Abstract

What determines states’ ability to influence the contents of international institutions? Extant scholarship on international economic negotiations highlights the importance of political and economic capacity in negotiations. In this article, we argue that another structural source of negotiating power has been overlooked: bureaucratic capacity. Building on in-depth interviews with a large sample of international economic negotiators, we develop a theory of how differences in bureaucratic capacity can give states advantages in bilateral negotiations. We test our theory on a dataset of bilateral investment treaties. To measure preference attainment, we combine a unique repository of states’ public negotiating mandates called model treaties and the texts of finalized investment treaties to compute the verbatim distances between states’ stated preferences and the treaties they negotiate. We then show that states with greater bureaucratic capacity than their counterparts tend to achieve higher preference attainment in investment treaty negotiations. Our results have important implications for scholarship on international negotiations and for policy-makers engaged in investment policy reform.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

How can states influence the content and design of international institutions? Negotiation scholars have grappled with this question for decades (Morgenthau, 1948; Baldwin, 1979; Odell, 2000). The existing literature – guided by rational choice models of strategic competition (Koremenos et al., 2001; Rosendorff and Milner, 2001) and early writings on the interplay between the national and international politics (Putnam, 1988; Milner and Rosendorff, 1997) – identify structural asymmetries in political and economic power between negotiating parties as key determinants of institutional design (Elkins et al., 2006; Allee and Peinhardt, 2010; Ásgeirsdóttir and Steinwand, 2015; Panke, 2017; Allee and Elsig, 2019). In contrast, empirical scholarship on the negotiation of international organizations (Johns, 2007; Johnson, 2013a, b; Johnson and Urpelainen, 2014; St John, 2018), intra-European Union (EU) negotiations (Tallberg, 2008; Malang and Holzinger, 2020), and negotiations of international trade and investment institutions (Odell, 1985; Busch et al., 2009; Poulsen, 2014) highlights the importance of individual expertise.

In this article, we present a theory that unifies the systemic and individual views on negotiation power. Building on in-depth interviews with 63 international economic negotiators from 34 countries, we argue that bureaucratic capacity is an important source of negotiating power. We therefore predict that states are likely to be more successful in bilateral negotiations where they have advantages in bureaucratic organization compared to their negotiating counterpart.

We test our theory on bilateral investment treaty (BIT) negotiations. Understanding the impact of negotiating power in the BIT context is particularly important as the investment treaty regime is currently undergoing fundamental changes. Foreign investors have now initiated more than 1000 investor-state dispute settlement (ISDS) cases against over 100 states under investment treaties,Footnote 1 and there is an ongoing discussion on whether the ISDS system allows too many frivolous claims to be made by investors (Johns et al., 2020). Recent research also indicate that ISDS cases often lead to regulatory chill in respondent states (Moehlecke, 2020; Berge and Berger, 2021) and that BITs may contribute to locking in low labor standards in developing countries (Ye, 2020).

States’ responses to this “legitimacy crisis” (Waibel et al., 2010; Abebe and Ginsburg, 2019; Poulsen, 2020) have been many and diverse (Peinhardt and Wellhausen, 2016; Haftel and Levi, 2019; Berge, 2020). The debate concerning BITs however, has largely focused on what commitments the future generation of BITs should include (UNCTAD, 2017). We note that such changes can only be brought about through (re)negotiations. While only a few hundred BITs have been renegotiated thus far (Haftel and Thompson, 2018; Thompson et al., 2019), many more are likely to be replaced over the next years. China, the Netherlands, India, and South Africa, to name a few, have already expressed intentions to re-negotiate some or all of their BITs, and states are consistently found to be updating their treaty preferences (Poulsen and Aisbett, 2013; Thompson et al., 2019).

In our empirical analysis we employ a novel measure of negotiation success. We compile a unique repository of public negotiation drafts – so-called model BITs (Brown, 2013) – to measure states’ BIT preferences. To measure success, we compute the textual difference between English language model BITs that have been used in at least one negotiation and finalized BITs negotiated using these models (Spirling, 2012; Alschner and Skougarevskiy, 2016a). We find that states’ ability to achieve their preferences in BIT negotiations is greater if they have higher levels of bureaucratic capacity than their negotiation partner.

Our findings have important implications for states currently reforming their BIT programs. While our results also confirm that economic power matters in BIT negotiations, the fact that bureaucratic capacity is so strongly associated with negotiation success suggests that states are well-advised to invest time and resources in building up their bureaucratic capacity. On the one hand, this is a question of domestic priorities. On the other hand, many developing states may need external assistance to build the necessary bureaucratic capacity. An advisory centre on international investment law, as proposed by some states in the ongoing negotiations on reform of ISDS at the United Nations Commission on International Trade Law (Sauvant, 2019), would be one avenue for institutionalizing such assistance.

2 Power in international economic relations

Who are the rule makers on the international economic stage? This question has been debated at least since the beginning of the institutionalization of international economic cooperation after the end of World War II. While some rely on realist assumptions about world politics to explain the rise of international economic institutions (Gowa and Mansfield, 1993; Gruber, 2000; Mansfield and Milner, 2012), negotiation analysts have long noted the paradox that weak states often emerge from negotiations with more powerful states with significant concessions (Fox, 1959; Zartman, 1971; Zartman and Rubin, 2002).

This paradox is rarely addressed in the empirical literature on international economic institutions. Instead, the focus tends to be on traditional structural variables.Footnote 2 Research on trade negotiations, for example, frequently assumes that political power, economic output, and military strength might explain the design of trade agreements (Büthe and Milner, 2014; Dür et al., 2014; Allee and Elsig, 2016; Allee and Elsig, 2017; Lechner and Wüthrich, 2018). Empirical studies of BIT-making rely on similar logics. Allee and Peinhardt (2010) find that the strength of legal delegation in BITs is a function of structural properties of states such as economic output, resource endowments, or military capabilities. Simmons (2014) finds that developing countries’ are more willing to ratify BITs with strong enforcement mechanisms when their domestic economy is under stress. Alschner and Skougarevskiy (2016a, b) find that economically developed states are the chief rule-makers in BIT negotiations. Elkins et al. (2006) and Jandhyala et al. (2011) argue that the diffusion of BITs can be explained by a logic of economic competition for investment. Lastly, Huikuri (forthcoming) finds that relative structural bargaining power is an important factor in determining weak states’ access to terminating or renegotiating BITs.

While it is difficult to argue against that fact that economic and political power give states preferential access to international rule making, we believe the empirical literature reviewed above overlooks one important structural trait of states: their bureaucratic capacity. States are by no means functionally equivalent in terms of the organization that surrounds their negotiating teams. Poulsen (2015: 28-29, 156-160) shows that many states suffer from both financial constraints and knowledge constraints when negotiating BITs, and St John (2018: 211) notes that the United States as a BIT negotiator is not only structurally powerful in the traditional sense, they also “have world-class technical capacity and legal skill” and a system to retain this expertise in-house. Bureaucracies in developing states often lack such structures to generate and retain expertise.

Moreover, scholarship on international negotiations more broadly suggests that structures facilitating expertise-building and access to information for negotiators have important bearings on negotiated outcomes. Habeeb (1988) finds that weak states punch above their weight through the use of carefully crafted negotiating tactics in studies of the Panama Canal negotiations and the Anglo-Icelandic cod wars. Odell (1980, 1985) finds that Latin American states and South Korea used technical preparation and persuasive arguments to force concessions in trade negotiations with the United States. Tallberg (2008) finds that negotiators’ technical understanding of the matters under negotiation in the European Council can make up for their states’ lack of economic and political power. Johnson (2013b) finds that international bureaucrats, through their issue area expertise, have substantial impact on the design of IOs. Lastly, Poulsen (2015: 156-160) details how politically and economically disadvantaged countries such as Costa Rica and Lebanon have set up well-functioning negotiating institutes and incorporated lawyers with international investment law expertise in their negotiating teams.

