Abstract

This paper examines whether the information contained in geopolitical risk (GPR) can improve the forecasting power of price volatility for carbon futures traded in the EU Emission Trading System. We employ the GARCH-MIDAS model and its extended forms to estimate and forecast the price volatility of carbon futures using the most informative GPR indicators. The models are examined for both statistical and economic significance. According to the results of the Model Confidence Set tests for the full-sample and sub-sample data, we find that the extended model, which accounts for the threat of geopolitical risk, exhibits superior forecasting ability for the full-sample data, while the model that includes drastic changes in geopolitical risk in Phase II and the model that considers serious geopolitical risk in Phase III have the best predictive power. Moreover, all GPR-related variables we use contribute to increasing economic gains. In particular, the threat of geopolitical risk contains valuable information for future EUA futures volatility and can provide the highest economic gains. Therefore, carbon market investors and policymakers should pay great attention to geopolitical risk, especially its threat, in risk and portfolio management.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

European Union allowances (EUA) futures—vital carbon assets traded in the European Union Emission Trading System—have undergone significant price surges, rising from 7.53 €/\({CO}_{2}\) on 30 Nov 2017 to 75.45 €/\({CO}_{2}\) on 30 Nov 2021.Footnote 1 This economic development has piqued the interest of carbon market investors, policymakers and academia. The substantial increases in the price of carbon futures can lead to portfolio investment value fluctuations with carbon assets (Bolton and Kacperczyk 2021). Consequently, it raises concerns among investors about whether to invest in carbon assets, given the challenge of accurately forecasting future price or return fluctuations of carbon assets.

The existing literature aimed to accurately forecast carbon market volatility (Byun and Cho 2013; Segnon et al. 2017; Guo et al. 2022); however, this task is challenging as the EU-ETS has four distinctive phases,Footnote 2 each with many uncertainties (Tan and Wang 2017; Van den Bremer and Van der Ploeg 2021). Uncertainties could influence the demand for EUA futures through the Energy-EUA and Macro economy-EUA channels. Energy-EUA signifies that uncertainties impact the dependence between EUA futures and energy prices, which varies across different phases (Tan and Wang 2017). Macro economy-EUA refers to uncertainties that could make investors conservative, weaken the macro economy due to the rational person hypothesis and real-option theory (Bloom 2009), and subsequently, fluctuate the EUA futures price. Geopolitical risk entails the threat, realisation and escalation of adverse events such as wars, terrorism and tensions among different states and political actors (Caldara and Iacoviello 2022). Hence, geopolitical risk is closely related to the total risk emerged (Jurado et al. 2015). In addition, the close ties of the carbon market to the government and the oil market render EUA futures geopolitically distinctive from other futures assets (Batten et al. 2021). Compared to the analysis of geopolitical risk in oil markets, few studies consider the geopolitical risk perspective in researching carbon markets (Gong and Xu 2022).

The complexity of geopolitical risk makes it challenging to measure and quantify it. Therefore, few papers robustly consider and explicitly analyse the impact of geopolitical risk on forecasting carbon market volatility. Only a limited number of studies delved into how geopolitical risk affects asset price volatility until Caldara and Iacoviello (2018) introduced the GPR index as a proxy for geopolitical risk based on text analysis. They further revised these indices in 2021 (Caldara and Iacoviello 2022).

The GPR index is constructed by identifying specific geopolitical risk words in English-language newspaper articles related to geopolitical tensions. It captures adverse geopolitical events and associated risks. A higher index can hinder investment and employment, increase the probability of disasters and raise downside risks (Caldara and Iacoviello 2022). Considering the intertwined effects of the threat, realisation and escalation of international violence, separating the ‘acts’ (GPRA) and ‘threats’ (GPRT) components from the GPR index w would satisfy researchers’ interest in studying a range of events (Caldara and Iacoviello 2022).

It is widely acknowledged that geopolitical risk could explain the price volatility of energy assets, such as oil. Oil markets are influenced by the characteristics of geopolitical differences and tend to be more volatile in the presence of uncertain geopolitical events and threat shocks in the oil market (Ivanovski and Hailemariam 2022; Kumar et al. 2021). However, there is no common consensus on whether geopolitical risk can predict fluctuations in energy assets and how this predictability evolves over time. Brandt and Gao (2019) found that geopolitical risk impacts oil prices in the short term but does not offer predictability. Liu et al. (2019) confirmed that significant geopolitical risk contributes to future oil volatility. Specially, Guo et al. (2022) argued that long- and short-term asymmetries and extremes in data characteristics resulting from external risks have predictability in EUA price volatility. Geopolitical risk is a part of external risk (Caldara and Iacoviello 2022). Hence, geopolitical risk contains complex interpretational information, and whether this information is consistent in forecasting volatility plays an important role in predicting asset price volatility. In summary, conducting a quantitative and concrete analysis of how geopolitical risk affects carbon market price volatility is crucial, and this remains a very limited open question.

Our paper differentiates from Liu et al. (2021) in several aspects. Firstly, the risk we consider in forecasting EUA futures volatility is different; we choose geopolitical risk and varying degrees of this risk, whereas Liu et al. have only examined China’s and the European Union’s economic policy uncertainty in forecasting EUA futures volatility. Secondly, although we both apply the GARCH-MIDAS framework, Liu et al. use a one-component GARCH-MIDAS method, and we use a two-component model that considers asymmetric information of short volatility to better explain and forecast volatility. Thirdly, we calculate the final economic gain by adding the leverage ratio to meet corresponding margin requirements when investors trade in the financial market, while Liu et al. did not consider it. In particular, we intend to answer three questions. First, how do we identify appropriate indexes to represent geopolitical risks? Second, does geopolitical risk have explanatory and predictive power regarding carbon emission market price volatility? Third, are the results consistent from both statistical and portfolio economic gain perspectives?

We address the above questions using a carefully designed research methodology consisting of four stages. First, it is critical to select suitable proxies for geopolitical risk. We adopt the new constructed monthly GPR index by Caldara and Iacoviello (2022). Although many studies use the older GPR index (Baur and Smales 2020; Kumar et al. 2021; Salisu et al. 2021), the revised GPR index contains a broader range of geopolitical risk information, reflecting adverse geopolitical events better than the older index (Caldara and Iacoviello 2022). While the new and old indices are highly correlated with each other, the new one exhibits a lower increasing trend than the previous index.Footnote 3 Consequently, it is appropriate to employ the new GPR index in this study.

