Abstract

Multichannel retailers need to understand how to allocate marketing budgets to customer segments and online and offline sales channels. We propose an integrated methodological approach to assess how email and direct mail effectiveness vary by channel and customer value segment. We apply this approach to an international beauty retailer in six countries and to an apparel retailer in the United States. We estimate multi-equation hierarchical linear models and find that sales responsiveness to email and direct mail varies by customer value segment. Specifically, direct mail drives customer acquisition in the offline channel, while email drives sales for both online and offline channels for current customer segments. A randomized field experiment with the beauty retailer provides causal support for the findings. The proposed reallocation of marketing resources would yield a revenue lift of 13.5% for the beauty retailer and 9.3% for the apparel retailer, compared with the 6.5% actual increase in the field experiment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Multichannel retail is important for today’s marketers (Cui et al., 2021; Dekimpe, 2020), but it requires managers to allocate marketing budgets to channels and customer segments. Customer transactional data give retailers detailed information about existing customers’ purchase history, allowing them to prioritize customer segments by value. However, which segments are most responsive to which marketing action is unclear a priori (Zhang et al., 2014). For example, direct mail volume increased 46% between 2019 and 2022 (Gendusa, 2022), with growth in impressions (28%) outpacing digital ad impressions (10%) in 2021; yet direct mail is also very expensive and therefore often targeted to the highest-value segments (Sahni et al., 2017). Our survey of 351 marketing managers reveals that 46% believe that the most expensive marketing action should be targeted at the most valuable customers while 41% believe that all marketing should be sent to all customer types.Footnote 1 Consistent with these statements, most companies target emails to least valuable customer segments, including prospects, with its low cost as the primary reason (Levinson, 2019; Medlar, 2017), and target costly marketing actions to high-value customer segments. However, managers need to assess marketing response in multiple channels to understand which marketing actions produce the best returns and to make budgeting decisions on which actions to invest in and which customer segments to target.

Prior marketing research advises companies to allocate marketing actions to customer segments most receptive to them (Kamakura & Russell, 1989) and finds that customers’ past experience with the company’s offering does not necessarily mean greater responsiveness to marketing actions (Ascarza, 2018). First, some current customers may not peruse direct mail because they already know the firm and its offerings and prefer reminder emails. However, prospective customers (prospects hereinafter), for whom transactional data is not available, and light buyers might be more responsive to direct mail because of the rich information provided. How much these customers subsequently buy is an open question. Second, customers’ intrinsic preferences for email and direct mail may depend on the intensity of their interactions with the firm (i.e., email opening or direct mail browsing frequencies) differ among customers. Consistent with this argument, Return Path’s (2015) study suggests that email targeting should depend on customers’ engagement level. Third, recent legal developments such as the European Union’s General Data Protection Regulation (GDPR), are removing up to 75% of third-party data from analysis, Indeed, direct mail “has greatly benefited from GDPR because it does not require consent from recipients” (PostGrid, 2022) while the use of emails may be impacted, making it more crucial to identify and target marketing-responsive customers instead of maximizing impressions (e.g., by emailing all customers) (Morris, 2019; Snyder, 2018).

Our research objective is therefore to address an important marketing-mix resource allocation problem for multichannel retailers. That is, we propose an integrated methodological approach to allocate online and offline marketing actions (in our case, email and direct mail), given the different responses in channels and customer segments, including prospects and dormant customers (i.e., those who have not purchased for a long time). To this end, we develop a decision-support system based on a systematic empirical modeling approach. We begin by describing the value of customers using the recency–frequency–monetary value–clumpiness (RFMC) model, which allows us to classify customers into value segments (Zhang et al., 2014). We then estimate multi-equation hierarchical linear models (HLMs) to assess the online and offline sales responsiveness to email and direct mail and customer value segment levels. When the data are from multinational retailers, we perform a meta-analysis of the estimates across countries for comparison. We use HLMs for out-of-sample sales prediction and marketing resource reallocation. Finally, we perform a field experiment to obtain the predicted benefits of the reallocation in a causal setting.

Specifically, we perform three empirical analyses. The first involves an international beauty retailer with data on every purchase transaction and all marketing communications for a four-year period for almost 85,000 customers randomly sampled from its six main markets: United States, Great Britain, Germany, France, Spain, and Italy. The second analysis involves a US apparel retailer with transactional data, online and offline channels, and marketing actions. In the third analysis, to evaluate our model-based results and provide causal inference support, we design and implement a randomized field experiment for the beauty retailer with all its 120,000 customers in Italy.

From a substantive perspective, our research is grounded in marketing managers’ challenges in multichannel retail, addressed with the empirics-first approach advocated by Golder et al. (2023) instead of starting from theory often borrowed from the founding disciplines (Kohli & Haenlein, 2021). Our work combines “conceptualization, research design and research execution” with “deep socialization with practice” (Stremersch, 2021, p. 13) and challenges the current wisdom held by many high-level decision makers (Kohli & Haenlein, 2021). Following Lehmann (2020), we adopt an integrative modeling approach that blends data and theory by combining prediction and explanation for two specific retailers in six developed countries. In terms of prescriptive implications, we assess potential revenue improvements (e.g., Lemmens & Gupta, 2020) following Mantrala et al. (1992), who argue that the biggest gains are to be realized not by optimizing the total budget, but by doing a reallocation of the current budget. Consistent with this argument, we find that a reallocation of the marketing budget over customer value groups yields substantial revenue improvement. While the specific results are particularly relevant to the marketing actions and companies studied, our findings may encourage scholarly thinking about how they generalize to other contexts (Stremersch et al., 2023).

Research on multichannel response to direct mail and email

Within the rich literature on multichannel marketing response, we focus our review on the two marketing actions, direct mail and emails, that capture offline and online marketing in our contexts and on how marketing responsiveness differs by customer segments. Table 1 shows our study’s contributions and positions it within related marketing literature.

Direct mail effectiveness

Despite the growth of online marketing, multichannel retailers rely on direct mail given its ease of processing by consumers, ability to generate greater brand recall, and higher response rates than digital marketing communication (e.g., email, paid search, online display, social media). Direct mail, which accounts for more than one-third of direct marketing expenditures in many countries (Direct Marketing Association, 2015), can arouse interest in a firm’s products and result in purchase through short-term rewards (Roberts & Berger, 1999; Rust & Verhoef, 2005).

Several studies have shown that direct mail significantly affects behavior (Hill et al., 2006; Verhoef, 2003) and adoption of a new technological product (Prins & Verhoef, 2007; Risselada et al., 2014). Naik and Peters (2009) provide empirical evidence that direct mail directly drives online visits to enable car configurations. Valentini et al. (2011) find that direct mail by a multichannel retailer can drive new customers’ choice of shopping in either online or offline channels (for a review of omnichannel retail, see Timoumi et al., 2022). In the context of direct mail for charity donations, Seenivasan et al. (2016) conduct a field experiment that varies the framing of the message and find that monthly framing of the donation, including a story of an in-group person, yields better outcomes. Verhoef et al. (2007) argue that direct mail has high ease of use, can result in channel lock-in, and exhibits cross-channel synergy between direct mail search and web purchase. Danaher and Dagger (2013) cite direct mail as an effective tool to reach unaware consumers. In their comparison of the relative effectiveness of multiple marketing tools, they identify direct mail as the second most effective tool when considering dollar sales as the focal outcome and the most effective when profit is the focal outcome. At the same time, contradictory evidence in the business-to-business sector suggests that direct mail is not effective in driving sales (Wiesel et al., 2011).

Direct mail response varies for customer groups and marketing interventions, which can be explained by customer characteristics and past purchase history (Rust & Verhoef, 2005). Research has found that marketing response can differ among customer groups depending on demographics or recency–frequency–monetary (RFM) value metrics (Wedel & Kamakura, 2002). For example, marketing actions such as promotions are more effective for prospects (Van Heerde & Bijmolt, 2005) but do little for acquired customers and could even have negative effects (Anderson & Simester, 2004). Rust and Verhoef (2005) find that loyal customers might have reached their full value in the service relationship in terms of the number of financial services purchased and might be less likely to purchase additional services, despite receiving direct mail with a call for action. Mark et al. (2019) develop a dynamic segmentation model of channel choice and purchase frequency to assess the responsiveness of segments to direct mail and email. They find that direct mail is an effective tool at influencing purchases in both offline and online channels. However, none of these studies consider how response to direct mail might vary for prospects versus acquired customers over time, in online and offline channels, and assessed with consumer transactional data in an econometrics analysis or a randomized field experiment (see Table 1).

Email effectiveness

Emails are effective in driving sales response for several reasons. First, they enable marketers to reach their customers at a low cost. Chittenden and Rettie (2003) report that the total cost per 5000 customers for email campaigns is $26,500 versus $69,600 for direct mail, so email costs about 38% of direct mail. Second, emails provide information that motivates customers to visit the physical store (Tezinde et al., 2002). Emails drive sales (Danaher & Dagger, 2013), average spending (Kumar et al., 2014), and customer retention (Drèze & Bonfrer, 2008). Third, emails may generate faster responses and create an opportunity for interactive communication with customers; customers can respond to an email the moment they receive it on their computer or mobile device.

As to cross-channel effects, emails make it more convenient for customers to use the online (vs. offline) channel because they can land on the firm’s web page by clicking on the email links. Ansari et al. (2008) find that emails have a positive effect on online sales but a negative effect on offline sales. Sahni et al. (2017) conduct a post hoc analysis of experiments and show the aggregate-level effects of emails on expenditure. Similarly, Zhang et al. (2017) capture the average effect of a customer’s response to emails on purchase.

Finally, several meta-analyses find that marketing effectiveness varies across countries and that country effects moderate the elasticity of advertising (Sethuraman et al., 2011) and promotions (Kremer et al., 2008). Importantly, this evidence comes mostly from a comparison between mature and emerging markets, whereas our data are from mature markets. In addition, as Table 1 shows, these studies do not consider cross-channel effects of marketing actions, except for a few single-country works (Pauwels & Neslin, 2015; Valentini et al., 2011).

Direct mail and email comparison in consumer segment response

How do direct mail and email compare in consumer responses? In surveys, 70% of Americans find direct mail more personal than email (Direct Marketing Association, 2020). Consumers view direct mail as more believable, formal, and important and email as quicker, more informal, and spontaneous (Niblock, 2017). While 56% of consumers note that direct mail makes them feel valued, only 40% indicate such about email (Niblock, 2017). When delving deeper into why this is so, consumers report that direct mail is tangible and real (Bozeman, 2019) and, “as a physical object, provides the space and time needed to appreciate what the company sends” (Medlar, 2017).

Regarding differences among consumer segments, direct mail’s trustworthiness and ability to evoke feelings of being valued might be more important for prospects than for current customers. Only 44% of consumers could recall the brand right after seeing a digital ad, while 75% could recall it after receiving direct mail (Niblock, 2017). Consumers prefer to receive direct mail for brochures and catalogs (63% vs 21%) and welcome packs (62% vs 23%) but prefer emails for news and updates (62% vs 17%) and confirmation or follow-up messages (57% vs 21%) (Niblock, 2017). While direct mail “appeals to … prospects in a very different way – a more emotional way” (Medlar, 2017), email is read while at work or relaxing at home and “doesn’t feel the same … as opening a piece of direct mail does” (Bozeman, 2019). Moreover, the physicality of direct mail versus email provides the space to communicate more creatively (Levinson, 2019), which might be more appealing for prospects who know less about the company offering.

Contributions

This research makes substantive and methodological contributions to the marketing literature on multichannel resource allocation (see Table 1). First, from a substantive standpoint, it tackles an important marketing mix resource allocation problem facing multichannel retailers—namely, how to allocate online and offline marketing actions given the different responses in channels and customer segments, including prospect and dormant customers. This research is the first to show that sending direct mail—the most expensive marketing action—to the highest-value customers results in lower performance. Our model-based results in several countries and across retailers, confirmed by a field experiment, show that retailers should allocate direct mail for customer acquisition. From a practice perspective, our decision-support system is embedded in a beauty retailer’s decision processes (Lilien, 2011).

Second, from a methodological perspective, we adopt an integrated approach to assess the effectiveness of email and direct mail, per channel and segment. Inspired by the iterative model-experiment decision-making procedure (Hanssens & Pauwels, 2016), we also assess our model-based findings in a field experiment. Fischer et al. (2011) similarly propose a decision model to guide marketing resource allocation in a business-to-business health care setting by determining near-optimal marketing budgets at the country–product–marketing activity level in an Excel-supported environment. Our approach differs from theirs in three ways. First, they do not obtain insights into direct mail and email effectiveness for customer segments, which are of academic and managerial interest. Second, their approach lacks an experimental field test, which is helpful for normative implications that prescriptively guide marketing resource allocation. Third, they analyze their budget allocation estimations under the assumption of the specific response function that best represents the data in their study. Instead, we use more flexible econometric estimation techniques.

Methodological approach

Modeling requirements

Our research objectives impose several methodological requirements. First, the modeling approach should allow for customer heterogeneity. An important decision is whether customer heterogeneity should be captured at the individual or segment level. We refer to aggregate segment-level models for three reasons: (1) we compare current customers with prospects and dormants, for whom historical purchase data are not available; (2) our objective is to support strategic decision-making on marketing resource allocation, and therefore we follow the literature on such models, which are typically at the aggregate level (e.g., Fischer et al., 2011; Hanssens et al., 2014; Srinivasan et al., 2016); and (3) targeting-related privacy concerns loom large when using consumer-level data, and scholars in the RFM tradition have advocated for summarizing consumer purchase histories and using data-compressed variables for modeling (e.g., Zhang et al., 2014).

Second, when confronted with email and direct mail campaigns, customer segments may exhibit different purchase behavior because of differences in overall consumption levels (i.e., intercept heterogeneity) and variations in their responses to email and direct mail campaigns (i.e., slope heterogeneity). These sources of variation are referred to as unobserved heterogeneity (Jain et al., 1994). Thus, our model should be flexible in accommodating unobserved heterogeneity among customer segments.

Third, we require a model that involves online and offline channels simultaneously and allows for cross-channel correlation. This enables us to account for channel variation in marketing responsiveness of each customer segment and consider the dependence between online and offline channels. These requirements lead us to estimate a multi-equation HLM (Leckie & Charlton, 2013) with two levels, with time-series observations nested within customer segments. Finally, because consumer segments could differ by country, we estimate our model separately for each country.

Thus, we develop and implement a multimethod modeling approach plus a field experiment to address retailers’ marketing problem. Table 2 outlines this approach, which combines customer value segmentation and cluster analysis (descriptive), econometric analyses through multi-equation HLMs (predictive), reallocation of marketing resources (prescriptive), and a field experimental study (causal).

Empirical methodology

Quantify customer value

We quantify customer value with the RFMC approach because it only requires customer purchase history and can be readily implemented by managers (Zhang et al., 2014).Footnote 2 The RFMC approach is an extension of the traditional RFM, which is widely used for customer valuation (Gupta et al., 2006), and adds the clumpiness metric. Clumpiness is the degree of nonconformity to identical spacing in purchasing, and its addition helps achieve improved customer valuation and predictive accuracy (Zhang et al., 2014). We operationalize clumpiness using the entropy measure.Footnote 3

Create customer segments

We create customer segments according to the standardized RFMC metrics in each country using k-means cluster analysis, an approach preferred for large data sets (James et al., 2013).Footnote 4 We use the Euclidean distance as the dissimilarity measure (Gordon, 1999). As a starting point for the clusters’ centroids, we use the quantiles of the standardized RFMC values because we want to obtain clusters that reflect a customer value continuum. For example, for a four-cluster solution, the starting points are the 20%–40%–60%–80% values of each standardized RFMC metric. In consultation with the beauty retailer, we opted for a static segmentation to ensure managerial tractability and ease of implementation, given the firm’s annual marketing budget allocation. Importantly, we consider two additional customer segments, prospects and dormants, for which RFMC values cannot be computed because data are not existent or not available because they have not purchased for a long time.

Evaluate responsiveness to emails and direct mail

We estimate multi-equation HLMs to assess online and offline sales responsiveness to emails and direct mail by customer value segment (Leckie & Charlton, 2013). Specifically, for each country, we use a two-level structure in which time-series observations are nested within customer value segments (Auer & Papies, 2020; Rabe-Hesketh & Skrondal, 2008; Raudenbush & Bryk, 2002). Similar to Steenkamp and Geyskens (2014), we develop our model formulation for each level to arrive at the equation we estimate.

Level 1

We include variables that vary with time as predictors in the level 1 formulation. Equations (1) and (2) include all the time-varying predictors (subscripts t and i denote time index and customer value segment index, respectively). Because we deal with time-series data, we specify a kth–order autoregressive terms to account for the autocorrelations in the residuals.Footnote 5 Thus, for both offline and online equations, we formulate level 1 as follows:

-

Level 1:

Across time within a customer value segment

where the superscripts off and on indicate that the coefficient is for the offline and online equation, respectively, OFF_SALES and ON_SALES stand for offline and online sales, and EMAIL and DIRECT_MAIL stand for email and direct mail. Moreover, DISC is the discount variable that controls for the applied promotions, and HOLIDAY is a categorical variable that captures the effect of major holidays.Footnote 6 The error terms, \({\varepsilon}_{ti}^{off}\) and \({\varepsilon}_{ti}^{on}\), follow a bivariate normal distribution with zero mean and time-invariant variance–covariance matrix, \(\Omega =\left[\begin{array}{cc}{\sigma}_{off}^2& {\sigma}_{off, on}\\ {}{\sigma}_{on, off}& {\sigma}_{on}^2\end{array}\right]\). Thus, Ω is nondiagonal; that is, the errors of the two equations are correlated (Leckie & Charlton, 2013).

Level 2

The level 1 equations suggest that the intercepts and slopes of the email and direct mail variables vary across customer value segments. Level 2 includes these varying parameters from level 1 as dependent variables:

-

Level 2:

Across customer value segments

Equation (3) shows that overall offline sales in segment i are a function of a baseline (\({\alpha}_{00}^{off}\Big)\) and a segment-specific intercept (\({\alpha}_{0i}^{off}\)). Similarly, Eq. (4) shows that overall online sales in segment j are a function of a baseline (\({\alpha}_{00}^{on}\Big)\) and a segment-specific intercept (\({\alpha}_{0i}^{on}\)). Equations (5)–(8) specify the slopes of the email and direct mail variables as fixed across time and varying across segments. For example, the slope for email in the offline sales equation is a function of the overall effect (\({\delta}_{00}^{off}\)) and a segment-specific effect (\({\delta}_{0i}^{off}\)).Footnote 7

We combine the two levels in a single formulation, as shown in Eqs. (9) and (10):

Model Estimation

We estimate the model simultaneously using maximum likelihood for each country, allowing the errors of the equations to be correlated (Leckie & Charlton, 2013). We focus on the combined significance of the parameter estimates across countries using the meta-analytical test of added Z’s (Rosenthal, 1984), because our main interest is in the overall effects of online and offline marketing actions (ter Braak et al., 2014). This test allows us to derive more generalizable insights because it combines evidence of the six countries in our data. The effect size of the parameters are the weighted mean response elasticity parameters across countries. The weight is the inverse of the estimate’s standard error, normalized to 1. Thus, weighted coefficients can be interpreted as a reliability-weighted mean, with estimates with higher reliability (lower standard error) obtaining a higher weight (ter Braak et al., 2014).

Endogeneity

Our explanatory variables may not be strictly exogenous. For example, managers may set email and direct mail levels according to certain customer responsiveness. This type of endogeneity can be overcome by using exclusion restrictions. In the “Robustness checks” section, we derive these exclusion restrictions and explain how we use the control function (CF) approach to account for this source of endogeneity exploiting multi-country data (Papies et al., 2017; Wooldridge, 2015). In addition, we conducted a field experiment that assesses the causal effects.

Obtain out-of-sample predictions

We compare the forecast accuracy of the proposed HLMs with several benchmarks. We re-estimate the model parameters holding out 15% of the estimation period to evaluate prediction accuracy. We use three benchmarks commonly used by managers: random walk (i.e., the value in the previous period), last value in the estimation period, and mean of the country’s customer segment in the estimation period. We also use two machine learning models as benchmarks: random forests and support vector machines (Hennig-Thurau et al., 2015; Zhang & Chang, 2021). We evaluate the forecast accuracy with two measures: mean absolute error (MAE) and mean absolute percentage error (MAPE).

Reallocate optimally emails and direct mail

We (re)allocate emails and direct mail using the HLM estimates that incorporate customer value segments as drivers of marketing effectiveness, under the constraint of management’s maximum total number of emails and direct mail to avoid consumer fatigue and backlash (see Web Appendix A instead for a reallocation setup under the constraint of a total monetary budget). In doing so, we obtain the online and offline contributions in terms of sales increase per unit of email and direct mail per customer segment in each country (Dinner et al., 2014). For a given customer segment, we define the constrained resource allocation decision as

where Π is a differentiable profit function, m is the contribution margin (%), OFF _ SALES is offline sales, ON _ SALES is online sales, cem is the unit cost of emails (€), and cdm is the unit cost of direct mail (€). We note that the feasible region is compact by Eq. (11), and therefore Π attains a local maximum on the feasible region according to the Weierstrass theorem (Sundaram, 1996). Thus, the solution of this problem is characterized by the Karush–Kuhn–Tucker (KKT) conditions, which we develop in detail in Web Appendix B. Since the beauty retailer had upper bounds for both email and direct mail campaigns, the net returns of email (NRem) become:

Assuming cem is constant, we define NRem = FCem − cem, where FCem denotes the financial contribution of emails. Then, as the short-term elasticities of offline and online sales with respect to number of emails are \({\eta}_{off, em}=\frac{\partial OFF\_ SALES}{\partial EMAIL}\ \frac{EMAIL}{OFF\_ SALES}\) and \({\eta}_{on, em}=\frac{\partial ON\_ SALES}{\partial EMAIL}\ \frac{EMAIL}{ON\_ SALES}\), we can define FCem as

Similarly, the financial contribution of direct mail is

Data

International beauty retailer data

We obtained data from L’Occitane en Provence, an international natural and organic ingredient-based beauty and wellness products retailer. Its product portfolio includes skin care, hair care, fragrance, and body and bath offerings, and stores exclusively sell their own products. In addition to the brick-and-mortar stores, the company sells online through an e-commerce website for each country. These websites do not differ across countries, beyond the different languages.

The purchase transaction data, which cover four years between 2011 and 2014, include both online and offline transactions and discounts at purchase at the individual customer level for 84,110 customers. We randomly sampled customers from the firm’s six main countries: United States, Great Britain, Germany, France, Spain, and Italy. The data comprise prospect, dormant, and active customers.

The marketing communication data, which cover the years 2013 and 2014, contain all the online and offline communications from the retailer. The only online communication the retailer uses is email, and the data include whether and when the email was received, opened, and clicked. The only offline communication is direct mail, and the data include the start and end dates of the direct mail campaigns. According to the retailer’s management, the content is typically the same for both marketing actions; we employed two independent coders to confirm that this is the case for a sample of 385 emails and direct mail pieces from the United States and Great Britain (both were in English, the native language of the coders).

Beyond emails and direct mail, the company offers discounts, which we treat as a control variable in our model (Srinivasan et al., 2010). During the analysis period, the prices were the same in both the online and offline channels in each country. The firm has email and postal addresses for 42% and 65% of its customers, respectively.Footnote 8 In addition, the firm has the contact information of multiple prospects, who have shown interest in the brand at the point of sale or website but have not yet purchased from the firm.

Data operationalization

For the operationalization, we specify emails as an email sent, instead of “opened,” because emails sent represent a firm marketing decision. We operationalize the direct mail variable as 1 divided by the length of the campaign for each week of the campaign, because we do not know the exact day customers received the direct mail and thus must assume a constant impact throughout the campaign. We measure discount as the value amount of the discount (Wiesel et al., 2011). Finally, we test for seasonality by considering all periods, as in Srinivasan et al. (2004), but we find that seasonality occurs only for the Christmas period. We therefore create a dummy variable that takes the value of 1 between weeks 47 and 52 around the Christmas holiday. Table 3 provides descriptive statistics of the variables by country.

We aggregate the data at the weekly level to obtain a panel of customer transactions and marketing actions. We used 96 weeks of data for the calibration period to compute RFMC metrics and to create customer value segments. For the estimation of the HLMs, we used between 51 and 60 weeks, depending on data availability per country. These HLMs use log-transformed data to reduce skewness in the variables, to facilitate interpretation of the coefficients directly as elasticities, and to make comparisons among marketing actions, segments, and countries feasible; the estimated elasticities are the basis of the recommended effective marketing resource (re)allocation.

US apparel retailer data

We obtained data for a second retailer on all purchases and marketing communications for 23,891 randomly selected customers in the United States from 2010 to 2012. The retailer’s products, apparel and accessories targeted at women, are sold exclusively through company-owned brick-and-mortar stores or through the retailer’s own website. Similar to the beauty retailer, the retailer’s only online (offline) communication channel is email (direct mail). Moreover, this retailer has a different marketing approach than the beauty retailer; it allocates a larger proportion of emails to the medium- and high-value segments, while direct mail allocation is proportional to the size of the segments. Web Appendix C provides descriptive statistics.

Model-free evidence

We first explore the relationship between both direct mail and email and sales. We do so without imposing any structure in the data by examining the correlations at the individual customer level for the three predefined customer groups: prospects, dormants, and current customers.

As shown on Table 4, the correlations between direct mail and sales are larger for prospects than for both dormants and current customers in four of the six countries (US, Great Britain, Germany, and Spain), while the correlation for prospects is of similar magnitude as for current customers in two countries (France and Italy). In contrast, for emails, the correlations with sales are mostly negative across these three customer groups and six countries and without a clear pattern of correlation magnitude. These results suggest that direct mail might be more effective for prospects.

Econometric analysis results

We begin with the results of the econometric analysis of the historical transaction data for both retailers. Then, we present several robustness checks where we: (1) specify a three-level cross-random-effects (CRE) model to evaluate sales variation drivers, (2) estimate a three-level HLM that combines all six countries, (3) estimate the HLM model with a Bayesian approach, and (4) assess endogeneity with the CF approach. We describe the field experiment design and results in the subsequent section.

International beauty retailer results

Customer value segments

We compute customer value in terms of the RFMC metrics for each customer. With these metrics, we then create customer value segments using cluster analysis.Footnote 9 From the comparison of different cluster solutions (see Web Appendix D), we obtain seven segments in the United States and Italy and six segments in Great Britain, Germany, France, and Spain. In each country, two segments consist of prospects and dormants, that is, customers who have never purchased from the retailer and customers who did not purchase during the two-year calibration period but have purchased before from the retailer. We label the other segments (i.e., consumers who made purchases during the calibration period) as nonrecent low value, recent low value, medium value, high value, and very high value. Table 5 reports the results of the cluster analysis. The table shows the breakdown of the customer value segments by country and the means and standard deviations of the RFMC metrics.

Prospects and dormants in combination represent at least half the customer base in all countries. However, there are notable country-specific differences: the United States has a larger proportion of prospects (38%) and a lower proportion of dormants (26%), while Great Britain has a larger proportion of dormants (40%) and a lower proportion of prospects (10%). The two low-value segments have similar levels of frequency, monetary value, and clumpiness but differ on the recency dimension. The recent low-value segment (nonrecent low-value segment) purchased, on average, eight weeks (one and half years) before the end of the calibration period. The United States (13%) and France (14%) have a lower proportion of these two segments. The medium-value segment mirrors the population average for the four metrics, while the high-value segments have large values of both frequency and monetary value. All countries are fairly similar in terms of the proportion of medium- and high-value customers, ranging from 25% to 30%, except the United States, which has a slightly lower representation of these customers (22%).

Effectiveness of direct mail and email

We estimate the HLMs with maximum likelihood estimation. All variables are stationary according to the augmented Dickey–Fuller and Levin–Lin–Chu panel unit-root tests (see Web Appendix E). We check for homoskedasticity of the residuals (see Web Appendix F). To determine the number of autoregressive terms, we test for residual autocorrelation, adding lags until the autocorrelation has been purged from the residuals; this resulted in two lags for the autoregressive terms. Our empirical findings suggest that random-effects components are not statistically significant in any of the six countries, and therefore a fixed-coefficients specification should be employed. Thus, in our models, we capture segment-level customer heterogeneity through the fixed-coefficients specification.

Table 6 presents the main results on the offline and online sales elasticities of email and direct mail for value segments consolidated across countries (ter Braak et al., 2014). Direct mail has positive and significant offline sales effects for prospects (.164, Z = 3.940, p < .05). The magnitude of the estimated direct mail elasticity is in line with expectations from previous research: Danaher and Dagger (2013) report .104 as an average direct mail elasticity. and Danaher et al. (2020) find catalog elasticities of .02 (online) to .03 (in-store). Email, by contrast, has positive and significant online sales effects for medium- and high-value segments (.432, Z = 1.793 and .478, Z = 1.764, both p < .1). We present the HLM estimation results for each country in Web Appendices H and I and the long-term elasticities in Web Appendix J.

In summary, we find important differences in the effectiveness of email and direct mail for channels and value segments. First, email has sales effects on medium- and high-value segments, while direct mail works only for prospects. Second, email has online sales effects, while direct mail has offline sales effects.

Out-of-sample forecasts

We compare the conditional forecast results for the last 15% of observations, for which the brand’s marketing-mix decisions are known. We obtain the forecasts from three traditional benchmarks (i.e., mean of customer value segment per country in the estimation period, the last period value in the estimation period, and a random walk) and from two machine learning models (i.e., random forest and support vector machines). As Table 7 shows, the best forecast accuracy comes from the HLM, given that it exploits the cross-sectional, time-series, and hierarchical structure of the data.Footnote 10

US apparel retailer results

For the second retailer, we compute the RFMC metrics for each individual customer at the weekly level for a calibration period of one year. We then segment the customer base according to the RFMC metrics into six segments to facilitate comparisons with the beauty retailer analysis. Table 8 shows that the proportion of customers in each segment is prospects (14%), dormants (7%), nonrecent low value (26%), recent low value (16%), medium value (34%), and high value (3%). We then evaluate the responsiveness to emails and direct mail in the estimation period consisting of 52 weeks.

Our results shown in Table 9 confirm the findings of the main analysis that own- and cross-channel effects of emails and direct mail vary by customer value segment. Specifically, direct mail has both offline and online effects for dormants (.02, p < .05; .05 p < 0.05, respectively), while email only has offline effects for both prospects and dormants (.12, p < .01; .14 p < 0.01, respectively). Notably, email shows only offline effects, and direct mail shows both offline and online effects.

Robustness checks

We test whether the results are robust to capturing country heterogeneity in a single main model, instead of having a separate model per each country. For the beauty retailer, first, we estimate three-level CRE models to evaluate the extent to which sales variation is explained by each possible level: time, customer value segment, and country. Second, we estimate a three-level HLM to incorporate country as a third level. We also present the robustness of our results to a Bayesian estimation and a CF approach.

Assessment of sales variation drivers

Similar to Hanssens et al. (2014), we estimate CRE models to examine the sales variation drivers. The CRE models show that for offline sales, customer value accounts for 90% of the explained variance, and country effects and time effects account for 8% and 2%, respectively. However, we find important differences for online sales—country effects explain as much as 50% of the explained variance, while customer value and time effects account for 42% and 8%, respectively. Thus, both country effects and customer value are essential to understand online sales variation, while customer value explains the majority of offline sales variation. All in all, the CRE results provide further empirical support for using multichannel marketing for customer value segments.

Analysis of countries jointly

Our model is flexible to allow resource allocation for customer segments at the global corporate level. That is, instead of six two-level HLMs, we estimate a three-level model, in which we constraint the number of segments to be the same in each country. This approach may be preferred by multinational retailers whose decisions for within-country allocations of expenditures between emails and direct mail are centralized. The number of optimal segments per country is six. The results are similar to the main results in both signs and significance. Specifically, the main finding that the most expensive marketing action, direct mail, is effective in driving customer acquisition of prospects in the offline channel holds (see Web Appendices K and L for details).

Bayesian estimation

To confirm that the results are not driven by the estimation procedure, we estimate the HLMs with a Bayesian approach for the main models and an alternative model with random intercepts, instead of fixed intercepts as in the main model. The results are similar to the main estimations in both signs and significance (see Web Appendix M).

CF approach

The marketing communication variables might be correlated with the error term. Such endogeneity can be overcome using exclusion restrictions. We explore the possible estimate bias with a CF approach (Papies et al., 2017; Wooldridge, 2015), which is equivalent to the two-stage least squares approach for linear models but uses fitted values of the first stage as additional regressors in the second stage. To construct instruments for each country, we use the level of marketing in the other countries (Kuebler et al., 2018). The assumption is that country managers do not consider the sales levels of other countries when determining the marketing actions for a focal country (exclusion restriction). That is, managers set marketing actions levels expecting a response on the consumers they impact, i.e., customers in their country of responsibility and not in other countries. At the same time, managers follow similar strategies per segment across countries, and therefore marketing actions in the same segment may be correlated across countries (relevance condition). Indeed, the correlations between the instruments and the endogenous variables fall in the ranges of .88 and .94 for direct mail and .72 and .88 for email, supporting our assumption on the relevance condition.

The CF analysis largely confirms the main analysis results. The CF estimates coincide in terms of direction and significance with those of the main analysis, except for the effect of email on online sales for high-value customers in the United States (see Web Appendix N). The instruments for the offline sales model are not significant (−.010, p > .1 and .064, p > .05, for direct mail and email, respectively), suggesting that the estimates of the offline sales model in the main analysis are not biased. However, the instruments for the online sales model are positive and significant (.112, p < .05 and .161, p < .05, for direct mail and email, respectively). When we account for this positive bias, the online equation results in a nonsignificant effect of emails for high-value customers in the United States. Moreover, the magnitude of the effect of email on online sales for high value customers in Italy and France is reduced but remains significant. All other results remain the same.

Field experiment

Field experiment design

The main goal of the field experiment is to test the model-based findings on the differential effects of emails and direct mail by customer value segment in a controlled causal setting. We designed and implemented the experiment together with the marketing team of the beauty retailer between July and November 2017 in Italy. The four experimental cells are (1) control (no marketing), (2) only emails, (3) only direct mail, and (4) both emails and direct mail. To ensure a balanced proportion in each cell, we stratified each cell in the six customer value segments. To create the six segments, we obtained individual-customer purchase data spanning two years before the experiment. The field experiment took into account customers’ expressed preferences not to be contacted by certain channels and therefore was run on a sample of customers contactable by both channels, to avoid self-selection, to compare email and direct mail responsiveness in online and offline channels. Although a pure random assignment should result in each segment being equally represented in the four experimental cells in theory, proportionate stratification ensures that all segments are equally represented in each cell in practice (Duflo et al., 2007). This stratification is especially important because the total amount of direct mail was constrained for budgetary reasons to 33,000 pieces, and we wanted to ensure that high-value customers, who are a small fraction of the overall population, are proportionally represented in cells 3 and 4. The total sample consists of 122,394 customers (Table 10).

To evaluate the differential effects of the treatment groups, we specify a random-effects regression for customers in the prospect and dormant segments, because the treatment is exogenous (Chintagunta et al., 1991). For customers in the other four value segments, we specify a difference-in-differences regression, because the treatment is exogenous and customers in these segments purchased within the two-year period before the experiment. We run a separate regression per each segment, in which customer sales (SALES) vary per customer (index i) and week (index t). Equation (14) presents the random-effects regression and considers only the campaign period because prospects and dormants did not purchase before the experiment. Equation (15) presents the difference-in-differences regression and considers the campaign period and the two years prior.

where αi represents the customer-level intercept; CELL2, CELL3, and CELL4 capture whether the customer belongs to cells 2, 3, and 4, respectively; 𝛾t represents time fixed effects; CAMPAIGN is a dummy variable that takes the value of 1 if the period belongs to the campaign and 0 otherwise; and εit is the residual error. The coefficients of interest are β2, β3, and β4 for Eq. (14) and β5, β6, and β7 for Eq. (15).

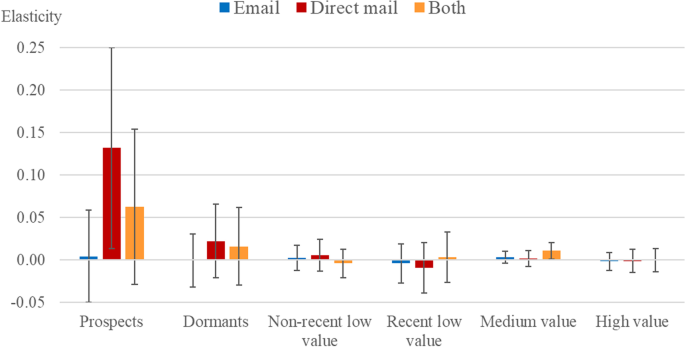

Field experiment results

Figure 1 shows the results of the field experiment on the differential effectiveness of email and direct mail for different consumer value segments. First, we confirm that direct mail is only effective for prospects, with an elasticity of .132 (p < .05), compared with the .164 estimate in the main analysis. Second, email is not effective for any of the segments, while it was significantly effective for medium- and high-value segments in the main analysis. Third, direct mail and email in combination (interaction effects) are effective for the medium-value segment (.011, p < .05), while the two marketing actions did not interact significantly in the main analysis; this effect, though significant, is small.

Managerial implications

We calculate revenue lifts from (1) the econometric analysis of the beauty retailer data, (2) the econometric analysis of the apparel retailer, and (3) the field experiment. To calculate the financial contribution of emails and direct mail (Eqs. (12) and (13)), we take the elasticity estimates from the empirical models and the mean levels of sales, emails, and direct mail per customer segment from the data. According to the beauty retailer’s annual report (L’Occitane, 2015), the cost of goods sold is 18%, and therefore we infer that the profit margin is 82%. Keeping the total number of emails and direct mail constrained in each country and holding the budget constant,Footnote 11 we assess how much the reallocation of marketing resources would improve the financial contribution.

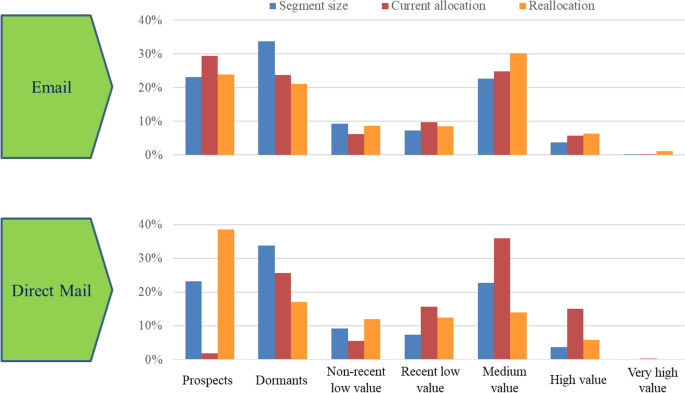

Figure 2 compares the current allocation of marketing resources with the proposed reallocation and reports the sizes of the customer value segments (see Web Appendix O for details by country). For emails, the current allocation is proportional to the size of the customer value segments (i.e., “bigger gets more”; Corstjens & Merrihue, 2003, p. 118); our reallocation proposes to reduce emails for prospects, dormants, and recent low-value segment and to increase them for nonrecent low-, medium-, and high-value segments, based on their response elasticities and segment sizes. For direct mail, the current allocation disproportionally considers the medium- and high-value segments and disregards prospects (i.e., the most expensive action for the most valuable customers); our reallocation suggests shifting direct mail to prospects. We evaluate the incremental revenue from the proposed reallocation by multiplying the financial contribution of the segment by the difference between the model-based proposed number of emails and direct mail and the actual number sent by the retailer based on the HLM.

Our reallocation of marketing actions would yield a sales lift of €340,000, 33% due to better allocation of emails and 67% due to better allocation of direct mail, which represents a 13.5% total revenue increase. Given the beauty retailer’s size, the global implementation of the proposed reallocations would amount to hundreds of millions of euros in incremental revenues.Footnote 12 For the apparel retailer, the effective reallocation of marketing actions would yield a sales lift of $26,000, 84% due to better allocation of emails and 16% due to better allocation of direct mail, which represents a 9.3% revenue increase.

Finally, we quantify the revenue lift potential with a marketing resource allocation that considers the field experiment estimates. We compute the revenue lift with respect to the status quo of the typical marketing allocation used by the retailer, as this condition is not present in our experimental cells (CELL1 in the experiment receives no marketing, which is not business-as-usual). Collectively, the marketing resource reallocation from the field experiment findings lifts revenue by 6.5% with respect to business-as-usual, holding marketing costs constant. The business-as-usual allocation has a revenue impact lift of 1.6% with respect to the control group of no marketing actions. Thus, we expect that a chainwide implementation of these recommendations will result in a lift of between 6.5% (from the field experiment) and 13.5% (using HLMs) in revenue for the beauty retailer.

Communication of these insights to the beauty retailer helped management adopt data-driven analytical tools and blend quantitative approaches with managerial intuition (Roberts, 2000). As one member of the marketing team noted: “The different effectiveness of direct mail and email depending on the customer type was surprising to us. Rethinking about this finding, we have a deep and increasing interest in investing in direct mail activities for customer acquisition and inactive customers.” The model-based recommendations helped the retailer embrace scientific decision-support systems and provided an opportunity to use marketing analytical dashboards with hands-on practice. In the words of Delphine Fournier, customer relationship management manager of L’Occitane: “The combination of marketing science tools with experimentation gives us a new perspective in understanding marketing effectiveness and helps us improve our resource allocation tremendously” (ISMS Practice Prize, 2018). L’Occitane has since implemented this model-based decision-making procedure consisting of iterative, model experiment, phases (Hanssens & Pauwels, 2016), and embedded marketing science models into its decision processes (Kumar & Petersen, 2005; Lilien, 2011).

Conclusions

Understanding online and offline sales responsiveness to email and direct mail for multichannel retailers is essential for academics and practitioners. Accordingly, we propose a systematic approach to quantify how email and direct mail influence online and offline sales for different customer value segments across countries. We conduct an empirical analysis using data from a beauty retailer with 84,110 customers from six countries and run a field experiment with 122,000 customers in one country for the retailer. We replicate the econometric analysis for an apparel retailer. In addition, we conduct several robustness checks to assess the validity of our findings.

This research provides four key insights. First, direct mail drives customer acquisition in the offline channel, while email drives both online and offline sales across different customer segments. Second, the model performs considerably better than benchmarks (up to 50%) in forecasting sales for channels and countries. Third, a reallocation of the marketing budget for customer value groups shows substantial revenue improvement of 13.5% for the HLM-based analysis and a revenue lift of 6.5% in the field experiment. Our model can be readily applied to other settings, as indicated by the 9.3% calculated revenue improvement for the apparel retailer. Moreover, the results of the field experiment in one country provide causal support for our empirical model findings.

Our findings challenge common wisdom, though they are consistent with surveys on different consumer experiences with direct mail versus emails. Receiving an expensive direct mail is more likely than an email to attract the attention of customers who have never purchased or stopped purchasing a while ago (dormants). This interpretation fits the broader consumer behavior theory that affective reactions are critical (e.g., Hoch & Loewenstein, 1991; Shiv & Fedorikhin, 1999); we would also add that emotional appeals are especially important to attract the attention of and gain new customers, while current customers do not need them to the same degree.

We offer several important insights for retail managers operating in a multichannel context. To allocate marketing resources effectively, managers should pay close attention to the different responsiveness of customer value segments to emails and direct mail. Both customer value and country effects are relevant to understand the online sales variation, even among the similar Western countries we analyzed. Our methodology can help retailers forecast future sales and optimally allocate marketing resources. Several of our insights may inspire companies to reassess how they run their email and direct mail campaigns. First, a customer’s “high-value” status with the company does not mean greater responsiveness to marketing actions. In our analysis, we find that such customers are less responsive to the (very expensive) direct mail. Second, as newly penetrated countries typically have a higher share of prospective customers and light buyers, direct mail resources might best be allocated to such countries. Finally, customer privacy issues have become even more important with recent legal developments, such as the GDPR, raising the stakes for companies to identify and target responsive customers.

This research has limitations that suggest directions for future research. First, we did not examine the order of emails and direct mail; thus, future research could test the ideal sequencing of email and direct mail, as “email makes for the perfect follow up to a direct mail campaign” (Bozeman, 2019) and companies should “create a lasting first impression with direct mail [and] reinforce it with email marketing” (Niblock, 2017). Future research could also explore a continuous (discrete) time dynamic optimization model through which Hamiltonian (Bellman) equations would be specified. Second, our data do not include competitors’ marketing actions. However, for both retail data sets used, the own-brand products are sold exclusively by the companies in question, rendering competition only indirect. Furthermore, future research could quantify marketing’s power to build long-term brand equity or to upgrade customers to higher-value segments. Our methodology can also be applied beyond the studied developed Western markets (e.g., developing countries), the analyzed product categories, and the studied channels (e.g., mobile) or marketing actions (e.g., phone calls, text notifications). In this study, we propose and implement a generalizable methodology for marketing resource allocation, which can be applied by any multichannel (multinational) retailer, whether they sell products or services, and can accommodate any number of countries, sales and communication channels. Finally, we call for future research to examine other regions to determine whether the findings generalize to non-Western countries.

Notes

Survey with N = 351, average experience = 3.8 years. The remainder (13%) agreed with the statement, “The most expensive communication should be sent to the least valuable customers.”

Other data (e.g., demographics, preferences, needs, attitudes) were not available for our partner companies.

Zhang et al. (2014) propose four measures (entropy, second moment, log utility, and sum of three largest components) and show that entropy is the most robust with the best performance.

Marketers have a long history of working with both a priori segmentation and latent response segments (e.g., Kamakura & Russell, 1989). The latter requires observing marketing response and leaves explaining the observed response differences to other analyses (e.g., comparing a priori customer characteristics to make the latent segments addressable). By contrast, a priori segmentation uses variables the company can observe (e.g., demographics) and then shows how marketing responses differ between these segments. A priori segmentation has evolved from demographics to customer purchase histories such as RFMC, which drive marketing response and are actionable for the company (e.g., Zhang et al., 2014). The evolving convention in the RFMC literature and our discussion with managers led us to choose this segmentation.

We estimated a model with heterogenous autoregressive coefficients across segments to assess whether they varied by segment. The likelihood ratio test results suggested the homogenous autoregressive coefficients across segments for all countries, except France. For France, we based our decision on the information criteria (AIC and BIC) result (see Web Appendix G), which favored the homogenous autoregressive coefficients across segments.

We estimated a model with interaction terms between the marketing actions to test whether they showed synergistic effects. Since we did not find significant synergistic effects, we choose to keep a more parsimonious specification in the model specification.

For the segment-specific intercepts and slopes, we use the fixed-effects formulation. An alternative approach is to use a random-effects specification that treats parameters as realizations of random variables following a probability distribution. To determine which specification to follow, we estimate the model with random-effects and test the significance of the random components. Our results favor the use of fixed-effects specification. We discuss this finding in the results section. This choice is also consistent with the recommendation that the fixed-effects approach should be used when the data have a small number of groups (i.e., fewer than 10) (Snijders & Bosker, 2011; Steenkamp & Geyskens, 2014).

We randomly selected the data for the econometric analysis in each country from the full customer base. Therefore, some sampled customers might not be contactable. The field experiment addresses the potential self-selection issue: we only include in the experiment the 120,000-plus customers who are contactable by email and direct mail to assess their responsiveness to both channels.

To select the number of cluster solutions, we take into account model requirement constraints, statistical criteria, and managerial considerations. We examine the reduction of variance in the RFMC metrics explained by the different number of clusters in each country. To this end, we use the comparison criteria of within-sum-of-squares, proportional reduction variance (eta coefficient), and proportional reduction error (Makles, 2012).

We focus on over-time forecasting validation because the HLM exploits the time-series structure as well as the cross-sectional and hierarchical structure of the data. However, we also perform a k-fold cross-validation. The fivefold validation uses 80% of the customers in a segment to predict the other 20%, rotating this approach through the full sample five times. The results based on the fivefold specification indicate an MAE and a MAPE of .732 and .265 for the offline sales equation, respectively, and .670 and .606 for the online sales equation, respectively.

The reason companies do not totally skew toward emails is twofold: (1) the optimal allocation depends on the ratio of elasticities (e.g., Dorfman & Steiner, 1954; Wright, 2009), and (2) companies want to avoid losing consumer goodwill by exceeding an unknown annoyance level of emails. We worked with the client, which set a maximum of three emails per week (seven in the United States). If we had not worked with a limit, some segments would have received two emails a day (i.e., 14 in one week), which seemed excessive to the managers.

Following Fischer et al. (2011), we also evaluate the reallocation considering the growth potential per segment and country applying a segment size multiplier. We obtain the multiplier from the growth observed in each segment. The reallocation results that consider this growth remain practically the same.

References

Anderson, E. T., & Simester, D. I. (2004). Long-run effects of promotion depth on new versus established customers: Three field studies. Marketing Science, 23(1), 4–20.

Ansari, A., Mela, C. F., & Neslin, S. A. (2008). Customer channel migration. Journal of Marketing Research, 45(1), 60–76.

Ascarza, E. (2018). Retention futility: Targeting high-risk customers might be ineffective. Journal of Marketing Research, 55(1), 80–98.

Auer, J., & Papies, D. (2020). Cross-price elasticities and their determinants: A meta-analysis and new empirical generalizations. Journal of the Academy of Marketing Science, 48(3), 584–605.

Bozeman, R. (2019). Direct mail vs email – Optimize both through the customer journey. Retrieved April 6, 2021 from https://www.postalytics.com/blog/direct-mail-vs-email/.

Chintagunta, P. K., Jain, C. D., & Vilcassim, N. J. (1991). Investigating heterogeneity in brand preferences in logit models for panel data. Journal of Marketing Research, 28(4), 417–428.

Chittenden, L., & Rettie, R. (2003). An evaluation of e-mail marketing and factors affecting response. Journal of Targeting, Measurement and Analysis for Marketing, 11(3), 203–217.

Corstjens, M., & Merrihue, J. (2003). Optimal marketing. Harvard Business Review, 81(10), 114–121.

Cui, T. H., Ghose, A., Halaburda, H., Iyengar, R., Pauwels, K., Sriram, S., Tucker, C., & Venkataraman, S. (2021). Informational challenges in omnichannel marketing: Remedies and future research. Journal of Marketing, 85(1), 103–120.

Danaher, P. J., & Dagger, T. S. (2013). Comparing the relative effectiveness of advertising channels: A case study of a multimedia blitz campaign. Journal of Marketing Research, 50(4), 517–534.

Danaher, P. J., Danaher, T. S., Smith, M. S., & Loaiza-Maya, R. (2020). Advertising effectiveness for multiple retailer-brands in a multimedia and multichannel environment. Journal of Marketing Research, 57(3), 445–467.

Dekimpe, M. G. (2020). Retailing and retailing research in the age of big data analytics. International Journal of Research in Marketing, 37(1), 3–14.

Dinner, I. M., Van Heerde, H. J., & Neslin, S. A. (2014). Driving online and offline sales: The cross-channel effects of traditional online display, and paid search advertising. Journal of Marketing Research, 51(5), 527–545.

Direct Marketing Association (2015). National client email 2015. Research report. Retrieved April 6, 2021 from https://www.emailmonday.com/wp content/uploads/2015/04/National-client-email-2015-DMA.pdf.

Direct Marketing Association (UK) (2020). Marketer email tracker 2020. Research report. Retrieved April 6, 2021 from https://dma.org.uk/uploads/misc/marketer-email-tracker-2020.pdf.

Dorfman, R., & Steiner, P. O. (1954). Optimal advertising and optimal quality. American Economic Review, 44(5), 826–836.

Drèze, X., & Bonfrer, A. (2008). Empirical investigation of the impact of communication timing on customer equity. Journal of Interactive Marketing, 22(1), 36–50.

Duflo, E., Glennerster, R., & Kremer, M. (2007). Using randomization in development economics research: A toolkit. In T. P. Schultz & J. A. Strauss (Eds.), Handbook of development economics (Vol. 4, pp. 3895–3962). Elsevier.

Fischer, M., Albers, S., Wagner, N., & Frie, M. (2011). Practice prize winner. Dynamic marketing budget allocation across countries, products, and marketing activities. Marketing Science, 30(4), 568–585.

Gendusa, J. (2022). 82 direct mail statistics you should know about in 2022, PostcardMania, Retrieved August 4, 2022 from https://www.postcardmania.com/blog/direct-mail-statistics-2022.

Golder, P. N., Dekimpe, M. G., An, J. T., van Heerde, H. J., Kim, D. S., & Alba, J. W. (2023). Learning from data: An empirics-first approach to relevant knowledge generation. Journal of Marketing, 87(3), 319–336.

Gordon, A. D. (1999). Classification. Chapman and Hall.

Gupta, S., Hanssens, D., Hardie, B., Kahn, W., Kumar, V., Lin, N., Ravishanker, N., & Sriram, S. (2006). Modeling customer lifetime value. Journal of Service Research, 9(2), 139–155.

Hanssens, D. M., & Pauwels, K. H. (2016). Demonstrating the value of marketing. Journal of Marketing, 80(6), 173–190.

Hanssens, D. M., Pauwels, K. H., Srinivasan, S., Vanhuele, M., & Yildirim, G. (2014). Consumer attitude metrics for guiding marketing mix decisions. Marketing Science, 33(4), 534–550.

Hennig-Thurau, T., Wiertz, C., & Feldhaus, F. (2015). Does Twitter matter? The impact of microblogging word of mouth on consumers’ adoption of new movies. Journal of the Academy of Marketing Science, 43(3), 375–394.

Hill, S., Provost, F., & Volinsky, C. (2006). Network-based marketing: Identifying likely adopters via consumer networks. Statistical Science, 21(2), 256–276.

Hoch, S. J., & Loewenstein, G. F. (1991). Time-inconsistent preferences and consumer self-control. Journal of Consumer Research, 17(4), 492–507.

ISMS Practice Prize (2018). Gary L. Lilien ISMS-MSI Practice Prize Videos. Retrieved April 6, 2021 from https://lilienpracticeprizevideos.org/category/2018/.

Jain, D. C., Vilcassim, N. J., & Chintagunta., P.K. (1994). A Random-Coefficients Logit Brand-Choice Model Applied to Panel Data. Journal of Business and Economic Statistics, 12(3), 317–328.

James, G., Witten, D., Hastie, T., & Tibshirani, R. (2013). An introduction to statistical learning. Springer.

Kamakura, W. A., & Russell, G. J. (1989). A probabilistic choice model for market segmentation and elasticity structure. Journal of Marketing Research, 26(4), 379–390.

Kohli, A. K., & Haenlein, M. (2021). Factors affecting the study of important marketing issues: Implications and recommendations. International Journal of Research in Marketing, 38(1), 1–11.

Kremer, S., Bijmolt, T., Leeflang, P., & Wieringa, J. (2008). Generalizations on the effectiveness of pharmaceutical promotional expenditures. International Journal of Research in Marketing, 25(4), 234–246.

Kuebler, R., Pauwels, K., Yildirim, G., & Fandrich, T. (2018). App popularity: Where in the world are consumers most sensitive to price and user ratings. Journal of Marketing, 82(5), 20–44.

Kumar, V., & Petersen, J. A. (2005). Using a customer-level marketing strategy to enhance firm performance: A review of theoretical and empirical evidence. Journal of the Academy of Marketing Science, 33(4), 504–519.

Kumar, V., Zhang, X., & Luo, A. (2014). Modeling customer opt-in and opt-out in a permission-based marketing context. Journal of Marketing Research, 51(4), 403–419.

L’Occitane (2015). 2015 Annual results announcement. Retrieved April 6, 2021 from https://group.loccitane.com/investors/financial-information.

Leckie, G., & Charlton, C. (2013). Runmlwin: A program to run the MlwiN multilevel modeling software from within Stata. Journal of Statistical Software, 52, 1–40.

Lehmann, D. R. (2020). The evolving world of research in marketing and the blending of theory and data. International Journal of Research in Marketing, 37(1), 27–42.

Lemmens, A., & Gupta, S. (2020). Managing churn to maximize profits. Marketing Science, 39(5), 956–973.

Levinson, I. (2019). E-mail versus direct mail: Which works better? Retrieved April 6, 2021 from https://www.businessknowhow.com/directmail/ideas/compare.html.

Lilien, G. L. (2011). Bridging the academic–practitioner divide in marketing decision models. Journal of Marketing, 75(4), 196–210.

Makles, A. (2012). Stata tip 110: How to get the optimal k-means cluster solution. The Stata Journal, 12(2), 347–351.

Mantrala, M. K., Sinha, P., & Zoltners, A. A. (1992). Impact of resource allocation rules on marketing investment-level decisions and profitability. Journal of Marketing Research, 29(2), 162–175.

Mark, T., Bulla, J., Niraj, R., Bulla, I., & Schwarzwäller, W. (2019). Catalogue as a tool for reinforcing habits: Empirical evidence from a multichannel retailer. International Journal of Research in Marketing, 36(4), 528–541.

Medlar, A. (2017). Direct mail vs. email: If you can only use one, which wins? Retrieved April 6, 2021 from https://www.enthusem.com/blog/direct-mail-vs.-email-if-you-can-only-use-one-which-wins.

Morris, G. (2019). Which EU countries accept B2B emails post-GDPR. Retrieved April 6, 2021 from https://www.leadiro.com/blog/gdpr-mapped.

Naik, P. A., & Peters, K. (2009). A hierarchical marketing communications model of online and offline media synergies. Journal of Interactive Marketing, 23(4), 288–299.

Niblock, R. (2017). Infographic: Direct mail vs email. Retrieved April 6, 2021 from https://www.digitaldoughnut.com/articles/2017/february/infographic-direct-mail-vs-email.

Papies, D., Ebbes, P., & Van Heerde, H. J. (2017). Addressing endogeneity in marketing models. In P. Leeflang, J. Wieringa, T. Bijmolt, & K. Pauwels (Eds.), Advanced methods for modeling markets (pp. 581–627). Springer.

Pauwels, K., & Neslin, S. A. (2015). Building with bricks and mortar: The revenue impact of opening physical stores in a multichannel environment. Journal of Retailing, 91(2), 182–197.

PostGrid (2022). Everything you need to know about direct mail and GDPR. Retrieved April 6, 2021 from https://www.postgrid.com/gdpr-compliance-for-direct-mail/.

Prins, R., & Verhoef, P. C. (2007). Marketing communication drivers of adoption timing of a new e-service among existing customers. Journal of Marketing, 71(2), 169–183.

Rabe-Hesketh, S., & Skrondal, A. (2008). Multilevel and longitudinal modeling using Stata. Stata P.

Raudenbush, S., & Bryk, A. S. (2002). Hierarchical linear models: Applications and data analysis methods. Sage.

Return Path (2015). Frequency matters: The keys to optimizing email send frequency. Research report. Retrieved April 6, 2021 from http://returnpath.com/wp-content/uploads/2015/06/RP-Frequency-Report-FINAL.pdf.

Risselada, H., Verhoef, P. C., & Bijmolt, T. (2014). Dynamic effects of social influence and direct marketing on the adoption of high-technology products. Journal of Marketing, 78(2), 52–68.

Roberts, J. H. (2000). The intersection of modelling potential and practice. International Journal of Research in Marketing, 17(2/3), 127–134.

Roberts, M. L., & Berger, P. D. (1999). Direct marketing management. Prentice Hall International.

Rosenthal, R. (1984). Meta-analytic procedures for social science research. Sage.

Rossi, P. E. (2014). Even the rich can make themselves poor: A critical examination of IV methods in marketing applications. Marketing Science, 33(5), 655–672.

Rust, R., & Verhoef, P. C. (2005). Optimizing the marketing interventions mix in intermediate-term CRM. Marketing Science, 24(3), 477–489.

Sahni, N., Zou, D., & Chintagunta, P. K. (2017). Do targeted discount offers serve as advertising? Evidence from 70 field experiments. Management Science, 63(8), 2397–2771.

Seenivasan, S., Sudhir, K., & Talukdar, D. (2016). Do store brands aid store loyalty. Management Science, 62(3), 802–816.

Sethuraman, R., Tellis, G. J., & Briesch, R. (2011). How well does advertising work? Generalizations from meta-analysis of brand advertising elasticities. Journal of Marketing Research, 48(3), 457–471.

Shiv, B., & Fedorikhin, A. (1999). Heart and mind in conflict: The interplay of affect and cognition in consumer decision making. Journal of Consumer Research, 26(3), 278–292.

Snijders, T. A., & Bosker, R. J. (2011). Multilevel analysis: An introduction to basic and advanced multilevel modeling. Sage.

Snyder, J. (2018). Post GDPR, clients will own data and agencies must get creative. Retrieved April 6, 2021 from https://adexchanger.com/data-driven-thinking/post-gdpr-clients-will-own-data-and-agencies-must-get-creative/.

Srinivasan, S., Pauwels, K., Hanssens, D. M., & Dekimpe, M. G. (2004). Do promotions benefit manufacturers, retailers, or both? Management Science, 50(5), 617–629.

Srinivasan, S., Rutz, O. J., & Pauwels, K. (2016). Paths to and off purchase: Quantifying the impact of traditional marketing and online consumer activity. Journal of the Academy of Marketing Science, 44(4), 440–453.

Srinivasan, S., Vanhuele, M., & Pauwels, K. (2010). Mind-set metrics in market response models: An integrative approach. Journal of Marketing Research, 47(4), 672–684.

Steenkamp, J.-B. E. M., & Geyskens, I. (2014). Manufacturer and retailer strategies to impact store brand share: Global integration, local adaptation, and worldwide learning. Marketing Science, 33(1), 6–26.

Stremersch, S. (2021). The study of important marketing issues: Reflections. International Journal of Research in Marketing, 38(1), 12–17.

Stremersch, S., Gonzalez, J., Valenti, A., & Villanueva, J. (2023). The value of context-specific studies for marketing. Journal of the Academy of Marketing Science, 51(1), 50–65.

Sundaram, R. K. (1996). A first course in optimization theory. Cambridge University Press.

ter Braak, A., Geyskens, I., & Dekimpe, M. G. (2014). Taking private labels upmarket: Empirical generalizations on category drivers of premium private label introductions. Journal of Retailing, 90(2), 125–140.

Tezinde, T., Smith, B., & Murphy, J. (2002). Getting permission: Exploring factors affecting permission marketing. Journal of Interactive Marketing, 16(4), 28–39.

Timoumi, A., Gangwar, M., & Mantrala, M. K. (2022). Cross-channel effects of omnichannel retail marketing strategies: A review of extant data-driven research. Journal of Retailing, 98(1), 133–151.

Valentini, S., Montaguti, E., & Neslin, S. A. (2011). Decision process evolution in customer channel choice. Journal of Marketing, 75(6), 72–86.

Van Heerde, H. J., & Bijmolt, T. (2005). Decomposing the promotional revenue bump for loyalty program members versus nonmembers. Journal of Marketing Research, 42(4), 443–457.

Verhoef, P. C. (2003). Understanding the effect of customer relationship management efforts on customer retention and customer share development. Journal of Marketing, 67(4), 30–45.

Verhoef, P. C., Neslin, S. A., & Vroomen, B. (2007). Multichannel customer management: Understanding the research-shopper phenomenon. International Journal of Research in Marketing, 24(2), 129–148.

Wedel, M., & Kamakura, W. A. (2002). Introduction to the special issue on market segmentation. International Journal of Research in Marketing, 19(3), 181–183.

Wiesel, T., Pauwels, K., & Arts, J. (2011). Marketing's profit impact: Quantifying online and offline funnel progression. Marketing Science, 30(4), 604–611.

Wooldridge, J. M. (2015). Control function methods in applied econometrics. Journal of Human Resources, 50(2), 420–445.

Wright, M. (2009). A new theorem for optimizing the advertising budget. Journal of Advertising Research, 49(2), 164–169.

Zhang, J. Z., & Chang, C. W. (2021). Consumer dynamics: Theories, methods, and emerging directions. Journal of the Academy of Marketing Science, 49(1), 166–196.

Zhang, X., Kumar, V., & Cosguner, K. (2017). Dynamically managing a profitable email marketing program. Journal of Marketing Research, 54(6), 851–866.

Zhang, Y., Bradlow, E. T., & Small, D. S. (2014). Predicting customer value using clumpiness: From RFM to RFMC. Marketing Science, 34(2), 195–208.

Acknowledgements

We are grateful to the Wharton Customer Analytics Initiative for providing the data sets used in this study and the management of L’Occitane en Provence for their collaboration in this project and for their feedback. We thank Eric Bradlow, Peter Fader, Dominique Hanssens, Gary Lilien, John Roberts, and Christian Schulze for their useful suggestions on this work. The first author is grateful for Boston University’s Questrom School of Business doctoral funding support.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note