Abstract

Despite the big strides taken by the countries on economic growth due to globalization from the last decade of the twenty-first century, lack of financial inclusion, illiteracy and poor health conditions continue to hinder the social development of many countries. At the turn of the current decade, countries are looking at ways to meet the 2030 deadline set for SDGs. This study will guide policy makers to make strategic choices related to their investment in health and education to improve social development sustainably leading to better and sustained financial inclusion. Data related to 18 emerging countries (as given in MSCI report) for the time 2004 to 2018 was retrieved and Fixed Effect Panel Quantile (FPQR) was employed to study the nexus of human development (education, health), financial inclusion and carbon emissions. Each of the constructs related to financial inclusion, human development, health, and education were defined by appropriate variable for which data was available for the 15-year period. Findings of the study include, (i) Income and education have a favorable impact on the FI, but health and CO2 have a negative impact. (ii) Education, GDP, and CO2 have a favorable influence on the health index and a negative impact on FI. (iii) FI, health, and CO2 have positive effects on education but negative effects on GDP. (iv) GDP, education, and health all have a negative impact on CO2 emissions. This study emphasizes the means to achieve financial inclusion through sustained human development through education and health. The effect of environmental degradation caused by economic progression is also considered to give a sustainable model. Emerging economies focusing on improving the FI and HD can have policy ramifications to boost the education level of its citizens as well as increase the access to healthcare services for them. A financially and digitally literate society will improve its score on the human development index.

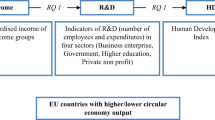

(Source: UNDP Human development report 2019)

Similar content being viewed by others

References

Ahamed, M. M., and Mallick, S. K. (2019). Is financial inclusion good for bank stability? International evidence. Journal of Economic Behavior and Organization, 157, 403–427.

Ahmed, Z., Zafar, M. W., Ali, S., and Danish. (2020). Linking urbanization, human capital, and the ecological footprint in G7 countries: An empirical analysis. Sustainable Cities and Society, 55. https://doi.org/10.1016/j.scs.2020.102064

Akin, C. S. (2014). The impact of foreign trade, energy consumption and income on CO2 emissions. International Journal of Energy Economics and Policy, 4(3), 465–475.

Allard, A., Takman, J., Uddin, G. S., and Ahmed, A. (2018). The N-shaped environmental Kuznets curve: An empirical evaluation using a panel quantile regression approach. Environmental Science and Pollution Research, 25(6), 5848–5861.

Alkire, S. (2002). Dimensions of human development. World development, 30(2), 181–205

Arora, R. U. (2012). Financial inclusion and human capital in developing Asia: The Australian connection. Third World Quarterly, 33(1), 177–197.

Arunachalam, R. S., and Crentsil, G. L. K. (2020). The Financial Inclusion Advocacy Centre Financial Inclusion in the Era OF COVID-19 Financial Inclusion in the COVID-19 Era. The Financial Inclusion Advocacy Centre, 233(26): 0–33.

Bagli, S., and Adhikary, M. (2013). Financial inclusion and human development. The Indian Economic Journal, 61(3), 390–406. https://doi.org/10.1177/0019466220130304

Bank, W. (2014). World development report 2015: Mind, society, and behavior. The World Bank.

Beck, T., and Demirgu, A. (2009). Beck, et al.,2009.pdf. 119–145.

Becker, G. S. (1994). Human capital revisited. In Human Capital: A Theoretical and Empirical Analysis with Special Reference to Education, Third Edition (pp. 15–28). The University of Chicago Press.

Chibba, M. (2009). Financial inclusion, poverty reduction and the millennium development goals. The European Journal of Development Research, 21(2), 213–230.

Cicchiello, A. F., Kazemikhasragh, A., Monferrá, S., and Girón, A. (2021). Financial inclusion and development in the least developed countries in Asia and Africa. Journal of Innovation and Entrepreneurship, 10(1), 1–13.

Conceição, P., Assa, J., Calderon, C., Gray, G., Gulasan, N., Nsu, Y.-C., … Tapia, H. (2019). Human Development Report 2019: beyond income, beyond averages, beyond today. In United Nations Development Program. Retrieved from https://hdr.undp.org/sites/default/files/hdr2019.pdf

Cook, T., and McKay, C. (2015). How M-Shwari works: The story so far. Consultative Group to Assist the Poor (CGAP) and Financial Sector Deepening (FSD).

Demirguc-Kunt, A., Klapper, L., Singer, D., Ansar, S., and Hess, J. (2018). The global findex database 2017: Measuring Financial inclusion and the fintech revolution. In World Bank. https://doi.org/10.1596/978-1-4648-1259-0

Dev, S. M. (2006). Financial inclusion: Issues and challenges. Economic and Political Weekly, 4310–4313.

Du, Q., Wu, N., Zhang, F., Lei, Y., and Saeed, A. (2022). Impact of financial inclusion and human capital on environmental quality: Evidence from emerging economies. Environmental Science and Pollution Research, 29(22), 33033–33045.

Epure, M., Peet, R., and Hartwick, E. (2015). Theories of development contentions, arguments, alternatives. Journal of Economic Development, Environment and People, 4(4), 76–79.

Feinstein, L., Sabates, R., Anderson, T. M., Sorhaindo, A., and Hammond, C. (2006). What are the effects of education on health. Measuring the Effects of Education on Health and Civic Engagement: Proceedings of the Copenhagen Symposium, 171–354. OECD Paris, France.

Frankel, J. A., and Romer, D. (1999). Does trade cause growth? American Economic Review, 89(3), 379–399.

Geraci, M., and Bottai, M. (2007). Quantile regression for longitudinal data using the asymmetric Laplace distribution. Biostatistics, 8(1), 140–154.

Geraldes, H. S. A., Gama, A. P. M., and Augusto, M. (2022). Reaching Financial Inclusion: Necessary and Sufficient Conditions. Social Indicators Research, 1–19.

Hickel, J. (2020). The sustainable development index: Measuring the ecological efficiency of human development in the anthropocene. Ecological Economics, 167, 106331.

Jack, W., and Suri, T. (2011). Mobile money: The economics of M-PESA. National Bureau of Economic Research.

Kabakova, O., and Plaksenkov, E. (2018). Analysis of factors affecting financial inclusion: Ecosystem view. Journal of Business Research, 89, 198–205. https://doi.org/10.1016/j.jbusres.2018.01.066

Kabakova, O., Plaksenkov, E., and Korovkin, V. (2016). Strategizing for financial technology platforms: Findings from four Russian case studies. Psychology and Marketing, 33(12), 1106–1111.

Kebede, J., Selvanathan, S., and Naranpanawa, A. (2021). Foreign bank presence, institutional quality, and financial inclusion: Evidence from Africa. Economic Modelling. https://doi.org/10.1016/j.econmod.2021.105572

Klapper, L., El-Zoghbi, M., and Hess, J. (2016). Achieving the sustainable development goals. The Role of Financial Inclusion. Available Online: . Ccgap. Org. Accessed, 23(5), 2016.

Koenker, R., and Bassett Jr, G. (1978). Regression quantiles. Econometrica: Journal of the Econometric Society, 33–50.

Koenker, R. (2004). Quantile regression for longitudinal data. Journal of Multivariate Analysis, 91(1), 74–89.

Kumar, N., and Arora, O. (2019). Financing sustainable infrastructure development in South Asia: The case of AIIB. Global Policy, 10(4), 619–624. https://doi.org/10.1111/1758-5899.12732

Kuri, P. K., and Laha, A. (2011). Financial inclusion and human development in India: An inter-state analysis. Indian Journal of Human Development, 5(1), 61–77.

Lamarche, C. (2010). Robust penalized quantile regression estimation for panel data. Journal of Econometrics, 157(2), 396–408.

Le, T. H., Le, H. C., & Taghizadeh-Hesary, F. (2020). Does financial inclusion impact CO2 emissions? Evidence from Asia. Finance Research Letters, 34, 101451

Lee, C.-C., and Lee, J.-D. (2009). Income and CO2 emissions: Evidence from panel unit root and cointegration tests. Energy Policy, 37(2), 413–423.

Liu, F., and Walheer, B. (2022). Financial inclusion, financial technology, and economic development: A composite index approach. Empirical Economics. https://doi.org/10.1007/s00181-021-02178-1

Matekenya, W., Moyo, C., and Jeke, L. (2021). Financial inclusion and human development: Evidence from Sub-Saharan Africa. Development Southern Africa, 38(5), 683–700.

Mbiti, I., and Weil, D. N. (2011). Mobile banking: the impact of M-Pesa in Kenya No. w17129 National Bureau of Economic Research.

OECD. (2020). Building back better - A sustainable, resilient recovery after COVID-19. OECD Policy Responses to Coronavirus (COVID-19), (June), 2–16. Retrieved from https://read.oecd-ilibrary.org/view/?ref=133_133639-s08q2ridhfandtitle=Building-back-better-_A-sustainable-resilient-recovery-after-Covid-19

Ofosu-Mensah Ababio, J., Attah-Botchwey, E., Osei-Assibey, E., and Barnor, C. (2021a). Financial inclusion and human development in frontier countries. International Journal of Finance and Economics, 26(1), 42–59. https://doi.org/10.1002/ijfe.1775

Ofosu-Mensah Ababio, J., Attah-Botchwey, E., Osei-Assibey, E., and Barnor, C. (2021b). Financial inclusion and human development in frontier countries. International Journal of Finance and Economics, 26(1), 42–59.

Omar, A., and Inaba, K. (2020). Does financial inclusion reduce poverty and income inequality in developing countries ? A panel data analysis. Journal of Economic Structures. https://doi.org/10.1186/s40008-020-00214-4

Ozili, P. K. (2020). Theories of financial inclusion. In Uncertainty and challenges in contemporary economic behaviour (pp. 89–115). Emerald Publishing Limited.

Pata, U. K. (2018). Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. Journal of Cleaner Production, 187, 770–779.

Pervaiz, R., Faisal, F., Rahman, S. U., Chander, R., and Ali, A. (2021). Do health expenditure and human development index matter in the carbon emission function for ensuring sustainable development? Evidence from the heterogeneous panel. Air Quality, Atmosphere and Health, 14(11), 1773–1784. https://doi.org/10.1007/s11869-021-01052-4

Pesaran, M. H. (2004a). General diagnostic tests for cross section dependence in panels. University of Cambridge, Faculty of Economics, Cambridge Working Papers in Economics No. 0435. Center for Economic Studies and Ifo Institute for Economic Research CESifo, (1229), 41.

Pesaran, M. H. (2004b). General diagnostic tests for cross section dependence in panels (IZA Discussion Paper No. 1240). Institute for the Study of Labor (IZA).

Pesaran, M. H., and Yamagata, T. (2008). Testing slope homogeneity in large panels. Journal of Econometrics, 142(1), 50–93.

Peters, S. (2010). Literature review: Transition from early childhood education to school. Report to the Ministry of Education, New Zealand

Rahman, M. M. (2011). Causal relationship among education expenditure, health expenditure and GDP: A case study for Bangladesh. International Journal of Economics and Finance, 3(3), 149–159.

Ranis, G., Stewart, F., and Samman, E. (2006). Human development: Beyond the human development index. Journal of Human Development, 7(3), 323–358. https://doi.org/10.1080/14649880600815917

RATNAWATI, K. (2020). The Impact of Financial Inclusion on Economic Growth, Poverty, Income Inequality, and Financial Stability in Asia. The Journal of Asian Finance, Economics and Business, 7(10), 73–85. https://doi.org/10.13106/jafeb.2020.vol7.no10.073

Rewilak, J. (2017). The role of financial development in poverty reduction. Review of Development Finance, 7(2), 169–176.

Rum, I. A. and H. (2013). The role of financial inclusion in human development: Empirical EvidenceTitle.

Sahay, R., Čihák, M., N’Diaye, P., and Barajas, A. (2015). Rethinking financial deepening: Stability and growth in emerging markets. Revista De Economía Institucional, 17(33), 73–107.

Sarma, M., and Pais, J. (2011). Financial inclusion and development. Journal of International Development, 23(5), 613–628.

Sha’banGirardoneSarkisyan, M. C. A. (2020). Cross-country variation in financial inclusion: A global perspective. European Journal of Finance, 26(4–5), 319–340. https://doi.org/10.1080/1351847X.2019.1686709

Shah, S. (2016). Determinants of human development index: a cross-country empirical analysis. International Journal of Economics and Management Studies, 3(5), 43–46.

Shahbaz, M., Tiwari, A. K., and Nasir, M. (2013). The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy, 61, 1452–1459.

Solaki, M. (2013). Relationship between education and GDP growth: A bi-variate causality analysis for Greece. International Journal of Economic Practices and Theories, 3(2), 133–139.

Staffa, S. J., Kohane, D. S., and Zurakowski, D. (2019). Quantile regression and its applications: A primer for anesthesiologists. Anesthesia and Analgesia, 128(4), 820–830.

Stewart, F., Ranis, G., and Samman, E. (2018). Advancing human development: Theory and practice. In Oxford Schlorship Online. https://doi.org/10.1093/oso/9780198794455.001.0001

Terziev, V. (2019). Importance of human resources to social development. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3310508

Thathsarani, U., Wei, J., and Samaraweera, G. (2021). Financial inclusion’s role in economic growth and human capital in south asia: An econometric approach. Sustainability (switzerland), 13(8), 1–18. https://doi.org/10.3390/su13084303

Thompson, I. H. (2005). The ethics of sustainability. Landscape and Sustainability. https://doi.org/10.5840/du1998811/126

UNDP. (2020). The Next Frontier: Human Development and the Anthropocene. In Human Development Report 2020. Retrieved from http://hdr.undp.org/en/2020-report

Vo, D. H., Nguyen, N. T., & Van, L. T. H. (2021). Financial inclusion and stability in the Asian region using bank-level data. Borsa Istanbul Review, 21(1), 36–43

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69(6), 709–748.

Westerlund, J., and Edgerton, D. L. (2007). A panel bootstrap cointegration test. Economics Letters, 97(3), 185–190.

WHO. (2022). World Health Statistics.

Yang, B., Jahanger, A., and Khan, M. A. (2020). Does the inflow of remittances and energy consumption increase CO 2 emissions in the era of globalization? A global perspective. Air Quality, Atmosphere and Health, 13(11), 1313–1328.

Zafar, M. W., Saud, S., and Hou, F. (2019). The impact of globalization and financial development on environmental quality: Evidence from selected countries in the organization for economic co-operation and development (OECD). Environmental Science and Pollution Research, 26(13), 13246–13262. https://doi.org/10.1007/s11356-019-04761-7

Zameer, H., Yasmeen, H., Zafar, M. W., Waheed, A., and Sinha, A. (2020). Analyzing the association between innovation, economic growth, and environment: Divulging the importance of FDI and trade openness in India. Environmental Science and Pollution Research, 27(23), 29539–29553.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author(s) declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bhuvaneskumar, A., Benedict, J. & Sankar, M. Does Financial Inclusion and Human Development Progress Sustainably? Evidence from Emerging Countries. Soc Indic Res 171, 189–213 (2024). https://doi.org/10.1007/s11205-023-03240-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-023-03240-4