Second, the most informative indicators of GPR must be identified, and whether the information consistently predicts EUA futures volatility under different phases must be analysed. Geopolitical risks, marked by their sudden and drastic changes, can significantly influence portfolio asset allocation and consequently impact EUA futures price fluctuations (Akbas et al. 2020). A higher growth rate of the GPR index reflects quicker market responses to geopolitical risk (Bolton and Kacperczyk 2021). Consequently, for a thorough analysis, we employ the GPR index, its proxies for acts (GPRA) and threats (GPRT), as well as a series of adjusted GPR indexes, including \(GPRS, \Delta GPR, \Delta GPRS\). The \(GPRS\) index characterises serious geopolitical risk (Liu et al. 2019), while the \(\Delta {\text{GPR}} {\text{and}} \Delta {\text{GPRS}}\) represent the growth rate of and dramatic changes in the GPR index. Since Phase I is not as developed as Phase II and Phase III, its data is not included in the full sample dataset. Several researchers have focused on carbon market data in Phase II and Phase III (Huang et al. 2022; Dai et al. 2021; Huang et al. 2021; Liu et al. 2017). Therefore, we have selected Phase II and Phase III of the EU-ETS as sub-samples to investigate the consistent role of these GPR-related variables in forecasting EUA futures volatility, allowing us to determine whether the GPR information in the sub-sample data mirrors its role in the full-sample data.

Third, we estimate and forecast daily EUA futures price volatility with monthly GPR-related indexes using a mixed frequency data sampling method (MIDAS) (Ghysels et al. 2004). We construct a benchmark GARCH-MIDAS model and two-component GARCH-MIDAS models following the approach of Engle et al. (2013). The GARCH-MIDAS model, introduced by Engle et al. (2013), incorporates the MIDAS framework into the generalised autoregressive conditional heteroskedasticity (GARCH) model. This approach aims to forecast the volatility of financial asset prices or other high-frequency data with the aid of low-frequency explanatory variables (Fang et al. 2020). Conrad and Kleen (2020) found that the GARCH-MIDAS model based on VIX and housing starts exhibited the best forecast performance among other models, including heterogeneous autoregression (HAR), realised GARCH models, high-frequency-based volatility (HEAVY) and Markov-switching (MS) GARCH models. Therefore, it is appropriate to utilise the extended GARCH-MIDAS model with monthly GPR series data to forecast daily EUA futures price volatility. Additionally, we compute the Model Confidence Set (MCS) at a 75% confidence level and examine which model survives (Amendola et al. 2020).

Fourth, we delve deeper into assessing the economic benefits of the extended models to obtain robust results regarding whether GPR-related variables possess substantial predictive power in determining carbon futures price volatility. Investors have the potential to enhance their carbon asset portfolios by factoring in geopolitical risk and its associated variables, resulting in significant economic gains (Bolton and Kacperczyk 2021). Therefore, it is essential to highlight the significance of geopolitical risk in portfolio management as it serves as a valuable reminder for investors.

In summary, this study makes three significant contributions. First, we innovatively extend the usage of newly constructed GPR index to \(GPRS, \Delta GPR, \Delta GPRS\) indexes, enabling us to explore the crucial role that geopolitical risk plays in forecasting carbon market volatility. We extract various valuable insights from geopolitical risk to predict price volatility, whereas many other papers primarily focus on analysing common geopolitical risks. For example, Su et al. (2019) examine the causality of GPR, oil prices and financial liquidity, while Wang et al. (2021) discover that quarterly geopolitical risk poses a threat to oil security.

Second, this study reveals that the series of geopolitical risk threats exhibits the strongest forecast performance for EUA futures price volatility in the full sample. However, the results do not demonstrate consistency when considering sub-sample data. We employ the GARCH-MIDAS model and find that \(\Delta GPRS\) performs best in Phase II, whereas \(GPRS\) provides valuable information in Phase III when forecasting EUA futures price volatility.

Third, we compute the economic gains for investors engaged in EUA futures investments, and the results reveal that GPR and its related variables, particularly geopolitical threat risks, can provide benefits to investors. This paper compares the economic gains derived from holding portfolios comprising three-month Treasury Bills and EUA futures assets, based on the forecasted volatility of various models. Our findings indicate that the model incorporating \(GPRT\) can obtain better out-of-sample forecast performance and greater economic gains than the other models forecasted in the full sample. These results emphasise the significance of considering geopolitical risk threats in portfolio adjustments to achieve adverse risk management.

Our paper is structured as follows: Sect. 2 presents the econometric models, including the GARCH-MIDAS model and its extended versions. Section 3 describes the data. Section 4 discusses the estimated models and evaluates the forecast performance. Section 5 encompasses the various robustness tests performed. Section 6 studies the economic gains followed by the conclusion in Sect. 7. Figure 1 presents the framework of this paper.

2 Methodology

To precisely explore the role of geopolitical risk in explaining and forecasting volatility of EUA futures, the frequency of data has to be considered in the empirical method. Geopolitical risk is quantified monthly, while the volatility of EUA futures is at a daily frequency. Therefore, the application of a mixed-frequency sampling method is used to study the problem.

2.1 The benchmark GARCH-MIDAS model

To study the contribution of monthly geopolitical risk variables to the daily volatility of EUA futures, we employ the GARCH-MIDAS method. This method is based on the frame of MIDAS approach and allows for the incorporation of data at different frequencies into a single model. However, no improvements are observed in forecasting dependent variable. Our use of the GARCH-MIDAS method aligns with previous studies (Conrad and Kleen 2020; Liu et al. 2021; Lu et al. 2022),, which have successfully employed it to forecast high-frequency variables using low-frequency explanatory variables. Specifically, Engle et al. (2013) demonstrated that the GARCH-MIDAS model can effectively forecast stock market volatility by incorporating macroeconomic fundamentals like the industrial production growth rate (IP) and IP growth volatility. Furthermore, considering both internal error terms and external variables, the GARCH-MIDAS model exhibits superior forecasting performance compared to competing models such as GARCH-type, HAR and HEAVY models (Ghysels et al. 2019; Conrad and Kleen 2020).

Following the idea of Engle and Rangel (2008), we assume that the unexpected return of financial assets is referred to as:

where \({r}_{i,t}\) is the log return of EUA futures on the \(ith\) day of month \(t\), \(\mu\) is the conditional mean of the return, \({N}_{t}\) represents the number of days in month \(t\). The term \({\varepsilon }_{i,t}\) follows the standard normal distribution within the information set \({\Phi }_{i-1,t}\) up to day \((i-1)\) of month \(t\). The term \({\tau }_{t}\) refers to the function determined by low-frequency variables, especially the external macro variables, while \({g}_{i,t}\) is affected by historical information and follows the process of GARCH-type model. If \({\tau }_{t}\) only depends on the lagged information of explanatory variables, then the daily conditional variance of daily return is

where \({\tau }_{t}\), long-term component of volatility, is constant across all days within month \(t\) and changes at the lower frequency. The short-term volatility component \({g}_{i,t}\) is intended to explain the day-to-day clustering of volatility and, therefore, is represented by a mean-reverting unit-variance process—the GJR-GARCH(1,1) process (Conrad and Kleen 2020):

where \(\alpha , \beta \mathrm{ and} \gamma\) are the parameters to be estimated for the components of GJR-GARCH process, and the conditions of \(\alpha >0, \alpha +\gamma >0, \beta \ge 0, and \alpha +\gamma /2+\beta <1\) must be satisfied. The long-run component,\({\tau }_{t}\), plays a role in describing smooth fluctuations in the conditional variance. In particular, as Engle et al. (2013) suggested, we consider monthly realised volatility which denoted \({RV}_{t}\) as one basic explanatory variable when measuring long-term component. Though the formula of \({\tau }_{t}\) requires nonnegative explanatory variables for its explanation, it is more efficiency if both positive and negative values of explanatory variables are suitable for explaining the long-term component. Therefore, we transform its conventional mode into logarithmic form as presented in Eq. (4) (Engle et al. 2013):

where \({\text{c}}\) refers to the intercept, \(\theta\) is the slope of weighted and lagged variable \({RV}_{t}\) on the logarithmic of long-term volatility component, and \(K\) refers to the optimal lag length of variable \({RV}_{t}\) corresponding to minimal Bayesian Information Criterion (BIC) value and contributes to smoothing volatility in MIDAS filtering. Realized volatility \({RV}_{t}\) is constant within month t, and calculated by the sum of 22 squared daily return of day \(i\) in month \(t\). We assume there are 22 days in one month, meaning that \({N}_{t}\) equals to 22. Specifically, \({\varphi }_{k}\left({\omega }_{1}, {\omega }_{2}\right)\) denotes the unrestrictive Beta weighting scheme depending on independent variables \({\omega }_{1}\) and \({\omega }_{2}\) and is computed as (Engle et al. 2013; Ghysels et al. 2006) follows:

The weight distributions resulting from an unrestrictive weighting scheme tend to exhibit attenuation and a hump-shaped pattern. However, as the lag orders increase, the influence of macro or lower-frequency variables on the long-term volatility component diminishes, causing the weighting function to become monotonic. Similar to Conrad and Kleen (2020), if we use the unrestricted beta methodology to calculate \({\varphi }_{k}\) and \({\omega }_{1} = 1\) is set to constrain the weighting scheme, then there would only be attenuated weight distributions. The weighting scheme is then transformed into the following function:

We use variance ratio (\(VR\)) to measure the relative importance of the long-term component on the total conditional variance, and it can be expressed as follows (Conrad and Kleen 2020):

where \({g}_{t}=\sum_{i = 1}^{{I}_{t}}{g}_{i,t}\), \({I}_{t}\) equals to the number of days in month t. Equation (1), (3), (4) and (6) form the GARCH-MIDAS method with one exogenous variable. This kind of model could be effectively estimated by applying one-step quasi-maximum likelihood estimation (QMLE) approach (Lu et al. 2022).

2.2 The extended GARCH-MIDAS model with geopolitical risk

To investigate the theme problem of whether geopolitical risk can explain and forecast EUA futures volatility, we first analyse the information regarding geopolitical risk. Geopolitical risk, indexed by GPR, is defined as adverse geopolitical events and associated risks that could contribute to reduced investments and employment, increased disaster probability, and elevated downside risks (Caldara and Iacoviello 2022). Accordingly, many financial market investors and government officials consider geopolitical risks key factors that can influence financial market fluctuations, including EUA futures dynamics (Carney 2016; Caldara and Iacoviello 2022). It is essential to specify the threat and realisation of risk. Specifically, these adverse consequences are driven by both the threat and the realisation of adverse geopolitical events through financial channels that result in the destruction of capital stock or increased precautionary behaviour. However, investors and governors of carbon financial markets have been unable to identify the determinant transmission channels when facing geopolitical risk, which further impairs their judgment regarding the carbon market. Hence, we define the threat and realisation of geopolitical risk as index GPRT and GPRA, respectively.

Based on the original GPR index information, we are interested in the effects of high levels of geopolitical risk, its changes and the severity of these changes on EUA futures volatility. Firstly, serious geopolitical risk, denoted as GPRS, refers to risk levels exceeding specific thresholds, such as 50, 70 and 90%, as suggested by Liu et al. (2019). Undoubtedly, people are more concerned about high-risk situations because they often lead to lasting consequences, such as divestment from carbon futures or withdrawal of capital from the carbon finance market. These consequences can reduce carbon futures volatility.

Secondly, \(\Delta GPR\) represents the growth rate or change in geopolitical risk, which transforms the GPR index into a more stable measure. This variable contains more information about geopolitical risk than its original level because it mitigates extreme values. Thirdly, \(\Delta GPRS\) is obtained by calculating the growth rate or change in the GPRS index, thereby enabling the study of risk consequences in comparison to the effects of \(\Delta GPR\) index. For example, we could determine whether constant or exacerbated serious geopolitical risk provides more insight into carbon futures volatility. We construct \(GPRS, \Delta GPR\mathrm{ and }\Delta GPRS\) variables as Eqs. (9), (10) and (11) based on GPR index suggested by Liu et al. (2019).

where \(I\) refers to the binary variable, meaning that \(I = 1\) when \({GPR}_{t-k} > \gamma\) in Eq. (9) and \({\Delta GPR}_{t-k} > \gamma\) in Eq. (11) respectively; otherwise, \(I = 0\). \(\upgamma\) is a certain threshold value set to be 50% normally, and 70 and 90% robustly of the corresponding samples (Liu et al. 2019).

Secondly, we add this various geopolitical risk information denoted by \({X}_{t}\) into Eq. (4). Following this, the long-term component of extended GARCH-MIDAS model can be written as follows:

where \({X}_{t}\) refers to GPR-related variables and \(m\) is the intercept. \({\theta }_{1}\) and \({\theta }_{2}\) are the slopes of lagged realised volatility and geopolitical risk indexes, respectively. Similarly, \(k1\) and \(k2\) are the optimal lagged orders based on minimising BIC values. The weighting schemes of variables \(R{V}_{t}\) and \({X}_{t}\) are unrestricted beta process similar to the GARCH-MIDAS model introduced by us, and we set constrained condition as \({\omega }_{11}= {\omega }_{21}= 1\). The models are listed in Table 1.

2.3 Loss functions and model confidence set (MCS) test

To assess the predictability of various models, we conduct the MCS test based on loss functions (Hansen et al. 2011), for which we first define the loss functions. We use the definition of \({\widehat{h}}_{m}^{2}\) as the daily conditional variance resulting from estimated models, and \(R{V}_{m}\) as the daily realised volatility. The use of \(H\) represents the in-sample period while \(M\) refers to the out-of-sample period. Thus, the loss functions of HMSE and HMAE can be obtained as follows:

The MCS test contains three concrete steps (Hansen et al. 2011). In the volatility of model sets \({M}_{0}\) (including \(1,\cdots ,{m}_{0}\)) and forecast the next step with a fixed length of rolling window which covers 95% of the (sub)sample periods (Conrad and Kleen 2020). In the meantime, the forecast length is assumed up to \(M\) days then \(m \mathrm{equals to }H+1, H+2, \cdots , H+M\). Finally, the loss function of each model u is recorded as \({L}_{u,m}\). Thus, the related losses of different models are:

In the second step, the set of better target models is denoted as \({M}^{*}\), which is represented by:

where \(E({d}_{i,uv,m})\) is the expected value of \({d}_{i,uv,m}\), and MCS test excludes models that do not pass the confidence test in the set \({M}_{0}\). The null hypothesis is:

In the third step, the condition for judging the null hypothesis is to calculate the statistics \({T}_{R}\) and \({T}_{SQ}\) using the confidence level of 0.25 used by most scholars to decide whether to accept the null hypothesis(Samuels and Sekkel 2017; Amendola et al. 2020). The calculation formulas of \({T}_{R}\) and \({T}_{SQ}\) statistics are:

where \({\overline{d} }_{i,uv}\) is the relatively average loss value of models \(u\) and \(v\). It should be noted that 1000 bootstrap calculations were used to obtain stable results in order to avoid excessive error in the results. As a result, the null hypothesis is accepted and the prediction accuracy of the model is good if the p-value is greater than 0.25. It can be seen from the above steps that the larger the p-value (up to 1), the higher the corresponding model’s predictive ability.

3 Data description

We analyse the carbon product of EU allowances (EUA) traded in EU-ETSFootnote 4 as it is considered as the largest and most established carbon market in terms of the trading volume. The EUA futures price is selected as a representative variable as it could forecast EUA spot price and EUA options price (Guo et al. 2022). We collected daily EUA futures prices of monthly continuous trading contracts from the ICE.Footnote 5 In terms of phases of EU-ETS, the full sample was defined only covering Phase II, Phase III and Phase IV of EU-ETS. It ranges from 1 January, 2008 to 30 November, 2021, and its size reaches 3258 daily observations after censoring 10% of the data to remove extreme values. We compute the daily return by using the formula \({r}_{t} ={\text{ln}}({p}_{t}/{p}_{t-1})\), which we multiply by 100 for presenting the results better, where \({p}_{t}\) and \({p}_{t-1}\) refer to the closing prices of two successive working days, and the unit of price is Euro/ton of \({CO}_{2}\) emissions.

To analyse the extent to which geopolitical risk impacts and forecasts carbon price volatility, we adopt the recently constructed monthly GPR indexFootnote 6 constructed by Caldara and Iacoviello (2022) at the Federal Reserve Board as a proxy for geopolitical risk. Caldara and Iacoviello (2022) calculate the new GPR index by analysing more news articles than the old index (Caldara and Iacoviello 2018), following the text analysis adopted by Baker et al. (2016). The GPR index reflects both the realised and expected risk of current adverse events and the forthcoming risk of adverse geopolitical threats or events; thus, monthly GPRT and GPRA indexes are constructed. In particular, the GPR index accurately and promptly measures the intensity of adverse event risk across the world and within countries. Numerous studies have researched the role of geopolitical risk in affecting energy and financial markets (Su et al. 2019; Kumar et al. 2021; Salisu et al. 2021). We further extract useful information on geopolitical risk by constructing the monthly \(GPRS, \Delta GPR, \Delta GPRS\) variables, as mentioned in Sect. 2.2. These variables contribute to the examination of the impact of higher levels and changes in geopolitical risk on EUA futures price volatility.

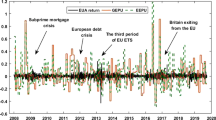

In Fig. 2, when examining the description of EUA futures price and returns, we visually observe significant shifts during the transition periods of EU-ETS phases, particularly between Phase I and Phase II, as well as between Phase III and Phase IV. While the GPR index fluctuates due to varying realisations and expectations of geopolitical events or threats (Caldara and Iacoviello 2022), it also exhibits differences across these phases.

EUA futures price, return and GPR-related indices for the full-sample periods. Note aIn the third plot, the blue solid line higher than the lower horizontal red dash line refers to the trend of the GPRS variable. The lower horizontal red dash line is named \(\upgamma\) and its value is 91.88. This threshold value equals 50% of the GPR sample. And the yellow solid line higher than the upper red dash line is the trend of the \(\Delta {\text{GPRS}}\) variable which is higher than 0

For example, GPR indices are notably higher during Phase III compared to Phase II and Phase IV. This might be attributed to the increased occurrence of geopolitical events and threats in Phase III, such as the Paris Terrorist Attacks in 2015, Syria Missile Strikes in 2018 and Iran Tension Escalation in 2020. Phase II appears relatively stable compared to Phase I and Phase III. Additionally, Phase I and Phase IV are characterised by shorter durations, with Phase I experiencing a price drop to near zero towards its end, potentially leading to spurious regression results. Thus, we conduct the GARCH-MIDAS model regression using data from the full sample (excluding Phase I) as the primary test and independently forecast data series for Phase II and Phase III.

The second panel in Fig. 2 represents the EUA futures returns, and the third panel includes a dual Y axis, with GPR represented on the left Y axis and \(\Delta GPR\) on the right Y axis. It can be seen that geopolitical risk index and its change series exhibit similar trends, with higher levels of geopolitical risk corresponding to similar trends.

The summary statistics of the related variables are presented in Table 2. We observe that the mean of the EUA futures return is 0.02%, and the difference between the minimum and maximum values of EUA futures prices reaches up to 39.64% when calculated as log returns. The EUA futures return is stationary as the p-value of the Augmented Dickey-Fuller (ADF) test is lower than 0.01 for all phases. It is clear that EUA futures return in the full sample; furthermore, in Phase II and Phase III. they are leptokurtic with thick tails. The Jarque–Bera test indicates that the examined variables are not normally distributed. Additionally, the results of ARCH test are significant. These results show that the all variables are suitable for estimating the GARCH-MIDAS model.

4 Estimation and forecasting

4.1 Estimation results

In the full-sample period, we estimate the benchmark model and extended GARCH-MIDAS models. Table 3 shows the full-sample estimated results of the seven aforementioned models.

