Abstract

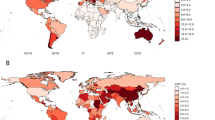

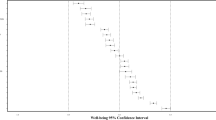

Is the association between debt and feeling of depression so fundamental that it occurs across time and place? Are some countries better at mitigating the depression related to debt than others? This paper addresses these questions by taking advantage of three harmonised longitudinal surveys, consisting of older adults in 21 European countries and the US. A series of logistic regression models show that, net of differences in other socioeconomic variables, people with household non-mortgage debt have higher odds of depression, measured using dichotomised versions of depressive symptom scores, in all countries. These associations are in many countries as strong as the association between low education level and depression. The association is particularly strong in countries with poor debt discharge legislation or low levels of indebtedness, both of which may be regarded as indicators of stigma related to debts. Overtime the association between debt and depression seems to be elevated within countries when the unemployment rate increases. These findings demonstrate how the links between debt and mental health are embedded in its institutional and economic contexts.

Similar content being viewed by others

Data availability

This paper uses data from SHARE Waves 1, 2, 3, 4, 5, 6, 7, 8 and 9 (DOIs: 10.6103/SHARE.w1.800, 10.6103/SHARE.w2.800, 10.6103/SHARE.w3.800, 10.6103/SHARE.w4.800, 10.6103/SHARE.w5.800, 10.6103/SHARE.w6.800, 10.6103/SHARE.w7.800, 10.6103/SHARE.w8.800, 10.6103/SHARE.w8ca.800, 10.6103/SHARE.w9ca800) see Börsch-Supan et al. (2013) for methodological details.(1) The SHARE data collection has been funded by the European Commission, DG RTD through FP5 (QLK6-CT-2001-00360), FP6 (SHARE-I3: RII-CT-2006-062193, COMPARE: CIT5-CT-2005-028857, SHARELIFE: CIT4-CT-2006-028812), FP7 (SHARE-PREP: GA N°211909, SHARE-LEAP: GA N°227822, SHARE M4: GA N°261982, DASISH: GA N°283646) and Horizon 2020 (SHARE-DEV3: GA N°676536, SHARE-COHESION: GA N°870628, SERISS: GA N°654221, SSHOC: GA N°823782, SHARE-COVID19: GA N°101015924) and by DG Employment, Social Affairs & Inclusion through VS 2015/0195, VS 2016/0135, VS 2018/0285, VS 2019/0332, and VS 2020/0313. Additional funding from the German Ministry of Education and Research, the Max Planck Society for the Advancement of Science, the U.S. National Institute on Aging (U01_AG09740-13S2, P01_AG005842, P01_AG08291, P30_AG12815, R21_AG025169, Y1-AG-4553-01, IAG_BSR06-11, OGHA_04-064, HHSN271201300071C, RAG052527A) and from various national funding sources is gratefully acknowledged (see https://wwww.shareproject.org).

Code availability

Replication codes are available online at https://osf.io/yw4h7/.

Notes

The development of the harmonised datasets was funded by the National Institute on Aging (R01 AG030153, RC2 AG036619, 1R03AG043052.

The respondents are asked not include mortgages or money owed on land, property or firms.

In ELSA the original weights provided by survey team, had a mean of 1. These weights were thus multiplied by sample/estimated population size (20,700,000, ONS estimate for 2018).

References

Allison, P. D. (2009). Fixed effects regression models (Vol. 160). SAGE publications.

Allison, P. D. (2019). Asymmetric fixed-effects models for panel data. Socius, 5, 2378023119826441. https://doi.org/10.1177/2378023119826441

Angel, S. (2016). The effect of over-indebtedness on health: Comparative analyses for Europe. Kyklos, 69(2), 208–227. https://doi.org/10.1111/kykl.12109

Angel, S., & Heitzmann, K. (2015). Over-indebtedness in Europe: The relevance of country-level variables for the over-indebtedness of private households. Journal of European Social Policy, 25(3), 331–351.

Banks, J., Batty, G. D., Breedvelt, J., Coughlin, K., Crawford, R., Marmot, M., & Zaninotto, P. (2022). English Longitudinal Study of Ageing: Waves, 0–9, 1998–2019.

Blomgren, J., Maunula, N., & Hiilamo, H. (2017). Do debts lead to disability pension? Evidence from a 15-Year follow-up of 54,000 finnish men and women. Journal of European Social Policy, 27(2), 109–122.

Börsch-Supan, A., Brandt, M., Hunkler, C., Kneip, T., Korbmacher, J., Malter, F., Schaan, B., Stuck, S., & Zuber, S. (2013). Data resource profile: The survey of health, ageing and retirement in Europe (Share). International Journal of Epidemiology, 42(4), 992–1001.

Bowers, J., & Drake, K. W. (2017). Eda for Hlm: Visualization when probabilistic inference fails. Political Analysis, 13(4), 301–326. https://doi.org/10.1093/pan/mpi031

Bryan, M. L., & Jenkins, S. P. (2015). Multilevel modelling of country effects: A cautionary tale. European Sociological Review, 32(1), 3–22. https://doi.org/10.1093/esr/jcv059

Callegari, J., Liedgren, P., & Kullberg, C. (2020). Gendered debt–a scoping study review of research on debt acquisition and management in single and couple households. European Journal of Social Work, 23(5), 742–754.

Clark, A. E. (2003). Unemployment as a social norm: Psychological evidence from panel data. Journal of Labor Economics, 21(2), 323–351.

Courtin, E., Knapp, M., Grundy, E., & Avendano-Pabon, M. (2015). Are different measures of depressive symptoms in old age comparable? An analysis of the Ces-D and Euro-D scales in 13 countries. International Journal of Methods in Psychiatric Research, 24(4), 287–304. https://doi.org/10.1002/mpr.1489

Dang, L., Dong, L., & Mezuk, B. (2020). Shades of blue and gray: A comparison of the center for epidemiologic studies depression scale and the composite international diagnostic interview for assessment of depression syndrome in later life. The Gerontologist, 60(4), e242–e253. https://doi.org/10.1093/geront/gnz044

Dobbie, W., & Song, J. (2015). Debt relief and debtor outcomes: Measuring the effects of consumer bankruptcy protection. American Economic Review, 105(3), 1272–1311. https://doi.org/10.1257/aer.20130612

Drentea, P., & Reynolds, J. R. (2012). Neither a borrower nor a lender be: The relative importance of debt and ses for mental health among older adults. Journal of Aging and Health, 24(4), 673–695. https://doi.org/10.1177/0898264311431304

Drentea, P., & Reynolds, J. R. (2015). Where does debt fit in the stress process model? Society and Mental Health, 5(1), 16–32.

Dunn, L F and Ida A M. 2012. Determinants of consumer debt stress: Differences by Debt type and gender. Unpublished manuscript, Department of Economics, Ohio State University, Columbus, Ohio.

Eurofound. (2020). Addressing Household over-Indebtedness. Luxembourg: Publications Office of the European Union.

Fitch, C., Hamilton, S., Bassett, P., & Davey, R. (2011). The relationship between personal debt and mental health: A systematic review. Mental Health Review Journal, 16(4), 153–166.

Gathergood, J. (2012). Debt and depression: Causal links and social norm effects. Economic Journal, 122(563), 1094–1114. https://doi.org/10.1111/j.1468-0297.2012.02519.x

Goode, J. (2010). The role of gender dynamics in decisions on credit and debt in low income families. Critical Social Policy, 30(1), 99–119.

Heuer, J-O. (2013). Social inclusion and exclusion in European consumer bankruptcy systems. in International conference «Shifting to Post-Crisis Welfare States in Europe.

Heuer, J.-O. (2020). Hurdles to debt relief for “no income no assets” debtors in Germany: A case study of failed consumer bankruptcy law reforms. International Insolvency Review, 29(S1), S44–S76. https://doi.org/10.1002/iir.1359

Hiilamo, A. (2020). Debt matters? Mental wellbeing of older adults with household debt in England. SSM-Population Health, 1(12), 100658.

Hiilamo, A., & Grundy, E. (2020). Household debt and depressive symptoms among older adults in three continental European countries. Ageing & Society, 40(2), 412–438.

Hodson, R., Dwyer, R. E., & Neilson, L. (2014). Credit card blues: The middle class and the hidden costs of easy credit. The Sociological Quarterly, 55(2), 315–340. https://doi.org/10.1111/tsq.12059

Hoffmann, T. (2012). The phenomenon of “consumer insolvency tourism” and its challenges to European legislation. Journal of Consumer Policy, 35(4), 461–475.

Hojman, D., Miranda, A., & Ruiz-Tagle, J. (2016). Debt trajectories and mental health. Social Science & Medicine, 167, 54–62.

Household Finance and Consumption Network. (2020). The household finance and consumption survey: Results from the 2017 wave. ECB Statistics Paper.

Jaime-Castillo, A. M., & Marqués-Perales, I. (2019). Social mobility and demand for redistribution in Europe: A comparative analysis. The British Journal of Sociology, 70(1), 138–165. https://doi.org/10.1111/1468-4446.12363

Jusko, K. L., & Phillips Shively, W. (2017). Applying a two-step strategy to the analysis of cross-national public opinion data. Political Analysis, 13(4), 327–344. https://doi.org/10.1093/pan/mpi030

Kasara, K., & Suryanarayan, P. (2015). When do the rich vote less than the poor and why? Explaining turnout inequality across the world. American Journal of Political Science, 59(3), 613–627. https://doi.org/10.1111/ajps.12134

Kedar, O., & Shively, W. (2017). Introduction to the special issue. Political Analysis, 13(4), 297–300. https://doi.org/10.1093/pan/mpi027

Lee, J. (2019). Credit access and household well-being: Evidence from payday lending. Available at SSRN 2915197.

Lewin-Epstein, N., & Semyonov, M. (2016). Household debt in midlife and old age: A multinational study. International Journal of Comparative Sociology, 57(3), 151–172.

Lewis, J. B., & Linzer, D. A. (2005). Estimating regression models in which the dependent variable is based on estimates. Political Analysis, 13(4), 345–364.

Mehrbrodt, T., Gruber, S., & Wagner, M. (2019). Scales and multi-item indicators. SHARE survey of health, ageing and retirement in Europe

Meltzer, H., Bebbington, P., Brugha, T., Jenkins, R., McManus, S., & Dennis, M. S. (2011). Personal debt and suicidal ideation. Psychological Medicine, 41(4), 771–778. https://doi.org/10.1017/S0033291710001261

Mudrazija, S., & Butrica, B. A. (2023). How does debt shape health outcomes for older Americans?. Social Science & Medicine, 116010.

Office for National Statistics. (2019). Wealth and Assets Survey.

Phelan, J. C., Link, B. G., & Dovidio, J. F. (2008). Stigma and prejudice: One animal or two? Social Science & Medicine, 67(3), 358–367. https://doi.org/10.1016/j.socscimed.2008.03.022

Prince, M. J., Reischies, F., Beekman, A. T., Fuhrer, R., Jonker, C., Kivela, S. L., Lawlor, B. A., Lobo, A., Magnusson, H., Fichter, M., van Oyen, H., Roelands, M., Skoog, I., Turrina, C., & Copeland, J. R. (1999). Development of the euro-D scale–a European, union initiative to compare symptoms of depression in 14 European centres. The British Journal of Psychiatry, 174, 330–338.

Purdam, K., & Prattley, J. (2021). Financial debt amongst older women in the United Kingdom–shame, abuse and resilience. Ageing & Society, 41(8), 1810–1832.

Purgato, M., & Barbui, C. (2013). Dichotomizing rating scale scores in psychiatry: A bad idea? Epidemiol Psychiatr Sci, 22(1), 17–19. https://doi.org/10.1017/s2045796012000613

Radloff, L. S. (1977). The ces-D scale: A self-report depression scale for research in the general population. Applied Psychological Measurement, 1(3), 385–401.

Richardson, R. A., Keyes, K. M., Medina, J. T., & Calvo, E. (2020). Sociodemographic inequalities in depression among older adults: cross-sectional evidence from 18 countries. The Lancet Psychiatry, 7(8), 673–681.

Richardson, T., Elliott, P., & Roberts, R. (2013). The relationship between personal unsecured debt and mental and physical health: A systematic review and meta-analysis. Clinical Psychology Review, 33(8), 1148–1162. https://doi.org/10.1016/j.cpr.2013.08.009

Rojas, Y. (2021). Financial Indebtedness and Suicide: A 1-year follow-up study of a population registered at the Swedish enforcement authority. International Journal of Social Psychiatry. https://doi.org/10.1177/00207640211036166

Sonnega, A., Faul, J. D., Ofstedal, M. B., Langa, K. M., Phillips, J. W. R., & Weir, D. R. (2014). Cohort profile: The health and retirement study (Hrs). International Journal of Epidemiology, 43(2), 576–585.

Stata manual. 2004. "Clogit—conditional (fixed effects) logistic regression." Stata Manual:216–35.

Steffick, D. E. (2000). Documentation of affective functioning measures in the health and retirement study (Vol. Ann). Institute for Social Research, University of Michigan.

Steptoe, A., Breeze, E., Banks, J., & Nazroo, J. (2012). Cohort profile: The English longitudinal study of ageing. International Journal of Epidemiology, 42(6), 1640–1648.

Sun, Amy Ruining and Jason N Houle. 2018. "Trajectories of unsecured debt across the life course and mental health at midlife." Society and Mental Health:2156869318816742.

Sweet, E. (2018). “Like you failed at life”: Debt, health and neoliberal subjectivity. Social Science & Medicine, 212, 86–93.

Sweet, E. (2020). Debt-related financial hardship and health. Health Education & Behavior, 1090198120976352.

Sweet, E., DuBois, L. Z., & Stanley, F. (2018). Embodied neoliberalism: Epidemiology and the lived experience of consumer debt. International Journal of Health Services, 48(3), 495–511. https://doi.org/10.1177/0020731418776580

Tay, L., Batz, C., Parrigon, S., & Kuykendall, L. (2017). Debt and subjective well-being: The other side of the income-happiness coin. Journal of Happiness Studies, 18(3), 903–937. https://doi.org/10.1007/s10902-016-9758-5

Turunen, E., & Hiilamo, H. (2014). Health effects of indebtedness: A systematic review. BMC Public Health, 14, 489. https://doi.org/10.1186/1471-2458-14-489

Warth, J., Puth, M.-T., Tillmann, J., Porz, J., Zier, U., Weckbecker, K., & Münster, E. (2019). Over-indebtedness and its association with sleep and sleep medication use. BMC Public Health, 19(1), 957.

West, M. D. (2003). Dying to get out of debt: Consumer insolvency law and suicide in Japan. in Law & economics working papers, edited by University of Michigan Law School.

Wiedemann, A. B. (2018). Indebted societies: Modern labor markets, social policy, and everyday borrowing. Massachusetts Institute of Technology.

Wiedemann, A. (2023). A social policy theory of everyday borrowing: On the role of welfare states and credit regimes. American Journal of Political Science, 67(2), 324–341.

Wilkinson, R., & Pickett, K. (2010). The spirit level—why equality is better for everyone. Allen Lane.

Zurlo, K. A., Yoon, W., & Kim, H. (2014). Unsecured consumer debt and mental health outcomes in middle-aged and older Americans. Journals of Gerontology Series B: Psychological Sciences and Social Sciences, 69(3), 461–469. https://doi.org/10.1093/geronb/gbu020

Acknowledgements

A version of this paper was included in the PhD thesis of the author. This work was supported by the Osk. Huttunen Foundation. I am grateful for the comments provided by my supervisors Tania Burchardt and Jouni Kuha. Any errors are mine.

Funding

The HRS (Health and Retirement Study) is sponsored by the National Institute on Aging (grant number NIA U01AG009740) and is conducted by the University of Michigan. ELSA is funded by the National Institute on Aging (R01AG017644), and by UK Government Departments coordinated by the National Institute for Health and Care Research (NIHR). The development of the harmonised datasets was funded by the National Institute on Aging (R01 AG030153, RC2 AG036619, 1R03AG043052.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The author declares no conflict of interest. This work was funded by the Osk Huttunen Foundation.

Ethical approval

Informed consents were obtained in all three analysed studies. This study does not analyse restricted, confidential data. In SHARE, during Waves 1 to 4, the study was reviewed and approved by the Ethics Committee of the University of Mannheim. Wave 4 of SHARE and the continuation of the project were reviewed and approved by the Ethics Council of the Max Planck Society. ELSA study has been approved by several Research Ethics Committees. The HRS study comply with the requirements of the University of Michigan’s Institutional Review Board (IRB).

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hiilamo, A. Household Non-mortgage Debt and Depression in Older Adults in 22 Countries: What is the Role of Social Norms, Institutions and Macroeconomic Conditions?. Soc Indic Res (2024). https://doi.org/10.1007/s11205-024-03314-x

Accepted:

Published:

DOI: https://doi.org/10.1007/s11205-024-03314-x