Abstract

Our study investigates the economic growth and catch-up of the NUTS3 regions of 6 Central and Eastern European (CEE) member states of the European Union (EU), 4 countries acceding in 2004 (Czechia, Poland, Hungary, and Slovakia) and further two admitted in 2007 (Bulgaria and Romania), compared to the average of 14 older members of the EU between 2000 and 2019. We based our analysis on the urban–rural region types of the EU in the case of 185 regions, identifying predominantly urban, intermediate, and predominantly rural types. We apply Theil Index to examine the development of disparities and test the phenomena with unconditional β-convergence hypothesis. The analysis indicates that the growth of all CEE countries and their regions is faster than the EU14 average; the capitals considerably exceed it, the catch-up of other urban regions is also relatively fast, while it is very slow in the case of other regions. The convergence between the 185 regions is weak, based on the EU region typology it was initially strong between the capitals, moderate in the case of intermediate and rural types, while divergence can be observed in the urban types. The catch-up of less developed regions is very slow despite EU cohesion funding, even though 80% of the population live here. The stagnation of regional disparities and slow catch-up of less developed regions indicate the poor efficiency of the EU cohesion policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

One of the most important goals of the regional policy of the European Union (EU) is to facilitate territorial cohesion, i.e., the catch-up of less developed countries and subnational regions. This issue was mainly brought into focus after the turn of the millennium, following the EU accession of the Central and Eastern European countries (CEE), since the development level of these countries was well below the development level of the older member states. Besides the catch-up of less developed regions, another important goal is to increase the competitiveness of the EU, which allocates resources mainly to urban regions. These two objectives partly contradict each other, which explains that convergence processes slowed down after 2010 and the focus was put on place-based development strategies related to special conditions of regions, nevertheless, their theoretical background is highly debated (Martin et al., 2022; Rodríguez-Pose, 2020). Iammarino et al., (2019, p. 273) state, “Both mainstream and heterodox theories have gaps in their ability to explain the existence of these different regional trajectories and the weakness of the convergence processes among them”.

In investigating the economic growth of the EU member states, several studies found that the less developed CEE member states are moving closer to the EU average, although at a relatively slow pace (Eurofund, 2018; Halmai & Vásáry, 2012; Kónya, 2018; Mihajlek, 2018). Farkas (2016) points out that the economic growth of the EU member states highly depends on the institutional system; the market economy model of CEE post-socialist countries is special and different from other country types, therefore, there are specific processes in the development of their regions as well.

The regional policy of the EU relies on the development level of NUTS2 regions in determining the grants of the 7-year programming periods. Becker et al. (2018) studied the Structural Supports of the EU over several periods on the basis of NUTS2 regions, and they pointed out regarding the 2007–13 Convergence Objective Regions that they succeeded in addressing employment problems after the 2008 crisis, but they hardly contributed to increasing incomes and convergence. Egri and Tánczos (2018) analysed economic (GDP/capita) and social (human development index) convergence processes between 2004 and 2014 in the CEE states. The absolute and club convergence analyses confirm the convergence on NUTS2 level for both phenomena, indicating a considerable difference according to social and economic dimensions.

In the past years, it has become more and more obvious that the NUTS2 regions are too large and heterogeneous, thus several studies based their investigation on the much smaller NUTS3 regions, which normally consist of a city and its agglomeration. In examining the convergence of the NUTS3 regions within the EU based on the annual data between 2000 and 2011, Goecke and Hüther (2016) conclude that although there is convergence between both the countries and the regions, several countries can be characterised more by divergence (e.g., Greece, Italy). Butkus et al. (2018) analysed the development of disparities between EU countries, NUTS2 regions, and NUTS3 regions over the period of 1995–2014, and they found that although convergence can be observed on different regional levels in the EU, the speed of convergence slows down. The disparities within the EU decreased primarily due to reducing differences between the member states, but they slightly increased on each subnational level in most member states.

Monastiriotis (2014) studied the convergence of the NUTS3 regions of the EU over the period of 1990–2008, comparing the regions of the older EU15 and the new CEE member states. He found that while regional convergence could be observed in the EU15, regional disparities in the CEE increased from 1990, indicating divergence, whose level primarily depends on the development of national economies. Lengyel and Kotosz (2018) examined the convergence processes of the NUTS3 regions of the four Visegrad countries (V4: Czechia, Poland, Hungary, and Slovakia) between 2000 and 2014, and the calculations show a lack of convergence, disparities were reduced substantively only in the years after the 2008 crisis.

