Abstract

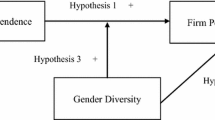

The aim of our research is to analyze how board characteristics influence firm performance. In this paper, we specifically examine how board size, board independence, CEO duality, female directors and board compensation affect firm performance in a sample of international firms. The final panel data sample is composed of 10,314 firm-year observations belonging to 34 countries that have been grouped into six geographic zones: Africa, Asia, Europe, Latin America, North America and Oceania. Drawing on agency theory and dependence resource theory, we posit five hypotheses. The results show that some board characteristics, such as board size, board independence and having a female director, are positively associated with firm performance, whereas CEO duality, contrary to our expectations, also impacts positively on firm performance. Moreover, board compensation is not associated with firm performance. Tobin’s Q was used to measure firm performance, although an accounting measure was also employed for robustness analyses and to provide more validity to our results.

Similar content being viewed by others

References

Abdo A, Fisher G (2007) The impact of reported corporate governance disclosure on the financial performance of companies listed on the JSE. Invest Anal J 66:43–56

Adams R, Ferreira D (2009) Women in the boardroom and their impact on governance and performance. J Financ Econ 94(2):291–309

Agrawal A, Knoeber C (1996) Firm performance and mechanisms to control agency problems between managers and shareholders. J Finan Quant Anal 31(3):377–397

Andreas J, Rapp MS, Wolf M (2012) Determinants of director compensation in two-tier systems: evidence from German panel data. Rev Manag Sci 6:33–79

Arosa B, Iturralde T, Naseda A (2010) Outsiders on the board of directors and firm performance: evidence from Spanish non-listed family firms. J Fam Bus Strategy 1:236–245

Baliga BR, Moyer C (1996) CEO duality and firm performance. What’s the fuss? Strateg Manag J 17(1):41–53

Bernard AB, Jensen JB (2007) Firm structure, multinationals, and manufacturing plant deaths. Rev Econ Stat 89(2):193–204

Bhagat S, Black B (2002) The non-correlation between board independence and long-term firm performance. J Corp Law 27(2):231–273

Bhatt RR, Bhattacharya S (2015) Board structure and firm performance in Indian IT firms. J Adv Manag Res 12(3):232–248

Boerkamp E (2016) Ownership concentration, ownership identity and firm performance: an empirical analysis of Dutch listed firms. Paper presented at the 7th IBA bacheloer thesis conference, July, University of Twente, The Faculty of Behavioural, Management and Social sciences, The Netherlands

Bozec R (2005) Board of directors, market discipline and firm performance. J Bus Finance Account 32(9–10):1921–1960

Brown LD, Caylor ML (2006) Corporate governance and firm valuation. J Account Public Policy 25:409–434

Brown W, Helland E, Smith JK (2006) Corporate philanthropic practices. J Corp Finance 12:855–877

Carter DA, Simkins BJ, Simpson WG (2003) Corporate governance, board diversity and firm value. Financ Rev 38:33–35

Carter DA, D’Souza F, Simkins BJ, Simpson WG (2010) The gender and ethnic diversity of US boards and board committees and firm financial performance. Corp Gov Int Rev 18(5):396–414

Chang C, Yu SW, Hung C (2015) Firm risk and performance: the role of corporate governance. Rev Manag Sci 9:141–173

Cheng S (2008) Board size and the variability of corporate performance. J Finan Econ 87:157–176

Christensen J, Kent P, Stewart J (2010) Corporate governance and company performance in Australia. Aust Account Rev 20(4):372–386

Chung KH, Pruitt SW (1994) A simple approximation of Tobin's q. Financ Manag 23(3):70–74

Claessens S, Yurtoglu BB (2013) Corporate governance in emerging markets: a survey. Emerg Mark Rev 15:1–33

Coles JW, McWilliams L, Sen N (2001) An examination of the relationship of governance mechanisms to performance. J Manag 27:23–50

Coles JL, Daniel ND, Naveen L (2008) Boards: does one size fit all? J Financ Econ 87(2):329–356

Conyon M (2006) Executive compensation and incentives. Acad Manag Persp 20:25–44

Corbetta G, Salvato C (2004) The board of directors in family firms: one size fitsall? Fam Bus Rev 17(2):119–134

Corporate Governance Code (2010) The Financial Reporting Council, London, UK

Dahya J, McConnell JJ (2007) Board composition, corporate performance and the Cadbury committee recommendation. J Financ Quant Anal 42(3):535–564

Dahya J, García LG, van Bommel J (2009) One man two hats: what’s all the commotion. Financ Rev 44(2):179–212

Dalton DR, Dalton CM (2011) Integration of micro and macro studies in governance research: CEO duality, board composition, and financial performance. J Manag 37(2):404–411

Dalton DR, Daily CM, Ellstrand AE, Johnson JL (1998) Meta-analytic reviews of board composition, leadership structure and financial performance. Strateg Manag J 19:269–290

Dey DK, Chauhan YK (2009) Board composition and performance in Indian firms: a comparison. IUP J Corp Gov 8(2):7–19

Donaldson L, Davis JH (1991) Stewardship theory or agency theory: CEO governance and shareholder returns. Aust J Manag 16:49–64

Du Rietz A, Henrekson M (2000) Testing the female underperformance hypothesis. Small Bus Econ 1:1–10

Ehikioya BI (2009) Corporate governance structure and firm performance in developing economies: evidence from Nigeria. Corp Gov 9(3):231–243

Eklund JE, Desai S (2013) Ownership and allocation of capital: Evidence from 44 countries. Working paper, Series from Swedish Entrepreneurship Forum, Sweden

Elsayed K (2007) Does CEO duality really affect corporate performance? Corp Gov Int Rev 15(6):1203–1214

Erhardt NL, Werbel JD (2003) Board of director diversity and firm financial performance. Corp Gov Int Rev 11:102–111

Faleye O (2007) Does one hat fit all? The case of corporate leadership structure. J Manag Gov 11:239–259

Fama EF, Jensen MC (1983) Separation of ownership and control. J of Law and Econ 26(2):301–325

Fauver L, Hung M, Li X, Taboada AG (2017) Board reforms and firm value: worldwide evidence. J Financ Econ 125(1):120–142

Fernández-Gago R, Cabeza-García L, Nieto M (2016) Corporate social responsibility, board of directors, and firm performance: an analysis of their relationships. Rev Manag Sci 10:85–104

Firth M, Lohne JC, Ropstad R, Sjo J (1995) Managerial compensation in Norway. J Multinatl Financ Manag 5(2/3):87–101

Fodio MI, Oba VC (2012) Gender diversity in the boardroom and corporate philanthropy: evidence from Nigeria. Res J Finance Account 3(8):63–69

Fosberg RH, Nelson MR (1999) Leadership structure and firmper formance. Int Rev Financ Anal 8:83–96

Gabrielsson J (2007) Correlates of board empowerment in small companies. Entrepr Theory Pract 31:687–711

García-Ramos R, Díaz-Díaz B, García-Olalla M (2017) Independent directors, large shareholders and firm performance: the generational stage of family businesses and the socioemotional wealth approach. Rev Manag Sci 11:119–156

Goyal VK, Park CW (2002) Board leadership structure and CEO turnover. J Corp Finance 8:49–66

Guest PM (2009) The impact of board size on firm performance: evidence from the U.K. Eur J Finance 15(4):385–404

Gul FA, Leung S (2004) Board leadership, outside directors’ expertise, and voluntary corporate disclosures. J Account Public Policy 23:351–379

Gul F, Srinidhi B, Ng A (2011) Does board gender diversity improve the informativeness of stock prices? J Account Econ 51:314–338

Handa R (2018) Does corporate governance affect financial performance: a study of select Indian banks. Asia Econ Financ Rev 8(4):478–486

Haniffa RM, Cooke TE (2002) Culture, corporate governance and disclosure in Malaysian corporations. Abac 38(3):317–349

Hashim AH, Devi S (2009) Board characteristics, ownership structure and earnings quality: Malaysian evidence. Res Account Emerg Econ 8:97–123

Hillman AJ, Dalziel T (2003) Board of directors and firm performance: integrating agency and resource dependence perspectives. Acad Manag Rev 28(3):383–396

Hillman AJ, Shropshire C, Canella AA (2007) Organizational predictors of women on corporate boards. Acad Manag J 50(4):941–952

Hoffmann SP (2014) Internal corporate governance mechanisms as drivers of firm value: panel data evidence for Chilean firms. Rev Manag Sci 8:575–604

Hoobler JM, Masterson CR, Nkomo SM, Michel EJ (2016) The business case for women leaders: meta-analysis, research critique, and path forward. Paper presented at closing the gender gap: advancing leadership and organizations. https://doi.org/10.5703/1288284316077

Hsu HH, Wu CYH (2014) Board composition, grey directors and corporate failure in the UK. Br Account Rev 46:215–227

