Abstract

Energy efficiency improvement (EEI) is generally known to be a cost-effective measure for meeting energy, climate, and sustainable growth targets. Unfortunately, behavioral responses to such improvements (called energy rebound effects) may reduce the expected savings in energy and emissions from EEI. Hence, the size of this effect should be considered to help design efficient energy and climate targets. Currently, there are significant differences in approaches for measuring the rebound effect. Here, we used a two-step procedure to measure both short- and long-term energy rebound effects in the Swedish manufacturing industry. In the first step, we used data envelopment analysis (DEA) to measure energy efficiency. In the second step, we use the efficiency scores and estimated a derived energy demand equation including rebound effects using a dynamic panel regression model. This approach was applied to a firm-level panel dataset covering 14 sectors in Swedish manufacturing over the period 1997–2008. We showed that, in the short run, partial and statistically significant rebound effects exist within all manufacturing sectors, meaning that the rebound effect decreased the energy and emission savings expected from EEI. The long-term rebound effect was in general smaller than the short-term effect, implying that within each sector, energy and emission savings due to EEI are larger in the long run compared to the short run. Using our estimates of energy efficiency and rebound effect, we further performed a post-estimation analysis to provide a guide to policy makers by identifying sectors where EEI have the most potential to promote sustainable economic growth with the lowest environmental impact.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

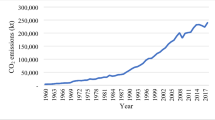

Greenhouse gas (GHG) emissions drive climate change (Intergovernmental Panel on Climate Change, 2013) and about 60% of these are generated by energy use (International Energy Agency, 2020). Therefore, global attempts to reduce GHG emissions and combat climate change have aimed to reduce energy use.Footnote 1

Energy efficiency improvement (EEI) is generally recognized as a cost-effective measure for reducing energy use. EEI can be achieved if either the same level of goods and services is produced using less energy, or if more goods and services are produced using the same level of energy. Improving energy efficiency should decrease the real unit price of energy service for an industrial firm. This change can initiate a re-optimization response that can appear in the form of substitution and output effects, and may ultimately mitigate, increase, or even reverse the energy and carbon emission savings expected from EEI. These offsets are respectively referred to as the energy (Khazzoom, 1980; Saunders, 1992) and carbon (e.g., Wu et al., 2018) rebound effect. Hence, if the aim is to improve overall energy efficiency (with the ultimate goal of ameliorating climate effects), it is essential to understand the size and scope of the rebound effect.

According to Saunders (2000), measuring the energy rebound effect ought to be straight forward, requiring only an estimate of the elasticity of demand for energy servicesFootnote 2 with respect to changes in energy efficiency. In practice, however, estimating this elasticity is not so simple, and empirical studies have used different methods to measure the energy rebound effect, with no clear consensus yet about what method(s) might be best. Each of these methods has limitations and drawbacks. For instance, one group of studies estimated the rebound effect indirectly through estimating price elasticities of energy demand (e.g., Bentzen, 2004; Dahlqvist et al., 2020; Saunders, 2013). These estimates provided proxies for the rebound effect but were potentially biased for two reasons (Sorrell et al., 2009). First, the energy rebound effect is a consumer’s behavioral response to a decrease in real unit price of energy service, whereas price elasticities of demand are usually estimated for periods with increasing energy prices. Using such elasticities potentially overestimates the size of the energy rebound effect, because energy demand responds more strongly to price increases than price decreases (see, e.g., Bentzen, 2004; Dahlqvist et al., 2020). Second, as opposed to energy price changes (which in most cases are exogenous), behavioral responses to EEI are driven endogenously by investments to replace the less efficient technology. Taking the price elasticity of demand as a proxy for energy rebound effect implies that such investments are exogenous, which they are not.

An alternative way to approach this problem was proposed by Orea et al. (2015), who integrated the measurement of rebound effect into a stochastic energy demand frontier model and estimated the effect according to the more theoretically sound definition suggested by Saunders (2000). This approach gave a direct measure of the energy rebound effect and avoided the problems of using the price elasticities as proxies. To obtain such a measure, they modified the conventional stochastic energy demand frontier model by adding an interaction term (i.e., a parameterized rebound function) with the inefficiency term, thereby estimating energy efficiency and the energy rebound effect simultaneously in a one-step procedure. Amjadi et al. (2018) adopted this approach for estimating the rebound effect for four energy-intensive sectors in the Swedish manufacturing industry. However, this approach had some limitations. First, it measured the rebound effect only through its determinants, and therefore may have been biased due to some omitted variables. Second, it precluded the existence of two potential types of rebound outcomes (“backfire” and “full rebound,” see discussion below) due to the one-sided nature of the inefficiency term in the stochastic frontier analysis (SFA) models, and the true size of the rebound effect might have been underestimated. Finally, convergence properties were also very sensitive to the variables included in the rebound function.

In another approach, Adetutu et al. (2016) adopted a two-stage strategy for measuring the energy rebound effect. In the first stage, they used SFA to measure the energy efficiency scores. In the second stage, they estimated a dynamic energy demand regression model in which various variables interacted with the energy efficiency term. The drawback to their approach, and to all parametric approaches in general, is that a functional form for the production technology must be assumed when estimating the efficiency scores. In addition, Adetutu et al. (2016) did not estimate the rebound effect and efficiency scores simultaneously in a one-step procedure, and therefore, their estimates are less efficient than Orea et al. (2015) or Amjadi et al. (2018).

In this paper, as Adetutu et al. (2016), we suggest a two-stage approach for measuring the energy rebound effect. The motivation for our empirical approach is to overcome some of the limitations and drawbacks of the previously mentioned approaches. In the first stage, we use data envelopment analysis (DEA) to obtain technical energy efficiency scores. In the second stage, a dynamic panel data regression model is used to measure the elasticity of energy demand with respect to changes in energy efficiency (the rebound effect).

