Abstract

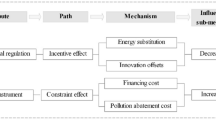

At present, China’s economy is transforming from rapid development to high-quality development, and the prominent problems in the industrial structure need to be resolved urgently. The implementation of the green credit policy restricts loans to industries with high energy consumption, high pollution, and overcapacity to prevent excessive expansion and consumption of resources, thereby achieving the goals of industrial restructuring and environmental protection. Technological innovation is an important means to cope with environmental changes and adjust the industrial structure. Can technological innovation under green credit achieve the upgrading of the industrial structure? This paper combines green credit, technological innovation, and industrial structure upgrading to conduct research, and theoretically analyzes the impact of green credit and technological innovation on industrial structure upgrading, and analyzes how green credit affects industrial structure upgrading through technological innovation. An empirical test using panel data from 30 provinces in China from 2005 to 2017 revealed that green credit can promote the upgrading of the industrial structure. Econometric analysis based on the mediation effect model found that green credit not only directly promotes the upgrading of the industrial structure, but also has the mediation effect that affects the upgrading of the industrial structure through technological innovation. In the sub-regional regression analysis, technological innovation affects the upgrading of the industrial structure. The mediation effect is still significant. Based on the research in this article, it is recommended to actively implement green credit policies, expand the scale of green credit, firmly implement the innovation-driven development strategy, and at the same time vigorously develop clean energy and reduce energy consumption. The research significance of the article is to explore the impact of green credit on industrial structure upgrading, which has implications for the implementation and promotion of subsequent green credit policies. At the same time, it enriches the research on green credit.

Similar content being viewed by others

Data availability

The datasets used and analyzed during the current study are available from the corresponding author on reasonable request.

References

Acemoglu D, Akcigit U, Hanley D (2016) Transition to clean technology. J Polit Econ 124(1):52–104

Aghion P, Dechezleprêtre A, Hemous D (2016) Carbon taxes, path dependency, and directed technical change: Evidence from the auto industry. J Polit Econ 124(1):1–51

Anderson J (2016) Environmental finance. In: Ramiah V, Gregoriou GN (eds) Handbook of environmental and sustainable finance. Elsevier Inc., Amsterdam

Ayyagari M, Demirgüç-Kunt A, Maksimovic V (2011) Firm innovation in emerging markets: The role of finance, governance, and competition. J Financ Quant Anal 46(6):1545–1580

Bougheas S (2004) Internal vs external financing of R&D. Small Bus Econ 22(1):11–17

Cai HJ, Wang XY, Tan C (2019) Green credit policy, incremental bank loans and environmental protection effect. Account Res 03:88–95

Chava S, Oettl A, Subramanian A (2013) Banking deregulation and innovation. J Financ Econ 109(3):759–774

Chen Y (2008) Green credit promotes sustainable economic and social development. China National Conditions and Strength 5:19–21

Ding N, Ren YN, Zuo Y (2020) Do the losses of the green credit policy outweigh the gains? —— a PSM -DID cost-efficiency analysis based on resource allocation. J Financ Res 04:112–130

Ding P, Jin WH, Chen N (2021) Green financial development, industrial structure upgrading and sustainable economic growth. South China Finan 02:13–24

Dong CR, Shao YY (2020) The driving effect of enterprise science and technology innovation on industrial structure upgrading ——an empirical analysis based on Shandong Province. Journal of the University of Jinan (Social Science Edition) 30(06):125–135+159–160

Feng Z, Cheng SN, Jian S (2021) Influence of industrial structure adjustment on high-quality economic development in China. J Nanjing Univ Finan Econ 04:1–12

Fu H, Mao YS, Song LS (2013) Empirical analysis on the effect of innovation on advancement of industrial structure process——based on panel datas of provinces from 2000 to 2011. China Ind Econ 09:56–68

Gan CH, Zheng RG, Yu DF (2011) An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ Res J 46(05):4–16+31

Gao JJ, Zhang WW (2021) Research on the impact of green finance on the ecologicalization of China’s industrial structure ——empirical test based on system GMM model. Econ Rev J 02:105–115

Gu AL, He CK, Lv ZQ (2016) Industrial structure changes impacts on carbon emissions in China based on LMDI method. Resour Sci 38(10):1861–1870

He LY, Liang X, Yang XL, Zhong ZQ (2019) Can green credit promote the technological innovation of environmental protection enterprises? Financ Econ Res 34(05):109–121

Hou XH, Wang B (2020) On green finance development in the context of financial supply-side structural reform. Seeking Truth 47(05):13–20

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res: 1–14

Huang W (2010) Mechanism analysis of credit exiting optimized industrial structure. Finance Forum 3:26–32

Jia CC, Chen SY (2018) Impact of technological innovation on transformation and upgrading of industrial structure under the new normal: an empirical test based on interprovincial panel data from 2011–2015. Sci Technol Manag Res 38(15):26–31

Jia HW, Zhang WT, Pan YZ (2021) Scientific and technological innovation, industrial structure upgrading and high-quality economic development. Shanghai J Econ 05:50–60

Levine R (1997) Financial development and economic growth: views and agenda. J Econ Lit 35(2):688–726

Li F, Li MX, Zhang YJ (2021) The empirical analysis of technological innovation and industrial structure upgrading to economic development. Technol Econ 40(07):1–10

Li XX, Xia G (2015) Green finance and sustainable development. J Financ Econ 20:30–40

Li Y, Hu HY, Li H (2020) Empirical analysis of the impact of green credit on the upgrading of China’s industrial structure: based on Chinese provincial panel data. On Economic Problems 01:37–43

Li YY, Jin H, Zhang YM (2015) Financial innovation and industrial structure adjustment: theory and evidence. Inquiry into Economic Issues 3:140–147

Lin CY, Kong FC (2016) Technological innovation, imitation innovation, technology introduction and industrial structure transformation and upgrading——research on durbin model based on dynamic space. Macroeconomics 5:106–118

Long YA, Chen GQ (2018) China’s green finance development and industrial structure optimization under the background of “beautiful China.” Enterprise Econ 37(4):11–18

Lu J, Yan Y, Wang TX (2021) The microeconomic effects of green credit policy——from the perspective of technological innovation and resource reallocation. China Ind Econ 01:174–192

Ma B, Lin L, Wu JF (2017) Research on the relationship between production capacity, financial support and economic fluctuation in supply-side structural reform. Ind Econ Res 5:12–24

Ning JH, Yuan ZM, Wang XQ (2021) Green credit policy and enterprise over-investment. Finance Forum 26(06):7–16

Peneder M (2003) Industrial structure and aggregate growth. Struct Chang Econ Dyn 14(4):427–448

Salazar J (1998) Environmental finance: linking two world. Presented Work Financ Innov Biodivers Bratislava (1):2–18

Shao C (2020) Green credit, risk management and industrial restructuring optimization. Jianghan Tribune 10:12–19

Shi LL, Zhao J (2018) Environmental regulation, technological innovation and industrial structure upgrading. Sci Res Manag 39(1):119–125

Shu XT (2017) The role and value of green credit in China’s industrial restructuring. Reformation & Strategy 10:123–125

Stiglitz JE (1985) Credit markets and the control of capital. J Money Credit Bank 17(2):133–152

Sun J, Wang F, Yin H (2019) Money talks: the environmental impact of China’s green credit policy. J Policy Anal Manage 38(3):653–680

Sun LW, Li YF, Ren XW (2020) Upgrading industrial structure, technological innovation and carbon emission: a moderated mediation model. Technol Econ 39(06):1–9

Thompson M (2018) Social capital, innovation and economic growth. J Behav Exp Econ 73:46–52

Wang GG, Liu SL (2020) Is technological innovation the effective way to achieve the “double dividend” of environmental protection and industrial upgrading? Environ Sci Pollut Res Int 27(15):18541–18556

Wang HB, Yang HX (2016) Innovation-driven development strategy and modern industry system in China: an empirical analysis based on provincial panel data. China Econ Q 15(04):1351–1386

Wang XH, Zhen C (2012) An analysis of Shaanxi R&D input and optimization of industrial structure. Commer Res 06:25–30

Wang YL, Lei XD, Long RY (2021) Can green credit policy promote the corporate investment efficiency? ——based on the perspective of high-pollution enterprises’ financial resource allocation. China Popul Resour Environ 31(01):123–133

Wu LC, Chen WH, Lin L, Feng Q (2021a) The impact of innovation and green innovation on corporate total factor productivity. J Appl Stat Manag 40(02):319–333

Wu S, Wu LP, Zhao XL (2021b) Impact of the green credit policy on external financing, economic growth and energy consumption of the manufacturing industry. China Popul Resour Environ 31(3):96–107

Xie QX, Zhang Y (2021) Green credit policies, supporting hand and innovation transformation of enterprises. Sci Res Manag 42(01):124–134

Yang L, Tang F (2020) To pursue high-Quality development of Xiongan New Area by following the path of green finance innovation 11223. Forum Sci Technol China 03:110–117

Ye YG, Sun L (2002) On resources efficiency and science and technology innovation. China Popul Resour Environ 06:17–19

Yin JF, Wang ZW (2016) China’s green financial road. Comp Econ Soc Syst 6:49–56

Zhang YY, Yuan FQ, Chen LF (2021) Can regional industry dependence change the impact of green credit policies on corporate innovation investment? ——evidence from quasi-natural experiments. Macroeconomics 03:120–135

Zhao N (2021) Can green credit improve regional green technology innovation? —— based on regional green patent data. On Economic Problems 06:33–39

Zhao ZX (2015) Commercial bank’s green credit practice and its promotion to economic green transformation. Financ Acc Mon (32):91-94

Zhou HY (2014) Thoughts on doing a good job of green credit in the adjustment of industrial structure. Chin Econ 9:167–167

Zhou X, Tao CQ (2021) Research on the driving effect of technological convergence innovation on the high level of industrial structure: based on the perspective of vertical knowledge spillovers. Manage Rev 33(07):130–142

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

The author calculated the index of advanced industrial structure and industrial structure rationalization in various regions, processed the data involved in the manuscript, explained the empirical results and put forward relevant suggestions. Meanwhile, the author translated and revised the article. The author read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhu, X. Does green credit promote industrial upgrading?—analysis of mediating effects based on technological innovation. Environ Sci Pollut Res 29, 41577–41589 (2022). https://doi.org/10.1007/s11356-021-17248-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17248-1