Abstract

The dramatic rise and sustained participation of recent cohorts of women in the labor force has coincided with their increased attachment to the labor market. In this paper we use twelve waves of the Health and Retirement Study (1992-2014) and investigate how married couples belonging to more recent birth cohorts compare with their predecessors in terms of coordinating their retirement decisions. Using a multinomial logit model we estimate the labor force dynamics of dual-earner married couples and find that couples with wives belonging to more recent birth cohorts are less likely to jointly exit the labor force. Further, this declining cohort trend in joint retirement can only partially be explained by commonly observed socio-economic, employment, and health related factors that affect retirement decisions, suggesting an important role for cohort changes in preferences and social norms such as preference for work and attitudes toward gender roles.

Similar content being viewed by others

Notes

Source : U.S. Census Bureau, National Projections 2014.

An example is the increase in the eligibility age for unreduced retirement benefits in the U.S. from age 65 to 67 with the normal retirement age (NRA) of 67 becoming fully effective for workers who reach age 62 in 2022 or later.

An exception is the study by Schellenberg and Ostrovsky (2008) who used the Canadian Longitudinal Administrative Database (LAD) to analyze the retirement patterns of dual-earner couples in which at least one spouse retired in 1986, 1991, 1996 or 2001. They found that between 1986 and 2001 the proportion of dual-earner couples in which both spouses retire within two years of each other declined by two percentage points while the proportion of wives retiring five or more years after their husbands increased by seven percentage points, implying some evidence for increasingly disjointed spousal retirements in Canadian data. However, their results at best provide suggestive evidence on this issue as they only compare cross sections of retiring cohorts at different points in time and hence their results may be confounded by the presence of cohort specific effects.

We use an exhaustive list of controls that include labor market characteristics, socio-economic and demographic variables, health status of both spouses. “Empirical Model” provides a full list of economic factors used in the benchmark estimation.

A related finding is by Ho and Raymo (2009) who use the first seven wave of the HRS data and found that couples retirement expectations are correlated with their joint retirement realization.

The baseline year is the first year when a married couple is observed in our sample.

For each such variable we include an indicator variable for non-response in our estimation model to account for missing observations.

Age difference is defined as age of the husband minus the wife’s age.

It should be noted that the main results of the paper are not sensitive to these sample restrictions. I have conducted the analysis with alternative sets of sample restrictions and obtained qualitatively similar results. These results are not reported in the paper for brevity but they are available upon request.

We also used an alternative definition of joint retirement based on the self reported retirement status of respondents in the HRS. Our main results are not sensitive to this alternative definition of retirement. These robustness checks are not reported for brevity and are available upon request.

Note that age difference is a linear function of the husband’s age and wife’s age. In our estimation equation we also control for the survey years and wife’s birth years. Hence, we effectively control for the effect age on the retirement decision of both spouses.

Of the included 2272 couples, 10.43% retired jointly, in 18.75% of couples the husband retired first and in 15.61% of couples the wife retired first.

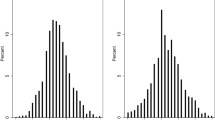

Table 2 reports the transition probabilities by combining observations into a 4 year band for the wife’s birth year. The main findings of this analysis are not dependent on the choice of the birth year band.

Based on our current definition we abstract away from other kinds of transitions such as partial retirement or self-employment. However, our framework can be easily extended to include additional states where one or both spouses may transition to partial retirement or self employment.

Given the biennial nature of the HRS, a period in our framework represents two years.

Without loss of generality, we assume here that R c t = 4, capturing the outcome that both spouses are working in period t, is the reference group.

Note that age difference is linear function of the husband’s age and wife’s age. In our empirical specification, in addition to the age difference, we also control for wife’s birth years and survey years. Hence, we are effectively controlling for age effect on the retirement decision in our model.

For brevity we do not report the predicted probabilities for other three outcomes as our goal here is to simply show that there is a declining cohort trend in joint retirement in the data.

Ho and Raymo (2009) use this approach to estimate the effect of initial retirement expectation on realized joint retirement outcomes for married couples using the HRS data.

References

Alesina A, Giuliano P, Nunn N (2013) On the origins of gender roles: Women and the plough. Q J Econ 128(2):469–530

Bailey MJ (2006) More power to the pill: The impact of contraceptive freedom on women’s life cycle labor supply. Q J Econ 121(1):289–320

Banks J, Blundell R, Casanova M (2010) The dynamics of retirement behavior in couples: Reduced-form evidence from england and the us. (mimeo)

Blau D (1998) Labor force dynamics of older married couples. J Labor Econ 16(3):595–629

Boyle MA, Lahey JN (2016) Spousal labor market effects from government health insurance: Evidence from a veterans affairs expansion. J Health Econ 45:63–76

Casanova M (2010) Happy together: A structural model of couples’ joint retirement choices. (mimeo)

Cebula RJ, Coombs CK (2008) Recent evidence on factors influencing the female labor force participation rate. J Lab Res 29:272–284

Coile C (2004) Retirement incentives and couples retirement decisions. The B.E. J Econ Anal Policy, De Gruyter 4(1):1–30

Fortin NM (2005) Gender role attitudes and the labour-market outcomes of women across oecd countries. Oxf Rev Econ Policy 21(3):416–38

Friedberg L, Webb A (2005) Retirement and the evolution of pension structure. J Hum Resour 40(2): 281–308

Goldin C, Katz L (2002) The power of the pill: Oral contraceptives and women’s career and marriage decisions. J Polit Econ 110(4):730–70

Gustman AL, Steinmeier TL (2000) Retirement in dual-career families: A indent structural model. J Labor Econ 18(3):503–545

Ho J, Raymo JM (2009) Expectations and realization of joint retirement among dual-worker couples. Res Aging 31(2):153–170

Honoré B, de Paula Á (2016) A new model for interdependent durations with an application to joint retirement. CEMMAP Working Paper, CWP07/16

Hospido L, Zamarro G (2014) Retirement patterns of couples in europe. IZA J European Labor Studies 3(12):1–18

Hurd M (1990) The joint retirement decision of husband and wives. In: Wise D (ed) Issues in the economics of aging (pp 231–254). Chicago, IL: The University of Chicago Press

Kalenkoski CM, Lacombe DJ (2015) Using spatial econometric techniques to analyze the joint employment decisions of spouses. J Labor Res 36:67–77

Kapur K, Rogowsky J (2007) The role of health insurance in joint retirement among married couples. Ind Labor Relat Rev 60(3):397–407

Maestas N (2007) Cohort differences in retirement expectations and realizations. In: Madrian B, Mitchell O, Soldo B (eds) Redefining retirement: How will boomers fare? Oxford University Press, Oxford, pp 13–35

Michaud P, Vermeulen F (2011) A collective labor supply model with complementarities in leisure: Identification and estimation by means of panel data. Labour Econ 18(2):159–167

Michaud PC (2003) Joint labor supply dynamics of older couples. IZA Discussion Papers No. 832

Schellenberg G, Ostrovsky Y (2008) Retiring together, or not. Perspectives on Labour and Income 20(2): 5–11

Schirle T (2008) Why have the labour force participation rates of older men increased since the mid-1990s? J Labor Econ 26(4):549–594

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The author declares that he has no conflict of interest.

Rights and permissions

About this article

Cite this article

Bhatt, V. Cohort Differences in Joint Retirement: Evidence from the Health and Retirement Study. J Labor Res 38, 475–495 (2017). https://doi.org/10.1007/s12122-017-9258-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12122-017-9258-3