Abstract

Our research investigates the role of social media communication in amplifying high-quality information and its impact on the success of ICOs in achieving their soft cap. We analyzed data from 3,644 ICOs and the demographics of 1,987 CEOs, CFOs, and CTOs to compare their quality attributes against their number of social media followers. Our findings reveal that the most significant factors for reaching the soft cap are the number of followers and team size, while the competencies (education and skills) of the management team have a very marginal effect, even when enhanced through social media. This indicates that widespread social media signals can positively influence investor behavior without necessarily reducing information asymmetries regarding the quality of the team. We propose that this effect arises from the combination of minimal investment amounts and stimulated herding behavior among investors.

Similar content being viewed by others

Explore related subjects

Find the latest articles, discoveries, and news in related topics.Avoid common mistakes on your manuscript.

1 Introduction

The constant quest for new financing sources by startups, alongside emerging technologies, has recently spawned various novel financial instruments in an explosive manner (Sun et al. 2023). Innovator-led instruments such as reward crowdfunding, equity crowdfunding, and peer-to-peer lending (Ahlers et al. 2015; Belleflamme et al. 2014; Wei Shi 2018), and more recently, Initial Coin Offerings (ICOs) (Adhami et al. 2018; Bellavitis et al. 2021; Fisch 2019) promise to support start-ups with raising capital (Alaassar et al. 2023). ICOs utilize blockchain technology to issue tokens that either provide investors with a stake in the venture (security tokens) or access to a service offered by the venture (utility tokens).

Similar to equity crowdfunding and IPOs, ICOs enable entrepreneurs to raise funds directly from a broad investor base at lower costs by bypassing intermediaries and regulations (Chen 2018; Fink et al. 2020b; Mollick 2014; Nakamoto 2008). However, the direct engagement between entrepreneurs and investors also implies that investors cannot depend on professional intermediaries for due diligence (Diamond 1984), making it difficult to assess the quality of the project. This challenge is primarily due to high information asymmetry, often stemming from the venture’s lack of history (Ang 1992; Berger and Udell 1998, 2006; Fink et al. 2020a; Winborg and Landstroem 2001). In such scenarios, investors must rely on signals (Spence 1973, 2002), whether through information voluntarily shared by the startup (e.g., posts on social media) or through involuntarily disseminated information (e.g., the education and skills of the management team) (Ante et al. 2018). While ICO researchers, such as Adhami et al. (2018), focus on the effects of voluntarily disseminated signals on investor decision-making, the impact of involuntarily disseminated signals remains underexplored.

Recognizing the critical role of the management team in a venture’s success (Brinckmann et al. 2011; Ortu et al. 2017; Sapsed et al. 2002; Thompson et al. 1996), we investigate whether social media communication enhances the impact of such high-quality and non-voluntarily disseminated information, thereby influencing the success of ICOs in achieving their soft cap (i.e., the minimum target amount of funding needed to support the project).

To address our research question, we focus on two primary objectives: (1) identifying publicly accessible signals that provide relevant information for evaluating a venture’s potential, and (2) examining the impact of these signals on the success of the ICO, specifically in terms of the likelihood of securing the necessary funds to reach its soft cap. We collected data from 3,644 ICOs, linking it with information about 1,987 CEOs, CFOs, and CTOs extracted from their LinkedIn profiles. Our dataset includes publicly available details such as team size, and the competencies of these C-level executives (education and skills), which serve as indicators of an ICO’s quality. We contrast these quality signals with more communication-oriented signals, such as the number of followers on the ICOs’ Twitter and Telegram accounts and on the managers’ LinkedIn profiles. Our analysis includes controls for significant external events, utilizing data from Google Trends. To address potential endogeneity issues, we employ Stata 17 for regression analysis, carefully examining the effects and interactions among these variables and their contributions to achieving the ICO’s soft cap.

We hypothesized that ICO ventures would utilize their social media channels to communicate quality and amplify its impact, enabling investors to use these amplified signals to assess the management team’s competence and make more informed decisions. Our expectations also included that a larger team size and higher C-level competence would positively affect the likelihood of reaching the soft cap, especially when these attributes are highlighted through vigorous social media engagement.

Contrary to our expectations, our findings indicate that while the number of social media followers and team size are critical in achieving the soft cap, the competencies of ICO managers, surprisingly, do not influence outcomes, even when considering the amplifying effect of social media.

Our study contributes to the understanding of ICO funding success in several ways, leveraging one of the largest datasets used in ICO analysis to date and building on prior research (e.g., Moro and Wang 2019; Fiedler and Sandner 2017; Jin et al. 2017). First, we extend the findings of previous ICO research, which emphasized Twitter, by demonstrating that the significance of social media presence is consistent across various platforms. Second, we expand upon signaling theory (Spence 19732002) by showing that while signals reaching a broad audience can positively impact the issuer, they do not necessarily diminish information asymmetries. Our results suggest that ICO investors primarily rely on visible cues, such as the popularity of the ICO on social media, rather than the education and skills of the management team. Third, our analysis reveals that the joint effect of low investment risk and herding behavior encourages investors to focus more on the volume of social signals rather than their quality. These insights are not only academically valuable but also practical for marketing managers and investors. They underscore the critical role of social media followers in ICO success and suggest areas for ventures to enhance their communication strategies. Importantly, we advise investors to be discerning with the limited reliable information available to improve their decision-making processes.

2 Blockchain and initial coin offering

Blockchain technology is a distributed ledger that operates on a peer-to-peer basis and is secured through cryptography. It is considered by some as a potential successor to central processing authority (Narayanan et al. 2016; Pilkington 2015). This technology allows for a decentralized database that is maintained across a global network of computers, or nodes, which communicate over the internet using hash functions. This ensures that no single authority can control all the information, and the system remains robust even if one or more nodes fail (Nakamoto 2008; Narayanan et al. 2017). When a transaction is initiated, it generates a new block that is added to the blockchain, validated by a distributed algorithm, and then communicated to all nodes to maintain a decentralized consensus within the network. The resilience and reliability of blockchain make it suitable for a wide range of transactions, from monetary exchanges to contracts. This includes the issuance and transfer of tokens that either represent ownership stakes in a venture (security tokens) or provide access to services offered by a venture (utility tokens) (Adhami et al. 2018; Chen 2018; Narayanan et al. 2017).

