Abstract

Home sharing platforms have experienced a rapid growth over the last decade. Following negative publicity, many cities have started regulating the short-term rental market. Regulations often involve a cap on the number of days a property can be rented out on a short-term basis. We draw on rich data for short-term rentals on Airbnb and for the long-term rental market to examine the impact of short-term rental regulations with a day cap on various stakeholders: hosts, guests, the platform provider, and residents. Based on a difference-in-differences design, we document a sizable drop in Airbnb activity. Interestingly, not only targeted hosts (i.e., hosts with reservation days larger than the day cap), but also non-targeted hosts reduce their Airbnb activity. The reservation days of non-targeted hosts decrease between 26.27% and 51.89% depending on the treatment. Targeted hosts experience a similar decline. There is, nevertheless, significant non-compliance: more than one third of hosts do not comply with enacted short-term rental regulations. Additional analyses show that few properties are redirected from short-term rental to long-term rental use and that there is no significant drop in long-term rents. Drawing on a theoretical model, we tie the estimated effects to changes in stakeholders’ welfare: Regulations significantly reduce the welfare of hosts, and the loss ranges between 46.30% and 9.02%. The welfare loss of the platform provider is proportional to the loss of the hosts. Welfare of guests decreases moderately ranging between 4.5% to 4.1%. The welfare of residents increases minimal. These results question the effectiveness and desirability of the studied short-term rental regulations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The concept of home-sharing emerged in the early 2000s when the later founders of Airbnb began renting out an air mattress to help cover their rent (https://news.Airbnb.com/about-us/). Since then, home-sharing—also called short-term renting—has gained traction as a sought-after alternative to traditional hotel stays. As of now, Airbnb is the leading short-term rental platform globally, boasting over 7 million active listings from around 4 million hosts across more than 100,000 cities (https://news.Airbnb.com/about-us/). In 2022, the average Airbnb host in the US earned approximately $14,000, making it a vital income stream for numerous households (https://news.airbnb.com). However, the surge in short-term rentals has not been without criticism. Residents in prime tourist destinations have expressed concerns about repurposing of residential properties to short-term rental use in tight urban housing markets, escalating housing costs, safety, and the impact of disruptive behavior from unruly guests (e.g., McClanahan, 2021). In some cities, frustration over increased short-term rental activity has sparked anti-tourism acts aimed at Airbnb and other short-term rental providers (e.g., Maldonado, 2018). In response to these concerns, several cities have implemented home-sharing ordinances (HSOs) to regulate the short-term rental market (von Briel & Dolnicar, 2021).

Table 1 shows short-term rental regulations in major cities worldwide, which broadly fall into three categories. The first category comprises short-term rental regulations that effectively ban short-term rentals.Footnote 1 The second and more prevalent category of short-term rental regulations constrain hosts with high levels of short-term rental activity. This type of regulation commonly puts a limit on the annual number of days properties are allowed to be rented out on a short-term basis (i.e., day cap).

The third category of short-term rental regulations is laxer, solely requiring hosts to register with the city. Some of the cities that have implemented a day cap also enacted a registration requirement as an enforcement tool (Table 1).

Although several major cities worldwide have enacted short-term rental regulations, extant research on short-term rental regulations and their market impact is surprisingly scarce. Prior research on the short-term rental market has largely focused on the dynamics of trust and reciprocity in this market (e.g., Proserpio et al., 2018; Zervas et al., 2021), or the effects of short-term rental activity on the hospitality industry and housing market (e.g., Barron et al., 2021; Farronato & Fradkin, 2022; Li & Srinivasan, 2019; Zervas et al., 2017). Only a few studies examine the effects of short-term rental regulations. Existing work thereby almost exclusively focuses on the effects of short-term rental regulations on the local housing market (e.g., Chen et al., 2022; Koster et al., 2021; Valentin, 2021). While understanding the consequences of such regulations for long-term housing and residents is of high policy interest, other stakeholders may equally be impacted by these regulations. In this study, we take a multi-stakeholder perspective and recognize that short-term rental regulations do not only affect residents but also short-term rental guests, hosts, and the platform provider.

We empirically determine the impact of short-term rental regulations on outcomes in the short- and long-term rental market in a unified framework, accounting for consequences of regulations for the various stakeholders: guests, hosts, the platform provider, and residents. The focus is on regulations that target high-activity hosts by implementing a day cap, which is a prevalent form of short-term rental regulation (cf. Table 1). To accomplish the aim of this study, we first develop a theoretical model that serves as the foundation for our empirical analyses. The model allows us to derive propositions based on economic theory and to obtain tractable expressions for changes in stakeholders’ welfare. This enables us to quantify adjustments in stakeholders’ welfare in response to short-term rental regulations, as these changes are expressed as a function of changes in observed short-term rental activity and price responses, which are empirically quantified in our analysis.

Our empirical analysis draws on a dataset on Airbnb transactions in Germany between 2015 and 2019. The data include information on all German Airbnb listings, reservation days, prices, locations of properties, and guests’ ratings. Using the introduction of short-term rental regulations in Berlin, Hamburg, and Munich as a testing ground, we determine the effects of a day cap on short-term rental activity and long-term rental market outcomes. The studied cities, in terms of size and structure, resemble many other cities worldwide that have implemented such regulations (Table 1). Methodologically, we rely on a difference-in-differences (DiD) approach. We determine the impact of the studied regulations on the number of reservation days, active properties, and prices in the short-term rental market by using cities with no regulation as the control group. Importantly, our analysis does not treat the group of hosts as homogenous but rather distinguishes between targeted and non-targeted hosts. Targeted hosts are hosts who, prior to the regulation, rented out their property for more days than allowed by the short-term rental regulation, while non-targeted hosts are hosts with smaller levels of short-term rental activity who are not directly affected by the regulation. This distinction allows us to test to what extent targeted hosts comply with the regulations and to determine the potential impact of a regulation on non-targeted hosts. The sign of the latter effect may be positive, neutral or negative. If short-term rental demand shifts to non-targeted hosts when targeted actors leave the market, the reservation days of non-targeted hosts may increase. But short-term rental regulations might also impose costs and constraints on non-targeted hosts and thereby lower their short-term rental activity. Such responses may relate to monetary costs when short-term rental regulations require hosts to register with the city, or to information or social costs (i.e., costs to understand legal texts or from increased social disapproval, respectively). Moreover, non-targeted hosts might reduce their short-term rental activity because regulations constrain their future revenue growth potential.

Our empirical estimates suggest that short-term rental regulations significantly decreased the number of reservation days and the number of active properties on Airbnb of both targeted and non-targeted hosts. The decrease in reservation days ranges from 18.48% to 49.77% for targeted hosts and from 26.27% to 51.89% for non-targeted hosts. While the effects on targeted hosts are intuitive, the decline in Airbnb activity of non-targeted hosts is intriguing. The findings suggest that regulations impose costs and constraints on non-targeted short-term rental activity and that these induce reductions in short-term rental activity, which overcompensate potential positive demand spillovers. In additional analyses, we show that particularly non-targeted hosts, who recently entered the short-term rental market, react strongly to short-term rental regulations. This observation is consistent with the notion that the day cap constrains the future revenue growth of hosts who have not yet reached their revenue targets. We, furthermore, provide indicative evidence that short-term rental regulations impose costs on non-targeted hosts, which trigger reductions in their short-term rental activity. Specifically, we show that registration requirements result in market exits of non-targeted hosts. We, furthermore, observe that many targeted hosts engage in short-term renting beyond what is allowed by the regulations; over one-third of properties are rented out for more days than permitted by the regulation. We thus provide evidence for substantive non-compliance with prevailing short-term rental regulations.

Using the theoretical model, we translate the empirically measured responses to short-term rental regulations into changes in welfare for stakeholders in the short-term rental market. Guests, hosts, and the platform provider are estimated to experience a substantive decrease in welfare. Residents, in turn, hardly benefit from the introduction of short-term rental regulations with a day cap. We reject significant long-term rental price responses. Additionally, only relatively few properties are redirected from the short- to the long-term rental market. This cast doubts on the effectiveness and desirability of short-term rental regulations.

Our study contributes to the literature on the effects of short-term rental regulations in three important ways. First, we are the first to examine the effects of short-term rental regulations from a multi-stakeholder perspective—accounting for their effects on hosts, guests, the platform provider, and residents. We are also the first to quantify actual welfare changes induced by regulations implementing a day cap for these stakeholder groups. Second, we are the first to show that not only hosts targeted by short-term rental regulations—i.e., hosts with high levels of short-term rental activity—respond to the regulation but also non-targeted hosts who are not directly impacted by the regulations. Third, our study is the first to document significant non-compliance with short-term rental regulations, which prevents regulations from fully delivering benefits to residents. These contributions shed light on the effectiveness of short-term rental regulations that implement a day cap—which are a prevalent type of regulation worldwide. The findings are of academic interest, and, simultaneously, offer valuable insights for policymakers and platform providers.

We organize the remainder of this paper as follows. Section “Literature” discusses related literature. In Section “Theoretical model”, we develop a theoretical model grounded in economic theory that allows deriving propositions and guides our empirical analyses. Sections “Institutional context and data” and “Methodology” describe the data and estimation approach. Sections “Estimation results” and “Welfare effects of short-term rental market regulations” provide the results of the empirical analyses. Finally, we discuss our findings as well as policy and managerial implications and point to avenues for future research.

Literature

Recent years have seen the emergence of a growing literature on home-sharing, and we refer the reader to Andreu et al. (2020), Dann et al. (2019), Dolnicar (2019), and Guttentag (2019) for literature reviews. These reviews highlight that most research on short-term renting focusses on guest behavior on short-term rental platforms. For example, several studies examine why travelers choose short-term renting (esp. Airbnb), and how they select accommodations (e.g., Guttentag, 2019). While these studies are pertinent to our understanding of the development of the short-term rental market, they are only loosely related to our paper.

More recent and closer to this study are a number of contributions that assess the impact of short-term renting on the local economy. The focus of this work is largely on the hospitality industry and the housing market. Research, for example, suggests that local restaurants benefit (e.g., Basuroy et al., 2022; Farronato & Fradkin, 2022), whereas the traditional hotel industry suffers from the rise of short-term renting (e.g., Farronato & Fradkin, 2022; Li & Srinivasan, 2019; Zervas et al., 2017). Studies considering local housing markets provide evidence for at least some positive correlation between Airbnb activity and housing prices (e.g., Barron et al., 2021; Franco & Santos, 2021; Garcia-López et al., 2020; Horn & Merante, 2017; Lee, 2016; Sheppard & Udell, 2016), which has bolstered calls to regulate the short-term renting industry. However, there has been limited attention in the literature to regulations governing short-term rentals (Andreu et al., 2020).

Table 2 presents an overview of studies that examine short-term rental regulations. These studies have in common that they largely focus on long-term housing prices as the main outcome variable of interest and thus put emphasis on the impact of short-term rental regulations on residents (Bibler et al., 2023; Chen et al., 2022; Duso et al., 2021; Koster et al., 2021; Valentin, 2021). The findings point to a moderate decrease in long-term housing prices in the wake of short-term rental regulations, with effects being strongest when short-term rentals are banned (Valentin, 2021). There is also evidence that the house price responses are driven by a reduction in short-term rental activity and increased availability of properties on the long-term housing market (Bibler et al., 2023; Chen et al., 2022; Duso et al., 2021; Koster et al., 2021). Bekkerman et al., (2022) furthermore reveal that regulations impact residential development.

As illustrated in Table 2, we have limited knowledge on the effect of short-term rental regulations on other stakeholders in the short-term rental market such as hosts, guests, and the platform provider. Regulatory effects, moreover, may depend on the specific short-term rental regulation. Prior research has looked at different types of short-term rental laws. Valentin (2021) assesses the effects of short-term rental bans, Chen et al. (2022) explore a one-host-one-home policy, while the studies by Koster et al. (2021), Bekkerman et al. (2022), and Bibler et al. (2023) examine a mix of short-term rental regulations. Regulations that implement a day cap have so far received limited attention, despite their prevalence. Prior research has, moreover, been silent on whether and to what extent hosts comply with short-term rental regulations and has paid limited attention to potential heterogeneity in hosts’ response to such regulations. A notable exception is the study by Bibler et al. (2023), showing that response behavior differs between hosts who offer parts and entire properties for short-term renting.

This study contributes to filling the identified gaps in the literature. We analyze the market and welfare impact of short-term rental regulations with a day cap. In doing so, we account for key stakeholders in the short-term rental market. We further provide evidence for non-compliance with short-term rental regulations and explicitly differentiate between the response of hosts who are targeted and non-targeted by the regulations. Our analysis thus provides a comprehensive assessment of the effectiveness of an important type of short-term rental law.

Theoretical model

We develop a theoretical model with two primary objectives. First, the model enables us to derive propositions grounded in economic theory on how short-term rental regulations impact supply and prices in short-term rental markets. Second, the model allows us to derive equilibrium expressions for changes in stakeholder welfare that can be linked to measurable and estimable outcomes. Consequently, we can quantify changes in stakeholder welfare induced by short-term rental regulations, even though stakeholder welfare is not directly observable in real-world data.

We rely on a workhorse model from industrial economics that aligns with the essential characteristics of the short-term rental market and ensures a tractable solution for the equilibrium expressions (e.g., Melitz & Redding, 2014; Thisse & Ushchev, 2018). The model centers on the pricing mechanism and captures both the extensive and intensive margin decisions of short-term rental hosts. The former is the decision of hosts to be active in the short-term rental market; the latter is the decision on how many days a property is rented out, conditional on being active. We assume that properties are differentiated (e.g., with respect to size, location, equipment, interior design) and that hosts engage in monopolistic competition. Each host has market power because of imperfect substitutability. The lower the level of substitutability between properties, the higher the market power of a host. Further, we allow hosts to differ in the costs that they encounter when offering short-term rentals on the market. These costs may comprise both monetary costs (e.g., promotional efforts, cleaning, and maintenance) and non-monetary costs (e.g., disutility from allowing strangers to live in one’s residence and from social disapproval).

In the following, we elaborate on the key model components, the equilibrium expressions, and the resulting market consequences of short-term rental regulations. For brevity, we present detailed derivatives and explanations in Online Appendix A.1.

Demand and supply in the short-term rental market

The demand for a property offered on the short-term rental market depends on its own price, the average price level, and general demand for short-term rentals in a local area called grid in the later empirical analysis. Thus, the demand function for property i (i = 1, …, I) that is located in local area j (j = 1, …, J) is:

where pj(i) is the rental price of property i located in area j, σ is the degree of substitutability (σ > 1), Xj is the total spending for short-term accommodation in area j (i.e., demand), and Pj is a price index that can be interpreted as the average price for short-term rentals in area j (i.e., a particular sub-area within a city). Thus, demand for property i in area j decreases in its own price and increases when the average price for short-term rentals in an area or demand increases. The profit-maximizing price for property i in area j is shown to be a constant mark-up over marginal costs c (cf. Online Appendix A.1):

Intuitively, the profit-maximizing price differs across hosts: hosts with higher marginal costs set a higher price. Moreover, the mark-up is lower when substitutability between properties is high as price increases then trigger strong reductions in demand.Footnote 2 Inserting the profit-maximizing price and demand in hosts’ profit function yields equilibrium profit, which is equal to:

where F depicts fixed costs and B is a constant further specified in Online Appendix A.1. Equation (3) governs supply in the short-term rental market, and entry into the short-term rental market pays off as long as equilibrium profit is positive. As profits are decreasing in c and F, hosts’ entry decision follows a cost-cutoff-rule: hosts with (marginal/fixed) costs below a specific threshold value enter the short-term rental market. If equilibrium profit becomes negative, hosts discard from being active in the short-term rental market.

Demand and supply in the long-term rental market

We also study the effects of short-term rental regulations on the long-term rental market, and model the demand in the long-term rental market analogous to the demand in the short-term rental market:

where superscript r denotes the long-term rental market, \(p_{j}^{r} \left( k \right)\) is the long-term rent of property k in area j, \(X_{j}^{r}\) represents total spending for long-term accommodation in area j, \(P_{j}^{r}\) is the average long-term rent in area j, and υ denotes the price elasticity of demand for long-term rentals (υ > 1). Supply in the long-term rental market comes from property owners who do not offer their property on the short-term rental market (Chen et al., 2022). It is thus inversely related to offers in the short-term rental market. Analogously to short-term rentals, the profit-maximizing price for long-term housing is set as a mark-up on marginal cost m:

Impact of short-term rental regulations on market outcomes

We focus on short-term rental regulations that implement a day cap.Footnote 3 As illustrated in Table 1, common day caps range between 30 and 120 days, and thus target hosts with relatively high short-term rental activity (i.e., reservations days > day cap). If targeted hosts intend to comply with the regulation, they need to reduce their number of reservation days below the regulatory limit. This can render short-term rental offerings unprofitable and trigger market exits. Hosts who stay in the market face additional costs: fines if non-compliance is detected by authorities, but also social costs (e.g., costs of social disapproval of short-term rental activities) and information costs (e.g., effort required to understand legal rules). Some targeted hosts might choose to exit the short-term rental market because of these additional costs. Thus, next to an intuitive intensive margin response by targeted hosts—i.e., a reduction in the number of reservation days—the model predicts:

P1

Short-term rental regulations that impose day caps lead to a decline in the number of properties offered by targeted hosts in the short-term rental market.

In turn, consequences for non-targeted hosts are theoretically ambiguous. Non-targeted hosts are hosts, who prior to the regulation rented out their property for less days than the regulation permits. They are hence outside of the scope of the short-term rental regulation. Consequently, they may benefit from the reduced supply by targeted hosts and attract a higher share of the overall short-term rental demand, leading to an expansion of their short-term rental activities.Footnote 4 However, non-targeted hosts, much like their targeted counterparts, may also face a rise in costs following the implementation of a regulation. Moreover, regulations may also limit prospects for future revenue growth. Non-targeted hosts might hence reduce their short-term rental activity when regulations are enacted—resulting in a decline in number of reservation days – or they may even leave the market—resulting in a decline in number of active properties. Whether the overall effect of regulations on the short-term rental activity of non-targeted hosts is positive, neutral, or negative depends on the relative size of the underlying mechanisms. As we lack a sound theoretical foundation for the relative size of the different possible effects, we refrain from stating a proposition, but rather consider identifying the sign of the overall effect a subject for empirical investigation. We empirically quantify the response of non-targeted hosts to short-term rental regulations in our empirical analysis and shed some light on the underlying mechanisms. This part of the analysis thus follows an empirics-first approach that serves as a stepping-stone to further theory building (Golder et al., 2022).

At the short-term rental market level, the model predicts that short-term rental regulations increase short-term rental prices as hosts experience higher marginal costs due to the regulation (cf. Equation (2)).

P2

Short-term rental regulations that impose day caps result in an increase in short-term rental prices.

The size of the effect hinges on hosts’ market power, and thus on the degree of substitutability (cf. Equation (1) and (3)). If the degree of substitutability is high, hosts can pass less of the additional costs on to guests by setting higher short-term rental prices. If short-term rental activity becomes unprofitable, hosts leave the short-term rental market, opting either to utilize the property for personal use or to make it available on the long-term rental market. It thus follows:

P3

Short-term rental regulations that impose day caps result in an increase in the number of properties offered for long-term renting.

Our model further predicts that prices in long-term rental markets remain unchanged when a short-term rental regulation is introduced. The reason is that prices in the long-term rental market are a function of marginal costs in this market and the degree of substitutability across properties (cf. Equation (5)). Both are unaffected by the introduction of a regulation. We thus derive the following proposition:

P4

Short-term rental regulations that impose day caps have no effect on the price of long-term rentals.

As illustrated in Table 1, short-term rental regulations that target high activity hosts through a day cap differ in whether they include a registration requirement or not. In our theoretical model, registration requirements increase hosts’ fixed costs F, reflecting non-monetary costs (i.e., costs related to the time to register) and/or monetary costs (i.e., registration fees). If the shift in F renders hosts’ profits negative, they leave the short-term rental market. It thus follows that the likelihood of short-term rental activities becoming unprofitable increases if a registration requirement is implemented in addition to a day cap. The decline in the number of active short-term rental properties (see Proposition 2) is amplified if short-term rental regulations come with a registration requirement.

P5a

The decline in the number of active properties offered by targeted hosts is larger when short-term rental regulations require a registration.

Registration costs also impact non-targeted hosts that are outside the scope of the day cap of the short-term rental regulation. Consequently, a registration requirement may prompt market exits by non-targeted hosts (cf. Equation (3)). The impact on non-targeted hosts may thereby be disproportionately larger than the impact on targeted hosts as non-targeted hosts generate less revenue. We thus propose:

P5b

Short-term rental regulations that require a registration result in market exits of initially non-targeted hosts, and their response is stronger than the response of targeted hosts.

Propositions P1 to P5b are derived from the theoretical model and make predictions on the effect of short-term rental regulations on observed market outcomes—namely, reservation days, properties active in the short-term rental market, and short-term rental prices (cf. Online Appendix A.1). We will test the propositions in the empirical analysis.

Impact of short-term rental regulations on stakeholder welfare

We further determine the impact of short-term rental regulations on the welfare of different stakeholders in the short-term rental market, which is naturally unobserved in real-world data. We use the theoretical model to express changes in welfare of hosts, guests, the platform provider, and residents as a function of empirically observed changes in market outcomes (e.g., changes in reservation days and prices).

We show that the change in welfare of hosts is governed by observed changes in revenues, which in turn, hinge on changes in the short-term rental price and the number of reservation days (accounting for intensive and extensive margin responses; cf. Online Appendix A.1). We estimate these market responses in Section “Impact of short-term rental regulations on stakeholder welfare” and use these estimates to derive the change in welfare of targeted and non-targeted hosts \(\left( {\Delta W_{j}^{host} } \right)\) in area j based on the following equation:

where \(\Delta r_{j} \left( i \right)\) denotes a regulation-induced relative change in revenue of property i in area j — which in turn hinges on changes in the number of reservation days and the short-term rental price. Changes in host revenues also shape the impact of short-term rental regulations on the platform provider. Specifically, the business model of the platform provider relies on a fee system, where hosts pay a share of their revenues to the platform. Welfare of the owners of the platform is hence proportional to hosts’ revenue.

Guest welfare depends on the number of properties offered in the short-term rental market and their respective prices (cf. Online Appendix A.1). We can express changes in guest welfare as

where \(\Delta {\overline{\text{q}}}_{{\text{j}}}\), \(\Delta \overline{p}_{{\text{j}}}\), and \(\Delta M_{j}\) denote percentage changes in the average number of reservation days, average price of short-term rentals, and number of active properties in area j, respectively. The first expression in Eq. (7) is a measure of the change in overall short-term rental supply in area j, and it is equivalent to the second expression since average price and quantity are inversely related (cf. Online Appendix A.1).

Analogously to Eq. (7), we derive the expression for the change in residents’ welfare, which decreases in the average long-term rental price, and increases in the number of properties available for long-term residential purposes (cf. Online Appendix A.1).Footnote 5 Formally, the change in residents’ welfare equals

where \(\Delta \overline{p}_{j}^{r}\) and \(\Delta M_{j}^{r}\) denote percentage changes in the average price of long-term rents and the number of properties in the long-term rental market. In Section “Welfare effects of short-term rental market regulations”, we report the welfare implications for the various stakeholders. We first estimate the effects of short-term rental regulations on market outcomes as derived in Propositions P1 to P5b.

Institutional context and data

Institutional background

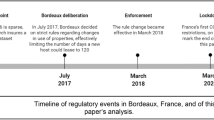

Our testing ground are the short-term rental regulations in three major German cities: Berlin, Hamburg, and Munich. Like many cities around the world, the short-term rental regulations in these three cities focus on high-activity hosts and impose a cap on the annual number of short-term rental reservation days (cf. Table 1).

Berlin tightened its original short-term rental regulation from 2016 in April 2018. While the original regulation prohibited the ‘repeated short-term renting’ of properties without any specific definition, the short-term rental regulation from 2018 introduced an annual 90-day limit for short-term rentals for secondary homes. Hosts are, moreover, required to register with the city. In the following, we focus on the effects of the short-term rental regulation from 2018. Findings for the effects of the short-term rental regulation in 2016 are discussed in Online Appendix A.4.1 since they support the interpretation of the findings related to the regulation from 2018. Hamburg enacted its first short-term rental regulation in 2013. Initially, the regulation was lenient, setting a cap on annual short-term rental reservation days at 183 days. The regulation was significantly tightened in October 2018, with the new rules becoming effective in January 2019. Under the new regulation, the allowed number of short-term rental days of primary residential properties was set to 56 days per year. In addition, hosts were required to register with the city. Since the initial regulation is outside of our sampling frame, we only assess the effect of the later, stricter regulation. The city of Munich enacted its short-term rental regulation in November 2017 and the law became effective in January 2018. The regulation sets a day limit of 56 days for primary and secondary homes. Unlike Berlin and Hamburg, Munich did not implement a registration requirement. The three cities all promoted compliance by establishing dedicated administrative units and enforcing fines of up to 500,000 Euros for non-compliance.

Data on the short-term rental market

The estimation of the impact of short-term rental regulations on reservation days and short-term rental prices is based on data from all Airbnb transactions in Germany between 2015 and 2019, obtained from AirDNA.Footnote 6 We account for all entire properties offered on the Airbnb platform as (shared) rooms are explicitly exempted from all regulations.

For each property, we observe for each day of the observation period whether the property was listed on Airbnb and whether the property was booked. The data also allow us to link properties to Airbnb hosts and provide information on revenues earned from short-term renting. This enables us to identify the entire listing and reservation histories of properties and hosts. However, the data do not include detailed background information about the hosts. We, for example, do not observe whether the offered property is a host’s primary or secondary residence.

Data on the long-term rental market

We draw on rental price data provided by the Research Data Centre of the Federal Statistical Office (RWI, 2020). The data comprises information on rental and sales offers and stems from www.immoscout24.de, the leading marketplace for real estate transactions in Germany.

In the analysis, we focus on long-term rents rather than house prices as the vast majority of residents in our treated cities live in rented units (e.g., Berlin: 82.6%, Hamburg: 76.1%).Footnote 7 For each offered property, we have information about the rental price, along with several property characteristics, including its size (measured in square meters), number of rooms, and utility costs.

Methodology

We use a difference-in-differences (DiD) design to estimate the effects of short-term rental regulations on both the short- and long-term rental market. The observational unit is the 1 km x 1 km city grid cell j in a specific month m. This follows our theoretical considerations, where we model short-term rental demand and supply in local areas and derive predictions on market outcomes (reservations and prices) at the level of area j. Note that our modelling approach is, moreover, consistent with prior empirical papers on the short-term rental market that also compare similar areas in treated and untreated cities (e.g., Barron et al., 2021; Bekkerman et al., 2022; Bibler et al., 2023; Koster et al., 2021; Zervas et al., 2017).Footnote 8

To partial out common outcome trends, our DiD design compares the development of short-term rental outcomes in treated grids to grids in untreated control cities. We keep the set of control units as large as possible to increase statistical power and include grid cells in all German cities with more than 100,000 inhabitants and no short-term rental regulation during our data frame. This follows the observation that Airbnb rentals are also highly common in second-tier German cities. In robustness checks (cf. Online Appendix A.5.4), we show that our estimates remain robust when we restrict the set of control grids to those in the largest untreated German cities (i.e., Dusseldorf, Essen, Frankfurt, and Leipzig).

Difference-in-differences model for short-term rental market

In a first step, we determine the impact of short-term rental regulations on (i) the number of reservation days and (ii) the number of active short-term rental properties for each host type h (i.e., targeted and non-targeted hosts respectively) in grid cell j in month m. In a second step, we estimate the impact of the regulations on the short-term rental price in a grid j in month m. All properties that were booked at least one day in the year prior to the regulation in treatment and control cities enter the estimation sample.

We estimate separate DiD models for each specific regulation t. In all models, we use the full set of non-treated German cities with more than 100,000 inhabitants as a control group. Formally, the model reads:

where \(y_{jm}^{ht}\) is the dependent variable of interest (i.e., reservation days of host type h (= targeted and non-targeted hosts respectively), number of active properties of host type h, and the price) measured in a (1 km x 1 km) grid j in month m.Footnote 9\(HSO_{jm}^{t}\) is the treatment dummy that takes the value of 1 if a regulation is in place in grid j in month m and 0 otherwise. We further account for grid \(\left( {\lambda_{j}^{ht} } \right)\) and month \(\left( {\theta_{m}^{ht} } \right)\) fixed effects that absorb time-constant differences in Airbnb outcomes across grids and common changes to Airbnb activity over time. The error term is reflected in \(\varepsilon_{jm}^{ht}\). The average treatment effect on the treated (ATT) is depicted by \(\beta_{jm}^{ht}\), capturing the change in \(y_{jm}^{ht}\) in treated grids relative to control grids after treatment.

We rely on different criteria to define targeted and non-targeted hosts. In the main analysis, targeted hosts are those whose reservation days, in the 12 months prior the regulation became effective, exceeded the annual day limit specified in the regulation (i.e., 90 days in Berlin; 56 days in Hamburg and Munich). In robustness checks, we augment this base definition to also account for other criteria for high short-term rental activity (see below for further details). The definition of non-targeted hosts aims to identify hosts with low short-term rental activity, and is thus defined based on multiple criteria: (i) the number of reservation days in the 12 months prior the regulation is lower than the annual reservation day limit in the city’s regulation; (ii) the host offers only one property in a given city on Airbnb; (iii) the property is not listed year-around,Footnote 10 and (iv) the generated short-term rental revenue is below the average rent for long-term rentals.Footnote 11

The treatment date is set to the date when a short-term rental regulation was passed (Abadie, 2021), which accounts for the possibility that hosts have already responded to the announcement of the regulation in a market where adjustment frictions are plausibly small. We take six pre-intervention and 12 post-intervention months in our DiD design into account. In the base analysis, we allow for serial correlation (i.e., for errors to be correlated at the grid level) but assume independence of errors between grids. In robustness checks, we relax this assumption and allow errors to be correlated at the city level.Footnote 12 In the analysis, we rely on wild bootstrap as the number of clusters (i.e., cities) in each estimation is small (MacKinnon et al., 2021; Roodman et al., 2019). Conventional inference methods based on large sample theory may hence provide a poor approximation of the finite sample properties of the test statistics.Footnote 13

The DiD analysis relies on the key identifying assumption that outcomes in treated and control grids would have developed in parallel in the absence of the regulation (Goldfarb et al., 2022). We test the validity of this assumption in several ways. We conduct event studies and show that outcomes emerged in parallel in treated and control grids prior to treatment (Schmidheiny & Siegloch, 2019; cf. Online Appendix A.6.1).Footnote 14 To further alleviate potential concerns that estimates might be biased because of confounding shocks that occur at the time of treatment, we model observed differences in socio-economic characteristics across grids, at the outset of the data frame, and allow outcome trends to flexibly vary in these base characteristics. Complementarily, we run specifications in which we reduce the imbalance between treated and control grids by matching techniques (cf. Online Appendix A.6.2). None of these modifications alters our substantive results. Furthermore, note that all control grids are ‘never-treated’ units, implying that we do not have to assume homogeneous treatment effects for the estimator to be consistent (Goodman-Bacon, 2021).

Difference-in-differences model for long-term rental market

To assess the impact of the short-term rental regulations on rents in the long-term rental market, we draw on rental price information to calculate the average price for long-term rentals per grid j and month m. We then estimate a DiD model analogous to Eq. (9):

where \(r_{jm}^{t}\) is the average property rent in grid j in month m for treatment t, and \(HSO_{jm}^{t}\) is the treatment indicator. Grid-cell fixed effects \(\left( {\delta_{j}^{t} } \right)\) absorb time-constant heterogeneity across grids, time fixed effects \(\left( {\mu_{m}^{t} } \right)\) capture common trends in property prices across all grids, and \(\eta_{jm}^{t}\) denotes the error term. The vector \(X_{jm}^{t}\) includes control variables that reflect changes in the composition of offered properties. We account for the size of the living space (in square meters), number of rooms, and utility costs. The latter variable serves as a proxy for property quality since high utility costs indicate poor energy efficiency of the property. Rather than simply including the set of average property characteristics as control variables, we allow for a flexible functional form between each property characteristic and the rental price. This is important, as rental prices may change nonlinearly in property characteristics. Property rents, for example, tend to increase under-proportionally in the size of the property. To allow for non-linear effects, we identify the demideciles for each property characteristic from the complete property sample. We then determine the proportion of properties in a specific grid belonging to each demidecile. These proportions are then incorporated into the vector of control regressors \(X_{jm}^{t}\). Again, we estimate the ATT separately for each short-term rental regulation.

Estimation results

We start with descriptive statistics on the short-term rental market in our treated cities. Table 3 depicts the number of short-term rental properties in Berlin, Hamburg, and Munich with at least one reservation day on Airbnb in 2017, respectively. The listing-to-reservation ratio varies across cities (Berlin: 70.56%, Munich: 69.60%, Hamburg: 87.97%) as does the share of properties, which are targeted by the city’s regulation (Berlin: 25.79%, Hamburg: 51.64%, Munich: 31.62%).

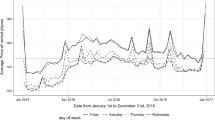

Figure 1 shows the development of monthly reservation days (Panel (a)) and of the average monthly reservation days (Panel (b)) in the treated cities over time. There is an upward trend in the number of reservation days towards the beginning of our sample frame but also considerable seasonality. Towards the end of the sample period reservation days tend to decline.

In line with this observation, Fig. 2 shows that the share of reservations days of targeted hosts relative to total reservation days in Panel (a) and the development of the share of targeted hosts in relation to all hosts in Panel (b) are remarkably stable over time. For example, for the city of Hamburg, the aggregate number of reservation days for targeted hosts drops from 757,722 to 482,295 (i.e., a decrease of 36%) from 2018 to 2019 (cf. Figure A.2.1 (a) in the Online Appendix); the aggregate number of reservation days of non-targeted hosts in Hamburg are, in general, smaller and decline from 122,545 to 60,045 (i.e., a decrease of 51%) (cf. Figure A.2.1 (b) in the Online Appendix). The share of reservation days of targeted hosts relative to non-targeted hosts remains about the same across the two years, being 0.861 in 2018 and 0.889 in 2019 (cf. Figure 2a). This provides a first indication that the regulations have not shifted short-term rental activity from targeted to non-targeted hosts.

Impact of short-term rental regulation on the short-term rental market

Baseline findings

We first present DiD estimates for the impact of short-term rental regulations on the number of reservation days, and the number of active properties. Table 4 shows the ATTs for the absolute and relative reduction in the number of reservation days and number of active properties for targeted and non-targeted hosts. The pooled estimates (i.e., not differentiated by the type of host) are presented in Online Appendix A.3.

Table 4 (Panel A) presents the estimated ATTs for the number of reservations days of targeted hosts, which are negative and statistically significant for all cities (p = 0.000). As expected, short-term rental regulations reduce the number of reservation days. The relative effect size for Berlin is smaller (ATT_rel = -18.48%) than for Munich (ATT_rel = -34.02%) and Hamburg (ATT_rel = -49.77%). Proposition P1, moreover, predicts that the number of active properties offered by targeted hosts declines. We also find support for this proposition (p = 0.000). Again, the relative effects are larger for Hamburg (ATT_rel = -44.82%) and Munich (ATT_rel = -34.82%) than for Berlin (ATT_rel = -25.19%). One interpretation of this result pattern is that targeted hosts react less strongly to modifications of existing regulations. Berlin was the only of our treated cities, which, at the time of treatment, already had a binding short-term rental regulation in place. This regulation – which came in effect in 2016 – explicitly targeted high-activity hosts, many of which left the market in response to this initial reform as documented by an additional analysis (cf. Online Appendix A.4.1).

To the extent that responsive hosts already had left the market, the regulation in 2018 thus treated a relatively inelastic set of remaining hosts, which might explain the relatively weaker response. In addition, we find at least some support for Proposition P5a that predicts that regulations with a registration requirement decrease the number of active properties offered by targeted hosts more than regulations without a registration requirement. Comparing the treatments in the city of Hamburg and Munich, which both established a 56-day cap, shows—in relative terms—stronger effects for Hamburg, which additionally requires hosts to register with the city (Δ ATT_rel = + 10 p.p.).

As discussed earlier, the effects of short-term rental regulations on non-targeted hosts are ambiguous and can either be positive, neutral, or negative. Table 4 (Panel B) shows that the regulations led to a significant decline in the number of monthly reservation days and active properties of non-targeted hosts in all three cities (p = 0.000). The monthly reservation days decreased between 26.27% (Berlin) and 51.89% (Hamburg). The number of active properties declined by 45.19% (Berlin) to 63.43% (Hamburg). This negative response may root in higher monetary and/or non-monetary costs of non-targeted hosts, or in diminished growth and future revenue prospect of non-targeted hosts (cf. Section “Demand and supply in the short-term rental market”). Eventually, the results indicate that any potential positive demand spillover is overcompensated by these negative effects. Moreover, we again find support for the proposition that effect sizes are larger if short-term rental regulations include a registration requirement. The effect on the number of active properties offered by non-targeted hosts is substantially larger for Hamburg (ATT_rel = 63.43%) than for Munich (ATT_rel = 49.83%). In support for Proposition P5b, we further observe a decline in the number of active properties of 63.43% for non-targeted and of only 44.82% for targeted hosts, pointing to a stronger reaction of non-targeted hosts compared to their targeted counterparts. Generally, the adjusted R2 values for models related to targeted hosts are higher than those for models concerning non-targeted hosts. This may, for example, reflect that targeted hosts are to a larger extent than non-targeted hosts clustered in areas with certain socio-economic characteristics that are modelled in our empirical analysis, while the activity of non-targeted hosts is less well explained by these observed characteristics of the grid.

Finally, we test Proposition P3, which proposes that the average short-term rental price increases in the wake of a short-term rental regulation. To enhance homogeneity within the selected set of properties, we assess the impact on the price of one-bedroom apartments, which make up approximately 75% of Airbnb listings. To mitigate the effect of outliers, we account for the median price per grid and month.Footnote 15 The point estimates are positive across all studied short-term rental regulations and point to a slight increase in short-term rental prices in response to the regulations (Table 5). For Hamburg, the point estimates are statistically significant at the 10% level, suggesting that substitutability is high: hosts cannot increase prices without experiencing a significant drop in demand.

Non-compliance of targeted hosts

Our baseline findings suggest that targeted hosts’ Airbnb activity drops in the wake of regulations. This observation is consistent with two types of behavioral adjustments: First, targeted hosts may—instead of leaving the market—shrink their level of Airbnb activity at the intensive margin to comply with the regulation. Second, some targeted hosts may leave the market after the regulation is in place, while others stay and maintain their high level of short-term rental activity. This latter strategy is particularly attractive if hosts perceive a city’s enforcement as weak and expected fines as low. Anecdotal evidence suggests that this might be a relevant scenario as enforcement units tend to be small and fines are relatively seldom levied.

Table 4 shows that the estimated decline in the number of active properties is about proportional to the overall decrease in the number of reservation days. This suggests that, while some targeted hosts leave the market in response to the regulation, the average number of reservation days of remaining hosts does not shift substantially. This observation is consistent with targeted hosts, who stay in the market, being non-compliant with the short-term rental regulation and renting out their property for more days than allowed.

In the following, we take a more direct route to shed light on hosts’ level of compliance with the implemented day limit. Specifically, we examine the distribution of monthly reservations days in Munich from before to after the studied regulation. The focus of the analysis is on Munich, as the day cap in Munich’s regulation applies to all properties in the city (irrespective of whether it is a host’s primary or secondary home), while in Hamburg the day cap only applies to primary residences, and in Berlin only to secondary residences. If hosts rent out their property for more than 56 days in Munich after 2018, this is direct evidence of non-compliance with the regulation.

Figure 3 depicts the distribution of the number of annual reservation days in Munich in 2017 (i.e., the year before regulation) as well as in 2018 and 2019. The distribution of reservation days is strikingly similar across the years. There is no bunching at the 56-day reservation day threshold and no indication of a reduction in the number of properties rented out on Airbnb for more than 56 days in 2018. Before and after the regulation, around every third property is rented out by more than 56 days. In 2019, the number of active Airbnb properties declines, but it is mainly properties with fewer than 56 reservation days that drop out of the market. Consequently, the share of properties in Munich that does not comply with the regulation increases to 46.6%. Figure 3 thus provides direct evidence for non-compliance of targeted hosts with the regulation in Munich.

We contacted the city of Munich and a representative confirmed that no exceptions to the reservation day limit have been granted since its introduction. Our findings therefore indicate a significant enforcement gap, as Munich is threatening (like Berlin and Hamburg) to impose fines of up to 500,000 Euros for non-compliance with the short-term rental regulation. It appears that the perceived likelihood of detecting non-compliance is very low. The average property classified as targeted in Munich earned around 14,000 Euros in revenue in 2017. Abstracting from operational costs, operating outside the realm of the short-term rental regulation becomes unattractive if the detection risk is 2.8% or higher (= 14,000/500,000). Then expected fines outweigh the revenue earned. If operational costs are positive, hosts would drop out of the market at even lower levels of detection risk. This result suggests that non-compliant hosts perceive detection risk to be low or cities, in fact, do not levy the fines that they prescribe in short-term rental regulations when non-compliance is detected.

We find a similar picture for Berlin and Hamburg (Fig. 4). Many hosts exceed the annual day cap by renting out their properties for more days than permitted—with the fraction not changing significantly from before to after the introduction of the day cap. Yet, the findings need to be interpreted with more caution since the data do not allow us to identify primary and secondary homes. Properties with reservation days exceeding the day limit may therefore be outside the scope of the short-term rental regulation in Berlin and Hamburg.

Yet overall, we provide empirical evidence for significant non-compliance with short-term rental regulations.

Response by non-targeted hosts: Underlying mechanisms

While the impact of the short-term rental regulations on targeted hosts is highly intuitive, the decline in reservation days and the number of active properties of non-targeted hosts is more surprising. As outlined in Section “Theoretical model”, the adverse reactions of non-targeted hosts may stem from reduced expectations regarding future short-term rental revenue potential and/or increased monetary and non-monetary costs resulting from the regulations.

We can show that reductions in future revenue potential do play a role in explaining the response by non-targeted actors. Specifically, we demonstrate that ‘new’ non-targeted hosts, referring to hosts who have recently entered the market, experience a more pronounced decrease in short-term rental activity following the implementation of regulations compared to experienced non-targeted hosts, who have been active in the short-term rental market for a longer period. The latter group of hosts has likely already reached their equilibrium short-term rental activity level, which might be small because of hosts’ underlying preferences: they may intend to rent out their property only occasionally (e.g., during summer holidays or specific festivities). In turn, the group of non-targeted hosts, who has just entered the market, plausibly comprises hosts with smaller and larger future short-term rental targets. Even if ‘new’ hosts expect to grow and become high activity hosts in the future, achieving this growth takes time as new entrants first need to gather reviews and build up reputation to attract a larger number of guests and thus reservation days (Guttentag, 2019; Lawani et al., 2019). In particular, hosts, who are new to the short-term rental market, may hence reduce their short-term rental activity in response to regulations.

Table 6 presents estimates for the impact of short-term rental regulations on the number of reservation days and active properties for hosts with different levels of experience on the Airbnb platform. We classify non-targeted hosts in three categories: (i) new hosts who first listed their property less than 12 months before the introduction of the regulation, and more experienced hosts (ii) who first listed their properties between 12 to 24 months before the regulation, and (iii) more than 24 months prior to the regulation, respectively. Consistent with our above considerations, the findings indicate that ‘new’ non-targeted hosts are considerably more likely to reduce their reservation days and exit the market in response to the regulation than hosts with more experience.

Our prior analyses, moreover, suggest that short-term rental regulations impose costs on non-targeted hosts that may trigger their responses. In particular, our findings point to stronger negative responses of non-targeted hosts if regulations include a registration requirement. Against the background of the existing literature, we also consider it plausible that short-term rental regulations come with non-monetary social and information costs for non-targeted actors. While we lack survey data that would allow us to granularly pin down this presumption, the literature discusses that the complexity of legal documents may hinder laws to unfold their full potential because of information costs and misunderstandings (e.g., de Lucio & Mora-Sanguinetti, 2022; Katz & Bommarito, 2014). Consistent with this notion, Airbnb has recently expanded its effort to provide legal information and counseling through its webpage. There is, moreover, a flourishing literature showing that social norm considerations impact individuals’ behavior (e.g., Bernheim, 1994; Reuben & Riedel, 2013 for seminal work). It seems reasonable that short-term rental regulations and the related buzz around them changes the social perceptions of Airbnb and other platform providers. Thus, short-term rental regulations may be perceived as a signal that society disapproves short-term rental activity.

