Abstract

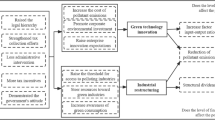

There is no conclusion on whether green development can symbiotically coexist with shared development, and the effect of environmental protection tax on labor share provides new evidence to answer this question. This paper presents a theoretical analysis of change in labor share in the exogenous impact of the enforcement of the Environmental Protection Tax Law of China, and proposes relevant hypotheses. At the same time, empirical data of listed firms on the main board from 2013 to 2019 are collected. A difference-in-differences model is constructed to test the hypotheses empirically. The study found that the reform of environmental protection fee to tax reduced the labor share of high-polluting firms by an average of about 1.43%. However, it did not significantly reduce the share of corporate executives’ income. The reform of environmental protection fee to tax reduces the labor share of high-polluting firms through the crowding-out effect and the substitution effect of production technology. The heterogeneity study revealed that the reform of environmental protection fee to tax has more substantial negative impacts on firms with high financing constraints, low market concerns, and low government subsidies. There is no significant difference between the impact on state-owned and private firms. The reform of environmental protection fee to tax has a more substantial negative impact on the firms in Central and Western China than those in more economically developed Eastern China.

Similar content being viewed by others

Data availability

The data presented in this study are available upon request from the first author.

Notes

OECD (2022), “Aggregate National Accounts, SNA 2008 (or SNA 1993): gross domestic product,” OECD National Accounts Statistics (database), https://doi.org/10.1787/data-00001-en.

The identification of high-polluting enterprises is mainly based on the Ministry of Environmental Protection’s 2008 “List of Listed Companies for Environmental Verification Industry Classification and Management” (Environmental Protection Office Letter 2008] No. 373) and the “Guidance on Environmental Information Disclosure for Listed Companies” (Environmental Protection Office Letter [2010] No. 78), which mainly includes 16 categories of industries including thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, chemical, petrochemical, building materials, paper, brewing, pharmaceutical, fermentation, textile, tannery, and mining.

References

Alexeev A, Good DH, Krutilla K (2016) Environmental taxation and the double dividend in decentralized jurisdictions. Ecol Econ 122:90–100. https://doi.org/10.1016/j.ecolecon.2015.12.004

Autor D, Dorn K, Lawrence F et al (2017) Concentrating on the fall of the labor share. Am Econ Rev. https://doi.org/10.1257/aer.p20171102

Barbera AJ, McConnell VD (1990) The impact of environmental regulations on industry productivity: direct and indirect effects. J Environ Econ Manag 18(1):50–65. https://doi.org/10.1016/0095-0696(90)90051-y

Berman E, Bui LT (2001) Environmental regulation and productivity: evidence from oil refineries. Rev Econ Stat 83(3):498–510. https://doi.org/10.3386/w6776

Bernauer T, Gampfer R, Meng T, Su YS (2016) Could more civil society involvement increase public support for climate policy-making? Evidence from a survey experiment in China. Glob Environ Chang 40:1–12. https://doi.org/10.1016/j.gloenvcha.2016.06.001

Bosquet B (2000) Environmental tax reform: does it work? A Survey of the Empirical Evidence 34(1):19–32. https://doi.org/10.1016/s0921-8009(00)00173-7

Brooks WJ, Kaboski JP, Li YA, Qian W (2021) Exploitation of labor? Classical monopsony power and labor’s share. J Dev Econ. https://doi.org/10.1016/j.jdeveco.2021.102627

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth: cash flow, external equity, and the 1990s R&D boom. J Financ 64(1):151–185. https://doi.org/10.2307/20487966

Brunnermeier SB, Cohen MA (2003) Determinants of environmental innovation in US manufacturing industries. J Environ Econ Manag 45(2):278–293. https://doi.org/10.1016/s0095-0696(02)00058-x

Carrión-Flores CE, Innes R (2010) Environmental innovation and environmental performance. J Environ Econ Manag 59(1):27–42. https://doi.org/10.1016/j.jeem.2009.05.003

Cole MA, Elliott RJ (2003) Determining the trade–environment composition effect: the role of capital, labor and environmental regulations. J Environ Econ Manag 46(3):363–383. https://doi.org/10.1016/s0095-0696(03)00021-4

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. Journal of Econ Lit 42(1):7–71. https://doi.org/10.1257/002205104773558047

Daudey E, Garca-Pealosa C (2007) The personal and the factor distributions of income in a cross-section of countries. J Dev Stud 43(5):812–829. https://doi.org/10.1080/00220380701384406

Decreuse B, Maarek P (2015) FDI and the labor share in developing countries: a theory and some evidence. Annals of Economics and Statistics/Annales d’Économie et de Statistique, (119/120), 289–319. https://doi.org/10.15609/annaeconstat2009.119-120.289

Ferjani A. (2011). Environmental regulation and productivity: a data envelopment analysis for Swiss dairy farms. Agricultural Economics Review, 12(389–2016–23439). https://doi.org/10.22004/ag.econ.178213

Gallaud D, Martin M, Reboud S, Tanguy C (2012) La relation entre innovation environnementale et réglementation: une application au secteur agroalimentaire français. Innovations 37:155–175. https://doi.org/10.3917/inno.037.0155

Graff Zivin J, Neidell M (2012) The impact of pollution on worker productivity. Am Econ Rev 102(7):3652–3673. https://doi.org/10.3386/w17004

Gray WB (1987) The Cost of regulation: OSHA, EPA and the productivity slowdown. Am Econ Rev 77(5):998–1006. https://doi.org/10.2307/1810223

Gray WB, Shadbegian RJ (2005) When and why do plants comply? Paper mills in the 1980s. Law & Policy 27(2):238–261. https://doi.org/10.1111/j.1467-9930.2005.00199.x

Hanna R, Oliva P (2015) The effect of pollution on labor supply: evidence from a natural experiment in Mexico City. J Public Econ 122:68–79. https://doi.org/10.1016/j.jpubeco.2014.10.004

Hung JH, Hammett P (2016) Globalization and the labor share in the United States. Eastern Econ J 42(2):193–214. https://doi.org/10.1057/eej.2014.50

Jorgenson DW, Wilcoxen PJ (1990) Environmental regulation and US economic growth. The Rand Journal of Economics, 314–340. https://doi.org/10.2307/2555426

Karabarbounis L, Neiman B (2014) The global decline of the labor share. Q J Econ 129(1):61–103. https://doi.org/10.1093/qje/qjt032

Kesidou E, Demirel P (2012) On the drivers of eco-innovations: empirical evidence from the UK. Res Policy 41(5):862–870. https://doi.org/10.1016/j.respol.2012.01.005

Maarek P, Orgiazzi E (2020) Development and the labor share. World Bank Economic Review, 34. https://doi.org/10.1093/WBER/LHY001

Mendieta-Muñoz I, Rada C, von Arnim R (2021) The decline of the US labor share across sectors. Rev Income and Wealth 67(3):732–758. https://doi.org/10.1111/roiw.12487

Murty MN, Kumar S (2003) Win-win opportunities and environmental regulation: testing of porter hypothesis for Indian manufacturing industries. J Environ Manage 67(2):139–144. https://doi.org/10.1016/s0301-4797(02)00203-7

Porter ME, van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspectives 9(4):97–118. https://doi.org/10.1257/jep.9.4.97

Thomas, Sterner (1994) Environmental tax reform: the Swedish experience. Eur Environ 4(6):20–25. https://doi.org/10.1002/eet.3320040606

Trevlopoulos NS, Tsalis TA, Evangelinos KI, Tsagarakis KP, Vatalis KI, Nikolaou IE (2021) The influence of environmental regulations on business innovation, intellectual capital, environmental and economic performance. Environ Syst Decisions 41(1):163–178. https://doi.org/10.1007/s10669-021-09802-6

Wagner M (2007) On the relationship between environmental management, environmental innovation and patenting: evidence from German manufacturing firms. Res Policy 36(10):1587–1602. https://doi.org/10.1016/j.respol.2007.08.004

Funding

This research was supported by the Scientific Research Fund of Hunan Provincial Education Department (Grant No. 20BJY039).

Author information

Authors and Affiliations

Contributions

Qian Xiao: writing—original draft, investigation, and methodology; Yaohui Jiang: writing—original draft, data curation and analysis, and validation; Rong Li: writing—reviewing and supervision; Sidi Xiao: writing—reviewing and editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Xiao, Q., Jiang, Y., Li, R. et al. Environmental protection tax and the labor income share of companies: evidence from a quasi-natural experiment in China. Environ Sci Pollut Res 30, 41820–41833 (2023). https://doi.org/10.1007/s11356-023-25239-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-25239-7