Abstract

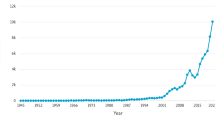

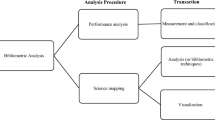

Relatedness has become fundamental to the analysis of corporate diversification and a wide range of strategy research. Its broad definition, however, leaves researchers with substantial leeway in theorizing and operationalizing the relatedness construct. While recent advances have contributed to a more sophisticated understanding of how relatedness creates value, the heterogeneity of scholarly efforts leaves relatedness research in a state of terminological, conceptual, and methodological fragmentation and in need of consolidation. This article seeks to close this research gap by taking stock of the extant literature and providing the first systematic review focused exclusively on related diversification. The review identifies and analyzes 82 peer-reviewed scholarly articles published between 1982 and 2017, providing a critical assessment of these research efforts and proposing a holistic relatedness research framework that can serve as a common foundation for future scholarship. The review concludes by offering eight avenues for future research as a contribution to the theoretical literatures on diversification and resource-based theory.

Similar content being viewed by others

Notes

Relatedness at the operating level refers to links between value chain functions, e.g., marketing and production. For long, this was the dominant understanding of the term in the strategy literature following the accentuation of the original Wrigley/Rumelt classification (Grant 1988).

References

Studies preceded by ‘*’ were included in the literature sample

*Ahuja G, Katila R (2001) Technological acquisitions and the innovation performance of acquiring firms: a longitudinal study. Strateg Manag J 22:197–220

*Ahuja G, Lampert CM, Tandon V (2014) Paradigm-changing vs. paradigm-deepening innovation: how firm scope influences firm technological response to shocks. Organ Sci 25:653–669

*Ahuja G, Novelli E (2017) Redirecting research efforts on the diversification-performance linkage: the search for synergy. Acad Manag Ann 11:342–390

*Anand J, Singh H (1997) Asset redeployment, acquisitions and corporate strategy in declining industries. Strateg Manag J 18:99–118

Ansoff HI (1965) Corporate strategy. McGraw-Hill, New York

Arnould RJ (1969) Conglomerate growth and public policy. In: Gordon L (ed) Economics of conglomerate growth. Corvallis, Oregon, pp 72–80

*Barney JB (1988) Returns to bidding firms in mergers and acquisitions: reconsidering the relatedness hypothesis. Strateg Manag J 9:71–78

Barney JB (1991) Firm resources and sustained competitive advantage. J Manag 17:99–120

Barney JB, Ketchen DJ, Wright M (2011) The future of resource-based theory: revitalization or decline? J Manag 37:1299–1315

*Bergh DD, Johnson RA, Dewitt R-L (2008) Restructuring through spin-off or sell-off: transforming information asymmetries into financial gain. Strateg Manag J 29:133–148

*Bettis RA, Hall WK (1982) Diversification strategy, accounting determined risk, and accounting determined return. Acad Manag J 25:254–264

*Bettis RA, Mahajan V (1985) Risk/return performance of diversified firms. Manag Sci 31:785–799

*Bruton GD, Oviatt BM, White MA (1994) Performance of acquisitions of distressed firms. Acad Manag J 37:972–989

*Bryce DJ, Winter SG (2009) A general interindustry relatedness index. Manag Sci 55:1570–1585

Campagnolo D, Camuffo A (2009) The concept of modularity in management studies: a literature review. Int J Manag Rev 12:259–283

Caves RE, Porter ME, Spence AM (1980) Competition in the open economy. Harvard University Press, Cambridge

*Celo S, Chacar A (2015) International coherence and MNE performance. J Int Bus Stud 46:620–628

*Chatterjee S (1990) Excess resources, utilization costs, and mode of entry. Acad Manag J 33:780–800

*Chatterjee S, Lubatkin M (1990) Corporate mergers, stockholder diversification, and changes in systematic risk. Strateg Manag J 11:255–268

*Chatterjee S, Wernerfelt B (1991) The link between resources and type of diversification: theory and evidence. Strateg Manag J 12:33–48

*Coff RW (1999) How buyers cope with uncertainty when acquiring firms in knowledge-intensive industries: caveat emptor. Organ Sci 10:144–161

Cohen WM, Levinthal DA (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35:128–152

David RJ, Han S-K (2004) A systematic assessment of the empirical support for transaction cost economics. Strateg Manag J 25:39–58

Davis R, Duhaime IM (1992) Diversification, vertical integration, and industry analysis: new perspectives and measurement. Strateg Manag J 13:511–524

*Davis PS, Robinson RB, Pearce JA, Park SH (1992) Business unit relatedness and performance: a look at the pulp and paper industry. Strateg Manag J 13:349–361

Dierickx I, Cool K (1989) Asset stock accumulation and sustainability of competitive advantage. Manag Sc 35:1504–1511

*Diestre L, Rajagopalan N (2011) An environmental perspective on diversification: the effects of chemical relatedness and regulatory sanctions. Acad Manag J 54:97–115

Dixit A (1989) Entry and exit decisions under uncertainty. J Polit Econ 97:620–638

Dixit A (1992) Investment and hysteresis. J Econ Perspect 6:107–132

*Døving E, Gooderham PN (2008) Dynamic capabilities as antecedents of the scope of related diversification: the case of small firm accountancy practices. Strateg Manag J 29:841–857

Durand R, Grant R, Madsen TL (2013) Reviews of strategic management research: call for papers for a special issue. https://www.strategicmanagement.net/media/download/conferences/smj/overview/special-issues/past-special-issues/_rightColumn/past-special-issues/reviews/file. Accessed 21 Apr 2016

Easterby-Smith M, Thorpe R, Jackson PR, Lowe A (2008) Management research, 3rd edn. SAGE, Los Angeles

Fan JPH, Lang LHP (2000) The measurement of relatedness: an application to corporate diversification. J Bus 73:629–660

*Farjoun M (1994) Beyond industry boundaries: human expertise, diversification and resource-related industry groups. Organ Sci 5:185–199

*Farjoun M (1998) The independent and joint effects of the skill and physical bases of relatedness in diversification. Strateg Manag J 19:611–630

*Gary MS (2005) Implementation strategy and performance outcomes in related diversification. Strateg Manag J 26:643–664

Gort M (1962) Diversification and integration in American industry. Princeton University Press, Princeton

*Grant RM (1988) On ‘dominant logic’, relatedness and the link between diversity and performance. Strateg Manag J 9:639–642

*Grant RM, Jammine AP (1988) Performance differences between the Wrigley/Rumelt strategic categories. Strateg Manag J 9:333–346

*Hansen MT (2002) Knowledge networks: explaining effective knowledge sharing in multiunit companies. Organ Sci 13:232–248

*Harrison JS, Hall EH, Nargundkar R (1993) Resource allocation as an outcropping of strategic consistency: performance implications. Acad Manag J 36:1026–1251

Harrison JS, Hitt MA, Hoskisson RE, Ireland RD (1991) Synergies and post-acquisition performance: differences versus similarities in resource allocations. J Manag 17:173–190

Harrison JS, Hitt MA, Hoskisson RE, Ireland RD (2001) Resource complementarity in business combinations: extending the logic to organizational alliances. J Manag 27:679–693

Hauschild S, Knyphausen-Aufseß D (2013) The resource-based view of diversification success: conceptual issues, methodological flaws, and future directions. Rev Manag Sci 7:327–363

*Helfat CE, Eisenhardt KM (2004) Inter-temporal economies of scope, organizational modularity, and the dynamics of diversification. Strateg Manag J 25:1217–1233

*Hill CW, Hoskisson RE (1987) Strategy and structure in the multiproduct firm. Acad Manag Rev 12:331–341

Hitt MA, Harrison JR, Ireland RD, Best A (1998) Attributes of successful and unsuccessful acquisitions of U.S. firms. British J Manag 9:91–114

*Homburg C, Bucerius M (2006) Is speed of integration really a success factor of mergers and acquisitions? An analysis of the role of internal and external relatedness. Strateg Manag J 27:347–367

*Hoskisson RE (1987) Multidivisional structure and performance: the contingency of diversification strategy. Acad Manag J 30:625–644

Hoskisson RE, Hitt, MA, Johnson, RA, Moesel, DD (1993) Construct validity of an objective (entropy) categorical measure of diversification strategy. Strateg Manag J 14:215–235

*Ilinitch AY, Zeithaml CP (1995) Operationalizing and testing Galbraith’s center of gravity theory. Strateg Manag J 16:401–410

Jacquemin AP, Berry CH (1979) Entropy measure of diversification and corporate growth. J Ind Econ 27:359–369

*Johnson G, Thomas H (1987) The industry context of strategy, structure and performance: the U.K. brewing industry. Strateg Manag J 8:343–361

*Kazanjian RK, Drazin R (1987) Implementing internal diversification: contingency factors for organizational design choices. Acad Manag Rev 12:342–354

*Kim SK, Arthurs JD, Sahaym A, Cullen JB (2013) Search behavior of the diversified firm: the impact of fit on innovation. Strateg Manag J 34:999–1009

*Kumar MVS (2013) The costs of related diversification: the impact of the core business on the productivity of related segments. Organ Sci 24:1827–1846

*Lee GK, Lieberman MB (2010) Acquisition vs. internal development as modes of market entry. Strateg Manag J 31:140–158

*Leten B, Belderbos R, van Looy B (2016) Entry and technological performance in new technology domains: technological opportunities, technology competition and technological relatedness. J Manag Stud 53:1257–1291

*Levinthal DA, Wu B (2010) Opportunity costs and non-scale free capabilities: profit maximization, corporate scope, and profit margins. Strateg Manag J 31:780–801

Libert B, Beck M, Wind Y (2016) Why are we still classifying companies by industry? Harv Bus Rev Digital Articles. https://hbr.org/2016/08/why-are-we-still-classifying-companies-by-industry. Accessed 7 Oct 2016

*Lieberman M, Lee GK, Folta TB (2017) Entry, exit and the potential for resource redeployment. Strateg Manag J 38:526–544

Lien LB, Klein PG (2009) Using competition to measure relatedness. J Manag 35:1078–1107

*Lien LB, Klein PG (2013) Can the survivor principle survive diversification? Organ Sci 24:1478–1494

Lubatkin M (1987) Merger strategies and stockholder value. Strateg Manag J 8:39–53

*Lubatkin M, O’Neill HM (1987) Merger strategies and capital market risk. Acad Manag J 30:665–684

*Lubatkin M, Srinivasan N, Merchant H (1997) Merger strategies and shareholder value during times of relaxed antitrust enforcement: the case of large mergers during the 1980s. J Manag 23:59–81

*Mahoney JT, Pandian JR (1992) The resource-based view within the conversation of strategic management. Strateg Manag J 13:363–380

*Makri M, Hitt MA, Lane PJ (2010) Complementary technologies, knowledge relatedness, and invention outcomes in high technology mergers and acquisitions. Strateg Manag J 31:602–628

Markides CC (1997) To diversify or not to diversify. Harv Bus Rev 75:93–99

*Markides CC, Williamson PJ (1994) Related diversification, core competences and corporate performance. Strateg Manag J 15:149–165

*Markides CC, Williamson PJ (1996) Corporate diversification and organizational structure: a resource-based view. Acad Manag J 39:340–367

*Meyer KE (2006) Globalfocusing: from domestic conglomerates to global specialists. J Manag Stud 43:1109–1144

Milgrom P, Roberts J (1990) The economics of modern manufacturing: technology, strategy, and organization. Am Econ Rev 80:511–528

Milgrom P, Roberts J (1995) Complementarities and fit: strategy, structure, and organizational change in manufacturing. J Account Econ 19:179–208

*Miller DJ (2006) Technological diversity, related diversification, and firm performance. Strateg Manag J 27:601–619

*Miller DJ, Yang H-S (2016) The dynamics of diversification: market entry and exit by public and private firms. Strateg Manag J 37:2323–2345

Montgomery CA (1994) Corporate diversification. J Econ Perspect 8:163–178

*Nayyar PR (1992) On the measurement of corporate diversification strategy: evidence from large U.S. service firms. Strateg Manag J 13:219–235

*Nayyar PR (1993a) Performance effects of information asymmetry and economies of scope in diversified service firms. Acad Manag J 36:28–57

*Nayyar PR (1993b) Stock market reactions to related diversification moves by service firms seeking benefits from information asymmetry and economies of scope. Strateg Manag J 14:569–591

*Nayyar PR, Kazanjian RK (1993) Organizing to attain potential benefits from information asymmetries and economies of scope in related diversified firms. Acad Manag Rev 18:735–759

*Neffke F, Henning M (2013) Skill relatedness and firm diversification. Strateg Manag J 34:297–316

Newbert SL (2007) Empirical research on the resource-based view of the firm: an assessment and suggestions for future research. Strateg Manag J 28:121–146

*Ng DW (2007) A modern resource based approach to unrelated diversification. J Manag Stud 44:1481–1502

*Nocker E, Bowen HP, Stadler C, Matzler K (2016) Capturing relatedness: comprehensive measures based on secondary data. Br J Manag 27:197–213

Novicevic MM, Harvey MG, Buckley MR, Adams GL (2008) Historicism in narrative reviews of strategic management research. J Manag Hist 14:334–347

*Palepu K (1985) Diversification strategy, profit performance and the entropy measure. Strateg Manag J 6:239–255

*Palich LE, Cardinal LB, Miller CC (2000) Curvilinearity in the diversification-performance linkage: an examination of over three decades of research. Strateg Manag J 21:155–174

*Palich LE, Gomez-Mejia LR (1999) A theory of global strategy and firm efficiencies: considering the effects of cultural diversity. J Manag 25:587–606

Panzar JC, Willig RD (1981) Economies of scope. Am Econ Rev 71:268–272

*Park C (2003) Prior performance characteristics of related and unrelated acquirers. Strateg Manag J 24:471–480

Parmigiani A, Mitchell W (2009) Complementarity, capabilities, and the boundaries of the firm: the impact of within-firm and interfirm expertise on concurrent sourcing of complementary components. Strateg Manag J 30:1065–1091

*Pehrsson A (2006) Business relatedness and performance: a study of managerial perceptions. Strateg Manag J 27:265–282

*Peng MW, Seung-Hyun L, Wang DYL (2005) What determines the scope of the firm over time? A focus on institutional relatedness. Acad Manag Rev 30:622–633

Peteraf MA (1993) The cornerstones of competitive advantage: a resource-based view. Strateg Manag J 14:179–191

Porter ME (1987) From competitive advantage to competitive strategy. Harv Bus Rev 65:43–59

Prahalad CK, Bettis RA (1986) The dominant logic: a new linkage between diversity and performance. Strateg Manag J 7:485–501

*Ray G, Ling X, Barney JB (2013) Impact of information technology capital on firm scope and performance: the role of asset characteristics. Acad Manag J 56:1125–1147

*Robins J, Wiersema MF (1995) A resource-based approach to the multibusiness firm: empirical analysis of portfolio interrelationships and corporate financial performance. Strateg Manag J 16:277–299

*Robins J, Wiersema MF (2003) The measurement of corporate portfolio strategy: analysis of the content validity of related diversification indexes. Strateg Manag J 24:39–59

Robinson JT (1956) The industry and the market. Econ J 66:360–361

Rumelt RP (1974) Strategy, structure, and economic performance. Harvard University Press, Cambridge

