Abstract

We investigate the narcissists’ response to failure and whether narcissists effectively learn from this negative experience. To address this, we leverage data from a leading crowdfunding platform, and analyze 116,981 failed crowdfunding attempts. Our analysis shows a positive relationship between narcissism and the probability of relaunching which is negatively moderated by the degree of failure. Indeed, due to their fragility, narcissistic entrepreneurs are more likely to engage in ego-defensive behavior, and thus, they are less likely to relaunch following high degrees of failure. Moreover, narcissistic entrepreneurs exhibit poorer performance in their subsequent endeavors. This underperformance is driven by external attribution of failure and lower levels of pro-activity. In fact, following failure, narcissistic entrepreneurs are less likely to change internal factors that might contribute to their previous failure and they are more likely to respond to failure by reattempting in a different context. Managerial and policy implications are discussed.

Plain English Summary

Most entrepreneurs rethink their decisions when their actions have resulted in undesirable outcomes. It seems natural to learn from failures: what should I have done differently? Not narcissists… Their refrain becomes “No one could have seen this coming! I must try again.” Using collected data from 161,114 failed crowdfunding projects, we determine the entrepreneurs’ degree of narcissism, and show that narcissists are more likely to relaunch projects following failure, unless the failure is too big. Also, when relaunching a crowdfunding project, narcissists will tend to switch industries, rather than adjust (more rewards, lower goals, or media usage) their projects because of learning. In adapting to dynamic environmental changes, learning from failure is vital and we show how entrepreneurs bounce back from setbacks. Being more aware of their narcissism, the entrepreneurs, and also the investors, could be encouraged to better adjust their responses to failure.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Entrepreneurial learning, defined as a process through which experience turns into knowledge that alters future performance, has gained considerable attention in recent years at the interface of the entrepreneurship and organizational learning literature (see Wang & Chugh, 2014 for a literature survey). In a learning process in which knowledge accumulated on the basis of past experience is updated, failure can be as informative as success (Minniti & Bygrave, 2001). Since high uncertainty and high failure rates characterize entrepreneurship, the particular role of learning from failure and its implications for future performance has been highlighted in the entrepreneurship literature (Barnett & Ceci, 2002; Lee & Chiravuri, 2019; Parker, 2013). Studies show that failure provides an opportunity for entrepreneurs to use feedback from their recent experience to learn and manage more effectively their subsequent ventures. However, even though failure provides an opportunity to learn, it does not necessarily induce learning.

Entrepreneurs’ negative emotions or cognitive biases, which are mainly driven by personality traits, can inhibit learning from failure (Liu et al., 2019). In this study, we analyze how an entrepreneur’s narcissistic tendency, defined as a personality trait associated with grandiose behavior, yet fragile self-esteem (Campbell & Foster, 2007; Foster & Brennan, 2011), reduces the entrepreneur’s motivation to learn, thus acting as a barrier to capitalizing on prior experience. Although narcissism has been shown to play an important role in entrepreneurial behavior and performance (Chatterjee & Hambrick, 2007; Navis & Ozbek, 2016), scant literature investigates the relationship between narcissism and learning from failure. Liu et al. (2019) conjecture that narcissistic entrepreneurs might be more likely to restart following failureFootnote 1 and warn about the downside of narcissists restarting since they report learning less from prior failure. In this paper, we empirically test this hypothesis using data from serial crowdfunding and quantify the negative consequences of narcissists’ relaunching.

Scholars analyzing learning in entrepreneurship have focused on serial entrepreneurs, defined as those that have had more than one venture creation experience. However, in the general entrepreneurial context, the lack of information on unsuccessful fundraising attempts hinders our understanding of learning from failure dynamics (Li & Martin, 2019; Sewaid et al., 2021b, 2022). To overcome this, we leverage data from serial reward-based crowdfunding. Serial crowdfunding provides an ideal setting to shed light on the narcissism-learning relationship and its consequences on future entrepreneurial decisions and performance, as it allows us to investigate three main research questions. First, we analyze how narcissism affects the entrepreneur’s likelihood of pursuing a second project following a first failed attempt. Second, we examine the entrepreneur’s subsequent performance conditional on relaunching. Third, since attribution theory and recent evidence suggests that narcissism’s cognitive and motivational attributes can hinder information scanning and interpretation involved in the learning process, as well as hamper behavioral change (Liu et al., 2019), we investigate the changes adopted in the subsequent attempt to explore how much the entrepreneur has learned from the previous business failure. Since failure is associated with financial, social, and psychological costs at both the individual and collective level (Ucbasaran et al., 2013) answering these research questions is particularly important.

In this study, we test our research questions using data on reward-based crowdfunding projects from the leading reward-based platform, Kickstarter, from its start in 2009 up to 2016. Our sample includes a total of 116,981 first failed attempts, out of which 13,593 entrepreneurs relaunched a second fundraising attempt. We find evidence that narcissistic entrepreneurs are more likely to persist following failure and relaunch a subsequent campaign. Nevertheless, this relationship is negatively moderated by the degree of failure. In their second attempt, the poorer fundraising performanceFootnote 2 exhibited by narcissistic entrepreneurs persists due to external attribution of failure. Specifically, they are less likely to revise their internal strategies and are more likely to change their exposure to the entrepreneurial context (i.e., industry).

Our study seeks to make a twofold contribution to the management literature. First, we contribute to the entrepreneurship literature on learning from failure by focusing on motivational aspects of learning, showing that entrepreneurs are less motivated to learn because of their narcissistic tendency. In particular, we substantially expand initial evidence offered by Liu et al. (2019) of a negative relationship between narcissism and reported learning from previous failure by leveraging data from serial crowdfunding. This allows us to explore entrepreneurs’ actual learning from failure and the real consequences of the narcissism-learning from failure relationship on subsequent performance and the actual mechanisms driving it. We thus complement existing literature by providing objective measures regarding the impact of narcissism on entrepreneurial behavior and performance. Second, our study contributes to the literature on narcissism in entrepreneurship, as well as to the nascent literature on the role of narcissism in crowdfunding. Recent evidence shows that there exists a negative (or inverse U) relationship between narcissism and crowdfunding success (Anglin et al., 2018; Bollaert et al., 2020; Butticé & Rovelli, 2020) and, additionally, that narcissistic entrepreneurs set less ambitious campaign goals and longer durations, in line with an ego-defensive behavior (Bollaert et al., 2020). However, these studies focus on single projects of entrepreneurs. Unlike them, we look at serial crowdfunding. By doing so, we do not look at the effect of narcissism on current performance, but we rather identify how narcissistic entrepreneurs learn from recent experience and use this experience in their following endeavors.

The rest of this paper is organized as follows. Section 2 presents the theoretical framework and develops the research hypotheses that we will empirically test in this paper. In Section 3 we describe the data that we will use, as well as define the main variables of interest. Section 4 discusses the results of our empirical analysis along with the robustness checks. Finally, in Section 5 we discuss the managerial and policy implications of our main findings, the limitations of our study, avenues for future research, and concluding remarks.

2 Theoretical development

Learning from failure is complex and could differ given degree of failure and personal traits. Among the research on personal traits and entrepreneurial performance, the critical role of narcissism has been highlighted (Chatterjee & Hambrick, 2007; Navis & Ozbek, 2016). Narcissism is often defined as an inflated, although fragile, self-concept of one’s importance or influence, characterized by a persistent preoccupation with success, grandiose thinking, and exaggerated perspectives of authority, superiority, and competitiveness (Anglin et al., 2018; Campbell & Foster, 2007; Chatterjee & Hambrick, 2007; Foster & Brennan, 2011; Wales et al., 2013). Previous literature on narcissism in entrepreneurship has linked narcissism to both positive and negative outcomes. Existing studies show that increased narcissism leads to a higher likelihood of pursuing innovations (Navis & Ozbek, 2016), and more entrepreneurial intentions and attention (Kramer et al., 2011; Hmieleski & Lerner, 2016; Wales et al., 2013), but also more volatile financial performance (Chatterjee & Hambrick, 2007) and worse performance (Haynes et al., 2015; Tucker et al., 2016). In the crowdfunding context, narcissistic entrepreneurs have been recently shown to be less successful than other entrepreneurs (Bollaert et al., 2020; Butticè & Rovelli, 2020), while Anglin et al. (2018) document an inverted-U relationship between narcissistic rhetoric and crowdfunding performance. Narcissism has also been shown to affect campaign design in reward-based crowdfunding, with narcissistic entrepreneurs setting less ambitious goals and longer campaign durations (Bollaert et al., 2020), evidence of ego-defensive behavior.

Although narcissism as a trait has attracted the attention of management and entrepreneurship scholars, scant literature has investigated how this trait affects learning from prior experience. Initial empirical evidence on the negative impact of narcissism on learning from failure is provided by Liu et al. (2019). Using a survey sample of startups, they find that narcissism is negatively associated with reported learning, particularly when social costs of failure are high. Although this preliminary evidence is welcome, reported learning might differ from actual learning since self-reported measures are affected by common method bias and retrospective recall. Moreover, self-reported learning is disclosed through the lens of a narcissistic entrepreneur with inflated self-views which can further bias the measure. Therefore, the effect of narcissism on actual learning remains unclear. Moreover, it remains unclear how narcissists adjust future strategic decisions following failure and the implications of these changes on future performance. We contribute to the existing literature by conceptually elaborating on the effect of narcissism on learning from failure for serial launchers. We provide evidence on the impact of this relationship on the probability of relaunching, subsequent performance, and strategic adjustments between attempts.

We, therefore, have three goals in this section. First, we analyze the effect that narcissism and learning from failure could have on the probability of relaunching, and the moderating role that the degree of failure has on the previous relationship. Second, we examine various behavioral theories of learning from failure to investigate the effect of narcissism on subsequent campaign performance, conditional on having relaunched. Third, we investigate the mechanisms through which narcissism affects future campaign performance. In particular, we look at whether narcissistic entrepreneurs are more likely to change internal factors or to change their exposure to external factors following failure.

2.1 Narcissism, degree of failure, and relaunching

Narcissistic tendencies are typically associated with patterns of grandiose behavior, leading individuals to take actions to enhance their ego. For example, narcissistic individuals might engage in seemingly risky behavior (Foster et al., 2009) or act impulsively (Vazire & Funder, 2006). Moreover, narcissism drives bold actions that attract attention and is positively associated with entrepreneurial intention (Wales et al., 2013). Thus, the grandiose behavior would lead to denial of current failure and persisting following failure. However, there is evidence in the literature that narcissistic entrepreneurs could also engage in ego-defensive behavior since they suffer from fragile self-esteem (Campbell & Foster, 2007; Foster & Brennan, 2011). The ego-defensive behavior would suggest refraining from persisting following failure due to the increased risk of ego-damage.

To clarify the impact of narcissism on the decision to relaunch, we reflect upon how narcissistic entrepreneurs view their failures. Previous studies indicate that predictions about future performance by narcissists are driven partially by previous performance assessments which are linked to actual performance, but also largely by predictions of performance made prior to awareness of actual performance (Campbell et al., 2004). Thus, narcissists only partially internalize performance feedback in their predictions about future performance. At the same time, narcissists tend to interpret their past behavior positively in an attempt to protect and maintain an unrealistically high level of self-esteem (Farwell & Wohlwend-Lloyd, 1998; Vazire & Funder, 2006). Moreover, narcissistic entrepreneurs are reluctant to negatively interpret their past decisions, which would imply undermining their self-esteem (Zhu & Chen, 2015). Since narcissistic entrepreneurs are self-conscious about how others perceive them, the above behavioral responses are especially true in contexts where previous performance is publicly visible (Campbell & Miller, 2011; Wallace & Baumeister, 2002). In crowdfunding, current and previous fundraising attempts are archived online on the platform. Related information is easily accessible by potential backers who can view prior strategies adopted by the entrepreneur, prior fundraising outcomes, current strategies, and current outcome.

Taken together, we conjecture that narcissistic entrepreneurs would respond defensively towards an ego-threat following failure, in an attempt to maintain their inflated positive self-views. Since their public reputation suffers a negative shock, we suspect that they would engage in grandiose actions and thus be more likely to relaunch. Following similar arguments, Liu et al. (2019) infer that “once a startup fails, a highly narcissistic entrepreneur might have a great intention to restart.” We therefore hypothesize:

-

Hypothesis 1a. Narcissism is positively associated with the probability of relaunching following failure.

Previous literature suggests that the degree of failure of the first venturing attempt might play a moderating role in the likelihood that certain types of entrepreneurs conduct second founding attempts. For example, Kuppuswamy and Mollick (2016) show that even though female entrepreneurs are less likely to relaunch in general, this gender gap is further intensified due to the negative moderating role of degree of failure on second founding attempts. A similar moderating role could be played by degree of failure in the likelihood that narcissistic entrepreneurs relaunch following failure to preserve their public reputation. When deciding whether to relaunch or not, the entrepreneurs weigh their prospects. There are two possible outcomes from a relaunching attempt. On the one hand, the second attempt could be successful, reestablishing their reputation on the platform by following their initial failure with a success. On the other hand, the second attempt could fail, further damaging their reputation on the platform. However, following failure, the entrepreneur would be relaunching with this experience liability or negative signal about their ability to succeed. The larger the degree of failure, the higher this liability, and the lower the likelihood of succeeding in the subsequent attempt of restoring the reputation on the platform. Hence, although highly narcissistic entrepreneurs might be more likely to launch a second project to maintain an unrealistically high level of self-esteem, they might also engage, at very high levels of failure, in ego-defensive behavior to minimize the risk of damaging their ego again. Thus, narcissistic entrepreneurs will be more reluctant to relaunch after high degrees of failure relatively to low degrees of failure. This suggests:

-

Hypothesis 1b. The degree of failure negatively moderates the positive association between narcissism and the likelihood of relaunching following failure.

2.2 Narcissism and learning from failure

Recent evidence from reward-based crowdfunding shows that narcissism negatively affects campaign performance (Bollaert et al., 2020; Butticè & Rovelli, 2020). Nevertheless, these studies analyze single ventures, not serial entrepreneurs’ performance. For serial entrepreneurs, both theoretical and empirical works link past entrepreneurial experience with higher performance (Lafuente et al., 2019; Minniti & Bygrave, 2001; Sarasvathy et al., 2013; Ucbasaran et al., 2010). For example, Minniti and Bygrave (2001) provide a theoretical framework of entrepreneurial learning in which failure is as informative as success. In this model, agents process information, make mistakes, update their decisions, and, possibly, improve their performance. Indeed, after learning from first venture attempts, entrepreneurs might take actions that improve the second campaign performance. Similarly, previous literature shows that failure generally motivates individuals to question existing routines and adopt corrective actions (Dahlin et al., 2018). Moreover, according to Cope (2011), learning from failure is a function of distinctive learning processes that facilitate higher-level learning outcomes. In fact, higher-level learning implies questioning the assumptions that lead to the actions and discovering new solutions and is thus exploratory in nature.Footnote 3 However, previous research in entrepreneurship predicts that narcissism partially prevents entrepreneurs from accepting feedback, and thus from learning (Navis & Ozbek, 2016). At the same time, narcissistic entrepreneurs are more likely to misevaluate opportunities and to fail to properly assess projects, thus missing good opportunities or investing in bad projects (Tucker et al., 2016). Moreover, recent evidence suggests that narcissism can create cognitive and motivational obstacles to learning from failure (Liu et al., 2019). Furthermore, failure might drive entrepreneurs into downward performance spirals (Sewaid et al., 2022; Singh et al., 2007). This is especially true for narcissistic entrepreneurs who are less likely to acknowledge their own deficiencies that contributed to the initial failure. Consequently, we contend that narcissistic entrepreneurs are less likely to succeed in a subsequent campaign, so that subsequent campaign performance is lower for narcissistic entrepreneurs.

On the other hand, future performance also depends on backers’ support. Backers on crowdfunding platforms actively observe changes to campaign design made by entrepreneurs from the first venture to a second attempt. Thus, backers (investors) also learn in the process and might penalize narcissistic entrepreneurs for not internalizing properly their previous failure’s feedback. These arguments culminate in the following hypothesis:

-

Hypothesis 2. Narcissism is negatively associated with subsequent campaign outcome following failure.

