Abstract

Inspired by macroeconomic scenarios, we aim to experimentally investigate the evolution of short- and long-run expectations under different specifications of the fundamentals. We collect individual predictions for future prices in a series of Learning to Forecast Experiments with a time-varying fundamental value. In particular, we observe how expectations evolve in markets where the fundamental value follows either a V-shaped or an inverse V-shaped pattern. These conditions are compared with markets characterized by a constant and a slightly linear increasing fundamental value. We assess whether minor but systematic variations in the fundamentals affect individual short- and long-run expectations by considering positive and negative feedback-expectation systems. Compared to a setting with constant fundamentals, the slowly varying fundamentals have a limited impact on how subjects form their expectations in positive feedback markets, whereas in negative feedback markets we observe notable changes.

Similar content being viewed by others

1 Introduction

Expectations play a crucial role in the evolution of economic systems: expectations shape the behavior of economic aggregates, and at the same time, economic aggregates mold agents’ expectations. Thus, an economy can be thought of as an expectation feedback system. The fixed point of such a system is usually defined as rational expectations. The term “rational expectations” typically refers to a set of expectations that provides consistently unbiased predictions of the future dynamics of the economy given the available information. Starting with the seminal paper of Muth (1961), an endless list of papers deals with the empirical validity of the rational expectations hypothesis, i.e., whether and under which conditions this benchmark is empirically relevant. Homogeneous rational expectations require agents with equal (maximal) cognitive capabilities who share the same model priors and private information. Likewise, a large number of studies consider bounded rationality as an alternative approach to rational expectations. In the pertinent literature, one can find much evidence of systematic deviations from rationality that open the possibility for the emergence of a certain degree of heterogeneity in the expectations (see, for example, Hommes et al. 2005a; Hommes 2011; Assenza et al. 2014).

The unobservable nature of expectations adds a determinant layer of complexity to the formal description of how expectations are formed and how they evolve. The development of techniques and methodologies to elicit and measure agents’ expectations is a very active research field. In particular, macroeconomic forecasting surveys constitute a widely employed methodology to elicit individual expectations on several macroeconomic variables like inflation, GDP, and interest rates. Even though their widespread use, the absence of economic incentives for survey respondents to reveal their expectations has raised recurrent criticisms. Nevertheless, Manski (2004, 2018) claim that surveys have proved to be a very informative source of analysis for expectation formation. Respondents usually report informative answers to questions regarding personally relevant future scenarios (see also the recently published “Handbook of Economic Expectations” by Bachmann et al. 2023).

Laboratory experiments constitute a complementary methodology to surveys to study the expectations formation mechanism under different scenarios and frames. Particularly, Learning to Forecasts Experiments (LtFEs), introduced by Marimon et al. (1993), are controlled laboratory experiments used to elicit subjects’ expectations in an expectation-feedback environment. Contrary to surveys, LtFEs incentivize subjects to make their predictions and the information at subjects’ disposal is controlled by the experimenter. These characteristics make LtFEs a powerful and flexible experimental setting for studying expectation formation under diverse scenarios, including macroeconomic frameworks. Several LtFEs have been conducted to analyze expectations formation in financial markets (Hommes et al. 2005b; Bao et al. 2021), real estate markets (Bao and Ding 2016), commodity markets (Bao et al. 2013), and in stylized macroeconomic frameworks (Anufriev et al. 2013; Cornand and M’baye 2018; Assenza et al. 2021). The external validity of the LtFEs as a decision-making tool for monetary policy has been studied by Cornand and Hubert (2020), who conclude that subjects’ predictions in a LtFE are relatively comparable to inflation surveys.

In all the above-mentioned experiments, only short-run expectations have been elicited, neglecting the importance of studying the evolution of long-run expectations. Since the paper of Mankiw et al. (2003), it has been routinely recognized that the dispersion of expectations of professional forecasters contains information on the future development of the business cycle or the inflation rate. Thus, the degree of disagreement in expectations and its persistence over time become variables of interest from a macroeconomic point of view. Patton and Timmermann (2010) analyze the term structure of the expectations dispersion over different time horizons. They observe that the dispersion increases with the time horizon and depends on the state of the economic cycle. In particular, they report that the degree of dispersion is counter-cyclical, increasing during bad states of the world. Furthermore, they observe that both the degree and the persistence of heterogeneity in expectations depend on the differences in priors and prediction models rather than on heterogeneous private information. The expectations horizon is, therefore, an essential characteristic to be considered when dealing with expectation formation. Focusing on monetary policy, an important determinant of its effectiveness is the degree of influence that central banks have on consumers’ and investors’ expectations in short and long horizons. The “forward guidance” communication strategy represents a perfect example of such an “expectationalist” viewpoint of modern monetary policy (Woodford 2001).

In the last decade, only a few experimental papers study the properties of long-run expectations. Haruvy et al. (2007) is the first experimental contribution that elicits long-run expectations in a laboratory asset market with bubbles. A kind of natural experiment is conducted by Galati et al. (2011) who elicit short, medium, and long-run inflation expectations using professional forecasters from central banks, academics, and students. Colasante et al. (2018, 2019) are pioneering works in eliciting both short- and long-run expectations in LtFEs, where subjects make predictions about the price evolution for all the remaining periods. In their setting, long-run predictions do not directly influence price formation, which is solely determined by one-step-ahead predictions. In this respect, this experimental setting can be considered similar to a macroeconomic survey, since subjects do not know the true generating mechanism and they have to guesstimate the evolution of macroeconomic aggregates without having a significant impact on them. Colasante et al. (2019) observe that short-run predictions are strongly anchored to the market price and they exhibit low volatility with respect to the long-run ones. They measure the so-called term structure of cross-sectional dispersion of expectations, finding an increased level of disagreement of subjects’ expectations about price evolution. These results are in line with the main finding of Patton and Timmermann (2010); Andrade et al. (2016); Czudaj (2022) about the increasing forecast disagreement across horizons. Evans et al. (2019) reach a similar conclusion by considering a different theoretical framework, i.e., they consider the Lucas tree asset pricing model. Anufriev et al. (2022) implement a LtFE similar to Colasante et al. (2018) but they solely collect predictions for either one, two, or three horizons. In their setting predictions determine the market price independently of the forecast horizon. They observe that the longer is the horizon, the less likely is the emergence of bubbles.

Our paper contributes to two strands of literature. Firstly, it emphasizes the relevance of long-run expectations. Secondly, it contributes to the literature that uses experiments to analyze the formation of expectations in the presence of time-varying fundamental values. In the context of the latter, Colasante et al. (2017) check whether an adaptive expectation scheme could provide a good description of individual one-step-ahead predictions in an environment with increasing fundamental value. In a different framework, Noussair and Powell (2010) introduce a non-constant fundamental value (peak and valley) to understand how these different patterns may affect bubble formation in asset markets observing larger heterogeneity in recession phases (i.e., decreasing fundamental value). Bao et al. (2012) evaluate how short-run expectations behave in the presence of unexpected large shocks in the fundamental value.

This current paper aims to check whether small but systematic changes in the fundamental value impact the formation of expectations. Indeed, we evaluate whether minor variations that lead to marginal effects in the short-run predictions could result in significant changes in long-run predictions. Inspired by the results of Patton and Timmermann (2010) about the dependence of the degree of expectations disagreement on the phase of the business cycle, our design studies individual predictions when the fundamental value pattern follows a V-shape or an inverse V-shape, where the turning point is an unanticipated event. We also run a baseline treatment with a constant fundamental value and a treatment with a linearly increasing fundamental value. For each of the four patterns of the fundamentals, we consider positive and negative expectations feedback between one-step-ahead predictions and the market price.Footnote 1

We find that the stylized facts of LtFEs are robust against changes in the fundamentals: fast coordination of short-run expectations and slow convergence to the fundamentals in positive feedback markets; slow coordination of short-run expectations and good convergence to the fundamentals in negative feedback markets (Heemeijer et al. 2009). If we consider the curvature of the term structure, we observe that it depends on the expectation-feedback system, as well as the pattern of the fundamentals. We observe that differences between short- and long-run expectations persist even in markets with negative feedback, where short- and long-run predictions are fairly homogeneous. In other words, homogeneous predictions across subjects can be an apparent effect of a stable price history. The heterogeneity in how subjects form their expectations emerges clearly when an unexpected event happens.

The remainder of the paper is organized as follows. Section 2 describes the experimental design, and Sect. 3 develops reference conjectures to interpret the results. Section 4 presents the experimental results, followed by conclusions in Sect. 5.

2 Experimental setting

The experimental setting is based on Colasante et al. (2018) in which the subjects’ task is to forecast prices at different time horizons for 20 periods. We distinguish between short-run predictions, which are the subjects’ one-period-ahead predictions, and long-run predictions which include the predictions for longer horizons. At the beginning of period t, subject i submits his/her short-run prediction for the market price at the end of period t as well as his/her long-run predictions for the price at the end of each one of the \(20-t\) remaining periods.Footnote 2 The market price depends exclusively and explicitly on the one-step-ahead predictions of the subjects and it is independent of the longer horizon predictions. Based on that difference, we decide to label the one-step-ahead predictions as short-run predictions, and for all the other predictions we employ the label “long-run” predictions.

The dependence of the market price on short-run predictions is a strong assumption of our experimental setting and it constitutes an important limitation. To justify our choice, we advocate that such a setting is simple to understand for the subjects, which is an essential feature of an experiment. Moreover, we can consider the long-run predictions as a kind of incentivized survey on the evolution of the market price. Despite its simplicity, our setting allows us to measure more precisely the disagreement of subjects’ expectations as compared to other LtFEs focusing exclusively on one-step-ahead predictions. For example, a very low dispersion in the subjects’ short-run predictions and a contemporaneous greater dispersion in their long-run predictions indicate that the subjects’ disagreement is significantly stronger, as compared to a situation in which only the short-run predictions had been considered in computing the level of disagreement. Our current setting can be considered as an intermediate step between the original LtFEs settings and the more complex feedback price expectations involving a wider spectrum of predictions.

2.1 Treatments

We implement eight treatments differing in the evolution of the fundamental value and the expectation-feedback system. For the Baseline treatment (B), the fundamental value is constant, whereas for the other treatments, it follows a time-varying pattern. In the Increasing treatment (I), the fundamental value rises linearly during the 20 periods. In the Peak (P) and the Trough (T) treatments the fundamental value follows either an inverse V-shaped or V-shaped trajectory. The total number of periods is divided into two phasesFootnote 3: periods 1-10 and 11-20 with a turning point at period 10. In the P(T) treatment the fundamental value linearly increases (decreases) until period 10, while it linearly decreases (increases) afterward. For each different pattern of the fundamental value, we consider both positive and negative feedback treatments to evaluate the effect of the feedback system on expectation formation. The feedback system is labeled by the subscript \({}_P\) for the positive and \({}_N\) for the negative system. We end up with the following eight treatments: \(B_P\) (\(B_N\)) baseline with positive (negative) feedback, \(I_P\) (\(I_N\)) increasing with positive (negative) feedback, \(P_P\) (\(P_N\)) peak with positive (negative) feedback, \(T_P\) (\(T_N\)) trough with positive (negative) feedback.

2.2 Information

Subjects receive qualitative information about the implemented feedback system, i.e., whether it presents a positive or negative relationship between subjects’ one-step-ahead predictions and the market price. They are informed that, in both feedback markets, the demand/supply of the asset or the good changes exogenously in each period (except in the baseline treatment where the fundamental value is constant). Subjects do not know the fundamental value nor the magnitude of its changes. They are shown on their screen the history of market price and their short-run and long-run past predictions. Subjects are also informed that the market price depends just on their one-step-ahead predictions. Besides this information, they can follow their payoff relative to each period and the cumulative gains. In Appendix B.1, one can find the translated version of the instructions and the computer screen that subjects see during the experiment (Fig. 10).

2.3 Procedures

The experimental sessions were conducted in the Laboratory of Experimental Economics at the Jaume I University in October 2020 and April 2021. We recruited 336 students who participated in eight experimental treatments. Most subjects were at least second-year economics, business, and engineering students. Each student only participated in one session.

In each session, subjects were randomly divided into 6-player markets that remained fixed throughout the session, creating independent markets. We have seven independent markets per treatment with a total of 20 periods per market. At the beginning of the session, subjects had printed copies of the instructions on their tables. After giving the subjects time to read the instructions, the experimenter explained the instructions aloud. All subjects’ questions were addressed privately by the experimenter. Sessions were programmed with the z-Tree software (Fischbacher 2007). Each subject earned on average 20 euros, including a show-up fee, in approximately one hour.

2.4 Expectations feedback and the fundamental value

As in Heemeijer et al. (2009), we consider positive and negative expectation feedback between predictions and the market price, which is determined exclusively by short-run predictions. Indeed, the market price is a function of the average of the six one-step-ahead predictions submitted at the beginning of period t, defined as \(\overline{p}^e_{t} = \frac{1}{6}\sum _{i=1}^6 {}_ip^e_{t,t} ,\) where \({}_ip^e_{t,t}\) stands for the expected price of subject i at the beginning of period t about the market price at the end of period t.

Following Heemeijer et al. (2009), the market price in period t depends positively on the average short-run predictions as described in the following equation:

According to this specification, the higher the individual predictions, the higher the market price. For negative feedback markets,Footnote 4 the market price in period t depends negatively on the average short-run price predictions so that, the higher the predictions, the lower the market price:

The term \(\varepsilon _t \sim N(0,0.25)\) is a small iid random shock following a normal distribution with zero mean that can be interpreted as accounting for small fluctuations of supply or demand due to exogenous motives.Footnote 5

The fundamental value may change over time depending on the treatment. In the \(I_P\) and \(I_N\) treatments, the variation of the value in each period is equal to \(\Delta f=0.6\). In the \(P_P\) and \(P_N\) treatments, the fundamental value increases as in the I treatments up to period 10 and then decreases following the same variation, i.e., \(\Delta f=0.6 \text { when } 1<t \le 10\), and \(\Delta f=-0.6 \text { when } 11 \le t \le 20\). Finally, in the \(T_P\) and \(T_N\) treatments, the fundamental value decreases in the first ten periods and then increases until the end of the market, that is \(\Delta f=-0.6 \text { when } 1<t \le 10\), and \(\Delta f=0.6 \text { when } 11 \le t \le 20\). The value \(\Delta f =0.6\) is chosen to be roughly of the same magnitude as the average of the absolute price change using the data from Colasante et al. (2019). Therefore, the systematic change of the fundamental value is hidden by the price fluctuations, so that, the signal-to-noise ratio is approximately equal to 1 in both, the positive as well as the negative feedback markets. Figure 1 summarizes the trajectories of the fundamental value in the different treatments.

Time evolution of fundamental value for each treatment. Without considering the feedback system, B corresponds to the baseline treatment with a constant fundamental value; I refers to the increasing treatments with a linear increasing fundamental value; P corresponds to the peak treatments in which the fundamental value firstly increases and then decreases; T refers to the trough treatments in which the fundamental value falls and then rises

2.5 Earnings

The subject’s earnings per period depend on the quadratic error of her short- and long-run predictions. We employ two different payment schedules to compute her short- or long-run earnings. Subject’s earnings from the short-run predictions (\(\pi ^s_{it}\)) are computed as:

The earnings of subject i from her long-run predictions at time t is \(\pi ^l_{it}=\sum _{j=1}^{t-1}{}_i\pi ^{l}_{t-j,t}\), where \({}_i\pi ^{l}_{t-j,t}\) represents the earnings based on the prediction \({}_ip^{e}_{t-j,t}\) done by the subject in period t-j about the future realization of market price in period t, with \(1 \le t \le 20-t\). The subject’s individual long-run prediction earnings are computed as:

Given the high level of uncertainty, it is a more difficult task to predict the evolution of the market price in the long run than in the short run. Therefore, the hyperbolic decay in the case of long-run predictions is milder than the short-run prediction – note the scaling factor 7 in the quadratic term in Eq. (4) as compared to the scaling factor 2 in the quadratic term in Eq. (3). Additionally, we calibrate the parameters for both equations in order to provide similar incentives for short- as well as long-run predictions. Essentially, the value 27 in Eq. (4) is computed using the constraint \(\max \sum _{t=1}^{20} \pi ^{l}_{it} = \max \sum _{t=1}^{20} \pi ^{s}_{it}\), for each i. In other words, if a subject predicted correctly the market price in all periods and for all horizons, she would earn the same amount of ECUs from her short- as well as long-run predictions.Footnote 6 Note that, while subjects receive immediate feedback on the forecasting errors of their short-run predictions, they experience some delay in evaluating the accuracy of their long-run predictions. Thus, we provide them with the Earnings Table to facilitate the evaluation of their long-run forecasting accuracy (see Table 3 in the Appendix). The individual earnings per period are \(\pi _{it}=\pi ^s_{it}+\pi ^l_{it}\). A subject’s total earnings are the sum of earnings across all periods, i.e., \(\Pi _{i}=\sum _{t=1}^{20}\pi _{it}\).

3 Conjectures

According to the rational expectations equilibrium, subjects should behave similarly in all treatments. Within this benchmark, the predictions of subjects closely coordinate around and converge to the time-varying fundamental value, regardless of the horizon and the expectation feedback system, i.e., \({}_ip_{t,t+k}^e \approx f_t\), and \(p_t\approx f_t\).

3.1 Coordination and convergence of predictions

The coordination of subjects’ predictions is traditionally measured by the standard deviation of their short-run predictions at a given period, \(\sqrt{Var[_ip^e_{t,t}]}\). In other words, the smaller the dispersion of the predictions, the higher the level of coordination. The convergence measures the alignment of subjects’ predictions and the market price to the fundamentals. As a measure of convergence, we can use, for instance, the mean absolute deviation of market price from \(f_t\).

The literature shows that the level of coordination and convergence of subjects’ predictions crucially depends on the feedback system. In particular, Heemeijer et al. (2009) show that short-run predictions quickly coordinate in a positive feedback system, while they need more time in a negative feedback system. Regarding price convergence, they observe significant and persistent price deviations from the fundamental value in the positive feedback system, while prices quickly converge to the fundamentals in the negative feedback system. Colasante et al. (2019) extend these results considering a larger time spectrum of expectations. They report that, in the positive feedback, prices and predictions (short- and long-run) slowly converge to the fundamental value. However, short- and long-run predictions widely differ in their degree of coordination.Footnote 7 Whereas subjects quickly coordinate their short-run predictions on the market price, they strongly disagree on their predictions on the future price trajectory. This result suggests that subjects’ disagreement markedly increases with the horizon. Conversely, in the negative feedback system, they report a strong connection between coordination and convergence: once the market price converges to the fundamental value, there is simultaneous coordination of short- and long-run predictions. In this case, the subjects’ disagreement mildly depends on the horizon.

Taking stock of the known experimental findings, we expect a qualitatively similar behavior in the evolution of the level of coordination and convergence of short-run predictions as compared to the results reported in the literature with constant fundamentals. Essentially, the small change in the fundamental value (\(\Delta f/f \approx \pm 1\%\) per period depending on the treatment) does not affect the properties of coordination and convergence of short-run predictions. Since the price depends on the short-run predictions, we expect the properties of the price pattern to be in line with the literature (Heemeijer et al. 2009). Therefore, our conjectures are:

Conjecture 1

Short-run predictions coordinate faster in the positive feedback system than in the negative feedback system, independently of the trajectory of the fundamentals.

Conjecture 2

Market prices converge to the fundamentals slower in the positive feedback system than in the negative feedback system, regardless of the evolution of the fundamental value.

Considering the extrapolative component in the formation of expectations (see, for instance, Colasante et al. 2019), in those treatments with time-varying fundamentals, the variability of fundamentals will amplify the heterogeneity of predictions. Hence, we conjecture that long-run predictions exhibit a higher heterogeneity with respect to short-run predictions, when compared to the benchmark treatment with constant fundamentals. Put differently, the increasing or decreasing fundamentals enlarge the disagreement of subjects predictions as a function of the time horizon.

Conjecture 3

Long-run predictions exhibit higher cross-sectional standard deviations with time-varying fundamentals with respect to short-run predictions, independently of the feedback system.

3.2 The term structure of cross-sectional dispersion of predictions

The understanding of the origin of heterogeneity in the subjects’ expectations is of crucial importance to model the mechanism of expectation formation. Our experiment allows us to precisely measure the level of subjects’ disagreement and its evolution over time and horizons. As a proxy for the level of disagreement among subjects, we consider the standard deviation of their predictions at different horizons. Following the analysis of Patton and Timmermann (2010), we introduce the term structure of subjects’ predictions to study the characteristics of the disagreement among subjects. The analysis of the term structure allows us to identify possible expectations formation rules. If we measure just one-step-ahead predictions, the presence of a small variance of short-run predictions can be interpreted as a direct consequence of a high level of agreement in the subjects’ future view of the price evolution. In other words, higher levels of coordination of short-run predictions imply homogeneous expectations. Even though short-run predictions might exhibit a low dispersion, if the variance of long-run predictions increases with the forecasting horizon, subjects’ expectations cannot be considered homogeneous. We can therefore infer that the subjects’ expectations are much more heterogeneous than they would be if evaluated considering only short-run predictions. In this sense, the term structure of subjects’ disagreement constitutes a more comprehensive measure of the heterogeneity of subjects’ expectations.

In the following, we propose three benchmarks of the term structure of subjects’ disagreement for the negative and positive feedback system. Starting from the previous contribution of Colasante et al. (2019), we assume that subjects anchor their long-run predictions to the last realized market price and linearly extrapolate the past price variations.Footnote 8 As typically detected in the literature, subjects are backward-looking in forming their expectations. Therefore, let us introduce the idea that the longer the forecasting horizon, the longer the past price history included in the formation of subjects’ expectations. In particular, we consider the linear extrapolation forecasting rule, where the extrapolation coefficient is the average of the past h price increments, where h stands for the price “history”. The parameter h depends on the subject, i.e., \({}_ih\). Formally, the expectations formation rule is given by:

where k is the forecast horizon. Note that the estimated price trend can be decomposed as follows:

Equation (5) implies that the expected price k periods ahead is linearly proportional to the average price variations \({}_ih\) periods in the past. In principle, k and \({}_ih\) do not have to be strictly proportional at the individual level. We might have a particular subject predicting far in future, looking at a few steps backward, and vice-versa. However, if we consider the entire population, we think it is plausible that the two-time scales, namely k and the average \({}_ih\), are somewhat proportional to each other. Given Eq. (5), we can compute the variance of subjects’ predictions and, therefore, propose some benchmarks for the term structure under the positive and negative expectation feedback. In Appendix A, we develop three benchmarks: two related to the negative feedback and one to the positive feedback. Based on the idea that to forecast further in future subjects consider longer price history, we can show that the strong convergence of the market price to the fundamentals in the negative feedback translates into a low dispersion of the subjects’ predictions. The term structure turns out to be either linearly increasing or flat. In the case of positive feedback, instead, the high volatility of prices and their poor convergence to the fundamentals lead to a quadratic term structure of variance predictions. In Appendix A, we further compute how an unexpected change in the slope of the fundamentals affects the shape of the term structure. In the negative feedback system, the shape parameter of the term structure after the turning point changes from flat or linear to quadratic. In the positive feedback system, instead, the benchmark predicts an essentially unchanged term structure that remains convex. We can quantitatively measure the shape of the term structure employing the following scaling law:

where the shape parameter \(\alpha\) measures the level of disagreement on the future evolution of prices as a function of the forecast horizon. Given the variance of short-run predictions, \(\alpha =0\) implies that the disagreement is independent of the forecast horizon, i.e., rather homogeneous expectations. \(\alpha <0\) implies that the disagreement about future prices decreases as the forecast horizon grows until dispersion vanishes. Conversely, \(\alpha >0\) implies that disagreement increases with the forecast horizon. For values \(0<\alpha <1\) the term structure is concave, indicating a medium forecast disagreement. When \(\alpha =1\), the scaling is linear. For values \(\alpha >1\) the term structure is convex, implying a strong forecast disagreement.

Colasante et al. (2019) compare the term structure between the two feedback systems in an experiment with constant fundamental value. They observe a high level of disagreement in positive feedback markets, reporting a value \(\alpha >1\). By contrast, the level of disagreement is lower in negative feedback markets, with an estimated range of \(0<\alpha <1\). They argue that the faster and more stable convergence to the fundamental value in the negative feedback markets leads to a higher level of agreement among subjects on price evolution.

Based on the term structure benchmarks, we guesstimate the expected range for the value of \(\alpha\) for each treatment (see Table 1). In positive feedback markets, we conjecture that the term structure is convex (note that the benchmark predicts \(\alpha =2\)). This is essentially due to the linear extrapolation of the recent past history (see Appendix A). In the negative feedback markets, we predict a concave term structure (note that the two proposed benchmarks predict either \(\alpha =0\) or \(\alpha =1\)). The convergence to the fundamentals provides the subjects with a much stronger anchor to their predictions, reducing the disagreement on the expected price pattern.

Conjecture 4

The curvature of the term structure depends on the feedback system: convex for the positive feedback markets and concave for the negative feedback markets.

Furthermore, our experimental setting allows us to analyze the impact of an unanticipated change in the slope of the fundamentals on the level of disagreement. Taking stock of the predictions of the benchmarks reported in Appendix A, we expect an increase in the value of the shape parameter after the turning point. The magnitude of such increment depends on the subjects’ heterogeneity the considered past history when forming their expectations, namely the between-subject variability of the individual parameter \({}_ih\). Table 1 displays the expected range of variability for the shape parameter of the term structure after the turning point.

Conjecture 5

The curvature of the term structure is affected by a change in the slope of the fundamentals in the negative feedback system, changing from concave to convex. In a positive feedback system the convex curvature of the term structure remains essentially unaffected.

4 Results

4.1 Coordination and convergence of short-run predictions and prices

Figures 2 and 3 plot the realized market price for each of the seven markets in each treatment in positive and negative feedback systems, respectively.

The observed patterns are in line with previous contributions (Heemeijer et al. 2009) and Colasante et al. (2018): (i) prices tend to deviate from the fundamental value in positive feedback markets whereas quickly converge to the fundamentals in negative feedback markets; (ii) the rational expectation equilibrium better accounts for the behavior in negative feedback markets than in positive feedback markets; (iii) no significant differences among treatments within a given feedback system emerge about the convergence of prices to the fundamentals.Footnote 9

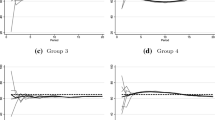

Figures 4 and 5 show the individual short-run predictions and the realized market price of one representative group per treatment in a positive and a negative feedback system, respectively.Footnote 10 In the positive feedback markets, Fig. 4 shows that individual predictions coordinate around the last realized price after a few periods in all treatments. On the contrary, in negative feedback markets, short-run predictions need approximately 10 periods to coordinate, as shown in Fig. 5. Even though we consider a time-varying fundamental value, results in terms of coordination of short-run predictions are in line with the existing literature (see Heemeijer et al. 2009; Colasante et al. 2018). Conjecture 1 and Conjecture 2 find support in the experimental evidence.

Realized price and individual short-run predictions of a representative group in each of the treatments with positive feedback. The black-solid line represents the realized market price, the gray lines represent individual one-step-ahead predictions and the dashed line represents the fundamental value

Realized price and individual short-run predictions of a representative group in each of the treatments with negative feedback. The black-solid line represents the realized market price, the gray lines represent individual one-step-ahead predictions and the dashed line represents the fundamental value

We illustrate the evolution of individual long-run predictions in one representative market for each treatment for positive and negative feedback systems (see Figs. 6 and 7, respectively). In positive feedback markets, a cone-shaped trajectory emerges, signaling the presence of a significant subjects’ disagreement about the future evolution of prices. In those markets, the persistent and systematic deviations from fundamentals, together with a linear extrapolation rule, prevent the subjects from providing long-run predictions close to the fundamentals. In fact, the dispersion in short- and long-run predictions does not show a notable increase in the proximity of the turning point of the fundamental value trajectory (i.e., period 11 in \(P_P\) and \(T_P\) treatments). In the negative feedback markets, Fig. 8, despite the convergence of short-run predictions to the fundamentals, we observe that long-run predictions are systematically more heterogeneous than short-run ones. Consistently with the main findings of Colasante et al. (2019), the cone-shaped trajectory is not observed in the negative feedback markets. Indeed, subjects replicate the market price shape drawing a hog cycle pattern in the initial periods, followed by a smoother pattern close to the fundamental value in the last periods. Comparing the results of all treatments, we conclude that having introduced time-varying fundamentals do not change the qualitative picture reported in Colasante et al. (2019) with constant fundamentals.

Realized price and individual long-run predictions of a representative market in each of the treatments with positive feedback. Dots represent the realized market price, the gray lines represent individual long-run predictions and the dashed line represents the fundamental value. From left to right, each column displays the baseline (\(B_P\)), the increasing (\(I_P\)), the peak (\(P_P\)), or the trough (\(T_P\)) in periods 2, 4, 8, and 16

Realized price and individual long-run predictions of a representative market in each of the treatments with negative feedback. Dots represent the realized market price, the gray lines represent individual long-run predictions and the dashed line represents the fundamental value. From left to right, each column displays either the baseline (\(B_N\)), the increasing (\(I_N\)), the peak (\(P_N\)), or the trough (\(T_N\)) in periods 2, 4, 8, and 16

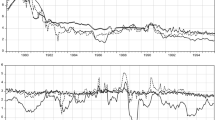

To evaluate Conjecture 3, we compute the standard deviation of both, one-step-ahead and five-step-ahead predictions to measure forecast disagreement. Figures 8 and 9 display the average standard deviation of the predictions for different horizons (one-step-ahead and five-step-ahead) in different markets. The first five and last five periods have been eliminated to avoid noise during the learning phase and ensure an equal number of observations in each horizon, respectively. Note that in period 15, the subject’s one-step-ahead prediction refers to the expected price for period 15 while the subject’s five-step-ahead prediction in period 15 refers to the expected price for period 20. In all but \(I_N\) treatments with time-varying fundamentals, we observe higher dispersion in the long-run predictions as compared to the short-run predictions, giving empirical support to Conjecture 3.

Standard deviation, averaged by markets, of both one- (gray-dashed line) and five-step-ahead predictions (dark-gray continuous line) for each of the treatments with positive feedback. The vertical line in the bottom panels is in correspondence with period 11. The panels display the Baseline (\(B_P\)), the increasing (\(I_P\)), the trough (\(T_P\)), and the peak (\(P_P\)) treatments, in a clockwise direction

Standard deviation, averaged by markets, of both one (gray-dashed line) and five-step-ahead predictions (dark-gray continuous line) for each of the treatments with negative feedback. The vertical line in the bottom panels is in correspondence with period 11. The panels display the Baseline (\(B_N\)), the increasing (\(I_N\)), the trough (\(T_N\)), and the peak (\(P_N\)) treatments, in a clockwise direction

4.2 The term structure of the cross-sectional dispersion of subjects’ predictions

Even though most of the contributions on LtFEs focus on short-run predictions, by collecting long-run predictions we could move forward in the analysis of the main properties of the term structure of expectations. To this aim, we estimate the value of \(\alpha\) for all treatments using a pooled panel regression of a log-linearization of Eq. (7) with normalized variances:

where g denotes the average across markets of a given treatment. The estimated values of the shape parameter \({\hat{\alpha }}\) for the different treatments are shown in Table 2. In particular, for treatments \(P_P\), \(P_N\), \(T_P\), and \(T_N\) the estimates \({\hat{\alpha }}\) refer to the periods before (i.e., from period 3 to period 10) and after (i.e., from period 11 to period 16) the turning point of the fundamental value.

The estimates are consistent with the expected ranges for the shape parameter based on Conjecture 4 (see Table 1) for treatments with positive feedback. In fact, we consistently observe a convex term structure for all the positive feedback treatments. Furthermore, as stated in Conjecture 5, in treatments \(P_P\) and \(T_P\), we do not observe a significant increase in \({\hat{\alpha }}\) after the unanticipated change of slope in the fundamentals.

Regarding the negative feedback markets, the estimates \({\hat{\alpha }}\) are consistent with a concave shape of the term structure, in line with Conjecture 4. Interestingly, in the negative feedback markets the change in the slope after period 10 does affect the curvature of the term structure. Indeed, in the \(P_N\) and \(T_N\) treatments, the term structure after the unanticipated change in the slope of the fundamentals becomes convex, signaling a more-than-linearly-increasing disagreement of long-run predictions. These results support Conjecture 5.

How can we interpret our results? Let us consider the simple expectation formation rule described by Eq. (5) and the corresponding benchmarks for positive and negative feedback systems. The convexity of the term structure for the positive feedback system stems from the high volatility of past price changes and the subjects’ heterogeneity in considering the past history of prices, leading to different estimates for the expected price trend. The combination of high volatility and heterogeneous trend estimates are the two main elements for the emergence of a remarkable level of disagreement in positive feedback markets. Moreover, the unanticipated change in the slope does not show a large impact on the time evolution of prices, given the low sensitivity of the market price to “small” changes in the slope of fundamentals. The shape of the term structure, therefore, is robust against smooth changes in the fundamentals. Note that the high level of coordination of short-run predictions is not an indication of homogeneous expectations. This apparent agreement of subjects on the future development of prices is an artifact of limiting the forecast horizon to one-step-ahead predictions.

The concavity of the term structure for the negative feedback system is a reflection of the rather stable price pattern and a stronger convergence of prices to the fundamentals. Even though subjects consider heterogeneous price histories (i.e., heterogeneous \({}_ih\) in Eq. (5)) when estimating the expected trend, their predictions reflect the stable past price fluctuations. Looking at a few steps backward or considering a longer price history leads to similar estimates for the expected price trend across subjects, hence to a concave term structure (see Eq. (A.1) in Appendix A). Such homogeneity of expectations is again apparent, similarly to the case of positive feedback markets. In fact, the unexpected change in the slope of the fundamentals and the consequent higher volatility are immediately reflected in a more heterogeneous price trend extrapolation across subjects, given the heterogeneityFootnote 11 in \({}_ih\). Therefore, the term structure significantly changes its shape, reflecting the variability of \({}_ih\) and the corresponding variability of the estimated trend across subjects.

The shape of the term structure is not robust even against small changes in the slope of the fundamentals in negative feedback markets. Note that, once again, an homogeneity in the predictions across horizons, characterized by a concave term structure, can be a misleading indicator of homogeneity of expectations across subjects. We show that the heterogeneity in subjects’ expectations is hidden by the homogeneity of price history and it strongly emerges after a small change in the slope of fundamentals. If we extended the number of periods in our experimental setting, we predict that, after the turning point, the term structure would return to a concave shape. However, the time needed will depend on the heterogeneity of the individual parameters \({}_ih\).

5 Conclusion

This paper evaluates the effects of time-varying fundamentals on subjects’ expectations in a LtFE. We simultaneously elicit a broad spectrum of expectations by asking subjects to submit their short- and long-run predictions on the future evolution of prices. Inspired by different macroeconomic scenarios, the fundamental value exhibits different patterns over time: (i) constant, (ii) linearly increasing, (iii) a V-shaped, or (iv) an inverse V-shaped. Changes in the fundamentals are smaller or comparable in magnitude with the price changes (unitary signal-to-noise ratio), and they are systematic for a vast number of periods. To a large extent, the small changes in fundamentals do not qualitatively impact short-run predictions, so we can study in isolation the modifications of the behavior of the subjects when forming long-run expectations.

Following the literature on macroeconomic surveys (Patton and Timmermann 2010), we analyze in detail the evolution of subjects’ expectations disagreement as a function of the forecasting horizon. We find that the empirical regularities of LtFEs are robust against changes in the fundamentals: fast coordination of short-run predictions and slow convergence to the fundamental value in positive feedback markets; slower coordination of expectations and a convergence to the fundamentals in negative feedback markets. The long-run predictions are characterized by a cone-shaped behavior in the positive feedback markets and smoother fluctuations around the fundamentals in the negative feedback markets. This different pattern of long-run expectations translates into a convex or concave term structure in the positive and negative feedback systems, respectively.

To interpret our results, we introduce an expectation formation rule assuming that subjects linearly extrapolate their short-run predictions to submit their long-run predictions. This rule is grounded on the principle that the longer the forecasting horizon, the more extensive the price history considered by the subjects. The backward-looking expectation formation rule, quite intuitively and seemingly obvious, implies that the features of long-run predictions mirror past price behavior. However, to accommodate the empirical observations, we must also consider that the extent of the price history used by subjects in forming their expectations is quite heterogeneous across individuals. In other words, if the individual history parameter would be homogeneous across subjects (i.e., \({}_ih=h\)), the expectations will be essentially homogeneous. Therefore, the contemporaneous presence of backward-looking subjects and the heterogeneous sensibility to price history are key elements to account for our experimental findings, especially if we focus attention on the evolution in the level of disagreement. In particular, we still observe a persistent heterogeneity in expectations in the negative feedback markets despite the price convergence to the fundamental value and the low disagreement in both, short and long-run predictions described by a concave term structure. In fact, after an unexpected and rather marginal shock, the heterogeneity of the expectations emerges again, leading to a high level of disagreement. The homogeneity in the predictions is merely an artifact of a “homogeneous” price history, which results in similar homogeneity in the predictions.

Overall, our setting clearly demonstrates to be a useful and flexible tool in eliciting expectations, complementing macroeconomic literature based on surveys about the origin of heterogeneity in expectations. As a matter of fact, the empirical data based on surveys show an increasing disagreement among respondents with the time horizon in several variables: interest rate (Andrade et al. 2016), exchange rate (ter Ellen et al. 2019) and price of oil (Czudaj 2022). Other macroeconomic variables, instead show a flat or a negative slope in inflation and GDP, respectively (Andrade et al. 2016). At the present stage, a systematic comparison between empirical data and experimental data proves challenging and provides limited practical implications. Future research will be devoted to evaluating the external validity of our setting. We will compare the properties of the short-and long-run subjects’ predictions generated in the laboratory with those measured in surveys, following the methodology of Cornand and Hubert (2020, 2022).

Notes

Subjects submit their prediction for period 1 only once, while they submit 20 predictions for period 20. For example, in period 2 they predict the price for periods 2, 3, 4, 5, and so on until period 20. When subjects enter period 3, they predict the price in periods 3, 4, 5, and the consecutive periods up to period 20. Finally, when subjects enter period 20, they only predict the price for period 20.

The choice is based on the constraint of having 20 periods. Setting the turning point in a later period would be detrimental to the statistical analysis of the post-shock dynamics. Similarly, selecting the turning point in earlier periods would lead to the same problem.

Henceforth, we will occasionally refer to the feedback system as the “feedback market” to facilitate smoother reading.

The number of short-run predictions is 20 and the long-run predictions are 189.

In the case of multiple horizon forecasts, the coordination of subjects’ predictions is measured by the standard deviation of their forecasts at a given period of time t and horizon k, \(\sqrt{Var[_ip^e_{t,t+k}]}\).

Following the literature, a more quantitative analysis has been performed in order to give a more firm base to the previous statements. Given that we essentially confirm known results, it is omitted in the paper (material upon request).

All the other groups show similar properties.

As an example, let us consider a subject who just takes into account the previous price change as a proxy for the future evolution of price k steps ahead. She will submit very different predictions than a subject considering a much longer price history.

The word “financial” refers to all markets in the positive feedback mechanism, while “goods” refers to the negative feedback markets.

References

Andrade P, Crump RK, Eusepi S, Moench E (2016) Fundamental disagreement. J Monet Econ 83:106–128

Anufriev M, Assenza T, Hommes C, Massaro D (2013) Interest rate rules and macroeconomic stability under heterogeneous expectations. Macroecon Dyn 17:1574–1604

Anufriev M, Chernulich A, Tuinstra J (2022) Asset price volatility and investment horizons: an experimental investigation. J Econ Behav Organ 193:19–48

Assenza T, Bao T, Hommes C, Massaro D (2014) Experiments on expectations in macroeconomics and finance. In: Experiments in Macroeconomics. Emerald Group Publishing Limited. volume 17, pp. 11–70

Assenza T, Heemeijer P, Hommes CH, Massaro D (2021) Managing self-organization of expectations through monetary policy: a macro experiment. J Monet Econ 117:170–186

Bachmann R, Topa G, van der Klaauw W (2023) Handbook of Economic Expectations. Academic Press

Bao T, Ding L (2016) Nonrecourse mortgage and housing price boom, bust, and rebound. Real Estate Econ 44:584–605

Bao T, Duffy J, Hommes C (2013) Learning, forecasting and optimizing: an experimental study. Eur Econ Rev 61:186–204

Bao T, Hommes C, Pei J (2021) Expectation formation in finance and macroeconomics: a review of new experimental evidence. J Behav Exp Financ 32:100591

Bao T, Hommes C, Sonnemans J, Tuinstra J (2012) Individual expectations, limited rationality and aggregate outcomes. J Econ Dyn Control 36:1101–1120

Barberis N, Shleifer A, Vishny R (1998) A model of investor sentiment. J Financ Econ 49:307–343

Colasante A, Alfarano S, Camacho E, Gallegati M (2018) Long-run expectations in a learning-to-forecast experiment. Appl Econ Lett 25:681–687

Colasante A, Alfarano S, Camacho-Cuena E (2019) The term structure of cross-sectional dispersion of expectations in a learning-to-forecast experiment. J Econ Interac Coord 14:491–520

Colasante A, Palestrini A, Russo A, Gallegati M (2017) Adaptive expectations versus rational expectations: evidence from the lab. Int J Forecast 33:988–1006

Cornand C, Hubert P (2020) On the external validity of experimental inflation forecasts: a comparison with five categories of field expectations. J Econ Dyn Control 110:103746

Cornand C, Hubert P (2022) Information frictions across various types of inflation expectations. Eur Econ Rev 146:104175

Cornand C, M’baye CK (2018) Does inflation targeting matter? an experimental investigation. Macroecon Dyn. 22:362–401

Czudaj RL (2022) Heterogeneity of beliefs and information rigidity in the crude oil market: evidence from survey data. Eur Econ Rev 143:104041

Evans GW, Hommes CH, McGough B, Salle I (2019) Are long-horizon expectations (de-) stabilizing? Theory and experiments. Techn Rep. Bank of Canada Staff Working Paper

Fischbacher U (2007) z-tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10:171–178

Galati G, Moessner R, Heemeijer P (2011) How do inflation expectations form? new insights from a high-frequency survey. New Insights from a High-Frequency Survey (2011)

Haruvy E, Lahav Y, Noussair CN (2007) Traders’ expectations in asset markets: experimental evidence. Am Econ Rev 97:1901–1920

Heemeijer P, Hommes C, Sonnemans J, Tuinstra J (2009) Price stability and volatility in markets with positive and negative expectations feedback: an experimental investigation. J Econ Dyn Control 33:1052–1072

Hirshleifer D (2001) Investor psychology and asset pricing. J Financ 56:1533–1597

Hommes C (2011) The heterogeneous expectations hypothesis: some evidence from the lab. J Econ Dyn Control 35:1–24

Hommes C (2013) Behavioral rationality and heterogeneous expectations in complex economic systems. Cambridge University Press

Hommes C, Sonnemans J, Tuinstra J, Van de Velden H (2005) Coordination of expectations in asset pricing experiments. The Review of Financial Studies 18:955–980

Hommes C, Sonnemans J, Tuinstra J, van de Velden H (2005) A strategy experiment in dynamic asset pricing. J Econ Dyn Control 29:823–843

Mankiw NG, Reis R, Wolfers J (2003) Disagreement about inflation expectations. NBER Macroecon Annu 18:209–248

Manski CF (2004) Measuring expectations. Econometrica 72:1329–1376

Manski CF (2018) Survey measurement of probabilistic macroeconomic expectations: progress and promise. NBER Macroecon Annu 32:411–471

Marimon R, Spear SE, Sunder S (1993) Expectationally driven market volatility: an experimental study. J Econ Theory 61:74–103

Muth JF (1961) Rational expectations and the theory of price movements. Econometrica, 315–335

Noussair CN, Powell O (2010) Peaks and valleys: price discovery in experimental asset markets with non-monotonic fundamentals. J Econ Stud

Patton AJ, Timmermann A (2010) Why do forecasters disagree? lessons from the term structure of cross-sectional dispersion. J Monet Econ 57:803–820

ter Ellen S, Verschoor WF, Zwinkels RC (2019) Agreeing on disagreement: heterogeneity or uncertainty? J Financ Markets 44:17–30

Woodford M (2001) Monetary policy in the information economy. Working Paper 8674. National Bureau of Economic Research

Acknowledgements

SA and ECC acknowledge the financial support of the Generalitat valenciana under the project AICO/2021/005, the Spanish Ministry of Science and Innovation under the project PID2022-136977NB-00 and the University Jaume I under the project UJI-B2021-66. ARB gratefully acknowledges the financial support of the Generalitat valenciana under the project CIGE/2022/132.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix A: Term structure benchmarks

This appendix describes the benchmarks for the term structure of the cross-sectional dispersion of predictions under the negative and positive feedback expectations mechanisms. In the following, we consider that the variation of the fundamental value is constant (Treatments B and I). Let us consider the following forecasting rule:

The expected value of the cross-sectional predictions as a function of the forecasting horizon is:

1.1 Appendix A.1: Negative feedback

According to the empirical evidence, the price converges “reasonably” well to the fundamental value f in negative feedback markets. To formalize this statement, we assume that:

where \(\varepsilon _t \sim {\mathcal {N}} (0,\sigma _\varepsilon ^2)\). The previous equation states that the average of the subjects’ estimated price variation is an unbiased estimator of the change in the fundamental value with an error inversely proportional to the forecasting horizon. In order to derive Eq. (A.3), we assume that the past market price increments are iid. Equation (A.3) stems from the assumption that subjects tend to consider a longer price history when they forecast far in future. Essentially, we assume that \({}_ih={}_i\lambda \cdot k\). The variable \(\lambda\) is a function of the parameters \({}_i\lambda\), which characterizes each subject. Given Eqs. (A.1) and (A.3), we can compute the variance of the expectations as a function of the forecasting horizon:

This benchmark applies to a linear term structure in the forecasting horizon for the negative feedback mechanism. This benchmark is valid when subjects are learning to coordinate their expectations around the fundamental value.

