Abstract

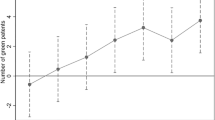

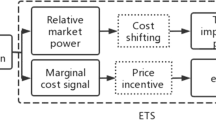

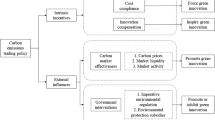

China’s carbon emission trading (CET) policy guides enterprises to carry out green innovation and address the growing environmental challenges through market-based instruments. However, can CET policy effectively promote enterprises’ green innovation? It has become a hot issue. Whether it can play the “Porter effect” is also controversial. We have little research on the effectiveness and heterogeneity of CET policy in China. We obtained the following conclusions from the empirical results: (1) CET policy has clearly promoted green innovation in enterprises, the proportion of green innovation of enterprises increased by 13.43%, and the “weak Porter hypothesis” was tenable. And the results of the research have been tested to be robust and reliable. (2) CET policy plays an obvious role in enhancing the enterprises’ green innovation with high-stock enterprise, large-scale enterprise, and state-owned enterprises. (3) Carbon quota auction does not motivate enterprises to improve green innovation; the CET policy under the ex-post allowance allocation of government can better inspire enterprises to undertake green innovation events. (4) The pilot policy of carbon emission trading can increase the introduction of scientific research talents, increase the expenditure of scientific research and development, and improve the net profit margin of enterprise assets, thus directly or indirectly promoting the development of green innovation of enterprises. Overall, the research in this article provides theoretical policy and empirical research for implementing carbon emission trading policy in developing countries and provides theoretical support for how to realize the “double dividend” of environmental protection and enterprises’ green innovation competitiveness. Meanwhile, it also provides reference for the national CET to be officially run, and it is instructive to establish a flexible market-based instruments.

Similar content being viewed by others

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Data sources: The Global Energy and Carbon Dioxide Status Report. https://www.iea.org/data-and-statistics/data-products.

Source: Carbon Trading Blue Book: China Carbon Trading Report (2017).

Data source: http://www.tanpaifang.com/tanpaimai/202008/1573279.html.

Data source: http://www.gov.cn/xinwen/2021-03/13/content_5592681.htm.

The market-based instruments (MBIs) include those instruments that motivate enterprises to reduce pollution emissions via market signals (Tang et al. 2016a, 2016c; Zhang and Jiang 2019), not mandatory restrictions.

Including electric power generation, steel manufacturing, petrochemicals, chemical products, construction and building, paper, non-ferrous metals and aerospace.

Data for the four provinces of Hong Kong, Macao, Taiwan, and Tibet are not included because of the difficulty of obtaining data.

China’s carbon trading policy officially began in 2013, and the sample interval selected for this paper is consistent with the principle of symmetry and has certain research significance.

The CET was issued in 2011; however, it has a lagging effect on the reduction of carbon emissions, and China’s carbon trading policy officially began in 2013; for the accuracy of the study results, we selected the year 2013.

In fact, compared with the green patent quantity, the ratio of green patents enables better reflect the relative importance of enterprises to green patents, and at the same time, other unobserved factors affecting innovation are effectively eliminated. Enterprise green innovation here is expressed quantitatively by the green patent application ratio (the sum of the green invention patent application ratio “Iapr” and the green utility model patent application ratio “Uapr”).

In this paper, the ratio of green invention patent applications (Iapr) and the ratio of green utility model patent applications (Uapr) are adopted from the scheme of BSE paper classification.

Source: http://www.tanpaifang.com. CET policy defines the emission threshold of enterprises and the punishment system faced by violations, allowing enterprises to buy and sell carbon quotas according to their own needs, which also leads to enterprises having to carry out green innovation, and then sell carbon quotas in the carbon trading market, so as to obtain profits.

References

Aiken LS, West SG (1991) Multiple regression: testing and interpreting interactions

Albrizio S, Kozluk T, Zipperer V (2017) Environmental policies and productivity growth: evidence across industries and firms. J Environ Econ Manag 81:209–226. https://doi.org/10.1016/j.jeem.2016.06.002

Barasa L, Knoben J, Vermeulen PA, Kimuyu P, Kinyanjui B (2017) Institutions, resources and innovation in East Africa: a firm level approach. Res Policy 46(1):280–291. https://doi.org/10.1016/j.respol.2016.11.008

Beck T, Levine R, Levkov A (2010) Big bad banks? The winners and losers from bank deregulation in the United States. J Financ 65(5):1637–1667

Blundell R, Griffith R, Van Reenen J (1995) Dynamic count data models of technological innovation. Econ J 105(3):333–344