Rumelt RP (1984) Towards a strategic theory of the firm. In: Lamb RB (ed) Competitive strategic management. Prentice-Hall, Englewood Cliffs, pp 566–570

*Sakhartov AV (2017) Economies of scope, resource relatedness, and the dynamics of corporate diversification. Strat Manag J 38:2168–2188

*Sakhartov AV, Folta TB (2014) Resource relatedness, redeployability, and firm value. Strateg Manag J 35:1781–1797

*Sakhartov AV, Folta TB (2015) Getting beyond relatedness as a driver of corporate value. Strateg Manag J 36:1939–1959

*Sampler JL (1998) Redefining industry structure for the information age. Strateg Manag J 19:343–355

*Sharma A, Kesner IF (1996) Diversifying entry: some ex ante explanations for postentry survival and growth. Acad Manag J 39:635–677

*Sicherman NW, Pettway RH (1987) Acquisition of divested assets and shareholders’ wealth. J Financ 42:1261–1273

*Singh H, Montgomery CA (1987) Corporate acquisition strategies and economic performance. Strateg Manag J 8:377–386

Sohl T, Vroom G (2014) Business model diversification, resource relatedness, and firm performance. Acad Manag Best Paper Proc. https://doi.org/10.5465/ambpp.2014.158

Sohl T, Vroom G (2017) Mergers and acquisitions revisited: the role of business model relatedness. In: Cooper CL, Finkelstein S (eds) Advances in mergers and acquisitions, vol 16. Emerald, Bingley, pp 99–113

*Speckbacher G, Neumann K, Hoffmann WH (2015) Resource relatedness and the mode of entry into new businesses: internal resource accumulation vs. access by collaborative arrangement. Strateg Manag J 36:1675–1687

*St John CH, Harrison JS (1999) Manufacturing-based relatedness, synergy, and coordination. Strateg Manag J 20:129–145

Stigler GJ (1968) The organization of industry. University of Chicago Press, Chicago

*Stimpert JL, Duhaime IM (1997) In the eyes of the beholder: conceptualizations of relatedness held by the managers of large diversified firms. Strateg Manag J 18:111–125

*Tanriverdi H (2005) Information technology relatedness knowledge management capability, and performance of multibusiness firms. MIS Q 29:311–334

*Tanriverdi H (2006) Performance effects of information technology synergies in multibusiness firms. MIS Q 30:57–77

*Tanriverdi H, Lee CH (2008) Within-industry diversification and firm performance in the presence of network externalities: evidence from the software industry. Acad Manag J 51:381–397

*Tanriverdi H, Venkatraman N (2005) Knowledge relatedness and the performance of multibusiness firms. Strateg Manag J 26:97–119

Teece DJ, Rumelt R, Dosi G, Winter S (1994) Understanding corporate coherence. J Econ Behav Organ 23:1–30

Teece DJ (1980) Economies of scope and the scope of the enterprise. J Econ Behav Organ 1:223–247

Teece DJ (1982) Towards an economic theory of the multi-product firm. J Econ Behav Organ 3:39–63

Teece DJ (1986) Profiting from technological innovation—implications for integration, collaboration, licensing and public policy. Res Policy 15:285–305

Toedt M (2015) Data revolution how big data will change the way of doing business? Epubli, Berlin

Tranfield D, Denyer D, Smart P (2003) Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag 14:207–222

*Tsai W (2000) Social capital, strategic relatedness and the formation of intraorganizational linkages. Strateg Manag J 21:925–939

*Wan WP, Hoskisson RE, Short JC, Yiu DW (2011) Resource-based theory and corporate diversification: accomplishments and opportunities. J Manag 37:1335–1368

Weiss M (2016) Related diversification: a critical reflection of relatedness and the diversification-performance linkage. In: Cooper CL, Finkelstein S (eds) Advances in mergers and acquisitions (16). Emerald, Bingley, pp 161–180

Wernerfelt B (1984) A resource-based view of the firm. Strateg Manag J 5:171–180

*Williams JR, Paez BL, Sanders L (1988) Conglomerates revisited. Strateg Manag J 9:403–414

Wrigley L (1970) Divisional autonomy and diversification. Dissertation, Harvard Business School

*Zhou YM (2011) Synergy, coordination costs, and diversification choices. Strateg Manag J 32:624–639

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Sample search protocol for ABI/Inform database

Search area | Peer-reviewed journals; english |

|---|---|

Step 1 | Relatedness or diversification and RBT in abstract or title |

Search terms | ((ab(“relatedness”) OR ti(“relatedness”)) OR (ab(“related diversif*”) OR ti(“related diversif*”)) OR (ab(“related acquisition”) OR ti(“related acquisition”))) OR ((ab(“resource-based”) OR ti(“resource-based”)) AND (ab(“diversification*”) OR ti(“diversification*”))) |

No. of articles found | 1172 |

Step 2 | All three keywords in full text |

Search terms | (((ab(“relatedness”) OR ti(“relatedness”)) OR (ab(“related diversif*”) OR ti(“related diversif*”)) OR (ab(“related acquisition”) OR ti(“related acquisition”))) OR ((ab(“resource-based”) OR ti(“resource-based”)) AND (ab(“diversification*”) OR ti(“diversification*”)))) AND (ft(“RBV” OR “RBT” OR “resource-based” OR “resource based” OR “Rumelt”) AND ft(“relatedness” OR “related diversif*” OR “related acquisition”) AND ft(“diversif*”)) |

No. of articles found | 111 |

Step 3 | Reference to value-creating mechanism |

Search terms | ((((ab(“relatedness”) OR ti(“relatedness”)) OR (ab(“related diversif*”) OR ti(“related diversif*”)) OR (ab(“related acquisition”) OR ti(“related acquisition”))) OR ((ab(“resource-based”) OR ti(“resource-based”)) AND (ab(“diversification*”) OR ti(“diversification*”)))) AND (ft(“RBV” OR “RBT” OR “resource-based” OR “resource based” OR “Rumelt”) AND ft(“relatedness” OR “related diversif*” OR “related acquisition”) AND ft(“diversif*”))) AND ft(“economies of scope” OR “synerg*” OR “complementar*” OR “redeploy*”) |

No. of articles found | 104 |

Appendix 2: Overview of journals, share and journal impact factor

Journal | No. of articles | Journal Impact Factor (JIF) | 5-Year JIF | Cum. share (%) | Total share (%) |

|---|---|---|---|---|---|

Strategic Management Journal | 46 | 3.341 | 6.061 | 56.1 | 56.1 |

Academy of Management Journal | 12 | 6.448 | 9.812 | 70.7 | 14.6 |

Organization Science | 6 | 3.775 | 6.309 | 78.0 | 7.3 |

Academy of Management Review | 4 | 7.475 | 10.736 | 82.9 | 4.9 |

Journal of Management | 3 | 6.071 | 9.238 | 86.6 | 3.7 |

Journal of Management Studies | 3 | 3.763 | 5.883 | 90.2 | 3.7 |

MIS Quarterly | 2 | 5.311 | 8.490 | 92.7 | 2.4 |

Management Science | 2 | 2.482 | 3.399 | 95.1 | 2.4 |

Academy of Management Annals | 1 | 7.769 | 10.866 | 96.3 | 1.2 |

British Journal of Management | 1 | 2.982 | 2.704 | 97.6 | 1.2 |

Journal of Intsernat. Business Studies | 1 | 3.563 | 6.067 | 97.6 | 1.2 |

Journal of Finance | 1 | 5.424 | 7.546 | 98.8 | 1.2 |

Rights and permissions

About this article

Cite this article

Lüthge, A. The concept of relatedness in diversification research: review and synthesis. Rev Manag Sci 14, 1–35 (2020). https://doi.org/10.1007/s11846-018-0293-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-018-0293-0