3 Bureaucratic capacity in international negotiations

Our main theoretical claim is that asymmetries in bureaucratic capacity between negotiating parties can influence preference attainment. By bureaucratic capacity we mean the degree to which states have implemented Weberian-type bureaucratic structures. In Weberian bureaucracies, decisions and intra-bureaucratic coordination are based on transparent and codified rules, the power to act is exerted impartially, and bureaucrats are recruited and promoted based on expertise and merits (Weber, 1978). Empirical research has demonstrated that bureaucratic capacity is associated with the quality of policy output (Krause et al., 2006; Dahlström et al., 2012), economic growth (Evans and Rauch, 1999; Cornell et al., 2020), trade policies (Betz, 2019), and the implementation of human rights treaties (Cole, 2015).

Existing research on international economic relations, however, does not deal with bureaucratic capacity as a factor that may influence negotiated outcomes.Footnote 3 A few contributions have dealt with the role of individual expertise and legal capacity (Tallberg, 2008; Busch et al., 2009) and the capacity-constraints of developing countries (Poulsen, 2015; Berge and St John, 2020), but none zoom in on the way in which states’ bureaucracies can be a structural factor that both directly and indirectly impacts on international negotiations.

We add to existing scholarship by outlining two modes through which bureaucratic capacity asymmetries may influence preference attainment in international negotiations. The first mode highlights a dynamic whereby bureaucratic advantages allow states to extract favorable concessions. The second mode expounds on how differences in bureaucratic capacity allow states to reshape the preferences of their negotiating counterparts. Our theory in part builds on interviews with 63 BIT negotiators from 34 states conducted in 2018 and 2019.Footnote 4

3.1 Mode 1: forcing unbalanced compromises

Figure 1 illustrates the first mode through which states can influence outcomes in negotiations they are party to. In mode 1, properties of the relationship between the negotiating parties are assumed to lead to unbalanced compromises (Schelling, 1960). \(\theta _a\) notes the preferred outcome of Country\(_a\) while \(\theta _b\) is the preferred outcome of Country\(_b\). A balanced compromise between the parties is indicated by \(\beta _1\) (the midpoint between \(\theta _a\) and \(\theta _b\)). \(\beta _2\) indicates an unbalanced compromise that is closest to Country\(_b\)’s preferred outcome.

Asymmetries in bureaucratic capacity between negotiating parties can lead to unbalanced compromises for at least three reasons. First, negotiators from bureaucracies with poor bureaucratic oversight and limited policy review functions, should make more extensive concessions in negotiations than officials from bureaucracies with extensive oversight mechanisms. Bureaucrats often seek to maximize their own welfare and career opportunities at the cost of the welfare of their employer (Abbott, 2008). Existing research on BIT negotiations confirms this dynamic: individual negotiators have strong economic incentives to seek many treaties rather than the best treaties for their state (Poulsen and Aisbett, 2016), and BITs are often used by negotiators as tools to advance broader foreign policy goals (Chilton, 2016; Gertz et al., 2018). All else equal, bureaucratic review procedures, such as intra-departmental hearing rounds on negotiating mandates, should minimize negotiators’ room to agree to terms based on their own incentives rather than those of the state that they represent, and thus increase their willingness to fight for their model text.

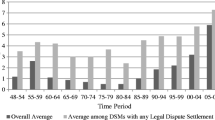

As an illustration, consider the United States (US), the by far most successful negotiating party when it comes to reproducing model text in finalized BITs (Fig. 4). While the US have more structural power than most states, the bureaucratic system that US negotiators operate within is also exceptional in terms of oversight and bureaucratic review (Vandevelde, 1988). The authority to negotiate BITs in the US lies with the United States Trade Representative and the State Department. However, the broader US bureaucracy follows the BIT negotiations closely through so-called Trade Policy Subcommittees that have broad representation from different ministries and regulatory agencies (Sharpe, 2020).Footnote 5 The chief function of these committees is to ensure that US negotiating positions always reflect the broader interests that feed into US trade and investment policy. US negotiators routinely present the status in ongoing negotiations to the different subcommittees. Partly as a function of this bureaucratic oversight, they report that it is difficult to diverge from their negotiating positions. On the opposite side of the spectrum, negotiators from countries with substantial economic capabilities and natural resources, but limited bureaucratic capacity – such as the Democratic Republic of Congo, Libya, and Pakistan – report that they often operate in complete isolation from the wider bureaucracy (Poulsen and Aisbett 2013, 2016).

Second, well-developed bureaucracies should be better at aggregating information and preferences (Betz, 2019: 389), and as such be better at disseminating the risk of international agreements than bureaucracies with poor intra-departmental communication and coordination. Bureaucratic capacity should therefore contribute to a more risk-sensitive approach to international negotiations. Being sensitive to risks, in turn, should increase the likelihood that negotiators stay close to their negotiating mandates. In BIT negotiations, this means staying close to the model texts, as most model BITs have been through extensive legal vetting (Calamita, 2012; Sharpe, 2020). BIT negotiators from a wide range of countries (Canada, Colombia, the Czech Republic, Norway, and the US) confirm that model BITs tend to be subject to substantial vetting.

Moreover, intra-departmental coordination may ensure that the agency that oversees defence in international legal matters (for example the Ministry of Justice) coordinates with the one that negotiates international agreements (for example the Ministry of Foreign Affairs) on relevant case law developments. States vary greatly in the degree to which they have institutionalized such coordination. On the one extreme you have Canada, a relatively successful BIT-negotiating party, but also one that has faced a lot of ISDS claims. Instead of splitting the negotiation and legal defence responsibilities in different ministries, Canada has set up the Trade Law Bureau, which is organized under both Global Affairs CanadaFootnote 6 and the Ministry of Justice. The Trade Law Bureau is composed of both policy people in charge of negotiations and lawyers in charge of defending against ISDS claims. The policy side and the legal side constantly coordinate efforts. Legal advisers we interviewed for this project reported that they both defend Canada in ISDS cases and have a key role in negotiating Canadian BITs. The result is that Canadian negotiators are always up to date on arbitral interpretations of Canadian BITs and very aware of the risk that different drafting variations carry.

India, which has not been as successful in negotiating BITs close to its model, exemplifies the other extreme. In India, the Ministry of Justice oversees the legal defence of the state (by external legal counsel), while negotiations are conducted by the Ministry of Finance. These two silos rarely coordinate. One former Indian negotiator even noted that officials responsible for the country’s legal defence opposed interference from negotiators.

Third, bureaucratic capacity may increase the credibility of claims of domestic constraints. If perceived as credible, such claims may help negotiators convince their counterparts that certain positions are non-negotiable (Schelling, 1960; Putnam, 1988). Institutionalized coordination between different branches of the civil service, and between the civil service and political leaders should increase negotiators’ ability to credibly communicate their domestic constraints. Indeed, negotiators that operate within bureaucratic systems that give them access to ministries with direct ownership over specific parts of negotiation mandates (typically so-called “red lines”), report how effective it is to use these stakeholders directly in negotiations. EU negotiators, for example, note that using people from the Legal Department in the Directorate General for Trade of the European Commission has been very effective to communicate how firmly the EU stands on their investment court system as an alternative to ISDS in BITs. Brazilian negotiators report that their negotiations are followed closely by a foreign trade board that has direct representation from a broad range of ministries, and other arms of the state such as the Central Bank, the Attorney General’s office, and the Securities and Exchange Commission. Brazil also tends to bring issue-area experts directly into negotiations to explicate Brazilian legislation and their history of non-ratification of BITs (Campello and Lemos, 2015).

3.2 Mode 2: Shifting the positions of the counterpart

Figure 2 illustrates the second mode through which states can influence outcomes in negotiations they are party to. In mode 2, the actual position of one party is allowed to move in direction of the position of the other party. This positional shift facilitates a change in what constitutes a balanced compromise between the two parties’ positions. The set-up is similar as in Fig. 1, but in Fig. 2, \(\theta _{a1}\), which indicates the initial position of Country\(_a\), moves towards the position of Country\(_b\) at \(\theta _{a2}\). As a consequence, what constitutes a balanced compromise between the parties moves from \(\beta _1\) to \(\beta _2\) (the new midpoint between \(\theta _{a2}\) and \(\theta _{b}\)).

There are at least three ways asymmetries in bureaucratic capacity may lead the state with the least developed bureaucracy to shift their position towards that of the state with higher bureaucratic capacity. First, negotiating parties that lack bureaucratic structures to build up the relevant legal or policy expertise may find it efficient to approximate the positions of counterparts that have demonstrated such expertise. Research on international trade negotiations notes how the use of previously vetted language “reduces the cost of drafting” (Peacock et al., 2019: 925), and “bureaucratic emulation” is seen as one way to overcome capacity constraints (Allee and Elsig, 2019: 604). Well-established “templates” such as the European Court of Justice is often used when states craft new international courts and legal institutions (Alter, 2012).

Second, states with limited bureaucratic capacity may also mimic the negotiating positions of counterparts with extensive negotiating experience and experience from defending international legal claims because they are seen as more “appropriate” than their own policies (March and Olsen, 1998). Administrative culture and foreign policies are core soft power assets (Nye, 2004), and for states with limited bureaucratic capacity, the negotiating positions of more experienced states might seem appealing to the extent that they choose to opt into them during negotiations, even though they started the negotiations with other positions.

Third, bureaucratic capacity may influence preference attainment in negotiations through the link between bureaucratic organization and expertise. A key facet of Weberian bureaucracies is meritocratic hiring and promotion procedures. As such, states with well-developed bureaucracies are more likely to have more expert negotiators. The question then is: does the agency of individual negotiators matter? Quantitative scholarship often adopts the assumption that international negotiations are instrumental processes where the balance of power between negotiating parties is translated into (unbalanced) agreements (Elster, 1986). At the negotiating table however, “individuals [...] make and respond to claims, arguments, and proposals with the aim of reaching mutually acceptable binding agreements” (Odell, 2012: 27). In this setting, arguing, justification, and reason-giving have been found to be very prominent (Ulbert and Risse, 2005).

Many of our interviewees note that negotiators with high international investment law expertise tend to be the ones that take charge of ad hoc drafting of legal text at the negotiating table, while also being the most persuasive negotiators when uncertainty, disagreements, or deadlocks occur in negotiations. While informants from high bureaucratic capacity states such as Canada, Singapore, and the US, report how they manage to attract some of their nations’ brightest minds to work in negotiation teams – negotiators from Chile and New Zealand report that capacity creation and capacity retention is important to counteract their financial constraints as small states. Negotiators from India, Jamaica, and Serbia, on the other hand, report how damaging the constant turnover in their negotiation teams is for their institutional knowledge base.

High-capacity bureaucracies also make expertise in the wider bureaucratic system more available to negotiators. Negotiators from high bureaucratic capacity states that have been relatively successful in reproducing their preferences in BITs – such as Canada, Mexico, Netherlands, and the US – report that efficient intra-departmental communication channels allow them to draw on issue-specific expertise when formulating arguments both when preparing for negotiations and during negotiations. Negotiators from low-bureaucratic capacity states that have had less success achieving their preferences in BIT negotiations – such as Colombia, Peru, South Africa, and Sri Lanka – report frustration around their inability to access expertise within their own government when preparing for negotiations.

The expertise of individual negotiators may therefore be important. The advantages of having expertise in negotiations is acknowledged for instrumental reasons: because international negotiations are characterized by high levels of uncertainty (Zartman, 1971; Winham, 1977) negotiators that possess superior knowledge should be better suited to craft persuasive arguments (Risse, 2000; Risse and Kleine, 2010), and consequently shape negotiated outcomes (Young, 1991; Tallberg, 2008). In the context of BIT negotiations, Poulsen (2015: 29) shows that bureaucratic structures in developing countries, such as forced rotation of administrative staff and poor hiring and retention procedures, obstructs expertise-building, which in turn has led many states to sign onto developed countries’ model BITs without proper deliberation. Similarly, Berge and St John (2020) show that capacity-constrained states often enact domestic investment laws proposed by the World Bank without comprehensive internal deliberations.

The scope conditions in BIT negotiations should enhance the importance of expert negotiators. Expertise, and particularly the ability to explain and justify negotiating positions, is particularly important when there are high levels of uncertainty concerning the (impact of) the subject matter under negotiation. Thus, the vagueness of BIT provisions coupled with the lack of a formal system of precedent in ISDS (Bonnitcha et al., 2017: 93-125) should heighten the importance of having negotiators with investment law expertise in BIT negotiations. Moreover, the ability to engage in merits-based argumentation is assumed to be more important when negotiations are carried out behind closed doors and negotiators can engage in open exchanges without having to worry about domestic audiences (Checkel, 2001).Footnote 7 Thus, the fact that BIT negotiations are usually held ad hoc with little public scrutiny puts a higher premium on investment law expertise than if the same negotiations were conducted publicly.

Table 1 summarizes the different modes through which bureaucratic capacity advantages may give states advantages in bilateral negotiations, and the different mechanisms underpinning each mode of influence. Our theory leads to the following hypothesis:

Hypothesis 1

States’ ability to attain their preferences in bilateral negotiations increases the more bureaucratic capacity they have relative to their negotiation partner.

4 Quantitative analysis

Our quantitative research design leverages the full texts of 62 model BITs containing the stated preferences of the author states and 727 BITs available in English from the United Nations Conference on Trade and Development’s (UNCTAD) investment policy hubFootnote 8 that had been negotiated by at least one country using a model BIT.Footnote 9 Rather than measuring states’ preferences in BIT negotiations, extant scholarship has tended to derive treaty preferences from a “developed” versus “developing” country dichotomy (Allee and Peinhardt, 2010; Simmons, 2014). While this approach may have been a defensible strategy when modelling early BIT negotiations between capital-rich and capital-scarce countries, the advent of BITs between states from the Global South and mega-regional trade and investment agreements between developed countries have made BIT negotiations more balanced (Poulsen, 2010; Berge, 2020). Thus, assuming states’ preferences are based on whether they have developed or developing economies may be too heroic. However, by comparing model BITs and concluded BITs, we can measure the extent to which states are able to negotiate BITs that are (textually) close to their preferences (Alschner and Skougarevskiy, 2016a).Footnote 10

4.1 Dependent variable: distance between model BITs and concluded BITs

Our dependent variable measures the overlap between states’ expressed preferences and the BITs they conclude. To measure states’ preferences over the textual content of their BITs, we rely on the fact that a many states codify their preferences in model BITs. Model BITs are developed and used for a range of reasons: because it is efficient not having to prepare a new draft before each individual negotiation; because the development process is a way to secure political buy-in on the model; to signal one’s policy to potential treaty partners; and, to secure a coherent treaty universe (Sharpe, 2020). Overall, model BITs provide templates for authoring states, and are often used as starting points for BIT negotiations (Brown, 2013: 2).

To understand how models are applied in practice, and the extent to which they actually represent a state’s preferences, we asked our interviewees whether they use model BITs when negotiating, and how models are applied in practice. They reported that the most common way of using model BITs is to send them to one’s counterpart at the beginning of a negotiation. Depending on whether the counterpart also uses a model, a joint negotiating draft is then established in one of two ways: either by one side bracketing language they cannot accept in the other side’s model, or through a joint integration of two models.

Negotiators from states all along the bureaucratic capacity-continuum reported to be using model BITs, and every negotiator interviewee from a state that used a model BIT confirmed that their model represents their home state’s preferences. An Indian negotiator, for example, noted that their model BIT represents India’s “negotiating position at the table.” A Czech negotiator remarked that “[our model BIT] is the initial position of the Czech Republic. [...] We take it as our best-case scenario. We would like to get as much as possible from this model.” Similarly, a Canadian negotiator underlined that “the model is where Canada wants to be ideally. If we could convince every partner to agree to our model, that’s what we would like to have.” Finally, a Japanese negotiator highlighted how their model “is 100 percent satisfactory to the Japanese side.”Footnote 11

We collected all model BITs we could find publicly available. Most of the models we identified were available in full text from UNCTAD,Footnote 12 but we also identified additional models in various book volumes (Dolzer and Stevens, 1995; Dolzer and Schreuer, 2008; Dolzer and Schreuer, 2012; Gallagher and Shen, 2009; Brown, 2013), from UNCTAD’s old international investment instrument compendiums,Footnote 13 or through direct contact with academics and ministries in relevant countries.Footnote 14

In total, we identified 102 different models, 100 of which we have a confirmed first year of commenced use. Of these, we use 62 English language models from 42 different countries that have been used in at least one negotiation from which we have a concluded BIT.Footnote 15 Because the collection of BITs that we compare the models to only contains English language BITs, we are only able to use English language models in our analysis, but we make available all the model BITs irrespective of language so that future research may extend our analysis to BITs concluded in other languages.

The countries for which we have identified at least one publicly available English language model BIT are displayed in Fig. 3. As shown in the Figure, model BITs are (or have been) used by developed economies such as Switzerland, the Netherlands, Germany, the United Kingdom, and the United States – by transitioning economies such as India, Turkey, and Malaysia – and, by developing economies such as Benin and Uganda. For states with vastly different economic and political power, as well as bureaucratic capacity, model BITs are thus available as measures of the stated preferences over investment treaties. In the supplementary materials, we further investigate the issue of selection effects due to certain countries being more likely to negotiate based on model BITs. We show that while there is indeed evidence that countries with stronger bureaucratic capacity, as well as countries that are richer and with stronger political constraints, are more likely to employ model BITs, our main results are robust to accounting for this selection using Heckman models and to only considering negotiations in which both sides employed model BITs (see sections J and E of the online appendix). It is nevertheless important to note that we are only able to measure preference attainment for states that employ models in BIT negotiations and that these states tend to enjoy both relatively great economic power and high bureaucratic capacity. Caution is warranted when extrapolating our results to the full population of BIT negotiations.

To measure the outcome of negotiations conducted using the model BIT, we downloaded all BITs from the UNCTAD website and converted them to a machine-readable format with optical character recognition (OCR). Next, we corrected typos and errors introduced by the OCR routine and removed all non-binding idiosyncratic text at the beginning and end of the treaties (such as preambles and time and place of signature). We identified a total of 727 English language BITs that had been negotiated between states where at least one party negotiated based on a model BIT.Footnote 16 Of these, 177 BITs were concluded after negotiations in which both states relied on model BITs. The earliest BITs included in our data are the 1975 treaties that the United Kingdom negotiated with Singapore and Egypt, using its 1972 model BIT. However, most of the included BITs are from the 1990s and 2000s in which several states negotiated BITs using model treaties. Because we collected our data in 2017, our dataset ends in 2016.

To measure states’ ability to negotiate BITs that approximate their stated preferences, we construct a dataset with one row for each model-BIT dyad. BITs for which both states relied on models thus appear twice in the dataset. We then measure the Jaccard similarity between the models and the BITs (Alschner and Skougarevskiy, 2016a). The Jaccard similarity is defined as the size of the intersection between the tokens (that is, words and sequences of words) in the model and the tokens in the BIT divided by the union of the two sets of tokens:

where M denotes the Model BIT, B denotes the finalized BIT, and T denotes the tokens. Theoretically, J(M, B) ranges from 0 in the case of complete dissimilarity to 1 in the case of complete similarity. As tokens we include words, bigrams and trigrams (sequences of two and three words). By including bigrams and trigrams – in addition to single words – we account for how the meaning of a word depends on the context it is used in. Similarly, to capture the legal context in which different words are employed, we do not remove stop words or infrequently used terms. This is particularly important in negotiations over legal texts such as BITs where the devil is very much in the details. However, section F of the online appendix shows that our results are robust to excluding stop words and infrequent terms.

Figure 4 displays the average similarity between each model and BITs concluded following negotiations in which the model was used. The figure indicates important variation in the textual similarities between models and concluded BITs. The most successful model is the 2004 model of the US. By contrast, the least successful model is China’s 1984 model followed by Romania’s 2004 model. The vertical bars indicate the \(\pm 1\) standard deviation, and show that there is also considerable within-model variation in the outcomes of negotiations. We are thus able to assess not only whether the United States is more successful in BIT negotiations than China or Romania, but also in which negotiations countries with low overall success are relatively successful.

To assess whether textual similarity between a state’s model BIT and a finalized BIT to which it is party constitutes preference attainment we have carried out a manual check of our dependent variable’s measurement validity. The check is reported in Appendix C, and shows that for a random set of model BIT-BIT pairs, low textual similarity corresponds with significant differences in the legal contents of the model BIT and the BIT respectively, and that high textual similarity corresponds with high legal similarity. With that said, it is likely that language and structure of BITs also matter to negotiators. Even though there are sometimes multiple ways to formulate and structure BITs that creates similar investment protection, negotiators do care about language and structure. There are at least two reasons for this. First, model BIT language is the product of extensive due diligence. Paired with extensive uncertainty around how similar, but not identical, BIT clauses are interpreted, negotiators should be most comfortable with the legally vetted language in their model BIT. Second, it is more difficult for negotiators to get a BIT that is very different from their pre-approved model BIT ratified than one that lies close to their model. This dynamic is likely to be present to some extent regardless of whether the differences between the model BIT and the finalized BIT constitute significant changes to the legal protection enshrined in the model, because the parliamentariens that ratify BITs rarely have investment law expertise.

4.2 Independent variable: asymmetries in bureaucratic capacity

Our theory anticipates that states’ ability to negotiate BITs close to their preferences depends on their bureaucratic capacity relative to the bureaucratic capacity of their negotiation partner. While our theory centres on bureaucratic capacity as employed in international negotiations, we are not aware of any indicators that directly measures the quality of states’ foreign services. Instead, we rely on indicators capturing states’ bureaucratic capacity more generally. While we expect general bureaucratic capacity to correlate highly with the quality of states’ foreign services, there is another good reason for why we think general measures of bureaucratic capacity is appropriate: states do not tend to send career diplomats to negotiate BITs. While this may have been the case in the 1980s and 1990s, as demonstrated by Poulsen (2015), only two of the 63 BIT negotiators we interviewed for this project were in fact career diplomats.Footnote 17 The rest were specialized bureaucrats working all across the government apparatus. Our interviews also highlighted how negotiating a BIT is complex. Negotiators from multiple branches of the state often partake in the same negotiation, working on different parts of the treaty. This creates a particular need for intra-departmental coordination in between negotiation rounds, which again is a property of states’ bureaucratic system writ large.

Our first measure of bureaucratic capacity is therefore the Bureaucratic quality measure from the International Country Risk Guide (ICRG). This measure is constructed to capture the degree to which “the bureaucracy has the strength and expertise to govern without drastic changes in policy or interruptions in government services” and having “an established mechanism for recruitment and training”.Footnote 18 This measure ranges from 1 to 4 with higher values indicating greater bureaucratic capacity.

As a second measure of bureaucratic capacity, we use the Rigorous and impartial public administration index from the Varieties of Democracy (V-Dem) project, which seeks to capture the “extent to which public officials generally abide by the law and treat like cases alike, or conversely, the extent to which public administration is characterized by arbitrariness and biases (i.e., nepotism, cronyism, or discrimination).” An important caveat is that the measure is intended to cover “the public officials that handle the cases of ordinary people.” Yet, because we expect high correlations between the qualities and capacities of different sections and levels of a country’s public administration, we consider this measure a useful proxy for the public administration’s capacity to conduct BIT negotiations. The variable is also used by existing scholarship as a proxy for the general quality of the state bureaucracy (e.g. Andersen & Doucette, 2022). The variable is available on an interval-level latent scale with greater values indicating a more rigorous and impartial public administration.

As a third measure of bureaucratic capacity, we use the Criteria for appointment decisions in the state administration measure from V-Dem, which captures whether “appointment decisions in the state administration [are] based on personal and political connections, as opposed to skills and merit?” As noted, such meritocratic recruitment is a key mechanism through which state bureaucracies, including the foreign services, build the kind of expertise we expect to be crucial in BIT negotiations. The variable is available on an interval-level latent scale with greater values indicating more meritocratic public recruitment. Because high values indicate greater levels of meritocratic recruitment, we refer to the variable as Meritocratic public recruitment in the remainder of the article.

The three above measures concern the quality and capacity of state bureaucracies in general. However, in the absence of bureaucratic structures fostering administration-wide expertise, Poulsen (2015: 29) suggests that “officials can [...] develop a level of experience through learning and feedback.” BIT negotiators from a wide range of countries underline the usefulness of negotiation experience. One EU official with chief negotiator responsibilities for example remarked: “Personally, I think it makes a difference if you have negotiating experience. [...] In short, experience can help you understand the technical level of treaties.” Similarly, a Canadian BIT negotiator with more than 20 years of experience noted:

As I got more experienced, when I would negotiate with another party I would wait for their arguments and then, you know, most arguments have been made many times before. It is like a chess match, if you have studied openings, you know your available responses.

Our fourth measure therefore aims to capture the degree to which a country is likely to have developed specific capacity concerning BIT negotiations. As a proxy for states’ issue-specific bureaucratic capacity, we consider the cumulative count of previous BITs that a state has negotiated. We refer to this variable as BIT experience.

Because we are interested in states’ bureaucratic capacity relative to their negotiation partner’s capacity, we calculate ratios by dividing the value of each measure for the model state with the value for its negotiation partner. Because these ratios are right skewed, we use their natural logarithms.

4.3 Control variables

We control for a number of possible confounders for the relationship between bureaucratic capacity and success in BIT negotiations. Existing work highlights the importance of economic power and the sizes of home markets (Allee and Peinhardt, 2010; Simmons, 2014; Alschner and Skougarevskiy, 2016a). We therefore control for the ratio of the gross domestic products and the ratio of gross capital formation (i.e. the amount of capital invested in a country in a year) between the model state and its negotiation partner. Both variables are available from the World Bank’s World Development Indicators.Footnote 19 As a robustness check, we also assess how our results are influenced by controlling for the ratio of gross domestic product per capita instead of the ratio of the gross domestic products.

Dyads of democracies might find it easer to negotiate with each other than other dyads and shared democratic institutions may also correlate with similar preferences concerning treaty language. We therefore control for the natural logarithm of ratio between the two states’ level of democracy, using the polyarchy measure from V-Dem.

The presence of strong domestic institutions inhabited by actors with diverging preference may be expected to correlate with development of a strong bureaucracy. At the same time, domestic veto players may be an independent source of leverage in international negotiations, as negotiators can lean on domestic constraints to extract concessions from their counterparts (Putnam, 1988). We therefore control for the level of political constraints resulting from domestic veto-players using the POLCON V measure (Henisz, 2002).

Model countries and partner countries may share their legal origin, have shared colonial ties, or have alliance ties. Such similarities are likely to influence the degree of overlap in preferences in BIT negotiations and thus the ability of the model state to achieve outcomes close to its stated preferences. Moreover, such ties may also correlate with the quality of state bureaucracies. We use data on French, English, German, Scandinavian, and Socialist legal origins from La Porta et al. (2008), data on colonial ties from the Issue Correlates of War Project Colonial History dataset,Footnote 20 and data on alliance ties from the Alliance Treaty Obligations and Provisions dataset (Leeds et al., 2002). Only alliances after World War II are taken into account, as almost all states were engaged in some sort of alliance during the war years.

The salience of BIT negotiations in different states may be influenced by previous exposure to ISDS. Poulsen and Aisbett (2013) and Thompson et al. (2019) show that countries often change their approach to BIT negotiations after experiencing ISDS claims. To control for exposure to ISDS, we create cumulative counts of the number of ISDS claims each state has experienced at the time of concluding each BIT. The data on previous claims are available from the PluriCourts Investment Treaty Arbitration Database (PITAD).Footnote 21

A concern with using model BITs as preference measure is that, even though many states have publicly updated their models over time, they may also be incrementally amended without public disclosure. BIT negotiators often referenced this fact when explaining the development of their model BITs. A Lithuanian BIT negotiator reported that “after each negotiation our model was slightly improved.” Similarly, a Slovak negotiator noted that “we go through our model from time to time [...] we are changing it based on our experiences from the negotiations.” We therefore control for the number of years that the model has been in force at the time of conclusion of the BIT.

The use of model BITs may in and of itself be a source of negotiating power (Peacock et al., 2019). Multiple interviewees confirmed that when only one party to the negotiations brings a model BIT, that model is likely to be the template from which the negotiations depart. As such, the model country is likely to have a type of agenda setting-power going into the negotiations. If both parties use model BITs however, the joint draft is more likely to be established by integration of the two models, and it should be more difficult to succeed for both parties. We therefore create a dummy variable that takes the value of 1 if the partner country also has a model and 0 otherwise.

Our measure of preference attainment is based on the English-language versions of model BITs and negotiated BITs. States with English as an official or main language may be at an advantage when negotiating treaties in their native language. To control for differences in negotiators’ ability to negotiate in their native language, all models now also include a dummy for whether English is the native language in the model country, a dummy for whether English is the native language in the partner country, and the interaction between these two variables, using data from “NationsOnLine”Footnote 22 included in the Graham and Tucker (2019) database.

Finally, we include fixed effects for the model treaties and the year in which the BIT was concluded. The model fixed effects account for differences in the level of detail and how actively the model was used in negotiations. The model fixed effects also account for unobserved differences at the state level, such as for unobserved differences in how states apply their models in negotiations and how far from their baseline preferences they are willing to venture. For example, it is widely known that the United States is very careful not to depart from the contents its model BITs (Vandevelde, 1988), while other states are slightly less “married” to the exact language in their model BITs (see various contributions in Brown, 2013). The fixed effects on the year in which the BIT was concluded accounts for temporal variation in the outcomes of BIT negotiations resulting for instance from countries learning how different types of treaty language influences the outcomes of ISDS cases.

Section D of the online appendix reports descriptive statistics and bivariate correlations for all variables used. The correlation matrix reveals high correlations between the measures of bureaucratic capacity and the measures of economic power. Despite the relatively high correlation between these measures, variance inflation factors for our main independent variables are only moderate in the main specifications.Footnote 23 Thus, despite the high correlation between bureaucratic capacity and economic power, we are able to retrieve reasonably precise estimates for our coefficients of interest.

4.4 Results

Figure 5 displays the bivariate relationships between each of our measures of bureaucratic capacity and the similarities countries achieve between their model BITs and negotiated BITs. For all four measures, there is a clear and positive relationship between having strong bureaucratic capacity relative to the partner state and achieving BITs that are textually close to the country’s stated preferences.

Table 2 displays linear regression models with the similarity between models and treaties, with standard errors clustered on the model treaty. Model 1 includes only the control variables and serves as a baseline. Consistent with previous research (Allee and Peinhardt, 2010; Simmons, 2014; Alschner and Skougarevskiy, 2016a), this model suggests that countries with larger economies than their negotiation partners are relatively successful in BIT negotiations. The relationship between economic capacity asymmetries and preference attainment is robust throughout the following models. In other words, our theory linking bureaucratic capacity to negotiation success should be seen as complementary to existing theories, rather than as competing. This finding confirms what the negotiators we interviewed reported. Even as they highlighted the importance of bureaucratic capacity, they also explained that economic power is important in BIT negotiations. The majority of negotiators interviewed note that there is an unspoken understanding between the parties to a negotiation of who needs the agreement being negotiated the most,Footnote 24 and that parties expecting gains in terms of incoming investment under a BIT have less room to make demands than parties expecting to export foreign investment. In particular, negotiators report that they adjust their starting positions before negotiations, and set their expectations for what can be gained through negotiations, based on economic power differentials.

Yet, beyond economic power, the interviewees noted the importance of various forms of bureaucratic capacity. Models 2-4 provide systematic evidence that such differences in bureaucratic capacity indeed influence negotiation outcomes independently of differences in economic power. Model 2 includes the ICRG’s bureaucratic quality index as a measure of bureaucratic capacity. In line with our theory, this model suggests that countries’ ability to negotiate BITs that are textually similar to their model BIT increases when they have greater bureaucratic capacity than their negotiation partner. The estimated coefficient of .195 suggests that going from the minimum to maximum value on the ratio in bureaucratic quality for the observations included in the model is expected to increase the similarity between the model and negotiated BIT by approximately a third of this variable’s range.

The estimated relationship between bureaucratic capacity and negotiation success is very similar in Model 3, which uses the rigorous and impartial public administration index from V-Dem. The coefficient for the ratio in the rigourousness in public administration is significant at the .01-level and its magnitude of .089 suggests that going from the smallest to largest value on this variable is related to change in the similarity between the model and negotiated BIT of about 0.33 points or a third of the variable’s range.

Model 4 employs Meritocratic public recruitment as the measure of bureaucratic quality. Also this model suggests a positive relationship between having greater bureaucratic quality than the negotiation partner and preference attainment, and the coefficient is statistically significant at the .05-level. The magnitude of the estimated coefficient is 0.095 which suggests that going from minimum to maximum values for this variable for the observations the model is estimated on is also expected to increase the level of preference attainment by about a third of the range of the dependent variable’s range.

Across the three measures of the differences in the general quality of the negotiating countries’ bureaucracies, the models in Table 2 thus provide robust support for our hypothesized relationship and the magnitude of this relationship is very stable irrespective of operationalization. These findings support what we learned from our interviews where our informants underlined that bureaucratic capacity matters for negotiated outcomes: states with bureaucratic capacity advantages are better suited to force both unbalanced compromises and to shift the positions of their counterparts in BIT negotiations (See Table 1).

What then, is the relative importance of economic capacity and bureaucratic capacity in BIT negotiations? Our quantitative analysis indicates that there is a link between bureaucratic capacity and negotiated outcomes than run independent of states’ economic capacity. Yet, our interviews also suggest that economic and bureaucratic capacity to a certain extent run hand-in-hand. Well-oiled bureaucracies are expensive to maintain, and to attract and retain expert negotiators you have to have wage budgets that match officials’ outside options in the private sector. However, our informants also described a situation whereby economic power differentials define the zone of agreement in negotiations,Footnote 25 and states’ can leverage their bureaucratic capacity to move the language of BITs within this zone. A high-level look at our quantitative data lends some support to this dynamic. In Fig. 4, we see that states who are relatively powerful from an economic point of view, but who consistently score below average on indicators of bureaucratic capacity – such as China and Italy – have relatively low degrees of preference attainment in BIT negotiations. Conversely, we see that states with relatively small economies, but with high levels of bureaucratic capacity – such as Austria, Denmark, Finland, and Sweden – have relatively high degrees of preference attainment in BIT negotiations.

For the issue specific measure of bureaucratic capacity, BIT experience, we find no clear relationship with negotiation outcomes. The coefficient is positive, but not statistically significant. Findings concerning this variable are inconsistent across the robustness checks reported below. We therefore conclude that we cannot reject the null hypothesis that experience negotiating BITs is unrelated to preference attainment in BIT negotiations.

4.5 Robustness tests

We conducted a number of robustness tests, reported in full in the online appendix. First, we test the extent to which our dependent variable measures preference attainment on questions in which the two states disagree. The models reported in Section E of the appendix are estimated only on the sample of BITs negotiated by pairs of states both using model BITs. When computing the dependent variable, we remove all tokens shared by both model BITs to assess states’ ability to have their uniquely preferred language adopted in BITs. The restricted sample has considerably fewer observations. We therefore estimate parsimonious models that omit the model BIT and year fixed effects. Our results remain relatively stable to these tests. Contrary to the main results, however, the models estimated only on unique tokens suggest that ratios in BIT experience between negotiating states influence preference attainment.

Second, we consider the sensitivity of our results to removing stop words and infrequently used tokens. Since these tokens can be crucial for legal content, we prefer not to remove them when calculating our dependent variable. Yet, removing such tokens is common in the literature. In section F of the appendix, we report models estimated after removing stop words and tokens used in less than one per cent of the documents. These models are very similar to our main results.

Third, we re-estimated our main models after replacing the ratio of gross domestic products with the ratio of gross domestic products per capita. The motivation for this specification is that the relationship between differences in bureaucratic capacity and negotiating outcomes may be confounded not just by differences in the size of the negotiating countries’ economies, but also by differences in wealth. Since gross domestic product per capita is so highly related to the measures of bureaucratic quality we employ, it is hard to disentangle the effects of bureaucratic capacity from other aspects of wealth. Indeed, several studies use gross domestic products per capita as a proxy for legal or bureaucratic capacity (see e.g. Busch et al., 2009: 561; Guzman & Simmons, 2005: 574-575). We therefore prefer not to control for ratios in gross domestic product per capita in our main models. Models that control for ratios in gross domestic product per capita are reported in section G of the appendix. Unsurprisingly, the coefficients from both our independent variables and the economic power measure suffer from higher variance inflation factors than those in our main specifications. Yet, most of our results hold under these tests. However, when using the rigorous and impartial public administration measure, the coefficient for the independent variable is statistically indistinguishable from zero when controlling for the ratios in gross domestic product per capita. This model also suffers from greater multicollinerarity problems than our main models.Footnote 26 When controlling for differences in wealth rather than in the size of economies, the BIT experience ratio is also significantly correlated with negotiation success, but we stress that this finding is not robust across specifications.

To further assess whether our results are driven by differences between relatively wealthy and poorer states, we reestimated our models on negotiations in which neither state was member of the Organisation for Economic Co-operation and Development (OECD). The results are reported in section H of the appendix. Restricting our dataset to non-OECD dyads severely reduces the number of observations and thus the statistical power of our analysis. Yet, the results are similar to our main results the p-values. Considering the low number of observations in these models, we consider these results as evidence that our findings are not driven primarily by differences between wealthy and middle-to-lower-income states.

Fourth, we estimated a set of models that control for outward foreign direct investment as a percentage of gross domestic product for both the model and partner state, using data on FDI flows from the World Development Indicators and on FDI stock from UNCTAD. Having a higher share of outward foreign direct investment may incentivize countries to invest more in reaching high levels of preference attainment in BIT negotiations. The results when controlling for outward foreign direct investment as a percentage of gross domestic products are similar to our main results.

Fifth, our main results include both bivariate models and models with a range of control variables and fixed effects on model treaty and year. Yet, because it is challenging to know the “true” specification of the regression models and some of the controls may be influenced by the independent variables, it would be a cause for concern if our results were sensitive to the specific set of controls included in the models. To assess such concerns, we conducted a sensitivity analysis in which we ran all possible combinations of control variables and fixed effects for each of our independent variables (Sala-I-Martin, 1997).Footnote 27 We report the distribution of t-values for each of our independent variables in section I of the appendix. The results show that when using the bureaucratic quality, rigorous and impartial public administration, and meritocratic public recruitment measures, the t-values are consistently positive and greater than 1.96. Thus, our findings when using these operationalizations are not driven by any particular combination of control variables in the model. Consistent with the general lack of robustness for the BIT experience measure, we find that t-values fluctuate below and above conventional levels for statistical significance when using this measure.

Sixth, we investigate the sensitivity of our results to removing each model BIT and associated BITs. We find that the relationship between differences in bureaucratic capacity and preference attainment is consistently positive and statistically significant when using the bureaucratic quality, rigorous and impartial public administration, and meritocratic public recruitment measures. Thus, our findings are not driven by the inclusion of any particular model BIT and associated treaties in our dataset. Again, we find that the results are not robust when using the BIT experience measure.

Seventh, although countries with different levels of economic power and bureaucratic capacity sometimes rely on model treaties when negotiating BITs, the decision to use a model in negotiations is not random. Using data on all BIT negotiations, the balance plot reported in section J of the appendix shows that models are more likely to be used by states that have relatively more economic power, greater wealth, and higher levels of bureaucratic capacity than their negotiating partners. Because we only measure our dependent variable for negotiations in which at least one country used a model, we face a sample selection problem. To assess the extent to which this sample selection influences our results, we estimated a series of Heckman selection models that are reported section J of the appendix.Footnote 28 The second-stage results of the Heckman models shows that our main results are robust to modelling the selection into our data: differences in bureaucratic quality, rigorous and impartial public administration, and meritocratic public recruitment are all significantly associated with preference attainment in BIT negotiations, whereas differences in BIT experience are not.

Finally, we note that while our regression results provide evidence of a robust correlation between differences in bureaucratic capacity and preference attainment in BIT negotiations, they do not ultimately prove a causal relationship. It may well be that some unobserved confounder accounts for the observed relationship. In section J of the appendix, we therefore report the results of an attempt at getting closer to credible causal inference using an instrumental variable approach. Specifically, we follow Betz (2019) in using differences in educational achievements between men and women as an instrument for bureaucratic capacity because countries with larger gender gaps have smaller pools of talented candidates to recruit from. We estimate a two-stage least squares model with gender gap in educational achievement in the model country (using data from Betz, 2019) as an instrument for the ratios in bureaucratic capacity.Footnote 29 Three important caveats are in order: first, there is considerable missingness on the “gender gap in educational achievement” variable which severely limits the data employed in this analysis. Second, gender gaps in educational achievement only correlates with the ratios on the bureaucratic quality and meritocratic public recruitment measures and even for these measures the first-stage regressions fail the conventional threshold of \(F > 10\).Footnote 30 We therefore limit the instrumental variable models to these two operationalizations and note that weak instrument bias is a concern even for the reported models. Third, while it is plausible that gender gaps influence the actual quality of candidates available for the bureaucracy, it is less likely that it affects the content of appointment rules. Thus, the instrument is more obviously relevant for the bureaucratic quality measure than for the meritocratic public recruitment measure. These caveats notwithstanding, we note that our findings concerning bureaucratic quality hold also in the instrumental variable model. For the meritocratic public recruitment measure, the instrumental variable model suggests a positive relationship between greater bureaucratic capacity and greater preference attainment, but this coefficient is not statistically significant (\(p = 0.07\)). Due to the listed caveats, we do not consider the instrumental variable models to allow for credible causal inference, but we see these models as providing additional evidence of the robustness of our results.

5 Conclusion

In this article we present a theory for why asymmetries in bureaucratic capacity between negotiating parties should influence negotiated outcomes in international economic negotiations. Unlike the comparative politics literature (Krause et al., 2006; Cornell et al., 2020), the empirical literature on international negotiations have not yet afforded bureaucratic capacity much attention as a source of negotiating power. We argue that having higher bureaucratic capacity than one’s negotiating counterpart, as understood in terms of the quality of Weberian-type bureaucratic structures, can increase states’ ability to reach agreement on unbalanced compromises that favor their position, but also help them shift their counterpart’s position during negotiations.

We then test our theory on BIT negotiations. Using a novel text-as-data methodology and a sample of 62 model BITs – which our interviews confirm are valid measures of state preferences – we estimate the textual distance between model BITs and finalized BITs negotiated using these models. We find that bureaucratic capacity advantages are robustly associated with increased preference attainment in BIT negotiations. This finding helps reconcile insights from case-based and qualitative research on BIT negotiations (Poulsen, 2014; Poulsen, 2015) and research highlighting the importance of bureaucratic capacity and expertise in international economic relations more generally (Odell, 1980; Odell, 1985; Busch et al., 2009; St John, 2018; Berge and St John, 2020; Berge and Berger, 2021), with large-N assessments of negotiated outcomes in such negotiations.

Another contribution of this article is that it presents future researchers with the largest sample of model BITs to date. This repository may be of interest for lawyers doing legal studies of states’ BIT programmes, or for more historically oriented scholars investigating the ebb and flow of states’ economic diplomacy. Moreover, we use text-as-data techniques for comparing treaty texts, to construct more precise, dyad-specific measures of preference attainment in BIT negotiations. This method has important empirical advantages. We do not have to make ex ante assumptions about states’ preferences. Through leveraging the fact that certain states use multiple model BITs over time, we can also account for how they sometimes update their preferences. Lastly, we can analyze how all of states’ preferences, as expressed in their model BITs, are retained or altered through negotiations, instead of just looking at individual provisions (Allee and Peinhardt, 2010).

Our findings are also relevant for the public policy debate around BITs. While our analysis underlines the important role that economic power plays in international economic negotiations (Allee and Peinhardt, 2010; Simmons, 2014; Alschner and Skougarevskiy, 2016a), it also suggests that bureaucratic capacity may cancel out some economic power differentials. Insulating and nurturing civil service systems conducive to bureaucratic capacity, thereunder the generation, retention, and application of expertise, may be one avenue through which states can increase their access to rule-making on the international economic stage. More specifically, for states engaged in negotiating or re-negotiating BITs, the normative implications of our analysis are pretty clear. To paraphrase Lauge Poulsen, if states do not have the necessary bureaucratic capacity to fully engage in knowledge-based discussions of treaty content, they should work to “increase the problem-solving capabilities of officials in charge of negotiating investment treaties”, and for “governments that have the resources, a key long term strategy [...] would be to invest in [...] ‘in-house’ experts” (Poulsen, 2015: 194). Systems to generate and apply investment law expertise is very important in BIT negotiations.

There are a number of future research avenues that follow from our study. First, more work needs to be done to properly disentangle the individual effects of bureaucratic and economic capacity on negotiated outcomes in international negotiations. Second, a further analysis building directly on our study would be to partition BITs at the provision level (Alschner and Skougarevskiy, 2016a), and investigate what parts of model BITs states most often fight for, or concede on, in negotiations.

Third, more research into how BITs are negotiated in practice, and the framing effect of model BITs, is also needed. While broad, descriptive accounts of states’ BIT programs exist (Brown, 2013; Poulsen, 2015), we still know little of what goes on inside the black box of BIT negotiations. How are negotiations sequenced? How deliberative are the discussions? What arguments carry the most weight? How are structural power resources leveraged in practice? What is the practical role of expertise and experience? Diving deeper into questions like these could enlighten us as to which of the different mechanisms proposed in our two modes of influence are actually at play – and whether there are other mechanisms at play that our theory does not capture.

Fourth, and finally, it would be interesting to see whether the mechanisms found to be at play in BIT negotiations also hold for other international (economic) negotiations, or whether they are a function of the idiosyncratic negotiation context and policy-area negotiated in BITs. More generally, inside-the-black-box studies could help researchers understand better how international negotiations should be modelled, and how state capacity should be operationalized. These insights could also help state officials understand how they should prepare for international economic negotiations in general, and BIT negotiations in particular.

Data Availability

The quantitative datasets generated and analysed during the current study, as well as the repository of model BITs, are available through the RIO dataverse.

Notes

See: https://pitad.org/.

Structural power variables also receive most attention in research on international climate negotiations. See for example Bailer and Weiler (2015).

Tallberg (2008: 689) briefly mentions that states’ “administrative capacity” may be a source of structural power in multilateral negotiations, but he does not further develop this concept.

See Table A1 in Appendix A for the list of interviewees. The Appendix is available on the Review of International Organization’s webpage. The interview project was approved by The Norwegian Centre for Research Data (NSD), project number 59188.

The Canadian equivalent of the Ministry of Foreign Affairs.

Closed door negotiations could in theory also cater for opposite effect, allowing negotiators to make significant concessions due to power asymmetries without losing face.

We initially intended to use the the repository of BIT texts available through the EDIT database (Alschner et al. , 2021). While EDIT offers a larger sample of BIT texts, we found some issues with them that would have introduced unnecessary bias in our analysis. We expand on these issues in Appendix B.

A similar approach to measuring preference attainment is taken in an unpublished paper by Allee and Lugg (2016).

The Japanese model BIT is not publicly available.

A full list of where each model BIT was obtained is on record with the authors.

Table A4 in the Appendix lists all model texts used in our analysis, and the number of concluded BITs matched per model BIT.

States sometimes keep model BITs internal for a few years before they publish them. We therefore allow BITs to be matched to Model BITs concluded up to five years before the model was published if they resemble this model more closely than the model in place in the year of the BIT or if no model had been published in the year the BIT was concluded.

See Table A1 in Appendix A.

See: https://pitad.org

The variance inflation factors for the ICTH log(bureaucratic quality ratio), the log(Rigorous and impartial public administration ratio), log(Meritocratic public recruitment ratio), and the log(BIT experience ratio) for the models reported in Table 2, are 4.4, 4.79, 5.52, and 4.87, respectively. The variance inflation factors for the log(grossdomesticproductratio) are lower than 4 in all models).

States’ relative dependence on an agreement is called preference intensity (Moravcsik, 1998: 60-66).

The zone of agreement in a bilateral negotiation is the area between each negotiating party’s resistance point. It is sometimes labelled the bargaining range or the contract zone (Odell, 2000: 26).

The variance inflation factors for the log(Rigorous and impartial public administration) and log(gross domestic product per capita ratio) coefficients are 7.21 and 6.66. For the other models controlling for log(gross domestic product per capita ratio), the variance inflation factors are similar to in our main specifications.

With 12 control variables and two sets of fixed effects, this means \(2^{14} = 16384\) different specifications, including the bivariate models that omit all controls. Because the number of observations vary considerably between different specifications due to differences in the degree of missingness, we depart from Sala-I-Martin (1997) in that we do not weight t-values by the likelihoods of the associated models.

We could not get the Heckman models to converge when using year or country fixed effects. These models are therefore estimated without fixed effects.

Consistent with the general approach of our analysis, we also considered using the ratio on this variable, but this approach resulted in weaker F-tests for the first-stage regressions).

Specifically, the F-score for the instrument is 4.47 in the first stage of the bureaucratic quality model and 6.8 in the first stage of the meritocratic public recruitment model.

References

Abbott, K. W. (2008). Enriching rational choice institutionalism for the study of international law. University of Illinois Law Review, 1, 5–46.

Abebe, D., & Ginsburg, T. (2019). The dejudicialization of international politics? International Studies Quarterly, 63, 521–530.

Allee, T., & Elsig, M. (2016). Why do some international institutions contain strong dispute settlement provisions? new evidence from preferential trade agreements. The Review of International Organizations, 11, 89–120.

Allee, T., & Elsig, M. (2017). Veto players and the design of preferential trade agreements. Review of International Political Economy, 24, 538–567.

Allee, T., & Elsig, M. (2019). Are the contents of international treaties copied and pasted? evidence from preferential trade agreements. International Studies Quarterly, 63, 603–613.

Allee, T., & Lugg, A. (2016). Do powerful states write the rules in bits: Comparing models and negotiated treaties. Paper Presented at the 2016 Annual Meeting of the American Political Science Association (APSA).

Allee, T., & Peinhardt, C. (2010). Delegating differences: Bilateral investment treaties and bargaining over dispute resolution provisions. International Studies Quarterly, 54, 1–26.

Alschner, W., Elsig, M., & Polanco, R. (2021). Introducing the electronic database of investment treaties (edit): The genesis of a new database and its use. World Trade Review, 20, 73–94.

Alschner, W., & Skougarevskiy, D. (2016). Mapping the universe of international investment agreements. Journal of International Economic Law, 19, 561–588.

Alschner, W., & Skougarevskiy, D. (2016). The new gold standard? Empirically situating the trans-pacific partnership in the investment treaty universe. The Journal of World Investment & Trade, 17, 339–373.

Alter, K. J. (2012). The global spread of European style international courts. West European Politics, 35, 135–154.

Andersen, D., & Doucette, J. (2022). State first? A disaggregation and empirical interrogation. British Journal of Political Science, 52, 408–415.

Ásgeirsdóttir, Á., & Steinwand, M. (2015). Dispute settlement mechanisms and maritime boundary settlements. The Review of International Organizations, 10, 119–143.

Bailer, S., & Weiler, F. (2015). A political economy of positions in climate change negotiations: Economic, structural, domestic, and strategic explanations. The Review of International Organizations, 10, 43–66.

Baldwin, D. A. (1979). Power analysis and world politics: New trends versus old tendencies. World Politics, 31, 161–194.

Berge, T. L. (2020). Dispute by design? Legalization, backlash, and the drafting of investment agreements. International Studies Quarterly, 64, 919–928.

Berge, T. L., & Berger, A. (2021). Do investor-state dispute settlement cases influence domestic environmental regulation? The role of respondent state bureaucratic capacity. Journal of International Dispute Settlement, 12, 1–41.

Berge, T. L., & St John, T. (2020). Asymmetric diffusion: World Bank ‘best practice’ and the spread of arbitration in national investment laws. Review of International Political Economy, 28, 584–610.

Betz, T. (2019). Tariff evasion and trade policies. International Studies Quarterly, 63, 380–393.