Initial Coin Offerings (ICOs) are defined by Adhami et al. (2018) as ‘an open call, through the Internet, for the provision of cryptocurrencies in exchange for tokens generated through smart contracts and relying on blockchain technology.’ Since becoming popular in 2016, ICOs have primarily been used to finance new, often highly technological startups, peaking in 2017 with $5.3 billion raised globally. The tokens issued in ICOs resemble shares and can also be traded as crypto assets on secondary markets, which function similarly to stock exchanges (Corbet et al. 2019; Fisch 2019; Jackson 2018; Kajtazi and Moro 2019; Moro and Wang 2019; Civardi et al. 2023).

Because the process does not involve intermediaries, it remains largely unregulated (Fisch 2019; Howell et al. 2020; Murphy 2018), allowing startups to raise funds directly at low costs (Adhami et al. 2018; Howell et al. 2020; Fisch 2019; Huang et al. 2020). Moreover, ICOs enable ventures to access investors globally without geographical or legal constraints and allow investors to contribute minimal amounts to new and innovative projects, potentially enhancing the ability to raise significant funds (Howell et al. 2020; Huang et al. 2020; Yermack 2017). Digital crypto assets traded on secondary markets—usually operated by privately owned and unregulated platforms—offer ease of transferability, a key difference from equity crowdfunding or peer-to-peer lending (Lukkarinen et al. 2016; Civardi et al. 2023). This transferability introduces a speculative motive for investors, similar to trading shares after an Initial Public Offering (IPO), whereby like shareholders, investors may participate in ICOs anticipating substantial aftermarket returns.

2.1 Theory and hypotheses

Entrepreneurial firms and startups are typically marked by significant information asymmetry between founders and investors. While entrepreneurs and managers often have a clear understanding of their team’s capabilities, they may lack the ability or willingness to provide detailed information (Lowry et al. 2014). Resource constraints in very young ventures may also lead to the use of entrepreneurial marketing techniques characterized by high risk-taking (Eggers et al. 2020). These opaque qualities make it difficult for external fund providers to accurately assess the firm’s risk (Berger and Udell 1998, 2006).

In the context of ICOs, this asymmetry is even more pronounced (Kristoufek 2015). Many blockchain-based projects are pioneering new markets, dealing with the inherent challenges of technical innovation and uncertain demand, often proposing services or products for markets that do not yet exist (Park et al. 2020; Breidbach and Tana 2021). Consequently, investors frequently have minimal information to evaluate the potential costs, risks, and returns of an investment. Additionally, the complexity of ICO processes must be communicated to a public that often possesses limited understanding of such mechanisms (Chester 2017; Cohney et al. 2019; Long 2018).

Assessing the merit of investments in environments characterized by high asymmetry and uncertainty involves analyzing both voluntarily disseminated signals, such as social media postings, and involuntarily disseminated signals, like the education and skills of the management team (Amsden and Schweizer 2018; Moro and Wang 2019; Ofir and Sadeh 2020; Yadav 2017; Spence 2002, 1973). For instance, Sendra-Pons et al. (2024) showed how different information disclosure strategies lead to crowdfunding success and even overfunding, and de Sousa-Gabriel et al. (2024) illustrated how investor sentiment generated from social networks influenced their investment behaviours. These signals are crucial for reducing information asymmetry, as noted by Stiglitz (2002). Signaling theory, widely used in management literature, identifies insiders such as board members, founders, and executives as primary signalers. They possess knowledge about individuals, products, or organizations that is typically inaccessible to outsiders like investors, customers, and competitors (Spence 1973; Ross 1977).

According to Stiglitz (2000), the most critical informational asymmetries pertain to quality and intent. Kirmani and Rao (2000) differentiate between high- and low-quality firms, Kreps and Wilson (1982) link quality to reputation, and Certo (2003) correlates quality with prestige. Financial economists argue that certain corporate behaviors, such as levels of firm debt (Ross 1973) and dividend policies (Bhattacharya 1979), signal firm quality. Entrepreneurship research has largely focused on the signaling value of venture capitalist and angel investor backing, primarily examining leaders of startup and IPO firms as signalers, with shareholders and debt holders as the receivers (Elitzur and Gavius 2003; Bruton et al. 2009; Zimmerman 2008; Certo et al. 2001; Elliot et al. 2009).

However, signalers and receivers often have conflicting interests, leading to situations where inferior signalers may be incentivized to ‘cheat’ by emitting deceptive signals (Johnstone and Grafen 1993). This issue is particularly pronounced in ICOs, where the quality and veracity of signals are frequently complicated by moral hazards (Momtaz 2021a).

Past research on Initial Coin Offerings (ICOs) primarily measures success in terms of total funds raised, ability to reach the minimum target amount (soft cap), or post-ICO market performance. Given that the total amount raised can vary significantly based on the venture’s industry and strategic approach (e.g., asset-intensive versus light asset projects), the soft cap provides a more inter-industry comparable metric. This metric is particularly useful when exploring the determinants of ICO success from the investors’ decision-making perspective across different industries. Reaching the soft cap indicates that a firm has secured sufficient funds to proceed through the startup phase as planned in its business plan.

Prior studies have applied signaling theory to analyze the impact of voluntarily disseminated signals on ICO outcomes, examining factors such as the availability of source code, presales to specific institutional investors, jurisdiction specifications, and the presence of hard caps during presales as illustrated in white papers (Adhami et al. 2018; Amsden and Schweizer 2018; Fisch 2019). Specifically focusing on the soft cap, research has shown that adherence to platform regulations and detailed technical and financial project information significantly increase the likelihood of reaching this goal, more so than softer types of information (Moro and Wang 2019).

Considering that ICOs predominantly operate online, social media emerges as the primary channel for signal dissemination. During ICO campaigns, communication mainly occurs through platforms like Twitter (now X) and Telegram. Research indicates that positive language and consistent community engagement on these platforms are linked to higher funding levels (Albrecht et al. 2020; de Sousa-Gabriel et al. 2024). Consistently, the level of Twitter activity, the number of tweets, and the amount of Twitter followers have been found to significantly boost ICO success in terms of funds raised (Fiedler and Sandner 2017; Fisch 2019; Benedetti and Kostovetsky 2021; Ante and Fiedler 2017; Howell et al. 2020; Jin et al. 2017). Based on this evidence, we hypothesize similar positive impacts on reaching the soft cap. As a robust investigation of social media communication should encompass various platforms, our first set of hypotheses will consider different social media channels and their levels of activity (Gartner et al. 2021).

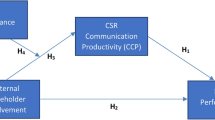

H1a: A higher number of Twitter followers of an ICO is positively associated with the likelihood of the ICO reaching its the soft cap.

H1b: A higher number of Telegram followers of an ICO is positively associated with the likelihood of the ICO reaching its the soft cap.

H1c: A higher number of LinkedIn followers of an ICOs C-Level individual is positively associated with the likelihood of the ICO reaching its the soft cap.

Consistent with prior research on startups (Bosma et al. 2004), studies on ICOs emphasize the significant role of the characteristics of the ICO leadership team in securing venture success (Amsden and Schweizer 2018; Howell et al. 2020; Momtaz 2021a). Key factors such as CEO status (Wang and Song 2016), board characteristics (Certo 2003), the digital entrepreneur’s profile (Felicetti et al. 2024), and especially the personal competencies of entrepreneurs (Busenitz et al. 2005) have been shown to positively impact investors’ decisions, thereby influencing a firm’s ability to secure its targeted funding amounts (Cerchiello et al. 2021; Amsden and Schweizer 2018).

The competencies of management teams, which encompass formal education and other acquired experiences, trainings and skills (Patrício and Ferreira 2024; Busenitz et al. 2005; Brinckmann et al. 2011; Ortu et al. 2017; Sapsed et al. 2002; Thompson et al. 1996), form the basis for our analysis. We follow a multi-faceted approach to evaluating these competencies by assessing skills and education individually, and then combining them into a ‘competency’ metric to research the overall interaction.

First, we employ the number of endorsements for specific skills on LinkedIn profiles as a publicly accessible measure of non-formal training and other acquired expereinces and skills of C-level managers. This method leverages a readily available data source to assess the expertise and qualifications that contribute to leadership effectiveness. Based on this, we formulate the following hypothesis:

H2a: A higher number of endorsements for each C-level executive is positively associated with the likelihood of the ICO reaching its soft cap.

In addition, formal education is a critical signal that may influence an ICO venture’s success. A deeper level of formal education in specialized areas such as technology, management, and finance equip the management team with the necessary background to quickly and effectively address challenges that arise during the early stages of a firm’s development. Properly assessed, this serves as a strong indicator that the project will be effectively managed throughout its execution (An et al. 2019; Ante et al. 2018; Burns and Moro 2018; Momtaz 2021b; Howell et al. 2020; Roosenboom et al. 2020; Yadav 2017; Amsden and Schweizer 2018). Based on this understanding, we propose the following hypothesis:

H2b: A higher level of formal education for each C-level executive is positively associated with the likelihood of the ICO reaching its soft cap.

Given the pivotal role of social media as the primary communication channel between ICOs and investors (Moro and Wang 2019; Mohit 2017; Amsden and Schweizer 2018; Yadav 2017), and its influence on ICO success, we expect that ICOs utilize their social media platforms to broadcast and amplify signals related to management competencies (education and skills). Furthermore, we anticipate that investors consider these publicly available signals about the quality of the management team in their investment decisions, irrespective of whether the ICO has actively highlighted these aspects or not. To investigate whether the publicly visible competencies of C-level management are consciously utilized as a positive signal in correlation with social media metrics, we propose the following hypotheses:

H3a: The interaction between a higher competency level of the C-level team and the number of an ICO’s Twitter followers is positively associated with the probability of reaching the soft cap.

H3b: The interaction between a higher competency level of the C-level team and the number of an ICO’s Telegram followers is positively associated with the probability of reaching the soft cap.

H3c: The interaction between a higher competency level of the C-level team and the number of individual C-level LinkedIn followers is positively associated with the probability of reaching the soft cap.

3 Data, methodology, variables and controls

3.1 Data

Empirical analysis of new venture creation based on samples of established firms is prone to survival bias (Gudmundsson and Lechner 2013) as public records do not contain start-ups that did not complete the process of market entry (Aldrich 1999). Similarly, research among failed business founders is often susceptible to a hindsight/retrospective bias (Cassar and Craig 2009) as entrepreneurs tend to incorrectly recall and report circumstances and facts (Dimov 2007). In fact, census data is only available for very few research projects, and most researchers must rely on carefully selecting representative samples and conscientious application of statistical methods to reduce selection bias (Winship and Mare 1992). However, collecting data from a near census is generally feasible for those sectors/sub-sectors of the economy where the sampling frame is relatively small and where observation of a phenomenon can be ensured in its entirety (Flint et al. 2002). Initial Coin Offerings (ICO) falls into this category because the number of ICOs initiated, albeit in a large number, is limited due to the clearly defined time frame of its existence. More importantly ICOs are a purely digital phenomenon with clear and hard-to-remove digital footprints, even from those projects that never succeeded and only existed for a short time.

The strategy of this study is to collect near-census data and followed a systematic approach to reproduceable identify, evaluate, and interpret the existing body of recorded documents, in our case to identify the relevant data sources about ICOs.

Our data collection took place between January and September 2021 and started with a search of all publications available in the academic database ProQuest.com. The search was conducted among all articles containing the string “initial coin offering” in the title, abstract or keywords regardless of publication time, status as peer-reviewed or language. This query returned 319 hits, resulting in 254 unique and full-text accessible publications. The articles were imported into a text analysis software to find and extract all web links the complete text contained to identify ICO or platforms containing data about ICO. The identified links were sorted and classified manually, resulting in the identification of 134 individual ICOs and, more importantly, in 34 online platforms, rating and news sites and other online resources that had listed additional ICOs. This collection was then supplemented by a Google, web forum and social media search, using keywords like “ICO list”, “ICO database”, “ICO ratings”, and equivalent search strings to identify additional 69 online resources. All 103 URLs were then looked up in the “similarweb.com” service, an online database to identify similar online resources, which added another 18 links to the collection, resulting in a total of 121 web domains. Of these 121 URLs, 23 did not contain ICO lists or were off-topic, and 43 were already offline. We manually collected all ICO entries from the 55 remaining online resources, including eight resources that were still online but stopped being updated after the initial ICO hype between 2017 and 2020. In addition, we also collected data from 16 offline websites that could partly be restored by accessing web archives or accumulating content from their orphaned but still online social media accounts. This particularly time-consuming step was necessary to get as complete as possible collection of all ICOs, including the previously mentioned short-lived and failed projects that can no longer be accessed on current trading platforms. After consolidating and cleaning for multiple entries, the exhaustive data collection approach led to the identification of 16,541 individual ICO projects between the period 2013 and 2021. All data gathered from the various sources, including the related LinkedIn profile links, were merged using an Excel script, manually completing, and correcting missing content via the original ICO websites, social media accounts or white papers. Care was taken to ensure that the number of followers corresponded to that at the time of the start of the ICO. This historical data was taken from the social media snapshot that information platforms such as ICObench or ICOgecko had taken at the time the campaign started. A similar careful approach was applied to obtain the team information. To record the original founding team, the profiles of the founders named in the white paper were used. We first downloaded all 4,853 available whitepapers and imported them into text analysis software to find and extract all LinkedIn links the text contained. In addition, we collected all LinkedIn profile links from the official ICO websites. After cleaning multiple entries, this approach allowed us to manually export the publicly accessible LinkedIn Profile information of 1,987 individual CEOs, CFOs, and CTOs.

3.2 Methodology

Given that our dependent variable is a dummy (reaching soft cap), we estimate our regressions using a probit approach. We also re-estimate the model by using logit regression. All the regressions are estimated using a robust standard error approach to deal with potential heteroskedasticity issues. Neither do our specifications suffer from reverse causality (from both the logical and temporal point of view, it is impossible that reaching the soft cap impacts the number of followers or the education/skills of the CEO, CFO and CTO) nor from simultaneity (from both the logical and temporal point of view, there is no reason for reaching the soft cap and the number of followers/the education/skills of the CEO, CFO, and CTO to be jointly determined). However, we cannot rule out that we are omitting a variable that affects both social media and reaching the soft cap so that the relation suggested by the regression is, in fact, spurious. The same applies to CEO, CFO and CTO skills and education. To deal with such an issue, we re-estimated our model by instrumenting the independent variables Twitter followers with the dimension of the marketing team in the ICO: a larger marketing team is expected to influence the intensity of social media activity. However, at the same time, it will not influence the decision of investors to invest in the venture, so it does not directly impact the probability of reaching the soft cap. This variable satisfies the exclusion criteria. For the education/skills, we use the proportion of the population with a university degree in the country where the CFO/CTO/CEO is born. The more significant the proportion of the population with a university degree in a country, the greater the probability that the CEO/CFO/CTO has a university degree and is more skilled. Thus, the variable is correlated to education and skill. At the same time, it does not impact the dependent variable satisfying the exclusion criteria. We estimate the regressions using the Stata17 software package, and the standard errors are estimated using the robust approach to deal with possible heteroskedasticity issues.

3.3 Dependent variables, independent variables and controls

The analysis focuses on whether the venture was able to reach its soft cap or not. Thus, we use a dummy for the dependent variable with a value of 1 in case the soft cap is reached and 0 otherwise.

The independent variables indicate the level of skills (number of endorsements in management, finance, or technical areas) and education (number of years in university education) of the CEO, CTO and CFO. As the distribution of the skills is highly skewed, we transform the independent variable into its natural log by applying the transformation log(1 + value) to retain all the original observations. In addition, we use the (natural log of) Twitter, Telegram, and LinkedIn followers of the firm as a metric to measure the impact of social media activity of the firm. Also, in this case we apply the transformation log(1 + value) to retain all the original observations. Moreover, to explore the joint effect of education/skills and social media, we generate interacted variables by multiplying the number of followers for the different platforms by the years in education and the (log of) endorsements again by applying the transformation log(1 + value).

We include a set of controls, both venture and context specific. Among the venture-specific controls, we used dummies that identify the industry the ICO operates in (Crypto, Fintech, Consulting, Entertaining, Health and Social), whether the venture implements a KYC or an MVP, restricts its ICO sales, offers a pre-ICO sale or bonuses or maintains a whitelist. All these variables signal quality and thus should positively impact the amount raised. We also include the type of currency accepted (USD, EUR, or other fiat currencies and BTC, ETH) because greater flexibility in accepting currencies should be more effortless for investors and, thus, result in a greater probability of reaching the soft cap. To account for contextual factors, we include Google trend indexes about “ICO” at the time of the ICO because the level of popularity of these themes during the ICO should positively impact the funds raised. The same applies to the area where the ICO is located (split between EU, Europe non-EU, North America, Central America and the Caribbean, South America, Pacific Basin, and Asia – Africa is represented by 0 in all the other dummies). Finally, we include dummies that control C-level managers participating in more than one ICO and the number of team members.

4 Results

The descriptive statistics related to the dataset we use are reported in Table 1.

Around 37.27% of the firms in our sample successfully reached the soft cap and secured their funding. The ICO teams consist of 1 to 20 members, with a mean of 10.19 team members. The CEO is involved in other ICOs in 27.8% of the cases suggesting some level of cross-fertilization among different projects. The c-level team has between 0 and 9 years of university education, with an average of 1.83 years for CEOs and 1.29 for CTOs. However, CFOs have only 0.43 years of university education, suggesting that past education is not considered relevant for the financial role. As perceived by the community, the skills show, on average, 23.51 endorsements in management and 8.76 in entrepreneurship for CEOs. CTOs have an average of 18.84 endorsements in technology, and CFOs only have 2.87 endorsements in finance. The joint reading of education and endorsements suggests that skills and education are not core regarding the financial role. As far as social media is concerned, the ICOs have, on average, 5,821 Twitter followers and 4,841 Telegram followers.

Table 2 reports the regression with the controls only. The result suggests that the industry affects the probability of reaching the soft cap. At the same time, the role of the area where the firm is headquartered is marginal (only North and South America dummies are significant). The same applies to currency (only USD is significant and negative), while information about the ICO (KYC, whitelist, MVP, bonus) is significant. The popularity of the ICOs (measured by Google Trends) is significant and negatively related to the probability of reaching the soft cap only in the case of the CFO’s involvement in other ICOs. Finally, the size of the team (number of team members) is significantly and positively associated with the probability of reaching the soft cap.

The results of the C-level skills are reported in Table 3.

For space reasons, the control variables (included in the estimation process) are not reported in the table. However, regarding the control variables, there are no relevant changes vis-à-vis the regression reported in Table 2. The first column reports the result of the log of the individual skills, the second the results for the log of the team skills, the third the results for the log of the social media followers, and the fourth the results for the log of the individual skills combined with the number of social media followers and the fifth the results for the log of the team skills combined with the number of social media followers. All the regressions are based on 1,978 individual team member observations or 1,446 ICOs with social media accounts. All the regressions we present in the analysis section do not suffer collinearity (the largest VIF is always smaller than ten, and the average VIF is between 1 and 2). The fact that we estimate the regressions using robust estimation of the standard error also deals implicitly with any heteroskedasticity issue. Besides, by using the log of the original values, we also reduce any estimation issues linked to outliers.

The first regression explores the role of C-level skills. The regression is significant, but the independent variables suggest that the managerial, financial and technical skills of CEOs, CFOs and CTOs do not affect the ICOs’ probability of reaching their soft cap. The same is true for the second regression, which examines the combination of skills at the team level. The third regression explores the role of the number of social media followers. It shows a positive and significant effect on the ICOs’ Twitter and Telegram accounts but not on the individual LinkedIn accounts of CFOs, CTOs, and CEOs. The same positive and significant effect remains in regressions four and five when the number of social media followers is combined with the skills on the individual or team level.

The results of the C-level education are reported in Table 4: the first column reports the result of the individual education, the second the results using dummies indicating the highest degree gained by the manager, the third one the results for the team education, the fourth, fifth and sixth one adds the log of the social media followers.

The first regression suggests that years of education are not relevant in granting funds. When it turns to the degree obtained, a master’s degree gained by the CEO is marginally negatively related to securing finance. The same applies to the CFO gaining a master while a CFO having a degree is positively associated to securing finance. It seems that it is more important that the CFO has a solid basic university knowledge than an advanced one. When we look at the year in university education at team level, the variable is significant (p < 0.05) and positively related to securing funds. The first three regressions suggest that securing funds is more a matter of overall team education than the education of the individual team member. The third, fourth and fifth regressions explore the effect of social media over and above the education. In all the cases, ICOs’ Twitter and Telegram followers are highly significant, while the individual LinkedIn accounts and searching activity on ICOs’ website are not. Intriguingly, the inclusion of the social media does not have any effect on the variables measuring education both individually and at team level since they maintain the same sign and significance level as in the previous regressions.

Table 5 reports the results by including skills, education, and social media at the same time. Interestingly, the results are in line with the previous ones.

Social media (Twitter and Telegram followers) are significant and positively related to securing finance. Skills are not significant both at individual and team levels while education is marginally significant at an individual level (only CFO degree and master’s).

The interactions of the combined experiences of the C-level managers (skills and education) and the number of social media followers are reported in Table 6. The first column reports the result including only the log of the interaction at an individual level. The second reports the results including the original variables. All the regressions are based on 1,446 observations.

Both regressions show a positive and significant effect for the ICOs’ Twitter and Telegram accounts but not for the individual LinkedIn accounts. The same positive and significant effect remains in the second regression at a team level. At the same time, the interaction between skills and individual education is not significant. The results are in line with the previous ones.

The regressions reported confirm our hypotheses 1a and 1b - a higher number of ICOs Twitter/Telegram followers of an ICO are positively associated with the probability of reaching the soft cap – but reject hypothesis 1c for the individual LinkedIn accounts of the C-Level managers. Also, we find very weak support to hypotheses H2a, H2b and H2c as we only find one minor significant effect on the years of university education of the CFO. At the same time, all other skills and educational factors did not influence the probability of reaching the soft cap. Finally, we also found no support for hypotheses H3a, H3b and H3c.

4.1 Robustness checks

As explained in the methodology section, we re-estimate all the models using logit regressions instead of probit regressions. The results (not reported for reason of space) are qualitatively like those we obtain with the original model suggesting that our results are robust to an alternative estimating process. Moreover, our estimations can be subject to endogeneity issues. In fact, given the temporal sequence (education and skills as well as the number of followers predate reaching the soft cap) we can exclude reverse causality and simultaneity. However, we cannot exclude possible omitted variables bias even if the lack of significance in the case of education and skills and the rejection of the related hypotheses implicitly nullifies issues related to endogeneity (there is no risk of accepting a wrongly tested hypothesis because endogeneity has not been properly addressed). Interestingly, the Wald tests on the instrumented regressions related to skills and education suggest that the model does not suffer from endogeneity. However, we still estimate instrumented regressions to deal with possible omitted variable bias for social media. Thus, we estimate the instrumented regression in the case of social media by instrumenting the number of social media followers with the dimension of the marketing team in the ICO. The results are reassuring: the Wald test suggests no need to instrument the regression. However, we estimated regressions present results qualitatively like those we obtained in the original model as shown in Table 7.

Finally, we made attempts with an alternative set of controls. For instance, we include variables measuring the number of words related to marketing, entrepreneurship, and team experience found in the white papers. These variables are always not significant, and their inclusion does not affect controls and, more importantly, the independent variables.

5 Discussion

Our research, utilizing data from 1,978 individual C-level managers, provides intriguing insights that extend recent studies on ICOs and enhance our understanding of how signals influence venture-investor relations. We discover that the number of social media followers significantly increases an ICO’s probability of reaching its soft cap, irrespective of the channel used (Twitter or Telegram). Interestingly, the number of LinkedIn followers for individual C-level team members does not impact the success rate. Additionally, consistent with previous studies, our extensive dataset confirms that larger ICO teams are more likely to reach the soft cap.

Contrary to our expectations, we found that neither the formal education nor the skills of individual C-level executives—nor the combined competencies of the C-level team as a whole—affect the likelihood of reaching the soft cap. Furthermore, interactions between higher levels of C-level management competencies and the number of social media followers—both ICO and individual accounts—which we anticipated would highlight the visibility of management’s education and skills for firms with a large social media following, have no significant impact. This suggests that superficial social media metrics, such as the number of followers, are more critical for achieving the soft cap than substantive signals like the education and skills of the leadership team.

However, our findings also suggest that potentially high team competencies are not fully utilized in communications by either high or low-quality projects. This underutilization presents an opportunity for ‘good’ companies to differentiate themselves by more effectively leveraging these high-quality signals in their communication strategies.

A possible explanation for our results lies at the intersection of investors’ fear of missing out (FOMO) and their herding behavior (Barnes 2018). FOMO is a psychological trait where individuals worry about missing rewarding experiences that others are having (Beyens et al. 2016; Elhai et al. 2016; Przybylski et al. 2013). ICOs, characterized by high information asymmetry, often involve very young startups pursuing highly innovative yet uncertain projects. This environment makes it difficult for even expert analysts to assess projects accurately, and nearly impossible for ordinary investors.

In scenarios of significant uncertainty about a project’s future performance, conventional wisdom might suggest abstaining from investment. Yet, potential investors may fear missing out on the next major success story like Google, Apple, or Amazon. This concern is magnified for those unfamiliar with the underlying technology (Gartner et al. 2022) and those under the acute time pressures typical during ICOs (Albrecht et al. 2020). Moreover, the minimal financial commitment encourages investors not to spend time on in-depth analysis, leading to ad-hoc investment decisions based on unverified information and emotional biases (Lahajnar and Rozanec 2018). Consequently, herding behavior emerges, with investors following the perceived wisdom of the crowd (Barnes 2018).

Many investors also adopt a short-term, speculative strategy, planning to quickly sell off tokens bought during an ICO once they hit secondary markets. In such cases, the educational background and skills of the leadership team are deemed irrelevant as these factors are unlikely to impact the token’s value in the immediate future. Instead, the hype around the token, which can signal potential future demand, becomes a more significant driver of price. This speculative approach is further fueled by herding behavior and FOMO, encouraging a rush to buy tokens during the ICO for potential high short-term gains. However, this strategy is risky as there is no guarantee that the token will be listed on a platform, and the typically illiquid market for tokens means that even small sales can significantly impact prices, potentially undermining the potential for profit.

