Abstract

Drawing on strategic management theory, this study examines the relationship between digitalization and innovation performance in small and medium-sized enterprises (SMEs). We hypothesize that SMEs with higher levels of digital diffusion have higher innovation performance, and that absorptive capacity moderates this relationship. To test this relationship, we use a sample of 1100 German SMEs from the Mannheim Innovation Panel of the Centre for European Economic Research. The results of the multinomial and multivariate probit estimations show that digital diffusion is a significant positive trigger of innovation in SMEs. We also find that absorptive capacity moderates the relationship between digital diffusion and innovation only in the case of product innovation and not for any other type of innovation. Finally, we discuss the implications of our study for research and practice.

Plain English Summary

What role does the integration of digital technologies play in the innovation activities of small and medium-sized enterprises? Do firms that prioritize research and skilled human capital benefit more from digital technologies than those that do not? To gain useful insights, we address these questions using survey data from 1100 German small and medium-sized enterprises and various statistical methods. The results show that a purposeful assimilation of digital technologies in business processes benefits the innovation activities of these firms. We also find that firms with high-quality research and human capital make good use of digital technologies to invent new products. The main implication of our study is that small and medium-sized firms should use digital technologies strategically to achieve market success.

Similar content being viewed by others

1 Introduction

Digitalization has radically transformed businesses across economies and industries, creating new opportunities for sustainable growth and expansion. Digitalization has also facilitated new business strategies amid changing customer preferences and business processes, especially among small and medium-sized enterprises (SMEs), which are considered the engine of economic growth and development. There is a growing interest among scholars and practitioners to determine how digitalization affects SMEs’ value creation processes, such as innovation (Nambisan et al., 2017; Yoo et al., 2012). Understanding this relationship can help SME entrepreneurs, researchers, and policymakers identify opportunities and industry trends, thereby mitigating risk in a highly evolving, complex, and dynamic digital environment.

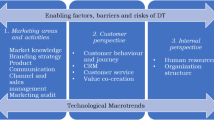

In recent years, a growing body of literature has attempted to understand the evolving nature of digital technologies and their integration in the business and innovation strategies of SMEs. However, research in this area is rather fragmented and conceptually inadequate to provide a comprehensive analytical framework (see the literature reviews of Zamani (2022) and De Mattos et al. (2023)). While the information systems literature focuses on the technical nature of digital technologies and innovation in organizations (Barczak et al., 2007; Kroh et al., 2018; Ordanini & Rubera, 2010), management research offers rather different perspectives: some consider digitalization as a new source of innovation (Mauerhoefer et al., 2017; Nambisan et al., 2017; Qin et al., 2021), others disagree and consider digitalization as a more generic resource (Usai et al., 2021). This ambiguity in management research points to the underexplored nature of digitalization in an innovation context, where it is often viewed as a technological (e.g., efficiency-enhancing) but not a strategic resource. We believe that more in-depth research is needed to determine the strategic position of digitalization in the innovation strategies of SMEs. Specifically, to what extent does the level of digitalization in SMEs influences their innovation performance, and what are the underlying organizational characteristics that moderate or mediate this relationship?

To address the stated questions, we empirically examine the relationship between digitalization and innovation in SMEs and how absorptive capacity may moderate this relationship. We contribute to the literature in several ways. First, we examine the strategic embeddedness of digital technologies (hereafter, digital diffusion) from a strategic management perspective to explore its influence on innovation performance. In this study, digital diffusion is viewed as the strategic combination of the characteristics and affordances of digital technologies with the firm’s internal capabilities to transform and create value in dynamic environments (Bharadwaj et al., 2013; Koch & Windsperger, 2017; Reis et al., 2018; Warner & Wäger, 2019; Zammuto et al., 2007). Since digital technologies are not unique to organizations, but are widely available, we suggest that absorptive capacity can play an important moderating role in the strategic assimilation of digital technologies to generate innovation. Second, by combining unbalanced panel data of German SMEs between 2016 and 2018 and using a variety of empirical methods, our large and representative sample of 1100 SMEs enables us to empirically test our assumptions about the rather ambiguous relationship between digital diffusion and innovation in SMEs and the moderating role of their absorptive capacity. Third, unlike some other studies, our dataset allows us to account for innovation-, industry-, and digital technology-specific heterogeneity to explore different in-depth dimensions of our robust dataset. With this approach, we offer important research and practical implications. For example, how the relationship between digital diffusion and innovation varies across industries, and which types of strategic technology diffusion lead to better innovation performance in German SMEs.

The remainder of our study is organized as follows: in the next section, we briefly review the literature and derive our hypotheses. We then present our data and explain our estimation methodology. In the subsequent section, we present our empirical results. Finally, we discuss our results and conclude.

2 Theory and hypotheses

Innovation—whether product, service, or process—is considered one of the main drivers of business performance and growth (Crossan & Apaydin, 2010; Feeny & Rogers, 2003; Hult et al., 2004; Klomp & Van Leeuwen, 2001; Skott, 2003). The innovation process is continuous, complex, and heterogeneous, and the literature provides different underpinnings to explain different types of innovation in organizations (Amable et al., 2009; Barney et al., 2011; Penrose, 1995). Traditionally, research has either focused on the importance of an organization’s internal, tangible, and unique resources in shaping its innovation potential (Barney, 1991; Grant, 1996; Teece & Pisano, 1994; Wernerfelt, 1995) or emphasized knowledge as a key source of innovation, with internal organizational capabilities playing an important role through learning and assimilating external sources of information (Grant, 1997).

In dynamic environments, the flexibility, adaptability, and agility of organizational resources are critical in responding to competitive pressure (Pavlou & Sawy, 2010; Teece et al., 1997). Rapid market changes require the continuous reconfiguration of organizational resources to remain competitive (Koch & Windsperger, 2017; Teece et al., 2016; Warner & Wäger, 2019). Research has emphasized that traditional means of value creation (Porter, 1980) may not always be enough to sustain profitability and innovation-driven competitive advantage (Mahoney, 1995). Moreover, the internal capabilities of organizations are not always a spontaneous consequence of the use of available internal resources. Some capabilities, referred to as dynamic, are gradually developed through the successful reconfiguration of organizational resources in response to changes in a rapidly evolving environment, such as emerging competition or technological advances (Eisenhardt & Martin, 2000; Helfat & Peteraf, 2003; Teece, 2018). While ordinary capabilities describe the simple use of assets for everyday tasks, dynamic capabilities can reshape the use of assets in new ways (Teece & Pisano, 1994). Organizations that are able to capitalize on their core capabilities in response to emerging competition and changing economic characteristics are then able to sustain their competitive advantage (Teece et al., 1997).

More recently, digitalization has been proposed as a potential source of innovation, seen as a combination of both tangible and intangible resources, knowledge, and procedures in organizations (Nambisan et al., 2017; Owalla et al., 2022; Warner & Wäger, 2019). Digitalization is the interconnection of different computer-assisted technologies embedded in the diffuse use of technologies through digital signals to provide improved processes, products, or service delivery in organizations (Castells, 2009; Lee et al., 2015; Rachinger et al., 2019; Westerman et al., 2011). Such technologies vary but share the characteristics of data-driven information homogenization, programmable digital architecture, and self-referential attributes (Yoo et al., 2010, 2012). Digital technologies are ubiquitous, as traditional sources of production have largely been replaced or supplemented by digital alternatives (Bharadwaj et al., 2013; Selander et al., 2013; Yoo et al., 2010).

Unlike traditional resources, digital technologies are often not unique or inimitable, as other organizations in the market have access to the same or similar technologies. From a dynamic capability perspective, emerging digital technologies should facilitate the efficient reconfiguration of internal resources in response to market dynamics (Borch & Madsen, 2007; Helfat & Peteraf, 2003; Teece et al., 1997; Weerawardena & Mavondo, 2011). This is because in a rapidly changing environment, traditional sources of value creation may not be as productive as modern digital architectures, where digital technologies are more responsive and adaptable, unlike traditional means of production and knowledge generation (Koch & Windsperger, 2017).

While traditional organizational resources have a more defined use, digital technologies can be adopted, converged, and optimized in multiple settings due to their flexibility, reprogrammability, and adaptability (Yoo et al., 2010, 2012; Zammuto et al., 2007). These flexible affordances of digital technologies are seen as a potential source of all types of innovation (Nambisan et al., 2017; Yoo et al., 2012). In particular, the strategic diffusion of digital technologies in organizations can enhance their specific innovation potential (Fichman et al., 2014; Koch & Windsperger, 2017; Singh et al., 2020; Yoo et al., 2012).

