Abstract

This paper examines the ‘additionality’ of energy savings in energy efficiency subsidy programs. ‘Additionality’ refers to the energy savings caused by actions beyond what would have occurred in the absence of the policy program. We characterise energy consumers’ strategic response to the subsidies in a formal adverse selection model and show how the subsidy program may fail to satisfy the additionality criterion. This occurs when energy consumers, who partake in the program, have different preferences for energy efficiency technologies that are unobservable. To resolve this, we propose an incentive compatible solution within the subsidy program that can mitigate the non-additionality problem and improve the effectiveness of the scheme.

Similar content being viewed by others

Notes

The International Energy Agency (IEA) 2017 report which focuses on market-based instruments shows that 52 jurisdictions until 2016 have implemented such instruments, which include 24 US states, 12 European countries, 4 Australian states and Territories, Brazil, Canada, China, Korea, South Africa and Uruguay.

In order to illustrate the idea, consider the following example from the NSW GGAS scheme (The New South Wales Greenhouse Gas Abatement Scheme). There are two kinds of subsidised efficient light bulbs: compact fluorescent lamp (CFL) and light emitting diode (LED). The LED technology is more efficient but more expensive than the CFL technology. For a consumer who uses and plans to keep using an incandescent lamp, choosing to adopt either LED or CFL would be regarded as additional energy efficiency improvement and would thus generate additional energy savings (additionality). However, in contrast, if the consumer has already installed or planned to install a CFL lamp, only the LED lamp would be considered as additional where the energy efficiency is enhanced compared to the baseline.

Energy consumers are heterogeneous because they tend to differ in investment capacities, discount rates of investment cost, knowledge of energy efficiency technologies, environmental concerns, the ownership of a property, energy demand and behavioural biases such as the attention and inattention to energy consumption costs etc., which we do not consider explicitly in this paper (Young et al. 2010; Allcott and Greenstone 2012; Frederiks et al. 2015; Joshi and Rahman 2015).

See the discussion of the free-riding problem in Linares and Labandeira (2010) and the relevant references.

It is generally not straightforward to see why utility companies can solve the information problems associated with energy conservation programs compared to a government that possesses the legitimacy and information advantage. Hirst (1992) provides the justifications, and Tietenberg (2009) and Wirl (2015) provide some discussions on this issue as well.

We recognise the importance of separating the deemed savings and the eligibility of the energy efficiency measures. In the theoretical analysis, we consider all the measures as eligible. The problem we wish to highlight is that although they are eligible measures, not all the eligible measures shall be counted as additional to each individual consumer.

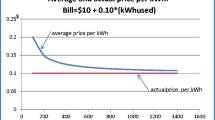

In our analysis, the current subsidy strategy is modelled as a linear function of the energy savings, not a function of their income. If a low-income consumer has a lower efficiency baseline, she/he would receive a higher subsidy by implementing a very efficient technology. The problem with this type of subsidy strategy is not being able to differentiate the eligibility of measures to each individual consumer.

Because some market-based energy efficiency policies allow utilities to trade the induced energy savings, the marginal benefit of energy savings should also be equal to the market price. If the level of subsidy for each unit of energy saving is larger than the market price of energy savings, the utility will stop subsidising and purchase energy savings at the market price. Consequently, there could be an upper bound for the marginal subsidise, which corresponds to the market price of the energy savings. We shall treat the tradable energy saving market as a perfect competitive market. The limitation of this assumption is in practice some utility firms might have substantial market power, so they may influence the market price of energy savings (Mundaca 2008).

In the beginning of the analysis, we assume each consumer’s original plan is to implement at least one energy-efficient measure without financial incentives, i.e. E ≥ 0. Here the theory shows that any consumer whose type is higher than the lowest one will have an incentive to install the energy efficiency measure that is only additional for the lowest type. In other words, these consumers tend to deviate from their original plan and implement a technology that is only additional for the lowest type, and thus might cause more energy consumption relative to their original plan.

We thank an anonymous reviewer for pointing this out.

See Appendix for derivation

References

Allcott, H., & Greenstone, M. (2012). Is there an energy efficiency gap ? Journal of Economic Perspectives, 26(1), 3–28.

Azariadis, C. (1983). Employment with asymmetric information. Quarterly Journal of Economics, Supplement, 98, 157–172.

Banfi, S., Farsi, M., Filippini, M., & Jakob, M. (2008). Willingness to pay for energy-saving measures in residential buildings. Energy Economics, 30, 503–516.

Baron, D. P., & Myerson, R. B. (1982). Regulating a monopolist with unknown costs. Econometrica: Journal of the Econometric Society, 55(4), 911–930.

Bertoldi, P., & Rezessy, S. (2008). Tradable white certificate schemes: fundamental concepts. Energy Efficiency, 1, 237–255.

Bertoldi, P., Rezessy, S., Lees, E., Baudry, P., Jeandel, A., & Labanca, N. (2010). Energy supplier obligations and white certificate schemes: comparative analysis of experiences in the European Union. Energy Policy, 38, 1455–1469.

Bertoldi, P., Castellazzi, L., Spyridaki, N.A., Fawcett, T. (2015). How is article 7 of the energy efficiency directive being implemented ? An analysis of national energy efficiency obligation schemes. ECEEE 2015 Summer Study Proc., pp. 455–465.

Bester, H. (1985). Screening versus rationing in credit market with imperfect information. American Economic Review, 75, 850–855.

Bolton, P., Dewatripont, M. (2005). Contract theory. MIT press.

Bundgaard, S. S., Dyhr-Mikkelsen, K., Hansen Kjaerbye, V., Togeby, M., Sommer, T., Larsen, A. E. (2013). Spending to save: evaluation of the energy efficiency obligation of Denmark. ECEEE Summer Study, Presque Ile de Giens, France.

Bushnell, J. B. (2011). Adverse selection and emissions offsets. Economics Working Papers (2002–2016), p. 95. http://lib.dr.iastate.edu/econ_las_workingpapers/95

Cayla, J.-M., Maizi, N., & Marchand, C. (2011). The role of income in energy consumption behaviour: evidence from French households data. Energy Policy, 39, 7874–7883.

Di Santo, D., Forni, D., Venturini, V., Biele, E. (2011). The white certificate scheme: the Italian experience and proposals for improvement. In European Council for an Energy Efficient Economy (ECEEE) Summer Study.

ENSPOL. 2015. Energy saving policies and energy efficiency obligation scheme: D2.1.1 Report on existing and planned EEOs in the EU, Part 1: Evaluation of existing schemes., Published at: http://enspol.eu/results

EU. (2012) Directive 2012/27/EU on energy efficiency, amending Directives 2009/125/EC and 2010/30/EC, and repealing Directives 2004/8/EC and 2006/32/EC (Article 7: Energy efficiency obligation schemes).

Fawcett, T., Rosenow, J., & Bertoldi, P. (2018). Energy efficiency obligation schemes: their future in the EU. Energy Efficiency. https://doi.org/10.1007/s12053-018-9657-1.

Feng, H. (2007). Green payments and dual policy goals. Journal of Environmental Economics and Management, 54(3), 323–335.

Frederiks, E. R., Stenner, K., & Hobman, E. V. (2015). Household energy use: applying behavioural economics to understand consumer decision-making and behaviour. Renewable and Sustainable Energy Reviews, 41, 1385–1394.

Gillingham, K., & Palmer, K. (2014). Bridging the energy efficiency gap: policy insights from economic theory and empirical evidence. Review of Environmental Economics and Policy, 8, 18–38.

Green, J. R., & Kahn, C. (1983). Wage employment contracts. Quarterly Journal of Economics, 98(Supplement), 173–189.

Greening, L. A., Greene, D. L., & Difiglio, C. (2000). Energy efficiency and consumption: the rebound effect: a survey. Energy Policy, 28, 389–401.

Grosche, P., & Vance, C. (2009). Willingness-to-pay for energy conservation and freeridership on subsidization: evidence from Germany. Energy Journal, 30, 135–154.

Harrison, G. W., Lau, M. I., & Williams, M. B. (2002). Estimating individual discount rates in Denmark: a field experiment. American Economic Review, 92, 1606–1617.

Hassett, K. A., & Metcalf, G. E. (1993). Energy conservation investment: do consumers discount the future correctly? Energy Policy, 21, 710–716.

Hirst, E. (1992). Price and cost impacts of utility Dsm programs. The Energy Journal, 13, 75–90.

IEA. (2017). Market-based instruments for energy efficiency, policy choice and design. Paris: International Energy Agency.

Jimenez Morei, R. A., Yépez-García, A. (2017): Understanding the drivers of household energy spending: micro evidence for Latin America, Working paper.

Joshi, B. (2012). Best practices in designing and implementing energy efficiency obligation schemes. Research report task XXII of the international energy agency demand side management Programme. Stockholm: IEA DSMRAP (Regulatory Assistance Project).

Joshi, Y., & Rahman, Z. (2015). Factors affecting green purchase behaviour and future research directions. International Strategic Management Review, 3, 128–143.

Larsen, A. (2013). Spending to save: evaluation of the energy efficiency obligation in Denmark. In eceee 2013 Summer Study proceedings : Rethink, renew, restart ECEEE.

Legendre, B., & Ricci, O. (2015). Measuring fuel poverty in France: which households are the most fuel vulnerable? Energy Economics, 49, 620–628.

Lewis, T. R. (1996). Protecting the environment when costs and benefits are privately known. RAND Journal of Economics, 27, 819–847.

Lewis, T. R., & Sappington, D. E. M. (1989). Inflexible rules in incentive problems. The American Economic Review, 79(1), 69–84.

Linares, P., & Labandeira, X. (2010). Energy efficiency: economics and policy. Journal of Economic Surveys, 24, 573–592.

Millard-Ball, A. (2013). The trouble with voluntary emissions trading: uncertainty and adverse selection in sectoral crediting programs. Journal of Environmental Economics and Management, 65, 40–55.

Millock, K. (2002). Technology transfers in the clean development mechanism: an incentives issue. Environment and Development Economics, 7, 449–466.

Mirrlees, J. A. (1971). An exploration in the theory of optimum income taxation. Review of Economic Studies, 38, 175–208.

Montero, J.-P. (2005). Pollution markets with imperfectly observed emissions. RAND Journal of Economics, 36, 645–660.

Moore, R. (2012). Definitions of fuel poverty: implications for policy. Energy Policy, 49, 19–26.

Mundaca, L. (2007). Transaction costs of tradable white certificate schemes: the energy efficiency commitment as case study. Energy Policy, 35, 4340–4354.

Mundaca, L. (2008). Markets for energy efficiency: exploring the implications of an EU-wide ‘tradable white Certificate’scheme. Energy Economics, 30, 3016–3043.

Nadel, S., Cowart, R., Crossley, D., Rosenow, J. (2017). Energy saving obligations across three continents: contrasting approaches and results. European Council for an Energy Efficient Economy (ECEEE) summer study.

Raynaud, M., Osso, D., Bourges, B., Duplessis, B., & Adnot, J. (2016). Evidence of an indirect rebound effect with reversible heat pumps: having air conditioning but not using it? Energy Efficiency, 9, 847–860.

Rosenow, J. (2012). Energy savings obligations in the Uk—a history of change. Energy Policy, 49, 373–382.

Rosenow, J., Bayer, E. (2016). Costs and Benefits of Energy Efficiency Obligation Schemes. Retrieved from: https://ec.europa.eu/energy/sites/ener/files/documents/final report on study on costs and benefits of eeos 0.pdf.

Sheriff, G. (2008). Optimal environmental regulation of politically influential sectors with asymmetric information. Journal of Environmental Economics and Management, 55, 72–89.

Stede, J. (2017). Bridging the industrial energy efficiency gap – assessing the evidence from the Italian white certificate scheme. Energy Policy, 104, 112–123.

Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review, 71, 393–410.

Suerkemper, F., Thomas, S., Osso, D., & Baudry, P. (2012). Cost-effectiveness of energy efficiency programmes—evaluating the impacts of a regional programme in France. Energy Efficiency, 5, 121–135.

Thomson, H., & Snell, C. (2013). Quantifying the prevalence of fuel poverty across the European Union. Energy Policy, 52, 563–572.

Tietenberg, T. (2009). Reflections—energy efficiency policy: pipe dream or pipeline to the future? Review of Environmental Economics and Policy, 3, 304–320.

Train, K. (1985). Discount rates in consumers’ energy-related decisions: a review of the literature. Energy, 10, 1243–1253.

Wirl, F. (2015). White certificates — energy efficiency programs under private information of consumers. Energy Economics, 49, 507–515.

Wirl, F., Huber, C., & Walker, I. O. (1998). Joint implementation: Strategic reactions and possible remedies. Environmental and Resource Economics, 12, 203–224.

Young, W., Hwang, K., McDonald, S., & Oates, C. J. (2010). Sustainable consumption: green consumer behaviour when purchasing products. Sustainable Development, 18, 20–31.

Acknowledgements

We thank the audience at presentations at the 2017 International Conference on Energy Finance for the helpful comments. We also thank Lana Friesen and Kjetil Telle for their constructive comments on the previous versions. Shen Peiyao gratefully acknowledges the financial support from the Natural Science Foundation of China (No.71873028). The invaluable and insightful comments by four anonymous referees and by Paolo Bertoldi have led to a much improved paper. All errors are ours.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Appendices

Appendix 1. Proof of Proposition 2

The incentive compatible constraint (IC) would induce the consumer or project recipient to choose to implement energy efficiency projects according to his true type θ, which means that the first- and second-order condition for the consumer’s optimisation problem must be satisfied at \( \widehat{\theta}=\theta \):

If we further differentiate (A1) with respect to θ, we obtain:

Taking the result from (A2), the equation of (A3) implies E′(θ) > 0. To derive the function of the optimal subsidised project, we follow the standard procedure introduced by Mirrlees (1971).

Appling the envelop theorem on the consumer’s objective function (12), we obtain

Therefore, by integrating,

At the optimum, the individual rationality constraint (IR) at the lowest type is binding; therefore,

From the consumer’s objective function (12), the above equation implies that:

\( T\left(\theta \right)=I\left(E\left(\theta \right)\right)-\theta E\left(\theta \right)+{\int}_{\theta_{\_}}^{\overline{\theta}}E(z) dz \). Substituting for T(θ) in the project developer’s objective function, the project developer’s problem becomes:

After integration by parts, we obtain a modified problem

The solution to the maximisation problem is given by the first-order condition with respect to E(θ) under the integral. Thus, we have:

Thus, the project developer offers subsidised projects to the consumers such that the marginal benefit from the energy efficiency project equals the marginal net cost while including an informational rent. Because the project developer’s benefit function V is assumed concave in E, the second-order condition for the project developer’s maximisation problem is satisfied.

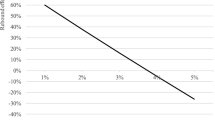

From Eq. (A6), we can immediately infer that the level of efficiency for the highest top consumer \( \overline{\theta} \) is not distorted. However, for consumers whose type is below \( \overline{\theta} \), \( \frac{1-F\left(\theta \right)}{f\left(\theta \right)} \), it is positive. Since V is concave in E, their subsidised project will be distorted downwards.

Finally, we need to check that the optimal solution in (A6) satisfies the monotonicity constraint for E(θ) in (3). Differentiate (A6) with respect to θ, we get

Since I is the assumed convex and V is the assumed concave in E, the monotonicity constraint E′(θ) > 0 is satisfied as long as the \( \frac{1-F\left(\theta \right)}{f\left(\theta \right)} \) is decreasing in θ.

Appendix 2

Rights and permissions

About this article

Cite this article

Shen, P., Betz, R. & Yong, S.K. Energy efficiency subsidies, additionality and incentive compatibility under hidden information. Energy Efficiency 12, 1429–1442 (2019). https://doi.org/10.1007/s12053-018-9745-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-018-9745-2