Overall, the popularity of an ICO, often gauged by strong social media presence, is mistakenly interpreted as a sign of quality. ICOs with robust social media engagement benefit from this dynamic, at least to the extent of reaching their soft cap. Thus, the decision to invest in an ICO often appears to be more driven by instinct than by rational analysis.

6 Conclusion

Building on the critical role of management teams in venture success and applying signaling theory, our research investigates how social media communication amplifies high-quality signals and influences the success of ICOs in reaching their soft cap. We analyzed data from 3,644 ICOs and demographics of 1,987 CEOs, CFOs, and CTOs. We focused on team size and the education and skills of C-level managers as reliable and publicly accessible quality features of an ICO, contrasting these with communicative-oriented signals, specifically the number of followers on Twitter, Telegram, and LinkedIn accounts.

We found that the most crucial factor for reaching the soft cap is the number of social media followers and the team size, while competencies related to ICO executives were deemed irrelevant. This study contributes to theory in three significant ways:

First, we expand on past ICO studies by using a much larger database, reinforcing findings about the critical role of social media, now known as X. We demonstrate that the impact of social media extends beyond Twitter to other platforms, affirming its significant role across various channels.

Second, we contribute to Signaling Theory by examining the role of publicly accessible information about C-level competencies as both voluntary and involuntary signals. Our findings show that signals directed at a large audience positively affect the issuer without necessarily diminishing information asymmetries. Specifically, in ICOs, information about management competencies, although potentially valuable for reducing asymmetries, showed no impact on ICO success. This indicates that the volume of signal reception is more crucial than signal quality.

Finaly, we shed light on investor intentions by highlighting how herding behavior and short-term investment strategies influence decisions. Many investors buy tokens during an ICO with the intent to sell them as soon as they are traded, prioritizing the potential for a price increase. In such scenarios, the hype around the ICO, often reflected through intense social media activity, is more influential in determining the future price of a token than the actual skills or education of the leadership team.

In conclusion, our research suggests that investors are more swayed by easily accessible, low-quality signals, such as social media intensity, than by high-quality but harder-to-access signals, such as team characteristics. This illustrates a non-rational behavior pattern among ICO investors and communicators alike, and introduces the simplicity of signal accessibility into the signaling discourse, offering critical insights into the dynamics shaping ICO markets.

Our findings also provide valuable insights for marketing managers by underscoring the importance of maximizing social media followers for ICO ventures, not only on platforms like Twitter but across all official social media channels. This highlights a need for marketing strategies that go beyond merely circulating information on social media to more effectively communicate the quality of ICOs. For investors, our research highlights the value of easily accessible and publicly available information on managers’ social media profiles as indicators of quality. This can assist in making informed investment decisions.

Given the unexpected finding that management competencies do not significantly influence the success of ICOs in terms of reaching the soft cap, future research could investigate the long-term financial performance and survival rates of ICOs and their correlation with management skills. Although short-term investment strategies may overlook the skills and education of the leadership team, the long-term success of a firm likely depends on these factors. Further, an in-depth analysis of ICOs’ social media discourse could provide insights into how ICO ventures and investors utilize management skill levels as a positive signal.

Our study has some limitations. Firstly, while we rely on a sample of 1,978 individual observations—one of the largest samples used in ICO research—it is still smaller than the total of approximately 16,000 ICOs identified during our dataset construction. Therefore, replicating this analysis with a larger or different dataset is recommended to validate our findings. Secondly, our study does not include controls for the financial performance of ICOs due to data limitations. Future research could address this gap by incorporating financial performance metrics or detailed usage of funds as these data become available.

Despite these limitations, our research enriches understanding by providing a detailed analysis of the role of signals in highly technological firms and expands our knowledge of how management teams impact venture-investor relationships.

Data availability

The data supporting this study’s findings are available from the corresponding author upon reasonable request.

References

Adhami S, Giudici G, Martinazzi S (2018) Why do businesses go Crypto? An empirical analysis of initial coin offerings. J Econ Bus 100:64–75

Ahlers GK, Cumming D, Günther C, Schweizer D (2015) Signaling in equity crowdfunding. Entrepreneurship Theory Pract 39(4):955–980

Alaassar A, Mention AL, Aas TH (2023) Facilitating innovation in FinTech: a review and research agenda. RMS 17:33–66. https://doi.org/10.1007/s11846-022-00531-x

Albrecht S, Lutz B, Neumann D (2020) The behavior of blockchain ventures on Twitter as a determinant for funding success. Electron Markets 30(2):241–257

Aldrich H (1999) Organizations evolving. Sage

Amsden R, Schweizer D (2018) Are Blockchain Crowdsales the New‘Gold Rush‘? Success Determinants of Initial Coin Offerings. Success determinants of initial coin offerings (April 16, 2018)

An J, Duan T, Hou W, Xu X (2019) Initial coin offerings and entrepreneurial finance: the role of founders’ characteristics. J Altern Investments 21(4):26–40

Ang JS (1992) On the theory of finance for privately held firms. J Entrepreneurial Finance 1(3):185–203

Ante L, Sandner P, Fiedler I (2018) Blockchain-based ICOs: pure hype or the dawn of a new era of startup financing? J Risk Financial Manage 11(4):80

Ante L, Fiedler I Cheap signals in security token offerings (STOs)., Ante L, Fiedler I (2020) (2020) Cheap Signals in Security Token Offerings (STOs). Quantitative Finance and Economics, 4(4), 608–639

Barnes P (2018) Crypto currency and its susceptibility to speculative bubbles, manipulation, scams and fraud. J Adv Stud Finance (JASF) 9(2):18

Bellavitis C, Fisch C, Wiklund J (2021) A comprehensive review of the global development of initial coin offerings (ICOs) and their regulation. J Bus Venturing Insights, 15, e00213

Belleflamme P, Lambert T, Schwienbacher A (2014) Crowdfunding: tapping the right crowd. J Bus Ventur 29(5):585–609

Benedetti H, Kostovetsky L (2021) Digital tulips? Returns to investors in initial coin offerings. J Corp Finance 66:101786

Berger AN, Udell GF (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J Banking Finance 22(6–8):613–673

Berger AN, Udell GF (2006) A more complete conceptual framework for SME finance. J Banking Finance 30(11):2945–2966