Although some studies do not find a positive relationship between digitalization and innovation performance (Rijswijk et al., 2019; Usai et al., 2021), the empirical evidence in the information processing and innovation management literature attests to the significant role of emerging digital technologies in enhancing organizational performance and innovation activities (Barczak et al., 2007; Kastelli et al., 2022; Khin & Ho, 2019; Klerkx & Begemann, 2020; Kroh et al., 2018; Niebel et al., 2019; Qin et al., 2021; Sarbu, 2021; Zawislak et al., 2013; Zhou & Wu, 2010). Various useful and automated features of digital technologies differentiate their capabilities from traditional organizational resources (Nambisan et al., 2019). For example, data generated by integrated digital sensors at various stages of value creation enables organizations to optimize production and service delivery (Lee et al., 2015).

2.1 Digital diffusion and innovation performance in SMEs

SMEs are known for their innovation capabilities (Grundström et al., 2012; Salavou et al., 2004) and are considered to have different characteristics compared to large organizations (Damanpour, 1992; Stock et al., 2002; Utterback, 1994). SMEs are often associated with the liability of smallness, which implies that they are not endowed with many tangible assets and resources (Aldrich & Auster, 1986; Gassmann et al., 2010). In terms of digital diffusion, SMEs seem to be cautious and slow to adopt new digital technologies in their business processes and value chains (Damanpour, 1992; Harland et al., 2007; Hassan et al., 2020).

Nevertheless, SMEs are considered strategically flexible due to their rather simple organizational structures, uncomplicated decision-making, and specific market orientations (D’Amboise & Muldowney, 1988; Hausman, 2005; Massa & Testa, 2008; Stock et al., 2002). This strategic flexibility allows SMEs to use their resources either to promote their existing products with innovative changes or to create disruptive innovations (O’Regan & Ghobadian, 2005). Furthermore, current research provides evidence that organizations can effectively mitigate some of their limitations through the affordances of digital technologies to increase their innovation potential (Yoo et al., 2012). In this case, increased digital diffusion potentially enables SMEs to identify opportunities, recalibrate their assets, and generate new knowledge through the productive interactions of digital resources (Autio et al., 2018; Joensuu-Salo et al., 2018; Nambisan et al., 2017; Zahra et al., 2006). This strategic and continuous reconfiguration of digital resources should lead to higher innovation in SMEs (Ray et al., 2013). In addition, digital diffusion can facilitate the organization’s dynamic capabilities in dynamic markets, as it enables SMEs to efficiently integrate and coordinate both internal and external sources by exploiting the wide range of digital opportunities. Moreover, SMEs with higher levels of digital diffusion should be able to learn, experiment, and transform organizational resources more productively in dynamic competitive environments (Wang & Ahmed, 2007). For example, social media is believed to form a base of public knowledge and opinion, and as such, obtaining information from social media may help SMEs improve their innovation performance, especially through open and data-driven innovation channels (Roberts et al., 2016). Similarly, information processing through big data and cloud computing may enable SMEs to obtain consumer data to optimize their market responses, update internal infrastructures, and generate new functions (Cui et al., 2014; Maglio & Lim, 2016; Qin et al., 2016; Tao et al., 2019; Wu et al., 2010).

Some studies also show that SMEs with a more diffused digital infrastructure and strategic flexibility are able to combine conventional and digital resources to improve their digital capabilities and innovation performance over time (Bhatt & Grover, 2005; Brennen & Kreiss, 2016; Kastelli et al., 2022; Niebel et al., 2019; Rachinger et al., 2019; Raymond et al., 2018; Sarbu, 2021; Venkatraman et al., 1993). Digital diffusion provides an integrated digital platform as a focal point for knowledge creation (Bhatt et al., 2005) and knowledge access (Dasgupta et al., 2002; Duane & Finnegan, 2003). Empirical research in the information processing literature emphasizes that embedded digitalization enables SMEs to combine internal and external information factors to create new value and products (Barczak et al., 2007; Kroh et al., 2018; Qin et al., 2021). Consequently, more digitally diffused SMEs should be able to source knowledge inputs from across the value chain and the market to generate innovations (Cai & Shi, 2009; Meroño-Cerdán et al., 2008; Qin et al., 2021; Raghuram, 2014; Wang et al., 2013). Therefore, taken together, we propose:

-

H1: higher diffusion of digital technologies in SMEs should lead to higher innovation performance.

2.2 Absorptive capacity: a moderator

Organizations may not be able to improve innovation performance simply by using similar or more technologies. In fact, dynamic capabilities in organizations develop differently due to differences in strategic capabilities, digital orientation, and complementary resources, which in turn lead to differences in organizational structures and performance (Eisenhardt & Martin, 2000; Gatignon & Xuereb, 1997; Zheng et al., 2011) as a result of their absorptive capacity (Cohen & Levinthal, 1990; Egbetokun & Savin, 2014). Absorptive capacity refers to an organization’s ability to recognize new external information, understand its value, absorb and assimilate it into the organization to improve performance, and gain a competitive advantage (Cohen & Levinthal, 1990). Studies suggest that absorptive capacity may moderate the relationship between technological opportunity and innovation (Nieto & Quevedo, 2005). Similarly, the absorptive capacity of SMEs may guide the strategic assimilation of external digital technological opportunities and exploitation (Flatten et al., 2011; Muscio, 2007; Tzokas et al., 2015; Zahra & George, 2002). Due to their absorptive capacity, organizations are first able to recognize the strategic potential of the combination of innovative digital technologies (Jansen et al., 2005, 2006). The ensuing strategic assimilation into business processes and organizational routines fosters continuous reconfiguration for value appropriation and transformation, ultimately generating new knowledge and innovation (Fichman et al., 2014; Jansen et al., 2005).

With respect to digital diffusion, technology affordances and constraint theory explain that organizations have different learning trajectories and outcomes despite using similar technologies because the level of dynamic interaction between human capital, technology, and processes (i.e., digital affordances) is not homogeneous across organizations (Autio et al., 2018; Nambisan, 2017; Nambisan et al., 2017). These affordances are related to an organization’s digital expertise and readiness (Müller et al., 2021; Zammuto et al., 2007) and allow organizations to reconfigure their digital capabilities in a changing environment through the optimal allocation of digital resources (Autio et al., 2018; Prahalad & Ramaswamy, 2003). Despite the use of similar digital technologies, some organizations are able to identify the strategic potential of digital affordances and reinvent their sources of competitive advantage through the optimal decoupling of value creation processes, the reduction of intermediary dependencies in value chains, and the efficient collaboration of dispersed organization resources (Autio et al., 2018; Owalla et al., 2022; Prahalad & Ramaswamy, 2003).

Studies have shown that an organization’s absorptive capacity enables it to sense impending changes and opportunities in the market and subsequently exploit the technological opportunities and digital affordances (Fabrizio, 2009; Klevorick et al., 1995; Müller et al., 2021; Nambisan et al., 2017, 2019; Nieto & Quevedo, 2005; Yoo et al., 2012). SMEs can be faster and more responsive to changes in dynamic environments due to their innovation potential, agility, and flexibility (Damanpour, 1992; Stock et al., 2002; Utterback, 1994). The strategic orientation of SME decision-makers defines their ability to recalibrate, reconfigure, and reintegrate digital resources to compete in the market (Eisenhardt & Martin, 2000), evolving over time through experience and learning, and translating into organizational cultures (Helfat & Peteraf, 2003; Schulz, 2003). Studies also show that it is the strategic implementation of digital technologies, guided by their absorptive capacity, that allows SMEs to improve their competitive positioning and innovation potential (Al-Ansari et al., 2013; Davenport et al., 2007; Zahra et al., 2006; Zhou & Wu, 2010; Zhou et al., 2005). Absorptive capacity combined with digital diffusion allows SMEs to leverage their specific characteristics with respect to exploitable digital affordances for innovation (Kastelli et al., 2022; Nambisan et al., 2019; Yoo et al., 2012). Therefore, we propose the following:

-

H2: the absorptive capacity of SMEs positively moderates the relationship between digital diffusion and innovation performance.

3 Data and methodology

3.1 Data

The data for this study derive from the ZEW Mannheim Innovation Panel (MIP): German contribution to the European Commission’s Community Innovation Survey. The MIP survey has been collecting representative information on the innovation behavior of firms in all industrial sectors in Germany since 1993 (Aschhoff et al., 2013). The survey population is drawn from 21 industrial sectors using stratified sampling. The dataset provides information on innovation from approximately 4000 German firms annually, and the survey focuses on a specific topic each year.

We used data from two MIP waves (2016 and 2018), as the questions on the use of digital technologies were only included in the 2016 wave. Given our focus on SMEs, we used the European Commission’s definition of SMEs (European Commission, 2003) to exclude non-SMEs from the dataset. We then removed all missing and inconsistent observations and merged the panel data from both waves. To avoid sample selection bias, we included both innovating and non-innovating SMEs in our final sample of 1100 SMEs, of which 78% (856 SMEs) reported having conducted some type of innovation, and about 22% (244 SMEs) did not report any type of innovation. In addition to innovation and digitalization-related information, our dataset also includes information on organizational characteristics, such as SME size, location, industry, and age.

In terms of location, our sample firms come from all 16 German states, with most (64%) located in former West Germany and 36% in former East Germany. This somewhat geographic disparity is consistent with the post-transition patterns of the German economy. At the aggregate level, our data include SMEs from both the manufacturing (67%) and service (33%) industries. A disaggregation of our sample according to the European Union’s industrial classification of economic activities (NACE) is presented in Table 1.

In our sample, the sectors with the highest proportions of SMEs are energy and water (9.27%), technical or R&D services (8.18%), transport equipment and postal services (8%), and consulting (7.64%) sectors. The sectors with the lowest proportion of SMEs are automobile retailers (1.09%) and glass and ceramics (1.55%). Nevertheless, the distribution of SMEs in their respective sectors is rather even and in line with the general industrial distribution in Germany. We do not observe any outliers in the industrial distribution of our sample.

3.2 Variables

We use several dependent and independent variables to test our main hypotheses. A list of all variables, their descriptions, and their measures are provided in Table 2. Our dataset contains information on four types of innovation:

-

1.

Product innovation refers to any new or significantly improved products (radically new features, software, components etc.).

-

2.

Process innovation refers to a new or significantly improved business process or procedure that has a significant impact on production, manufacturing, distribution, feedback mechanisms, and product quality.

-

3.

Marketing innovation refers to innovations in marketing methods that are either significantly different from an SMEs’ previous marketing strategies or have never been used before, such as new packaging, promotional activities, product design, or pricing strategy.

-

4.

Organizational innovation refers to innovative business practices driven by the management’s strategic decisions, including new business practices, radically new information management methods, employee/workplace organization, and internal/external networking.

3.2.1 Dependent variables

We measure the innovation performance of our sample SMEs using two indicators. First, we use the composite variable innovator as a proxy for innovation performance with a categorical scale (0–4) that measures the frequency and type of innovation output for each observation. The second is a binary measure (0, 1) for each type of innovation in our sample: (1) product innovation, (2) process innovation, (3) marketing innovation, and (4) organizational innovation.

3.2.2 Explanatory variables

Digital diffusion

In the 2016 MIP wave, we asked respondents about the adoption of 11 digital technologies in their organization. Specifically, “to what extent does your firm currently use the following digitalization applications across different business functions?” The list of digital technologies and related statistics are shown in Table 8 in the Appendix. As it may not be statistically feasible to use all 11 categorical response items as covariates, we used several techniques to test and develop our measure of digital diffusion. First, we conducted a reliability test on the response items, as this allowed us to determine the internal consistency of the survey questions. The high reliability score of Cronbach’s alpha (α = 0.8932) and the Kaiser–Meyer–Olkin measure of sampling adequacy (KMO) (0.877) indicate significant internal consistency and that using all covariates together is not feasible. Therefore, in a second step, we used principal component analysis (PCA) on all 11 response items to create a digital diffusion index in our sample firms.

Digital technology groups

We also tested the disaggregated impact of technology on innovation. To do so, we first grouped the digital technologies (Table 3) according to their diffusion in four domainsFootnote 1: (1) core production and services, (2) internal collaboration, (3) external communication/customer interaction, and (4) information processing. In the next step, we created four categorical group variables as shown in Table 3.

Absorptive capacity

We expect that the absorptive capacity of an SME moderates the relationship between digital diffusion and innovation performance. Absorptive capacity is thought to be a consequence of R&D activities and a function of prior knowledge and related resources (Cohen & Levinthal, 1990; Grimpe & Sofka, 2009). Traditionally, R&D intensity (R&D expenditure as a percentage of total sales) has been used as a proxy for absorptive capacity (Cantner & Pyka, 1998; Cohen & Levinthal, 1989, 1990; Stock et al., 2001). Later studies have used a variety of proxies to assess a firm’s absorptive capacity, such as patent data (Mowery et al., 1998) or the presence of a dedicated R&D department and staff (Veugelers, 1997). However, the rather cumulative nature of absorptive capacity (Van Den Bosch et al., 1999) warrants the inclusion of additional factors to operationalize a good measure (Escribano et al., 2009). Studies have also used a combination of R&D intensity with other firm-specific R&D related aspects, such as human capital (Grimpe & Sofka, 2009; Schmidt & Rammer, 2007). More recently, researchers have used proxies to account for different dimensions of absorptive capacity (acquisition, assimilation, transformation, and exploitation) (Jansen et al., 2005; Wales et al., 2013). However, there is currently no agreed-upon proxy that integrates all the key dimensions of absorptive capacity (Flatten et al., 2011). Moreover, it is empirically challenging to include the relevant proxies in regressions due to their large number and the related correlation issues. Given these methodological limitations, scholars have used techniques, such as exploratory factorization or principal component analysis, to account for most, if not all, dimensions of absorptive capacity. Some recent studies use a large number of proxies to operationalize absorptive capacity (Pütz et al., 2022), while others use a combination of available and widely used proxies to construct a single indicator of a firm’s absorptive capacity through principal component analysis (Escribano et al., 2009).

Similarly, we identified three key proxies for absorptive capacity in our dataset: R&D intensity, skilled labor, and specialized R&D labor. We then computed the PCA of our three proxies (KMO: 0.591). Each of these proxies has been used in the literature, individually or in combination, to operationalize absorptive capacity. For example, R&D intensity was a popular choice among earlier researchers (Belderbos et al., 2004; Cantner & Pyka, 1998; Cohen & Levinthal, 1989, 1990; Stock et al., 2001), assuming that it reflects the generation of new knowledge, contributes to internal capabilities, and enhances absorptive capacity, especially in environments where external knowledge appropriation is difficult (Cohen & Levinthal, 1990). Similarly, the number of R&D staff and employees with degrees have also been used as a reflection of an organization’s absorptive capacity (Escribano et al., 2009; Muscio, 2007).

Control variables

We included additional variables to control for age, size, location, and industry in our sample.

3.3 Estimation methodology

We adopted a simplified model to estimate the probability of innovation among our sample SMEs, assuming that the probability depends on digital diffusion, and that the relationship is moderated by their absorptive capacity.

Specification (I) presents our basic nonlinear estimation model. We hypothesize that an SME’s digital diffusion leads to a higher innovation performance.

In specification (I), the dependent variable (\({Y}_{it}\)) is innovation performance measured either by the innovation output of SME i at time t or by the output of one of the four innovation types (product, process, marketing, or organizational). Our dependent variable is a function of the vector (\({X}_{it-1}\)) of our independent variables at time t − 1, and β is a vector of our estimation parameters. Important to note is that all our dependent variables are from the years preceding the 2018 MIP survey wave. By accounting for this lag, we aim to control for endogeneity in our estimation models.

First, we estimated the relationship between digital diffusion and innovation performance in our sample SMEs using the multinomial probit technique to estimate the coefficients. In the second step, since our four types of innovation are potentially interdependent, and estimating four separate equations could lead to inconsistent estimates, we used the multivariate probit technique with the simulated maximum likelihood procedure. This allowed us to estimate the four models simultaneously and to freely correlate the error term across specifications to obtain unbiased and accurate estimates (Cappellari & Jenkins, 2003; Freedman & Sekhon, 2010).

4 Results

4.1 Basic descriptive statistics

Table 4 presents the summary statistics of our explanatory variables and Table 5 the pairwise correlation matrix of our main covariates. To test for multicollinearity before estimating our specification, we computed a variance inflation factor (VIF). Since the mean VIF of 1.17 is far below the acceptable threshold (Barnett, 1975), our estimation model does not suffer from serious multicollinearity issues.

4.2 Estimation results

We first estimated specification (I) using the multinomial probit estimation technique. The results are presented in Table 6 and show that the coefficient of our main explanatory variable digital diffusion is positive and significant for the probability of medium (β = 0.422, p < 0. 5) and high innovation (β = 0.519, p < 0. 5) output of our sample SMEs. This confirms our first hypothesis that the higher the digital diffusion in an SME, the more likely it is to innovate.

We also assume that an SME’s absorptive capacity moderates the relationship between digital diffusion and innovation performance. The results in Table 6 show that although the coefficient of our explanatory variable absorptive capacity is positive and significant for all levels of innovation (p < 0.001), our interaction variable (absorptive capacityM) does not seem to moderate the relationship, as the coefficient of our moderator variable is insignificant. This leads us to reject our second hypothesis. As for our control variables, only size has positive and significant coefficients for medium and high innovation outputs. We also computed the average marginal effects of our multinomial probit model, and the results are reported in Table 9 in the Appendix.

In the second step, we sought to further explore the role of innovation-, industry-, and digital technology-specific heterogeneities in the innovation performance of our sample SMEs. Therefore, we first estimated specification (I) using multivariate probit estimation to examine the effects of our explanatory variables on the four types of innovation. Table 7 presents the results showing that the coefficients of digital diffusion are positive and significant on the probability of product innovation (β = 0.553, p < 0.001), process innovation (β = 0.272, p < 0.001), marketing innovation (β = 0.288, p < 0.001), and organizational innovation (β = 0.291, p < 0.001). Regarding our second hypothesis, the results in Table 7 show that absorptive capacity only moderates the relationship between digital diffusion and product innovation. This result partially supports our second hypothesis. Regarding our control variables, while SME size plays a positive and significant role in the propensity for all types of innovation, the control variables age and location are insignificant.

We then used the split sample method and estimated specification (I) separately for the manufacturing (732 SMEs) and service industry (368 SMEs) subsamples. The results of our multivariate probit estimations are presented in Table 10 in the Appendix and reveal some interesting insights into the relationship between digital diffusion and the different types of innovation across industries. In particular, manufacturing SMEs seem to benefit significantly from digital diffusion to generate all types of innovation.

In addition, absorptive capacity moderates the relationship between digital diffusion and product innovation in the manufacturing SME subsample. Among service SMEs, digital diffusion positively influences the probability of process and organizational innovation, and absorptive capacity shows no moderation effect.

Finally, we examine the disaggregated effect of digital diffusion by including the four digital technology groups (presented in Table 3) as independent estimators and re-estimated specification (I). The results are reported in Table 11 in the Appendix and show that the diffusion of digital technologies in the information systems group (TG4) positively influences all innovation types except organizational innovation. Furthermore, the diffusion of digital technologies in TG1 (core production and services) positively affects the process and organizational innovation outcomes. Finally, TG2 (internal collaboration) and TG3 (external communication) show a strong effect on organizational innovation performance in our sample SMEs.

4.3 Robustness checks

We also conducted some robustness checks to test the reliability of our baseline estimates. First, we tested our key assumption about the relationship between digital diffusion in SMEs and their innovation performance using an alternative measure of innovation performance: innovation sales as a percentage of total sales. We then modelled specification (I) in a linear setting of ordinary least squares (OLS) estimation. Our OLS results are presented in Table 12 in the Appendix and show similarity to our baseline specification. Moreover, the linear estimation setting allowed us to test for endogeneity because innovative firms may also be more open to integrating new digital technologies (Dibrell et al., 2008). Therefore, we performed a Durbin-Wu-Hausman test. The insignificant p-value (0.13390) and our results indicate that the OLS is consistent and our measure of digital diffusion is not endogenous to innovation.

5 Discussion and conclusion

In this study, we go beyond recent research and use a strategic management approach to understand the relationship between digitalization and innovation. In particular, we seek to understand whether the strategic integration of digital technologies (digital diffusion) leads to better innovation performance in SMEs and how the organizational capabilities embodied in absorptive capacity may affect this relationship. Our study and detailed empirical analyses contribute to the growing debate about digitalization and innovation.

Although digitalization is seen as a new source of innovation (Nambisan et al., 2017; Yoo et al., 2012), some recent research underscores that digitalization has little influence on innovation as most digital technologies have generic applications and little to no role in the generation of innovation, whereas more complex digital technologies can be important for innovation (e.g., Usai et al., 2021). In our study, we add to this debate by understanding the nature of digital technologies as a source of innovation in an SME context. We emphasize that digital resources differ from the traditional underpinnings due to their widespread availability, cost-effectiveness, and flexible affordances (Nambisan et al., 2017; Yoo et al., 2012; Zammuto et al., 2007). We argue that the true benefits of digitalization lie in digital diffusion, rather than the mere adoption of digital technologies (Kane et al., 2015; Warner & Wäger, 2019). Furthermore, the strategic integration of digital technologies is rooted in previously accumulated digital expertise and investments in related infrastructure. With progressive digital diffusion, organizations can gradually build and optimize their digital capabilities in response to the rapid evolution of technological infrastructures and changes in the dynamic markets (Autio et al., 2018; Zammuto et al., 2007). Along these lines, we first assumed that SMEs, given their greater flexibility and agility in dynamic environments (Teece et al., 1997; Zahra & George, 2002; Eisenhardt & Martin, 2000; Teece, 2018), should potentially be able to take advantage of digital diffusion to produce innovations. Moreover, we theoretically argued that absorptive capacity should moderate the relationship between digital diffusion and innovation. This is because absorptive capacity should complement the strategic flexibility of SMEs to identify, assimilate, and apply new information and tap external resources and networks to increase their innovation potential (Cohen & Leventhal, 1990).

Using a representative and large sample of German SMEs, we provide evidence that digital diffusion does lead to higher innovation performance among SMEs. However, contrary to our initial expectations, we observe the moderating role of absorptive capacity only when industrial and innovation heterogeneities are taken into account. While absorptive capacity moderates the relationship between digital diffusion and the product innovation performance of manufacturing SMEs, we do not find any significant moderating role for process innovation. This might be explained by the fact that product innovation usually involves the organizational ability to integrate external knowledge, technologies, and market insights, whereas process innovation deals with the optimization of internal capabilities and processes to enhance operational features and gain efficiencies. We know from the existing literature that absorptive capacity is an organization’s ability to identify, assimilate, and apply external knowledge, and the manufacturing sector is generally associated with a strong focus on research skills and the production of tangible output (Cohen & Levinthal, 1990; Eisenhardt & Martin, 2000; Zahra & George, 2002). Thus, it is not surprising to see manufacturing-sector SMEs capitalize on the combination of digital diffusion and absorptive capacity to be more creative and innovative.

To gain deeper insights and ascertain our assumptions about the relationship between digital diffusion and innovation performance, we examined differences across industries and digital technologies in detail. Our results indicate that manufacturing SMEs perform better than their counterparts in the service industry when it comes to gaining strategic benefits from digital diffusion and generate innovations. This result appears to contradict some prior research in Germany that shows that digital technologies enhance the product innovation potential of service sector organizations compared to the manufacturing sector ones (e.g., Sarbu, 2021). However, it is important to note that Sarbu (2021) uses a sample of rather large innovating organizations and assesses the role of selective digital technologies, whereas our study specifically focuses on strategic and extensive integration of digital technologies in SMEs and thus offering new insights.

In our findings, we also identified systematic differences across various digital technologies regarding innovation performance. However, unlike recent studies about German organizations, we employ SMEs as a unit of analysis and group similar technologies to explore their influence on innovation performance instead of evaluating the effectiveness of particular digital technologies (e.g., Niebel et al., 2019; Sarbu, 2021). By doing so, we are not only able to circumvent some of our data limitations but also to investigate the combined effects of similar digital technologies. Our results show that digital technologies related to information processing have greater innovation potential than other technologies. These findings are consistent with related scholarly debate and empirical findings and show that SMEs can leverage the key benefits of modern information processing technologies (e.g., big data) and their affordances to gain detailed data-specific insights into new product development, process optimization, and market dynamics (Kastelli et al., 2022; Nambisan et al., 2019; Niebel et al., 2019; Sarbu, 2021; Usai et al., 2021; Yoo et al., 2012). Interestingly, our analysis reveals that organizational innovation in SMEs can greatly benefit from the utilization of various digital technologies. Specifically, we find that the increased diffusion of digital technologies related to main business activities, internal collaboration, and external communication leads to better organizational innovation performance. This shows that SMEs, by using strategic digitalization, tend to continuously readjust to changing customer preferences and reconfigure the organizational structure for optimal responses in dynamic markets (Teece, 2018; Warner & Wäger, 2019; Yoo et al., 2012).

Our study offers important implications for research and practice. First, the integration of generic efficiency-oriented digital technologies into business processes appears to generally facilitate only the optimization of basic business processes but does not provide a significant mechanism for value creation or capture. Our findings show that it is the strategic integration of more specialized and complex digital technologies that has greater potential for value identification, capture, creation, and subsequent business transformation.

Second, our study has shown that absorptive capacity can be useful in bridging effective digital technology integration and new value creation. The gradual assimilation of digital technologies into an organization’s daily practices and routines (Singh et al., 2020) should enable the diffusion of digital technologies to continuously transform business processes and identify new opportunities (Fichman et al., 2014; Zammuto et al., 2007). Data-driven insights from successful digital diffusion can potentially empower SME owners to optimize their business operations to generate innovation, respond to emerging customer preferences, and develop new products and services. In addition, by converging existing and unique firm-specific resources with information processing technologies, SME managers can sense emerging trends and gain foresight on market trends to counteract impending disruptive innovations (Bzhalava et al., 2022).

Third, despite an increased level of digitalization among German SMEs (Sarbu, 2021), SMEs tend to adopt technologies for efficiency gains or simply through the bandwagon effect or competitive pressure without actually implementing digital technologies in their innovation strategies (Hassan et al., 2020; Qalati et al., 2021). Moreover, there are some misleading, prevailing perceptions (e.g., expensive integration, no gains, privacy concerns, loss of competition) among SME entrepreneurs, which might hamper the strategic adoption of digital technologies and the associated absorptive capacity (Hassan et al., 2020; Yunis et al., 2018). We recommend that SME managers not be discouraged by the misleading perceptions surrounding digital technologies. Instead, they should rethink their business strategy to integrate digital technologies into their innovation processes for strategic renewal in dynamic markets (Warner & Wäger, 2019). Managers can also benefit from a better understanding of the broad and specific impacts of digitalization across different aspects of their business operations, enabling them to identify critical success factors that contribute to the effective diffusion of digital technologies and achieve positive outcomes. Similarly, the exploration of additional moderating and mediating factors, such as management style, organizational culture, and competitive context, can help managers uncover nuanced linkages between digital diffusion and innovation. Finally, policymakers should develop policies to create an enabling environment for SME digitalization, which can have multiple benefits for regional entrepreneurial activities, economic development, and the knowledge economy. For example, successful digital transformation in some SMEs can lead to widespread replication among other SMEs, which can promote not only knowledge-sharing among regional SMEs but also enhance their agility, responsiveness, and adaptability to market changes and enhance their global competitiveness.

Our study also has some limitations. In particular, we operationalized our explanatory variable of absorptive capacity by mainly using the quantitative dimension (knowledge-based assets), since data on the qualitative dimensions of absorptive capacity (such as knowledge diffusion, knowledge transfer) were not available in our dataset. Future research should focus on obtaining detailed information on all the dimensions of absorptive capacity (acquisition, assimilation, transformation, and exploitation of external knowledge) to construct more detailed proxies. In addition, our dataset does not have detailed information on other commonly used control variables (e.g., ownership structure, specific industry focus). Future researchers should use such data when available to avoid any omitted variable bias. Moreover, we were only able to use a relatively old dataset due to limitations in data availability. Despite obtaining significant insights from our analyses, digital technologies are evolving rapidly. Therefore, we encourage future researchers to test our findings using more recent data, newer digital technologies (e.g., artificial intelligence), and more detailed information on innovation activities (e.g., patents). Finally, since our analyses focus only on German SMEs from two main industrial sectors, our results have limited generalizability. Future research should test our findings in other geographic, industry, and economic contexts to gain valuable insights and improve our understanding of the complex relationship between digital diffusion and innovation. Overall, future research should account for industry- and digital technology-specific heterogeneities to disentangle the specific role of different digital technologies across industries.

In conclusion, while the role of digitalization in innovation is somewhat ambiguous, we examined this relationship from a strategic management perspective. By using a large and representative sample of German SMEs, our study provides solid evidence in this regard, showing that strategic integration, rather than generic integration, of digital technologies can be a game changer for the innovation capabilities of SMEs.

Notes

TG1: core production/service including four digital technologies (T1: digital connectivity within production/services, T2: digital connectivity between production/services and logistics, T3: digital connectivity with customers, and T4: digital connectivity with suppliers).

TG2 2: internal collaboration (T5: teleworking, T6: software-based communication (e.g., Skype), T7: intranet-based platforms, e.g., Wikis).

TG3: external communication (T8: e-commerce, T9: social media, e.g., Facebook, Twitter, Xing).

TG4: information processing (T10: cloud computing applications, T11: big data analytics).

References

Al-Ansari, Y., Altalib, M., & Sardoh, M. (2013). Technology orientation, innovation and business performance: A study of Dubai SMEs. The International Technology Management Review, 3(1), 1–11. https://doi.org/10.2991/itmr.2013.3.1.1

Aldrich, H., & Auster, E. R. (1986). Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in Organizational Behavior, 8, 165–198.

Amable, B., Demmou, L., & Ledezma, I. (2009). Product market regulation, innovation, and distance to frontier. Industrial and Corporate Change, 19(1), 117–159. https://doi.org/10.1093/icc/dtp037

Aschhoff, B., Baier, E., Crass, D., Hud, M., Hünermund, P., Köhler, C., Peters, B., Rammer, C., Schricke, E., Schubert, T., & Schwiebacher, F. (2013). Innovation in Germany - Results of the German CIS 2006 to 2010, ZEW-Documentation, No. 13–1, Mannheim. Retrieved February 11, 2020, from https://ftp.zew.de/pub/zew-docs/co2panel/docus/dokumentation1301.pdf

Autio, E., Nambisan, S., Thomas, L. D. W., & Wright, M. (2018). Digital affordances, spatial affordances, and the genesis of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 72–95. https://doi.org/10.1002/sej.1266

Barczak, G., Sultan, F., & Hultink, E. J. (2007). Determinants of IT usage and new product performance. Journal of Product Innovation Management, 24(6), 600–613. https://doi.org/10.1111/J.1540-5885.2007.00274.X

Barnett, V. (1975). Review of applied linear statistical models by J. Neter & W. Wasserman. Journal of the Royal Statistical Society Series A (General), 138(2), 258–258. https://doi.org/10.2307/2984653

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

Barney, J. B., Ketchen, D. J., & Wright, M. (2011). The future of resource-based theory. Journal of Management, 37(5), 1299–1315. https://doi.org/10.1177/0149206310391805

Belderbos, R., Carree, M., Diederen, B., Lokshin, B., & Veugelers, R. (2004). Heterogeneity in R&D cooperation strategies. International Journal of Industrial Organization, 22(8–9), 1237–1263. https://doi.org/10.1016/j.ijindorg.2004.08.001

Bharadwaj, A., Sawy, O. A. E., Pavlou, P. A., & Venkatraman, N. (2013). Digital business strategy: Toward a next generation of insights. Management Information Systems Quarterly, 37(2), 471–482. https://doi.org/10.25300/misq/2013/37:2.3

Bhatt, G. D., & Grover, V. (2005). Types of information technology capabilities and their role in competitive advantage: An empirical study. Journal of Management Information Systems, 22(2), 253–277. https://doi.org/10.1080/07421222.2005.11045844

Bhatt, G., Gupta, J. N. D., & Kitchens, F. (2005). An exploratory study of groupware use in the knowledge management process. Journal of Enterprise Information Management, 18(1), 28–46. https://doi.org/10.1108/17410390510571475

Borch, O. J., & Madsen, E. L. (2007). Dynamic capabilities facilitating innovative strategies in SMEs. International Journal of Technoentrepreneurship, 1(1), 109–125. https://doi.org/10.1504/ijte.2007.014731

Brennen, J. S., & Kreiss, D. (2016). Digitalization. The International Encyclopedia of Communication Theory and Philosophy, 1–11. https://doi.org/10.1002/9781118766804.wbiect111

Bzhalava, L., Hassan, S. S., Kaivo-Oja, J., Köping Olsson, B., & Imran, J. (2022). Mapping the wave of industry digitalization by co-word analysis: An exploration of four disruptive industries. International Journal of Innovation and Technology Management, 19(2), 2250001. https://doi.org/10.1142/S0219877022500018

Cai, H., & Shi, A. (2009). Research on the innovation of marketing channels for high-tech enterprises in the background of e-commerce. 1st International Conference on Multimedia Information Networking and Security, 50–52. https://doi.org/10.1109/mines.2009.8

Cantner, U., & Pyka, A. (1998). Absorbing technological spillovers: Simulations in an evolutionary framework. Industrial and Corporate Change, 7(2), 369–397. https://doi.org/10.1093/icc/7.2.369

Cappellari, L., & Jenkins, S. P. (2003). Multivariate probit regression using simulated maximum likelihood. The Stata Journal: Promoting Communications on Statistics and Stata, 3(3), 278–294. https://doi.org/10.1177/1536867x0300300305

Castells, M. (2009). The rise of the network society. John Wiley & Sons. https://doi.org/10.1002/9781444319514

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: The two faces of R&D. The Economic Journal, 99(397), 569–596. https://doi.org/10.2307/2233763

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152. https://doi.org/10.2307/2393553

Crossan, M. M., & Apaydin, M. (2010). A multi-dimensional framework of organizational innovation: A systematic review of the literature. Journal of Management Studies, 47(6), 1154–1191. https://doi.org/10.1111/j.1467-6486.2009.00880.x

Cui, B., Mei, H., & Ooi, B. C. (2014). Big data: The driver for innovation in databases. National Science Review, 1(1), 27–30. https://doi.org/10.1093/nsr/nwt020

D’Amboise, G., & Muldowney, M. (1988). Management theory for small business: Attempts and requirements. Academy of Management Review, 13(2), 226–240. https://doi.org/10.2307/258574

Damanpour, F. (1992). Organizational size and innovation. Organization Studies, 13(3), 375–402. https://doi.org/10.1177/017084069201300304

Dasgupta, S., Granger, M., & McGarry, N. (2002). User acceptance of e-collaboration technology: An extension of the technology acceptance model. Group Decision and Negotiation, 11(2), 87–100. https://doi.org/10.1023/A:1015221710638

Davenport, T. H., Leibold, M., & Voelpel, S. C. (2007). Strategic management in the innovation economy. Wiley.

De Mattos, C. S., Pellegrini, G., Hagelaar, G., & Dolfsma, W. (2023). Systematic literature review on technological transformation in SMEs: A transformation encompassing technology assimilation and business model innovation. Management Review Quarterly. https://doi.org/10.1007/s11301-023-00327-7

Dibrell, C., Davis, P. S., & Craig, J. (2008). Fueling innovation through information technology in SMEs. Journal of Small Business Management, 46(2), 203–218. https://doi.org/10.1111/J.1540-627X.2008.00240.X

Duane, A., & Finnegan, P. (2003). Managing empowerment and control in an intranet environment. Information Systems Journal, 13(2), 133–158. https://doi.org/10.1046/j.1365-2575.2003.00148.x

Egbetokun, A., & Savin, I. (2014). Absorptive capacity and innovation: When is it better to cooperate? Journal of Evolutionary Economics, 24(2), 399–420. https://doi.org/10.1007/s00191-014-0344-x

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10–11), 1105–1121. https://doi.org/10.1002/1097-0266(200010/11)21:10/11%3c1105::AID-SMJ133%3e3.0.CO;2-E

Escribano, A., Fosfuri, A., & Tribó, J. A. (2009). Managing external knowledge flows: The moderating role of absorptive capacity. Research Policy, 38(1), 96–105. https://doi.org/10.1016/j.respol.2008.10.022

European Commission. (2003). Commission recommendation of 6 May 2003 concerning the definition of micro, small and medium-sized enterprises. Official Journal of the European Union, L124, 36–41. Retrieved February 11, 2020, from https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2003:124:0036:0041:EN:PDF

Fabrizio, K. R. (2009). Absorptive capacity and the search for innovation. Research Policy, 38(2), 255–267. https://doi.org/10.1016/j.respol.2008.10.023

Feeny, S., & Rogers, M. (2003). Innovation and performance: Benchmarking Australian firms. Australian Economic Review, 36(3), 253–264. https://doi.org/10.1111/1467-8462.00285

Fichman, R. G., Dos Santos, B. L., & Zheng, Z. (2014). Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Quarterly, 38(2), 329–343. https://doi.org/10.25300/misq/2014/38.2.01

Flatten, T. C., Engelen, A., Zahra, S. A., & Brettel, M. (2011). A measure of absorptive capacity: Scale development and validation. European Management Journal, 29(2), 98–116. https://doi.org/10.1016/j.emj.2010.11.002

Freedman, D. A., & Sekhon, J. S. (2010). Endogeneity in probit response models. Political Analysis, 18(2), 138–150. https://doi.org/10.1093/pan/mpp037

Gassmann, O., Enkel, E., & Chesbrough, H. (2010). The future of open innovation. R&D Management, 40(3), 213–221. https://doi.org/10.1111/j.1467-9310.2010.00605.x

Gatignon, H., & Xuereb, J. (1997). Strategic orientation of the firm and new product performance. Journal of Marketing Research, 34(1), 77–90. https://doi.org/10.2307/3152066

Grant, R. M. (1996). Prospering in dynamically-competitive environments: Organizational capability as knowledge integration. Organization Science, 7(4), 375–387. https://doi.org/10.1287/orsc.7.4.375

Grant, R. M. (1997). The knowledge-based view of the firm: Implications for management practice. Long Range Planning, 30(3), 450–454. https://doi.org/10.1016/s0024-6301(97)00025-3

Grimpe, C., & Sofka, W. (2009). Search patterns and absorptive capacity: Low- and high-technology sectors in European countries. Research Policy, 38(3), 495–506. https://doi.org/10.1016/j.respol.2008.10.006

Grundström, C., Sjöström, R., Uddenberg, A., & Rönnbäck, A. Ö. (2012). Fast-growing SMEs and the role of innovation. International Journal of Innovation Management, 16(3), 1240003. https://doi.org/10.1142/S1363919612400038

Harland, C. M., Caldwell, N. D., Powell, P., & Zheng, J. (2007). Barriers to supply chain information integration: SMEs adrift of eLands. Journal of Operations Management, 25(6), 1234–1254. https://doi.org/10.1016/j.jom.2007.01.004

Hassan, S. S., Reuter, C., & Bzhalava, L. (2020). Perception or capabilities? An empirical investigation of the factors influencing the adoption of social media and public cloud in German SMEs. International Journal of Innovation Management., 25(01), 2150002. https://doi.org/10.1142/S136391962150002X

Hausman, A. (2005). Innovativeness among small businesses: Theory and propositions for future research. Industrial Marketing Management, 34(8), 773–782. https://doi.org/10.1016/j.indmarman.2004.12.009

Helfat, C. E., & Peteraf, M. A. (2003). The dynamic resource-based view: Capability lifecycles. Strategic Management Journal, 24(10), 997–1010. https://doi.org/10.1002/smj.332

Hult, G. T. M., Hurley, R. F., & Knight, G. A. (2004). Innovativeness: Its antecedents and impact on business performance. Industrial Marketing Management, 33(5), 429–438. https://doi.org/10.1016/j.indmarman.2003.08.015

Jansen, J. J. P., Van Den Bosch, F. A. J., & Volberda, H. W. (2005). Managing potential and realized absorptive capacity: How do organizational antecedents matter? Academy of Management Journal, 48(6), 999–1015. https://doi.org/10.5465/amj.2005.19573106

Jansen, J. J. P., Van Den Bosch, F. A. J., & Volberda, H. W. (2006). Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Management Science, 52(11), 1661–1674. https://doi.org/10.1287/mnsc.1060.0576

Joensuu-Salo, S., Sorama, K., Viljamaa, A., & Varamäki, E. (2018). Firm performance among internationalized SMEs: The interplay of market orientation, marketing capability and digitalization. Administrative Sciences, 8(3), 31–44. https://doi.org/10.3390/admsci8030031

Kane, G. C., Palmer, D., Phillips, A. N., Kiron, D., & Buckley, N. (2015). Strategy, not technology, drives digital transformation. MIT Sloan Management Review, 14 (2015), 1–25. Retrieved 01 June 2023, from https://sloanreview.mit.edu/projects/strategy-drives-digital-transformation/

Kastelli, I., Dimas, P., Stamopoulos, D., & Tsakanikas, A. (2022). Linking digital capacity to innovation performance: The mediating role of absorptive capacity. Journal of the Knowledge Economy, 1–35. https://doi.org/10.1007/S13132-022-01092-w

Khin, S., & Ho, T. C. (2019). Digital technology, digital capability and organizational performance. International Journal of Innovation Science, 11(2), 177–195. https://doi.org/10.1108/ijis-08-2018-0083

Klerkx, L., & Begemann, S. (2020). Supporting food systems transformation: The what, why, who, where and how of mission-oriented agricultural innovation systems. Agricultural Systems, 184, 102901. https://doi.org/10.1016/j.agsy.2020.102901

Klevorick, A. K., Levin, R. C., Nelson, R. R., & Winter, S. G. (1995). On the sources and significance of interindustry differences in technological opportunities. Research Policy, 24(2), 185–206. https://doi.org/10.1016/0048-7333(93)00762-i

Klomp, L., & Van Leeuwen, G. (2001). Linking innovation and firm performance: A new approach. International Journal of the Economics of Business, 8(3), 343–364. https://doi.org/10.1080/13571510110079612

Koch, T., & Windsperger, J. (2017). Seeing through the network: Competitive advantage in the digital economy. Journal of Organization Design, 6(6), 1–30. https://doi.org/10.1186/s41469-017-0016-z

Kroh, J., Luetjen, H., Globocnik, D., & Schultz, C. (2018). Use and efficacy of information technology in innovation processes: The specific role of servitization. Journal of Product Innovation Management, 35(5), 720–741. https://doi.org/10.1111/jpim.12445

Lee, J. H., Ardakani, H. D., Yang, S., & Bagheri, B. (2015). Industrial big data analytics and cyber-physical systems for future maintenance & service innovation. Procedia CIRP, 38, 3–7. https://doi.org/10.1016/j.procir.2015.08.026

Maglio, P. P., & Lim, C. (2016). Innovation and big data in smart service systems. Journal of Innovation Management, 4(1), 11–21. https://doi.org/10.24840/2183-0606_004.001_0003

Mahoney, J. T. (1995). The management of resources and the resource of management. Journal of Business Research, 33(2), 91–101. https://doi.org/10.1016/0148-2963(94)00060-r

Massa, S., & Testa, S. (2008). Innovation and SMEs: Misaligned perspectives and goals among entrepreneurs, academics, and policy makers. Technovation, 28(7), 393–407. https://doi.org/10.1016/j.technovation.2008.01.002

Mauerhoefer, T., Strese, S., & Brettel, M. (2017). The impact of information technology on new product development performance. Journal of Product Innovation Management, 34(6), 719–738. https://doi.org/10.1111/JPIM.12408

Meroño-Cerdán, Á. L., Soto-Acosta, P., & López-Nicolás, C. (2008). How do collaborative technologies affect innovation in SMEs? International Journal of E-Collaboration, 4(4), 33–50. https://doi.org/10.4018/jec.2008100103

Mowery, D. C., Oxley, J. E., & Silverman, B. S. (1998). Technological overlap and interfirm cooperation: Implications for the resource-based view of the firm. Research Policy, 27(5), 507–523. https://doi.org/10.1016/s0048-7333(98)00066-3

Müller, J. M., Buliga, O., & Voigt, K. I. (2021). The role of absorptive capacity and innovation strategy in the design of industry 4.0 business models - A comparison between SMEs and large enterprises. European Management Journal, 39(3), 333–343. https://doi.org/10.1016/j.emj.2020.01.002

Muscio, A. (2007). The impact of absorptive capacity on SMEs’ collaboration. Economics of Innovation and New Technology, 16(8), 653–668. https://doi.org/10.1080/10438590600983994

Nambisan, S. (2017). Digital entrepreneurship: Toward a digital technology perspective of entrepreneurship. Entrepreneurship Theory and Practice, 41(6), 1029–1055. https://doi.org/10.1111/etap.12254

Nambisan, S., Lyytinen, K., Majchrzak, A., & Song, M. (2017). Digital innovation management: Reinventing innovation management research in a digital world. Mis Quarterly, 41(1), 223–238. https://doi.org/10.25300/MISQ/2017/41:1.03

Nambisan, S., Wright, M., & Feldman, M. (2019). The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Research Policy, 48(8), 103773. https://doi.org/10.1016/j.respol.2019.03.018

Niebel, T., Rasel, F., & Viete, S. (2019). Big data – Big gains? Understanding the link between big data analytics and innovation. Economics of Innovation and New Technology., 28(3), 296–316. https://doi.org/10.1080/10438599.2018.1493075

Nieto, M., & Quevedo, P. (2005). Absorptive capacity, technological opportunity, knowledge spillovers, and innovative effort. Technovation, 25(10), 1141–1157. https://doi.org/10.1016/j.technovation.2004.05.001

O’Regan, N., & Ghobadian, A. (2005). Innovation in SMEs: The impact of strategic orientation and environmental perceptions. International Journal of Productivity and Performance Management, 54(2), 81–97. https://doi.org/10.1108/17410400510576595

Ordanini, A., & Rubera, G. (2010). How does the application of an IT service innovation affect firm performance? A theoretical framework and empirical analysis on e-commerce. Information and Management, 47(1), 60–67. https://doi.org/10.1016/j.im.2009.10.003

Owalla, B., Gherhes, C., Vorley, T., & Brooks, C. (2022). Mapping SME productivity research: A systematic review of empirical evidence and future research agenda. Small Business Economics, 58(3), 1285–1307. https://doi.org/10.1007/S11187-021-00450-3

Pavlou, P. A., & Sawy, O. A. E. (2010). The “third hand”: IT-enabled competitive advantage in turbulence through improvisational capabilities. Information Systems Research, 21(3), 443–471. https://doi.org/10.1287/isre.1100.0280

Penrose, E. (1995). The theory of the growth of the firm. Oxford University Press. https://doi.org/10.1093/0198289774.001.0001

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competitors. Free Press.

Prahalad, C. K., & Ramaswamy, V. (2003). The new frontier of experience innovation. MIT Sloan Management Review, 44(4), 12–18.

Pütz, L., Schell, S., & Werner, A. (2022). Openness to knowledge: Does corporate social responsibility mediate the relationship between familiness and absorptive capacity? Small Business Economics, 60, 1–34. https://doi.org/10.1007/S11187-022-00671-0

Qalati, S. A., Yuan, L. W., Khan, M. A. S., & Anwar, F. (2021). A mediated model on the adoption of social media and SMEs’ performance in developing countries. Technology and Society, 64, 101513. https://doi.org/10.1016/j.techsoc.2020.101513

Qin, J., Liu, Y., & Grosvenor, R. (2016). A categorical framework of manufacturing for industry 4.0 and beyond. Procedia CIRP, 52, 173–178. https://doi.org/10.1016/j.procir.2016.08.005

Qin, J., van der Rhee, B., Venkataraman, V., & Ahmadi, T. (2021). The impact of IT infrastructure capability on NPD performance: The roles of market knowledge and innovation process formality. Journal of Business Research, 133, 252–264. https://doi.org/10.1016/j.jbusres.2021.04.072

Rachinger, M., Rauter, R., Müller, C., Vorraber, W., & Schirgi, E. (2019). Digitalization and its influence on business model innovation. Journal of Manufacturing Technology Management, 30(8), 1143–1160. https://doi.org/10.1108/jmtm-01-2018-0020

Raghuram, S. (2014). Telecommuting in India: Pitfalls and possibilities. South Asian Journal of Human Resources Management, 1(2), 207–220. https://doi.org/10.1177/2322093714549108

Ray, G., Xue, L., & Barney, J. B. (2013). Impact of information technology capital on firm scope and performance: The role of asset characteristics. Academy of Management Journal, 56(4), 1125–1147. https://doi.org/10.5465/amj.2010.0874

Raymond, L., Uwizeyemungu, S., Fabi, B., & St-Pierre, J. (2018). IT capabilities for product innovation in SMEs: A configurational approach. Information Technology and Management, 19(1), 75–87. https://doi.org/10.1007/s10799-017-0276-x

Reis, J., Silva, C., Melão, N. & De Matos, P. A. (2018). Digital transformation: A literature review and guidelines for future research. Advances in Intelligent Systems and Computing, 411–421. https://doi.org/10.1007/978-3-319-77703-0_41

Rijswijk, K., Klerkx, L., & Turner, J. M. A. (2019). Digitalisation in the New Zealand agricultural knowledge and innovation system: Initial understandings and emerging organisational responses to digital agriculture. NJAS - Wageningen Journal of Life Sciences, 90–91(1), 1–14. https://doi.org/10.1016/j.njas.2019.100313

Roberts, D. L., Piller, F. T., & Lüttgens, D. (2016). Mapping the impact of social media for innovation: The role of social media in explaining innovation performance in the PDMA comparative performance assessment study. Journal of Product Innovation Management, 33, 117–135. https://doi.org/10.1111/jpim.12341

Salavou, H., Baltas, G., & Lioukas, S. (2004). Organisational innovation in SMEs. European Journal of Marketing, 38(9/10), 1091–1112. https://doi.org/10.1108/03090560410548889

Sarbu, M. (2021). The impact of industry 4.0 on innovation performance: Insights from German manufacturing and service firms. Technovation, 113, 102415. https://doi.org/10.1016/j.technovation.2021.102415

Schmidt, T., & Rammer, C. (2007). Non-technological and technological innovation: Strange bedfellows ? European Economic Research. https://doi.org/10.2139/ssrn.1010301

Schulz, M. (2003). Pathways of relevance: Exploring inflows of knowledge into subunits of multinational corporations. Organization Science, 14(4), 440–459. https://doi.org/10.1287/orsc.14.4.440.17483

Selander, L., Henfridsson, O., & Svahn, F. (2013). Capability search and redeem across digital ecosystems. Journal of Information Technology, 28(3), 183–197. https://doi.org/10.1057/jit.2013.14

Singh, A., Klarner, P., & Hess, T. (2020). How do chief digital officers pursue digital transformation activities? The role of organization design parameters. Long Range Planning, 53(3), 101890. https://doi.org/10.1016/j.lrp.2019.07.001

Skott, P. (2003). Business cycles. The Elgar Companion to Post Keynesian Economics. https://doi.org/10.4337/9781843768715.00015

Stock, G. N., Greis, N. P., & Fischer, W. A. (2001). Absorptive capacity and new product development. Journal of High Technology Management Research, 12(1), 77–91. https://doi.org/10.1016/S1047-8310(00)00040-7

Stock, G. N., Greis, N. P., & Fischer, W. A. (2002). Firm size and dynamic technological innovation. Technovation, 22(9), 537–549. https://doi.org/10.1016/S0166-4972(01)00061-X

Tao, F., Sui, F., Liu, A., Qi, Q., Zhang, M., Song, B., Guo, Z., Lu, S. C. Y., & Nee, A. Y. C. (2019). Digital twin-driven product design framework. International Journal of Production Research, 57(12), 3935–3953. https://doi.org/10.1080/00207543.2018.1443229

Teece, D. J. (2018). Business models and dynamic capabilities. Long Range Planning, 51(1), 40–49. https://doi.org/10.1016/j.lrp.2017.06.007

Teece, D. J., & Pisano, G. (1994). The dynamic capabilities of firms: An introduction. Industrial and Corporate Change, 3(3), 537–556. https://doi.org/10.1093/icc/3.3.537-a

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533. https://doi.org/10.1002/(SICI)1097-0266(199708)18:7%3c509::AID-SMJ882%3e3.0.CO;2-Z

Teece, D. J., Peteraf, M. A., & Leih, S. (2016). Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy. California Management Review, 58(4), 13–35. https://doi.org/10.1525/cmr.2016.58.4.13

Tzokas, N., Kim, Y. H., Akbar, H., & Al-Dajani, H. (2015). Absorptive capacity and performance: The role of customer relationship and technological capabilities in high-tech SMEs. Industrial Marketing Management, 47, 134–142. https://doi.org/10.1016/j.indmarman.2015.02.033

Usai, A., Fiano, F., Petruzzelli, A. M., Paoloni, P., Farina Briamonte, M. F., & Orlando, B. (2021). Unveiling the impact of the adoption of digital technologies on firms’ innovation performance. Journal of Business Research, 133, 327–336. https://doi.org/10.1016/j.jbusres.2021.04.035

Utterback, J. M. (1994). Mastering the dynamics of innovation: How companies can seize opportunities in the face of technological change. Harvard Business School Press.

Van den Bosch, F. A. J., Volberda, H. W., & De Boer, M. R. (1999). Coevolution of firm absorptive capacity and knowledge environment: Organizational forms and combinative capabilities. Organizational Science, 10(5), 551–568. https://doi.org/10.1287/orsc.10.5.551

Venkatraman, N., Henderson, J. C., & Oldach, S. (1993). Continuous strategic alignment: Exploiting information technology capabilities for competitive success. European Management Journal, 11(2), 139–149. https://doi.org/10.1016/0263-2373(93)90037-I

Veugelers, R. (1997). Internal R&D expenditures and external technology sourcing. Research Policy, 26(3), 303–315. https://doi.org/10.1016/S0048-7333(97)00019-X

Wales, W. J., Parida, V., & Patel, P. C. (2013). Too much of a good thing? Absorptive capacity, firm performance, and the moderating role of entrepreneurial orientation. Strategic Management Journal, 34(5), 622–633. https://doi.org/10.1002/smj.2026

Wang, C. L., & Ahmed, P. K. (2007). Dynamic capabilities: A review and research agenda. International Journal of Management Reviews, 9(1), 31–51. https://doi.org/10.1111/j.1468-2370.2007.00201.x

Wang, Y., Chen, Y., Nevo, S., Jin, J., Tang, G., & Chow, W. (2013). IT capabilities and innovation performance: The mediating role of market orientation. Communications of the Association for Information Systems, 33. https://doi.org/10.17705/1cais.03309

Warner, K. S. R., & Wäger, M. (2019). Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Planning, 52(3), 326–349. https://doi.org/10.1016/j.lrp.2018.12.001

Weerawardena, J., & Mavondo, F. T. (2011). Capabilities, innovation and competitive advantage. Industrial Marketing Management, 40(8), 1220–1223. https://doi.org/10.1016/j.indmarman.2011.10.012

Wernerfelt, B. (1995). The resource-based view of the firm: Ten years after. Strategic Management Journal, 16(3), 171–174. https://doi.org/10.1002/smj.4250160303

Westerman, G., Calméjane, C., Bonnet, D., Ferraris, P., & McAfee, A. (2011). Digital transformation: A road-map for billion-dollar organizations. MIT Center for Digital Business and Capgemini Consulting, 1(2011), 1–68.

Wu, M., Lu, T., Ling, F., Sun, J., & Du, H. (2010). Research on the architecture of internet of things. Proceedings of the 3rd International Conference on Advanced Computer Theory and Engineering (ICACTE), 5, 484–487. https://doi.org/10.1109/ICACTE.2010.5579493

Yoo, Y., Henfridsson, O., & Lyytinen, K. (2010). Research commentary - The new organizing logic of digital innovation: An agenda for information systems research. Information Systems Research, 21(4), 724–735. https://doi.org/10.1287/isre.1100.0322

Yoo, Y., Boland, R. J., Lyytinen, K., & Majchrzak, A. (2012). Organizing for innovation in the digitized world. Organization Science, 23(5), 1398–1408. https://doi.org/10.1287/orsc.1120.0771

Yunis, M., Tarhini, A., & Kassar, A. (2018). The role of ICT and innovation in enhancing organizational performance: The catalysing effect of corporate entrepreneurship. Journal of Business Research, 88, 344–356. https://doi.org/10.1016/j.jbusres.2017.12.030

Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203. https://doi.org/10.5465/amr.2002.6587995

Zahra, S. A., Sapienza, H. J., & Davidsson, P. (2006). Entrepreneurship and dynamic capabilities: A review, model and research agenda. Journal of Management Studies, 43(4), 917–955. https://doi.org/10.1111/j.1467-6486.2006.00616.x

Zamani, S. Z. (2022). Small and medium enterprises (SMEs) facing an evolving technological era: A systematic literature review on the adoption of technologies in SMEs. European Journal of Innovation Management, 25(6), 735–757. https://doi.org/10.1108/ejim-07-2021-0360

Zammuto, R. F., Griffith, T. L., Majchrzak, A., Dougherty, D. J., & Faraj, S. (2007). Information technology and the changing fabric of organization. Organization Science, 18(5), 749–762. https://doi.org/10.1287/orsc.1070.0307

Zawislak, P. A., Alves, A. C., Tello-Gamarra, J., Barbieux, D., & Reichert, F. M. (2013). Influences of the internal capabilities of firms on their innovation performance: A case study investigation in Brazil. International Journal of Management, 30(1), 329.

Zheng, S., Zhang, W., & Du, J. (2011). Knowledge-based dynamic capabilities and innovation in networked environments. Journal of Knowledge Management, 15(6), 1035–1051. https://doi.org/10.1108/13673271111179352

Zhou, K. Z., & Wu, F. (2010). Technological capability, strategic flexibility, and product innovation. Strategic Management Journal, 31, 547–561. https://doi.org/10.1002/smj.830

Zhou, K. Z., Gao, G. Y., Yang, Z., & Zhou, N. (2005). Developing strategic orientation in China: Antecedents and consequences of market and innovation orientations. Journal of Business Research, 58(8), 1049–1058. https://doi.org/10.1016/j.jbusres.2004.02.003

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions