Abstract

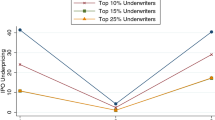

This paper investigates the controversial effect of underwriter reputation on underpricing by applying a meta-analysis methodology. The aim is to verify whether and to what extent the magnitude of this relationship is conditioned by institutional-specific moderators. Companies that go public with the support of prestigious underwriters report a changing effect on underpricing. The relation between underwriter reputation and underpricing was negative in the seventies, while it shifted to be positive in the nineties and two thousands. The positive effect between underwriter reputation and underpricing is higher in common law countries compared to civil law countries. In particular, there was a strong positive effect in the USA starting in the two thousands. This paper also provides a methodological contribution by the application, for the first time in management topic, of the robust variance estimation method to address the issue of within-paper heterogeneity.

Similar content being viewed by others

Notes

In addition to the standard measure of underpricing, as suggested by Ritter (1984), it can be calculated as the difference between the “simple” underpricing above and the market index return measured between the day of the admission to the trading and the beginning of the public offering (Rock 1986; McGuinness 1992; Carter et al. 1998; Ljungqvist 1999; Certo et al. 2001a, b; Loughran and Ritter 2004; Chahine and Filatotchev 2008a, b).

Brau et al. (2004) support this view by submitting a questionnaire about the decision to go public to 336 chief financial officers (CFOs) of non-financial U.S. companies. The questionnaire asked about positive and negative signals to investors in the context of an IPO. Ninety-one percent of the respondents indicated that profitability is the most positive signal to investors and it consolidates a company’s reputation even more than continuous positive operating results, because investors view past successes as indicating future profits. The second-most-popular opinion of the respondents was that the quality of an investment is further guaranteed by a partnership with a major investment bank (74% of CFOs), and the third-most popular indicator of quality was a venture capitalist’s ownership of an equity stake in a company (40%). According to the majority of the respondents, signals perceived by outsiders to be very negative include the sale of a large part of the capital or the sale of a significant proportion of shares by internal shareholders. The willingness of insiders to quit the company en masse will surely cause investors to believe that the organisation has financial problems.

“… when an underwriter is faced with an IPO that exhibits an unusually high demand among investors, s/he adjusts the offer price to a point above the high end of the initial filing range but significantly below the anticipated market price for the IPO shares. Therefore, investors that disclose their high reservation prices for these high-demand IPOs not only receive a larger allocation of IPO shares but also a higher than normal initial return …” (Cooney et al. 2001: 17).

The term “study” refers to a single regression inside a paper. To deal with the fact that in each paper there can be many regressions (studies) that are not independent correlations, the robumeta approach will be used.

I also checked that the results were not affected by posing away observations that were more than 3.0 standard deviation far from the mean effect size, instead of the winsorizing approach.

The diversity among the studies that included a meta-analysis necessarily leads to statistical heterogeneity.

Doidge et al. (2004) show that for a given level of legal protection for investors, the incentive to adopt better governance mechanisms depends on a country’s financial development.

References

(*Studies included in the meta-analysis, respecting the selection criteria and, in particular, having in the same model empirical measures of underpricing and underwriter reputation)

*Aggarwal RK, Krigman L, Womack KL (2002) Strategic IPO underpricing, information momentum, and lockup expiration selling. J Financ Econ 66(1):105–137

*Aggarwal RK, Purnanandam AK, Wu G (2006) Underwriter manipulation in initial public offerings. Unpublished Working Paper, version: January 26, 2006

*AIDEA (2013) Bank reputation and IPO underpricing: evidence from the Istanbul Stock Exchange. Working Paper, Conference AIDEA

Allen F, Faulhaber GR (1989) Signalling by underpricing in the IPO market. Financ Econ 23(2):303–323

Anderson CW, Huang J (2017) Institutional investment in IPOs and post-IPO M&A activity. J Empirical Finance 41(C) 1–18

*Arrfelt M, Mannor M, Nahrgang JD, Christensen AL (2018) All risk-taking is not the same: examining the competing effects of firm risk-taking with meta-analysis. Rev Manag Sci 12(3):621–660

Arthurs JD, Hoskisson RE, Busenitz LW, Johnson RA (2008) Managerial agents watching other agents: multiple agency conflicts regarding underpricing in IPO firms. Acad Manag J 51(2):277–294

*Arthurs JD, Busenitz LW, Johnson RA, Hoskisson RE (2009) Signaling and initial public offerings: the use and impact of lockup period. J Bus Ventur 24(4):360–372

Autore DM, Boulton TJ, Smart SB, Zutter CJ (2014) The impact of institutional quality on initial public offerings. J Econ Bus 73(2):65–96

*Bade M (2018) Determinants of IPO-firms’ merger appetite. Rev Manag Sci. https://doi.org/10.1007/s11846-018-0291-2

*Bairagi RK, Dimovski W (2011) The underpricing of REIT IPOs: 1996–2010. J Prop Res 28(3):233–248

Beatty RP (1989) Auditor reputation and the pricing of initial public offerings. Account Rev 64(4):693–709

Beatty RP, Ritter JR (1986) Investment banking, reputation, and the underpricing of initial public offerings. J Financ Econ 15(1–2):213–232

*Beatty R, Welch I (1996) Issuer expenses and legal liability in initial public offerings. J Law Econ 39(3):545–602

*Bédard J, Coulombe D, Courteau L (2008) Audit committee, underpricing of IPOs and accuracy of management earnings forecasts. Corp Gov Int Rev 16(6):519–535

Bergh DD, Connelly BL, Ketchen DJ Jr, Shannon LM (2014) Signalling theory and equilibrium in strategic management research: an assessment and a research agenda. J Manag Stud 51(8):1334–1360

Booth JR, Smith RL (1986) Capital raising, underwriting and the certification hypothesis. J Financ Econ 15(1–2):261–281

Booth JR, Chua L (1996) Ownership dispersion, costly information and IPO underpricing. J Financ Econ 41(2):291–310

Boulton TJ, Smart SB, Zutter CJ (2010) IPO underpricing and international corporate governance. J Int Bus Study 41(2):206–222

Boulton TJ, Smart SB, Zutter CJ (2017) IPO underpricing around the world. In: Cumming D, Johan S (eds) Oxford handbook of IPOs. Oxford University Press, Oxford

*Bozzolan S, Ipino E (2007) Information asymmetries and IPO underpricing: the role of voluntary disclosure of forward-looking information in the prospectus. Working Paper, SSRN 999518

*Bradley DJ, Jordan BD (2002) Partial adjustment to public information and IPO underpricing. J Financ Quant Anal 37(4):595–616

*Brau JC, Brown RA, Osteryoung JS (2004) Do venture capitalists add value to small manufacturing firms? An empirical analysis of venture and non venture capital-backed initial public offerings. J Small Bus Manag 42(1):78–92

*Carter R, Manaster S (1990) initial public offerings and underwriter reputation. J Finance 45(4):1045–1067

*Carter RB, Dark FH, Singh AK (1998) Underwriter reputation, initial returns, and the long-run performance of IPO stocks. J Finance 53(1):285–311

*Certo ST, Covin J, Daily CM, Dalton DR (2001a) Wealth and the effects of founder management among IPO-stage new ventures. Strateg Manag J 22(6–7):641–658

*Certo ST, Daily CM, Dalton DR (2001b) Signaling firm value through board structure: an investigation of initial public offerings. Entrep Theory Pract 26(2):33–50

Certo ST, Holcomb TR, Holmes RM Jr (2009) IPO research in management and entrepreneurship: moving the agenda forward. J Manag 35(6):1340–1378

Chahine S, Filatotchev I (2008a) The effects of information disclosure and board independence on IPO discount. J Small Bus Manag 46(2):219–241

Chahine S, Filatotchev I (2008b) The effects of venture capitalist affiliation to underwriters on short- and long-term performance in French IPOs. Glob Finance J 18(3):351–372

*Chahine S, Goergen M (2011) VC board representation and performance of US IPOs. J Bus Finance Account 38(3–4):413–445

*Chahine S, Saade S (2011) Shareholders’ rights and the effect of the origin of venture capital firms on the underpricing of US IPOs. Corpor Gov Int Rev 19(6):601–621

*Chahine S, Filatotchev I, Wright M (2007) Venture capitalists, business angels, and performance of entrepreneurial IPOs in the UK and France. J Bus Finance Account 34(3/4):505–528

*Chahine S, Filatotchev I, Zahra S (2011) Building perceived quality of founder-involved IPO firms: founders’ effects on board selection and stock market performance. Entrep Theory Pract 35(2):319–335

*Chahine S, Arthurs JD, Filatotchev I, Hoskisson RE (2012) The effects of venture capital syndicate diversity on earnings management and performance of IPOs in the US and UK: an institutional perspective. J Corp Finance 18(1):179–192

Chemmanur TJ, Fulghieri P (1994) Investment bank reputation, information production, and financial intermediation. J Finance 49(1):57–79

*Chen CR, Mohan NJ (2002) Underwriter spread, underwriter reputation, and IPO underpricing: a simultaneous equation analysis. J Bus Finance Account 29(3/4):521–540

*Cheng H-P, Chan C-H (2009) A meta-analytic review of ownership structure, board composition, and IPO underpricing. SSRN Working Paper, SSRN ID = 1343679

*Cliff MT, Denis DJ (2004) Do initial public offering firms purchase analyst coverage with underpricing? J Finance 59(6):2871–2901

*Coakley J, Hadass L, Wood A (2009) UK IPO underpricing and venture capitalists. Eur J Finance 15(4):421–435

Cohen J, Cohen P (1983) Applied multiple regression/correlation analysis for the behavioral sciences, 2nd edn. Erlbaum, Hillsdale

Connelly BL, Certo T, Reutzel CR (2011) Signaling theory: a review and assessment. J Manag 37(1):39–67

*Cook DO, Kieschnick R, Van Ness RA (2006) On the marketing of IPOs. J Financ Econ 82(1):35–61

*Cooney JW, Singh AK, Carter RB, Dark FH (2001) IPO initial returns and underwriter reputation: has the inverse relation flipped in the 1990s? Working Paper, University of Kentucky, Case Western Reserve University and Iowa State University

Daily CM, Certo ST, Dalton DR, Roengpitya R (2003) IPO underpricing: a meta-analysis and research synthesis. Entrep Theory Pract 27(3):271–295

*Dell’Acqua A, Guardasole A, Bonini S (2013) Grandstanding and spinning in VC-backed IPOs on AIM UK. SSRN Working Paper, SSRN-ID = 2280411

*Dimovski W, Philavanh S, Brooks R (2011) Underwriter reputation and underpricing: evidence from the Australian IPO market. Rev Quant Finance Account 37(4):409–426

Djankov S, La Porta R, Lopez-de-Silanes F, Shleifer A (2008) The law and economics of self-dealing. J Financ Econ 88(3):430–465

Doidge C, Karolyi GA, Stulz RM (2004) Why are foreign firms listed in the US worth more? J Financ Econ 71(2):205–238

Dunbar CG (2000) Factors affecting investment banks initial public offering market share. J Financ Econ 55(1):3–41

Dyck A, Zingales L (2004) Private benefits of control: an international comparison. J Finance 59(2):537–600

Easterbrook FH (1984) Two agency-cost explanation of dividends. Am Econ Rev 74(4):650–659

Edelen RM, Kadlec GB (2005) Issuer surplus and the partial adjustment of IPO prices to public information. J Financ Econ 77(2):347–373

Ekkayokkaya M, Pengniti T (2012) Governance reform and IPO underpricing. J Corp Finance 18(2):238–253

Engelen P-J, van Essen M (2010) Underpricing of IPOs: firm-, issue- and country-specific characteristics. J Bank Finance 34(8):1958–1969

*Fang LK (2005) Investment bank reputation and the price and quality of underwriting services. J Finance 60(6):2729–2761

*Fernando CS, Krishnamurthy S, Spindt PA (2004) Are share price levels informative? Evidence from the ownership, pricing, turnover and performance of IPO firms. J Financ Mark 7(4):377–403

*Filatotchev I, Bishop K (2002) Board composition, share ownership, and underpricing of UK IPO firms. Strateg Manag J 23(10):941–955

*Fohlin C (2000) IPO underpricing in two universes: Berlin, 1882–1892, and New York, 1998–2000. Working Paper 1088, California Institute of Technology

*Francis B, Hasan I, Lothian JR, Sun X (2010) The signaling hypothesis revisited: evidence from foreign IPOs. J Financ Quant Anal 45(1):81–106

*Francis B, Hasan I, Zhou M (2012) Strategic conservative earnings management of technology firms: evidence from IPO market. Financ Mark Inst Instrum 21(5):261–293

*Franzke SA (2003) Underpricing of venture-backed and non venture-backed IPOs: Germany’s Neuer Markt. RICAFE working paper (Risk Capital and the Financing of European Innovative Firms), No. 003

Fulghieri P, Spiegel J (1991) Underpriced initial public offers as a multi-product investment house strategy. Paper fb-21, Columbia—Graduate School of Business

*Geranio M, Mazzoli C, Palmucci F (2013) Conflicts of interest in IPO pricing. Working Paper, University of Bocconi

Geyskens I, Krishnan R, Steenkamp JEM, Cunha PV (2009) A review and evaluation of meta-analysis practices in management research. J Manag 35(2):393–419

*Gompers PA (1996) Grandstanding in the venture capital industry. J Financ Econ 42(1):133–156

*Gounopoulos D (2003) The initial and aftermarket performance of IPOs: evidence from Athens Stock Exchange. Working Paper, Manchester School of Management

*Gounopoulos D, Nounis C, Stylianides P (2008) The short and long term performance of initial public offerings in the Cyprus Stock Exchange. J Financ Decis Mak 4(1):1–28

Grinblatt M, Hwang CY (1989) Signalling and the pricing of new issues. J Finance 44(2):393–420

*Guenther DA, Willenborg M (1999) Capital gains tax rates and the cost of capital for small business: evidence from the IPO market. J Financ Econ 53(3):385–408

*Guo RJ, Lev B, Shi C (2006) Explaining the short- and long-term IPO anomalies in the US by R&D. J Bus Finance Account 33(3–4):550–579

*Habib M, Ljungqvist A (2001) Underpricing and entrepreneurial wealth losses in IPOs: theory and evidence. Rev Financ Stud 14(2):433–458

Hanley KW (1993) The underpricing of initial public offerings and the partial adjustment phenomenon. J Financ Econ 34(2):231–250

Hansen RS, Torregrosa P (1992) Underwriter compensation and corporate monitoring. J Finance 47(4):1537–1555

Hao GQ (2007) Laddering in initial public offerings. J Financ Econ 85(1):102–122

Hardy MA (1993) Regression with dummy variables. quantitative applications in the social sciences, SAGE University Paper, 93

Hedges LV, Olkin I (1985) Statistical methods for meta-analysis. Academic Press, Orlando

Hedges LV, Vevea JL (1998) Fixed- and random-effects models in meta-analysis. Psychol Methods 3(4):486–504

Hedges LV, Tipton E, Johnson MC (2010) Robust variance estimation in meta-regression with dependent effect size estimates. Res Synth Methods 1(1):39–65

Heugens PPMAR, van Essen M, van Oosterhout J (2009) Meta-analyzing ownership concentration and firm performance in Asia. Towards a more fine-grained understanding. Asia Pac J Manag 26(3):481–512

*Hoberg G (2007) The underwriter persistence phenomenon. J Finance 62(3):1169–1206

Hopp C, Dreher A (2013) Do differences in institutional and legal environments explain cross-country variations in IPO underpricing? Appl Econ 45(4):435–454

*Howton SD, Howton SW, Olson GT (2001) Board ownership and IPO return. J Econ Finance 25(1):100–114

Hunter JE, Schmidt FL (2004) Methods of meta-analysis: correcting error and bias in research findings, 2nd edn. Sage, Thousand Oaks

Ibbotson RG (1975) Price performance of common stock new issues. J Financ Econ 2(3):235–272

Jackson D, Riley R, White IR (2011) Multivariate meta-analysis: potential and promise. Stat Med 30(20):2481–2498

Jagannathan R, Sherman AE (2005) Reforming the bookbuilding process for IPOs. J Appl Corp Financ 17(1):67–72

Jenkinson T, Ljungqvist A (2001) Going public: the theory and evidence on how companies raise equity finance, 2nd edn. Oxford University Press, Oxford

Johnson J, Miller R (1988) Investment banker prestige and the underpricing of initial public offerings. Financ Manag 17(2):19–29

*Karlis PL (2000) IPO underpricing. Park Place Econ VIII:81–89

Kaufmann D, Kraay A, Mastruzzi M (2004) Governance matters III: governance indicators for 1996, 1998, 2000, and 2002. World Bank Econ Rev 18(2):253–287

*Kirkulak B, Davis C (2005) Underwriter reputation and underpricing: evidence from the Japanese IPO market. Pac Basin Finance J 13(4):451–470

*Kutsuna K, Dimovski W, Brooks R (2008) The pricing and underwriting costs of Japanese REIT IPOs. J Prop Res 25(3):221–239

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. J Finance 52(3):1131–1150

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1998) Law and finance. J Political Econ 106(6):1113–1155

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1999) The quality of government. J Law Econ Organ 15(1):222–279

Leland HE, Pyle DH (1977) Information asymmetries, financial structure, and financial intermediation. J Finance 32(2):371–387

*Leone AJ, Rock S, Willenborg M (2007) Disclosure of intended use of proceeds and underpricing in initial public offerings. J Account Res 45(1):111–153

*Lin TH (1996) The certification role of large block shareholders in initial public offerings: the case of venture capitalists. Q J Bus Econ 35(2):55–65

*Liu X, Ritter JR (2011) Local underwriter oligopolies and IPO underpricing. J Financ Econ 102(3):579–601

*Ljungqvist A (1999) IPO underpricing, wealth losses and the curious role of venture capitalists in the creation of public companies. Unpublished working paper

*Ljungqvist A, Wilhelm WJ (2003) IPO pricing in the dot-com bubble. J Finance 58(2):723–752

Logue DE (1973) On the pricing of unseasoned equity issues: 1965–1969. J Financ Quant Anal 8(1):91–103

Logue DE, Rogalski RJ, Seward JK, Foster-Johnson L (2002) What is special about the roles of underwriter reputation and market activities in initial public offerings? J Bus 75(2):213–243

Loughran T, Ritter JR (2002) Why don’t issuers get upset about leaving money on the table in IPOs? Rev Financ Stud 15(2):413–443

*Loughran T, Ritter J (2004) Why has IPO underpricing changed over time? Financ Manag 33(3):5–37

*Loureiro G (2010) The reputation of underwriters: a test of the bonding hypothesis. J Corp Finance 16(4):516–532

*Lowry M, Murphy KJ (2007) Executive stock options and IPO underpricing. J Financ Econ 85(1):339–365

Lowry M, Schwert GW (2004) Is the IPO pricing process efficient? J Financ Econ 71(1):3–26

Lypsey MW, Wilson DB (2001) Practical meta-analysis. Sage Publications, Thousand Oaks

*McGuinness P (1992) An examination of the underpricing of initial public offerings in Hong Kong: 1980–1990. J Bus Finance Account 19(2):165–186

*Megginson W, Weiss KA (1991) Venture capital certification in initial public offerings. J Finance 46(3):879–903

*Michaely R, Shaw WH (1994) The pricing of initial public offerings: tests of adverse-selection and signaling theories. Rev Financ Stud 7(2):279–319

Mulherin JH (2007) Measuring the costs and benefits of regulation: conceptual issues in securities markets. J Corp Finance 13(2–3):421–437

Pagano M, Panetta F, Zingales L (1998) Why do companies go public? An empirical analysis. J Finance 53(1):27–64

Pham PK, Kalev PS, Steen AB (2003) Underpricing, stock allocation, ownership structure and post-listing liquidity of newly listed firms. J Bank Finance 27(5):919–947

*Pollock TG (2004) The benefits and costs of underwriters’ social capital in the US Initial Public Offerings market. Strateg Organ 2(4):357–388

Pollock TG, Fund B, Baker T (2009) Dance with the one that brought you? Venture capital firms and the retention of founder-CEOs. Strateg Entrep J 3(3):199–217

*Rasheed AMA, Datta DK, Chinta RR (1997) Determinants of price premiums: a study of initial public offerings in the medical diagnostics and devices industry. J Small Bus Manag 35(4):11–23

*Reber B, Fong C (2006) Explaining mispricing of initial public offerings in Singapore. Appl Financ Econ 16:1339–1353

Ritter JR (1984) Signaling and the valuation of unseasoned new issues: a comment. J Finance 39(4):1231–1237

Ritter JR (1987) The costs of going public. J Financ Econ 19(2):269–281

*Robinson RM, Robinson MA, Peng C-C (2004) Underpricing and IPO ownership retention. J Econ Finance 28(1):132–146

Rock K (1986) Why new issues are Underpriced? J Financ Econ 15(1–2):187–212

Rosenthal R (1991) Meta-analytic procedures for social research, Revised edn. Sage, Newbury Park

Sapienza H, Manigart S, Vermeir W (1996) Venture capitalist governance and value added in four countries. J Bus Ventur 11(6):439–469

*Schenone C (2004) The effect of banking relationships on the firm’s IPO underpricing. J Finance 59(6):2903–2958

*Schertler A (2002) The determinant of underpricing: initial public offerings on the Neuer Markt and the Nouveau Marché. EIFC Working Paper, 02–12

*Schrand C, Verrecchia RE (2005) Information disclosure and adverse selection explanations for IPO underpricing. Working Paper SSRN No. 316824

*Smart SB, Zutter CJ (2003) Control as motivation for underpricing: a comparison of dual and single class IPOs. J Financ Econ 69(1):85–110

*Song K, Choi Y-S, Lee JE (2012) Revisiting the certifying role of financial intermediaries on IPOs. J Appl Bus Res 28(5):1017–1034

Spamann H (2010) The “antidirector rights index” revisited. Rev of Financ Stud 23(2):467–486

Stanley TD (2001) Wheat from chaff: meta-analysis as quantitative literature review. J Econ Perspect 15(3):131–150

Stanley TD, Doucouliagos H, Jost MG, Heckemeyer H, Johnston RJ, Laroche P, Nelson JP, Paldam M, Poot J, Pugh G, Rosenberger RS, Rost K (2013) Meta-analysis of economics research reporting guidelines. J Econ Surv 27(2):390–394

Stoll H, Curley AJ (1970) small business and the new issues markets for equities. J Financ Quant Anal 5(3):309–322

Stübben J, Berkholz R (2014) Determinants of IPO underpricing—a comparison between the UK and Germany. Master thesis. Lund University

Su C (2015) Does institutional reform improve the impact of investment bank reputation on the long-term stock performance of initial public offerings? Br Account Rev 47(4):445–470

*Su C, Bangassa K (2011) The impact of underwriter reputation on initial returns and long-run performance of Chinese IPOs. J Int Financ Mark Inst Money 21(5):760–791

Tanner-Smith EE, Tipton E (2013) Robust variance estimation with dependent effect sizes: practical considerations including a software tutorial in Stata and SPSS. Res Synth Methods 5(1):13–30

