Abstract

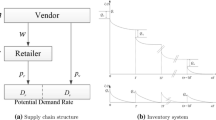

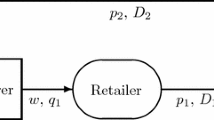

Dynamic pricing is a crucial revenue management technique when product status changes over time. It can become more prominent if applied in conjunction with an inventory management strategy for deteriorating items. This paper presents a framework for dynamic pricing in a continuous time horizon for a dual-channel supply chain consisting of a manufacturer and a retailer. The manufacturer produces a deteriorating product and sells through direct and indirect retail channels, and both channels compete with each other over retail prices. The freshness of the product varies with time, and thus both channels invest in preservation technology, which further leads to carbon emissions. We derive an analytical solution to the dual-channel pricing model. Furthermore, the case of single-channel pricing has been investigated to study and compare its pricing strategy with the dual-channel pricing strategy. Lastly, a numerical illustration is presented to study the impact of key parameters on optimal decisions through sensitivity analysis. We provide managerial recommendations in various scenarios like an increase in competition, the shift of consumer preference between channels and fluctuation in demand.

Similar content being viewed by others

References

Xu W, Zhou S, Zhao K, Shi Y and Bingzhen S 2021 Optimal pricing model for non-instantaneous deterioration items with price and freshness sensitive demand under the e-commerce environment in China. Kybernetes 51(2): 623–640

Pearson B 2019 Research: Half of Shoppers Buy Perishables Online, And It's Changing Customer Service. https://www.forbes.com/sites/bryanpearson/2019/06/14/research-half-of-shoppers-buy-perishables-online-and-its-changing-customer-service/?sh=5d0075a2548f. (Accessed on 06th December, 2022)

Kohli S, Timelin B, Fabius V and Veranen S M 2020 How COVID-19 is changing consumer behavior–now and forever. McKinsey & Company, 1–2

India Online Grocery Market 2022 By Product Category (Packaged Food & Beverages, Personal Care, Household Products, Fruits & Vegetables, & Others (Pet Care, Baby Care, etc.)), By Platform, By Region, Competition, Forecast & Opportunities, FY2017-FY2027

Ranjan A and Jha J K 2019 Pricing and coordination strategies of a dual-channel supply chain considering green quality and sales effort. J. Clean. Prod. 218: 409–424

Wee H M 1997 A replenishment policy for items with a price-dependent demand and a varying rate of deterioration. Prod. Plan. Control 8(5): 494–499

Page V 2022 How Amazon Fresh Works. https://www.investopedia.com/articles/personal-finance/052015/how-amazon-fresh-works.asp (Accessed on 05th December, 2022)

Seifert R W and Markoff R 2017 Amazon fresh and the disruption of the supply chain, International Institute for Management Development. https://www.imd.org/research-knowledge/articles/amazon-fresh-and-the-disruption-of-the-supply-chain. (Accessed on 12th December, 2023)

Hsu P H, Wee H M and Teng H M 2010 Preservation technology investment for deteriorating inventory. Int. J. Prod. Econ. 124(2): 388–394

Dye C Y and Hsieh T P 2012 An optimal replenishment policy for deteriorating items with effective investment in preservation technology. Eur. J. Oper. Res. 218(1): 106–112

Dye C Y 2013 The effect of preservation technology investment on a non-instantaneous deteriorating inventory model. Omega 41(5): 872–880

Zhang J, Chiang W Y K and Liang L 2014 Strategic pricing with reference effects in a competitive supply chain. Omega 44: 126–135

Mohanty D J, Kumar R S and Goswami A 2018 Trade-credit modeling for deteriorating item inventory system with preservation technology under random planning horizon. Sādhanā 43(3): 45

Tiwari R K, Khedlekar N K and Khedlekar U K 2021 Optimal pricing policy for stock dependent demand with effective investment in preservation technology. Int. J. Nonlinear Anal. Appl. 12(2): 249–264

Global Responsibility Report. 2018. Reducing greenhouse gas emissions. https://corporate.walmart.com/media-library/document/2018-global-responsibility-report/_proxyDocument?id=00000170-ac54-d808-a9f1-ac7e9d160000 (Accessed 08 December, 2022)

Greenhouse Gas Emissions from the Dairy Sector: A Life Cycle Assessment. Food and agriculture organisation of the United Nations 2010. https://www.fao.org/3/k7930e/k7930e00.pdf. (Accessed 08 December, 2022)

REFRIGERATION (COOLED STORAGE). https://brc.org.uk/climate-roadmap/section-5-pathway-2-operating-efficient-sites-powered-by-renewables/513-refrigeration-cooled-storage. (Accessed on 08 December, 2022)

Liu X, Tang O and Huang P 2008 Dynamic pricing and ordering decision for the perishable food of the supermarket using RFID technology. Asia Pacific J. Mark. Logist. 20(1): 7–22

Mandel P 2021 Can grocery stores afford dynamic pricing https://www.quicklizard.com/blog/can-grocery-stores-afford-dynamic-pricing/ (Accessed on 07th December, 2022)

Chande A, Dhekane S, Hemachandra N and Rangaraj N 2005 Perishable inventory management and dynamic pricing using RFID technology. Sadhana 30: 445–462

Patidar R, Agrawal S and Pratap S 2018 Development of novel strategies for designing sustainable Indian agri-fresh food supply chain. Sādhanā 43: 1–16

Helmer J 2022 Can Dynamic Pricing Reduce Food Waste in Supermarkets? https://foodprint.org/blog/food-waste-management (Accessed on 08 December, 2022)

Zhang F and Wang C 2018 Dynamic pricing strategy and coordination in a dual-channel supply chain considering service value. Appl. Math. Model. 54: 722–742

Fang F, Nguyen T D and Currie C S 2021 Joint pricing and inventory decisions for substitutable and perishable products under demand uncertainty. Eur. J. Oper. Res. 293(2): 594–602

Zhang C, Liu Y and Han G 2021 Two-stage pricing strategies of a dual-channel supply chain considering public green preference. Comput Ind Eng 151: 106988

Chenavaz R, Klibi W and Schlosser R 2022 Dynamic pricing with reference price effects in integrated online and offline retailing. Int. J. Prod. Res. 60(19): 5854–5875

Li Z, Yang W and Si Y 2022 Dynamic pricing and coupon promotion strategies in a dual-channel supply chain based on differential game. Kybernetes 51(11): 3201–3235

Li M and Mizuno S 2022 Dynamic pricing and inventory management of a dual-channel supply chain under different power structures. Eur. J. Oper. Res. 303(1): 273–285

He Y, Huang H and Li D 2020 Inventory and pricing decisions for a dual-channel supply chain with deteriorating products. Oper. Res. 20(3): 1461–1503

Yang L and Tang R 2019 Comparisons of sales modes for a fresh product supply chain with freshness-keeping effort. Transp. Res. E: Logist. Transp. Rev. 125: 425–448

Yang L, Ji J, Wang M and Wang Z 2018 The manufacturer’s joint decisions of channel selections and carbon emission reductions under the cap-and-trade regulation. J. Clean. Prod. 193: 506–523

Xie J, Liu J, Huo X, Meng Q and Chu M 2021 Fresh Food Dual-Channel Supply Chain Considering Consumers’ Low-Carbon and Freshness Preferences. Sustainability 13(11): 6445

Zheng Q, Wang M and Yang F 2021 Optimal channel strategy for a fresh produce E-commerce supply chain. Sustainability 13(11): 6057

Toptal A, Özlü H and Konur D 2014 Joint decisions on inventory replenishment and emission reduction investment under different emission regulations. Int. J. Prod. Res. 52(1): 243–269

Tiwari S, Cárdenas-Barrón L E, Goh M and Shaikh A A 2018 Joint pricing and inventory model for deteriorating items with expiration dates and partial backlogging under two-level partial trade credits in supply chain. Int. J. Prod. Econ. 200: 16–36

Daryanto Y, Wee H M and Astanti R D 2019 Three-echelon supply chain model considering carbon emission and item deterioration. Transp. Res. E: Logist. Transp. Rev. 122: 368–383

Lu C J, Yang C T and Yen H F 2020 Stackelberg game approach for sustainable production-inventory model with collaborative investment in technology for reducing carbon emissions. J. Clean. Prod. 270: 121963

Rout C, Paul A, Kumar R S, Chakraborty D and Goswami A 2020 Cooperative sustainable supply chain for deteriorating item and imperfect production under different carbon emission regulations. J. Clean. Prod. 272: 122170

Sepehri A and Gholamian M R 2022 Joint pricing and lot-sizing for a production model under controllable deterioration and carbon emissions. Int. J. Syst. Sci. Oper. Logist. 9(3): 324–338

Guo Q, Chen Y J and Huang W 2022 Dynamic Pricing of New Experience Products with Dual-channel Social Learning and Online Review Manipulations. Omega, 102592

Hu W, Ding J, Yin P and Liang L 2023 Dynamic pricing and sales effort in dual-channel retailing for seasonal products. J. Ind. Manag. Optim. 19(2): 1528–1549

Chen M and Chen Z L 2015 Recent developments in dynamic pricing research: multiple products, competition, and limited demand information. Prod. Oper. Manag. 24(5): 704–731

Ranjan A and Jha J K 2022 Multi-period dynamic pricing model for deteriorating products in a supply chain with preservation technology investment and carbon emission. Comput Ind Eng, 108817

Gallego G and Van Ryzin G 1994 Optimal dynamic pricing of inventories with stochastic demand over finite horizons. J. Manag. Sci. 40(8): 999–1020

Lu J, Zhang J, Jia X and Zhu G 2019 Optimal dynamic pricing, preservation technology investment and periodic ordering policies for agricultural products. RAIRO Oper. Res. 53(3): 731–747

Anderson E J and Bao Y 2010 Price competition with integrated and decentralised supply chains. Eur. J. Oper. Res. 200(1): 227–234

Rabbani M, Zia N P and Rafiei H 2017 Joint optimal inventory, dynamic pricing and advertisement policies for non-instantaneous deteriorating items. RAIRO Oper. Res. 51: 1251–1267

Kumar S, Singh A K and Patel M K 2016 Optimization of Weibull deteriorating items inventory model under the effect of price and time dependent demand with partial backlogging. Sādhanā 41: 977–984

Zarouri F, Khamseh A A and Pasandideh S H R 2022 Dynamic pricing in a two-echelon stochastic supply chain for perishable products. RAIRO Oper. Res. 56(4): 2425–2442

Li R and Teng J T 2018 Pricing and lot-sizing decisions for perishable goods when demand depends on selling price, reference price, product freshness, and displayed stocks. Eur. J. Oper. Res. 270(3): 1099–1108

Sethi S P and Thompson G L 2000 Optimal Control Theory: Applications to Management Science and Economics. Kluwer, Dordrecht, Netherlands

Kamien M I, and Schwartz N L 1991 The calculus of variations and optimal control in economics and management. Dynamic Optimization 2nd ed. New York, Elsevier Science

Voros J 2019 An analysis of the dynamic price-quality relationship. Eur. J. Oper. Res. 277(3): 1037–1045

Zhang J, Lu J and Zhu G 2022 Optimal shipment consolidation and dynamic pricing policies for perishable items. J. Oper. Res. Soc., 1–17

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A

-

The retailer's profit function is jointly concave in both control variable \(p_{r}\) and state variable \(I_{r}\)

Proof

As the \({\text{Hessian of }}H_{r} = \left[ {\begin{array}{*{20}c} { - 2f\left( {\gamma + b_{r} } \right)} & 0 \\ 0 & 0 \\ \end{array} } \right].\)

So, the Hamiltonian \(H_{r}\) is jointly concave in control and state variables and thus, the retailer's profit function is jointly concave in both control variable \(p_{r}\) and state variable \(I_{r}\).

-

The manufacturer's profit function is jointly concave in both control variables \(p_{m}\) and \(P\) and state variable \(I_{m}\).

Proof

As the \({\text{Hessian of }}H_{m} = \left[ {\begin{array}{*{20}c} { - 2f\gamma } & 0 & 0 \\ 0 & 0 & 0 \\ 0 & 0 & 0 \\ \end{array} } \right].\)

So, the Hamiltonian \(H_{m}\) is jointly concave in control and state variables. Thus, the manufacturer's profit function is jointly concave in both control variables \(p_{m}\) and \(P\) and state variable \(I_{m}\).

Appendix B

-

The profit function of the retailer is jointly concave in both control variable \(p_{rs}\), \(P_{s}\) and state variable \(I_{rs}\) and \(I_{ms}\)

Proof

As the \({\text{Hessian of }}H_{s} = \left[ {\begin{array}{*{20}c} { - 2fb_{r} } & 0 & 0 & 0 \\ 0 & 0 & 0 & 0 \\ 0 & 0 & 0 & 0 \\ 0 & 0 & 0 & 0 \\ \end{array} } \right].\)

So, the Hamiltonian is jointly concave in both control and state variables.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

RANJAN, A., JHA, J.K. Continuous dynamic pricing strategy under competition for deteriorating products in a dual-channel supply chain. Sādhanā 49, 132 (2024). https://doi.org/10.1007/s12046-024-02468-1

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12046-024-02468-1