Beyens I, Frison E, Eggermont S (2016) I don’t want to miss a thing: adolescents’ fear of missing out and its relationship to adolescents’ social needs, Facebook use, and Facebook related stress. Comput Hum Behav 64:1–8

Bhattacharya S (1979) An exploration of nondissipative dividend-signaling structures. J Financial Quant Anal 14(4):667–668

Bosma N, Van Praag M, Thurik R, De Wit G (2004) The value of human and social capital investments for the business performance of startups. Small Bus Econ 23(3):227–236

Breidbach CF, Tana S (2021) Betting on Bitcoin: how social collectives shape cryptocurrency markets. J Bus Res 122:311–320

Brinckmann J, Salomo S, Gemuenden HG (2011) Financial management competence of founding teams and growth of new technology–based firms. Entrepreneurship Theory Pract 35(2):217–243

Bruton GD, Chahine S, Filatotchev I (2009) Founders, private equity investors, and underpricing in entrepreneurial IPOs. Entrepreneurship Theory Pract 33(4):909–928

Burns L, Moro A (2018) What makes an ICO successful? An investigation of the role of ICO characteristics, team quality and market sentiment. An Investigation of the Role of ICO Characteristics, Team Quality and Market Sentiment (September 27, 2018)

Busenitz LW, Fiet JO, Moesel DD (2005) Signaling in venture capitalist—new venture team funding decisions: does it indicate long–term venture outcomes? Entrepreneurship Theory Pract 29(1):1–12

Cassar G, Craig J (2009) An investigation of hindsight bias in nascent venture activity. J Bus Ventur 24(2):149–164

Cerchiello P, Toma AM, Caluzzi M (2021) ICOs White papers: identity card or lark mirror? (No. 197). University of Pavia, Department of Economics and Management

Certo ST (2003) Influencing initial public offering investors with prestige: signaling with board structures. Acad Manage Rev 28(3):432–446

Certo ST, Daily CM, Dalton DR (2001) Signaling firm value through board structure: an investigation of initial public offerings. Entrepreneurship Theory Pract 26(2):33–50

Chen Y (2018) Blockchain tokens and the potential democratization of entrepreneurship and innovation. Bus Horiz 61(4):567–575

Chen MA, Wu Q, Yang B (2019) How valuable is FinTech innovation? Rev Financial Stud 32(5):2062–2106

Chester J (2017) Your guide to running an initial coin offering, for better or worse. Retrieved from: https://www.forbes.com/sites/jonathanchester/2017/08/16/your-guide-on-how-to-run-an-ico-for-better-or-worse. Last accessed: September 22nd, 2018

Civardi C, Moro A, Winborg J (2023) All that glitters is not gold! The (unexplored) determinants of Equity Crowdfunding. https://doi.org/10.1007/s11187-023-00813-y. Small Business Economics

Cohney S, Hoffman D, Sklaroff J, Wishnick D (2019) Coin-operated capitalism. Columbia Law Rev 119(3):591–676

Corbet S, Lucey B, Urquhart A, Yarovaya L (2019) Cryptocurrencies as a financial asset: a systematic analysis. Int Rev Financial Anal 62:182–199

de Sousa-Gabriel VM, Lozano-García MB, Matias MFLI et al (2024) Global environmental equities and investor sentiment: the role of social media and Covid-19 pandemic crisis. RMS 18:105–129. https://doi.org/10.1007/s11846-022-00614-9

Diamond DW (1984) Financial intermediation and delegated monitoring. Rev Econ Stud 51(3):393–414

Dimov D (2007) From opportunity insight to opportunity intention: the importance of person–situation learning match. Entrepreneurship Theory Pract 31(4):561–583

Eggers F, Niemand T, Kraus S, Breier M (2020) Developing a scale for entrepreneurial marketing: revealing its inner frame and prediction of performance. J Bus Res 113:72–82

Elhai JD, Levine JC, Dvorak RD, Hall BJ (2016) Fear of missing out, need for touch, anxiety and depression are related to problematic smartphone use. Comput Hum Behav 63:509–516

Elitzur R, Gavious A (2003) Contracting, signaling, and moral hazard: a model of entrepreneurs,‘angels,’and venture capitalists. J Bus Ventur 18(6):709–725

Elliott WB, Prevost AK, Rao RP (2009) The announcement impact of seasoned equity offerings on bondholder wealth. J Banking Finance 33(8):1472–1480

Felicetti AM, Corvello V, Ammirato S (2024) Digital innovation in entrepreneurial firms: a systematic literature review. RMS 18:315–362. https://doi.org/10.1007/s11846-023-00638-9

Fiedler M, Sandner P Identifying Leading Blockchain Startups on a Worldwide Level. FSBC Working Paper., Retrieved (2017) from http://www.explore-ip.com/2017_Analysis-of-leading-blockchain-startups-worldwide.pdf. Accessed 11 Mar 2019

Fink M, Hatak I, Scholz M, Down S (2020) He who pays the piper calls the tune? Setting the stage for an informed discourse on third-party funding of academic business research. RMS 14(2):335–343

Fink M, Koller M, Gartner J, Floh A, Harms R (2020b) Effective entrepreneurial marketing on Facebook–A longitudinal study. J Bus Res 113:149–157

Fisch C (2019) Initial coin offerings (ICOs) to finance new ventures. J Bus Ventur 34(1):1–22

Fisch C, Momtaz PP (2020) Institutional investors and post-ICO performance: an empirical analysis of investor returns in initial coin offerings (ICOs). J Corp Finance 64:101679

Flint DJ, Woodruff RB, Gardial SF (2002) Exploring the phenomenon of customers‘ desired value change in a business-to-business context. J Mark 66(4):102–117

Gartner J, Fink M, Floh A, Eggers F (2021) Service quality in social media communication of NPOs: the moderating effect of channel choice. J Bus Res 137:579–587

Gartner J, Fink M, Maresch D (2022) The role of fear of missing out and experience in the formation of SME decision makers’ intentions to adopt New Manufacturing technologies. Technol Forecast Soc Chang 180:121723

Gudmundsson SV, Lechner C (2013) Cognitive biases, organization, and entrepreneurial firm survival. Eur Manag J 31(3):278–294

Howell ST, Niessner M, Yermack D (2020) Initial coin offerings: financing growth with cryptocurrency token sales. Rev Financial Stud 33(9):3925–3974

Huang W, Meoli M, Vismara S (2020) The geography of initial coin offerings. Small Bus Econ 55(1):77–102

Jackson O (2018) Confusion reigns: are cryptocurrencies commodities or securities? International Financial Law Review

Jin S, Ali R, Vlasov AV (2017) Cryptoeconomics: Data applica- tion for token sales analysis. In Proceedings of the Thirty Eighth International Conference on Information Systems

