Abstract

This study proposes a new measure of wage risk based on estimated probabilities to earn an hourly wage that is below some specific lower quantile of the wage distribution. Using the German SOEP as an information rich data base, we determine wage risks overall and for nine job categories during the period from 1992 until 2015. We find that the low-wage workers in Germany are worse off after the Hartz reforms. In Western Germany this evidence stems from both a reduction of low wages and an increase of wage risk. In Eastern Germany, it is largely due to increased wage risk. Moreover, overall evidence hides important developments at the occupational level.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In modern economies labor income is the primary earning source such that threats of job loss and wage cuts are delicate for a large share of the population. As a reflection, academic interests have turned to understanding determinants and effects of both unemployment and wage risks, i.e., the probabilities of jobs loss and of adverse wage fluctuations, respectively. Among these, the latter is typically seen as an important source of uninsurable risk faced by most individuals (Fagereng et al., 2018). Hence, individuals have to make considerable adjustments of the choices they would undertake under the absence of wage uncertainty. Such changes in behaviour comprise the accumulation of precautionary savings and consumption adjustments (Blundell et al., 2008), the increase of labor supply (Parker et al., 2005; Jessen et al., 2018) or the re-composition of financial portfolios in order to reduce the share of risky assets (Heaton & Lucas, 2000).

A core prerequisite for understanding the evolution of wage risk over time and its consequences for inequality and welfare is a reliable measure of this latent quantity. With regard to the question of how to measure wage risk (or wage uncertainty), the literature can be divided into two main branches. A first branch proceeds from a structured representation of (log) wages that allows to identify their permanent and transitory components (e.g., Abowd et al., 1999; Baker & Solon, 2003; Low et al., 2010; Mecikovsky & Wellschmied, 2016). Wage risk is measured then as the variance of the transitory wage component. When it comes to assessing wage uncertainty dynamically at the level of individual wages or with job-category-specific resolution, however, structured wage decompositions might suffer from weak flexibility. A second branch of the literature considers that past variations of individual income are informative for current levels of wage uncertainty (e.g., Parker et al., 2005; Jessen et al., 2018; Hospido, 2012). While such structured time series approaches promise consistent extrapolations of wage uncertainties, they also suffer from limited flexibility in approximating wage uncertainties with high resolution at individual or job-category-specific levels. As a matter of fact, available metrics of wage risk are of two-sided nature and, hence, implicitly attach equal importance to wage shocks of either direction.

Taking advantage of the prominent distinction between two-sided indicators of income inequality (e.g., the Gini index) and left-sided poverty measures (e.g., fixed shares of the median income), this study proposes a new metric of wage risk that builds upon the idea that agents want to guard against particular events of unfavorable wage cuts. Specifically, wage risk is approximated as the (probit model implied) probability to realize wage earnings below a certain lower quantile of the occupation- and time-specific distribution of hourly wages.Footnote 1 Unlike the aforementioned measures (Abowd et al., 1999; Baker & Solon, 2003; Low et al., 2010; Mecikovsky & Wellschmied, 2016; Hospido, 2012; Parker et al., 2005; Jessen et al., 2018), our metric has the advantage to avoid strong structural or homogeneity assumptions, allowing identification of wage risks at the individual level. Moreover, our measure of wage risk builds upon probit models that are commonly used to explain labor market outcomes.Footnote 2

Using the German Socio-Economic Panel (SOEP), we determine occupation- and time-specific individual wage risks over the period 1992–2015 for four major labor market segments in Germany (namely, female and male workers in Western and Eastern Germany). Our main results can be summarized as follows. First, we obtain that in the period after the Hartz reforms low-wage workers in Germany are clearly worse off. For male and female workers in Western Germany, this is because the increase in their wage risks has been accompanied by a decline in their real wage level. For male and female low-wage workers in Eastern Germany, this is due to a marked increase in their wage risks, whereas their wage levels have remained rather unchanged. Second, overall effects hide important developments at the occupation-specific level. In Western Germany, losses in wage levels and increases in wage risk have been particularly typical for Unskilled workers, Service & sales workers, Craftsmen and Operatives, while low-wage Managers have gained in terms of an increased wage level accompanied by a reduction of wage risk. In Eastern Germany marked upward changes of wage risks have been typical for male and female Unskilled workers and Craftsmen and female Operatives, Clerks and Technicians.

The remainder of this paper is organized as follows. Section 2 overviews the literature on measuring wage risk and suggests a flexible approach to determine wage risk in a time-varying manner with job-category-specific resolution. Section 3 introduces the data and outlines our empirical approach. Results are discussed in Sect. 4. Section 5 concludes. Definitions and descriptive statistics of the variables are in "Appendix A". "Appendix B" provides occupation-specific regression outcomes for the considered segments of the German labor market. Almost throughout our empirical analysis refers to the 10% wage quantile. "Appendix C" documents robustness analysis for the 5% wage quantile.

2 Measurement of Wage Risk

In empirical studies, it has become a convention to consider wage risk as a form of idiosyncratic uncertainty which is often measured as the variance of transitory wage components (e.g., Low et al., 2010). By implication, such quantifications of risk derive from assuming symmetric effects of positive and negative changes of individual wages. Under the paradigm of decreasing marginal utility of income, however, negative wage shocks are associated with utility losses that exceed in absolute magnitude the utility gains from positive wage shocks of the same size. Hence, and in analogy to the distinction between indicators of income inequality (e.g., the Gini index) and poverty (e.g., fixed shares of the median income), it appears natural to develop a left-sided indicator of wage risk.

We next provide a concise review of studies where wage risk is associated with the variance of wages. Subsequently, we introduce the one-sided metric of wage risk proposed in this work.

2.1 Variation-Based Measures

The literature has quantified wage risks by: (i) identifying the transitory component of the stochastic log-wages (e.g., Low et al., 2010); or (ii) through past variations of individual incomes (e.g., Parker et al., 2005; Jessen et al., 2018). With regard to the first strand of the literature, the stochastic (or residual) components of the (log) wage process are often formalized as the sum of two orthogonal components: a permanent and a transitory one.Footnote 3 Wage uncertainty or wage risk under such a structured representation of individual wage processes is measured by means of empirical moments of the transitory wage component. In this vein, using a 20-year longitudinal sample of US workers from the Survey of Income and Program Participation, Mecikovsky and Wellschmied (2016) provide an interesting perspective on the decomposition of time trends in wage uncertainty of male individuals, aged between 25 and 61. Distinguishing three subperiods, the contribution of the permanent component to wage risk is relatively small throughout. During the period 2004–2013 and in comparison with former time spans (1983–1993, 1994–2003), wage risks stemming from transitory components have decreased for workers with at least some college education, while their wage risks stemming from external job offers have increased.

A second strand of the literature focuses on the measurement of individual and time-specific wage risks. There, it has been argued that experienced variations in wages are useful for forming ex-ante expectations about future earning opportunities. Building on this presumption, scholars have used past variations of individual wages (or residuals thereof) to quantify wage risk (e.g., Parker et al., 2005; Jessen et al., 2018). In (unbalanced) panels with large cross-sections and short time series, such realized variance statistics might suffer from both high estimation uncertainty and excess persistence, with the latter contributing to other sources of unobserved heterogeneity (Parker et al., 2005).Footnote 4 In light of scarce sample information and acknowledging that realized variances are eventually weak predictors for future wage risks, one might opt for a model-based assessment of wage uncertainty. In this regard, a suggestion of Hospido (2012) grounds in the class of (generalized) autoregressive conditionally heteroskedastic ((G)ARCH) processes. More precisely, Hospido (2012) proposes a panel model that copes with the issue of typically short time horizons by means of the imposition of strong cross-sectional restrictions of parameter homogeneity.

2.2 A Probit Approach

Owing to their often restrictive parametric or structured form, established measures of wage risk in the form of the variance of transitory wage components lack sufficient flexibility to determine wage risk with timely or job-specific resolution (see also De Nardi et al. (2021) for motivations of more flexible measures of wage risk).Footnote 5 The wage risk measure that we adopt in this study is inspired by the so-called value-at-risk which has become prominent in financial analysis (Jorion, 2007). The core idea that underlies this metric is that agents want to guard against specific unfavorable events (negative portfolio returns in the original work and unexpected wage cuts in the present context) to which one can assign a prespecified probability.Footnote 6 In lack of objective data on agent-specific earning distributions, we quantify such unfavorable events on the basis of the distribution of occupation and year-specific earnings. Unfavorable states in the sense of the value-at-risk approach, are then wage outcomes that are below some lower reference quantile of the wage distribution. To assess wage risks, we determine individual and time-specific probabilities to realize earnings that are below the 10% quantile of occupation- and year-specific distributions of hourly wages.Footnote 7 Consequently, our measure focuses on downside wage risk, i.e., on the lower tail of the wage distribution, and has the advantage to adopt flexibly to occupation- and time-specific patterns of earning opportunities. Next, we outline this measure of wage risk formally.

Let \(\Omega _{jt}\) denote the distribution of hourly wages \(w_{ij,t}\) for individuals \(i,\,i=1,2,\ldots ,N\), in job category j and time t. Moreover, \(w_{\alpha }(\Omega _{jt})\) is a lower quantile of this distribution, where \(\alpha\) is a nominal probability level of interest. For instance, choices of \(\alpha =0.05,\,0.1\) refer to two specific lower thresholds of the wage distribution. Our measure of wage risk is the probability to earn a wage that falls below this critical threshold \(\text{ Prob }\left( w_{ij,t} \le w_{\alpha }(\Omega _{jt})\right)\). We estimate this probability conditional on covariate information by means of a probit model. Specifically, the dependent variable is defined in a binary way as

To quantify the probabilities of interest in unbalanced panels, we apply pooled probit regression models as:

where \(\Phi\) indicates the Gaussian distribution function, \({\varvec{x}_{i,t}}\) is a vector collecting covariate information, and \(N_{jt}\) is the number of individuals in job category j with available wage quotes in time t. To quantify the probabilities of interest in a flexible manner, the model parameters in \(\nu _j\) and \(\varvec{\beta }_j\) are job-category-specific. For providing overall evidence, we also implement an occupation-invariant model imposing the restrictions \(\nu _j=\nu\) and \(\varvec{\beta }_j=\varvec{\beta }\).Footnote 8

After evaluating the alternative probit models by means of maximum likelihood estimation, we determine the estimated probits from pooled regressions as

and occupation-specific regression models as

From averaging time-specific probit estimates over the surveyed individuals in occupation j at time t (i.e., \(N_{jt}\)), we extract time and occupation-specific trends in wage risk, respectively, asFootnote 9

and

3 Data and Empirical Approach

3.1 Data

Our empirical analysis is based on data from the German Socio-Economic Panel (SOEP, version 32), a representative panel of German private household data.Footnote 10 As compared to other databases that have been used to analyze the German labor market (namely, the Sample of Integrated Employment Biographies (SIAB), the German Structure of Earnings Survey (GSES), the BIBB-IAB/BAuA Labor Force Surveys (BLFS)), the SOEP is unique in allowing to obtain hourly wages (with job category resolution) based on the effective number of hours worked on an annual basis.Footnote 11 Our sample covers the period 1992–2015, where 1992 is the first year in which the SOEP includes a consumer price index for East Germany, and 2015 is the last available year in its 32nd version.Footnote 12 As it is common in the related literature (e.g., Dustmann et al., 2014; Jessen et al., 2018; De Nardi et al., 2021), our sample is restricted to married individuals between 25 and 56 years who work between 20 and 80 hours per week. Overall, this yields a sample of 112,957 observations from 16,155 (12,398) male (female) workers.

Our sample period covers the great financial crisis starting in 2008 and the subsequent European sovereign debt crisis, as well as important institutional changes in the German labor market: (i) the so-called Hartz reforms implemented in three waves between 2003 and 2005, and (ii) the introduction of the minimum wage on Jan 1st, 2015. The main purpose of the first wave of reforms (Hartz I and Hartz II), implemented in 2003, was to increase labor demand by reducing employers’ hiring and firing costs for specific jobs, as well as allowing more flexibility in employment levels. The aim of Hartz III, that became effective in 2004, was to improve the employability of job searchers through improved training and job matching efficiency. Finally, Hartz IV, put into effect in 2005, had the purpose to increase the incentives for the unemployed to accept new jobs.

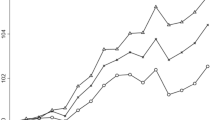

Figure 1 shows the evolution of the 5% and 10% quantiles of real hourly wages for the four German labor market segments over the period from 1992 until 2015. For male and female workers in Western Germany, we observe a clear downward trend in the wage quantiles in the aftermath of the Hartz labor market reforms (implemented between 2003 and 2005), an observation that is consistent with findings in other studies (e.g., Dustmann et al., 2014; Fitzenberger & Seidlitz, 2020). By contrast, wage quantiles have remained fairly stable for male and female workers in Eastern Germany, with the notable exception of a decline after the 2008 financial crisis and a subsequent recovery between 2013 and 2015. Moreover, we observe that these tendencies in the evolution of wage quantiles are not characteristic to a particular wage quantile, as both the 5% and 10% wage quantile feature rather similar patterns.

3.2 Probit Model

As hourly wages are not directly provided by the SOEP, we construct Hourly wage by dividing weekly gross labor income (in constant 2010 euro) by the actual hours of work per week.Footnote 13 Zero wages and wages exceeding 100 euro per hour are considered as outliers and, therefore, excluded from our sample.

To account for major segmentation of the German labor market, we employ henceforth the index s, \(s \in \{\)male workers in Western Germany, male workers in Eastern Germany, female workers in Western Germany, female workers in Eastern Germany\(\}\). The employed data base provides wage information at the job level with a distinction of \(J=10\) job categories that we index by means of j.

To assess the probability of earning a wage which is in some specific lower quantile (i.e., decile or quartile) of the wage distribution, we condition the analysis on covariates that are typically considered in regression models for explaining wage levels, namely:Footnote 14 Age related variables (Age, Age squared), indicators for the duration of education and employment experiences (Education, Work experience, Unemployment experience, Tenure), firms size related variables (\(>2000\) workers, 200–2000 workers, 20–200 workers, \(<20\) workers), family related variables (Number of children \(<2\) years, Number of children 2–7 years, Number of children \(>7\) years, Migration background), occupational position dummies (Blue collar, Civil servant, White collar, Self-employed). The dummy variables enter our model with reference to the benchmarks: ‘\(> 2000\) workers’ (firm size), ‘blue collar worker’ (occupational position) and ‘absence of migration background’ (migration background). As observed in (1), \(d_{ij,t}(\alpha )\) is based on time-specific wage distributions. Consequently, we do not include time effects within the probit model. For detailed variable definitions and descriptive statistics, see "Appendix A".

4 Results: Empirical Patterns of Wage Risks in Germany

The discussion of empirical results in this section proceeds in four steps. We first describe briefly binary regression outcomes. While we shed some light on the determinants of wage risks, the major purpose of these models is to deliver observation-specific estimates of being a low-wage worker, i.e., of earning a wage that is below the 10% quantile of time and occupation-specific wage distributions. In the second place, we discuss unconditional features of wage risks for the four labor market segments and turn, thirdly, to a discussion of time trends characterizing wage risks and low-wages in Germany. Fourthly, we take a disaggregated perspective and discuss wage levels and risks for low-wage workers in nine job-categories, namely, Skilled agricultural & fishery workers, Managers, Service & Sales, Unskilled, Craftsmen, Operatives, Clerks, Technicians, Professionals.Footnote 15 Finally, we discuss our results with reference to the so-called German labor market miracle.

4.1 Probit Estimates

Table 1 shows results from pooled probit regressions based on all occupations as formalized in Eq. (3). The results allow to obtain an overall perspective on the determinants of wage risk, i.e, the probability that wage earnings fall below the 10% quantile of the year- and occupation-specific wage distribution.Footnote 16 Moreover, in "Appendix B", probit regression results by occupation as formulated in Eq. (4) are documented for the four labor market segments: male workers in Western (Table 6) and Eastern (Table 7) Germany, and female workers in Western (Table 8) and Eastern (Table 9) Germany. For the four regressions obtained after pooling the data at the occupational level, the pseudo \(R^2\) statistics are between 10.98% (female workers in Western Germany) and 13.86% (male workers in Western Germany). The pseudo \(R^2\) statistics for occupation-specific models vary between 10.4% (Western male workers, ‘Agricultural and fishery workers’ ) and 39.4% (Eastern male workers, ‘Service and sales’ ). Among these 37 occupation-specific probit regressions, eight empirical models obtain a pseudo \(R^2\) in excess of 25%.

At the overall level, as expected, the results in Table 1 indicate that for all labor market segments the wage risk decreases with age (however, at a decreasing rate), years of education, work experience and tenure. By contrast, years of unemployment increase the wage risk (except for female workers in Western Germany). With regard to firm size, the overall results allow for the conclusion that being employed in a large firm (i.e., a firm with more than 2000 workers) somehow shields an employee against hourly earnings that are below the 10% quantile of the occupation-specific wage distribution. Working in a small firm with less than 20 workers raises the probability of interest throughout and with high significance. Having children reduces with high significance the probability of interest for male workers in Western Germany, while the effects are opposite (though not with comparable significance) for female workers in Western Germany. In Eastern Germany, male workers with a migration background are significantly at risk to earn less than the 10% quantile of the wage distribution, while a migration background does not have significant effects for the remaining three labor market segments (Western male, Western and Eastern female workers). With regard to the occupational position, it is interesting to see that the group of the self-employed faces a significantly higher wage risk as compared with the reference group of blue-collar workers. Interestingly, working as a civil servant reduces the wage risk significantly for Eastern male workers and Western female workers (relative to blue-collar workers), but increases the wage risk for Western male workers. Finally, with the exception of Eastern male workers, white-collar employees face lower wage risks as compared with blue-collar workers.

Unsurprisingly, occupation-specific probit results documented in "Appendix B" are more heterogeneous in comparison with the outcomes from pooled regressions. In addition, estimation uncertainty is sizeable in several models featuring only a relatively small number of observations. For instance, out of all 37 occupation-specific probit regressions, six models condition on less than 500 observations. Most observations are throughout available for male workers in Western Germany and the results documented in Table 6 come mostly close to those discussed before for the entire labor market (Table 1). Across occupations, a few estimates show reversals of significant effects. For instance, with 10% significance having migration background increases (decreases) wage risk for Technicians and Service & sales workers (Operatives) within the segment of male workers in Western Germany. Similarly, having a migration background increases (decreases) wage risk for female Clerks (Unskilled workers) in Western Germany. Moreover, being a self-employed male worker increases (decreases) with 5% significance the wage risk of Skilled agricultural & fishery workers and Craftsmen (Professionals).

4.2 Unconditional Properties of Empirical Wage Risks

The probit regressions documented in Table 1 summarize information from pooled samples comprising unequal numbers of observations. The analysis covers 54,669 observations for male workers in Western Germany, 14,561 (for Eastern male) 30,177 (for Western female) and 13,550 (for Eastern female). After implementing the probit regressions for each occupation (see tabulated results in "Appendix B"), we extract model implied probits for further processing.Footnote 17 Descriptive results for estimated probabilities to earn a wage below the 10% quantile of the (year and occupation-specific) distribution of hourly wages are documented in Table 2, and corresponding histograms are shown in Fig. 2.

The empirical means of estimated probits are between 10.31% (Western male workers) and 10.92% (Eastern female workers). Since we model the probability of falling short of the (nominal) 10% quantile of wage distributions, the close correspondence of the nominal threshold with the average (empirical) probits indicates model accuracy in a broad sense. Indicating a left-skewed distribution, the median probits are by a factor of about 0.7 smaller than the empirical means. Hence, pointing to a kind of labor market segregation, the majority of workers is not exposed to wage risks as defined in this study. Underpinning this claim, it is interesting to see that between 51.8% (Eastern male) and 56.9% (Western male) of all workers are characterized by an empirical probability below 7.5% to earn less than the 10% quantile of their respective (occupation and time-specific) wage distribution. Moreover, from the results documented in Table 2 we also see that more than 15% of the workers are subject to a risk of at least 20% to become a low-wage earner. From this perspective it is evident that enhanced wage risks are an important characteristic of the German labor market. In the following sections we provide more structured insights into these (enhanced) wage risks. In particular, we subject the estimated probits to a descriptive analysis of their evolution over time, and describe effects that are specific to the considered occupations. Since the overall utility of a low-wage worker depends ceteris paribus on both, the wage level and the wage risk, we complement the discussion of wage risks with a view at the levels of time and occupation-specific 10% wage quantiles.

4.3 Time Trends in Aggregated Wage Risks and Lower Quantiles

Figure 3 shows the time variation of average probabilities to earn an hourly wage that is below the 10% quantile of the year- and occupation-specific wage for the considered four labor market segments. With regard to the evolution of aggregate wage risks, a few observations are worth making. First, unsurprisingly all estimates are somehow close to the nominal 10% threshold. Second, the results for Eastern female workers show the strongest variation. In the early 1990s (i.e., shortly after the German reunification) average probabilities of interest were below the nominal benchmark. After the great financial crisis average probits exceed the nominal benchmark to reach almost 13% in 2015. Hence, Eastern female workers faced particular burdens of being paid with a wage below the 10% quantile after the financial crisis. Third, male workers in Western Germany have been subject to a positive trend in wage risks subsequent to the German reunification. A possible explanation for this positive trend is that labor supply in Western Germany after reunification was subject to an upward shift.Footnote 18 Wage risks for male workers in Western Germany decreased from 1997 until 2002. Between 2003 and 2011, average probits have stabilized close to the nominal 10% benchmark. Fourth, increased wage risks are observed in all labor market segments after 2010, where Eastern Germany is characterized by the most pronounced average effects.

As regards to the evolution of the 10% wage quantiles, we observe a decrease of about 2 euro in Western Germany (both for male and female workers) between 2008 and 2015. The 10% wage quantiles of Eastern German workers have remained fairly stable at around 7 euro (for male workers) and 6 euro (for female workers).

Summarizing these findings, we obtain that in the period after the Hartz reforms the low-wage workers in Germany are clearly worse off. For male and female workers in Western Germany, this is because the increase in their wage risks has been accompanied by a decline in their wage level. For male and female low-wage workers in Eastern Germany, this is due to a marked increase in their wage risks whereas their wage levels have remained largely stable. Next, we undertake a more refined view at wage risk with occupational resolution.

4.4 Occupation-Specific Wage Levels and Risks

Figures 4 and 5 show the evolution of occupation-specific wage quantiles and wage risks over time, respectively. To mention an exemplary case, we obtain with regard to male workers in Western Germany that Unskilled and Craftsmen are subject to both a decrease of their 10% wage quantile and an increase of the probability to earn a wage below this quantile. Furthermore, it is interesting to observe such a pattern for the Unskilled also with regard to other segments of the German labor market. Overall, however, the results displayed in Figs. 4 and 5 are largely heterogeneous and subject to sizeable variation (in particular for Eastern male and female workers). Therefore, we next take a more condensed perspective on the simultaneous development of wage quantile levels and wage risks as displayed in Fig. 6.

The occupation-specific disaggregation offers interesting insights into the origin of the overall adverse effects for male and female low-wage workers in Western Germany. Evidently, losses in wage levels and increases in wage risk are particularly typical for Unskilled workers, Service & sales workers, Craftsmen and Operatives. Pointing to heterogeneous developments, by contrast, Skilled agricultural & fishery workers and Managers have benefited from upward changes of the 10% wage quantile and a reduction of their wage risk. With regard to the timing of the described overall effects, Fig. 6 reveals that they stem by-and-large from labor market adjustments that took place after the Hartz reforms (i.e., after 2005).

The overall increases in wage risk summarized above for male and female workers in Eastern Germany reflect the following origins with occupational resolution. Male and female Unskilled workers and Craftsmen have been subject to increases in their wage risks. In addition, marked upward changes of wage risks are typical for female Operatives, Clerks and Technicians in Eastern Germany.

Summarizing the informational content of Fig. 6 further, Fig. 7 displays the changes of wage levels and risks for the considered segments of the German labor market. The displayed results confirm that labor market outcomes allow a clear distinction of winners and losers among low-wage workers in Western Germany. With regard to labor markets in Eastern Germany, we observe that low-wage workers in most occupations have less suffered from reductions in low wages in comparison with workers in Western Germany.

4.5 Wage Risk and the German Employment Miracle

Several scholars refer to the persistent rise of employment in Germany that started in 2003 as the German labor market miracle (e.g. Burda & Hunt, 2011; Krause & Uhlig, 2012; Rinne & Zimmermann, 2012; Dustmann et al., 2014; Burda & Seele, 2016). In this context, the potential role of the Hartz reforms for this development has become an important matter of debate. Bradley and Kügler (2019) find that the reforms shortened the duration of unemployment spells, however, did not reduce unemployment as a whole. With regard to wages, they conclude that the reforms led to a decline which was more pronounced for low-skilled workers. Results of Burda and Seele (2016) indicate that labor supply factors related to the reforms explain the evolution of the labor market after 2003, particularly in Western Germany, while labor demand has been largely stable after the reforms. In Western Germany employment increased and real wages declined, where both tendencies were more accentuated among part-time employees. Noticing structural changes after reunification, the authors refrain from conclusions regarding the impact of the Hartz reforms on the labor market in Eastern Germany. According to Krause and Uhlig (2012), shortening the duration of granting unemployment benefits under Hartz IV has reduced the unemployment rate by 2.8%. In the aftermath of the financial crisis in 2008, however, the job-maintenance subsidies to firms initiated under Hartz I played a crucial role in the outstanding labor market performance in Germany (for a similar argument on the effects of short-time work subsidies see Rinne & Zimmermann, 2012).

In a nutshell, the literature on the effects of the Hartz reforms on the level of (low) wages is well in line with the evidence provided in this study. However, the focus of this study on both wage levels and wage risks highlights that the literature on the reform effects yet lacks an important perspective. In this regard, it is worth underpinning that we have detected increasing wage risks in all segments of the German labor market since 2008, and in particular so for low skilled occupational groups. While the binary regressions conducted in this work provide some guidance on potential determinants of wage risk, ultimately, the broad trends in wage risk might be traced back to two conceptually distinct origins. On the one hand, these developments might reflect medium to long-term effects of the Hartz reforms (e.g., reductions of the duration of unemployment benefits, introduction of so-called ‘minijobs’ ). On the other hand, it appears reasonable to relate increases of wage risks with the adverse effects of the great recession (e.g., negative general or occupation-specific labor demand shocks). A disentangling of both potential origins is particularly difficult, as they are not necessarily exclusive. As a promising approach to obtain well-identified causal channels, one might consider an explicit treatment analysis for the effects of the Hartz reforms. We consider such an econometric analysis as an interesting topic for future research.

5 Conclusion

In this study we propose a new flexible metric of wage risks. The suggested measure is based on estimated probit models and can be interpreted as the probability to realize wage earnings that are below a certain lower quantile of the wage distribution. Hence, unlike variation-based measures of wage risk, the suggested statistic is one-sided and focused on adverse labor market outcomes contributing to the left-hand side of the wage distribution. With an information rich sampling framework (SOEP), we implement wage risk measures with time and occupation-specific resolution for the period 1992–2015 and for four major labor market segments, namely, male and female workers in Western and Eastern Germany.

Our empirical results show that, firstly, the low-wage workers in Germany are clearly worse off after the Hartz reforms. Workers in Western Germany have experienced both a decline in low-wages and a rise of wage risk, while workers in Eastern Germany suffered from trends in wage risk only. Secondly, both in Western and Eastern Germany, the overall evidence hides important heterogeneity showing up at occupational levels. In Western Germany, the described utility losses have been particularly strong for Unskilled workers, Service & sales workers, Craftsmen and Operatives. In Eastern Germany, this holds for male and female Unskilled workers and Craftsmen and female Operatives, Clerks and Technicians.

Some caveats of our analysis should be noted. First, our focus is on occupation-specific wage levels and risks and, therefore, our analysis is conditional on workers who are continuously employed in the same occupation and focuses exclusively on the level and variation of their wages. Naturally, a more extensive analysis would require also considering the risks of occupational frictions, unemployment and underemployment. Second, our analysis does not include firm-specific factors, which are known to account for a considerable part of the variation in wage inequality (e.g., Barth et al., 2016; Card et al., 2013; Schaefer & Singleton, 2020; Song et al., 2019). While this information is available in other German databases, these databases do not allow to obtain hourly wages based on the effective number of hours worked, which are unique to the SOEP database. Finally, this study focuses on individual wage risk. Analyzing the evolution of wage risk in the German labor market at the household level is an interesting avenue for future research.

Notes

In the financial literature such a type of indicator has become prominent in the vein of the so-called value-at-risk statistic (see Jorion, 2007 for a textbook treatment). Herwartz et al. (2021) have used such probability estimates for adjustments of a family of wage inequality measures that take the form of the difference between typical upper and lower quantiles of wage distributions.

Also arguing in favor of more flexible approaches to quantify wage risks, De Nardi et al. (2021) suggest specific skewness and kurtosis statistics that derive from quantiles of (residuals of) individual gross earnings which lack, however, an occupational and flexible time-specific resolution.

Some studies extend this basic framework by considering further stochastic components in modelling the wage process. For instance, Mecikovsky and Wellschmied (2016) include a further stochastic source of wage variation which captures the arrival of outside job offers from a wage offer distribution, i.e., earning opportunities after potential job change. Abowd et al. (1999) include worker- and firm-specific components in their structural log wage model.

The close relationship between wage risk and unobserved heterogeneity has also become a matter of concern in the literature on (uncertain) returns to schooling (see, e.g., Hartog, 2011 for a review of this discussion.)

De Nardi et al. (2021) suggest skewness and kurtosis statistics that derive from quantiles of individual gross earnings. These quantiles refer to age-group-specific incomes and, hence, lack resolution with respect to occupational levels. Moreover, time dependence is also handled restrictively as, in addition to further covariate information, observed earnings are conditioned on time effects. Finally, it is worth noticing that, by construction, their skewness and kurtosis measures of the wage risk process sample information from both upper and lower quantiles of the earnings distribution. Hence the one-sided nature of ‘risk‘ is not acknowledged.

Using similar arguments in the context of the estimation of notions of ‘health uncertainty’ , Jappelli et al. (2007) focus on unfortunate individual health outcomes. Instead of modelling the probability of such events, however, their health uncertainty statistic derives from the estimated variances attached to probability estimates of realizing such an unfortunate health outcome. The empirical results that we discuss in this study are qualitatively almost identical to modelling the probability of interest directly or the standard error of such probability estimates. This can be seen from the approximation \(p \approx {p(1-p)}\) for small values of p, where p is the success probability in a Bernoulli experiment and \(p(1-p)\) is the variance of a corresponding estimator based on binary observations.

All empirical results discussed in this work are qualitatively identical when considering the 5% quantile (see also the robustness results in "Appendix C").

Pooling panel observations might suffer from the neglect of unobserved heterogeneity. In addition, the model specification does not include autoregressive patterns of earning a critical wage. As a potential alternative, the inclusion of fixed effects is not feasible in the present context due to the huge cross section dimension of more than 20,000 individuals. Moreover, dynamic model variants suffer from a marked loss of sample information within our unbalanced panel of not necessarily consecutive observations. Hence, occupation-specific evidence becomes unavailable for some of the considered labor market segments (Eastern female and male workers, Western female workers). Unreported results that are available from the authors upon request show that outcomes from pooled logit regressions are largely in line with estimates from cross sectional regressions performed for large samples of Western male workers.

In the empirical analysis, all models and probit estimates are determined independently for four major segments of the German labor market (i.e., male and female workers in Western and Eastern Germany).

For more information on this database see Wagner et al. (2007). SOEP online documentation (including version 32) can be accessed at URL: https://www.diw.de/en/diw_02.c.222516.en/data.html.

Despite information differences among these databases, Biewen et al. (2018) conclude that using alternative databases yields rather similar conclusions when analysing wage inequalities, as can be observed by comparing the results in: Dustmann et al. (2009) and Fitzenberger (2012) using the SIAB, Fitzenberger (2012) employing GSES data, Antonczyk et al. (2009) based on BLFS data, and Gernandt and Pfeiffer (2007) using the SOEP.

The SOEP has been extended in 2002 by including additional information about 2671 respondents from 1224 households with a monthly net household income above 4.500 EUR (High income sample). As the inclusion of these individuals would yield to a structural break in the wage quantiles, we do not consider these data.

Weekly gross labor income is obtained by dividing monthly gross labor income by the average weeks per month (i.e., 4 + 1/3).

Heckman et al. (2003) provide an extensive review of the literature on so-called Mincer wage regressions.

The categories account for the respondents’ occupation as defined by the One-Digit International Standard Classification of Occupations (ISCO, https://www.ilo.org/public/english/bureau/stat/isco/isco08/index.htm. We have also performed probit regressions for Armed forces for which sufficient sample information is available only for Western men. We omitted this occupation from the discussion of results.

This table has also been documented in Herwartz et al. (2021).

For all labor market segments, the implications for model implied probits are very similar if these are extracted from occupation-specific or pooled probit regressions.

Several authors report an increase in the growth of the relative supply of low skilled labor after the German reunification and the economic integration of Eastern European countries into the European Union, with the subsequent outsourcing of production sites from (Western) Germany (e.g., Acemoglu & Autor, 2011; Dustmann et al., 2014)

References

Abowd, J., Kramarz, F., & Margolis, D. (1999). High wage workers and high wage firms. Econometrica, 67(2), 251–333.

Acemoglu, D., & Autor, D. (2011). Skills, tasks and technologies: Implications for employment and earnings. In O. Ashenfelter & D. Card (Eds.), Handbook of labor economics, volume 4 of handbook of labor economics, chapter 12 (pp. 1043–1171). Elsevier.

Antonczyk, D., Leuschner, U., & Fitzenberger, B. (2009). Can a task-based approach explain the recent changes in the German wage structure? Journal of Economics and Statistics (Jahrbuecher fuer Nationaloekonomie und Statistik), 229(2–3), 214–238.

Baker, M., & Solon, G. (2003). Earnings dynamics and inequality among Canadian men, 1976–1992: Evidence from longitudinal income tax records. Journal of Labor Economics, 21(2), 289–321.

Barth, E., Bryson, A., Davis, J. C., & Freeman, R. (2016). It’s where you work: Increases in the dispersion of earnings across establishments and individuals in the United States. Journal of Labor Economics, 34(S2), S67–S97.

Biewen, M., Fitzenberger, B., & de Lazzer, J. (2018). The role of employment interruptions and part-time work for the rise in wage inequality. IZA Journal of Labor Economics, 7(1), 1–34.

Blundell, R., Pistaferri, L., & Preston, I. (2008). Consumption Inequality and Partial Insurance. American Economic Review, 98(5), 1887–1921.

Bradley, J., & Kügler, A. (2019). Labor market reforms: An evaluation of the Hartz policies in Germany. European Economic Review, 113(C), 108–135.

Burda, M. C., & Hunt, J. (2011). What explains the German labor market miracle in the great recession. Brookings Papers on Economic Activity, 42(1), 273–335.

Burda, M. C., & Seele, S. (2016). No role for the Hartz reforms? Demand and supply factors in the German labor market, 1993-2014. SFB 649 Discussion Papers SFB649DP2016-010, Sonderforschungsbereich 649, Humboldt University, Berlin, Germany.

Card, D., Heining, J., & Kline, P. (2013). Workplace heterogeneity and the rise of west German wage inequality. The Quarterly Journal of Economics, 128(3), 967–1015.

De Nardi, M., Fella, G., Knoef, M., Paz-Pardo, G., & Van Ooijen, R. (2021). Family and government insurance: Wage, earnings, and income risks in the Netherlands and the U.S. Journal of Public Economics, 193(C), 104327.

Dustmann, C., Fitzenberger, B., Schönberg, U., & Spitz-Oener, A. (2014). From sick man of Europe to economic superstar: Germany’s resurgent economy. Journal of Economic Perspectives, 28(1), 167–188.

Dustmann, C., Ludsteck, J., & Schönberg, U. (2009). Revisiting the German wage structure. The Quarterly Journal of Economics, 124(2), 843–881.

Fagereng, A., Guiso, L., & Pistaferri, L. (2018). Portfolio choices, firm shocks, and uninsurable wage risk. Review of Economic Studies, 85(1), 437–474.

Fitzenberger, B. (2012). Expertise zur Entwicklung der Lohnungleichheit in Deutschland. Working Papers 04/2012, German Council of Economic Experts / Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung.

Fitzenberger, B., & Seidlitz, A. (2020). The 2011 break in the part-time indicator and the evolution of wage inequality in Germany. Journal for Labour Market Research, 54(1), 1–14.

Gernandt, J., & Pfeiffer, F. (2007). Rising wage inequality in Germany. Journal of Economics and Statistics (Jahrbuecher fuer Nationaloekonomie und Statistik), 227(4), 358–380.

Hartog, J. (2011). Chapter 4—A risk augmented mincer earnings equation? Taking stock. In S. Polachek & K. Tatsiramos (Eds.), Research in Labor Economics (Vol. 33, pp. 129–173). Emerald Group Publishing Limited.

Heaton, J., & Lucas, D. (2000). Portfolio choice in the presence of background risk. Economic Journal, 110(460), 1–26.

Heckman, J. J., Lochner, L. J., & Todd, P. E. (2003). Fifty years of mincer earnings regressions. Working Paper 9732, National Bureau of Economic Research.

Herwartz, H., Rodriguez-Justicia, D., & Theilen, B. (2021). A revisit of wage inequality in Germany. Mimeo.

Hospido, L. (2012). Modelling heterogeneity and dynamics in the volatility of individual wages. Journal of Applied Econometrics, 27, 386–414.

Jappelli, T., Pistaferri, L., & Weber, G. (2007). Health care quality, economic inequality, and precautionary saving. Health Economics, 16(4), 327–346.

Jessen, R., Rostam-Afschar, D., & Schmitz, S. (2018). How important is precautionary labour supply? Oxford Economic Papers, 70(3), 868–891.

Jorion, P. (2007). Value at risk: The new benchmark for managing financial risk. McGraw Hill.

Krause, M. U., & Uhlig, H. (2012). Transitions in the German labor market: Structure and crisis. Journal of Monetary Economics, 59(1), 64–79.

Low, H., Meghir, C., & Pistaferri, L. (2010). Wage risk and employment risk over the life cycle. American Economic Review, 100(4), 1432–1467.

Mecikovsky, A., & Wellschmied, F. (2016). Wage risk, employment risk and the rise in wage inequality. IZA Discussion Papers 10451, Institute of Labor Economics (IZA).

Parker, S. C., Belghitar, Y., & Barmby, T. (2005). Wage uncertainty and the labour supply of self-employed workers. Economic Journal, 115(502), 190–207.

Rinne, U., & Zimmermann, K. (2012). Another economic miracle? The German labor market and the great recession. IZA Journal of Labor Policy, 1.

Schaefer, D., & Singleton, C. (2020). Recent changes in British wage inequality: Evidence from large firms and occupations. Scottish Journal of Political Economy, 67(1), 100–125.

Song, J., Price, D. J., Guvenen, F., Bloom, N., & Von Wachter, T. (2019). Firming up inequality. The Quarterly Journal of Economics, 134(1), 1–50.

Wagner, G. G., Frick, J. R., & Schupp, J. (2007). The German socio-economic panel study (SOEP): Scope, evolution and enhancements. SOEPpapers on Multidisciplinary Panel Data Research 1, DIW Berlin, The German Socio-Economic Panel (SOEP).

Acknowledgements

We thank Annekatrin Niebuhr, Uwe Jensen and an anonymous reviewer for helpful comments and acknowledge financial support from the Spanish Ministerio de Ciencia e Innovación and the European Union under project PID2019-105982GB-I00/AEI/ 10.13039/501100011033 and Universitat Rovira i Virgili and Generalitat de Catalunya under project 2019PFR-URV-53. The authors declare that they have no relevant or material financial interests that relate to the research described in this work.

Funding

Open access funding provided by Universitat Rovira i Virgili.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 A. Variable Definitions and Descriptive Statistics

The following tables provide variable definitions and descriptive statistics (Tables 3, 4 and 5).

1.2 B. Occupation-Specific Probit Regressions

1.3 C. Robustness Analysis for \(\alpha =0.05\)

To address an important direction of robustness analysis, this Appendix collects some summary results from the analysis of low wages and wage risks with regard to the 5% quantile. Core results discussed in the main text are confirmed for this more restrictive quantile choice (Table 10, Figs. 8 and 9).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Herwartz, H., Rodriguez-Justicia, D. & Theilen, B. A New Measure of Wage Risk: Occupation-Specific Evidence for Germany. Soc Indic Res 164, 1427–1462 (2022). https://doi.org/10.1007/s11205-022-02995-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-022-02995-6