Abstract

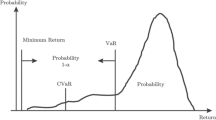

Overnight returns are significantly positive while day returns are significantly negative in the COMEX gold front futures contract, the gold spot market (London Fix), gold mining company stocks, and gold related closed end mutual funds and exchange traded funds. The findings are consistent with gold price being (too) high at the opening of the various markets. The asymmetry is shown to be present in both up and down markets for gold. The results are economically important even with transaction costs.

Similar content being viewed by others

Notes

The S&P 500 declined 50.5% over the period March 2000 through October 2002 and declined 57.7% over the period October 2007 through March 2009.

See O’Connell et al. (2017) GFMS Gold Survey 2017. Dollar value is calculated using $1250.60 per ounce - the 2016 average price of gold. Jewelry is reported because at least some Jewelry purchases represent gold investment.

Daily bond Equivalent Yields on 4-week T-Bills obtained from https://www.federalreserve.gov/ releases/h15/update/ . The S&P 500 increased at a geometrical average annual rate of 8.24% over the 30 year period.

We set these dates as the beginning and end of the bull market based on the high and low settlement prices on the COMEX front future contract (see Figure 1). The high and low prices for the London PM fix were on different dates. The low was 252.8 on July 20, 1999 and the high was 1895.0 on September 6, 2011;

COMEX ended open outcry trading in gold in July 2015. All contracts are now traded on an electronic platform.

Observe from the start dates of the funds in Table 6, that from 7/01/85 through 03/17/92 there was only one stock in the equally weighted portfolio. The company, ASA Gold and Precious Metals, invests in gold, silver, platinum, and diamond mining companies. Accordingly the company is unlikely to have the sensitivity to gold price that would be present in the companies only investing in gold mining companies and gold bullion. The returns for ASA are the only returns affecting the first seven years of the 30 year period and can be expected to have a substantial effect on the returns during that longer period.

We surveyed nine retail stock brokers and nine retail futures brokers to get an estimate of brokers fees. The most expensive stock brokerage fee was $9.99 and the least expensive was $4.00. The cost of a futures trade of one contract ranged from $1.00 to $9.70. The cost per futures contract declines substantially as the number of contracts traded increases.

For small trades of a few hundred shares, the transaction cost per share declines as the size of the order increases. Wagner and Glass (2001) argue that for larger trades there are additional costs that are often overlooked that can be greater than the broker’s fees. These include market impact costs, the cost of delaying an order until liquidity develops, and the opportunity cost associated with not trading or only partially completing an order. These costs will depend upon the size of the trade and the liquidity of the market and will increase as the size and difficulty of the trade increases.

In May and June 2013, India installed a series of restrictions on the importation of gold. The restrictions were designed to address balance of trade and currency issues associated with gold imports. In 2012 India imported 860 tons of gold making it the largest importer of gold in the world. The restrictions were eased in November 2014.

References

Aboody D, Even-Tov O, Lehavy R, Trueman B (2015) Overnight returns and firm-specific investor sentiment. Available at SSRN 2554010

Ball CA, Torous WN, Tschoegl AE (1982) Gold and the “weekend effect”. J Futur Mark 2(2):175–182

Baur DG (2013) The seasonality of gold-the autumn effect. Res Int Bus Financ 27(1):1–11

Berkman H, Koch PD, Tuttle L, Zhang YJ (2012) Paying attention: overnight returns and the hidden cost of buying at the open. J Financ Quant Anal 7:715–741

Blose LE, Gondhalekar V (2013) Weekend gold returns in bull and bear markets. Account Finance 53(3):609–622

Blose LE, Gondhalekar V (2014) Overnight gold returns. Appl Econ Lett 21(18):1269–1272

Blose LE, Shieh JCP (1995) The impact of gold price on the value of gold mining stock. Rev Financ Econ 4:125–139

Branch B, Ma A (2012) Overnight return, the invisible hand behind intraday returns? J Appl Finance 22:90–100

Branch B, Ma A, Sawyer J (2010) Around-the-clock performance of closed-end funds. Financ Manag 39:1177–1196

Bray C (2015) Swiss regulator is examining precious-metals market. New York Times

Burne K, Day M, Shumsky T (2013, Mar 14) U.S. probes gold pricing. Wall Street J 261(60):1

Chua J, Stick G, Woodward R (1990) Diversifying with gold stocks. Financ Anal J 46:76–79

Cliff M, Cooper MJ, Gulen H (2008) Trading differences between trading and non-trading hours: like night and day. Working paper Available at SSRN: http://ssrn.com/abstract=1004081 or doi:10.2139/ssrn.1004081

Comerton-Forde C, Putniņš TJ (2014) Stock price manipulation: prevalence and determinants. Review of Finance 18(1):23–66

Feuer A (2014) Banks sued on claims of fixing price of gold. New York Times B3

Fuertes AM, Kalotychou E, Todorovic N (2015) Daily volume, intraday and overnight returns for volatility prediction: profitability or accuracy? Rev Quant Finan Acc 45(2):251–278

Kang L, Babbs SH (2012) Modeling overnight and daytime returns using a multivariate generalized autoregressive conditional heteroskedasticity copula model. J Risk 14(4):35–63

Kelly MA, Clark SP (2011) Returns in trading versus non-trading hours: the difference is day and night. J Asset Manag 12:132–145

Klement J, Longchamp Y (2010) Managing currency risks for global families. J Wealth Manag 13(2):76–87

Ledgerwood SD, Carpenter PR (2012) A framework for the analysis of market manipulation. Rev Law Econ 8:253–295

Lou D, Polk C, Skouras S (2015) A tug of war: overnight versus intraday expected returns. Working paper, London School of Economics and Athens University of Economics and Business

Lucey BM, Tully E (2006) The evolving relationship between gold and silver1978–2002: evidence from a dynamic cointegration analysis: a note. Appl Financ Econ Lett 2:47–53

Lucey BM, Poti V, Tulley E (2006) International portfolio formation, skewness and the role of gold. Frontiers in Finance and Economics 3(1):49–68

Ma CK (1986) A further investigation of the day-of-the-week effect in the gold market. J Futur Mark 6(3):409-419

O’Connell R., Alexander C, Strachan R, Always B, Nambiath S, Wiebe J, Li S, Aranda D (2017) GFMS Gold Survey 2017. Thompson Reuters, London

O’Connor FA, Lucey BM, Batten JA, Baur DG (2015) The financial economics of gold – a survey. Int Rev Financ Anal 41:186–205

Riedel C, Wagner N (2015) Is risk higher during non-trading periods? The risk trade-off for intraday versus overnight market returns. J Int Financ Mark Inst Money 39:53–64

Sherman E (1982) Gold: a conservative, prudent diversifier. J Portf Manag 8(3):21–27

Todorova N, Souček M (2014) The impact of trading volume, number of trades and overnight returns on forecasting the daily realized range. Econ Model 36:332–340

Triacca U, Focker F (2014) Estimating overnight volatility of asset returns by using the generalized dynamic factor model approach. Decisions Econ Finan 37(2):235–254

Wagner WH, and Glass S (2001) What every plan sponsor needs to know about transaction costs. Trading 2001(1):20-35

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Blose, L.E., Gondhalekar, V. & Kort, A. Overnight versus day returns in gold and gold related assets. J Econ Finan 42, 526–549 (2018). https://doi.org/10.1007/s12197-017-9403-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-017-9403-0