Robustness checks

We ran several robustness checks to corroborate the sensitivity of our baseline findings. In the following, we briefly describe these tests (see Online Appendix A.5 for details):

-

One particular concern in public and policy debates has been that properties are solely used for short-term rental purposes and therefore stripped from the long-term rental market (Filippas et al., 2020). This redirection negatively impacts the welfare of long-term renters (cf. Section “Theoretical model”). Some short-term rental regulations thus also rely on other means than the day cap to target high activity hosts: Berlin, for example, explicitly prohibited ‘repeated’ short-term renting in the initial version of its regulation; moreover, the city explicitly forbids that hosts rent out several properties. In several robustness checks (cf. Online Appendix A.5.1), we thus aim to proxy for properties used solely for short-term rental purposes based on the following criteria:

-

(i)

A property is offered by a host who lists multiple properties on Airbnb in a given city at the same time. Since it is likely that only one property per city is for personal use, this criterion suggests that properties are solely dedicated to short-term renting.

-

(ii)

A property is, on average, listed for more than 25 days per month in a given year (i.e., for more than 300 days annually). Continuous listings of properties on Airbnb suggest that they are not just occasionally rented out during the hosts’ personal absence but are primarily used for short-term rental purposes. We also use different threshold for the number of listing days in further robustness checks.

-

(iii)

A property generates high revenues. It only pays to use properties exclusively for short-term renting if earnings exceed the opportunity cost of offering the property in the long-term rental market. We quantify these opportunity cost with monthly revenues of 500 Euros (i.e., 6,000 Euros p.a.), which corresponds to the price of small apartments (with a size of 40 square meters) at the observed average rent per square meter in areas with high Airbnb intensity in our focal cities (12.8 Euros per month, cf. Table A.2.2. in the Online Appendix). Areas with high Airbnb intensity are in the 10th decile of the distribution of Airbnb intensity related to the share of Airbnb listings in a grid cell. In further analyses, we find that our results are not sensitive to the particular choice of the opportunity cost threshold.

-

(i)

-

We, furthermore, evaluated the sensitivity of our results to changes in the reservation day cut-off in the definition of targeted hosts/properties (cf. Online Appendix A.5.2).

-

We restricted the control group to the largest German cities without regulations—namely, Dusseldorf, Essen, Frankfurt, and Leipzig (cf. Online Appendix A.5.4).Footnote 16

None of these robustness analyses alters our substantive findings. Additionally, we ran a number of tests to assess the validity of our empirical identification approach (cf. Online Appendix A.6). First, we explore the dynamics of the regulations in an event study. We find support for the common trend assumption. There are no significant differences in the pre-trends of targeted Airbnb activity between treated and control grids. In terms of post-regulation dynamics, we find that targeted Airbnb activity declines rapidly after the introduction of a regulation and then remains constant at the decreased level.

Second, we also address concerns that treatment and control grids differ in underlying characteristics, and that these differences might shape the trends of Airbnb activity over time. If differential effects accrue at the time of treatment, they would not show up in pre-trend differences. We account for this possibility in two ways. We use a control strategy and augment the regression model in Eq. (9) by a vector of socio-economic characteristics of the grids (i.e., age structure, unemployment rate, income level, population density compared to other grids in the same city and pre-regulation Airbnb intensity) interacted with a full set of month fixed effects. This specification non-parametrically controls for differences in short-term rental trajectories across grids with different characteristics (Altonji et al., 2005). Next, we employ coarsened exact matching (CEM) to reduce imbalance in the characteristics of treated and control grids (Iacus et al., 2012). That is, we temporarily coarsen the data based on the observed characteristics mentioned above and determine unique observations of the coarsened data—each of which is defined as a stratum. Treated and control grids are then exactly matched on these strata, and weights are used to compensate for the different sizes of strata. Importantly, and contrary to many other matching strategies, coarsened exact matching does not only account for imbalances in means but also for imbalances in higher moments and interactions (Blackwell et al., 2009; Iacus et al., 2012). Our findings are robust to these modifications. This result also holds if we account for differences in property characteristics prior to the regulation, namely property size (i.e., share of Airbnb properties offered in the grid with 1- or 2-bedrooms) and property quality captured by the share of high-quality properties in a grid, with either an above average rating (> 4.7) or a host with a ‘superhost’ status. We also obtain similar estimates to the ones presented in Table 4 when we estimate the model based on data on the property-type-grid-month level.Footnote 17

Furthermore, one might have concerns that the estimates might be affected by strategic behavior such as hosts’ diversion of short-term rental activity to other platforms to reduce the risk that high short-term rental activity is detected by the authorities. While we cannot fully rule out that such diversion takes place, we consider hosts’ incentives to be relatively weak as there has been no information sharing between Airbnb and authorities during our sample frame. We also checked Google searches for different short-term rental platforms and could not detect any pattern that points to diversion of short-term rental activity around the treatment dates.

Impact of regulations on long-term rental market

We finally assess the impact of short-term rental regulations on the long-term residential market. As outlined in Section “Theoretical model”, the welfare of residents depends on both the number of properties in the long-term rental market and the prices of long-term residential properties.

We, first, provide an estimate for the number of properties that are redirected from the short- to the long-term rental market in the wake of the studied regulations (cf. Chen et al. (2022) for a similar argumentation (Online Appendix A.7). The analysis draws on our estimates of the regulation-induced changes in the number of active Airbnb properties per grid—which, in support of Proposition P2, suggest that the number of targeted properties declines in the wake of short-term rental regulations. To estimate the long-term impact on residential property supply, we focus on properties exclusively used for short-term renting, as defined previously and in Online Appendix A.5.1.

The resulting drop in the number of active Airbnb properties—that were presumably used for short-term renting only and may thus have been redirected from the short- to the long-term rental market—ranges between 185 in Munich and 1,067 in Hamburg (cf. Column [1] of Table 7; cf. Online Appendix 7 for details on the methodology). The quantitative differences across cities largely relate to differences in the number of properties with high Airbnb activity levels prior to the regulation (cf. Table 3). In all cities, these estimates are dwarfed by the cities’ housing needs.

Note that our estimates mechanically hinge on the breadth of the definition of targeted properties. Although the applied definition of targeted properties is broad, our estimates suggest that only a relatively small number of properties are redirected to the long-term rental market. Even if we, quite unrealistically, assumed that all exits from the short-term rental market, including those of occasional non-targeted Airbnb properties (depicted in Column (2) of Table 7 and determined analogously to the calculation of the exits by targeted Airbnb properties) triggered a one-to-one rise in the number of properties used for long-term residential purposes, the total increase (i.e., the sum of the entries in Columns [1] and [2] of Table 7) would still be small relative to cities’ housing needs.

Furthermore, we test Proposition P4, which suggests that there is no effect of short-term rental regulations on the average rental price in the long-term rental market. The results are presented in Table 8. The sample is restricted to grids characterized by a high Airbnb intensity, namely grids in the 10th decile of an Airbnb intensity distribution—measured by the share of Airbnb listings in an area relative to the overall number of properties in the year before the short-term rental regulation. These areas tend to be in the city center and close to touristic sights. If regulations impact long-term rental prices, we expect rental price shifts to emerge in these city areas.

