Abstract

This paper proposes a conceptual framework to determine a greenwashing indicator on firm level, based on five pillars of information that capture the key drivers of greenwashing: soft ESG data, textual self-representation, green marketing expenses, green virtue for the apparent green performance, and hard ESG data as a measure of the real green performance. The proposed framework is built on a literature review of greenwashing typology and drivers and can be applied to a broad set of firms at the same time, while most existing approaches are built on a detailed investigation of individual cases. The greenwashing indicator in our framework is based on the difference between real and apparent green performance. This approach allows the implicit calculation of the real green performance using the concept of a firm misconduct factor that helps to identify the greenwashing indicator without knowledge of the real (and often hard to measure) green performance of a firm.

Similar content being viewed by others

1 Introduction

In January 2023, Amazon was accused of “greenwashing on a grotesque scale” for failing to take responsibility for the majority of greenhouse gas emissions which it causes as the world’s largest online retailer (Chua 2023). Already two years before this incident, there were allegations of greenwashing after the firm pledged to be carbon neutral by 2040 while continuing to work with oil and gas firms. Amazon was criticized by Greenpeace for not taking enough immediate action to reduce its carbon footprint and for the lack of transparency about its emissions. Since Amazon is one of the most respected firms in the world with thousands of analysts watching it closely, greenwashing activities of Amazon might be relatively easy to be detected. In general, greenwashing accusations on firm level require a deep investigation of the firm behavior and thus are time consuming. Therefore, it is likely that a large number of greenwashing cases remain undetected as there is no framework to calculate a firm-level greenwashing indicator for a large cross-section.

To fill this gap, this paper presents a conceptual framework aiming at measuring greenwashing on firm level which is based on information that can systematically be collected for many firms. The framework is built on theoretical considerations derived from a comprehensive literature review on the drivers of greenwashing. Greenwashing is conceived primarily as a corporate phenomenon which is characterized by the focus on disclosure of information, assumed to be a deliberate strategy which is beneficial for firms and detrimental to society, and related to social and environmental issues (Bowen 2014; Seele and Schultz 2022). The importance of a reliable assessment of greenwashing stems from the fact that accusing firms of greenwashing when their CSR communication is not misleading (so-called false greenwashing) has the same negative effects on legitimacy as greenwashing (Seele and Gatti 2017). Gallicano (2011) highlights this importance at discussing the challenges of appropriate corporate communication using Starbucks as an example. The author emphasizes that since the accusation of greenwashing of a firm has negative implications for the firm independent of the significance of the claims, the accusation by stakeholder should be “fair” in the way that it addresses factual and non-negligible misconduct.

A reliable greenwashing assessment is particularly difficult to find since only a few environmental and social reporting standards for firm disclosure such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) exist. However, their widely voluntary nature and uncertain regulation in general are possible drivers for greenwashing (Laufer 2003; Delmas and Burbano 2011). Moreover, the available assessments for the sustainability performance such as environment, social, and governance (ESG) ratings are widely unaudited, and there exists no global governing body and no specific regulatory guideline to ensure the accuracy of reported ESG data (Khan et al. 2016; Yu et al. 2020). One initiative of the European Commission to prevent greenwashing is the Green Claims Directive (GCD) that requires firms to substantiate environmental claims about products and firm activities in the business-to-consumer communication (European Commission 2023). General environmental claims that cannot be substantiated and whose proof is not on the packaging will be prohibited. However, while this may be a first step to prevent certain forms of greenwashing, there still are many ways in which claimed and actual environmental actions of firms can diverge.

In any case, the (subjective) norms of the accusing party are crucial determinants for the identification of greenwashing. Even if firms comply with the regulatory (or: standard-setting) environment, a greenwashing accusation is possible whenever the accusing party shares a different view on what is green. In such a case, the greenwashing accusation is often also directed to the standard-setting entity, which theoretically adds a fourth level of greenwashing to the current discussion in the greenwashing literature. One example for this level of greenwashing is the current accusation of the EU by NGOs such as Greenpeace regarding the label of green energy production for gas and nuclear power.

Based on this perspective, we propose a conceptual framework for measuring greenwashing on firm level that relies on variables measuring corporate apparent and real green performance along different dimensions of greenness, which correspond to the (subjective) view of the assessing entity. Our approach first measures greenwashing in several dimensions and then aggregates these measures into one indicator.

We propose a procedure to derive the variables from data structured in five pillars of relevant information, i.e., ESG data, textual self-representation, green marketing expenses, and green virtue for calculating the apparent green performance and hard ESG data for calculating the real green performance of a firm. These pillars of information capture the major firm characteristics that existing literature has documented to be crucial drivers of greenwashing (e.g., Bauckloh et al. 2023; Papoutsi and Sodhi 2020; Szabo and Webster 2021). For those cases in which the real green performance is hard to measure in reality, we suggest its estimation using an indicator variable for corporate misconduct. Finally, we determine the greenwashing indicator as the difference between the apparent and the real green performance on the mentioned green aspects.

2 Literature review

The term Greenwashing became popular in the late 1990s, after it has been introduced in the environmental and green marketing discussion (Greer and Bruno 1996). While greenwashing originally was linked to environmental aspects, it is also used in the context of social and economic issues nowadays (Hamann and Kapelus 2004; Lyon and Maxwell 2011). This section summarizes the broad streams of literature on greenwashing.

2.1 Greenwashing typology

Greenwashing is categorized as a type of selective disclosure (Lyon and Maxwell 2011; Marquis et al. 2016; de Freitas Netto et al. 2020), i.e., being rather silent on negative information regarding a firm’s corporate social responsibility and highlighting positive information about it. In particular, Seele and Schultz (2022) summarize five different types of misleading behavior: (i) misleading with words, (ii) misleading with visuals or graphics, (iii) misleading by omission, (iv) misleading with symbolic action, and (v) misleading with covert lobbying. Thus, researchers (e.g., Guo et al. 2018; Siano et al. 2017; Walker and Wan 2012; Pope and Wæraas 2016) consider greenwashing as decoupling behavior in which green talk is not linked to any concrete activities, i.e., as the gap between symbolic and substantive actions. Both, symbolic and substantive actions are legitimacy-seeking responses to institutional pressuresFootnote 1 (Ashforth and Gibbs 1990). While a substantive action “involves real, material change in organizational goals, structures, and processes, or socially institutionalized practices” ( Ashforth and Gibbs 1990, p. 178), a symbolic action implies that “rather than actually change its ways, the organization might simply portray—or symbolically manage—them so as to appear consistent with social values and expectations” ( Ashforth and Gibbs 1990, p. 180). Therefore, several studies link greenwashing behavior to signaling and legitimacy theory (Seele and Gatti 2017). For instance, firms use communication on corporate social performance to ensure legitimacy (e.g., Archel et al. 2009; Deegan 2002; O’Donovan 2002). However, whether this communication is linked to substantive action or is used for greenwashing (symbolic action) is subject of debate (e.g., Haque and Ntim 2018; Kim and Lyon 2015; Laufer 2003; Lyon and Maxwell 2011; Mahoney et al. 2013).

Besides substantive and symbolic actions, materiality regards the relevance of the green activities to address sustainable challenges. In this context, the term “double materiality” emerged and requires disclosure of material sustainability risks that may affect the firm, as well as how the firm is likely to contribute to societal and the environmental risks (Lashitew 2021). New regulation such as the Sustainability Conflict of interest Regulation 2019 and the Taxonomy Regulation 2020 align their framework with the idea of double materiality to avoid greenwashing.Footnote 2

According to de Freitas Netto et al. (2020), greenwashing activities are either “claim” or “executional.” While claim greenwashing relates to the wording used in firm reporting or product description, executional greenwashing uses specific colors or images to induce false perceptions of a firm’s greenness (Parguel et al. 2015). The type of wording of claim greenwashing is categorized in the seven sins of product marketing (TerraChoice 2010). Scanlan (2017) extended the seven sins to thirteen sins of greenwashing. In general, these thirteen sins of greenwashing refer to the fact that the claims a firm makes about its services, products, and production do not fully reflect its actual environmental reality (de Freitas Netto et al. 2020). Such greenwashing activities can be intentional (i.e., the organization applies a conscious deception) or unintentional (e.g., supply chains are less sustainable than the organization assumes them to be) (Szabo and Webster 2021).

The term greenwashing covers a proliferation of different levels. Delmas and Burbano (2011) differentiate between greenwashing on firm level and product or service level. This differentiation is further developed by Torelli et al. (2020) into four notions: Corporate-level greenwashing, strategic-level greenwashing, dark-level greenwashing, and product-level greenwashing. While both categorizations coincide on the product-level greenwashing, firm-level greenwashing is divided in greenwashing of the today’s actual image and reputation (corporate level), misleading communication about the firm’s future strategy (strategic level), and misleading communication to finalized hidden illegal activities (dark level).

2.2 Drivers of greenwashing

From a theoretical perspective, Delmas and Burbano (2011) provide a framework of institutional/external, organizational, and individual drivers of product and corporate greenwashing. In general, only firms with positive communication (in contrast to firms with no communication) of environmental activities have the potential to greenwash (Delmas and Burbano 2011). According to the framework of Delmas and Burbano (2011), the main external drivers are (i) a lax and uncertain regulatory environment (e.g., see Laufer 2003), (ii) activist, NGO, and media pressure (e.g., see Marciniak 2010), and (iii) consumer and investor demands (e.g., see Sheehy 2015) as well as competitive pressures (e.g., see Du 2015).

Organizational driver comprise (i) firm characteristics (e.g., size, industry, see Szabo and Webster 2021), (ii) incentive structure and culture (Hosmer 1987; Wimbush et al. 1997), (iii) effectiveness of intra-firm communication (Delmas and Burbano 2011), and (iv) organizational inertia (Maxwell et al. 1997). Gregory (2021) shows that firms with low stock volatility, high costs of capital, strong pricing power, and high information asymmetry are more likely to apply greenwashing. Organizational drivers that mitigate the occurrence of ESG greenwashing are strong governance (e.g., independent directors) and high institutional ownership (Yu et al. 2020).

The main individual drivers are (i) optimistic bias (Kahneman and Lovallo 1993), (ii) narrow decision framing (Kahneman and Lovallo 1993), and (iii) hyperbolic inter-temporal discounting (Delmas and Burbano 2011). Some research also presents evidence for financial incentives of firms to conduct greenwashing (Li et al. 2023). Therefore, greenwashing could be a signaling technology, as higher levels of corporate social responsibility help firms mitigate a crisis shock in terms of real impacts such as profitability and revenue growth, making these firms better able to adjust their operating margins and have lower risk (Epure 2022). Moreover, highly narcissistic CEOs are likely to disclose more CSR activities in order to play the role of the protagonist who receives validation and applause from the audience (Lassoued and Khanchel 2023).

2.3 Measuring greenwashing

Chen and Chang (2013) suggest an approach to measure greenwashing on product level, green consumer confusion, green perceived risk, and green trust based on survey responses. The greenwashing measure contains five components: (i) the product misleads with words in its environmental features, (ii) the product misleads with visuals or graphics in its environmental features, (iii) the product possesses a green claim that is vague or seemingly unprovable, (iv) the product overstates or exaggerates how its green functionality actually is, and (v) the product leaves out or masks important information, making the green claim sound better than it is (Chen and Chang 2013). de Vries et al. (2015) suggest a specific framework to measure greenwashing on firm level of energy firms based on three questions.Footnote 3 Another approach presented by Bauckloh et al. (2023) measures how consistent a firm’s communication of corporate social responsibility is with its real green performance. The authors consider the joining of a financial institution to a sustainable initiative (the Principles for Responsible Investment) as a signal to the stakeholders that sustainability aspects are taken into account in this financial institution. The seriousness with which the financial institutions implement the sustainability aspects is measured with ESG scores. A firm that participates in the initiative is then expected to show a greater improvement in sustainability performance than a comparable financial institution that has not joined the initiative.

Roulet and Toubo (2015) define greenwashing as the difference between substantive and the symbolic actions of a firm. The authors identify different data points in the Asset4 rating methodology of extra-financial performance as being rather symbolic (e.g., does the firm claim to have a policy for reducing environmental emissions? Does it claim to strive to improve its employee health and safety?) or rather substantive (e.g., amount of \(\mathrm{{CO}}_2\) emissions reduced in the past year, number of injuries and fatalities at work). The final measure of greenwashing is the ratio of symbolic to substantive actions.

In the same vein, Yu et al. (2020) measure greenwashing as the difference of a measure of the quantity of ESG disclosure (Bloomberg ESG disclosure scores) and a measure of the ESG performance (Asset4 ESG scores). The rationale behind this metrics is that firms with a high number of ESG disclosure and a low ESG performance are likely to obscuring weak ESG performance by revealing a large amount of ESG data.

Mateo-Márquez et al. (2022) empirically study the greenwashing activities of firms based on the theoretical framework presented by Delmas and Burbano (2011). Mateo-Márquez et al. (2022) suggest a method to identify greenwashing based on the carbon performance and disclosure of firms. They document that the number of existing regulations related to climate change negatively influences the propensity of firms to engage in greenwashing. Moreover, firms located in countries with stringent climate-related regulations show a lower likelihood to engage in greenwashing practices.

Another empirical study (Marquis et al. 2016) based on a sample of 4750 publicly-listed firms from 45 countries show that environmentally damaging firms less likely apply selective disclosure if they are exposed to strong scrutiny and global norms due to the regulatory environment of the country they operate in. The measure of greenwashing is derived from a variable obtained from Trucost that assesses the selective disclosure magnitude. This variable represents the extent to which firms risk creating a misleading impression of transparency and accountability by disclosing relatively benign environmental metrics rather than those more representative of their overall environmental harm (Marquis et al. 2016).

So far, the literature does not present a widely accepted framework to measure greenwashing. Moreover, approaches based on surveys and case studies are not scalable on a broad sample of firms. Since we are not aware of any general framework to measure greenwashing on firm level, we present a conceptual framework that might help future empirical studies to rely on when measuring greenwashing in the following sections.

2.4 Related terms and phenomena

Before we continue with the conceptual framework, we close the literature section with a classification of several terms related or similar to greenwashing. Moreover, we outline which of these terms could be captured by the conceptual framework presented in our paper after some modifications.

Three notions (bluewashing, pinkwashing, and carbon washing) appear generally similar to greenwashing in the sense of this paper. These terms also exist on firm level, and thus the presented concept of the greenwashing indicator can be applied on these phenomenons. Bluewashing focuses on social instead of green aspects. Some authors even use the term greenwashing for bluewashing. Pinkwashing is a specific kind of bluewashing that focuses on the aspect of LBGTQ rights. Finally, carbon washing describes the specific case of greenwashing in which only the carbon emission dimension is considered.

