Abstract

We examine preference for randomization, and link it to conflicting preference-led indecisiveness in social settings. In an ultimatum game experiment where receivers may face conflicting preferences between material gains and equity, we allow receivers to assign non-zero probabilities to both acceptance and rejection (the randomized choice) in addition to the standard binary choice of acceptance or rejection. We further elicit receivers’ willingness to pay for using the randomized choice instead of the binary choice. We find that a theoretical model incorporating receivers’ conflicting preferences explains the experimental results well: most receivers randomized actively between acceptance and rejection, and many were willing to pay for randomization. Our results suggest that allowing people to randomize when making choices with conflicting preferences may improve individual welfare.

Similar content being viewed by others

1 Introduction

Indecisiveness is commonly experienced in real life. From personal decisions, such as enrolling in retirement benefit plan or signing advance medical directive, to social decisions, such as which presidential candidate to vote for or whether to support the admission and resettlement of refugees in one’s country in a referendum, people are often unable to make a firm decision. For many of these decisions, indecisiveness may arise because people are unable to resolve internal conflicts from weighing some important preferences against others (Dubra et al., 2004; Eliaz & Ok, 2006; Levi, 1986; Ok, 2002; Ok et al., 2012; Sen, 1997). As a result, they may postpone a decision, refuse to make a decision, or change their minds about a decision repeatedly (Agranov & Ortoleva, 2017; Danan & Ziegelmeyer, 2006; Tversky & Shafir, 1992).

Studying indecisiveness is challenging because underlying preferences are not directly observable and indecisiveness is commonly associated with the inability to make choices. According to the revealed preference approach, preferences are assumed to be complete once a choice is made, ignoring whether the choice is made with confidence or not (Mandler, 2005).Footnote 1 To examine unobservable underlying incomplete preferences from observable revealed complete preferences, we follow Nishimura and Ok (2018) and link underlying conflicting preferences with revealed preference for randomization: the unobservable and potentially incomplete preferences are captured by multiple utility functions (Dubra et al., 2004; Galaabaatar & Karni, 2013; Ok et al., 2012) and the revealed complete preferences are obtained through a cautious completion of the underlying incomplete preferences (Cerreia-Vioglio, 2009; Cerreia-Vioglio et al., 2015; Qiu, 2015; Richter & Rubinstein, 2017). We demonstrate that individuals prefer to randomize when they are indecisive but forced to make a decision, consistent with the common assumption in the incomplete preference literature (Bewley, 2002; Cettolin & Riedl, 2019). Moreover, they randomize more for choices with strong conflicting preferences and are willing to pay more to randomize for those choices.

To illustrate how conflicting preferences may drive preference for randomization, we examine the indecisiveness of the receiver in an ultimatum game where she faces two conflicting preferences: maximizing own earnings versus being treated fairly (Camerer & Thaler, 1995; Nowak et al., 2000; Sanfey et al., 2003). Our study departs from standard ultimatum games by allowing the receiver to make the randomized choice of assigning non-zero probabilities to both acceptance and rejection besides the standard binary choice of either acceptance or rejection. We utilize the strategy method to obtain the receiver’s randomized choice for each allocation where conflict is likely to occur (unequal offer), and observe how the probability of acceptance varies with the level of conflict. To distinguish indecisiveness from indifference, we elicit the receiver’s willingness to pay (WTP) for randomization.

Standard decision models assuming complete preferences predict that the receiver in the ultimatum game assigns non-zero probabilities to both acceptance and rejection at most once at the allocation where the receiver is indifferent and never pays to randomize. In contrast, if the receiver’s preference is incomplete due to conflict in trading off material payoff with fairness and the receiver makes decisions using cautious rules, she will reveal indecisiveness through randomization, and the way she randomizes varies systematically with the share offered to her. Furthermore, the receiver is willing to pay to implement the randomized choice as her final choice because the randomized choice allows her to “hedge” across conflicting preferences and gives a higher decision utility than the binary choice. We elaborate this point in Section 2.2.

We have two main findings. First, the vast majority of receivers (86.5%) randomized over two allocations or more and acceptance probability in the randomized choice varied positively with the share for the receiver. These results are consistent with predictions from models of incomplete preferences and inconsistent with models of complete preferences. We also show that receivers may face strong conflict at the allocations where they switch between rejection and acceptance, and they were more likely to randomize at these allocations compared to other unequal allocations. Second, a large majority of receivers who randomized (66%) were willing to pay a strictly positive amount of money for randomization and they were willing to pay more for randomization choices with acceptance probability around 0.5. This finding shows that the randomized choices made by the receivers are not cheap talk but deliberate and meaningful. The extensive use of randomization suggests that complete preferences may be less prevalent than commonly believed in scenarios involving conflicting preferences such as in the ultimatum game, and that indecisiveness is a common human behavior not to be neglected.

Our paper builds on recent experiments demonstrating behaviors that are consistent with indecisiveness. Experimental participants were found to deliberately randomize in repeated choices even when they were explicitly told that the choice set in each decision was the same (Agranov & Ortoleva, 2017). They preferred to postpone their decisions (Costa-Gomes et al., 2022; Danan & Ziegelmeyer, 2006; Gerasimou, 2017), delegate decision-making (Cettolin & Riedl, 2019; Dwenger et al., 2018), or report low confidence in their choice (Cubitt et al., 2015) when they were allowed to do so. See Bayrak and Hey (2020b) for a recent review. While these studies used monetary lotteries to examine indecisiveness, we chose the ultimatum game instead of monetary lotteries as the workhorse because conflicting social preferences are among the most important reasons for indecisiveness in real life. Furthermore, three design features of our experiment allow us to more directly examine indecisiveness and rule out alternative explanations. First, in the ultimatum game the receiver’s payoff following acceptance or rejection is certain, hence the randomized choice is a simple lottery. This avoids the confounding effect of making the randomized choice due to violations of rules to reduce compound lotteries. Second, the receiver in the ultimatum game faces no risk following acceptance or rejection, while regret arises only when an individual faces prospects of which at least one is risky and the realized outcome of the chosen prospect is worse than the realized outcome of the unchosen prospect(s). Since choosing acceptance or rejection does not induce regret, the receiver will not use the randomized choice to avoid regret. Third, the WTP for randomized choice over binary choice is elicited, and a positive WTP strictly discriminates indecisiveness from indifference.

Our approach of modelling indecisiveness is related to recent models incorporating preference uncertainty or imprecision. Fudenberg et al. (2015) axiomatized a choice rule called additive perturbed utility. In their model, the individual faces preference uncertainty and is averse to it. The individual may prefer to randomize because it allows her to balance the probability of errors due to preference uncertainty against the cost of avoiding them (Fudenberg et al., 2015, p.2373). Arts et al. (2020) captured an individual’s preference uncertainty by a set of utility functions. They showed that when the individual is averse to preference uncertainty in the sense of Klibanoff et al. (2005) and Cerreia-Vioglio et al. (2015), she may prefer to randomize to reconcile the disagreement among the different utility functions. There are also models that focus on examining preference uncertainty over lotteries. Bayrak and Hey (2015) considered preference imprecision arising from the individual’s vague understanding of numerical probabilities. When combined with the \(\alpha\) maxmin criterium (Arrow & Hurwicz, 1972; Hurwicz, 1951), Bayrak and Hey (2015) showed that their model could explain preference reversals and other economic anomalies. Cerreia-Vioglio et al. (2019) studied deliberate stochastic choices and characterized a model of Cautious Expected Utility preferences over lotteries. They predict a preference for randomization when the individual faces non-degenerated lotteries. In the dispersion and skewness theory, Bayrak and Hey (2020a) assumed that an individual has a distribution of utilities about a lottery, and she considers the dispersion and skewness of this utility distribution in addition to the standard expected utility. As randomization affects the dispersion and skewness of the utility distribution, she may prefer to randomize under certain conditions (more specifically, in the lower-right area of the Machina-Marshak triangle, see Figs. 2 and 3 in Bayrak and Hey 2020a).

Our study is also connected to the experimental literature demonstrating a preference for randomization in social decisions (see e.g., Bohnet et al., 2008; Bolton and Ockenfels, 2010; Brock et al., 2013; Cappelen et al., 2013; Krawczyk and Lec, 2016; Rohde and Rohde, 2011). Sandroni et al. (2013) observed that a third of the dictators preferred to flip a coin to decide between two allocations, of which one would give them a larger amount, and they showed that the players’ randomization behavior violated most decision theories. Karni et al. (2008) allowed dictators to allocate an indivisible good probabilistically among three equally deserving players including themselves and found that many dictators were willing to sacrifice their own probability of winning for a fairer overall allocation procedure. Krawczyk and Lec (2010) found that dictators were willing to share an average 5% to 18% chance to win a prize with a dummy player. Miao and Zhong (2018) allowed dictators to randomize between two allocations varying in inequality and efficiency to reveal the trade-off between ex ante and ex post fairness preferences. These studies focused on the dictator game and had a different research question. Most importantly, they did not elicit the WTP for randomization, which is crucial for differentiating indecisiveness from indifference.

Our paper proceeds as follows. Section 2 reports the experimental design. Section 2.2 derives predictions under models of incomplete preference. Experimental results are reported in Section 3. Finally, Section 4 concludes and provides some general discussions.

2 Experimental design and analysis

Similar to the standard ultimatum game, a proposer makes a proposal to divide €20 with a receiver. Both players receive the proposed allocation if the receiver accepts and nothing otherwise. As the proposer faces strategic uncertainty in his decision, we focus on the choices made by the receiver to examine indecisiveness arising from conflicting preferences. Hence, below we will only describe the choices faced by the receiver. The proposer’s choices, unless they are directly relevant to explain the receiver’s choices, are elaborated in Appendix D.Footnote 2

2.1 Structure of the experiment

The proposer faces ten pairs of allocations in random order, each comprised of an equal allocation (€10, €10) and an unequal allocation favoring the proposer, (€20 – a, €a), where a is the receiver’s share and \(a=0,1,2,...,9\). For each allocation pair, the proposer can either offer to the receiver the equal allocation or the unequal allocation. At the same time, the receiver has to decide whether to accept or reject each possible offer that could be made by the proposer. After all the decisions are made, one pair of allocations is randomly selected, and the receiver’s decisions for that pair of allocations are matched to the proposer’s decision for the same pair to determine the outcome of the game. The following paragraphs detail the three stages of decision-making faced by the receiver.

Stage 1: Binary choice

In this stage, we elicit the receiver’s binary choices via the strategy method (see, e.g., Brandts and Charness 2011; Selten 1967). The receiver has to make a decision about each offer that could be proposed by the proposer. For each possible pair of allocations (€10, €10) and (€20 – a, €a), \(a=0,1,2,...,9\), the receiver has to decide whether to reject or accept if the proposer proposes the unequal allocation. To elicit the receiver’s choice when the proposer chooses an equal allocation, the receiver is additionally asked to decide, for any pair of allocations, (€10, €10) and (€20 – a, €a), whether to reject or accept if the proposer proposes the equal allocation. In total, the receiver makes 11 binary choices in a random sequence.

Stage 2: Randomized choice

The randomized choices are also elicited via the strategy method. The receiver is told that instead of choosing either acceptance or rejection, she can assign a probability p to acceptance and \(1.0-p\) to rejection to each possible offer, where \(0\le p\le 1.0\). The value of p is the probability according to which payoffs are determined if the receiver chooses to accept the allocation, and \(1-p\) is the probability according to which payoffs are determined if the receiver chooses to reject the allocation. For example, if the receiver indicates a decision \((40\%,\,\textrm{Acceptance};\;60\%,\,\textrm{Rejection})\) for an unequal offer, the receiver stands a 40% chance of accepting the unequal allocation and a 60% chance of rejecting it. Probabilities are presented in 10% increments, and thus the receiver can choose \(p=\{0,10\%,20\%,30\%,...,100\%\}\) by moving a slider. Figure 1 provides an illustration of the receiver’s decision screen. In total, the receiver makes 11 randomized choices in a random sequence.

Stage 3: Eliciting willingness to pay

In Stage 3, we elicit the receiver’s WTP for the randomized choice. First, one pair of allocations (an equal allocation and an unequal allocation) is randomly selected and revealed to the receiver. The receiver is informed that the decisions made for this pair of allocations will be used to determine the final payment. Given this information, the receiver then makes two WTP decisions, first assuming that the proposer proposes the unequal allocation, then assuming that the proposer proposes the equal allocation. We elicit the receiver’s WTP for just one randomly chosen allocation to avoid experimental fatigue and experimenter demand effects. If a systematic relationship between the WTP and the randomization probability emerges across participants, we are more confident that the WTP reflects the added value of randomized choice over the binary choice, and the WTP and randomization choices are deliberate rather than an artifact of the experimenter demand effects.

Figure 2 shows the decision screen for the scenario where the proposer proposes the unequal allocation. The top panel reports the pair of allocations faced by the proposer and her decision to make the unequal offer to the receiver. To help the receiver recall her decisions, this panel also reports the receiver’s binary choice and her randomized choice in Stage 1 and Stage 2 for the corresponding offer. The bottom panel implements the Becker-DeGroot-Marschak mechanism (Becker et al., 1964) in a multiple price list with 11 rows, each of which requires a decision from the receiver. In each row, the fee to use the randomized choice is specified in the first column. For each row, the receiver has to choose if she is willing to pay the stated fee to implement the randomized choice instead of the binary choice to determine the final payoff. While not stated in this figure, the receiver is told in an earlier instruction screen that the binary choice is free of charge. The fee to use the randomized choice ranges from €0 to €2, with an increment of €0.20.

The receiver is informed that the computer will match her responses to the actual offer made by the proposer. One row of the multiple price list will be randomly chosen by the computer, and the chosen option in that row will determine whether the randomized choice is implemented and the corresponding fee for doing so.

Experimental implementation

The experiment was run at the DISCON lab at Radboud University. Recruitment was via ORSEE (Greiner, 2015). The experiment lasted about one hour, and the average payment was €11.53. We conducted eight sessions with 192 subjects in total.Footnote 3

2.2 Theoretical predictions

By the independence axiom of EUT, it is obvious that \(p\in (0,1)\) occurs only when receivers are indifferent between A and R, and the WTP \(=0\) for all p. In fact, any models which satisfy betweenness, a requirement weaker than the independence axiom, would make the same prediction (Chew, 1983, 1989; Dekel, 1986; Gul, 1991).Footnote 4 This prediction also applies to some popular non-EUT models such as CPT (Tversky & Kahneman, 1992) and RDU (Quiggin, 1982).Footnote 5

Below we derive the benchmark solutions by exploiting Nishimura and Ok (2018) preference structures model. There are two core elements in this model: the unobservable potentially incomplete underlying preferences, which we capture by models of incomplete preference (Dubra et al., 2004; Galaabaatar & Karni, 2013; Ok et al., 2012); and a revealed complete preference, which we obtain via the maxmin rule—a cautious completion—of the underlying incomplete preferences (Gilboa & Schmeidler, 1989; Wald, 1949). The two preferences satisfy the four properties of a preference structure in Nishimura and Ok (2018): (i) the underlying preference is reflexive and transitive but not necessarily complete, (ii) the revealed preference is by definition complete, (iii) the revealed preference extends from the underlying preference since the former is a cautious completion of the latter, and finally (iv) the revealed preference is transitive with respect to the underlying preference. We show that according to this approach, the receiver may have a strict preference for randomization when she is indecisive.

Our main interest is to examine the underlying, potentially incomplete preferences of the receiver. When the receiver’s underlying preference is incomplete, Dubra et al. (2004) suggest that there exists a set \(\left\{ u_{\tau }\right\} _{\tau \in \varGamma }\) of real functions such that, for all options \(l_{1}\) and \(l_{2}\),

where \(EU(u_{\tau },l)\) denotes the expected utility of l given the utility function \(u_{\tau }\). The literature suggests that the receiver in an ultimatum game faces mainly two conflicting preferences: maximizing own earnings versus being treated fairly (Camerer & Thaler, 1995; Nowak et al., 2000; Sanfey et al., 2003). Following the literature, we assume the receiver has two selves: a material payoff-driven self and an inequity-averse self. The material payoff-driven self evaluates the allocation \((20-a,a)\), where a stands for the payoff of the receiver, as:

The inequity-averse self, on the other hand, cares only about the difference in the payoffs between the two players, which is captured by \(|20-2a|.\) Following Fehr and Schmidt (1999) and noticing that in our experimental design the receiver faces an equal or less favorable payoff than the proposer (\(20-a\ge a\)), we write the utility function of the inequity-averse self as

where \(k>0\) is a level parameter that makes the utilities of the two selves comparable and \(\gamma\) captures the individual’s sensitivity to inequity.Footnote 6

The receiver in our experiment is required to make a decision, whether or not she is indecisive, and thus her revealed preference is necessarily complete. To link the receiver’s revealed complete preferences to her underlying incomplete preferences, we need models that explicitly acknowledge indecisiveness, in the sense of having a set of utility functions, and propose rules to complete the underlying preference in order to make the final decision. In this paper we assume that the receiver dislikes indecisiveness and behaves cautiously in her aggregation of selves. The receiver dislikes indecisiveness because aggregating across selves is similar to reaching consensus among individuals with different opinions, and it takes time and cognitive efforts to resolve conflicts when her two selves disagree with each other.

We use the maxmin rule (Wald, 1949; Gilboa & Schmeidler, 1989)—a popular cautious rule—to obtain the benchmark solution. According to the maxmin rule, the receiver uses the expected utility of the most pessimistic utility function to evaluate options. Specifically, an option l is then evaluated as

Note that when the receiver chooses an option based on the maxmin rule, her revealed preference appears complete, but her underlying preference remains incomplete. The receiver remains conflicted between self-interest and inequity aversion. A manifestation of this indecisiveness is the continuing presence of \(u_{S}\) and \(u_{F}\), and her inability to aggregate the two selves into a unique utility function \(u(20-a,a)\).

We provide a simple numerical example in Table 1 to illustrate the intuition before proceeding to the general derivation. In this example, the material payoff-driven self has a utility of 5 if the receiver accepts the offer, and 0 otherwise. The inequity-averse self, on the other hand, has a utility of 5 if the receiver rejects the offer, and 0 if she accepts the offer. Applying the maxmin rule, there exists a unique \(p^{*}=0.5\) maximizing the decision utility of the randomized choice such that the decision utility of the randomized choice is higher than the decision utility of either accepting or rejecting the offer, \(V(0.5,A;0.5,R)=2.5>V(A)=V(R)=0\). Thus, by randomizing between A and R, the receiver benefits from “hedging” across selves and is strictly better off (Cerreia-Vioglio, 2009; Cerreia-Vioglio et al., 2019).

We now proceed to derive two propositions, restricting our attention to allocations where \(u_{F}(20-a,a)<u_{S}(20-a,a)\).Footnote 7 Applying the maxmin rule, the decision utility of acceptance is:

The decision utility of rejection is:

The decision utility of a randomized choice \((p,A;1-p,R)\) is:

Comparing the decision utility from the randomized choice with the decision utility from the binary choice of either acceptance or rejection, we derive the following propositions that link indecisiveness directly to acceptance probability. Proofs are in Appendix A.

Proposition 1

When the receiver is indecisive and relatively sensitive to inequity \((\gamma >\frac{1}{2})\), for allocations such that \(u_{F}(20-a,a)<u_{S}(20-a,a)\) she has a strict preference for randomization over rejection or acceptance, and the optimal acceptance probability increases with the receiver’s share.

Proposition 2

When the receiver is indecisive and relatively sensitive to inequity \((\gamma >\frac{1}{2})\), the WTP for the use of the randomized choice has an inverse U-shape relationship with optimal acceptance probability.

3 Results

We present our experimental results in the following order. In Section 3.1, we examine the receivers’ binary and randomized choices. We show that most receivers’ decisions were consistent with the propositions derived from our benchmark solutions. In Section 3.2, we show that many receivers are willing to pay for randomization, implying that there are gains in decision utility from making randomized choice. Finally, we briefly summarize the results for proposers in Section 3.3.

3.1 Binary and randomized choices

Before we begin to examine indecisiveness, we first establish the comparability of our study and the stylized findings in ultimatum game experiments. Similar to earlier findings on ultimatum games, such as Camerer and Thaler (1995) and Roth (1995), we find that acceptance rate fell sharply once the allocation offered to the receiver fell to 20% of the total sum or less. The checked boxes in Fig. 3 show the acceptance rates in the binary choices by each possible offer. Only one third of the receivers (34%) accepted in the binary choice when 20% of the total sum (€4) was offered. At €5, half of the receivers were willing to accept the allocation. Overall, our results are comparable with the results of other ultimatum game experiments, and hence indecisive behavior in our experiment is unlikely to be unique to our sample.

Next we proceed to the analysis of the randomized choice. We show that receivers’ behavior was inconsistent with the standard models of complete preferences by reporting the number of times receivers chose \(0<p<1\) in Stage 2. Standard models assuming complete preferences predict that receivers randomize at most over one allocation where they are indifferent between acceptance and rejection. Randomizing over multiple allocations will be inconsistent with that prediction.

Result 1

Inconsistent with the prediction of standard models, the majority of receivers (86.5%) randomized over two allocations or more.

Support: We find that 86.5% (83 out of 96 receivers) of receivers randomized over at least two allocations and only 13.5% could have had complete preferences. The average number of allocations where receivers randomized was approximately 5 out of 11 allocations. The results suggest the vast majority of receivers displayed some degree of indecisiveness. We provide the detailed breakdown of the receivers’ binary and randomized choices for each possible offer in Table 3 in Appendix B.

While the first result is inconsistent with standard models, it is not sufficient to show indecisiveness. To infer indecisiveness, we examine the consistency of receivers’ behavior with Proposition 1.

Result 2

Consistent with the indecisive behavior specified in Proposition 1, the acceptance probability in randomized choice increased with receivers’ share.

Support: Figure 3 reports receivers’ probability of acceptance for each possible offer. The boxplot shows that in aggregate, the probability of acceptance increases as the share allocated to the receiver increases. More precisely, the median acceptance probability becomes greater than zero when the share allocated to the receiver increases to €3. The median acceptance probabilities were 0.1 when the receiver’s share was €3, 0.3 for €4, 0.6 for €5, 0.7 for €6, and 0.8 for €7 respectively. The median acceptance probability reaches 1.0 when the share allocated to the receiver increases to €8 or higher. The findings are similar for average acceptance probability.

We also checked the consistency of the above relationship at the individual level. For each receiver, we compare the acceptance probabilities for a and \(a+1,\) and behavior is considered consistent with Proposition 1 when the acceptance probabilities for \(a+1\) is weakly larger than that for a, \(a=0,1,2,\ldots 9\). This amounts to 10 comparisons for each subject. We find that virtually all receivers (99%) behaved consistently in at least 8 out of 10 comparisons, among which 60% of the receivers (58 out of 96 receivers) behaved consistently in all 10 comparisons. In contrast, if the receivers had assigned a random acceptance probability to each offer, the binomial distribution with random choices predicts that only 4% of the receivers will behave consistently in 8 out of 10 comparisons and \(<1\%\) for 10 out of 10 comparisons. As receivers behaved in a way highly consistent with our proposition despite making decisions in a random sequence, it is unlikely that randomization is purely due to error or experimenter demand effects.

There are other empirical observations which provide further support of indecisiveness. A common focal point in the ultimatum game is the minimum acceptable offer (MAO), which corresponds to the minimum offer where the receiver switches from rejection to acceptance under binary choices. We can likewise define the maximum rejection offer (MRO), which corresponds to the maximum offer before the receiver switches from rejection to acceptance.Footnote 8 When the receiver has complete preferences, she is indifferent to rejecting or accepting an offer between MRO and MAO and the acceptance probability at this offer can be any value from 0 to 1.0. However, the first result showing most receivers randomized at least twice casts doubt that MRO and MAO are linked to indifference.

In contrast, if the receiver has incomplete preference and faces two opposing selves, indecisiveness may be the strongest at the switching points. This implies that the receiver is more likely to choose an interior acceptance probability (\(0<p<1\)) for offers between MRO and MAO. Further, the acceptance probability will move away from 0 and increase when the receiver’s share approaches MRO from below, and it will also move away from 1 and decrease when the receiver’s share approaches MAO from above. Neuroimaging studies provide evidence that receivers face conflict at MRO and MAO. Sanfey et al. (2003) show that at low unequal offers of 10% and 20% of the sum (which correspond to MRO and MAO reported in many studies), there appears to be competition between two regions in the brain of the receiver, one related to negative emotions and the other cognitive processes, which affects acceptance. If such competition is more intense at MRO and MAO than at other unequal allocations, receivers may take longer to make decisions at MRO and MAO as choices requiring more cognitive activity take more time than choices requiring less cognitive activity (Rubinstein, 2007).

To examine the hypothesis above, we ran two OLS regressions to check the response time of receivers at MRO and MAO compared to other unequal allocations. Columns (1) and (2) of Table 2 show that the decision time taken at MRO and MAO is significantly longer than at other unequal allocations in both the binary choice stage and the randomized choice stage. These findings are consistent with our interpretation that receivers face a stronger conflict at MRO and MAO than at other unequal allocations.

Result 3

Consistent with indecisive behavior, the proportion of receivers choosing an interior acceptance probability is higher at MRO and MAO compared to other unequal allocations. The acceptance probability varies systematically with the level of conflict: Acceptance probability increases significantly when receivers’ share increases from 0 to MRO and decreases significantly when receivers’ share decreases from 10 to MAO.

Support: The proportion of receivers choosing an interior acceptance probability (\(0<p<1\)) is 56% at MRO-2, 63% at MRO-1, 70% at MRO, 79% at MAO, 61% at MAO+1, and 49% at MAO+2, with the proportion being highest around MRO and MAO. Column (3) of Table 2 shows that the odds of randomizing at MAO and at MRO is 8 times and 3 times as high as other unequal allocations.

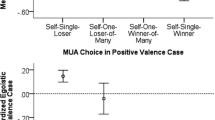

Figure 4 shows receivers’ acceptance probability at allocations around MRO and MAO. Median acceptance probability falls to 0 below MRO-2 and reaches 1 above MAO+2. Those allocations are hence omitted from the figure. We find that acceptance probability increases significantly from MRO-2 to MRO-1, and from MRO-1 to MRO, and decreases significantly from MAO+2 to MAO+1, and from MAO+1 to MAO (paired one-sided Wilcoxon Rank Sum tests, \(p<0.01\) for all tests).

For completeness, we also examine receivers’ acceptance probability at MRO and MAO compared to other unequal allocations. The numerical example in Section 2.2 illustrates a receiver with two utility functions exerting an equal “push” on her in the opposite direction. When this happens, the receiver faces the strongest conflict and chooses an acceptance probability of \(p^{*}=0.5\) to maximize her decision utility. Since the receiver may face the strongest conflict around MRO and MAO, it follows that the acceptance probability at these allocations is more likely to be around \(p=0.5\) compared to other unequal allocations.

Figure 4 shows that the receivers were more likely to choose acceptance probability between 0.40 and 0.60 at MRO and MAO compared to other nearby allocations. The mean acceptance probabilities at MRO-2, MRO-1, MRO, MAO, MAO+1, and MAO+2 are 0.13, 0.21, 0.32, 0.64, 0.81, and 0.87 (median acceptance probabilities of 0.10, 0.10, 0.30, 0.70, 0.90, and 1.00 respectively). The proportion of randomized choice with \(0.40\le p\le 0.60\) is significantly larger at MRO or MAO than at other unequal allocations (25% at MRO or MAO versus 7% at other unequal allocations; two sample test of proportions, \(p<0.000\)). Overall, receivers’ choices at MRO and MAO relative to other unequal allocations are consistent with indecisive behavior, but not with behaviors arising from indifference.

3.2 Willingness to pay for randomized choice

We have shown that randomization is common among the receivers and they randomize in a way consistent with indecisiveness. This section links randomization directly to decision utility by studying receivers’ willingness to pay for randomization. In Section 2.2, we have illustrated how decision utility may be improved through making randomized choice instead of binary choice if a receiver is indecisive. In contrast, making randomized choice instead of binary choice will not increase decision utility if preferences are complete. This difference allows us to infer indecisiveness from receivers’ WTP.

Recall that each receiver made only one WTP decision ranging from €0 to €2 with an increment of €0.2 for a randomly chosen allocation.Footnote 9 We report the number of receivers who were willing to pay a positive price to use the randomized choice instead of the binary choice when they face an unequal offer.

Result 4

Consistent with Proposition 1, of the receivers who randomized, more than half (66.0%) were willing to pay a strictly positive amount of money to use the randomized choice instead of the binary choice.

Support: Of the 47 receivers with acceptance probability \(0<p<1\) for the randomly chosen unequal offer, the majority (66.0%, 31 receivers) stated a strictly positive WTP. Of the remaining 16 receivers, eight stated a WTP of €0 but would have liked to use the randomized rather than the binary choice. These receivers were either indifferent between the randomized choice and the binary choice or were willing to pay less than €0.2 to use the randomized choice. We compare the WTP of the 47 receivers with acceptance probability \(0<p<1\) and 49 receivers with acceptance probability of either \(p=0\) or 1.Footnote 10 The median WTP of receivers with an acceptance probability \(0<p<1\) was €0.40. In comparison, of the 49 receivers with acceptance probabilities of \(p=0\) or 1, only four receivers stated a positive WTP, and the median response was not to use the randomized choice. The one-sided Wilcoxon rank sum test suggests that receivers with an acceptance probability of \(0<p<1\) had significantly higher WTP than those with an acceptance probability of \(p=0\) or 1 (\(p-value<0.01\)). The finding that WTP is linked to the randomization suggests that receivers were making meaningful WTP decisions rather than responding to experimenter demand effects.

The finding that receivers were willing to pay for randomization suggests that receivers may gain decision utility from randomization. The next step is to study the relationship between the gain in decision utility, as proxied by the receiver’s WTP for randomization, and acceptance probability.

Result 5

Consistent with Proposition 2, receivers’ WTP for randomization has an inverse-U shape with the randomization probability.

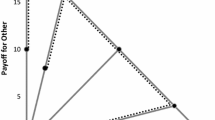

Support: Figure 5 shows the distribution of the receivers’ WTP for five groups of acceptance probabilities. We categorize randomized choices with an acceptance probability of 0 as one group, those with an acceptance probability of 1 as another group. Base on the earlier findings that the receivers were more likely to choose an acceptance probability of 0.4, 0.5, and 0.6 for allocations which involve strong conflict, we build three further subgroups: those with an acceptance probability of 0.1, 0.2, or 0.3, those with an acceptance probability of 0.4, 0.5, or 0.6, and those with an acceptance probability of 0.7, 0.8, or 0.9.

Boxplot relating the WTP for randomization and acceptance probability. The WTP ranges from €0 to €2 with an increment of €0.2. The WTP below 0 represents receivers were not willing to use the randomized choice even if it was free, while the WTP equal to 0 represents receivers would have liked to use the randomized choice if it was free

Nine out of ten receivers with acceptance probabilities \(p=0.4,0.5,0.6\) stated a positive WTP, with a median WTP of €0.80. In contrast, of the 19 receivers with acceptance probabilities \(p=0.1,0.2,0.3\), 13 receivers stated a positive WTP, with a median WTP of €0.20; of the 18 receivers with acceptance probabilities \(p=0.7,0.8,0.9\), nine receivers stated a positive WTP, with a median WTP of €0.10. A one-sided Wilcoxon rank sum test suggests that receivers deciding for an acceptance probability of \(p=0.4,0.5,0.6\) have a WTP significantly higher than those deciding for an acceptance probability of \(p=0.1,0.2,0.3\) or \(p=0.7,0.8,0.9\) (\(p-value<0.05\)), consistent with Proposition 2. Table 4 in Appendix B further connects receivers’ acceptance probability in the randomized choice with their decision in the binary choice. It suggests that the receivers who were willing to randomize strictly and to pay to implement the randomized choice could have stated acceptance or rejection in the binary choice, and that the acceptance probability they had chosen was lower if they had chosen rejection in the binary choice and higher if they had chosen acceptance in the binary choice.

This result suggests that experimental demand effects are not the main driver of the findings. Recall that receivers were given only one randomly selected allocation to report their WTP. Hence, it is unlikely that receivers would be sufficiently coordinated to report the WTP such that it has an inverse U-shaped relationship with acceptance probability across participants purely out of experimental demand effects.

3.3 Results for proposers

So far, we have focused on receivers’ behavior. We briefly summarize the results for proposers here. More details can be found in Appendix C.

Result 6

(1) Around 90% of proposers chose a randomization probability \(0<p<1.00\) at least twice. (2) Proposers who chose the randomization probability of \(p=0\) or \(p=1.00\) had significantly lower WTP than proposers choosing a probability of \(0<p<1.00\).

Despite the similarities in the results, proposers’ decision-making processes are likely to be different from those of receivers. In addition to incomplete preferences, proposers may also face strategic uncertainty. Hence, even though the findings from the proposers were broadly similar to those of the receivers, they may not be solely attributable to conflicting preferences.

4 Discussion

Our study contributes to the literature by examining conflicting preferences-led indecisiveness from choices in an ultimatum game where receivers wish to maximize own gains and be treated fairly. Our experiment allowed receivers to make randomized choices regarding acceptance and rejection through which they could express their indecisiveness. We find that (1) the vast majority of receivers (86.5%) randomized actively and their chosen acceptance probability was positively correlated with the size of the offers made to them; (2) more than half of receivers who randomized (66%) were willing to pay a strictly positive amount of money to express their indecisiveness via randomized choices, and they were willing to pay more when they faced stronger conflict.

The assumption of the completeness of preferences is neither realistic nor normative (Aumann, 1962; von Neumann & Morgenstern, 1944). The prevalence of indecisiveness and the improvement in decision utility achievable through randomization found in our study suggest that recognizing indecisiveness and allowing individuals to express it is important. Despite this, standard economics continues to assume that individuals have complete preferences and can readily compare options, however complex or difficult these choices may be. This has three consequences. First, choices made under indecisiveness (options are hard to compare) are misinterpreted as choices arising from indifference (options are equally attractive). Since indifference is used in the measurement of many important parameters, such as time discount rates, valuations of goods, risk attitudes, and probability estimates, confusing indecisiveness with indifference may lead to measurement errors in these parameters. Alternatively, indecisive behavior may be mistaken for errors and biases that violate rationality requirements, resulting in data being discarded and information lost, consequently biasing inferences about individuals’ behavior. Third, indecisive behavior such as randomized choices will continue to be associated with undesirable traits such as procrastination (Tibbett & Ferrari, 2015), obsessive compulsive disorder (Frost & Shows, 1993), or the lack of leadership (Dubno, 1965) and allowing randomization in decisions will be seen as reinforcing these negative traits and discouraging decision makers from gathering information which is needed to make a good judgement.

When used properly, however, allowing people to express conflicting preferences through randomization can be beneficial without compromising decision quality. We discuss three possible uses of randomization at the individual, organizational, and societal level. Allowing individuals to express conflicting preferences through randomized choices could help to reduce default bias. Individuals are often found to behave overly cautious, i.e., sticking to the default too long, when facing important and difficult decisions (Levitt, 2021; Sautua, 2017). Randomization enables individuals to obtain a higher decision utility than they would when they are forced to choose one option, including the default option, making it easier for them to escape default.

Organizations may also benefit from adopting randomization in some decision-making processes. For example, a hiring committee may not have a clear preference despite thorough research and deliberation based on the predetermined criteria. Forcing the committee to pick a candidate may then cause them to make a decision based on additional criteria that are unrelated to the competency of the candidate (Bouacida & Foucart, 2020), such as gender or race, leading to discrimination in the labor market. By allowing the committee to make randomized choices between candidates, not only does the organization save time and cost, candidates who are subject to negative bias unrelated to their competency may also have a positive chance of being selected.Footnote 11

Socially, the use of randomization may encourage voting. Voting often requires individuals to make difficult trade-offs between candidates and policies. Consequently, individuals may choose not to participate in voting, preferring the “safer” option of not acting (Masatlioglu & Ok, 2005), i.e., not to vote. Increasing decision utility by allowing voters to vote probabilistically may be useful for increasing participation. This inclusive system may also lead to an outcome that better reflects the aggregate preference of the community. Further research into these applications is encouraged.

Notes

Note that the underlying preference may well remain incomplete after a decision is made. Levi (1986) calls these scenarios decisions with unresolved conflicts.

The experiment is symmetric for proposers and receivers. The proposer also faces three choices as described below: the binary choice of proposing either the equal payoff distribution or the unequal payoff distribution, the randomized choice between the two distributions, and the WTP for using the randomized choice instead of the binary choice to determine the final payoff. We did this so that all participants were kept occupied throughout the experimental session and would complete the session at the same time. This makes it more difficult for participants to identify who are the proposers and who are the receivers.

The first four sessions were run on Dec. 7th, 2016. To increase the sample size and to check the robustness of the results, we conducted four more sessions on June 8th, 2018. The additional four sessions also served to correct two minor programming errors regarding the decision time (the decision time in the first period of Stage 1 and Stage 2 included the time for reading the instructions) and the recording of receivers’ WTP for using the randomized choice when they faced the equal allocation. These two corrections should not affect the subjects’ choices because subjects’ decision screens remained the same.

Betweenness requires that: \(A\succeq R\Longleftrightarrow A\succeq p A+1-(p)R\succeq R\), where A stands for acceptance and R stands for rejection. The betweenness axiom is weaker than the independence axiom because it requires preference ordering to stay the same when two lotteries are mixed with each other rather than mixed with any common third lottery.

With a slight abuse of notations, let \(v(\cdot )\) denote the value function, \(V(\cdot )\) denote the prospect value of a lottery, \(w(\cdot )\) denote the probability weighting function. By CPT the prospect value of the randomized choice \((p,A;1-p,R)\) is \(V(p,A;1-p,R)\) \(=w(p)v[(A)]\) \(+ [1-w(p)]v[R]\) \(= v[R]\) \(+ w(p)[v[A]-v[R]]\). Since w(p) increases with p, the optimal p is either 0 or 1. RDU gives qualitatively the same evaluation as CPT when the lotteries are binary (Observation 7.11.1 in Wakker, 2010, p.231).

Our utility function for the inequity-averse self includes Fehr-Schmidt preferences as a special case. To see this, let \(k=10\) and \(\gamma =\alpha +0.5\), and it follows that \(u_{F}(20-a,a)=k-\gamma (20-2a)=a-\alpha (20-2a),\) which is Eq. (2) in Fehr and Schmidt (1999). The two selves are a simplification of the general setup, where \(u_{\tau }(20-a,a)=k_{\tau }-\gamma _{\tau }(20-2a)\) and different selves are identified by the different values of \(k_{\tau }\) and \(\gamma _{\tau }\).

For allocations where a is sufficiently high such that \(u_{F}(20-a,a)\ge u_{S}(20-a,a)\), the own material payoff-driven self would be dominated by the inequality-averse self (\(u_{F}(0,0)=k\ge u_{F}(20-a,a)=k-\gamma (20-2a)\ge u_{S}(20-a,a)=a\ge u_{S}(0,0)=0\)). Since we consider the maxmin rule for the completion of preferences, the final decision in those allocations would be determined only by the own material payoff-driven self; randomization offers no hedging benefits across selves, and the receiver always accepts.

We define a receiver’s MRO as the receiver’s share at and below which she always rejects but switches to acceptance when the share increases to MRO\(+1\), and MAO as the receiver’s share at and above which she always accepts but switches to rejection when the share decreases to MAO\(-1\). Thus, the receiver consistently rejects at and below MRO, accepts at and above MAO, and switches from consistent rejection to consistent acceptance between MRO and MAO. When the receiver switches once from rejection to acceptance with the increase of a, MAO−MRO \(=1\). The simultaneous use of MRO and MAO allows us also to consider receivers who switch multiple times from rejection to acceptance with the increase of a (MAO−MRO\(>1\)). Consider, e.g., subject no. 18 whose binary choices were (Reject at \(a\le 4;\) Accept at \(a=5;\) Reject at \(6\le a\le 8;\) Accept at \(a=9\) or 10), and we have MRO \(=4\) and MAO \(=9\). It is important to include those receivers since they may be subject to indecisiveness. Results stay qualitatively the same if we exclude receivers who switch multiple times.

We code the choice of not using the randomized choice as having a negative WTP. As we report median responses and use non-parametric tests, the exact value of the negative WTP is irrelevant.

The proportions of receivers who chose \(p=0\,or\,1\) over \(0<p<1\) per se are not important, as they depended heavily on the randomly chosen pairs.

To see this concretely, suppose there are two candidates - A and B - who need to be assessed according to two criteria. Suppose the committee slightly favors the male candidate - candidate A - in the following way: \(u_{1}(A)=1+\varepsilon\) and \(u_{1}(B)=0,\) and \(u_{2}(A)=0+\varepsilon\) and \(u_{2}(B)=1\), where \(u_{i}(\cdot )\) denotes criterion i and \(\varepsilon\) is a small positive value that measures the degree of the bias. When the committee has to select one candidate and applies the maxmin rule as in Eq. (1) to make the final choice, candidate A will always be chosen. Given a possibility of randomization, however, candidates are chosen roughly equally likely.

References

Agranov, M., & Ortoleva, P. (2017). Stochastic choice and preferences for randomization. Journal of Political Economy, 125, 40–68.

Arrow, K., & Hurwicz, L. (1972). An optimality criterion for decision making under ignorance. In C. F. Carter & J. L. Ford (Eds.), Uncertainty and expectations in economics. Oxford: Basil Blackwell.

Arts, S., Ong, Q., & Qiu, J. (2020). Measuring subjective decision confidence. MPRA Paper 106811. University Library of Munich, Germany.

Aumann, R. J. (1962). Utility theory without the completeness axiom. Econometrica, 30, 445–462.

Bayrak, O. K., & Hey, J. (2015). Preference cloud theory: Imprecise preferences and preference reversals. 2015 Papers pba1276. Job Market Papers.

Bayrak, O. K., & Hey, J. D. (2020a). Decisions under risk: Dispersion and skewness. Journal of Risk and Uncertainty, 61, 1–24.

Bayrak, O. K., & Hey, J. D. (2020b). Understanding preference imprecision. Journal of Economic Surveys, 34, 154–174.

Becker, G. M., Degroot, M. H., & Marschak, J. (1964). Measuring utility by a single-response sequential method. Behavioral Science, 9, 226–232.

Bewley, T. (2002). Knightian decision theory. Part I. Decisions in Economics and Finance, 25, 79–110.

Bohnet, I., Greig, F., Herrmann, B., & Zeckhauser, R. (2008). Betrayal aversion: Evidence from Brazil, China, Oman, Switzerland, Turkey, and the United States. American Economic Review, 98, 294–310.

Bolton, G., & Ockenfels, A. (2010). Betrayal aversion: Evidence from Brazil, China, Oman, Switzerland, Turkey, and the United States: Comment. American Economic Review, 100, 628–33.

Bouacida, E., & Foucart, R. (2020). The acceptability of lotteries in allocation problems. Working Papers 301646245. Lancaster University Management School, Economics Department.

Brandts, J., & Charness, G. (2011). The strategy versus the direct-response method: a first survey of experimental comparisons. Experimental Economics, 14, 375–398.

Brock, M., Lange, A., & Ozbay, E. (2013). Dictating the risk: Experimental evidence on giving in risky environments. American Economic Review, 103, 415–37.

Camerer, C., & Thaler, R. (1995). Anomalies: Ultimatums, dictators and manners. The Journal of Economic Perspectives, 9, 209–219.

Cappelen, A., Konow, J., Sørensen, E., & Tungodden, B. (2013). Just luck: an experimental study of risk-taking and fairness. American Economic Review, 103, 1398–1413.

Cerreia-Vioglio, S. (2009). Maxmin expected utility over a subjective state space: Convex preferences under risk. Working Paper Bocconi University.

Cerreia-Vioglio, S., Dillenberger, D., & Ortoleva, P. (2015). Cautious expected utility and the certainty effect. Econometrica, 83, 693–728.

Cerreia-Vioglio, S., Dillenberger, D., Ortoleva, P., & Riella, G. (2019). Deliberately stochastic. American Economic Review, 109, 2425–2445.

Cettolin, E., & Riedl, A. (2019). Revealed preferences under uncertainty: Incomplete preferences and preferences for randomization. Journal of Economic Theory, 181, 547–585.

Chew, S. (1983). A generalization of the quasilinear mean with applications to the measurement of income inequality and decision theory resolving the allais paradox. Econometrica, 51, 1065–1092.

Chew, S. (1989). Axiomatic utility theories with the betweenness property. Annals of operations Research, 19, 273–298.

Costa-Gomes, M. A., Cueva, C., Gerasimou, G., & Tejiscak, M. (2022). Choice, deferral, and consistency. Quantitative Economics, 13, 1297–1318.

Cubitt, R., Navarro-Martinez, D., & Starmer, C. (2015). On preference imprecision. Journal of Risk and Uncertainty, 50, 1–34.

Danan, E., & Ziegelmeyer, A. (2006). Are preferences complete? An experimental measurement of indecisiveness under risk. Papers on Strategic Interaction 2006-01. Max Planck Institute of Economics, Strategic Interaction Group.

Dekel, E. (1986). An axiomatic characterization of preferences under uncertainty: Weakening the independence axiom. Journal of Economic Theory, 40, 304–318.

Dubno, P. (1965). Leadership, group effectiveness, and speed of decision. The Journal of Social Psychology, 65, 351–360.

Dubra, J., Maccheroni, F., & Ok, E. (2004). Expected utility theory without the completeness axiom. Journal of Economic Theory, 115, 118–133.

Dwenger, N., Kübler, D., & Weizsäcker, G. (2018). Flipping a coin: Evidence from university applications. Journal of Public Economics, 167, 240–250.

Eliaz, K., & Ok, E. (2006). Indifference or indecisiveness? Choice-theoretic foundations of incomplete preferences. Games and Economic Behavior, 56, 61–86.

Fehr, E., & Schmidt, K. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economics, 114, 817–868.

Frost, R. O., & Shows, D. L. (1993). The nature and measurement of compulsive indecisiveness. Behaviour Research and Therapy, 31, 683–IN2.

Fudenberg, D., Iijima, R., & Strzalecki, T. (2015). Stochastic choice and revealed perturbed utility. Econometrica, 83, 2371–2409.

Galaabaatar, T., & Karni, E. (2013). Subjective expected utility with incomplete preferences. Econometrica, 81, 255–284.

Gerasimou, G. (2017). Indecisiveness, undesirability and overload revealed through rational choice deferral. The Economic Journal, 128, 2450–2479.

Gilboa, I., & Schmeidler, D. (1989). Maxmin expected utility with non-unique prior. Journal of Mathematical Economics, 18, 141–153.

Greiner, B. (2015). Subject pool recruitment procedures: Organizing experiments with orsee. Journal of the Economic Science Association, 1, 114–125.

Gul, F. (1991). A theory of disappointment aversion. Econometrica, 59, 667–686.

Hurwicz, L. (1951). Some specification problems and applications to econometric models. Econometrica, 19, 343–344.

Karni, E., Salmon, T., & Sopher, B. (2008). Individual sense of fairness: an experimental study. Experimental Economics, 11, 174–189.

Klibanoff, P., Marinacci, M., & Mukerji, S. (2005). A smooth model of decision making under ambiguity. Econometrica, 73, 1849–1892.

Krawczyk, M., & Lec, F. (2010). ‘Give me a chance!’ An experiment in social decision under risk. Experimental Economics, 13, 500–511.

Krawczyk, M., & Lec, F. (2016). Dictating the Risk: Experimental evidence on giving in risky environments: Comment. American Economic Review, 106, 836–839.

Levi, I. (1986). Hard choices: Decision making under unresolved conflict. Cambridge University Press.

Levitt, S. D. (2021). Heads or tails: The impact of a coin toss on major life decisions and subsequent happiness. The Review of Economic Studies, 88, 378–405.

Mandler, M. (2005). Incomplete preferences and rational intransitivity of choice. Games and Economic Behavior, 50, 255–277.

Masatlioglu, Y., & Ok, E. (2005). Rational choice with status quo bias. Journal of Economic Theory, 121, 1–29.

Miao, B., & Zhong, S. (2018). Probabilistic social preference: How Machina’s mom randomizes her choice. Economic Theory, 65, 1–24.

Nishimura, H., & Ok, E. (2018). Preference structures. Working Paper New York University.

Nowak, M. A., Page, K. M., & Sigmund, K. (2000). Fairness versus reason in the ultimatum game. Science, 289, 1773–1775.

Ok, E., Ortoleva, P., & Riella, G. (2012). Incomplete preferences under uncertainty: Indecisiveness in beliefs versus tastes. Econometrica, 80, 1791–1808.

Ok, E. A. (2002). Utility representation of an incomplete preference relation. Journal of Economic Theory, 104, 429–449.

Qiu, J. (2015). Completing incomplete preferences. Working Paper MPRA.

Quiggin, J. (1982). A theory of anticipated utility. Journal of Economic Behavior & Organization, 3, 323–343.

Richter, M., & Rubinstein, A. (2017). Convex preferences: A new definition. Working Paper University of London.

Rohde, I., & Rohde, K. (2011). Risk attitudes in a social context. Journal of Risk and Uncertainty, 43, 205–225.

Roth, A. (1995). Bargaining experiments. In J. H. Kagel & A. E. Roth (Eds.), The handbook of experimental economics. Princeton University Press.

Rubinstein, A. (2007). Instinctive and cognitive reasoning: A study of response times. The Economic Journal, 117, 1243–1259.

Sandroni, A., Ludwig, S., & Kircher, P. (2013). On the difference between social and private goods. The BE Journal of Theoretical Economics, 13, 1–27.

Sanfey, A., Rilling, J., Aronson, J., Nystrom, L., & Cohen, J. (2003). The neural basis of economic decision-making in the ultimatum game. Science, 300, 1755–1758.

Sautua, S. (2017). Does uncertainty cause inertia in decision making? An experimental study of the role of regret aversion and indecisiveness. Journal of Economic Behavior & Organization, 136, 1–14.

Selten, R. (1967). Die Strategiemethode zur Erforschung des eingeschrankt rationalen Verhaltens im Rahmen eines Oligopolexperiments. In H. Sauermann (Ed.), Beitrage zur experimentellen Wirtschaftsforschung (pp. 136–168). Mohr, Tubingen: J.C.B.

Sen, A. (1997). Maximization and the act of choice. Econometrica, 65, 745–779.

Tibbett, T. P., & Ferrari, J. R. (2015). The portrait of the procrastinator: Risk factors and results of an indecisive personality. Personality and Individual Differences, 82, 175–184.

Tversky, A., & Kahneman, D. (1992). Social preferences under risk: Equality of opportunity versus equality of outcome. Journal of Risk and Uncertainty, 5, 297–323.

Tversky, A., & Shafir, E. (1992). Choice under conflict: The dynamics of deferred decision. Psychological Science, 3, 358–361.

von Neumann, J., & Morgenstern, O. (1944). Theory of Games and Economic Behavior. Princeton University Press.

Wakker, P. (2010). Prospect theory: for risk and ambiguity. Cambridge, UK: Cambridge University Press.

Wald, A. (1949). Statistical decision functions. The Annals of Mathematical Statistics, 20, 165–205.

Acknowledgements

We thank the editor and the reviewer for their valuable comments and suggestions, which greatly improved the paper. We also thank (in alphabetical order) Aurelien Baillon, Simone Cerreia Vioglio, Itzhak Gilboa, Jack Knetsch, Jan Potters, Matthias Sutter, Severine Toussaert, Peter Wakker, and the participants in D-Tea 2018, and the seminar audiences at Radboud University, Erasmus University Rotterdam, and Tilburg Universityfor their helpful comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendices

1.1 A. Proofs

Proposition 1

When the receiver is indecisive and relatively sensitive to inequity \((\gamma >\frac{1}{2})\), for allocations such that \(u_{F}(20-a,a)<u_{S}(20-a,a)\) she has a strict preference for randomization over rejection or acceptance and the optimal acceptance probability increases with the receiver’s share.

Proof for Proposition 1

When the receiver randomizes \((p,A;1-p,R)\), the decision utility of such a randomized choice is:

When \(u_{F}(20-a,a)<u_{S}(20-a,a)\) there is potential gain from randomization and the maximal \(V(p,A;(1-p),R)\) obtains when \(pa=k-p\gamma (20-2a).\) The optimal \(p^{*}\) can be calculated as:

The randomization is strict (\(0<p^{*}<1\)) since \(u_{F}(20-a,a)=k-\gamma (20-2a)<u_{S}(20-a,a)=a\Leftrightarrow k<20\gamma -(2\gamma -1)a\) and \(k>0\). As we can see, \(p^{*}\) increases with a when the receiver is relatively sensitive to inequity (\(\gamma >\frac{1}{2}\)), and this proves the second part of Proposition 1. With the optimal \(p^{*}\) the decision utility of \((p^{*},A;1-p^{*},R)\) becomes

Next, we show that the receiver strictly prefers the randomized choice over rejection and acceptance. It is straightforward to show that the receiver prefers the randomized choice over rejection (\(V(p^{*},A;(1-p^{*}),R)>V(R)=0\)) since \(20\gamma -(2\gamma -1)a\ge 20\gamma -(2\gamma -1)10>0\), where inequalities obtain from \(\gamma >\frac{1}{2}\) and \(a\le 10\).

To show that the receiver prefers the randomized choice over acceptance (\(V(p^{*},A;(1-p^{*}),R)>V(A)\)), note that \(u_{F}(20-a,a)<u_{S}(20-a,a)\Leftrightarrow V(A)\) \(=min_{\tau \in \{S,\,F\}}\,EU(u_{\tau },A)\) \(=min\left\{ u_{S}(20-a,a),\,u_{F}(20-a,a)\right\}\) \(=u_{F}(20-a,a)=k-\gamma (20-2a)\). The inequality \(V(p^{*},A;(1-p^{*}),R)>V(A)\) holds since \(V(A)=k-\gamma (20-2a)\) \(=\frac{1}{20\gamma -(2\gamma -1)a}\left[ k-\gamma (20-2a)\right]\) \(\times \left[ 20\gamma -(2\gamma -1)a\right]\) \(=\frac{1}{20\gamma -(2\gamma -1)a}\{ ka-\gamma (20-2a)\) \(\left[ 20\gamma -(2\gamma -1)a-k\right]\}\) \(< \frac{ka}{20\gamma -(2\gamma -1)a}\) \(=V(p^{*},A;(1-p^{*}),R)\). The last inequality follows from \(\gamma (2a-20)\le 0\) and \(u_{F}(20-a,a)\) \(= k-\gamma (20-2a)\) \(< u_{S}(20-a,a)\) \(=a\Leftrightarrow 20\gamma -(2\gamma -1)\) \(a-k > 0\).

Proposition 2

When the receiver is indecisive and relatively sensitive to inequity \((\gamma >\frac{1}{2})\), the WTP for randomization has an inverse U-shape relationship with optimal acceptance probability.

Proof for Proposition 2

As explained in Footnote 7, for allocations such that \(u_{F}(20-a,a)\ge u_{S}(20-a,a)\) the receiver always accepts. Randomization offers no benefit, and consequently the WTP for randomization is zero. In the calculation below, we focus on allocations such that \(u_{F}(20-a,a)<u_{S}(20-a,a)\). For these allocations the receiver’s utility gain from randomization is calculated as:

To show that the WTP for randomization has an inverse U-shape relationship with \(p^{*}\), we show that there is a threshold \(\overline{p}^{*}\), which is the acceptance probability at the allocation where \(V(A)=V(R)\), and WTP increases with \(p^{*}\) when \(p^{*}\le \overline{p}^{*}\) and decreases with \(p^{*}\) otherwise.

We first consider those allocations such that \(V(A)=k-\gamma (20-2a)\le V(R)=0\Longleftrightarrow a\le \frac{20\gamma -k}{2\gamma }\), which implies \(max\left\{ V(A),V(R)\right\} =V(R)=0\). Note that \(p^{*}=\frac{k}{20\gamma -a(2\gamma -1)}\). Using \(p^{*}\) to define the value of a, we have \(a=\frac{20\gamma -k/p^{*}}{2\gamma -1}\). Notice also that \(a\le \frac{20\gamma -k}{2\gamma }\), and thus \(\frac{20\gamma -k/p^{*}}{2\gamma -1}\le \frac{20\gamma -k}{2\gamma }.\) This defines the threshold of \(p^{*}\) as \(\overline{p}^{*}\le \frac{2\gamma k}{20\gamma +(2\gamma -1)k}\). When \(p^{*}\le \overline{p}^{*}\) we have:

Thus, the utility gain from randomization \(\Delta V\) and accordingly the WTP for the randomized choice increases with \(p^{*}\) when \(p^{*}\le \overline{p}^{*}=\frac{2\gamma k}{20\gamma +2k\gamma -k}\).

With a sufficiently large a the utility of acceptance is larger than the utility of rejection, i.e., \(V(A)\) \(=min\{ u_{S}(20-a,a),\) \(u_{F}(20-a,a)\}\) \(=u_{F}(20-a,a)\) \(=k-\gamma (20-2a)\) \(\ge V(R)\) \(=0\Longleftrightarrow a\) \(\ge \frac{20\gamma -k}{2\gamma}\). Similarly, using \(p^{*}\) to define the value of a we have \(a=\frac{20\gamma -k/p^{*}}{2\gamma -1}\ge \frac{20\gamma -k}{2\gamma }\), and this gives \(\overline{p}^{*}\ge \frac{2\gamma k}{20\gamma +(2\gamma -1)k}\). When \(p^{*}\ge \overline{p}^{*}\) we have:

Taking the first-order derivative of \(\Delta V\) with respect to \(p^{*}\) gives that:

The inequality is obtained by recognizing that the optimal acceptance probability is (weakly) increasing in a and reach the highest level when \(a=10\), which implies \(p^{*}=\frac{k}{20\gamma -(2\gamma -1)a}\le \frac{k}{20\gamma -(2\gamma -1)\times 10}=\frac{k}{10}\), or equivalently \(20p^{*}-2k\le 0\). The inequality is strict when \(0<p^{*}<1\): \(20p^{*}-2k<20p^{*2}-2k<0\). The negative first-order derivative implies the utility gain and accordingly the WTP of randomization decreases with \(p^{*}\) when \(p^{*}\) is above \(\frac{2\gamma k}{20\gamma +(2\gamma -1)k}\).

1.2 B. Details of receivers’ binary and randomized choices

1.3 C. Results for proposers

We report the results for the proposers here. Note that the motives behind the proposer’s decisions are more complicated and different from the receiver. In addition to the (potentially different) conflicting motives that the receiver faces, the proposer also faces strategic uncertainty.

The general pattern for proposers is similar to that of receivers. Table 5 reports the proportion of proposers choosing the equal allocation in binary choices, the proportion of proposers who randomized in randomized choices, and the corresponding median and mean probability of proposing the equal allocation given the receiver’s share in the unequal allocation. Figure 6 shows the proposer’s probability of proposing the equal allocation over the receiver’s share in the unequal allocation. Proposers randomized actively in all allocation pairs. Overall, we find that 89.6% of proposers (86 out of 96 proposers) randomized at least twice. A majority (62%) of proposers chose \(0.4\le p\le 0.6\) at least once, among which 36% made such choices two times or more often. Thus the majority of proposers feel strongly indecisive in some situations. Those with incomplete preferences made randomized choices for around 70% of allocation pairs.

A boxplot of the proposer’s probability of proposing the equal allocation, depending on the receiver’s share out of €20 in the unequal allocation. Checked boxes denote the population ratios of proposing the equal allocation in binary choices, and stars denote the mean probability of proposing the equal allocation

Interestingly, the relationship between the receiver’s share and the group average in binary choices (denote by checked boxes) is steeper than with mean probabilities of proposing the equal allocation (denote by stars). This means that compared to group averages in binary choices, when allowed to randomize, proposers are less likely to propose the equal allocation when the unequal allocation in the pair is more unfair, and are more likely to propose the equal allocation when the unequal allocation in the pair is more fair. The former result - proposers are less likely to propose the equal allocation when the unequal allocation in the pair is more unfair - suggests some sense of cautiousness: when forced to make a decision in the binary choice, proposers lean toward the safe option—the equal allocation—that is more likely to be accepted.

Similar to the results of receivers, proposers who chose to offer the equal allocation with probability of \(p=0\) or \(p=1.00\) have significantly lower WTP than proposers choosing probability of \(0<p<1.00\) (Wilcoxon rank sum test, \(p<0.01\)). Among those who randomized with \(0<p<1.00\) (60 proposers), 50% indicated a strictly positive WTP. There is one significant difference: proposers with proposing probabilities of \(p=0.1,0.2,\,or\,0.3\) have the WTP significantly higher than those with proposing probabilities of \(p=0.4,0.5,\,or\,0.6\) or \(p=0.7,0.8,\,or\,0.9\) (two-sided Wilcoxon rank sum test, \(p<0.05\)). This suggests that proposers chose randomization probability of \(p=0.1,0.2,\,or\,0.3\) when they face the strongest conflict (Fig. 7) illustrates the results graphically.

The WTP of using the randomized choice and its associated probability of proposing the equal allocation (10, 10).The WTP ranges from €0 to €2 with an increment of €0.2. The WTP below 0 represents proposers were not willing to use the randomized choice even if it is free while the WTP equals to 0 represents proposers would like to use the randomized choice if it is free

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ong, Q., Qiu, J. Paying for randomization and indecisiveness. J Risk Uncertain 67, 45–72 (2023). https://doi.org/10.1007/s11166-023-09407-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-023-09407-1

Keywords

- Indecisiveness

- Randomization

- Incomplete preference

- Preference uncertainty

- Imprecision

- Conflicting preferences

- Ultimatum game