Following the previous reasoning, we propose an alternative benchmark for the case of a strong alignment of the short- as well as long-run expectations, and the market price to the fundamental value. In other words, this benchmark applies when subjects have already coordinated to the fundamental value. We can assume that:

which is independent of \({}_ih\). When subjects are strongly coordinated around the fundamental value, the estimated trend is robust to the price history they consider, since \(\Delta f\) is time invariant, being either 0 or 0.6 in treatments B and I, respectively. We can rewrite the expectations’ formation rule as:

where \({}_i\eta _{t}\) represents a small perturbation distributed as \({}_i\eta _{t} \sim {\mathcal {N}} (0,\sigma _\eta ^2)\). The resulting term structure is given by:

This benchmark leads to a flat term structure as a function of the forecasting horizon for the negative feedback mechanism. Note that we could also include an additive noise in Eq. (A.1) as done in Eq. (A.6), without significantly changing the result given by Eq. (A.4).

Let us now consider the previous benchmarks under treatments T and P. \(\Delta f\) is now time dependent and therefore Eqs. (A.3) and (A.5) do not hold anymore after the turning point of the fundamentals, since individual price history considered \({}_ih\) plays now a role. We define \({}_im\) the individual estimated price trend considering an individual price history \({}_ih\). Once the turning point of the fundamentals is reached, the estimated price trend \({}_im\) depends on the individual price history considered \({}_ih\): the longer the individual price history considered, the smaller will be the change of \({}_im\). Equation (A.6) must be rewritten as:

The resulting term structure will be:

According to the benchmark the term structure of predictions after the turning point of the fundamentals changes from constant or linear to quadratic.

1.2 Appendix A.2: Positive feedback

We now describe the case of the positive feedback mechanism. According to the empirical evidence from our experiment and the LtFEs literature, the price converges poorly to the fundamental value f in positive feedback markets. Instead, the market price exhibits large swings around f or even bubbles-and-crashes events. Consequently, the estimated trend is very heterogeneous across subjects, since it depends on their individual choice of \({}_ih\). The new benchmark expectation formation rule is:

where \({}_im\) is the individual coefficient of extrapolation:

Note the difference with respect to the negative feedback, where the estimated price trend is rather robust with respect to the choice of \({}_ih\) given the strong convergence to the fundamental value. In other words, given a much more volatile price pattern, the individual extrapolation coefficient \({}_im\) strongly depends on the individual past history \({}_ih\). From Eq. (A.10) we compute the variance of the individual expectations in a given market as a function of the forecasting horizon:

Posing \(k=0\), we have \(\text {Var}[{}_im]=\text {Var}[{}_ip^e_{t,t}]\), we arrive at:

This benchmark leads to a quadratic term structure in the forecasting horizon for the positive feedback mechanism. In the case of treatments T and P, because of the weak dependence of the price to changes in the fundamentals, the term structure of predictions is weakly affected by changes in the slope of the fundamentals. Put differently, the estimation of \({}_im\) would be hardly affected by the shock.

Appendix B: Instructions and screenshot

1.1 Appendix B.1: Translation of the instructions

1.1.1 General information

Welcome to the Laboratory of Experimental Economics. You are participating in an experiment in which you will take decisions in a financial (goods) market.Footnote 12 The instructions are very simple but, please, read them carefully. During the whole experiment you will play with experimental currency units (ECU) and, at the end of the experiment, your final profit, which will be added to a show-up fee of 3 euros, will be converted into euro according to the following exchange rate: 1 Euro = 500 ECU. The total amount will be paid at the end of the experiment in cash.

1.1.2 Only for positive feedback treatments

You are a financial advisor to a pension fund that wants to invest an amount of money. In each period, the pension fund has to choose between investing its money in a bank account and buying a risky asset that pays dividends. To take an optimal decision, the pension fund will decide how many assets to buy based on your price prediction. The market price will be determined by the demand for the asset. If the demand for the asset increases, the price will rise.

Consider that the market price is determined by the decisions of the pension funds (you are advising one of them). Higher price predictions raise the market demand for assets. As a consequence, the market price will rise. The asset price in each period is positively affected by the advisors’ predictions of the market price in that period.

The total demand is largely determined by the sum of the pension funds’ demand.

[For non-stationary treatments] Additionally, there are exogenous shocks every period that cause fluctuations in the supply or demand.

1.1.3 Only for negative feedback treatments

You are an advisor to an import firm. In each period, the manager of the firm decides how many units of this particular product she wants to buy or sell in the next period. To take an optimal decision, the manager needs a good prediction of the market price in the next period. The market price will be determined by the demand and supply of the product. If the demand for the product is higher than its supply, the price will rise. Conversely, if the supply of the product is higher than its demand, the price will fall.

Consider that the market price is determined by the decisions of the firms (you are advising one of them). Higher price predictions raise the quantity these firms will be willing to import of the product that will later come into the market, thereby increasing the market supply. As a consequence, the market price will fall. The price of the product in each period is negatively affected by the advisors’ predictions of the market price in that period.

The total demand and supply are largely determined by the sum of firms’ demand and supply (you are advising one of them).

[For non-stationary treatments] Additionally, there are exogenous shocks every period that cause fluctuations in the supply or demand (e.g., transportation delay).

1.1.4 General information

Your task is to predict the price for 20 periods. In each period (t) you will predict the price for all the remaining \(20-t\) periods, i.e., in period 1 you will submit 20 predictions starting from the prediction about the price at the end of period 1, in period 2 you will submit 19 predictions, and so on. Your predictions must be between 0 and 100 in the first two periods. In period 1 you will submit predictions without any information about the market. From period 2 onward, you will have the following information: a graph with both the time series of your past predictions and the time series of the market prices, all your past predictions, the earnings from the predictions you submit for the end of the period as well as the earning you get for the other predictions. In the graph, green dots represent the time series of your predictions for the end of the current period, while blue dots represent the market price. In the table, you can see the value for both the market price as well as of all your past predictions.

Once each subject has submitted his/her prediction for each period, the price will be computed according to the demand and the supply and it will be shown at the beginning of period 2. The same mechanism will be used for subsequent periods. This means that in period 3, for example, you will see the market price for both period 1 and period 2.

Your profit will depend on the accuracy of your predictions. The smaller the error of your forecasts (the distance between your prediction and the market price in a period), the greater the profit you will get. Your benefits will be calculated at the end of each period. Regarding the predictions you submit for the end of the period, in case you predict exactly the next period’s price your earning will be 250 ECU and in case your prediction error will be higher than 15 your earning will be less than 5 ECU. Moreover, for each prediction you submit for subsequent periods, you will receive an extra profit. This extra profit will be computed according to the following table (see Table 3):

1.2 Appendix B.2: The computer screen

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Alfarano, S., Camacho-Cuena, E., Colasante, A. et al. The effect of time-varying fundamentals in learning-to-forecast experiments. J Econ Interact Coord (2023). https://doi.org/10.1007/s11403-023-00397-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11403-023-00397-6

Keywords

- Long-run expectations

- Coordination

- Convergence

- Heterogeneous expectations

- Expectations feedback

- Experimental economics