Many analysed the evolution of convergence or divergence based on the concentration within countries as urbanisation agglomeration economies, as well as on urban–rural typology. Castells-Quintana and Royuela (2015) studied the relationship between the spatial concentration of resources and development in the case 51 countries over the period of 1970–2007, and among their findings they highlighted that a strong impact on economic growth can be seen especially in the initial stage of urbanisation. Van Leeuwen (2015) analysed the urban–rural neighbourhood relations based on about 1000 NUTS3 regions of the EU and showed that neighbourhood is beneficial for both urban and rural regions. De Falco (2021) analysed the effect of spatial concentrations on growth in Italy on NUTS3 territorial level based on the employment data of sectors and found substantial differences between the larger regions of the country.

Chapman and Meliciani (2018) examined the decisive factors and the development of income disparities between the regions of the CEE countries in the period of 1991–2011, identifying urban, old industrialised, and peripheral areas. They found that the increase of regional disparities within countries can be explained with these region types, especially after the turn of the millennium. Lengyel (2017) identified 4 types (strong, rising, weak, and uncompetitive) in analysing the competitiveness of the NUTS3 regions of the V4 countries between 2004 and 2013, with the capitals and the traditional industrial regions forming the most competitive group.

Several studies emphasised that the economic growth of the capitals, as first-tier cities, differs from other cities, these second-tier cities being the “engines” of economic growth in the older EU member states (Cardoso & Meijers, 2016; Parkinson et al., 2015). The study of Camagni et al. (2015) pointed out that metropolitan agglomerations, small town areas, and rural regions have different development paths. Smetkowski (2018) analysed growth factors in the NUTS3 regions of CEE countries over the periods before and after the 2008 crisis, comparing metropolitan and nonmetropolitan regions, and found that the development processes of the two region groups were similar in many respects. Smirnykh and Wörgötter (2021) in studying the convergence of the NUTS3 regions of CEE countries emphasise that capitals have a different development path compared to other regions, and its investigation is of particular importance. It was also proposed that the development of cities and their agglomeration should be facilitated rather than that of regions in the EU (Rauhut & Humer, 2020). Based on the analysis of the literature, it can be seen that there is no complete agreement between scholars on the assessment of the catch-up of regions, which can also be explained by the fact that the investigations considered different periods and different territorial levels.

In our study, we analyse the economic growth of the 185 NUTS3 regions of 6 Central and Eastern European (CEE) member states of the European Union (EU), 4 countries acceding in 2004 (Czechia, Poland, Hungary, and Slovakia) and further two admitted in 2007 (Bulgaria and Romania), between 2000 and 2019, thereby we can also include the characteristics of the post-COVID-19 period. We typed the regions based on the findings of the literature, we relied on the EU’s urban–rural types, identifying predominantly urban, intermediate, and predominantly rural types. We analysed the two periods separately due to the structural break caused by the 2008 crisis, namely the periods of 2000–2008 and 2010–2019. Based on the literature of the topic, we divided the predominantly urban areas, categorising the capital regions in a distinct type as first-tier regions, while the other urban regions essentially form the group of second-tier urban areas.

We analyse three research questions:

-

(1)

In terms of the economic growth of the 185 regions, is there convergence or divergence between 2000 and 2019?

-

(2)

Are the convergence processes of the periods before and after the 2008 crisis until the COVID-19 similar or different?

-

(3)

Does the catch-up of the regions of the CEE6 countries depend on the urban–rural type of the regions?

In the first part of the study, we present the database, the typology of the regions, and the applied methods, and then we cover the empirical description of the regional disparities between the region types. The phenomena show weak convergence and different growth dynamics of the region types, and we test it by using unconditional β-convergence approach. We close the study with our methodological and regional policy conclusions drawn from the analysis, as well as the questions left open for further research.

Database and Methodology

There is a total of 185 NUTS3 regions in the studied CEE6 countries: in Bulgaria 28 ‘oblasati’, in Czechia 14 ‘kraje’, in Poland 73 ‘podregiony’, in Hungary 20 ‘megye’, in Romania 42 ‘judet’, in Slovakia 8 ‘kraje’, and each capital forms a separate territorial unit (Eurostat, 2018). In our analysis, between 2000 and 2019 we relied on the annual Gross domestic product (GDP) at current market prices by NUTS3 regions (nama_10r_3gdp) and Average annual population given in PPS from the website of Eurostat Database by themes to calculate regional GDP data (thousand persons) by NUTS3 regions (nama_10r_3popgdp).

One of the goals of the EU cohesion policy is catching up CEE countries to older member states; in the present study, we make comparisons to the average of the 14 older member states, we do not take the United Kingdom into account. We are aware that GDP shown on Purchasing Power Parity on NUTS3 level can be considered only as an estimate, but the relevant literature also takes it as its basis (Camagni et al., 2015; Smetkowski, 2018).

For typing the regions, we relied on the categories elaborated by the Eurostat. The urban–rural typology is a classification based on the following three categories (Eurostat, 2018, p. 74):

-

“predominantly urban regions, NUTS3 regions where more than 80% of the population live in urban clusters;

-

Intermediate regions, NUTS3 regions where more than 50% and up to 80% of the population live in urban clusters;

-

Predominantly rural regions, NUTS3 regions where at least 50% of the population live in rural grid cells.”

The 6 countries contain 21 predominantly urban regions (URB), 84 intermediate regions (INT), and 80 predominantly rural regions (RUR) (see Table 1 and Appendix). As we have mentioned, the economic growth of the first-tier-level capitals of the 6 countries considerably differs from the other regions (Capello and Cerisola, 2021; Lengyel & Kotosz, 2018), therefore, we classified the 6 capitals into a separate category. Based on the above, we identified 4 types, thus 15 regions remained in the category of predominantly urban regions, which we consider second-tier urban areas.

The urban network of five out of six countries can be considered unipolar, the capital qualifies as predominantly urban (URB) type, only Poland is polycentric, where several URB urban areas can be found. In the case of the Czech and Romanian capitals, their agglomeration is also urban (URB), the agglomeration of the Hungarian capital is intermediate (INT), while the agglomeration of the Slovakian and Bulgarian capital is rural (RUR).

In our study, we apply several methods to address our research questions. We use Theil Index to analyse the development of the differences in the values of GDP per capita and the disparities between the regions and their types. Given a per-unit variable (\({Y}_{i}\)), which is calculated as a quotient of two absolute variables (\({X}_{i}\) és \({F}_{i}\)), the disparity in the per-unit variable can be given with the help of generalised Theil Index (\(TE\)) (Lengyel & Kotosz, 2018; Niebuhr & Peters, 2021):

where \({x}_{i}\) and \({f}_{i}\) are distribution ratios constituted from the absolute variables.

The base of the logarithm is optional, it is common to use binary or exponential logarithm. The generalised Theil Index measures the disparities between the units of observation, the closer it is to 0, the greater the alignment, i.e., level of equalisation (Lengyel & Kotosz, 2018; Thissen et al., 2013).

The generalised Theil Index is also suitable to determine what extent of the total disparities comes from the disparities within the aggregated territorial units (\({TE}_{within})\) and between the aggregated territorial units (\({TE}_{between})\) through aggregating the territorial level, i.e., the \(TE\) value can be decomposed into the sum of two values (Gorzelak, 2021):

To interpret the convergence between regions, we test unconditional β-convergence hypothesis carried out on cross-sectional data based on the study of Barro and Sala-i-Martin (1995). Take t = 0 as the first year and t = T as the last year of the period, then the following regression equation can be used for testing (Gallo and Fingleton, 2021; Smirnykh & Wörgötter, 2021; Viegas & Antunes, 2013):

where n is the number of regions and i = 1,…n, while yi,0 and yi,T are the indicator applied for examining convergence (in this case, GDP capita) in ith region in the first and last observed year; β0 is a constant, εi is the random error. The average growth rate between the two points in time is showed by \(log\frac{{y}_{i, T}}{{y}_{i, 0}}\). There is unconditional β-convergence if β1 is negative and significant. The speed of convergence between regions can be estimated as follows:

Regional disparities within CCE6

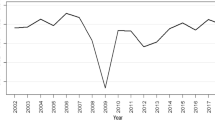

There is significant economic growth in the CEE6 countries between 2000 and 2019, they move increasingly closer to the EU14 average (Fig. 1). Per-unit GDP increased in Romania and Bulgaria to the greatest extent, although starting at a low value. Czechia stands out from the CEE6 countries, reaching 86% of EU14 average by the end of the studied period; four countries (Poland, Hungary, Romania, and Slovakia) reached a similar level, between 64–67%, while Bulgaria showed 49% lagging behind the others. A dynamic catch-up can be observed for each country compared to the starting position, which stalls due to the 2008 crisis, but it is relatively consistent again from 2010, with the exception of Slovakia, falling back in 2015.

GDP per capita increased between 2000 and 2019 in all 185 NUTS3 regions, although to a different extent, but the relationship between the two time series can be regarded relatively close (R2 = 0.734) (Fig. 2). The economic growth of the six capitals stands out, in 2000 only two capitals exceeded the EU14 average, Praha (122%) and Warszawa (116%). However, in 2019 several regions, the capitals in particular, exceeded the EU14-average, Warszawa (200%) and Praha (191%), with Bucuresti (169%), Bratislava (148%), and Budapest (140%) slightly behind. They are followed by three Polish metropolitan regions (Poznan 136%, Wroclaw 117%, and Kraków 114%), while the capital of Bulgaria (Sofia) is found behind them (111%), and two further Polish regions exceed the EU14 average (Plocki 107% and Trojmiejski 101%). Most of the regions are concentrated in the lower left corner of the Fig. 2, 93 out of the 185 regions did not reach 50% of the EU14 average in 2019.

Regarding the economic growth of regions, not only the country effect but also the type of region can be important, and, as we have mentioned, we created 4 region types. The effect of the differentiating factors between countries and within countries, as well as between types and within types can be distinguished by using Theil Index (Fig. 3). The EU cohesion policy relies on NUTS2 regions; therefore, it is also practical to show the development of disparities between and within NUTS2.

The disparities (Total) between the 185 regions reduced to a limited extent over two decades, in the meantime, smaller discontinuities can be found in 2004 and 2012. Total disparities are significantly affected by disparities within countries (C-within), which increase after 2004 and stagnate from 2010. In line with this, the differentiation between countries (C-between) continuously decrease from 2000, as it is indicated by Fig. 1, and stagnates at a low level from 2010. Relying on urban–rural typology, the moderation of total disparities is primarily caused by the equalisation within each type (T-within), while the disparities between types (T-between) intensify until 2008 and stagnate at a high level from that point. The differences between NUTS2 regions (N-between) – as the basis of analysing territorial cohesion in the EU regional policy – decreased, even though with smaller fluctuations, while they increased moderately within NUTS2 regions (N-within). The disparities between NUTS2 regions were probably reduced by the EU cohesion funding, while these funds are concentrated in urban areas within the regions, thereby increasing disparities within regions.

The 4 region types become increasingly distinct since, as we have described, the disparities within region types (T-within) decrease and relatively small, while they are large between region types (T-between). Similarly to countries, catch-up is shown in each region type between 2000 and 2019 (Fig. 4). The growth of the capital type (CAP) is dynamic, it exceeds the EU14 average as early as in 2005, after the slowdown of 2008 it is strong again from 2010 and it reaches its 162% in 2019. The catch-up of the predominantly urban (URB) type without capitals is also fast, reaching 85% of the EU14 average in 2019. However, the economic growth of intermediate (INT) and predominantly rural (RUR) types is much more contained, reaching 57% and 48% of EU14 average in 2019, respectively. It can be observed that in the older member states of the EU the growth of second-tier cities is strong rather than that of the capitals, while in the CEE countries the role of capitals is prominent, other urban areas are less relevant.

The increase of GDP per capita can also be influenced by the change of population. The number of population in the CEE6 countries was 94.7 million in 2000, which decreased to 90.6 million in 2019, i.e., by 4.3%-kal (Table 2). This process is contrary to what can be observed in the EU14, where 319 million people lived in 2000, and 343 million in 2019.

The population of capitals (CAP) and urban areas (URB) in the CEE6 countries increased minimally, while INT decreased by 1.8 million and RUR by 2.7 million. The distribution of GDP between region types only slightly changed, which was obviously influenced by the change of population. The economic role of the capitals is outstanding, the proportion of population living here is 9.6%, but they produce 23.1% of GDP. The economy of other urban areas (URB) did not change significantly over the two decades. The GDP share of INT and RUR regions decreased, in 2019, GDP accounted for 63.4%, while their population for 79.7%. Four fifths of the population of the CEE6 countries still live in less developed regions at present, their catch-up process has a rather slow pace. A moderate spatial concentration of both population and GDP can be seen, the latter being somewhat more intensive.

According to the presented empirical data, catch-up to the EU14 average can be observed in each region, but at a different rate by type. Intermediate (INT) and rural (RUR) regions are significantly behind the economic growth of capitals and urban areas and, as a result, the territorial cohesion measured on NUTS3 level within the CEE6 countries is slow, what is more, spatial disparities stagnate rather than decrease despite substantial EU fundings in the past years.

Growth in the period preceding and following the economic crisis also reflects urban–rural differentiation in economic growth. In the pre-crisis period, the Polish cities, the urban regions of Romania and the metropolitan areas (Prague, Bratislava, Bucharest, Sofia) had a significant advantage. In the period 2010–2019, Polish and Romanian urban areas also stand out in terms of economic growth.

Convergence Between and Within Region Types

On each region, as well as within each urban–rural type we apply the indicator of weighted relative standard deviation to measure the development of disparities in the values of GDP per capita (sigma-convergence). If the value of the indicator decreases, it indicates convergence, and if it increases, it refers to divergence.

The weighted relative standard deviation of per-unit GDP in the case of the 185 regions – similarly to the total Theil Index – shows a slight change from 2000 to 2004, but we can see slightly increasing divergence after 2004, which turned into moderate convergence after 2011 (Fig. 7). There is strong convergence between the capitals (CAP) before 2008, then slight divergence until 2013, followed by weakly decreasing differences, i.e., convergence emerges again. There is slight convergence between urban areas (URB) until 2004, followed by gradual divergence until 2019. Similarly, there are diminishing disparities alongside smaller fluctuations for intermediate (INT) and rural (RUR) regions, which indicates convergence. The extent of deviation becomes very close for three region types (URB, INT, RUR) in 2019.

The development of the Theil Index (Fig. 3) and deviation (Fig. 5) only illustrates the existence of convergence or divergence between the 185 regions and within region types, it is also needed to conduct a more accurate analysis of these phenomena. In our study, we apply the approach of unconditional β-convergence to test convergence, i.e., we assume that the regions with lower income have a higher rate of growth and vice versa. As the periods before and after the 2088 crisis mostly have partly different trends, we separate the two time periods (Figures 6 and 7).

In the case of the 185 regions, we tested our regression models explaining convergence on the periods of 2000–2008, 2010–2019, and 2000–2019 (Table 3). According to the OLS regressions, all three periods are characterised by absolute convergence, i.e., the growth of less developed regions is significantly higher, indicating catch-up to more developed regions. This phenomenon can be experienced alongside the persistence of spatial disparities, i.e., Barro and Sala-i Martin (1995) accurately point out that beta-convergence does not necessarily result in sigma-convergence.

The speed of convergence can also be calculated with beta coefficients, which is relatively high in the period of 2000–2008 (3.3%), but it significantly drops, by almost half, between 2010 and 2019. Considering the entire period, there is an intermediate speed of convergence of 2% provided by Barro and Sala-i Martin (1995). The half-life is in line with the above speed of convergence, based on the growth in the period of 2000–2008 the shortest time can be observed until the half of the total convergence, which is 21 years.

Both the Theil Index (Fig. 3) and the per-unit GDP of each urban–rural region type (Fig. 4) indicate that these region types can also be interpreted as convergence clubs having specific disparity and growth path (Szakálné Kanó & Lengyel, 2021). For testing this, we completed the traditional unconditional β-convergence equation with additional regression terms. As population density data cannot be applied due to differences in region delineation (see, for example, in the case of Bratislava and Warszawa), we use the urban–rural types as dummy variables, the RUR group forming the reference group.

The coefficient of the initial level is still negative and significant in each period, i.e., a lower level of development is accompanied by higher growth, indicating significant convergence (Table 4). By the inclusion of the urban–rural dimension, the speed of convergence accelerates in each case compared to the basic model, and it is especially apparent in the period of 2000–2008, where the speed of convergence increases by over half. In addition, the fit of the model explaining convergence also clearly improves, i.e., the inclusion of new variables substantively contributes to the explanation of convergence.

The significant dummy variables of the types show that there is differentiation between the types in terms of growth in the studied period. CAP and URB regions are characterised by significantly higher growth compared to RUR in the period of 2000–2008, as well as in the entire period of 2000–2019. The regression coefficient of CAP is nearly three times that of URB in both periods, i.e., capitals have a substantial effect on the growth and catch-up of the CEE6. INT regions obstruct the growth of CEE6 regions compared to rural (RUR) regions; they emerge significantly only after the crisis, even though all 6 countries received substantial EU cohesion funding over this period.

In the models extended with urban–rural typology, increasing speed of convergence entail a considerable decrease of half-lives. The half of the time required for convergence drops nearly by half in the period of 2000–2008, decreases by 15% following the crisis, while it drops by one-third (11 years) in the entire period.

Conclusions

In our study, we analysed the convergence of the NUTS3 regions of the CCE6 countries and the catch-up of region types to EU14 average over the period of 2000–2019. We formulated three research questions and applied the methodologies used in convergence literature to address them.

The first question referred to the economic growth of the 185 regions of the CEE6 over the period of 2000–2019. The analyses showed that there was weak convergence on average in the pre-COVID-19 period, spatial disparities decreased moderately and the catch-up of the regions to the EU14 average is contained. Out of the results we emphasise that we can confirm Barro and Sala-i-Martin’s (1995) finding that β-convergence is not accompanied by sigma-convergence.

The second question addressed whether the convergence processes before and after the 2008 crisis can be considered identical or different. In the two periods, both the sigma- and beta-convergence clearly differ in the NUTS3 regions of the CEE6. Although considering the entire period spatial disparities did not decrease significantly, the two periods are distinct; until the 2008 crisis the disparities within countries substantially increased, followed by stagnation. Unconditional β-convergence shows a rapid convergence rate until the crisis, while the speed significantly slows down afterwards, not even reaching its half.

The third question covered whether the catch-up of the regions of the CEE6 countries depend on urban–rural typology. Based on our study, the growth of types is different, we maintain that the region types can also be interpreted as convergence clubs. Of the 4 region types, the economic growth of capital regions (CAP) was dynamic, reaching the EU14 average as early as in 2004, and achieving its one and a half times in 2019. Urban areas (URB) also catch up gradually, slightly behind the EU14 average in 2019. The development of the other two region types, INT and RUR is slow, reaching roughly the half of the EU14 average, even though 80% of the population live here. In the CEE6 countries, economic growth is closely linked to the economy of the capital regions, however, the catch-up of less developed regions is rather slow despite cohesion funding.

The growth of second-tier cities significantly differs from the growth of the capitals as first-tier cities, which shows a substantial difference from the processes observed in the EU14 member states. The faster development of the capitals can probably be explained by the concentration of EU resources, besides urbanisation agglomeration economies.

The unconditional β-convergence analyses indicate that although the catch-up of less developed regions (INT, RUR) is an existing phenomenon, its extent appears to be rather small in both pre- and post-crisis periods. The analysis of the entire period does not show a substantial improvement for these types, either. Nevertheless, the β-convergence results completed with an urban–rural typology are accompanied by an evident acceleration of the convergence speed. The results of the regression calculations overall support the findings of Cardoso and Meijers (2016) and Camagni et al. (2015) on different economic growth paths.

Several studies deal with the analysis of the different development trajectories of the regions of CEE countries. According to Rodríguez-Pose and Ketterer (2020), government quality matters for regional growth, and one-size-fits-all policies for lagging regions are not the solution. Rodríguez-Pose (2020) suggests several ways to improve how a better understanding of the regional development form of institutions can lead to more effective development policies. Based on an empirical study by Capello and Cerisola (2023), it was found that the reallocation of resources towards higher value-added sectors in CEE countries can actually lead to greater regional inequalities, as the competitiveness of the capital cities' economies improves. Using evolutionary economic geography analyses, Simone (2022) demonstrates that the possibility of unrelated diversification is narrower for lagging regions.

We believe that the inclusion of urban–rural types in convergence analysis contribute to understanding the catch-up and convergence of the CEE6 regions with relevant information and highlight the diverse effects of each type in space and time. Using these results is advised for regional policymakers as various region types indicate the necessity of different development strategies.

Data Availability

The data used in this study was collected from publicly available sources.

Change history

22 April 2024

A Correction to this paper has been published: https://doi.org/10.1007/s12061-024-09579-6

References

Barro, R., & Sala-i-Martin, X. (1995). Economic growth theory. McGraw-Hill.

Becker, S. O., Egger, P. H., & von Ehrlich, M. (2018). Effects of EU Regional Policy: 1989–2013. Regional Science and Urban Economics, 69, 143–152. https://doi.org/10.1016/j.regsciurbeco.2017.12.001

Butkus, M., Cibulskiene, D., Maciulyte-Sniukiene, A., & Matuzeviciute, K. (2018). What is the Evolution of Convergence in the EU? Decomposing EU Disparities up to NUTS3 level. Sustainability, 10(5), 1–37. https://doi.org/10.3390/su10051552

Camagni, R., Capello, R., & Caragliu, R. (2015). The Rise of Second-Rank Cities: What Role for Agglomeration Economies? European Planning Studies, 23(6), 1069–1089. https://doi.org/10.1080/09654313.2014.904999

Capello, R., & Cerisola, S. (2021). Catching-up and Regional Disparities: A Resource-Allocation Approach. European Planning Studies, 29(1), 94–116. https://doi.org/10.1080/09654313.2020.1823323

Capello, R., & Cerisola, S. (2023). Industrial Transformations and Regional Inequalities in Europe. The Annals of Regional Science, 70(1), 15–28. https://doi.org/10.1007/s00168-021-01097-4

Cardoso, R., & Meijers, E. (2016). Contrasts Between First-Tier and Second-Tier Cities in Europe: A Functional Perspective. European Planning Studies, 24(5), 996–1015. https://doi.org/10.1080/09654313.2015.1120708

Chapman, S., & Meliciani, V. (2018). Explaining Regional Disparities in Central and Eastern Europe. Economics of Transition, 26(3), 469–494. https://doi.org/10.1111/ecot.12154

Castells-Quintana, D., & Royuela, V. (2015). Are Increasing Urbanisation and Inequalities Symptoms of Growth? Applied Spatial Analysis and Policy, 8(3), 291–308. https://doi.org/10.1007/s12061-015-9146-2

De Falco, S. (2021). Spatial Dynamics Regarding Geographical Concentration of Economic Activities. Italian NUTS-3 Analysis. Applied Spatial Analysis and Policy, 14(4), 795–825. https://doi.org/10.1007/s12061-021-09379-2

Egri, Z., & Tánczos, T. (2018). The Spatial Peculiarities of Economic and Social Convergence in Central and Eastern Europe. Regional Statistics, 8(1), 49–77. https://doi.org/10.15196/RS080108

Eurofound. (2018). Upward convergence in the EU: concepts, measurements and indicators. Luxembourg: European Union. https://doi.org/10.2806/68012

Eurostat. (2018). Methodological manual on territorial typologies. Luxembourg: European Union.

Farkas, B. (2016). Models of capitalism in the European Union: Post-crisis perspectives. Palgrave Macmillan.

Goecke, H., & Hüther, M. (2016). Regional Convergence in Europe. Intereconomics, 51(3), 165–171. https://doi.org/10.1007/s10272-016-0595-x

Gorzelak, G. (2021). Regional policies in East-Central Europe. In M. Fischer & P. Nijkamp (Eds.), Handbook of regional science (second and (extended, pp. 1088–1113). Springer.

Halmai, P., & Vásáry, V. (2012). Convergence Crisis: Economic Crisis and Convergence in the European Union. International Economics and Economic Policy, 9(3–4), 297–322. https://doi.org/10.1007/s10368-012-0218-3

Iammarino, S., Rodriguez-Pose, A., & Storper, M. (2019). Regional Inequality in Europe: Evidence, Theory and Policy Implications. Journal of Economic Geography, 19(2), 273–298.

Kónya, I. (2018). Economic growth in small open economies: Lessons from the Visegrad countries. Springer.

Le Gallo, J., & Fingleton, B. (2021). Regional growth and convergence empirics. In M. Fischer & P. Nijkamp (Eds.), Handbook of regional science (second and (extended, pp. 679–706). Springer.

Lengyel, I. (2017). Competitive and uncompetitive regions in transition economies: the case of the Visegrad post-socialist countries. In R. Huggins & P. Thompson (Eds.), Handbook of Regions and Competitiveness. Contemporary Theories and Perspectives on Economic Development (pp. 398–415). Edward Elgar. https://doi.org/10.4337/9781783475018

Lengyel, I., & Kotosz, B. (2018). The Catching Up Processes of the Regions of the Visegrad Group Countries. Comparative Economic Research, 21(4), 5–24. https://doi.org/10.2478/cer-2018-0024

Martin, R., Martinelli, F., & Clifton, J. (2022). Rethinking Spatial Policy in An Era of Multiple Crises. Cambridge Journal of Regions, Economy and Society, 15, 3–21. https://doi.org/10.1093/cjres/rsab037

Mihaljek, D. (2018). Convergence in Central and Eastern Europe: Can All get to EU Average? Comparative Economic Studies, 60(2), 217–229. https://doi.org/10.1057/s41294-018-0063-7

Monastiriotis, V. (2014). Regional Growth and National Development: Transition in Central and Eastern Europe and the Regional Kuznets Curve in the East and the West. Spatial Economic Analysis, 9(2), 142–161. https://doi.org/10.1080/17421772.2014.891156

Niebuhr, A., & Peters, J. C. (2021). Population Diversity and Regional Economic Growth. In M. M. Fischer & P. Nijkamp (Eds.), Handbook of regional science (second and (extended, pp. 738–753). Springer.

Parkinson, M., Meegan, R., & Kartecha, J. (2015). City Size and Economic Performance: Is Bigger Better, Small more Beautiful or Middling Marvellous? European Planning Studies, 23(6), 1054–1068. https://doi.org/10.1080/09654313.2014.904998

Rauhut, D., & Humer, A. (2020). EU Cohesion Policy and Spatial Economic Growth: Trajectories in Economic Thought. European Planning Studies, 28(11), 2116–2133. https://doi.org/10.1080/09654313.2019.1709416

Rodríguez-Pose, A. (2020). Institutions and the Fortunes of Territories. Regional Science Policy & Practice, 12, 371–386. https://doi.org/10.1111/rsp3.12277

Rodríguez-Pose, A., & Ketterer, T. (2020). Institutional Change and the Development of Lagging Regions in Europe. Regional Studies, 54(7), 974–986. https://doi.org/10.1080/00343404.2019.1608356

Simone, A. (2022). The Sources of Unrelated Diversification and Its Implications for Lagging Regions. GeoJournal, 88, 2139–2152. https://doi.org/10.1007/s10708-022-10739-9

Smetkowski, M. (2018). The Role of Exogenous and Endogenous Factors in the Growth of Regions in Central and Eastern Europe: The Metropolitan/ Non-Metropolitan Divide in the Pre- and Post-Crisis era. European Planning Studies, 26(2), 256–278. https://doi.org/10.1080/09654313.2017.1361585

Smirnykh, L. & Wörgötter, A. (2021). Regional convergence in CEE before and after the Global Financial Crisis. ECON WPS - Working Papers in Economic Theory and Policy, No. 03/2021. Retrieved December 11, 2022 from https://nbn-resolving.org/urn:nbn:de:0168-ssoar-75847-6

SzakálnéKanó, I., & Lengyel, I. (2021). Convergence clubs of NUTS3 regions of the V4 group. E and M Ekonomie a Management, 24(4), 22–38. https://doi.org/10.15240/tul/001/2021-4-002

Thissen, M., Van Oort, F., Diodato, D., & Ruijs, A. (2013). Regional Competitiveness and Smart Specialization in Europe: Place-based Development in International Economic Networks. Edward Elgar. https://doi.org/10.4337/9781782545163

van Leeuwen, E. (2015). Urban-rural synergies: An explorative study at the NUTS3 level. Applied Spatial Analysis and Policy, 8(3), 273–289. https://doi.org/10.1007/s12061-015-9167-x

Viegas, M., & Antunes, M. (2013). Convergence in the Spanish and Portuguese NUTS3 regions: An exploratory spatial approach. Intereconomics, 1, 59–66. https://doi.org/10.1007/s10272-013-0445-z

Funding

Open access funding provided by Hungarian University of Agriculture and Life Sciences.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Egri, Z., Lengyel, I. Convergence and Catch-Up of the Region Types in the Central and Eastern European Countries. Appl. Spatial Analysis 17, 393–415 (2024). https://doi.org/10.1007/s12061-023-09551-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12061-023-09551-w