We established restricted weighting schemes with \({\omega }_{11}=1, {\omega }_{21}=1\), as previously mentioned, to reduce noisy information. The results of \({\omega }_{12}\) and \({\omega }_{22}\) are regressed without error and presented in Table 3. The lag length K of realised volatility and geopolitical risk series variables is 22, as the full-sample period is short and the corresponding BIC values obtained from the estimation are minimal. The weighting schemes \({\varphi }_{k}\) for each model are presented in Fig. 3. It is evident that the influence of almost all variables on the long-term component volatility of EUA futures is declining to zero, indicating that all variables used have suitable weight to help explain the long-term component of the daily volatility of the EUA futures. Furthermore, Fig. 3 shows that the \({\varphi }_{k}\) of extended models with geopolitical risk are larger than the benchmark model, which is approximately 0.04. This suggests that geopolitical risk information can explain EUA futures volatility.

Table 3 also shows that \(\alpha ,\upbeta ,\upgamma , {\theta }_{1}, and {\omega }_{12}\) are almost all significant at the 1% level. In addition, it is noticeable that the sum of \(\alpha ,\mathrm{ \beta and \gamma }/2\) in various estimation results are less than but close to 1, indicating that all models are stable. Moreover, all models are also asymmetric during different market conditions, as evidenced by the significance of the \(\upgamma\) coefficients in all models. The significant values of \({\theta }_{1} and {\theta }_{2}\) indicate that the lags of realised volatility of EUA futures prices and series variables of geopolitical risk impact the long-term component of EUA futures price volatility.

It Is worth noting that the coefficient values of \({\theta }_{2}\), as extensions of GARCH-MIDAS models with GPRT, \(GPRS\mathrm{ and }\Delta GPRS\), are 0.06, 0.03 and 0.715, implying that these variables significantly contribute to long-term carbon emission market volatility. Particularly, significant changes in both threats and the realisation of adverse events can induce long-term volatility in carbon futures. This may be attributed to substantial shifts in geopolitical risk prompting investors and markets to consider greater uncertainty in their investment decisions, while historical geopolitical threats and realisations may be overlooked. The value of \(VR\) indicates the percentage of long-run volatility to total volatility, and Table 3 shows that the benchmark model has the largest \(VR\) value, indicating that historical risk in EUA futures plays an important role in explaining future risk. Although \(VR\) values decrease when exogenous risk variables are added, it indicates that long-term volatility could be accurately explained within specific weighting schemes.

We could conclude that geopolitical risk contains valuable information for explaining daily EUA futures volatility. The estimation results reveal that threats and significant shifts in geopolitical risk can influence the decisions of participants in the carbon emission market, including investors, speculators and producers, as they hold distinct expectations regarding carbon market price returns under geopolitical risk.

4.2 Forecast evaluation

In this section, we evaluate the recursive out-of-sample forecasting performance of various models. First, we estimate a one-forward rolling sample dataset with a fixed window size, covering 95% of the corresponding full-sample size. This involves removing the initial calculation data to ensure non-overlapping, constant estimation results. Second, we use the estimation results of each model to predict multi-period forwards, such as 1-day, 1-week and 1-month lengths. Since EU-ETS trading conditions change with the transformation of Phases every few years, there is no need to predict EUA futures volatility beyond a yearly frequency. Hence, it is plausible and reliable to select a forecast length of 1-day as the primary test, with 5-days and 22-days as robustness tests. Third, when comparing the forecasted volatilities of benchmark models and the extended models with GPR-related variables to daily EUA futures realised volatility, we observe similar results. This indicates that that the forecasting models perform well. Loss functions like HMAE and HMSE are widely used to calculate the loss value of volatility (Hansen et al. 2011; Segnon et al. 2017; Ghysels et al. 2019). Smaller loss values indicate better model performance. However, comparing absolute loss values can be limited by differences in data samples and time periods. Therefore, we further utilise the MCS method to assess the predictability of various models.

Table 4 presents the MCS test results for the extended GARCH-MIDAS models, incorporating various GPR variables to assess 1-day out-of-sample forecasting performance. In the full-sample panel, it’s evident that the extended GARCH-MIDAS model with \(GPRT\) performs the best among the models, with the largest p-value equal to 1. All geopolitical risk variables perform well in forecasting volatility when the p-value calculated by HMSE and HMAE methods almost exceed 0.25. This indicates that the threats or future risk of adverse events provides basic information for other related geopolitical risk factors and could significantly improve the forecasting performance of EUA futures volatility. This suggests that investors and government managers in the carbon allowances market should consider the threats of geopolitical risk in portfolio and risk management. However, the realisation and escalation of historical geopolitical risks may have been overlooked, as indicated by the large MCS value of these variables. Serious geopolitical risks and unexpectedly severe growth rates of geopolitical threats and events might prompt investors to change portfolios without additional risk information. Still, they are more likely to manage portfolios and hedge risk effectively if they have information about the threats posed by geopolitical risks.

When given information of certain Phases of EU-ETS, investors tend to price carbon futures with consideration of threats of geopolitical risk while sometimes ignoring serious geopolitical risks or their dramatic growth. Investors could manage risk more effectively if they had information about serious or rapidly escalating geopolitical events, which means that these two variables can forecast carbon futures volatility better than the threats risk.

The second panel in Table 4 shows the MCS results for 1-day out-of-sample data of Phase II. The sample size is the length of Phase II and in-sample size is 95% of the sample in Phase II. Note that the indices of \(GPRS\) and \(\Delta GPRS\) are calculated by choosing \(GPR\mathrm{ and }\Delta GPR\) indices that surpass certain corresponding thresholds of 50% values in the periods of Phase II. From the Phase II panel, we conclude that the RV-\(\Delta GPRS\) performs best among all these models, as analysed previously. The benchmark model and the extended model with \(GPRS\) index have better forecast performance. Contrary to the full-sample period, the geopolitical risk—especially the \(\Delta GPRS\)—has great ability to capture information on carbon market price fluctuations in Phase II. Investors and policymakers in Phase II could expect carbon price volatility because EU-ETS in Phase II reduced the cap on allowances. Thus, the price could indicate more information about the actual demand and supply of carbon emissions allowances than the full-sample period (Hintermann et al. 2016). Thus, serious geopolitical risk and high growth rate of geopolitical risk contain powerful information in forecasting daily EUA futures volatility.

Similarly, in Phase III, the panel in Table 4 indicates that the RV-GPRS model has the largest p-value among other models according to the MCS results for 1-day out-of-sample forecasting performance. Furthermore, GPR and GPRT indexes contain some useful information, while \(\Delta GPRS\) captures less information than the other variables proxying for geopolitical risk in forecasting carbon emission market volatility. Therefore, both significant geopolitical risk and drastic changes in geopolitical risk contain valuable information for forecasting carbon emission market fluctuations, but the impact of this information varies across different phases.