Johnstone RA, Grafen A (1993) Dishonesty and the handicap principle. Anim Behav 46(4):759–764

Kajtazi A, Moro A (2019) The role of bitcoin in well diversified portfolios: a comparative global study. Int Rev Financial Anal 61:143–157

Kirmani A, Rao AR (2000) No pain, no gain: a critical review of the literature on signaling unobservable product quality. J Mark 64(2):66–79

Kreps DM, Wilson R (1982) Reputation and imperfect information. J Econ Theory 27(2):253–279

Kristoufek L (2015) What are the main drivers of the bitcoin price? Evidence from wavelet coherence analysis. PLoS ONE, 10(4), e0123923

Lahajnar S, Rozanec A (2018) Initial coin offering (ICO) evaluation model. Investment management and financial innovations, (15, Iss. 4), 169–182

Long C (2018) ICOs were 45% of IPOs in Q2 2018, as cryptos disrupt investment banks. Forbes. Retrieved from: https://www.forbes.com/sites/caitlinlong/2018/07/22/icos-were-45-of-ipos-in-q2-2018-as-cryptos-disrupt-investm

Lowry PB, Posey C, Roberts TL, Bennett RJ (2014) Is your banker leaking your personal information? The roles of ethics and individual-level cultural characteristics in predicting organizational computer abuse. J Bus Ethics 121(3):385–401

Lukkarinen A, Teich JE, Wallenius H, Wallenius J (2016) Success drivers of online equity crowdfunding campaigns. Decis Support Syst 87:26–38

Mohit Y (2017) Exploring signals for investing in an initial coin offering (ICO). SSRN Electron J. https://doi.org/10.2139/ssrn.3037106

Mollick E (2014) The dynamics of crowdfunding: an exploratory study. J Bus Ventur 29(1):1–16

Momtaz PP (2020) Initial coin offerings. PLoS ONE 15(5):e0233018

Momtaz PP (2021) Entrepreneurial finance and moral hazard: evidence from token offerings. J Bus Ventur 36(5):106001

Momtaz PP (2021a) CEO emotions and firm valuation in initial coin offerings: an artificial emotional intelligence approach. Strateg Manag J 42(3):558–578

Moro A, Wang D (2019) Fintech projects and initial coin offerings: a research note. J Entrepreneurial Finance 21(1):2

Murphy H (2018) Canada securities regulators involved in more than 200 crypto probes. US

Nakamoto S (2008) Bitcoin: a peer-to-peer electronic cash system. Decentralized Bus Rev, 21260

Narayanan A, Bonneau J, Felten E, Miller A, Goldfeder S (2016) Bitcoin and cryptocurrency technologies: a comprehensive introduction. Princeton University Press

Narayanan A, Bonneau J, Felten E, Miller A, Goldfeder S (2017) Bitcoin and Cryptocurrencies Technology, 1st edn. Princeton University Press, Princeton NJ

Ofir M, Sadeh I (2020) ICO vs. IPO: empirical findings, information asymmetry, and the Appropriate Regulatory Framework. Vand J Transnat‘l L 53:525

Ortu M, Destefanis G, Counsell S, Swift S, Tonelli R, Marchesi M (2017) How diverse is your team? Investigating gender and nationality diversity in GitHub teams. J Softw Eng Res Dev 5(1):1–18

Park G, Shin SR, Choy M (2020) Early mover (dis) advantages and knowledge spillover effects on blockchain startups’ funding and innovation performance. J Bus Res 109:64–75

Patrício LD, Ferreira JJ (2024) Unlocking the connection between education, entrepreneurial mindset, and social values in entrepreneurial activity development. RMS 18:991–1013. https://doi.org/10.1007/s11846-023-00629-w

Pilkington M (2015) Blockchain. In: Olleros FX, Zheg M (eds) Research Handbook on Digital transformations. Edward Elgar Publishing Inc

Przybylski AK, Murayama K, DeHaan CR, Gladwell V (2013) Motivational, emotional, and behavioral correlates of fear of missing out. Comput Hum Behav 29(4):1841–1848

Roosenboom P, van der Kolk T, de Jong A (2020) What determines success in initial coin offerings? Venture Capital 22(2):161–183

Ross SA (1973) The economic theory of agency: the principal‘s problem. Am Econ Rev 63(2):134–139

Ross SA (1977) The determination of financial structure: the incentive-signalling approach. bell J Econ, 23–40

Sapsed J, Bessant J, Partington D, Tranfield D, Young M (2002) Teamworking and knowledge management: a review of converging themes. Int J Manage Reviews 4(1):71–85

Sendra-Pons P, Garzón D, Revilla-Camacho MÁ (2024) Catalyzing success in equity crowdfunding: trust-building strategies through signaling. RMS. https://doi.org/10.1007/s11846-024-00734-4

Spence M (1973) Job market signaling. Quart J Econ 87:355–374

Spence M (2002) Signaling in retrospect and the informational structure of markets. Am Econ Rev 92(3):434–459

Stiglitz JE (2000) The contributions of the economics of information to twentieth century economics. Q J Econ 115(4):1441–1478

Stiglitz JE (2002) Information and the change in the paradigm in Economics. Am Econ Rev 92(3):460–501

Sun Y, Li S, Wang R (2023) Fintech: from budding to explosion - an overview of the current state of research. RMS 17:715–755. https://doi.org/10.1007/s11846-021-00513-5

Thompson JE, Stuart R, Lindsay PR (1996) The competence of top team members: a framework for successful performance. Journal of Managerial Psychology

Wang T, Song M (2016) Are founder directors detrimental to new ventures at initial public offering? J Manag 42(3):644–670

Wei Shi S (2018) Crowdfunding: Designing an effective reward structure. Int J Market Res 60(3):288–303

Winborg J, Landström H (2001) Financial bootstrapping in small businesses: examining small business managers‘ resource acquisition behaviors. J Bus Ventur 16(3):235–254

Winship C, Mare RD (1992) Models for sample selection bias. Ann Rev Sociol, 327–350

Yadav M (2017) Exploring signals for investing in an initial coin offering (ICO). Available at SSRN 3037106

Yermack D (2017) Corporate governance and blockchains. Rev Financ 21(1):7–31

Zimmerman MA (2008) The influence of top management team heterogeneity on the capital raised through an initial public offering. Entrepreneurship Theory Pract 32(3):391–414

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gartner, J., Moro, A. Followers beat content: social media and the managers in initial coin offerings (ICOs). Rev Manag Sci (2024). https://doi.org/10.1007/s11846-024-00790-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11846-024-00790-w