Abstract

A ‘bonus culture’ among financial traders has been blamed for the excessive risk-taking in the run-up to the latest financial crisis. I show that when individuals are more social gain seeking than social loss averse (i.e. gloating is stronger than envy), social comparison predicts more risk-taking as well as a preference for negatively correlated gambles. Testing these two joint propositions in a laboratory experiment, I find that preference for positively or negatively correlated outcomes is highly correlated with risk-taking in a social risky investment task. While only a third of subjects prefer negatively correlated outcomes in a peer comparison setting, in line with relatively stronger social gain seeking, those subjects invest on average 50 % more in a risky gamble in their peer comparison setting than a reference group that made the same decision in an isolated individual setting. Subjects with a preference for positively correlated outcomes, in line with relatively stronger social loss aversion, do not show a higher propensity to invest in a risky gamble compared to the individual reference group.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the popular press, the excessive risk-taking by bankers and traders in the run-up to the latest financial crisis is often blamed on a ‘bonus culture’ among financial professionals. In a survey performed after the financial crisis among risk and compliance officers at financial services firms, 72 % of respondents agreed that the bonus culture in the City of London had led to “uncontrollable risk-taking”.Footnote 1 Indeed in a recent experiment with financial professionals, these professionals proved to respond to the mere display of their rank stronger than to actual bonus incentives (Kirchler et al. 2016). And it is not just financial professionals for whom risk appetite may depend on their social surroundings. Also, households tend to invest more in the stock market when they socialize more with their neighbors (Hong et al. 2004), and when those neighbors invest more themselves (Brown et al. 2008). This suggests that social context can influence people’s risk-taking decisions, and thus it is important to investigate this channel to understand how and for whom social comparison can lead to increased or even excessive risk-taking.

In the same way that choices over risky gambles reflect the shape and curvature of a utility function over monetary outcomes, choices over risky gambles in a social context would reflect the shape and curvature of the social comparison function. The social comparison function entails two important parts: the utility one experiences when having a better outcome than a peer (referred to in this paper as social gain seeking), and the utility one experiences when having a worse outcome than a peer (referred to in this paper as social loss aversion).Footnote 2 In an extension of earlier work on the shape of the social comparison function and emulating behavior (Clark and Oswald 1998; Maccheroni et al. 2012), I show that when social gain seeking is stronger than social loss aversion, an agent would (i) prefer gambles that are negatively correlated with the outcomes of their peers and (ii) take more risk in a situation where social comparison is possible. By contrast agents for whom social loss aversion is stronger than social gain seeking, would prefer positively correlated outcomes and could even reduce risk-taking when social comparison is possible.

In a simple between-subjects experimental risky investment game with both a social and an individual treatment, I find a strong correlation between choices for negatively correlated outcomes and risk-taking in the social COMPARISON treatment. Overall, about one third of subjects reveal a preference for negatively correlated outcomes, and these subjects invest almost 50 % more of their endowment in a risky investment than comparable subjects in the baseline INDIVIDUAL treatment. Subjects that reveal a preference for positively correlated outcomes in the social COMPARISON treatment do not invest significantly more than the individual control group. Thus this paper provides evidence that social comparison could lead to more risk-taking as long as there are sufficiently many individuals for whom social gain seeking is stronger than their social loss aversion. Furthermore, this paper shows that there is significant and important individual heterogeneity when it comes to risk-taking and social preferences, and provides a novel tool (preference for correlated outcomes) to investigate such heterogeneity.

These findings corroborate recent results on the physiological and neurological responses to social gains and social losses, where subjects showed bigger physiological and neurological responses to social gains than to losses (Bault et al. 2008, 2011). The results presented in this paper provide further evidence for an important implication of such preferences, namely the increased and possibly excessive amount of risk-taking that a social context can induce for part of the population (see Hong et al. 2004; Brown et al. 2008). Combined with the findings of Linde and Sonnemans (2012) that found that when it comes to social comparison subjects behave less risk-averse in social gains than in social loss situations (contra the predictions of traditional Prospect Theory, Kahneman and Tversky 1979), this paper further adds to the evidence that social reference points may have different effects on risky choice than traditional private reference points.

This paper is related to a few different strands of literature. In the first place there is the strand of literature that focuses on the effect of social comparison on economic decision-making in general, starting with Veblen’s Theory of the Leisure Class (1899). Since then, social comparison has been implicated in saving behavior (Duesenberry 1949; Bertrand and Morse 2013; Frank et al. 2014), the demand for positional and non-positional goods (Hirsch 1976; Frank 1985), wage compression within firms (Frank 1984) and excessive consumption of status goods (Ireland 1998; Hopkins and Kornienko 2004). It has also been shown to have an effect on happiness (Luttmer 2005) and wage satisfaction (Clark et al. 2009), and could explain the Easterlin paradox (Clark et al. 2008). Furthermore, the existence of relative preferences would have implications for public good provision and taxation (Aronsson and Johansson-Stenman 2008; Ireland 2001), economic growth (Corneo and Jeanne 2001; Cooper et al. 2001), environmental policy (Wendner 2005) and even monetary stabilization policy (Ljungqvist and Uhlig 2000).

The second strand of literature is related to the shape of the social comparison function itself. Clark and Oswald (1998) theoretically show that comparison-concave preferences lead to emulation and herding behavior, whereas comparison-convex preferences give rise to diversity and deviance. With a comparison-convex utility function the marginal utility from social comparison is (strictly) increasing the further one is ahead, whereas the marginal disutility from comparison is (strictly) declining the further you are behind. Thus for any comparison-convex utility function, social gain seeking is necessarily stronger than social loss aversion. When utility is comparison-concave, social loss aversion is stronger than social gain seeking. Maccheroni et al. (2012) show that the results of Clark and Oswald (1998) hold broadly and only depend on the convexity or concavity of the kink around the reference point. I show that the distinction also affects preferences over positively or negatively correlated outcomes in gambles.

