Abstract

Greenhouse gas effect is known as the main cause of worldwide warming and environmental change. The present study was planned to examine the causal relationship between carbon dioxide (CO2) emissions, CO2 emissions from solid fuel consumption (CO2S), energy use (EU), fossil fuel energy consumption (FOF), gross domestic product (GDP), and net domestic credit (NDC). This research work is based on Pakistan’s annual data from 1971 to 2014. Autoregressive distributed lag (ARDL) bound testing design was used to measure both long-run and the short-run relationships among all study variables. To inspect the stationarity of the study variables, augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) tests were also carried out. The outcome of the long-run estimates indicated that CO2S, EU, and GDP all have a significant relationship with CO2 emissions while both FOF and NDC did not exhibit any significant effect. The value of error correction term (ECT) was − 0.977 which signifies that the deviation of CO2 emissions from short-run to long-run equilibrium was fitted by 97.7% per year. Johansen co-integration test results display a long-run association between the study variables. Based on the study findings, the government requires to take effective measures for constructive policy-making and identification of environmental threats in Pakistan. Additionally, emission decreasing actions should be settled the fundamental agenda in energy and environmental strategies of Pakistan for the reduction in damages connected with carbon dioxide emissions.

Similar content being viewed by others

References

Afzal M, Farooq M, Ahmad H (2010) Relationship between school education and economic growth in Pakistan: ARDL bounds testing approach to cointegration. Pak Econ Soc Rev 48(1):39–60. https://doi.org/10.2307/41762413

Akaike H (1974) A new look at the statistical model identification. IEEE Trans Autom Control 19(6):716–723. https://doi.org/10.1109/TAC.1974.1100705

Akpan GE, Akpan UF (2012) Electricity consumption, carbon emissions and economic growth in Nigeria. Int J Energy Econ Policy 2(4):292–306

Ali S, Gucheng L, Ying L, Ishaq M, Shah T (2019a) The relationship between carbon dioxide emissions, economic growth and agricultural production in Pakistan: an autoregressive distributed lag analysis. Energies 12(24). https://doi.org/10.3390/en12244644

Ali S, Liu Y, Abdullah, Nazir A, Ishaq M, Shah T, Ye X, Ilyas A, Ahmad Khan A, Din, Izhar-Ud D, Tariq A (2019b) The effect of climate change on economic growth: evidence from Pakistan. Pacific Int J 2(3):44–53. https://doi.org/10.1007/s10018-015-0116-3

Ali S, Ying L, Shah T, Tariq A, Chandio AA, Ali I (2019c) Analysis of the nexus of CO2 emissions, economic growth, land under cereal crops and agriculture value-added in Pakistan using an ARDL approach. Energies 12(23):1–19

Ali S, Liu Y, Nazir A, Ishaq M, Khan SB, Abdullah, Shah T (2020) Does technical progress mitigate climate effect on crops yield in Pakistan? J Animal Plant Sci 30(3):663–676. https://doi.org/10.36899/JAPS.2020.3.0079

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sust Energ Rev 41:237–247. https://doi.org/10.1016/j.rser.2014.08.004

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35(10):4772–4778. https://doi.org/10.1016/j.enpol.2007.03.032

Ang JB (2009) CO2 emissions, research and technology transfer in China. Ecol Econ 68(10):2658–2665. https://doi.org/10.1016/j.ecolecon.2009.05.002

Asumadu-Sarkodie S, Owusu PA (2016) The relationship between carbon dioxide and agriculture in Ghana: a comparison of VECM and ARDL model. Environ Sci Pollut Res 23(11):10968–10982. https://doi.org/10.1007/s11356-016-6252-x

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113(October 2017):356–367. https://doi.org/10.1016/j.enpol.2017.10.050

Begum RA, Sohag K, Abdullah SMS, Jaafar M (2015) CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew Sust Energ Rev 41:594–601. https://doi.org/10.1016/j.rser.2014.07.205

Bekun FV, Emir F, Sarkodie SA (2019) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765. https://doi.org/10.1016/j.scitotenv.2018.11.271

Ben Jebli M, Ben Youssef S (2017) Renewable energy consumption and agriculture: evidence for cointegration and Granger causality for Tunisian economy. Int J Sust Dev World 24(2):149–158. https://doi.org/10.1080/13504509.2016.1196467

Ben Mbarek M, Saidi K, Rahman MM (2018) Renewable and non-renewable energy consumption, environmental degradation and economic growth in Tunisia. Qual Quant 52(3):1105–1119. https://doi.org/10.1007/s11135-017-0506-7

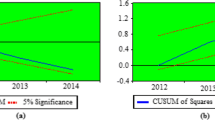

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc Ser B Methodol 37(2):149–163. https://doi.org/10.1111/j.2517-6161.1975.tb01532.x

Callan T, Lyons S, Scott S, Tol RSJ, Verde S (2009) The distributional implications of a carbon tax in Ireland. Energy Policy 37(2):407–412. https://doi.org/10.1016/j.enpol.2008.08.034

Chang CC (2010) A multivariate causality test of carbon dioxide emissions, energy consumption and economic growth in China. Appl Energy 87(11):3533–3537. https://doi.org/10.1016/j.apenergy.2010.05.004

Chen Y, Wang Z, Zhong Z (2019) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216. https://doi.org/10.1016/j.renene.2018.07.047

Cherni A, Essaber Jouini S (2017) An ARDL approach to the CO2 emissions, renewable energy and economic growth nexus: Tunisian evidence. Int J Hydrog Energy 42(48):29056–29066. https://doi.org/10.1016/j.ijhydene.2017.08.072

CPEIR. (2015). Pakistan - Climate Public Expenditure and Institutional Review (CPEIR), UNDP, Islambad, Pakistan. 143. http://www.pk.undp.org/content/dam/pakistan/docs/Environment%2520&%2520Climate%2520Change/UNDP%2520Climate%2520Report%2520V10.pdf.

Danish, Zhang B, Wang B, Wang Z (2017) Role of renewable energy and non-renewable energy consumption on EKC: evidence from Pakistan. J Clean Prod 156:855–864. https://doi.org/10.1016/j.jclepro.2017.03.203

Danish, Zhang B, Wang Z, Wang B (2018) Energy production, economic growth and CO2 emission: evidence from Pakistan. Nat Hazards 90(1):27–50. https://doi.org/10.1007/s11069-017-3031-z

David M (2016) International Institute for Applied Systems Analysis (IIASA). http://www.iiasa.ac.at/staff/staff.php?type=auto&visibility=visible&search=true&login=mccollum. Accessed 12 March 2020

David E, Vera K, Laura S (2017) Global Climate Risk Index 2018. Germanwatch, Bonn, Germany

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431. https://doi.org/10.1080/01621459.1979.10482531

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676. https://doi.org/10.1007/s11356-015-4767-1

Gallo Cassarino T, Sharp E, Barrett M (2018) The impact of social and weather drivers on the historical electricity demand in Europe. Appl Energy 229(July):176–185. https://doi.org/10.1016/j.apenergy.2018.07.108

Granger CWJ, Jji E (1988) Concept of causality. J Econ 39:199–211

Guo J, Zhang YJ, Zhang KB (2018) The key sectors for energy conservation and carbon emissions reduction in China: evidence from the input-output method. J Clean Prod 179:180–190. https://doi.org/10.1016/j.jclepro.2018.01.080

Huang Y, Li H, Campbell KA, Han Z (2011) Defending false data injection attack on smart grid network using adaptive CUSUM test. 2011 45th Annual Conference on Information Sciences and Systems, CISS 2011. https://doi.org/10.1109/CISS.2011.5766111

Hui TS, Rahman SA, Labadin J (2012) Statistical modelling of CO2 emissions in Malaysia and Thailand. Int J Adv Sci, Eng Inform Technol 2(5):350. https://doi.org/10.18517/ijaseit.2.5.221

IEA (2015) Key trends in CO2 emissions except from: Co2- emissions from fuel combustion. International Energy Agency

IPCC (2013) Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge.

IPCC (2014) Climate change 2014: mitigation of climate change. Fifth assessment report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge http://www.ipcc.ch/report/ar5/wg3. Accessed 12 March 2020

Jiang XT, Li R (2017) Decoupling and decomposition analysis of carbon emissions from electric output in the United States. Sustainability 9(6):1–13. https://doi.org/10.3390/su9060886

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration — with applications to the demand for money. Oxf Bull Econ Stat 52(2):169–210. https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Khan AU (2015) Pak-China economic corridor: the hopes and reality. Institute of Regional Studies, January, 32. http://www.irs.org.pk/. Accessed 12 March 2020

Khan A, Jamil F (2015) Energy related carbon dioxide emissions in Pakistan: a decomposition analysis using LMDI. S3H Working Paper Series Number, National University of Sciences and Technology (NUST), 08

Khan MM, Zaman K, Irfan D, Awan U, Ali G, Kyophilavong P, Shahbaz M, Naseem I (2016) Triangular relationship among energy consumption, air pollution and water resources in Pakistan. J Clean Prod 112:1375–1385. https://doi.org/10.1016/j.jclepro.2015.01.094

Khan MTI, Ali Q, Ashfaq M (2018) The nexus between greenhouse gas emission, electricity production, renewable energy and agriculture in Pakistan. Renew Energy 118:437–451. https://doi.org/10.1016/j.renene.2017.11.043

Khim V, Liew S (2004) Which lag length selection criteria should we employ? Econ Bull 3(33):1–9

Koondhar MA, Qiu L, Li H, Liu W, He G (2018) A nexus between air pollution, energy consumption and growth of economy: a comparative study between the USA and China-based on the ARDL bound testing approach. Agric Econ (Czech Republic) 64(6):265–276. https://doi.org/10.17221/101/2017-AGRICECON

Lee S, Ha J, Na O, Na S (2003) The cusum test for parameter change in time series models. Scand J Stat 30(4):781–796. https://doi.org/10.1111/1467-9469.00364

Li H, Wei YM, Mi Z (2015) China’s carbon flow: 2008-2012. Energy Policy 80:45–53. https://doi.org/10.1016/j.enpol.2015.01.025

Lin B, Ahmad I (2016) Technical change, inter-factor and inter-fuel substitution possibilities in Pakistan: a trans-log production function approach. J Clean Prod 126:537–549. https://doi.org/10.1016/j.jclepro.2016.03.065

Lin B, Ahmad I (2017) Analysis of energy related carbon dioxide emission and reduction potential in Pakistan. J Clean Prod 143:278–287. https://doi.org/10.1016/j.jclepro.2016.12.113

Liu J, Diamond J (2005) China’s environment in a globalizing world. Nature 435:1179–1186

Mackinnon JG, Haug AA, Michelis L (1999) Numerical distribution functions of likelihood ratio tests for cointegration. J Appl Econ 14(5):563–577. https://doi.org/10.1002/(SICI)1099-1255(199909/10)14:5<563::AID-JAE530>3.0.CO;2-R

Menyah K, Wolde-Rufael Y (2010) Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ 32(6):1374–1382. https://doi.org/10.1016/j.eneco.2010.08.002

Mi Z, Zhang Y, Guan D, Shan Y, Liu Z, Cong R, Yuan XC, Wei YM (2016) Consumption-based emission accounting for Chinese cities. Appl Energy 184:1073–1081. https://doi.org/10.1016/j.apenergy.2016.06.094

Mi Z, Meng J, Guan D, Shan Y, Liu Z, Wang Y, Feng K, Wei YM (2017a) Pattern changes in determinants of Chinese emissions. Environ Res Lett 12(7). https://doi.org/10.1088/1748-9326/aa69cf

Mi Z, Wei YM, Wang B, Meng J, Liu Z, Shan Y, Liu J, Guan D (2017b) Socioeconomic impact assessment of China’s CO2 emissions peak prior to 2030. J Clean Prod 142:2227–2236. https://doi.org/10.1016/j.jclepro.2016.11.055

Mikayilov JI, Galeotti M, Hasanov FJ (2018) The impact of economic growth on CO2 emissions in Azerbaijan. J Clean Prod 197(2018):1558–1572. https://doi.org/10.1016/j.jclepro.2018.06.269

Naseem S, Guang Ji T, Kashif U (2020) Asymmetrical ARDL correlation between fossil fuel energy, food security, and carbon emission: providing fresh information from Pakistan. Environ Sci Pollut Res 27(25):31369–31382. https://doi.org/10.1007/s11356-020-09346-3

Nazirah Wahid I, Abd Aziz A, Hashim Nik MN (2013) Energy consumption, economic growth and CO2 emissions in selected ASEAN countries. PROSIDING PERKEM VIII, JILID 2:758–765

NEAA (2014) Trends in global CO2emissions: 2014 report. The Hague: PBL Netherlands Environmental Assessment Agency; Ispra: European Commission, Joint Research Centre. 1490

Nnaji CE, Chukwu JO, Moses N (2013) Electricity supply, fossil fuel consumption, CO2 emissions and economic growth: implications and policy options for sustainable development in Nigeria. Int J Energy Econ Policy 3(3):262–271

Omri A, Euchi J, Hasaballah AH, Al-Tit A (2019) Determinants of environmental sustainability: evidence from Saudi Arabia. Sci Total Environ 657:1592–1601. https://doi.org/10.1016/j.scitotenv.2018.12.111

Orubu CO, Omotor DG (2011) Environmental quality and economic growth: searching for environmental Kuznets curves for air and water pollutants in Africa. Energy Policy 39(7):4178–4188. https://doi.org/10.1016/j.enpol.2011.04.025

Payne JE (2002) Inflationary dynamics of a transition economy: the Croatian experience. J Policy Model 24(3):219–230. https://doi.org/10.1016/S0161-8938(02)00106-0

Pesaran M, & Pesaran B (1997). Working with Microfit 4.0: interactive econometric analysis. Oxford University Press, Oxford.

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326. https://doi.org/10.1002/jae.616

Peters GP, Weber CL, Guan D, Hubacek K (2007) China’s growing CO2 emissions - a race between increasing consumption and efficiency gains. Environ Sci Technol 41(17):5939–5944. https://doi.org/10.1021/es070108f

Phillips PCB, Perron P (1988) Biometrika trust testing for a unit root in time series regression testing for a unit root in time series regression. Biometrika 75(2):335–381 http://finpko.faculty.ku.edu/myssi/FIN938/Phillips%26Perron_Biometrika_1988_UnitRootTest.pdf. Accessed 12 March 2020

Ploberger W, Kramer W (1992) The CUSUM test with OLS residuals. Econometrica 60(2):271–285

Rahman MM, Kashem MA (2017) Carbon emissions, energy consumption and industrial growth in Bangladesh: empirical evidence from ARDL cointegration and Granger causality analysis. Energy Policy 110(March):600–608. https://doi.org/10.1016/j.enpol.2017.09.006

Rauf A, Zhang J, Li J, Amin W (2018) Structural changes, energy consumption and carbon emissions in China: empirical evidence from ARDL bound testing model. Struct Chang Econ Dyn 47:194–206. https://doi.org/10.1016/j.strueco.2018.08.010

Razak M, Ahmad I, Bujang I, Talib A, Ibrahim Z (2013) IPAT-Fuzzy model in measuring air pollution: evidence from Malaysia. Am Int J Contemp Res 3(6):62–69 http://www.aijssnet.com/journals/Vol_2_No_4_June_2013/9.pdf Accessed 12 March 2020

Rehman A, Rauf A, Ahmad M, Chandio AA, Deyuan Z (2019) The effect of carbon dioxide emission and the consumption of electrical energy, fossil fuel energy, and renewable energy, on economic performance: evidence from Pakistan. Environ Sci Pollut Res 26(21):21760–21773. https://doi.org/10.1007/s11356-019-05550-y

Saboori B, Sulaiman J, Mohd S (2012) Economic growth and CO 2 emissions in Malaysia:acointegration analysis of the environmental Kuznets curve. Energy Policy 51:184–191. https://doi.org/10.1016/j.enpol.2012.08.065

Saidi K, Rahman MM, Amamri M (2017) The causal nexus between economic growth and energy consumption: new evidence from global panel of 53 countries. Sustain Cities Soc 33(December 2016):45–56. https://doi.org/10.1016/j.scs.2017.05.013

Salahuddin M, Gow J (2014) Economic growth, energy consumption and CO2 emissions in Gulf cooperation council countries. Energy 73:44–58. https://doi.org/10.1016/j.energy.2014.05.054

Sarkodie SA (2018) The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ Sci Pollut Res 25(22):21993–22022. https://doi.org/10.1007/s11356-018-2347-x

Sarkodie SA, Adams S (2018) Renewable energy, nuclear energy, and environmental pollution: accounting for political institutional quality in South Africa. Sci Total Environ 643:1590–1601. https://doi.org/10.1016/j.scitotenv.2018.06.320

Schwarz G (1978) Estimating the dimension of a model. Ann Stat 6(2):461–464 http://projecteuclid.org/euclid.aop/1176996548. Accessed 12 March 2020

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renew Sust Energ Rev 52:347–356. https://doi.org/10.1016/j.rser.2015.07.118

Shahbaz M, Lean HH, Shabbir MS (2012a) Environmental Kuznets curve hypothesis in Pakistan: cointegration and Granger causality. Renew Sust Energ Rev 16(5):2947–2953. https://doi.org/10.1016/j.rser.2012.02.015

Shahbaz M, Zeshan M, Afza T (2012b) Is energy consumption effective to spur economic growth in Pakistan? New evidence from bounds test to level relationships and Granger causality tests. Econ Model 29(6):2310–2319. https://doi.org/10.1016/j.econmod.2012.06.027

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Loganathan N, Muzaffar AT, Ahmed K, Ali Jabran M (2016) How urbanization affects CO2 emissions in Malaysia? the application of STIRPAT model. Renew Sust Energ Rev 57:83–93. https://doi.org/10.1016/j.rser.2015.12.096

Shan Y, Guan D, Zheng H, Ou J, Li Y, Meng J, Mi Z, Liu Z, Zhang Q (2018) China CO 2 emission accounts 1997-2015. Sci Data 5:1–14. https://doi.org/10.1038/sdata.2017.201

Shao M, Tang X, Zhang Y, Li W (2006) City clusters in China: air and surface water pollution. Front Ecol Environ 4(7):353–361. https://doi.org/10.1890/1540-9295(2006)004[0353:CCICAA]2.0.CO;2

Tang CF, Tan BW (2015) The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79(C):447–454. https://doi.org/10.1016/j.energy.2014.11.033

Tiwari AK (2011) Energy consumption, CO 2 emissions and economic growth: a revisit of the evidence from India. Appl Econ Int Dev 11(2):165–189

UCS (2017) Union of concerned scientists. http://www.ucsusa.org/global_warming/science_and_impacts/science/co2-andglobal-warming-faq.html#.WTEX42jyhPY. Accessed 12 March 2020

Wang K, Wei YM, Zhang X (2013) Energy and emissions efficiency patterns of Chinese regions: a multi-directional efficiency analysis. Appl Energy 104:105–116. https://doi.org/10.1016/j.apenergy.2012.11.039

Wang S, Li G, Fang C (2018) Urbanization, economic growth, energy consumption, and CO2 emissions: empirical evidence from countries with different income levels. Renew Sust Energ Rev 81(March 2017):2144–2159. https://doi.org/10.1016/j.rser.2017.06.025

Westerlund J (2005) A Panel CUSUM Test of the Null of Cointegration. Oxf Bull Econ Stat 67(2):231–262

World Bank (2007) Growth and CO2 emissions: how do different countries fare. Environment Department, Washington, D.C. http://siteresources.worldbank.org/INTCC/2145741192124923600/21511758/co2DecompositionfinalOct2007.pdf Accessed 12 March 2020

Wu XF, Chen GQ (2017) Energy use by Chinese economy: a systems cross-scale input-output analysis. Energy Policy 108(May):81–90. https://doi.org/10.1016/j.enpol.2017.05.048

Xiao Z, Phillips PCB (2002) A CUSUM test for cointegration using regression residuals. J Econ 108(1):43–61. https://doi.org/10.1016/S0304-4076(01)00103-8

Xu B, Lin B (2017) What cause a surge in China’s CO2 emissions? A dynamic vector autoregression analysis. J Clean Prod 143:17–26. https://doi.org/10.1016/j.jclepro.2016.12.159

Yu L, Li YP, Huang GH, Fan YR, Nie S (2018) A copula-based flexible-stochastic programming method for planning regional energy system under multiple uncertainties: a case study of the urban agglomeration of Beijing and Tianjin. Appl Energy 210(June 2017):60–74. https://doi.org/10.1016/j.apenergy.2017.10.099

Zakarya GY, Mostefa B, Abbes SM, Seghir GM (2015) Factors affecting CO2 emissions in the BRICS countries: a panel data analysis. Procedia Econ Fin 26(May):114–125. https://doi.org/10.1016/s2212-5671(15)00890-4

Zhou R, Li S (2011) A study on the development of low-carbon economy in shandong province-based on empirical analysis on the influence factor of carbon emission. Energy Procedia 5:2152–2159. https://doi.org/10.1016/j.egypro.2011.03.372

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sust Energ Rev 72(July 2016):1067–1075. https://doi.org/10.1016/j.rser.2016.10.018

Acknowledgments

The authors would also like to extend gratitude to anonymous reviewers for providing helpful suggestions on an earlier draft of this paper.

Availability of data and materials

All relevant data are within the paper.

Funding

This work was supported by the Fundamental Research Funds for the Central Universities of China (Program No. 2662017PY062). The authors are thankful to the Chinese Scholarship Council (CSC) for providing financial assistance to carry-out this research as part of his PhD studies in China.

Author information

Authors and Affiliations

Contributions

Conceptualization by Sajjad Ali; data curation by Raheel Anjum and Adnan Nazir; formal analysis by Sajjad Ali; methodology by Sajjad Ali, Abdullah Shalmani, and Tariq Shah; supervision by Liu Ying; writing original draft by Sajjad Ali; writing review and editing by Farooq Shah.

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

Not applicable

Consent to participate

Not applicable

Consent to publish

Not applicable

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ali, S., Ying, L., Anjum, R. et al. Analysis on the nexus of CO2 emissions, energy use, net domestic credit, and GDP in Pakistan: an ARDL bound testing analysis. Environ Sci Pollut Res 28, 4594–4614 (2021). https://doi.org/10.1007/s11356-020-10763-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-10763-7