Abstract

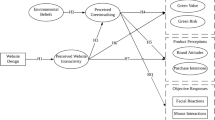

The growing concerns about global climate change have thrust green banking and green finance into the forefront of discussions. The research suggests that green banking plays a pivotal role in advancing environmental sustainability. This study focuses on examining the profound impact of green banking practices on the environmental performance of banks, with a specific focus on both private and public sector banks operating in India through a survey involving 500 bank employees the study employed partial least squares structural equation modelling (PLS-SEM). The findings highlight various aspects of green banking, encompassing employee-related practices, operational procedures, customer engagement, and policy adherence, and significantly contribute to the promotion of green finance, resulting in substantial positive effects. Moreover, the study underscores the substantial and positive influence of banks’ green financing on their environmental performance. Interestingly, the operational features of green banking practices emerged as having a notable impact on banks’ environmental performance, whereas aspects related to employees, policies, and customers did not directly and significantly influence environmental performance. The results of the study carry significant policy implications, especially for India’s banking sector, in the pursuit of environmental sustainability.

Similar content being viewed by others

Data availability

Not required.

Change history

03 March 2024

A Correction to this paper has been published: https://doi.org/10.1007/s11356-024-32772-6

References

Akter N, Siddik AB, Mondal MSA (2018) Sustainability reporting on green financing: a study of listed private sustainability reporting on green financing: a study of listed private commercial banks in Bangladesh. J Bus Technol XII:14–27

Alola AA, Ozturk I (2021) Mirroring risk to investment within the EKC hypothesis in the United States. J Environ Manag 293:112890. https://doi.org/10.1016/j.jenvman.2021.112890

Awang Z (2014) Research methodology and data analysis, 2nd edn. Universiti Teknologi Mara, UiTM Press, Selangor

Awawdeh AE, Ananzeh M, El-khateeb AI, Aljumah A (2022) Role of green financing and corporate social responsibility (CSR) in technological innovation and corporate environmental performance: a COVID-19 perspective. China Finance Rev Int 12(2):297–316. https://doi.org/10.1108/CFRI-03-2021-0048

Biswas D (2011) A study of conceptual framework on green banking. J Commer Manag Thought 7(1):39

Bose S, Khan H, Rashid A, Islam S (2018) What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pac J Manag 35:501–527. https://doi.org/10.1007/s10490-017-9528-x

Bose S, Khan HZ, Monem RM (2021) Does green banking performance pay off? Evidence from a unique regulatory setting in Bangladesh. Corp Governance: Int Rev 29:162–187. https://doi.org/10.1111/corg.12349

Chang N, Fong C (2010a) Green product quality, green corporate image, green customer satisfaction, and green customer loyalty. Afr J Bus Manag 4(13):2836–2844. https://doi.org/10.5897/AJBM.9000310

Chowdhury TU, Datta R, Mohajan HK (2013) Green finance is essential for economic development and sustainability. Int J Res Commer 3:104–108

Cohen J (2013) Statistical power analysis for the behavioral sciences. Academic press

Donaldson T, Dunfee T (2002) Ties that bind in business ethics: social contracts and why they matter. J Bank Finance 26(9):1853–1865

Evangelinos, K., Skouloudis, A., Nikolaou, I., & Filho, W. (2009). An analysis of corporate social responsibility (CSR) and sustainability reporting assessment in the Greek banking sector. In: Idowu S, Filho W, Professionals’ Perspectives of Corporate Social Responsibility. (2nd Ed.). Springer

Fornell C, Larcker DF (1981) Evaluating structural equation models with unobservable variables and measurement error. J Mark Res 18:39. https://doi.org/10.2307/3151312

Grove S, Fisk R, Pickett G, Kangun N (1996) Going green in the service sector. Eur J Mark 30(5):56–66

Guang-Wen Z, Siddik AB (2022) Do corporate social responsibility practices and green finance dimensions determine environmental performance? An empirical study on Bangladeshi banking institutions. Front Environ Sci 10. https://doi.org/10.3389/fenvs.2022.890096

Hair JF, Black WC, Babin BJ, Anderson RE (2010) Multivariate Data Analysis, 4th edn. Prentice Hall, Upper Saddle River, NJ, USA