Most work on social preferences that follow in the vain of Fehr and Schmidt (1999) and Bolton and Ockenfels (2008) assume highly comparison-concave preferences where individuals not only get disutility from disadvantageous inequality but also from advantageous inequality. Also, most papers that model relative preferences as a function of the difference between own consumption and average consumption in the population (e.g. Rauscher 1992; Mui 1995; Cooper et al. 2001, etc) assume that this social comparison function is indeed concave (social loss aversion being stronger than social gain seeking), although they do not posit disutility from disadvantageous inequality. This comparison concavity then leads to overconsumption of positional goods, which to some extent can be remedied by progressive taxation. A different strand of literature that looks at preference for social rank (e.g. Robson 1992; Frank 1985; Hopkins and Kornienko 2004, etc) presumes that individuals have preferences over the rank ordering of income or consumption, and that the difference between first place and second place is bigger than the difference between second place and third place. These kind of preference specifications could be seen as comparison-convex (social gain seeking stronger than social loss aversion). Thus the theoretical literature is still divided on how best to specify relative preferences. This paper provides evidence that relative preferences may vary significantly across the population.

Finally, this paper touches upon the small but growing literature on the intersection of social preferences and risky choice. A nice recent overview of work on social influences and risk is provided by the handbook chapter of Trautmann and Vieider (2011). Bault et al. (2008) find that when subjects can observe both the outcome of their own lottery choice and the outcome of another subject, they react more strongly to social gains than to social losses, both in their subjective appraisal and their physiological reactions. Bolton and Ockenfels (2008) find that subjects act more risk-averse when the outcome of a lottery extends to another subject, and are more likely to choose a risky option when the safe option implies unfavorable inequality. Linde and Sonnemans (2012) let subjects choose between risky lotteries when a reference subject either has a high fixed payoff or a low fixed payoff. They find less risk-aversion when outcomes are contextualized as social gains than as social losses. Dijk et al. (2014) find that fund managers in an experimental investment game tend to increase their investments in positively skewed lottery-type assets when lagging behind in a tournament setting, but also find the same type of behavior when only the relative rank in performance is displayed, even without the corresponding tournament incentives. Similarly, Fafchamps et al. (2013) find evidence that subjects increase their risk-taking after observing previous subjects winning similar lotteries. Schoenberg and Haruvy (2012) show that larger asset bubbles occur when subjects learn about the wealth of the leading trader than when they learn about the wealth of the laggard. On the other hand, Rohde and Rohde (2011) do not find a significant effect of the risk that other subjects are exposed to on the risk attitudes of a decision-maker. Delgado et al. (2008) find that social loss aversion (fear of losing a bidding war with others) could explain overbidding in auctions. Linde and Sonnemans (2015) study a decision between two options of three potential outcomes each with the same expected value. They find no difference when subjects make this decision individually, or when they are matched with two other subjects that made the same decision and each subject gets one of the three potential outcomes.

2 Theory and predictions

2.1 A simple preference model of social comparison

Suppose that a person has a standard (increasing, concave) utility function \(u\left( {x_0 } \right) \) over own outcome \(x_0 \), and an additive comparison utility \(v\left( {x_0 ,x_1 } \right) \)over the difference with someone else’s (e.g. a peer or neighbor) outcome \(x_0 \).

Let’s then assume a simple piecewise linear function for \(v\left( {x_o ,x_1 } \right) \). The linearity keeps the analysis simple and as Macheroni et al. (2012) showed, the results would carry through for more complicated specifications as long as there is a concave or convex kink around the reference point:

The first part of this specification reflects social gain seeking or the feeling of gloating: enjoying positive utility from having a better outcome than your peer. The second part reflects social loss aversion or the feeling of envy: suffering negative utility from having a worse outcome than your peer. Social gains are multiplied by the coefficient \(\alpha \) (the social gain seeking parameter), and social losses by the coefficient \(\beta \) (the social loss aversion parameter). This specification parsimoniously fits the several theories for social preferences. With parameters \(\alpha =\beta =0\) social comparison does not play a role at all. When social gain seeking dominates social loss aversion (\(\alpha >\beta )\) comparison utility is convex at the kink. For parameter values \(0<\alpha <\beta \), comparison utility is concave at the kink: social loss aversion is stronger than social gain seeking. Finally, when \(\alpha <0\) individuals are inequity-averse, that is they both get disutility from disadvantageous inequality and advantageous inequality.

We should note here that the most commonly used utility specification for social preferences often dubbed fairness preferences or inequity aversion (Fehr and Schmidt 1999; Bolton and Ockenfels 2008), not only assumes that comparison utility is concave, but that it is even negatively sloping for social gains (see panel (c) of Fig. 1). That is, people are assumed to experience disutility when they are better off than others. However, these utility specifications are usually calibrated based on games where subjects can only make themselves better off by making other’s worse off, such as the dictator or ultimatum game. Recent evidence suggests that behavior in such games is largely determined by dispositional guilt-aversion and reciprocity (Regner and Harth 2010), or social norm following (Kimbrough and Vostroknutov 2013) rather than preferences over outcome distributions per se. In the experiment presented in this paper, subjects cannot in any way affect other subjects’ earnings, and thus social norms and guilt aversion should play much less of a role. In this setting, subjects are thus more likely to reveal a pure preference for advantageous or disadvantageous inequality.

There are two main implication of the shape of the social comparison function for risk-taking decisions in a social setting. The first implication is a derivative of the Clark and Oswald (1998) conclusions applied to risky outcomes. As social loss aversion yields a preference for emulation, it also makes positively correlated outcomes more attractive. Likewise, as social gain seeking yields a preference for diversity it makes negatively correlated outcomes more attractive.Footnote 3 The second implication is that social gain seeking makes increased risk-taking more attractive under most circumstances when in a setting where social comparison is possible. We will now show these results in the particular decision problem used in this paper.

2.2 The decision problem

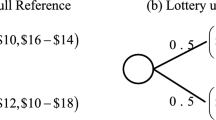

In the setup of this paper, subjects are making a risky investment \(g_0\) that either pays off a positive return of \(Rg_0\) or a negative return of \(-g_0 \) both with equal probability. Given an initial endowment of Y, a gamble of size \(0<g_0 <Y\) will thus result in payoffs \(x_0 \in \left\{ {Y-g_0 , Y+Rg_0 } \right\} \). Basically you make a bet on a coin flip and you either lose your entire investment \(g_0 \), or get a positive return \(Rg_0 >g_0 \). Your optimal level of investment would then depend on both your degree of risk-aversion and the attractiveness of the gamble (i.e. the size of the return \(R>1)\). But what happens when simultaneously a neighbor makes the exact same decision on their own risky investment \(0<g_1 <Y\) and you would be able to observe the outcome? Such an investment will result in similar payoffs for the neighbor of \(x_1 \in \left\{ {Y-g_1 , Y+Rg_1 } \right\} \), so if you care at all about your neighbor’s outcome relative to your own (i.e. we are not in the case of \(\alpha =\beta =0\) as specified in the previous section), how would this affect the size of your investment \(g_0\) and would you prefer your own outcome and your neighbor’s outcome to be positively or negatively correlated? It turns out that the answer depends on the relative strength of your social gain seeking \(\alpha \) and the degree of social loss aversion \(\beta \).

Using the piecewise linear additive social comparison utility function as defined by Eq. (2), the expected utility of a gamble \(g_0\) given a gamble \(g_1\) by the neighbor, is given by:

Let \(EU_\mathrm{POS} \left( {g_0 ,g_1 } \right) \) be the expected utility of a gamble \(g_0 \) when the neighbor’s outcome \(x_1 \) is positively correlated with own outcome \(x_0 \) such that \(\left( {x_0 ,x_1 } \right) \in \left\{ {\left( {Y-g_0 ,Y-g_1 } \right) , \left( {Y+Rg_0 ,Y+Rg_1 } \right) } \right\} \), i.e. either both win or both lose. Conversely, let \(EU_\mathrm{NEG} \left( {g_0 ,g_1 } \right) \) be the expected utility of a gamble \(g_0 \), when the neighbor’s outcome \(x_1 \) is negatively correlated with own outcome \(x_0 \) such that \(\left( {x_0 ,x_1 } \right) \in \left\{ {\left( {Y+Rg_0 ,Y-g_1 } \right) , \left( {Y-g_0 ,Y+Rg_1 } \right) } \right\} \): i.e. when I win you lose and vice versa. Then it is easy to show that \(EU_\mathrm{NEG} \left( {g_0 ,g_1 } \right) >EU_\mathrm{POS} \left( {g_0 ,g_1 } \right) \) iff \(\alpha >\beta \) for \(\forall g_0 ,g_1 \).

We distinguish two cases: \(g_0 <g_1\) and \(g_0 >g_1 \), as they have different implications for when the decision-maker will experience gloating and envy with positively correlated outcomes. With negatively correlated outcomes the decision-maker experiences gloating equal to \(v\left( {x_0 ,x_1 } \right) =\alpha \left( {Rg_0 -\left( {-g_1 } \right) } \right) \) when winning and envy equal to \(v\left( {x_0 ,x_1 } \right) =-\beta \left( {Rg_1 -\left( {-g_0 } \right) } \right) \) when losing. We leave out Y as these are the same constant endowment for both, and thus cancel out. With positively correlated outcomes, both the decision-maker and the neighbor would win at the same time, thus if you had invested less than your neighbor \((g_0 <g_1 )\) you would also win less and so experience envy equal to \(v\left( {x_0 ,x_1 } \right) =-\beta \left( {Rg_1 -Rg_0 } \right) \) . If you had invested more \((g_0 >g_1 )\) you would have won more than your neighbor and so would have experienced gloating equal to \(v\left( {x_0 ,x_1 } \right) =\alpha \left( {Rg_0 -Rg_1 } \right) \). However, when you both lose, and you had invested less \((g_0 <g_1 )\) you would also lose less and so would feel gloating equal to \(v\left( {x_0 ,x_1 } \right) =\alpha \left( {-g_0 -\left( {-g_1 } \right) } \right) \). Had you invested more \((g_0 >g_1 )\) and you both lost, you would experience envy equal to \(v\left( {x_0 ,x_1 } \right) =-\beta \left( {-g_1 -\left( {-g_0 } \right) } \right) \).

Thus when \(g_0 <g_1\), an individual would have a higher expected utility from the negatively correlated outcomes (i.e. \(EU_\mathrm{NEG} \left( {g_0 ,g_1 } \right) >EU_\mathrm{POS} \left( {g_0 ,g_1 } \right) \)) when \(\frac{1}{2}\alpha \left( {Rg_0 -\left( {-g_1 } \right) } \right) -\frac{1}{2}\beta \left( {Rg_1 -\left( {- g_0 } \right) } \right) > -\frac{1}{2}\beta \left( {Rg_1 -Rg_0 } \right) +\frac{1}{2}\alpha \left( {-g_0 -\left( {-g_1 } \right) } \right) \). Which after a bit of cancellation readily reduces to \(\alpha >\beta \). With \(g_0>g_1 , EU_\mathrm{NEG} \left( {g_0 ,g_1 } \right) >EU_\mathrm{POS} \left( {g_0 ,g_1 } \right) \) when \(\frac{1}{2}\alpha \left( {Rg_0 -\left( {-g_1 } \right) } \right) -\frac{1}{2}\beta \left( Rg_1 -\left( {- g_0 } \right) \right) > \frac{1}{2}\alpha \left( {Rg_0 -Rg_1 } \right) -\frac{1}{2}\beta \left( {-g_1 -\left( {-g_0 } \right) } \right) \). Which after a bit of cancellation again readily reduces to \(\alpha >\beta \).

In other words, individuals with stronger social gain seeking than social loss aversion \((\alpha >\beta )\) strictly prefer negatively correlated outcomes over positively correlated outcomes. The intuition is that individuals that are mostly driven by social gain seeking gain more from advantageous inequality than they suffer from disadvantageous inequality. The easiest way to maximize the potential advantageous inequality is by choosing a gamble or strategy that pays off when others lose and vice versa.

