Abstract

Economic ups and downs condition science and innovation. The research strength of business firms and their cooperation with universities are important functions of science systems. The aim of this research is to analyse some of the links between business scientific output co-creation and impact throughout the economic cycle. Economic growth increases the probability of firms fostering both their scientific knowledge co-creation output and their scientific impact, until reaching an inflection point, after which those relationships become negative. Co-creation with universities intensifies the scientific impact of firms’ output; however, although in theory this effect should vary according to the economic phase, the evidence shows that it remains steady. In this mixed-method study, the theory is grounded through interviews with key university and firm co-authors, and an empirical test is conducted on publications from 15,000 Spanish firms between 2000 and 2016 and their citations—a period which includes the Spanish Great Recession (2008–2014). The analysis suggests that policies to promote business co-creation output with universities should be more stable throughout the economic cycle: with high growth, governments should maintain the support for co-creation that is typical with low growth; with low growth, governments should not expect co-creation with universities to have an even greater positive effect on firms’ scientific quality than it already has with high growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Knowledge creation stands as a foundational element within scientific, innovation, and economic systems, serving as a cornerstone for progress in these domains. Companies play a crucial role in this process by actively contributing to knowledge creation through the dissemination of scientific codified knowledge—a concept we define as business scientific output (McManus et al., 2021). This dissemination not only enhances competitive advantage and attracts qualified scientists but also leads to improved scientific, technological outcomes, and innovation (McMillan et al., 2014; Perkmann et al., 2011; Soh & Subramanian, 2014; Tseng et al., 2020).

Collaborative knowledge creation, particularly through partnerships with universities, is a notable avenue for scientific advancement (Camerani et al., 2018). Such collaborations offer benefits such as a stronger connection with open science, heightened absorptive capacity, and increased business scientific impact (Beck et al., 2021; Belderbos et al., 2016; Fabrizio, 2009; McKelvey & Rake, 2016, 2020). Business scientific impact, defined as the recognition within a professional community of knowledge producers by firms (D’Este et al., 2018), emerges as a critical aspect of collaborative knowledge creation.

Previous research highlights the influence of individual, organizational, and institutional factors on the output of university-industry scientific knowledge co-creation and the scientific impact of firms (Arora et al., 2021; McKelvey & Rake, 2020). However, a significant research gap exists concerning the role of time, specifically the effect of economic growth and business cycles, on both university-industry knowledge co-creation output and firms’ scientific impact (Barberá-Tomás et al., 2021). While some authors within the field of scientometrics have explored the consequences of scientific knowledge creation on economic growth or the effects of scientific impact on economic growth (Azmeh, 2022; Inglesi-Lotz & Pouris, 2013; Inglesi-Lotz et al., 2014; Pinto & Teixeira, 2020; Solarin & Yen, 2016), a void remains in the literature regarding the effects of economic growth on co-creation output and business scientific impact.

This paper seeks to address this gap by examining the influence of economic growth on business scientific output co-creation and impact. Therefore, our research question focuses on understanding the specific effects of economic growth on these dimensions, shedding light on a heretofore neglected antecedent in the literature.

Our study makes a significant contribution to future scientometrics research by providing insights into the dynamics of university-industry knowledge co-creation and its impact on firms’ scientific output, particularly in the context of economic growth. By elucidating how economic cycles affect collaborative knowledge creation and business scientific impact, our findings offer valuable implications for policymakers and practitioners seeking to optimize strategies for fostering innovation and scientific advancement in dynamic economic environments.

This study is structured as follows. Section “Theoretical framework, interview protocol and hypotheses” presents a review of the literature and the hypotheses of the study, supported by interviews with prolific university and industry co-authors of joint publications; Section “Research context” describes the context of the study; Section “Data and methods” presents the data on co-publications made by companies; Section “Results” presents the estimations of the effects of economic growth on university-industry knowledge co-creation and firms’ scientific impact; and Section “Conclusions” concludes by offering policy recommendations and suggestions for future research.

Theoretical framework, interview protocol and hypotheses

A business cycle is a series of fluctuations in real gross domestic product (GDP) growth, real personal income, employment and other indicators (NBER, 2008). Fig. 1 presents an overview of major global economic recessions since the 1960s: the first oil crisis (1973–1975), the second oil crisis (1978–1981), the 90 s recession (1990–1992) and the Great Recession (2008–2014)—the latter being the most recent incident and the object of the empirical study in this research. Cycles are composed of phases of crisis and expansions, as presented in Fig. 1 in the years corresponding to the Great Recession. They correspond broadly to phases of low and high economic growth, and often a threshold in GDP growth is used to delimitate the two phases, e.g., the International Monetary Fund considered that less than 3 percent GDP growth in 2008 and 2009 would identify the Great Recession (IMF, 2008).

To establish the foundation for our theoretical contribution regarding the interaction between university-industry scientific knowledge co-creation output and firms’ scientific impact in response to economic growth, we conducted interviews with prominent business and university scientific knowledge co-creators. Selection criteria for industry researchers involved identifying one of the most prolific firms from our empirical sample, characterized by over 50 co-publications with universities spanning the analysis period (2008–2016). Interviews were conducted with four researchers from this firm. Additionally, we selected five university researchers who were among the most prolific co-authors of publications with firms, ensuring representation across periods of both low and high growth. Virtual interviews lasting 30–40 min were conducted to gather insights. We opted not to include more researchers as redundancy in the information provided became redundant. Table 1 presents anonymized individual data from these interviews.

Industry researchers are all in the same company. University researchers are affiliated Spanish public universities. Names of scientific fields are at the first level of aggregation of Web of Science.

University-industry knowledge co-creation output and economic growth

The impact of economic growth on university-industry knowledge co-creation output is ambivalent. First, the reasons to expect a positive or negative linear effect will be developed, and then the hypothesis of a curvilinear effect due to growth will be tested.

Increasing or decreasing university-industry knowledge co-creation output in economic growth

The scientific knowledge creation output of firms is driven by business R&D (Arora et al., 2021; Chakrabarti, 1990; Cincera & Dratwa, 2011; Halperin & Chakrabarti, 1987). R&D activity has a procyclical behaviour (Barlevy, 2007). Economic growth favours the financial stability of firms, and, therefore, that the cash flow of the company finances investment in R&D (Hall, 1992; Himmelberg & Petersen, 1994; Rafferty & Funk, 2008). The more R&D-intensive that firms are, the higher their absorptive capacity, the more open their external search strategies (Perkmann & Walsh, 2007) and the higher their scientific co-creation output with universities (Azagra-Caro et al., 2019; Vedovello, 1998). This implies a positive relationship between economic growth and firms’ scientific co-creation output with universities.

However, opposing arguments can also be found. For some companies to invest time, money and other resources to absorb external knowledge might be risky when the rewards are uncertain. According to Hess and Rothaermel (2011), when companies participate in formal university collaborations, they may experience a loss in research productivity because of knowledge redundancies and high costs in the management and monitoring of research results (Laursen & Salter, 2006).

Faced with this risk, companies may prefer to rely on their resources and capabilities to develop new products and knowledge internally (Laursen & Salter, 2006). Economic growth endows companies with the ability to self-finance their own R&D projects (Hall, 2002; Hud & Rammer, 2015; Schumpeter & Fels, 1939). Therefore, they may not be interested in collaborating with organisations with different institutional norms, or, if they are, they may have more power to retain intellectual property and not publish the results (Azagra-Caro et al., 2019).

Industry researchers provide evidence of a negative relationship between economic growth and firms’ scientific knowledge co-creation output with universities, as the following statement shows:

During the first years of the crisis [2008–2010] the company was in the process of creating a knowledge base and researching at a basic level. From 2012 onwards, the company started to have its own knowledge of certain technologies and processes, which it didn’t want to share, so it stopped publishing the results of the research.

(Industry Researcher 2)

There are, therefore, reasons to justify both a positive and a negative effect of economic growth on co-creation output. It will now be argued that one effect or the other will prevail according to the level of economic growth.

University-industry knowledge co-creation output: increasing with low economic growth and decreasing with high economic growth

With low economic growth, firms facing financial constraints are likely to reduce their investment in R&D (Freeman, 1987; Schumpeter & Fels, 1939), and the low demand also negatively affects firm’s R&D (Shleifer, 1986). The low economic growth has a dual effect on policymaking: on the one hand, the shock affects innovation systems, reducing R&D public budgets; on the other hand, governments increase their efforts to maintain innovation capacity and employment levels (Aghion et al., 2012; Hud & Hussinger, 2015). More specifically, government policies seek to counterbalance the negative effects of low economic growth by promoting university-industry research cooperation. D’Agostino and Moreno (2018) showed that the positive effects of R&D cooperation on innovation activities were stronger in times of economic turbulence than with high economic growth, and innovation also stimulates cooperation with universities (Azagra-Caro et al., 2014). This makes low economic growth a friendly environment in which companies can innovate (Filippetti & Archibugi, 2011; Pellens et al., 2020).

This postulate coincides with the following statement made by a university researcher during an interview:

Normally, when there is low economic growth, companies stop doing research or postpone it; however, the public sector invests money so that companies can receive assistance for doing research in the form of loans of which a percentage is forgivable. Then you suddenly find yourself having greater possibilities for collaboration with companies and projects with companies in which there is mutual interest.

(University Researcher 7)

Some examples of national government policies that have tackled the effects of low economic growth can be found in Canada, Japan, Argentina and Mexico. In Canada, although federal and local governments reduced education funding due to the 1970s oil crises, they did not stop providing Canadian universities with support and continued developing programmes to promote the university-industry relationship in science and technology (Doutriaux & Baker, 1995; Liévana, 2010; Naimark, 1989). Japan, in the 1990s, experienced a “lost decade” due to economic stagnation. The government supported university-industry collaboration by promoting technology transfer in 1998 (Whittaker, 2001). In Argentina, during the crisis of the 1990s, the government promoted a series of plans for research collaboration (Thorn, 2005). Mexico, in 2008 and 2009, was facing the worst moment of the Great Recession. Despite this, the government launched an Incentive Programme for Innovation (2009–2013) that included economic incentives for companies in association with public–private universities or research centres.

A similar response can be found at the supranational level, by the European Community (EC) during the Great Recession. Of the four Specific Programmes under the EC’s Seventh Framework Programme (FP7), the largest budget was for the Cooperation Programme, whose objective was to strengthen research collaboration between universities and firms, especially transnational cooperation (Szücs, 2018; Veugelers & Cassiman, 2005). Policymakers, as a way to minimise “government failures” in the allocation of subsidies and to increase the effectiveness of intersectoral R&D collaboration, follow a “picking-the-winner strategy” (Cantner & Kösters, 2009; Shane, 2009). In so doing, programme agencies select consortia with previous experience and a proven ability to generate results. Evaluators rate the outputs generated in the collaboration process by considering, among other aspects, the number of co-publications and their citation impact. Hence, firms will find that co-publishing with universities revalorises with low economic growth (Azagra-Caro et al., 2019). This view is acknowledged in the following statement from a researcher:

[In our company we are] very strong when it comes to project submissions. We were particularly active in the framework of FP7 projects [2007–2013], in which co-publications were associated with these projects.

(Industry Researcher 4)

In fact, Azagra-Caro et al. (2019) confirm that firms’ R&D spending fosters university-industry knowledge co-creation output, but after a certain threshold, the relationship becomes negative; i.e., it follows the shape of an inverted U: increasing with low economic growth (with low business R&D growth), and decreasing during high economic growth (with high business R&D growth). Such a shape is typical of concomitant phenomena. Laursen and Salter (2006) establish that the benefits of openness are subject to diminishing returns, which indicates that there is a point at which additional research becomes unproductive. This explains how innovation performance can decline after an excessive amount of corporate research (Koput, 1997).

To be precise, the following postulate is made:

Hypothesis 1

The probability of firms’ scientific knowledge co-creation output is initially increasing with economic growth, but above a certain point it is negatively related with economic growth.

The scientific impact of firm’s co-creation output with universities and economic growth

Firms’ scientific impact: increasing in low economic growth and decreasing in high economic growth

Scientific impact is measured in terms of the popularity, influence, novelty or usefulness of a research publication (Cohen et al., 2010). In the context of firms, many of these attributes may depend on the level of economic growth. Archibugi et al. (2013) observed that the innovation behaviour of firms follows different patterns in times of low economic growth. Actually, the growth of firms relies significantly on increasing production capacity and workforce with high economic growth, but it relies even more on increasing R&D budgets with low economic growth, despite the difficulties (Köksal & Özgül, 2007). Low economic growth nurtures the innovations that lead to recovery; creative destruction lies beneath growth cycles, and with low economic growth, firms are more likely to pioneer new pathbreaking scientific and technological ideas which will have a potential impact (Schumpeter, 1942). Similarly, firms that seek longer-run, explorative strategies are better suited to face low economic growth (Archibugi et al., 2013). This is compatible with the idea that economic growth will allow firms to develop more science-based innovation, and thus better science, during downturns.

Some extracts from interviews with company researchers on the performance of the scientific impact of firms illustrate how the cycle led to new pathways in their R&D strategy.

The company’s marketing activities were disrupted by the economic crisis [the Great Recession]. At the innovation level, it also had an impact that, in this case, may have been positive. That is to say, any disruption and any interruption in activity led to a search for new lines of work. In this sense, we were urged to search for alternative routes for process optimisation or the creation of alternative materials that could be used to reduce production costs.

(Industry Researcher 1)

University researchers emphasised the particular characteristics of research conducted during times of low economic growth that may have positively influenced the scientific impact of the co-publications made by firms:

Even though not much research is carried out with low economic growth, that which is tends to be more thorough. The results that arise from this research have a more appealing scope, more time and resources are devoted to refining the work, and their contribution is often highly focused on the social requirements of the context, thereby generating a great deal of interest.

(University Researcher 9)

Hence, with low economic growth, we may expect a positive relationship between economic growth and scientific impact. With high economic growth, this needs not to be true. On the contrary, some reasons suggest a negative relationship. As aforementioned, with high economic growth, the growth of firms relies significantly on increasing production capacity and workforce (Köksal & Özgül, 2007), as well as on exploitative strategies (Archibugi et al., 2013). This will result into lower-quality R&D activities and fewer explorative strategies that would more likely lead to higher scientific impact. Particularly, with the high economic growth after the Great Recession, firms’ basic research concentrated in fewer firms, which puts long-run innovation in danger (Krieger et al., 2021), and potentially scientific impact (Bloch et al., 2019). On the other hand, business research is underproductive with high economic growth, because by the time others can benefit from spillovers, the economy is likely to go through low economic growth (Barlevy, 2007). Similarly, business research with low economic growth has high quality and prepares for future situation of low economic growth, whereas business research with high economic growth has lower quality and does not prepare for future low economic growth (Amore, 2015). All these reasons indicate that with high economic growth, economic growth will hamper the scientific impact of business firms.

These reflections allow the next postulate to be made:

Hypothesis 2

Economic growth initially increases the scientific impact of firms’ output, but above a certain point, that relationship becomes negative.

The scientific impact of firms in collaboration with universities

Scientific co-production with universities may increase the quality of industrial science in three ways. First, university science tends to be more basic, related to general principles and forward looking, which is likely to broaden the perspective of firms (Frenken et al., 2005; Krieger et al., 2021). Second, scientific production is at the core of the academic profession, much more so than for companies; universities are more familiar with institutions like peer-review and can offer firms an increase in quality by shaping results according to the standards of the scientific circuits. Third, scientific co-production with universities opens up access for firms to new diffusion networks, and thus to enhanced recognition of quality, through conference and workshop presentations, informal discussion with colleagues, preprints, etc. (Aksnes, 2003; Goldfinch et al., 2003). Some of these arguments can be reflected in the statements researchers make on their experience:

Universities always endeavour to publish the results of their research with companies, because the CVs of doctoral students, professors and lecturers are supported by the measure of their publications. Therefore, any work done by the company with a university group is bound to boost its quality, in terms of its presentation as well as its analysis, writing and dissemination.

(University Researcher 7)

Empirical evidence suggests that this is the case. For example, the impact of university–industry scientific publications was higher in Canada (1988–2005) than that of purely university papers and industry papers (Lebeau et al., 2008). Abramo et al. (2020) provide empirical evidence that during the period of 2010–2015, largely coinciding with the Great Recession in Italy, until reaching the start of recovery in 2017, private–public collaboration had a positive effect on the impact of publications. As well as Bloch et al. (2019) in the case of Danish industry publications from the period of 1995–2013, who found that articles in collaboration with university present higher impact than other type of collaboration. Similarly, other works find evidence of the positive effect of co-publications in collaboration with universities in scientific impact of firms (Gielfi et al., 2014; Krieger et al., 2021).

Hence, it can be expected that scientific co-production with universities will have a positive effect on business science.

Hypothesis 3

Scientific co-production with universities increases firms’ scientific impact.

The moderating effect of economic growth in the relationship between university co-authorship and the quality of business science

It has been argued that scientific co-production with universities increases firms’ scientific impact irrespective of the level of economic growth; i.e. this positive effect is expected at any point in time. However, another situation is expected in which the contribution from universities will be more meaningful. Although little theorising has been made about this aspect, on the one hand, enhanced public support to university-industry cooperation with low economic growth is based on the assumption that universities are particularly useful in crisis, with low economic growth. On the other hand, the idea of a more valuable contribution from universities would be compatible with some recommendations stemming from the open innovation paradigm for firms to open up to universities in order to tackle low economic growth (Chesbrough, 2020; Hughes, 2011).

Some statements made by university researchers also suggest that with low economic growth firms are more open to novel ideas from universities, which could have a greater scientific impact, as shown by the following excerpt:

Certain issues come into vogue when crisis arises and call certain realities into question. Researchers working on these issues take advantage of the moment to propose solutions that previously may not have been interesting to the company. My research group and the companies with which I collaborated worked on projects with themes that were in vogue. The low economic growth gave rise to innovative ideas that, due to the relevance of the subject matter at that time, had a high impact in publications.

(University Researcher 7)

If this higher (lower) relevance of universities during economic downturns (upturns) translates into better cooperative science outlets, the following hypothesis could be established:

Hypothesis 4

Economic growth decreases the positive effect of scientific co-creation output with universities on the scientific impact of business science.

Research context

The above hypotheses will be tested in the context of the Spanish Great Recession. Figure 2 shows how Spain mimicked the world trend; i.e. an economic acceleration (2000–2007) followed by an economic contraction (2008–2009), only that in Spain the contraction lasted longer (till 2014). The world Great Recession began in the United States with the collapse of Lehman Brothers in September 2008, due to failures in economic and financial regulation, and was followed by a financial crisis in the rest of the world (Grusky et al., 2011). Attempting to stabilise their economies, some governments developed bailout policies to save companies from bankruptcy. The world economy recovered between 2010 and 2012. Spain, however, experienced a lower recovery. The Spanish Great Recession started with the collapse of the property bubble in 2008, and it was deepened with the effects of the global financial crisis and by very high levels of unemployment and poverty (Meardi, 2014).

The Spanish Great Recession had immediate effects on Spanish science and innovation. On the private side, there was a reduction in the number of firms that introduced technological and non-technological innovations, by 43% and 55%, respectively (COTEC Foundation, 2018). On the public side, government R&D spending stagnated in 2008 and 2009, and in 2010 it decreased heavily (Cruz-Castro & Sanz-Menéndez, 2016), affecting research institutions that depend on public financing such as universities and public research centres. However, public opinion was more favourable to considering science and technology as a policy priority (Sanz-Menéndez & Van Ryzin, 2015), and some regional governments and specific types of firms could effectively sustain business R&D efforts and collaborations despite the difficulties (Cruz-Castro et al., 2018; García-Sánchez & Rama, 2020).

From 2006 to 2017, the Spanish government instituted three programmes to support business R&D cooperation. Their main objective was to promote public–private alliances by providing direct public funding to universities and other research organisations to develop applied research activities in collaboration with private companies. Fig. 3 shows the evolution of the individual budgets of these three collaborative programmes and in terms of the percentage of the total national R&D budget. The National Strategic Consortia for Technical Research (CENIT) programme (2006–2010) was launched as part of the Ingenio 2010 Strategy, funded by the Centre for Industrial Technological Development (CDTI). The launch of this first programme took place in 2006, when the economy was expanding, although this high economic growth phase was about to end. In 2009, a Ministerial order considered CENIT as part of the 2008–2011 Spanish National R&D&I Plan (Orden CIN/1.559/2009). The last two years of the CENIT programme finalised under this framework (2009–2010), although the 2008–2011 Plan already incorporated a reinforced programme for public–private collaboration named Innpacto. The launch of this second programme occurred in 2008, when the economy plummeted. The Innpacto programme was promoted by the Ministry of Economy and Competitiveness and lasted for three years of the crisis (2010–2012). Fig. 3 shows that Innpacto allocated a higher percentage of collaborative resources than CENIT. The structure of this programme continued from 2013 to 2019 under the name of the Challenges-Collaboration Programme. This third programme started in 2013, when the economy began to recover, with a reduced percentage of collaborative budget compared to Innpacto, but still higher than that of CENIT. These data reflect the fact that the percentage of budget allocation to promote business R&D collaboration was significantly higher during the phases of low economic growth than during phases of high economic growth. This is consistent with Hypothesis 1.

Data and methods

Bibliometric data are a way to measure knowledge co-creation output and its scientific impact. In this study, university-industry knowledge co-creation output is measured through data on their co-publications. There is an ongoing debate on the use of university-industry co-publications as a proxy for joint scientific output. For instance, authors such as Lundberg et al. (2006) consider that university-industry co-publications are not a representative indicator of all the scientific output that can be generated from joint collaboration. However, authors such as Calvert and Patel (2003), Tijssen et al. (2009) and Abramo et al. (2009) have validated this approach, arguing that the number of co-publications is related to the occurrence of cooperation in research.

For the purposes of this study, the scientific impact of a publication is measured by the number of citations of the publications from each unit. Despite several criticisms to the use of citation counts, some authors considered it to be an appropriate statistical indicator of quality research (Cole, 1992).

The affiliation data for the authors was collected from the Web of Science records of publications in academic journals between 2000 and 2016 and contributed by any Spanish organisation. The resulting 188,458 Spanish addresses were classified as universities, firms and other organisations (hospital, research centre, joint institute, public organisation, non-profit organisation). The unit of analysis used is the publication. The sample consists of the publications made by firms and their co-publications with other organisations, which translates into almost 15,500 publications, applying Hadi’s (1994) method to exclude citation and team size outliers. If the non-firm organisation is a university, it is a university-industry co-publication. Publications are duplicated if different types of co-authoring organisations exist; however, in the econometric estimations of this study, this will be controlled by weighting the share of the number of organisational affiliations.

Economic growth is measured through the Spanish GDP annual growth rate (source: Spanish National Statistics Institute). To match publication and GDP data, a time-lag of two years has been assumed, since the effect of economic growth on publications is not immediate. The sign and significance of the estimated coefficients in the regression analysis do not change after testing with three-, four- and five-year lags.

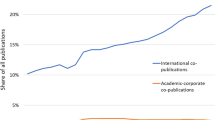

Table 2 provides the mean and standard deviations of the sample. A little less than half of the sample are co-publications of firms with universities. Figs. 4 and 5 are constructed to provide some descriptive insight into the trend of university co-authorship and firms’ scientific impact in the economic cycle.

As Fig. 4 shows, university co-authorship increased from 0.29 in 2000 to 0.54 in 2016. The main increase occurred between 2008 and 2009, at the beginning of the Great Recession. Actually, the evolution of university co-authorship exhibits a countercyclical behaviour, it being clearer during the phase of low economic growth, which roughly corresponds to the prediction of Hypothesis 1.

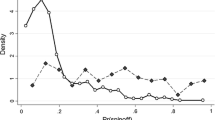

Figure 5 shows a substantial increase in firms’ scientific impact, especially during the expansion. In crisis, stagnation is observed, albeit with fluctuations, before recovering at the end of 2016. Hence, the scientific impact of firms in some way behaves as predicted by Hypothesis 2, it being clearer with high economic growth.

The empirical analysis involved two models. First, binary logistic regression was used to estimate the probability of a firm publication in collaboration with universities:

The dependent variable, university co-authorship, takes the value of 1 if a Spanish firm publication is co-authored with a university, 0 otherwise; i is the publication; j the firm; and t is time. The independent variables used in both groups of models are ∆GDP and ΔGDP2, the squared term corresponding to the possibility of non-linearities in the data; and θ includes a set of control variables.

Second, a negative binomial model was used to estimate the scientific impact of the creation output of firms. The dependent variable used is the scientific impact, based on a two-year citation window (publication year and the following two years). This two-year window is imposed by the recency of the data when we created the database: the last publication year analysed was 2016, and citation data was available until 2018. Some may consider this to be a limitation of the study. However, other authors indicated that citation patterns are different for each scientific field (Althouse et al., 2009; Garfield, 1972; Moed, 2006). For example, in life sciences and physical sciences, the citations peak arises two years after publishing, and these are the most abundant fields in the sample used in this study. In addition, several papers have argued that a two-year lapse after publication is useful as an indicator of the long-term quality and this is a sufficiently robust indicator of scientific impact (Adams, 2005; Dorta-Gonzalez & Dorta-Gonzalez, 2013).

The form of the proposed models is:

Results

Probability of university-industry co-publication

The results from the logistic estimation of Eq. (1) are shown in Table 3. Column 1 includes control variables only, based on previous studies of industry (co-)publications (e.g. Arora et al., 2021; Carayol & Matt, 2006; Halperin & Chakrabarti, 1987; McKelvey & Rake, 2016, 2020; Yegros-Yegros et al., 2016). The control variables generally have the expected results on the full sample, but they vary according to the phase of the cycle. Smaller companies are relatively more eager to co-publish with universities, both pre- and post-crisis. These results probably reflect that small, highly specialised firms have the necessary capacities and resources to acquire public funds for collaborative R&D projects (Wanzenboeck et al., 2014); however, this contrasts with Giunta et al. (2016), who indicate that larger firms co-publish more than smaller ones. The coefficient of foreign collaboration is positive and significant in the full sample and the post-crisis period. The coefficients of team size are not significant in the full sample nor in pre-crisis, but during the phase of low economic growth the effect is negative and significant. The coefficients of multidisciplinarity are positive in the full sample and before the crisis, and they are not significant afterwards.

Column 2 shows that the coefficient of ΔGDP is negative and significant, which means that the probability of firms’ co-publications with universities is countercyclical. However, according to the negative and significant coefficient of ΔGDP2 (Column 3), this occurs after a threshold, and before that the effect of economic growth is positive. To corroborate the presence of an inverted U-shape, the test proposed by Lind and Mehlum (2010) was used, as suggested by Haans et al. (2016). The test verifies an inverted U-shaped relationship between GDP growth and the probability of co-publication. Hence, the evidence supports Hypothesis 1: economic growth maintains an inverted U-shaped quadratic relationship with university co-authorship. When economic growth decelerates or contracts, the negative relationship between economic growth and university-industry co-publications becomes positive.

To obtain a more intuitive understanding of the effect of economic growth in each phase of the cycle, the data is split into pre- and post-crisis periods. Column 4 shows that the effect of GDP growth before the crisis is significant with a negative sign. On the contrary, Column 5 shows that impact of GDP growth rate, during and after the crisis, is significant and positive.

Scientific impact of industry publications

The second group of estimations focuses on the scientific impact of publications. The results of the negative binomial regressions appear in Table 4. All estimations include fixed effects for the region and science field. Regarding control variables, Column 1 shows that all of them have positive, significant effects on scientific impact. The positive sign of firm size implies the greater the size of firms, the greater the scientific impact of their publications. The positive sign of foreign collaboration indicates that international co-publications may be more beneficial than national ones (Goldfinch et al., 2003). Team size appears to have a positive effect, probably because there are more authors researching and communicating with other researchers, who subsequently cite them (Frenken et al., 2010; Mckelvey & Rake, 2020). Finally, multidisciplinarity indicates a positive effect, probably due to the association of this variable with high-quality research results.

Column 2 shows the negative linear effect of ΔGDP on the scientific impact of firms’ creation output; i.e. the overall countercyclical behaviour of this scientific impact. However, the coefficient of ΔGDP2 is statistically significant and reveals a negative quadratic relationship with scientific impact, as observed in Column 3: that is, with low economic growth, when the economy stagnates and slows down, the scientific impact of firms increases; however, when the economy recovers, the scientific impact of firms decreases. The test by Lind and Mehlum (2010) confirms the presence of an inverted U-shape relationship between GDP growth rate and the scientific impact of firms’ creation output. Hence, this result confirms Hypothesis 2.

The effect of knowledge co-creation with universities, university co-authorship, on firms’ scientific impact is positive and significant, regardless of whether ΔGDP2 is excluded (Column 2) or included (Column 3). Hence, co-creation with universities increases scientific impact. This confirms Hypothesis 3.

Column 4 adds an interaction between university co-authorship and ∆GDP. It does not provide a significant result, implying that the economic growth does not moderate the effect of university co-authorship on firms’ scientific impact; therefore, Hypothesis 4 is not confirmed. University co-authorship was also studied in interaction with ΔGDP2 in order to test whether the scientific co-creation output with universities flattened the curvilinear effect of economic growth on the scientific impact of business science; however, no significant results were obtained. Taken together with the verification of Hypothesis 1, the results suggest that the scientific impact of firms grows with low economic growth because the probability of co-authorship with university increases, not because co-authorship yields better results than with high economic growth.

The results in columns 5 and 6 break down the sample by period. For the pre-crisis sample, GDP growth rate has a significant and negative effect on firms’ scientific impact, whereas for the post-crisis sample, GDP growth rate has a positive significant effect. University co-authorship has a similar positive effect.

Split sample analysis by scientific field

It was determined whether the sign and significance of the coefficients of the independent variables vary across scientific fields in the first level of aggregation of Web of Science subject categories (Life sciences & Biomedicine, Physical sciences, Technology).Footnote 1 Table 5 Columns 1 to 3 confirm the inverted U-shaped relationship between GDP growth rate and the probability of university co-authorship for every science field. Columns 4 to 6 confirm the negative effect of squared GDP growth rate and the positive effect of university co-authorship on business scientific impact for every science field.

With regard to the interaction between university co-authorship and ∆GDP on firms’ scientific impact, Columns 4 and 5 support the original result of the non-effect in the case of Life sciences and Physical sciences; however, in the case of Technology, Column 6 shows that economic growth increases the positive effect of scientific co-creation output with universities on the scientific impact of business science. The significance of the estimated coefficient is weak (less than 10%), but the fact that it contradicts Hypothesis 4 deserves some discussion. A possible explanation of this distinctive feature is that in periods of high economic growth, technologically innovative firms become important drivers of the higher innovation investment (Archibugi et al., 2013). With high economic growth, technological firms are willing to expand innovation though the formalisation of R&D interactions and capitalisation of technological opportunities (Archibugi et al., 2013; Perez, 2003). This upswing in the economy would also lead to an improvement in the impact of business science as the novelty of new technology increases (Foster et al., 2015).

Another explanation, especially in the case of Technology, is that firms’ scientific impact may receive greater benefits from scientific co-production with academic partners who provide predominantly basic knowledge, while the research of technological firms focuses mostly on applied activities, which leads to better quality research output (Scandura & Iammarino, 2021).

Robustness checks

A set of robustness tests were applied to the findings. First, it was decided to refine the analysis regarding firm size variable. In previous estimations, in order to maintain the number of observations from the full sample, the total number of co-publications from firms was used as a proxy variable for firm size. However, to provide a more precise empirical examination, an additional regression analysis was conducted in which firm size calculation was based on the number of employees and profitability based on the return on investment (ROI) of firms (Hartmann et al., 2006; Kamien & Schwartz, 1978). To this end, the System of Analysis of Iberian Balance Sheets (SABI database), compiled by Bureau van Dijk, was used to control for firm-level data. Information on approximately 30,000 companies was downloaded. Matches were found for 500 firms from 2426 companies in the total sample by using a company name‐matching algorithm and manual review. The results in Table 6 confirm previous finding and reinforce the support for Hypotheses 1 to 3, but not 4.

Second, a robustness check was performed to overcome the limitations regarding the use of citation counts as an indicator of scientific impact. Frenken et al. (2010) mentioned that this measure does not consider the relative impact or the citation behaviour across disciplines. Therefore, a different specification of the second dependent variable was considered, the Field Normalised Citation Score (FNCS). The indicator aims to normalise citation counts for differences between fields, so that the computation of scientific impact is not influenced by/independent of the subject category of a paper (Rehn et al., 2007). To calculate FNCS, the relative number of citations of a single publication (2-year windows) was divided by the average of citations received by all Spanish papers in the same subject fields and the same period. Consider the following example: a Spanish paper published in 2016 belongs to two categories: “Biomedicine” and “Physical Sciences”, their FNCS would be the number of citations received in 2016, 2017 and 2018 divided by the average number of citations of all publications in “Biomedicine” in 2016, plus the number of citations received in those same years divided by the average of citations of all publications in “Physical Sciences” in 2016 and divided by 2.

To check the scientific impact of the co-creation of firms using the FNCS indicator the Tobit model was applied, because FNCS presents continuous observations that take values greater than zero, which reflects a censored data distribution. It was noted that the results in both models do not change. The results in Table 7, Column 1, support the finding of an inverted U-shaped relationship between ΔGDP and the scientific impact of the creation output of firms. In the pre-crisis sample, a significant and negative effect of GDP growth rate is observed on firms’ scientific impact, whereas for the post-crisis sample, GDP growth rate has a positive significant effect. Moreover, the effect of knowledge co-creation with universities, university co-authorship, on the scientific impact of firms confirms the result that co-creation with universities increases scientific impact.Footnote 2

Conclusions

The literature on university-industry scientific knowledge co-creation output and firms’ scientific impact has demonstrated the dependence of both phenomena on individual, organizational, and institutional factors. Concurrently, another line of research has emphasized the role of economic growth in shaping innovation activities. This study bridges these two streams of literature to articulate a theoretical framework regarding how university-industry scientific knowledge co-creation output and firms’ scientific impact respond to economic growth. We propose a university-industry cycle theory, positing that economic growth maintains a curvilinear relationship with firms’ co-creation of scientific knowledge with universities and its scientific impact, being negative with high economic growth but positive with low economic growth.

By utilizing a comprehensive database of co-publications by Spanish firms with universities during the Great Recession, we have empirically validated this theoretical framework, confirming the curvilinear behavior of firms' scientific impact in response to economic growth. Additionally, we have identified that scientific co-creation output with universities amplifies firms’ scientific impact across all economic phases.

These contributions hold significant implications for the field of scientometrics. While previous research predominantly focused on the effects of scientific knowledge creation and impact on economic growth (Azmeh, 2022; Inglesi-Lotz & Pouris, 2013; Inglesi-Lotz et al., 2014; Pinto & Teixeira, 2020; Solarin & Yen, 2016), our study shifts the spotlight to university-industry co-creation and impact, elucidating their reactions to economic growth. Moreover, by employing a mixed-methods approach encompassing qualitative insights alongside quantitative analysis, we extend beyond the traditional quantitative-only studies in this domain.

Our findings also carry practical implications. They underscore the need for nuanced public policies tailored to different stages of the economic cycle to reinforce R&D cooperation effectively. During periods of low economic growth, initiatives promoting knowledge co-production should be prioritized, bolstering industry collaboration and expediting the publication of co-creation output. Conversely, in times of high economic growth, support for co-creation efforts becomes crucial to enhancing the quality of firms' scientific output and preparing for potential future economic downturns.

Furthermore, our study reveals distinct implications for different scientific fields. In the Life sciences and Physical sciences, sustaining scientific knowledge co-creation during periods of high economic growth is vital, while in Technology-related fields, high economic growth amplifies the contribution of university co-authorship to firms’ scientific impact. This underscores the necessity for tailored policy efforts aligned with the phase of the economic cycle and the specific scientific field.

Despite these contributions, our study has limitations and suggests avenues for future research. While we have contributed to theory by identifying mechanisms between economic growth and scientific co-production or impact, further analysis of these mechanisms is warranted. Additionally, expanding the dataset to encompass other countries and longer time spans would enhance the generalizability of our findings. Moreover, future research could explore analogous questions pertaining to technological cooperation and impact, as well as conduct robustness tests with longer citation windows. Finally, the effects of the coronavirus pandemic on knowledge co-creation warrant further investigation, as it has introduced unprecedented challenges and opportunities in the economic landscape.

In conclusion, our study underscores the significance of studying economic growth and science co-created by companies and universities in navigating economic fluctuations. The innovative policies governments implement in response to economic shifts will play a pivotal role in leveraging the challenges posed by low economic growth as opportunities for scientific advancement and economic resilience.

Notes

Social sciences and Arts & Humanities were excluded, due to the small number of observations. This is not surprising, given that data referring to this field are not sufficiently covered by WoS (Hicks, 2004).

The results are also robust to the exclusion of the firm size outliers or the exclusion of firm co-publications with joint university-government labs.

References

Abramo, G., D’Angelo, C. A., Di Costa, F., & Solazzi, M. (2009). University-industry collaboration in Italy: A bibliometric examination. Technovation, 29(6), 498–507.

Abramo, G., D’Angelo, C. A., & Di Costa, F. (2020). The relative impact of private research on scientific advancement. arXiv preprint arXiv:2012.04908.

Adams, J. (2005). Early citation counts correlate with accumulated impact. Scientometrics, 63(3), 567–581.

Aghion, P., Askenazy, P., Berman, N., Cette, G., & Eymard, L. (2012). Credit constraints and the cyclicality of R&D investment: Evidence from France. Journal of the European Economic Association, 10(5), 1001–1024.

Aksnes, D. W. (2003). Characteristics of highly cited papers. Research Evaluation, 12(3), 159–170.

Althouse, B. M., West, J. D., Bergstrom, C. T., & Bergstrom, T. (2009). Differences in impact factor across fields and over time. Journal of the American Society for Information Science and Technology, 60(1), 27–34.

Amore, M. D. (2015). Companies learning to innovate in recessions. Research Policy, 44(8), 1574–1583.

Archibugi, D., Filippetti, A., & Frenz, M. (2013). The impact of the economic crisis on innovation: Evidence from Europe. Technological Forecasting and Social Change, 80(7), 1247–1260.

Arora, A., Belenzon, S., & Sheer, L. (2021). Knowledge spillovers and corporate investment in scientific research. American Economic Review, 111(3), 871–898.

Azagra-Caro, J. M., Pardo, R., & Rama, R. (2014). Not searching, but finding: How innovation shapes perceptions about universities and public research organisations. The Journal of Technology Transfer, 39(3), 454–471.

Azagra-Caro, J. M., Tijssen, R. J. W., Tur, E. M., & Yegros-Yegros, A. (2019). University-industry scientific production and the Great Recession. Technological Forecasting and Social Change, 139, 210–220.

Azmeh, C. (2022). Quantity and quality of research output and economic growth: Empirical investigation for all research areas in the MENA countries. Scientometrics, 127(11), 6147–6163.

Barberá-Tomás, D., Azagra-Caro, J. M., & D’Este, P. (2021). Dynamic perspectives on technology transfer: Introduction to the special section. The Journal of Technology Transfer, 47, 1299–1307.

Barlevy, G. (2007). On the cyclicality of research and development. American Economic Review, 97(4), 1131–1164.

Beck, S., LaFlamme, M., Bergenholtz, C., Bogers, M., Brasseur, T. M., Conradsen, M. L., & Xu, S. M. (2021). Examining Open Innovation in Science (OIS): what Open Innovation can and cannot offer the science of science. Industry and Innovation 1–15.

Belderbos, R., Gilsing, V. A., & Suzuki, S. (2016). Direct and mediated ties to universities: “Scientific” absorptive capacity and innovation performance of pharmaceutical firms. Strategic Organization, 14(1), 32–52.

Bloch, C., Ryan, T. K., & Andersen, J. P. (2019). Public-private collaboration and scientific impact: An analysis based on Danish publication data for 1995–2013. Journal of Informetrics, 13(2), 593–604.

Buheji, M., & Ahmed, D. (2020). Foresight of Coronavirus (COVID-19) opportunities for a better world. American Journal of Economics, 10(2), 97–108.

Calvert, J., & Patel, P. (2003). University-industry research collaborations in the UK: Bibliometric trends. Science and Public Policy, 30(2), 85–96.

Camerani, R., Rotolo, D., & Grassano, N. (2018). Do firms publish? A multi-sectoral analysis. A Multi-Sectoral Analysis (October 2018). SWPS, 21.

Cantner, U., & Kösters, S. (2009). Picking the winner? Empirical evidence on the targeting of R&D subsidies to start-ups (No. 2009, 093). Jena Economic Research Papers.

Carayol, N., & Matt, M. (2006). Individual and collective determinants of academic scientists’ productivity. Information Economics and Policy, 18(1), 55–72.

Chakrabarti, A. K. (1990). Scientific output of small and medium size firms in high tech industries. IEEE Transactions on Engineering Management, 37(1), 48–52.

Chesbrough, H. (2020). To recover faster from Covid-19, open up: Managerial implications from an open innovation perspective. Industrial Marketing Management, 88, 410–413.

Cincera, M., & Dratwa, D. (2011). Determinants of scientific production: An empirical study of the world’s top R&D companies. Université Libre de Bruxelles.

Cohen, M. Z., Alexander, G. L., Wyman, J. F., Fahrenwald, N. L., Porock, D., Wurzbach, M. E., & Conn, V. S. (2010). Scientific impact: Opportunity and necessity. Western Journal of Nursing Research, 32(5), 578–590.

Cole, S. (1992). Making science: Between nature and society. Harvard University Press.

Foundation, C. O. T. E. C. (2018). Informe Cotec 2018. Fundación Cotec para la Innovación Tecnológica.

Cruz-Castro, L., Holl, A., Rama, R., & Sanz-Menéndez, L. (2018). Economic crisis and company R&D in Spain: Do regional and policy factors matter? Industry and Innovation, 25(8), 729–751.

Cruz-Castro, L., & Sanz-Menéndez, L. (2016). The effects of the economic crisis on public research: Spanish budgetary policies and research organizations. Technological Forecasting and Social Change, 113, 157–167.

D’Agostino, L. M., & Moreno, R. (2018). Exploration during turbulent times: An analysis of the relation between cooperation in innovation activities and radical innovation performance during the economic crisis. Industrial and Corporate Change, 27(2), 387–412.

D’Este, P., Ramos-Vielba, I., Woolley, R., & Amara, N. (2018). How do researchers generate scientific and societal impacts? Toward an analytical and operational framework. Science and Public Policy, 45(6), 752–763.

Dorta-Gonzalez, P., & Dorta-González, M. I. (2013). Impact maturity times and citation time windows: The 2-year maximum journal impact factor. Journal of Informetrics, 7(3), 593–602.

Doutriaux, J., & Baker, M. (1995). University & industry in Canada: report on a complicated relationship.

Fabrizio, K. R. (2009). Absorptive capacity and the search for innovation. Research Policy, 38(2), 255–267.

Filippetti, A., & Archibugi, D. (2011). Innovation in times of crisis: National Systems of Innovation, structure, and demand. Research Policy, 40(2), 179–192.

Freeman, C. (1987). Technical innovation, diffusion, and long cycles of economic development. The long-wave debate (pp. 295–309). Springer.

Frenken, K., Hölzl, W., & de Vor, F. (2005). The citation impact of research collaborations: The case of European biotechnology and applied microbiology (1988–2002). Journal of Engineering and Technology Management, 22(1), 9–30.

Frenken, K., Ponds, R., & Van Oort, F. (2010). The citation impact of research collaboration in science-based industries: A spatial-institutional analysis. Papers in Regional Science, 89(2), 351–271.

Foster, J. G., Rzhetsky, A., & Evans, J. A. (2015). Tradition and innovation in scientists’ research strategies. American Sociological Review, 80(5), 875–908.

Gómez-Aguayo, A.M, Azagra-Caro, J.M. & Benito-Amat, C. (2022). The steady effect of knowledge co-creation with universities on business scientific impact throughout the economic cycle. INGENIO WP 2022-02.

García-Sánchez, A., & Rama, R. (2020). Foreign ownership and domestic cooperation for innovation during good and harsh economic times. International Journal of Multinational Corporation Strategy, 3(1), 4–25.

Garfield, E. (1972). Citation analysis as a tool in journal evaluation. Science, 178(4060), 471–479.

Gielfi, G. G., Furtado, A. T., & Campos, A. L. S. (2014) University-industry collaboration in the Brazilian oil industry: A Bibliometric examination. 12th Globelics International Conference.

Giunta, A., Pericoli, F. M., & Pierucci, E. (2016). University–industry collaboration in the biopharmaceuticals: The Italian case. The Journal of Technology Transfer, 41(4), 818–840.

Goldfinch, S., Dale, T., & DeRouen, K. (2003). Science from the periphery: Collaboration, networks and “Periphery Effects” in the citation of New Zealand Crown Research Institutes articles, 1995–2000. Scientometrics, 57(3), 321–337.

Grusky, D. B., Western, B., & Wimer, C. (2011). The great recession. Russell Sage Foundation.

Haans, R. F., Pieters, C., & He, Z. L. (2016). Thinking about U: Theorizing and testing U-and inverted U-shaped relationships in strategy research. Strategic Management Journal, 37(7), 1177–1195.

Hadi, A. S. (1994). A modification of a method for the detection of outliers in multivariate samples. Journal of the Royal Statistical Society Series b: Statistical Methodology, 56(2), 393–396.

Hall, B. H. (1992). Investment and research and development at the firm level: does the source of financing matter? (No. w4096). National Bureau of Economic Research.

Hall, B. H. (2002). The financing of research and development. Oxford Review of Economic Policy, 18(1), 35–51.

Halperin, M. R., & Chakrabarti, A. K. (1987). Firm and industry characteristics influencing publications of scientists in large American companies. R&D Management, 17(3), 167–173.

Hartmann, G. C., Myers, M. B., & Rosenbloom, R. S. (2006). Planning your firm’s R&D investment. Research-Technology Management, 49(2), 25–36.

Hess, A. M., & Rothaermel, F. T. (2011). When are assets complementary? Star scientists, strategic alliances, and innovation in the pharmaceutical industry. Strategic Management Journal, 32(8), 895–909.

Hicks, D. (2004). The four literatures of social science. Handbook of quantitative science and technology research (pp. 473–496).

Himmelberg, C. P., & Petersen, B. C. (1994). R & D and internal finance: A panel study of small firms in high-tech industries. The Review of Economics and Statistics, 76, 38–51.

Hud, M., & Hussinger, K. (2015). The impact of R&D subsidies during the crisis. Research Policy, 44(10), 1844–1855.

Hud, M., & Rammer, C. (2015). Innovation budgeting over the business cycle and innovation performance. SSRN Electronic Journal.

Hughes, A. (2011). Open innovation, the Haldane principle and the new production of knowledge: Science policy and university–industry links in the UK after the financial crisis. Prometheus, 29(4), 411–442.

IMF. (2008). World Economic Outlook 2008. International Monetary Fund.

Inglesi-Lotz, R., Balcilar, M., & Gupta, R. (2014). Time-varying causality between research output and economic growth in US. Scientometrics, 100, 203–216.

Inglesi-Lotz, R., & Pouris, A. (2013). The influence of scientific research output of academics on economic growth in South Africa: An autoregressive distributed lag (ARDL) application. Scientometrics, 95, 129–139.

Kamien, M. I., & Schwartz, N. L. (1978). Self-Financing of an R and D Project. The American Economic Review, 68(3), 252–261.

Koput, K. W. (1997). A chaotic model of innovative search: Some answers, many questions. Organization Science, 8(5), 528–542.

Köksal, M. H., & Özgül, E. (2007). The relationship between marketing strategies and performance in an economic crisis. Marketing Intelligence & Planning, 25(4), 326–342.

Krieger, B., Pellens, M., Blind, K., Gruber, S., & Schubert, T. (2021). Are firms withdrawing from basic research? An analysis of firm-level publication behaviour in Germany. Scientometrics, 126(12), 9677–9698.

Laursen, K., & Salter, A. (2006). Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strategic Management Journal, 27(2), 131–150.

Lebeau, L. M., Laframboise, M.-C., Larivière, V., & Gingras, Y. (2008). The effect of university–industry collaboration on the scientific impact of publications: The Canadian case, 1980–2005. Research Evaluation, 17(3), 227–232.

Lind, J. T., & Mehlum, H. (2010). With or without U? The appropriate test for a U-shaped relationship. Oxford Bulletin of Economics and Statistics, 72(1), 109–118.

Liévana, C. M. (2010). The Relationship between industry and universities. Cuadernos De Estudios Empresariales, 20(1), 81–105.

Lundberg, J., Tomson, G., Lundkvist, I., Skår, J., & Brommels, M. (2006). Collaboration uncovered: Exploring the adequacy of measuring university-industry collaboration through co-authorship and funding. Scientometrics, 69(3), 575–589.

McKelvey, M., & Rake, B. (2016). Product innovation success based on cancer research in the pharmaceutical industry: Co-publication networks and the effects of partners. Industry and Innovation, 23(5), 383–406.

McKelvey, M., & Rake, B. (2020). Exploring scientific publications by firms: What Are the Roles of Academic and Corporate Partners for Publications in High Reputation or High Impact Journals? Scientometrics, 122(3), 1323–1360.

Meardi, G. (2014). Employment relations under external pressure: Italian and Spanish reforms during the Great Recession (pp. 332–350). Comparative Political Economy of Work, Palgrave.

Ministry for Science and Innovation. (2019). State R&D Program Oriented to the Challenges of the Society. Retrieved 23 March 2021, from https://www.aei.gob.es/programa/programa-estatal-idi-orientada-retos-sociedad

McMillan, G. S., Mauri, A., & Casey, D. L. (2014). The scientific openness decision model: “Gaming” the technological and scientific outcomes. Technological Forecasting and Social Change, 86, 132–142.

Minister of the Treasury. (2018). General State Budget for 2018. Retrieved 15 January 2021, from https://www.hacienda.gob.es

McManus, C., Baeta Neves, A. A., & Prata, A. T. (2021). Scientific publications from non-academic sectors and their impact. Scientometrics, 126(11), 8887–8911.

Moed, H. F. (2006). Citation analysis in research evaluation (Vol. 9). Springer Science & Business Media.

Naimark, A. (1989). Is there a crisis in university research funding? In University research and the future of Canada: proceedings of the national conference held in Edmonton, Alberta, 26–29 April 1988 (p. 60). University of Ottawa Pr.

NBER’s Recession Dating Procedure. (2008). Nber.org. Retrieved 14 August 2016, from http://www.nber.org/cycles/jan08bcdc_memo.html

Perez, C. (2003). Technological revolutions and financial capital. Edward Elgar Publishing.

Pellens, M., Peters, B., Hud, M., Rammer, C., & Licht, G. (2020). Public R&D investment in economic crises. ZEW-Centre for European Economic Research Discussion Paper (pp. 20–088).

Perkmann, M., & Walsh, K. (2007). University–industry relationships and open innovation: Towards a research agenda. International Journal of Management Reviews, 9(4), 259–280.

Perkmann, M., Neely, A., & Walsh, K. (2011). How should firms evaluate success in university–industry alliances? A Performance Measurement System. R&D Management, 41(2), 202–216.

Pinto, T., & Teixeira, A. A. (2020). The impact of research output on economic growth by fields of science: A dynamic panel data analysis, 1980–2016. Scientometrics, 123(2), 945–978.

Rafferty, M., & Funk, M. (2008). Asymmetric effects of the business cycle on firm-financed R&D. Economics of Innovation and New Technology, 17(5), 497–510.

Rehn, C., Kronman, U., & Wadskog, D. (2007). Bibliometric indicators—definitions and usage at Karolinska Institutet. Karolinska Institutet, 13, 2012.

Sanz-Menéndez, L., & Van Ryzin, G. G. (2015). Economic crisis and public attitudes toward science: A study of regional differences in Spain. Public Understanding of Science, 24(2), 167–182.

Scandura, A., & Iammarino, S. (2021). Academic engagement with industry: the role of research quality and experience. The Journal of Technology Transfer, 47, 1000–1036.

Schumpeter, J. A., & Fels, R. (1939). Business cycles: a theoretical, historical, and statistical analysis of the capitalist process (Vol. 2, pp. 1958–65). McGraw-Hill.

Schumpeter, J. (1942). Creative destruction. Capitalism, Socialism and Democracy, 825, 82–85.

Shane, S. (2009). Why encouraging more people to become entrepreneurs is bad public policy. Small Business Economics, 33(2), 141–149.

Shleifer, A. (1986). Implementation cycles. Journal of Political Economy, 94(6), 1163–1190.

Soh, P. H., & Subramanian, A. M. (2014). When do firms benefit from university–industry R&D collaborations? The implications of firm R&D focus on scientific research and technological recombination. Journal of Business Venturing, 29(6), 807–821.

Solarin, S. A., & Yen, Y. Y. (2016). A global analysis of the impact of research output on economic growth. Scientometrics, 108, 855–874.

Stoll, J. D. (2020). Crisis has jump-started America’s innovation engine: What took so long. The Wall Street Journal, April, 10.

Szücs, F. (2018). Research subsidies, industry–university cooperation and innovation. Research Policy, 47(7), 1256–1266.

Thorn, K. (2005). Science, technology and innovation in Argentina. A profile of issues and practices.

Tijssen, R. J. W. (2012). Co-authored research publications and strategic analysis of public-private collaboration. Research Evaluation, 21(3), 204–215.

Tijssen, R. J. W., van Leeuwen, T. N., & van Wijk, E. (2009). Benchmarking university–industry research cooperation worldwide: Performance measurements and indicators based on co-authorship data for the world’s largest universities. Research Evaluation, 18(1), 13–24.

Tseng, F. C., Huang, M. H., & Chen, D. Z. (2020). Factors of university–industry collaboration affecting university innovation performance. The Journal of Technology Transfer, 45(2), 560–577.

Vedovello, C. (1998). Firms’ R&D activity and intensity and the university-enterprise partnerships. Technological Forecasting and Social Change, 58(3), 215–226.

Veugelers, R., & Cassiman, B. (2005). R&D cooperation between firms and universities. Some empirical evidence from Belgian manufacturing. International Journal of Industrial Organization, 23(5–6), 355–379.

Wanzenboeck, I., Scherngell, T., & Brenner, T. (2014). Embeddedness of regions in European knowledge networks: A comparative analysis of inter-regional R&D collaborations, co-patents and co-publications. The Annals of Regional Science, 53(2), 337–368.

Whittaker, D. H. (2001). Crisis and Innovation in Japan: A New Future through Technoentrepreneurship? In W. W. Keller & R. J. Samuels (Eds.), Crisis and Innovation in Asian Technology (pp. 57–85). Cambridge University Press.

World Bank. (2019). World development indicators. Retrieved 13 January 2021, from https://data.worldbank.org/country/ES

Yegros-Yegros, A., Azagra-Caro, J. M., López-Ferrer, M., & Tijssen, R. J. W. (2016). Do university–industry co-publication outputs correspond with university funding from firms? Research Evaluation, 25(2), 136–150.

Acknowledgements

The Spanish Ministry of Science, Innovation and Universities and the Valencian Government funded this research through Projects CSO2016-79045-C2-2-R of the Spanish National R&D&I Plan and AICO\2021\21, respectively. The Spanish Ministry of Economy and Competitiveness funded a pre-doctoral contract, BES-2017-082285, to develop the thesis within the framework of the same project. This paper has been presented at the Research Evaluation in the SSH Conference 2019, the Technology Transfer Society (T2S) Conference 2019, the 2020 DRUID Academy Conference, the 2020 UVB International Dimensions of Academic Entrepreneurship Workshop and the INGENIO PhD in Progress Day 2020. Our thanks go to the attendants for their comments, which have enriched this work, especially to Pablo D’Este and our discussants HC Kongsted and Anna Maria Kindt. Thanks also to Pauline Mattsson and Elodie Carpentier for revising an earlier draft. A working paper containing preliminary work: Gómez-Aguayo et al. (2022).

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gómez-Aguayo, A.M., Azagra-Caro, J.M. & Benito-Amat, C. The steady effect of knowledge co-creation with universities on business scientific impact throughout the economic cycle. Scientometrics 129, 2771–2799 (2024). https://doi.org/10.1007/s11192-024-04986-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11192-024-04986-5