Remotely related to the ideas presented in this paper is the term impact washing (Diener 2022). This is a phenomenon mostly observed for financial intermediaries or for firms issuing a financial instrument, which is supposed to be an instrument for impact investment. The impact of impact investments is already supposed to be measured in a hard way. Thus, impact washing needs some activity of making a real impact look more substantial than it is. A milder form of impact washing comprises a situation in which some real environmental progress takes place but this would happen anyway, i.e., even without the impact investment instrument at hand. In this case, there is impact but no additionality through the investment. Yu et al. (2020) state that recent voluntary instruments in the area of impact investing are the development of Impact Reporting and Investment Standards (IRIS), a system for assessing the social and environmental impact of firms, and Global Impact Investment Rating System (GIIRS), a fund impact ratings framework. Our framework is not capable to make assessments about the impact of an investment instrument.

3 The levels of greenwashing

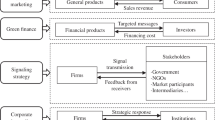

In light of the different streams of literature, we propose a four-level perspective to describe the different contexts in which greenwashing can occur. Our approach aims at generalizing several of the definitions and taxonomies in the literature. Figure 1 illustrates the different levels of greenwashing. The conceptual framework we present later in the paper is to identify greenwashing on firm level.

This figure shows the four greenwashing levels and the greenwashing assessment. The dashed arrows display the screening along the norms used by the entity that assesses greenwashing. The dotted arrows display potential channels through which greenwashing on firm level possibly can be transferred to the product/service and the financial-intermediary level

The entity of the left-hand side in Fig. 1 is the greenwashing assessing entity, i.e., an NGO or a court that assesses possible greenwashing of a particular entity (right-hand side entity) based on particular normative basis. The dashed arrows represent this evaluation process. In this consideration, different levels of entities could be accused of greenwashing. First, in a given economic context there is usually a standard-setting environment which defines the notion of a green activity or technology (such as the EU Sustainable Finance Taxonomy). It is conceivable that the standards as such and the entity defining these standards (illustrated by the circle in Fig. 1) are accused of greenwashing, which we identify as a level of greenwashing on its own. One reason for such accusations are weak standards as a result of lobbying activities of corporations (e.g., see Lyon and Montgomery 2015). An example for this level of greenwashing are the allegations of Greenpeace against the EU for the inclusion of natural gas and nuclear power in the Sustainable Finance Taxonomy, which classifies these power technologies as being sustainable energy sources (Smith 2022). More generally, such type of greenwashing takes place when a technology or corporate behavior is basically classified as green, although according to the view of the assessing entity this is not the case. This type of greenwashing is difficult to define in an objective manner, because the entity that assesses greenwashing must itself form a concept of greenness, and this may then have to take precedence over that of the standard-setting authority. A technology such as nuclear power, which does not emit carbon dioxide, may well be considered green from a pure carbon emissions viewpoint (EU perspective), but it does not have to be if one focuses more on the long-radiating wastes (Greenpeace perspective). Independent of the fact whether the above mentioned classification is correct, political decisions influencing the standard-setting environment may produce the possibility of normative clashes that influence the greenness behavior of firms and financial intermediaries they operate in.

Second, besides the standard-setting environment level of greenwashing, Fig. 1 highlights the greenwashing on (i) product/service level, (ii) firm level, and (iii) financial-intermediary level. Under normal conditions, one would assume that products, firms, and financial intermediaries that adhere to the norms defined by the standard-setting environment are not under suspicion of greenwashing.

The product/service level of greenwashing has a long tradition and has extensively been discussed in the literature (e.g., Delmas and Burbano 2011; Torelli et al. 2020). As mentioned above, on this level a specific product or service is marketed by the firm as green, while in reality the product is less green as claimed. Examples range from food products that are wrongly presented as being organic and healthy to claims that a certain amount of the used materials comes from recycled end-of-life products, while the real figures are lower. Whereas in the first example all assigned attributes represent unprotected terms and are, therefore, only non-binding advertising terms, the misleading claim in the second example is easier to measure. The above-mentioned seven (or even thirteen) sins of greenwashing are one framework to assess greenwashing on product/service level, as these sins describe the specific ways, through which a product can be greenwashed. It should be noted that due to deviations in the greenness notion of the standard-setting environment and the assessing entity, it is possible that greenwashing on the product/service level appears although the products and services under accusation are in line with the standards set by the environment. Clearly, this is not supposed to be the major case, albeit conceivable.

Next, we discuss greenwashing on firm level. This type of greenwashing comprises the corporate-level, the strategic-level, and the dark-level greenwashing according to Torelli et al. (2020), which we do not distinguish as separate cases in our measurement. The reason for this is that firm-level greenwashing is defined as the discrepancy between a firm’s green appearance and its actual green performance. For instance, a firm might claim to be on its way to net-zero carbon emissions in its production process, while the actual strategy to reach this goal does not include a material reduction of carbon emission but the purchase of carbon offsets from (questionable) issuers. Another example of firm-level greenwashing is the overemphasis of the membership in a sustainable initiative that really exists but touches on a topic that is material only for a small part of a firm’s activities. Moreover, a systematic, firm-wide greenwashing of product-related aspects (such as the claim that packaging is made of a high percentage of recycled material for most of the firm’s products) is connected with greenwashing on firm level. Such cases are represented by the dotted arrow in Fig. 1 between product/service and firm level. A real-world example for such a spill-over is the Conscious Choice line of H &M (Kaner 2021), which clearly implies greenwashing on the firm and the product level. Note that these cases are possible but not necessary, i.e., firms can greenwash without offering greenwashed products and some mildly greenwashed products will not in any case represent clear greenwashing on firm level.

Moreover, adhering to the clash-of-norms statement from above, it is imaginable that a firm is totally aligned with the standards set by the environment and still it is accused of greenwashing if there is such a conflict of standards.Footnote 4 Most cases of firm-level greenwashing are, however, not of this nature.

Finally, the financial-intermediary level plays an important role for the capital allocation in an economy (Kaustia and Yu 2021). Greenwashing on this level is defined by offering a financial product such as a sustainable investment fund that in reality is not as sustainable as claimed. While one might want to argue that this type of greenwashing is simply product level greenwashing, there are arguments against this view. Greenwashing of financial intermediaries can be defined as a level of its own, as greenwashing on this level does not only have a possible impact on the legitimacy of the financial institution but also spillover effects on investment targets. Thus, mis-allocation of invested capital due to greenwashing can have negative spillover effects on sustainable agendas of investors. A substantial recent example for this level of greenwashing is the DWS ESG scandal. In 2020, the asset manager DWS claimed a large part of their assets under management would be invested in a responsible way. Actually, as was revealed by a whistle blower, this was an exaggeration, since for many of the funds the ESG criteria were not really rigidly applied. The negative spillover effects for the sustainable agendas of investors are (i) choosing DWS as the asset manager due to claimed sustainability reasons and (ii) having the capital allocated in assets that due to DWS marketing appear to be sustainable but actually are not. Obviously, the DWS case is a case of intentional greenwashing. The idea of this type of greenwashing focuses more on financial products than on the firms behind them.

A conceivable case of unintentional financial-intermediary level greenwashing would be an ESG fund that invests exclusively in firms with high ESG scores, and the high ESG scores of some firms are the result of fraudulent behavior of the respective firm, i.e., of greenwashing on firm level. This type of greenwashing transfer is represented by the corresponding dotted arrow in Fig. 1 from the firm level to the financial intermediary level. Additionally, the greenwashing through “false” standards set by the environment can theoretically also apply on this level.

Although different levels of greenwashing have been identified in earlier studies and this paper, the occurrence of greenwashing on each level is related to corporate misconduct in general. Therefore, the conceptional framework we present in the next section of this paper is general enough to be considered as a global approach to track greenwashing on all levels. Nevertheless, we focus on the firm level and rely our measure also on variables of service/product level that might be relevant for only one specific small aspect of the entire firm’s sustainability communication.

4 Greenwashing indicator on firm level

Based on the earlier described normative basis for greenness measurement, we build a framework for creating a greenwashing indicator on firm level in this section. While measuring greenwashing on product/service level is more accessible and broadly discussed, there is no comprehensive framework to measure greenwashing on firm level. Moreover, the case study-based approach of how product/service-level greenwashing is currently detected, is not feasible on a large set of firms as firms usually have many products. Nevertheless, as opposed to product level, firms constitute an entity that is easily observable on the broad level, i.e., for overviewing greenwashing activities worldwide. Therefore, both firms (particularly firm behavior) and the normative basis for the notion of greenness are central to the greenwashing phenomenon on all four levels.

Our approach does not distinguish between intentional and unintentional greenwashing since the aim of the framework is to monitor whether the phenomenon takes place in a firm and then enable decision-makers to draw respective consequences (e.g., divestment). Another necessary prerequisite for the measurement of greenness on firm level is a normative basis, i.e., a notion what is conceived as green corporate behavior or technology. This normative basis may be in line with or deviate from the standard-setting environment of Fig. 1. Examples for such a normative basis are the six dimensions of the EU Sustainable Finance Taxonomy and the three dimensions “resource use,” “emissions,” and “product innovation,” which could be employed by an ESG rating provider to measure the E dimension.

The presented framework requires clear evidence for specific misaligned or deceptive behavior of a firm. Thus, undetected greenwashing cannot be measured in the first place. All measured greenwashing, however, relates to disclosed greenwashing. Nevertheless, greenwashing can also exist without being detected. The identification of undetected greenwashing cases usually requires deep investigation inside a firm to elicit if there are any non-negligible deviations from the officially announced environmental efforts. If someone were to do this, for example an NGO or an investigative journalist, there would usually be a public disclosure of the process and we can only speak of greenwashing as a fact (not as a suspicion) if it is a matter of disclosed greenwashing. Nevertheless, once the greenwashing indicator is determined, it could be calculated also for firms without a greenwashing assessment and therefore help to identify undetected greenwashing.

The basic idea of our greenwashing indicator follows the framework of Delmas and Burbano (2011), in which a “greenwashing firm engages in two behaviors simultaneously: poor environmental performance and positive communication about its environmental performance.” Thus, in the center of the measurement of greenwashing on firm level is the comparison between the apparent green performance and the real green performance. We assume the existence of J dimensions of greenness as elements of the chosen normative basis, which are explicitly considered in the greenwashing measurement. For instance, one dimension of greenness is (disclosure of net) greenhouse gas emissions. The differentiation into J dimensions is necessary to measure greenwashing with respect to certain dimensions and not just over one aggregated greenness (otherwise positive and negative aspects could compensate each other). Additionally, clearly not every piece of information is accounted for in each of the dimensions. As an example, consider a firm that makes a statement about its low nitrogen oxides emission figures. Obviously, this firm adheres to the idea that this type of pollution caused by a firm is a relevant green matter. However, in the end this statement is evaluated along the norms applied by the assessing entity. For instance, in an environment in which only greenhouse gas emissions matter, greenwashing is supposed to be measured only with respect to climate action. In this environment, there will be no greenwashing value for this firm regardless whether the claimed nitrogen oxides emissions are correct or not. Please note that this is just one theoretical example to illustrate the principle.

Without loss of generality, we assume all of the indicator variables presented in the following to be standardized to a range between 0 and 1. In this context, it may be appropriate to apply a different measurement (and standardization) for the indicator variables for different industry sectors depending on the corresponding differences in materiality.

4.1 Apparent and real green performance

This subsection details on the areas of variables we derived from literature to measure the apparent and the real green performance of a firm. In general, our conceptual framework suggests that greenwashing on firm level exists when the apparent green performance is higher than the real green performance. The basic idea is to consider various dimensions in which the difference between the apparent and the real green performance should be measured. This measurement in each dimension is based on different aspects, which we refer to as pillars of information. An example for such a dimension could be greenhouse gas emissions. While the real green performance of greenhouse gas emissions could be measured by one number (for instance, emitted tons of \(\mathrm{{CO}}_2\) equivalents), the apparent green performance could be influenced by different pillars of information. One pillar of information could comprise information on a strategy to reduce emissions, another pillar of information could consider memberships in initiatives in which members claim to share the objective to manage emissions. Figure 2 illustrates the concept of pillars of information, dimensions of greenness, and the variables of apparent and real green performance. With \(ap^{(1) },\dots ,ap^{(J)}\) we denote the apparent green performance in each of the J dimensions and with \(rp^{(1) },\dots ,rp^{(J)}\) the real green performance in each dimension. In the following, we explain the pillars of information we derived from the literature in more detail.

We measure the apparent green performance of a firm by using variables that provide information about firms’ communication of their green performance from different pillars of information. In the optimal case, we have variables from the following pillars of information (for each firm and each year) at hand to measure the apparent green performance:

-

ESG data (soft): Several ESG rating agencies provide, besides the aggregated ESG scores, also underlying data on a more granular level, e.g., some information on the data items the E score is assembled from. An approach that considers granular level ESG data is in line with the findings that aggregated ESG assessments are useless when it comes to predicting corporate scandals (Utz 2019). Examples are an indicator of whether there exists a sustainability board or whether there is a process in the firm aimed at reducing the impact on biodiversity. Many of such data items can usually be collected. It is clear that for several industries the expectations regarding the norms have to be adapted to the type of industry, since, for instance, an IT service provider has other magnitudes of emissions as a chemical corporation. Those data items that are directly reported or disclosed by the firm, such as the existence of a sustainability board, add to the apparent green performance (Eccles et al. 2020). Roulet and Toubo (2015) call this type of information “symbolic.” We select those items of soft ESG information and denote them by the variables \(ae^{(j)}_i\) with \(i = 1, \dots , I_j\) for each dimension of greenness j. Note that the number of variables may be different in each dimension, which is why we use a subscript to denote it. Moreover, one should keep in mind that the selection of the ESG rating provider might impact the results since different ESG rating providers show a low level of agreement on ESG scores (Dorfleitner et al. 2015; Berg et al. 2022), and scholars have found biases in ESG scores such as according to firm size (Dobrick et al. 2023; Drempetic et al. 2020).

-

Textual self-representation: Corporate self-representation in text form such as sustainability report or information issued by the firm answering open questions regarding the green behavior contains text information. Such information contributes to the apparent sustainability performance (Papoutsi and Sodhi 2020). Thus, text analytics can be an important tool to process this information and derive a text greenness variable from such disclosure, which we denote by \(at^{(j)}\). Note that this variable may have some overlap with some ESG information items. Thus, we explicitly focus on those aspects that are not already contained in the soft ESG information.

-

Green marketing expenses: Moreover, expenses for (green) marketing purposes in a specific year could be a useful piece of information on the desire to appear green (cf. Szabo and Webster 2021), we denote the standardized value by the variable in the dimension of greenness j by \(am^{(j)}\).

-

Green virtue: Information whether the firm reveals some (green) virtue signaling in the respective year, e.g., by joining some voluntary initiative such as the science-based targets or an initiative with the reputation of being sensitive to considering sustainability aspects in the business activities such as the PRI (see, e.g., Bauckloh et al. 2023). We denote this by the variable in the dimension of greenness j by \(as^{(j)}\).

Generally, the variable \(ap^{(j)}\) depends on the firm’s green behavior and its efforts to appear green. Since \(ap^{(j)}\) is standardized (i.e., it ranges between 0 and 1), it represents a spectrum between no green appearance (\(ap^{(j)}=0\)) and 100% green appearance (\(ap^{(j)}=1\)). The apparent green performance \(ap^{(j)}\) is an overall measure that represents the aggregation of the \(I_j\) variables related with the jth dimension in the pillars of information. As the variables are already standardized between 0 and 1, the natural way of aggregation is to calculate a weighted average. The simplest variant of aggregation is the arithmetic mean, but more sophisticatedly derived weights are also possible. In a first step, we aggregate the E score-related variables \(ae^{(j)}_1,\dots ,ae^{(j)}_{I_j}\) according to weights \(\lambda ^{(j)}_1,\dots , \lambda ^{(j)}_{I_j}\) (summing up to 1) ending up with:

The whole apparent green performance can now, for each of the pillars of information, be calculated as

given some carefully chosen weights \(w^{(j)}_e\) (ESG pillar), \(w^{(j)}_t\) (textual self-representation), \(w^{(j)}_m\) (green marketing), and \(w^{(j)}_s\) (virtue signaling) for dimension j, which sum up to 100%. More details on how \(w^{(j)}_e\), \(w^{(j)}_t\), \(w^{(j)}_m\), and \(w^{(j)}_s\) can be determined are provided in Sect. 4.4. For here, these weights can be determined combining the different pillar of information scores in a way that best measures the apparent green performance and its impact on a greenwashing indicator.

In the following we detail on the variables that we suggest to use for measuring the real green performance of a firm. A measurement of the real green performance, which we denote for different variables with \(re_k^{(j)}\) with \(k = 1, \dots , K_j\), rests on hard ESG data and hard data from other sources. Opposed to the soft ESG information, there usually are some data items from the context of building ESG scores that can clearly be objectified and are validated by external entities (e.g., a metric variable of how much \(\hbox {CO}_2\) is emitted on Scope 1 and 2 level by the firm). Roulet and Toubo (2015) call this type of information “substantive.” Besides the ESG rating providers, there can be other third party sources that provide hard data about firms such as the Toxic Release Inventory (TRI)Footnote 5 in the US. We use these variables for determining the real green performance.

We denote the firm’s real green performance in dimension of greenness j with the variable \(rp^{(j)}\). Let \(\gamma ^{(j)}_1,\dots , \gamma ^{(j)}_{K_j}\) be some weights (summing up to 1), then the real green performance is

4.2 Greenwashing indicator

We consider one specific dimension of greenness j (one out of J) and define greenwashing in this dimension as a positive difference between \(ap^{(j)}\) and \(rp^{(j)}\). Thus, the greenwashing indicator (\(GW^{(j)}\)) of dimension j is

Indeed, such a measurement concept takes on a positive value if \(ap^{(j)} > rp^{(j)}\), even equals the maximum value of 1 if \(ap^{(j)}=1\), \(rp^{(j)}=0\), and takes a value of zero, if \(ap^{(j)}\le rp^{(j)}\). This is in line with the matrix of Szabo and Webster (2021). However, while they only consider green marketing, we measure the appearance in a more sophisticated way.

As the above computations are conducted for each of the J dimensions of greenness, we finally obtain the row vector \((GW^{(1) },\dots , GW^{(J)})\) for each firm. A simple one-number greenwashing indicator needs to aggregate the J dimensions. To this end, we suggest a greenwashing indicator of the respective firm in the following form:

This aggregation rule reflects the idea, that every piece of evidence for greenwashing in each of the J dimensions of greenness should be considered and generally increase the overall greenwashing score, but not above a value of 100%. The overall score according to Eq. (5) thus can be interpreted as the probability that there is greenwashing in a firm in at least one of the J dimensions of greenness if \(GW^{(j)}\) denotes the probability that there is greenwashing in the jth dimension of greenness.

We introduce a two firm real-world example for illustration purposes of this conceptual framework. We consider one firm with a documented greenwashing case in 2023 (Zalando SEFootnote 6) and one comparable firm without a greenwashing case in 2023 (Delivery Hero). We assume that there are two dimensions with one variable for the apparent and real green performance each. All variables used in this example are taken from Refinitiv in 2022. We call the first dimension of greenness “environmental impact” and use the Environmental Pillar score as the apparent green performance \(ap^{(1)}\) and the Emission score as the real green performance \(rp^{(1)}\). We call the second dimension of greenness “green activities” and measure the apparent green performance \(ap^{(2)}\) by the Environmental Partnerships Score and the real green performance \(rp^{(2)}\) by the ESG Controversies Score. Table 1 shows the particular scores. Using the figures from Table 1, we determine \(GW^{(1)}=\max (0.298-0.162,0)=0.136\) and \(GW^{(2)}=\max (0-0.602,0)=0\) for Delivery Hero and \(GW^{(1)}=0\) and \(GW^{(2)}=0.909\) for Zalando. Applying Eq. (5) leads to a greenwashing indicator of 0.136 for Delivery Hero and 0.909 for Zalando. Thus, according to the calculated indicator value, Zalando has a high risk for facing a greenwashing case while Delivery Hero only has weak indication for a greenwashing case.

We provide another, artificial simple example to illustrate the need for (i) considering different dimensions of greenness and (ii) using Eq. (5) as an aggregation method to identify greenwashing. Assume two dimensions of greenness, and let the apparent green performance of a firm in the two dimensions of greenness be \(ap^{(1)}=1\) and \(ap^{(2)}=0\). The real green performance of a firm is \(rp^{(1)}=0\) and \(rp^{(2)}=1\). This means that we observe greenwashing in the first dimension of greenness and no greenwashing in the second. Following our definition of greenwashing, the greenwashing values are

Thus, the overall GW value is \(GW=1-(1-1)\cdot (1-0) = 1\). Note that this number could be interpreted as the likelihood that the firm faces a greenwashing case. If one dimension shows a greenwashing case with 100% (i.e., \(GW^{(j)}=1\)), the entire greenwashing indicator equals 1 due to the fact the greenwashing occurs with certainty. Based on this example, we also want to highlight the importance to consider the dimensions of greenwashing separately. If we did not consider different dimensions of greenwashing, i.e., \(J=1\) and weight both dimensions equally, we would consequently calculate the (now one-dimensional) apparent and real green performance as

This results in a GW value of \(ap-rp=0.5-0.5=0\), which does not represent the fact that the firm applies greenwashing in the first dimension of greenness.

4.3 Firm misconduct approximation for the real green performance

There may be cases in which it is hard to assess the real green performance rp, because most of the official information about a firm’s greenness is already represented by ap. To discuss this situation, we assume to consider one particular dimension of greenness j and drop the index. For this situation, we suggest to approximate the real green performance as follows: The implementation of rp can be defined dependent on an evident corporate misconduct, which we denoted cm in the same specific year (with values between 0 and 1). The real green performance is then represented by

Additional pieces of information for corporate misconduct can be the number or intensity of environmental scandals by the firm in the respective dimension (such as a major accident that was due to poor maintenance). Such scandals may have led to legal processing, but this is not a necessary condition. In a comparable context, Fauser and Utz (2021) show that the ESG controversy score (in principle a quantity derived from firm scandals) helps to predict the risk of future firm misconduct in terms of litigation risk. As this type of information can come from S different sources, we define the variables: \(cms_1,\dots ,cms_S\). An example of such information items are the controversy scores that some ESG providers also provide as an additional variable (Dorfleitner et al. 2022).

Let \(\delta _1,\dots , \delta _S\) be weights that sum up to 1 and represent the importance of the S different sources of corporate misconduct. The measure of corporate misconduct cm is then defined as the linear combination of the figures of the different sources:

If we put equation (8) into the definition (4), we obtain a formula to estimate greenwashing independent of the real green performance:

To move from purely mathematical considerations closer to reality, we illustrate the framework at the three dimensions of greenness “resource use,” “emissions,” and “product innovation.” A car manufacturer might claim to produce reasonably resource-efficiently with a large share of recycling, to minimize emissions in the production process and those of the produced cars, and to have some projects for product innovation to foster all dimensions of greenness. In a specific year, the vector of the apparent green performance may be represented by (0.75, 0.8, 0.7), i.e., each of the values is rather high, but below the theoretical maximum of 1. In this very year, it turns out that the cars emit much more in pollutants than claimed. In addition, there is software that recognizes when a measurement process takes place and then switches to a low-emission mode that is not possible in normal operation.Footnote 7 A big scandal occurs, and there is no doubt of clear and huge corporate misconduct in the pollution dimension. This results in a cm vector that is represented by (0, 0.95, 0). Thus, the GW row vector would be (0, 0.76, 0) and a one-number GW indicator of 0.76, which marks a significant extent of greenwashing in the specific year.

4.4 Practical considerations

We end this section with the some practical considerations that must be taken into account when implementing the measurement procedure outlined above.

-

Size and industry adjustments: In some cases a size adjustment is reasonable when assessing different variables for different firms. As an example, consider the carbon emissions of two differently large firms in the same industry. If the larger firm produces 150% of the emissions of the smaller firm, it still may be superior if it is twice as large. Clearly, fractions whose denominator is a size measure, such as market capitalization to name a example, can accommodate this aspect. Moreover, it will be helpful to account for industry specific properties. In some industries some environmental norms are harder to achieve than in others. Consider, for example, energy efficiency in a steel manufacturing firm versus that of a bank. In the first industry, efficiency is closely related to the manufacturing of the product as such, while in the latter it is more about the efficient operation of office buildings, which has nothing directly to do with the product and is much easier to achieve. One might also look at the volume of energy efficiency projects that are financed through the bank. Such figures, however, are a type of variable that is not applicable for other industries albeit sensible in case of financial institutions.

As an example, consider (real or claimed) GHG emission reductions, which are suitable data items in the “emission” dimension, but not in the “resource use” dimension. This problem can easily be handled by setting the corresponding weight to zero.

-

Measuring greenwashing risk: When choosing the approach utilizing the corporate misconduct and thus measuring greenwashing rather indirectly than directly, it is possible to use an overall corporate misconduct variable that is, for instance, derived from general corporate governance issues or scandals within and beyond the dimensions of greenness. In this case, there is no clear evidence that we have a corporate misconduct in the dimension of greenness under consideration, but rather general indications that the firm tends to engage in problematic behavior. If we use this cm variable to multiply it with ap and if the value of ap is high, then a high GW value will result. The best interpretation of the value achieved by this procedure is that it is an indication of greenwashing risk (and not so much of disclosed greenwashing). The idea behind this is: If a firm has a high apparent green performance and at the same time generally shows deceptive behavior, the probability that this apparent green performance is not true is high. We consider this pattern as greenwashing risk.

-

Calibration: In the theoretical concept presented above, we have assumed the existence of weighting factors and standardizations, which are difficult to derive directly in practice. A feasible approach is calibration of the weightings and standardizations with a limited set of firm-year observations for which it can be said from in-depth case examination whether and to what extent greenwashing has occurred. As a result, the greenwashing values match the observed reality ex post. With the measurement calibrated in this way, other firms and years can then be measured in a forward manner.

To be more concrete, one can consider for each dimension of greenness \(j\in \{1,\dots ,J\}\) variables available for measuring the real and others for measuring the apparent green performance as given for N firm observations. The weights linking this set of variables with \(ap^{(j)}\) and \(rp^{(J)}\) are to be determined. For the N firm observations, we also have observations of GW values,Footnote 8 which is linked to \(ap^{(1)},\dots , ap^{(J)}\) and \(rp^{(1)},\dots , rp^{(J)}\) according to

$$\begin{aligned} GW= 1-\prod _{j=1}^J \left( 1-\max \left( ap^{(j)}- rp^{(j)},0\right) \right) . \end{aligned}$$The weights can now be chosen in a way to minimize the quadratic deviation of the observed GW values versus those generated by the model-generated GW indicator. This procedure corresponds to the least squares estimation (under certain constraints for the weights) of a non-linear regression.

One can take this line of reasoning even further and apply a machine learning procedure to find a relation between the explanatory variables from the pillars of information and the observed cases of greenwashing respectively no greenwashing.Footnote 9 In this case, the aggregation would follow different rules and would remain hidden in a black box. Yet, if the learning sample is large enough, this can theoretically lead to good results. However, the explicit modeling of the relations according to the above equations should always be performed additionally and serve as a comparison benchmark.

5 Conclusion

This paper classifies existing and new terms in the discussion of greenwashing on four levels. We complement the established view on the phenomenon, which comprises firm-level and product-level greenwashing by additionally introducing the financial-intermediary and the standard-setting environment level. Moreover, we present a conceptual framework to measure greenwashing by a proposed greenwashing indicator, which is built on a (subjective) normative basis for the notion of greenness which comprises several dimensions.

One challenge for future research that aims at determining such a greenwashing indicator empirically, is the availability of proper data. We suggest particular pillars of information for which the apparent and real green performance should be measured to determine the greenwashing indicator. The so-generated greenwashing indicator can be calculated for a large sample of firms. The availability of such a measure for greenwashing enables decision-makers to include risks stemming from greenwashing activities (and which have not been able to integrate until now without a comprehensive case study investigation) in the decision-making process. Thus, such a greenwashing indicator helps to detect greenwashing. Moreover, it contributes to a more efficient protection of the environment and mitigation of climate risk since it alleviates searching costs for investors and customers to learn about the “real” green performance of a firm and to react accordingly in investment and purchasing situations. Moreover, a measurement of past greenwashing is important, as this is necessary for answering questions such as the drivers of greenwashing, predicting greenwashing, and for surveying improvements over time.

Data availability

Our manuscript has no associate data.

Notes

One, currently very important institutional pressure for (gas sector) firms relates to firms’ strategies to combat climate change (Lebelhuber and Greiling 2022).

See Art. 2 of the Sustainability Conflict of interest Regulation 2019, as well as environmentally sustainable objectives defined in the Taxonomy Regulation 2020 and the forthcoming social taxonomy envisaged by the Commission, https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/finance-events-210226-presentation-social-taxonomy_en.pdf.

The questions were (i) “I think that the case firm aims to improve its reputation by presenting itself as an environmentally friendly organization,” (ii) “To what extent do you think the case firm has a hidden agenda?,” and (iii) “I think the case firm pretends to be more environmentally friendly than it actually is” (see de Vries et al. 2015, p. 147).

The Airbus case is a recent example of this type of incident, as new Airbus aircraft are considered sustainable under the EU taxonomy, which only requires that new aircraft replace and be more efficient than older generation aircraft (Transport and Environment 2021).

See https://www.epa.gov/toxics-release-inventory-tri-program for details.

Obviously, there is a real-world precedent for this example. However, since the figures used are for illustrative purposes only and not derived from reality, we refrain from explicitly referring to this famous case.

While these observations on a limited set of firms can be produced by applying human judgment of several persons looking systematically at a certain set of forms, the aim of the approach presented here is clearly to overcome such a laborious procedure.

It is well-known that machine learning approaches can represent any functional relation between some observable output variables and some explanatory input variables (Sarker 2021). This technique is also attributable here, once the greenwashing value is fixed. Indeed, Cojoianu et al. (2020) already apply AI methods to detect greenwashing in the context of climate change mitigation. However, the details of this approach remain unclear.

References

Archel P, Husillos J, Larrinaga C, Spence C (2009) Social disclosure, legitimacy theory and the role of the state. Account Audit Account J 22:1284–1307. https://doi.org/10.1108/09513570910999319

Ashforth BE, Gibbs BW (1990) The double-edge of organizational legitimation. Organ Sci 1:177–194. https://doi.org/10.1287/orsc.1.2.177

Bauckloh T, Schaltegger S, Utz S, Zeile S, Zwergel B (2023) Active first movers vs. late free-riders? An empirical analysis of unpri signatories’ commitment. J Bus Ethics 182:747–781. https://doi.org/10.1007/s10551-021-04992-0

Berg F, Kölbel JF, Rigobon R (2022) Aggregate confusion: the divergence of ESG ratings. Rev Financ 26:1315–1344. https://doi.org/10.1093/rof/rfac033

Bowen F (2014) After greenwashing: symbolic corporate environmentalism and society. Cambridge University Press, Cambridge. https://doi.org/10.1017/CBO9781139541213

Chen YS, Chang CH (2013) Greenwash and green trust: the mediation effects of green consumer confusion and green perceived risk. J Bus Ethics 114:489–500. https://doi.org/10.1007/s10551-012-1360-0

Chua JM (2023) Amazon accused of ’greenwashing on a grotesque scale’. https://sourcingjournal.com/topics/sustainability/amazon-greenwashing-accusations-334758/. Accessed 13 Apr 2023

Cojoianu T, Hoepner AGF, Ifrim G, Lin Y (2020) Greenwatch-shing: using AI to detect greenwashing. AccountancyPlus-CPA Ireland, SSRN Working paper 3627157

de Freitas Netto SV, Sobral MFF, Ribeiro ARB, Soares GRdL (2020) Concepts and forms of greenwashing: a systematic review. Environ Sci Europe 32:19. https://doi.org/10.1186/s12302-020-0300-3

de Vries G, Terwel BW, Ellemers N, Daamen DDL (2015) Sustainability or profitability? How communicated motives for environmental policy affect public perceptions of corporate greenwashing. Corp Soc Responsib Environ Manag 22:142–154. https://doi.org/10.1002/csr.1327

Deegan C (2002) The legitimising effect of social and environmental disclosures—a theoretical foundation. Account Audit Account J 15:282–311. https://doi.org/10.1108/09513570210435852

Delmas MA, Burbano VC (2011) The drivers of greenwashing. Calif Manag Rev 54:64–87. https://doi.org/10.1525/cmr.2011.54.1.64

Diener J (2022) Impact case or impact washing? An analysis of investors’ strategies to influence corporate behavior. Sustain Account Manag Policy J ahead-of-print. https://doi.org/10.1108/SAMPJ-02-2022-0088

Dobrick J, Klein C, Zwergel B (2023) Size bias in refinitiv ESG data. Financ Res Lett 55:104014. https://doi.org/10.1016/j.frl.2023.104014

Dorfleitner G, Halbritter G, Nguyen M (2015) Measuring the level and risk of corporate responsibility—an empirical comparison of different ESG rating approaches. J Asset Manag 16:450–466

Dorfleitner G, Kreuzer C, Sparrer C (2022) To sin in secret is no sin at all: On the linkage of policy, society, culture, and firm characteristics with corporate scandals. J Econ Behav Organ 202:762–784. https://doi.org/10.1016/j.jebo.2022.08.027

Drempetic S, Klein C, Zwergel B (2020) The influence of firm size on the ESG score: corporate sustainability ratings under review. J Bus Ethics 167:333–360. https://doi.org/10.1007/s10551-019-04164-1

Du X (2015) How the market values greenwashing? Evidence from China. J Bus Ethics 128:547–574. https://doi.org/10.1007/s10551-014-2122-y

Eccles RG, Johnstone-Louis M, Mayer C, Stroehle J (2020) The board’s role in sustainability. Harvard Business Review September/October 2020

Epure M (2022) Corporate social responsibility as a signaling technology. Rev Manag Sci 16:907–930. https://doi.org/10.1007/s11846-021-00472-x

European Commission (2023) Proposal for a directive of the European parliament and of the council on substantiation and communication of explicit environmental claims (Green ClaimsDirective). Technical Report. European Commission. 2023/0085 (COD) published on March 22, 2023

Fauser DV, Utz S (2021) Risk mitigation of corporate social performance in US class action lawsuits. Financ Anal J 77:43–65. https://doi.org/10.1080/0015198X.2020.1861896

Gallicano TD (2011) A critical analysis of greenwashing claims. Public Relat J 5:1–21

Greer J, Bruno K (1996) Greenwash: The reality behind corporate environmentalism. Apex Press, Udaipur

Gregory RP (2021) When is greenwashing an easy fix? J Sustain Financ Invest. https://doi.org/10.1080/20430795.2021.1907091

Guo R, Zhang W, Wang T, Li CB, Tao L (2018) Timely or considered? Brand trust repair strategies and mechanism after greenwashing in China-from a legitimacy perspective. Ind Market Manag 72:127–137. https://doi.org/10.1016/j.indmarman.2018.04.001

Hamann R, Kapelus P (2004) Corporate social responsibility in mining in Southern Africa: Fair accountability or just greenwash? Development 47:85–92. https://doi.org/10.1057/palgrave.development.1100056

Haque F, Ntim CG (2018) Environmental policy, sustainable development, governance mechanisms and environmental performance. Bus Strategy Environ 27:415–435. https://doi.org/10.1002/bse.2007

Hosmer LT (1987) The institutionalization of unethical behavior. J Bus Ethics 6:439–447. https://doi.org/10.1007/BF00383286

Kahneman D, Lovallo D (1993) Timid choices and bold forecasts: a cognitive perspective on risk taking. Manag Sci 39:17–31. https://doi.org/10.1287/mnsc.39.1.17

Kaner G (2021) Greenwashing: how difficult it is to be Transparent to the consumer–H &M case study. Springer, Cham, pp 203–226. https://doi.org/10.1007/978-3-030-74065-8_9

Kaustia M, Yu W (2021) Greenwashing in mutual funds. SSRN. https://doi.org/10.2139/ssrn.3934004

Khan M, Serafeim G, Yoon A (2016) Corporate sustainability: first evidence on materiality. Account Rev 91:1697–1724