From the forecasting results of different sample periods, we could conclude that the GPRT variable has more powerful information during full-sample period. On the other hand, \(\Delta GPRS\) and \(GPRS\) have more information during Phase II and Phase III than the realised volatility and other variables forecasting EUA futures volatility.

5 Robust analysis

To validate the presented results concerning whether geopolitical threats contain fundamental information for forecasting carbon futures volatility during the full-sample period, we conducted two robustness tests. Firstly, we varied the forecasting window sizes, recognising that different horizons of forecasting may yield inconsistent empirical results (Inoue et al. 2017; Fezzi and Mosetti 2020). Secondly, we assessed the forecasting performance using different lengths of long-term volatility, including double-month and three-month volatility. Additionally, we examined whether different threshold values of variables could impact predictability during different phases by assessing the MCS results with threshold values of 70% and 90%.

5.1 Forecast evaluation at different forecasting horizons

We conducted further tests to assess the forecasting performance using 5-day and 22-day data from the full-sample, Phase II and Phase III periods. Table 5 shows the results. Our full-sample results indicate that threats of adverse events perform the best among all variables, while the benchmark model did not pass the MCS test when the p-value threshold was set at 0.5. The \({\text{RV}}\_\Delta {\text{GPRS}}\) model performs better in short forecasting windows, such as 1-day and 1-week, while the \({\text{RV}}\_{\text{GPRS}}\) model performs better in long forecasting windows, such as 1-month. This data is presented in comparison with the benchmark model as well as other models for Phase II. In general, dramatic changes in risk, which represent relative value, appear to be more robust than serious risk, which refers to the absolute value. In addition, the p-values of the \({\text{RV}}\_\Delta {\text{GPRS}}\) model are larger than the benchmark model, indicating that sudden changes in geopolitical risk contain information for forecasting carbon emission market volatility for Phase III. In summary, these findings confirm the robustness of the results across various forecasting windows for all periods.

5.2 Forecast evaluation for alternative length of long-term volatility

For the full-sample period, we applied different lengths of long-term volatility to test the forecasting performance of threats of geopolitical risk. Table 6 presents the results. The threshold value of \(\Delta GPRS\) for Phase II is converted because \(\Delta GPRS\) has the best forecasting performance, and we change the threshold value of \(GPRS\) for Phase III based on the results of Table 4. \({\text{RV}}\_\Delta {\text{GPRS}}\) model and \({\text{RV}}\_{\text{GPRS}}\) model have the largest p-values in Phase II and Phase III, respectively. Specifically, serious geopolitical risk and drastic changes in geopolitical risk is expected to harm economic certainty and cause carbon emission price uncertainty more than normal geopolitical risk does, as investors and policymakers would consider more severe geopolitical threats and events compared to a normal environment (Bolton and Kacperczyk 2021).

In conclusion, results of robustness tests assure that \({\text{RV}}\_{\text{GPRT}}\) model outperforms the other models for the full-sample period. Furthermore, \({\text{RV}}\_\Delta {\text{GPRS}}\) and \({\text{RV}}\_{\text{GPRS}}\) models perform better for Phase II and Phase III than the other models when forecasting EUA futures volatility. Our conclusions are robust and reliable.

6 Portfolio management

In the last section, we report that the RV-\({\text{GPRT}}\) model performs best for the full-sample period using statistical measures. To supplement our analysis, we move on to the impact on economic value because investors and policymakers show significant interest in economic value of the portfolio investment (Taylor 2014). This section investigates the economic gains of all models for the full-sample period and answers two questions: whether \(GPR\) series indicators help gain economic benefits and whether the threat of adverse geopolitical events provides the best economic advantages.

Carbon is a good hedge against higher-order moments risk at short-run timescales (Bolton and Kacperczyk 2021). Here, we construct a portfolio containing two assets: one is EUA futures performed as risky asset, the other is three-month treasury bill in the US marketFootnote 7 known as risk-free assets (van Binsbergen et al. 2022). The weights of futures in this portfolio can be set as:

where \(\gamma\) refers to the investor’s coefficient of relative risk aversion, \({\widehat{r}}_{t+1}\) represents the forecast for the excess return obtained by subtracting risk-free return from futures return and \({{\widehat{\sigma }}^{2}}_{t+1}\) is the estimated variance of a single time-series variable which is the expected excess return. The value of estimated \({w}_{t}\) is set between the number of 0 and 1 to fit most of the risk-neutral or even risk-averse investors. We set the weight = 0 if the calculated weight is lower than 0 and set weight = 1 if the calculated weight exceeded 1. When the investor allocates assets using the weights we obtained from Eq. (21), they could get an expected return of the portfolio as

where \({\overline{R} }_{p}\) and \({\sigma }_{p}^{2}\) are the out-of-sample mean and variance of the portfolio return. The CER value indicates that investors would like to pay for a monthly percentage of the portfolio management cost. However, Eq. (21) does not consider the margin level that investors need to pay a little part of with respect to the total trading values as futures margin (Longin 1999). So, we set \(\theta\) as the leverage ratio (Zhang et al. 2018), with \({r}^{f}\) being risk-free interest rate. Then, the return and variance of the portfolio are written as:

where \({\sigma }^{2}\) is the variance of excess return. To get the maximal expected utility, we could calculate the new weights of the portfolio as Eq. (25) (Zhang et al. 2018).

Here, we assume the margin level named \(\uptheta\) is 6% and 8%, respectively. We also consider the investors’ coefficient of risk aversion as 3 and 7, which is similar to what Liu et al. (2019) considered. Table 7 represents the robust results of out-of-sample economic values with different leverage levels and risk aversion coefficients. It is noted that the values of CER of the benchmark model is 0.129 and 0.056 with different risk aversion effect. It is reasonable to expect that the values of volatility and economic gain with higher leverage and lower risk aversion would be larger than the values with contrary consequences. Table 7 shows that the values remain almost unchanged because of the limited amount of monthly data available after forecasting. The same is true for Sharpe ratio results.

Investors obtain positive returns by investing in a portfolio that consists of only EUA futures and three-month treasury bills, with both weights ranging from 0 to 1. Referring to the results in Table 7, we observe that the CER values for all models are positive. Notably, the \({\text{RV}}\_{\text{GPRT}}\) model could obtain the largest value, which is 0.134 or 0.058 among other models. This implies that the extended models with GPR series variables, especially the model with the threats of geopolitical events variable, could reduce the loss when compared with the benchmark model.