Haque MS, Murtaz M (2018) Green Financing in Bangladesh. In: Jahur MS, Uddin SMS (eds) In Proceedings of the International Conference on Finance for Sustainable Growth and Development. Department of Finance, Faculty of Business Administration, University of Chittagong, Chittagong‐4331, Bangladesh, pp 82–89

Hartmann P, Apaolaza Ibáñez V, Forcada Sainz F (2005) Green branding effects on attitude: functional versus emotional positioning strategies. Mark Intell Plan 23(1):9–29 (Journal of Financial Services Marketing, 17(2), 177–186)

Hoque N, Mowla MM, Uddin MS, Mamun A, Uddin MR (2019) Green banking practices in Bangladesh: a critical investigation. Int J Econ Financ 11:58. https://doi.org/10.5539/ijef.v11n3p58

Hossain M (2018) Green finance in Bangladesh: policies, institutions, and challenges. ADBI Work Pap Ser 892:1–24

Huang C-C, Wang Y-M, Wu T-W, Wang P-A (2013) An empirical analysis of the antecedents and performance consequences of using the moodle platform. Int J Inf Educ Technol 3:217–221. https://doi.org/10.7763/ijiet.2013.v3.267

Indriastuti M, Chariri A (2021a) Social responsibility investment on sustainable the role of green investment and corporate social responsibility investment on sustainable performance. Cogent Bus Manag 8(1). https://doi.org/10.1080/23311975.2021.1960120

Indriastuti M, Chariri A (2021b) Social responsibility investment on sustainable the role of green investment and corporate social responsibility investment on sustainable performance. Cogent Bus Manag 8:8. https://doi.org/10.1080/23311975.2021.1960120

Islam MS, Das PC (2013) Green banking practices in Bangladesh. IOSR J Bus Manag 8:39–44. https://doi.org/10.9790/487x-0833944

Jha D, Bhoome S (2013) A study of green banking trends in India. Int Mon Ref J Res Manag Technol 127–132

Jha DN, Bhome S (2013) A study of green banking trends in India. Int Mon Ref J Res Manag Technol 2:127–132

Julia T, Kassim S, Julia T (2019) Exploring green banking performance of Islamic banks vs conventional banks in Bangladesh based on Maqasid Shariah framework. J Islam Mark 11:729–744. https://doi.org/10.1108/JIMA-10-2017-0105

Kärnä J, Hansen E, Juslin H (2003) Environmental activity and forest certification in marketing of forest products — a case study in Europe. Silva Fennica 37(2)

Khairunnessa F, Vazquez-Brust DA, Yakovleva N (2021) A Review of the Recent Developments of Green Banking in Bangladesh. Sustainability 13:1904

Khan_PhD MS, Khan I, Bhabha_PhD JI, Qureshi_PhD QA, Khan NAQR (2015) The Role of Financial institutions and the Economic Growth: A Literature Review. Indicator 7(1)

Kumar K, Prakash A (2018) Developing a framework for assessing sustainable banking performance of the Indian banking sector. Soc Responsib J 15(5):689–709. https://doi.org/10.1108/SRJ-07-2018-0162

Lalon RM (2015) Green banking: going green. Int J Econ Financ Manag Sci 3:34–42. https://doi.org/10.11648/j.ijefm.20150301.15

Lam LW (2012) Impact of competitiveness on salespeople’s commitment and performance. J Bus Res 65:1328–1334. https://doi.org/10.1016/j.jbusres.2011.10.026

Liu N, Liu C, Xia Y, Ren Y, Liang J (2020) Examining the coordination between green finance and green economy aiming for sustainable development: a case study of China. Sustainability 12:3717. https://doi.org/10.3390/su12093717

Lober DJ (1996) Evaluating the environmental performance of corporations. J Manag Issues 8:184

Lymperopoulos C, Chaniotakis I, Soureli M (2012) A model of green bank marketing. J Financ Serv Mark 17(2):177–186

Malsha KPPHGN, Anton Arulrajah A, Senthilnathan S (2020) Mediating role of employee green behaviour towards sustainability performance of banks. J Gov Regul 9:92–102. https://doi.org/10.22495/jgrv9i2art7

Masukujjaman M, Aktar S (2014) Green banking in Bangladesh: a commitment towards the global initiatives. J Bus Technol 8:17–40. https://doi.org/10.3329/jbt.v8i1-2.18284

Masukujjaman M, Siwar C, Mahmud MR, Alam SS (2017) Bankers’ perception of green banking: learning from the experience of Islamic banks in Bangladesh. Geografa-Malays J Soc Space 12(2)

Miah MD, Rahman SM, Haque M (2018) Factors affecting environmental performance: evidence from banking sector in Bangladesh. Int J Financ Serv Manag 9:22–38. https://doi.org/10.1504/ijfsm.2018.10011001

Mousa G, Hassan NT (2015) Legitimacy theory and environmental practices: short notes. Int J Bus Stat Anal 2:42–53

Narwal M (2007) CSR initiatives of Indian banking industry. Soc Responsib J 3(4):49–60

Nawaz MA, Seshadri U, Kumar P, Aqdas R, Patwary AK, Riaz M (2020) Nexus between green finance and climate change mitigation in N-11 and BRICS countries: empirical estimation through difference in differences (DID) approach. Environ Sci Pollut Res 28:6504–6519. https://doi.org/10.1007/s11356-020-10920-y

Ngwenya N, Simatele MD (2020) The emergence of green bonds as an integral component of climate finance in South Africa. S Afr J Sci 116:10–12. https://doi.org/10.17159/sajs.2020/6522

Nizam E, Ng A, Dewandaru G, Nagayev R, Nkoba MA (2019) The impact of social and environmental sustainability on financial performance: a global analysis of the banking sector. J Multinatl Financ Manag 49:35–53

Peattie K, Charter M (1994) Green marketing. In E. Baker, The marketing book (1st Ed.). Butterworth-Heinemann Ltd

Portney P (2008a) The (not so) new corporate social responsibility: an empirical perspective. Rev Environ Econ Policy 2(2):261–275

Portney P (2008b) The (not so) new corporate social responsibility: an empirical perspective. Rev Environ Econ Policy 2(2):261–275 (Return)

Prakash A, Kumar K, Srivastava A (2018) Consolidation in the Indian banking sector: evaluation of sustainable development readiness of the public sector banks in India. Int J Sustain Strateg Manag 6(1):3

Rai R, Kharel S, Devkota N, Paudel UR (2019) Customers perception on green banking practices: a desk review customers perception on green banking practices: a desk review. J Econ Concerns 10:83–95

Raihan MZ (2019) Sustainable finance for growth and development of banking industry in Bangladesh: an equity perspective. MIST J Sci Technol 7:41–51

Rajput D, Kaura M, Khanna M (2013) Indian banking sector towards a sustainable growth: a paradigm shift. Int J Acad Res Bus Soc Sci 3(1):2222–6990

Rehman A, Ullah I, Afridi F-A, Ullah Z, Zeeshan M, Hussain A, Rahman HU (2021) Adoption of green banking practices and environmental performance in Pakistan: a demonstration of structural equation modelling. Environ Dev Sustain 23:13200–13220. https://doi.org/10.1007/s10668-020-01206-x

Rifat A, Nisha N, Iqbal M, Suviitawat A (2016) The role of commercial banks in green banking adoption: a Bangladesh perspective. Int J Green Econ 10:226–251. https://doi.org/10.1504/IJGE.2016.081906

Risal N, Joshi SK (2018) Measuring green banking practices on bank’s environmental performance: empirical evidence from Kathmandu Valley. J Bus Soc Sci 2:44–56. https://doi.org/10.3126/jbss.v2i1.22827

Roca L, Searcy C (2012) An analysis of indicators disclosed in corporate sustainability reports. J Clean Prod 20(1):103–118

Sahoo P, Nayak B (2007) Green banking in India. Indian Econ J 55(3):82–98

Sarma P, Roy A (2020) A scientometric analysis of literature on green banking (1995–March 2019). J Sustain Financ Invest 11:1–20. https://doi.org/10.1080/20430795.2020.1711500

Scholtens B (2009) Corporate social responsibility in the international banking industry. J Bus Ethics 86:159–175. https://doi.org/10.1007/s10551-008-9841-x

Scholtens B (2011) Corporate social responsibility in the international insurance industry. Sustain Dev 19(2):143–156

Shaumya K, Arulrajah AA (2016) Measuring green banking practices: evidence from Sri Lanka. In Proceedings of the 13th International Conference on Business Management 2016, Colombo, Sri Lanka, 8, pp 1000–1023

Shaumya S, Arulrajah A (2017) The impact of green banking practices on bank’s environmental performance: evidence from Sri Lanka. J Financ Bank Manag 5:77–90. https://doi.org/10.15640/jfbm.v5n1a7

Srivastava A (2016) Green banking: support and challenges. Int Adv Res J Sci Eng Technol 3:135–137. https://doi.org/10.17148/IARJSET.2016.3528

Stone M (1974) Cross-validatory choice and assessment of statistical predictions. J R Stat Soc: Series B (Methodological) 36(2):111–133

Suchman MC (1995) Managing legitimacy: strategic and institutional approaches. Acad Manag Rev 20:571–610. https://doi.org/10.2307/258788

Tara K, Singh S (2014) Green banking: an approach towards environmental management. Prabandhan: Indian J Manag 7(11):7

Tu TTT, Dung NTP (2017) Factors affecting green banking practices: exploratory factor analysis on Vietnamese banks. J Econ Dev 24:4–30. https://doi.org/10.24311/jed/2017.24.2.05

Vidyakala K (2020) A study on the impact of green banking practices on bank’s environmental performance with special reference to Coimbatore City. Afr J Bus Econ Res 15:1–6. https://doi.org/10.31920/1750‐4562/2020/09/20n3a21

Wang Y, Zhi Q (2016) The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Procedia 104:311–316

Weber O, Chowdury RK (2020) Corporate sustainability in Bangladeshi banks: proactive or reactive ethical behavior? Sustainability 12:7999. https://doi.org/10.3390/su12197999

Weber O (2016) The sustainability performance of Chinese banks: institutional impact. SSRN Electro J

Xu H, Mei Q, Shahzad F, Liu S, Long X, Zhang J (2020) Untangling the impact of green finance on the enterprise green performance: a meta-analytic approach. Sustainability. 12. https://doi.org/10.3390/su12219085

Yadav R, Pathak GS (2013) Environmental sustainability through green banking: a study on private and public sector banks in India. OIDA Int J Sustain Dev 6:37–48

Zhang X, Wang Z, Zhong X, Yang S, Siddik AB (2022) Do Green Banking Activities Improve the Banks’ Environmental Performance? The Mediating Effect of Green Financing. Sustain 14:989. https://doi.org/10.3390/su14020989

Zheng G, Siddik AB, Masukujjaman M, Fatema N (2021a) Factors affecting the sustainability performance of financial institutions in Bangladesh: the role of green finance. Sustainability 13:165. https://doi.org/10.3390/su131810165

Zheng GW, Siddik AB, Masukujjaman M, Fatema N, Alam SS (2021b) Green finance development in Bangladesh: the role of private commercial banks (PCBs). Sustainability 13:795. https://doi.org/10.3390/su13020795

Zhixia C, Hossen MM, Muzafary SS, Begum M (2018) Green banking for environmental sustainability—present status and future agenda: experience from Bangladesh. Asian Econ Financ Rev 8:571–585. https://doi.org/10.18488/journal.aefr.2018.85.571.585

Zhou X, Tang X, Zhang R (2020) Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environ Sci Pollut Res 27:19915–19932. https://doi.org/10.1007/s11356-020-08383-2

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Rafia Gulzar, Ajaz Akber Mir, and Aijaz Ahmad Bhat performed material preparation, data collection, and analysis. The first draft of the manuscript was written by Aijaz Ahmad Bhat, Seyed Alireza Athari, Ahmad Samed Al-Adwan. All authors commented on previous versions of the manuscript. And all authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval

Not required.

Consent to participate

All authors participated in this research.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised: The corresponding Author incorrectly modified the 4th Author name to “Sayed Aalirez Athar” and deleted the affiliation. The correct name should be “Seyed Alireza Athari” and affiliated to “Department of Business Administration, Faculty of Economics and Administrative Sciences, Cyprus International University, Northern Cyprus, Turkey”

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Gulzar, R., Bhat, A.A., Mir, A.A. et al. Green banking practices and environmental performance: navigating sustainability in banks. Environ Sci Pollut Res 31, 23211–23226 (2024). https://doi.org/10.1007/s11356-024-32418-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-024-32418-7