Abstract

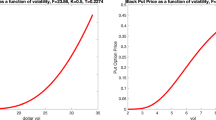

In his 2008 letter to shareholders, Warren Buffett, Chairman and CEO of Berkshire Hathaway, criticizes the ability of the Black-Scholes model to accurately price long-dated options. Buffet discusses how the model leads to over-pricing of put options with long maturities using examples of Berkshire’s investments in derivatives contracts. We confirm that traditional implied volatility estimates do indeed overstate long-term volatility. As an alternative, we propose a maturity-matching technique for estimating long-term volatility using historical holding period returns. We focus on three large asset classes, large cap stocks, long-term bonds, and treasury bills, to demonstrate how volatility evolves over different holding periods. We apply this rolling-period simulation method to estimate volatility for annual maturities ranging from 1 to 30-years within the Black-Scholes model. This method generates superior long-dated option values, and effectively answers Buffett’s critique. This is of particular importance for firms with significant investment holdings, as the issuance and valuation of these derivatives can have a substantial effect on firm capital.

Similar content being viewed by others

Notes

A 2005 report by ComplianceWeek found that 80% of companies used the Black-Scholes option pricing framework to determine the value of their option holdings; the remainder generally used a binomial (lattice-form) model.

$1 billion put contract × 1% likelihood × 50% anticipated loss = $5 million.

Cornell (2010) states that the values are reasonable estimates based on the Buffett letter.

Cornell (2010) notes that raising the risk free rate to 5.8% lowers the put value to $0.45 million, but we argue that in an era of low interest levels, this adjustment is unreasonable. Dividends are likewise deemed appropriate, matching both the current and long-term S&P yields.

See Sears, Steven “Here come the Super Options.” Barron’s, September, 7, 2012. http://online.barrons.com/news/articles/SB50001424053111904294104577631491840049660

Last Accessed 7/17/2014.

See SEC Release No. 34-68164: http://www.sec.gov/rules/sro/cboe/2012/34-68164.pdf

The small discrepancies result from fluctuations in the market between Buffett’s contract initiation date and our assumed date.

References

Bachelier L (1900) Théorie de la spéculation. Annales Ecole Normale Supérieure 3(17):21–86

Berkowitz J (2009) On justifications for the Ad Hoc Black-Scholes method of option pricing. Stud Nonlinear Dyn Econom 14(1):1558–3708

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81:637–659

Brandt MW, Wu T (2002) Cross-sectional tests of deterministic volatility functions. J Empir Financ 9:525–550

Buffett, W. (2009), “Chairman’s Letter”. In Berkshire Hathaway Inc.’s 2008 Annual Report, 3-21. Retrieved February 16, 2013 from http://www.berkshirehathaway.com/2008ar/2008ar.pdf.

Campa JM, Chang PHK (1995) Testing the expectations hypothesis on the term structure of volatilities in foreign exchange options. J Financ 50:529–547

Collin-Dufresne P, Goldstein RS, Yang F (2012) On the relative pricing of long-maturity index options and collateralized debt obligations. J Financ 67(6):1983–2014

Cooley PL, Hubbard CM, Walz DT (1998) Retirement savings: choosing a withdrawal rate that is sustainable. AAII J 20(2):16–21

Cornell B (2010) Warren Buffett, Black-Scholes and the valuation of long-dated options. J Portf Manag 36(4):107–111

Coval JD, Jurek JW, Stafford E (2009) Economic catastrophe bonds. Am Econ Rev 99(3):628–666

Cox J, Ross S, Rubinstein M (1979) Option pricing: a simplified approach. J Financ Econ 7:229–263

Davis M (2001) Mathematics of financial markets. In: Engquist B, Schmid W (eds) Mathematics unlimited—2001 and beyond. New York, Springer, pp 361–380

Deelstra G, Rayée G (2013) Local volatility pricing models for long-dated FX derivatives. Appl Math Financ 20(4):380–402

Duan JC, Fulop A (2009) Estimating the structural credit risk model when equity prices are contaminated by trading noises. J Econ 150(2):288–296

Duffie D, Lando D (2001) Term structures of credit spreads with incomplete accounting information. Econometrica 69(3):633–664

Dumas B, Fleming F, Whaley R (1998) Implied volatility functions: empirical tests. J Financ 53:2059–2106

Dupire B (1994) Pricing with a smile. Risk 7:18–20

Dwyer, DW, Kocagil, AE, Stein, RM (2004) “Moody’s KMV RISKCALCTM v3.1 Model”. Whitepaper. Retrieved March 19, 2013 from http://www.moodys.com/sites/products/ProductAttachments/RiskCalc%203.1%20Whitepaper.pdf.

Eom YH, Helwege J, Huang JZ (2004) Structural models of corporate bond pricing: an empirical analysis. Rev Financ Stud 17:499–544

Figlewski S (2004) Forecasting volatility. Working paper, NYU Stern School of Business

Garman M, Kolhagen SW (1983) Foreign currency option values. J Int Money Financ 2:231–237

Gupta NJ, Pavlik R, Synn W (2012) Adding “value” to sustainable post-retirement portfolios. Finan Serv Rev 21(1):19–33

Haug EG (1998) The complete guide to option pricing formulas. McGraw-Hill, New York

Jarrow RA, Turnbull SM (1995) Pricing derivatives on financial securities subject to credit risk. J Financ 50:53–86

Jeanblanc M, Le Cam Y (2007) Reduced form modelling for credit risk”. working paper. Universite d’Evry Val d’Essonne and French Treasury, France

Kim IJ, Jang BG, Kim KT (2013) A simple iterative method for the valuation of american options. Quant Financ 13(6):885–895

Lando D (2005) Credit risk modeling - theory and applications. Princeton University Press, New Jersey

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Financ 29:449–470

Pan J (2002) The jump-risk premia implicit in options: evidence from an integrated time-series study. J Financ Econ 63(1):3–50

Poterba J, Summers L (1986) The persistence of volatility and stock market fluctuations. Am Econ Rev 76:1142–1151

Rubinstein M (1994) Implied binomial trees. J Financ 49:771–818

Samuelson P (1965), “Rational theory of warrant pricing”. Ind Manag Rev 6(2):13–39

Sprenkle C (1964) Warrant prices as indicator of expectation. Yale Econ Essays 1:412–474

Walker TB (2005) Estimating default with discrete duration and structural models. In: Working paper. Indiana University, Indiana

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gupta, N.J., Kurt, M. & White, R. The Buffett critique: volatility and long-dated options. J Econ Finan 40, 524–537 (2016). https://doi.org/10.1007/s12197-015-9319-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-015-9319-5