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasinatural experiment in China. J Dev Econ 123:73–85. https://doi.org/10.1016/j.jdeveco.2016.08.003

Chang K, Chen R, Chevallier J (2018) Market fragmentation, liquidity measures and improvement perspectives from China’s emissions trading scheme pilots. Energy Econ 75:249–260. https://doi.org/10.1016/j.eneco.2018.07.010

Chen Z, Zhang X, Chen F (2021) Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol Forecast Soc Chang 168:120744. https://doi.org/10.1016/j.techfore.2021.120744

Clarke RA, Stavins RN, Greeno JL, Bavaria JL, Cairncross F, Esty DC, Smart B, Piet J, Wells RP, Gray R, Fischer K, Schot J (1994) The challenge of going green. Harv Bus Rev 72(4):37–48

Clarkson PM, Li Y, Richardson GD (2004) The market valuation of environmental capital expenditures by Pulp and Paper Companies. Account Rev 79(2):329–353

Cong RG, Wei YM (2010) Potential impact of (CET) carbon emissions trading on China’s power sector: a perspective from different allowance allocation options. Energy 35:3921–3931

Cramton P, Kerr S (2002) Tradeable carbon permit auctions. Energy Policy 30(4):333–345

Crepon B, Duguet M, Mairesse J (1998) Research, innovation, and productivity: an econometric analysis at the firm level. Econ Innov New Technol 7(2):115–158

Cui LB, Fan Y, Zhu L, Bi QH (2014) How will the emissions trading scheme save cost for achieving China’s 2020 carbon intensity reduction target? Appl Energy 136:1043–1052

Dachian S, Hai D, Ping W, Jianjiang L (2018) Can smart city construction reduce environmental pollution. China Indus Econ 06:117–135

Dahlmann F, Brammer S, Millington A (2008) Environmental management in the United Kingdom: new survey evidence. Management Decision 46(2):264–283

Dechezlepretre A, Einiö E, Martin R, Nguyen K-T, Reenen JV (2016) "Do tax incentives for research increase firm innovation? An RD design for R&D," LSE Research Online. London School of Economics and Political Science, LSE Library. Documents on Economics 66428

Dong F, Dai Y, Zhang S, Zhang X, Long R (2019) Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci Total Environ 653:565–577. https://doi.org/10.1016/j.scitotenv.2018.10.395

Fan Z, Zhao R (2019) Can rule of law reinforcement promote pollution governance? Evidence from the establishment of environmental courts. Econ Res 54(03):21–37

Gray WB, Shadbegian RJ (2003) Plant vintage, technology, and environmental regulation. J Environ Econ Manag 46(3):384–402. https://doi.org/10.1016/S0095-0696(03)00031-7

Han Y (2020) Impact of environmental regulation policy on environmental regulation level: a quasi-natural experiment based on carbon emission trading pilot. Environ Sci Pollut Res 27:23602–23615. https://doi.org/10.1007/s11356-020-08658-8

Hart S (1995) A natural-resource-based view of the firm. Acad Manag Rev 20(4):986–1014

Heyman F, Sjöholm F, Tingvall PG (2007) Is there really a foreign ownership wage premium? Evidence from matched employer employee data. J Int Econ 73(2):24–32

Hicks JR (1932) The Theory of Wages. Macmillan and Co.Limited

Hu Y, Ren S, Wang Y, Chen X (2020a) Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ 85:104590. https://doi.org/10.1016/j.eneco.2019.104590

Hu JF, Huang QH, Pan XX (2020b) Carbon emissions trading system and firm innovation quality: inhibiting or facilitating. China Popul Resour Environ 30(2):49–59

Hu J, Xinxin P, Qinghua H (2020c) Quantity or quality? The impacts of environmental regulation on firms’ innovation Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol Forecast Soc Chang 158:120122. https://doi.org/10.1016/j.techfore.2020.120122

Jia J, Zhang W (2014) Analysis of path dependence and environmental regulation impacts in green technology innovation. Science and Science and Technology Management 35 (05)

Johnstone N, Managi S, Rodriguez MC, Hascic I, Fujii H, Souchier M (2017) Environmental policy design, innovation and efficiency gains in electricity generation. Energy Econ 63:106–115. https://doi.org/10.1016/j.eneco.2017.01.014

Kettner C, Koppl A, Schleicher S, Thenius G (2008) Stringency and distribution in the EU emissions trading scheme: first evidence. Clim Policy 8(1):41–61. https://doi.org/10.3763/cpol.2007.0394

Kromer MA, Bandivadekar A, Evans C (2010) Long-term greenhouse gas emission and petroleum reduction goals: evolutionary pathways for the light-duty vehicle sector. Energy 35(1):387–397. https://doi.org/10.1016/j.energy.2009.10.006

Lee M (2011) Potential cost savings from internal/external CO2 emissions trading in the Korean electric power industry. Energy Policy 39(10):6162–6167

Lee KH, Min B (2015) Green R & D for eco-innovation and its impact on carbon emissions and firm performance. J Clean Prod 108:534–542. https://doi.org/10.1016/j.jclepro.2015.05.114

Levinson A (1996) Environmental regulations and manufacturers’ location choices: evidence from the Census of Manufactures. J Public Econ 62:5–29

Levinsohn J, Petrin A (2003) Estimating production functions using inputs to control for unobservables. Rev Econ Stud 70(2):317–342

Li W, Lu C (2015) The research on setting a unified interval of carbon price benchmark in the national carbon trading market of China. Appl Energy 155:728–739. https://doi.org/10.1016/j.apenergy.2015.06.018

Li D et al (2017) The Impact of the EU carbon trading system on emission control enterprises and implications. R & D Manag 29(06):91–98

Li WJ, Zheng M (2016) Substantive or strategic innovation-the impact of macro-industrial policies on micro-enterprise innovation. Econ Res 51(4):60–73

Li Y, Gao D, Wei P (2021) Can central environmental inspectors induce green innovation in enterprises? Studies in Science of Science 39(08): 1504–1516 https://doi.org/10.16192/j.cnki.1003-2053.20210202.004

Li G, Zhang W, Wang Y (2016) Foreign direct investment, environmental regulation and China Green technology innovation in China. Res Sci Technol Manag 36(13):227–231

Lin B, Jia Z (2019) Energy, economic and environmental impact of government fines in china's carbon trading scheme. Scie Total Environ 667:658–670

Liu Y, Zhang X (2017) Carbon emissions trading system and corporate R&D innovation-an empirical study based on triple difference model. Economic Science No. 3 in Chinese

Liu LW, Sun XR, Chen CX, Zhao E (2016) How will auctioning impact on the carbon emission abatement cost of electric power generation sector in China. Appl Energy 168:594–609. https://doi.org/10.1016/j.apenergy.2016.01.055

Lu H, Ma X, Huang K, Azimi M (2020) Carbon trading volume and price forecasting in China using multiple machine learning models. J Clean Prod 249:119386. https://doi.org/10.1016/j.jclepro.2019.119386

Luo S, He G (2022) Research on the influence of emission trading system on enterprises’ green technology innovation. Discret Dyn Nat Soc 9:1694001. https://doi.org/10.1155/2022/1694001

Magat WA (1978) Pollution control and technological advance: a dynamic model of the firm. J Environ Econ Manag 5(1):1–25

Marino M, Parrotta P, Valletta G (2019) Electricity (de) regulation and innovation. Res Policy 48(3):748–758. https://doi.org/10.1016/j.respol.2018.11.005

Montgomery WD (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5:395–418

Tang P, Jiang Q, Mi L (2021) One-vote veto: the threshold effect of environmental pollution in China’s economic promotion tournament. Ecol Econ 185:107069. https://doi.org/10.1016/j.ecolecon.2021.107069

Taylor KE, Stouffer RJ, Meehl GA (2012) An overview of cmip5 and the experiment design. Bull Am Meteorol 93(4):485–498

Popp D (2002) Induced innovation and energy prices. Am Econ Rev 92(1):160–180. https://doi.org/10.1257/000282802760015658

Popp D (2006) International innovation and diffusion of air pollution control technologies: the effects of NOX and SO2 regulation in the US, Japan and Germany. J Environ Econ Manag 51(1):46–71. https://doi.org/10.1016/j.jeem.2005.04.006

Qi S, Lin C, Cui J (2018) Can environmental equity trading market induce green innovation? Evidence based on data on green patents of listed companies in China. Econ Res 12 in Chinese

Ramanathan R, Ramanathan U, Bentley YM (2018) The debate on flexibility of environmental regulations, innovation capabilities and financial performance-a novel use of DEA. Omega-Int J Manag Sci 75:131–138. https://doi.org/10.1016/j.omega.2017.02.006

Rong Z, Wu XK, Boeing P (2017) The effect of institutional ownership on firm innovation: evidence from Chinese listed firms. Res Policy 46(9):1533–1551. https://doi.org/10.1016/j.respol.2017.05.013

Rubashkina Y, Galeotti M, Verdolini E (2015) Environmental regulation and competitiveness: empirical evidence on the Porter hypothesis from European manufacturing sectors. Energy Policy 83(288):300

Schumpeter JA, Schumpeter J, Schumpeter J, Schumpeter JP, Schumpeter JA, Schumpeter J et al (1934) The theory of economics development. J Polit Econ 1(2):170–172

Shen J, Tang P, Zeng H (2020) Does China’s carbon emission trading reduce carbon emissions? Evidence from listed firms. Energy Sustain Dev 59:120–129. https://doi.org/10.1016/j.esd.2020.09.007

Smulders S, Tsur Y, Zemel A (2012) Announcing climate policy: can a green paradox arise without scarcity? J Environ Econ Manag 64(3):364–376

Song ML, Wang SH, Sun J (2018) Environmental regulations, staff quality, green technology, R&D efficiency, and profit in manufacturing. Technol Forecast Soc Chang 133:1–14. https://doi.org/10.1016/j.techfore.2018.04.020

Su ZQ, Xiao ZP, Yu L (2018) Do political connections enhance or impede corporate innovation International. International Review of Economics and Finance, Elsevier. 63(C):94–110 https://doi.org/10.1016/j.iref.2018.08.012

Tang K, Hailu A (2020) Smallholder farms’ adaptation to the impacts of climate change: evidence from China’s Loess Plateau. Land Use Policy 91:104–353. https://doi.org/10.1016/j.landusepol.2019.104353

Tang L, Wu JQ, Yu L, Bao Q (2015) Carbon emissions trading scheme exploration in China: a multi-agent-based model. Energy Policy 81:152–169. https://doi.org/10.1016/j.enpol.2015.02.032

Tang PC, Yang SW, Shen J, Fu SK (2018a) Does China’s low-carbon pilot programme really take off? Evidence from land transfer of energy-intensive industry. Energy Policy 114:482–491

Tang P, Yang S, Boehe D (2018b) Ownership and corporate social performance in China: why geographic remoteness matters. J Clean Prod 197:1284–1295

Tang K, Hailu A, Yang Y (2020a) Agricultural chemical oxygen demand mitigation under various policies in China: a scenario analysis. J Clean Prod 250:119513. https://doi.org/10.1016/j.jclepro.2019.119513

Tang K, Liu Y, Zhou D, Qiu Y (2020b) Urban carbon emission intensity under emission trading system in a developing economy: evidence from 273 Chinese cities. Environ Sci Pollut Res 28:5168–5179. https://doi.org/10.1007/s11356-020-10785-1

Topalovap P (2010) Factor immobility and regional impacts of trade liberalization: evidence on poverty from India. Am Econ J: Appl Econ 2(4):1–41. https://doi.org/10.1257/app.2.4.1

Wang BB (2017) Review of environmental policy and technological innovation. Econ Rev 4:131–148

Wang Q, She S (2020) Assessment of green growth effects of low carbon pilot policies in China from the perspective of urban heterogeneity. Chin Soft Sci 34(9):1–8

Wang Y, Shen N (2016) Environmental regulation and environmental productivity: the case of China. Renew Sustain Energy Rev 62:758–766

Wang Q, Yang Z (2016) Industrial water pollution, water environment treatment, and health risks in China. Environ Pollut 218:358–365. https://doi.org/10.1016/j.envpol.2016.07.011

Wang P, Dai HC, Ren SY, Zhao DQ, Masui T (2015) Achieving Copenhagen target through carbon emission trading: economic impacts assessment in Guangdong Province of China. Energy 79:212–227. https://doi.org/10.1016/j.energy.2014.11.009

Wang W, Xie P, Wang W, Zhao D (2019) Overview and evaluation of the mitigation efficiency for China’s seven pilot ETS. Part A: Recovery, Utilization, and Environmental Effects. Energy Sources 1–15. https://doi.org/10.1080/15567036.2019.1646352

Weng Q, Xu H, Kazmerski L (2018) A review of China’s carbon trading market. Renew Sustain Energy Rev 91:613–619. https://doi.org/10.1016/j.rser.2018.04.026

Xiao R, Shen L, Qian L (2020) Study on the green innovation efficiency and its influencing factors of industrial enterprises in provinces along “the Belt and Road.” Soft Sci 34(8):37–43

Xin S, Shi ZS (2019) The impact of dual environmental regulations and government subsidies on firms’ innovation output and their regulation. China Popul Resour Environ 10(3):31–39

Yang P, Cui C, Li L, Chen W, Shi Y, Mi Z, Guan D (2020) Carbon emissions in countries that failed to ratify the intended nationally determined contributions: a case study of Kyrgyzstan. J Environ Manage 255:109–892. https://doi.org/10.1016/j.jenvman.2019.109892

Zang J, Wan L, Li Z, Wang C, Wang S (2020) Does emission trading scheme have spillover effect on industrial structure upgrading? Evidence from the EU based on a PSM-DID approach. Environ Sci Pollut Res 27:12345–12357

Zhang H (2014) The mystery of the “green paradox”: an interpretation from the perspective of local government competition. Financ Econ Res 12:114–127

Zhang Lu, Cuicui Cao, Fei Tang, Jiaxin He, Dayuan Li (2018) Does China’s emissions trading system foster corporate green innovation? Evidence from regulating listed companies. Technol Anal Strateg Manag 1–14. https://doi.org/10.1080/09537325.2018.1493189

Zhang YJ, Shi W, Jiang L (2019a) Does China’s carbon emissions trading policy improve the technology innovation of relevant enterprises? Bus Strateg Environ 29(3):872–885. https://doi.org/10.1002/bse.2404

Zhang L, Cao C, Tang F, He J, Li D (2019b) Does China’s emissions trading system foster corporate green innovation? Evidence from regulating listed companies. Tech Anal Strat Manag 31(2):199–212. https://doi.org/10.1080/09537325.2018.1493189

Zhang Q, Zheng Y, Kong D (2019c) Regional environmental governance pressure, executive experience and corporate investment in environmental protection-a quasi-natural experiment based on the Ambient Air Quality Standard ( 2012). Econ Res 6 in Chinese

Zhang W, Li J, Li G, Guo S (2020a) Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 196:117117. https://doi.org/10.1016/j.energy.2020.117117

Zhang YJ, Liang T, Jin YL, Shen B (2020b) The impact of carbon trading on economic output and carbon emissions reduction in China’s industrial sectors. Appl Energy 260:114290. https://doi.org/10.1016/j.apenergy.2019.114290

Zhao Y, Wang C, Sun Y, Liu X (2018) Factors influencing companies’ willingness to pay for carbon emissions: emission trading schemes in China. Energy Econ 75:357–367

Zhao X, Ma XW, Chen BY, Shang YP, Song ML (2022) Challenges toward carbon neutrality in China: strategies and countermeasures. Resources, conservation, and recycling 176:105959. https://doi.org/10.1016/j.resconrec.2021.105959

Zheng S, Kahn ME, Sun W (2014) Incentives for China’s urban mayors to mitigate pollution externalities: the role of the central government and public environmentalism. Reg Sci Urban Econ 47:61–71. https://doi.org/10.1016/j.regsciurbeco.2013.09.003

Zhou B, Zhang C, Song H, Wang Q (2019) How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci Total Environ 676:514–523

Zhou D, Liang X, Zhou Y, Tang K (2020) Does emission trading boost carbon productivity? Evidence from China’s pilot emission trading scheme. Int J Environ Res Public Health. https://doi.org/10.3390/ijerph17155522

Zhu L, Zhang XB, Li Y, Wang X, Guo JX (2017) Can an emission trading scheme promote the withdrawal of outdated capacity in energy-intensive sectors? A case study on China’s iron and steel industry. Energy Econ 63:332–347. https://doi.org/10.1016/j.eneco.2017.02.004

Zhu J, Fan Y, Deng X, Xue L (2019a) Low-carbon innovation induced by emissions trading in China. Nat Commun 10:4088. https://doi.org/10.1038/s41467-019-12213-6

Zhu J, Fan Y, Deng X, Xue L (2019b) Low-carbon innovation induced by emissions trading in China. Nat Commun 10(1):1–8

Acknowledgements

Thanks for the help of the editors, reviewers, and all the authors.

Funding

This study was funded by the National Natural Science Foundation of China (Young Scientists Fund Project: Grant No. 72004210). The research program and financial support provided by professor Shuwang Yang.

Author information

Authors and Affiliations

Contributions

Tingshuai Lu carried out scheme refinement, collected data, empirical analysis, the main author of the paper, and submitted the manuscript. Tiancheng Huang checked and reviewed the grammar of the paper. Chao Wang sorted out the format and data collection of the paper.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent for publication

Approve.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The double dividend refers to the good protection of ecological environment and the benign economic development.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yang, S., Lu, T., Huang, T. et al. Re-examining the effect of carbon emission trading policy on improving the green innovation of China’s enterprises. Environ Sci Pollut Res 30, 7696–7717 (2023). https://doi.org/10.1007/s11356-022-22621-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-22621-9