Hutchinson M, Gul FA (2004) Investment opportunity set, corporate governance practices and firm performance. J Corp Finance 182:1–20

Ibrahim NA, Angelidis JP (1995) The corporate social responsiveness orientation of board members: are there differences between inside and outside directors? J Bus Ethics 14(5):405–410

Iliev P, Lins KV, Miller DP, Roth L (2015) Shareholder voting and corporate governance around the world. Rev Financ Stud 28(8):2167–2202

Jackling B, Johl S (2009) Board structure and firm performance: evidence from India’s top companies. Corp Gov Int Rev 17(4):492–509

Jensen MC (1986) The agency costs of free cash flow. Am Econ Rev Pap Proc 76:326–329

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behaviour, agency costs and ownership structure. J Financ Econ 3:305–360

Jensen MC, Murphy KJ (2004) Remuneration: where we’ve been, how we got to here, what are the problems, and how to fix them. Working paper series in finance. European Corporate Governance Institute. www.ecgi.or/wp. Accessed 9 Apr 2018

Jeppson T, Smith W, Stone R (2009) CEO compensation and firm performance: is there any relationship? J Bus Econ Res 7:81–94

Jermias J (2007) The effects of corporate governance on the relationship between innovative efforts and performance. Eur Acc Rev 16(4):827–854

Jermias J, Gani L (2014) The impact of board capital and board characteristics on firm performance. Br Account Rev 46:135–153

Jia M, Zhang Z (2013) Managerial ownership and corporate social performance: evidence from privately owned chinese firms’ response to the Sichuan earthquake. Corp Soc Responsib Environ Manag 20:257–274

Jiang H, Habib A, Gong R (2015) Business cycle and management earnings forecasts. Abacus 51(2):279–310

Jizi M, Salama A, Dixon R, Stratling R (2014) Corporate governance and the content of corporate social responsibility disclosure. J Bus Ethics 125(4):601–615

Jorgenson D, Vu KH (2005) Information technology and the world economy. Scand J Econ 107(4):631–650

Judge WQ, Naoumova I, Koutzevol N (2003) Corporate governance and firm performance in Russia: an empirical study. J World Bus 38(4):385–396

Kalsie A, Shrivastav SM (2016) Analysis of board size and firm performance: evidence from NSE companies using panel data approach. Ind J Corp Gov 9(2):148–172

Kiel GC, Nicholson GJ (2003) Board composition and corporate performance: how the Australian experience informs contrasting theories of corporate governance. Corp Gov Int Rev 11(3):189–205

Kılıç M, Kuzey C (2016) The effect of board gender diversity on firm performance: evidence from Turkey. Gender Manag Int J 31(7):434–455

Kim Y (2005) Board network characteristics and firm performance in Korea. Corp Gov Int Rev 13:613–631

Kim EH, Lu Y (2013) Corporate governance reforms around the world and cross-border acquisitions. J Corp Finance 22:236–253

Klein A (1998) Firm performance and board committee structure. J Law Econ 41:275–304

Kong G, Kong D (2017) Corporate governance, human capital, and productivity: evidence from Chinese non-listed. Appl Econ 49(27):2655–2668

Konrad AM, Kramer VW, Erkut S (2008) Critical mass: the impact of three or more women on corporate boards. Organ Dyn 37(2):145–164

Kota HB, Tomar S (2010) Corporate governance practices in Indian firms. J Manag Organ 16(2):266–279

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1998) Law and finance. J Polit Econ 106:1113–1155

Larcker DF, Scott A, Richardson SA, Tuna I (2007) Corporate governance, accounting outcomes, and organizational performance. Accoount Rev 82(4):963–1008

Lee S, Qu X (2011) An examination of the curvilinear relationship between capital intensity and firm performance for publicly traded US hotels and restaurants. Int Contem Hosp Manag 23(6):862–880

Lehn KM, Patro S, Zhao M (2009) Determinants of the size and composition of US Corporate Boards: 1935–2000. Finan Manag 38(4):747–780

Li M-YL, Yang T-H, Yu S-E (2015) CEO stock-based incentive compensation and firm performance: a quantile regression approach. J Int Financ Manag Account 26(1):39–71

Lin C, Ma Y, Su D (2009) Corporate governance and firm efficiency: evidence from China’s publicly listed firms. Manag Decis Econom 30(3):193–209

Liu Y, Wei Z, Xie F (2013) Do women directors improve firm value in China? J Corp Finance 46:1–16

Magnan M, St-Onge S, Gélinas P (2010) Director compensation and firm value: a research synthesis. Int J Discl Gov 7(1):28–41

Mak YT, Kusnadi Y (2005) Size really matters: further evidence on the negative relationship between board size and firm value. Pac Basin Finance J 13(3):301–318

Masulis RW, Wang C, Xie F (2012) Globalizing the boardroom—the effects of foreign directors on corporate governance and firm performance. J Account Finance 53:527–664

Matolcsy Z, Wright A (2011) CEO compensation structure and firm performance. Account Finance 51(3):745–763

Maury B, Pajuste A (2005) Multiple large shareholders and firm value. J Bank Finance 29(7):1813–1834

McIntyre ML, Murphy SA, Mitchell P (2007) The top team: examining board composition and firm performance. Corp Gov 7(5):547–561

Miller S, Yang T (2015) Board leadership structure of publicly-traded insurance companies. J Insur Issues 38(2):184–232

Mintzberg H (1993) Structure in fives: designing effective organizations. Prentice-Hall, Englewood Cliffs

Mishra RK, Kapil S (2018) Board characteristics and firm value for Indian companies. J Ind Bus Res 10(1):2–32

Miwa Y, Ramseyer M (2005) Who appoints them, what do they do? Evidence on outside directors from Japan. J Econ Manag Strateg 14(2):299–337

Molonko LK (2004) Board structure, board compensation and firm profitability. Evidence from the banking industry. Research project for the Degree of Master of Business Administration. Faculty of Commerce, University of Nairobi, Kenya

Müller V, Ienciu I, Bonaci CG, Filip CI (2014) Board characteristics best practices and financial performance. Evidence from the European capital market. Amfiteatru Econ J 16(36):672–683

Mura R (2007) Firm performance: do non-executive directors have minds of their own? Evidence from UK panel data. Financ Manag 36(3):81–112

Murphy K (1999) Executive compensation. In: Ashenfelter O, Cars D (eds) Handbook of labor economics, vol 3B. North-Holland, Amsterdam, pp 2485–2563

Nielsen S, Huse M (2010) The contribution of women on boards of directors: going beyond the Surface. Corp Gov Int Rev 18(2):136–148

Noor MA, Fadzil FH (2013) Board characteristics and performance from perspective of governance code in Malaysia. World Rev Bus Res 3:191–206

O’Connell V, Cramer N (2010) The relationship between firm performance and board characteristics in Ireland. Eur Manag J 28(5):387–399

Ozkan N (2007) Do corporate governance mechanisms influence CEO compensation? An empirical investigation of UK companies. J Multnatl Finan Manag 17(5):349–364

Palaniappan G (2017a) Board characteristics relating to firm performance: a study on manufacturing firms in India. J Commer Account Res 6(1):26–36

Palaniappan G (2017b) Determinants of corporate financial performance relating to board characteristics of corporate governance in Indian manufacturing industry: an empirical study. Eur J Manag Bus Econ 26(1):67–85

Palmberg J (2015) The performance effect of corporate board of directors. Eur Law Econ 40(2):273–292

Pearce J, Zahra S (1992) Board composition from a strategic contingency perspective. J Manag Stud 29:411–438

Pfeffer J, Salancik G (1978) The external control of organizations: a resource dependency perspective. Harper and Row, New York

Prevost AK, Rao RP, Hossain M (2002) Board composition in New Zealand: an agency perspective. J Bus Finance Account 29(5–6):731–760

Pucheta-Martínez MC (2015) El papel del Consejo de Administración en la creación de valor en la empresa. Span Account Rev 18(2):148–161

Randöy T, Thomsen S, Oxelheim L (2006) A Nordic perspective on corporate board diversity. Nordic Innovation Centre, Oslo

Rechner PL, Dalton DR (1991) CEO duality and organizational performance: a longitudinal analysis. Strateg Manag J 12:155–160

Reddy K, Locke S, Scrimgeour F (2010) The efficacy of principle-based corporate governance practices and firm financial performance: an empirical investigation. Int J Manag Finance 6(3):190–219

Ritchie T (2007) Independent directors: magic bullet or Band-Aid? Corporate Governance eJournal. http://epublications.bond.edu.au/cgej/5. Accessed June 2017

Rogers W (1993) Regression standard errors in clustered samples. Stata Tech Bull 13:19–23

Roundtable B (2012) Principles of corporate governance. The Business Roundtable, Washington

Seierstad C (2016) Beyond the business case: the need for both utility and justice rationales for increasing the share of women on boards. Corp Gov Int Rev 24(4):390–405

Shehata N, Salhin A, El-Helaly M (2017) Board diversity and firm performance: evidence from the U.K. SMEs. Appl Econ 49(48):4817–4832