Our contribution to the empirical research about the energy rebound effect can be summarized as follows. Applying DEA in the first stage allowed us to account for bad outputs (emissions) when measuring energy efficiency scores, and DEA do not require specifying any parametric production technology (at this stage). Furthermore, using a dynamic panel regression model in the second stage allowed for measuring both short- and long-term rebound effects. Finally, the approach allowed for all possible (known) rebound effects (which Orea et al., 2015, and Amjadi et al., 2018, were not able to do in their SFA one-stage estimation).

The results of this study also contribute to policy design by providing insights to policy makers in order to set more realistic energy and climate-related targets. EEI may have both positive and negative effects on energy and carbon emission savings and the overall effect would be ambiguous due to existence of energy rebound effect. EEI will initially reduce energy demand and carbon emissions. However, savings due to productivity gains may lead to economic growth, followed by increase in energy demand and carbon emissions. This take-back or rebound effect will partially or wholly offset the energy and emission savings expected from EEI. Knowledge about the size of energy and carbon rebound effect is necessary in order to design policy mandates that show an awareness of responses to EEI. To this aim, we further use the results obtained from the first and the second stages to perform a post-estimation analysis to provide a guide to policy makers by identifying sectors in which EEI is more likely to have a positive impact on the environment, energy savings, and/or sustainable growth (where economic development comes with minimal harm to the environment). How EEI affects the environment, energy savings, and economic growth varies with sector-specific characteristics, such as the level of CO2 emissions, energy consumption, output per unit of emission, level of energy efficiency, and size of the rebound effect.

The rest of this paper is structured as follows. The “Rebound effect: mechanisms and empirical literature review” section introduces the concept of energy rebound effects and its driving mechanisms, as well as empirical studies about the producer-side rebound effect. The “Methodology” and “Data” sections present the empirical framework and describe the data used, respectively. The “Results” section presents the results and gives policy guidelines based on post-estimation calculations, and in the “Conclusions” section, we conclude.

The rebound effect: mechanisms and empirical literature review

This section gives a short background to the energy rebound effect and the underlying mechanisms, which is then complemented by a literature review focusing on empirical studies that measure the energy rebound effect for the production side of the economy.

Background and mechanisms

As long ago as the middle of the nineteenth century, William Stanley Jevons noticed that the invention of more efficient steam engines increased industrial use of coal. This phenomenon became known as “Jevons paradox.” Later, Khazzoom (1980) assigned the term energy rebound effect to this paradox in the economic literature.

“Production-side energy rebound effect” refers to a producer’s behavioral changes in energy use that have been induced by energy use becoming more efficient. Two effects drive this change, namely the substitution/intensity effect and the output effect (see, e.g., Saunders, 1992, 2008). EEI decreases the energy intensity, meaning that more output can be produced using the same level of energy input. The real unit price of energy service decreases and, hence, the price of energy (relative to other inputs) also falls. Producers may, to some extent, substitute energy for other inputs, and when this happens, it is called the substitution/intensity effect. Cost savings due to the substitution effect might then be used for scaling up production levels, which in turn increases energy use, and this increase is called the scale/output effect. These two effects determine the size of the energy rebound effect, which is defined as the difference between the actual energy savings and the expected energy saving from EEI that had been calculated from an engineering point of view. The size of the rebound effect depends on the elasticities of substitution and productivity gains (Greening et al., 2000). The energy rebound effect is a re-optimization response to changes in relative input prices and cost savings, and it creates economic value; in that sense, it enhances the level of welfare (Borenstein, 2015). That said, the size of the rebound effect should be considered when policies addressing climate change and energy demand are set, or when the effectiveness of energy efficiency policies is evaluated.

There are three types of rebound effects: (i) a direct effect, (ii) an indirect effect, and (iii) an economy-wide effect (Greening et al., 2000). The direct effect is initiated when producers re-optimize their demand for inputs as energy becomes more efficient and in real terms relatively cheaper. This re-optimization may, potentially, lead to an increase in energy consumption. The indirect effect is linked to scaling up the production level due to cost savings from EEI. The economy-wide effect may occur if the direct and the indirect effects are large and change relative prices significantly. The size of the energy rebound effect will fall within the range of the five scenarios presented in Table 1, namely, backfire, full rebound, partial rebound, zero rebound, and super-conservation (see, e.g., Greening et al., 2000).

Empirical studies on producer-side rebound effect

Measuring the size of the rebound effect may seem straightforward, because in principle, it only requires the elasticity of demand for energy services with respect to changes in energy efficiency (Saunders, 2000). In practice, data about demand for energy services and/or energy efficiency is usually lacking, which means that elasticity cannot be estimated directly (Orea et al., 2015; Sorrell et al., 2009). Instead, most empirical studies have used other elasticities as a proxy for the energy rebound effect (Sorrell & Dimitropoulos, 2008). The majority of these studies have looked at consumer-side rebound effect because data for measuring these elasticities are readily available. Few studies have tried to measure the size of the energy rebound effect for producers. Nadel (1993) reviewed a small sample of existing studies and concluded that the energy rebound effect accounted for about a 2% less than expected savings, on average, due to scaling up the production level (the output effect).

A few more recent studies have tried to estimate producer-side energy rebound effects by estimating various elasticities as proxies for the direct rebound effect. In one such study, Bentzen (2004) estimated an energy price elasticity using a system of factor demand equations. He used data on the US manufacturing sector from 1949 to 1999 and estimated an upper bound of 24% for the direct rebound effect. Another example is Saunders (2013), who measured short- and long-term direct rebound effects for 30 US sectors from 1960 to 2005 by estimating the elasticity of substitution between energy and other production factors, assuming no technological gains after 1980. He concluded that the overall sector average short- and long-term direct rebound effects were about 125% (backfire) and 60% respectively.

There are a few studies measuring the energy rebound effects using data from China. Lin & Li (2014) estimated the direct rebound effects for heavy industry through a system of cost share equations derived from a translog cost function, resulting in a direct rebound effect of about 74%. Lin & Xie (2015) looked at the direct rebound effect for China’s food production industry by estimating a system of cost share equations, resulting in a rebound effect of about 34%. In another study, Lin & Tan (2017) estimated the potential for the energy conservation from six most energy and capital intensive industries in China, including manufacture of raw chemical materials and chemical products and non-metallic mineral products, taking into account the energy rebound effect. They used the latent variable approach and found that the average energy rebound effect is more than 90%, equal to about 14–26 million tons of standard coal equivalent in 2020 and 44–81 million tons of standard coal equivalent in 2030.

Two other studies estimated the rebound effect for Sweden’s heavy industrial sectors pulp and paper, basic iron and steel, chemical, and mining. Amjadi et al. (2018) used a stochastic energy demand frontier model to estimate fuel and electricity rebound effects using a firm-level panel dataset for the period 2000–2008, finding that the average fuel rebound effect was 58–65%, while the average electricity rebound effect was 76–86%. Dahlqvist et al. (2020) also estimated electricity and fuel rebound effects using a factor demand model approach and a firm-level dataset. Their estimates of electricity rebound effects showed a backfire response, while the fuel rebound effect were 24–80% across the four energy-intensive sectors. Methodological differences between these two studies mean that their results are complementary — Amjadi et al. (2018) focused on movement towards the energy efficiency frontier, while Dahlqvist et al. (2020) were looking at energy-related technological changes that were moving the frontier itself.

The economy-wide rebound effect is usually measured using computable general equilibrium (CGE) models, where the estimates range from partial rebound to backfire (see, e.g., Grepperud & Rasmussen, 2004; Washida, 2004; Allan et al., 2007; Vikström, 2008; Hanley et al., 2009; Broberg et al., 2015). For a more detailed list of empirical papers estimating industrial rebound effect, see Safarzadeh et al. (2020).

In summary, studies on producer-side rebound effect show a wide range of rebound effects from partial to backfire. These results are however not always comparable to each other because of differences in methods, data, and definitions (Gillingham et al., 2014; Orea et al., 2015).

Methodology

Following Saunders (2008), we define the producer-side rebound effect (R) as:

where η represents the elasticity of demand for energy (E) with respect to energy efficiency improvement (EEI), i.e., \(\eta =dlnE/dlnEEI\). Instead of estimating an elasticity as a proxy for η (as most previous studies have done), we directly estimate η and the rebound effect using a two-stage approach. In the first stage, energy efficiency scores are calculated using DEA, while in the second stage, energy demand is modeled using a dynamic panel data regression (including the first-stage energy efficiency scores), allowing estimation of both short- and long-term energy rebound effects.

Measuring energy efficiency by a joint production technology

Ever since the groundbreaking work of Debreu (1951) and Farrell (1957), efficiency has been measured using different approaches and techniques. One general approach (e.g., Färe & Grosskopf, 1985; Färe & Grosskopf, 2004) uses the linear programming technique DEA, which does not require specifying a functional form for the production function (i.e., no particular relationship between inputs and outputs) or any assumptions about the distribution of efficiency scores.

We applied DEA to measure the energy efficiency scores at firm-level. The scores indicated the maximum feasible reduction of energy input given the amount of other inputs and levels of outputs, both bad and good. There are quite a few empirical studies in which energy efficiency is calculated using this framework (e.g., Lin & Du, 2013). We followed the approach proposed by Färe & Grosskopf (2004), called the joint production framework, where the production of desirable outputs creates undesirable outputs. Desirable outputs are marketed goods, while undesirable outputs are by-products with negative effects on the environment and humans. This framework has two main assumptions. First, it is assumed that the production of desirable outputs always generates undesirable outputs (this is called the null-joint assumption). Given the joint production of desirable and undesirable outputs and a constant bundle of inputs, it is further assumed that any reduction in undesirable outputs is conditional on a proportional reduction of desirable outputs, implying that the disposal of undesirable outputs is costly (this is called the weak disposability assumption). This framework has the advantage that it allows one to take into account the production of undesirable outputs when evaluating the efficiency of decision-making units such as firms. Indeed, it allows for crediting firms for their abatement activities while measuring different types of performance efficiencies. In this setting here, it would mean we gauge the potential energy efficiency improvement that is possible without increasing emissions.

Setting up the linear programming model to measure energy efficiency scores proceeded like this. First, there are \(k\) individual firms in a sector. For each firm, there are \(n\) non-energy inputs x, and energy input e, and \(m\) desirable outputs y, and \(j\) undesirable outputs u. Next, an assumption on the return to scale of the production technology is the minimal requirement within the DEA framework. In this paper, we assumed a constant return to scale technology, allowing for no scale inefficiency.Footnote 3 Under these assumptions, the general linear programming problem to obtain the energy technical efficiency score (\({\alpha }_{{k}^{^{\prime}}})\) for firm k´ was:

where z is referred to as an intensity variable and only takes a non-negative real number for each firm; this variable defines the extent to which each firm contributes to constructing the production frontier. α is included on the right-hand side of the energy input constraint and measures the technical efficiency in use of energy, holding the level of other inputs and desirable and undesirable outputs constant. α can have values from 0 to 1, where 1 implies full technical efficiency in use of energy, meaning that no reduction in the energy input is feasible given the level of other inputs and desirable and undesirable outputs. The inclusion of the second constraint in Eq. (2) implies that we consider the production of undesirable outputs when evaluating technical efficiency in the use of energy, which improves the analysis because it appropriately credits firms for their abatement activities.

DEA-based point estimates of energy efficiency scores obtained from Eq. (2) are based on a finite sample of firms, and are necessarily affected by sampling variation because the distances to the frontier will be underestimated if the best performing firms in the population are not included in the sample (Simar & Wilson, 1998). We therefore followed the bootstrapping approach proposed by Simar & Wilson (1998) which constructs confidence intervals for DEA energy efficiency scores. This approach used the output from Eq. (2) to simulate a true sampling distribution of efficiency scores. A new dataset was created, and energy efficiency scores were calculated using this dataset. This process was repeated many times in order to obtain a good approximation of the true distribution of the sampling. The bootstrapping procedure can be summarized as follows:

-

1)

Use DEA to calculate the energy efficiency scores using Eq. (2).

-

2)

Draw with replacement from the empirical distribution of energy efficiency scores.

-

3)

Divide the original energy efficiency levels by the pseudo-efficiency scores drawn from the empirical distribution to obtain a bootstrap set of pseudo-energy inputs.

-

4)

Apply DEA using the new set of pseudo-inputs and the same set of outputs and calculate the bootstrapped efficiency scores.

-

5)

Repeat steps 2–4 and use bootstrapped scores for statistical inference and hypothesis testing.

The outcome of this process is a bias-corrected \(\widehat{{\alpha }_{k}}\) for \({\alpha }_{k}\).

Measuring the rebound effect using a dynamic panel data regression model

In the second stage, we use a dynamic panel data regression to model energy demand. We use the bias-corrected firm-level energy efficiency scores from the first stage as a regressor to estimate both the short- and long-term elasticities of demand for energy with respect to EEI.

For a cost-minimizing firm,Footnote 4 our derivation of energy demand follows Kumbhakar and Lovell (2000) and is a function of the output level, the relative price of other inputs to energy, and the level of energy efficiency. Assuming a log-linear or Cobb–Douglas type of production technology for the frontier with inputs labor, capital, and energy, our dynamic energy demand regression model is written as:

where

Subscripts k and t represent firm and year, respectively. The dependent variable E denotes energy demand and is treated as a long-run equilibrium (see, e.g., Adetutu et al., 2016). βs and γs are vectors of parameters to be estimated. \({E}_{k,t-1}\) is the lagged energy demand and indicates the dynamic characteristic of the model.

Including the lagged dependent variable among regressors is a standard and widely used approach to perform dynamic analysis (Wooldridge, 2010). The model specified in Eq. (3) is essentially static, which in this case means that energy demand, due to price changes, instantaneously adjusts to (long-run) equilibrium. To introduce dynamics, we will assume that there is some kind of adjustment cost that may create differences between short- and long-run demands. For example, changing energy use or energy mix may be costly due to technological constraints. Here, we will follow Treadway (1970, 1974) by simply assuming that the production function also includes rates of change in energy use. As usual, we have that the marginal product of energy is positive, but in addition, we have that adjustment costs due to changes in energy use will constrain production. See, e.g., Considine & Mount (1984), Jones (1995, 1996), Yi (2000), and Brännlund & Lundgren (2004) for empirical energy demand applications based on the theoretical underpinnings laid out in Treadway (1970, 1974). In practice, it entails adding a lagged dependent variable (in this case, energy use in previous period) to the energy demand equation, and the coefficient reflects the speed of adjustment to the long run (see Considine & Mount (1984) for a complete description of this). The parameter \({\beta }_{1}\) indicates the speed of transition from short run to long run. Because energy demand in any current period is expected to be correlated with energy demand in a past period, we expect a positive sign for \({\beta }_{1}\).

Y is the quantity of output produced and it is expected to have a positive effect on the energy demand. RPCE and RPLE are the relative price of capital and labor to the energy price, respectively, and they could affect energy demand either positively or negatively, depending on whether capital/labor and energy are substitutes or complements. EF is the bias-corrected firm-level energy efficiency score obtained from DEA. The estimated coefficient of this variable shows the elasticity of energy demand with respect to changes in energy efficiency and therefore can be used to estimate the energy rebound effect according to Eq. (1). As can be seen, this coefficient is modeled as a function of a constant term and a few firm-specific and policy-related variables, which allows us to differentiate responses to EEI due to heterogeneity of firm-specific characteristics. Our choice of particular variables to be included in the rebound function is justified by policy interests rather than by a theoretical ground per se. The variables are (i) a dummy variable for energy cost share (DECS) to distinguish firms with potentially high cost savings due to EEI, (ii) the energy price (EP) to study the effects of energy price level and variation on the energy rebound effect,Footnote 5 and (iii) a dummy variable for firm size (DFS) to study whether the rebound effect differs between large and small firms. For each firm in each year, the dummy variable DECS takes the value 1 if energy cost share of that firm is larger than the median of the sector to which the firm belongs for that year, otherwise this value is 0. In a similar manner, dummy variable DFS takes the value 1 if the output level is larger than the median of the sector for that year; otherwise, it is 0. These variables interact with EF and allow us to evaluate how the energy rebound effect changes with these variables. The term wk controls for unobserved firm’s heterogeneity, while Dt is a set of year dummies controlling for year-specific effects. vkt is the independent and identically distributed error term with mean zero and a constant variance, i.e., \({v}_{kt}\sim N\left(0,{\sigma }^{2}\right)\).

Equation (3) was estimated separately for each of the 14 sectors in the Swedish manufacturing industry using the system generalized method of moments (GMM) estimator developed by Arellano & Bover (1995). The estimator deals with issues related to dynamic panel data regression models, such as correlation between the lagged dependent variable and the unobservable fixed effects, endogeneity, and serial correlation (for detailed information about system GMM see, e.g., Roodman, 2009). For each firm and year, we can obtain both short-run and long-run elasticities of energy demand with respect to changes in energy efficiency as:

Substituting these elasticities in Eq. (1) provides firm-level short- and long-term rebound effects (see also Adetutu et al., 2016, for a similar approach). Both the sign and the magnitude of these elasticities determine the range of the energy rebound effect from backfire to super-conservation. Unlike the one-stage SFA approaches proposed by Orea et al. (2015), this dynamic two-stage approach allows for all possible sizes of the rebound effects. The steps followed in this study are summarized in Fig. 1.

Data

We used a firm-level (unbalanced) panel dataset covering all sectors in the Swedish manufacturing industry from 1997 to 2008. The fourteen sectors are basic iron and steel, chemical, electro, fabricated metal products, food, machinery, mining, motor vehicles, printing, pulp and paper, rubber and plastic, stone and mineral, textiles, and wood. The dataset was provided by Statistics Sweden and includes firm-level information on inputs, outputs, and various emissions. Descriptive statistics for an average firm and year are presented in Table 2. All variables with monetary units are based on 2008 prices measured in Swedish Crowns (SEK).

The production inputs were capital, labor, and energy. The capital stock was calculated by the perpetual inventory method using gross investment data (excluding investments in buildings). The capital depreciation rate was set to 0.087 for all firms and sectors in this study as suggested in King & Fullerton (1984) and Bergman (1996). Labor was the number of employees. Energy was the sum of electricity, district heating, wood fuel, coal, solid fuel, and gaseous fuel, and were all converted to energy equivalents (GWh) by Statistics Sweden using the same conversion rates for all sectors.

The desirable output for each firm and year was calculated as the final sales divided by its corresponding producer price index for a given sector and year. The undesirable outputs were sulfur dioxide (SO2) and nitrogen oxide (NOx) measured by the metric ton.Footnote 6 The capital price was defined as the user cost of capital and calculated based on national- and sector-level indices (Lundgren, 1998; Brännlund & Lundgren, 2010). Unit prices of labor (i.e., salary) and energy prices were calculated as the ratio of these input costs to the quantities used.

Results

Here, we present sector-level averages of energy efficiency scores obtained from the DEA model, followed by parameter estimates for the dynamic energy demand model. The sector-level averages of the short- and long-term energy rebound effects are presented, followed by conclusions that provide a guide to policy makers by identifying sectors where promoting EEI benefited the industry or the environment.

Energy efficiency scores from the DEA model

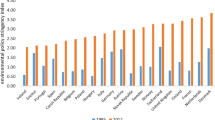

Table 3 and Fig. 2 show sector-level averages of energy efficiency scores obtained from the DEA model in Eq. (2) for all 14 sectors of Swedish manufacturing industry. These averages were calculated for the bias-corrected firm-level energy efficiency scores taking into account the production of undesirable outputs, meaning that firms are credited for their abatement activities while measuring energy efficiency.

Table 3 lists sectors according to their sector-level average energy efficiency scores, meaning that the farther one reads down the table, there is a larger potential for EEI. The efficiency score is a relative measure and Table 3 indicates how firms within one sector perform on average relative to best practices available. For instance, on average, firms in the most efficient sector, pulp and paper, perform closer to their best practice peers than do firms in any other sectors.Footnote 7

The dynamic energy demand model

Table 4 presents the results of estimating Eq. (3) using a system GMM estimator. System GMM is an appropriate estimator for this study since our dataset covers a relatively small number of time periods and a relatively large number of firms in each sector (Roodman, 2009). Our estimates all passed the Sargan/Hansen test for the joint validity of the set of instruments as well as AR(1) and AR(2) tests. To determine the lag order of instruments for each sector, we applied the model and moment selection criteria proposed by Andrews & Lu (2001).Footnote 8

Our coefficient estimates of the lagged dependent variable showed statistically significant and positive effects on energy demand, as expected, within all sectors. The results, where statistically significant, also suggested that the energy demand increased by the output level, which is expected. The coefficient estimates of relative price of capital and labor to the energy price were mostly positive, where significant, implying that capital/labor and energy were substitutes in general.Footnote 9

As mentioned earlier, the elasticity of energy demand with respect to changes in energy efficiency is modeled as a function of a constant term and a few policy-relevant and firm-characteristic variables. The constant term was statistically insignificant in most sectors. The coefficient estimates of the interaction term DECSlnEF were, in most sectors, statistically significant and negative, indicating that in each sector, the rebound effect was lower among firms with higher energy cost share, implying less pronounced adaptation and behavioral responses among such firms. The coefficient estimates of the interaction term EPlnEF were very small, and statistically insignificant in most sectors, suggesting that the rebound effect did not vary with the energy price in those sectors. Furthermore, the estimated coefficients of DFSlnEF were in all of sectors insignificant, implying that the rebound effect did not depend on the firm size, ceteris paribus. The coefficient estimates of the lagged energy demand imply that there is a difference between short- and long-term rebound effects.

Rebound effect estimates

To obtain estimates of the short- and long-term rebound effects for each firm and year, we used our coefficient estimates in Table 4 and calculated the short- and long-term firm-level elasticities defined by Eq. (4). Finally, we use Eq. (1) to estimate the short- and long-term rebound effects for each firm in each year. Using these estimates in each sector, we can obtain the sector-level averages of the short- and long-term energy rebound effects presented in Table 5 and Figs. 3 and 4.

Table 5 reveals that the short-term rebound effect is on average partial in a majority of the studied sectors, ranging from 92% in Wood to 100% in Textile. It also indicates that in all the studied sectors, the short-run rebound effect is statistically different from zero.Footnote 10 These results suggest that in most sectors (except Textile), the energy (and emissions) savings expected from EEI were not totally offset because of the short-term rebound effect. However, given the magnitude of these numbers, we can conclude that partial rebound effect in the short run was quite substantial in Swedish manufacturing. In the long run, the averaged energy rebound effects are statistically significant in most sectors and partial where significant. Partial rebound effects were smallest in the mining sector and largest in the basic iron and steel sector. Our results suggest that in the short run, firms substantially respond to EEI and re-optimize their energy use (indicated by a large energy rebound effect), but in the long run, there are some adaptations to EEI and in some sectors the rebound disappears (insignificant estimates). It is also notable that, in all studied sectors, the long-term rebound effect was smaller than the short-term effect, implying that within each sector, energy and emission savings due to EEI are larger in the long run compared to the short run.

Sector averages of short- and long-term rebound effects ranged from partial to full rebounds, but firm-level rebound effects varied over an even wider range. Indeed, all possible scenarios ranging from backfire to super-conservation were observed at firm-level. Therefore, policy aimed at EEI must account for this heterogeneity in some way, because the impact will vary substantially among firms and to some degree among sectors. Last but not least, it is worthy to note that the rebound effect varies between sectors because different sectors respond differently to EEI’s, that is, as a firm in electro modifies its behavior to EEI’s in a specific way, a pulp and paper firm responds differently. This is because their technologies are different, and changes in input substitution/mix and output response are therefore also different.

EEI outcomes in the Swedish manufacturing industry

EEI potentially benefits the environment through emission savings, the industry by cost savings from re-optimization of inputs, or of course it can benefit both concerns. In this section, we conduct a post-estimation descriptive analysis to identify sectors in which EEI mainly benefited the environment or the industry.

To do this, we used the sector averages of energy efficiency scores as well as the short- and long-term rebound effects obtained from our firm-level results.Footnote 11 For each sector, we also considered the yearly averages of energy use, CO2 emissions, and output. We also calculated the yearly averages of energy and CO2 intensities, defined respectively as energy and CO2 emissions per unit of output (similarly to Pardo Martínez & Silveira, 2013) during the period 1997–2008. These measures are presented in Table 6.Footnote 12 Indeed, numbers reported in Table 6 reveal the total outcomes for each sector based on estimated results of energy efficiency and short- and long-term rebound effect for an average firm. There are substantial differences among the different sectors in terms of energy efficiency scores, short- and long-term energy rebound effects, energy use, and CO2 emissions and output.

Promoting EEI in stone and mineral and basic iron and steel had by far the largest environmental impact in terms of CO2 emission savings in the short run and long run, respectively. Basic iron and steel, mining, chemical, and food followed stone and mineral in the short run. In the long term, EEI in stone and mineral, chemical, mining, and pulp and paper resulted in the largest CO2 emission savings after basic iron and steel, based on CO2 emissions and sector-level energy efficiency and rebound effect.

In terms of energy savings, EEI in wood and chemical led to the largest energy savings in absolute terms in the short and long run, respectively. In the short run, stone and mineral, pulp and paper, mining, and chemical also had substantial energy savings from EEI. In the long run, pulp and paper, basic iron and steel, mining, and wood had the largest energy savings due to EEI. This ranking is based on the energy demand in absolute terms as well as sector averages of energy efficiency and the rebound effect.

EEI reduces the real unit cost of energy service for producers and gives incentives to re-optimize such that the energy input is substituted for other inputs to the extent that it is physically possible (and economically feasible/beneficial). This reduction in the cost of energy and subsequent re-optimization could result in production being scaled up, which in turn would potentially increase emissions, and the end results would be harm to the environment. A sustainable solution suggests that EEI should be promoted in sectors where economic growth can come with the lowest environmental impact, hereafter referred to as “sustainable” output growth. Such sectors should be characterized by these conditions: (i) energy efficiency is low and hence there is enough room for EEI to have an effect; (ii) the rebound effect is high, implying that producers will have large cost savings due to re-optimization of inputs; (iii) output per unit of CO2 emission is relatively high, implying that environmental effects of scaling up production are not substantial in relative terms. In Table 6, we report an index constructed on these three conditions that ranks the manufacturing sectors in terms of their potential for “sustainable” output growth (see rows “Sustainable growth in the short run” and “Sustainable growth in the long run”). The top contender for achieving “sustainable” output growth, both in the short and long run, is electro, while the next two sectors are motor vehicles and machinery. EEI in these sectors have the largest potential for scaling up production with minimal harm to the environment. This information is highly relevant for policy makers when they allocate resources for promoting EEI. Table 7 in the Appendix presents the formulas used to calculate our indicators in Table 6.

Conclusions

In this study, we estimated the short- and long-term energy rebound effects for all 14 sectors in the Swedish manufacturing industry over the period 1997–2008. We applied a two-stage approach, first using data envelopment analysis to calculate an energy efficiency score for each firm for each year, and then using a dynamic panel data regression model to estimate both the short- and long-term rebound effects. We also explored the effects that firm characteristics and policy-related variables had on the size of rebound effects.

We found that the energy rebound effect was best described as partial, where statistically significant, within majority of manufacturing sectors, meaning that the rebound effect mitigated, but did not totally offset, the expected energy and emission savings from energy efficiency improvement, but the offset is substantial. Hence, promoting energy efficiency improvement is beneficial from both environmental and energy saving perspectives, but to a varying and modest degree. Complete realization of emission and energy savings from energy efficiency improvement may require complementary policy actions, such as energy taxes, to correct upwards the price of energy, which would mitigate the rebound effect.

Our post-estimation analysis provides a guide to policy makers by identifying sectors where promoting energy efficiency improvement is more likely to have a desirable impact on the environment, energy savings, and/or “sustainable” output growth. Our results suggested that different desirable outcomes can potentially be achieved by EEI in different sectors, mainly due to sector-specific characteristics such as CO2 emissions, energy consumption, and output per unit of emission. We found that energy efficiency improvement had the largest positive impact on the environment, energy saving, and “sustainable” output growth in stone and mineral, wood, and electro, in that order.

Because energy demanded by Swedish manufacturing is about 45% of Sweden’s total energy use in 2008 (Statistics Sweden (SCB); cited in Pardo Martínez & Silveira, 2013), the energy rebound effects have important implications for design and implementation of energy and climate-related policies. For example, in sectors with significant rebound effects, policy aimed at energy efficiency improvement should be accompanied by complementary measures (such as energy taxes) to help mitigate the effects of energy becoming effectively less costly, and thus neutralize some of the unintended consequences that come with energy efficiency improvement.

Future research should include more recent data, and the methodology presented here also can be extended to other contexts where the rebound effect is of interest to study empirically, for example eco-efficiency (see theoretical discussion in Chenavaz et al., 2021).

Change history

16 January 2023

Missing Open Access funding information has been added in the Funding Note.

Notes

For instance, there is a target to reduce global energy intensity, i.e., the ratio of energy use per unit of output, by 40% by 2030 (United Nation Secretary General`s Advisory Group on Energy and Climate Change, 2010). A lower energy intensity implies that less energy is used to produce one unit of output, and is therefore desirable in this context.

Economists generally define energy services as useful work (Ayres & Ayres, 2010). Alternatively, energy services can be defined as the effect or outcome of using an energy flow, for example, the heating of a room to a particular temperature or the transportation of something over a certain distance within a certain time (Baumgartner & Midttun, 1987).

A constant return to scale technology also leads to an upper bound for inefficiency scores and rebound effect.

Indeed, our energy demand is derived based on using the cost frontier model outlined in Schmidt and Lovell (1979) and Kumbhakar and Lovell (2000). The cost-minimizing framework has been a natural choice when the focus is on input choice (e.g., energy in this paper) with the objective to minimize costs for given level of output (Kumbhakar et al., 2015). Hence, it measures input-oriented (in)efficiency energy. The derivation of a cost frontier efficiency model is discussed in details in, e.g., Kumbhakar and Lovell (2000). In contrast, when the objective is to maximize profits or output, the revenue or profit frontier model would be more appropriate to use.

This price also serves as a policy variable, because policy aimed at reducing energy use or mitigating emissions is likely to affect the price of energy, e.g., an energy tax.

Statistics Sweden computes CO2 emission by multiplying fuel consumption by an emission factor associated with fuel. The DEA framework in this paper allows for maximum feasible reduction of energy input while keeping other inputs and desirable and undesirable outputs constant. Hence, inclusion of CO2 as bad output is inappropriate because reduction of energy input implies reduction of CO2 and makes us deviate from the DEA framework by not holding the undesirables constant.

Note that firms in different sectors do not have exactly the same technology. Thus, ranking sectors based on their average efficiency scores is not adequate because it may be easier in some sectors to perform closer to the firms defining the frontier compared to other sectors.

In our empirical estimation, the number of lags as instruments is not the same in all sectors.

High P values remain still high even after estimating the model with fewer moment conditions.

The Delta method is used to construct the confidence intervals. See for instance Weisberg (2014) for a reference to the Delta method.

Note that we have used the point estimates of the average rebound effect in our calculations even for the sectors where the rebound effect was statistically not significant based on 95% confidence intervals presented in Table 5. So, the results should be considered indicative for those sectors.

Sector names are shortened in Table 6 as follows: basic iron and steel (BIS), chemical (CHE), electro (ELC), fabricated metal products (FAB), food (FOO), machinery (MCH), mining (MIN), motor vehicles (MVH), printing (PRT), pulp and paper (PAP), rubber and plastic (RPL), stone and mineral (STM), textiles (TEX), wood (WOO).

References

Adetutu, M. O., Glass, A. J., & Weyman-Jones, T. G. (2016). Economy-wide estimates of rebound effects: Evidence from panel data. Energy Journal, 37(3), 251–269.

Allan, G., Hanley, N., McGregor, P., Swales, K., & Turner, K. (2007). The impact of increased efficiency in the industrial use of energy: A computable general equilibrium analysis for the United Kingdom. Energy Economics, 29, 779–798.

Amjadi, G., Lundgren, T., & Persson, L. (2018). The rebound effect in Swedish heavy industry. Energy Economics, 71, 140–148.

Andrews, D. W. K., & Lu, B. (2001). Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. Journal of Econometrics, 101, 123–164.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68, 29–51.

Ayres, R. U., & Ayres, E. H. (2010). Crossing the energy divide: Moving from fossil fuel dependence to a clean-energy future. Wharton School Publishing.

Baumgartner, T., & Midttun, A. (Eds.). (1987). The politics of energy forecasting: A comparative study of energy forecasting in Western Europe and North America. Oxford University Press.

Bentzen, J. (2004). Estimating the rebound effect in US manufacturing energy consumption. Energy Economics, 26, 123–134.

Bergman, M. (1996). Estimating Investment Adjustment Costs and Capital Rates from the Production Function, Umeå Economic Studies 406. Umeå University.

Borenstein, S. (2015). A microeconomic framework for evaluating energy efficiency rebound and some implications. Energy Journal, 36(1), 1–21.

Brännlund, R., & Lundgren, T. (2004). A dynamic analysis of interfuel substitution for Swedish heating plants. Energy Economics, 26(6), 961–976.

Brännlund, R., & Lundgren, T. (2010). Environmental policy and profitability – Evidence from Swedish industry. Environmental Economics and Policy Studies, 12(1–2), 59–78.

Broberg, T., Berg, C., & Samakovlis, E. (2015). The economy wide rebound effect from improved energy efficiency in Swedish industries – A general equilibrium analysis. Energy Policy, 83, 26–37.

Chenavaz, R. Y., Dimitrov, S., & Figge, F. (2021). When does eco-efficiency rebound or backfire? An analytical model. European Journal of Operational Research, 290, 687–700.

Considine, T. J., & Mount, T. D. (1984). The use of linear logit models for dynamic input demand systems. Review of Economics and Statistics, 66, 434–443.

Dahlqvist, A., Lundgren, T. & Marklund, P. (2020). The rebound effect in energy-intensive industries: A factor demand model with asymmetric price response, The Energy Journal, vol.42(3).

Debreu, G. (1951). The coefficient of resource utilization. Econometrica, 19(3), 273–292.

Färe, R., & Grosskopf, S. (2004). New directions: Efficiency and productivity, New York: NY: Springer Science & Business Media, Inc.

Färe, R., & Grosskopf, S. (1985). A nonparametric cost approach to scale efficiency. Scandinavian Journal of Economics, 87, 594–604.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society, 120, 253–281.

Gillingham, K., Rapson, D., & Wagner, G. (2014). The rebound effect and energy efficiency policy. Review of Environmental Economics and Policy, 10(1), 68–88.

Greening, L. A., Greene, D. L., & Difiglio, C. (2000). Energy efficiency and consumption – The rebound effect – A survey. Energy Policy, 28(6–7), 389–401.

Grepperud, S., & Rasmussen, I. (2004). A general equilibrium assessment of rebound effects. Energy Economics, 26, 261–282.

Hanley, N. D., McGregor, P., Swales, J., & Turner, K. (2009). Do increases in energy efficiency improve environmental quality and sustainability? Ecological Economics, 68, 692–709.

Jones, C. T. (1995). A dynamic analysis of interfuel substitution in U.S. industrial energy demand. Journal of Business and Economic Statistics, 13, 459–465.

Jones, C. T. (1996). A pooled analysis of interfuel substitution in industrial energy demand by the G-7 countries. Applied Economics, 28, 815–821.

Khazzoom, J. D. (1980). Economic implications of mandated efficiency in standards for household appliances. Energy Journal, 1(4), 21–40.

King, M. A., & Fullerton, D. (1984). The taxation of income from capital. The University of Chicago Press.

Lin, B., & Du, K. (2013). Technology gap and China’s regional energy efficiency: A parametric metafrontier approach. Energy Economics, 40, 529–536.

Lin, B., & Li, J. (2014). The rebound effect for heavy industry: Empirical evidence from China. Energy Policy, 74, 589–599.

Lin, B., & Tan, R. (2017). Estimating energy conservation potential in China’s energy intensive industries with rebound effect. Journal of Cleaner Production, 156, 899–910.

Lin, B., & Xie, X. (2015). Factor substitution and rebound effect in China’s food industry. Energy Conversion and Management, 105, 20–29.

Lundgren, T. (1998). Capital spending in the Swedish Forest Industry Sector - Four classical investment models. Journal of Forest Economics, 4(1), 61–83.

Nadel, S. (1993). The take-back effect – Fact or fiction? [Online], Available from: https://www.aceee.org/research-report/u933 [Accessed 2 January 2018].

Orea, L., Llorca, M., & Filippini, M. (2015). A new approach to measuring the rebound effect associated to energy efficiency improvements: An application to the US residential energy demand. Energy Economics, 49, 599–609.

Pardo Martínez, C. I., & Silveira, S. (2013). Energy efficiency and CO2 emissions in Swedish manufacturing industries. Energy Efficiency, 6, 117–133.

Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal, 9(1), 86–136.

Safarzadeh, S., Rasti-Barzoki, M., & Hejazi, S. R. (2020). A review of optimal energy policy instruments on industrial energy efficiency programs, rebound effects, and government policies. Energy Policy, 139, 111342.

Saunders, H. D. (1992). The Khazzoom-Brookes postulate and neoclassical growth. Energy Journal, 13(4), 130–148.

Saunders, H. D. (2000). A view from the macro side: Rebound, backfire, and Khazzoom-Brookes. Energy Policy, 28, 439–449.

Saunders, H. D. (2008). Fuel conserving (and using) production functions. Energy Economics, 30, 2184–2235.

Saunders, H. D. (2013). Historical evidence for energy consumption rebound in 30 US sectors and a toolkit for rebound analysts. Technological Forecasting and Social Change, 80(7), 1317–1330.

Simar, L., & Wilson, P. W. (1998). Sensitivity analysis of efficiency scores: How to bootstrap in nonparametric frontier models. Management Science, 44(1), 49–61.

Sorrell, S., & Dimitropoulos, J. (2008). The rebound effect: Microeconomic definitions, limitations and extensions. Ecological Economics, 65, 636–649.

Sorrell, S., Dimitropoulos, J., & Sommerville, M. (2009). Empirical estimates of direct rebound effects: A review. Energy Policy, 37, 1356–1371.

Stocker, T. F., Qin, D., Plattner, G., Tignor, M. M. B., Allen, S. K., Boschung, J., Nauels, A., Xia, Y., Bex, V., & Midgley, P. M. (eds.) (2013). Climate Change 2013: The Physical Science Basis [Online], Available from: https://www.ipcc.ch/site/assets/uploads/2018/03/WG1AR5_SummaryVolume_FINAL.pdf[Accessed8January2020].

Swedish Energy Agency (2015) Energy in Sweden 2015 [Online], Available from: https://www.energimyndigheten.se[Accessed15January2018].

The Secretary - General’s Advisory Group on Energy and Climate Change (AGECC) (2010) Energy for a Sustainable Future [Online], Available from: https://www.unido.org/sites/default/files/2010-05/AGECCsummaryreport_0.pdf [Accessed 15 September 2020].

Treadway, A. B. (1970). Adjustment costs and variable inputs in the theory of the firm. Journal of Economic Theory, 2, 329–347.

Treadway, A. B. (1974). The globally optimal flexible accelerator. Journal of Economic Theory, 7, 17–39.

Vikström, P. (2008) Energy efficiency and energy demand: A historical CGE investigation on the rebound effect in the Swedish economy 1957, Umeå Papers in Economic History, number 35.

Washida, T. (2004) Economy-wide model of rebound effect for environmental efficiency, International Workshop on Sustainable Consumption, Leeds: University of Leeds. Also 3rd World Congress of Environmental and Resource Economists, Kyoto.

Weisberg, S. (2014) Applied Linear Regression, John Wiley & Sons, Incorporated, 2013. ProQuest Ebook Central, https://ebookcentral.proquest.com/lib/umeaub-ebooks/detail.action?docID=1574352

Wooldridge, J. M. (2010) Econometric analysis of cross section and panel data. MIT Press, 2010.

Wu, L., Chen, Y., Feylizadeh, M. R., & Liu, W. (2018). Estimation of China’s macro-carbon rebound effect: Method of integrating Data Envelopment Analysis production model and sequential Malmquist-Luenberger index. Journal of Cleaner Production, 198, 1431–1442.

Yi, F. (2000). Dynamic energy-demand models: A comparison. Energy Economics, 22(2), 285–297.

Zhang, S., Lundgren, T., & Zhou, W. (2016). Energy efficiency in Swedish industry – A firm-level data envelopment analysis. Energy Economics, 55, 42–51.

Zhou, P., & Ang, B. W. (2008). Linear programming models for measuring economy-wide energy efficiency performance. Energy Policy, 36(8), 2911–2916.

Acknowledgements

I would like to thank seminar and conference participants (including the EWEPA, 2020 conference) for helpful comments. Special thanks to our anonymous reviewers for their feedback. We also gratefully acknowledge the financial support of the Swedish Energy Agency. Last but not the least, a special thanks to Mrs. Christine Lamé for her generous support during the revision of this paper.

Funding

Open access funding provided by Umea University. This study was funded by the Swedish Energy Agency.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Amjadi, G., Lundgren, T. & Zhou, W. A dynamic analysis of industrial energy efficiency and the rebound effect: implications for carbon emissions and sustainability. Energy Efficiency 15, 54 (2022). https://doi.org/10.1007/s12053-022-10059-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12053-022-10059-4