2.3 Narcissism and failure attribution

We now turn to the mechanisms that drive subsequent campaign performance. In particular, we are interested in analyzing how entrepreneur’s learning from previous experience affects future behavior, by materializing into changes to campaign design and entrepreneurial context with the aim of increasing the success of the second fundraising attempt. Extensive research has been conducted on the determinants of success in reward-based crowdfunding. Regarding campaign design, the most important characteristics of the campaign affecting success are the funding goal or target capital (e.g., Colombo et al., 2015; Mollick, 2014; Zheng et al., 2014), the number of rewards offered to backers (Boeuf et al., 2014; Gerber & Hui, 2013), and the media usage including the use of videos (Dushnitsky & Marom, 2013; Mollick, 2014) and images (Colombo et al., 2015). Following an unsuccessful campaign, we would thus expect an entrepreneur to make changes in the design of the second campaign, according to the learning experience, modifying some of those variables that determine campaign performance. For example, one would expect an increase in the use of media, such as images and videos which positively affect campaign success, or an increase in the number of rewards which is also a positive determinant of success. Similarly, a lower funding goal would be expected after a failure, given the negative relationship between funding goal and success.

However, narcissism can act as an obstacle to learning (Liu et al., 2019), where highly narcissistic entrepreneurs do not acknowledge flaws in their own strategic decisions. Highly narcissistic entrepreneurs may deny failure or justify it through self-serving behavior by engaging in self-aggrandizement and self-enhancement (Judge et al., 2006; O’Boyle et al. 2012). According to attribution theory, narcissistic entrepreneurs might attribute success to their own self-perceived superior abilities but blame failure on others or the environment (Jones & Harris, 1967; Vazire & Funder, 2006). Therefore, they will be unlikely to look into the causes of failure and might superficially scan and process information, impeding proper information interpretation that might be transferable to subsequent campaigns. Even when they do realize that they are responsible for their own failure, they might refuse to revise their behavior in an attempt to maintain their grandiose self-view and superiority. Cognitive and motivational attributes of narcissism can thus impede behavioral change that might lead to improvements in the design of future campaigns to increase subsequent campaign performance. We therefore posit:

-

Hypothesis 3a. Entrepreneurs exhibiting higher levels of narcissism are less likely to (i) increase their media usage, (ii) increase the number of rewards, and (iii) decrease the funding goal of their subsequent campaign.

In addition to making changes to campaign design following failure, an entrepreneur might decide to change entrepreneurial context. In reward-based crowdfunding, when launching a campaign, entrepreneurs identify the category to which the project belongs. This category has been widely used as a proxy for industry (Allison et al., 2017; Butticè et al., 2017; Oo et al., 2019; Scheaf et al., 2018). The most prominent change that an entrepreneur could make when relaunching is to change industry (Delmar & Shane, 2006; Klepper, 2002). Findings in the previous literature suggest that many entrepreneurial skills are industry-specific (Delmar & Shane, 2006) and changing industry might have an adverse effect on performance (Eggers & Song, 2015). To learn from failure, entrepreneurs need to recognize the causes of failure for it to yield any benefit (Cannon & Edmondson, 2001). As previously argued, narcissistic entrepreneurs fail to do so since they are preoccupied with maintaining their grandiose self-view. Instead, they might blame failure on external factors such as industry, competition, or customers. Consequently, instead of analyzing the internal causes of failure and accurately grasping what has gone wrong, highly narcissistic entrepreneurs will attempt to change their exposure to the external factors. We, therefore, contend that highly narcissistic entrepreneurs are more likely to respond to failure by changing category. This is summarized in the following hypothesis:

-

Hypothesis 3b. Entrepreneurs exhibiting higher levels of narcissism are more likely to change industry following failure.

3 Data and methodology

3.1 Data source and sample construction

To investigate the effects of learning and narcissism on relaunching following failure, subsequent performance, and the mechanisms driving subsequent performance, we turn to the crowdfunding context. Among reward-based crowdfunding platforms, Kickstarter is the leading platform worldwide. To date, projects on Kickstarter have more than $5 billion USD in pledged capital by backers. For our purpose, as a starting point, we utilized the data kindly made available by the UC Berkeley’s CrowdBerkeley team (http://crowd.berkeley.edu/). More specifically, we follow Yu et al. (2017) that were the authors that built and made the Kickstarter database available for public use. The variables in this initial dataset include project title, description, category, location (city, state, country), founder details, fundraising goal amount (in USD), actual fundraised amount (in USD), and project status (success, failed, canceled). Building on the initial dataset, we construct our final dataset by scraping additional data and the textual content pertaining to all projects launched on the platform during the period April 1, 2009 up to November 29, 2016.

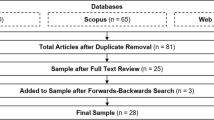

Campaign launching on crowdfunding platforms provides a great context to investigate learning dynamics due to the availability of information on both successful and failed fundraising attempts (Li & Martin, 2019; Sewaid et al., 2021b, 2022). Our initial dataset consists of 248,624 first launching attempts on the platform, out of which 161,114 projects failed to raise their requested capital (64.80% of all first launching attempts). Since our analysis focuses on the effects of narcissism at the individual level, we discard crowdfunding projects launched by teams or business entities. By restricting our sample to projects launched by individuals, our sample drops to 192,456 campaigns (77.40% of all first launching attempts). Finally, we drop observations where gender of the entrepreneur could not be identified with at least 90% certainty.Footnote 4 This leaves us with a sample of 176,783 campaigns (71.10% of all first launching attempts) that we refer to as the population. Given that the core of our analysis relates to the dynamics of learning from failure, in the first stage of our analysis, we restrict our population to first-launch campaigns that have failed to secure their requested capital. There are 116,981 first-launch failed campaigns which represents 66.17% of the campaigns in our population. This failure rate is not significantly different from that exhibited in the initial dataset with all first launching attempts (64.80%). In the subsequent stages of our analysis, our investigation involves second-launch campaigns of entrepreneurs who failed in their initial campaign and subsequently relaunched. This refined sample contains 13,593 second-launch campaigns.

3.2 Measures

3.2.1 Dependent variables

Our research question is sequential in nature and explores three different aspects related to the dynamics of learning from failure. First, we explore the effects of our independent variables on the decision to relaunch a subsequent crowdfunding campaign following failure. To that end, our variable denoted Relaunch is a dummy variable which takes the value 1 if the entrepreneur relaunches a subsequent campaign following failure and 0 otherwise.

Second, given initial failure, to explore the effect of our independent variable on subsequent performance, we capture subsequent performance using the dummy variable Success. This variable is the most common proxy for performance in the crowdfunding literature since Kickstarter is an all-or-nothing platform: failing to meet the campaign’s goal results in no funds being disbursed to the entrepreneur (Cumming et al., 2019).Footnote 5 Hence, Success takes the value 1 if the campaign goal is met and 0 otherwise.

Third, to investigate the channel by which our independent variable affects performance, we operationalize four mechanism variables. More Media is a dummy variable that takes the value 1 if the second campaign contains more media content relative to the first campaign and 0 otherwise. More Rewards is a dummy variable that takes the value 1 if the second campaign offers more reward options relative to the first campaign and 0 otherwise. Lower Goal is a dummy variable that takes the value 1 if the second campaign’s goal is lower than the initial campaign’s goal and 0 otherwise. Industry Change is a dummy variable that takes the value 1 if the second campaign is launched in a different industry relative to the first campaign and 0 otherwise.

3.2.2 Independent variables

In our analysis we are interested in investigating the effects of narcissism on learning from failure. To capture Narcissism, following Bollaert et al. (2020) and Butticè & Rovelli (2020), we scrape the campaign content section and extract all first-person pronouns. We split these pronouns into first-person singular pronouns (I, me, my, mine, and myself) and first-person plural pronouns (we, us, our, ours, and ourselves) and create a count variable for each set of first-person pronouns. We then proceed by constructing a ratio of the number of first-person singular pronouns used to the total number of first-person pronouns used (singular and plural). A higher narcissism ratio indicates a higher level of narcissism exhibited by the entrepreneur.

Worth noting, even though our proxy for narcissism captures expressed personality traits, the ability of “digital footprints” to predict personality traits have been shown to be in line with that of behavioral predictions (Azucar et al., 2018). Moreover, even if individuals adapted their expressed traits to their context, we would still expect that there would be differences in the displayed narcissism between those who are low vs. high on this trait outside the platform.

3.2.3 Control variables

In our analysis, we control for a set of variables that are known to be associated with our dependent variables. Since the degree of failure can significantly affect the decision to relaunch a campaign and subsequent performance, we operationalize a proxy to measure the degree of failure of the current campaign. Degree of Failure is the distance between capital raised and the campaign’s goal in % terms. A higher percentage indicates a higher degree of failure.

In the analysis pertaining to the relaunching decision, we control for Degree of Failure, the entrepreneur’s gender, campaign category/subcategory, and the year the campaign was launched. Gender is a dummy variable that takes the value 1 if the entrepreneur is classified as a female and 0 otherwise. The classification is conducted using the entrepreneur’s first name and a Python classification package (genderizer). This package assigns a gender based on the entrepreneur’s first name, along with the degree of classification accuracy, since some names are unique or can be associated with both genders. Similar to previous literature we use an accuracy cut-off point of 90% for our classification (Kuppuswamy & Mollick, 2016). Observations for which gender cannot be determined with a 90% certainty were dropped from our analysis. Category and Subcategory dummies are included in the analysis and are based on a pre-defined list set by Kickstarter. Year dummies control for the year that the initial campaign was launched. Additionally, to gauge how the effect of Narcissism on the decision to relaunch differs given initial campaign’s extent of failure, we include an interaction term of our independent variable with Degree of Failure, Degree of Failure × Narcissism.

In the analysis pertaining to the performance of the campaign following failure, we control for initial Degree of Failure and campaign specific variables that are known to be associated with fundraising performance (Mollick, 2014). Time since last campaign captures the number of days elapsed since last campaign. Goal is the campaign’s goal in USD. Rewards are the number of reward options offered by the entrepreneur. Video Pitch is a dummy variable that takes the value 1 if the campaign has a video pitch and 0 otherwise. Video Content and Image Content are the count of videos and images incorporated in the campaign’s content section. Textual Content is the textual length of the campaign’s content section. Duration captures the number of days that the campaign is publicly available on the platform. We additionally include Category and Year dummies.

In the analysis pertaining to the mechanism driving the exhibited performance, our control variables are similar to those used in the initial analysis to investigate the entrepreneur’s relaunching decision. A list of the variables used in our analysis and their descriptions is provided in Table 1.

Given the skewness of the control variables and the zero values encountered, we transformed all unscaled continuous variables using the inverse hyperbolic sine transformation. This transformation has an identical interpretation to that of the natural log transformation (Burbidge et al., 1988; Franke & Richey, 2010; Sewaid et al., 2021a).

3.3 Descriptive statistics and correlations

Table 2 presents the descriptive statistics of all variables included in our analysis. Panel A of Table 2 presents the descriptive statistics corresponding to all first campaigns that have failed, whereas panel B of Table 2 presents the descriptive statistics corresponding to the second campaign launches. Table 3 provides the correlation matrix and variance inflation factors (VIFs) for the sample included in panel B. The values presented in Table 3 do not raise any concerns.Footnote 6 We note that the correlation levels among the independent variables are not alarming with the highest correlation being 0.431 in absolute terms. This is also verified by the VIFs where the average VIF (1.28) and the maximum VIF (1.74) are well below the thresholds established in the literature. This reassures us that our analysis is not prone to any multicollinearity issue.

Table 4 presents the difference in means of our main dependent variables at different quartile levels of narcissism. The difference in means analysis is conducted relative to the lowest quartile. From this preliminary analysis we note that entrepreneurs exhibiting higher levels of narcissism are more likely to relaunch a subsequent campaign and that they are less likely to succeed in their subsequent campaign. We additionally note that entrepreneurs exhibiting higher levels of narcissism do not tend to increase media content and reward offerings and they are more likely to switch industries. Based on this we proceed with our multivariate analysis in the main analysis.

3.4 Estimation models

To test the association between Narcissism, its interaction with Degree of Failure, and relaunching a subsequent campaign, we model the probability of relaunching a subsequent campaign (Relaunch) using a probit regression model. We report the coefficients and the robust standard errors (the latter one in parentheses) in Table 5. This analysis also serves as the selection model that we will use in the analysis presented in Tables 6 and 7.

To test the association between Narcissism and subsequent campaign performance, we need to control for selection, since subsequent performance is only observable for entrepreneurs who have relaunched a campaign following failure (Sewaid et al., 2021b, 2022). To address this issue, we run a two-stage Heckman correction model. In the first stage, we run the selection model presented above and use it to generate the inverse Mills ratio (IMR) which controls for the probability that we observe the entrepreneur in the second stage (Heckman, 1979). If the coefficient on the IMR is statistically significant, it will indicate that our analysis is prone to sample selection bias; however, including the IMR in the analysis will correct for this sample selection issue. If the coefficient on the IMR is not statistically significant, then it will indicate that our analysis is not prone to sample selection bias (Heckman, 1979).Footnote 7 In the second stage, we use a probit regression model to model the probability of success (Success). The results of this analysis are presented in Table 6.

In order to identify the mechanisms driving the association between Narcissism and Success, we run a series of probit regression models with a set of mechanisms as our dependent variables (More Media, More Rewards, Lower Goal, and Industry Change) and Narcissism as our independent variable. The previously generated IMR is included as a control variable in our analysis to correct for selection issues that are inherent to the setting. The results of this analysis are presented in Table 7.

4 Empirical results

In our analyses we sought to investigate the following: (i) whether narcissistic entrepreneurs are more likely to relaunch following failure and if the extent of their initial failure moderates this result, (ii) the effect of narcissism on subsequent performance given relaunching, and (iii) the mechanism driving the subsequent underperformance of narcissistic entrepreneurs. In Table 5 we report the results pertaining to our analysis of the effect of narcissism on the relaunching decision and the moderating role of the degree of failure. In column (1) we report the association between our controls and relaunching a subsequent campaign. We show that at higher degrees of failure, entrepreneurs are less likely to relaunch which is consistent with recent findings (Fan-Osuala, 2021). Moreover, we complement Kuppuswamy and Mollick (2016)’s findings and show that female entrepreneurs are less likely to relaunch following failure.

Hypothesis 1a posits that entrepreneurs exhibiting higher levels of narcissism are more likely to persist and relaunch following failure. In column (2) we add Narcissism to the model presented in column (1). Indeed, we find support for Hypothesis 1a (Narcissism = 0.1039, p < 0.01) indicating that narcissistic entrepreneurs are more likely to persist following failure. Specifically, we note that for a 1 SD (standard deviation) increase in the level of exhibited narcissism, the entrepreneur is 7.83% more likely (from 10.47 to 11.29%) to relaunch a subsequent campaign. Hypothesis 1b suggests that this documented effect is negatively moderated by the degree of failure, such that narcissistic entrepreneurs are less likely to relaunch at higher levels of failure, as they engage in ego-defensive behavior. In column (3) we introduce the interaction term (Degree of Failure × Narcissism) to the prior analysis. The interaction term is significantly associated with relaunching a subsequent campaign (Degree of Failure × Narcissism = − 0.3121, p < 0.01). In Fig. 1, we plot the association between Narcissism and the probability of relaunching for different extents of failure. From the plot we note that highly narcissistic entrepreneurs are more sensitive to the degree of failure in their decision to relaunch a subsequent campaign. The regression results in column (3) along with the plot in Fig. 1 provide support for Hypothesis 1b.

In Table 6, we report the results pertaining to the effect of narcissism on subsequent campaign performance. In column (1) we report the coefficients for our control variables. All the variables exhibit the same association with performance as those established in the literature. We highlight that better-elaborated campaigns, characterized by more rewards and more media content, and campaigns with lower goals enjoy better performance.

Hypothesis 2 suggests that narcissistic entrepreneurs would exhibit poorer subsequent fundraising performance. In column (2) we add Narcissism to the model presented in column (1). The results presented provide support for Hypothesis 2 (Narcissism = − 0.2826, p < 0.01) indicating that narcissistic entrepreneurs are less likely to succeed in their subsequent fundraising attempt. Specifically, we note that a 1 SD increase in the level of exhibited narcissism is associated with a 15.85% decrease (from 20.30 to 17.08%) in the likelihood of success in the subsequent campaign.

Having established that although narcissistic entrepreneurs are more likely to persist and relaunch, they tend to exhibit poorer subsequent performance, we attempt to disentangle the possible mechanisms driving this underperformance. As established in the control analysis conducted in Table 6 and the prior literature, more media content (Courtney et al., 2017), more rewards (Sewaid et al., 2021a), and lower goals (Mollick, 2014), are associated with better fundraising outcomes. Hence, entrepreneurs who internalize initial failure and are pro-active in their subsequent campaign, such that they increase their media content and number of rewards offered while lowering their campaign goal, will exhibit better fundraising outcomes. If the entrepreneur’s failure to attribute failure to internal factors was the mechanism behind the underperformance of narcissistic entrepreneurs, we would expect that narcissistic entrepreneurs would be less likely to (i) increase their media content, (ii) increase the number of rewards offered, and (iii) lower their campaign goal. Moreover, if they attributed their initial failure to external factors, we would expect narcissistic entrepreneurs to respond to failure by changing their industry, a change which is also known to be associated with unfavorable campaign outcomes (Sewaid et al., 2022). The statistical insignificance of the IMR indicates that this specific analysis was not prone to sample-selection bias.

In Table 7, we note that in their subsequent campaigns, entrepreneurs exhibiting higher levels of narcissism are less likely to increase their media content usage (Narcissism = − 0.1874, p < 0.01) and are less likely to lower their campaign goal (Narcissism = − 0.0825, p < 0.01). Specifically, we note that a 1 SD increase in the level of exhibited narcissism is associated with an 8.32% decrease (from 34.72 to 31.83%) in the likelihood of increasing media content and a 1.75% decrease (from 70.14 to 68.92%) in the likelihood of lowering the campaign goal in the subsequent campaign. This result provides partial support for Hypothesis 3a and, in turn, explains the subsequent underperformance of entrepreneurs exhibiting higher levels of narcissism. Additionally, we note that entrepreneurs exhibiting higher levels of narcissism are more likely to change the industry in their subsequent venture (Narcissism = 0.1004, p < 0.01). We document that a 1 SD increase in the level of exhibited narcissism is associated with a 5.48% increase (from 25.17 to 26.55%) in the likelihood that the entrepreneur switches industry in the subsequent campaign. This result provides support for Hypothesis 3b and also aids in explaining the mechanism driving the subsequent underperformance of entrepreneurs exhibiting higher levels of narcissism.

In summary, our results indicate that narcissistic entrepreneurs are more likely to relaunch following failure in line with Hypothesis 1a. However, this effect is negatively moderated by the extent of failure in the first fundraising campaign, a result consistent with Hypothesis 1b. Moreover, we show that, having relaunched, narcissistic entrepreneurs underperform other entrepreneurs, providing evidence in support of Hypothesis 2. Our analysis of the mechanisms driving this underperformance indicates that narcissistic entrepreneurs are less likely to learn from their previous campaigns. Specifically, we find partial evidence that they are less likely to improve their campaigns, in line with Hypothesis 3a, and are more likely to change their exposure to initial external factors via switching industry in their subsequent ventures, as predicted by Hypothesis 3b. The statistical significance of the IMR indicates that this specific analysis was prone to sample-selection bias. However, the inclusion of the IMR in the model corrected this issue.

4.1 Robustness checks

To validate our results, we conduct a battery of robustness checks. First, in our main analysis we have used the dummy variable Success to gauge subsequent campaign performance. Similar to prior literature we repeat our analysis using an alternative continuous measure to gauge performance, Amount Raised. This variable captures the amount of funds pledged by backers to this specific campaign regardless of whether the goal is met or not. We report the results in Table 8, and they are not qualitatively different from those presented in the main results. Second, to eliminate country differences that could be associated with the entrepreneurs’ pitching style and our measure of narcissism, we limit our analysis to campaigns launched in the USA. We repeat all our analysis and the main results continue to hold. Third, we operationalized a quartile measure of exhibited narcissism rather than the continuous measure of narcissism and repeat our analysis. We again find that all our main results continue to hold. Fourth, we repeat all our analysis using the logistic regression model; the results do not differ from those presented under the probit model. Finally, we control for outliers that could possibly bias our results by both trimming and winsorizing our variables at the 1% and 5% level. Using both approaches (trimming and winsorizing) our main results continue to hold. Hence, these additional checks build confidence in our results.

5 Discussion and conclusion

5.1 Summary and discussion

In this study we examine how narcissism affects the probability of relaunching following failure in serial crowdfunding and how it could act as a barrier to learning, negatively affecting subsequent performance. Moreover, we identify the mechanisms through which narcissism affects subsequent performance by analyzing the internal and external changes that the entrepreneur makes following failure. We show that narcissistic entrepreneurs are more likely to relaunch following failure, in an attempt to maintain their inflated positive self-views. We find supporting evidence that the effect of narcissism is moderated by the degree of failure. In line with attribution theory, we pose that narcissistic entrepreneurs might blame failure on others and the environment (Jones & Harris, 1967; Vazire & Funder, 2006). This would result in the refusal to revise their own behavior to maintain their grandiose self-view and superiority, which might not be real. Hence, motivational attributes of narcissism impede behavioral change that could lead to improvements in campaign design and, thus, in subsequent performance. Indeed, we find that narcissistic entrepreneurs are, following failure, less likely to increase media content and to lower funding goal, but more likely to change industry. In our analysis, we do not find support for our arguments that narcissistic entrepreneurs are less likely to increase the number of reward offerings. Hence, they do not differ in this element from non-narcissistic entrepreneurs whose initial campaign failed. This could be explained by the higher cost associated with increasing the number of rewards, in comparison to increasing media content or lowering the campaign goal, making it a less attractive adjustment regardless of the level of exhibited narcissism.

Taken together, these findings indicate reduced learning benefits for narcissistic entrepreneurs. This is specifically crucial in online contexts since reduced learning is visible to platform backers who are able now to compare entrepreneurs’ current and prior fundraising attempts. Repeated launches by an entrepreneur allow potential backers to learn about the entrepreneur. This learning by backers on the platform allows for a favorable appraisal of entrepreneurs who have learned from their prior failures. The entrepreneur’s learning is inferred through a comparison of the entrepreneur’s current and previous campaigns. If the entrepreneur responds to failure by developing a better articulated campaign, then backers will be more likely to pledge funds to the entrepreneur’s current campaign. However, if the entrepreneur does not demonstrate this learning and responds to failure by changing industry, backers will penalize the entrepreneur and will be less likely to pledge funds to the entrepreneur’s campaign (Sewaid et al., 2022).

5.2 Implications for platform managers and policymakers

This study has important implications both for platform managers and policymakers. Our empirical evidence suggests that, to maintain their grandiose self-view, narcissistic entrepreneurs are more likely to relaunch following failure. However, since narcissists tend to attribute failure to external factors, they learn less from failure and they are less likely to adjust their own behavior. Therefore, they are also more likely to exhibit poorer performance in subsequent attempts. Our study suggests that to improve platform success and limit the effects of narcissism, platform managers could identify narcissistic entrepreneurs through project descriptions and take actions aimed at raising awareness of narcissistic tendencies and their negative impact among entrepreneurs. These practical implications are in line with those of Liu et al. (2019) who also point out these entrepreneurs’ need of raising awareness of their narcissistic tendencies with the help of others. Moreover, we complement the implications of Liu et al. (2019) by suggesting that platforms managers could provide tailored advice and tips to entrepreneurs rebounding from failure (e.g., through their blogs), enabling entrepreneurs to address actual drivers of current underperformance and perform better in subsequent endeavors.

Regarding policymakers, they can attenuate the negative consequences of narcissism by offering programs tailored to dealing with failure and how to successfully reboot and improve performance. Given the emergence of crowdfunding as a viable source of financing, programs can be tailored to the crowdfunding setting identifying different mechanisms to cope with failure. Also, financial literacy programs on the determinants of crowdfunding success could assist narcissistic entrepreneurs in making changes to subsequent campaign design (increase media content, modify rewards, etc.) resulting in an increase in the likelihood of superior performance. Moreover, in line with the implications of Liu et al. (2019), creating a more failure-tolerant environment could also hamper narcissistic entrepreneurs’ self-defensive behavior and, in turn, promote learning.

Although we believe that these measures could have a positive impact on narcissistic profiles, some might argue that the defensive behavior attached to narcissism could hinder the adoption of these practices by narcissistic entrepreneurs. Indeed, previous evidence shows that giving advice to narcissists has limited effectiveness (Kausel et al., 2015; O’Reilly & Hall, 2021). To address this issue, platform managers could leverage algorithmic nudging techniques to foster entrepreneurial learning of narcissistic entrepreneurs. Algorithmic nudging is the practice of leveraging algorithms and artificial intelligence systems to subtly influence user behavior towards specific goals. It involves “nudging” individuals to take specific actions or make particular choices (Möhlmann, 2021). On crowdfunding platforms, algorithms can offer real-time feedback on campaign construction elements, conduct instant risk assessments, provide comparative analysis with successful campaigns, and offer compliance reminders. For narcissistic entrepreneurs, algorithmic nudging can be an effective tool in helping them internalize their failures. The human-free nature of algorithmic prompts reduces self-defensive behavior during interactions with the platform and the guidance provided will not feel judgmental (Raveendhran & Fast, 2021). This will allow for covert influence over the entrepreneur’s choices while providing the sense of greater autonomy; hence, the entrepreneurs can maintain their self-esteem and grandiose self-view while learning and adjusting behaviors.

This process can contribute to enhancing the overall quality of campaigns and increasing the likelihood of success. However, effective implementation of algorithmic nudging requires crowdfunding platforms to prioritize the design of user-friendly feedback systems. The feedback provided by algorithms should be clear, actionable, and presented in a manner that facilitates entrepreneurs’ understanding and decision-making. Nonetheless, it is crucial for platforms to strike a balance between automation and human oversight. Human review and intervention remain critical to validate the feedback provided by algorithms, address complex or subjective issues, and handle exceptional cases that algorithms may not account for (Gal et al., 2020).

Finally, our results supporting Hypothesis 3b suggest that if an entrepreneur changes industry when relaunching a new venture, the probability of failure increases. Therefore, since narcissists and in general entrepreneurs are not “Jack of all trades” (Lazear, 2005) policymakers and platform managers must be aware of serial entrepreneurs changing industry when relaunching a new venture, as it can be a factor increasing the probability of failure.Footnote 8

5.3 Limitations and future research

Despite its contribution, our study is not devoid of limitations that, nevertheless, suggest fruitful avenues for future research. First, similar to prior studies (Butticè et al., 2017; Sewaid et al., 2021b, 2022), our study is based on a single reward-based crowdfunding platform, Kickstarter. Hence, we lack information on other funding campaigns that the same entrepreneurs might have launched on other platforms following failure on Kickstarter. Thus, the number of actual serial launchers might actually be higher than those we identify in our dataset. Although this is a possible concern, information on prior funding attempts on other platforms is not easily accessible (nor visible) to potential backers and would not play a significant role in their decision to back a campaign. Moreover, different platforms have a different backer base and a different campaign section structure; hence, gauging changes in the campaign and its performance might be contaminated by the platform effect.

Second, our analysis focuses on reward-based crowdfunding; thus, we need to be cautious about the generalizability of our results for other types of crowdfunding platforms. In particular, it would be interesting to know if narcissism has similar effects for equity crowdfunding and marketplace lending platforms. We suspect a differential effect since ventures soliciting funds on equity crowdfunding and marketplace lending platforms are established businesses in a more advanced stage and their response to fundraising failure could differ for a battery of reasons. For instance, narcissistic entrepreneurs’ external attribution of failure and lower levels of pro-activity following failure could be diluted in ventures with larger and more heterogeneous teams.

Third, although our proxy for narcissism is well established in previous literature that uses textual analysis (e.g., Bollaert et al., 2020; Butticè & Rovelli, 2020), we encourage future research on alternative measures of narcissism to confirm the robustness of the findings. A combination of archival platform data and surveys of entrepreneurs to gauge narcissism using alternative approaches would be welcome. For example, surveying entrepreneurs, like the Narcissistic Personality Inventory proposed by Raskin & Terry (1988), could be used to capture narcissism as it is typically done in the psychology literature. Fourth, entrepreneurs that decide not to relaunch after a first failed attempt might also learn from their failure and decide not to relaunch precisely because of that learning. Although the learning outcome in this case is more difficult to measure, we encourage future research in this area.Footnote 9 Finally, future research could complement our study by investigating how narcissism affects different dimensions of learning. For example, it would be interesting to analyze the relationship between the breadth and depth of learning (Zahra, 2012; Zahra et al., 2000). Furthermore, since previous literature shows that venture launching experience mitigates the adverse effect of changing industry on fundraising performance, we encourage research on narcissism and experiential learning as opposed to vicarious learning (Manz & Sims, 1981; Trevino & Youngblood, 1990).

5.4 Concluding remarks

To the best of our knowledge, this is the first study to investigate how the narcissism-learning from failure relationship affects an entrepreneur’s future strategic decisions and performance. Our analysis of 116,981 entrepreneurs who failed in their initial attempt on Kickstarter shows that narcissistic entrepreneurs are more likely to relaunch following failure. Worth noting, narcissism acts as a barrier to learning; entrepreneurs do not adjust their behavior following failure by modifying the campaign design. On the contrary, they attribute failure to external factors by changing the context of their following attempt, therefore leading to downward performance spirals. For entrepreneurs, our study highlights the need for narcissistic entrepreneurs to gain awareness of their narcissistic tendency which hampers learning. Through proper acknowledgement of these tendencies, entrepreneurs can better respond to failure and improve their future prospects. For policymakers, our study suggests that a more failure-tolerant environment and programs both on financial literacy and mechanisms to cope with failure could mitigate the negative consequences of narcissistic tendencies.

Data availability

The data that support the findings of this study are not openly available, but are available from the authors upon reasonable request.

Notes

See their Section 5, Discussion and conclusions, p. 509: “it can be inferred that once a startup fails, a highly narcissistic entrepreneur might have a great intention to restart.”.

We use the most common proxy for performance in the crowdfunding literature: if the campaign goal is met, the entrepreneur will be successful, and otherwise, will fail. This is because Kickstarter is an all-or-nothing platform, where failing to meet the campaign’s goal results in no funds being disbursed to the entrepreneur.

Exploratory learning, together with exploitative learning, is one of the three pairs of key learning types that Wang & Chugh (2014) highlighted in their systematic review of the literature on entrepreneurial learning as deserving more attention in future research.

The process of gender classification is explained in more detail in Section 3.2.3.

As a robustness check, we repeat our analysis using alternative continuous measures of performance.

In unreported results, a correlation matrix and variance inflation factors (VIFs) have been constructed for the sample included in Panel A as well, and they do not raise any multicollinearity concerns.

The set of first-stage regressors should include a variable that is not included in the second stage of the analysis. The excluded variable should be associated with the selection variable (Relaunch) but not the dependent variable (Success). Absent better exclusion restrictions, we use subcategory dummies as our exclusion variable (Cumming et al., 2021). Current subcategory should affect whether the entrepreneur decides to relaunch a subsequent campaign since the cost of failure varies by subcategory. However, subsequent performance is not affected by the initial subcategory since current performance would depend on the current category that the campaign is launched in.

We thank an anonymous referee for suggesting this implication.

We thank the managing editor for this suggestion.

References

Allison, T. H., Davis, B. C., Webb, J. W., & Short, J. C. (2017). Persuasion in crowdfunding: An elaboration likelihood model of crowdfunding performance. Journal of Business Venturing, 32(6), 707–725. https://doi.org/10.1016/j.jbusvent.2017.09.002

Anglin, A. H., Wolfe, M. T., Short, J. C., McKenny, A. F., & Pidduck, R. J. (2018). Narcissistic rhetoric and crowdfunding performance: A social role theory perspective. Journal of Business Venturing, 33(6), 780–812. https://doi.org/10.1016/j.jbusvent.2018.04.004

Azucar, D., Marengo, D., & Settanni, M. (2018). Predicting the big 5 personality traits from digital footprints on social media: A meta-analysis. Personality and Individual Differences, 124(1), 150–159. https://doi.org/10.1016/j.paid.2017.12.018

Barnett, S. M., & Ceci, S. J. (2002). When and where do we apply what we learn?: A taxonomy for far transfer. Psychological Bulletin, 128(4), 612–637. https://doi.org/10.1037/0033-2909.128.4.612

Boeuf, B., Darveau, J., & Legoux, R. (2014). Financing creativity: Crowdfunding as a new approach for theatre projects. International Journal of Arts, 16(3), 33–48. http://www.jstor.org/stable/24587184

Bollaert, H., Leboeuf, G., & Schwienbacher, A. (2020). The narcissism of crowdfunding entrepreneurs. Small Business Economics, 55(1), 57–76. https://doi.org/10.1007/s11187-019-00145-w

Burbidge, J. B., Magee, L., & Robb, A. L. (1988). Alternative transformations to handle extreme values of the dependent variable. Journal of the American Statistical Association, 83(401), 123. https://doi.org/10.2307/2288929

Butticè, V., Colombo, M. G., & Wright, M. (2017). Serial crowdfunding, social capital, and project success. Entrepreneurship Theory and Practice, 41(2), 183–207. https://doi.org/10.1111/etap.12271

Butticè, V., & Rovelli, P. (2020). “Fund me, I am fabulous!” Do narcissistic entrepreneurs succeed or fail in crowdfunding? Personality and Individual Differences, 162, 110037. https://doi.org/10.1016/j.paid.2020.110037

Campbell, W. K., & Foster, J. D. (2007). The narcissistic self: Background, and extended agency model, and ongoing controversies. In C. Sedikides, & S. Spencer (Eds.), The Self (p. 115–138). Psychology Press. https://doi.org/10.4324/9780203818572

Campbell, W. K., Goodie, A. S., & Foster, J. D. (2004). Narcissism, confidence, and risk attitude. Journal of Behavioral Decision Making, 17, 297–311. https://doi.org/10.1002/bdm.475

Campbell, W. K., & Miller, J. D. (2011). The handbook of narcissism and narcissistic personality disorder. Wiley, Hoboken, NJ. https://doi.org/10.1002/9781118093108

Cannon, M. D., & Edmondson, A. C. (2001). Confronting failure: Antecedents and consequences of shared beliefs about failure in organizational work groups. Journal of Organizational Behavior, 22(2), 161–177. https://doi.org/10.1002/job.85

Chatterjee, A., & Hambrick, D. C. (2007). It’s all about me: Narcissistic chief executive officers and their effects on company strategy and performance. Administrative Science Quarterly, 52(3), 351–386. https://doi.org/10.2189/asqu.52.3.351

Colombo, M. G., Franzoni, C., & Rossi-Lamastra, C. (2015). Internal social capital and the attraction of early contributions in crowdfunding. Entrepreneurship Theory and Practice, 39(1), 75–100. https://doi.org/10.1111/etap.12118

Cope, J. (2011). Entrepreneurial learning from failure: An interpretative phenomenological analysis. Journal of Business Venturing, 26(6), 604–623. https://doi.org/10.1016/j.jbusvent.2010.06.002

Courtney, C., Dutta, S., & Li, Y. (2017). Resolving information asymmetry: Signaling, endorsement, and crowdfunding success. Entrepreneurship Theory and Practice, 41(2), 265–290. https://doi.org/10.1111/etap.12267

Cumming, D., Leboeuf, G., & Schwienbacher, A. (2019). Crowdfunding models: Keep-It-All vs. All-Or-Nothing. Financial Management. https://doi.org/10.1111/fima.12262

Cumming, D., Meoli, M., & Vismara, S. (2021). Does equity crowdfunding democratize entrepreneurial finance? Small Business Economics, 56(2), 533–552. https://doi.org/10.1007/s11187-019-00188-z

Dahlin, K. B., Chuang, Y. T., & Roulet, T. J. (2018). Opportunity, motivation, and ability to learn from failures and errors: Review, synthesis, and ways to move forward. Academy of Management Annals, 12(1), 252–277. https://doi.org/10.5465/annals.2016.0049

Delmar, F., & Shane, S. (2006). Does experience matter? The effect of founding team experience on the survival and sales of newly founded ventures. Strategic Organization, 4(3), 215–247. https://doi.org/10.1177/1476127006066596

Dushnitsky, G., & Marom, D. (2013). Crowd monogamy. Business Strategy Review, 24(4), 24–26. https://doi.org/10.1111/j.1467-8616.2013.00990.x

Eggers, J. P., & Song, L. (2015). Dealing with failure: Serial entrepreneurs and the costs of changing industries between ventures. Academy of Management Journal, 58(6), 1785–1803. https://doi.org/10.5465/amj.2014.0050

Fan-Osuala, O. (2021). All failures are not equal: Degree of failure and the launch of subsequent crowdfunding campaigns. Journal of Business Venturing Insights, 16. https://doi.org/10.1016/j.jbvi.2021.e00260

Farwell, L., & Wohlwend-Lloyd, R. (1998). Narcissistic processes: Optimistic expectations, favorable self-evaluations, and self-enhancing attributions. Journal of Personality, 66(1), 65–83. https://doi.org/10.1111/1467-6494.00003

Foster, J.D., & Brennan, J.C. (2011). Narcissism, the agency model, and approach-avoidance motivation. In W. K. Campbell & J. D. Miller (Eds.), The Handbook of Narcissism and Narcissistic Personality Disorder, 89–100. John Wiley & Sons, Inc. https://doi.org/10.1002/9781118093108

Foster, J. D., Shenesey, J. W., & Goff, J. S. (2009). Why do narcissists take more risks? Testing the roles of perceived risks and benefits of risky behaviors. Personality and Individual Differences, 47(8), 885–889. https://doi.org/10.1016/j.paid.2009.07.008

Franke, G. R., & Richey, R. G. (2010). Improving generalizations from multi-country comparisons in international business research. Journal of International Business Studies, 41(8), 1275–1293. https://doi.org/10.1057/jibs.2010.21

Gal, U., Jensen, T. B., & Stein, M. K. (2020). Breaking the vicious cycle of algorithmic management: A virtue ethics approach to people analytics. Information and Organization, 30(2), 100301. https://doi.org/10.1016/j.infoandorg.2020.100301

Gerber, E. M., & Hui, J. (2013). Crowdfunding: Motivations and deterrents for participation. ACM Transactions on Computer-Human Interaction, 20(6), 1–31. https://doi.org/10.1145/2530540

Haynes, K. T., Hitt, M. A., & Campbell, J. T. (2015). The dark side of leadership: Towards amid-range theory of hubris and greed in entrepreneurial contexts. Journal of Management Studies, 52(4), 479–505. https://doi.org/10.1111/joms.12127

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161. https://doi.org/10.2307/1912352

Hmieleski, K. M., & Lerner, D. A. (2016). The dark triad and nascent entrepreneurship: An examination of unproductive versus productive entrepreneurial motives. Journal of Small Business Management, 54(1), 7–32. https://doi.org/10.1111/jsbm.12296

Jones, E. E., & Harris, V. A. (1967). The attribution of attitudes. Journal of Experimental Social Psychology, 3(1), 1–24. https://doi.org/10.1016/0022-1031(67)90034-0

Judge, T. A., LePine, J. A., & Rich, B. L. (2006). Loving yourself abundantly: Relationship of the narcissistic personality to self-and other perceptions of workplace deviance, leadership, and task and contextual performance. Journal of Applied Psychology, 91(4), 762. https://doi.org/10.1037/0021-9010.91.4.762

Kausel, E. E., Culbertson, S. S., Leiva, P. I., Slaughter, J. E., & Jackson, A. T. (2015). Too arrogant for their own good? Why and when narcissists dismiss advice. Organizational Behavior and Human Decision Processes, 131, 33–50. https://doi.org/10.1016/j.obhdp.2015.07.006

Klepper, S. (2002). Firm survival and the evolution of oligopoly. The RAND Journal of Economics, 33(1), 37–61. https://doi.org/10.2307/2696374

Kramer, M., Cesinger, B., Schwarzinger, D., & Gelléri, P. (2011). Investigating entrepreneurs’ dark personality: How narcissism, machiavellianism, and psychopathy relate to entrepreneurial intention. Proceedings of the 25th ANZAM Conference (December). Wellington: Australia and New Zealand Academy of Management.

Kuppuswamy, V., & Mollick, E. R. (2016). Second thoughts about second acts: Gender differences in serial founding rates. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2752689

Lafuente, E., Vaillant, Y., Vendrell-Herrero, F., & Gomes, E. (2019). Bouncing back from failure: Entrepreneurial resilience and the internationalisation of subsequent ventures created by serial entrepreneurs. Applied Psychology: An International Review, 68(4), 658–694. https://doi.org/10.1111/apps.12175

Lazear, E. P. (2005). Entrepreneurship. Journal of Labor Economics, 23(4), 649–680. https://doi.org/10.1086/491605

Lee, C. H., & Chiravuri, A. (2019). Dealing with initial success versus failure in crowdfunding market: Serial crowdfunding, changing strategies, and funding performance. Internet Research, 29(5), 1190–1212. https://doi.org/10.1108/INTR-03-2018-0132

Li, E., & Martin, J. S. (2019). Capital formation and financial intermediation: The role of entrepreneur reputation formation. Journal of Corporate Finance, 59, 185–201. https://doi.org/10.1016/j.jcorpfin.2016.04.002

Liu, Y., Li, Y., Hao, X., & Zhang, Y. (2019). Narcissism and learning from entrepreneurial failure. Journal of Business Venturing, 34(3), 496–512. https://doi.org/10.1016/j.jbusvent.2019.01.003

Manz, C. C., & Sims, H. P. (1981). Vicarious learning: The influence of modeling on organizational behavior. Academy of Management Review, 6(1), 105–113. https://doi.org/10.2307/257144

Minniti, M., & Bygrave, W. (2001). A dynamic model of entrepreneurial learning. Entrepreneurship Theory & Practice, 25(3), 5–16. https://doi.org/10.1177/104225870102500301

Möhlmann, M. (2021, April 22). Algorithmic nudges don’t have to be unethical. Harvard Business Review. https://hbr.org/2021/04/algorithmic-nudges-dont-have-to-be-unethical

Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1–16. https://doi.org/10.1016/j.jbusvent.2013.06.005

Navis, C., & Ozbek, O. V. (2016). The right people in the wrong places: The paradox of entrepreneurial entry and successful opportunity realization. Academy of Management Review, 41(1), 109–129. https://doi.org/10.5465/amr.2013.0175

O’Boyle, E. H., Jr., Forsyth, D. R., Banks, G. C., & McDaniel, M. A. (2012). A meta-analysis of the dark triad and work behavior: A social exchange perspective. Journal of Applied Psychology, 97(3), 557–579. https://doi.org/10.1037/a0025679

Oo, P. P., Allison, T. H., Sahaym, A., & Juasrikul, S. (2019). User entrepreneurs’ multiple identities and crowdfunding performance: Effects through product innovativeness, perceived passion, and need similarity. Journal of Business Venturing, 34(5), 1–16. https://doi.org/10.1016/j.jbusvent.2018.08.005

O’Reilly, C. A., & Hall, N. (2021). Grandiose narcissists and decision making: Impulsive, overconfident, and skeptical of experts—But seldom in doubt. Personality and Individual Differences, 168, 110280. https://doi.org/10.1016/j.paid.2020.110280

Parker, S. C. (2013). Do serial entrepreneurs run successively better-performing businesses? Journal of Business Venturing, 28(5), 652–666. https://doi.org/10.1016/j.jbusvent.2012.08.001

Raskin, R., & Terry, H. (1988). A principal-components analysis of the Narcissistic Personality Inventory and further evidence of its construct validity. Journal of Personality and Social Psychology, 54(5), 890–902. https://doi.org/10.1037/0022-3514.54.5.890

Raveendhran, R., & Fast, N. J. (2021). Humans judge, algorithms nudge: The psychology of behavior tracking acceptance. Organizational Behavior and Human Decision Processes, 164, 11–26. https://doi.org/10.1016/j.obhdp.2021.01.001

Sarasvathy, S. D., Menon, A. R., & Kuechle, G. (2013). Failing firms and successful entrepreneurs: Serial entrepreneurship as a temporal portfolio. Small Business Economics, 40(2), 417–434. https://doi.org/10.1007/s11187-011-9412-x

Scheaf, D. J., Davis, B. C., Webb, J. W., Coombs, J. E., Borns, J., & Holloway, G. (2018). Signals’ flexibility and interaction with visual cues: Insights from crowdfunding. Journal of Business Venturing, 33(6), 720–741. https://doi.org/10.1016/j.jbusvent.2018.04.007

Sewaid, A., Garcia-Cestona, M., & Silaghi, F. (2021a). Resolving information asymmetries in financing new product development: The case of reward-based crowdfunding. Research Policy, 50(10), 104345. https://doi.org/10.1016/j.respol.2021.104345

Sewaid, A., Parker, S. C., & Kaakeh, A. (2021b). Explaining serial crowdfunders’ dynamic fundraising performance. Journal of Business Venturing, 36(4), 106124. https://doi.org/10.1016/j.jbusvent.2021.106124

Sewaid, A., Garcia-Cestona, M., & Silaghi, F. (2022). Do learning benefits accrue equally over successive fundraising attempts? Strategic change and the moderating role of experience. British Journal of Management, 33(4), 1710–1734. https://doi.org/10.1111/1467-8551.12551

Singh, S., Corner, P., & Pavlovich, K. (2007). Coping with entrepreneurial failure. Journal of Management & Organization, 13(4), 331–344. https://doi.org/10.5172/jmo.2007.13.4.331

Trevino, L. K., & Youngblood, S. A. (1990). Bad apples in bad barrels: A causal analysis of ethical decision-making behavior. Journal of Applied Psychology, 75(3), 378–385. https://doi.org/10.1037/0021-9010.75.4.378

Tucker, R. L., Lowman, G. H., & Marino, L. D. (2016). Dark triad traits and the entrepreneurial process: A person-entrepreneurship perspective. Research in Personnel and Human Resources Management, 34, 245–290. https://doi.org/10.1108/S0742-730120160000034013

Ucbasaran, D., Shepherd, D. A., Lockett, A., & Lyon, S. J. (2013). Life after business failure: The process and consequences of business failure for entrepreneurs. Journal of Management, 39, 163–202. https://doi.org/10.1177/0149206312457823

Ucbasaran, D., Westhead, P., Wright, M., & Flores, M. (2010). The nature of entrepreneurial experience, business failure and comparative optimism. Journal of Business Venturing, 25(6), 541–555. https://doi.org/10.1016/j.jbusvent.2009.04.001

Vazire, S., & Funder, D. C. (2006). Impulsivity and the self-defeating behavior of narcissists. Personality and Social Psychology Review, 10(2), 154–165. https://doi.org/10.1207/s15327957pspr1002_4

Wales, W. J., Patel, P. C., & Lumpkin, G. T. (2013). In pursuit of greatness: CEO narcissism, entrepreneurial orientation, and firm performance variance. Journal of Management Studies, 50(6), 1041–1069. https://doi.org/10.1111/joms.12034

Wallace, H. M., & Baumeister, R. F. (2002). The performance of narcissists rises and falls with perceived opportunity for glory. Journal of Personality & Social Psychology, 82(5), 819–834. https://doi.org/10.1037/0022-3514.82.5.819

Wang, C. L., & Chugh, H. (2014). Entrepreneurial learning: Past research and future challenges. International Journal of Management Reviews, 16(1), 24–61. https://doi.org/10.1111/ijmr.12007

Yu, S., Johnson, S., Lai, C., Cricelli, A., & Fleming, L. (2017). Crowdfunding and regional entrepreneurial investment: An application of the CrowdBerkeley database. Research Policy, 46(10), 1723–1737. https://doi.org/10.1016/j.respol.2017.07.008

Zahra, S. A. (2012). Organizational learning and entrepreneurship in family firms: Exploring the moderating effect of ownership and cohesion. Small Business Economics, 38(1), 51–65. https://doi.org/10.1007/s11187-010-9266-7

Zahra, S. A., Ireland, R. D., & Hitt, M. A. (2000). International expansion by new venture firms: International diversity, mode of market entry, technological learning, and performance. Academy of Management Journal, 43(5), 925–950. https://doi.org/10.2307/1556420

Zheng, H., Li, D., Wu, J., & Xu, Y. (2014). The role of multidimensional social capital in crowdfunding: A comparative study in China and US. Information & Management, 51(4), 488–496. https://doi.org/10.1016/j.im.2014.03.003

Zhu, D. H., & Chen, G. L. (2015). CEO narcissism and the impact of prior board experience on corporate strategy. Administrative Science Quarterly, 60(1), 31–65. https://doi.org/10.1177/0001839214554989

Acknowledgements

We are grateful to the guest editors, the managing editor and two anonymous referees for thoughtful comments and suggestions. Florina Silaghi, Serra Húnter Fellow, and Miguel A. García Cestona gratefully acknowledge financial support through grants PID2020-114460GB-C31 and PID2020-115018RB-C32 respectively, funded by MCIN/AEI/10.13039/50110 0011033.

Funding

Open Access Funding provided by Universitat Autonoma de Barcelona.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions