Abstract

This paper analyses regional competitiveness at the subregional level through a novel methodological approach that adopts a matching design. By comparing the performance of similar firms in different parts of the region, it is possible to detect whether different places provide different competitive territorial assets. Using data for Lombardy, a large and competitive European region, the analysis shows that the different territories of the region are differently competitive in different industries, even when they are similar in terms of total GDP per capita or specialization. The paper also confirms that measuring competitiveness on different indicators (Labour Productivity, TFP, Profitability) can provide different results, and this especially happens when comparing static and dynamic indicators. The methodology presented here is especially relevant to the design of regional policies, that are mostly deployed at the NUTS-2 level but would benefit from accounting for the presence of strongly dis-homogeneous territories inside the same region.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The concept of competitiveness has, in recent decades, risen from being a firm-related concept to being a central element for the understanding of the economic development of countries and regions. Indeed, firm competitiveness and territorial competitiveness are closely related. Firms competing among each other in a globalized economy are not monads; rather, they are tightly rooted in the territorial context surrounding them, where their competitiveness is strongly affected, if not determined, by the local context in which they operate (Boschma, 2004). A large set of elements influencing firm competitiveness are, in fact, highly territorialized and unevenly distributed in space (e.g., infrastructure, human capital, skilled workers and quality institutions) (Dierickx & Cool, 1989; Maskell & Malmberg, 1999); even the presence of other firms (both related and nonrelated) may be important for their competitiveness (Balland, Boschma, & Frenken, 2015).

While many studies focus on comparing the competitiveness of countries and regions, difficulties arise when researchers and policymakers need to look at territorial units smaller than usual statistical regions, for instance, when the aim is to understand the possible differentials of competitiveness inside the same region, to highlight the presence of territorial specificities in competitiveness and its dynamic evolution.

Two main approaches in fact exist, one based on composite indicators, and one based on firm data. Composite indicators are normally impossible to use at scales smaller than the regional indicators due to the lack of statistical data at smaller spatial scales. For example, in the EU, Eurostat reports many indicators and statistics at the NUTS-2 level and only fewer indicators and statistics at the NUTS-3 levelFootnote 1.

Firm-level data, on the other hand, might allow us to go into a smaller scale, but they are mostly used to understand the competitiveness of firms. When they are used to understand territorial patterns, they are usually aggregated, so it is difficult to understand whether the results depend on the territory, or industrial specialization, or the type of firms that are present in a certain region.

This paper aims to fill this gap with a methodology to estimate the differentials of competitiveness between small statistical units, e.g., the different subregions of a NUTS-2 region. This is done with a novel methodological approach that involves a two-step matching procedure with firm-level data.

The case study in which this novel approach is tested is Lombardy, in Italy, one of the most productive and competitive regions in the EU and commonly considered the core engine of the Italian productive system; Lombardy is a densely populated (both by people and firms) large region with consistently high scores in the Regional Competitiveness Index (RCI) computed by the EU Commission. Lombardy is, on the one hand, the most populated region of the country and, on the other hand, the one with the highest scores in the RCI.

Another possibility to illustrate the methodology could have been by using a cross section of different Italian provinces (NUTS-3), but in case they belong to different regions, they would have been affected by different political and institutional settings.

The research has a number of objectives that sequentially follow one from the other, since the first (methodological) objective is the main objective of the paper, while the second and third are ancillary and follow from a first application of the methodology to the case study region.

The main aim of this paper is to propose a methodological approach to measure territorial competitiveness in a novel way by analysing it through the impact of territorial factors on firm competitiveness. In particular, the levels of competitiveness at the territorial level are detected—rather than from composite indicators—by the fact that similar firms that operate in different territories have different competitive performances. By controlling for firms’ characteristics and sectoral dynamics, the differences in the performance of firms can only be due to their location and, therefore, when a significant difference in competitiveness is detected, this is due to the territorial characteristics of places, especially on the levels of what is now commonly called territorial capital (Camagni, 2009; Fratesi & Perucca, 2019). The corresponding null hypothesis — validated by the eventual absence of differential effects in the empirical results — would, on the contrary, suggest that at the selected territorial level, the competitiveness of firms is mainly impacted only by individual firms’ choices, characteristics and industrial dynamics reinforced by cumulative processes.

Fulfilling the main aim of the paper, also enables to confront two important open issues of regional competitiveness. The first of these ancillary objectives is to show how much the use of different indicators can lead to different rankings on territorial competitiveness. If this is confirmed, in fact, one can induce those analyses that focus on just one indicator may be weak, since they would not be confirmed with other indicators. In particular, the expectation is to find a difference between the results obtained through the use of static competitive indicators and results obtained when competitiveness is measured in dynamic terms.

The second ancillary objective of the paper, also illustrative of the potentialities of the methodology, is to characterize the differences in competitiveness within the Lombardy region between its territories. Despite the fact that most analyses of regional competitiveness in the European Union adopt the NUTS-2 level, the emergence of dis-homogeneities between the different territories inside a single region is expected and going to be tested, in particular the presence of subregions with similar levels of GDP and/or specialization that are differently competitive in one industry or another.

The results of this paper show how important it is to measure territorial competitiveness at smaller territorial units with respect to NUTS-2 regions, since in this way it is possible to provide valuable new policy information on the territorial strengths and weaknesses inside the region, such information will help design more effective industrial policies at the territorial level and reduce the risk of wasting time and resources into ineffective actions.

Knowing the competitiveness specificities of territories smaller than EU NUTS-2 regions is especially important in light of Smart Specialization Strategies (S3), which have been at the core of European regional competitiveness policies for programming period 2014–2020 (whose payments will end in 2023).

The rest of the paper is organized as follows: Sect. 2 will provide a brief review of the two ways of measuring competitiveness at the regional and firm levels, and Sect. 3 will present the choice of the case study and the data that are used. Section 4 will present the new methodological approach that has been developed to assess territorial competitiveness based on firm-level data and a two-step matching procedure, alongside the tests performed for the validation of the model. Section 5 will present the results on static and dynamic indicators. Section 6 concludes and argues the importance of being aware of territorial differences at smaller spatial scales.

2. Literature review.

1.1 The concept of competitiveness

The concept of competitiveness was born for the analysis of firms but was soon translated to include spatial units, first nations and then regions and cities. Most likely, the most influential seminal book, which revamped the whole literature, was the one by (Porter, 1990), a scholar who had studied competitiveness at the firm level, before extending the analysis at the national level, with the ideation of the famous diamond, where national success in a certain sector depends on elements such as factor conditions, demand conditions, firm strategy, structure and rivalry and, finally, the presence of related and supporting industries. All these elements are not only different between countries but also between regions inside countries and sometimes essentially local, as this seminal contribution was aware of when analysing the role of geographic concentration. In the 1990s, thereafter, the number of analyses of regional competitiveness was very high and used in a variety of ways and contexts (Turok, 2004). Even more relevant was the importance of this word in the public policy debate, which led to the criticisms by Krugman (1994, 1996), who considered that the view of countries as competing in the global arena, similar to firms, was misleading and leading to wrong economic policies. However, another influential scholar (Camagni, 2002) confuted that statement by showing how the regional and national levels are different so that competing for regions is different than for nations due to the absence of a number of macroeconomic adjustment mechanisms. As a consequence, in contrast to countries, being competitive for regions is a necessity to avoid exclusion, decline and, possibly, desertification.

The regional science literature shows that competitiveness is a phenomenon with a clear spatial characterization. On the one hand, regional competitiveness depends on the competitiveness of the firms that are located there. At the same time, however, the competitiveness of firms is influenced by the factors and conditions that are present at the regional level in their place of location.

Regional competitiveness, therefore, is normally “understood to refer to the presence of conditions that both enable firms to compete in their chosen markets and enable the value these firms generate to be captured within a particular region” (Huggins & Thompson, 2017, p.2). Although most authors would agree on such a definition, the theoretical underpinnings of the competitiveness discourse are often blurred and vary between the micro and the macro, so that the success of the competitiveness term may be owed to the need of policymakers to justify certain courses of action (Bristow, 2005).

Consistent with this two-level definition of regional competitiveness, the measurements of competitiveness that are relevant to this work have been achieved within two strands, one at the level of firms and the other at the level of regions. The competitiveness of firms is normally assessed through various indicators of firm performance, in many cases coming from the firm balance sheets, in others from aggregate performance indicators such as employment or revenues. In contrast, the competitiveness of regions and cities is normally measured through composite indicators and indexes.

1.2 The measurement of competitiveness with firm data

Examples of the measurement of competitiveness using indicators at the firm level are in the papers by Akben-Selcuk (2016), Čadil, Mirošník, & Rehák (2017), Rodríguez-Pose & Hardy (2017). These indicators are normally the same as those used in the literature on the microeconomic impacts of regional policy, for instance, in the papers by Bernini, Cerqua, & Pellegrini (2017), Bernini & Pellegrini (2011), Sterlacchini & Venturini (2019). Early studies in the 1990s focused on a “resource-based” view where a firm’s competitive advantage derives from those resources that match specific conditions; later, scholars moved more towards a “capability-based” perspective, emphasizing a more dynamic view of competition (Depperu, & Cerrato, 2005). Following Ma’s (Ma, 2000) dichotomy of “positional” and “kinetical” advantages for competitiveness, positional advantages (static) derive from the position in a specific market and ownership or access to resources, while kinetical advantages (dynamic) derive from a firm’s capabilities, competence and knowledge.

Some of the recent papers focus on static indicators (Productivity, Profitability, etc.), e.g., (Akimova, 2000; Bramanti & Ricci, 2020; Laureti & Viviani, 2011). Other papers, instead, analyse competitiveness based on dynamic indicators (productivity growth, GVA growth, employment growth, etc.), e.g., (Aguiar & Gagnepain, 2017; Albanese, de Blasio, & Locatelli, 2021; Bhattacharya & Rath, 2020).

Literature indicates that many empirical works, employing firm-level data, are still limited by difficulties in isolating the different sources of effects induced by different factors (Cerqua & Pellegrini, 2014) or by specific local conditions. A wide range of counterfactual methodologies have been applied to firm-level microdata to deal with these issues. Examples of different strategies employed to contain these issues can be found – especially – in the literature on the microeconomic impacts of regional policy, where different matching designs, both binary and generalized (Adorno, Bernini, & Pellegrini, 2007a) are used to control for firms’ characteristics.

Most interesting, in reference to this paper, is a contribution by de Zwaan and Merlevede (2013) tasked with the problem of studying the impact of a policy over a very differentiated pan-European context. They resolved to control the heterogeneous social and economic composition of EU territories by employing a ‘two-tier’ matching strategy where they first match among them different European regions (NUTS-2) based on aggregate characteristics and then – inside these groups – matches treated and nontreated firms controlling for firm’s characteristics (Zwaan & Merlevede, 2013).

1.3 The measurement of competitiveness with composite indicators

For the measurement of competitiveness at the level of cities and regions, as mentioned before, most analyses use composite indicators. One of the most interesting earlier attempts is the one by (Huggins, 2003). At that time, a number of indexes existed at the country level, produced by several important international bodies, while at the regional and local levels, information was lacking, so his measurement for the UK regions was empirically an advancement, but even more it was conceptually interesting because it used indicators that belong to three phases of the competitiveness process, i.e., the inputs, the outputs and the outcomes. This classification is common in policy evaluation, but unfortunately, it is less diffused in the competitiveness discourse.

Later, the European Union started to systemically benchmark the competitiveness of its regions against each other, creating the European Regional Competitiveness Index (RCI), which has been produced every three years starting in 2010 and has reached its 4th edition (Annoni, Dijkstra, & Gargano, 2017; Annoni & Kozovska, 2010; Djikstra & Annoni, 2019). Having a systemic and timely measurement is helpful because it allows interregional comparisons but also, at least to a certain extent, time comparisons because it is possible to see whether the position of a certain region improves or worsens in time. The RCI is based on the idea that many different pillars are relevant to regional competitiveness (each measured through a number of basic indicators) and that these pillars can be aggregated inside three main groups, whose weight changes according to the level of development of regions. In fact, if for low levels of regional GDP per head, the most important factors of competitiveness are those of the basic group, for those with higher levels the importance of efficiency group, and then of the innovation group, is larger (Annoni, Dijkstra, & Gargano, 2017; Annoni & Kozovska, 2010).

Similar exercises with composite indicators also exist at the urban level, since urban agglomerations are competing against each other, not only in terms of production but also in terms of the attraction of multinationals and functions (Kamiya & Ni, 2020; Kresl & Singh, 2012; Ni & Kresl, 2010; Sáez, Periáñez, & Heras-Saizarbitoria, 2017).

Regional competitiveness has also been an important objective at the level of policy, and this has not changed for some time now, especially in the EU. For instance, within the European cohesion policy programming period 2014–2020, the reference to competitiveness has been important within all thematic objectives related to smart growth, particularly TO1Footnote 2. In the context of cohesion policy design, understanding the internal regional differences in territorial competitiveness is pivotal for both the effectiveness and efficiency of the enacted policies. Despite that, to the knowledge of the authors, a reliable instrument to measure such differences has not yet been proposed.

2 Case study and data selection

2.1 Lombardy a large and competitive region

To fulfil the purpose of this study, and especially its third objective, necessary is the selection of a suitable study area that allows us to illustrate how the methodology works and how large the differentiation of competitiveness can be even within a region that is normally labelled competitive. Indeed, from an empirical point of view, a study such as this one could be applied to all subregions of a whole country, but the paper focuses on only one NUTS-2 Italian region due to 3 main considerations stemming from the objective of characterizing internal regional competitiveness. Focusing on only one region was the most suitable decision due to:

-

i)

administrative boundaries and differences. Indeed, many items of social, economic and industrial regulations are delegated to the regional government – this also applies to the programming of public and European policies, so taking only one region is the only way to ensure that the administrative and legal framework is exactly the same;

-

ii)

Regional cultures and social practices may be extremely differentiated between regions;

-

iii)

Italy is known to have a very large economic and industrial gap between the northern and southern regions; moreover, significant differences can also be found between closer regions.

Focusing on a single region to perform the analysis allows us to compare territories that not only share the same administrative structure but also share similar cultures and social and economic practices.

Lombardy – the selected study area – is a NUTS-2 region in the northern part of Italy. Many reasons indicate that it is a very suitable case study to understand and characterize internal territorial differences.

First, Lombardy is a large region: one of the largest Italian regions in terms of area but also the largest in terms of population and economic activity, and the second most populated European NUTS-2 regionFootnote 3. Both in terms of population and GDP Lombardy is closer to small European countries rather than other Italian or European NUTS-2 regions: its 2019 population of 10,010,000 inhabitants was larger than that of Austria and Hungary, and slightly less than Greece and Czechia; its 2019 total GDP at market prices (Euro 398 billion) was almost identical to that of Austria (397 billion) and not far from that of Belgium (Euro 476 billion)Footnote 4. As a term of reference, the second highest GDP of an Italian NUTS-2 region is that of Lazio (200 billion) which is almost half of that of Lombardy. Despite its size, there is just one Lombardy in the regional competitiveness index, and there is just one smart specialization strategy for the region.

Second, Lombardy as a whole is generally considered a highly competitive and productive region, often compared to other well-performing European NUTS-2 regions rather than other Italian regions (Vezzani et al., 2017). In the last edition of the European Competitiveness Index (2019), Lombardy is the first Italian region, ranked 145 out of 268 EU regions, with a GDP per capita at 127% of the EU average (Djikstra & Annoni, 2019).

This allows us to study and characterize the internal competitiveness of a well-performing region, in a context not blurred by decades of lagging and struggling economy and often ineffective public interventions, as is the case of many other—especially southern—Italian regions (Cannari, Magnani, & Pellegrini, 2010; Trigilia, 2012).

As the most competitive region of the country, Lombardy has been studied in a number of different academic and policy studies (Beber & Brugnoli, 2012; Bramanti & Ricci, 2020; Dal Bianco & Fratesi, 2020; Vezzani et al., 2017).

From a geographic point of view, Lombardy is relatively wide and has high territorial variability: in the same region, one can find vast lowlands filled with large and small cities and economic activities, as well as many mountainous and rural areas. Administratively, the region is divided into 12 provinces (NUTS-3 areas). Inside this highly variated territory, one large metropolitan area can be found, the city of Milan, which is not only the largest city of the region but also the largest economic centre of the country. Alongside the metropolitan area of Milan, there are also other large cities with different economic and social vocations, as well as many medium and small cities.

A map of the region and its NUTS-3 areas is presented in Fig. 1.

2.2 Data and timespan of the research

For this research, a wide range of data was gathered – especially firms’ microdata – originating from different institutional and proprietary sources. Three are the main sources of data: (i) Italian Census data to define provincial administrative boundaries and provincial characteristics (ISTAT, 2011); (ii) the ASIA database (The Italian register for active firms and companies) providing provincial aggregate data on all Italian firms and their employees (ISTAT, 2020); and (iii) AIDA, proprietary database from Bureau Van Dijk providing balance sheet information for firms located inside Italian territory (Bureau van Dijk, 2020).

The core of this empirical strategy resides in the use of these firm-level data. Indeed, using firm-level data allows us to locate each firm in the Lombardy region inside its specific NUTS-3 province and match them with firms located outside based on firms’ characteristics.

However, while these microdata have the advantage of reporting a large number of firm characteristics, it is important to consider that they also have some major drawbacks. The first drawback is that the AIDA database does not report data for all Italian firms, and the reported sample is unbalanced towards larger and more established firms (Pinto Ribeiro, Menghinello, & Backer, 2010); moreover, some of the reported information – such as the address and geo-localization – may not be completely accurate and updated or may even be missing. These issues were limited by cleaning the database, recoding some geo-localization data and excluding various typologies of outliers (based on core firm characteristics) from the analysis. A final note on data management regards firms entering and exiting the market. The dynamics of firms’ demography are a central issue in the discussion of territorial competitiveness (Audretsch & Peña-Legazkue, 2012; Fritsch, 2008; Van Dijk & Pellenbarg, 2000); however, available data are not suitable for a specific focus on firms entering or exiting the market. Therefore, those firms incorporated after the initial period are excluded from the analysis, as those firms that are non-active at the time of the final period (see below for the definition of initial and final periods).

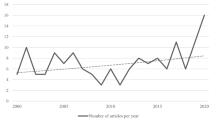

At the time of the research, the AIDA database, providing firm-level balance sheet information, was updated to 2018. Thus, yearly firm data for the 2009–2018 period are collected.

As an additional measure to account for eventual missing data, errors in the reporting of data and possible “yearly outliers”, two time periods composed of multiple years are defined: the “initial period”, between 2009 and 2011, and the “final period”, 2016–2018. Both firms’ characteristics and competitiveness indicators are calculated as the mean values over these periods to reduce noise.

3 Methodology

3.1 A Counterfactual measure of Territorial Competitiveness

The main purpose of this article is to measure territorial competitiveness at a smaller territorial level with respect to the one for which indexes exist. Such an aim poses several challenges, including the lack of an indicator—or indicators—for territorial competitiveness at a smaller administrative level than NUTS-2. Theoretically, these challenges could be overcome by adapting existing competitiveness indexes at smaller administrative levels; however, this would require gathering a large amount of new data or making strong assumptions on the spatial distribution of the competitiveness factors recorded by the index.

Moreover, the literature on territorial capital (Camagni, 2009; Fratesi & Perucca, 2019; Perucca, 2014) shows that territorial factors are multiple and heterogeneous in their impact and that there is no satisfying way—yet—measure all of them.

Instead of relying on a set of proxies or indicators, this article proposes a different methodology to measure territorial competitiveness through the impact of territorial factors on firms’ competitiveness. This strategy, and the methodology presented below, have two main advantages. First, it relies on already available firm-level data, which allow easy implementation and change of the level of analysis from the still quite large administrative units NUTS-3 (as presented in this paper) to even smaller territories or aggregates of territories (e.g., LAUs, LLSs, or classes of municipalities). Second, it does not directly measure the different factors of territorial competitiveness; rather, it isolates the overall impact of territorial capital from other sources of competitiveness.

Based on the extended literature on both firms’ competitiveness and territorial capital, we can regroup the main factors influencing the competitiveness of individual firms in the three following aspects: (i) firms’ characteristics, (ii) industrial sector dynamics, and (iii) territorial capital. Given this assumption, a counterfactual workflowFootnote 5 was developed, able to isolate the effect produced by disparities in territorial capital. This allows us to indirectly measure the competitiveness of territories by proxying it via the differential effect on the competitiveness of firms located inside a specific territory.

The presence of statistically significant differentials, produced with this counterfactual workflow, will validate the hypothesis that there are significant and impacting differences in territorial capital at a smaller level than NUTS-2 regions, calling for more research and attention on the matter by both policy makers and scholars. The alternate hypothesis is the absence of differential effects so that—inside the same region—the competitiveness of firms is mainly impacted only by individual firms’ choices, characteristics, and industrial dynamics.

The counterfactual strategy — as described in detail below — is implemented via a “two-step” matching design (Rosenbaum & Rubin, 1985) including an exact match and propensity score matching, which allow the identification of the differential effects — on the competitiveness ability of firms, measured via firm-level productivity indicators — of being part of a certain territory.

If, in fact, two firms are similar on any other characteristics and only different in terms of their location in one territory or the other, the difference of competitive performance between these two firms will be due to the external conditions in which they operate, i.e., the territorial characteristics of places and the possible presence of external economies there.

This design is tested separately over multiple indicators of firms’ competitiveness measuring both levels of competitiveness in a static setting and differences in competitiveness growth over time in a dynamic setting.

In both static and dynamic settings, firms are matched based on whether they are localized inside a specific province; the same strategy is repeated for all provinces (12 NUTS-3 provinces) in the study area.

To validate the methodology and the credibility of the produced results, several tests are performed and reported in Annexes A and B.

3.2 A two-step matching design

Firms are matched using a two-step procedure: step 1 is an exact matching on the industrial sector of the specific firm, accounting for the different dynamics produced by participating in different industrial sectors. After that, Step 2 is propensity score matching (estimated via a probit function) over the most important firm characteristics implemented through the use of various data coming from balance sheets and a database of regional policies at the microlevel, both available in Italy.

The first step stems from the fact that the industry in which the firm operates is a very influential aspect to be considered. On the one hand, dynamic opportunities are different in different economic sectors because some sectors are expected to grow more than others just because of conjuncture and demand conditions. On the other hand, industries are also different in static terms, as they operate in different markets, which implies that they have different margins and different organizational requirements.

These multiple effects produced by firms participating in different industrial sectors are accounted for in the first step via exact matching: firms are classified based on the main industrial sector in which they participate through the NACE Rev.2 classification for industrial sectors and aggregated into 11 categories following the SNA/ISIC aggregation (known as the ISIC “High-level aggregation”). Based on this established aggregation (Horvát & Webb, 2020), firms are matched and compared only with other firms in the same sector; moreover, among the 11 sectors, only 6 are considered for the analysis, excluding 5 sectors due to specific sectorial dynamics or due to a very small number of observationsFootnote 6.

The 6 sectors that are considered in the analysis (manufacture, construction, retail, info and communications, financial activities, real estate and scientific and technical professions) participate in the exact matching (step 1 of the design), ensuring that firms in one sector are compared only to firms in the same sector.

Step 2 is composed of propensity score matching over relevant firm characteristics.

The first firm’s characteristic considered is the age of the firm. If younger firms are normally expected to be more innovative and dynamic, elderly and more established firms are normally more robust and able to benefit from their consolidated presence in the markets (Ottaviano, & Mayer, 2007). The age of the firm is recorded as a continuous variable marking how many years have passed between the year of incorporation of the firm and the last year considered in this analysis (2018).

Some firms may benefit from public policy interventions, while others do not and normally those who do should gain an advantage compared to the others (Adorno, Bernini, & Pellegrini, 2007b; Cerqua & Pellegrini, 2014). This is characterised via a dummy variable identifying those firms that participated in public policy programmes for the programming period “2007–2014”.

The Italian economy is characterised by a large presence of firms in the cooperative sector. Due to their nature, cooperatives are expected to be less interested in producing profits and more interested in the social consequences of their activities. For this reason, in the matching procedure, cooperative firms are identified through a specific dummy.

Not all firms are operating with the same geographical extent. Some of them are firms that compete in international markets against international competitors, and others are firms whose clients are more local and focus on producing goods and services that are sold only locally, either to local people or to local firms, when they act as suppliers. For this reason, there is a control for whether firms are exporting because it is impossible to control for the actual export intensity with existing data.

Large and small firms can also operate differently because small firms are normally managed through a much smaller and flexible structure, while larger and more established firms—although lacking in flexibility—are stable and less influenced by small market dynamics (Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, 2011; Mayer & Ottaviano, 2008). Larger firms can also lead local economies and smaller ones (Altomonte & Békés, 2016). Moreover, small and large firms are subject to different regulations. Among the different firm-size indicators, the number of employees is used here because it has official thresholds in Italian regulations. This variable is used in a continuous form, recording the number of employees.

Firms may also be different in the extent to which they rely on immaterial assets. This can produce large differences between firms belonging to different sectors (an issue that is solved by considering the sectors separately) but also within the same sector due to different firms’ strategies. This aspect is controlled by a continuous variable registering the share of immaterial assets (over total assets) declared by a specific firm, which is present in the database.

Another important aspect is the financial position of firms (Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, 2011); firms having larger debts may find it harder to obtain enough resources to endeavour new investments. The financial position is considered via a continuous variable registering the ratio of debts on the total gross earnings of firms.

Using propensity score matching—estimated via a probit function with a caliper of 0.05 - firms are matched inside the same industrial sector based on this wide set of characteristics, ensuring that the residual differentials on the indicators of firms’ competitiveness are due to differences in territorial capital. Both the Pearson correlation and the Spearman rank’s correlation coefficients confirm the absence of high levels of correlation among these variables. Specifically, the Pearson correlation test confirms that no pair of variables shows levels of correlations above 0.7.

Finally, one more constraint is implemented in the matching design to address the possible “sorting effect” of firms when choosing their localization. Big cities, especially large metropolitan areas, are – not only in terms of social and territorial capital – exceptionally more attractive to firms than other territories. This is due not only to higher stocks of territorial capital but also to being a “place on the map” (i.e., branding opportunities, name recognition) (Wheeler, 2001). The sorting effect puts metropolises and large cities on a totally different scale compared to other territories when firms decide where to localize. To avoid the possible confounding effect generated by the sorting effect, a simple restriction to the matching design is employed: the province of Milan (which is mostly composed of the metropolitan area of Milan, the only truly “big” city in the region) is compared with the rest of the region; conversely, when matching firms from the other provinces, firms located in the province of Milan are excluded from the computation.

3.3 Firms’ indicators of competitiveness

The competitiveness of firms, i.e., their ability to successfully compete in markets, cannot be measured directly but only through related proxies. There are therefore many variables that can be related to competitiveness.

Some of these may measure the static performance of firms, assuming that firms that are in a better situation are as such because they are more competitive. Other variables measure, instead, the dynamic performance of firms, which assume that more competitive firms can improve their situation faster.

Since the empirical strategy involves both static and dynamic settings, measures that are adaptable for both settings are used.

Among the many possible measures, three are especially relevant because of their diffusion in the literature and because the selected variables are indicators of the fact that a firm is more competitive than others. These three indicators are related to the fact that the firm is either more productive or more profitable and both things are related to competitiveness, although productivity is more an input of it, while Profitability is an output.

Two different variables are used to measure the productivity of firms:

The first one is value added per employee, computed as the simple ratio between these two variables available in the database (VA/emp). This is probably the most common and established variable used to compare the competitiveness of firms. Value added per employee to measure Labour Productivity is used in the papers by Aguiar & Gagnepain (2017, Bhattacharya & Rath (2020), Falciola, Jansen, & Rollo (2020), Laureti & Viviani (2011), Nemethova, Siranova, & Sipikal (2019).

The second variable measuring productivity, Total Factor Productivity (TFP), is more complex than value added per employee, but is also more informative. TFP is computed as the residual of a Solow production function (Solow, 1956) based on value added and calculating the capital stock at the firm level using the perpetual inventory method (PIM) (Gal, 2013). TFP is used, among others, in the papers by Albanese et al. (2021), Ciani, Locatelli, & Pagnini (2018), Gal (2013), Lasagni, Nifo, & Vecchione (2015).

The third selected indicator for firms’ competitiveness focuses on firms’ Profitability rather than productivity. To measure Profitability, EBIDTA (earnings before interest, taxes, depreciations and amortizations) is used as a ratio on turnover. This indicator is very different from the previous two; rather than measuring an “input” generating competitiveness, it measures an “output” of being competitive. Indeed, when a firm is or becomes more competitive inside its sector, it generates more profits. This measure is used in the papers by Aguiar & Gagnepain (2017), Akimova (2000), Bharadwaj (2000), Bramanti & Ricci (2020).

These three indicators of competitiveness are used for both static and dynamic settings. In the static setting, the indicators are used to calculate the differentials of competitiveness for matched firms—sector by sector—due to being localized in different NUTS-3 provinces. For the dynamic setting, the growth rate of the indicators is used.

Both the initial period (2009–2011) and the final periods (2016–2018) are calculated as mean values to reduce the problem of nonreported balance-sheet data in some years; indeed, data in the AIDA dataset are mostly self-reported by the firms themselves (via the submission of balance sheets), and it often happens to find some gap-years in the database. Regarding the matching for the dynamic setting, a variable reporting the specific value of the selected indicator in the initial period is included. This allows us to effectively compare firms that may have different orders of values on the specific indicator.

3.4 Validation of the model

Several aspects of the employed strategy can indeed hinder the reliability of the model: the two most critical aspects regard the pool of available firm-level observations and the reliability of the propensity score matching. Currently, firm-level databases reporting balance sheet information do not include the entirety of firms present in the territory. One critical aspect of the empirical strategy regards the ability of the available information to represent the real distribution of firms inside the region. The consistency of data was tested in a two-way matrix (province—sector) against the distribution of “local units” gathered from the ASIA database (ISTAT, 2020). The results of this Altham test (Altham & Ferrie, 2007)—providing a metric of row-column association in a matrix without requiring a specific assumption on the ordinality of data—show that the available observations are similarly distributed among provinces and industrial sectors. Annex A reports the results and metrics for the row-column association of the two matrixes and elaborates on the application and interpretation of the Altham test.

The reliability of the model is tested, producing balancing reports for each individual matching. For most cases, a satisfactory level of balancing is present, with fewer exceptions for smaller industries, especially in smaller provinces, as expected from the numerosity of data (see Annex B for balancing reports).

Both the strategy and the 2-steps matching model developed, tested on real data, appear to be reliable in matching similar firms located in different territories and—overall—isolating the territorial effects on firms’ competitiveness from the effects produced by sectoral dynamics and individual firm characteristics.

The real test, however, in order to confirm the main hypothesis, is whether they are able to individuate statistically significant differences in competitiveness between territories inside the same NUTS-2 region.

4 Estimation results

4.1 Results for static competitiveness indicators

The counterfactual strategy discussed above produces interesting results, showing the dis-homogeneous distribution of territorial competitiveness inside the selected NUTS-2 region and hence providing evidence supporting the hypothesis that it is worthwhile to analyse the differences in competitiveness at smaller spatial scales.

As described in the “Methodology” section, the two-step matching strategy is used to compare—over three different indicators (Labour Productivity, TFP and, Profitability)—the competitiveness of firms based on their location in one of the 12 provinces of the Lombardy region to measure the role of the territorial dimension on internal regional competitiveness.

In this section, the results for each indicator are presented in a specific table reporting provincial ATTs, alongside their T-stat, for every industry considered. In the purpose of this paper, tables will not be described cell by cell; instead, an effort will be made to describe the ability of the model to individuate significant differentials of territorial competitiveness and highlight differences and similarities between indicators and settings.

Tables, in addition to results produced with the described two-step matching for each industrial sector, also include a column labelled “Total” provided to give additional clarity and robustness to the results. The ATTs reported in this column—which are not integral part of the described counterfactual strategy—are calculated without the first step of exact sectoral matching (otherwise the larger sectors would be predominant) but including the NACE variable among the covariates of the propensity score.

Tables 1 and 2, and 3 report the results for the three indicators in a static setting.

The first noticeable result is that each indicator, in the static setting, is able to individuate significant differences due to firms being located in a specific province. Moreover, this holds consistently true either when looking at a specific industrial sector alone (with this proposed two-step strategy) or if looking at all sectors together (the first column, labelled “Total”).

The results tables are easily read by column or row where significant coefficients (ATTs) are indicated with asterisks, a positive and significant coefficient indicates that firms located in the specific province operating in one specific industrial sector have higher productivity or Profitability (depending on the indicator) than similar firms located elsewhere; in contrast, a negative and significant coefficient indicates that firms located in the province have lower levels of productivity or Profitability than similar firms located in the rest of the region.

Comparing the results produced using the three indicators produces some similarities but also, more interestingly, some differences.

Both Labour Productivity and Total Factor Productivity are indicators of productivity and are expected to produce similar and consistent results. While they, indeed, generally produce similar results, it is very interesting to note that this is not always the case. While Labour Productivity only considers the value added per employee, the computation for the TFP also includes the capitalization of firms as an element of productivity. Including the capitalization of firms may produce different results depending on the industrial sectors. While services are generally more impacted by the levels of capitalization of firms, these differences can also be seen in other sectors; for example, both the provinces of Brescia and Lecco have a long history of manufacturing vocation, and the indicator of Labour Productivity mostly reflects this history; indeed, they both have positive and significant ATTs. Looking at Table 2 for TFP, however, these two provinces are presented in a different light. Indeed, including the capitalization of firms in the equation, while the rest of the model stays the same, the province of Lecco shows no significant differences (in manufacturing) from the rest of the region, while the province of Brescia now shows a negative and significant coefficient, indicating that firms located there are less productive than similar firms located elsewhere.

Table 4 reports the results for the indicator of Profitability. The results presented here are expected to be less consistent with the previous two indicators. Indeed, while all three indicators are somewhat different, this indicator is more different than the other two. Instead of measuring an “input” generating competitiveness, it measures an “output” of being competitive. Indeed, when a firm is or becomes more competitive inside its sector, it generates more profits, becoming more profitable.

The differential effects recorded using this indicator (purely in terms of the number of significant coefficients) are less than those recorded with the other two indicators; however, they are not less relevant. Indeed, this third indicator looks at a different, but still crucial, aspect of the concept of competitiveness.

By observing, together, the results produced by the different indicators, it is possible to better understand the territorial complexity and differences inside the region. Indeed, beyond being able to characterize the strengths and weaknesses of the specific provinces, some more generalizable effects can be highlighted. The province of Milan is mostly composed of its metropolitan area; on the production side, firms located in the province consistently overperform similar firms located elsewhere in every industrial sector. However, Table 3 for Profitability shows that for most industries (excluded Information and Communication and Real Estate), Milan’s differentials are not significant, indicating that firms located there are similarly profitable than firms located elsewhere.

Looking at all results together, they suggest that being located in or near the metropolitan area provides a sensible advantage for firms in terms of productivity and availability of assets and territorial capital and that firms located there may not necessarily be more profitable, since they are more capitalized than firms elsewhere and need to afford higher competition for resources and localization costs.

4.2 Results for dynamic competitiveness indicators

Moving to the dynamic setting, Tables 4 and 5, and 6 report ATTs—with related T-stats—for the three indicators in terms of relative growth. The two-step matching strategy is the same, and the only adjustment in the propensity score matching model is the addition, case by case, of the initial value of the specific indicator.

The results for the dynamic setting indicate that firms located in some provinces grew more, in terms of productivity and Profitability, than similar firms located elsewhere.

It was already highlighted how, inside the workflow, it is possible to observe different facets of the concept of competitiveness by using different indicators; here, the interest is showing that changing between a static or dynamic setting, albeit with the same indicator, can also produce interesting nuances. Starting with the two dynamic indicators of productivity growth (whose results are reported in Tables 4 and 5), it can be noticed that the indicators are still able to identify a fair number of differences between provinces, with both positive and negative statistically significant coefficients. The fact that the sheer number of significant differentials is lower (compared with the relative indicator in a static setting) suggests that the dynamic growth in productivity is partially affected by common trends and economic dynamics. It is relevant to note, however, that the smaller number of observations available for the dynamic setting (due to an overall higher number of missing information in the firms’ database) might also be partially connected to this drop in the number of significant differentials individuated.

The most interesting observations these results provide emerge by comparing specific cases. The differences in coefficients between static and dynamic settings for the province of Milan provide a good example of these observations. In the static setting, firms located in the province of Milan easily overperform similar firms located elsewhere; this is expected, and—from a competitiveness point of view—this is expected also to happen in the dynamic setting. While Table 5 reporting results for firms’ growth in Total Factor Productivity confirms the expectation, Table 4 (reporting results for growth in Labour Productivity) instead shows a negative significant ATT for the total economy and, going sector by sector, only one significant (and positive) coefficient—the one for scientific and technical professions. This is extremely interesting, and what it appears to suggest is that firms located in the province of Milan (mostly occupied by its metropolitan area) are more competitive than firms located elsewhere, both in static and dynamic terms. However, the results also suggest how those firms are growing over time. Indeed, the fact that Milan’s coefficients for Labour Productivity are mostly not significant (while they were all significant in the static setting) indicates that firms located there do not improve in terms of value added per employee more than similar firms located elsewhere. Combining this with the results from Table 5 (reporting results for the growth in total factor productivity), which are mostly significant and all positive, suggests that firms located in Milan compete in their respective markets by investing and committing more capital in their production rather than improving their employee efficiency. Most likely, this is not due to collective firms’ choices but due to the context in which they operate; indeed, static results indicate that firms located there already have a higher level of Labour Productivity and, the lack of additional growth in this indicator, is most likely because they have less opportunity to grow in terms of value added per employee but are able to remain competitive (and become more competitive over time) by committing and investing more capitals.

Table 6 reports the results for the third dynamic indicator, growth in Profitability. As already observed in the static setting, the dynamic version of this indicator also records a lower number of statistically significant differentials between firms located in different provinces compared to the other dynamic indicators. However, it is interesting to observe that the two versions (static and dynamic) of this indicator are extremely consistent, contrary to what happens with the other two indicators. Many of the significant coefficients maintain the same sign, and among those who do not, no one inverts its sign despite some losing or gaining in terms of statistical significance.

This correlation between static and dynamic results for the same indicator may suggest either that the Profitability of firms is heavily impacted by common trends or that the timeframe selected for the analysis may not be wide enough to show relevant differences in dynamic terms.

4.3 Additional robustness tests

After the estimation, additional checks are performed to test the reliability and adaptability of the strategy.

It is known that the AIDA dataset has a prominence of large firms over smaller ones, and the results were tested by excluding the smaller 10% of firms or the larger 10% of firms. While not all coefficients remain exactly the same, most effects remain unchanged, including the differences between provinces and the effect of the metropolitan area of MilanFootnote 7, suggesting that the proposed strategy is quite robust in its ability to match firms and measure differentials in territorial competitiveness.

Moreover, to test the adaptability of the strategy to a different specification and much finer industrial dynamics, the model is run again, including a finer specification of the industrial sector using the 4-Digit NACE code. The results for each group of industries in the manufacturing category are reported in Annex C for all indicators. While a finer industrial classification in the first step produces a smaller number of observations participating in each propensity score matching, as noticeable from the blank cells in the tables indicating an insufficient number of observations to perform a reliable propensity score matching, the model is still able to identify multiple differentials in territorial competitiveness. Indeed, not only does the strategy appear to be quite adaptable to a different specification, but the differentials individuated are – overall – quite robust in sign with the differentials measured for the manufacture category in the previous specifications.

The choice of the industry and spatial scales at which to perform the analysis, therefore, is not something bounded by the technique but is something that can come, conceptually, from the research questions to be investigated and the policy issues to be addressed.

It could be possible to apply the technique at the level of functional regions instead of administrative units. For illustrative purposes, this paper chose to use administrative units (at the NUTS-3) level because they are usually more relevant to policymakers, but conceptually, it could have been possible to show the example using local labour market areas (SSL, sistemi locali del lavoro), which are functional areas built by Istat on commuting flows. The drawback would have been the risk of finding a large number of cells for which the number of observations is insufficient, since there are only 12 provinces but as many as 52 SSL in Lombardy.

5 Conclusions

This paper presented a novel methodological approach that exploits data at the firm level to assess territorial competitiveness through the use of a two-step matching strategy. This methodology has been designed to complement existing indexes of territorial competitiveness, for which statistical data do not allow us to go into small territorial units and have to be limited to fairly aggregate regional levels (e.g., NUTS-2 in the EU Regional Competitiveness Index).

To illustrate the methodology and the need for going into smaller spatial scales for the analysis of territorial competitiveness, the paper analysed the competitiveness of different territories inside the same region (at the NUTS-3 level) using the case study of Lombardy, a large and competitive European region.

While the main objective of the paper is achieved by validating the proposed model and testing its reliability, a number of other interesting results emerge from the analysis conducted on real data for a time span of 10 years after the 2008 crisis.

First, we confirm the assumption that the use of different indicators can lead to different rankings of territorial competitiveness. The analysis, in fact, adopts three diffused but different indicators of firm competitiveness, and the results for territories are quite consistent but not perfectly so. In fact, if the effect of the large agglomeration represented by the city of Milan is almost always present, the results on the competitiveness of the various industries in the different provinces are similar but never exactly the same. Moreover, it is interesting to notice how one of the indicators may be more adapt than the others to detect difference depending on the industrial sector (e.g., it identifies a higher number of significant differentials). These differences are clear in sectors like Manufacturing or Retail—which are highly reliant on human workforce—where the highest number of significant differentials if found in Labour Productivity; however, indicating a general pattern or correlation between indicators and industrial sectors would require a wider study and a more in-depth analysis of the results from the one that can be provided here.

A much wider difference arises when comparing a static analysis with a dynamic analysis. In fact, our results show that competitiveness differentials, for the same indicator, detected in the static analysis (at a certain point in time) are quite different from those detected in the dynamic analysis (growth in time). It is by observing together the results for both settings that it is possible to draw an accurate picture of the territorial differences in terms of competitiveness inside the region, focusing only on one dimension would produce a limited or partial depiction of the situation.

Related to this first result, another important result to consider is that different territories (at the NUTS-3 level) within the same region (at the NUTS-2 level) have different levels of competitiveness. What makes this result even more compelling is the fact that this varies according to the industry, so that two territories with similar levels of aggregate competitiveness are one more competitive than the average in certain industries and the other in other industries.

This simple result is indeed very important conceptually because most analyses of regional competitiveness take place at the NUTS-2 level but, in this way, hide the significant differences existing inside regions. This result is also very important from a policy point of view, since most regional development policy strategies are designed at large spatial scales. For example, the EU classifies regions at the NUTS-2 level and builds most regional operational plans at that level.

Measuring interregional territorial competitiveness using firm data poses a series of challenges, both theorical and practical. The paper was able to tackle many of them, but some limitations to this approach remain. It was possible to manage the noise produced by the “sorting effect” by restraining the comparison between firms located in the province of Milan and firms located elsewhere. Indeed, firms in the province of Milan, which is mostly composed of its metropolitan area, are compared to similar firms in the rest of the region to generate the provincial ATTs but are then excluded from the matching when generating the ATTs for other provinces.

While it is able to overcome the lack of data at a scale smaller than Nuts2, also this approach is limited by the availability of data. If there are not enough data at the firm level, it will be impossible to go down to the small spatial scale of interest due to the need for representativeness. Moreover, firm-level data come from surveys and normally do not involve all firms but only a sample. For instance, the database AIDA, which is the main data source of the example shown here, does not cover the full population of firms, thus creating a slight imbalance towards larger and more established firms.

Another limit, common to all analytical techniques, is that the results obviously depend on the choice of industry aggregation to be used, as it was discussed in the methodological sections. In this sense, the technique is neutral and the choice of the relevant industries to be analysed is something to be decided ex-ante on the basis of data availability and of the issues to be analysed.

From a theoretical point of view, there is room for advancement in looking for a way to distinguish between the differences in competitiveness due to first and second “nature” geography, which is still impossible in this counterfactual approach, which only detects the differences without being able to explain them.

All limitations considered, the approach and results presented in this paper should be highly valuable not only from an academic point of view but also from a policy perspective. Indeed, the methodology presented here is not intended to replace existing regional competitiveness indicators and indexes already used in both policy design and implementation but to integrate those indexes to provide finer spatial analyses so that policymakers could have a deeper understanding of the internal territorial differences inside a NUTS-2 region and better allocate limited funds and resources more efficiently.

For example, smart specialization strategies involve focusing on vertical priorities that address specific emerging industries and sectors to improve the general competitiveness of a region, are the workhorse of EU regional innovation and competitiveness policies for the 2014-20 programming period and have been designed at the NUTS-2 level or are consistent with the eligibility of structural fund support. However, this spatial scale may be large enough to hide many specificities. By showing the presence of territorial competitiveness differentials inside the same region, different by industry, the paper provides support to the idea that smart specialization strategies should take into account processes happening at a smaller spatial scale with respect to the current one and that policymakers should therefore consider helpful to take into consideration finer territorial specificities in the design of Smart Specialization Strategies.

Notes

NUTS is the acronym for Nomenclature of Territorial Units for Statistics, which are the statistical units of the European Union, periodically revised by Eurostat, the official statistical office of the EU. The last update was published in 2020 (Eurostat, 2020). For Italy, NUTS-2 correspond to administrative regions, while NUTS-3 correspond to provinces and metropolitan areas. For a map of NUTS in the case study presented in the paper, the reader will refer to Sect. 3.1.

Both the European Structural and Investment Funds and the Cohesion Fund are structured to support 11 investment priorities, also known as thematic objectives (TO). In particular, TO1 supports the “Strengthening research, technological development and innovation”.

The most populated European NUTS-2 region is the Île de France, the capital region of France (12,252,000 inhabitants) the third Andalucía (8,427,000 inhabitants). The second most populated Italian NUTS-2 region is instead Lazio, the capital region of Italy, with only 5,773,000 inhabitants.

Official data from Eurostat database, downloaded in 2021.

Counterfactual methods include a group of techniques widely employed in impact evaluation. Generally, they involve comparing the outcomes of interest of those having benefitted from a policy or programme (the “treated group”) with those of a non-benefitted group similar in all respects to the treatment group (the “comparison/control group”). In the workflow developed for this research, the comparison is performed on a spatial dimension (being located in a specific territory) rather than on receiving a policy treatment.

The five sectors which are excluded are “agriculture, forestry and fishing”, “mining and quarrying”, “public administration and defence”, “finance”, and the residual category “other service activities”. These are all sectors where either the public sector is particularly important, directly or in terms of regulations and subsidies or, as is the case for the financial sector, observations are very few and highly concentrated in a specific place due to external factors.

Results are available from the authors.

References

Adorno, V., Bernini, C., & Pellegrini, G. (2007a). the Impact of Capital Subsidies: New Estimations Under Continuous Treatment. Source: Giornale Degli Economisti e Annali Di Economia Nuova Serie PAPERS FROM THE “SECOND ITALIAN CONGRESS OF ECONOMETRICS AND EMPIRICAL ECONOMICS Giornale Degli Economisti e Annali Di Economia, 66(1), 67–92. Retrieved from http://www.jstor.org/stable/23248196%5Cnhttp://about.jstor.org/terms

Adorno, V., Bernini, C., & Pellegrini, G. (2007b). THE IMPACT OF CAPITAL SUBSIDIES: NEW ESTIMATIONS UNDER CONTINUOUS TREATMENT. Giornale Degli Economisti e Annali Di Economia, 66(1), 67–92. Retrieved from https://www.jstor.org/stable/23248196

Aguiar, L., & Gagnepain, P. (2017). European cooperative R&D and firm performance: Evidence based on funding differences in key actions. International Journal of Industrial Organization, 53, 1–31. https://doi.org/10.1016/j.ijindorg.2016.12.007

Akben-Selcuk, E. (2016). Factors Affecting Firm Competitiveness: Evidence from an Emerging Market. International Journal of Financial Studies, 4(2), 9. https://doi.org/10.3390/ijfs4020009

Akimova, I. (2000). Development of market orientation and competitiveness of Ukrainian firms. European Journal of Marketing, 34(9/10), 1128–1148. https://doi.org/10.1108/03090560010342511

Albanese, G., de Blasio, G., & Locatelli, A. (2021). Does EU regional policy promote local TFP growth? Evidence from the Italian Mezzogiorno. Papers in Regional Science, 10(2), 327–348. https://doi.org/10.1111/pirs.12574

Altham, P. M. E., & Ferrie, J. P. (2007). Comparing contingency tables: Tools for analyzing data from two groups cross-classified by two characteristics. Historical Methods, 40(1), 3–16. https://doi.org/10.3200/HMTS.40.1.3-16

Altomonte, C., & Békés, G. (2016). Measuring competitiveness in Europe: resource allocation, granularity and trade. Brussels.: Bruegel Blueprint Series Vol. XVIV,: Bruegel

Annoni, P., Dijkstra, L., & Gargano, L. (2017). The EU Regional Competitiveness Index 2016 (No. 02/2017). Regional and Urban Policy Working Papers. https://doi.org/10.2776/94425

Annoni, P., & Kozovska, K. (2010). EU Regional Competitiveness Index 2010. Ispra: European Commission. https://doi.org/10.2788/88040. Joint Research Centre

Audretsch, D. B., & Peña-Legazkue, I. (2012). Entrepreneurial activity and regional competitiveness: An introduction to the special issue. Small Business Economics, 39(3), 531–537. https://doi.org/10.1007/s11187-011-9328-5

Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2011). Small vs. young firms across the world: contribution to employment, job creation, and growth.

Balland, P. A., Boschma, R., & Frenken, K. (2015). Proximity and Innovation: From Statics to Dynamics. Regional Studies, 49(6), 907–920. https://doi.org/10.1080/00343404.2014.883598

Beber, M. M., & Brugnoli, A. (2012). The pursuit of regional competitiveness in Lombardy: productivity, resilience and aggregate welfare. In A. Brugnoli, & A. Colombo (Eds.), Government, Governance and Welfare Reform: Structural Changes and Subsidiarity in Italy and Britain (pp. 67–78). Cheltenham, UK and Northampton, MA, USA: Edward Elgar

Bernini, C., Cerqua, A., & Pellegrini, G. (2017). Public subsidies, TFP and efficiency: A tale of complex relationships. Research Policy, 46(4), 751–767. https://doi.org/10.1016/j.respol.2017.02.001

Bernini, C., & Pellegrini, G. (2011). How are growth and productivity in private firms affected by public subsidy? Evidence from a regional policy. Regional Science and Urban Economics, 41(3), 253–265. https://doi.org/10.1016/j.regsciurbeco.2011.01.005

Bharadwaj, A. S. (2000). A resource-based perspective on information technology capability and firm performance: An empirical investigation. MIS Quarterly: Management Information Systems, 24(1), 169–193. https://doi.org/10.2307/3250983

Bhattacharya, P., & Rath, B. N. (2020). Innovation and Firm-level Labour Productivity: A Comparison of Chinese and Indian Manufacturing Based on Enterprise Surveys. Science, Technology and Society, 25(3), 465–481. https://doi.org/10.1177/0971721820912902

Boschma, R. A. (2004). Competitiveness of regions from an evolutionary perspective. Regional Studies, 38(9), 1001–1014. https://doi.org/10.1080/0034340042000292601

Bramanti, A., & Ricci, S. (2020). Structure and performance of the Italian alpine “core”: a counterfactual analysis. Worldwide Hospitality and Tourism Themes, 12(4), 387–407. https://doi.org/10.1108/WHATT-05-2020-0026

Bristow, G. (2005). Everyone’s a ‘winner’: problematising the discourse of regional competitiveness. Journal of Economic Geography, 5(3), 285–304. https://doi.org/10.1093/jeg/lbh063

Bureau van Dijk (2020). Balance sheet data for Italian Firms. AIDA. Retrieved from https://orbis.bvdinfo.com/

Čadil, J., Mirošník, K., & Rehák, J. (2017). The lack of short-term impact of cohesion policy on the competitiveness of SMEs. International Small Business Journal: Researching Entrepreneurship, 35(8), 991–1009. https://doi.org/10.1177/0266242617695382

Camagni, R. (2002). On the Concept of Territorial Competitiveness: Sound or Misleading? Urban Studies, 39(13), 2395–2411. https://doi.org/10.1080/0042098022000027022

Camagni, R. (2009). Territorial capital and regional development. In R. Capello, & P. Nijkamp (Eds.), Handbook of Regional Growth and Development Theories (pp. 118–132). Cheltenham: Edward Elgar

Cannari, L., Magnani, M., & Pellegrini, G. (2010). Critica della ragione meridionale: Il Sud e le politiche pubbliche. Laterza

Cerqua, A., & Pellegrini, G. (2014). Do subsidies to private capital boost firms’ growth? A multiple regression discontinuity design approach. Journal of Public Economics, 109, 114–126. https://doi.org/10.1016/j.jpubeco.2013.11.005

Ciani, E., Locatelli, A., & Pagnini, M. (2018). Evoluzione territoriale della TFP: analisi dei dati delle società di capitali manifatturiere tra il 1995 e il 2015 (Questioni di Economia e Finanza No. 438). Bank of Italy Occasional Papers (Vol. 438)

Dal Bianco, A., & Fratesi, U. (2020). Territorial resilience and competitiveness policies: lombardy in programming period 2007–2013. Scienze Regionali, 19(1), 55–90. https://doi.org/10.14650/95928

Depperu, D., & Cerrato, D. (2005). Analyzing international competitiveness at the firm level: concepts and measures. Quaderni Del Dipartimento Di Scienze Economiche e Sociali, Università Cattolica Del Sacro Cuore–Piacenza, 32, 2007–2013

Dierickx, I., & Cool, K. (1989). Asset Stock Accumulation and Sustainability of Competitive Advantage. Management Science, 35(12), 1504–1511. https://doi.org/10.1287/mnsc.35.12.1504

Djikstra, L., & Annoni, P. (2019). The EU Regional Competitiveness Index 2019. Luxembourg: Publications Office of the European Union

Eurostat. (2020). Statistical Regions in the European Union and Partner Countries. Luxembourg: Publications Office of the European Union. https://doi.org/10.2785/72829

Falciola, J., Jansen, M., & Rollo, V. (2020). Defining firm competitiveness: A multidimensional framework. World Development, 129, 104857. https://doi.org/10.1016/j.worlddev.2019.104857

Fratesi, U., & Perucca, G. (2019). EU regional development policy and territorial capital: A systemic approach. Papers in Regional Science, 98(1), 265–281. https://doi.org/10.1111/pirs.12360

Fritsch, M. (2008). How does new business formation affect regional development? Introduction to the special issue. Small Business Economics, 30(1), 1–14. https://doi.org/10.1007/s11187-007-9057-y

Gal, P. N. (2013). Measuring Total Factor Productivity at the Firm Level using OECD-ORBIS Recent. OECD Economics Department Working Papers, (1049), 1–59

Horvát, P., & Webb, C. (2020). The OECD STAN Database for industrial analysis: Sources and methods. OECD Science, Technology and Industry Working Papers, OECD Publishing, Paris, 2020/10. https://doi.org/10.1787/ece98fd3-en

Huggins, R. (2003). Creating a UK competitiveness index: Regional and local benchmarking. Regional Studies, 37(1), 89–96. https://doi.org/10.1080/0034340022000033420

Huggins, R., & Thompson, P. (2017). Introducing regional competitiveness and development: contemporary theories and perspectives. In R. Huggins, & P. Thompson (Eds.), Handbook of Regions and Competitiveness: Contemporary Theories and Perspectives on Economic Development (pp. 1–31). Cheltenham: Edward Elgar

ISTAT (2011). 15° Censimento della popolazione e delle abitazioni 2011. Retrieved from www.istat.it

ISTAT (2020). Registro statistico delle imprese attive (ASIA). Retrieved from www.istat.it

Kamiya, M., & Ni, P. (2020). Global Urban Competitiveness Report (2019–2020) The World: 300 years of transformation into city

Kresl, P., & Singh, B. (2012). Urban competitiveness and US metropolitan centres. Urban Studies, 49(2), 239–254. https://doi.org/10.1177/0042098011399592

Krugman, P. (1994). Competitiveness: A Dangerous Obsession. Foreign Aff., 73(28)

Krugman, P. (1996). Making sense of the competitiveness debate. The Oxford Review of Economic Policy, 12(3), 17–25

Lasagni, A., Nifo, A., & Vecchione, G. (2015). Firm productivity and institutional quality: Evidence from italian industry. Journal of Regional Science, 55(5), 774–800. https://doi.org/10.1111/jors.12203

Laureti, T., & Viviani, A. (2011). Competitiveness and productivity: A case study of Italian firms. Applied Economics, 43(20), 2615–2625. https://doi.org/10.1080/00036840903357439

Ma, H. (2000). Of competitive advantage: Kinetic and positional. Business Horizons, 43(1), 53–64. https://doi.org/10.1016/S0007-6813(00)87388-7

Maskell, P., & Malmberg, A. (1999). The competitiveness of firms and regions. “Ubiquitification” and the importance of localized learning. European Urban and Regional Studies, 6(1), 9–25. https://doi.org/10.1177/096977649900600102

Mayer, T., & Ottaviano, G. I. P. (2008). The Happy Few: The Internationalisation of European Firms. Intereconomics, 43(3), 135–148. https://doi.org/10.1007/s10272-008-0247-x

Nemethova, V., Siranova, M., & Sipikal, M. (2019). Public support for firms in lagging regions-evaluation of innovation subsidy in Slovakia. Science and Public Policy, 46(2), 173–183. https://doi.org/10.1093/scipol/scy046

Ni, P., & Kresl, P. K. (2010). The global urban competitiveness report – 2010. Cheltenham: Edward Elgar

Perucca, G. (2014). The Role of Territorial Capital in Local Economic Growth: Evidence from Italy. European Planning Studies, 22(3), 537–562. https://doi.org/10.1080/09654313.2013.771626

Pinto Ribeiro, S., Menghinello, S., & Backer, K. D. (2010). “The OECD ORBIS Database: Responding to the Need for Firm-Level Micro-Data in the OECD. Statistics Working Papers, 2010/01, OECD Publishing. https://doi.org/10.1787/5kmhds8mzj8w-en OECD

Porter, M. E. (1990). The Competitive Advantage of Nations. Worchester: Billing and Sons

Rodríguez-Pose, A., & Hardy, D. (2017). Firm competitiveness and regional disparities in Georgia. Geographical Review, 107(2), 384–411. https://doi.org/10.1111/j.1931-0846.2016.12180.x

Rosenbaum, P. R., & Rubin, D. B. (1985). Constructing a Control Group Using Multivariate Matched Sampling Methods That Incorporate the Propensity Score. The American Statistician, 39(1), 33–38. https://doi.org/10.1080/00031305.1985.10479383

Sáez, L., Periáñez, I., & Heras-Saizarbitoria, I. (2017). Measuring urban competitiveness: ranking European large urban zones. Journal of Place Management and Development, 10(5), 479–496. https://doi.org/10.1108/JPMD-07-2017-0066

Solow, R. M. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70(1), 65–94. https://doi.org/10.2307/1884513

Sterlacchini, A., & Venturini, F. (2019). R&D tax incentives in EU countries: does the impact vary with firm size? Small Business Economics, 53(3), 687–708. https://doi.org/10.1007/s11187-018-0074-9

Trigilia, C. (2012). Why the Italian Mezzogiorno did not Achieve a Sustainable Growth: Social Capital and Political Constraints. Cambio, 2(4), 138–148

Turok, I. (2004). Cities, regions and competitiveness. Regional Studies, 38(9), 1069–1083. https://doi.org/10.1080/0034340042000292647

Van Dijk, J., & Pellenbarg, P. H. (2000). Spatial perspectives on firm demography. Papers in Regional Science, 79(2), 107–110. https://doi.org/10.1111/j.1435-5597.2000.tb00763.x

Vezzani, A., Baccan, M., Candu, A., Castelli, A., Dosso, M., & Gkotsis, P. (2017). Smart Specialisation, seizing new industrial opportunities. JRC Technical Report. https://doi.org/10.2760/485744

Wheeler, C. H. (2001). Search, sorting, and urban agglomeration. Journal of Labor Economics, 19(4), 879–899. https://doi.org/10.1086/322823

Zwaan, M., De, & Merlevede, B. (2013). Regional Policy and Firm Productivity. European Trade Study Group (ETSG) Working Pape, (377), 1–15

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions