Abstract

We study subsidiary capital structure as a mechanism of intra-MNE (multinational enterprise) governance from the perspective of “new internalization theory”. We build on the argument from transaction cost theory that equity and debt are not just financial instruments but also alternative governance structures, with equity useful for financing specific assets that do not serve well as collateral, especially when external uncertainty is high. Inside an MNE, debt represents a partial reintroduction of market mechanisms that can limit governance costs and strengthen subsidiary manager incentives. However, debt financing may be inappropriate if subsidiaries possess specific assets that are lost if debt contracts are enforced. Using subsidiary-level panel data from Norwegian MNEs, we argue that patents registered in the subsidiary represent MNE-specific non-location bound knowledge assets, while subsidiary R&D income represents location-bound and subsidiary-specific assets. We predict MNE-specific assets to be negatively related to external debt, and subsidiary-specific assets to be negatively related to all debt, under conditions of external uncertainty. We find only partial support for our hypotheses. Patents are negatively related to external debt when external uncertainty in the form of political risk is high. However, we do not find similar significant results for location-bound and subsidiary-specific assets, measured by subsidiary R&D income. For both measures, there is evidence that debt financing is viable in low-risk contexts. Further analysis indicates different effects for joint ventures as compared to wholly owned subsidiaries. We build on the partly unexpected results to propose an expanded internalization perspective on subsidiary capital structure.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A growing literature in international business (IB) and finance demonstrates important linkages between corporate finance and international trade and investment, such as implications of credit constraints when internationalizing, multinational enterprises’ (MNEs) use of internal capital markets, and the effects of multinationality on a firm’s capital structure (e.g., Agmon, 2006; Bowe et al., 2010; Desai et al., 2004b; Foley & Manova, 2015). Yet, despite the mutual value IB and finance can offer each other the integration between these disciplines is still limited (Puck & Filatotchev, 2020), with many areas of common interest remaining unexplored. This paper combines IB and finance arguments to study subsidiary financing from an internal governance perspective.

According to a prominent IB theory on the MNE, internalization theory (Narula et al., 2019), international transactions are carried out within the boundaries of a firm when doing so implies lower costs than using external markets. Scholars in this tradition have identified key drivers of internalization in factors such as information asymmetry and transaction costs, especially when transacting knowledge and other specific assets (Buckley & Casson, 1976; Hennart, 1982; Rugman, 1981; Williamson, 1981). Although less explored by internalization theorists in IB, internalization also creates the opportunity to run an internal capital market, where subsidiaries can be financed directly from headquarters (HQs) or sister subsidiaries, rather than by the external capital market. A substantial existing finance literature has studied the costs and benefits of operating internal capital markets as opposed to relying on external ones (e.g., Gertner et al., 1994; Inderst & Müller, 2003; Rajan et al., 2000; Stein, 1997). Proposed benefits of internal capital markets include reduced transaction costs through better information and monitoring, and co-insurance of projects whereby well-performing subsidiaries can help support struggling ones. Additional benefits exist for MNEs with multinational capital markets, such as opportunities for tax arbitrage (e.g., Chowdhry & Coval, 1998; Chowdhry & Nanda, 1994; Huizinga et al., 2008; Mintz & Weichenrieder, 2010), and being linked to larger MNEs can help subsidiaries overcome limitations in host country local financial markets (e.g., De Haas & Van Lelyveld, 2010; Desai et al., 2004b; Gulamhussen & Lavrador, 2014).

However, while internal capital markets mitigate transaction costs and information asymmetries associated with external capital markets, such issues do not disappear within the boundaries of a firm. Whereas internalization theory originally focused on how the boundaries of the MNE are set and the transfer of HQ-developed advantages to subsidiaries, internalization theory literature has more recently also turned its attention towards the inside of the MNE, exploring the nature of subsidiary assets and internal governance (Rugman & Verbeke, 1992, 2001, 2008). Reflecting the internal capital markets literature, some studies consider how internalization potentially leads to other costs, such as attenuated subsidiary manager incentives and increased scope for internal rent-seeking (Gertner et al., 1994; Lunnan et al., 2016; Scharfstein & Stein, 2000). The governance challenges related to internal capital markets are likely even more acute for MNEs than for domestic firms, given the greater geographic distance and diversity of host-country institutions that MNEs face (e.g., Hennart, 1991; Marin & Schnitzer, 2011).

In a theoretical article exploring the role of subsidiary capital structure in intra-MNE governance, Rygh and Benito (2018) argue that MNE HQ may introduce external and internal debt in subsidiaries’ capital structure as a market-based mechanism to limit internal governance costs related to intervention in subsidiary activities, to curtail intra-MNE rent-seeking, and to strengthen subsidiary manager incentives for effort. They build on Williamson’s (1988) transaction cost arguments that equity and debt are not just financial instruments, but also distinct governance structures. Debt is argued by Williamson (1988) to approximate a market mode, relying on rules that are specified ex ante, but with limited influence for debt holders on project-related decisions. In contrast, equity approximates hierarchy, allowing providers of funds to better monitor and control projects. Williamson (1988) predicts that when significant external uncertainty prevents complete contingent contracting, specific assets tend to be financed with equity, since debt financing terms for assets with less collateral value will be less favorable, and since enforcing debt contracts could hinder necessary adaptation and even lead to liquidation and loss of specific assets.

Adapting Williamson’s (1988) arguments to the intra-MNE setting, Rygh and Benito (2018) propose that a strategy of using debt will require that HQ can credibly commit to allow debt contracts to be enforced and not to intervene ex post, given that within the MNE, HQ nominally own all assets and may intervene at any time. Such credible commitment is more likely when assets are unspecific or if assets can be easily transferred elsewhere in the MNE, as in these cases the consequences of insufficient adaptation or liquidation of the subsidiary are less serious for the MNE. In contrast, if assets are specific, HQ cannot credibly commit to enforcing debt contract as it will have an incentive to intervene to safeguard the assets. A capital structure based on equity may then be preferred from the outset.

This study embeds the transaction cost focused arguments of Rygh and Benito (2018) within a “new internalization theory” framework (Rugman & Verbeke, 2001) and analyses empirically the use of debt in subsidiary financing, using a unique dataset of Norwegian MNEs’ foreign subsidiaries (2000–2006) that includes balance sheet information on debt and assets of subsidiaries, as well as patents, and R&D payments between parent and subsidiary. This setting is highly pertinent given the increasing attention in IB literature to the internationalization of R&D, including R&D carried out in subsidiaries (Cantwell & Mudambi, 2005; Vrontis & Christofi, 2021). Our innovative empirical strategy builds on two “tip of the iceberg” arguments. First, we argue that a subsidiary’s knowledge assets in the form of patents involve a high degree of MNE-specificity, given that such knowledge assets are often closely linked to other complementary assets and human capital in the MNE (Hall & Lerner, 2009; Helfat, 1994; Williamson, 1988), while still being non-location bound and transferable internally in the MNE (Gertner et al., 1994). We refer to such subsidiary assets as MNE-specific, assuming that while they are not highly specific to the subsidiary, they are specific to the MNE of which the subsidiary is part. Second, we argue that subsidiary R&D income (from the parent) is associated with subsidiary-specific assets, as such R&D will not only lead to innovation but also localized learning and development of human capital (Cohen & Levinthal, 1989). This in turn implies that these subsidiaries’ assets may be more difficult to transfer internally within the MNE. When combined with external uncertainty, both forms of specificity will make complete debt contracting problematic (Williamson, 1988). In host-country contexts with high external uncertainty, as proxied by political risk, we therefore expect external debt to be negatively related to knowledge assets, and both external and internal debt to be negatively related to subsidiary R&D.

Our empirical tests control for key factors such as host-country taxes and the availability of parent-guaranteed subsidiary debt. We alternatively use random effects Tobit and system-GMM estimations to account for the limited dependent variable, and potential endogeneity and partial adjustment of subsidiary capital structure, respectively. Overall, the results suggest that specific knowledge assets are positively associated with debt financing, indicating that the transaction cost arguments in Rygh and Benito (2018) do not tell the full story. Most analyses produce the expected negative interaction effect from MNE-specific assets as measured by patents and external uncertainty on debt. However, the level of external uncertainty required to lead to a negative effect of patents on leverage turns out to be relatively high. In lower-risk contexts, debt use is positively associated with patents. For subsidiary-specific assets as measured by subsidiary R&D, some analyses suggest that such assets are positively related with debt with no significant role for external uncertainty, again contradicting the simple transaction cost logic. We explore these unexpected findings theoretically, considering a potential signal effect to external financers of the presence of MNE-specific and subsidiary-specific advantages that may counteract the problems with using specific assets as collateral. In further analyses, we find differences between joint ventures (JV) and wholly owned subsidiaries (WOS) that we explore theoretically based on potential differential transferability of assets among partners and ensuing governance issues.

Our findings contribute both to IB literature and finance literature. So far, the most prominent perspective on intra-MNE governance has been based on agency theory, a perspective that has proved useful to understand intra-firm governance (Hoenen & Kostova, 2015) and produced important insights on how internalization of capital markets affects subsidiary manager incentives. Yet, the agency-based literature has given little consideration to how the nature of the subsidiary’s assets can affect governance, and hence to the question of whether governance may need to be more differentiated across subsidiaries. By considering the role of the specificity of assets, our internalization theory perspective provides complementary insights. We extend and test the recent arguments of Rygh and Benito (2018) using an innovative empirical strategy. Our results suggest there are potential roles for both an asset specificity and an asymmetric information logic, highlighting a dual effect of specific advantages for financing. The analysis also demonstrates the importance of understanding firm-specific advantages and their implications for internal governance, a key focus in “new internalization theory” (Rugman & Verbeke, 2008). Finally, we outline new internalization theory aspects of internal governance of equity joint ventures.

We also contribute to finance literature in general and internal capital market literature specifically by building on IB theory to demonstrate the relevance of the intra-MNE context for financing. We provide evidence that MNE subsidiaries can attract debt financing for intangible knowledge assets and activities, whereas previous tests of Williamson’s (1988) arguments at the corporate level have suggested this is difficult (Balakrishnan & Fox, 1993; Choate, 1997; Kochhar, 1996; Močnik, 2001). Hence, our study demonstrates benefits of IB perspectives for finance literature (Puck & Filatotchev, 2020). The intra-MNE context provides rich empirical variation in internalization and transaction cost-related explanatory factors such as external uncertainty across host-country contexts (Desai et al., 2004b; Roth & Kostova, 2003). Our results suggest that the transaction cost logic of capital structure is modified somewhat when investment objects are part of a larger MNE, and that differences across host countries matter.

Finally, our analysis has managerial implications: in low-risk contexts, it appears that debt financing of specific assets is often viable, while high-risk contexts may lead to a preference for equity. Managers also need to consider particular capital structure aspects that may arise in jointly owned subsidiaries that involve differences in internal transferability of resources between partners, and governance issues and conflicts of interest more generally.

The next section presents the theory and hypotheses; the following two sections present the data and methods, and results, respectively; before a final section offers a discussion of the contributions and limitations of the paper, as well as potential avenues for future research building on this study.

2 Literature and Theory

2.1 Internal Governance of MNEs

Two major theoretical perspectives have been used in IB literature to understand the governance of HQ-subsidiary relationships: Agency theory (Filatotchev & Wright, 2011; Hoenen & Kostova, 2015), and internalization theory (Buckley & Strange, 2011; Hennart, 1991; Tomassen & Benito, 2009). The agency perspective postulates HQs as the “principal”, that decides about the tasks of the subsidiary as the “agent”. The theories have some common preoccupations and similarities in assumptions, including potential conflicts of interest between actors and opportunistic behavior. Key differences include the focus in agency theory on “behavioural aspects of decision-making processes within the MNE”, notably risk preferences and contracting, while internalization theory focuses on governance structure (Filatotchev & Wright, 2011: 473–4), in relation to characteristics of transactions and markets under incomplete contracting. Internalization theory is thus suitable for our purpose of considering how subsidiary asset characteristics may affect capital structure when considered as a governance form.

From its original aim of explaining the boundaries of the firm in an international context, the scope of internalization theory has expanded to explaining a wide range of strategic decisions by MNEs (Narula et al., 2019). This includes aspects of intra-MNE governance, based on a recognition that the fundamental drivers of transaction costs do not disappear within an MNE (Buckley & Strange, 2011; Tomassen & Benito, 2009; Tomassen et al., 2012; Verbeke & Yuan, 2005). So-called “new internalization theory” pays more attention to what is going on inside MNEs, including specific assets and governance aspects of subsidiaries (Rugman & Verbeke, 2008). These studies have among others built on Rugman’s (1981) discussion of firm-specific advantages and country-specific advantages to consider how subsidiary advantages may be specific to the subsidiary and/or bound to the location of the subsidiary, in contrast to the original focus in internalization theory on HQ-developed advantages that could be diffused to the MNE’s foreign subsidiaries (Rugman & Verbeke, 1992, 2001).

Literature based on internalization theory has acknowledged that factors driving transaction costs, such as bounded rationality and opportunism, although mitigated, remain relevant within an MNE (Hennart, 1991; Tomassen et al., 2012). Even with better capacity for monitoring internally, information asymmetry does not disappear, and exercising close control over numerous and remote foreign subsidiaries is costly (Hennart, 1991). Furthermore, internalization leads to new types of governance costs, a theme that has also been prominent in internal capital markets studies in finance. Since subsidiary managers do not get all the rents from their efforts, incentives are reduced (Gertner et al., 1994; Williamson, 1981). Internalization also increases the scope for influence activities, “corporate socialism” and rent-seeking inside the firm that could divert from productive activities (e.g., Lunnan et al., 2016; Poppo, 1995; Scharfstein & Stein, 2000).

2.2 Capital Structure of Subsidiaries

So far, financial aspects have received less attention from the perspective of internalization theory. Some IB studies considered aspects of internal capital markets in MNEs (Aulakh & Mudambi, 2005; Gulamhussen & Lavrador, 2014; Mudambi, 1999; Nguyen & Almodóvar, 2018; Nguyen & Rugman, 2014). However, implications of internalization theory for the financing and capital structure of subsidiaries have remained largely unexplored. A notable exception is Gulamhussen and Lavrador (2014), who found that foreign subsidiaries in the banking sector may benefit from parent MNE advantages as well as home-country advantages, allowing them to attract more local funding in the form of debt. Rygh and Benito (2018) explore theoretically the potential role of specificity of subsidiary assets for capital structure, but their theory has not been empirically tested until the present study.

Capital structure has been a major topic in finance literature, departing from the stylized results from Modigliani and Miller (1958) on the irrelevance of capital structure under perfect financial markets to develop a range of sophisticated capital structure theories. Originally developed for the corporate level, key theories such as trade-off theories and pecking-order theories (Fama & French, 2002) have also been applied to subsidiary financing. Trade-off theories argue that the level of debt financing of a firm is determined by the costs and benefits of additional debt at the margin. Benefits of debt include tax deductibility of interest expenses, as well as limiting agency issues arising when free cash flows allow managers to pursue personal interests (Jensen, 1986); while costs of debt include potential financial distress costs. A trade-off logic is evident in arguments that MNEs finance subsidiaries in countries with high corporate taxes with debt if interest payments are deductible from corporate profits. Kolasinski (2009) further argues that limiting free cash flow through high debt leverage can mitigate self-serving subsidiary manager actions. These benefits of debt must however be traded off against potential financial distress and bankruptcy costs (Chowdhry & Coval, 1998; Chowdhry & Nanda, 1994; Mintz & Weichenrieder, 2010). Instead, pecking order theories focus on asymmetric information and transaction cost challenges of issuing equity, given that investors understand equity issues are most likely to take place when managers believe the firm is overvalued. According to these theories, given the difficulties of equity issues, firms prefer internal financing, followed by debt and with equity only as a last resort. A modified pecking order logic for subsidiary financing is found in Dewaelheyns and Van Hulle (2010) arguing that internal capital market financing (internal equity or debt) is preferred, followed by external debt and finally external equity (i.e. joint subsidiary ownership).

The above-mentioned studies of subsidiary financing do not explicitly consider the nature of the subsidiary’s assets to be financed. Applying an agency perspective, Marin and Schnitzer (2011) consider two different subsidiary manager incentive problems: motivating unobservable effort and motivating repayment of unobservable profits. The authors argue that for knowledge-intensive activities, it is more difficult for HQ to control subsidiary manager effort. Hence, to motivate managerial effort, debt levels will be lower to leave more payoff to the subsidiary manager. Further, HQ may choose external financing (local bank financing) rather than internal financing. In this case, monitoring by local banks will be less close than monitoring by HQs, while HQs will prefer a lower debt level to ensure continuation of the project, both of which will increase the manager’s effort level as the manager will keep a larger share of the returns. However, this study does not directly address the question of the implications of specificity of assets for subsidiary financing.

2.3 Internalization Theory and Hypotheses on Subsidiary Capital Structure

Rygh and Benito (2018) provide an explicit internalization perspective by building on Williamson’s (1988) transaction cost theory (TCT) of capital structure, arguing that debt represents a price-based mechanism for subsidiary governance. Following TCT, the interaction of decision makers’ bounded rationality and opportunism with transaction characteristics such as asset specificity (implying a lower value of the assets outside the relationship) and external uncertainty (making it difficult to write adequate contingent contracts) lead to transaction costs. This can motivate replacing market governance based on the price mechanism with hierarchical governance based on rules and directives to help reduce transaction costs. Following this logic, Williamson (1988) likens debt to market governance, with transaction terms agreed upon ex ante. Failing scheduled repayments, the project is liquidated, and debtholders recover value to the extent that the project’s assets are redeployable. However, this means that debt governance is less suitable for more specific (less redeployable) assets with less collateral value, as external financers will demand more compensation. Furthermore, enforcement of debt contracts can hinder adaptation to new circumstances, risking undesired liquidation with loss of specific assets (Močnik, 2001). Williamson (1988) therefore argues that specific investments are better financed through equity, giving funders cash flow and control rights, better access to information and improved monitoring powers. The added controls associated with equity allow providers of funds to offer better terms of finance and promotes adaptation to changed conditions to safeguard valuable specific assets.

In the intra-firm setting, HQ already nominally own all assets, and finance studies have assumed that subsidiary assets can be redeployed costlessly within the firm (Gertner et al., 1994). However, Rygh and Benito (2018) build on studies of internal governance costs (e.g. Hennart, 1991; Shelanski, 2004; Spicer, 1988; Tomassen & Benito, 2009; Tomassen et al., 2012), also citing location-boundness and subsidiary-specificy of assets (Rugman & Verbeke, 2001) to argue that there may be limits on the actual ability of HQ to control and redeploy assets even inside a firm. Citing Hennart’s (1991) distinction between the organizational form (firm versus market) and the method of organization (price versus hierarchy), they argue that even within an MNE debt retains features of a price or rule-based governance mechanism, based on settling the terms in advance, deciding on the amount of the loan, the interest to be paid, and scheduling repayments. As such, using debt can be considered a partial re-introduction into the internal capital market of the price mechanism as opposed to the hierarchy mechanism. This can help governance issues associated with internal capital markets, including costs of gathering information and monitoring subsidiary managers (e.g., Buckley & Strange, 2011; Tomassen & Benito, 2009). By using debt, HQ can re-introduce market-like incentives and a harder budget constraint for subsidiary managers, effectively “outsourcing” some of the governance of the subsidiary to external debt holders. Finance literature has argued that creditors can play an active role in governance, even before default states have been reached (Chava & Roberts, 2008; Nini et al., 2012).

However, given that HQ remain the owners of the subsidiary, the viability of this strategy depends on whether HQ can make a credible commitment to let debt contracts be enforced and not to intervene ex post to “save” the subsidiary by paying its debt to external debt holders. Rygh and Benito (2018) build on Williamson (1988) to argue that when subsidiary assets are unspecific, they can serve as collateral for external debt holders. This will not only reduce the cost of external debt financing but will also mean that in the case of default and liquidation of the subsidiary, there would not be a loss of specific assets, with potentially detrimental consequences for the whole MNE.Footnote 1 Their argument can be usefully framed in terms of the distinction in new internalization theory between non-location bound, location-bound and subsidiary-specific advantages (Nguyen & Almodóvar, 2018; Rugman & Verbeke, 1992, 2001). Non-location bound advantages represent the firm-specific advantages traditionally studied in IB, such as technology, marketing and administrative knowledge, that can be transferred across borders and are available to the whole network of subsidiaries of the MNE (Nguyen & Almodóvar, 2018). These represent advantages specific to the MNEs as a whole that are often assumed in internal capital market studies to be costlessly redeployable within a firm (Gertner et al., 1994). Rygh and Benito (2018) theorize a role for internal debt in financing such assets, as there would be a credible commitment by HQ (as both the owner and financer) to allow the subsidiary to be liquidated if the assets retain their value for the rest of the MNE.

In contrast, location-bound advantages are “idiosyncratic strengths with limited geographic deployment and exploitation potential” that are tied to the subsidiaries. Such advantages can include “standalone resources linked to location advantages (e.g. a network of privileged retail locations), local resources, local best practices, and routines” (Nguyen and Almodóvar, 2018: 233), and are more difficult to redeploy elsewhere. Rugman and Verbeke (2001: 244) consider a further category of subsidiary-specific advantages. Unlike location-bound advantages, subsidiary-specific advantages do not focus on local responsiveness, and when “embodied in products or services” they can lead to value creation in other parts of the MNE. However, although such advantages “reflect capabilities and competencies that can be exploited globally” they cannot be easily transferred internally as intermediate products. Such assets are not only of less value for external financers, but there could also be significant costs for the MNE if they were lost through liquidation of the subsidiary.

The key predictions from an internalization perspective for subsidiary capital structure can be summarized as follows. Firstly, if the subsidiary’s assets are non-location bound but MNE-specific advantages, they have less value as collateral to external debt holders, and using external debt would likely be excessively costly, overshadowing its benefits in terms of reducing internal governance costs. If there is also substantial external uncertainty, acceptably complete contracting will be infeasible. In such cases internal funding (internal debt or equity) will be preferred. This leads to the first hypothesis.

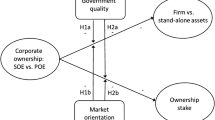

Hypothesis 1. MNE-specific non-location bound assets are negatively related to the use of external debt when external uncertainty is high.

Secondly, if a subsidiary possesses location-bound advantages that are mainly of value when exploited within a particular location, and/or subsidiary-specific advantages that can be only imperfectly redeployed to the rest of the MNE network, they will not only be of less value to external debt holders, but liquidation of the subsidiary would also impose additional costs on the whole MNE, meaning that enforcing internal debt contracts is also unviable. If there is also substantial external uncertainty, acceptably complete contracting will be infeasible. In such cases internal equity will be preferred. This leads to our second hypothesis.

Hypothesis 2. Location-bound and subsidiary-specific assets are negatively related to the use of all debt (internal and external debt) when external uncertainty is high.

3 Data and Methods

3.1 Empirical Context

We model capital structure at the subsidiary-year level as determined by measures of specific knowledge assets at the subsidiary-level, host-country external uncertainty, their interaction, and a set of subsidiary-level, parent-level and host-country level controls. Our unbalanced subsidiary-level panel data on Norwegian outward foreign direct investment (FDI) between 2000 to 2006 was originally collected through the Foreign Company Report surveys by the Norwegian Tax Directorate and provided by Statistics Norway (SSB).Footnote 2 In principle, these data represent a full count of Norwegian FDIs during the period. The surveys asked for accounting and balance sheet information about entities owned abroad, including subsidiary patent stocks and some variables on transactions between parent and subsidiary, including R&D payments. These unique data allow a test of whether knowledge assets are related to capital structure at the subsidiary level, with panel data methods accounting for unobserved time-invariant subsidiary heterogeneity (Wooldridge, 2002). We link the FDI data to parent-level and host-country-level variables described below. Investing firms represent a wide range of industries, although overall manufacturing dominates. Many subsidiaries are also found in the energy, infrastructure and financial sectors. Baseline analyses exclude firms from financial and regulated sectors, where capital structure may be determined by special factors (Gonzalez & González, 2008), but including all sectors yields broadly similar results for both hypotheses as detailed below.

3.2 Dependent Variables: Capital Structure

The average overall subsidiary leverage in our estimation sample is around 0.35. In this study, we focus on long-term debt to measure “equilibrium” capital structure, so our dependent variables are the ratios of subsidiary long-term external or total debt to long-term assets.Footnote 3 All are at book values.Footnote 4 External debt is calculated by subtracting parent debt (internal debt) from long-term debt. A limitation of our data, often characterizing studies of subsidiary capital structure (e.g., Desai et al., 2004b), is that we cannot specifically identify loans between subsidiaries of the same MNE, and some non-parent debt may in fact be intra-firm debt. We believe that in our case, this would bias against finding support for Hypothesis 1, as any presence of internal debt in the external debt measure would mask the effect of MNE-specificity on the use of external debt. We disregard loans from subsidiary to parent when calculating internal debt, in line with the focus on debt as a governance mechanism. Measured in this way, long-term external debt represents roughly 11% of long-term financing on average, while long-term internal debt is relatively negligible at 3%.

The SSB data being anonymized, we are unable to conduct additional checks against other sources and rely on a set of automated data quality controls. We omit observations with negative or zero values for assets, costs, or debt, or with missing industry classification. Furthermore, to focus on subsidiaries in a “normal” capital structure situation, we omit observations with negative or zero values for equity.Footnote 5 These requirements exclude observations where total debt takes values outside the [0,1] interval (Ramalho & da Silva, 2013). We also drop observations where reported values are inconsistent with the balance sheet identity (i.e. debt plus equity equal assets).Footnote 6 Finally, we require that a subsidiary’s account does not inconsistently report larger internal debt than total debt, dropping observations where this anomaly occurs. This requirement eliminates observations with values outside the [0,1] interval also for the external debt variable.

3.3 Independent Variables

We use two different knowledge-related variables from our dataset to capture the different categories of specificity. Firstly, we proxy non-location bound but MNE-specific assets using the ratio of the value of patents as registered in the subsidiary’s balance sheet to the value of total subsidiary assets. Our measure thus captures the knowledge intensity of the assets of the subsidiary.Footnote 7 Although traditionally theorized as a public good, it is now commonly assumed that knowledge has an important degree of firm-specificity (Helfat, 1994; Macher & Richman, 2008). Helfat (1994: 175) points to the role of complementary assets and notes that the “outcome of firm-specific R&D can prove difficult for other firms to imitate, if they do not have access to the assets to which the R&D was applied.” While patents arguably represent the most codified and tradable knowledge, our use of patents as a measure of MNE-specific assets builds on the common assumption in the modern theory of the firm that “the knowledge asset created by R&D investment is intangible, partly embedded in human capital, and ordinarily very specialized to the particular firm in which it resides” (Hall & Lerner, 2009: 13). In this sense, measured “visible” knowledge assets such as patents represent the “tip of an iceberg” including complementary assets, especially human capital assets, and we assume that patents represent a relatively more mobile and transferable type of assets within an MNE. About 80% of the subsidiary-years in the dataset do not report positive patent values.Footnote 8 However, patents are reported for subsidiaries in a wide range of countries in all regions,Footnote 9 and from many different sectors, including petroleum, financial services, manufacturing, wholesale trade, real estate, and telecommunications. We exclude observations with negative patent values and where patent values exceed the value of subsidiary assets, assuming this to reflect erroneous reporting.

As our measure of location-bound and subsidiary-specific assets, we use a variable on payments for R&D from the reporting MNE to the subsidiary, as indicated in the survey. Following an analogous “tip of the iceberg” argument as above, we argue that such R&D will both lead to and build on location-bound and subsidiary-specific advantages. Being tasked by HQs to conduct R&D is likely to be related with specific capabilities at the subsidiary-level. Innovation literature has also highlighted that besides leading to innovation, R&D also promotes organizational learning and the development of absorptive capacity (Cohen & Levinthal, 1989). R&D-intensive subsidiaries are thus likely to have built up a stock of complementary assets over time, but these assets may also be linked to specific human capital in the subsidiaries and local advantages and be difficult to transfer within the MNE. We divide the R&D amount with the revenue of the subsidiary to create a ratio measuring R&D intensity. Similar as for other variables, we attempt to guard against data errors by dropping a handful of observations where R&D income exceeds total subsidiary revenue.Footnote 10

Our moderator variable is host-country external uncertainty. According to Williamson’s transaction cost theory, it is the interaction between external uncertainty (making it difficult to write adequate contingent contracts ex ante) and asset specificity (increasing the risk of ex post opportunism) that leads to substantial transaction costs.Footnote 11 For MNEs, the host-country institutional environment represents a particularly important source of external uncertainty (Gatignon & Anderson, 1988), not only in terms of potential threats posed by the host government, but also broader effects on the functioning of the economy, the respect for contracts and the scope for opportunistic behavior by local business actors. We capture external uncertainty using a composite measure from the International Country Risk Guide (ICRG) included in the extensive Quality of Government dataset (Teorell et al., 2017); a dataset from which we have also culled our other country-level variables discussed below. The ICRG measure averages three (normalized) components from the ICRG Researcher’s Data Set, namely Law and Order, Corruption, and Bureaucratic Quality. The corruption component focuses on corruption within the political system, which besides distorting economic and financial decisions, introduces instability into the political process itself. Law and order concerns “the strength and impartiality of the legal system” as well as “popular observance of the law” (Teorell et al., 2017: 297). This component also picks up on intellectual property rights. Finally, in low-risk countries, the bureaucracy “tends to be somewhat autonomous from political pressure and to have an established mechanism for recruitment and training” (Teorell et al., 2017: 298). To facilitate interpretation, we reverse the ICRG index such that higher values indicate higher political risk.

ICRG is a broad measure, appropriate to capture various types of uncertainty stemming from the political and institutional environment. However, being based on expert coding it may involve subjectivity bias. In robustness checks, we alternatively use the Political Constraints (Polcon) index (Henisz, 2000), which is based on more “objective” features of the political environment, but also narrower in scope. The Polcon index measures the extent to which a change in the preferences of a single political actor can cause a change in government policy (Teorell et al., 2017) and is thus closely linked to the credibility of the political regime, including on core dimensions of interest for MNEs such as protection of property rights. Again, we reverse the index so that higher values indicate lower political constraints, assumed in turn to imply higher political risk.

3.4 Control Variables

A key control variable is corporate taxes (Mintz & Weichenrieder, 2010), with a higher tax rate promoting the use of debt due to tax deductibility. Our preferred tax measure is the highest marginal corporate tax rate, which is only available for the years 2003–2006 (KPMG, n.d.). For the longer sample, we use an alternative measure from the International Centre for Tax and Development (ICTD) on non-resource component of taxes on income, profits, and capital gains (Prichard et al., 2014). Like Mintz and Weichenrieder (2010), we include the squared tax rate to account for a possibly diminishing effect. We also control for several other variables that might affect subsidiary leverage.Footnote 12 Subsidiary-level controls comprise size measured by subsidiary assets (transformed using the natural logarithm) (David et al., 2008), as well as a dummy indicating whether the subsidiary is wholly owned (coded 1) or a JV (coded zero), since joint owners of a subsidiary may have diverging interests for instance on tax planning (Desai et al., 2004a).Footnote 13 Another dummy variable takes the value of one if the subsidiary is directly owned and zero otherwise, as intra-MNE ownership structures may influence subsidiary capital structure (Mintz & Weichenrieder, 2010).Footnote 14 A benefit of the dataset is also that we are able to include a control dummy variable for whether the subsidiary had parent-guaranteed debt.Footnote 15 Subsidiary profitability, measured as returns before tax on assets (ROA), is the final subsidiary-level control.

Parent-level controls include company size proxied by the log of the number of employeesFootnote 16 and a variable containing the log of the total number of affiliates the parent company has in each year. The latter variable proxies companies’ international experience, as well as the potential for companies with extensive foreign operations to lack sufficient internal funds for full subsidiary equity financing. Moreover, this variable also captures the important agency issues that accrue in more complex MNE organizations. Although we are unable to include a full set of investing firm dummies due to the relatively small population of foreign investors, we include a dummy for investor affiliation to a larger concern as indicated in the dataset. Further, since a particular feature of the Norwegian context is the importance of state-owned MNEs (Benito et al., 2016) and state ownership could affect financing (Le & O'Brien, 2010), we include a dummy for parent majority state ownership. Industry dummies (only available at the parent company level) are also included.Footnote 17

Finally, at the host-country level we control for growth opportunities of the subsidiary as proxied by economic growth, and for the cost of debt (and, indirectly, financial development) measured by the country’s real interest rate. We also include exchange rate volatility, measured as the standard deviation of the host country’s real exchange rate to that of Norwegian kroner over the preceding four years. Geographical distance proxies the extent of information asymmetry between subsidiary and HQs, which could influence agency costs (Buckley & Strange, 2011; Hennart, 1991). We use a weighted distance measure from the Centre d’études prospectives et d’informations internationales (CEPII) calculating the “distance between two countries based on bilateral distances between the biggest cities of those two countries, those inter-city distances being weighted by the share of the city in the overall country’s population” (see Mayer & Zignago, 2006: 5). We transform this measure using the natural logarithm. Finally, we include year dummies.

The variables with data sources are listed in Appendix Table 6. Descriptive statistics appear in Table 1 while Appendix Table 7 displays a correlation matrix. Our key result is foreshadowed by a statistically significant although weak positive correlation between patents/assets and long-term external leverage (0.12). There is a significantly negative but weak correlation between the ICRG measure and leverage (− 0.04), and a positive but weak correlation between tax rate and leverage (0.03). In the smaller sample available for Model 1 in Table 3, the correlation between the R&D and patents measures is virtually zero (− 0.0197), as is the correlation with long-term debt (0.0046). Variance inflation factors and Cook’s D statistics from preliminary OLS regressions did not suggest issues of multicollinearity or influential observations.

4 Estimation and Results

As our dependent variables are ratios bounded between zero and one, our main analyses apply a random effects Tobit model. Zero debt, which is common in our sample, may arise following the firm’s capital structure optimization problem. Wooldridge’s (2002, Sect. 16.1) discussion of Tobit models refers to a response like this as a “corner solution outcome”. A Tobit model allows accounting for the potential clustering of values at zero. However, our Tobit models could be prone to endogeneity, as R&D investment leading to innovation could itself be influenced by capital structure, and/or unobserved strategic motives may determine both capital structure and R&D. Additionally, as suggested by the trade-off model (Fama & French, 2002), MNEs may be unable to adjust capital structure optimally in each period, instead having a target level over time (partial adjustment). As a robustness check we therefore run generalized method of moments (GMM) analyses (Blundell & Bond, 1998), also a common approach in capital structure studies (e.g., De Miguel & Pindado, 2001).

4.1 Random Effects Tobit Analyses

Table 2 reports baseline random effects Tobit results for long-term external debt leverage (Model 1). In line with Hypothesis 1, we find a significant negative interaction coefficient in Model 1. In the capital structure setting, we are interested in the (non-linear) observed sample variable, not the (linear) latent variable (Ramalho & da Silva, 2013), and further interpret the interaction effect in the resulting non-linear Tobit model by considering average marginal effects at different values of our measure of external uncertainty (Zelner, 2009). The hypothesized negative interaction effect implies a downward sloping curve. When confidence intervals (CIs) for the estimates of the effect of patents-assets ratio for different levels of external uncertainty do not overlap, statistical significance is lower than 1%, while moderate overlap may still imply significance at the 5% level (Cumming, 2009).

Figure 1 showing average marginal effects with 95% CIs confirms a negative moderation effect. The estimated marginal effect is positive until political risk reaches a value of about 0.5 (countries having a value near this in 2006 included Mexico, Brazil and China). At this value, the CI is fully non-overlapping with the CI for the lowest-risk countries (countries with a value of zero or close include Finland and Denmark), suggesting different effects in these environments at a significance level of less than 1%. Overall, the baseline Tobit analyses provide partial support for Hypothesis 1. Long-term external leverage is negatively related to the interaction between MNE-specific assets and external uncertainty. However, the estimated marginal effect itself is positive over a range of low and intermediate political risk contexts. Moreover, the confidence intervals for the estimated negative effects at higher political risk include zero.

Control variables generally behave as expected from previous literature, including a positive, but diminishing effect of taxes on leverage, as in Mintz and Weichenrieder (2010). The results are also consistent with MNEs using external (local) debt to limit the amount of assets at risk in risky environments (e.g., Desai et al., 2004b), while the positive and statistically significant effect of subsidiary profitability could be taken to support a trade-off model of capital structure (Fama & French, 2002) at the subsidiary level, although the host-country real interest rate is not statistically significant. As expected, guaranteed debt is associated with higher external leverage. Interestingly, investor state ownership is also positively associated with subsidiary debt.

Several robustness checks appear in additional columns in Table 2 (marginal effects graphs available on request). First, using the full sample including financial and regulated firms produces similar results (Model 2), although the statistical significance of the interaction effect is slightly reduced with more overlap of confidence intervals. Second, using the alternative ICTD tax measure and extending the sample back to 2000 produces consistent main results (Model 3), although the tax variable itself is now insignificant. Third, instead using the total long-term debt ratio as the dependent variable provides similar results (Model 4). This includes internal debt, which is however small compared to external debt. Fourth, winsorizing also the ratio of patents to assets at the top and bottom 1% gives similar results (Model 5), although with slightly weaker significance. Fifth, alternatively using the Polcon index (Henisz, 2000) to measure external uncertainty produces qualitatively similar results (Model 6), but the interaction effect turns insignificant. Arguably though, the broader ICRG measure is preferable to the narrower Polcon measure in this context, as we are not mainly concerned about potential expropriation and similar actions from the host government as much as about opportunistic actions from other business competitors.

Table 3 presents corresponding results for our test of Hypothesis 2. Although the interaction term has the expected negative sign in all models, it is never significant. Instead, the baseline model (Model 1) produces a significant positive main effect, as does the model that includes all industries (Model 2) and a model using external debt as the dependent variable (Model 4). In the model using the long sample (Model 3) and the model with Polcon as an alternative measure of external uncertainty (Model 5) also the main effect is insignificant. The marginal effects graph in Fig. 2 shows that while the line is downward sloping, the confidence intervals are overlapping, indicating lack of statistical significance for the interaction effect. Overall, there is no support for Hypothesis 2, and the main result, although not fully robust, is that subsidiary R&D has a positive effect on debt financing.

4.2 System-GMM Analyses

Further robustness tests for Hypotheses 1 and 2 use GMM (Model 7 in Tables 2 and 3, respectively). We use the system GMM version that is reported to perform well under realistic data conditions in corporate finance (Flannery & Hankins, 2013). GMM estimation is based on generating instruments internal to the model (Roodman, 2009). The original difference-GMM model (Arellano & Bond, 1991) addresses possible endogeneity by using lagged values in levels as instruments, also accounting for unobserved time-invariant subsidiary factors. Blundell and Bond (1998) showed that estimation efficiency can be improved by also using differences as instruments in level equations (system GMM). We use the orthogonal deviation transformation (Arellano & Bover, 1995) to maximize sample size in our panel with gaps, and the two-step version of GMM implementing the Windmeijer (2005) bias correction for standard errors.

Besides the patents-assets ratio or the subsidiary R&D ratio (and their interactions with external uncertainty), we instrument subsidiary size and profitability, the parent-guaranteed debt dummy, and full ownership versus JV dummy, which may be determined jointly with capital structure. Our preferred specification sets the first lag used at the third. Tests for second order autocorrelation are insignificant at conventional levels (p = 0.86 for H1, and p = 0.14 for H2). The Sargan test for instrument exogeneity is insensitive to the number of instruments, but not robust to heteroskedasticity; while the Hansen J-test is robust to heteroskedasticity, but potentially weakened by many instruments (Roodman, 2009). Too many instruments is unlikely to be an issue in our case since the number of groups vastly outnumbers instruments. While the Sargan test is significant (p = 0.00 and p = 0.01 respectively), the Hansen test is insignificant (p = 0.76 and p = 0.46 respectively), suggesting the instruments are valid. For H1, the hypothesized negative interaction is supported, while the coefficient for the main effect remains positive. For H2, the coefficient for the main effect is positive and that of the interaction is negative, but neither is statistically significant.

An additional set of GMM analyses include alternatively host-country dummies and concern-dummies, to account for potential biases that could follow from the multi-level structure of the analysis (Lindner et al., 2021). These analyses (tabulated results available on request) provide very similar results to the main analyses: H1 remains corroborated, while H2 remains unsupported.Footnote 18

4.3 Additional Analyses

Finally, subsample analyses (Tables 4, 5), explore our results further beyond the original hypothesis development. First, while we included a control for joint ownership in the subsidiary in the main regressions, the governance features of capital structure could be influenced by whether ownership is complete or shared. We therefore re-run the main model in subsamples of WOS and JVs, respectively. Testing H1, in the WOS sample we find that although the interaction coefficient has the hypothesized sign, it is insignificant, while in the JV sample the result is significant. Thus, the support for H1 is driven by the sample of JVs. Testing H2, the main effect is positive and significant in the WOS sample, but insignificant in the JV sample. The interaction remains insignificant with no support for H2 in either sample. Second, to check more closely if state ownership in many Norwegian MNEs matters (Benito et al., 2016), we run subsample analyses for majority state-owned and majority private-owned investors, respectively. These analyses indicate that the results are driven by private firms, as the effects are insignificant (although coefficients have the same sign) in the state-owned subsamples. However, these subsamples are very small compared to the samples of private firms.

5 Discussion and Conclusion

Financial aspects have remained relatively neglected in IB research until recently (Oxelheim et al., 2001; Puck & Filatotchev, 2020; Remmers, 2004). However, Agmon (2006) noted that the progressive introduction of financial contracting theories in finance, moving beyond the focus on perfect financial markets, provides more scope for cross-fertilization between finance and IB, with IB’s emphasis on market imperfections in theories such as internalization theory. We set out to investigate whether internalization theory, a powerful tool for understanding MNE boundary (and related) decisions, can also contribute to understanding MNEs’ capital structure decisions for their subsidiaries. Building on Rygh and Benito’s (2018) application of Williamson’s (1988) transaction cost theory of finance to subsidiary capital structure, we hypothesized that under conditions of notable external uncertainty, external debt financing of subsidiaries is negatively related to the presence of patents on the subsidiary’s balance sheet, while both external and internal debt are negatively related to subsidiary R&D. Our empirical tests using data on Norwegian FDI subsidiaries find partial support for the first hypothesis but no support for the second hypothesis. The interaction between MNE-specific knowledge assets and external uncertainty discourages the use of long-term debt versus equity, consistent with our transaction cost arguments. However, we find a positive effect in many lower-risk contexts. While this is not inconsistent with transaction cost arguments, which assume that notable external uncertainty is needed to prevent acceptably complete contracting, the results do suggest that the level of external uncertainty needs to be relatively high for debt financing of MNE-specific knowledge assets to be problematic. Moreover, we also find a positive effect of subsidiary R&D on total debt in some analyses, an effect that is not negatively moderated by external uncertainty. Overall, the key story emerging from the analysis is that there is often scope for financing subsidiary knowledge assets and activities with debt.

Overall, while there is some support for the internalization perspective, some features of the results are unexpected and call for further theoretical and empirical research. It appears that the simple transaction cost logic presented in Rygh and Benito (2018), driven by asset specificity, cannot tell the whole story on financing of knowledge-intensive subsidiaries. In line with new internalization theory’s increased focus on firm-specific advantages through increased alignment with the resource-based view and dynamic capabilities (Narula & Verbeke, 2015; Narula et al., 2019), a possible counteracting effect may be that high knowledge intensity also acts as a signal to investors of an MNE and its subsidiaries’ specific advantages and hence the value creation potential of the subsidiaries. Moreover, while our analyses control for the presence of parent-guaranteed debt in subsidiaries, we cannot rule out that external investors still perceive an implicit guarantee by parent firms, possibly bolstered by the parents’ own overall firm-specific advantages. This is consistent with Gulamhussen and Lavrador’s (2014: 376) findings that MNE parent bank advantages such as size and equity “signal strength and safety to investors”, allowing their subsidiary banks to attract more debt funding. As suggested by recent literature, patents seem to have collateral value (Fischer & Ringler, 2014). However, the negative interaction results suggest this collateral effect is overwhelmed in contexts of high political risk, with associated greater problems with financial contracting and enforcement of intellectual property rights, as well as with internal governance.

Post-hoc analysis also reveals differences between sub-samples of wholly-owned subsidiaries versus jointly owned subsidiaries. The support for H1 is clearest for JVs as compared to WOS, while the positive effect for subsidiary R&D is clearest for WOS. One possible interpretation of the first result is that using external debt as an internal governance instrument is most useful in subsidiaries where co-ownership could lead to additional governance issues (Desai et al., 2004a; Reuer et al., 2011). The relationship between ownership structure and capital structure is little researched, with a handful of studies considering capital structure of samples of JVs without comparing with WOS (Boateng, 2004; Li et al., 2011). However, the distinction in new internalization theory between non-location bound, location-bound and subsidiary-specific assets (Rugman & Verbeke, 2001) offers elements for further theorization about the governance of jointly owned subsidiaries. Specifically, the degree of location-boundness and internal transferability of a given joint subsidiary’s assets may differ for different owners. We do not know the identity of the co-owners from the data, but two stylized cases can be considered theoretically: The co-owner is (i) another MNE or (ii) a local partner. Between two MNE owners, one partner could find it easier than the other to redeploy and combine a subsidiary’s assets with other assets in its MNE network, possibly due also to different recombination capabilities (Lee et al., 2021). On their hand, local partners may be less impacted than foreign MNEs by location-boundedness of assets. Based on such differences between partners in the transferability of assets from a venture, co-ownership could involve a risk of conflict over the use of assets or attempts by one or both owners at expropriation of value from the subsidiary based on differential ability to capture value. External financers may expect such potential conflicts between owners to intensify in contexts of greater external uncertainty, making them less willing to provide finance.Footnote 19

As for the positive effect from subsidiary R&D in WOS, a possible conjecture is that investors expect that even if subsidiaries possess subsidiary-specific assets, parent MNEs rely on them for value creation and will be unlikely to allow them to fail. This signal effect may not be weakened even when external uncertainty increases. The lack of a negative interaction effect could potentially also reflect that debt contracting takes on a slightly different nature within an MNE, an aspect that was not considered by Rygh and Benito (2018). Specifically, the equity link provides a background for incomplete contracting between HQ and subsidiary, unlike for similar contracting with an external financer. The lack of a positive significant main effect for JVs could reflect that external investors are concerned that joint ownership of subsidiaries with subsidiary-specific assets could entail bargaining among partners and risks related to disruption of beneficial resource transfer. Given the nature of the data where we cannot identify co-owners, we are unable to examine these questions empirically further but believe they are important questions for future research.

5.1 Contributions and Implications

Drawing on and refining theoretical arguments from Rygh and Benito (2018), this study presents the first empirical test of an internalization perspective on subsidiary capital structure, leveraging a unique panel data set allowing us to study the role of knowledge-related variables at the subsidiary-level. Our results suggest that subsidiary knowledge assets and activities do matter for subsidiary financing, albeit in an unexpected way: in many analyses, specific knowledge variables are positively related to the use of debt, contrary to what was assumed in Williamson’s (1988) theory and its application to the subsidiary-level by Rygh and Benito (2018). Exploring these results further within our new internalization theory framework (Rugman & Verbeke, 2001), we conjecture that while specific assets may involve additional transaction costs in financing, they may also act as a signal to financers of the presence of strong subsidiary-specific advantages, possibly combined with the support of general MNE-specific advantages (Gulamhussen & Lavrador, 2014). Based on differences in results for WOS and JVs, we also provide elements of new theorizing on governance and financing of jointly owned subsidiaries for which different co-owners may differ in terms of the location-boundedness and internal transferability of relevant subsidiary assets. As such, some unexpected features of the results have catalyzed further theoretical contributions of this paper.

Overall, this study offers a novel perspective on MNE subsidiary governance, addressing a research gap in IB literature related to incentivization through financial contracting arrangements, including the possibility of having external institutions functioning as “delegated monitors” (Bowe et al., 2010) of subsidiaries. From the perspective of internalization theory, our results showcase a fruitful application to a new context in terms of MNE subsidiary capital structure. The results suggest there are potentially relevant differences between the corporate-level and the subsidiary-level in terms of the viability of debt financing of knowledge assets, although external uncertainty may still impose bounds on the scope for debt financing of specific assets.

Our study also has managerial implications in terms of highlighting the role of specific assets for subsidiary financing. Specifically, debt financing of such assets appears to be viable, except in contexts involving substantial external uncertainty related to the institutional environment and indirectly a risk of insufficient property rights protection and contract enforcement, along with potential opportunistic behavior by business partners.

5.2 Limitations and Avenues for Future Research

Although we are leveraging a unique dataset for our analyses, the data comes with several limitations, as discussed in the methods section. Datasets allowing a distinction between fully external debt and sister subsidiary debt would provide a more accurate test, while characteristics of co-owners in joint ventures represent an omitted variable preventing us from further exploring factors related to co-ownership and subsidiary capital structure. Additional controls such as debt covenants would also be valuable. Hence, our results should be considered tentative and future research with more detailed data available could provide stronger tests including additional controls and more explicit tests against alternative capital structure theories.

Given our focus on the less studied context of Norwegian FDI, questions of generalizability must also be considered. Norway is an advanced small open economy, where internationalization represents a relevant option for many firms (Benito et al., 2016). As such, there should be less risk that our firms represent a highly selected sample than in many other contexts. We have also accounted explicitly in our analysis for particular features of the Norwegian economy such as its petroleum reliance and the importance of state ownership. Nevertheless, caution is warranted when generalizing beyond a population of similar small advanced open economies. Debt use by Norwegian subsidiaries seems to be on average smaller than found for instance in previous studies on US MNEs (Desai et al., 2004b). We should also not assume that the results would generalize to emerging market MNEs. Therefore, similar studies in other contexts would be beneficial.

Extending our findings on the differences between wholly-owned subsidiaries and joint ventures, it would also be interesting to explore ownership structure and financial structure from a dynamic perspective. Fisch and Schmeisser’s (2020) recent study related to internal capital markets found that MNEs may choose a joint venture mode when entering new markets in order to be able to better access local resources, and later convert this into wholly owned to promote subsequent resource transfer within the MNE. Fisch and Schmeisser (2020) focus on capital resources, but a similar logic could apply to other types of resources including local knowledge resources that R&D-intensive subsidiaries may access in the host country. The goal of first accessing resources in a host country and then transferring them to the rest of the network may have implications not only for the ownership structure of the subsidiary, but also for its capital structure to the extent that the latter has a governance rationale.

It would also be valuable in future research to consider the roles that subsidiaries play within the MNE, and how this will affect their assets and governance. For instance, subsidiary mandates (Gillmore, 2022; Meyer et al., 2020) could potentially also affect the willingness of external financers to provide debt finance, given the important role that subsidiaries with mandates play within the MNE and hence the motivation of HQs to keep them thriving. This can be linked up to Rygh and Benito’s (2018) notion of system asset specificity, referring to subsidiaries with assets that have importance for the whole MNE system. Rygh and Benito (2018) argue that HQs would tend to prefer tight control over such subsidiaries through equity financing. However, our findings suggest other mechanisms may also be at play. Besides the potential need for extensive autonomy for subsidiaries with key mandates (Mudambi, 1999), it could also be that external financers feel reassured financing them with debt, as they would expect MNEs not to let these key subsidiaries fail. In other words, external financers may also base their decisions on an understanding of intra-MNE governance aspects, highlighting the need to account for potentially more complex effects when internal governance is partially “outsourced” to external actors.

Finally, although we have provided elements for an expanded internalization theory of subsidiary capital structure, there is scope to further explore theoretically the role of different distinct factors related to internalization theory, distinguishing between asset specificity, information asymmetry and signaling effects, and exploring the opportunities for combining and synthesizing internalization theory arguments with agency theory arguments; see Grøgaard et al. (2019) for an example. Internalization theory represents a broad research program where different strands of literature focus on different aspects (Narula et al., 2019). We hope that this first step will spur further research in the area of subsidiary capital structure and beyond.

Data Availability

The analysis is based on a proprietary dataset from Statistics Norway that cannot be publicly shared. The authors can provide instructions on how to apply to Statistics Norway for data access upon request.

Notes

An interesting case providing a first illustration of the relevance of the arguments is Elkem. The establishment of Elkem ASA goes back to 1904. It was founded in Norway as an electrochemical company, but over its century-long history, the company has also covered activities in metals, such as aluminium. While originally Norwegian, the company was acquired by the Chinese company Bluestar in 2011, its current majority owner. Elkem ASA is also listed on the Oslo stock exchange. It is a multinational enterprise with 7000 employees and 30 production plants around the world. The company focuses now on two main business areas—silicones and silicone products, and carbons—where it is a world-leading company. Size-wise, the silicone businesses are by far the largest with about 90% of the company’s revenues. However, it is the carbon business dating back more than a hundred years to the patented invention of the Söderberg electrode—which significantly increased the efficiency of smelting furnaces—that is a unique and defining part of Elkem’s activities. Is that specificity reflected in its capital structure? To find out, we examined the balance sheets of Elkem’s registered companies in Norway (thus controlling for country-related factors). In addition to Elkem ASA (the corporation and its headquarters), the activities in Norway are organized into Elkem Carbon AS, and two companies in silicones; Elkem Silicones Scandinavia AS and Elkem Silicone Product Development AS. The following pattern of debt-to-assets ratio emerges (2021 data, but the pattern is consistent over the last 5 years): Elkem Silicone Product Development AS 0.81; Elkem ASA 0.59; Elkem Silicones Scandinavia AS 0.38; and, finally Elkem Carbon AS 0.21. The pattern is in agreement with the thesis that companies with higher specificity are likely to have lower leverage, i.e. their parents/owners rely relatively more on equity than on debt capital. Of course, while illustrative, this is just one case. However, it is worth noting that all mentioned companies have consistently produced solid financial results in recent years (specifically, we checked the 2017 to 2021 period), which suggests that the companies’ capital structures reflect deliberate choices (by Elkem ASA and China National Bluestar, respectively) rather than transient attempts at dealing with, for example, financial duress.

More recent subsidiary-level data are unavailable after the Norwegian Tax Directorate discontinued the Foreign Company Report from 2006.

Since we cannot accurately identify long-term assets from the data, the denominator in this measure is long-term debt plus equity.

Many subsidiaries are unlisted. As the data is anonymized, retrieving market values for listed subsidiaries is also infeasible.

Some subsidiaries have negative equity explained, inter alia, by some petroleum FDI projects having large costs in their first years of operations, and by some large unsuccessful investments by other firms. In our main analyses, the petroleum sector is excluded along with the financial sector.

We allow for small discrepancies (one unit, i.e. 1000 Norwegian kroner) that likely reflect rounding errors.

According to the survey instrument, this variable, called “patents” in the dataset, can also include other intangible assets such as trademarks. To the extent that this is the case, the variable still represents a relevant measure of non-location bound MNE-specific assets.

We assume that missing values for patents (and debt) reflect a true value of zero, with one rationale being that reporting is mandatory.

Few subsidiaries in typical tax haven countries report patents, indicating our analysis is not seriously hampered by intangible assets having their nominal geographical location shifted for tax purposes (Lipsey, 2010).

Since some subsidiaries report zero income, using this ratio leads to more missing values and a smaller sample used for the estimations.

Empirically, focusing on the interaction effect also provides a stronger test of TCT vis-à-vis related capital structure theories also stressing the importance of collateral (e.g., Benmelech, 2009; Benmelech and Bergman, 2009). In adverse selection theories, collateral is used as a signaling device by high-quality firms. In contrast, according to moral hazard theories, low-quality firms offer collateral in order to increase their pledgeable income.

To mitigate remaining concerns about outliers and data entry errors, we follow common practice in finance literature and winsorize subsidiary-and investor-level variables at the top and bottom 1%, except for the patents-assets and R&D income ratios where winsorizing is done in robustness checks.

In the majority of cases, the parent company has full ownership of the subsidiary.

We have information about whether a subsidiary is directly or indirectly owned, but not sufficient information to identify ownership chains. Another control variable that would be desirable given its potential governance implications, but for which information is unavailable, is whether the subsidiary was a greenfield investment or an acquisition (Slangen and Hennart, 2008).

As pointed out by an anonymous reviewer, it would also be beneficial to include data on debt covenants, but such data is unfortunately unavailable. We also lack a direct measure of cash.

Another data limitation is that employment (and turnover) in a number of investing units are not available or enter as zero. These may include units specifically focusing on investments abroad in a particular region or country. Hence, the size control is associated with particular measurement error. Analyses excluding investors reporting zero employment yield insignificant results for the interaction term, while the main effect is still positive.

The aggregated industry categories are Agriculture and fishing; Mining and quarrying (including petroleum); Electricity, gas and water; Construction; Transport; Financial services; Real estate and business; Education, health and social services; and Retail and hotel. The omitted reference category is manufacturing. We used this relatively high level of industry aggregation in order to facilitate maximum likelihood estimation in Tobit.

It was not feasible to include these sets of dummies in the random effects Tobit analysis. However, the similarity between our Tobit and GMM results in general suggest that this would be unlikely to affect the main results.

A complementary argument based on agency theory (Hoenen and Kostova, 2015), could be that governance issues may be mitigated by tying up not just subsidiary management, but also mutually the co-owners, based on a modified free cash flow logic. However, when specificity is coupled with external uncertainty, even this logic may break down and equity may be used as a last resort.

References

Agmon, T. (2006). Bringing financial economics into international business research: Taking advantage of a paradigm change. Journal of International Business Studies, 37, 575–577.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51.

Aulakh, P. S., & Mudambi, R. (2005). Financial resource flows in multinational enterprises: The role of external capital markets. Management International Review, 45(3), 307–325.

Balakrishnan, S., & Fox, I. (1993). Asset specificity, firm heterogeneity and capital structure. Strategic Management Journal, 14(1), 3–16.

Benito, G. R. G., Rygh, A., & Lunnan, R. (2016). The benefits of internationalization for state owned enterprises. Global Strategy Journal, 6(4), 269–288.

Benmelech, E. (2009). Asset salability and debt maturity: Evidence from nineteenth-century American railroads. Review of Financial Studies, 22(4), 1545–1584.

Benmelech, E., & Bergman, N. K. (2009). Collateral pricing. Journal of Financial Economics, 91(3), 339–360.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143.

Boateng, A. (2004). Determinants of capital structure: Evidence from international joint ventures in Ghana. International Journal of Social Economics, 31(1/2), 56–66.

Bowe, M., Filatotchev, I., & Marshall, A. (2010). Integrating contemporary finance and international business research. International Business Review, 19(5), 435–445.

Buckley, P. J., & Casson, M. (1976). The future of the multinational enterprise. MacMillan.

Buckley, P. J., & Strange, R. (2011). The governance of the multinational enterprise: Insights from internalization theory. Journal of Management Studies, 48(2), 460–470.

Cantwell, J., & Mudambi, R. (2005). MNE competence-creating subsidiary mandates. Strategic Management Journal, 26(12), 1109–1128.

Chava, S., & Roberts, M. R. (2008). How does financing impact investment? The role of debt covenants. Journal of Finance, 63(5), 2085–2121.

Choate, G. M. (1997). The governance problem, asset specificity and corporate financing decisions. Journal of Economic Behavior & Organization, 33(1), 75–90.

Chowdhry, B., & Coval, J. D. (1998). Internal financing of multinational subsidiaries: Debt vs. equity. Journal of Corporate Finance, 4(1), 87–106.

Chowdhry, B., & Nanda, V. (1994). Financing of multinational subsidiaries: Parent debt vs. external debt. Journal of Corporate Finance, 1(2), 259–281.

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: The two faces of R&D. Economic Journal, 99(397), 569–596.

Cumming, G. (2009). Inference by eye: Reading the overlap of independent confidence intervals. Statistics in Medicine, 28(2), 205–220.

David, P., O’Brien, J. P., & Yoshikawa, T. (2008). The implications of debt heterogeneity for R&D investment and firm performance. Academy of Management Journal, 51(1), 165–181.

De Haas, R., & Van Lelyveld, I. (2010). Internal capital markets and lending by multinational bank subsidiaries. Journal of Financial Intermediation, 19(1), 1–25.

De Miguel, A., & Pindado, J. (2001). Determinants of capital structure: New evidence from Spanish panel data. Journal of Corporate Finance, 7(1), 77–99.

Desai, M. A., Foley, C. F., & Hines, J. R., Jr. (2004a). The costs of shared ownership: Evidence from international joint ventures. Journal of Financial Economics, 73(2), 323–374.

Desai, M. A., Foley, C. F., & Hines, J. R., Jr. (2004b). A multinational perspective on capital structure choice and internal capital markets. Journal of Finance, 59(6), 2451–2487.