Abstract

Although social innovation can help multinational enterprise (MNE) subsidiaries create social value for developing countries, they often encounter significant challenges in successfully implementing social innovation projects. This research applies the knowledge-based perspective to propose and test a theoretical framework to explain why MNE subsidiaries differ in their ability to pursue social innovation successfully in a developing country. The framework contends that MNEs’ relationship learning contributes to social innovation variability under varying levels of subsidiary autonomy and mode of entry. Analysis of primary data collected from 207 subsidiaries of MNEs operating in Ghana shows that relationship learning has a positive relationship with social innovation. Further analysis reveals that subsidiary autonomy enhances the positive association between relationship learning and social innovation, and that this moderating effect is stronger for subsidiaries with equity entry mode as opposed to non-equity entry mode. These insights advance the limited understanding of the antecedents of MNEs’ social innovation in developing countries and offer guidance on how MNE subsidiaries can successfully pursue social innovation interventions in a developing country.

Similar content being viewed by others

Explore related subjects

Find the latest articles, discoveries, and news in related topics.Avoid common mistakes on your manuscript.

1 Introduction

Sub-Saharan African countries offer under-tapped resources and cheap labor, combined with burgeoning consumer markets, making them attractive to multinational enterprises (MNEs) seeking growth and prosperity (The Amankwah-Amoah et al., 2018; Economist, 2019). As a result, the region has become increasingly appealing to a wide range of MNEs (Ewalefoh, 2022; Osabutey & Jackson, 2019; Yakovleva & VazQuez-Brust, 2018). Nonetheless, like in many developing countries, these markets face numerous grand challenges, including extreme poverty, hunger, health issues, climate-related disasters, and modern slavery (Fernhaber & Zou, 2022; George et al., 2016). Developing countries lack critical resources, such as finance, human capital, and technology, to address these complex challenges. Therefore, although MNEs are frequently perceived as contributors to sustainability challenges in these countries (Gutiérrez & Vernis, 2016; Yakovleva & VazQuez-Brust, 2018), there is a growing expectation for them to actively engage in social innovation to generate social value within these nations (Fernhaber & Zou, 2022; Lind et al., 2022; Dionisio & de Vargas, 2020). For example, Zipline operates in seven African countries, such as Ghana, Rwanda, and Kenya, implementing innovative solutions to improve healthcare and food accessibility, create economic opportunities, and reduce carbon emissions (Oke & Nair, 2023; Zipline, 2023).

Social innovation, defined as innovative activities and services aimed at addressing social needs (Mulgan, 2006), contributes to societal well-being and can enhance shareholder value (Canestrino et al., 2015; Herrera, 2015). However, not all social innovation projects succeed, with some projects failing to meet the needs and expectations of stakeholders, including beneficiaries (Chandra et al., 2021; Seelos & Mair, 2016; Brown & Wyatt, 2010). Consequently, MNEs recognize the significance of collaborating with stakeholders to design and execute effective social innovation initiatives (Fernhaber & Zou, 2022; Lind et al., 2022). Nevertheless, establishing these relationships can pose challenges and entail costs due to their intricate and ever-changing nature (Boso et al., 2023). For instance, in sub-Saharan African countries like Ghana, MNEs must establish networks with a diverse array of local institutions, including local community leaders, religious figures, national political leaders, and regulatory bodies, each having unique and evolving expectations and demands (Amankwah-Amoah et al., 2022a, 2022b; Boso et al., 2023). Therefore, it becomes essential for MNEs to prioritize the process of relationship learning (Li et al., 2020) when embarking on social innovation projects (Gutiérrez & Vernis, 2016; Lind et al., 2022). Relationship learning (RL) denotes the extent to which MNEs exchange information, engage in joint problem-solving initiatives, and adapt their interactions with relevant stakeholders (Fang et al., 2011; Bryan Jean & Sinkovics, 2010).

While some empirical research suggests that RL can enhance innovation (Hernandez-Espallardo et al., 2018; Bryan Jean & Sinkovics, 2010), other studies indicate that its impact on innovation depends on context-specific factors (Zhu et al., 2018). Furthermore, while extant literature recognizes RL as vital for MNEs to overcome liabilities of foreignness and outsidership in foreign markets (Li et al., 2020), there is a scarcity of theoretical models and empirical analyses regarding the roles and boundary conditions of RL in driving MNE social innovation. Accordingly, this study proposes and tests a framework that details how and when RL can drive social innovation among MNE subsidiaries in a sub-Saharan African country, Ghana. We argue that, through ongoing engagement with stakeholders, MNEs can learn from their long-term partnerships, networks, and alliances, which can subsequently lead to successful social innovations (Pittaway et al., 2004; Rydehell et al., 2019). Additionally, we extend our RL–social innovation model by examining the moderating roles of subsidiary autonomy and the entry mode choices of MNEs. We contend that subsidiary autonomy, uniquely and in interaction with type of MNE entry mode, moderates the relationship between relationship learning and social innovation. Both subsidiary autonomy and the choice of entry mode are crucial characteristics of MNEs that drive their competitiveness in host markets (Galli Geleilate et al., 2020), yet the extent to which they function to drive social innovation in host markets is unclear. We argue that the link between RL and social innovation is influenced by subsidiary autonomy, with this influence varying depending on whether the subsidiary is wholly owned or a joint venture.

We test our argument by using primary data gathered from 207 subsidiaries of MNEs operating in Ghana. The study’s findings contribute to the MNE social innovation literature in two important ways. First, the study identifies RL as a crucial source of heterogeneity in MNE subsidiary social innovation. Specifically, it demonstrates that learning from local relationships and collaborations drives MNEs’ social innovation. This insight expands knowledge of the determinants of social innovation. Second, the study sheds novel insights into the boundary conditions of the relationship between RL and social innovation by revealing how subsidiary autonomy, independently and jointly with entry mode, moderates the relationship. The study demonstrates that RL benefits social innovation more when there is strong subsidiary autonomy and the entry mode choice is predominantly equity.

The structure of this paper is as follows: the subsequent section provides a theoretical background and hypotheses that explain the relationships among RL, subsidiary autonomy, entry mode, and social innovation. Next, the research methodologies employed for sampling, data collection, and analysis are described. The findings are then presented, followed by a discussion on the research and practical implications of the findings. The paper ends with research limitations and directions for future research.

2 Theory and Hypotheses

2.1 Knowledge-Based Perspective

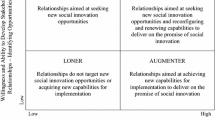

As shown in Fig. 1, we draw on the knowledge-based perspective to theorize that MNE subsidiaries’ RL contributes to social innovation, especially when they have more autonomy and adopt an equity-based entry mode. The central tenet of the knowledge-based perspective suggests that knowledge is the most strategically important firm resource and as such its accumulation and utilization can benefit organizational outcomes (Amankwah-Amoah et al., 2022a, 2022b; Arend et al., 2014; Grant, 1996, 2015). Knowledge can be classified as codified, easily captured and shared, or tacit, which requires more externalization and deep engagement with stakeholders to appropriate and share (Reilly et al., 2023). Knowledge is, therefore, salient for both firms seeking to internationalize and MNEs already operating within the domain of international markets. We theorize that RL is a crucial mechanism through which MNE subsidiaries can acquire and leverage critical knowledge about their host country's social problems and generate innovative solutions for addressing such problems.

Not only can RL contribute to knowledge acquisition, it can also provide a foundation for MNE subsidiaries to embed themselves in and extract value from external networks. The embeddedness concept contends that subsidiaries are internally embedded in corporate relationships with their headquarters and externally embedded in local networks, enabling subsidiaries to access resources potentially available from the local environment (Meyer et al., 2020; Achcaoucaou et al., 2014). By extension, this concept suggests that subsidiaries can assimilate knowledge through relational learning from their local networks for onward transfer to the headquarters or other MNE sub-units. The evidence in the literature further points to the fact that MNE subsidiaries that maintain frequent interaction with multiple firm internal and external linkages were found to have developed the highest levels of innovative capabilities (Hansen et al., 2020; Ciabuschi et al., 2014).

The depth of a subsidiary's external embeddedness within its business network was found to be positively associated with innovation-related outcomes (Ciabuschi et al., 2014). Greater external embeddedness can help subsidiaries evaluate the needs and requirements of their local markets and share innovation-related interests to a greater extent. Subsidiaries can be embedded in various spheres of the local environment that transcend the business networks to include networks with non-market actors (e.g., local community opinion leaders, religious leaders, and local and national politicians) (Boso et al., 2023). These facets of external embeddedness can facilitate a subsidiary’s ability to assimilate knowledge from its suppliers and customers to generate not only local but also global innovations (Meyer et al., 2020).

Murphree et al.’s (2022) study on how MNE subsidiaries operating in a peripheral region source knowledge further amplifies the importance of knowledge acquisition from a subsidiary’s local environment. They argue that, irrespective of the depth of a subsidiary’s corporate embeddedness, which guarantees it access to global knowledge channels, local sources may still be preferred when the knowledge to resolve specific technological challenges can only be found locally. The import of their study, like others in the extant literature, gives emphasis and credence to external sources of knowledge as an important determinant of MNE subsidiary success in host markets (Hansen & Lema, 2019; Hansen et al., 2020; Ciabuschi et al., 2014).

Hansen et al. (2020) affirm that subsidiaries can advance to higher levels of innovative capabilities to the extent to which they deliberately devote resources to learning. Organizational learning is an important component of knowledge acquisition (Huber, 1991). The extant literature asserts that multinational subsidiaries can acquire knowledge from outside the firm's boundaries, from its customers, collaborators, and host countries' environment, and this can be expected to enhance its innovativeness (Fu et al., 2018; Park, 2012). However, the mere exposure that a subsidiary has to external knowledge does not guarantee that learning takes place (Meyer et al., 2020). Rather, a more curated long-term relationship in the firm’s daily routine is a critical foundation for effective learning (Hansen et al., 2020; Park, 2012). Extant literature highlights a host of factors that can determine the efficacy and benefits of MNE subsidiaries’ RL: human resource management practices, subsidiary absorptive capacity, relational capital, knowledge transfer capacity of MNEs' collective learning routines (Meyer et al., 2020; Park, 2012; Hansen et al., 2020). This research analyzes subsidiary autonomy and entry mode as important contingencies in the link between RL and MNE subsidiary social innovation.

2.2 Relationship Learning and Social Innovation

RL, as a component of organizational learning, is defined as “a joint activity between a supplier and a customer in which the two parties share information, which is then jointly interpreted and integrated into a shared relationship-domain-specific memory that changes the range or likelihood of potential relationship-domain-specific behavior” (Selnes & Sallis, 2003, p. 80). RL manifests through sharing information, joint sense-making, and developing relationship-specific memories (Bryan Jean & Sinkovics, 2010; Selnes & Sallis, 2003). These aspects of RL can contribute to social innovation, as successful social innovation projects require MNE subsidiaries to deploy boundary-spanning activities that foster new interactions that integrate institutionally diverse organizations, individuals, and communities (Crupi et al., 2022).

Through the process of learning, MNEs subsidiaries are able to identify and develop novel solutions or imitate existing solutions that are relevant to the needs of the local market. This learning can serve as an information-processing system that helps MNE subsidiaries continually gather and analyze pertinent information from their interactions with stakeholders, allowing them to implement measured responses to local communities’ problems.

Further, by learning from local relationships and collaborations, MNE subsidiaries are able to transfer distinctive and privileged local market information to their decision-making processes, which can subsequently lead to more innovative outcomes. Through building such closely-knit collaborations with their respective host market partners, MNE subsidiaries can leverage the social capital to keep adjusting their understanding of the end-user needs, new market segments and opportunities for diversification (e.g., social innovation market), which can help suppliers develop better products and services (Bryan Jean & Sinkovics, 2010).

From a stakeholder theory perspective, Segarra-Oña et al.’s (2017) study found that the social innovation orientation within a company is influenced by both process and product-oriented innovation activities. They argue that the source of ideas for these two key innovation-oriented activities of process and product innovation can be traced to information sources derived from the firms’ close environment, particularly through customer–supplier exchange relationships. Their findings suggest that social innovation can be generated through the RL sub-process of information sharing. Thus, MNEs and their subsidiaries’ ability to adapt social innovation business models will be predicated on the depth of their relational learning capabilities from the various local markets they operate in.

The above arguments and analyses imply that RL can enable MNE subsidiaries to generate critical knowledge resources from local stakeholders to design and execute social innovation projects that meet the expectations of intended end-users (Selnes & Sallis, 2003). Accordingly, this study hypothesizes that:

H1: Relationship learning has a positive relationship with social innovation.

2.2.1 The Effect of Subsidiary Autonomy

Subsidiary autonomy is the level of empowerment or authority granted to subsidiaries to make strategic and operational decisions (Chiao & Ying, 2014). The goal of granting autonomy to subsidiaries is to improve their efficiency, flexibility, and responsiveness in dealing with the affairs of the host market (Gammelgaard et al., 2012). Even so, subsidiary autonomy depends on the scope of value activities and decisions that subsidiaries are permitted to make, as well as the scale of decision-making power that they wield for undertaking scope activities (Chiao & Ying, 2014; Gammelgaard et al., 2012; Kawai & Strange, 2014). Nonetheless, Chiao and Ying (2014) argue that the extent to which a subsidiary’s autonomy can be determined as high or low is reflected in how much scope and scale it has for actioning value activities.

According to Gammelgaard et al. (2012), a subsidiary’s autonomy is high when that subsidiary is imbued with the power to primarily make operational and/or strategic decisions. This implies that subsidiaries have more managerial control over how they leverage firm-specific resources to engage in decision-making, and pursue local strategies including the adoption of social innovation business models (Kawai & Strange, 2014). Similarly, subsidiaries that are independent and have very strong external networks (with local networks and partners) can build social capital and tacit knowledge that enhance the efficacy of their RL activities. Furthermore, strong autonomy can enable MNE subsidiaries to rapidly and effectively modify RL initiatives to react to changes in social problems and find the answers required to address such issues (Chiao & Ying, 2014; Gammelgaard et al., 2012). Contrastingly, where autonomy is low, subsidiaries may face greater difficulties in leveraging RL to adapt to changing conditions in host markets (Kawai & Strange, 2014).

It is conventionally argued that social innovation processes originate from within cross-sector collaborations among institutionally diverse organizations, where the goal is to co-create value in new products and services (Lind et al., 2022). Thus, a high level of subsidiary autonomy can complement the learning derived from these collaborations to drive social innovation. Furthermore, social innovation mostly involves multilateral networks of actors which develop and sustain new and innovative services (Lind et al., 2022). Particularly, Chiao and Ying (2014), in their study on the role of a subsidiary’s internal and external networks in MNC success, find that subsidiaries that can maintain stable exchange relationships with external stakeholders can acquire the requisite knowledge resources through the external network. However, in instances where subsidiary autonomy is low or non-existent, the focal subsidiaries may not be able to effectively form networks or collaborate with local partners.

Put together, we contend that subsidiaries with high autonomy that have developed strong local relationships through RL may be more able to engage in more socially innovative activities that are relevant to the needs of the community within which they operate. Formally, we hypothesize that:

H2: Subsidiary autonomy moderates the link between relationship learning and social innovation, such that the link is more positive in autonomous subsidiaries.

2.2.2 The Effect of Entry Mode Choice

The international business literature outlines two paths of internationalization for firms. These are the equity market entry mode and non-equity market entry modes. The major differentiating factor between the two modes can be chalked down to the level of resource commitment and international involvement that characterizes each mode. Particularly, the equity modes encompass larger resource commitments and international involvement by MNEs to foreign markets, and they include strategies such as greenfields, acquisitions, and wholly-owned subsidiaries (Adomako et al., 2019; Amankwah-Amoah et al., 2022a, 2022b). The non-equity modes encompass a low level of involvement by MNEs in the international market and require minimal resources. MNEs pursue non-equity-based market entry through licensing contracts, research and development contracts, and alliances (Amankwah-Amoah et al., 2022a, 2022b). We contend that equity-based (as opposed to non-equity-based) subsidiaries that are more autonomous with regard to decision-making are likely to maximize the benefits of RL for social innovation.

MNEs that are heavily invested in a local market through the equity-based mode require more information gathering and more detailed due diligence in the target market, seeking information on competitive conditions, market, legal and social norms, and cultural differences in the host country (Adomako et al., 2019). We contend that the drive for information or knowledge of the target market does not end after entry. Rather, MNEs, through their subsidiaries, will engage further in building learning relationships that deepen their understanding and penetration of market segments in the host market. Equity-based subsidiaries that have an external locus of control will have little operational and strategic influence over decisions (low autonomy). Hence, they may be sluggish in exploiting unconventional local market opportunities in social innovations. However, equity-based subsidiaries with an internal locus of control (high autonomy) coupled with strong external networks can acquire and assimilate knowledge effectively and can be responsive in aligning their business strategies to unconventional market opportunities in social innovations (Lind et al., 2022).

Contrastingly, MNEs that choose non-equity entry modes do not need much information about foreign markets as their subsidiaries do not bear a greater percentage of the risk. This is because non-equity-based entry modes do not require MNEs to be highly involved or commit many resources to the host-country market (Amankwah-Amoah et al., 2022a, 2022b). Hence, the incentive for MNEs to support or encourage social innovation is minimal or, in worst-case scenarios, non-existent. Against this background, we hypothesize that:

H3: The positive relationship between relationship learning and social innovation is jointly moderated by subsidiary autonomy and entry mode choice, such that relationship learning will have the strongest (positive) relationship with social innovation for autonomous subsidiaries whose mode of entry is equity-based.

3 Method and Data

The study’s sample comprises subsidiaries of emerging market multinational enterprises operating in multiple industries and sectors in Ghana. Over the past 20 years, Ghana has maintained a relatively stable foreign direct investment (FDI) inflow, a testament to its conducive business environment and confidence from MNEs seeking to internationalize in Africa (UNCTAD, 2003; Edjigu & Moors, 2023). In 2021, Ghana became the second largest FDI recipient in West Africa and seventh largest in Africa. Before this period, it out-paced Nigeria—Africa’s largest economy—as the largest recipient of FDI in sub-Saharan Africa from 2015 to 2019 (Edjigu & Moors, 2023). Again, Ghana has a reputable track record of achieving significant economic growth and a stable socio-political transformation through its continuous trade liberalization policies and democratic principles compared to other sub-Saharan African countries (Acquaah, 2007). These features have led to significant MNE growth within the country (Donbesuur et al., 2020). Moreover, recent international business literature has emphasized how most businesses in Ghana and other sub-Saharan African countries have gained significant levels of internationalization due to their presence in neighboring international markets within the ECOWAS sub-region by leveraging on sub-Saharan Africa market size of over 700 million inhabitants (Boso et al., 2017; Blankson et al., 2018). However, as with most countries in the region, Ghana is fraught with several grand social problems (World Bank, 2022). These issues make a sample of MNE subsidiaries in Ghana suitable for testing our hypotheses.

We used a survey approach to collect data as there is a lack of secondary data for capturing the study’s constructs. The sample was drawn from the Ghana Investment Promotion Centre (GIPC) database, which keeps records of MNEs’ subsidiaries in the country. We purposively selected 542 MNE subsidiaries that have operated in Ghana for at least five years and have at least 50 or more full-time employees. After our sample selection, we developed a comprehensive questionnaire (in the English language) and sent it to all participating subsidiaries. We supervised a team of trained research assistants to deliver and collect the questionnaires upon completion. Key informants occupying senior management positions, such as CEOs, new business development managers, and R&D officers, provided the data. After several rounds and reminders of data collection activities, we received 207 complete and usable questionnaires – representing a 38.19% response rate. The sampled subsidiaries have an average age of 19 years and 103 full-time employees.

3.1 Measurement

We relied on existing measures to capture the study’s variables. Where applicable, multi-item scales were applied to ensure measure reliability and validity. A 7-point Likert scale was used to rate all the items. We used covariance-based confirmatory factor analysis to validate all multi-items. Table 1 presents the items and their validity results.

3.1.1 Substantive Variables

The items for RL were adapted from Bryan Jean and Sinkovics (2010). The items tap into multiple aspects of the construct: information sharing, joint-sense making, and relationship-specific memory. Three items were used to measure each dimension of RL. We adapted six items from previous studies (e.g., Segarra-Oña et al., 2017; Adomako & Tran, 2022) to measure social innovation. A dummy scale was used to operationalize foreign market entry mode (Hollender et al., 2017). Specifically, non-equity entry mode (i.e., direct export, export through distributors, franchises, licensing, long-term contractual agreements) is coded as “0”, whereas equity entry mode (i.e., joint ventures, equity participations, acquisitions, and wholly-owned subsidiaries) is coded as “1”. We adapted five items from past research (e.g., Gammelgaard et al., 2012; Kawai & Strange, 2014) to measure subsidiary autonomy.

3.1.2 Control Variables

The study controlled for other variables that may influence social innovation and the proposed conceptual model. Specifically, as per previous studies and within the context of the study (e.g., Gammelgaard et al., 2012; Adomako & Tran, 2022; Borah et al., 2022), we controlled for each subsidiary’s age, size, the existence of an R&D unit, the industry, financial performance, and slack resources. We also controlled for the perceived competition within the subsidiary’s host market environment.

3.2 Reliability and Validity Assessment

We used Amos 27 to estimate a multi-confirmatory factor analysis (CFA) model to assess the validity and reliability of the multi-scale items in the study. The CFA model fits the data: χ2/df = 1.44, RMSEA = 0.04, CFI = 0.95, NFI = 0.87, TLI = 0.94 (Bagozzi & Yi, 2012; Hair et al., 2019). As detailed in Table 1, the standardized factor loadings are above 0.50 and significant at 1%. Composite reliability and average variance extracted associated with the items are greater 0.60 and 0.50, respectively, demonstrating unidimensionality, internal consistency, and convergent validity (Hair et al., 2019). Moreover, as shown in Table 2, the square root values of the average variance extracted are far greater than the correlations between the variables, indicating that the study’s measurement items exhibit discriminant validity (Hair et al., 2019).

4 Regression Analysis and Results

4.1 Hypothesis Testing

Table 2 displays the descriptive statistics and the correlations for the study’s variables. We used hierarchical moderated regression analysis to test the research hypotheses. The study hypothesized the main effect of RL. Accordingly, RL and subsidiary autonomy were mean-centered before creating the interaction terms (Hayes, 2018). Table 3 reports the hierarchical regression analysis results, whereas Figs. 2 and 3 present the surface of the interaction effects.

The results (Model 2) indicate that RL has a positive relationship with social innovation (β = 0.25, t = 3.80, p < 0.001), supporting H1. The results (Model 3) further show that subsidiary autonomy positively moderates the relationship between RL and social innovation (β = 0.22, t = 3.46, p < 0.001). As shown in Fig. 2, RL has a stronger positive relationship with social innovation under high subsidiary autonomy conditions compared to low subsidiary autonomy conditions. These results support H2. The three way-interaction among RL, subsidiary autonomy, and entry mode positively affects social innovation (β = 0.22, t = 2.70, p < 0.01). We conducted a three-way interaction slope plot to interpret this result (Hayes, 2018). The results reported in Fig. 3 indicate that RL has the strongest positive relationship with social innovation for autonomous subsidiaries whose mode of entry is more equity-based, supporting H3.

4.2 Robustness Checks

First, we performed a split sample analysis to check the robustness of our three-way interaction effect (the moderating role of entry mode). Specifically, we re-estimated the moderating effect of subsidiary autonomy on the relationship between RL and social innovation for the samples of MNEs with non-equity-based entry mode and those with equity-based mode. For the non-equity-based sample, we found that subsidiary autonomy does not enhance the positive relationship between RL and social innovation (β = 0.15, p > 0.05). However, we found a significant positive moderating effect of subsidiary autonomy on the relationship between RL and social innovation for the equity-based sample (β = 0.50, p < 0.001). These results are consistent with the main results.

Second, we checked for potential endogeneity bias as MNEs desiring more social innovation outcomes may be encouraged to emphasize RL. Moreover, engaging in social innovation activities can help MNEs learn more from their relationships and collaborations with local stakeholders. Thus, it may be the case that there is a simultaneous causality between RL and social innovation. To account for this, we followed previous recommendations of using the 3SLS approach (e.g., Poppo et al., 2016; Zaefarian et al., 2017) to test our hypotheses again. At the first stage, we regressed RL on the moderator and control variables to obtain residuals. In the second stage, we regressed the dependent variable—social innovation—on the obtained residual instead of RL itself and found the relationship to be significant (0.24, p < 0.001). In the third stage, we used the residual to create the interaction terms for the purposes of testing the moderating effects. Accordingly, we found that subsidiary autonomy enhances the relationship between RL and social innovation (0.23, p < 0.001) and that the effect is stronger for equity-based subsidiaries (0.18, p < 0.05). The findings are consistent with the initial findings, hence the issue of endogeneity arising from simultaneous causality is minimized.

5 Discussion and Implications

5.1 Research Implications

While there is a burgeoning literature on social innovations, our understanding of how MNE subsidiaries in developing economies can engage in social innovation activities is still in its infant stages. Based on the knowledge-based view, this study investigates how RL drives social innovation and the extent to which this relationship is moderated by subsidiary autonomy and entry mode choice. Analyzing survey data from subsidiaries of MNEs operating in Ghana, we find that RL has a positive relationship with social innovation. This relationship is stronger in MNE subsidiaries with more autonomy, especially when their mode of entry is equity-based (rather than a non-equity-based entry mode). These findings significantly contribute to the international business literature and advance knowledge of how MNEs operating in developing economies can drive social value-creation outcomes.

Our results expand and enrich the RL literature, which centers on the process of knowledge acquisition, knowledge exchange and knowledge sharing with relevant partners and stakeholders in product or service innovation settings (e.g., Jiang et al., 2020; Thakur-Wernz & Bosse, 2023; Zhu et al., 2018). In extending this literature to social innovation research, this study demonstrates the utility of RL by theorizing and empirically showing how it contributes to MNE subsidiaries’ social innovation in a developing country. Specifically, the findings advance our understanding of how MNEs’ efforts to learn in their relationships with stakeholders foster successful social innovation initiatives (Lind et al., 2022).

The study further advances RL and the international business literature by identifying subsidiary autonomy and entry mode as previously underexplored factors determining the conditions under which RL contributes to different levels of MNE subsidiary social innovation. The study reveals that, though subsidiary autonomy is a crucial contingency in the relationship between RL and social innovation, its moderating effect is conditioned by MNEs’ entry mode choice. These findings contribute to clarifying the boundaries of subsidiary autonomy, whose performance implications have received conflicting evidence (Ferraris et al., 2020; Geleilate et al., 2020; Lind et al., 2022). Our results indicate that, in the context of MNE subsidiaries’ responses to grand social problems, subsidiary autonomy if bundled with RL and equity-entry mode is more effective in driving social innovation. Thus, rather than focusing attention on the direct effect of subsidiary autonomy (Geleilate et al., 2020), the results from this study suggest its explanatory power is contingent upon other MNE subsidiary characteristics. While entry mode choice is a strategic decision that can influence MNEs’ performance outcomes (Geleilate et al., 2020; Chhabra et al., 2021), it is not clear how such choices alter the levels of social innovation. This study’s findings show that MNEs that adopt an equity entry mode, characterized by substantial ownership, may enhance the joint effect of RL and subsidiary autonomy in driving social innovations.

The above insights broadly extend the existing understanding of factors that determine MNE social innovation (Lind et al., 2022; Dionisio & de Vargas, 2020). A major theoretical implication from this study is that contingency and configurational models, incorporating MNE subsidiary-specific characteristics, can generate richer insight into why some MNEs’ social innovations are more successful than others. In particular, the study’s three-way interaction analysis shows how different configurations of RL, subsidiary autonomy, and entry mode explain different levels of social innovation. Such analysis helps identify which of the combinations of the levels of these three factors predict more significant levels of MNE subsidiary social innovation.

5.2 Managerial Implications

The study’s findings have important implications for MNE subsidiaries aiming to contribute to social value creation in developing countries. While forming relationships with formal and informal networks within communities is significant, learning from such relationships is equally important. Such learning can aid MNE subsidiaries in better cooperating with relevant stakeholders in pursuing innovative projects that enrich the welfare of local communities. MNE subsidiaries encourage openness, two-way information sharing, and trust, and have a formal mechanism to monitor and respond to the dynamics of their relationships with stakeholders. These initiatives can help foster and sustain the efficacy with which they learn from their relationships with stakeholders.

The study’s findings further suggest that subsidiary autonomy and equity-based entry mode are critical conditions that enable MNE subsidiaries to succeed in leveraging relationship learning to drive social innovation. Thus, MNEs operating in Ghana should consider giving their subsidiaries the freedom to make certain strategic decisions, especially in the context of social interventions requiring subsidiaries to work with local stakeholders. Again, MNEs seeking to engage in social interventions in Ghana may consider equity (as opposed to non-equity) as the entry mode choice for their subsidiaries.

6 Research Limitations and Suggestions for Future Research

The study’s findings and implications have some limitations. The study focused on testing a theoretically-based model instead of pursuing empirical generalization. While the results are consistent with the study’s theoretical expectations, they may not generalize beyond the sample. Importantly, emerging MNEs operating in a country face more homogeneous institutional forces that may influence their perceptions of and attitudes toward RL and social innovation. The experiences of managers regarding RL and social innovation may differ across diverse contexts, particularly when considering variations in institutional development (Lee et al., 2021). Hence, future research can advance this study by testing its conceptual model in an institutionally similar or distinct setting or using cross-country data to test if the model is contingent upon certain country-level factors, such as culture (e.g., uncertainty avoidance and collectivism/individualism) and legal/political environment (e.g., political instability and governance quality).

Again, the study's reliance on a cross-sectional sample hampers its capacity to establish causal relationships between the examined variables. In addressing this limitation, future research can employ a longitudinal survey design by collecting data from multiple periods. A field experiment that allows for RL and social innovation manipulation could prove helpful. Moreover, a longitudinal study can be implemented to explore how changing dynamics of RL over time affect social innovation under changing characteristics of MNE subsidiaries (e.g., size and autonomy). Additional limitations of this study is the overreliance on subjective scales to measure the constructs of interest. Future research can mitigate these concerns by exploring if the MNEs have relevant archival data (e.g., on investment in social innovation projects).

Although this study’s theoretical and empirical analyses shed new light on the determinants of MNE subsidiary social innovation in a developing country, knowledge in this area is still underdeveloped. Future research can build on this research (as discussed above) or explore a new set of antecedents of social innovation using qualitative research. For example, qualitative studies can take a step back to understand how RL occurs (i.e., RL’s antecedents) and the context-specific boundary conditions that link it to particular social value-creation outcomes. Such studies can further explore how attentional focus and distribution of MNE subsidiaries regarding grand social issue analysis and resource allocation help or hinder social innovation outcomes. This line of inquiry holds promise in steering organizations toward optimal resource allocation strategies to bolster meaningful social innovation efforts.

References

Acquaah, M. (2007). Managerial social capital, strategic orientation, and organizational performance in an emerging economy. Strategic Management Journal, 28(12), 1235–1255.

Adomako, S., Amankwah-Amoah, J., Dankwah, G. O., Danso, A., & Donbesuur, F. (2019). Institutional voids, international learning effort and internationalisation of emerging market new ventures. Journal of International Management, 25, 100666.

Adomako, S., & Tran, M. D. (2022). Local embeddedness, and corporate social performance: The mediating role of social innovation orientation. Corporate Social Responsibility and Environmental Management, 29(2), 329338.

Amankwah-Amoah, J., Boso, N., & Debrah, Y. A. (2018). Africa rising in an emerging world: An international marketing perspective. International Marketing Review, 35(4), 550–559. https://doi.org/10.1108/IMR-02-2017-0030

Amankwah-Amoah, J., Adomako, S., Danquah Opoku, R. A., Danquah, J. K., & Zahoor, N. (2022a). Foreign market knowledge, entry mode choice and SME International Performance in an Emerging Market. Journal of International Management. https://doi.org/10.1016/j.intman.2022.100955

Amankwah-Amoah, J., Boso, N., & Kutsoati, J. K. (2022b). Institutionalization of protection for intangible assets: Insights from the counterfeit and pirated goods trade in sub-Saharan Africa. Journal of World Business, 57(2), 101307.

Arend, R. J., Patel, P. C., & Park, H. D. (2014). Explaining post-IPO venture performance through a knowledge-based view typology. Strategic Management Journal, 35, 376–397. https://doi.org/10.1002/smj.2095

Bagozzi, R. P., & Yi, Y. (2012). Specification, evaluation, and interpretation of structural equation models. Journal of the Academy of Marketing Science, 40, 8–34. https://doi.org/10.1007/s11747-011-0278-x

Blankson, C., Nkrumah, M. F., Opare, G., & Ketron, S. (2018). Positioning strategies and congruence in the position- ing of high-end indigenous and foreign retailers in sub-Saharan Africa: An illustration from Ghana. Thunderbird International Business Review. https://doi.org/10.1002/tie.21960

Borah, P. S., Pomegbe, W. W. K., & Dogbe, C. S. K. (2022). Mediating role of green marketing orientation in stakeholder risk and new product success relationship among European multinational enterprises in Ghana. Society and Business Review, 17, 485.

Boso, N., Amankwah-Amoah, J., Essuman, D., Olabode, O. E., Bruce, P., Hultman, M., & Adeola, O. (2023). Configuring political relationships to navigate host-country institutional complexity: Insights from Anglophone sub-Saharan Africa. Journal of International Business Studies, 54, 1–35.

Boso, N., Oghazi, P., & Hultman, M. (2017). International entrepreneurial orientation and regional expansion. Entrepreneurship and Regional Development, 29(1–2), 4–26.

Brown, T. & Wyatt, J. (2010). Design thinking for social innovation. Standard Social Innovation Reivew. https://ssir.org/articles/entry/design_thinking_for_social_innovation# (accessed on 08 Oct 2023).

Bryan Jean, R. J., & Sinkovics, R. R. (2010). Relationship learning and performance enhancement via advanced information technology: The case of Taiwanese dragon electronics firms. International Marketing Review, 27(2), 200–222.

Canestrino, R., Bonfanti, A., & Oliaee, L. (2015). Cultural insights of CSI: How do Italian and Iranian firms differ? Journal of Innovation and Entrepreneurship, 4(12), 1–9.

Chandra, Y., Shang, L., & Mair, J. (2021). Drivers of success in social innovation: Insights into competition in open social innovation contests. Journal of Business Venturing Insights, 16, e00257. https://doi.org/10.1016/j.jbvi.2021.e00257

Chhabra, A., Popli, M., & Li, Y. (2021). Determinants of equity ownership stake in foreign entry decisions: A systematic review and research agenda. International Journal of Management Reviews, 23(2), 244–276.

Crupi, A., Liu, S., & Liu, W. (2022). The top-down pattern of social innovation and social entrepreneurship. Bricolage and agility in response to COVID-19: Cases from China. R&D Management, 52, 313–330.

Donbesuur, F., Ampong, G. P. A., Owusu-Yirenkyi, D., & Chu., I. (2020). Technological innovation, organizational innovation and international T performance of SMEs: The moderating role of domestic institutional environment. Technological Forecasting & Social Change, 161, 120252.

Edjigu, H. T. & Moors, R. 2023. Does the Origin of Multinational Enterprises Matter? Findings from Ethiopia, Kenya, and Ghana. The African Center for Economic Transformation (ACET)

Ewalefoh, J. (2022). The new scramble for Africa. In S. O. Oloruntoba & T. Falola (Eds.), The Palgrave Handbook of Africa and the changing global order. Cham: Palgrave Macmillan.

Fang, S. R., Fang, S. C., Chou, C. H., Yang, S. M., & Tsai, F. S. (2011). Relationship learning and innovation: The role of relationship-specific memory. Industrial Marketing Management, 40(5), 743–753.

Fernhaber, S. A., & Zou, H. (2022). Advancing societal grand challenge research at the interface of entrepreneurship and international business: A review and research agenda. Journal of Business Venturing, 37(5), 106233. https://doi.org/10.1016/j.jbusvent.2022.106233

Ferraris, A., Bogers, M. L., & Bresciani, S. (2020). Subsidiary innovation performance: Balancing external knowledge sources and internal embeddedness. Journal of International Management, 26(4), 100794.

Gammelgaard, J., McDonald, F., Stephan, A., Tuselmann, H., & Dörrenbache, C. (2012). The impact of increases in subsidiary autonomy and network relationships on performance. International Business Review, 21, 1158–1172.

Geleilate, J. M. G., Andrews, D. S., & Fainshmidt, S. (2020). Subsidiary autonomy and subsidiary performance: A meta-analysis. Journal of World Business, 55(4), 101049.

George, G., Howard-Grenville, J., Joshi, A., & Tihanyi, L. (2016). Understanding and tackling societal grand challenges through management research. Academy of Management Journal, 59(6), 1880–1895.

Grant, R. (2015). Knowledge-based view. Strategic Management. https://doi.org/10.1002/9781118785317.weom120172

Grant, R. M. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, Winter Special Issue, 17, 109–122.

Gutiérrez, R., & Vernis, A. (2016). Innovations to serve low-income citizens: When corporations leave their comfort zones. Long Range Planning, 49(3), 283–297.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2019). Multivariate data analysis (8th ed.). Cengage Learning EMEA.

Hayes, A. F. (2018). Introduction to mediation, moderation, and conditional process analysis: A Regression-based approach. The Guilford Press.

Hernandez-Espallardo, M., Osorio-Tinoco, F., & Rodriguez-Orejuela, A. (2018). Improving firm performance through inter-organizational collaborative innovations: The key mediating role of the employee’s job-related attitudes. Management Decision, 56(6), 1167–1182.

Herrera, M. E. B. (2015). Creating competitive advantage by institutionalizing corporate social innovation. Journal of Business Research, 68(7), 1468–1474.

Hollender, L., Zapkau, F. B., & Schwens, C. (2017). SME foreign market entry mode choice and foreign venture performance: The moderating effect of international experience and product adaptation. International Business Review, 26(2), 250–263.

Jiang, W., Wang, A. X., Zhou, K. Z., & Zhang, C. (2020). Stakeholder relationship capability and firm innovation: A contingent analysis. Journal of Business Ethics, 167, 111–125.

Kawai, N., & Strange, R. (2014). Subsidiary autonomy and performance in Japanese multinationals in Europe. International Business Review, 23(3), 504–515.

Lee, C. K., Wiklund, J., Amezcua, A., Bae, T. J., & Palubinskas, A. (2021). Business failure and institutions in entrepreneurship: A systematic review and research agenda. Small Business Economics, 58, 1–27.

Lind, C. H., Holmstrom, C., Kang, O. L., Ljung, A., & Rosenbaum, P. (2022). Involvement of multinational corporations in social innovation: Exploring an emerging phenomenon. Journal of Business Research, 151(4), 207–221. https://doi.org/10.1016/j.jbusres.2022.07.003

Mulgan, G. (2006). The process of social innovation. Innovations: Technology Governance, Globalization, 1, 145–162.

Oke, A., & Nair, A. (2023). From chaos to creation: The mutual causality between supply chain disruption and innovation in low-income markets. Journal of Supply Chain Management, 59(3), 20–41.

Osabutey, E. L. C., & Jackson, R. (2019). The impact on development of technology and knowledge transfer in Chinese MNEs in sub-Saharan Africa: The Ghanaian case. Technological Forecasting and Social Change, 148, 1–12.

Pittaway, L., Robertson, M., Munir, K., Denyer, D., & Neely, A. (2004). Networking and innovation: A systematic review of the evidence. International Journal of Management Reviews, 5(3–4), 137–168.

Reilly, M., Tippmann, E., & Sharkey Scott, P. (2023). Subsidiary closures and relocations in the multinational enterprise: Reinstating cooperation in subsidiaries to enable knowledge transfer. Journal of International Business Studies, 54, 1–30.

Poppo, L., Zhou, K. Z., & Li, J. J. (2016). When can you trust “trust”? Calculative trust, relational trust, and supplier performance. Strategic Management Journal, 37(4), 724–741.

Rydehell, H., Isaksson, A., & Löfsten, H. (2019). Business networks and localization effects for new Swedish technology-based firms’ innovation performance. The Journal of Technology Transfer, 44(5), 1547–1576.

Seelos, C. & Mair, J. (2016). When innovation goes wrong. Standard Social Innovation Reivew. https://ssir.org/articles/entry/when_innovation_goes_wrong (accessed on 08 Oct 2023).

Segarra-Oña, M., Peiró-Signes, A., Albors-Garrigós, J., & Miguel-Molina, B. D. (2017). Testing the social innovation construct: An empirical approach to align socially oriented objectives, stakeholder engagement, and environmental sustainability. Corporate Social Responsibility and Environmental Management, 24(1), 15–27.

Selnes, F., & Sallis, J. (2003). Promoting relationship learning. Journal of Marketing, 67(3), 80–95.

Thakur-Wernz, P., & Bosse, D. (2023). Configurational framework of learning conduits used by emerging economy firms to improve their innovation performance. Journal of Business Research, 157, 113634.

The Economist. (2019). Africa is attracting ever more interest from powers elsewhere: They are following where China led. https://www.economist.com/briefing/2019/03/07/africa-is-attracting-ever-more-interest-from-powers (accessed 6 Oct 2023)

United Nations Conference on Trade and Development. (2003). Investment Policy Review Ghana. UNCTAD/ITE/IPC/Misc.14. ISBN 92-1-112569-3.

World Bank. (2022). Ghana profile: social sustainability and inclusion. Washington, DC. http://hdl.handle.net/10986/38241 License: CC BY 3.0 IGO.

Yakovleva, N., & Vazquez-Brust, D. A. (2018). Multinational mining enterprises and artisanal small-scale miners: From confrontation to cooperation. Journal of World Business, 53(1), 52–62.

Zaefarian, G., Kadile, V., Henneberg, S. C., & Leischnig, A. (2017). Endogeneity bias in marketing research: Problem, causes and remedies. Industrial Marketing Management, 65, 39–46.

Zhu, Q., Krikke, H., & Caniëls, M. C. (2018). Supply chain integration: Value creation through managing inter-organizational learning. International Journal of Operations & Production Management, 38(1), 211–229.

Zipline. (2023). About Zipline. https://www.flyzipline.com/about (accessed 8 Oct 2023).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Nkrumah, M., Owusu-Yirenkyi, D., Nyuur, R.B. et al. Examining the Drivers and Boundary Conditions of Social Innovation: Evidence from MNE Subsidiaries in a Developing Economy. Manag Int Rev 64, 397–417 (2024). https://doi.org/10.1007/s11575-024-00542-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-024-00542-8