Abstract

While research on entrepreneurship and entrepreneurial ecosystems (EEs) has consolidated over the last decade, one question remains unanswered: how can the sustainability orientation of EE actors facilitate the intensity and growth orientation of entrepreneurship in the ecosystem? Entrepreneurship activity relies on the sustainability orientation of the ecosystem, which is lacking in most developing countries where reaching the UN’s Sustainable Development Goals (SDGs) is the most pressing concern. Using primary data on 1789 EE actors from 17 cities in East and South-East Europe and econometric analysis techniques, we investigate the relationship between the sustainability orientation of EE actors and EE outcomes. We find that this relationship is conditional on the country’s institutional quality and is consistent for a variety of EE outcomes. Practical implications for regional policymakers and entrepreneurs are developed.

Plain English Summary

This paper finds that regions in the developing countries are able to level up in growth orientation and intensity of entrepreneurial activity with the regions in developed countries should entrepreneurial ecosystem prioritizes sustainability orientation. Most scholars agree that entrepreneurial ecosystems facilitate growth aspirations and create opportunities for entrepreneurs. However, a few studies have lately suggested that sustainability orientation of ecosystem—under specific circumstances—may actually level up growth orientation and intensity of entrepreneurial ecosystems when sustainable orientation is supported by an increase in institutional quality in developing countries. This paper goes deeper into the sustainability view of entrepreneurial ecosystems by studying cities in Eastern and South-Eastern Europe. In this region, the sustainability orientation of entrepreneurs has received increasing attention. However, as of yet, the literature has focused only on single actors (the entrepreneurs) and the development of their ventures. How the sustainability orientation of entrepreneurial ecosystem actors as a whole (including, e.g., policymakers, university professors, investors, managers of business incubators) may influence EE outcomes, and if there might be differences between developed and developing regions, remains an unaddressed gap. The aim of this study of this paper is to examine the entrepreneurial ecosystem outcomes across regions with different levels of sustainable orientation and quality of institutional environment. An important implication of our findings is that even in Europe’s least developing regions, active sustainability orientation and a marginal improvement of institutional quality are particularly pertinent for entrepreneurial ecosystems growth orientation and the rate of entrepreneurship in the ecosystem.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the rush to promote entrepreneurial activity, both policymakers and researchers have embraced the concept of the entrepreneurial ecosystem (EE) (Isenberg, 2010). A plethora of systematic empirical evidence and detailed studies has confirmed that, along with sustainable solutions for cities (Fan & Zheng, 2020; Sodiq et al., 2019), the development of EEs can enhance entrepreneurial activity and subsequently regional economic development (Qian, 2010, 2018).

Despite all the impressive progress made in the literature in defining EEs and determining their impact, the role of formal institutional quality on EE outcomes was often only a secondary aspect in the literature. One of the reasons for this glaring omission may be that the focus has generally been on the context of developed economies (Audretsch & Belitski, 2017, 2021; Content et al., 2020; Spigel, 2017; Stam & Bosma, 2015; Stam et al., 2012; Szerb et al., 2019) where a quality of formal institutions is high. Further improving formal institutional quality in developed economies will thus only slightly affect EE outcomes, while the few studies focusing on the formal institutional context in developing economies show relatively large effects (Desai et al., 2013; Estrin et al., 2013).

As the world faces an increasing number of economic, social, and environmental challenges—also known as the “grand challenges” (Audretsch et al., 2021a; Doh et al., 2019)—entrepreneurs are considered to be central actors in resolving these challenges through entrepreneurial solutions (Antolin-Lopez & Montiel, 2018; Markman et al., 2019; Volkmann et al., 2019). As the grand challenges appear worldwide, corresponding measures for supporting entrepreneurs leading to the desired EE outcomes in both developed and developing economies are needed.

Many different proxies have been used to determine EE outcomes in the literature. However, following Brown and Mason (2017), Stam (2018), and Stangler and Bell-Masterson (2015), this study is based on two basic and central proxies: EE growth orientation and EE intensity.

The purpose of this paper is to show that not all EEs are equal, and EE outcomes between developed and developing economies vary. By analyzing a novel database of 17 distinct urban EEs in the contexts of developing and developed countries of South-Eastern and Eastern Europe, the paper furthermore investigates how the sustainability orientation of EE actors shapes EE outcomes.

The paper makes three key contributions to the entrepreneurship literature. First, this paper is the first to explain and demonstrate that it is not just formal institutions which matter in shaping EE growth orientation and EE intensity but those policies and measures enhancing the sustainability of EE actors in particular. Second, in sharp contrast to the findings in the extant literature, this paper shows that developing economies with lower-quality formal institutions are not pre-empt from reaching high-level EE outcomes, as long as the orientation towards sustainability is enhanced among the entrepreneurial actors comprising the EE. A strong sustainability orientation within the EE apparently can more than offset the deleterious impact of low-quality formal institutions prevalent in the developing country context. Third, it is one of the first attempts to link the sustainability orientation of EE actors (not solely entrepreneurs) and EE outcomes with urban development. While formal institutional quality depends to a great extent on national governments, increasing the sustainability orientation of EE actors in a city can be strongly influenced by mayors and urban policymakers. Mayors and urban policymakers thus have a tool for enhancing EE outcomes, along with sustainable urban development, which can be implemented in the short term.

The remainder of this paper is set out as follows. Section 2 outlines the conceptual framework, while Sect. 3.2 presents our data and outlines our methodology. Section 4.2 conducts empirical analysis with robustness checks, and Sect. 5 discusses our major findings and concludes.

2 Conceptual framework

This paper is mainly based on the EE approach, including entrepreneurship as well as concepts of institutional quality.

Entrepreneurship generates taxable revenues and profits, creates jobs, builds new business networks (Colombo et al., 2019), develops infrastructure, and facilitates economic development (Carree & Thurik, 2010; Neumeyer et al., 2019). Additionally, as mentioned earlier, entrepreneurs play a fundamental role in solving the grand challenges the world faces (Antolin-Lopez & Montiel, 2018; Markman et al., 2019; Volkmann et al., 2019). EEs are considered to be the most suitable—if not the optimal—approach to fostering entrepreneurship (Audretsch & Belitski, 2017; Isenberg, 2011; Stam, 2015).

Exclusively focusing on the quantity of entrepreneurs as the ultimate EE outcome is insufficient (Chowdhury et al., 2019; Sobel, 2008), as both the rate and the growth orientation of entrepreneurs are important. The “more the merrier” principle does not apply to entrepreneurial activity, as an increase in entrepreneurship is not per se associated with economic growth and wealth creation (Belitski & Korosteleva, 2010; Carree & Thurik, 2010; Thurik et al., 2008). Instead of concentrating on Isenberg’s (2010) ironic question “How many entrepreneurs are enough?”, it is therefore necessary to focus on more suitable EE outcome measures.

2.1 The role of formal institutions in entrepreneurial ecosystems

There is a rich body of literature on formal institutions and entrepreneurship which covers how their interactions shape EE outcomes (Fuentelsaz et al., 2015; Raza et al., 2018). It is generally agreed that formal institutions determine the role of the game (entrepreneurial activity) in society (Leendertse et al., 2021).

Improving the quality of formal institutions helps to enhance productive entrepreneurship (Baumol, 1990, 1993; Sanders & Weitzel, 2013; Sobel, 2008). This is because honest, non-corrupt local authorities who respect property rights and the rule of law (Estrin et al., 2013) reduce the payoffs given to illegal economic activities while also fostering desirable opportunity-driven entrepreneurship. More precisely, basic formal institutions, such as property rights, business freedom, fiscal freedom, labor freedom, and financial capital tend to foster opportunity-driven entrepreneurship, while their absence stimulates the less desirable necessity-driven entrepreneurship (Fuentelsaz et al., 2015). Not explicitly being the focus of this study, the relationship between formal and informal institutions (e.g., culture and social capital) and how improvements in formal institutions may lead to changes in informal institutions (De Soysa & Jütting, 2007; Farrell & Heritier, 2003) needs to be acknowledged. With increasing quality of formal institutions, both the rate and growth orientation of entrepreneurship will increase. As rules and rights in the ecosystem are respected, more actors join the EE, and more actors reinforce their activities in supporting entrepreneurs. This is because in high-quality formal institutions, their effort and engagement are awarded correspondingly. At the same time, in high-quality formal authorities punish illegal or gray economic activities, incentivizing entrepreneurs for legal and growth-oriented entrepreneurial activity. We therefore hypothesize:

-

H1: An increase in high-quality formal institutions fosters growth orientation and intensity of EE.

2.2 Sustainability orientation as the new entrepreneurial ecosystem pillar

While the quality of the institutional environment will affect the way entrepreneurs make their choices (Baumol, 1990, 1993) and determine the intensity of EE actors, it is the sustainability orientation of the ecosystem which is a core factor (Roundy, 2017).

In addition to commercial and social orientation, entrepreneurs also respond to environmental market failure (Mair & Marti, 2006) and commit to sustainability orientation (Doherty et al., 2014; Seyfang et al., 2014). For some entrepreneurs, the new products, processes, and services sold to commercial markets are directly related to the sustainability, e.g., ICT reuse (Ongondo et al., 2013), green energy production (Huybrechts & Haugh, 2018), and eco-living communities (Kunze, 2012). In the context of an EE, we define a “sustainability orientation” as “support for pro-environmental and pro-social initiatives in community” (J. Thompson & Doherty, 2006). This reflects the degree to which a sustainability orientation is valued in society, including the awareness to protect the nature and what consequences irresponsible behavior may bring.

Sustainability orientation may not substitute for a lack of formal institutional development (Ben Youssef et al., 2018), but may start moving entrepreneurship decision-making towards more sustainable entrepreneurial activities (Fuentelsaz et al., 2015) aiming to create better environments and communities.

Building on prior (social and sustainable) EE literature (Audretsch & Belitski, 2017; Brown & Mason, 2017; Cameron, 2012; Kabbaj et al., 2016; Stam, 2015; Volkmann et al., 2019), we argue that sustainability orientation may be used as a pillar of EEs. A sustainability orientation helps to increase the level of sustainable-oriented entrepreneurial activity (Koe & Majid, 2014; Spence et al., 2011).

This is because, even if an EE is characterized by a high level of opportunity-driven entrepreneurship, it has been observed that only certain population groups participate in and profit from economic growth. As a result, groups such as, e.g., the elderly, unemployed, or lower-skilled can be left behind. Zahra et al. (2009) suggest focusing on total wealth, which is composed of economic and social wealth. As sustainability orientation (and the following behavior) may strongly influence social wealth, it needs to be included in the composition of total wealth. Sustainability policy and responsible behavior of EE actors and communities thus facilitate business growth and entrepreneurship (Meek et al., 2010) and also make it possible for entrepreneurial activity to benefit society as a whole (Koe et al., 2014; Szerb et al., 2019).

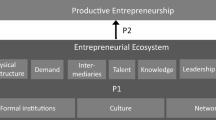

Following Cantner et al. (2020) and Isenberg’s (2011) six pillars of EE, we claim that a sustainability orientation could become the 7th and the most important pillar of EEs. The importance of adding this 7th pillar to EEs further increases, as many environmental issues are currently worsening and affecting millions—if not billions—of people, who are now asking for more sustainable solutions. Entrepreneurs bear responsibility for either solving or—at least—not worsening these issues (Eichler & Schwarz, 2019; Volkmann et al., 2019). In EE a certain transition concerning the task, role, and attitude of entrepreneurs can therefore be observed. This change in entrepreneurship did not come out of the blue. On the one hand, many entrepreneurs have experienced the devastating outcome of non-responsible behavior (Azmat & Samaratunge, 2009), increasing insolvency and hostile business environments (Desai et al., 2013). On the other hand, the effects of harming nature have become more visible to societies around the world, including entrepreneurs and EE actors. This transition can be observed today, as the previous “value capture” motivation of entrepreneurs is being replaced by “value creation” (Santos, 2012) as sustainable entrepreneurship (Schaltegger & Wagner, 2011; Volkmann et al., 2019) and social entrepreneurship (Bacq & Janssen, 2011; Lumpkin et al., 2018; Phillips et al., 2015) are the subject of greater attention by the scholars and policymakers addressing the social and environmental issues we face (Hervieux & Voltan, 2018; Kostetska & Berezyak, 2014).

Furthermore, a culture of sustainability orientation (Cohen, 2006; Sánchez-Hernández and Maldonado-Briegas 2019) includes accepting and supporting individuals attempting to start their own businesses who are pursuing environmentally-friendly and productive goals. The EE is an effective mechanism by which to share risks through collaboration, engage in joint action in addressing global challenges, and focus on activities that support various EE actors such as entrepreneurs, society, government, and investors in a Schumpeter (1934) and productive way (Baumol, 1990).

While the explanations let us assume that increasing sustainability orientation increases the growth orientation and innovativeness of entrepreneurs in the ecosystem, the existing literature does not provide many hints as to how intensity of entrepreneurship may be affected. However, as most of the grand challenges we face are of a complex nature, extensive cooperation is required between entrepreneurs and EE actors, as well as society. As sustainability awareness increases, more people will become aware of their potential to support their local EE and thus become EE actors. We therefore hypothesize:

-

H2: An increase in sustainability orientation of EE actors fosters growth orientation and intensity of EE.

2.3 Sustainability orientation compensating for weak institutions in entrepreneurial ecosystems

Following the previously derived two hypothesis, it would appear logical and straightforward for policymakers to foster formal institutional development and implement policies which enhance sustainability orientation. However, governments in developing countries may not have the financial resources to support long-term-oriented goals and also face high levels of corruption. They might thus prefer to implement changes with imminent effects for economic, social, and political reasons, focusing more on short-term goals than long-term objectives. At the same time, this may not be the best policy if they aim to develop their regional economy and stimulate opportunity-driven entrepreneurial activity, which includes sustainable and social targets (Sanders & Weitzel, 2013). Many entrepreneurs (and societies) have seen the devastating outcome of irresponsible and unsustainable behavior (Azmat & Samaratunge, 2009), which has increased insolvency and the hostility of the business environment (Desai et al., 2013), particularly in developing countries. Always more policymakers recognized this threat and aim to implement corresponding policies. The desirable outcomes of EEs nowadays are therefore productive and opportunity-driven entrepreneurship (Cantner et al., 2020; Stam, 2018). While many developed countries have managed to limit undesirable entrepreneurial activity thanks to their high-quality formal institutions, developing countries still lack the necessary governance and law enforcement (Ben Youssef et al., 2018). Despite approaching this topic at a country or even global level, an increasing number of recent studies address the topic from a city perspective (Fan & Zheng, 2020; Sodiq et al., 2019; Wang & Zheng, 2020). However, a common issue remains: policies which aim to reduce illegal economic activities and enforce anti-corruption laws mainly depend on national legislations, and the possibilities of mayors and city governments in this field are limited. Nonetheless, the given study follows the city approach and tests a new way of fostering growth orientation and intensity of EEs. To be precise, sustainability orientation as a compensation for weak formal institutions in a regional EE is examined.

While the geography of the entrepreneurship literature has provided a number of insights into the role of EE drivers (Qian et al., 2013; Stam and Ven, 2019), all these elements may be viewed as the fundamental preconditions for the introduction of sustainable innovation (Cohen, 2006; Qian, 2017). They all use sustainability as a driver for productivity-oriented entrepreneurs (Acemoglu, 1995; Desai, 2008; Desai et al., 2013; Murphy et al., 1991) in regions where institutions are weak and underdeveloped. One of the most important assumptions of the approach that enhances sustainability is to create a combination of formal and informal institutions and institutional trust (Estrin et al., 2013) to facilitate opportunity-driven entrepreneurship. Countries with formal institutions too weak to support entrepreneurship (Aidis et al., 2012; Autio et al., 2014; Belitski & Desai, 2016) will move away from formal institutions as these cannot be developed quickly due to an absence of trust (Estrin et al., 2013) and infrastructure. As such, our conceptual framework draws on institutional quality research for developing and developed countries (Chowdhury et al., 2019; Sobel, 2008).

Opportunity-oriented entrepreneurship and EE follow a long-term vision. While such a long-term orientation often prevails in developed countries, a “here and now” mentality dominates in developing countries due to high market uncertainty and risks (Aidis et al., 2008). Reasons for the missing long-term orientation in developing countries include the high share of necessity-driven entrepreneurship and a prevailing “vicious circle of unproductive entrepreneurship” (Carden, 2008, p.356). An increase in sustainable behavior offers the chance to break this vicious circle and approach the opportunity-driven entrepreneurship rates of developed countries.

Prior literature on entrepreneurship and institutions (Baumol, 1990, 1993; Qian et al., 2013) has focused on the most opportunity-driven entrepreneurs and their importance to regional entrepreneurship. In the context of developing countries, the prior literature has focused on the trade-off between different entrepreneurial activities (Desai et al., 2013). While in developed countries the bottom-up approach to EE mainly focuses on opportunity-driven and ambitious entrepreneurs (Stam, 2018; Stam et al., 2012; Stenholm et al., 2013), in developing countries, the ability to rapidly change inefficient formal regulations is limited (Aidis et al., 2008). The latter creates more regulatory uncertainty (Hoffmann et al., 2009) than security and stability.

In order to facilitate growth orientation and intensity of EEs, it is important to focus on a sustainable EE orientation (Cohen, 2006; T. A. Thompson et al., 2018) as well as improving the formal institutional environment (Sobel, 2008; Stenholm et al., 2013). The components of sustainable-oriented behavior in the ecosystem include the demand-side mechanisms such as recycling, demand for green products, veganism, and sustainable lifestyles. It also includes the supply-side mechanisms which result from socially irresponsible behavior, such as high environmental pollution due to economic activity and outdated technology, as well non-sustainable resource extraction and manufacturing. These supply-side mechanisms are particularly an issue for developing countries. As mentioned earlier, entrepreneurs bear responsibility for unsustainable behavior, as they are important actors in solving or at least mitigating the grand challenges such as the issues considered in the Sustainable Development Goals (SDGs) (Volkmann et al., 2019). The sustainability orientation therefore measures the emergence of environmental concerns and sustainable behavior by businesses and consumers that may affect a distinct type of entrepreneurial activity (Baumol, 1990). Sustainable businesses require a set of framework conditions that provide an opportune environment for enhancing sustainable and environmentally friendly innovation (Qian, 2017; Saebi et al., 2019). These framework conditions that enable more sustainable behavior include suitable conditions, “feeder” industries, and institutions.

As the sustainability orientation increases, both supply-side and demand-side mechanisms may switch entrepreneurship activity from unsustainable and market exploitation (Belitski & Grigore, 2022; Kirzner, 1973, 1999) to market exploration and creation (Desai, 2008; Schumpeter, 1934). Taken together with other components of the EE, the sustainability orientation of entrepreneurial actors in the EE can be used as a toolbox response to weak formal institutions and unstable economic development. We argue that an increase in the sustainability orientation of EE actors in economies with lower-quality formal institutions is likely to affect the growth orientation of entrepreneurs (Desai, 2008; Stam, 2015; Webb et al., 2020) towards more sustainable-oriented entrepreneurship (Estrin et al., 2013; D. Di Zhang & Swanson, 2014). Should these changes take place, economies with weak institutions will benefit more than countries with strong institutions, as in relative terms a greater share of necessity-driven entrepreneurs may switch to opportunity-driven and growth-oriented activities (Desai, 2008). This may not be the case in economies with higher-quality formal institutions, which on average have higher shares of opportunity-driven and growth-oriented entrepreneurs. A marginal increase in sustainability orientation in developed countries will affect a smaller share of entrepreneurs than in developing countries. In the sub-field of sustainable and social EE (Almeida et al., 2012; Kabbaj et al., 2016; Siddike & Kohda, 2016), there are already hints that improvement of the sustainability orientation will have a greater effect on EE outcomes in developing economies than in developed economies (Charron et al., 2014; Szerb et al., 2013). It is therefore likely that developing countries will benefit more from sustainable growth behavior, being cautious with the environment, and sustainable living (Audretsch et al., 2019). Based on this, we hypothesize:

-

H3: In countries with weak institutional quality, an increase in the sustainability orientation will have a greater effect on growth orientation and intensity of EE than in countries with relatively more developed institutions.

3 Data and methodology

3.1 Survey and data collection

To test our hypotheses, we collected data from 1789 EE actors across the following cities and countries: Warsaw (103 obs.) and Wroclaw (102 obs.) in Poland; Lviv (96 obs.) and Kyiv (120 obs.) in Ukraine; Cluj (119 obs.) and Bucharest (120 obs.) in Romania; Plovdiv (100 obs.) and Sofia (101 obs.) in Bulgaria; Astana (104 obs.) and Almaty (106 obs.) in Kazakhstan; Batumi (62 obs.) and Tbilisi (132 obs.) in Georgia; Istanbul (89 obs.) in Turkey; Klagenfurt (114 obs.) in Austria; Zagreb (115 obs.) and Osijek (105 obs.) in Croatia; and Sarajevo (103 obs.) in Bosnia and Herzegovina. The data was collected between December 2018 and February 2020. The sample was derived from the register of companies, the public authorities in each city, and from self-employed accountants, agents, and journalists. The sample compiled by the Registrar which lists every active company or self-employed individual in each city (country) is available from the Chamber of Commerce in every city. We collected information on companies and the self-employed that satisfies the requirements stipulated for EE agents. Drawing on Liu et al. (2021), our research targeted 17 cities in ten countries of Central and Eastern Europe (Poland, Austria, Ukraine), South-Eastern Europe (Romania, Bulgaria, Georgia, and Turkey), Central Asia (Kazakhstan), and the Balkan states (Croatia, Bosnia and Herzegovina). While cities in a sample may share some informal institutions, their formal institutions are very different. Five countries are part of the European Union (EU), while the other five are not. The region is characterized by the diversity of its formal and informal institutions; Poland and Romania joined the EU in 2004 and 2007, respectively, while other countries such as Ukraine, Georgia, and Bosnia and Herzegovina are preparing to join the EU in the years to come. Kazakhstan aims to reintegrate itself into the Eurasian Economic Union, while Turkey has developed stronger authoritarian power and autonomy and is seeking partnerships with Russia and the USA.

The survey development steps, research process, and quantitative analysis approach used to test our hypotheses are discussed in detail in the following section. To improve the reliability of the survey, we operationalized the measures using variables that had been successfully applied in previous research on EEs (Audretsch & Belitski, 2017) and institutions (Webb et al., 2020). Validated questions were employed to measure respondents’ understanding of EE and sustainability concepts, building on Rao and Holt (2005). The survey was pre-tested in two phases prior to data collection. First, in March 2018, the survey was submitted to a panel of 6 entrepreneurs, 6 venture capitalist, and 3 scientists located in Istanbul, Turkey, and Wroclaw, Poland, and the questions were then adjusted for clarity. Second, in October 2018, the survey was pilot-tested online with a sample of 14 entrepreneurs, two lawyers, one policymaker, and six professors to ensure that the questions were understood by the respondents and that the empirical data would satisfy the research objectives and to check the feasibility and content validity of the survey. The results from the pilot survey are not included in the data analysis.

A statistically random sample was created in which a key respondent (Kumar et al., 1993), such as a company founder, policymaker, or university professor, was invited to complete the survey. The survey included questions to verify that the respondent was the key decision-maker. After two rounds of invitations using the list of EE stakeholders across 17 cities, our response rate was 23.17%, which is slightly higher than the other enterprise surveys of 19% (Weber et al., 2015). Parametric and non-parametric tests found no evidence of response bias with regards to geographical location, sector, field, or age of the respondents.

The age structure of the dataset can be characterized as follows: 486 (27.17%) observations were from stakeholders aged 29 or under, 614 (34.32%) of observations were from stakeholders aged 30–39; 414 (23.14%) of observations were from stakeholders aged 40–49; and 200 (11.18%) of observations were from stakeholders aged 50–59. The rest of the groups were over 60 years old. Almost 85% of respondents had a university degree or above.

Our four major groups of stakeholders were entrepreneurs (33.0% of sample), university professors (9.2% of sample), policymakers (7.4% of sample), or possessed multiple affiliations and roles (35.1% of sample). Other stakeholders included investors, managers in multinational firms, technology transfer office (TTO) managers, managers in techno parks, managers in business incubators, and lawyers.

All institutional data used in this study is reported in Table 1, while all variables collected between 2018 and 2020 and correlations between the variables are presented in Table 2. Considering the few missing observations, researchers often use averaged indicators to predict the role of institutions in entrepreneurial activity. This is incorrect, as it may produce different results and causality cannot be claimed.

3.2 Dependent variables

We use two dependent variables to describe the performance of EEs, including the growth orientation and intensity of the EE, drawing on prior research by Brown and Mason (2017), Stam (2015, 2018), and Audretsch and Belitski (2017). Our first variable relates to the growth orientation of EE. We use the survey question “Entrepreneurs in my city (region) have distinct growth ambition” on the Likert scale from 1, do not agree, to 7, fully agree. The statement regarding a strong and efficient EE is associated with studies of ecosystem dynamism and high-growth firms (Stam, 2018; Stam et al., 2012; Webb et al., 2020). The average value of EE growth orientation is 4.67, and there is a standard deviation of 1.49. We expect that entrepreneurship cases substantially deviate from the productivity model, as the reality in regions with weak institutions is always much more chaotic and diverse than any framework could represent. However, our question focuses on the extent to which experts believe entrepreneurship activity and support mechanisms are allocated to produce “productive” entrepreneurs which are growth oriented. While this approach was theorized in the works of Sanders and Weitzel (2013) as well as Desai et al. (2013), it has not been empirically tested in the context of developing regions.

Our second measure of the dependent variable describes the intensity of entrepreneurial activity within an EE and is measured by the question “The number of entrepreneurs in my region (city) is growing fast” (1, do not agree; 7, fully agree). The average level of EE intensity is 4.72 with 1.57 standard deviation. Taken together our two measures represent a novel approach to measuring various aspects of EEs, building on Khyareh’s (2017) recent quality of entrepreneurship review.

3.3 Independent and control variables

Our independent variables reflect respondent’s attitudes towards the four pillars of EE, as well as their perceptions regarding institutional quality, which adds to the complex system of interactions between various elements of entrepreneurial economies in a region (Roundy et al., 2018; Stam and Ven, 2019). Our main explanatory variable, sustainability orientation, draws on the work of Kunze (2012) and Hooi et al. (2016) and is measured on the Likert scale: “There is a strong awareness of sustainability in my region/city (healthy life style, veganism, energy efficiency, sustainable growth, corporate social responsibility, climate change, recycling) which influences business and start-ups” (1, do not agree; 7, fully agree). This indicator was also used in previous studies (Hooi et al., 2016; Kuckertz & Wagner, 2010; Roxas et al., 2017; Salonen et al., 2018).

We use both continuous and a binary measures of the Global Entrepreneurship Development Index (GEDI) at a country level where entrepreneurial system is studied. An increase in the index means an increase in the quality of institutions in a country and region which may facilitate regional entrepreneurship. The GEDI is composed of three indicators which are not part of the survey and do not duplicate it. GEDI consists of three blocks or sub-indexes: entrepreneurial attitudes, entrepreneurial abilities, and entrepreneurial aspirations with 14 pillars-indicators (Acs et al., 2018a). The pillars of GEDI which represent entrepreneurial attitudes include opportunity perception by entrepreneurs, their startup skills, fear of failure and networking opportunities, and cultural support. The pillars related to entrepreneurial abilities include opportunity startups, digital capabilities and tech sector, human capital, and the level of competition. Finally, the entrepreneurial aspirations part includes product and process innovation, the extent of high growth aspiration, and internationalization by entrepreneurs. Using the final amalgam indicator, we are able to disentangle cities located in countries with low-medium to medium and high levels of GEDI. We introduce the GEDI binary variable to differentiate between the high and low quality of entrepreneurial institutions in cities. This binary variable equals one if the GEDI of a city is greater than or equal to a sample mean value of GEDI across the countries in the sample drawing on (Acs et al., 2014; Autio et al., 2014; Szerb et al., 2013, 2019). We posit that higher quality of institutions measured by the GEDI implies that cities have been able to achieve and sustain relatively higher level of institutional quality than countries with lower levels of GEDI. The development of entrepreneurship is assumed to accelerate the positive relationship between institutional quality in a city and the growth orientation and intensity of EE (Mirjam van Praag & Versloot, 2007; Venkataraman & Shane, 2000).

An interaction term between GEDI and sustainability will reveal whether regions with higher-quality entrepreneurship institutions indeed benefit less from an increase in sustainability policy than regions with weaker institutions. Other control variables that were used in this study measure the effectiveness of the various components in an ecosystem (Brown & Mason, 2017). We use control variables for the role that formal and informal networks (Motoyama & Knowlton, 2016) play in entrepreneurial activity and productive entrepreneurship. Networks can be described as a form of collaborative relationship that entrepreneurs and firms enter into with their competitors and other stakeholders (de Wit & Meyer, 1998). Following Acs et al. (2014), we control for formal and informal institutions directly. In addition, we also apply a measure of entrepreneurship-specific institutions (Acs et al., 2018a, 2018b).

We measure the efficiency of government programs intended to support entrepreneurship in a region as perceived by respondents (Chowdhury et al., 2019; Feldman & Zoller, 2012).

We control for the level of corruption measured as “There is political entrepreneurship in my city (economic activity in a strong formal and informal collaboration with local/national government to access limited ecosystem resources)” on the Likert scale 1, not at all, to 7, very much used in a region (Belitski & Desai, 2016; De Soto, 2000). This indicator describes perceptions about the use of public office for private gain, including both petty and grand forms of corruption, as well as the “capture” of the state by elites and private interests (Kaufmann et al., 2011). Further controls build on prior studies (Aidis et al., 2012; Audretsch & Belitski, 2017; Fritsch et al., 2019; Kogut & Ragin, 2006; Ostrom, 2005) and are related to the extent of media support to entrepreneurship (Stenholm et al., 2013) or entrepreneurial culture in a region (Belitski et al., 2019; Godley et al., 2019).

We use the respondent’s occupation as a set of binary variables, including gender, human capital (university degree or above), and age range (Reynolds & Curtin, 2010; Reynolds et al., 1999), as well as their perceptions of region’s embedded knowledge of sustainability and sustainable development on the Likert scale from 1, not at all, to 7, very high. We control for city agglomeration effects (Audretsch et al., 2015; Fritsch & Mueller, 2004) as a binary variable taking on the value of one if a city is a capital, zero otherwise. Capital cities are known to generate more entrepreneurship and agglomeration effects, and in the region of study, they are important centers of economic development and growth. However, markets in capital and large cities may be more competitive and therefore require more finance to enter. We interact the GEDI binary variables as a proxy for the institutional quality of entrepreneurship and the binary variable “capital city” to capture potential regional differences in the capital-periphery nexus.

3.4 Model

To test our research hypotheses, we employ ordinary least squares (OLS) regression models controlling for heteroscedasticity in standard errors. The following model was estimated:

where yi is EE intensity and growth orientation, with each variable varying from 1 (low) to 7 (very high). β and Ɵ are the parameters to be estimated, xi is a vector of independent explanatory variables including elements of EE and formal institutional proxies, while zi is a vector of control variables such as the individual characteristics of respondents and year and city-fixed effects; \({u}_{it}\) is then the error term. To address concerns of multicollinearity, we used a variance inflation factor (VIF) in all models.

4 Empirical analysis

4.1 Analysis using OLS regression model

The analyses are presented in Table 3. Specifications 1–4 explain the dependent variable EE growth orientation, while specifications 5–8 detail the dependent variable EE intensity. Starting with EE growth orientation, specification 1 only includes selected control variables (government support, media support, entrepreneurship culture, corruption, professor, multiple professions, gender, university, age, and population) as well as our main variables of interest—sustainability and GEDI. Specification 1 explains 40% of the dependent variables, and all independent variables are significant except professor, multiple, gender, and age.

Adding informal and formal networks along with financial equity and financial debt to specification 2 increases R2 to 0.46. All added variables except for formal networks are significant. GEDI index is positive and significant (β = 0.01, p < 0.01), supporting H1. In specification 3, all control variables are contained, and 47% of the regression is explained. The results of specifications 2 and 3 demonstrated a positive and significant effect of sustainability on the perception of EE growth orientation (β = 0.089, p < 0.01, spec. 1–2, Table 3), supporting H2. We also found that an increase in sustainability awareness in countries with a higher GEDI had a lower marginal increase growth orientation of EE than for countries with a lower GEDI (β = − 0.021; p < 0.05, spec. 3, Table 3), supporting H3. This means that countries with high institutional quality will benefit less from sustainability than countries where institutional quality is lower.

With regard to EE intensity, sustainability has a significant and positive effect which increases from specification 7 (β = 0.065, p < 0.01), supporting H2, while GEDI index is positive and significant as well, supporting H1. The interaction of GEDI with sustainability is negative and significant, supporting H3. This again supports the previous argument that an increase in sustainability in countries with a lower GEDI has a greater marginal increase in EE intensity than in countries with a higher GEDI (β = − 0.029; p < 0.05, spec. 7, Table 3).

4.2 Robustness check

As part of the robustness check, we used specification 4 and specification 8 in Table 3. We use a binary variable of GEDI to visualize the interaction coefficients of GEDI (below and above the mean) and the sustainability of the ecosystem actors. Figures 1 and 2 enable us to plot the predictive margins of a change in sustainability awareness and its effect on our dependent variables between regions with weak and strong institutions. Our hypothesis is supported in both figures, as we evidence for “catching up” effect for regions with lower-quality institutions should they implement sustainability policies. Interestingly, an increase in sustainability orientation allows a region with weak formal institutions to reach the same level of growth orientation of EE and its intensity as regions with strong formal institutions. While the initial conditions are different, those regions that prioritized sustainability orientation will be able to achieve the same EE performance. To some extent, sustainability orientation by stakeholders leverages the effect of weak formal institutional quality on entrepreneurship.

Figure 1 demonstrates that moving from 1 to 7 on the sustainability orientation axis for countries with a GEDI below the mean increases growth orientation of EE from 4 to almost 5. Moving from 1 to 7 for countries with a GEDI above the mean leads to an increase growth orientation of EE from about 4.5 to just above 5. The statistically significant difference in the marginal effect further supports our hypotheses.

Figure 2 illustrates the catching-up effect as well at the highest level of sustainability. An increase in sustainability orientation from 1 to 7 increases EE intensity from 4.25 to 5 for countries with a GEDI below the mean. Meanwhile, the same increases in sustainability orientation increases EE intensity only slightly (from 4.75 to 5) for countries with a GEDI above the mean. The marginal effect of an increase in sustainability orientation is thus larger for countries with weak formal institutions than for countries with strong formal institutions. Sustainability orientation compensates for the issues of weak formal institution countries and allows them to reach the same level of EE intensity as countries characterized by strong formal institutions.

5 Discussion and conclusion

In developed countries, the majority of entrepreneurs are engaged in growth-oriented activities aimed at increasing wealth and economic efficiency (Audretsch et al., 2021b; Baumol, 1990; Hitt et al., 2001). This is not always the case in developing countries (Aidis et al., 2008, 2012). This study furthers prior research in entrepreneurship and public policy, e.g., Desai et al. (2013), Desai and Acs (2007) and Minniti (2008), who have demonstrated that entrepreneurship is not inherently productive but can be split into productive, unproductive, and destructive forms. This study confirms the argument posited by these scholars that in economies with weak institutions (Belitski et al., 2022), the trade-off between productive and unproductive entrepreneurship activity is often blurred. Particularly, formal institutions are often weak or inefficient in developing economies, and they are subject to change, with high uncertainty and risks leading to regional differences in institutions (Hoffmann et al., 2009; Williams et al., 2015). In such economies, unproductive mechanisms such as corruption, informal networks, and access to resources may be required in order to enter markets and promote growth.

Entrepreneurs received a mandate from public policymakers as well as society to contribute to sustainable and social goals via sustainable and productive entrepreneurial activities (Volkmann et al., 2019) which is true for both developed and developing countries (United Nations, 2015). Our study adds to a conversation in the social entrepreneurship literature on entrepreneurs working for the “greater good” (Besser et al., 2006) and exploring entrepreneurial opportunities that would benefit the public (Bacq & Janssen, 2011). Our work also demonstrates that EEs that aim to support social entrepreneurship (Volkmann et al., 2019) are conduits for regional economic development (Audretsch et al., 2015). By applying the ecosystem perspective, the answer to the question “How can more sustainable and productive entrepreneurial activities be fostered?” is in the institutional context of regions and their orientation towards sustainable policy.

Since EEs in developed countries are characterized by strong formal institutions and contain widespread sustainable and social aspects, we argue that creating strong formal institutions in developing countries might at first appear to be the obvious way to create productive and sustainable EEs. However, establishing strong formal institutions in developing countries would require an enormous amount of time. This is because institutions are rigid and can only be improved slowly (Fritsch et al., 2019). Since many of the social and environmental issues we are facing now should have been addressed yesterday rather than today, developing countries cannot follow the same institutional “top-down” approach as developed countries.

In order to offer a solution, our study extends the existing literature on productive entrepreneurship and ecosystems (Bosma & Sternberg, 2014; Content et al., 2020), spotlighting the role of formal and informal regional institutions (Szerb et al., 2013, 2019) and sustainability policy for entrepreneurship (Eichler & Schwarz, 2019; Volkmann et al., 2019).

First, this study demonstrates that institutions are not the only key factor shaping the outcome of the EE: the sustainability orientation of EE actors was identified as also strongly influencing EE performance.

Second, this study examines the link between institutions, sustainability, and productive entrepreneurship by highlighting that the lower quality of institutions in many developing countries does not inhibit productive entrepreneurship, as long as the orientation towards sustainability is supported by ecosystem actors. A strong prevailing sustainability orientation within the EE can leverage the weak institutions and allow for a divergence of productive entrepreneurial activity between regions with different levels of institutional development.

More precisely, we found evidence in the survey data, comments, and regression analysis that increasing sustainability orientation is more effective in regions with weaker GEDI than in regions with stronger GEDI. This is because EEs in regions with lower GEDI may still include a substantial share of unproductive and destructive entrepreneurs, and thus, introducing sustainability policies to these countries and working on institutional support will have a significant incremental effect on EE outcomes. The smaller (but still worth mentioning) positive effect of sustainability orientation on EE performance in institutionally developed regions can be explained by the smaller share of necessity and unproductive entrepreneurship. Instead, in developed countries, entrepreneurs use sustainability and social aspects already in their growth ambition since both aspects are important and a prevailing aspect in society.

Our survey data thus demonstrates that there are only positive effects in fostering sustainability orientation in both institutionally more- and less-developed regions. However, greater benefits can be obtained with weaker institutions, where sustainability orientation will allow the intensity and growth orientation of EE to be expanded.

Due to an increasing focus on sustainability, entrepreneurs in countries with weak institutions will focus their business models on sustainability. In doing so, the EE outcomes of these countries may eventually converge to the EE outcomes of countries with strong institutions. A widespread sustainable and social orientation of the EE actors leads to a “bottom-up” approach to productive entrepreneurship and also sets the basis for nascent sustainable and social entrepreneurs to start off their projects (Bacq & Alt, 2018). Hertel et al., (2019, p.451) explicitly stress the importance of societal “acknowledgement of achievement” for social entrepreneurs.

While a prevailing sustainability orientation is known to have a positive impact on EE outcomes, it is also expected to boost many other sustainability related topics, enforcing the effects of sustainability policies and contributing to sustainable urban development (Kern et al., 2019; L. Zhang et al., 2018). The sustainability orientation of EE actors thus becomes the basis of productive urban entrepreneurship and a more sustainable urban development.

Our findings have the following policy implications. First, for countries with low quality of institutions, the continuing increase in sustainability may enable compliance with the Sustainable Development Goals (SDGs) in the long term. Explanations for this increase in the sustainability orientation of EE actors include both supply and demand factors. Financial austerity has created opportunities for the establishment of new social enterprises to bid for contracts to deliver out-sourced public services (Uyarra et al., 2014; Vickers et al., 2017). At the same time, entrepreneurs have responded to deficiencies in economic justice and rising societal inequality by turning to productive entrepreneurship activities in order to transform society by addressing gaps in the market and government policy failures (van Wijk et al., 2019).

Second, should policymakers adopt sustainability policies to leverage institutional voids in their countries and regions (Webb et al., 2020), they may enable further convergence in intensity and growth orientation of EEs and the creation of stronger long-term regional institutions. Third, while many benefits have been associated with EE creation (Stam, 2015, 2018) and an increase in institutional quality for entrepreneurship (Audretsch et al., 2022), EE conditions that promote sustainability orientation have yet to be secured. In our study, the sustainability orientation of EE actors is positively related to EE outcomes and further leverages the institutional voids for entrepreneurship.

Implications of our research for practice also include encouraging sustainability orientation and awareness within an EE and in particular encouraging entrepreneurs to appreciate the strategic benefits of investing resources in building relationships with all EE stakeholders. Relationships with EE agents provide conduits for information about entrepreneurial opportunities arising from market and government policy failures, ideas for how to respond to such failures, and how a competitive advantage can be secured by leveraging the benefits of collaborating with EE agents and finding sustainable solutions in the highly volatile and uncertain institutional context.

There are a number of theoretical limitations to this study. First, the equal measure of GEDI which captures the quality of formal and informal institutions, human capital, and innovation culture for entrepreneurs is not available at regional level and is only available at country level. Given the small size of countries and the major cities included in this study, we pose an assumption that country-level institutions aiming to support entrepreneurial attitudes, abilities, and aspirations are close to homogeneous between regions within the same country. The measures of GEDI pillars are different from explanatory and control variables used in the survey, due to their focus on a combination of both perceptional and observed indicators for entrepreneurship including innovation, internationalization, networks, human capital, skills, and culture supporting entrepreneurship in a country. While we agree that the measure of local institutions with Regional Entrepreneurship and Development Index (REDI) could allow to consider region-specific effects, the REDI indicator is not available for most of cities in the data which does not allow for compatible study. Further research will aim to use the regional institutional quality measures created for countries outside Europe.

Second, there could be an endogeneity issue which makes it impossible to claim the causality between the variables. In this study, the endogeneity is mainly caused by missing variables, as well as the respondent’s attitude towards the local EE which significantly affected the regression results. For a positive respondent who is optimistic about the local EE, both the independent variables (sustainability, government support, etc.) and dependent variables (EE outcomes) will have relatively high scores. If the respondent is pessimistic, their scores will be relatively low. In addition, government support and sustainability orientation may have a lagging impact on EE performance, which cannot be explored by cross-sectional data. Future studies will aim to match diverse data about the ecosystems and sustainable policy, in particular when perceptional survey data is used.

There are two main methodological limitations to this paper. The first weakness is its static focus. While all survey responses and interviews took place between the end of 2018 and the beginning of 2020, the role of time may be important, and there is a lack of detail about changes in regulation and sustainability goals over time. The second methodological weakness is the number of cities in this study.

Future research will be able to use longitudinal data to provide more detail about the variety of stakeholders and how they have been involved in changing institutions and sustainability orientation over time. Qualitative studies such as rapid ethnography, interviews with EE actors, and focus groups are needed to further investigate the factors driving the transformation of entrepreneurs from unproductive to productive and sustainable behavior. This will complement current quantitative research and will demonstrate if sustainability orientation is able to reduce the share of unproductive entrepreneurship activity in developing countries.

Data Availability

Data file in stata format is provided for replication and further research and can be accessed at https://doi.org/10.1371/journal.pone.0247609.s002.

References

Acemoglu, D. (1995). Reward structures and the allocation of talent. European Economic Review, 39(1), 17–33.

Acs, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476–494.

Acs, Z. J., Estrin, S., Mickiewicz, T., & Szerb, L. (2018a). Entrepreneurship, institutional economics, and economic growth: An ecosystem perspective. Small Business Economics, 51(2), 501–514. https://doi.org/10.1007/s11187-018-0013-9

Acs, Z. J., Szerb, L., Lafuente, E., & Lloyd, A. (2018b) Global Entrepreneurship and Development Index. Springer India

Aidis, R., Estrin, S., & Mickiewicz, T. (2008). Institutions and entrepreneurship development in Russia: A comparative perspective. Journal of Business Venturing, 23(6), 656–672.

Aidis, R., Estrin, S., & Mickiewicz, T. M. (2012). Size matters: Entrepreneurial entry and government. Small Business Economics, 39(1), 119–139.

Almeida, M., De Mello, J. M. C., & Etzkowitz, H. (2012). Social innovation in a developing country: Invention and diffusion of the Brazilian cooperative incubator. International Journal of Technology and Globalisation, 6(3), 206. https://doi.org/10.1504/IJTG.2012.048326

Antolin-Lopez, R., & Montiel, I. (2018). Entrepreneurial collective responses to sustainability-related grand challenges. In Academy of Management Proceedings (2018, 11471). Academy of Management Briarcliff Manor, NY 10510

Audretsch, D. B., & Belitski, M. (2017). Entrepreneurial ecosystems in cities: Establishing the framework conditions. The Journal of Technology Transfer, 42(5), 1030–1051. https://doi.org/10.1007/s10961-016-9473-8

Audretsch, D. B., & Belitski, M. (2021). Towards an entrepreneurial ecosystem typology for regional economic development: The role of creative class and entrepreneurship. Regional Studies, 55(4), 735–756. https://doi.org/10.1080/00343404.2020.1854711

Audretsch, D. B., Heger, D., & Veith, T. (2015). Infrastructure and entrepreneurship. Small Business Economics, 44(2), 219–230.

Audretsch, D. B., Cunningham, J. A., Kuratko, D. F., Lehmann, E. E., & Menter, M. (2019). Entrepreneurial ecosystems: Economic, technological, and societal impacts. The Journal of Technology Transfer, 44(2), 313–325.

Audretsch, D. B., Eichler, G. M., & Schwarz, E. J. (2021a). Emerging needs of social innovators and social innovation ecosystems. International Entrepreneurship and Management Journal. https://doi.org/10.1007/s11365-021-00789-9

Audretsch, D. B., Belitski, M., & Cherkas, N. (2021b). Entrepreneurial ecosystems in cities: The role of institutions. PLoS ONE, 16(3), e0247609.

Audretsch, D. B., Belitski, M., Caiazza, R., & Desai, S. (2022). The role of institutions in latent and emergent entrepreneurship. Technological Forecasting and Social Change, 174, 121263.

Autio, E., Kenney, M., Mustar, P., Siegel, D., & Wright, M. (2014). Entrepreneurial innovation: The importance of context. Research Policy, 43(7), 1097–1108.

Azmat, F., & Samaratunge, R. (2009). Responsible entrepreneurship in developing countries: Understanding the realities and complexities. Journal of Business Ethics, 90(3), 437–452. https://doi.org/10.1007/s10551-009-0054-8

Bacq, S., & Alt, E. (2018). Feeling capable and valued: A prosocial perspective on the link between empathy and social entrepreneurial intentions. Journal of Business Venturing, 33(3), 333–350. https://doi.org/10.1016/j.jbusvent.2018.01.004

Bacq, S., & Janssen, F. (2011). The multiple faces of social entrepreneurship: A review of definitional issues based on geographical and thematic criteria. Entrepreneurship & Regional Development, 23(5–6), 373–403. https://doi.org/10.1080/08985626.2011.577242

Baumol, W. (1993). Entrepreneurship, management, and the structure of payoffs. MIT Press.

Baumol, W. (1990). Entrepreneurship: Productive, unproductive, and destructive. Journal of Political Economy, 98(5), 893–921. https://econpapers.repec.org/RePEc:ucp:jpolec:v:98:y:1990:i:5:p:893-921

Belitski, M., & Desai, S. (2016). Creativity, entrepreneurship and economic development: City-level evidence on creativity spillover of entrepreneurship. The Journal of Technology Transfer, 41(6), 1354–1376.

Belitski, M., & Korosteleva, J. (2010). Entrepreneurial activity across European cities. In 50th European Regional Science Association (ERSA) Conference. Jönköping (Sweden): Louvain-la-Neuve: European Regional Science Association (ERSA)

Belitski, M., & Grigore, A. M. (2022). The economic effects of politically connected entrepreneurs on the quality and rate of regional entrepreneurship. European Planning Studies, 30(10), 1892–1918.

Belitski, M., Aginskaja, A., & Marozau, R. (2019). Commercializing university research in transition economies: Technology transfer offices or direct industrial funding? Research Policy, 48(3), 601–615.

Belitski, M., Cherkas, N., & Khlystova, O. (2022). Entrepreneurial ecosystems in conflict regions: evidence from Ukraine. The Annals of Regional Science, 1–22. https://doi.org/10.1007/s00168-022-01203-0

Ben Youssef, A., Boubaker, S., & Omri, A. (2018). Entrepreneurship and sustainability: The need for innovative and institutional solutions. Technological Forecasting and Social Change, 129, 232–241. https://doi.org/10.1016/j.techfore.2017.11.003

Besser, T. L., Miller, N., & Perkins, R. K. (2006). For the greater good: Business networks and business social responsibility to communities. Entrepreneurship and Regional Development, 18(4), 321–339.

Bosma, N., & Sternberg, R. (2014). Entrepreneurship as an urban event? Empirical evidence from European cities. Regional Studies, 48(6), 1016–1033.

Brown, R., & Mason, C. (2017). Looking inside the spiky bits: A critical review and conceptualisation of entrepreneurial ecosystems. Small Business Economics, 49(1), 11–30.

Cameron, H. (2012). Social entrepreneurs in the social innovation ecosystem BT - Social innovation: Blurring boundaries to reconfigure markets. In A. Nicholls & A. Murdock (Eds.), (pp. 199–220). London: Palgrave Macmillan UK. https://doi.org/10.1057/9780230367098_9

Cantner, U., Cunningham, J. A., Lehmann, E. E., & Menter, M. (2020). Entrepreneurial ecosystems: A dynamic lifecycle model. Small Business Economics, 1–17. https://doi.org/10.1007/s11187-020-00316-0

Carden, A. (2008). Making poor nations rich: Entrepreneurship and the process of economic development, edited by Benjamin Powell 2008 Stanford: Stanford Economics and Finance and the Independent Institute. The Review of Austrian Economics, 21(4), 355–359. https://doi.org/10.1007/s11138-008-0052-6

Carree, M. A., & Thurik, A. R. (2010). The impact of entrepreneurship on economic growth. In Handbook of entrepreneurship research (pp. 557–594). Springer

Charron, N., Dijkstra, L., & Lapuente, V. (2014). Regional governance matters: Quality of government within European Union member states. Regional Studies, 48(1), 68–90.

Chowdhury, F., Audretsch, D. B., & Belitski, M. (2019). Institutions and entrepreneurship quality. Entrepreneurship Theory and Practice, 43(1), 51–81.

Cohen, B. (2006). Sustainable valley entrepreneurial ecosystems. Business Strategy and the Environment, 15(1), 1–14. https://doi.org/10.1002/bse.428

Colombo, M. G., Dagnino, G. B., Lehmann, E. E., & Salmador, M. (2019). The governance of entrepreneurial ecosystems. Small Business Economics, 52(2), 419–428.

Content, J., Bosma, N., Jordaan, J., & Sanders, M. (2020). Entrepreneurial ecosystems, entrepreneurial activity and economic growth: New evidence from European regions. Regional Studies, 54(8), 1007–1019. https://doi.org/10.1080/00343404.2019.1680827

De Soto, H. (2000). The mystery of capital: Why capitalism triumphs in the West and fails everywhere else. Civitas Books.

De Soysa, I., & Jütting, J. (2007). Informal institutions and development: How they matter and what makes them change. Informal institutions. How social norms help or hinder development, 29–43

de Wit, B., & Meyer, R. (1998). Strategy: Process, content, context: An international perspective. Cengage Learning.

Desai, S. (2008). Essays on entrepreneurship and postconflict reconstruction. George Mason University.

Desai, S., Acs, Z. J., & Weitzel, U. (2013). A model of destructive entrepreneurship: Insight for conflict and postconflict recovery. Journal of Conflict Resolution, 57(1), 20–40.

Desai, S., & Acs, Z. J. (2007). A theory of destructive entrepreneurship. Jena economic research paper, (2007–085)

Doh, J. P., Tashman, P., & Benischke, M. H. (2019). Adapting to grand environmental challenges through collective entrepreneurship. Academy of Management Perspectives, 33(4), 450–468.

Doherty, B., Haugh, H., & Lyon, F. (2014). Social enterprises as hybrid organizations: A review and research agenda. International Journal of Management Reviews, 16(4), 417–436.

Eichler, G., & Schwarz, E. (2019). What sustainable development goals do social innovations address? A systematic review and content analysis of social innovation literature. Sustainability, 11(2), 522. https://doi.org/10.3390/su11020522

Estrin, S., Korosteleva, J., & Mickiewicz, T. (2013). Which institutions encourage entrepreneurial growth aspirations? Journal of Business Venturing, 28(4), 564–580.

Fan, Y., & Zheng, S. (2020). Dockless bike sharing alleviates road congestion by complementing subway travel Evidence from Beijing. Cities, 107, 102895. https://doi.org/10.1016/j.cities.2020.102895

Farrell, H., & Heritier, A. (2003). Formal and informal institutions under codecision: Continuous constitution-building in Europe. Governance, 16(4), 577–600. https://doi.org/10.1111/1468-0491.00229

Feldman, M., & Zoller, T. D. (2012). Dealmakers in place: Social capital connections in regional entrepreneurial economies. Regional Studies, 46(1), 23–37. https://doi.org/10.1080/00343404.2011.607808

Fritsch, M., & Mueller, P. (2004). Effects of new business formation on regional development over time. Regional Studies, 38(8), 961–975.

Fritsch, M., Sorgner, A., & Wyrwich, M. (2019). Self-employment and well-being across institutional contexts. Journal of Business Venturing, 34(6), 105946. https://doi.org/10.1016/j.jbusvent.2019.105946

Fuentelsaz, L., González, C., Maícas, J. P., & Montero, J. (2015). How different formal institutions affect opportunity and necessity entrepreneurship. BRQ Business Research Quarterly, 18(4), 246–258.

Godley, A., Morawetz, N., & Soga, L. (2019). The complementarity perspective to the entrepreneurial ecosystem taxonomy. Small Business Economics, 1–16

Hertel, C., Bacq, S., & Belz, F.-M. (2019). It takes a village to sustain a village: A social identity perspective on successful community-based enterprise creation. Academy of Management Discoveries, 5(4), 438–464. https://doi.org/10.5465/amd.2018.0153

Hervieux, C., & Voltan, A. (2018). Framing social problems in social entrepreneurship. Journal of Business Ethics, 151(2), 279–293. https://doi.org/10.1007/s10551-016-3252-1

Hitt, M. A., Ireland, R. D., Camp, S. M., & Sexton, D. L. (2001). Strategic entrepreneurship: Entrepreneurial strategies for wealth creation. Strategic Management Journal, 22(6–7), 479–491. https://doi.org/10.1002/smj.196

Hoffmann, V. H., Trautmann, T., & Hamprecht, J. (2009). Regulatory uncertainty: A reason to postpone investments? Not necessarily. Journal of Management Studies, 46(7), 1227–1253.

Hooi, H. C., Ahmad, N. H., Amran, A., & Rahman, S. A. (2016). The functional role of entrepreneurial orientation and entrepreneurial bricolage in ensuring sustainable entrepreneurship. Management Research Review, 39(12), 1616–1638. https://doi.org/10.1108/MRR-06-2015-0144

Huybrechts, B., & Haugh, H. (2018). The roles of networks in institutionalizing new hybrid organizational forms: Insights from the European renewable energy cooperative network. Organization Studies, 39(8), 1085–1108.

Isenberg, D. (2011). The entrepreneurship ecosystem strategy as a new paradigm for economic policy: Principles for cultivating entrepreneurship. Dublin: Institute of International European Affairs.

Isenberg, D. (2010). How to start an entrepreneurial revolution. Harward Business Review, 88(6)

Kabbaj, M., El OuazzaniEchHadi, K., Elmarani, J., & Lemtaoui, M. (2016). A study of the social entrepreneurship ecosystem: The case of Morocco. Journal of Developmental Entrepreneurship, 21(04), 1650021. https://doi.org/10.1142/S1084946716500217

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2011). The worldwide governance indicators: Methodology and analytical issues. Hague Journal on the Rule of Law, 3(02), 220–246. https://doi.org/10.1017/S1876404511200046

Kern, F., Rogge, K. S., & Howlett, M. (2019). Policy mixes for sustainability transitions: New approaches and insights through bridging innovation and policy studies. Research Policy, 48(10), 103832.

Khyareh, M. M. (2017). Institutions and entrepreneurship: the mediating role of corruption. World Journal of Entrepreneurship, Management and Sustainable Development

Kirzner, I. M. (1973). Entrepreneurship and competition. University of Chicago Press.

Kirzner, I. M. (1999). Creativity and/or alertness: A reconsideration of the Schumpeterian entrepreneur. The Review of Austrian Economics, 11(1–2), 5–17.

Koe, W.-L., & Majid, I. A. (2014). Socio-cultural factors and intention towards sustainable entrepreneurship. Eurasian Journal of Business and Economics, 7(13), 145–156.

Koe, W.-L., Omar, R., & Majid, I. A. (2014). Factors associated with propensity for sustainable entrepreneurship. Procedia - Social and Behavioral Sciences, 130, 65–74. https://doi.org/10.1016/j.sbspro.2014.04.009

Kogut, B., & Ragin, C. (2006). Exploring complexity when diversity is limited: Institutional complementarity in theories of rule of law and national systems revisited. European Management Review, 3(1), 44–59. https://doi.org/10.1057/palgrave.emr.1500048

Kostetska, I., & Berezyak, I. (2014). Social entrepreneurship as an innovative solution mechanism of social problems of society. Management Theory and Studies for Rural Business and Infrastructure Development, 36(3), 569–577.

Kuckertz, A., & Wagner, M. (2010). The influence of sustainability orientation on entrepreneurial intentions — Investigating the role of business experience. Journal of Business Venturing, 25(5), 524–539. https://doi.org/10.1016/j.jbusvent.2009.09.001

Kumar, N., Stern, L. W., & Anderson, J. C. (1993). Conducting interorganizational research using key informants. Academy of Management Journal, 36(6), 1633–1651.

Kunze, I. (2012). Social innovations for communal and ecological living: Lessons from sustainability research and observations in intentional communities. Communal Societies: Journal of the Communal Studies Association, 32(1), 50–67.

Leendertse, J., Schrijvers, M., & Stam, E. (2021). Measure twice, cut once: Entrepreneurial ecosystem metrics. Research Policy, 104336

Liu, S., Qian, H., & Haynes, K. E. (2021). Entrepreneurship in small cities: Evidence from US micropolitan areas. Economic Development Quarterly, 35(1), 3–21.

Lumpkin, G. T., Bacq, S., & Pidduck, R. J. (2018). Where change happens: Community-level phenomena in social entrepreneurship research. Journal of Small Business Management, 56(1), 24–50. https://doi.org/10.1111/jsbm.12379

Mair, J., & Marti, I. (2006). Social entrepreneurship research: A source of explanation, prediction, and delight. Journal of World Business, 41(1), 36–44.

Markman, G. D., Waldron, T. L., Gianiodis, P. T., & Espina, M. I. (2019). E pluribus unum: Impact entrepreneurship as a solution to grand challenges. Academy of Management Perspectives, 33(4), 371–382.

Meek, W. R., Pacheco, D. F., & York, J. G. (2010). The impact of social norms on entrepreneurial action: Evidence from the environmental entrepreneurship context. Journal of Business Venturing, 25(5), 493–509. https://doi.org/10.1016/j.jbusvent.2009.09.007

Minniti, M. (2008). The role of government policy on entrepreneurial activity: Productive, unproductive, or destructive? Entrepreneurship Theory and Practice, 32(5), 779–790. https://doi.org/10.1111/j.1540-6520.2008.00255.x

Mirjam van Praag, C., & Versloot, P. H. (2007). What is the value of entrepreneurship? A review of recent research. Small Business Economics, 29(4), 351–382.

Motoyama, Y., & Knowlton, K. (2016). From resource munificence to ecosystem integration: The case of government sponsorship in St. Louis. Entrepreneurship & Regional Development, 28(5–6), 448–470.

Murphy, K. M., Shleifer, A., & Vishny, R. W. (1991). The allocation of talent: Implications for growth. The Quarterly Journal of Economics, 106(2), 503–530.

Neumeyer, X., Santos, S. C., & Morris, M. H. (2019). Who is left out: Exploring social boundaries in entrepreneurial ecosystems. The Journal of Technology Transfer, 44(2), 462–484.

Ongondo, F. O., Williams, I. D., Dietrich, J., & Carroll, C. (2013). ICT reuse in socio-economic enterprises. Waste Management, 33(12), 2600–2606.

Ostrom, E. (2005). Doing institutional analysis digging deeper than markets and hierarchies. In Handbook of New Institutional Economics (pp. 819–848). Berlin/Heidelberg: Springer-Verlag. https://doi.org/10.1007/0-387-25092-1_31

Phillips, W., Lee, H., Ghobadian, A., O’Regan, N., & James, P. (2015). Social innovation and social entrepreneurship. Group & Organization Management, 40(3), 428–461. https://doi.org/10.1177/1059601114560063

Qian, H. (2010). Talent, creativity and regional economic performance: The case of China. The Annals of Regional Science, 45(1), 133–156.

Qian, H. (2017). Skills and knowledge-based entrepreneurship: Evidence from US cities. Regional Studies, 51(10), 1469–1482.

Qian, H. (2018). Knowledge-based regional economic development: A synthetic review of knowledge spillovers, entrepreneurship, and entrepreneurial ecosystems. Economic Development Quarterly, 32(2), 163–176.

Qian, H., Acs, Z. J., & Stough, R. R. (2013). Regional systems of entrepreneurship: The nexus of human capital, knowledge and new firm formation. Journal of Economic Geography, 13(4), 559–587. https://doi.org/10.1093/jeg/lbs009

Rao, P., & Holt, D. (2005). Do green supply chains lead to competitiveness and economic performance? International journal of operations & production management

Raza, A., Muffatto, M., & Saeed, S. (2018). The influence of formal institutions on the relationship between entrepreneurial readiness and entrepreneurial behaviour: A cross-country analysis. Journal of small business and enterprise development

Reynolds, P. D., & Curtin, R. T. (2010). New business creation: An international overview (Vol. 27). Springer Science & Business Media

Reynolds, P. D., Hay, M., & Camp, S. M. (1999). Global entrepreneurship monitor. Kansas City, Missouri: Kauffman Center for Entrepreneurial Leadership.

Roundy, P. T. (2017). Social entrepreneurship and entrepreneurial ecosystems complementary or disjoint phenomena? International Journal of Social Economics, 44(9), 1252–1267. https://doi.org/10.1108/IJSE-02-2016-0045

Roundy, P. T., Bradshaw, M., & Brockman, B. K. (2018). The emergence of entrepreneurial ecosystems: A complex adaptive systems approach. Journal of Business Research, 86, 1–10.

Roxas, B., Ashill, N., & Chadee, D. (2017). Effects of entrepreneurial and environmental sustainability orientations on firm performance: A study of small businesses in the Philippines. Journal of Small Business Management, 55, 163–178. https://doi.org/10.1111/jsbm.12259

Saebi, T., Foss, N. J., & Linder, S. (2019). Social entrepreneurship research: Past achievements and future promises. Journal of Management, 45(1), 70–95.

Salonen, A., Siirilä, J., & Valtonen, M. (2018). Sustainable living in Finland: Combating climate change in everyday life. Sustainability, 10(2), 104. https://doi.org/10.3390/su10010104

Sánchez-Hernández, & Maldonado-Briegas. (2019). Sustainable entrepreneurial culture programs promoting social responsibility: A European regional experience. Sustainability, 11(13), 3625. https://doi.org/10.3390/su11133625

Sanders, M., & Weitzel, U. (2013). Misallocation of entrepreneurial talent in postconflict environments. Journal of Conflict Resolution, 57(1), 41–64.

Santos, F. M. (2012). A positive theory of social entrepreneurship. Journal of Business Ethics, 111(3), 335–351. https://doi.org/10.1007/s10551-012-1413-4

Schaltegger, S., & Wagner, M. (2011). Sustainable entrepreneurship and sustainability innovation: Categories and interactions. Business Strategy and the Environment, 20(4), 222–237.

Schumpeter, J. (1934). The theory of economic development Harvard University Press. Cambridge, MA: UK.

Seyfang, G., Hielscher, S., Hargreaves, T., Martiskainen, M., & Smith, A. (2014). A grassroots sustainable energy niche? Reflections on community energy in the UK. Environmental Innovation and Societal Transitions, 13, 21–44.

Shepherd, D. A., & Patzelt, H. (2011). The new field of sustainable entrepreneurship: Studying entrepreneurial action linking “What is to be sustained” with “What is to be developed.” Entrepreneurship Theory and Practice, 35(1), 137–163. https://doi.org/10.1111/j.1540-6520.2010.00426.x

Siddike, A. K., & Kohda, Y. (2016). Towards a service system for social innovation in education: A possible application of MOOCs. Knowledge Management and E-Learning, 8(1), 124–137. https://www.scopus.com/inward/record.uri?eid=2-s2.0-84963955057%7B&%7DpartnerID=40%7B&%7Dmd5=31451ee529e0111041d9424e8dd5035f

Sobel, R. S. (2008). Testing Baumol: Institutional quality and the productivity of entrepreneurship. Journal of Business Venturing, 23(6), 641–655. https://doi.org/10.1016/j.jbusvent.2008.01.004

Sodiq, A., Baloch, A. A. B., Khan, S. A., Sezer, N., Mahmoud, S., Jama, M., & Abdelaal, A. (2019). Towards modern sustainable cities: Review of sustainability principles and trends. Journal of Cleaner Production, 227, 972–1001.

Spence, M., Gherib, B. B., & J., & OndouaBiwolé, V. (2011). Sustainable entrepreneurship: Is entrepreneurial will enough? A north–south comparison. Journal of Business Ethics, 99(3), 335–367. https://doi.org/10.1007/s10551-010-0656-1

Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory and Practice, 41(1), 49–72. https://doi.org/10.1111/etap.12167

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23(9), 1759–1769. https://doi.org/10.1080/09654313.2015.1061484

Stam, E. (2018). Measuring entrepreneurial ecosystems. Entrepreneurial ecosystems (pp. 173–197). Springer.

Stam, E., & van de Ven, A. (2019). Entrepreneurial ecosystem elements. Small Business Economics, 56(2), 809–832. https://doi.org/10.1007/s11187-019-00270-6

Stam, E., & Bosma, N. (2015). Local policies for high-growth firms. The Oxford handbook of local competitiveness, 286–305

Stam, E., Bosma, N., Van Witteloostuijn, A., De Jong, J., Bogaert, S., Edwards, N., & Jaspers, F. (2012). Ambitious entrepreneurship: A review of the academic literature and directions for public policy (1–162). Den Haag: Advisory Council for Science and Technology Policy.

Stangler, D., & Bell-Masterson, J. (2015). Measuring an entrepreneurial ecosystem. Kauffman Foundation. Online at: https://papers. ssrn. com/sol3/papers. cfm

Stenholm, P., Acs, Z. J., & Wuebker, R. (2013). Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing, 28(1), 176–193.

Szerb, L., Lafuente, E., Horváth, K., & Páger, B. (2019). The relevance of quantity and quality entrepreneurship for regional performance: The moderating role of the entrepreneurial ecosystem. Regional Studies, 53(9), 1308–1320. https://doi.org/10.1080/00343404.2018.1510481