Shleifer A, Vishny R (1997) A survey of corporate governance. J Finance 52:737–783

Singh S, Tabassum N, Darwish K, Batsakis G (2018) Corporate governance and Tobin’s Q as a measure of organizational performance. Br J Manag 29:171–190

Smith N, Smith V, Verner M (2006) Do women in top management affect firm performance? A panel study of 2,500 Danish firms. Int J Perform Manag 55:569–593

Solimene S, Coluccia D, Fontana S (2017) Gender diversity on corporate boards: an empirical investigation of Italian listed companies. Palgrave Commun 3:1–7

Song F, Yuan P, Gao F (2006) Does large state shareholder affect the governance of Chinese board of directors? Working paper, Tsinghua University

Sonnenfeld J (1981) Executive apologies for price fixing: role biased perceptions of causality. Acad Manag J 24(1):192–198

Stanwick PA, Stanwick SD (2010) The relationship between corporate governance and financial performance: an empirical study of Canadian firms. Bus Rev 16(2):35–41

Surroca J, Tribo JA (2008) Managerial entrenchment and corporate social performance. J Bus Finance Account 35:748–789

Terjesen S, Couto EB, Francisco PM (2016) Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. J Manag Gov 20(3):447–483

Tsui JSL, Jaggi B, Gul FA (2001) CEO domination, growth opportunities, and their impact on audit fees. J Account Audit Finance 16(3):189–208

Tsuruta D (2017) Variance of firm performance and leverage of small businesses. J Small Bus Manag 55(3):404–429

Tuggle CS, Simon DG, Reutzel CR, Biernmen L (2010) Commanding board of director attention: investigating how organization performance and CEO duality affect board members. Atten Monit Strateg Manag J 31(9):946–968

Tyagi SH, Nauriyal DK, Gulat R (2018) Firm level R&D intensity: evidence from Indian drugs and pharmaceutical industry. Rev Manag Sci 12:167–202

Ullah W (2017) Evolving corporate governance and firms performance: evidence from Japanese firms. Econ Gov 18:1–33

Vafeas N, Theodorou E (1998) The relationship between board structure and firm performance in the UK. Br Account Rev 30:383–407

Vafei A, Ahmed K, Mather P (2015) Board diversity and financial performance in the top 500 Australian firms. Aust Account Rev 25(4):413–427

Vieira ES (2017) Debt policy and firm performance of family firms: the impact of economic adversity. Int J Man Finance 13(3):267–286

Volonte C (2015) Boards: independent and committed directors? Int Rev Law Econ 41:25–37

Watson R, Wilson N (2005) Board pay and the separation of ownership from control in U.K. SMEs. Small Bus Econ 24(5):465–476

Webb E (2004) An examination of socially responsible firms’ board structure. J Manag Gov 8:255–277

Weir C, Laing D (2001) Governance structures, director independence and corporate performance in the UK, Euro. Bus Rev 13(2):86–95

Weir C, Laing D, McKnight PJ (2002) Internal and external governance mechanisms: their impact on the performance of large UK public companies. J Bus Finance Account 29(5–6):579–611

Williams R (2000) A note on robust variance estimation for cluster-correlated data. Biometrics 56:645–646

Yermack D (1996) Higher market evaluation of companies with small board of directors. J Financ Econ 40:185–212

Zahra SA, Pearce JA (1989) Boards of directors and corporate financial performance: a review and integrative model. J Manag 15:291–301

Zahra SA, Stanton WW (1988) The implications of board of directors’ composition on corporate strategy and performance. Int J Manag 5(2):229–236

Zhang Y (2002) Voting rights, corporate control, and firm performance. Dissertation, Michigan State University, Michigan, USA

Zhu H, Wang P, Bart C (2016) Board processes, board strategic involvement, and organizational performance in for-profit and non-profit organizations. J Bus Ethics 136(2):311–328

Acknowledgements

The authors acknowledge financial support from the Spanish Ministry of Economy, Industry and Competitiveness for the Research Project ECO 2017-82259-R and from the University Jaume I, Spain, for the Research Project UJI-B2018-15.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author(s) declare no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Pucheta-Martínez, M.C., Gallego-Álvarez, I. Do board characteristics drive firm performance? An international perspective. Rev Manag Sci 14, 1251–1297 (2020). https://doi.org/10.1007/s11846-019-00330-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-019-00330-x

Keywords

- Board size

- Board independence

- CEO duality

- Female director

- Board compensation

- Corporate performance

- International companies