Kim EH, Lyon TP (2015) Greenwash vs. brownwash: exaggeration and undue modesty in corporate sustainability disclosure. Organ Sci 26:705–723. https://doi.org/10.1287/orsc.2014.0949

Lashitew AA (2021) Corporate uptake of the sustainable development goals: Mere greenwashing or an advent of institutional change? J Int Bus Policy 4:184–200. https://doi.org/10.1057/s42214-020-00092-4

Lassoued N, Khanchel I (2023) Voluntary CSR disclosure and CEO narcissism: the moderating role of CEO duality and board gender diversity. Rev Manag Sci 17:1075–1123. https://doi.org/10.1007/s11846-022-00555-3

Laufer WS (2003) Social accountability and corporate greenwashing. J Bus Ethics 43:253–261. https://doi.org/10.1023/A:1022962719299

Lebelhuber C, Greiling D (2022) Strategic response to institutional pressures of climate change: an exploration among gas sector companies. Rev Manag Sci 16:863–905. https://doi.org/10.1007/s11846-021-00449-w

Li W, Li W, Seppänen V, Koivumäki T (2023) Effects of greenwashing on financial performance: moderation through local environmental regulation and media coverage. Bus Strategy Environ 32:820–841. https://doi.org/10.1002/bse.3177

Lyon TP, Maxwell JW (2011) Greenwash: corporate environmental disclosure under threat of audit. J Econ Manag Strategy 20:3–41. https://doi.org/10.1111/j.1530-9134.2010.00282.x

Lyon TP, Montgomery AW (2015) The means and end of greenwash. Organ Environ 28:223–249. https://doi.org/10.1177/1086026615575332

Mahoney LS, Thorne L, Cecil L, LaGore W (2013) A research note on standalone corporate social responsibility reports: Signaling or greenwashing? Crit Perspect Account 24:350–359. https://doi.org/10.1016/j.cpa.2012.09.008

Marciniak A (2010) Greenwashing as an example of ecological marketing misleading practices. Comp Econ Res Central Eastern Europe 12:49–59. https://doi.org/10.2478/v10103-009-0003-x

Marquis C, Toffel MW, Zhou Y (2016) Scrutiny, norms, and selective disclosure: a global study of greenwashing. Organ Sci 27:483–504. https://doi.org/10.1287/orsc.2015.1039

Mateo-Márquez AJ, González-González JM, Zamora-Ramírez C (2022) An international empirical study of greenwashing and voluntary carbon disclosure. J Clean Prod 363:132567. https://doi.org/10.1016/j.jclepro.2022.132567

Maxwell J, Rothenberg S, Briscoe F, Marcus A (1997) Green schemes: corporate environmental strategies and their implementation. Calif Manag Rev 39:118–134. https://doi.org/10.2307/41165902

O’Donovan G (2002) Environmental disclosures in the annual report: extending the applicability and predictive power of legitimacy theory. Account Audit Account J 15:344–371. https://doi.org/10.1108/09513570210435870

Papoutsi A, Sodhi MS (2020) Does disclosure in sustainability reports indicate actual sustainability performance? J Clean Prod 260:121049. https://doi.org/10.1016/j.jclepro.2020.121049

Parguel B, Benoit-Moreau F, Russell CA (2015) Can evoking nature in advertising mislead consumers? The power of ‘executional greenwashing’. Int J Advert 34:107–134. https://doi.org/10.1080/02650487.2014.996116

Pope S, Wæraas A (2016) CSR-washing is rare: a conceptual framework, literature review, and critique. J Bus Ethics 137:173–193. https://doi.org/10.1007/s10551-015-2546-z

Roulet TJ, Toubo S (2015) The intentions with which the road is paved: attitudes to liberalism as determinants of greenwashing. J Bus Ethics 128:305–320. https://doi.org/10.1007/s10551-014-2097-8

Sarker IH (2021) Machine learning: algorithms, real-world applications and research directions. SN Comput Sci 2:160. https://doi.org/10.1007/s42979-021-00592-x

Scanlan SJ (2017) Framing fracking: scale-shifting and greenwashing risk in the oil and gas industry. Local Environ 22:1311–1337. https://doi.org/10.1080/13549839.2017.1345877

Seele P, Gatti L (2017) Greenwashing revisited: in search of a typology and accusation-based definition incorporating legitimacy strategies. Bus Strategy Environ 26:239–252. https://doi.org/10.1002/bse.1912

Seele P, Schultz MD (2022) From greenwashing to machinewashing: a model and future directions derived from reasoning by analogy. J Bus Ethics 178:1063–1089. https://doi.org/10.1007/s10551-022-05054-9

Sheehy B (2015) Defining CSR: problems and solutions. J Bus Ethics 131:625–648. https://doi.org/10.1007/s10551-014-2281-x

Siano A, Vollero A, Conte F, Amabile S (2017) “More than words’’: expanding the taxonomy of greenwashing after the Volkswagen scandal. J Bus Res 71:27–37. https://doi.org/10.1016/j.jbusres.2016.11.002

Smith S (2022) Greenpeace to sue European Union for ‘gas and nuclear greenwashing’. Independent 2022, September 19. https://www.independent.co.uk/climate-change/news/greenpeace-european-union-sue-taxonomy-gas-nuclear-greenwashing-b2168267.html

Szabo S, Webster J (2021) Perceived greenwashing: the effects of green marketing on environmental and product perceptions. J Bus Ethics. https://doi.org/10.1007/s10551-020-04461-0

TerraChoice (2010) The sins of greenwashing: home and family edition. https://greenbusinessbureau.com/green-practices/the-seven-sins-of-greenwashing/. Accessed 13 Feb 2023

Torelli R, Balluchi F, Lazzini A (2020) Greenwashing and environmental communication: effects on stakeholders’ perceptions. Bus Strategy Environ 29:407–421. https://doi.org/10.1002/bse.2373

Transport & Environment (2021) EU investment rules will ’greenwash’ 90% of airbus’ polluting planes. https://www.transportenvironment.org/discover/eu-investment-rules-will-greenwash-90-of-airbus-polluting-planes/. Accessed 27 Mar 2023

Utz S (2019) Corporate scandals and the reliability of ESG assessments: evidence from an international sample. Rev Manag Sci 13:483–511. https://doi.org/10.1007/s11846-017-0256-x

Walker K, Wan F (2012) The harm of symbolic actions and green-washing: corporate actions and communications on environmental performance and their financial implications. J Bus Ethics 109:227–242

Wimbush JC, Shepard JM, Markham SE (1997) An empirical examination of the relationship between ethical climate and ethical behavior from multiple levels of analysis. J Bus Ethics 16:1705–1716. https://doi.org/10.1023/A:1017952221572

Yu E, Luu BV, Chen CH (2020) Greenwashing in environmental, social and governance disclosures. Res Int Bus Financ 52:101192. https://doi.org/10.1016/j.ribaf.2020.101192

Acknowledgements

The authors are pleased to acknowledge funding from the Stiftung Mercator for a project entitled “Machbarkeitsstudie Greenwashing Scores” (Grant Number 220232).

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Dorfleitner, G., Utz, S. Green, green, it’s green they say: a conceptual framework for measuring greenwashing on firm level. Rev Manag Sci (2023). https://doi.org/10.1007/s11846-023-00718-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11846-023-00718-w

Keywords

- Greenwashing

- Greenwashing indicator

- Firm misconduct

- Real green performance

- Apparent green performance

- ESG