Abstract

For incomplete preference relations that are represented by multiple priors and/or multiple—possibly multivariate—utility functions, we define a certainty equivalent as well as the utility indifference price bounds as set-valued functions of the claim. Furthermore, we motivate and introduce the notion of a weak and a strong certainty equivalent. We will show that our definitions contain as special cases some definitions found in the literature so far on complete or special incomplete preferences. We prove monotonicity and convexity properties of utility buy and sell prices that hold in total analogy to the properties of the scalar indifference prices for complete preferences. We show how the (weak and strong) set-valued certainty equivalent as well as the indifference price bounds can be computed or approximated by solving convex vector optimization problems. Numerical examples and their economic interpretations are given for the univariate as well as for the multivariate case.

Similar content being viewed by others

Notes

There are alternative approaches to define the indifference buy and sell prices in the literature. Indeed, there is a recent discussion stating that the indifference prices provided above satisfy the so called “complementary symmetry property”, see for instance [10, 22]; and there are experiments showing that this property is systematically violated [6]. Accordingly, it is possible to define, for instance, the utility indifference sell price as a solution of

$$\begin{aligned} \sup _{V_T \in \mathcal {A}(x_0)}{\mathbb {E}}u(V_T+C_T) = \sup _{V_T \in \mathcal {A}(x_0+p^s)} {\mathbb {E}}u(V_T), \end{aligned}$$(3)which accounts for the situation that one owns \(C_T\) in order to sell it. Thus, the agent’s initial pre-trade position is \((x_0, C_T)\), that is, \(x_0\) at time zero, and \(C_T\) initial wealth at time T. This would lead to an alternative description for \(P^s\). The definition in (4) corresponds to the situation, where the agent’s initial pre-trade position is \((x_0, 0)\), that is, \(x_0\) at time zero, and zero initial wealth at time T, see also [17]. This could also be interpreted as leading to the indifference short-selling price, with (3) as the indifference sell price. However, when we discuss the extensions of these concepts in Sect. 4, we keep the usual terminology and the sets as in (4), since they are quite standard in Financial Mathematics, see for instance [3, 8, 9, 17, 18].

Note that it is also possible to consider the slighly more general preference relation in [26], where there is a set of probability measure and utility pairs, say, \(\mathcal {UQ}\) and

$$\begin{aligned} Y \succsim Z \iff \,\, \forall (u,Q)\in \mathcal {UQ}: \,\,\, {\mathbb {E}}_Q u(Y) \ge {\mathbb {E}}_Q u(Z). \end{aligned}$$In this case, we would assume that there exists finitely many pairs in \(\mathcal {UQ}\) instead of what is stated in Assumption 2.8a. However, keeping the representation as in Definition 2.5 will be useful in simplifying some expressions throughout.

In [7], Campi and Owen define a multivariate utility function in a similar way. Different from Definition 2.7, they require \(C_u:=\mathrm{cl \,}(\mathrm{dom\,}u)\) to be a convex cone such that \(\mathbb {R}^d_+\subseteq C_u \ne \mathbb {R}^d\) and u to be increasing with respect to the partial order \(\le _{C_u}\). Note that as \(C_u\supseteq \mathbb {R}^d_+\), our definition is more general.

If we consider a representation given by a set of probability measures paired with utility functions as in [26], we would list all the pairs in order to obtain \(U(\cdot )\) and all the results of this section would remain the same, see also Footnote 2.

Following the remark given in Footnote 1, an alternative definition for the set-valued sell price of \(C_T\) would be \({\tilde{P}}^s(C_T) =\{p^s \in \mathbb {R}^d |\;V(x_0 + p^s, 0) \supseteq V(x_0, C_T)\}\). With this definition, Remark 4.6 is not correct anymore. Hence, one needs to check the rest of the results in Sect. 4 separately for \({\tilde{P}}^s(C_T)\). It is straightforward to see that Propositions 4.7-1., 4.7-2. and 4.9 hold correct for this definition. Moreover, both the statements and the proofs of Propositions 4.11 and 4.12 can be modified accordingly. However, the steps followed to prove Propositions 4.7-3. and 4.8 can not be applied directly to the alternative definition. Note that as Proposition 4.7-1. holds correct, the computations of \({\tilde{P}}^s(C_T)\) can be done by applying similar techniques as described in Sect. 5.

Note also the relationship to the definition of the certainty equivalent, in particular between \(\mathrm{C^{up} \,}(C_T)\) and \(P^s(C_T)\). A certain amount \(c\in \mathrm{bd \,}\mathrm{C^{up} \,}(C_T)= \mathrm{C^{w} \,}(C_T)\) is preferred to \(C_T\) (\(c \succsim C_T\)), but for any \(\varepsilon \in \mathrm{int \,}\mathbb {R}^d_+\), \(c-\varepsilon \) is not anymore preferred to it (\(c-\varepsilon \not \succsim C_T\)). Similarly, for a price \(p\in \mathrm{bd \,}P^s(C_T)\), the decision maker would prefer selling the claim at that price rather than not taking any action, but for any \(\varepsilon \in \mathrm{int \,}\mathbb {R}^d_+\), \(p-\varepsilon \) is not anymore a sell price for him/her (see Propositions 3.5-1. and 4.11-2.). Moreover both sets are convex upper sets. The situation is somehow different when we consider \(\mathrm{C^{lo} \,}(C_T)\). This set is not necessarily convex (unlike \(P^b(C_T)\)). Moreover, for any \(c\in \mathrm{C^{lo} \,}(C_T)\), \(C_T\) is preferred to c (not the other way around), and for any \(\varepsilon \in \mathrm{int \,}\mathbb {R}^d_+\), \(C_T\) is not anymore preferred to \(c+\varepsilon \).

References

Armbruster, B., Delage, E.: Decision making under uncertainty when preference information is incomplete. Manag. Sci. 61, 111–128 (2015)

Aumann, R.: Utility theory without the completeness axiom. Econometrica 30, 445–462 (1962)

Benedetti, G., Campi, O.: Multivariate utility maximization with proportional transaction costs and random endowment. SIAM J. Control Optim. 50(3), 1283–1308 (2012)

Benson, H.P.: An outer approximation algorithm for generating all efficient extreme points in the outcome set of a multiple objective linear programming problem. J. Glob. Optim. 13, 1–24 (1998)

Bewley, T.F.: Knightian decision theory: part 1. Decis. Econ. Finance 25, 79–110 (2002)

Birnbaum, M.H., Yeary, S., Luce, R.D., Zhao, L.: Empirical evaluation of four models of buying and selling prices of gambles. J. Math. Psychol. 75, 183–193 (2016)

Campi, L., Owen, M.P.: Multivariate utility maximization with proportional transaction costs. Finance Stoch. 15(3), 461–499 (2011)

Carmona, R.: Indifference Pricing: Theory and Applications. Princeton University Press, Princeton (2008)

Cheridito, P., Kupper, M.: Recursiveness of indifference prices and translation-invariant preferences. Math. Financ. Econ. 2(3), 173–188 (2009)

Chudziak, J.: On complementary symmetry under cumulative prospect theory. J. Math. Psychol. 95, 102312 (2020)

Dubra, J., Maccheroni, F., Ok, E.: Expected utility theory without the completeness axiom. J. Econ. Theory 115, 118–133 (2004)

Ehrgott, M., Shao, L., Schöbel, A.: An approximation algorithm for convex multi-objective programming problems. J. Glob. Optim. 50(3), 397–416 (2011)

Eichfelder, G.: Adaptive scalarization methods in multiobjective optimization. Springer, Berlin (2008)

Galaabaatar, T., Karni, E.: Subjective expected utility with incomplete preferences. Econometrica 81(1), 255–284 (2013)

Hamel, A., Löhne, A.: Minimal element theorems and Ekeland’s principle with set relations. J. Nonlinear Convex Anal. 7(1), 19–37 (2006)

Hamel, A., Wang, S.Q.: A set optimization approach to utility maximization under transaction costs. Decis. Econ. Finance 40(1–2), 257–275 (2017)

Henderson, V., Hobson, D.: Indifference Pricing: Theory and Applications, Chapter Utility Indifference Pricing—An Overview, pp. 44–74. Princeton University Press, Princeton (2009)

Henderson, V., Liang, G.: A multidimensional exponential utility indifference pricing model with applications to counterparty risk. SIAM J. Control Optim. 54(2), 690–717 (2016)

Jahn, J.: Vector Optimization—Theory, Applications, and Extensions. Springer, Berlin (2004)

Kabanov, Y., Rásonyi, M., Stricker, C.: No-arbitrage criteria for financial markets with efficient friction. Finance Stoch. 6, 371–382 (2002)

Kuroiwa, D., Tanaka, T., Ha, T.X.D.: On cone convexity of set-valued maps. Nonlinear Anal. Theory Methods Appl. 30(3), 1487–1496 (1997)

Lewandowski, M.: Complementary symmetry in cumulative prospect theory with random reference. J. Math. Psychol. 82, 52–55 (2018)

Löhne, A., Rudloff, B.: An algorithm for calculating the set of superhedging portfolios in markets with transaction costs. Int. J. Theor. Appl. Finance 17(2), 1450012 (2014)

Löhne, A., Rudloff, B., Ulus, F.: Primal and dual approximation algorithms for convex vector optimization problems. J. Glob. Optim. 60(4), 713–736 (2014)

Luc, D.: Theory of Vector Optimization. Lecture Notes in Economics and Mathematical Systems, vol. 319. Springer (1989)

Nau, R.: The shape of incomplete preferences. Ann. Stat. 34(5), 2430–2448 (2006)

Nobakhtian, S., Shafiei, N.: A Benson type algorithm for nonconvex multiobjective programming problems. TOP 25(2), 271–287 (2017)

Ok, E.: Utility representation of an incomplete preference relation. J. Econ. Theory 104, 429–449 (2002)

Ok, E., Ortoleva, P., Riella, G.: Incomplete preferences under uncertainty: indecisiveness in beliefs versus tastes. Econometrica 80(4), 1791–1808 (2012)

Pagani, E.: Certainty equivalent: many meanings of a mean. Working Paper Series Department of Economics, University of Verona (2015)

Pascoletti, A., Serafini, P.: Scalarizing vector optimization problems. J. Optim. Theory Appl. 42(4), 499–524 (1984)

Ruzika, S., Wiecek, M.M.: Approximation methods in multiobjective programming. J. Optim. Theory Appl. 126(3), 473–501 (2005)

Von Neumann, N., Morgenstern, O.: Theory of Games and Economic Behavior. Princeton University Press, Princeton (1947)

Wang, S.Q.: Utility. Junior Project. Princeton University, Princeton (2010)

Acknowledgements

We are grateful to Andreas Hamel for initiating many applications of set-valued analysis and in particular introducing set-valued extensions of concepts from economics and financial mathematics, which shaped and motivated the subject of this manuscript. In particular, he initiated the discussion of a set-valued certainty equivalent which resulted in [34]. We would also like to thank Özgür Evren, Zachary Feinstein, Efe Ok and Frank Riedel for fruitful discussions and their constructive feedback. Furthermore, we would like to thank two anonymous referees for detailed and helpful comments and pointing us to further related literature.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Proof of the results from Sect. 4

Appendix: Proof of the results from Sect. 4

Proof of Proposition 4.7

-

1.

We first show that \(P^b(C_T)\) is a lower set, that is, \(P^b(C_T) = P^b(C_T) - \mathbb {R}^d_+\). It is clear that \(P^b(C_T) \subseteq P^b(C_T) - \mathbb {R}^d_+\). To show the reverse inclusion, let \(p^b \in P^b(C_T)\) and \(r \in \mathbb {R}^d_+\). By Assumption 4.2c., \(\mathcal {A}(x_0 - p^b +r) \supseteq \mathcal {A}(x_0-p^b)\). Then, by definition of \(V(\cdot , \cdot )\) and since \(p^b \in P^b(C_T)\), we have \(V(x_0-p^p+r, C_T) \supseteq V(x_0-p^b, C_T) \supseteq V(x_0, 0)\). Thus, \(p^b - r \in P^b(C_T)\).

Next we show that \(P^b(C_T) \subseteq \mathbb {R}^d\) is a convex set. Let \(p^1, p^2 \in P^b(C_T)\), \(\lambda \in [0,1]\) and \(p^{\lambda }:=\lambda p^1 + (1-\lambda )p^2\). First, note that \(V(x_0-p^i, C_T) \supseteq V(x_0, 0)\) for \(i=1,2\) implies

$$\begin{aligned} \lambda V(x_0-p^1, C_T) + (1-\lambda )V(x_0-p^2, C_T) \supseteq V(x_0,0). \end{aligned}$$In order to show \(p^{\lambda } \in P^b(C_T)\), it would be enough to prove

$$\begin{aligned} V(x_0-p^{\lambda }, C_T) \supseteq \lambda V(x_0-p^1, C_T) + (1-\lambda )V(x_0-p^2, C_T). \end{aligned}$$(30)Consider \(U(V_T^i)-r^i \in V(x_0-p^i, C_T)\), where \(V_T^i \in \mathcal {A}(x_0-p^i)\) and \(r^i \in \mathbb {R}^q_+\) for \(i =1,2\). By concavity of \(u \in \mathcal {U}\), we have

$$\begin{aligned} \lambda U(V_T^1+C_T)+ (1-\lambda )U(V_T^2+C_T)&\le U(\lambda V_T^1 + (1-\lambda )V_T^2 + C_T). \end{aligned}$$Clearly, for some \({\tilde{r}}\in \mathbb {R}^q_+\), where \(r^{\lambda }= \lambda r^1 + (1-\lambda )r^2\), it holds

$$\begin{aligned} \lambda U(V_T^1+C_T)+ (1-\lambda )U(V_T^2+C_T) -r^{\lambda }&= U(\lambda V_T^1 + (1-\lambda )V_T^2 + C_T) -r^{\lambda }- {\tilde{r}}. \end{aligned}$$As \(\lambda V_T^1 + (1-\lambda )V_T^2 \in \mathcal {A}(x_0 - p^{\lambda })\) by Assumption 4.2b., we have

$$\begin{aligned} U(\lambda V_T^1 + (1-\lambda )V_T^2 + C_T) -r^{\lambda }- {\tilde{r}} \in V(x_0-p^{\lambda }, C_T), \end{aligned}$$which implies (30).

-

2.

We show that \(P^b(\cdot )\) is monotone with respect to \(\le \) and \(\curlyeqprec \). Let \(C_T^1, C_T^2 \in L(\mathcal {F}, \mathbb {R}^d)\) with \(C_T^1 \le C_T^2\) and \(p^b \in P^b(C_T^1)\). Then, by Remark 4.3a., and by the definition of \(P^b(\cdot )\),

$$\begin{aligned} V(x_0-p^b, C_T^2) \supseteq V(x_0-p^b, C_T^1) \supseteq V(x_0,0). \end{aligned}$$This concludes that \(P^b(C_T^1)\subseteq P^b(C_T^2)\), which implies \(P^b(C_T^1) \curlyeqprec P^b(C_T^2)\).

-

3.

We show \( \lambda P^b(C_T^1) + (1-\lambda )P^b(C_T^2) \subseteq P^b(C_T^{\lambda })\), which implies (13). Let \(p^i \in P^b(C_T^i)\), that is, \(V(x_0, 0) \subseteq V(x_0-p^i, C^i_T)\) for \(i = 1,2\). Clearly,

$$\begin{aligned} V(x_0, 0) \subseteq \lambda V(x_0-p^1, C_T^1) + (1-\lambda )V(x_0-p^2, C_T^2). \end{aligned}$$Then, it would be enough to show that

$$\begin{aligned} \lambda V(x_0-p^1, C_T^1) + (1-\lambda )V(x_0-p^2, C_T^2) \subseteq V(x_0 - p^{\lambda }, C_T^{\lambda }), \end{aligned}$$(31)where \(p^{\lambda }:= \lambda p^1 + (1-\lambda )p^2\). Let \(V_T^i \in \mathcal {A}(x_0-p^i)\) and \(r^i \in \mathbb {R}^q_+\) for \(i=1,2\). By the concavity of \(U(\cdot )\), we have

$$\begin{aligned} \lambda (U(V_T^1+C_T^1)-r^1)&+ (1-\lambda ) (U(V_T^2+C_T^2)-r^2) \\&= \lambda U(V_T^1+C_T^1) + (1-\lambda ) U(V_T^2+C_T^2) - r^{\lambda } \\&= U(\lambda V_T^1 + (1-\lambda )V_T^2 + C_T^{\lambda }) -r^{\lambda } -{\tilde{r}} \end{aligned}$$for some \({\tilde{r}} \in \mathbb {R}^q_+\), where \(r^{\lambda } := \lambda r^1 + (1-\lambda )r^2\). Note that \(\lambda V_T^1 + (1-\lambda )V_T^2 \in \mathcal {A}(x_0-p^{\lambda })\) by Assumption 4.2 b. Then, (31) is implied by

$$\begin{aligned} \lambda (U(V_T^1+C_T^1)-r^1) + (1-\lambda ) (U(V_T^2+C_T^2)-r^2) \in V(x_0 - p^{\lambda }, C^T_{\lambda }). \end{aligned}$$

\(\square \)

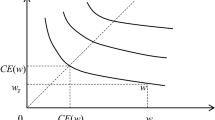

Set-valued buy price \(P^b(C_T)\) (dark green) and sell price \(P^s(C_T)\) (dark blue); set of all subhedging portfolios \(\mathrm{SubHP \,}(C_T)\) (light green) and superhedging portfolios \(\mathrm{SHP \,}(C_T)\) (light blue) for Example 6.7. (Color figure online)

Proof of Proposition 4.8

-

1.

Let \(p \in P^b(C_T)\cap P^s(C_T)\), that is, \(V(x_0-p,C_T) \supseteq V(x_0,0)\) and \(V(x_0+p,-C_T) \supseteq V(x_0,0)\). Let \(v^b \in \bigcup _{V_T^b\in \mathcal {A}(x_0-p)}[U(V_T+C_T)-\mathbb {R}^q_+]\) and \(v^s \in \bigcup _{V_T^b\in \mathcal {A}(x_0+p)}[U(V_T-C_T)-\mathbb {R}^q_+]\). Then, \(v^b = U(V_T^b+C_T)-r^b\) and \(v^s = U(V_T^s-C_T)-r^s\) for some \(V_T^b\in \mathcal {A}(x_0-p)\), \(V_T^s\in \mathcal {A}(x_0+p)\) and \(r^b,r^s \in \mathbb {R}^q_+\). By the concavity of U, we have

$$\begin{aligned} \frac{1}{2} v^b+\frac{1}{2} v^s \le U(\frac{1}{2} V_T^b+\frac{1}{2} V_T^s)-\frac{1}{2}(r^b+r^s). \end{aligned}$$Note that for any \(V_T^b\in \mathcal {A}(x_0-p)\) and \(V_T^s\in \mathcal {A}(x_0+p)\), we have \(V_T^b + p, V_T^s - p \in \mathcal {A}(x_0)\) and \(\frac{1}{2} V_T^b + \frac{1}{2} V_T^s \in \mathcal {A}(x_0)\) by Assumption 4.2d. Then, \(U(\frac{1}{2} V_T^b+\frac{1}{2} V_T^s)-\frac{1}{2}(r^b+r^s) \in V(x_0,0)\) and hence, \(\frac{1}{2} v^b+\frac{1}{2} v^s \in V(x_0,0)\). Now, for any \(V^b \in V(x_0-p,C_T), V^s \in V(x_0+p,-C_T)\), there exists sequences \((v_n^b)\in \bigcup _{V_T^b\in \mathcal {A}(x_0-p)}[U(V_T+C_T)-\mathbb {R}^q_+], (v_m^s)\in \bigcup _{V_T^b\in \mathcal {A}(x_0+p)}[U(V_T-C_T)-\mathbb {R}^q_+]\) with \(\lim _{n\rightarrow \infty } v^b_n = V^b\) and \(\lim _{n\rightarrow \infty } v^s_n = V^s\). Since for each \(n,m \ge 1\), \(\frac{1}{2} v_n^b+\frac{1}{2} v_m^s \in V(x_0,0)\) and since \(V(x_0,0)\) is closed, we have \(\frac{1}{2} V^b+\frac{1}{2} V^s \in V(x_0,0)\), which proves that

$$\begin{aligned} \frac{1}{2} V(x_0-p,C_T)+\frac{1}{2} V(x_0+p,-C_T) \subseteq V(x_0,0). \end{aligned}$$(32)As \(V(x_0-p,C_T), V(x_0+p,-C_T), V(x_0,0)\) are lower closed sets and both \(V(x_0-p,C_T), V(x_0+p,-C_T)\) are supersets of \(V(x_0,0)\), (32) holds only if we have \(V(x_0-p,C_T) = V(x_0,0) = V(x_0+p,-C_T)\).

-

2.

Let \(p\in P^b(C_T)\cap P^s(C_T)\). Then, by Proposition 4.8-1., \(V(x_0-p,C_T)=V(x_0,0)\). Moreover, by Assumption 4.2d., and by Remark 4.3d., \(V(x_0-p+\epsilon ,C_T)\supsetneq ~V(x_0,0)\) for any \(\epsilon \in \mathrm{int \,}\mathbb {R}^d_+\). Thus, \(p - \epsilon \notin P^b(C_T)\cap P^s(C_T)\) for any \(\epsilon \in \mathrm{int \,}\mathbb {R}^d_+\). Then, \(\mathrm{int \,}(P^b(C_T)\cap P^s(C_T)) = \emptyset \).

\(\square \)

Proof of Proposition 4.9

We will show that \(P^b(C_T)\) is closed. By Proposition 4.7, it is enough to show that \(\mathrm{bd \,}P^b(C_T) \subseteq P^b(C_T)\). Moreover, as \(P^b(C_T)\) is a lower set for any \(p \in \mathrm{bd \,}P^b(C_T)\), there exists a sequence \((p^n)_{n\ge 1} \in P^b(C_T)\) such that \(p^{n+1} \ge p^{n}\) for all \(n\ge 1\) and \(\lim _{n \rightarrow \infty } p^n = p\). The proof will be complete if

holds. Indeed, together with the fact that \(V(x_0-p^n,C_T)\supseteq V(x_0,0)\) for all \(n \ge 1\), (33) implies that \(V(x_0-p,C_T) \supseteq \bigcap _{n\ge 1} V(x_0-p^n,C_T) \supseteq V(x_0,0)\); hence \(p \in P^b(C_T)\).

In order to show (33), first note that \(\mathcal {A}(x_0-p)= \bigcap _{n\ge 1} \mathcal {A}(x_0-p^n)\) by Assumption 4.2 e. Then, we have

Let \(y \in \bigcap _{n \ge 1}V(x_0-p^n,C_T)\). Since y is an element of the lower image \(V(x_0-p^n,C_T)\), it is true that \(\{y\} - \mathrm{int \,}\mathbb {R}^q_+ \subseteq \bigcup _{V_T \in \mathcal {A}(x_0-p^n)}\left( U(V_T+C_T) - \mathbb {R}^q_+\right) \) for all \(n \ge 1\). Let \((y^k)_{k\ge 1} \in \{y\} - \mathrm{int \,}\mathbb {R}^q_+\) be a sequence with \(\lim _{k \rightarrow \infty } y^k = y.\) Clearly, for each \(k\ge 1\),

\(y^k \in \bigcap _{n\ge 1}\bigcup _{V_T \in \mathcal {A}(x_0-p^n)}\left( U(V_T+C_T) - \mathbb {R}^q_+\right) \), hence

\(\square \)

Proof of Proposition 4.12

Assume for a proof by contradiction that \(V(x_0,0)\subseteq \mathrm{int \,}V(x_0-p,C_T)\). Hence, there exists \(\epsilon > 0\) such that \(V(x_0-p,C_T)\supseteq V(x_0,0)+B(0,\epsilon )\). It is enough to show that there is \({\tilde{p}}>p\) such that

as this implies that \(V(x_0-{\tilde{p}},C_T) \supseteq V(x_0,0)\), hence \({\tilde{p}} \in P^b(C_T)\), which contradicts that \(p\in \mathrm{bd \,}P^b(C_T)\). To prove (34) note that as each \(u\in \mathcal {U}\) is uniformly continuous, there exists \(\delta > 0\) such that \(\left\| x-y\right\| \le \delta \) implies that \(\left| u(x)-u(y)\right| \le \frac{\epsilon }{\sqrt{q}}\). Let \({\tilde{\delta }} \in (0,\delta )\) and \({\tilde{p}}:= p+{\tilde{\delta }}\frac{e}{\left\| e\right\| }\), where \(e\in \mathbb {R}^d\) is the vector of ones. Note that

as \(\mathcal {A}(x_0-{\tilde{p}}) = \mathcal {A}(x_0-p)-{\tilde{\delta }}\frac{e}{\left\| e\right\| }\). Let \(U(V_T+C_T)-r \in V(x_0-p,C_T)\) for some \(V_T \in \mathcal {A}(x_0-p)\) and \(r\in \mathbb {R}^q_+\). Clearly, for each \(u\in \mathcal {U}\) and \(Q\in \mathcal {Q}\), we have

Then

Hence, \(U(V_T+C_T) -r \in U(V_T+C_T-{\tilde{\delta }}\frac{e}{\left\| e\right\| })+B(0,\epsilon )-\mathbb {R}^q_+\) and (34) holds. \(\square \)

Rights and permissions

About this article

Cite this article

Rudloff, B., Ulus, F. Certainty equivalent and utility indifference pricing for incomplete preferences via convex vector optimization. Math Finan Econ 15, 397–430 (2021). https://doi.org/10.1007/s11579-020-00282-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-020-00282-x

Keywords

- Utility maximization

- Indifference price bounds

- Certainty equivalent

- Incomplete preferences

- Convex vector optimization