44] in a multiple regression study.

Matsumoto et al. [45] reported that geographical distribution of CT and MRI technology depends on spatial competition derived from market forces, arguing that scanners are first installed in the largest cities offering the highest expectations in terms of use, income, and profits. However, as more hospitals acquire the technology, competition for patients in smaller cities also grows, leading to uptake in increasingly less populated areas. From another perspective, Hofmann and Gransjøen [46] have studied geographic variations in outpatient CT and MRI studies and conclude that they affect quality of care and equity in access to technology; especially for the private sector.

The duration of obsolete technology was not found to affect CT and MRI technology uptake to a statistically significant degree. This finding contradicts [47], who concluded that the adoption rate of new technology is reduced if the innovation is a replacement for equipment with a relatively lengthy remaining useful life, and also contradicts [48], who suggested that there is a natural defence of past investments in time, effort, and money made by professionals and institutions in incorporating and mastering the corresponding technologies. Similar results are reported by [49] in a study on the relationship between adoption and abandonment of medical technologies.

Beyond financial incentives and hospital size, [50, 51] argue that acquiring an innovation enhances the prestige of a hospital and its physicians, and, as suggested by [52], can additionally be perceived as an ind icator of care quality. However, our study shows that the availability of other high-tech equipment does not significantly influence uptake of CT and MRI technologies. The explanation may be found in game theory applied to the hospital sector [53]. In competitive advantage terms, any hospital that innovates potentially obtains more referrals and more demand for its services and so forces other hospitals to adopt the new technology. While this situation removes the competitive advantage for both hospitals, the hospital that does not innovate will be left at a competitive disadvantage. Rei and Hirotaka [54] report a positive correlation between CT and MRI technology uptake and a competitive private hospital market. However, [42], in their study of private and public German hospitals, show that CT and MRI technology uptake decreases as nearby hospitals adopt the innovations, and [55] report similar results for cancer treatment technology uptake.

The high and positive coefficients that we found for hospital size, inhabitants, and population density in relation to CT and MRI technology uptake by private hospitals corroborate [56], who reported that increased diffusion of medical technologies was related to private but not public insurance, with insurance coverage understood as an indicator of medical technology diffusion in the private sector. Hillman and Schwartz [57], however, reported that a system that remunerates services on the basis of prospective funding, i.e., the system used for Contracts, implies greater investment recovery risk than a system based on retrospective funding, i.e., the system used for public hospitals. Indeed, according to [58], the main factors influencing the decision to adopt MRI technology are acquisition cost and the investment recovery rate. However, for [38], the insurance companies that ultimately fund CT and MRI scanners play a limited role in diffusion of these technologies. In this respect, authors such as [26] argue that a retrospective financing system, based on costs incurred, generates incentives for the adoption (and use) of new technologies by guaranteeing cost recovery.

Our study also points to the lack of influence of public subsidies in CT and MRI private sector technology uptake, corroborating the findings of both [42] regarding adoption of CT, MRI, and positron emission tomography (PET) in German private hospitals, and Sorenson et al. [59] on the role of hospital payments in new medical technology uptake in different countries. Hillman et al. [57] point out that the prospective funding system, as used by SERGAS for Contractcs, implies a greater risk for investment recovery than the retrospective funding system used for public hospitals. The fact that cost recovery is guaranteed generates incentives for the adoption and use of new technologies, and also explains the competitive relationship between public and private healthcare.

The non-significance of sociodemographic variables may support the hypothesis that medical technology demand is induced from the private sector, as suggested by Calcott [60]. Our finding that population density is significant, yet has no influence on the probability of a private hospital acquiring a CT or MRI scanner, corroborates [61], who suggested that the non-significance of sociodemographic variables in models of demand for health services may point to the existence of induced demand. Sandoval et al. [41] also pointed to demand induction for CT and MRI technologies, especially in small hospitals. However, our finding contradicts [62], who showed that areas of between 50,000 and 100,000 inhabitants are more likely to incur private healthcare expenditure than areas with smaller populations.

Finally, the positive value of the population density coefficient suggests that the likelihood of technology uptake by a hospital is greater, the more densely populated its catchment area. This finding corroborates [37], who observed that technology uptake is broader and faster in areas of strong population growth, reflecting market expansion, but contradicts [63], who found no significant relationship between the degree of market concentration and medical technology uptake.

5 Conclusions

We analysed the factors that influence CT and MRI technology uptake by private hospitals, using a logistic regression model to explore the impact of hospital size, various population characteristics, Contracts for the provision of services, and hospital access to other diagnostic and therapeutic technologies.

The variable that most influenced the decision by private hospitals to adopt medical technologies, whether CT or MRI, is hospital size, measured by the number of beds. Regarding CT technology uptake, demand is induced in private hospitals, other high-tech equipment (e.g., gamma camera, lithotripsy, linear accelerator, etc.) behaves as a substitute, and Contracts have a counterfactual effect. As for MRI technology uptake sociodemographic variables affect the adoption decision, positively in the case of the number of inhabitants and negatively in the case of the population aged > 64 years; the availability of a CT scanner reduces the probability of a private hospital adopting MRI technology, suggesting that MRI is a substitute rather than a complementary technology in private hospitals; Contracts have a negative influence on MRI technology uptake.

Our study is framed within the need to provide information on new medical technology trends to healthcare policy-makers so that they can address deficits in implantation and accessibility, and also evaluate costs, given the potential impact on health spending. Our research also contributes to behavioural studies of early adopters of innovations and of possiblly premature diffusion of technologies prior to full understanding of their efficacy.

Data availability

The authors declare that they had full access to all of the data in this study and they take complete responsibility for the integrity of the data and the accuracy of the data analysis.

Notes

Technological improvement uncovers a previously underdetected problem [64], enhancing the concept of ‘success’ and increasing interest in new technologies,thus, CT and MRI technologies, in improving the detection (and elimination) of small papillary cancers, has improved outcomes, thereby enhancing success rates, which in turn, increases technological innovation [65].

Puig Junoy [22] points out that innovation adoption depends on the nature of the technology itself (the marginal advantage over previous technology), the objectives of the hospital as a firm (the characteristics of the firm that adopts the technology), and the nature of the market.

Ruiz-Mallorquí et al. [7] conclude that Contracts improve the financial performance of private hospitals, as the average profitability gain is 2–4 points greater than for hospitals not participating in a Contract.

All data are publicly available at https://www.ige.gal/ and https://extranet.sergas.es/catpb/Publicaciones/

References

Wooldridge JM. Econometric Analysis of Cross Section and Panel Data. Cambridge, Massachusetts: MIT Press; 2010.

Bishai D, Sachathep K. The role of the private sector in health systems. Health Policy Plan 2015 Mar;30 Suppl 1:i1. https://doi.org/10.1093/heapol/czv004. PMID: 25759449.

Asociación de Hospitales de Galicia (AHG). Diagnóstico de la Sanidad en Galicia 2019. 2020.

Instituto para el desarrollo e Integración de la Sanidad (IDIS). Sanidad privada, aportando valor. Análisis de situación. Informe número 11. Madrid. 2022.

Jennett B. High technology medicine. Benefits and burdens. The Nuffield Provincial Hospitals Trust. Londres. 1984.

COCIR the European Coordination Committee of the Radiological, Electromedical and Healthcare IT Industry. Medical Imaging Equipment Age Profile & Density - 2019 Edition. 2019.

Collado Belvis A, Solano López A, Sanz Marín M. Tomografía computarizada helicoidal: introducción conceptual y aplicaciones clínicas. Todo Hospital. 1995;120;59-65.

Robin A, Maley A, Epstein L. High Technology in Health Care. Ed. American Hospital Publishing Inc. USA. 1993;181–228.

American College of Radiology. Appropriateness Criteria for imaging and treatment decisions. ACR. 1996;2.

The Royal College of Radiologists. Making the best use of a Department of Clinical Radiology. Guidelines for Doctors, 2 edition. London. 1993.

European Commission. Guía de indicaciones para la correcta solicitud de pruebas de diagnóstico por imagen. Protección Radiológica 118. Ed. Comisión Europea, Dirección General de Medio Ambiente. Italy. 2000.

Espallargues M, de Solà-Morales O, Moharra M, Cristian Tebé C, Pons JMV. Las tecnologías médicas más relevantes de los últimos 25 años según la opinión de médicos generalistas. Gac Sanit. 2008;22(1):20–8.

Bhidé A, Datar S, Stebbins K. Case histories of significant medical advances: Magnetic resonance imaging. Working Paper 20-001. Harvard Business School. Harvard University. 2021.

Fuchs VR, Sox HC Jr. Physicians’ views of the relative importance of thirty medical innovations. Health Affairs (Project Hope). 2001;20:30–42.

NHS England. Diagnostics: Recovery and Renewal. London. United Kingdom. 2020.

Mahler H. The Meaning of "Health for All by the Year 2000". Am J Public Health. 2016;106(1):36–8.

Cardete Vilaplana A. Análisis de Costes en el Área de Imagen Médica del Hospital Universitario y Politécnico La Fe. Universidad de Valencia. 2011.

Grant L. Facing the future: the effects of the impeding financial drought on NHS finances and how UK radiology services can contribute to expected efficiency savings. Br J Radiol. 2012;85:784–91.

Newhouse JP. Medical Care Costs: How Much Welfare Loss?. J Econ Perspect. 1992;6(3):3-21

Devers KJ, Brewster LR, Casalino LP. Changes in Hospital Competitive Strategy: A New Medical Arms Race? Health Serv Res. 2003;38(1p2):447–469.

Wright JD, Tergas AI, Hou JY, Burke WM, Chen L, Hu JC, Neugut AI, Ananth CV, Hershman DL. Effect of Regional Hospital Competition and Hospital Financial Status on the Use of Robotic-Assisted Surgery. JAMA Surg. 2016;151(7):612–20.

Puig i Junoy J. Crecimiento, empleo y tecnología en el sector hospitalario español. Generalitat de Catalunya, Departament de Sanitat i Seguritat Social; 1993. p. 99–124.

Brescia AA, Patel HJ, Likosky DS, et al. Volume-outcome relationships in surgical and endovascular repair of aortic dissection. Ann Thorac Surg. 2019;108:1299–306.

Schmidt CM, Turrini O, Parikh P et al. Effect of hospital volume, surgeon experience, and surgeon volume on patient outcomes after pancreaticoduodenectomy. A single-institution experience. Arch Surg. 2010.

Vaughan L, Edwards N. The problems of smaller, rural and remote hospitals: Separating facts from fiction. Future Healthcare Journal. 2020;7:38–45.

Chambers J, May K, Neumann P. Medicare covers the majority of FDA-approved devices and Part B drugs, but restrictions and discrepancies remain. Health Affairs. 2013;32(6):1109-15.

Album D, Westin S. Do diseases have a prestige hierarchy? A survey among physicians and medical students. Soc Sci Med. 2008;66:182–8.

Hofmann B. When means become ends: technology producing values. Seminar.net 2006. 2006. http://seminar.net/index.php/volume-2-issue-2-2006-previousissuesmeny-114/66-when-means-become-ends-technology-producing-values

Wolf S, Berle B. The technological imperative in medicine. Plenum Press; 1981.

Moynihan R, Heath I, Henry D. Selling sickness: the pharmaceutical industry and disease mongering. BMJ. 2002;324:886–91.

Payer L. Disease-mongers: how doctors, drug companies, and insurers are making you feel sick. Wiley; 2006.

ESCRI Microdata Cover the 2010-2016 Period. Spanish Ministry of Health, Hospital Statistical Information. 2016. https://www.mscbs.gob.es/estadEstudios/estadisticas/estHospiInternado/inforAnual/homeESCRI.htm.

Lázaro y de Mercado P. Evaluación de Servicios Sanitarios, La Alta Tecnología Médica en España. Editorial: Fondo de Investigación Sanitaria (Madrid). ISBN: 978-84-404-6925-0. 1990.

Moons KGM, Kengne AP, Woodward M, et al. Risk prediction models: I. Development, internal validation, and assessing the incremental value of a new (bio)marker. Heart 2012;98:683-90.

Richter AN, Khoshgoftaar TM. A review of statistical and machine learning methods for modeling cancer risk using structured clinical data. Artif Intell Med. 2018;90:1–14.

Folland S, Goodman AC, Stano M. The economics of health and health care. New Jersey: Prentice Hall; 1997. p. 321–35.

Russell LB. Technology in hospitals: medical advances and their diffusion. Washington: The Brookings Institution; 1979. p. 99–131.

Abedini Z, Akbari SA, Rahimi FA, Jaafaripooyan E. Diffusion of advanced medical imaging technology, CT, and MRI scanners in Iran: A qualitative study of determinants. Int J Health Plann Manage. 2019;34:e397–410.

Hong JS. Association between years since manufacture and utilization of computed tomography scanner in South Korea. A cross-sectional study, Medicine. 2018;97:43.

Hall AE. Regional Patterns in Medical Technology Utilization. Bureau of Economic Analysis. September. 2015.

Sandoval GA, Brown AD, Wodchis WP, Anderson GM. The relationship between hospital adoption and use of high technology medical imaging and in-patient mortality and length of stay. J Health Organ Manag 2019;33(3):286–303.

Dreger M, Langhoff H, Henschke C. Adoption of large-scale medical equipment: the impact of competition in the German inpatient sector. Eur J Health Econ. 2022 Jul;23(5):791–805.

Zhu X, Tao Y, Zhu R, Wu D, Ming WK. Impact of hospital characteristics and governance structure on the adoption of tracking technologies for clinical and supply chain use: Longitudinal study of US hospitals. J Med Internet Res. 2022 May 26;24(5):e33742

Suzuki T, Isomi Y, Tsuji S, Tani Y, Tanikawa T, Yamasina H, Katsuhiko Ogasawara K. Penetration factors and introduction possibility for image diagnostic equipment. Health Policy and Techno 2018;7(2):142–48.

Matsumoto M, Koike S, Kashima S, Awai K. Geographic Distribution of CT, MRI and PET Devices in Japan: A Longitudinal Analysis Based on National Census Data. PLoS ONE 2015;10(5):1–12.

Hofmann BM, Gransjøen AM. Geographical variations in the use of outpatient diagnostic imaging in Norway 2019. Acta Radiol Open. 2022;11(2).

Mansfield E. Technical change and the rate of imitation. Econometrica. 1961;29(4):741–66.

Barnes, BA. Discarded operations: surgical innovation by trial and error. Cost, Risks and benefits of surgery. Ed. Oxford University Press. Nueva York. 1977.

Bergquist H. An Examination Of Medical Technology Disadoption And Its Relation To Technology Adoption And Physician Organization. Publicly Accessible Penn Dissertations. 2017;2188. https://repository.upenn.edu/edissertations/2188.

Lee RH, Waldman DM. The diffussion of innovations in hospitals. Some econometric considerations. J health Econ. 1985.

McGregor, M. Technology and the allocation of resources. N Engl J Med. 1989;320(2):118–20.

Newhouse JA. Toward a theory of nonprofit institutions: an economic model of a hospital. Am Econ Rev. 1970;1:64–7

Gardner R. Juegos para empresarios y economistas. Ed. Antoni Bosch editor. 1996;42–74.

Rei G, Hirotaka K. Hospital competition and technology adoption: An econometric analysis of imaging technology in Japan. RIETI Discussion Paper Series 19-E-013. 2019.

Aggarwal A, Lewis D, Mason M, Purushotham A, Sullivan R, van der Meulen J. Effect of patient choice and hospital competition on service configuration and technology adoption within cancer surgery: a national, population-based study. Lancet Oncol. 2017 Nov;18(11):1445–53.

Sloan FA, Valvona J, Perrin JM, Adamache KW. Diffusion of surgical technology. An exploratory study. J Health Econ. 1986;17(17):31–40.

Hillman AL, Schwartz JS. The adoption and diffusion of CT and MRI in the United States: a comparative analysis. Med Care. 1985;1283–94.

Booth-Clibborn N, Packer C, Stevens A. Health technology diffusion rates. Int J Technol Assess Health Care. 2000;16(3):781–6.

Sorenson C, Drummond M, Torbica A, Callea G, Mateus C. The role of hospital payments in the adoption of new medical technologies: an international survey of current practice. Health Econ Policy Law. 2015 Apr;10(2):133–59.

Calcott P. Demand inducement as cheap talk. Health Econ. 1999;8:721–33.

Hay J, MJ Leahy. Physician-induced demand: an empirical analysis of the consumer information gap. J Health Econ 1992;1(3):231–44.

Bonet MJ. El gasto en bienes y servicios de salud: relación entre demanda privada y oferta pública. In: Editores SG, editor. Instrumentos para la gestión en sanidad, XV Jornadas de Economía de la Salud. Barcelona; 1995. p. 254–81.

Banta HD, Behney CJ, Willems JS. Toward rational technology in medicine. Springer series on healthcare and society: Springer Publishing Company. Nueva York. 1981;5.

Dybczak K, Przywara B. The role of technology on health care expenditure in the EU. European Economy-Economic Paper 400. Directorate General for Economic and Monetary Affairs. 2010.

Fisher ES, Welch HG. Avoiding the unintended consequences of growth in medical care: how might more be worse? JAMA 1999;281:446–55.

Institute of Medicine (US) Council on Health Care Technology Priority-Setting Group. National Priorities for the Assessment of Clinical Conditions and Medical Technologies: Report of a Pilot Study. Lara ME, Goodman C, editors. Washington (DC): National Academies Press (US) 1990.

Artells JJ. La incidencia tecnológica. Debate sanitario: medicina, sociedad y tecnología. Ed. BBV Foundation. Bilbao. 1992;353–64.

Huang X, Wei Y, Sun H, Huang J, Chen Y, Chenget J. Assessment of equity and efficiency of magnetic resonance imaging services in Henan Province, China. Cost Eff Resour Alloc 2023;21:32. https://doi.org/10.1186/s12962-023-00440-0.

Carrier ER, Dowling M, Berenson RA. Hospitals’ geographic expansion in quest of well-insured patients: will the outcome be better care, more cost, or both? Health Affairs (Project Hope) 2012;31:827–35.

Funding

Manel Antelo acknowledges financial support to research groups received from the Xunta de Galicia (Spain) through Project ED431C 2019/11 Consolidación e estruturación – 2019 GRC GI-2060 Análise económica dos mercados e institucións.

Author information

Authors and Affiliations

Contributions

Francisco Reyes-Santias conceived of the study, its design, performed part of the literature review and coordinate the draft the manuscript; Octavio Cordova-Arevalo performed part of the literature review and helped to draft the manuscript; Manel Antelo participated in the design of the study, performed part of the literature review and helped to draft the manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

Highlight 1: The variable that most influenced the decision by private hospitals to adopt medical technologies, whether CT or MRI, is hospital size.

Highlight 2: The availability of a CT scanner reduces the probability of a private hospital adopting MRI technology.

Highlight 3: PPPs have a negative influence on MRI technology uptake.

Highlight 4: For MRI technology uptake, sociodemographic variables affect the adoption decision.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Reyes-Santias, F., Cordova-Arevalo, O., Dominguez, I.B. et al. Factors influencing medical imaging technology uptake by private hospitals. Health Technol. 13, 937–945 (2023). https://doi.org/10.1007/s12553-023-00774-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12553-023-00774-y