However, another way of maximizing potential advantageous inequality is by increasing your own potential high payoff by simply taking more risk. For example, with negatively correlated outcomes, expected utility is given by \(EU_\mathrm{NEG} \left( {g_0 ,g_1 } \right) =\frac{1}{2}u\left( {Y-g_0 } \right) +\frac{1}{2}\left( {Y+Rg_0 } \right) +\frac{1}{2}\alpha \left( {Rg_0 -g_1 } \right) -\frac{1}{2}\beta \left( {Rg_1 -g_0 } \right) \). Taking the first derivate with respect to gamble size \(g_0\):

When social gain seeking dominates \((\alpha >\beta )\) then marginal utility from comparison of increasing the gamble size \(g_0 \) is positive, increasing in \(\alpha \) and decreasing in \(\beta \). In other words, the more the utility function of an individual is dominated by social gain seeking, the more that individual will take risks in settings where comparison is possible compared to where it is not. Although even with social loss aversion dominating only slightly, social comparison would induce bigger gambles, as long as \(\alpha >\left( {\frac{1}{R}} \right) \beta \), due to the positive expected value of the gamble.

For positively correlated gambles, the derivative looks the same as long as \(g_0 >g_1 \):

For gambles smaller than the neighbor’s \((g_0 <g_1 )\), the opposite holds: the optimal gamble is actually decreasing in \(\alpha \) and increasing in \(\beta \):

Basically individuals for whom social gain seeking dominates prefer to maximize the expected difference in their outcomes with others. If they cannot do so by choosing negatively correlated outcomes, or taking more risk than the other, then the final option would be to respond to the other’s maximized risk-taking by minimizing their own.

2.3 Predictions

The foregoing results, leads us to two predictions that we will proceed to test experimentally:

Prediction 1 Individuals for whom social gain seeking is stronger than social loss aversion prefer negatively correlated gambles over positively correlated gambles. In addition, individuals for whom social gain seeking is stronger than social loss aversion prefer larger gambles than individuals for whom social loss aversion is stronger than social gain seeking, when able to compare their outcome with a peer. Thus the preference for outcome correlation and gamble size should themselves be correlated.

Prediction 2 Individuals for whom social gain seeking is stronger than social loss aversion will increase their risk-taking when able to compare outcomes with a peer, relative to performing the task in isolation. Given sufficiently many subjects for whom social gain seeking is stronger than social loss aversion, on average subjects will take more risk when social comparison is possible, than when performing the same risky investment task in isolation.

3 Experimental setup

To test the above two predictions, the experimental setup aims to measure both subjects’ preference for correlated gambles and their risk appetite. Two distinct treatments were run, with subjects only participating in one such treatment. In treatment COMPARISON, subjects could decide on whether to make their outcomes positively or negatively correlated with their neighbor’s outcome and compare their risky investment decisions and outcomes with the same neighbor. This treatment allows us to test for a correlation between the preference for outcome correlation and risk-taking. In treatment INDIVIDUAL, subjects made an identical risky investment decision, but in isolation, without information about the neighbor’s decision and performance. This treatment allows us to compare the level of risk-taking of subjects in the COMPARISON treatment to a baseline where no social comparison is possible.

Each round of the experiment a subject started with an initial endowment of €8.00. Subjects could then invest a part X of their endowment in a lottery described as follows (based on Gneezy and Potters 1997):

You have a one half chance (50 %) to lose the amount X you bet and a one half chance (50 %) to win one-and-a-half times the amount (1.5X) you bet.

As the expected gain of the gamble is equal to 0.25X, a risk-neutral subject would invest the entire endowment. More risk-averse subjects would invest only a part of their endowment. This basic decision was then repeated for 12 rounds, out of which only a single round would be randomly selected for payment.

Subjects participated in the lottery by betting on the outcome of a coin toss: Heads or Tail. At the end of the round a coin toss was simulated by the computer and if the coin toss matched the subject’s winning coin side they won 1.5 times their investment, and otherwise they lost their investment. After every round subjects were informed about the outcome of the simulated coin toss, and hence their earnings that round. Subjects were then asked to rate their subjective satisfaction with the outcome on a scale from “Extremely Negative” to “Extremely Positive”.

In the COMPARISON treatment, subjects were matched with their direct physical neighbor in the lab for the entire experiment. Making the comparison subject clearly identifiable and geographically proximate as opposed to a random (re-matched every round) other subject in the lab was chosen to increase the likelihood of more intense social emotions. This setup also matches real world cases where you typically know whom you are comparing yourself with, these people are typically nearby, and you compare yourself with the same people over a longer stretch of time. Subjects were told that a single coin toss would determine the outcome for both themselves and their neighbor. A round consisted of three stages: a coin side choice/allocation stage, an investment decision stage and a result stage.

In the coin side choice/allocation stage, subjects were either assigned a winning coin side directly by the computer (e.g. they were informed that “This round your winning coin side is Heads”) or they were asked to choose their winning coin side themselves (e.g. “Your neighbors winning coin side this round will be Heads. Do you wish your winning coin side this round to be Heads or Tails?”). In each pair of neighbors the winning coin side for at least one of the subjects would be fixed exogenously by the experimental software. If the neighboring subject was then asked to decide on their own winning coin side, subjects could either assure that outcomes would be positively correlated by choosing the same winning coin side, or they could assure negatively correlated outcomes by choosing the opposite coin side.

In the investment stage, subjects then made their investment decision X. In this stage, they could observe their own (chosen or assigned) winning coin side and that of their neighbor, but they were no longer able to make changes to this winning coin side. For a period of 60 s the subjects were then able to update their preferred investment size as many times as they wanted. The initial default investment was set to \(X=0\). Each time they updated their decision this would immediately be observable by their neighbor. This was done for two reasons: the theory presumes that subjects can make their investment decision conditional on the other’s investment decision, so this information should be available to the subjects in the experiment as well. A more practical reason is that subjects knew that they were matched with their direct neighbor and so could be more inclined to spy on their neighbors decision, despite the separation walls. By providing the neighbors decision in realtime, there would be no reason for such circumference of lab regulations. See Appendix Fig. 4 for a screenshot of this investment stage.

In the final result stage of the round, subjects were informed of the result of the coin toss, their own payoff and the payoff off their neighbor. They were then asked to rate their satisfaction with the outcome on a scale from Extremely Negative to Extremely Positive, similar to Bault et al. (2008). Subjects were informed of their result that round immediately instead of only at the end of the experiment again to induce immediate social comparison emotions. This also gave subjects a chance to learn from their own emotional reactions to outcomes and adjust their behavior over the course of the experiment. See Appendix Fig. 6 for a screenshot of the result screen in the COMPARISON treatment.

In the COMPARISON treatment, subjects faced three different types of rounds: Type I: Your neighbor gets assigned a winning coin side and you decide whether to choose the same coin side or the opposite. Type II: You get assigned a winning coin side and your neighbor decides whether to choose the same coin side or the opposite. Type III: Both you and your neighbor get assigned winning coin sides by the computer. Each of these three types of rounds would be played out four times in random order. The purpose of the Type III rounds was to balance out the number of same and opposite coin rounds that subjects participated in. For example, if subjects mainly chose opposite coin sides, in the Type III rounds the computer would assign both subjects the same coin side and vice versa. Subjects were only informed that they were assigned a coin side, or were asked to make a coin side decision. Thus it was not possible for subjects to distinguish between Type II rounds and Type III rounds.Footnote 4

In the INDIVIDUAL treatment, subjects made their decisions in isolation: they only observed their own decisions and outcomes, and not those of their neighbor, nor were they aware of the winning coin side of their neighbor. As in the COMPARISON treatment in the INDIVIDUAL treatment in four out of twelve rounds, individuals would decide their own winning coin side, and in the other rounds they were simply assigned a winning coin side. See Appendix Fig. 3 and Fig. 5 for screenshots. In both the INDIVIDUAL and the COMPARISON treatment at the start of the experiment neighboring subjects were instructed to shake hands and wish each other luck. This was done to create some minimal social tie between neighbors.

After all 12 rounds had been completed a questionnaire was administered. Besides, the usual questions about age, gender and university department, three additional measures were included. The first was a similarity question. Subjects were asked to rate their neighbor on a 10-point similarity scale from 1 (“The person at this university least similar to me”) to 10 (“The person at this university most similar to me”). This question is motivated by the finding in the psychology literature that emotions related to social comparison are most salient with those whom we consider similar to us (Mummendey and Schreiber 1984; Brown and Abrams 1986). Also included was an 8-item Dispositional Envy Scale questionnaire developed by Smith et al. (1999) that purports to measure the dispositional enviousness of a respondent. Finally, a 14-item Competitiveness Index developed by Houston et al. (2002) was included. After the questionnaire was completed, one of the 12 rounds was randomly selected for payoff. Neighboring subjects would have the same round selected for payoff. Subjects were then informed about their final earnings for the experiment.

The experimental setup was programmed with the help of the experimental software z-Tree (Fischbacher 2007).

4 Results

In December 2010, and April 2011, a total of six experimental sessions were deployed at the Center for Research in Experimental Economics and Political Decision making (CREED) at the Universiteit van Amsterdam. Out of 138 subjects, 48 subjects participated in the INDIVIDUAL treatment and 90 subjects participated in the COMPARISON treatment.Footnote 5 Each session consisted of three separate experiments, out of which one random experiment would be selected for payoff. The experiment reported in this paper was always the first experiment in the session. The second and third treatment consisted of pilot projects not reported here. The average session lasted 90 minutes and the average payments was about €14.00 including a €5.00 show up fee.

Result 1 Subjects with a preference for negatively correlated outcomes, take significantly larger gambles than subjects with a preference for positively correlated outcomes.

Out of the four rounds where subjects could choose their winning coin side, after having learned the exogenously fixed winning coin side of their neighbor, about 7 % of subjects consistently chose the same coin side and about 12 % consistently chose the opposite coin side. While 36 % of subjects chose the opposite coin side more than half the time, 41 % of subjects chose the same coin side over half the time. About 23 % of subjects showed no preference and chose both the same and the opposite coin side half the time. On average, subjects made their final investment decision after 35 s, with subjects that made later decisions on average investing more.

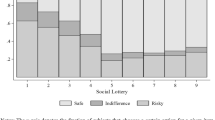

I compare the gambles of those subjects that chose the opposite coin side more than half the time with those that chose the same coin side over half the time in Table 1. Those with a preference for the opposite coin side gamble significantly more (average gamble is €6.30, 79 % of endowment) than those who prefer the same coin side (average gamble is €4.97, 62 % of endowment).Footnote 6 In fact, the gambles of those who have a preference for the same coin side are not significantly different from the INDIVIDUAL treatment,Footnote 7 while the difference is highly significant for those with opposite coin preferences.Footnote 8 See Appendix Fig. 2 for histograms of the gamble size distribution for the different treatment and conditions. Interestingly, there was no significant difference found between rounds where the subject made their own coin side decision and where they did not, nor between rounds where the two subjects had the same winning coin side and where they were opposite (see appendix Table 4). It seems that it is mostly the average propensity to choose negatively correlated gambles that predicts average risky investment. This is, however, in line with the theory where individuals for whom social gain seeking is stronger than their social loss aversion increase their gambles both in positively correlated and negatively correlated settings.

To test for the robustness of the above finding I construct a measure OppositeCoin which is defined by the number of opposite coin choices out of total number of coin choices made. Thus OppositeCoin varies from 0 for subjects that always chose positively correlated gambles, to 1 for subjects that always chose negatively correlated gambles. I then regress the gamble size on a number of factors including OppositeCoin using GLS estimation, and report the result in Table 2.

Simply estimating the equation with OLS and controlling for the neighbor’s gamble size would lead to an endogeneity issue, as subject 1’s gamble decision is a function of subject 2’s gamble decision, which is a function of subject 1’s gamble decision, etc. Thus a GLS estimation is used where the neighbor’s gamble decision is left out of the system of equations, and instead the error terms of neighboring subjects are allowed to correlate. In addition, the error terms for a subject across periods are also allowed to correlate, similar to controlling for clustered standard errors in OLS estimations. For completeness a similar OLS estimation with clustered standard errors is reported in Appendix Table 3.

Under all specifications the coefficient for OppositeCoin is positive and significant. Those who preferred negatively correlated gambles on average gambled more than two euro more (out of an initial endowment of €8) than those that preferred positively correlated gambles. Thus a revealed preference for negatively correlated outcomes is associated with more risk-taking.Footnote 9

Result 2 Average gambles are significantly larger in the COMPARISON treatment than in the INDIVIDUAL treatment.

In the INDIVIDUAL treatment, subjects invested on average €4.16 (52 %) out of their initial endowment of €8.00 (see Table 1). In the COMPARISON treatment, they invested on average €5.59 (or 70 % of their initial endowment).Footnote 10 As reported above, this result is mostly due to those subjects that preferred opposite coin side as they on average invested €6.30, whereas those subjects that mostly chose the same winning coin side on average only invested €4.79 which was not significantly different from the €4.16 in the INDIVIDUAL treatment. This is in line with the hypothesis that given a sufficient number of social gain seeking individuals in a population, increased social comparison will result in increased risk-taking.Footnote 11

One potential alternative explanation for the difference in average investment between treatments is emulation: low investment subjects can emulate a high investment neighbor in the COMPARISON treatment, thus raising average investment. As can be seen from Table 2, the error terms of neighboring subjects are indeed highly positively correlated (ranging from 0.85 to 0.89 depending on the specification). Estimating the model with standard OLS and clustered standard errors gives a coefficient between 0.41 and 0.44 on the neighbor’s gamble size regressor (see Appendix Table 3). Although this estimate suffers from the endogeneity issues discussed earlier, it is suggestive of a large effect size. This indicates that increasing gamble size by one subject is likely to increase their neighbor’s gamble size as well. However, this emulation effect would not explain why it is only those subjects with a preference for opposite winning coin side that statistically significantly increase their investment compared to the INDIVIDUAL treatment (see Table 1).

It could also be that the history of wins and losses compared to the neighbor induces additional investment in the COMPARISON treatment. However, in Table 5 of the Appendix, it shows that having had higher total payoffs or more wins so far only has a minor effect on gamble size (between €0.13 and €0.29 out of an initial endowment of €8.00), while the sign on the coefficient for the ratio of relative payoffs or number of wins is actually negative. In addition, in none of the GLS estimates is the Period variable significant, suggesting no overall trend across periods (although there is suggestion of a weakly positive trend in the OLS estimates). Taken together, it appears that the combined dynamic effects of subjects responding to earlier outcomes in the COMPARISON treatment is rather weak, and do not account for the sizeable difference with the INDIVIDUAL treatment.

Finally, in addition to the main results I find a typical gender effect where males choose bigger gamble sizes than females (see Croson and Gneezy 2009; Eckel and Grossman 2008), however, the gender of the neighbor does not seem to play a role. Out of the measures constructed from questionnaires at the end of the experiment, only the Enjoyment of Competition measure significantly affects gambling size. Neither Dispositional Envy, nor the self-reported similarity of the neighbor show up as significant. The effect of enjoyment of competition is rather sizeable though: increasing this measure from the lowest to the highest level is associated with an increase in gamble size of more than two euro, a similar effect size as the OppositeCoin measure. There is no increase or decrease of gamble size over time (see coefficient on period). An investigation of the non-incentivized subjective emotional responses to the outcomes of the lotteries did not reveal a significant difference between the COMPARISON and INDIVIDUAL treatments.

5 Discussion and conclusion

This paper has investigated the effect of social comparison on preferences for correlated outcomes and risk-taking. The three main results are that (i) a sizeable minority of subjects prefer negatively correlated outcomes over positively correlated outcomes, (ii) these subjects invest significantly more in a risky lottery in a social setting than subjects that prefer positively correlated outcomes and (iii) it is only these subjects that invest significantly more in a risky lottery than subjects making an identical decision in isolation. Thus social comparison may indeed increase risk-taking, but only for those subjects for whom social gain seeking dominates. Eliciting preferences for correlated outcomes can act as a convenient proxy for the shape of the social comparison function.

These findings also imply that the standard findings of Prospect Theory do not necessarily apply to social reference points. In Prospect Theory losses loom larger than gains (Kahneman and Tversky 1979), whereas my results as well as the evidence from Bault et al. (2008, 2011) show that for a significant part of the subject population social gains may loom larger than social losses. In this paper I show that this can have important implications for risk-taking in a social context. In addition, I show that the convexity of the social comparison function, i.e. whether social gain seeking is stronger than social loss aversion, can be studied with a relatively simple elicitation mechanism (i.e. eliciting the preference for positively or negatively correlated outcomes).

In contrast to Linde and Sonnemans (2015) (but in line with Bault et al. (2008)), I do find an effect of social comparison on risky decision-making. One important difference with Linde and Sonnemans (2015) is that in their setup subjects are matched with other subjects that made the same exact decision. According to Coricelli and Rustichini (2010), social emotions such as envy have evolved to be triggered when we make different decision than others and these others get a better outcome. Thus envy triggers a learning process that results in better learning over the long term. It is therefore likely that this only shows up in settings where the peer chose better than you did, not just that they had a better outcome having made the same exact choice.

These results also have some important other implications. First of all it would provide an additional explanation for the finding that people with more social interaction on average invest more in the stock market (possibly mainly driven by a minority of social gain seeking households). Second, it implies that for professions where people have significant latitude in determining the riskiness of their strategies, such as financial traders or high level managers, social competition could lead to increased risk-taking when these professions are mainly populated by social gain seeking individuals. One could expect to find more people with social gain seeking preferences on a trading floor than among say nurse practitioners, and thus the risk of social competition leading to excessive risk-taking could be especially high in the financial service sector.

Notes

Brooke Masters, “Bonus measures fail to reform risk takers.”, Financial Times, January 11, 2010.

Alternative ways of stating that social gain seeking is stronger than social loss aversion, also used in the literature, are for example that gloating looms larger than envy (e.g. Bault et al. 2008). Another way is by referring to the social comparison function as comparison-convex when social gains seeking is stronger than social loss aversion and comparison-concave when social loss aversion is stronger than social gain seeking as in Clark and Oswald (1998).

This is similar to Roussanov’s (2010) argument that those who are mainly concerned by getting ahead of the Jones’ (as opposed to catching up), should underdiversify their financial portfolio’s.

One referee brought up the fact that choices in Type I rounds could therefore also affect the balancing coin assignments in type III rounds, without the subjects being aware of this fact. However, given that fact that this coin assignment is in fact not payoff relevant in expected terms (expected own payoff is the same regardless of same or opposite winning coin side), plus the fact that subjects were simply told that “Some rounds you will be assigned a coin side, and some rounds you will be asked to submit a coin side at the beginning of the round.“ we do not consider this a case of subject deception.

More subjects were recruited to the COMPARISON treatment to have more power for the analysis of correlation between coin side choice and risky investments. The INDIVIDUAL only served as a baseline risky investment comparison, and therefore, 48 subjects were deemed sufficient.

Wilcoxon double sided test for difference in average gamble: \(p=0.03\).

Wilcoxon double sided test for difference in average gamble: \({p}>0.10\).

Wilcoxon double sided test for difference in average gamble: \({p}<0.001\).

One potential alternative interpretation of these results is that subjects do not have stronger social gain seeking than social loss aversion per se, but rather have utility over the sum of their and their neighbors earnings (preference for efficiency). By choosing the opposite coin side they can assure that at least one of them will win, and thus minimize the variance of the sum of their earnings. Having reduced the variance of the gamble, they would then be willing to invest a larger amount.

Double sided Wilcoxon test for difference in average gamble size: \({p}<0.05\).

As pointed out by a referee, this higher investment in the COMPARISON treatment could also be due to subjects with lower risk-taking propensity increasing their risk-taking to signal their neighbor that they are not “intimidated” by risk. However, in this latter case we would not expect to find a difference between subjects that prefer the same winning coin side versus those that prefer the opposite.

References

Aronsson, T., & Johansson-Stenman, O. (2008). When the Joneses’ consumption hurts: Optimal public good provision and nonlinear income taxation. Journal of Public Economics, 92(5), 986–997.

Bault, N., Coricelli, G., & Rustichini, A. (2008). Interdependent utilities: How social ranking affects choice behavior. PLoS One, 3(10), e3477.

Bault, N., Joffily, M., Rustichini, A., & Coricelli, G. (2011). Medial prefrontal cortex and striatum mediate the influence of social comparison on the decision process. Proceedings of the National Academy of Sciences, 108(38), 16044–16049.

Bertrand, M., & Morse, A. (2013). Trickle-Down Consumption (No. w18883). USA: National Bureau of Economic Research

Bolton, G., & Ockenfels, A. (2008). Risk Taking and Social Comparison. A Comment on ‘Betrayal Aversion: Evidence from Brazil, China, Oman, Switzerland, Turkey, and the United States’. American Economic Review, 100(1), 628–633.

Brown, R., & Abrams, D. (1986). The effects of intergroup similarity and goal interdependence on intergroup attitudes and task performance. Journal of Experimental Social Psychology, 22(1), 78–92.

Brown, J. R., Ivković, Z., Smith, P. A., & Weisbenner, S. (2008). Neighbors matter: Causal community effects and stock market participation. The Journal of Finance, 63(3), 1509–1531.

Clark, A. E., & Oswald, A. J. (1998). Comparison-concave utility and following behaviour in social and economic settings. Journal of Public Economics, 70(1), 133–155.

Clark, A. E., Frijters, P., & Shields, M. A. (2008). Relative income, happiness, and utility: An explanation for the Easterlin paradox and other puzzles. Journal of Economic Literature, textit46(1), 95–144.

Clark, A. E., Kristensen, N., & Westergård-Nielsen, N. (2009). Job satisfaction and co-worker wages: Status or signal? The Economic Journal, 119(536), 430–447.

Coricelli, G., & Rustichini, A. (2010). Counterfactual thinking and emotions: Regret and envy learning. Philosophical Transactions of the Royal Society of London B: Biological Sciences, 365(1538), 241–247.

Corneo, G., & Jeanne, O. (2001). Status, the distribution of wealth, and growth. The Scandinavian Journal of Economics, 103(2), 283–293.

Cooper, B., Garcia-Penalosa, C., & Funk, P. (2001). Status effects and negative utility growth. The Economic Journal, 111(473), 642–665.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 448–474.

Delgado, M. R., Schotter, A., Ozbay, E. Y., & Phelps, E. A. (2008). Understanding overbidding: Using the neural circuitry of reward to design economic auctions. Science, 321(5897), 1849–1852.

Duesenberry, J. S. (1949). Income, saving, and the theory of consumer behavior. Massachusetts: Harvard University Press.

Dijk, O., Holmen, M., & Kirchler, M. (2014). Rank matters—The impact of social competition on portfolio choice. European Economic Review, 66, 97–110.

Eckel, C. C., & Grossman, P. J. (2008). Men, women and risk aversion: Experimental evidence. Handbook of Experimental Economics Results, 1, 1061–1073.

Fafchamps, M., Kebede, B., & Zizzo, D. J. (2013). Keep up with the winners: experimental evidence on risk taking, asset integration, and peer effects. Cambridge: Centre for Economic Policy Research.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economics, 114(3), 817–868.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Frank, R. H. (1984). Are workers paid their marginal products?. The American economic review, 74(4),549–571.

Frank, R. H. (1985). The demand for unobservable and other nonpositional goods. The American Economic Review, 75(1), 101–116.

Frank, R. H., Levine, A. S., & Dijk, O. (2014). Expenditure cascades. Review of behavioral. Economics, 1(1), 55–73.

Gneezy, U., & Potters, J. (1997). An experiment on risk taking and evaluation periods. The Quarterly Journal of Economics, 112(2), 631–645.

Hirsch, F. (1976). Social limits to economic growth. Cambridge: Harvard University.

Hong, H., Kubik, J. D., & Stein, J. C. (2004). Social interaction and stock-market participation. The Journal of Finance, 59(1), 137–163.

Hopkins, E., & Kornienko, T. (2004). Running to keep in the same place: Consumer choice as a game of status. American Economic Review, 1085–1107.

Houston, J. M., Harris, P., McIntire, S., & Francis, D. (2002). Revising the competitiveness index using factor analysis. Psychological Reports, 90, 31–34.

Ireland, N. J. (1998). Status-seeking, income taxation and efficiency. Journal of Public Economics, 70(1), 99–113.

Ireland, N. J. (2001). Status-seeking by voluntary contributions of money or work. Annales d’Economie et de Statistique, 155–170. http://www.jstor.org/stable/20076300

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica: Journal of the Econometric Society, 47(2) 263–291. http://www.jstor.org/stable/1914185

Kimbrough, E. O., & Vostroknutov, A. (2013). Norms Make Preferences Social (No. dp13-01).

Kirchler, M., Lindner, F., & Weitzel, U. (2016). Rankings and Risk-Taking in the Finance Industry (No. 2016-02).

Linde, J., & Sonnemans, J. (2012). Social comparison and risky choices. Journal of Risk and Uncertainty, 44(1), 45–72.

Linde, J., & Sonnemans, J. (2015). Decisions under risk in a social and individual context: The limits of social preferences? Journal of Behavioral and Experimental Economics, 56, 62–71.

Ljungqvist, L., & Uhlig, H. (2000). Tax policy and aggregate demand management under catching up with the Joneses. American Economic Review, 356–366. http://www.jstor.org/stable/25098760

Luttmer, E. F. (2005). Neighbors as negatives: Relative earnings and well-being. The Quarterly Journal of Economics, 120(3) 963–1002. http://www.jstor.org/stable/25098760

Maccheroni, F., Marinacci, M., & Rustichini, A. (2012). Social decision theory: Choosing within and between groups. The Review of Economic Studies, 79(4), 1591–1636.

Mummendey, A., & Schreiber, H. J. (1984). Social comparison, similarity and ingroup favouritism—A replication. European Journal of Social Psychology, 14(2), 231–233.

Mui, V. L. (1995). The economics of envy. Journal of Economic Behavior & Organization, 26(3), 311–336.

Rauscher, M. (1992). Keeping up with the Joneses: Chaotic patterns in a status game. Economics Letters, 40(3), 287–290.

Regner, T., & Harth, N. S. (2010). Jena economic research papers (No. 2010, 072). http://www.jstor.org/stable/2951568

Robson, A. J. (1992). Status, the distribution of wealth, private and social attitudes to risk. Econometrica: Journal of the Econometric Society, 60(4) 837–857. http://www.jstor.org/stable/2951568

Rohde, I. M., & Rohde, K. I. (2011). Risk attitudes in a social context. Journal of Risk and Uncertainty, 43(3), 205–225.

Roussanov, N. (2010). Diversification and its discontents: Idiosyncratic and entrepreneurial risk in the quest for social status. The Journal of Finance, 65(5), 1755–1788.

Schoenberg, E. J., & Haruvy, E. (2012). Relative performance information in asset markets: An experimental approach. Journal of Economic Psychology. 33(6), 1143–1155.

Smith, R. H., Parrott, W. G., Diener, E. F., Hoyle, R. H., & Kim, S. H. (1999). Dispositional envy. Personality and Social Psychology Bulletin, 25(8), 1007–1020.

Trautmann, S. T., & Vieider, F. M. (2011). Social Influences on Risk Attitudes: Applications in Economics. Handbook of Risk Theory. Berlin: Springer.

Veblen, T. (1899) . The Theory of the Leisure Class, 2001. A. Wolfe (Ed.). New York: The Modern Library.

Wendner, R. (2005). Frames of reference, the environment, and efficient taxation. Economics of Governance, 6(1), 13–31.

Author information

Authors and Affiliations

Corresponding author

Additional information

O. Dijk would like to thank Pascal Courty, Jeffrey V. Butler, Massimo Marinacci, Debrah Meloso, Luigi Guiso, Eric S. Schoenberg, Robert H. Frank, Ori Heffetz, Joep Sonnemans, Jona Linde, Gary Charness, David K. Levine, Joël van der Weele and seminar participants at the Cornell LabMeeting, University of Amsterdam, Max Planck Institute for Economics in Jena, EUI, University of Gothenburg and Bilgi University for their feedback and comments. Lorenzo Magnolfi is thanked for his excellent research assistance. The financial support of the European Research Council (advanced Grant, BRSCDP-TEA) is gratefully acknowledged.

Appendices

Appendix A: Additional tables and figures

See Tables 3, 4, 5 and Fig. 2.

Appendix B: Screenshots

Appendix C: Experimental instructions

Welcome to our experimental study of decision-making. The experiment will last about an hour and a half. The instructions for the experiment are simple, and if you follow them carefully, you can earn a considerable amount of money. The money you earn is yours to keep, and will be paid to you immediately after the experiment.

The experiment consists of twelve successive rounds. In each round you will start with an amount of E8.00. You must decide which part of this amount (between E0.00 and E8.00) you wish to bet in the following lottery:

You have a 50 % chance to lose the amount you bet and a 50 % chance to win one-and-a-half (1.5) times what you bet.

The lottery is executed by a coin flip (Heads or Tail). Some rounds you will be assigned a coin side, and some rounds you will be asked to submit a coin side at the beginning of the round.

At the end of every round, the computer tosses a fair coin, landing either Heads or Tail. You win in the lottery if your coin side matches the computer toss. Since there are only two sides to a coin, the chance of winning in the lottery is one half (50 %) and the chance of losing is one half (50 %).

Thus, your earnings in the lottery are determined as follows. If you have decided to put an amount of X cents in the lottery, then your earnings in the lottery for the round are equal to \(\mathrm{E}8.00-X\) cents if the computer coin does not match your coin side (you lose the amount bet) and equal to \(\mathrm{E}8.00+1.5X\) cents if the computer coin matches your coin side. Your potential earnings will be shown on the screen.

Each round will last for one minute, with the remaining time shown on the screen. You can change your decision as many times as you want during the round.

[*** START COMPARISON TREATMENT ONLY***]

During this experiment you will be connected with the subject sitting next to you, designated your NEIGHBOR. During the experiment your screen will show both the decision that your NEIGHBOR is making as well as your NEIGHBOR’s outcomes. The computer coin drawn will be the same for you and your NEIGHBOR. Thus is you both have the same coin side, you will both win or both lose. If you have a different coin side, one of you will win and the other will lose.

[*** END COMPARISON TREATMENT ONLY***]

One of the twelve rounds will be randomly selected for payment for both you and your NEIGHBOR. GOOD LUCK!

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Dijk, O. For whom does social comparison induce risk-taking?. Theory Decis 82, 519–541 (2017). https://doi.org/10.1007/s11238-016-9578-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-016-9578-4