Tanner-Smith EE, Tipton E, Polanin JR (2016) Handling complex meta-analytic data structures using robust variance estimates: a tutorial in R. J Dev Life-Course Criminol 2(1):85–112

Thompson SG, Higgins JPT (2002) How should meta-regression analyses be undertaken and interpreted? Stat Med 21(11):1559–1573

Tinic SM (1988) Anatomy of initial public offerings of common stock. J Finance 43(4):789–822

Tipton E (2013) Robust variance estimation in meta-regression for binary dependent outcomes. Res Synth Methods 4(2):169–187

*Vismara S (2014) Patents, R&D investments and post-IPO strategies. Rev Manag Sci 8(3):419–435

Vong API, Trigueiros D (2010) The short-run price performance of initial public offerings in Hong Kong: new evidence. Glob Finance J 21(3):253–261

*Vong API, Zhao N (2008) An examination of IPO underpricing in the growth enterprise market of Hong Kong. Appl Financ Econ 18(19):1539–1547

Welch I (1989) Seasoned offerings, imitation costs and the underpricing of initial public offerings. J Finance 44(2):421–449

*Wen W (2005) What has explained IPO underpricing? Working Paper Simon Fraser University

*Wolf FM (1986) Meta-analysis: quantitative methods for research synthesis. Quantitative applications in the social sciences. SAGE University Paper, 59

World Bank (2016) The worldwide governance indicators. http://www.worldbank.org/. Accessed Feb 2016

Wurgler J (2000) Financial markets and the allocation of capital. J Financ Econ 58(1–2):187–214

*Yang L (2012) An analysis of the IPO underpricing for high-tech companies in Japan. Working Paper Saint Mary’s University, Halifax N.S

*Yeh Y-H, Shu P-G, Guo R-J (2008) Ownership structure and IPO valuation—evidence from Taiwan. Financ Manag 37(1):141–161

Zhang F (2012) Information precision and IPO pricing. J Corp Finance 18(2):331–348

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

List of the management, entrepreneurship and finance journals used for manually search of papers, which were the journals that I found in the first set of papers that I obtained as output using the first research-criteria.

List of the Journals | |

|---|---|

Academy of Management Journal; Academy of Management Review; Applied Financial Economics; British Journal of Management; Corporate Governance: An International Review; Entrepreneurship Theory and Practice; European Economic Review; European Journal of Finance; Financial Management; Financial Markets; Financial Markets, Institutions & Instruments; Financial Review; Global Finance Journal; Investment Management and Financial Innovations; Journal of Accounting Research; Journal of Applied Business Research; Journal of Banking and Finance; Journal of Business; Journal of Business Venturing; Journal of Business, Finance and Accounting; Journal of Corporate Finance; Journal of Economics and Business; Journal of Economics and Finance; Journal of Economic Perspectives; Journal of Finance; Journal of Financial and Quantitative Analysis; Journal of Financial Decision Making; Journal of Financial Economics; Journal of Financial Markets; Journal of Financial Services Research; Journal of International Financial Market, Institution & Money; Journal of Law and Economics; Journal of Management Studies; Journal of Multinational Financial Management; Journal of Property Research; Journal of Property Investment & Finance; Journal of Small Business Management; Pacific-Basin Finance Journal; Park Place Economist; Quarterly Journal of Business and Economics; Quarterly Review of Economics and Finance; Review of Financial Studies; Review of Managerial Science; Review of Quantitative Finance and Accounting; Small Business Economics; Strategic Management Journal; Strategic Organization. |

Rights and permissions

About this article

Cite this article

La Rocca, T. Do prestigious underwriters shape IPO pricing? A meta-analytic review. Rev Manag Sci 15, 573–609 (2021). https://doi.org/10.1007/s11846-019-00356-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-019-00356-1

Keywords

- Corporate governance

- Underpricing

- Underwriter reputation

- Prestigious underwriter

- Meta-analytic moderator analysis

- Robumeta approach