Furthermore, based on the results of the volatility column for different leverage levels, we know that the portfolios forecasted by the extended GARCH-MIDAS models exhibit more stable trends than the portfolio forecasted by the benchmark model. In addition, the portfolio forecasted by the \(RV\_GPRT\) model has the most stable trends among all portfolios forecasted by the other models. Finally, the columns displaying the Sharpe ratio (SP) show the \({\text{RV}}\_{\text{GPRT}}\) model also has the second highest SP ratio, with the exception of the \({\text{RV}}\_{\text{GPRA}}\) model, both in different leverage levels and different coefficients of risk aversion. A higher SP ratio signifies greater risk-taking of portfolio (Ledoit and Wolf 2008). Therefore, the results of the economic value test align with the statistical findings, suggesting that drastic changes in geopolitical risk provide more valuable information than the other models, especially the benchmark model, in forecasting daily EUA futures volatility.

7 Conclusions

This paper investigated the role of various information on geopolitical risk in explaining and forecasting the volatility of carbon futures prices from statistical and economic perspectives. First, geopolitical risk information is represented by geopolitical risk, the occurrence of adverse geopolitical events, severe geopolitical risk, the growth rate of geopolitical risk and significant changes in geopolitical risk, proxied by \(GPR, GPRT, GPRA, GPRS, \Delta GPR\mathrm{ and }\Delta GPRS\). We then estimate and forecast both the benchmark model and comparable models using the GARCH-MIDAS model. The results indicate that geopolitical risk, particularly threats of geopolitical risk, provides valuable information for interpreting and forecasting EUA futures volatility during the full-sample period. In particular, we further examine whether the threat-related geopolitical information is essential during Phase II and Phase III sub-sample periods. We find that \(\Delta GPRS\) and \(GPRS\) exert the strongest effects on future EUA futures volatility for Phase II and Phase III, respectively. Moreover, the robustness test is examined by changing the length of forecast days and long-term volatility or the threshold values of \(GPRS \mathrm{or }\Delta GPRS\). The conclusions are confirmed to be robust. Finally, the economic value test results align with the statistical test findings for the full-sample period; the extended GARCH-MIDAS model with \(GPRT\) index yields higher economic gains than the other models. These findings underscore the significant effect of \(GPRT\) on EUA futures volatility. The study emphasises that investors and policymakers should prioritise the importance of geopolitical risk threats in risk and portfolio management within the carbon emission market.

Data availability

The datasets generated during and/or analyzed during the current study are available from the corresponding author upon reasonable request.

Notes

We can find the data at https://www.ice.com/products/18709519/EUA-Daily-Future.

EU-ETS has four phases. Phase I ranges from 2005 to 2007, Phase II ranges from 2008 to 2012, Phase III ranges from 2013 to 2020 and Phase IV ranges from 2021 to 2030.

Details can be found at https://www.matteoiacoviello.com/gpr_files/gpr_methodology.htm.

We can find related information at https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets_en.

GPR index can be downloaded from https://www.matteoiacoviello.com/gpr.htm.

We can find the secondary market rate of the three-month treasury bill titled TB3MS at this link: https://fred.stlouisfed.org/series/TB3MS.

References

Akbas F, Jiang C, Koch PD (2020) Insider investment horizon. J Finance 75:1579–1627. https://doi.org/10.1111/jofi.12878

Amendola A, Braione M, Candila V, Storti G (2020) A model confidence set approach to the combination of multivariate volatility forecasts. Int J Forecast 36:873–891. https://doi.org/10.1016/j.ijforecast.2019.10.001

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty*. Q J Econ 131:1593–1636. https://doi.org/10.1093/qje/qjw024

Batten JA, Maddox GE, Young MR (2021) Does weather, or energy prices, affect carbon prices? Energy Econ 96:105016. https://doi.org/10.1016/j.eneco.2020.105016

Baur DG, Smales LA (2020) Hedging geopolitical risk with precious metals. J Bank Finance 117:105823. https://doi.org/10.1016/j.jbankfin.2020.105823

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77:623–685. https://doi.org/10.3982/ECTA6248

Bolton P, Kacperczyk M (2021) Do investors care about carbon risk? J Financ Econ 142:517–549. https://doi.org/10.1016/j.jfineco.2021.05.008

Brandt MW, Gao L (2019) Macro fundamentals or geopolitical events? A textual analysis of news events for crude oil. J Empir Finance 51:64–94. https://doi.org/10.1016/j.jempfin.2019.01.007

Byun SJ, Cho H (2013) Forecasting carbon futures volatility using GARCH models with energy volatilities. Energy Econ 40:207–221. https://doi.org/10.1016/j.eneco.2013.06.017

Caldara D, Iacoviello M (2018) Measuring geopolitical risk. Int. Finance Discuss. Pap. https://doi.org/10.17016/IFDP.2018.1222

Caldara D, Iacoviello M (2022) Measuring geopolitical risk. Am Econ Rev 112:1194–1225. https://doi.org/10.1257/aer.20191823

Carney M (2016) Uncertainty, the economy and policy. Bank Engl. 16

Conrad C, Kleen O (2020) Two are better than one: Volatility forecasting using multiplicative component GARCH-MIDAS models. J Appl Econom 35:19–45. https://doi.org/10.1002/jae.2742

Dai X, Xiao L, Wang Q, Dhesi G (2021) Multiscale interplay of higher-order moments between the carbon and energy markets during phase III of the EU ETS. Energy Policy 156:112428. https://doi.org/10.1016/j.enpol.2021.112428

Engle RF, Rangel JG (2008) The spline-GARCH model for low-frequency volatility and its global macroeconomic causes. Rev Financ Stud 21:1187–1222. https://doi.org/10.1093/rfs/hhn004

Engle RF, Ghysels E, Sohn B (2013) Stock market volatility and macroeconomic fundamentals. Rev Econ Stat 95:776–797. https://doi.org/10.1162/REST_a_00300

Fang T, Lee T-H, Su Z (2020) Predicting the long-term stock market volatility: a GARCH-MIDAS model with variable selection. J Empir Finance 58:36–49. https://doi.org/10.1016/j.jempfin.2020.05.007

Fezzi C, Mosetti L (2020) Size matters: estimation sample length and electricity price forecasting accuracy. Energy J. https://doi.org/10.5547/01956574.41.4.cfez

Ghysels E, Santa-Clara P, Valkanov R (2006) Predicting volatility: getting the most out of return data sampled at different frequencies. J Econom 131:59–95. https://doi.org/10.1016/j.jeconom.2005.01.004

Ghysels E, Plazzi A, Valkanov R, Rubia A, Dossani A (2019) Direct versus iterated multiperiod volatility forecasts. Annu Rev Financ Econ 11:173–195. https://doi.org/10.1146/annurev-financial-110217-022808

Ghysels E, Santa-Clara P, Valkanov R (2004) The MIDAS touch: mixed data sampling regression models

Gong X, Xu J (2022) Geopolitical risk and dynamic connectedness between commodity markets. Energy Econ 110:106028. https://doi.org/10.1016/j.eneco.2022.106028

Guo X, Huang Y, Liang C, Umar M (2022) Forecasting volatility of EUA futures: new evidence. Energy Econ. https://doi.org/10.1016/j.eneco.2022.106021

Hansen PR, Lunde A, Nason JM (2011) The model confidence set. Econometrica 79:453–497. https://doi.org/10.3982/ECTA5771

Hintermann B, Peterson S, Rickels W (2016) Price and market Behavior in Phase II of the EU ETS: a review of the literature. Rev Environ Econ Policy 10:108–128. https://doi.org/10.1093/reep/rev015

Huang Y, Dai X, Wang Q, Zhou D (2021) A hybrid model for carbon price forecasting using GARCH and long short-term memory network. Appl Energy 285:116485. https://doi.org/10.1016/j.apenergy.2021.116485

Huang W, Wang H, Qin H, Wei Y, Chevallier J (2022) Convolutional neural network forecasting of European Union allowances futures using a novel unconstrained transformation method. Energy Econ 110:106049. https://doi.org/10.1016/j.eneco.2022.106049

Inoue A, Jin L, Rossi B (2017) Rolling window selection for out-of-sample forecasting with time-varying parameters. J Econom 196:55–67. https://doi.org/10.1016/j.jeconom.2016.03.006

Ivanovski K, Hailemariam A (2022) Time-varying geopolitical risk and oil prices. Int Rev Econ Finance 77:206–221. https://doi.org/10.1016/j.iref.2021.10.001

Jurado K, Ludvigson SC, Ng S (2015) Measuring uncertainty. Am Econ Rev 105:1177–1216. https://doi.org/10.1257/aer.20131193

Kumar S, Khalfaoui R, Tiwari AK (2021) Does geopolitical risk improve the directional predictability from oil to stock returns? Evidence from oil-exporting and oil-importing countries. Resour Policy 74:102253. https://doi.org/10.1016/j.resourpol.2021.102253

Ledoit O, Wolf M (2008) Robust performance hypothesis testing with the Sharpe ratio. J Empir Finance 15:850–859. https://doi.org/10.1016/j.jempfin.2008.03.002

Liu X, An H, Wang L, Jia X (2017) An integrated approach to optimize moving average rules in the EUA futures market based on particle swarm optimization and genetic algorithms. Appl Energy 185:1778–1787. https://doi.org/10.1016/j.apenergy.2016.01.045

Liu J, Ma F, Tang Y, Zhang Y (2019) Geopolitical risk and oil volatility: a new insight. Energy Econ 84:104548. https://doi.org/10.1016/j.eneco.2019.104548

Liu J, Zhang Z, Yan L, Wen F (2021) Forecasting the volatility of EUA futures with economic policy uncertainty using the GARCH-MIDAS model. Financ Innov 7:76. https://doi.org/10.1186/s40854-021-00292-8

Longin FM (1999) Optimal margin level in futures markets: Extreme price movements. J Futur Mark 19:127–152. https://doi.org/10.1002/(SICI)1096-9934(199904)19:2%3c127::AID-FUT1%3e3.0.CO;2-M

Lu H, Gao Q, Li MC (2022) Does economic policy uncertainty outperform macroeconomic factor and financial market uncertainty in forecasting carbon emission price volatility? Appl. Econ, Evidence from China. https://doi.org/10.1080/00036846.2022.2156470

Salisu AA, Pierdzioch C, Gupta R (2021) Geopolitical risk and forecastability of tail risk in the oil market: evidence from over a century of monthly data. Energy 235:121333. https://doi.org/10.1016/j.energy.2021.121333

Samuels JD, Sekkel RM (2017) Model confidence sets and forecast combination. Int J Forecast 33:48–60. https://doi.org/10.1016/j.ijforecast.2016.07.004

Segnon M, Lux T, Gupta R (2017) Modeling and forecasting the volatility of carbon dioxide emission allowance prices: a review and comparison of modern volatility models. Renew Sustain Energy Rev 69:692–704. https://doi.org/10.1016/j.rser.2016.11.060

Su C-W, Khan K, Tao R, Nicoleta-Claudia M (2019) Does geopolitical risk strengthen or depress oil prices and financial liquidity? Evidence Saudi Arabia Energy 187:116003. https://doi.org/10.1016/j.energy.2019.116003

Tan X-P, Wang X-Y (2017) Dependence changes between the carbon price and its fundamentals: a quantile regression approach. Appl Energy 190:306–325. https://doi.org/10.1016/j.apenergy.2016.12.116

Taylor N (2014) The economic value of volatility forecasts: a conditional approach. J Financ Econom 12:433–478. https://doi.org/10.1093/jjfinec/nbt021

van Binsbergen JH, Diamond WF, Grotteria M (2022) Risk-free interest rates. J Financ Econ 143:1–29. https://doi.org/10.1016/j.jfineco.2021.06.012

Van den Bremer TS, Van der Ploeg F (2021) The risk-adjusted carbon price. Am Econ Rev 111:2782–2810. https://doi.org/10.1257/aer.20180517

Wang K-H, Su C-W, Umar M (2021) Geopolitical risk and crude oil security: a Chinese perspective. Energy 219:119555. https://doi.org/10.1016/j.energy.2020.119555

Zhang Y, Ma F, Shi B, Huang D (2018) Forecasting the prices of crude oil: an iterated combination approach. Energy Econ 70:472–483. https://doi.org/10.1016/j.eneco.2018.01.027

Acknowledgements

Rita D'Ecclesia was the editor for this article. We thank the editor and two anonymous referees for constructive suggestions.

Funding

The research leading to these results received funding from the National Social Science Fund of China (23BGL224) and from the Jiangsu Office of Philosophy and Social Science (2022SJZD049). This work was partially funded by European Union—Next generation EU and Romanian Government, under National Recovery and Resilience Plan for Romania, contract no.760050/ 23.05.2023, cod PNRR-C9-I8-CF 267/ 29.11.2022, and contract no.760034/ 23.05.2023, cod PNRR-C9-I8-CF 255/ 29.11.2022, through the Romanian Ministry of Research, Innovation and Digitalization, within Component 9, Investment I8. The authors have no relevant financial or non-financial interests to disclose.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lu, H., Gao, Q., Xiao, L. et al. Forecasting EUA futures volatility with geopolitical risk: evidence from GARCH-MIDAS models. Rev Manag Sci 18, 1917–1943 (2024). https://doi.org/10.1007/s11846-023-00722-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-023-00722-0