In the specifications presented in Table 8, we used large German cities without regulations at the time of interest as control group (i.e., Dusseldorf, Essen, Frankfurt, and Leipzig), reflecting that underlying trends in long-term rental prices differ significantly between leading urban areas and smaller-scale cities. However, this approach is not material for our results. In robustness checks (cf. Online Appendix A.5.4), we show that similar results emerge if we use a larger set of control cities (i.e., cities with more than 100,000 inhabitants). All estimated effects are statistically insignificant and close to zero (Table 8), what rejects a significant link between the studied short-term rental regulations and long-term rental prices.

Welfare effects of short-term rental market regulations

As discussed previously, we draw on the estimated effects on short- and long-term rental market outcomes to determine the welfare impact of regulations for various stakeholders in the short-term rental market.

Guests

The change in guests’ welfare is given in Eq. (7) and intuitively hinges on price and quantity adjustments in the short-term rental market in the wake of regulations. Inserting the observed quantity and price responses (cf. Tables 4 and 5) in Eq. (7) results in a negative welfare effect for short-term rental guests in a narrow range between 4.1% and 4.5% across the treatments. The relatively moderate decline in guest welfare is consistent with Airbnb guests being able to draw on close substitutes to short-term renting in the form of hotel accommodation.Footnote 18

Hosts

The change in host welfare corresponds to the change in short-term rental profits. Profits are unobserved in real world data, but our model shows that hosts’ welfare change can be expressed as a function of changes in observed revenues (Eq. (6)). Table 9 Column (1) reports estimates for the effect of regulations on hosts’ revenues. The estimated effects are negative and statistically significant (p = 0.000). They are quantitatively closely aligned with the booking responses reported in Table 4. Revenue reductions range between 9.02% (Berlin) and 46.30% (Hamburg). In terms of interpretation, these estimates are upper bounds for the actual change in host welfare ─ as the latter also depends on the unobserved profits from the next-best use of hosts’ resources.

Platform provider

As the short-term rental platform participates in hosts’ revenues through a fee system, the regulation-induced reduction in hosts’ revenues directly translates into a reduction in revenues and income of the platform. Again, the estimates must be regarded as an upper bound to the true welfare impact as the outside options of platform providers are unobserved. In addition to the direct and immediate effects of short-term rental regulations on short-term rental revenue and platform providers’ income, regulations can also have medium and long-term consequences by altering the quality of listings on short-term rental platforms and, consequently, the platform’s appeal to users. If high-quality offers leave the platform following regulations, the value the platform delivers to its users may decrease. We thus test for the impact of short-term rental regulations on high-quality offerings on Airbnb. Quality is operationalized by properties that have a high rating (rating > 4.7; corresponding to the sample mean) or are offered by ‘superhosts’. Table 9 Column (2) shows a decline of high-quality offers in response to the regulations, that is—in terms of relative effect size—comparable to the overall response. The findings thus suggest that, while short-term rental offers substantially decline in the wake of regulations, the average quality of the offers on the Airbnb platform does not significantly decrease.

Residents

Short-term rental regulations are implemented to protect residents from externalities of short-term renting (e.g., Barron et al., 2021). It is thus of particular interest to understand whether short-term rental regulations meet the intended policy goal and improve the welfare of long-term renters. As indicated in Eq. (8), changes in welfare of residents depend on two effects: First, on the number of properties that are redirected from short- to long-term rental use; and second, on price changes in the long-term rental market. Our findings indicate that supply of properties in the long-term rental market increases only marginally, relative to local housing needs (Table 7) and that long-term rental prices remain unchanged in the wake of the short-term rental regulations (Table 8). Our results thus reject that short-term rental regulations exert a quantitatively relevant impact on residents’ welfare.

General discussion and conclusion

Policymakers worldwide have implemented regulations aimed at curbing short-term rental activity in densely populated urban areas. Many of the regulations target high-activity short-term rental hosts by restricting the annual number of days a property can be rented out on a short-term basis. In this study, we analyzed the effectiveness of this type of regulation in three major cities by assessing its impact on short-term rental activities and testing for broader implications for the urban housing market. Our investigation involved a comparative analysis of short- and long-term rental market dynamics before and after the implementation of short-term rental regulations. Table 10 provides a summary of our key findings and presents implications for the platform provider and policymakers.

Our empirical analysis suggests that short-term rental regulations with a day cap decrease the number of reservation days and the number of active properties of both targeted and non-targeted hosts. Reservation days of non-targeted properties have seen a significant decrease, ranging from 26.27% to 51.89%. This decline is quantitatively comparable to the observed decline in reservations days of targeted properties. Non-targeted hosts hence do not significantly benefit from regulations and demand spillovers. We find indication that the reduction in non-targeted hosts’ activity roots in regulation-induced constraints on hosts’ future revenue growth and in costs from the regulations (e.g., related to registration requirements).

While the activity of targeted hosts significantly declines in the wake of short-term rental regulations, we still find that many targeted hosts are non-compliant with the regulations after their introduction. We show that more than every third property is rented out for more days than permitted by the city’s regulation. We further document that only relatively few properties are redirected from the short- to the long-term rental market; and long-term rents also do not significantly change in the wake of short-term rental regulations. We use the estimates for the market responses and our theoretical model to derive changes in stakeholder welfare. Hosts, guests, and the platform provider experience a significant decrease in welfare. Residents, in turn, do not benefit from the short-term rental regulations, which questions the effectiveness and desirability of the studied short-term rental regulations.

Implications for platform providers

Our analysis indicates that short-term rental regulations pose a potential risk to the sustainability of the business models adopted by short-term rental platform providers. We show that platform providers lose revenue and income in the wake of the regulations. Importantly for platform providers, the decline in short-term rental activity stems to a significant extent from hosts, who are not targeted by short-term rental regulations. Targeted information campaigns, which inform hosts about the scope of legal regulations and position smaller-scale short-term rental activity as being legally and socially approved, may help mitigate the negative responses and related losses.

Furthermore, we find that registration requirements amplify the negative effects of regulations on short-term rental activity—in particular by increasing the number of market exits by non-targeted hosts. Simplifying the registration process with cities by integrating it into the short-term rental platform may decrease perceived registration costs and encourage hosts to stay in the market. In general, such a feature could improve the perceived value of the platform’s service offerings and help attracting hosts who prefer a hassle-free compliance process. Interestingly from the perspective of platform providers, we also find that high-quality offers leave the platform at about the same rate as other offerings in the wake of short-term rental regulations. While the average quality of offers thus remains about unchanged, platform providers may worry about the market exits of high-quality hosts, who plausibly decisively shape the customer value of short-term rental platforms. Engaging in strategic listings management and fostering strategies to improve the quality of listings in cities with short-term rental regulations may help platforms to avoid tipping points, where customers stop using platform services because of too few attractive offerings.

Finally, our analysis indicates that many targeted hosts stay in the market and engage in short-term rental activity beyond what is legally allowed. This non-compliance poses a reputational risk to the platform provider. Platform providers may want to develop strategies to protect their brand image. They may, for example, consider monitoring host activity on their platform. This reduces legal risks and might, at the same time, improve guests’ perceived platform value (as they can be assured that their hosts comply with short-term rental laws). Platforms may also actively focus on attracting hosts who comply with short-term rental regulations. This may, eventually, help to avert the imposition of stricter regulations. Our analyses thus offer valuable insights for platform providers that may help them to cushion negative consequences of short-term rental regulations for their business model and to mitigate regulation-related future business risks.

Implications for policymakers

Our results reject a significant impact of short-term rental regulations on the welfare of residents – implying that policymakers failed to reach their intended policy goal. Furthermore, our findings suggest that the studied regulations significantly reduced the welfare of short-term rental guests, hosts, and the platform provider. This calls for a reevaluation of the social desirability and design of short-term rental regulations.